Attached files

| file | filename |

|---|---|

| 8-K - 8-K - Seritage Growth Properties | brhc10024898_8k.htm |

Exhibit 99.1

2 0 2 1 Annual Shar e ho l de r M e e t i ng M a y 2 0 2 1

Note: all statistics as of March 31, 2021. C O M P A N Y O V E R V I E W To maximize value for

shareholders by repositioning the Company’s portfolio through leasing, redevelopment, formation of strategic partnerships, and other bespoke solutions. 1 7 9 p r o p e r t i e s 2 5 . 9 m i l l i o n s q u a r e f e e t 2 , 4 0 0 a c r e s

o f l a n d 4 1 s t a t e s + P u e r t o R i c o M I S S I O N P O R T F O L I O P.1 I N V E S T M E N T H I G H L I G H T S UNLOCKING VALUE THROUGH DENISIFICATION and DIVERSIFICATION Opportunities to reimagine assets inclusive

of conversion to nonretail uses and development of excess land | Approximately half of the portfolio are prime candidates for non-retail uses | Portfolio has an average of 13 acres per site, providing ample land for additional leasable

area | Robust entitlement program underway to unlock highest and best use

N E W C H A P T E R A T S E R I T A G ESix Primary Uses Identified in Portfolio GROCERY-ANCHORED

RETAIL | Multi-tenant retail locations anchored by grocery stores with long-term NNN leases| Majority under development or in pipeline to be developed STRIP-CENTER/MULTI-TENANT RETAIL SINGLE-TENANT/PAD LOCATIONS | Open-air centers

with a mix of daily needs, big boxes, value retail and others| Over 50% stabilized| Targeting long-term NNN leases | Single-tenant locations primarily with long-term NNN leases| Includes stabilized & pipeline projects OFFICE/LIFE

SCIENCES | Large scale office and/or life sciences locations (laboratory space), including La Jolla, CA and Southern San Francisco| Pursuing industry expert joint venture partnerships RESIDENTIAL BUILD-FOR-RENT (“BFR”) | New build

residential projects across a spectrum of densities| Developed with industry expert joint venture partners| First site projected to open in 4Q21 | Low-density, self-parked apartments| 10-20 sites identified for near-term execution, many

other sites under evaluation for BFR opportunities| Estimated 3-5 years for stabilization P.2

O R G A N I Z A T I O N A L R E S T R U C T U R I N GAligning the Team with the Business Plan |

Completed deep dive into each asset second quarter of 2021| Focused on activating entire portfolio based upon actionable business plans| Streamlined C-suite, consolidated corporate operations in NYC and reorganized management team to align

with the business plan and to drive portfolio optimization| Targeting strategic partnerships and accretive capital sources to unlock value P.3

U N L O C K I N G T A L E N T T O D R I V E V A L U E C R E A T I O NOverview of Company

Leadership Andrea Olshan, Chief Executive Officer and President| Former CEO of Olshan Properties from 2012 to 2021, now Chair of Board of Directors| Former board member of Morgans Hotel Group| Extensive experience investing in, developing

and managing retail, residential, office, hospitality and mixed-use properties Amanda LombardChief Financial Officer Matthew FernandChief Legal Officer Andrew GalvinChief Investment Officer Mary RottlerChief Operating

Officer | Promoted from CAO in 2020 | General Counsel of SRG since inception | Promoted from SVP Investments in 2019 | Former EVP – Leasing since inception | Former CAO of Gramercy Property Trust | Former partner in Sidley

Austin LLP’s real estate group | Held investment positions at Centennial Real Estate, Rouse Properties & GGP | Former VP of Real Estate at Wal-Mart Stores, Inc. P.4 Eric Dinenberg – Executive Vice President – Development Edouard

Cuilhé – Senior Vice President, Chief Accounting Officer Nino Cammalleri – Senior Vice President and Real Estate Counsel Maurice Funes – Senior Vice President of LeasingKevin Vilke – Senior Vice President of Human Resources ꞁ

Fully-integrated platform with leasing, development, construction, asset management, investments, accounting, operations and legal services staffed in house ꞁ 53 employeesꞁ Headquartered in New York City, with employees across the US

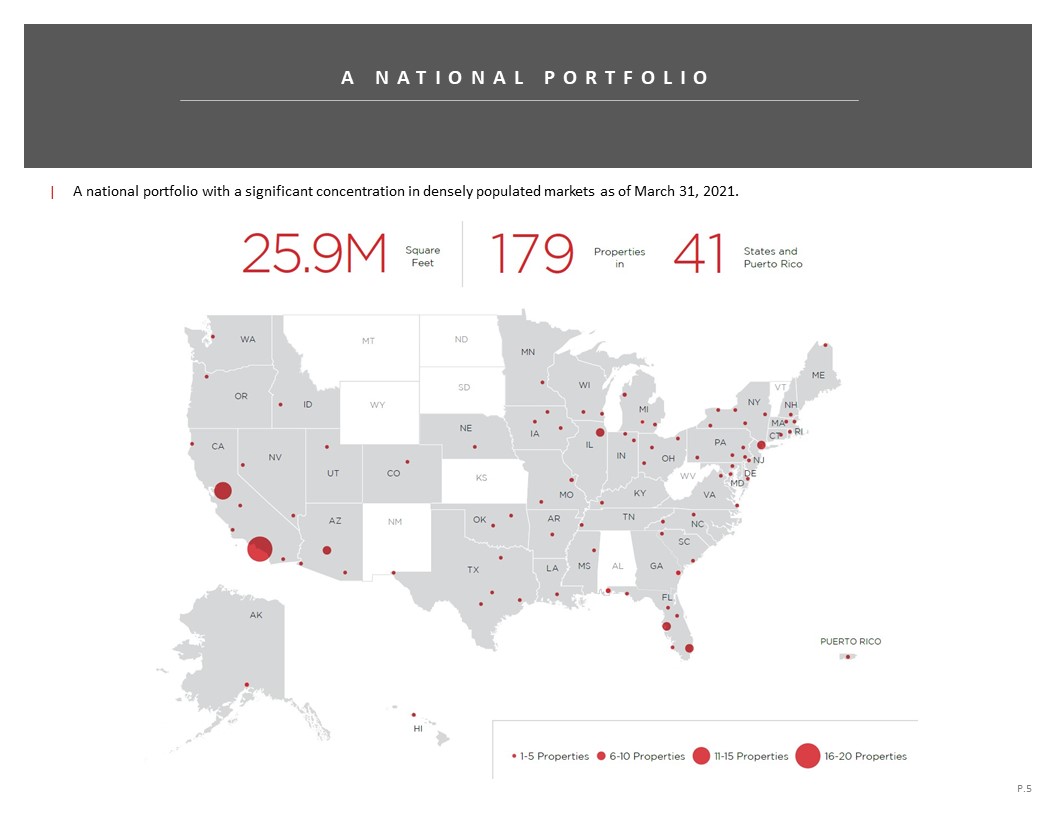

A N A T I O N A L P O R T F O L I O | A national portfolio with a significant concentration in

densely populated markets as of March 31, 2021. P.5

D E V E L O P M E N T P R O J E C T S O N G O I N G A N D A N T I C I P A T E D | Land/vacant

asset pipeline| Assets to be entitled and redeveloped| Smaller, weaker market assets to be sold| Focused on projects with higher return opportunities in solid markets| Selectively partnering with third-party developers and/or capital partners

when accretive and/or add synergistic skill sets| Development pipeline is comprised of:| Active and near-term activations of primarily grocery anchored, strip-center retail and NNN pad sites| Medium term lease up of multi-tenant retail

portfolio that is expected to be mostly stabilized in next three years| Longer dated development opportunities consisting primarily of non-retail and larger mixed-use master planned sites P.6

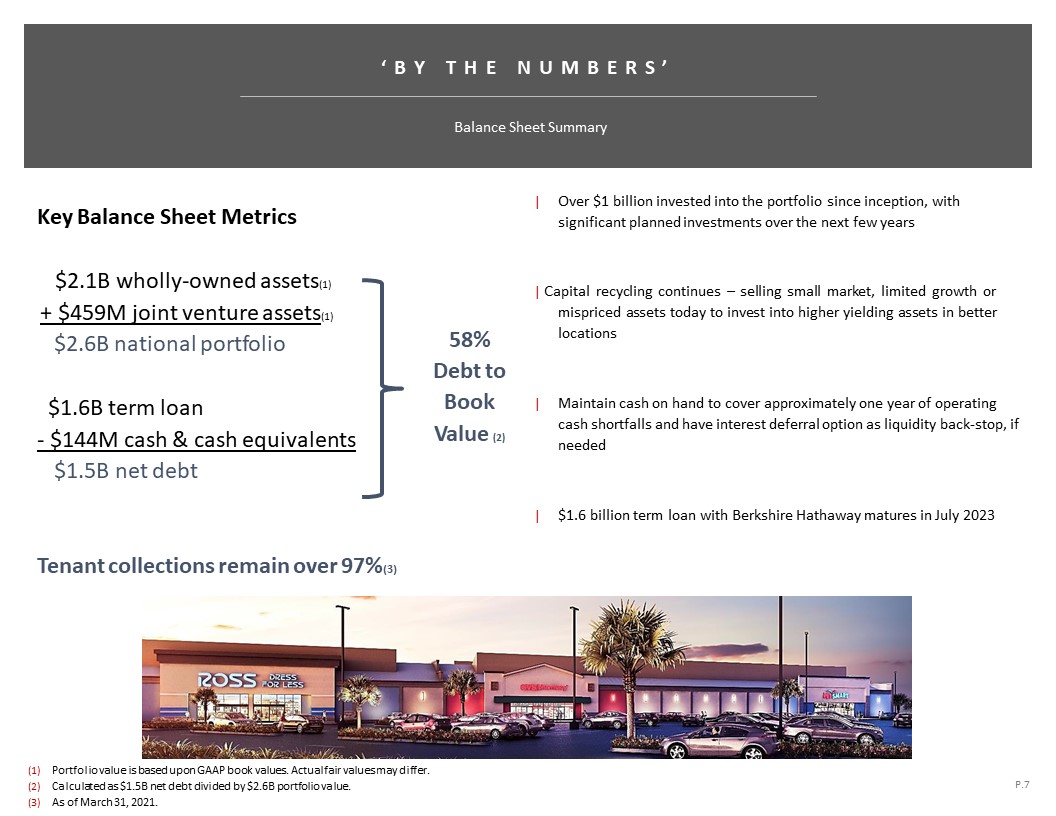

‘ B Y T H E N U M B E R S ’Balance Sheet Summary P.7 Key Balance Sheet Metrics $2.1B wholly-owned

assets(1)+ $459M joint venture assets(1)$2.6B national portfolio $1.6B term loan- $144M cash & cash equivalents$1.5B net debt Tenant collections remain over 97%(3) | Over $1 billion invested into the portfolio since inception, with

significant planned investments over the next few years | Capital recycling continues – selling small market, limited growth or mispriced assets today to invest into higher yielding assets in better locations | Maintain cash on hand to

cover approximately one year of operating cash shortfalls and have interest deferral option as liquidity back-stop, if needed | $1.6 billion term loan with Berkshire Hathaway matures in July 2023 58%Debt to Book Value (2) Portfolio value

is based upon GAAP book values. Actual fair values may differ.Calculated as $1.5B net debt divided by $2.6B portfolio value.As of March 31, 2021.

B E R K S H I R E H A T H A W A Y L O A NEfficient, Flexible Capital Allows for Maximum Growth |

$1.6 billion term loan with 7% coupon maturing in July 2023| $400 million additional facility, with 1% undrawn use fee, is accessible if certain conditions are met which is not expected in the next 24 months| Amended loan in May 2020 to

provide flexibility to defer interest expense under certain circumstances| Have not deferred any interest to date, nor are we expecting to under current business plan| Berkshire Hathaway has approval rights over all sales| Reaffirmed support

for sales program in May 2020 modification| Flexible, efficient capital| No complicated cash management requirements - allows Company to utilize cash flow to best maximize business| Covenant violations do not translate into defaults| No

paydown requirements with sales – monitoring leverage closely to ensure leverage stays reasonable 9

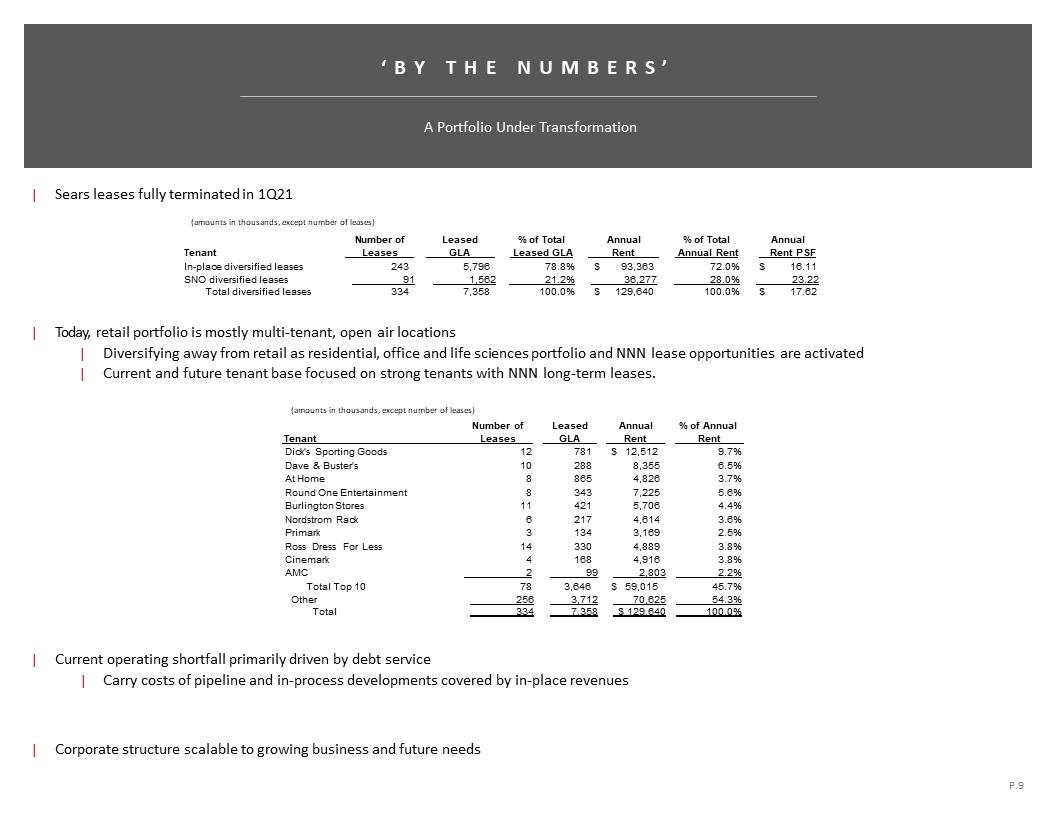

‘ B Y T H E N U M B E R S ’A Portfolio Under Transformation | Sears leases fully terminated in

1Q21 10 | Today, retail portfolio is mostly multi-tenant, open air locations| Diversifying away from retail as residential, office and life sciences portfolio and NNN lease opportunities are activated| Current and future tenant base focused

on strong tenants with NNN long-term leases. | Current operating shortfall primarily driven by debt service| Carry costs of pipeline and in-process developments covered by in-place revenues | Corporate structure scalable to growing business

and future needs (amounts in thousands, except number of leases) (amounts in thousands, except number of leases) Tenant Number of Leases Leased GLA % of Total Leased GLA Annual Rent % of Total Annual Rent Annual Rent PSF

In-place diversified leases 243 5,796 78.8% $ 93,363 72.0% $ 16.11 SNO diversified leases 91 1,562 21.2% 36,277 28.0% 23.22 Total diversified leases 334 7,358 100.0% $ 129,640 100.0% $ 17.62 Number of Tenant

Leases Leased GLA Annual Rent % of Annual Rent Dick's Sporting Goods 12 781 $ 12,512 9.7% Dave & Buster's 10 288 8,355 6.5% At Home 8 865 4,826 3.7% Round One Entertainment 8 343 7,225 5.6% Burlington Stores

11 421 5,706 4.4% Nordstrom Rack 6 217 4,614 3.6% Primark 3 134 3,169 2.5% Ross Dress For Less 14 330 4,889 3.8% Cinemark 4 168 4,916 3.8% AMC 2 99 2,803 2.2% Total Top 10 78 3,646 $ 59,015 45.7% Other 256

3,712 70,625 54.3% Total 334 7,358 $ 129,640 100.0%

F I N A N C I A L T R E N D S & 2 0 2 1 O U T L O O K | Planning to invest $130-$175 million

into portfolio in 2021, with expectation to bring on $10-$15 million of annual base rent| Working with municipalities to entitle sites for non- retail use| Extending timeline for Aventura (Miami, FL) project opening to late 2022| Small shop

and restaurant tenants still recovering from the pandemic| Calibrating tenant mix for post-pandemic world| Culled significant portion of weak tenants and/or unfavorable uses from development pipeline| Little capital invested in weak tenants

pre- termination| Reaffirming expectation that Board will not declare dividends for remainder of 2021 and 2022, unless required to maintain REIT status 11

E N V I R O N M E N T A L , S O C I A L & C O R P O R A T E G O V E R N A N C E We are committed

to environmental, social responsibility and governance practices That we believe benefit our shareholders, our team and our communities.ENVIRONMENTALOur redevelopment projects are focused on reimaging aging and energy inefficient structures

into modern, more energy efficient sites that take advantage of alternative energy sources, building management technology and remote monitoring.SOCIALWe are focused on building projects that complement and are assets to the communities in

which they are located. We also support minority owned businesses, and we provide competitive employee benefits.GOVERNANCEWe are focused on maintaining high governance standards and increasing the diversity of our Board and leadership. In

2019, our Board of Trustees elected an additional female director. In 2020, we appointed a female Chief Financial Officer. In 2021, our Board appointed a female Chief Executive Officer and President who also serves on our Board and also

promoted a female Chief Operating Officer. We will continue to evaluate the diversity of our executive leadership and Board in the future. 12

Seritage Growth Properties | Forward Looking Statements This document contains forward-looking

statements within the meaning of the federal securities laws. Forward-looking statements relate to expectations, beliefs, projections, future plans and strategies, anticipated events or trends and similar expressions concerning matters that

are not historical facts. In some cases, you can identify forward-looking statements by the use of forward-looking terminology such as “may,” “will,” “should,” “expects,” “intends,” “plans,” “anticipates,” “believes,” “estimates,” “predicts,”

or “potential” or the negative of these words and phrases or similar words or phrases that are predictions of or indicate future events or trends and that do not relate solely to historical matters. Forward-looking statements involve known

and unknown risks, uncertainties, assumptions and contingencies, many of which are beyond the company’s control, which may cause actual results to differ significantly from those expressed in any forward-looking statement. Factors that could

cause or contribute to such differences include, but are not limited to: our historical exposure to Sears Holdings and the effects of its previously announced bankruptcy filing; the litigation filed against us and other defendants in the

Sears Holdings adversarial proceeding pending in bankruptcy court; Holdco’s termination and other rights under its master lease with us; competition in the real estate and retail industries; risks relating to our recapture and redevelopment

activities; contingencies to the commencement of rent under leases; the terms of our indebtedness; restrictions with which we are required to comply in order to maintain REIT status and other legal requirements to which we are subject;

failure to achieve expected occupancy and/or rent levels within the projected time frame or at all; the impact of ongoing negative operating cash flow on our ability to fund operations and ongoing development; our ability to access or obtain

sufficient sources of financing to fund our liquidity needs; our relatively limited history as an operating company; and the impact of the COVID-19 pandemic on the business of our tenants and our business, income, cash flow, results of

operations, financial condition, liquidity, prospects, ability to service our debt obligations and our ability to pay dividends and other distributions to our shareholders. For additional discussion of these and other applicable risks,

assumptions and uncertainties, see the “Risk Factors” and forward-looking statement disclosure contained in our filings with the Securities and Exchange Commission, including the risk factors relating to Sears Holdings and Holdco. While we

believe that our forecasts and assumptions are reasonable, we caution that actual results may differ materially. We intend the forward-looking statements to speak only as of the time made and do not undertake to update or revise them as more

information becomes available, except as required by law. 13

500 Fifth Avenue | New York, NY 10110 212-355-7800 | www.seritage.com