Attached files

| file | filename |

|---|---|

| 8-K - 8-K - LAKE SHORE BANCORP, INC. | lsbk-20210519x8k.htm |

ANNUAL SHAREHOLDERS’ MEETING May 19, 2021 1 LAKE SHORE BANCORP, INC. 2 Safe Harbor Statement This release contains certain forward-looking statements within the meaning of the Private Securities Litigation Reform Act of 1995, that are based on current expectations, estimates and projections about the Company’s and the Bank’s industry, and management’s beliefs and assumptions. Words such as anticipates, expects, intends, plans, believes, estimates and variations of such words and expressions are intended to identify forward-looking statements. Such statements are not a guarantee of future performance and are subject to certain risks, uncertainties and assumptions that are difficult to forecast. Therefore, actual results may differ materially from those expressed or forecast in such forward-looking statements. The Company and Bank undertake no obligation to update publicly any forward-looking statements, whether as a result of new information or otherwise. There are risks, uncertainties and other factors that could cause the actual results of the Company to differ materially from the results expressed or implied by such forward-looking statements. Information on factors that could affect the Company’s business and results is discussed in the Company’s periodic reports filed with the Securities and Exchange Commission. Forward looking statements speak only as of the date they are made. The Company undertakes no obligation to publicly update or revise forward looking information, whether as a result of new, updated information, future events or otherwise.

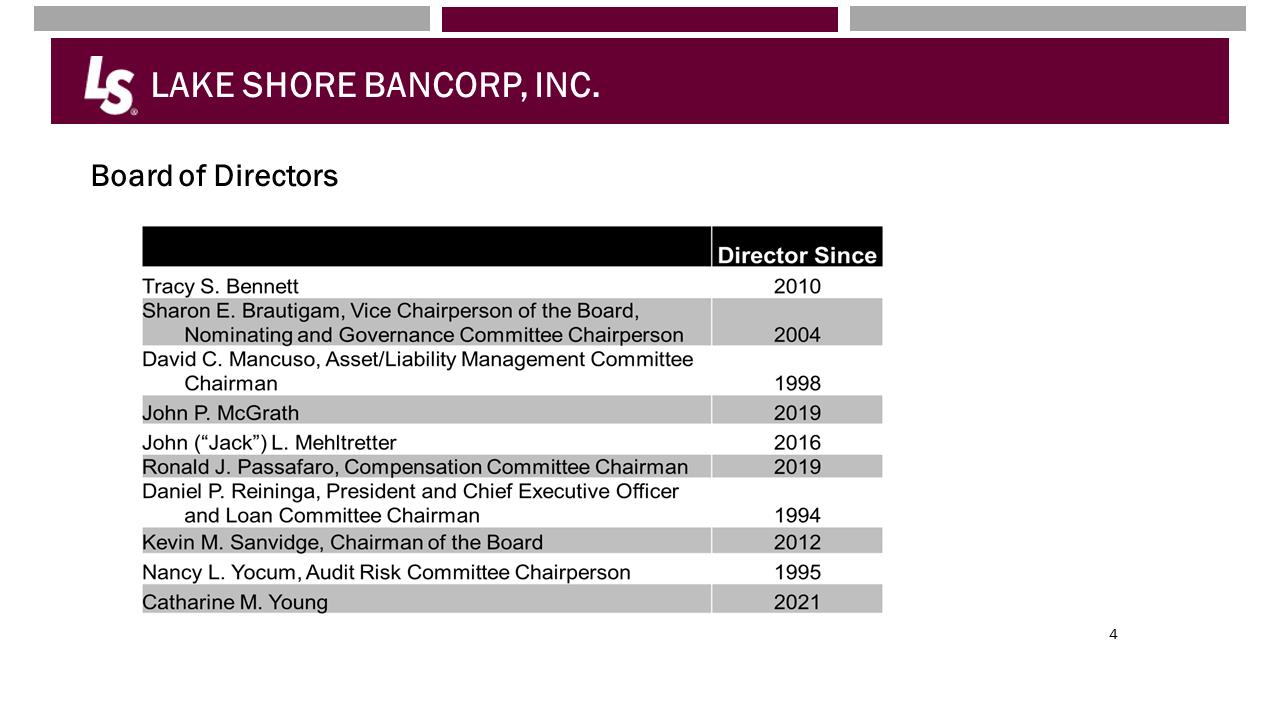

LAKE SHORE BANCORP, INC. 3 Agenda Call to Order – Kevin M. Sanvidge, Chairman Introduction of Officers, Directors and Director Nominees Secretary’s Report Presentation of Proposals Executive Management Report to Shareholders Vote Report Adjournment A person in a suit smiling Description automatically generated with medium confidenceLAKE SHORE BANCORP, INC. 4 Board of DirectorsDirector Since Tracy S. Bennett 2010 Sharon E. Brautigam, Vice Chairperson of the board, Nomination and Governance Committee Chairperson 2004 David C. Mancuso, Asset/Liability Management Committee Chairman 1998 John P. McGrath 2019 John (“Jack”) L. Mehltretter 2016 Ronald J. Passafaro, Compensation committee Chairman 2019 Daniel P. Reininga, President and Chief Executive Office and Loan Committee Chairman 1994 Kevin M. Sanvidge, Chairman of the Board Nancy L. Yocum, Audit Risk Committee Chairperson 1995 Catharine M. Young 2021

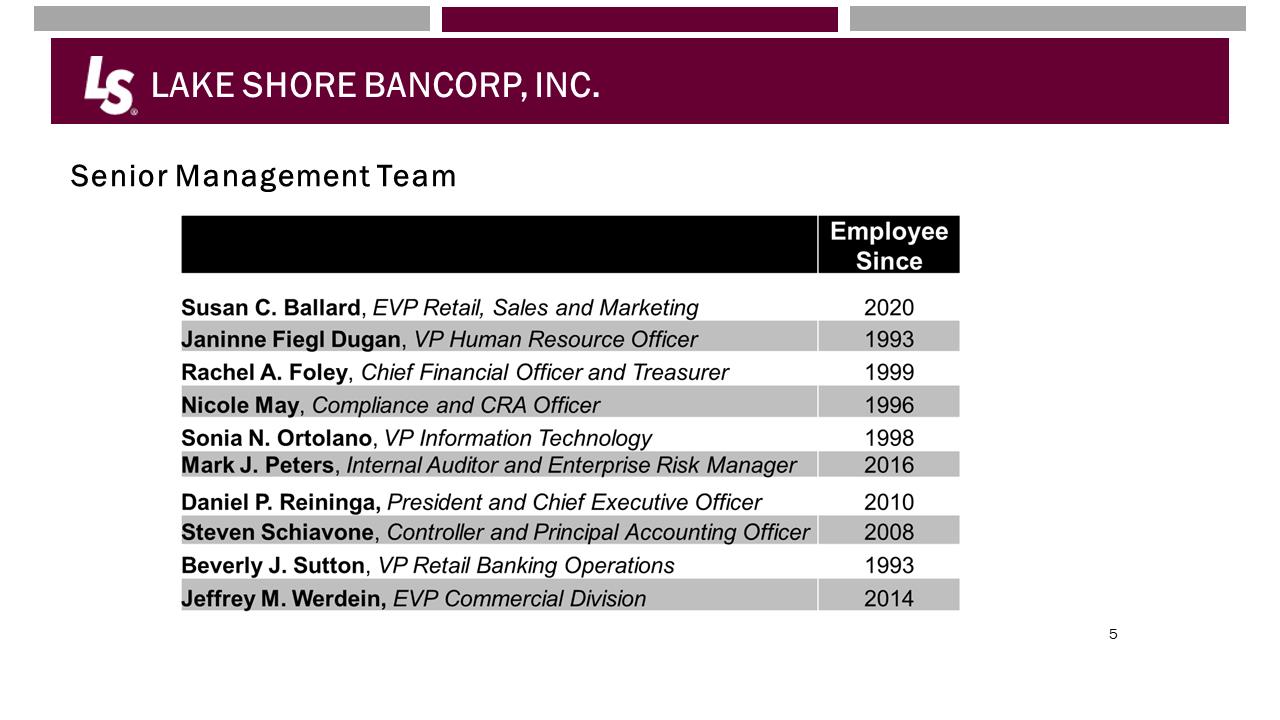

LAKE SHORE BANCORP, INC. Senior Management Team Employee since Susan C. Ballard, EVP Retail, Sales and Marketing 2020 Janinne Fiegl Dugan, VP Human Resource Officer 1993 Rachel Foley, Chief Financial Officer and Treasurer 1999 Nicole May, Compliance and CRA Officer 1996 Sonia N. Ortolano, VP Information Technology 1998 Mark J. Peters, Internal Auditor and Enterprise Risk Manager 2016 Daniel P. Reininga, President and Chief Executive Officer 2010 Steven Schiavone, Controller and Principal Accounting Officer 2008 Beverly J. Sutton, VP Retail Banking Operations 1993 Jeffrey M. Werdein, EVP Commercial Division 20145 LAKE SHORE BANCORP, INC. 6 Business of Annual Shareholders Meeting 1.Election of Directors: Elect three Class One directors to serve until the 2024 annual meeting and one Class Two director to serve until the 2022 annual meeting: Class One Directors John P. McGrath Ronald J. Passafaro Nancy L. Yocum Class Two Director Catharine M. Young

LAKE SHORE BANCORP, INC. 7 Business of Annual Shareholders Meeting, cont. 2.Say on Pay Proposal: A non-binding “say on pay” proposal to approve the compensation of our named executive officers. 3.Appointment of Independent Registered Public Accounting Firm: Ratify the appointment of Baker Tilly US, LLP as the Company’s independent registered public accounting firm for the year ending December 31, 2021. 4.Other Business: Any other business properly brought before the shareholders at the meeting, and any adjournment or postponement thereof. LAKE SHORE BANCORP, INC. 8

LAKE SHORE BANCORP, INC. 7 Business of Annual Shareholders Meeting, cont. 2.Say on Pay Proposal: A non-binding “say on pay” proposal to approve the compensation of our named executive officers. 3.Appointment of Independent Registered Public Accounting Firm: Ratify the appointment of Baker Tilly US, LLP as the Company’s independent registered public accounting firm for the year ending December 31, 2021. 4.Other Business: Any other business properly brought before the shareholders at the meeting, and any adjournment or postponement thereof. LAKE SHORE BANCORP, INC. 8

Executive Management Presentation Daniel P. Reininga, President and Chief Executive Officer A person in a suit and tie

9LAKE SHORE BANCORP, INC. Navigating to Calmer Waters Community banks rose to the top by providing stellar customer service Quick pivot to meet customers’ changing needs throughout unprecedented crisis Previous strategic focus on “clicks vs bricks” – allowed us to provide safe and effective banking services and tools while prioritizing health and safety for all Efficient and timely access to government stimulus funds using existing technology and ATM network Proactively managed exposure Reduced in-person access to branch network – but continued with full-service options via drive thru lanes and appointment only access to branch lobbies Moved 58 support staff personnel to remote work the first week of the pandemic Social distancing, enhanced cleaning and PPE - installed plexiglass barriers in all branch locations, enhanced cleaning services, provided face masks and hand sanitizing stations for customer use 9 LAKE SHORE BANCORP, INC. Navigating to Calmer Waters Paycheck Protection Program (“PPP”) Loans Quickly and effectively implemented a program to originate PPP loans First Draw - 2020 - Originated $26.9 million, or 252 loans Second Draw - 1st Quarter 2021 - originated $9.7 million, or 29 loans Small businesses unable to secure PPP funds from large banks were able to turn to community banks 10

9LAKE SHORE BANCORP, INC. Navigating to Calmer Waters Community banks rose to the top by providing stellar customer service Quick pivot to meet customers’ changing needs throughout unprecedented crisis Previous strategic focus on “clicks vs bricks” – allowed us to provide safe and effective banking services and tools while prioritizing health and safety for all Efficient and timely access to government stimulus funds using existing technology and ATM network Proactively managed exposure Reduced in-person access to branch network – but continued with full-service options via drive thru lanes and appointment only access to branch lobbies Moved 58 support staff personnel to remote work the first week of the pandemic Social distancing, enhanced cleaning and PPE - installed plexiglass barriers in all branch locations, enhanced cleaning services, provided face masks and hand sanitizing stations for customer use 9 LAKE SHORE BANCORP, INC. Navigating to Calmer Waters Paycheck Protection Program (“PPP”) Loans Quickly and effectively implemented a program to originate PPP loans First Draw - 2020 - Originated $26.9 million, or 252 loans Second Draw - 1st Quarter 2021 - originated $9.7 million, or 29 loans Small businesses unable to secure PPP funds from large banks were able to turn to community banks 10

LAKE SHORE BANCORP, INC. Navigating to Calmer Waters COVID-19 and Credit Risk Loan Modification Program Implemented 2nd quarter 2020 Deferral of principal and interest for 90 days, and up to 180 days or longer in some instances in accordance with regulatory guidelines At maximum, 219 loans, representing $103.1 million or 21.1% of Bank’s loan portfolio. As of March 31, 2021, 5 loans, representing 3 borrowers and $15.5 million or 2.9% of loan portfolio 11 LAKE SHORE BANCORP, INC. Navigating to Calmer Waters Continued support of our communities PPE contributions to local hospitals Food bank donations Donations to COVID-19 focused Community Funds to meet pandemic needs in communities we serve Wellness checks Participation in FHLBNY Small Business Recovery Grant Program – distributed $200,000 in grants to small business customers Superior Team and Leadership High performing team, record results - produced record results in 2020 while being challenged by the daily impact of the pandemic, which was catastrophic for many and challenging for all 12

LAKE SHORE BANCORP, INC. Navigating to Calmer Waters COVID-19 and Credit Risk Loan Modification Program Implemented 2nd quarter 2020 Deferral of principal and interest for 90 days, and up to 180 days or longer in some instances in accordance with regulatory guidelines At maximum, 219 loans, representing $103.1 million or 21.1% of Bank’s loan portfolio. As of March 31, 2021, 5 loans, representing 3 borrowers and $15.5 million or 2.9% of loan portfolio 11 LAKE SHORE BANCORP, INC. Navigating to Calmer Waters Continued support of our communities PPE contributions to local hospitals Food bank donations Donations to COVID-19 focused Community Funds to meet pandemic needs in communities we serve Wellness checks Participation in FHLBNY Small Business Recovery Grant Program – distributed $200,000 in grants to small business customers Superior Team and Leadership High performing team, record results - produced record results in 2020 while being challenged by the daily impact of the pandemic, which was catastrophic for many and challenging for all 12

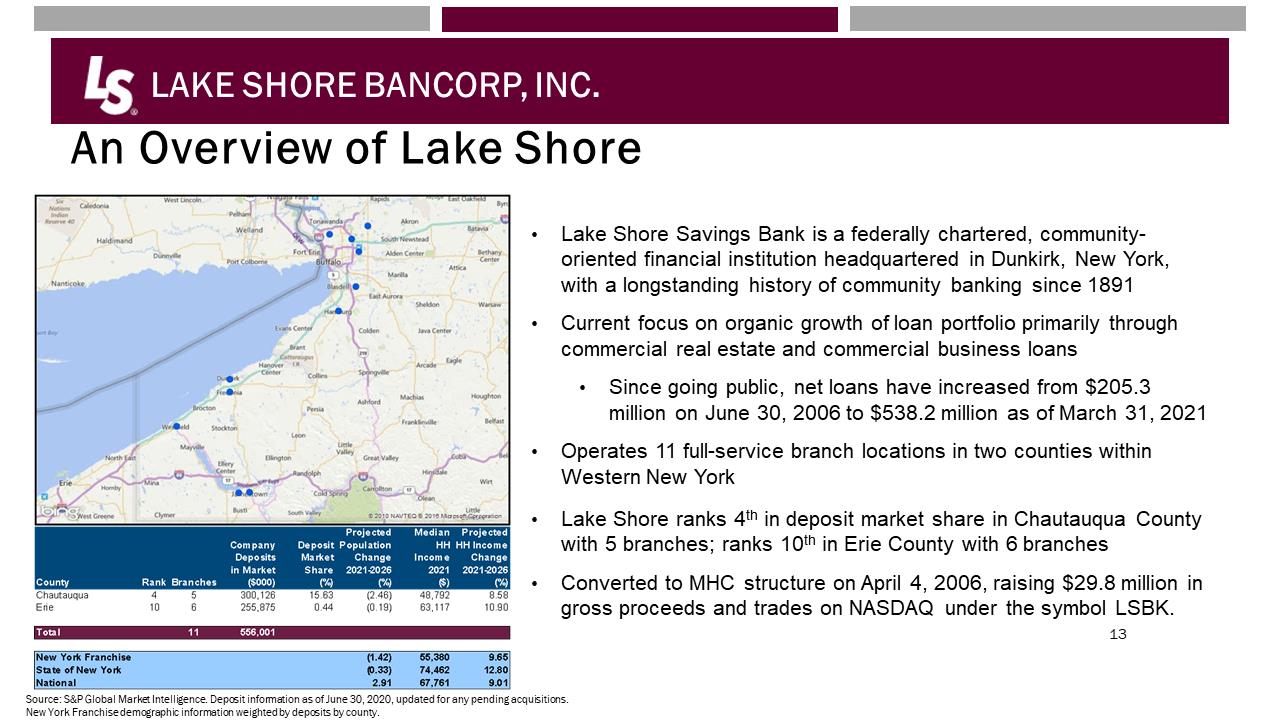

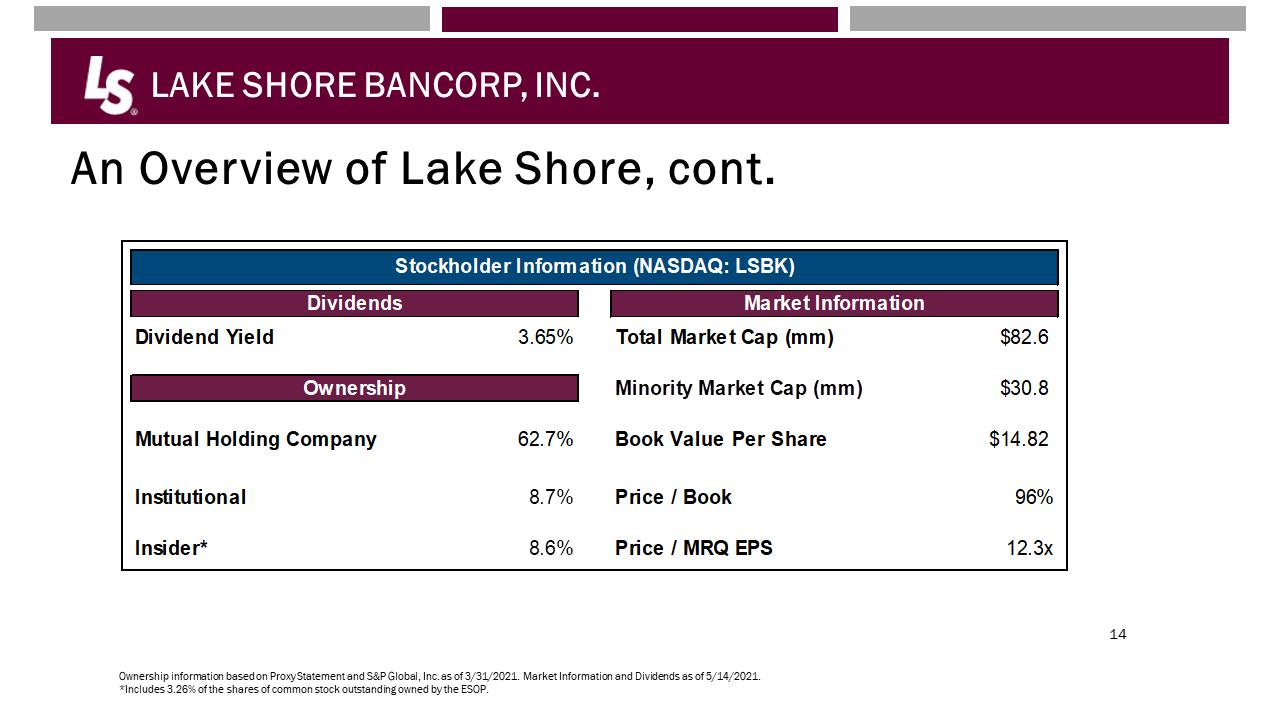

LAKE SHORE BANCORP, INC. An Overview of Lake Shore 13 Lake Shore Savings Bank is a federally chartered, community-oriented financial institution headquartered in Dunkirk, New York, with a longstanding history of community banking since 1891 Current focus on organic growth of loan portfolio primarily through commercial real estate and commercial business loans Since going public, net loans have increased from $205.3 million on June 30, 2006 to $538.2 million as of March 31, 2021 Operates 11 full-service branch locations in two counties within Western New York Lake Shore ranks 4th in deposit market share in Chautauqua County with 5 branches; ranks 10th in Erie County with 6 branches Converted to MHC structure on April 4, 2006, raising $29.8 million in gross proceeds and trades on NASDAQ under the symbol LSBK.ad trades on NASDAQ under the symbol LSBK County Rank Branches Company Deposits in Market ($000) Deposit Market Share (%) Projected Population Change 2021-2026 Median HH Income 2021 ($) Projected HH Income Change 2021-2026 (%) Chautauqua 4 5 300,126 15.63 (2.48) 48,792 8.58 Erie 10 6 255,875 0.44 (0.19) 63,117 10.90 New York Franchise (1.42) 55,380 9.65 State of New York (0.33) 74,462 12.8 National 2.91 67,761 9.01Source: S&P Global Market Intelligence. Deposit information as of June 30, 2020, updated for any pending acquisitions. New York Franchise demographic information weighted by deposits by county. LAKE SHORE BANCORP, INC. An Overview of Lake Shore, cont. Stockholder Information (NASDAQ: LSBK) Dividends Dividend Yield 3.65% Ownership Mutual Holding Company 62.7% Institutional 8.7% Insider* 8.6% Market Information Total Market Cap (mm) $82.6 Minority Market Cap (mm) $30.8 Book Value Per Share $14.82 Price/Book 96% Price/MRQ EPS 12.3 14

LAKE SHORE BANCORP, INC. An Overview of Lake Shore 13 Lake Shore Savings Bank is a federally chartered, community-oriented financial institution headquartered in Dunkirk, New York, with a longstanding history of community banking since 1891 Current focus on organic growth of loan portfolio primarily through commercial real estate and commercial business loans Since going public, net loans have increased from $205.3 million on June 30, 2006 to $538.2 million as of March 31, 2021 Operates 11 full-service branch locations in two counties within Western New York Lake Shore ranks 4th in deposit market share in Chautauqua County with 5 branches; ranks 10th in Erie County with 6 branches Converted to MHC structure on April 4, 2006, raising $29.8 million in gross proceeds and trades on NASDAQ under the symbol LSBK.ad trades on NASDAQ under the symbol LSBK County Rank Branches Company Deposits in Market ($000) Deposit Market Share (%) Projected Population Change 2021-2026 Median HH Income 2021 ($) Projected HH Income Change 2021-2026 (%) Chautauqua 4 5 300,126 15.63 (2.48) 48,792 8.58 Erie 10 6 255,875 0.44 (0.19) 63,117 10.90 New York Franchise (1.42) 55,380 9.65 State of New York (0.33) 74,462 12.8 National 2.91 67,761 9.01Source: S&P Global Market Intelligence. Deposit information as of June 30, 2020, updated for any pending acquisitions. New York Franchise demographic information weighted by deposits by county. LAKE SHORE BANCORP, INC. An Overview of Lake Shore, cont. Stockholder Information (NASDAQ: LSBK) Dividends Dividend Yield 3.65% Ownership Mutual Holding Company 62.7% Institutional 8.7% Insider* 8.6% Market Information Total Market Cap (mm) $82.6 Minority Market Cap (mm) $30.8 Book Value Per Share $14.82 Price/Book 96% Price/MRQ EPS 12.3 14

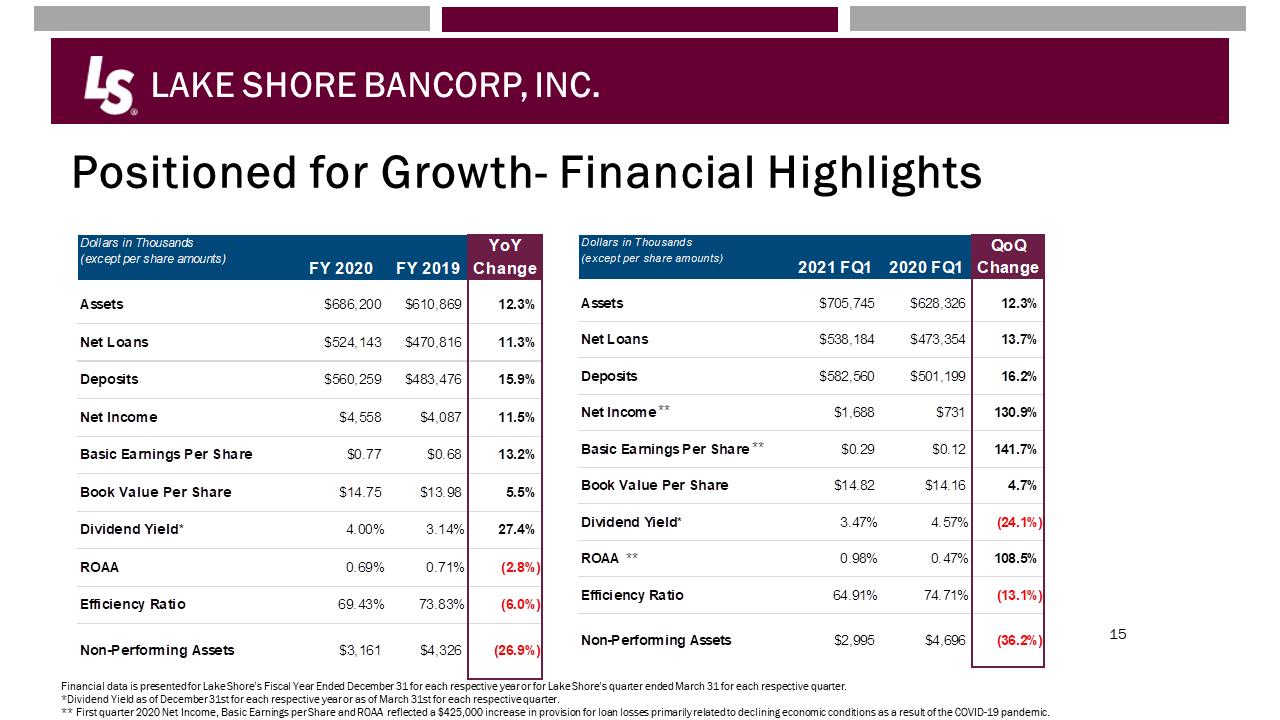

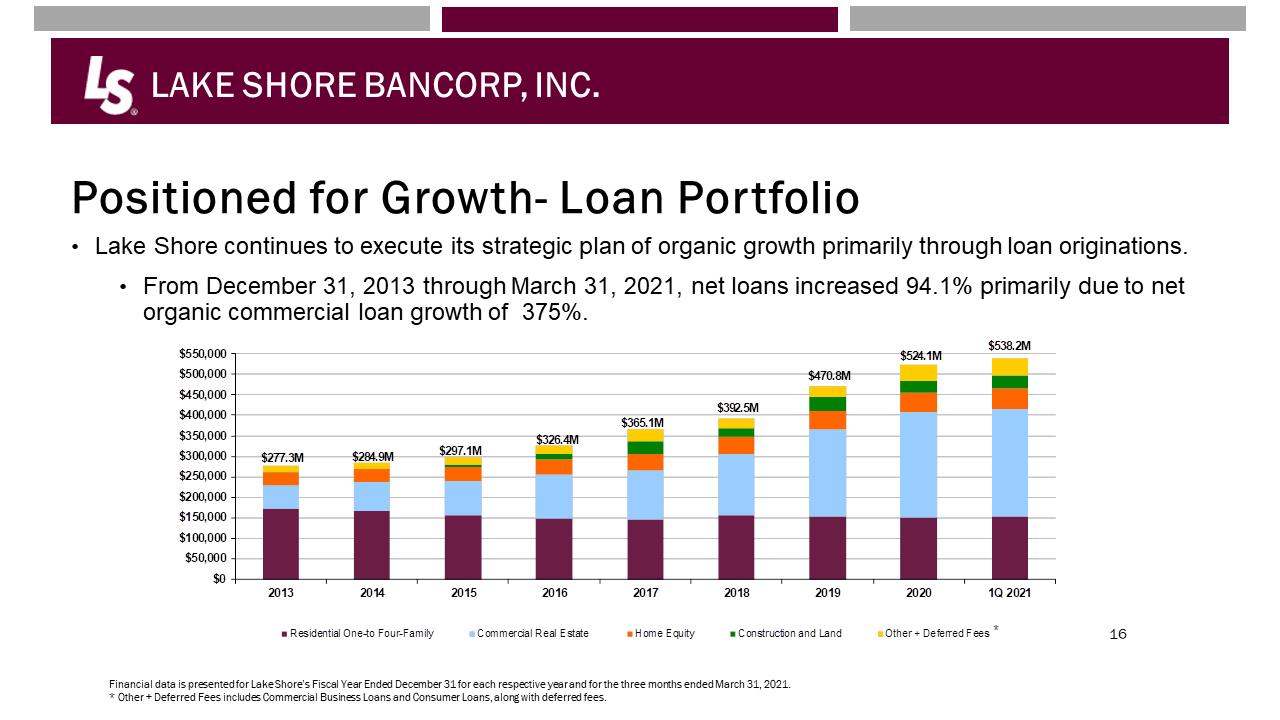

LAKE SHORE BANCORP, INC. Positioned for Growth- Financial Highlights Dollars in Thousands(except per share amounts)FY 2020FY 2019YoY ChangeAssets$686,200$610,86912.3%Net Loans$524,143$470,81611.3%Deposits$560,259$483,47615.9%Net Income$4,558$4,08711.5%Basic Earnings Per Share $0.77$0.6813.2%Book Value Per Share$14.75$13.985.5%Dividend Yield*4.00%3.14%27.4%ROAA0.69%0.71%(2.8%)Efficiency Ratio69.43%73.83%(6.0%)Non-Performing Assets$3,161$4,326(26.9%)15 Dollars in Thousands(except per share amounts)2021 FQ12020 FQ1QoQ ChangeAssets$705,745$628,32612.3%Net Loans$538,184$473,35413.7%Deposits$582,560$501,19916.2%Net Income$1,688$731130.9%Basic Earnings Per Share $0.29$0.12141.7%Book Value Per Share$14.82$14.164.7%Dividend Yield*3.47%4.57%(24.1%)ROAA0.98%0.47%108.5%Efficiency Ratio64.91%74.71%(13.1%)Non-Performing Assets$2,995$4,696(36.2%)Financial data is presented for Lake Shore’s Fiscal Year Ended December 31 for each respective year or for Lake Shore’s quarter ended March 31 for each respective quarter. *Dividend Yield as of December 31st for each respective year or as of March 31st for each respective quarter. ** First quarter 2020 Net Income, Basic Earnings per Share and ROAA reflected a $425,000 increase in provision for loan losses primarily related to declining economic conditions as a result of the COVID-19 pandemic. ** ** **15LAKE SHORE BANCORP, INC. Positioned for Growth- Loan Portfolio Lake Shore continues to execute its strategic plan of organic growth primarily through loan originations. From December 31, 2013 through March 31, 2021, net loans increased 94.1% primarily due to net organic commercial loan growth of 375%. 16 $277.3M$284.9M$297.1M$326.4M$365.1M$392.5M$470.8M$524.1M$538.2M$0$50,000$100,000$150,000$200,000$250,000$300,000$350,000$400,000$450,000$500,000$550,000201320142015201620172018201920201Q 2021Residential One-to Four-FamilyCommercial Real EstateHome EquityConstruction and LandOther + Deferred FeesFinancial data is presented for Lake Shore’s Fiscal Year Ended December 31 for each respective year and for the three months ended March 31, 2021. * Other + Deferred Fees includes Commercial Business Loans and Consumer Loans, along with deferred fees.

LAKE SHORE BANCORP, INC. Positioned for Growth- Financial Highlights Dollars in Thousands(except per share amounts)FY 2020FY 2019YoY ChangeAssets$686,200$610,86912.3%Net Loans$524,143$470,81611.3%Deposits$560,259$483,47615.9%Net Income$4,558$4,08711.5%Basic Earnings Per Share $0.77$0.6813.2%Book Value Per Share$14.75$13.985.5%Dividend Yield*4.00%3.14%27.4%ROAA0.69%0.71%(2.8%)Efficiency Ratio69.43%73.83%(6.0%)Non-Performing Assets$3,161$4,326(26.9%)15 Dollars in Thousands(except per share amounts)2021 FQ12020 FQ1QoQ ChangeAssets$705,745$628,32612.3%Net Loans$538,184$473,35413.7%Deposits$582,560$501,19916.2%Net Income$1,688$731130.9%Basic Earnings Per Share $0.29$0.12141.7%Book Value Per Share$14.82$14.164.7%Dividend Yield*3.47%4.57%(24.1%)ROAA0.98%0.47%108.5%Efficiency Ratio64.91%74.71%(13.1%)Non-Performing Assets$2,995$4,696(36.2%)Financial data is presented for Lake Shore’s Fiscal Year Ended December 31 for each respective year or for Lake Shore’s quarter ended March 31 for each respective quarter. *Dividend Yield as of December 31st for each respective year or as of March 31st for each respective quarter. ** First quarter 2020 Net Income, Basic Earnings per Share and ROAA reflected a $425,000 increase in provision for loan losses primarily related to declining economic conditions as a result of the COVID-19 pandemic. ** ** **15LAKE SHORE BANCORP, INC. Positioned for Growth- Loan Portfolio Lake Shore continues to execute its strategic plan of organic growth primarily through loan originations. From December 31, 2013 through March 31, 2021, net loans increased 94.1% primarily due to net organic commercial loan growth of 375%. 16 $277.3M$284.9M$297.1M$326.4M$365.1M$392.5M$470.8M$524.1M$538.2M$0$50,000$100,000$150,000$200,000$250,000$300,000$350,000$400,000$450,000$500,000$550,000201320142015201620172018201920201Q 2021Residential One-to Four-FamilyCommercial Real EstateHome EquityConstruction and LandOther + Deferred FeesFinancial data is presented for Lake Shore’s Fiscal Year Ended December 31 for each respective year and for the three months ended March 31, 2021. * Other + Deferred Fees includes Commercial Business Loans and Consumer Loans, along with deferred fees.

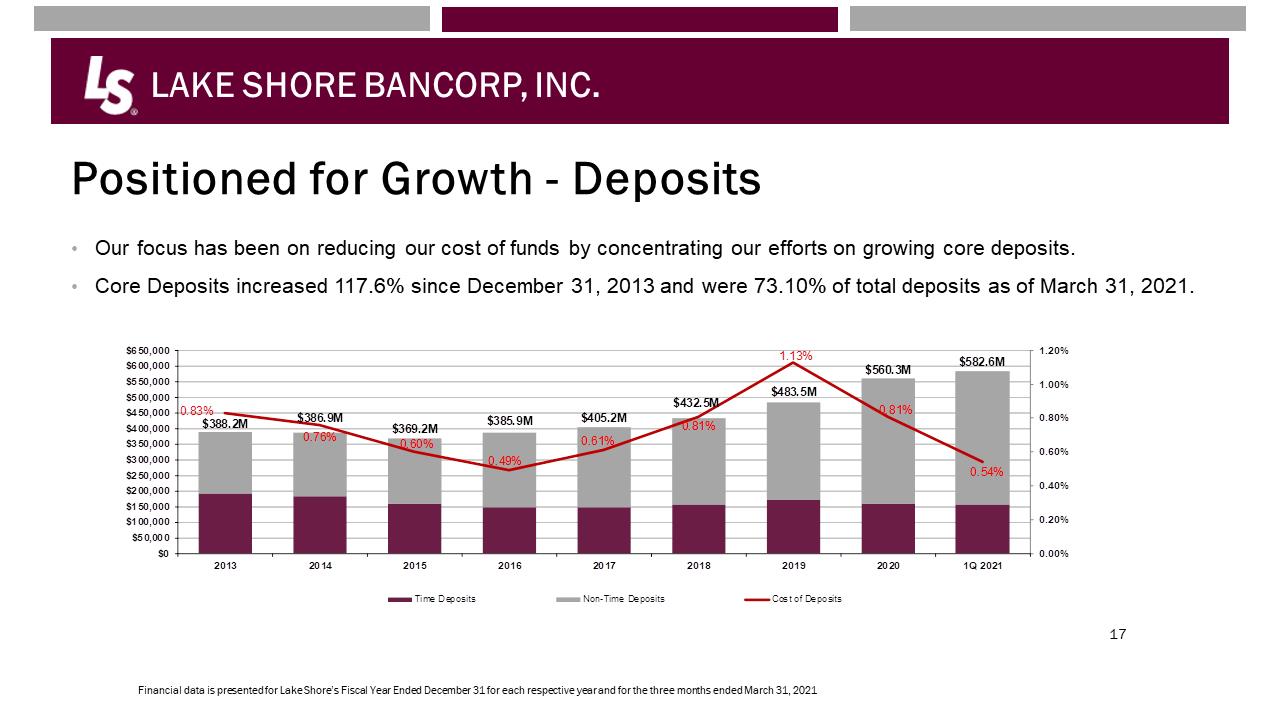

LAKE SHORE BANCORP, INC. Positioned for Growth - Deposits Our focus has been on reducing our cost of funds by concentrating our efforts on growing core deposits. Core Deposits increased 117.6% since December 31, 2013 and were 73.10% of total deposits as of March 31, 2021. 17 Financial data is presented for Lake Shore’s Fiscal Year Ended December 31 for each respective year and for the three months ended March 31, 2021 $388.2M$386.9M$369.2M$385.9M$405.2M$432.5M$483.5M$560.3M$582.6M0.83%0.76%0.60%0.49%0.61%0.81%1.13%0.81%0.54%0.00%0.20%0.40%0.60%0.80%1.00%1.20%$0$50,000$100,000$150,000$200,000$250,000$300,000$350,000$400,000$450,000$500,000$550,000$600,000$650,000201320142015201620172018201920201Q 2021Time DepositsNon-Time DepositsCost of DepositsLAKE SHORE BANCORP, INC. Generations, Economic Development and Community Service Small Business Cortese Construction Family owned small business – loan for new headquarters Economic Development Gold Wynn Commercial real estate loan, facilitate economic development and housing access in City of Buffalo Community Support Brooks Hospital Well established local medical facility and long-time customer, PPP loan – protect employee payroll funds during pandemic to stabilize community access to critical health services 18

LAKE SHORE BANCORP, INC. Positioned for Growth - Deposits Our focus has been on reducing our cost of funds by concentrating our efforts on growing core deposits. Core Deposits increased 117.6% since December 31, 2013 and were 73.10% of total deposits as of March 31, 2021. 17 Financial data is presented for Lake Shore’s Fiscal Year Ended December 31 for each respective year and for the three months ended March 31, 2021 $388.2M$386.9M$369.2M$385.9M$405.2M$432.5M$483.5M$560.3M$582.6M0.83%0.76%0.60%0.49%0.61%0.81%1.13%0.81%0.54%0.00%0.20%0.40%0.60%0.80%1.00%1.20%$0$50,000$100,000$150,000$200,000$250,000$300,000$350,000$400,000$450,000$500,000$550,000$600,000$650,000201320142015201620172018201920201Q 2021Time DepositsNon-Time DepositsCost of DepositsLAKE SHORE BANCORP, INC. Generations, Economic Development and Community Service Small Business Cortese Construction Family owned small business – loan for new headquarters Economic Development Gold Wynn Commercial real estate loan, facilitate economic development and housing access in City of Buffalo Community Support Brooks Hospital Well established local medical facility and long-time customer, PPP loan – protect employee payroll funds during pandemic to stabilize community access to critical health services 18

LAKE SHORE BANCORP, INC. Environmental, Social and Governance (“ESG”) Three factors used to evaluate corporate behavior, and to improve long term sustainability Integrated with Bank’s Mission Statement Environmental Factor Strive towards Electronic Processing, Paperless Research and implement more efficient payment technologies Remote Meetings 19 LAKE SHORE BANCORP, INC. Environmental, Social and Governance (“ESG”) Social Factor Focus on Equity Affordable mortgage products 130 years of residential lending to support community growth and sustainability Serve diverse community groups and organizations Meet needs of underbanked Engaged – supporting community via donation of services and dollars to non-profit organizations Positive, healthy and successful workplace, focus on diversity, inclusion and mutual respect Organization more than 80% female; 30% of Board members female 20

LAKE SHORE BANCORP, INC. Environmental, Social and Governance (“ESG”) Three factors used to evaluate corporate behavior, and to improve long term sustainability Integrated with Bank’s Mission Statement Environmental Factor Strive towards Electronic Processing, Paperless Research and implement more efficient payment technologies Remote Meetings 19 LAKE SHORE BANCORP, INC. Environmental, Social and Governance (“ESG”) Social Factor Focus on Equity Affordable mortgage products 130 years of residential lending to support community growth and sustainability Serve diverse community groups and organizations Meet needs of underbanked Engaged – supporting community via donation of services and dollars to non-profit organizations Positive, healthy and successful workplace, focus on diversity, inclusion and mutual respect Organization more than 80% female; 30% of Board members female 20

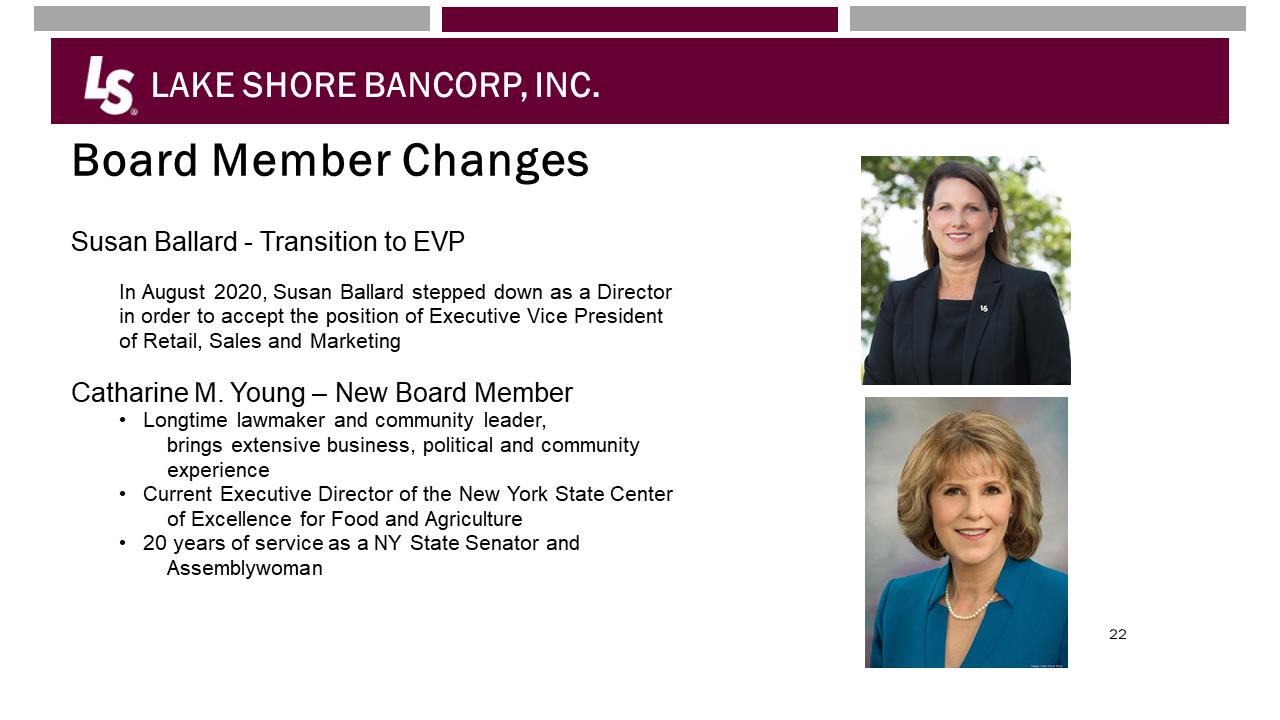

LAKE SHORE BANCORP, INC. Environmental, Social and Governance (“ESG”) Corporate Governance Ethical leadership and sound decision making Corporate Mission –four pronged – customers, employee, community and shareholder focus Focus on high performing results that drive shareholder value 21 LAKE SHORE BANCORP, INC. Board Member Changes Susan Ballard - Transition to EVP In August 2020, Susan Ballard stepped down as a Director in order to accept the position of Executive Vice President of Retail, Sales and Marketing Catharine M. Young – New Board Member Longtime lawmaker and community leader, brings extensive business, political and community experience Current Executive Director of the New York State Center of Excellence for Food and Agriculture 20 years of service as a NY State Senator and Assemblywoman 22

LAKE SHORE BANCORP, INC. Environmental, Social and Governance (“ESG”) Corporate Governance Ethical leadership and sound decision making Corporate Mission –four pronged – customers, employee, community and shareholder focus Focus on high performing results that drive shareholder value 21 LAKE SHORE BANCORP, INC. Board Member Changes Susan Ballard - Transition to EVP In August 2020, Susan Ballard stepped down as a Director in order to accept the position of Executive Vice President of Retail, Sales and Marketing Catharine M. Young – New Board Member Longtime lawmaker and community leader, brings extensive business, political and community experience Current Executive Director of the New York State Center of Excellence for Food and Agriculture 20 years of service as a NY State Senator and Assemblywoman 22

LAKE SHORE BANCORP, INC. Board Member Changes Retirement of David C. Mancuso, Director and former President and CEO In May 2021 Mr. Mancuso will retire, after more than 55 years of service to the bank. 23 LAKE SHORE BANCORP, INC. Future Focus Commercial Loan Growth – focus on Commercial Real Estate Increase market penetration in Erie County Capture the Millennial Customer High Quality Customer Service, Technological Enhancements Evolve as fintech evolves – create value for shareholders 24

LAKE SHORE BANCORP, INC. Board Member Changes Retirement of David C. Mancuso, Director and former President and CEO In May 2021 Mr. Mancuso will retire, after more than 55 years of service to the bank. 23 LAKE SHORE BANCORP, INC. Future Focus Commercial Loan Growth – focus on Commercial Real Estate Increase market penetration in Erie County Capture the Millennial Customer High Quality Customer Service, Technological Enhancements Evolve as fintech evolves – create value for shareholders 24

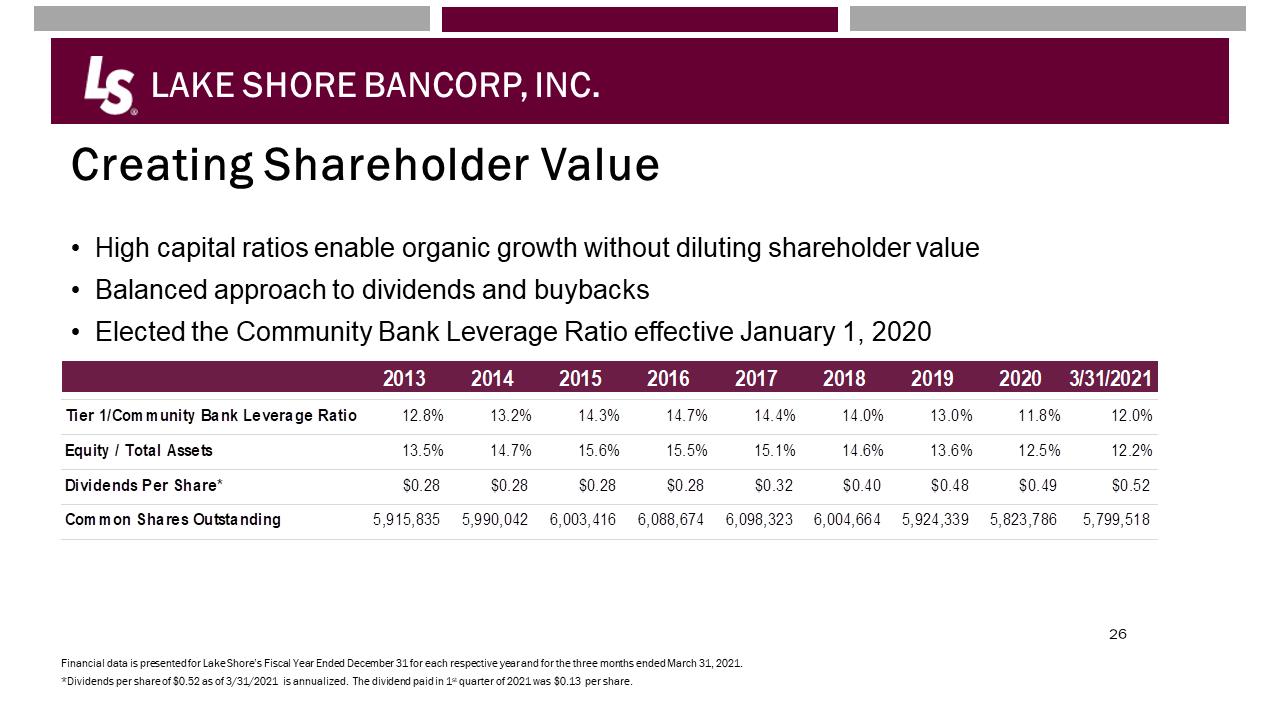

LAKE SHORE BANCORP, INC. Future Focus Core System Conversion New and innovative processing platform that will allow us to better serve our customers Continuity of current banking features and services Deliver a better banking experience Advanced Digital and Mobile Banking Improved Security Features for Debit Card and Account Transactions New Bank to Bank Funds Transfer Features Direct Integration into Accounting Software (Quicken/Quickbooks) Efficiencies in back-office processing 25 LAKE SHORE BANCORP, INC. Creating Shareholder Value High capital ratios enable organic growth without diluting shareholder value Balanced approach to dividends and buybacks Elected the Community Bank Leverage Ratio effective January 1, 2020 26 201320142015201620172018201920203/31/2021Tier 1/Community Bank Leverage Ratio12.8%13.2%14.3%14.7%14.4%14.0%13.0%11.8%12.0%Equity / Total Assets13.5%14.7%15.6%15.5%15.1%14.6%13.6%12.5%12.2%Dividends Per Share*$0.28$0.28$0.28$0.28$0.32$0.40$0.48$0.49$0.52Common Shares Outstanding5,915,8355,990,0426,003,4166,088,6746,098,3236,004,6645,924,3395,823,7865,799,518 Financial data is presented for Lake Shore’s Fiscal Year Ended December 31 for each respective year and for the three months ended March 31, 2021. *Dividends per share of $0.52 as of 3/31/2021 is annualized. The dividend paid in 1st quarter of 2021 was $0.13 per share.

LAKE SHORE BANCORP, INC. Future Focus Core System Conversion New and innovative processing platform that will allow us to better serve our customers Continuity of current banking features and services Deliver a better banking experience Advanced Digital and Mobile Banking Improved Security Features for Debit Card and Account Transactions New Bank to Bank Funds Transfer Features Direct Integration into Accounting Software (Quicken/Quickbooks) Efficiencies in back-office processing 25 LAKE SHORE BANCORP, INC. Creating Shareholder Value High capital ratios enable organic growth without diluting shareholder value Balanced approach to dividends and buybacks Elected the Community Bank Leverage Ratio effective January 1, 2020 26 201320142015201620172018201920203/31/2021Tier 1/Community Bank Leverage Ratio12.8%13.2%14.3%14.7%14.4%14.0%13.0%11.8%12.0%Equity / Total Assets13.5%14.7%15.6%15.5%15.1%14.6%13.6%12.5%12.2%Dividends Per Share*$0.28$0.28$0.28$0.28$0.32$0.40$0.48$0.49$0.52Common Shares Outstanding5,915,8355,990,0426,003,4166,088,6746,098,3236,004,6645,924,3395,823,7865,799,518 Financial data is presented for Lake Shore’s Fiscal Year Ended December 31 for each respective year and for the three months ended March 31, 2021. *Dividends per share of $0.52 as of 3/31/2021 is annualized. The dividend paid in 1st quarter of 2021 was $0.13 per share.

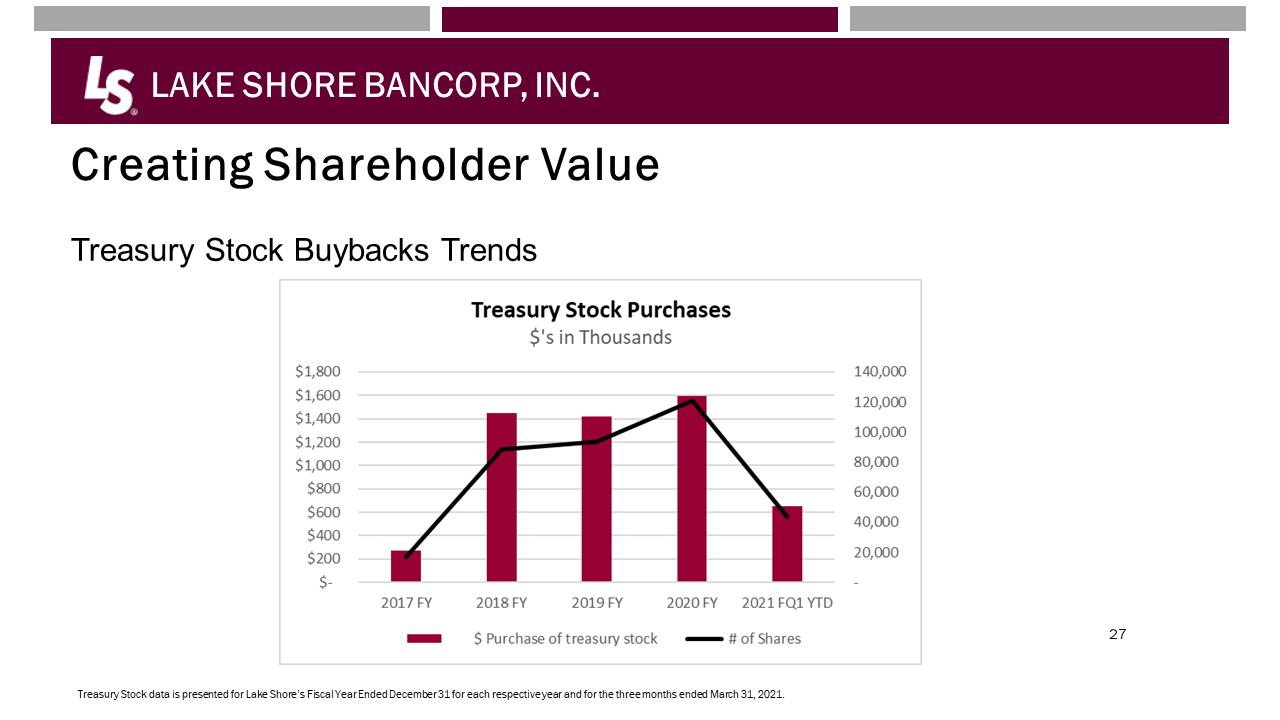

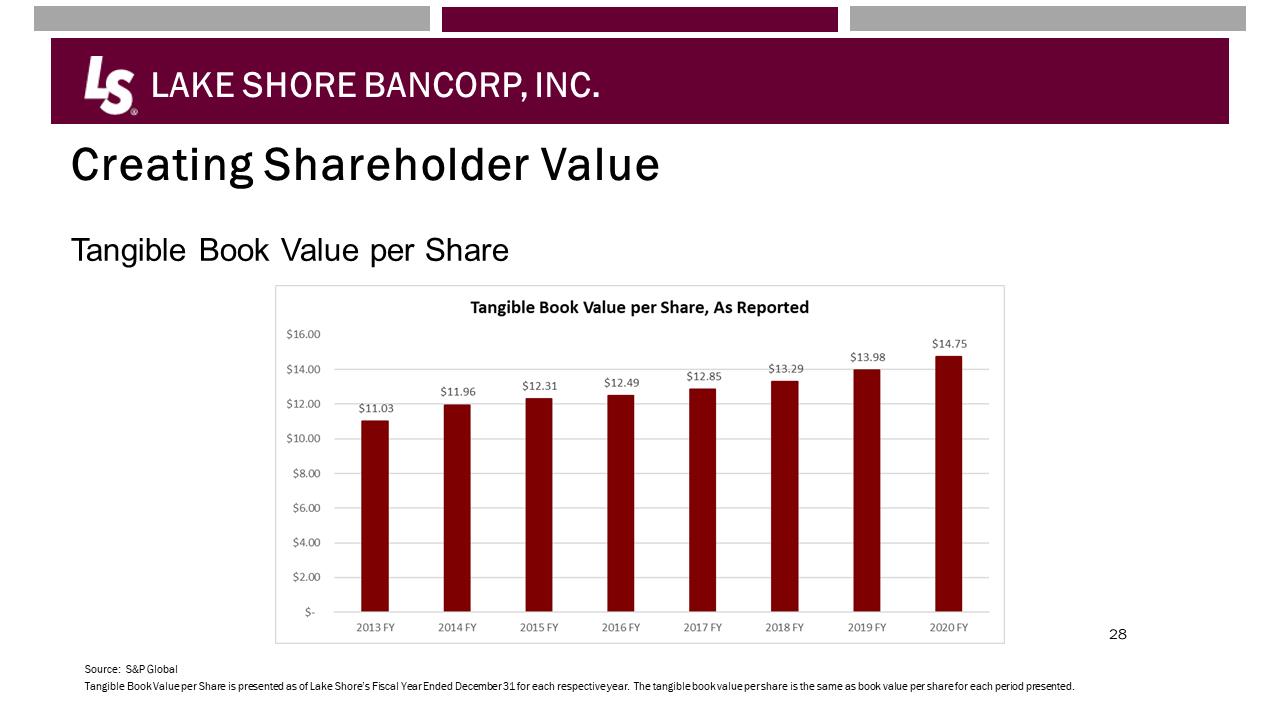

LAKE SHORE BANCORP, INC. Creating Shareholder Value Treasury Stock Buybacks Trends Treasury Stock Purchases $’s in Thousands 2017 FY 2018 FY 2019 FY 2020 FY 2021 FQ1 YTD $ Purchase of Treasury stock # of Shares 27 $1,800 $1,600 $1,400 $1,200 $1,000 $800 $600 $400 $200 $- 140,000 120,000 100,000 80,000 60,000 40,000 20,000Treasury Stock data is presented for Lake Shore’s Fiscal Year Ended December 31 for each respective year and for the three months ended March 31, 2021. LAKE SHORE BANCORP, INC. Creating Shareholder Value Tangible Book Value per Share Tangible Book Value per share, As Reported 28 Source: S&P Global Tangible Book Value per Share is presented as of Lake Shore’s Fiscal Year Ended December 31 for each respective year. The tangible book value per share is the same as book value per share for each period presented. $16.00 414.00 $12.00 $10.00 $8.00 $6.00 $4.00 $2.00 $11.036 $11.96 $12.31 $12.49 $12.85 $13.29 $13.98 $14.75 2013 FY 2014 FY 2015 FY 2016 FY 2017 FY 2018 FY 2019 FY 2020

LAKE SHORE BANCORP, INC. Creating Shareholder Value Treasury Stock Buybacks Trends Treasury Stock Purchases $’s in Thousands 2017 FY 2018 FY 2019 FY 2020 FY 2021 FQ1 YTD $ Purchase of Treasury stock # of Shares 27 $1,800 $1,600 $1,400 $1,200 $1,000 $800 $600 $400 $200 $- 140,000 120,000 100,000 80,000 60,000 40,000 20,000Treasury Stock data is presented for Lake Shore’s Fiscal Year Ended December 31 for each respective year and for the three months ended March 31, 2021. LAKE SHORE BANCORP, INC. Creating Shareholder Value Tangible Book Value per Share Tangible Book Value per share, As Reported 28 Source: S&P Global Tangible Book Value per Share is presented as of Lake Shore’s Fiscal Year Ended December 31 for each respective year. The tangible book value per share is the same as book value per share for each period presented. $16.00 414.00 $12.00 $10.00 $8.00 $6.00 $4.00 $2.00 $11.036 $11.96 $12.31 $12.49 $12.85 $13.29 $13.98 $14.75 2013 FY 2014 FY 2015 FY 2016 FY 2017 FY 2018 FY 2019 FY 2020

LAKE SHORE BANCORP, INC. Summary As we enter our 130th year in business, we continue to be a local bank that cares about its customers and communities. At Lake Shore Savings, that has always meant “Putting People First”. We will continue to put our customers, communities and shareholders “First”, as we adopt new technology, products and services to meet the future needs of our customers 29 LAKE SHORE BANCORP, INC. 30 Financial Highlights Rachel A. Foley, Chief Financial Officer and Treasurer A picture containing outdoor, tree, person, skyDescription automatically generated

LAKE SHORE BANCORP, INC. Summary As we enter our 130th year in business, we continue to be a local bank that cares about its customers and communities. At Lake Shore Savings, that has always meant “Putting People First”. We will continue to put our customers, communities and shareholders “First”, as we adopt new technology, products and services to meet the future needs of our customers 29 LAKE SHORE BANCORP, INC. 30 Financial Highlights Rachel A. Foley, Chief Financial Officer and Treasurer A picture containing outdoor, tree, person, skyDescription automatically generated

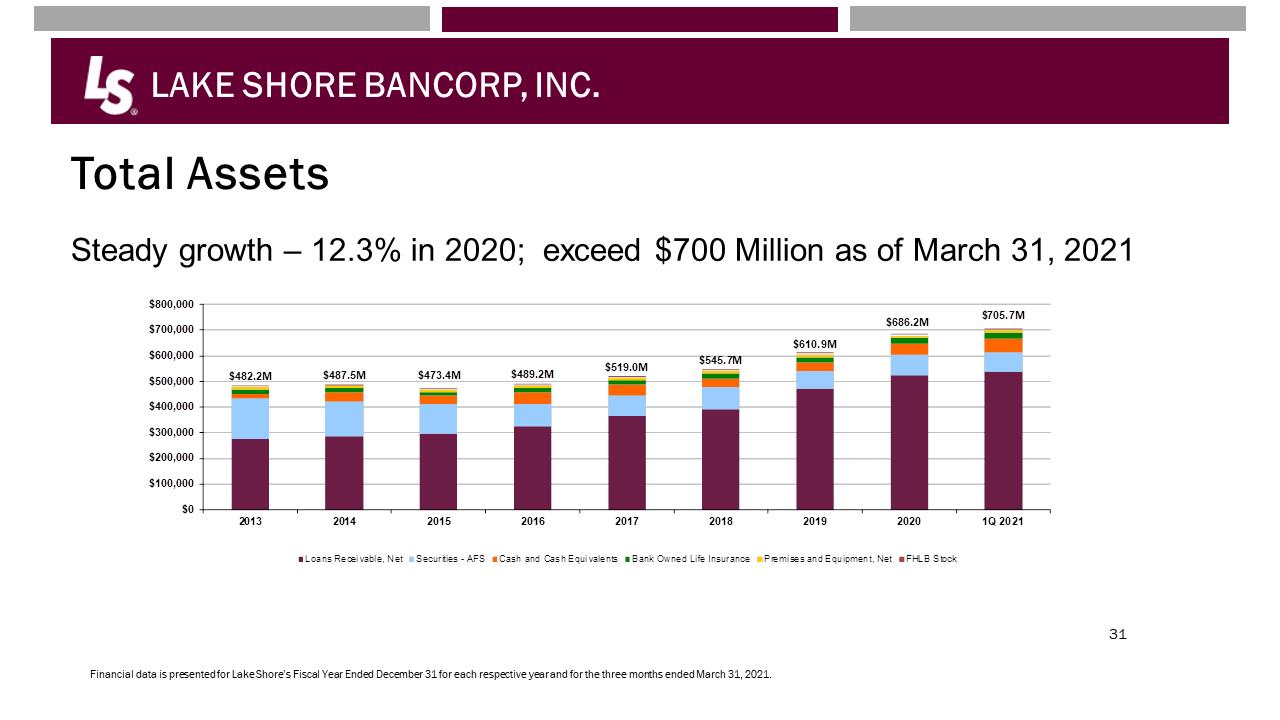

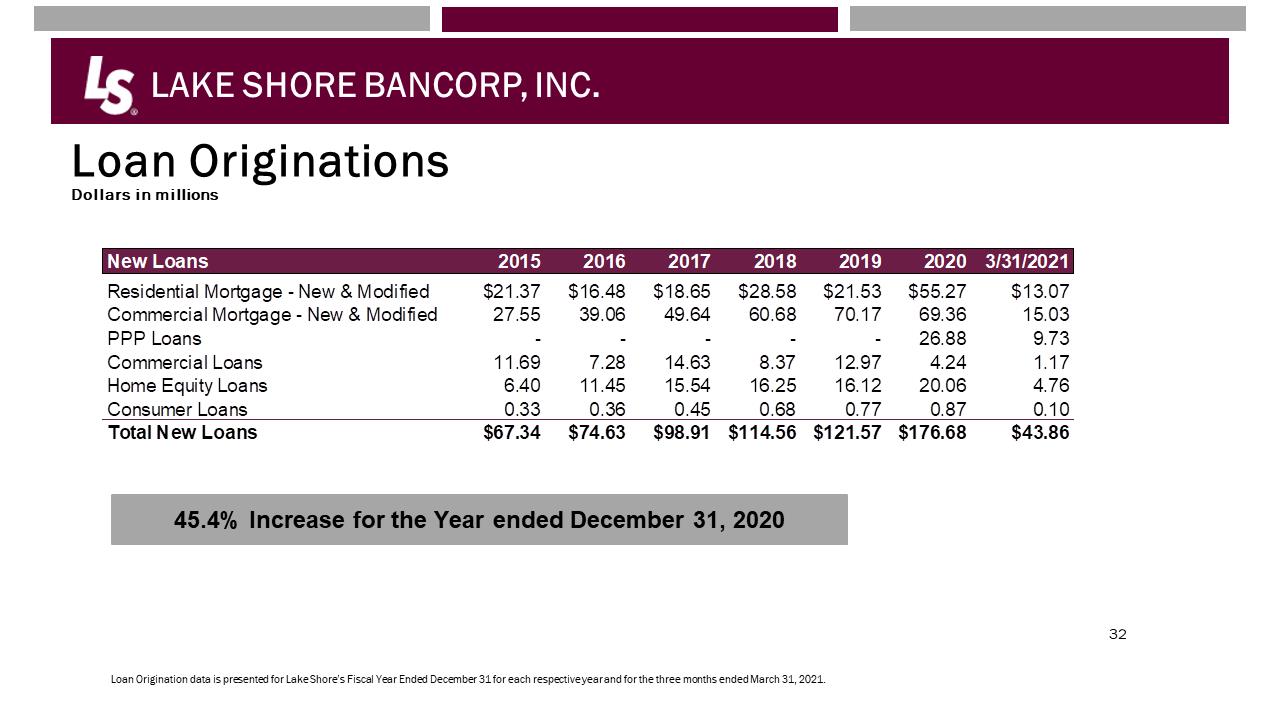

LAKE SHORE BANCORP, INC. Total Assets Steady growth – 12.3% in 2020; exceed $700 Million as of March 31, 2021 31 $482.2M$487.5M$473.4M$489.2M$519.0M$545.7M$610.9M$686.2M$705.7M$0$100,000$200,000$300,000$400,000$500,000$600,000$700,000$800,000201320142015201620172018201920201Q 2021Loans Receivable, NetSecurities - AFSCash and Cash EquivalentsBank Owned Life InsurancePremises and Equipment, NetFHLB StockFinancial data is presented for Lake Shore’s Fiscal Year Ended December 31 for each respective year and for the three months ended March 31, 2021. LAKE SHORE BANCORP, INC. Loan Originations Dollars in millions 32 45.4% Increase for the Year ended December 31, 2020 Loan Origination data is presented for Lake Shore’s Fiscal Year Ended December 31 for each respective year and for the three months ended March 31, 2021. New Loans2015201620172018201920203/31/2021Residential Mortgage - New & Modified$21.37$16.48$18.65$28.58$21.53$55.27$13.07Commercial Mortgage - New & Modified27.5539.0649.6460.6870.1769.3615.03PPP Loans-----26.889.73Commercial Loans11.697.2814.638.3712.974.241.17Home Equity Loans6.4011.4515.5416.2516.1220.064.76Consumer Loans0.330.360.450.680.770.870.10Total New Loans$67.34$74.63$98.91$114.56$121.57$176.68$43.86

LAKE SHORE BANCORP, INC. Total Assets Steady growth – 12.3% in 2020; exceed $700 Million as of March 31, 2021 31 $482.2M$487.5M$473.4M$489.2M$519.0M$545.7M$610.9M$686.2M$705.7M$0$100,000$200,000$300,000$400,000$500,000$600,000$700,000$800,000201320142015201620172018201920201Q 2021Loans Receivable, NetSecurities - AFSCash and Cash EquivalentsBank Owned Life InsurancePremises and Equipment, NetFHLB StockFinancial data is presented for Lake Shore’s Fiscal Year Ended December 31 for each respective year and for the three months ended March 31, 2021. LAKE SHORE BANCORP, INC. Loan Originations Dollars in millions 32 45.4% Increase for the Year ended December 31, 2020 Loan Origination data is presented for Lake Shore’s Fiscal Year Ended December 31 for each respective year and for the three months ended March 31, 2021. New Loans2015201620172018201920203/31/2021Residential Mortgage - New & Modified$21.37$16.48$18.65$28.58$21.53$55.27$13.07Commercial Mortgage - New & Modified27.5539.0649.6460.6870.1769.3615.03PPP Loans-----26.889.73Commercial Loans11.697.2814.638.3712.974.241.17Home Equity Loans6.4011.4515.5416.2516.1220.064.76Consumer Loans0.330.360.450.680.770.870.10Total New Loans$67.34$74.63$98.91$114.56$121.57$176.68$43.86

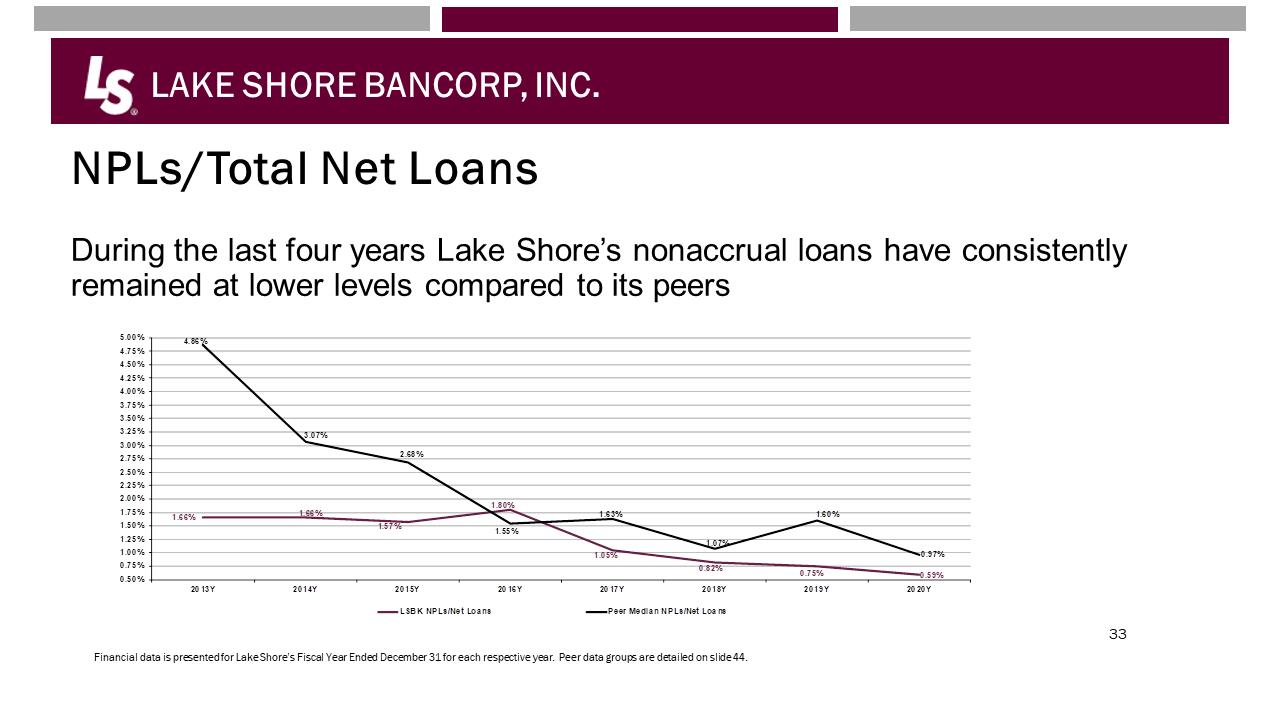

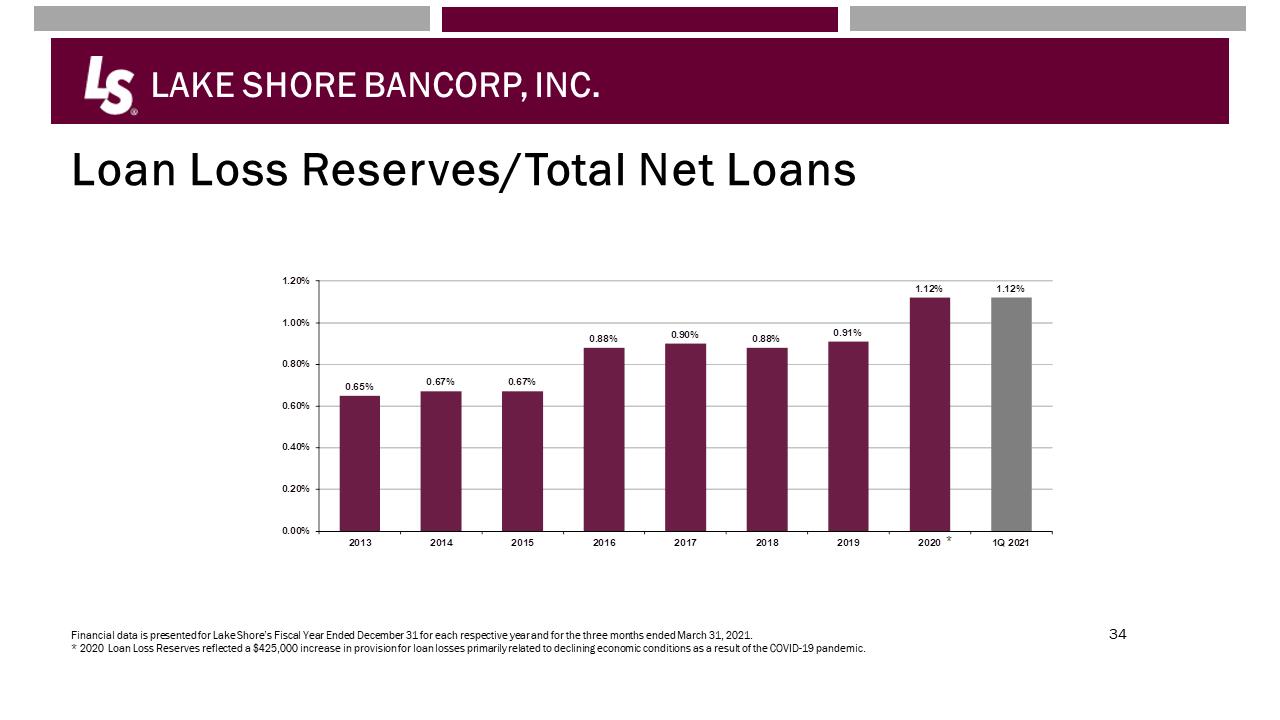

LAKE SHORE BANCORP, INC. NPLs/Total Net Loans During the last four years Lake Shore’s nonaccrual loans have consistently remained at lower levels compared to its peers 33 1.66%1.66%1.57%1.80%1.05%0.82%0.75%0.59%4.86%3.07%2.68%1.55%1.63%1.07%1.60%0.97%0.50%0.75%1.00%1.25%1.50%1.75%2.00%2.25%2.50%2.75%3.00%3.25%3.50%3.75%4.00%4.25%4.50%4.75%5.00%2013Y2014Y2015Y2016Y2017Y2018Y2019Y2020YLSBK NPLs/Net LoansPeer Median NPLs/Net LoansFinancial data is presented for Lake Shore’s Fiscal Year Ended December 31 for each respective year. Peer data groups are detailed on slide 44. LAKE SHORE BANCORP, INC. Loan Loss Reserves/Total Net Loans 34 0.65%0.67%0.67%0.88%0.90%0.88%0.91%1.12%1.12%0.00%0.20%0.40%0.60%0.80%1.00%1.20%201320142015201620172018201920201Q 2021Financial data is presented for Lake Shore’s Fiscal Year Ended December 31 for each respective year and for the three months ended March 31, 2021. * 2020 Loan Loss Reserves reflected a $425,000 increase in provision for loan losses primarily related to declining economic conditions as a result of the COVID-19 pandemic. *

LAKE SHORE BANCORP, INC. NPLs/Total Net Loans During the last four years Lake Shore’s nonaccrual loans have consistently remained at lower levels compared to its peers 33 1.66%1.66%1.57%1.80%1.05%0.82%0.75%0.59%4.86%3.07%2.68%1.55%1.63%1.07%1.60%0.97%0.50%0.75%1.00%1.25%1.50%1.75%2.00%2.25%2.50%2.75%3.00%3.25%3.50%3.75%4.00%4.25%4.50%4.75%5.00%2013Y2014Y2015Y2016Y2017Y2018Y2019Y2020YLSBK NPLs/Net LoansPeer Median NPLs/Net LoansFinancial data is presented for Lake Shore’s Fiscal Year Ended December 31 for each respective year. Peer data groups are detailed on slide 44. LAKE SHORE BANCORP, INC. Loan Loss Reserves/Total Net Loans 34 0.65%0.67%0.67%0.88%0.90%0.88%0.91%1.12%1.12%0.00%0.20%0.40%0.60%0.80%1.00%1.20%201320142015201620172018201920201Q 2021Financial data is presented for Lake Shore’s Fiscal Year Ended December 31 for each respective year and for the three months ended March 31, 2021. * 2020 Loan Loss Reserves reflected a $425,000 increase in provision for loan losses primarily related to declining economic conditions as a result of the COVID-19 pandemic. *

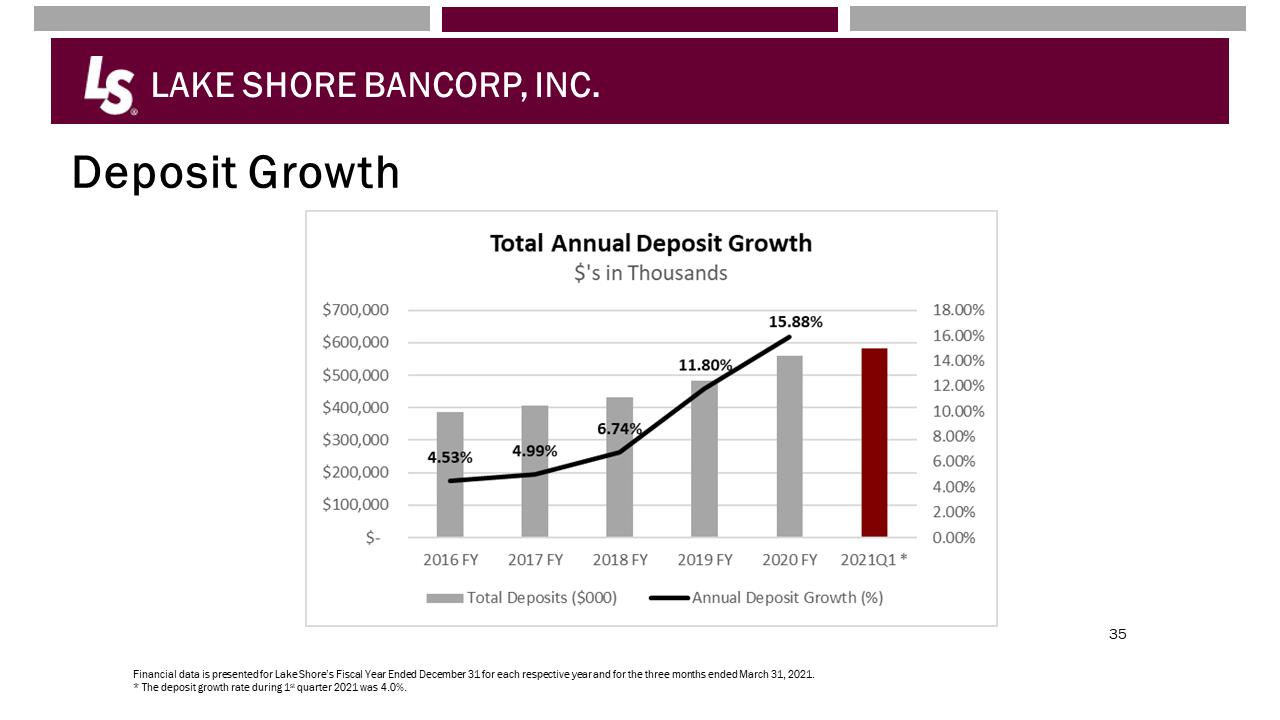

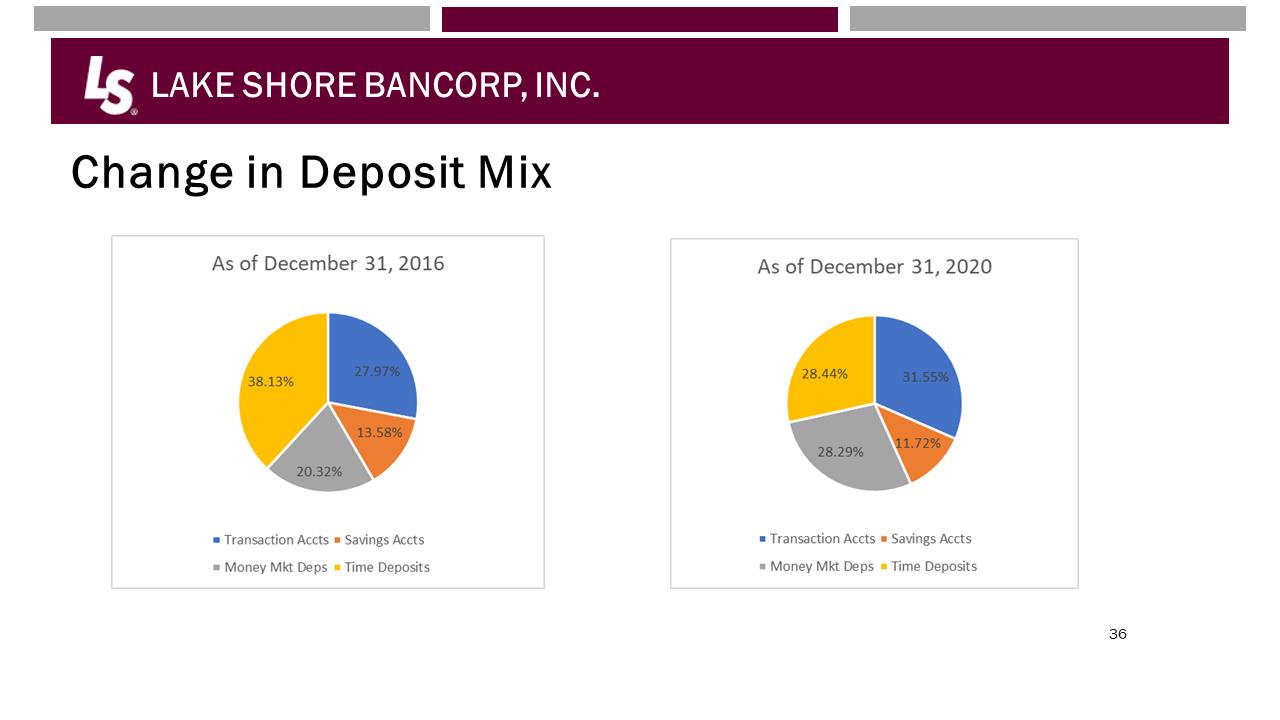

LAKE SHORE BANCORP, INC. Deposit Growth 35 Financial data is presented for Lake Shore’s Fiscal Year Ended December 31 for each respective year and for the three months ended March 31, 2021. Total Annual Deposit Growth $’s in Thousands $700,000 $600,000 $500,000 $400,000 $300,000 $200,000 $100,000 $- 4.53% 4.99% 6.74% 11.80% 15.88% 18.00% 16.00% 14.00% 12.00% 10.00% 8.00% 6.00% 4.00% 2.00% 0.00% 2016 FY 2017 FY 2018 FY 2019 FY 2020 FY 2021Q1* Total Deposits ($000) Annual Deposit Growth (%)* The deposit growth rate during 1st quarter 2021 was 4.0%. LAKE SHORE BANCORP, INC. Change in Deposit Mix As of December 31, 2016 38.13% 27.97% 20.32% 13.58% Transaction Accts Savings Acts Money Mkt Deps Time Deposits As of December 31, 2020 28.44% 31.55% 28.29% 11.72% Transaction Accts Savings Accts Money Mkt Deps Time Deposits36

LAKE SHORE BANCORP, INC. Deposit Growth 35 Financial data is presented for Lake Shore’s Fiscal Year Ended December 31 for each respective year and for the three months ended March 31, 2021. Total Annual Deposit Growth $’s in Thousands $700,000 $600,000 $500,000 $400,000 $300,000 $200,000 $100,000 $- 4.53% 4.99% 6.74% 11.80% 15.88% 18.00% 16.00% 14.00% 12.00% 10.00% 8.00% 6.00% 4.00% 2.00% 0.00% 2016 FY 2017 FY 2018 FY 2019 FY 2020 FY 2021Q1* Total Deposits ($000) Annual Deposit Growth (%)* The deposit growth rate during 1st quarter 2021 was 4.0%. LAKE SHORE BANCORP, INC. Change in Deposit Mix As of December 31, 2016 38.13% 27.97% 20.32% 13.58% Transaction Accts Savings Acts Money Mkt Deps Time Deposits As of December 31, 2020 28.44% 31.55% 28.29% 11.72% Transaction Accts Savings Accts Money Mkt Deps Time Deposits36

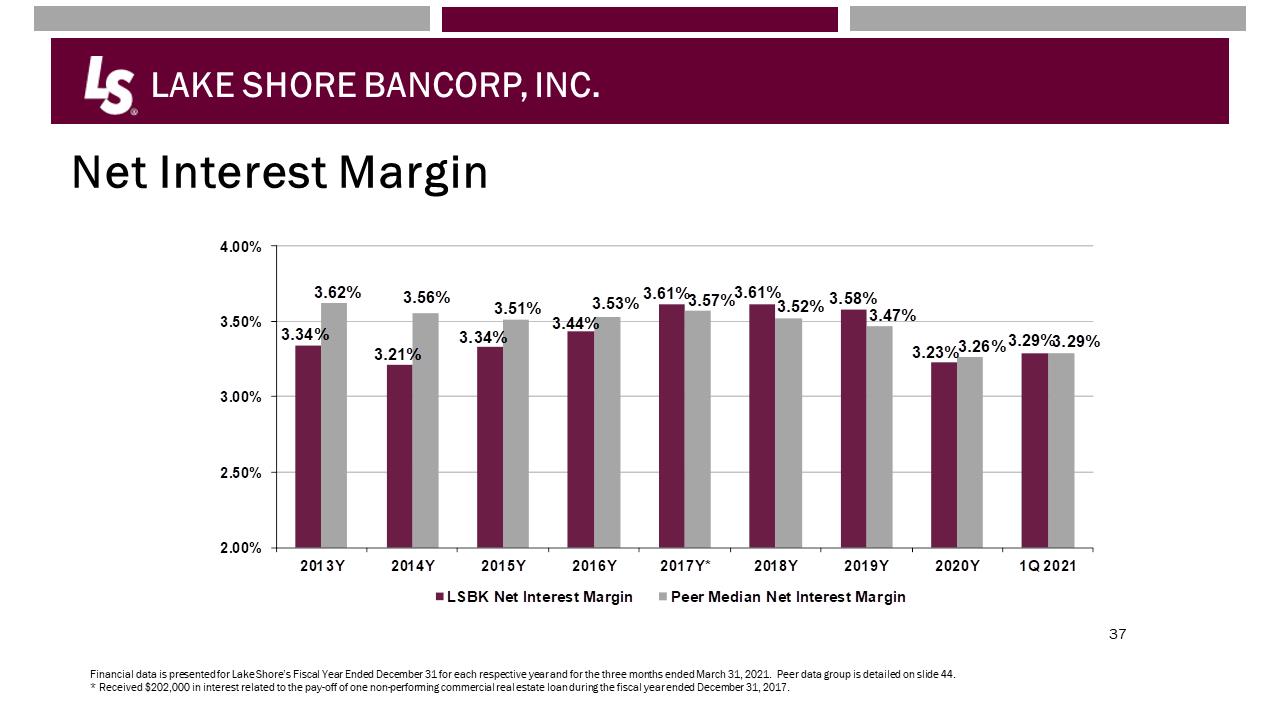

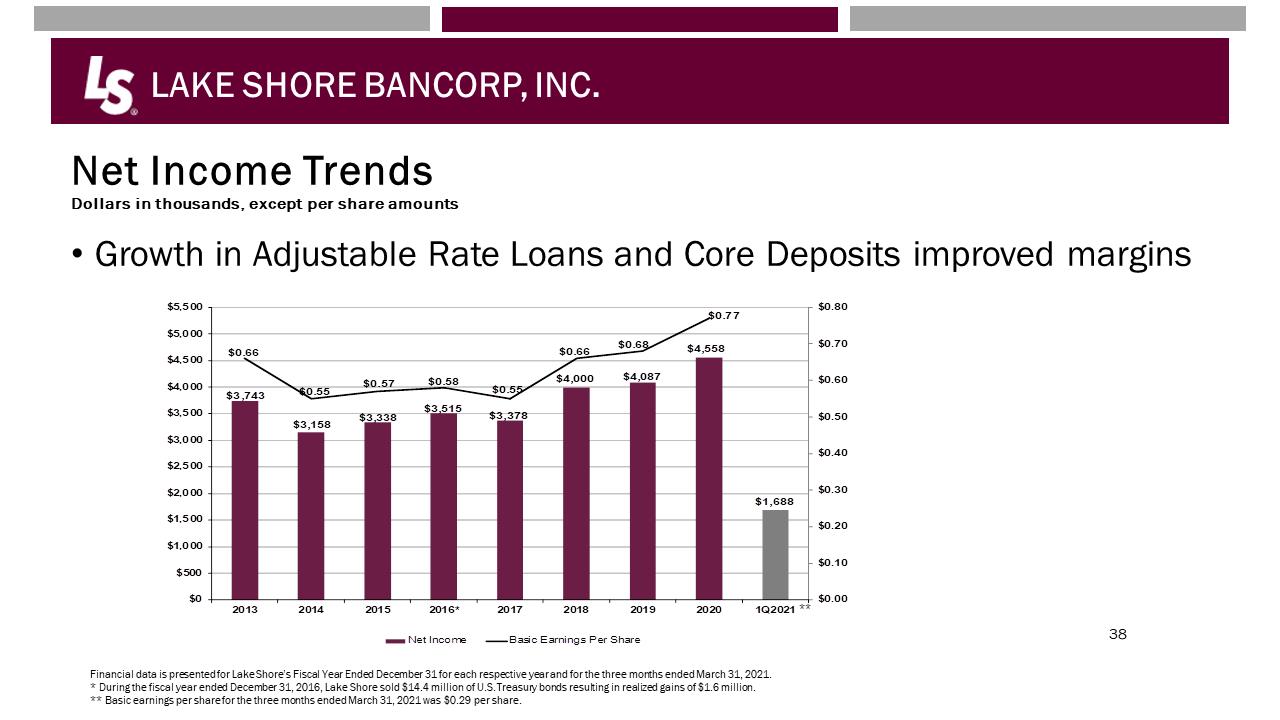

LAKE SHORE BANCORP, INC. Net Interest Margin 37 Financial data is presented for Lake Shore’s Fiscal Year Ended December 31 for each respective year and for the three months ended March 31, 2021. Peer data group is detailed on slide 44. * Received $202,000 in interest related to the pay-off of one non-performing commercial real estate loan during the fiscal year ended December 31, 2017. 3.34%3.21%3.34%3.44%3.61%3.61%3.58%3.23%3.29%3.62%3.56%3.51%3.53%3.57%3.52%3.47%3.26%3.29%2.00%2.50%3.00%3.50%4.00%2013Y2014Y2015Y2016Y2017Y*2018Y2019Y2020Y1Q 2021LSBK Net Interest MarginPeer Median Net Interest MarginLAKE SHORE BANCORP, INC. Net Income Trends Dollars in thousands, except per share amounts Growth in Adjustable Rate Loans and Core Deposits improved margins 38 $3,743$3,158$3,338$3,515$3,378$4,000$4,087$4,558$1,688$0.66$0.55$0.57$0.58$0.55$0.66$0.68$0.77$0.00$0.10$0.20$0.30$0.40$0.50$0.60$0.70$0.80$0$500$1,000$1,500$2,000$2,500$3,000$3,500$4,000$4,500$5,000$5,5002013201420152016*20172018201920201Q2021Net IncomeBasic Earnings Per ShareFinancial data is presented for Lake Shore’s Fiscal Year Ended December 31 for each respective year and for the three months ended March 31, 2021. * During the fiscal year ended December 31, 2016, Lake Shore sold $14.4 million of U.S. Treasury bonds resulting in realized gains of $1.6 million. ** Basic earnings per share for the three months ended March 31, 2021 was $0.29 per share. **

LAKE SHORE BANCORP, INC. Net Interest Margin 37 Financial data is presented for Lake Shore’s Fiscal Year Ended December 31 for each respective year and for the three months ended March 31, 2021. Peer data group is detailed on slide 44. * Received $202,000 in interest related to the pay-off of one non-performing commercial real estate loan during the fiscal year ended December 31, 2017. 3.34%3.21%3.34%3.44%3.61%3.61%3.58%3.23%3.29%3.62%3.56%3.51%3.53%3.57%3.52%3.47%3.26%3.29%2.00%2.50%3.00%3.50%4.00%2013Y2014Y2015Y2016Y2017Y*2018Y2019Y2020Y1Q 2021LSBK Net Interest MarginPeer Median Net Interest MarginLAKE SHORE BANCORP, INC. Net Income Trends Dollars in thousands, except per share amounts Growth in Adjustable Rate Loans and Core Deposits improved margins 38 $3,743$3,158$3,338$3,515$3,378$4,000$4,087$4,558$1,688$0.66$0.55$0.57$0.58$0.55$0.66$0.68$0.77$0.00$0.10$0.20$0.30$0.40$0.50$0.60$0.70$0.80$0$500$1,000$1,500$2,000$2,500$3,000$3,500$4,000$4,500$5,000$5,5002013201420152016*20172018201920201Q2021Net IncomeBasic Earnings Per ShareFinancial data is presented for Lake Shore’s Fiscal Year Ended December 31 for each respective year and for the three months ended March 31, 2021. * During the fiscal year ended December 31, 2016, Lake Shore sold $14.4 million of U.S. Treasury bonds resulting in realized gains of $1.6 million. ** Basic earnings per share for the three months ended March 31, 2021 was $0.29 per share. **

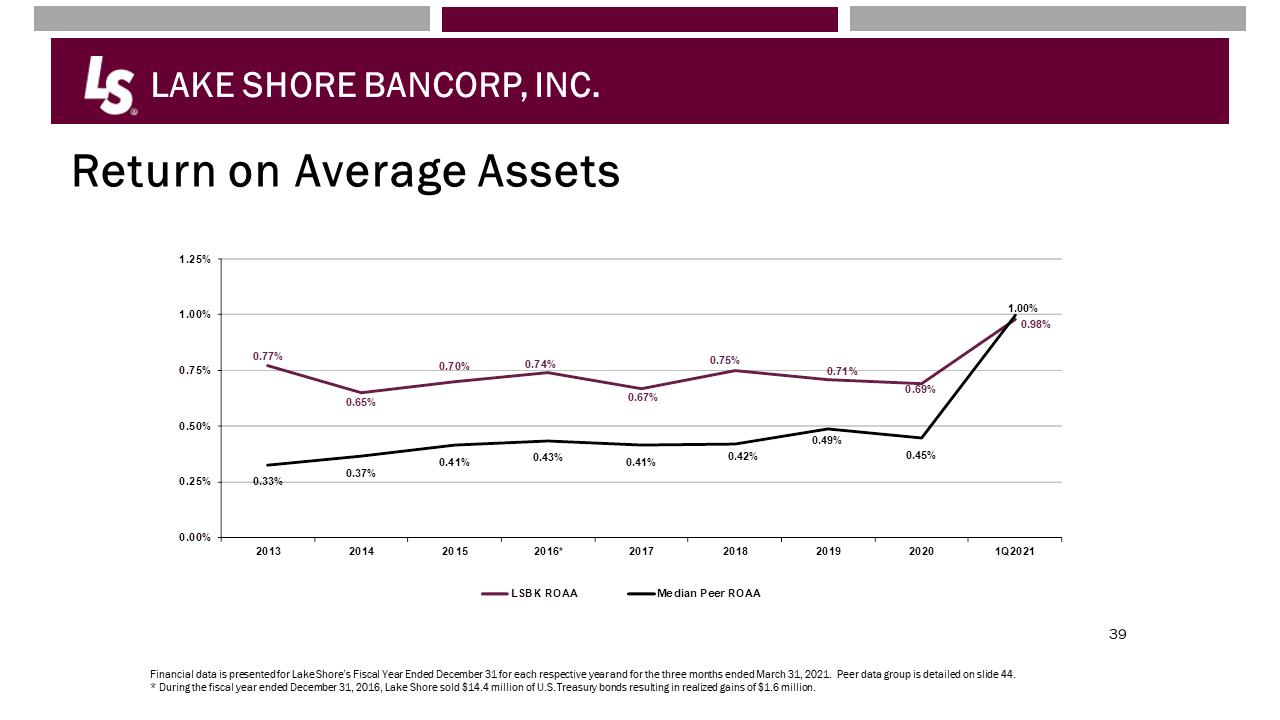

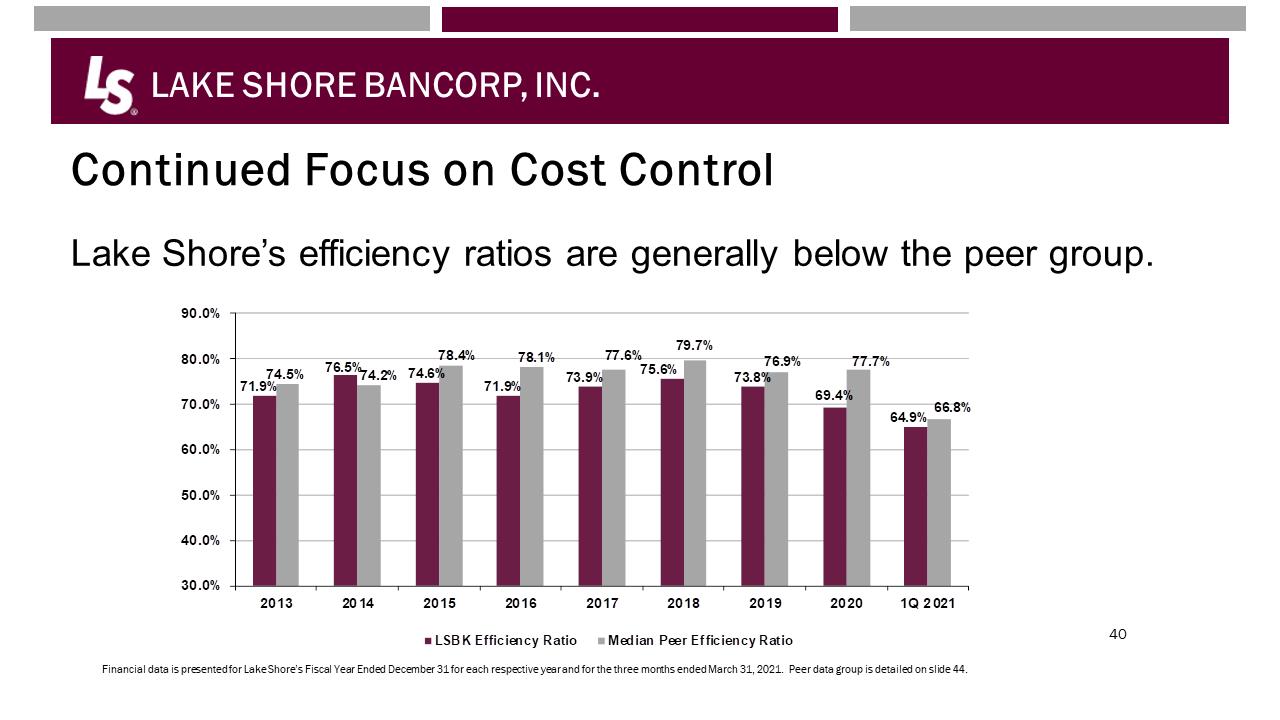

LAKE SHORE BANCORP, INC. Return on Average Assets 39 Financial data is presented for Lake Shore’s Fiscal Year Ended December 31 for each respective year and for the three months ended March 31, 2021. Peer data group is detailed on slide 44. * During the fiscal year ended December 31, 2016, Lake Shore sold $14.4 million of U.S. Treasury bonds resulting in realized gains of $1.6 million. 0.77%0.65%0.70%0.74%0.67%0.75%0.71%0.69%0.98%0.33%0.37%0.41%0.43%0.41%0.42%0.49%0.45%1.00%0.00%0.25%0.50%0.75%1.00%1.25%2013201420152016*20172018201920201Q2021LSBK ROAAMedian Peer ROAALAKE SHORE BANCORP, INC. Continued Focus on Cost Control Lake Shore’s efficiency ratios are generally below the peer group. 40 Financial data is presented for Lake Shore’s Fiscal Year Ended December 31 for each respective year and for the three months ended March 31, 2021. Peer data group is detailed on slide 44. 71.9%76.5%74.6%71.9%73.9%75.6%73.8%69.4%64.9%74.5%74.2%78.4%78.1%77.6%79.7%76.9%77.7%66.8%30.0%40.0%50.0%60.0%70.0%80.0%90.0%201320142015201620172018201920201Q 2021LSBK Efficiency RatioMedian Peer Efficiency Ratio

LAKE SHORE BANCORP, INC. Return on Average Assets 39 Financial data is presented for Lake Shore’s Fiscal Year Ended December 31 for each respective year and for the three months ended March 31, 2021. Peer data group is detailed on slide 44. * During the fiscal year ended December 31, 2016, Lake Shore sold $14.4 million of U.S. Treasury bonds resulting in realized gains of $1.6 million. 0.77%0.65%0.70%0.74%0.67%0.75%0.71%0.69%0.98%0.33%0.37%0.41%0.43%0.41%0.42%0.49%0.45%1.00%0.00%0.25%0.50%0.75%1.00%1.25%2013201420152016*20172018201920201Q2021LSBK ROAAMedian Peer ROAALAKE SHORE BANCORP, INC. Continued Focus on Cost Control Lake Shore’s efficiency ratios are generally below the peer group. 40 Financial data is presented for Lake Shore’s Fiscal Year Ended December 31 for each respective year and for the three months ended March 31, 2021. Peer data group is detailed on slide 44. 71.9%76.5%74.6%71.9%73.9%75.6%73.8%69.4%64.9%74.5%74.2%78.4%78.1%77.6%79.7%76.9%77.7%66.8%30.0%40.0%50.0%60.0%70.0%80.0%90.0%201320142015201620172018201920201Q 2021LSBK Efficiency RatioMedian Peer Efficiency Ratio

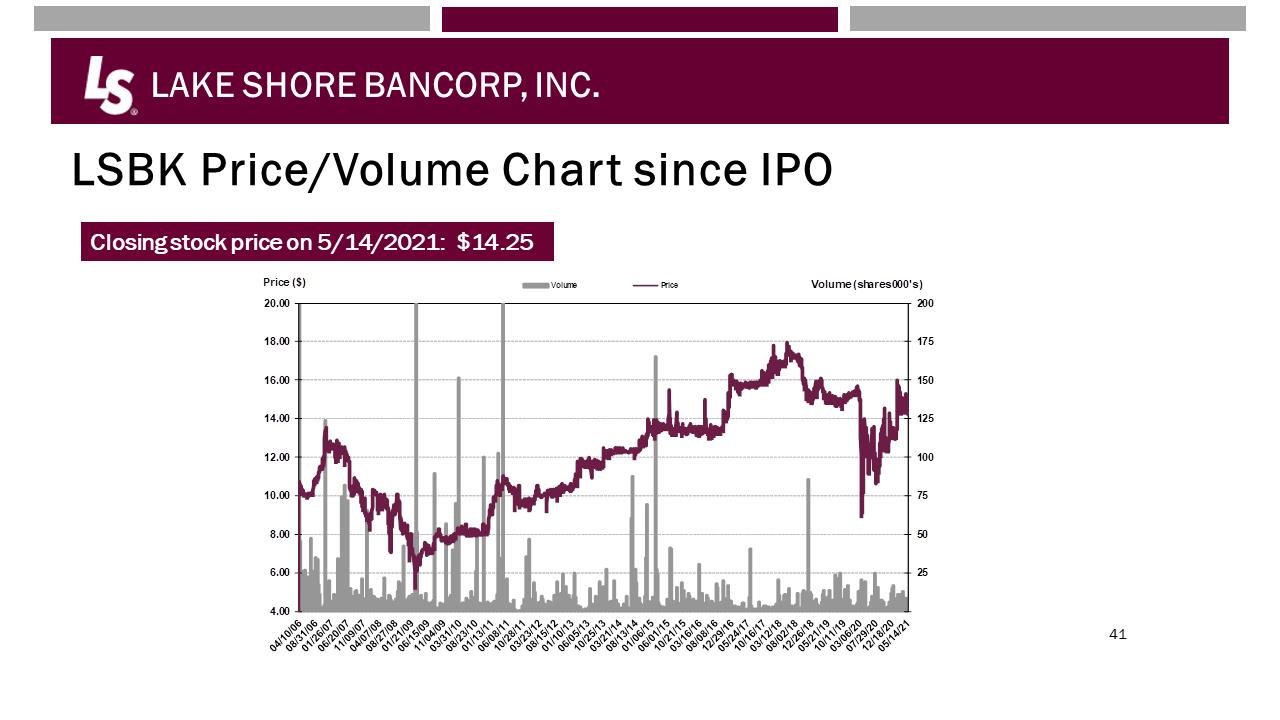

LAKE SHORE BANCORP, INC. LSBK Price/Volume Chart since IPO 41 Closing stock price on 5/14/2021: $14.25 4.006.008.0010.0012.0014.0016.0018.0020.00255075100125150175200Price ($)Volume (shares 000's)VolumePriceLAKE SHORE BANCORP, INC. 42 Questions and Answers

LAKE SHORE BANCORP, INC. LSBK Price/Volume Chart since IPO 41 Closing stock price on 5/14/2021: $14.25 4.006.008.0010.0012.0014.0016.0018.0020.00255075100125150175200Price ($)Volume (shares 000's)VolumePriceLAKE SHORE BANCORP, INC. 42 Questions and Answers

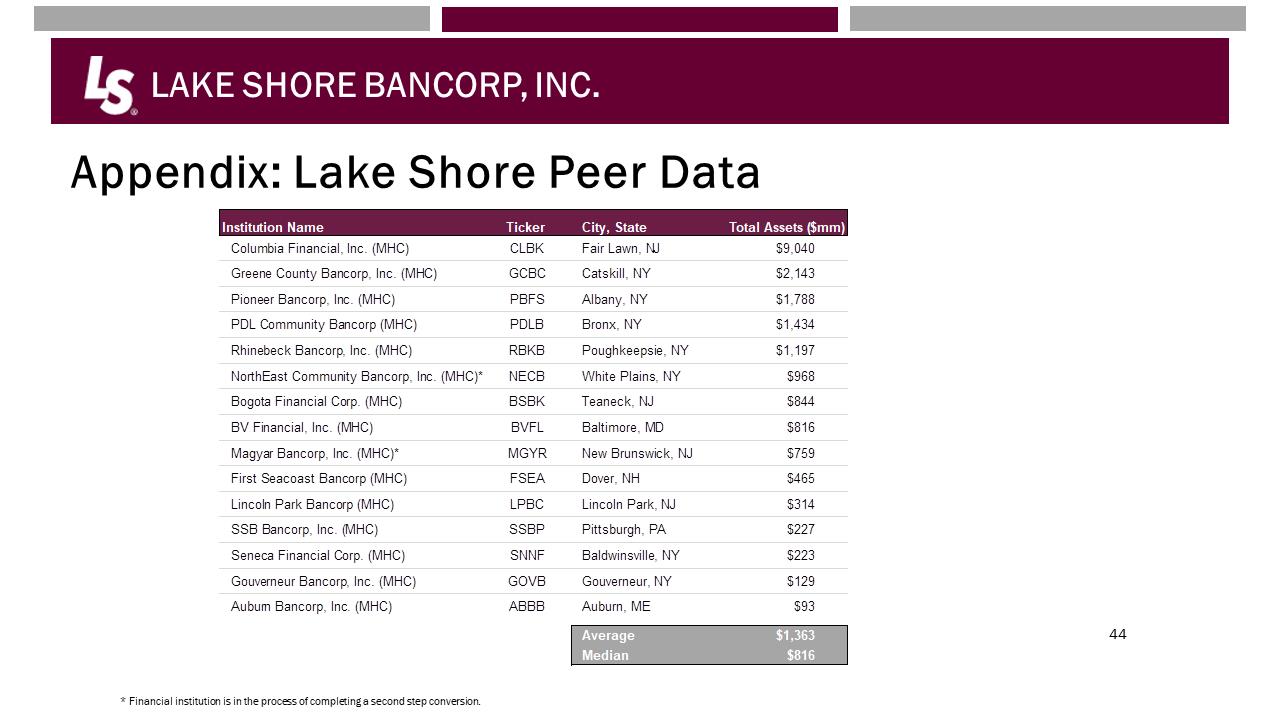

LAKE SHORE BANCORP, INC. 43 Vote Report Adjournment of Annual Shareholder’s Meeting LAKE SHORE BANCORP, INC. Appendix: Lake Shore Peer Data 44 * Financial institution is in the process of completing a second step conversion. Institution Name Ticker City, State Total Assets ($mm)Columbia Financial, Inc. (MHC)CLBKFair Lawn, NJ$9,040Greene County Bancorp, Inc. (MHC)GCBCCatskill, NY$2,143Pioneer Bancorp, Inc. (MHC)PBFSAlbany, NY$1,788PDL Community Bancorp (MHC)PDLBBronx, NY$1,434Rhinebeck Bancorp, Inc. (MHC)RBKBPoughkeepsie, NY$1,197NorthEast Community Bancorp, Inc. (MHC)*NECBWhite Plains, NY$968Bogota Financial Corp. (MHC)BSBKTeaneck, NJ$844BV Financial, Inc. (MHC)BVFLBaltimore, MD$816Magyar Bancorp, Inc. (MHC)*MGYRNew Brunswick, NJ$759First Seacoast Bancorp (MHC)FSEADover, NH$465Lincoln Park Bancorp (MHC)LPBCLincoln Park, NJ$314SSB Bancorp, Inc. (MHC)SSBPPittsburgh, PA$227Seneca Financial Corp. (MHC)SNNFBaldwinsville, NY$223Gouverneur Bancorp, Inc. (MHC)GOVBGouverneur, NY$129Auburn Bancorp, Inc. (MHC)ABBBAuburn, ME$93Average$1,363Median$816

LAKE SHORE BANCORP, INC. 45 Lake Shore, MHC Annual Meeting of MembersCall to Order Introduction of Proposal to Elect Directors Tabulation of Votes Adjournment