Attached files

| file | filename |

|---|---|

| 8-K - CURRENT REPORT - Clarus Therapeutics Holdings, Inc. | ea141314-8k_bluewater.htm |

Exhibit 99.1

CORPORATE PRESENTATION M A Y 202 1 INNOVATING FOR BETTER HEALTH

DISCLAIMER This presentation (“Presentation”) is for informational purposes only and is being furnished solely for the purpose of assisting interested parties in making their own evaluation with respect to a potential transaction involving Blue Water Acquisition Corp. (“Blue Water”) and Clarus Therapeutics, Inc. (“Clarus”). This presentation shall neither constitute an offer to sell or the solicitation of an offer to buy any securities, nor shall there be any sale of securities in any jurisdiction in which the offer, solicitation or sale would be unlawful prior to the registration or qualification under the securities laws of any such jurisdiction. Any investment in or purchase of any securities of Blue Water is speculative and involves a high degree of risk and uncertainty. Certain statements in this Presentation may be considered “forward looking statements” within the meaning of Section 27A of the Securities Act of 1933, as amended (the “Securities Act”) as well as Section 21E of the Securities Exchange Act of 1934, as amended, and the Private Securities Litigation Reform Act of 1995, as amended. Forward - looking statements generally relate to future events or Blue Water’s or Clarus’s future financial or operating performance. Terminology such as “may,” “should,” “anticipates,” “believes,” “estimates,” “expects,” “intends,” “plans,” “predicts,” “potential,” “projects,” “will,” or the negatives of these terms or variations of them or other similar terminology may identify such forward - looking statements. Such forward - looking statements are subject to risks, uncertainties, and other factors over which Blue Water and Clarus have no control and which could cause actual results to differ materially from those expressed or implied by such forward - looking . For example, statements concerning the following include forward - looking statements: (i) the success, cost and timing of product development and commercialization activities, including timing of completion and data readouts for clinical trials; (ii) the potential attributes and benefits of the product, including with respect to activity, tolerability profile and relevant indications; (iii) the size and growth potential of the markets for the product and ability to serve those markets; (iv) conditions to the completion of the proposed business combination and additional stakeholder investment, including shareholder approval of the business combination, may not be satisfied, or any regulatory approvals required for the proposed business combination may not be obtained on the terms expected or on the anticipated schedule: (v) the occurrence of an event, change or other circumstance that could give rise to the termination of the business combination or agreement between the parties; (vi) the effect of the announcement or pendency of the proposed business combination on Clarus’ business relationships; (vii) risks that the proposed business combination disrupts Clarus’ current plans; (viii) risks related to diverting management’s attention from Clarus’s ongoing business operations; (ix) potential litigation that may be instituted against Blue Water or Clarus or their respective directors or officers related to the proposed business combination or in relation to Clarus’s business; (x) the amount of the costs, fees, expenses and other charges related to the proposed business combination and stakeholder investment; (xi) the outcome of existing legal proceedings in which Clarus is involved with respect to its intellectual property; (xii) risks related to the satisfaction of Clarus’s business objectives and the timing of expected development and commercialization milestones; (xiii) the effects of competition on Clarus’s future business; (xiv) the amount of redemption requests made by Blue Water’s public shareholders; (xv) the impact of the global COVID - 19 pandemic on any of the foregoing risks; and (xvi) such other factors as are set forth in Blue Water’s periodic public filings with the SEC, which are available via the SEC’s website at www.sec.gov. Nothing in this Presentation should be regarded as a representation by any person that the forward - looking statements set forth herein will be achieved or that any of the contemplated results of such forward - looking statements will be achieved. You should not place undue reliance on forward - looking statements in this Presentation, which speak only as of the date they are made and are qualified in their entirety by reference to the cautionary statements herein. Blue Water, or Clarus do not undertake any duty to update these forward - looking statements or the other information contained in this presentation. The information contained herein does not purport to be all - inclusive and neither Blue Water nor Clarus nor any of their respective affiliates nor any of its or their control persons, officers, directors, employees or representatives makes any representation or warranty, express or implied, as to the accuracy, completeness or reliability of this Presentation or any other information contained herein or any other information (whether written or oral) that has been or will be provided to you. Nothing contained herein or in any other oral or written information provided to you is, nor shall be relied upon as, a promise or representation of any kind by Blue Water or Clarus. Without limitation of the foregoing, Blue Water and Clarus expressly disclaim any representation regarding any projections concerning future operating results or any other forward - looking statement contained herein or that otherwise has been or will be provided to you. Neither Blue Water nor Clarus shall be liable to you or any prospective investor or any other person for any information contained herein or that otherwise has been or will be provided to you, or any action heretofore or hereafter take or omitted to be taken, in connection with this potential transaction. You will be entitled to rely solely on the representations and warranties made to you by Blue Water in a definitive written agreement relating to a transaction involving Clarus, when and if executed, and subject to any limitations and restrictions as may be specified in such definitive agreement. No other representations and warranties will have any legal effect. Additional Information . In connection with the proposed transaction, Blue Water has filed with the SEC a registration statement on Form S - 4 containing a preliminary proxy statement/prospectus of Blue Water, and after the registration statement is declared effective, Blue Water will mail a definitive proxy statement/prospectus relating to the proposed transaction to its shareholders. This Presentation does not contain all the information that should be considered concerning the proposed transaction and is not intended to form the basis of any investment decision or any other decision in respect of the proposed transaction. Blue Water’s shareholders and other interested persons are advised to read, when available, the preliminary proxy statement/prospectus and the amendments thereto and the definitive proxy statement/prospectus and other documents filed in connection with the proposed transaction, as these materials will contain important information about Clarus, Blue Water and the proposed transaction. When available, the definitive proxy statement/prospectus and other relevant materials for the proposed transaction will be mailed to shareholders of Blue Water as of a record date to be established for voting on the proposed transaction. Participants in the Solicitation. Blue Water, Clarus and their respective directors, executive officers, other members of management and employees may be deemed participants in the solicitation of proxies from the Company’s stockholders with respect to the proposed business combination. Investors and securityholders may obtain more detailed information regarding the names and interests in the proposed business combination of the Blue Water's directors and officers in the Company’s filings with the SEC, including the registration statement on Form S4, and such information with respect to Clarus’ directors and executive officers will also be included in such registration statement. 2

DISCLAIMER (CONT’D) This Presentation does not purport to summarize all of the conditions, risks and other attributes of an investment in Blue Water or Clarus. Information contained herein will be superseded by, and is qualified in its entirety by reference to, any other information that is made available to you in connection with your investigation of Blue Water and Clarus. Each prospective purchaser is invited to meet with a representative of Blue Water and/or Clarus and to discuss with, ask questions of, and receive answers from, such representative concerning Clarus and the terms and conditions of any potential transaction. No Offer or Solicitation . This communication is for informational purposes only and does not constitute, or form a part of, an offer to sell or the solicitation of an offer to sell or an offer to buy or the solicitation of an offer to buy any securities, and there shall be no sale of securities, in any jurisdiction in which such offer, solicitation or sale would be unlawful prior to registration or qualification under the securities laws of any such jurisdiction. No offer of securities shall be made except by means of a prospectus meeting the requirements of Section 10 of the Securities Act, and otherwise in accordance with applicable law. Certain information contained in this Presentation relates to or is based on studies, publications, surveys and Clarus’s own internal estimates and research. In addition, all of the market data included in this Presentation involves a number of assumptions and limitations, and there can be no guarantee as to the accuracy or reliability of such assumptions. Finally, while Clarus believes its internal research is reliable, such research has not been verified by any independent source. This meeting and any information communicated at this meeting are strictly confidential and should not be discussed outside your organization. Blue Water and Clarus are free to conduct the process for any transaction as they in their sole discretion determine (including, without limitation, negotiating with any prospective investors and entering into an agreement with respect to any transaction without prior notice to you or any other person), and any procedures relating to such transaction may be changed at any time without notice to you or any other person. No sales will be made, no commitments to invest in Blue Water will be accepted, and no money is being solicited or will be accepted at this time. Any indication of interest from prospective purchasers in response to this Presentation involves no obligation or commitment of any kind. This Presentation should not be distributed to any person other than the addressee to whom it was initially distributed. This Presentation contains certain information that has not been prepared in accordance with U.S. generally accepted accounting principles (“GAAP”) and such information is intended to supplement and not substitute for comparable GAAP measures. This Presentation contains financial forecasts. Neither Blue Water’s nor Clarus’s independent auditors have studied, reviewed, complied or performed any procedures with respect to the projections for the purpose of their inclusion in this presentation, and accordingly, neither of them has expressed an opinion or provided any other form of assurance with respect thereto for the purpose of this presentation. These projections are for illustrative purposes only and should not be relied upon as being necessarily indicative of future results. 3

R O BERT DUDLEY, PH . D P r esident & C EO • Over 30 years experience in TRT field • Clarus co - founder • Extensive R&D experience and partnership with the FDA • Co - inventor and developer of AndroGel 1% • Co - inventor of JATENZO • Track record of success with public company • Abbott, Solvay, Unimed • Urologist devoted to Men’s Health issues • Extensive experience with TRT • Focus in MH diagnostics and therapeutics • Wide network of urology thought leaders • Launched two novel urologic diagnostics • Abbott/ AbbVie, OPKO, Genomic Health J A Y NEW M ARK , M D , MBA Chief Medical Officer • Tech transfer of 200+ drugs and biologics • Directed manufacturing site & process design • Launched multiple drugs, biologics, & vaccines • Grew R&D engineering outsourcing • Pharmacia, Wyeth, Cardinal Health, Catalent JAMES HOLLOWAY VP , Ma nufac t u r ing & Su pp ly CLARU S LEADER SHIP TEAM CLARU S BOAR D O F DIRECTORS ROBER T DUD L EY, PH . D. Pres id e nt , C E O and Chair m an B R U C E R O B E R T S O N , P H . D . H . I . G . C a p i t a l M AR K P RY G OCKI Executive Director; former President, Medicis M E N G J I A N G C - B r i d g e C a p i t a l JAMES THOMAS Thomas, McNerney & Partners EL I ZABET H CER M AK Former EVP, Pozen; former VP, J&J AL EX Z ISSON Thomas, McNerney & Partners / H.I.G. Capital • Over 20 years of successful global financial leadership • Experienced in capital markets, private and public offerings (IPO), secondary financings • Established relationships with institutional funds, financial analysts and investment bankers • Medicis, Novan, Sienna RI C PE T ERS O N Chief Financial Officer • 17 years experience in TRT market • Clarus co - founder • Over 30 years in start - up life sciences • Raised over $250M in debt & equity • Aksys, PWC, Ernst & Young ST EVEN B O URNE Chief Administrative Officer FRANK JAEGER, MA , MBA Chief Commercial Officer • 20+ years commercial background with significant TRT experience • Launched AndroGel 1.62% and grew to $1.3B • Successful co - c o mm e rc i al i zati o n experience • Responsible for multiple launches over career • AbbVie, Abbott, Solvay 4

FRANK JAEG E R , MA , MBA Chie f C o mmerci a l Of ficer • Significant Medical Affairs experience • Multiple therapeutic area experience including TRT & Men's Health • Medical science liaison (MSL) team management • AbbVie, Abbott, Solvay, Searle Medical Affairs Support L a Tonya Wri g ht VP, Sales • Significant TRT commercial leadership experience • Built & led numerous award - winning sales teams • Extensive experience in multiple product launches • AbbVie, Abbott, Amgen, Merck Schering - Plough Steve Stark VP , C o mmerci a l Anal y tics and O perations • Extensive TRT and orphan disease commercial experience • Led 70 person, $35MM AbbVie Sales Operations team • Significant assessment, diligence, & integration experience • Supported multiple launches over career • Lundbeck, AbbVie, Abbott, ZS Associates Wou n Se o, Ph.D. Senior Director, Medical Affairs Rozit a P a s s arella VP, Marketing • Experienced sales and marketing leader in TRT • Multiple specialty launches • Drove double digit growth in Immunology • Large IDN and group practice experience • Abbott, AbbVie COMMERCIAL AND MEDICAL AFFAIRS TEAM SE N I O R L E A D E R SH I P T E A M W I T H T R A C K R E C O R D O F SU C C E SS I N T H E T R T M A R K E T 5

• 25+ years of experience in healthcare • Founded or led 8 healthcare and pharmaceutical companies (i.e. Innovative Biosensors, Blue Water Vaccines, Noachis Terra) • Previously Chairman of Microlin Bio, Ember Therapeutics, Sydys Corporation JOE H ERNA N DEZ , MS , MBA Chairman and CEO BLU E WATER LEADER SHIP TEAM AND BOARD STRONG INSTITUTIONAL INVESTOR SUPPORT KIMBERLY MURPHY Former VP of the Influenza Franchise and Global Vaccine Commercialization Leader, GlaxoSmithKline JAMES SAPIRSTEIN President and CEO, AzurRx BioPharma M I C H AE L LERNER Chair of the Life Sciences Group, Lowenstein Sandler Y V ONN E M C BURNEY VP of Operations, Alivia Specialty Pharmacy • 20+ years of financial leadership in healthcare • Previously CFO of Pyramid Healthcare, Monte Nido, Clearant, Network IP and Simplified Development • Served as Co - Founder and Vice President of Acquisition for Coach USA JON GARF I ELD Chief Financial Officer DIRECTORS 6

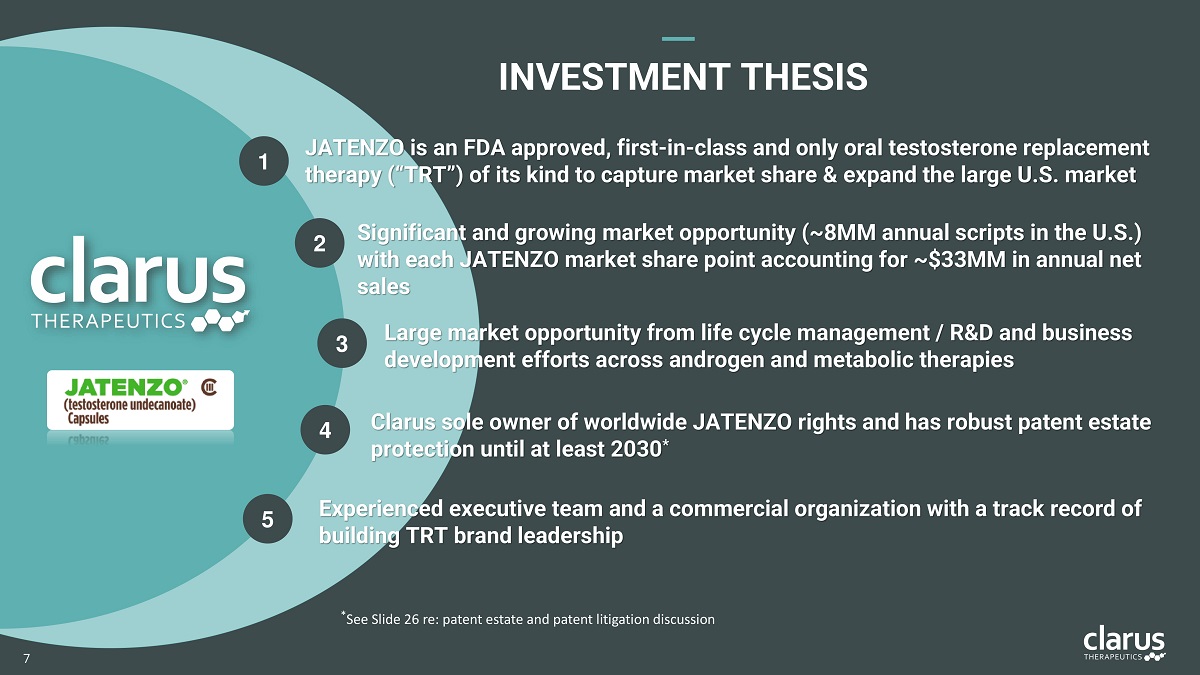

1 2 5 3 4 JATENZO is an FDA approved, first - in - class and only oral testosterone replacement therapy (“TRT”) of its kind to capture market share & expand the large U.S. market Significant and growing market opportunity (~ 8 MM annual scripts in the U . S . ) with each JATENZO market share point accounting for ~ $ 33 MM in annual net sales Experienced executive team and a commercial organization with a track record of bui l ding TRT br a nd leadership Large market opportunity from life cycle management / R&D and business development efforts across androgen and metabolic therapies Clarus sole owner of worldwide JATENZO rights and has robust patent estate protection until at least 2030 * INVESTMEN T THESIS * See Slide 26 re: patent estate and patent litigation discussion 7

8 THE JATENZO O PP O R T U N I T Y

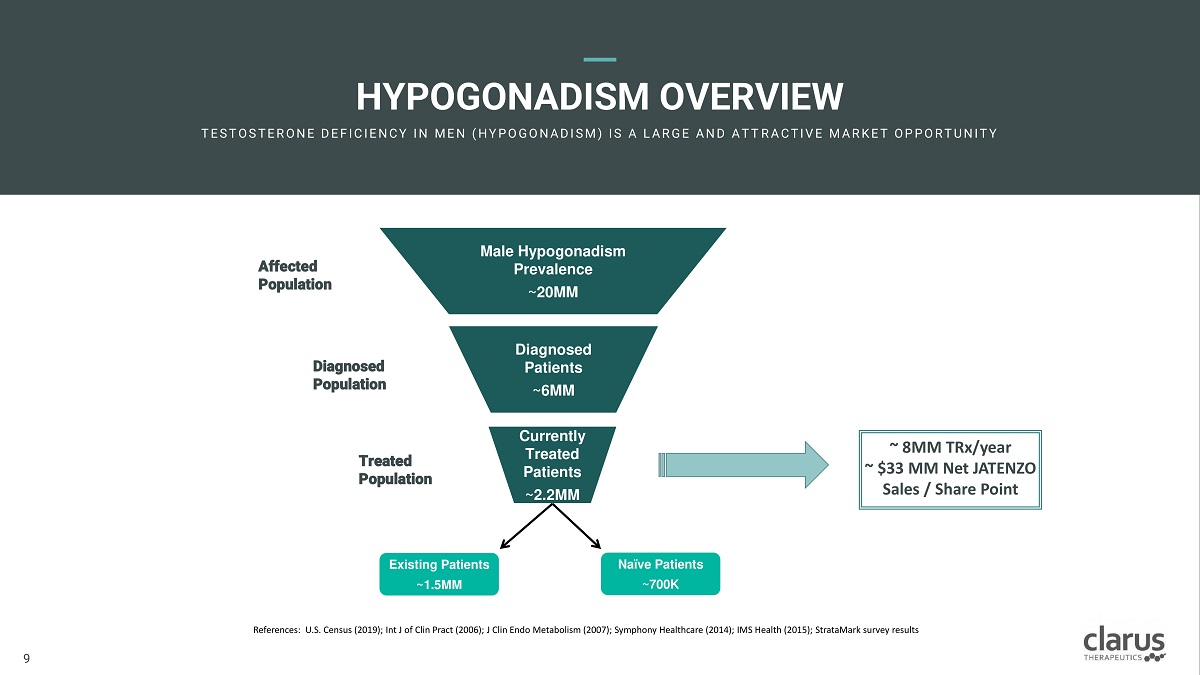

HYPOGONADIS M OVERVIEW T E ST O ST E R O N E D E F I C I E N C Y I N M E N ( H Y PO G O N A D I SM ) I S A L A R G E A N D A T T R A C T I V E M A R K E T O PPO R T U N I T Y Male Hypogonadism Prevalence ~20MM Diag n os e d Patients ~6MM C u rrently Treated Patients ~2.2MM Existing Patients ~1.5MM Naïve Patients ~700K Diagnosed P o pulation Treated Population Affected P o pulation References: U.S. Census (2019); Int J of Clin Pract (2006); J Clin Endo Metabolism (2007); Symphony Healthcare (2014); IMS Health (2015); StrataMark survey results 9 9 ~ 8MM TRx/year ~ $33 MM Net JATENZO Sales / Share Point

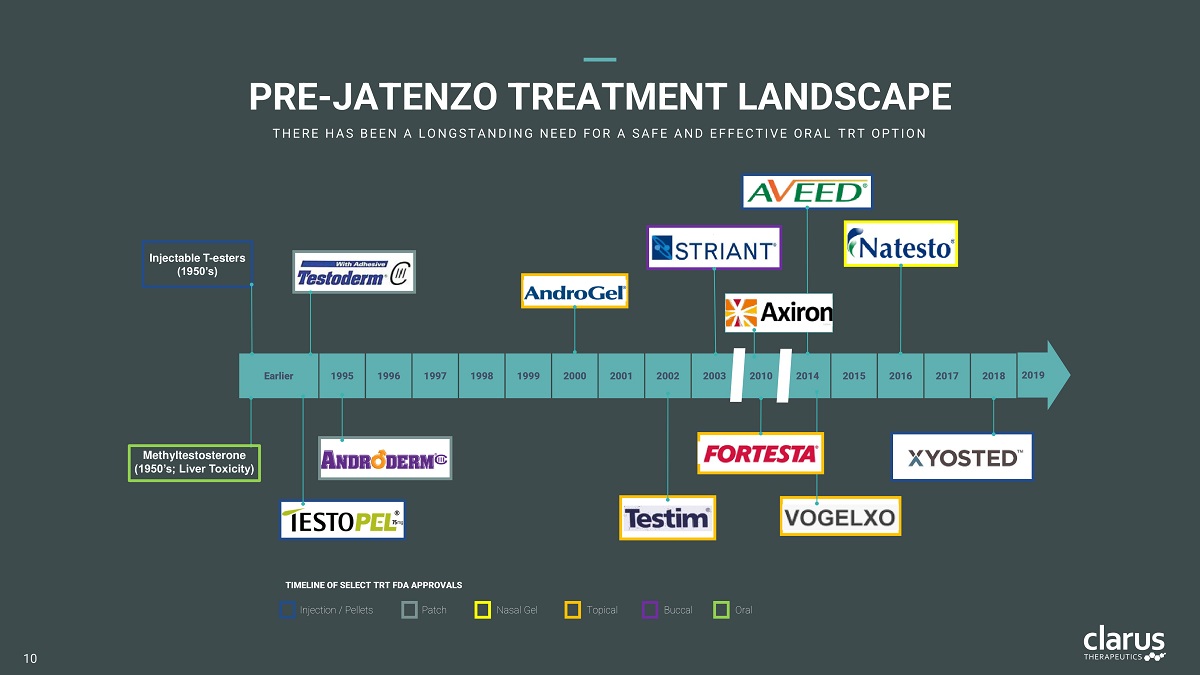

2014 2010 2003 Earlier 1995 1996 1997 1998 1999 2000 2001 2002 2015 2016 2017 2018 2019 TIM E L I N E O F S E L E C T TR T FDA APP R OVA L S Injection / Pellets Patch T opi c al Buc cal Na s al Gel O r al Methyltestosterone (1950’s; Liver Toxicity) Injectable T - esters (1950’s) PRE - JATENZO TREATMENT LANDSCAPE T H E R E H A S B E E N A L O N G S T A N D I N G N E E D F O R A S A F E A N D E F F E C T I V E O R A L T R T O P T I O N 10

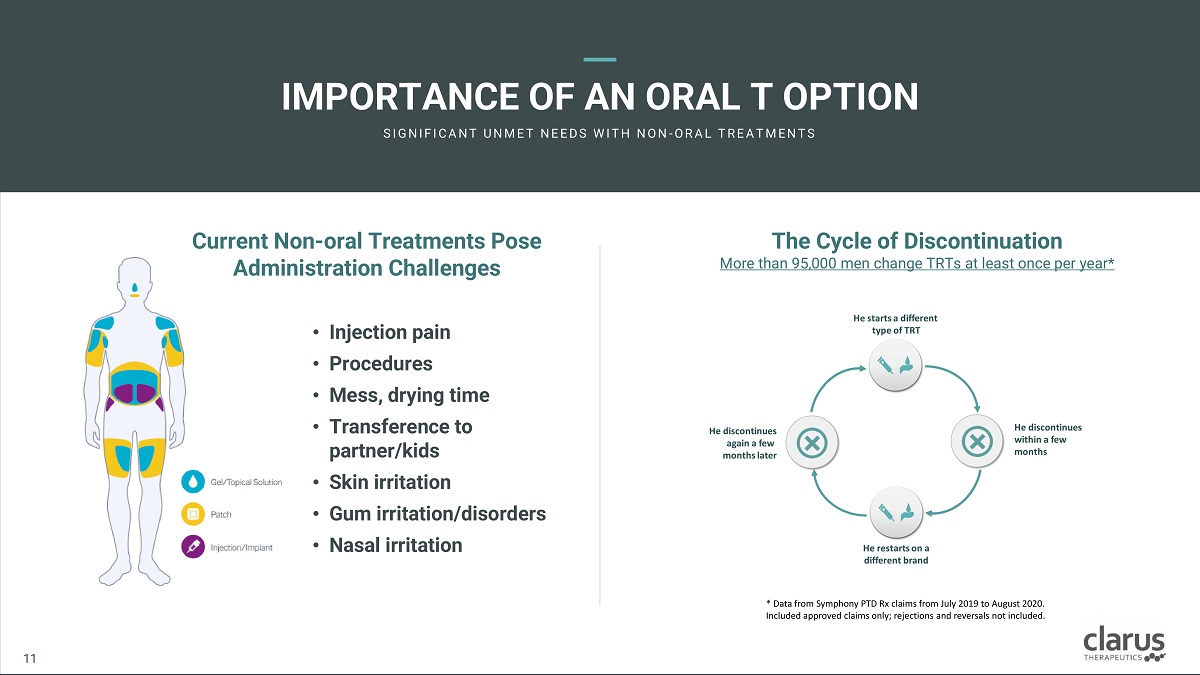

The C ycl e o f Disconti n ua t ion More than 95,000 men change TRTs at least once per year* Curren t Non - ora l Trea t m e nts Po s e Administration Challenges • Injectio n pain • Procedures • Mess, drying time • Transferen c e to partner/kids • Skin irritation • Gum irr i tation/diso r d e rs • Nasal irritation IMPORTANC E O F AN ORA L T OPTION SI G N I F I C A N T U N M E T N E E D S W I T H N O N - O R A L T R E A T M E N T S 11 11 * Data from Symphony PTD Rx claims from July 2019 to August 2020. Included approved claims only; rejections and reversals not included.

THE J ATEN Z O OPPORTUNITY F I R ST O R A L T O F I T S K I N D A PPR O V E D B Y F D A – A L O N G - A W A I T E D A D V A N C E! CONVENIENT • Easy - to - swallow soft gel taken BID with food (twice daily) • Dose adjustable, if necessary EFFECTIVE • 87% o f me n achi e ved T levels in norma l range • Restore d T levels to mi d - norma l ra n ge SAFE • Safety prof i le consisten t wit h TRT class • No liver toxicity -- JATENZO bypasses first - pass hepatic metabolism * In JATENZO Phase III Clinical Trials * 11 12

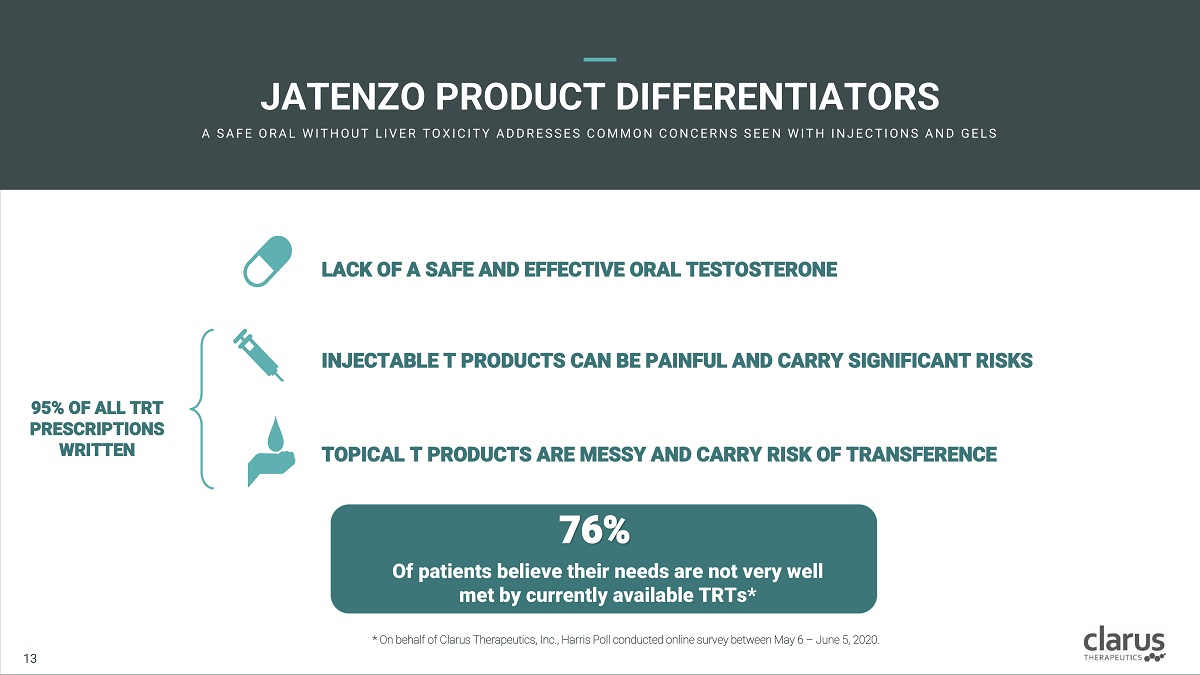

JATE N ZO P R ODUC T DI F FE R ENTIATORS A SA F E O R A L W I T H O U T L I V E R T O X I C I T Y A D D R E SSE S C O M M O N C O N C E R N S SE E N W I T H I N J E C T I O N S A N D G E L S LACK O F A SAFE AN D EFF E CTIV E ORA L T ES T OSTER O NE INJECTABLE T PRODUCTS CAN BE PAINFUL AND CARRY SIGNIFICANT RISKS TOPICAL T PRODUCTS ARE MESSY AND CARRY RISK OF TRANSFERENCE 95% O F A LL TRT PRESCRIPTION S WRITTEN 76% O f patie n ts believe th e ir ne e ds ar e no t very w e ll me t by currently avai l able TR Ts* 11 13 * On behalf of Clarus Therapeutics, Inc., Harris Poll conducted online survey between May 6 – June 5, 2020.

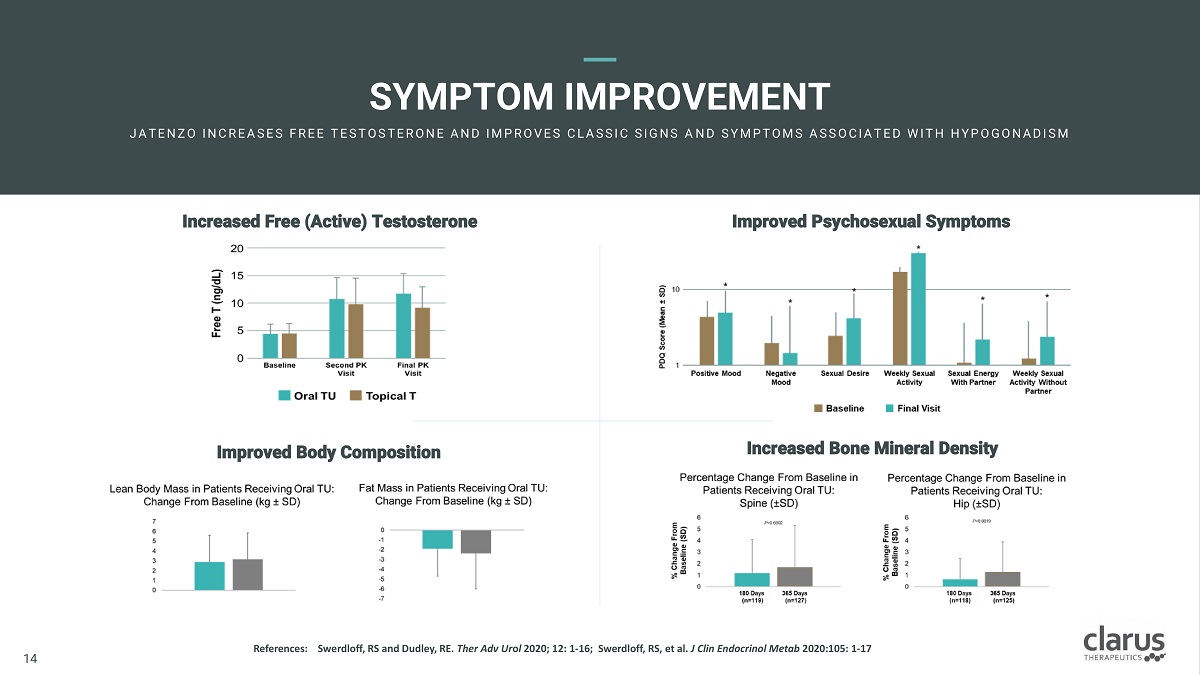

SYMPTOM IMPROVEMENT JA T E N Z O I N C R E A SE S F R E E T E ST O ST E R O N E A N D I M PR O V E S C L A SSI C SI G N S A N D S Y M PT O M S A S S O C I A T E D W I T H H Y PO G O N A D I S M Increased Bone Mineral Density Improved Body Composition Improved Psychosexual Symptoms Increased Free (Active) Testosterone R e f e r en c e s : 11 14 Swerdloff, RS and Dudley, RE. Ther Adv Ur o l 2020; 12: 1 - 16; Swerdloff, RS, et al. J Clin Endocrinol Metab 2020:105: 1 - 17

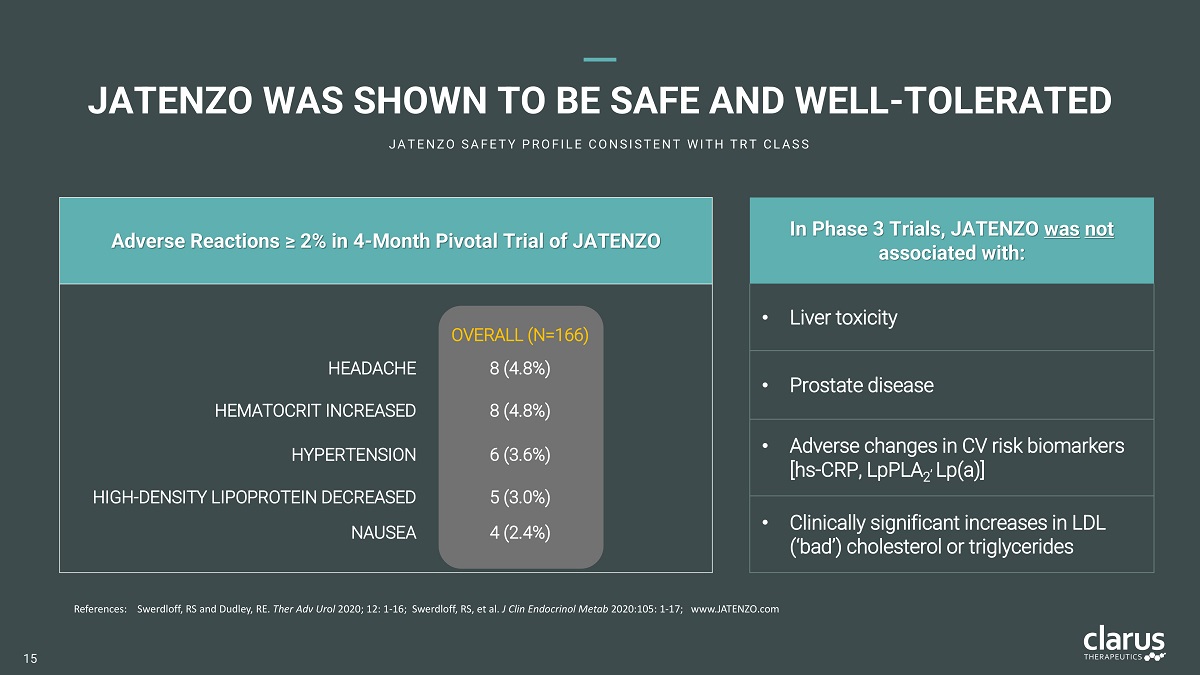

Adverse Reactions ≥ 2% in 4 - Month Pivotal Trial of JATENZO JATENZO WAS SHOWN TO BE SAFE AND WELL - TOLERATED J A T E N Z O S A F E T Y P R O F I L E C O N S I S T E N T W I T H T R T C L A S S R e f e r e n c es : Swerdloff, RS and Dudley, RE. Ther Adv Ur o l 2020; 12: 1 - 16; Swerdloff, RS, et al. J Clin Endocrinol Metab 2020:105: 1 - 17; www.JATENZO.com OVER A L L ( N= 166 ) HEADACHE 8 (4.8%) HE MA T O C R I T I N C R E A S E D 8 (4.8%) HYPERTENSION 6 (3.6%) HIGH - DENSITY LIPOPROTEIN DECREASED 5 (3.0%) NAUSEA 4 (2.4%) I n Phase 3 Trials, JA T E N ZO wa s not associated with: • Liver toxicity • Prostate disease • A d ve r s e ch a n g e s in C V r i s k b i o m a r k e r s [ h s - C R P , L pP L A , L p ( a) ] 2 • Clinically significant increases in LDL (‘ ba d ’ ) cho l es t e r o l o r t r i g l y c er i d e s 15

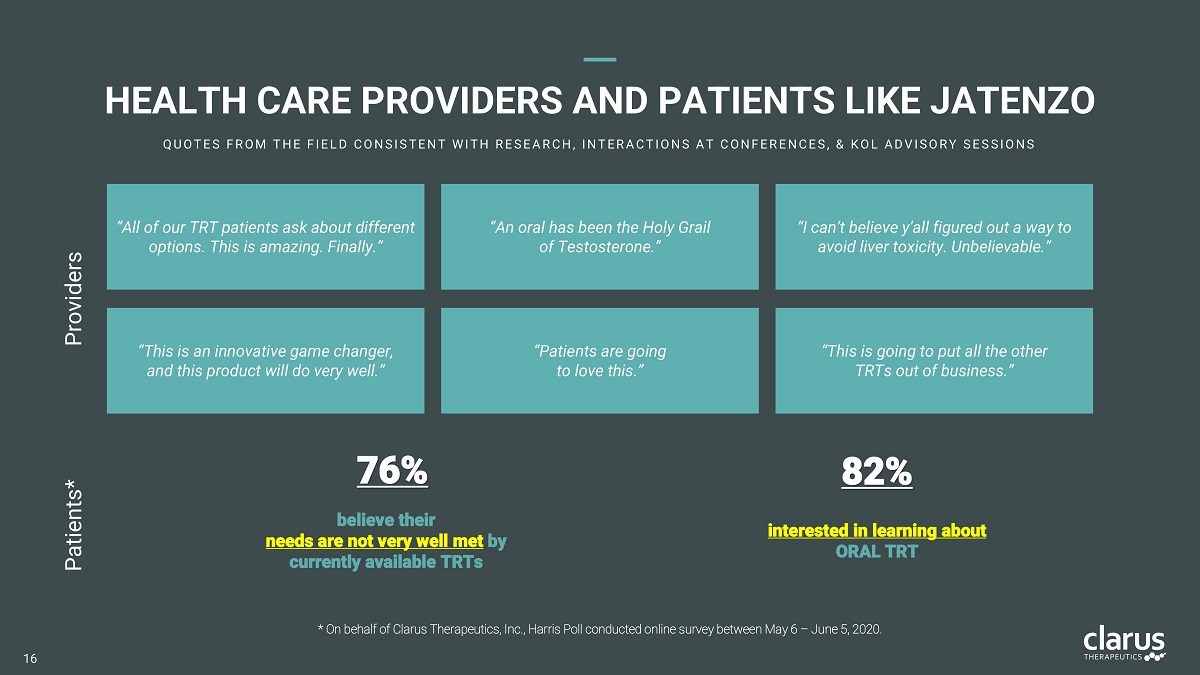

“All of our TRT patients ask about different options. This is amazing. Finally.” “This is an innovative game changer, and this product will do very well.” “An oral has been the Holy Grail of Testosterone.” “This is going to put all the other TRTs out of business.” “Patients are going to love this.” “I can’t believe y’all figured out a way to avoid liver toxicity. Unbelievable.” 76% believe their need s ar e no t ver y wel l me t by currently available TRTs 82% interested in learning about ORA L TRT * On behalf of Clarus Therapeutics, Inc., Harris Poll conducted online survey between May 6 – June 5, 2020. Providers Patients* HEALT H CAR E PROVIDERS AND PATIENTS LIK E JATENZO Q U O T E S FR O M T H E FI E L D C O N SI ST E N T W I T H R E SE A R C H , I N T E R A C T I O N S A T C O N FE R E N C E S , & K O L A D V I SO R Y SE SSI O N S 16

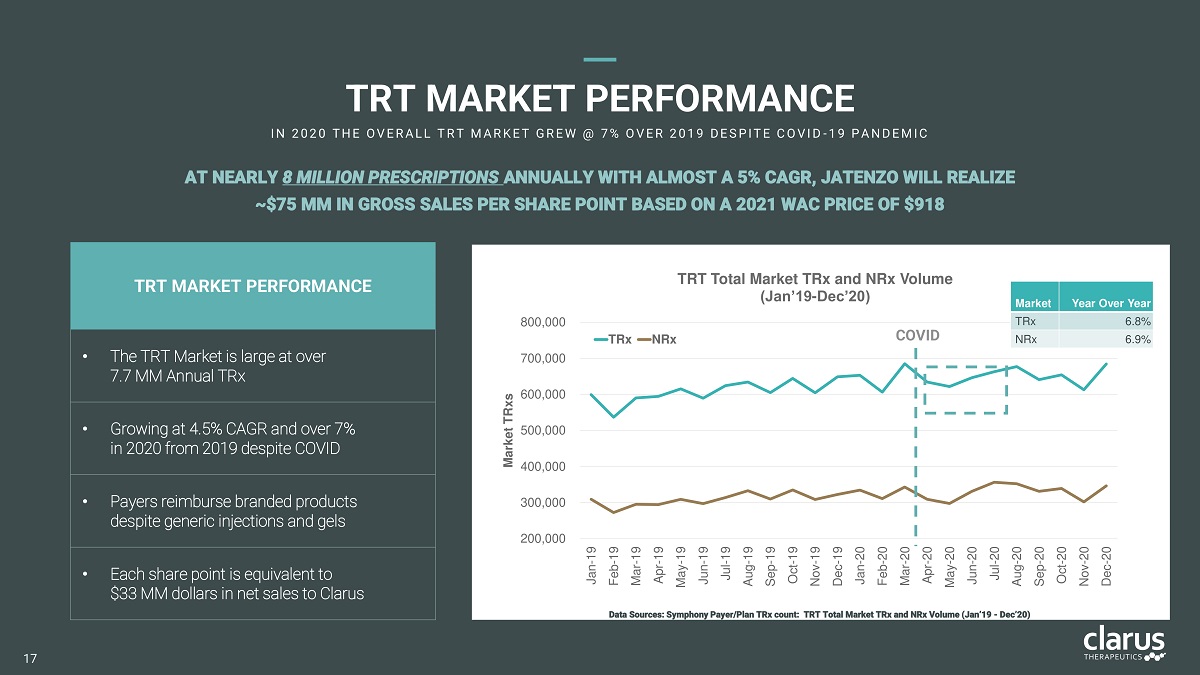

70 0 , 0 00 60 0 , 0 00 50 0 , 0 00 40 0 , 0 00 30 0 , 0 00 20 0 , 0 00 80 0 , 0 00 Jan - 19 Fe b - 1 9 Mar - 19 Apr - 19 May - 19 Jun - 19 Jul - 19 Aug - 19 Sep - 19 Oct - 19 Nov - 19 Dec - 19 Jan - 20 Feb - 20 Mar - 20 Apr - 20 May - 20 Jun - 20 Jul - 20 Aug - 20 Sep - 20 Oct - 20 Nov - 20 Dec - 20 Market TRxs TRT Total Market TRx and NRx Volume (Jan’19 - Dec’20) T R x N Rx TRT MA R KET P ERF ORMANCE I N 2 0 2 0 T H E O V E R A L L T R T M A R K E T G R E W @ 7 % O V E R 2 0 1 9 D E SPI T E C O V I D - 1 9 PA N D E M I C Data Sources: Symphony Payer/Plan TRx count: TRT Total Market TRx and NRx Volume (Jan’19 - Dec’20) AT NEARLY 8 MILLION PRESCRIPTIONS ANNUALLY WITH ALMOST A 5% CAGR, JATENZO WILL REALIZE ~$75 MM IN GROSS SALES PER SHARE POINT BASED ON A 2021 WAC PRICE OF $918 CO V I D T R T MARKE T PE R FORM A N C E • The TRT Market is large at over 7 . 7 M M A n nu a l TR x • G r o w in g a t 4 . 5 % C A G R a n d o v e r 7 % i n 20 2 0 f r o m 20 1 9 d e s pi t e C O V ID • P a y e r s r e i m b ur s e b r a nd e d p r o d u c t s despite generic injections and gels • E ac h sh a r e p o i n t i s e q u i v a l e n t to $3 3 M M d o ll a r s i n n e t s a l e s t o C l a ru s Ma r k e t TRx NRx Year Over Year 6.8% 6.9% 17

FOCUSED T ARG E TING C L A R U S I S E N G A G I N G T H E K E Y T R T H C PS A N D T H E PA T I E N T S T H E Y T R E A T Endocrinologi s ts , Urologis ts , Primar y Car e P h ysicians Targeting Deciles 8 - 10 Healthcare Providers 55 Territories = 62% TRT Market Coverage 10 0 T e r r i t o r i e s = 85 % T R T M a r k e t C o v e r a g e Hypogonadal Patients Digital Advertising / Paid Search Social Media / Programmatic Advertising Data Source: Symphony Health PrescriberSource data February 2021 18 18

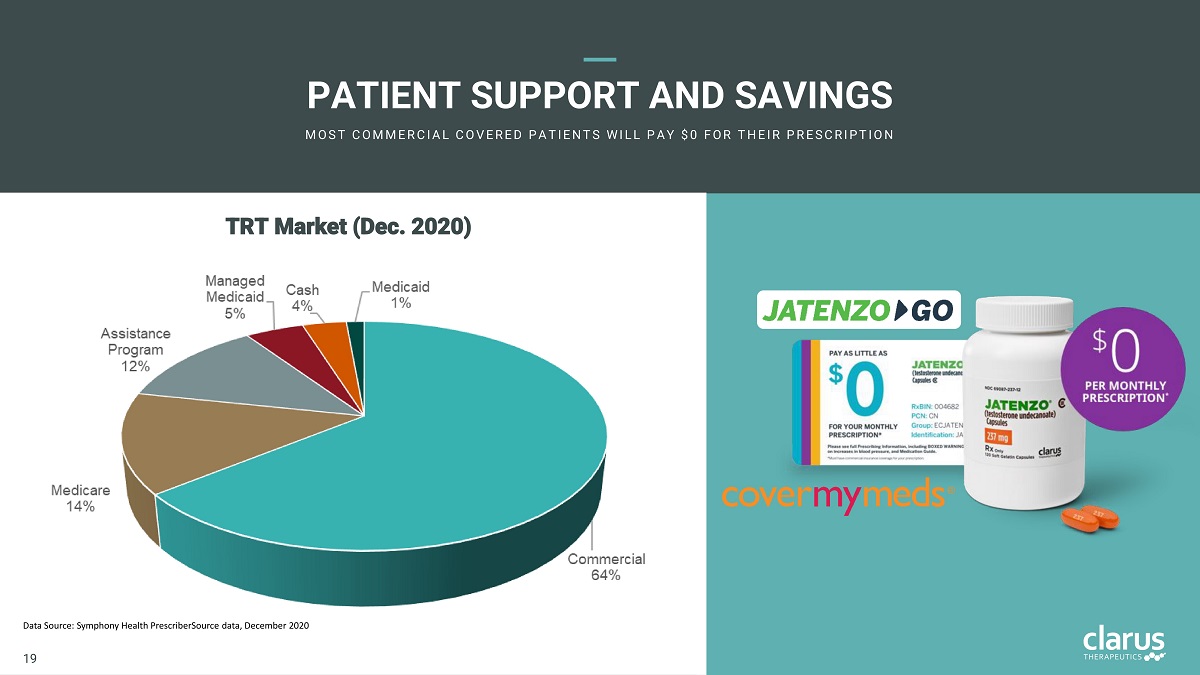

PATI E NT SUPPORT AND SAVINGS M O S T C O M M E R C I A L C O V E R E D PA T I E N T S W I L L PA Y $ 0 F O R T H E I R PR E S C R I PT I O N TRT Marke t (Dec . 2020) Data Source: Symphony Health PrescriberSource data, December 2020 18 19

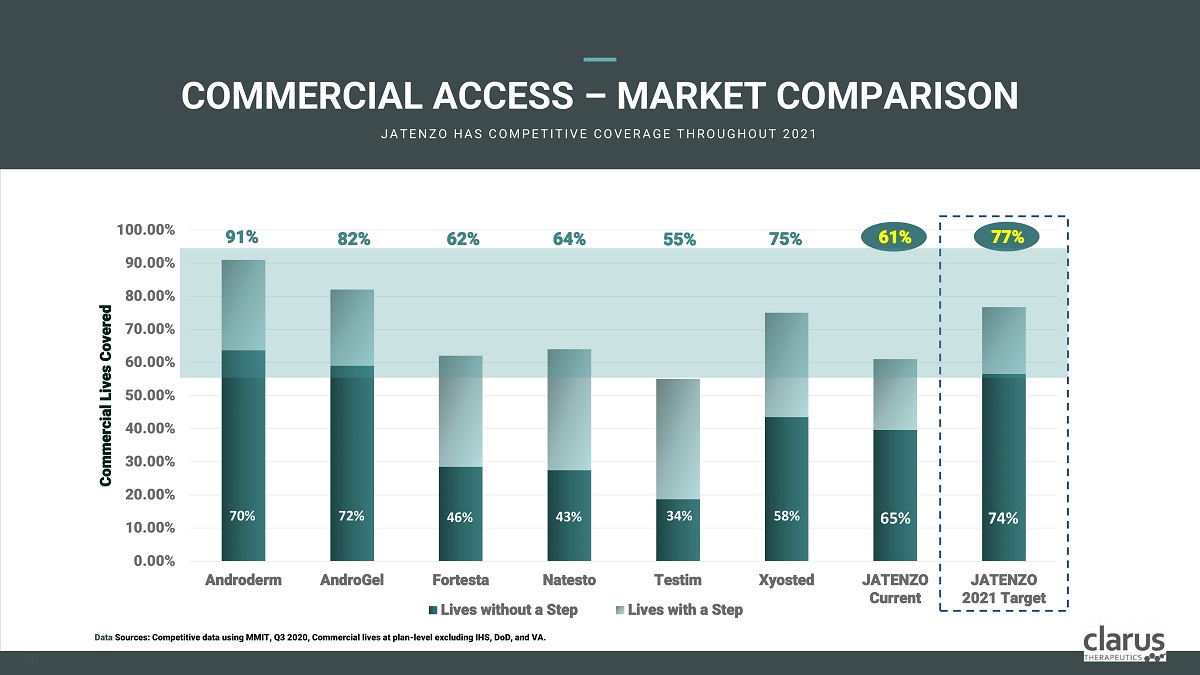

COMMERCIAL ACCESS – MARKET COMPARISON JA T E N Z O H A S C O M PE T I T I V E C O V E R A G E T H R O U G H O U T 2 0 2 1 0 . 00 % 10 . 00 % 90.00% 80.00% 70.00% 60 . 00 % 50.00% 40.00% 30.00% 20.00% 100.00% And r oderm And r oGel X y osted JATE N ZO Current JATENZO 2021 Target Co m mercia l Li v es Covered For t esta Na t esto Lives without a Step Testim Lives with a Step 91% 82% 62% 64% 55% 75% 61% 70% 72% 46% 43% 34% 58% 65% Data Sources: Competitive data using MMIT, Q3 2020, Commercial lives at plan - level excluding IHS, DoD, and VA. 77% 74% 20

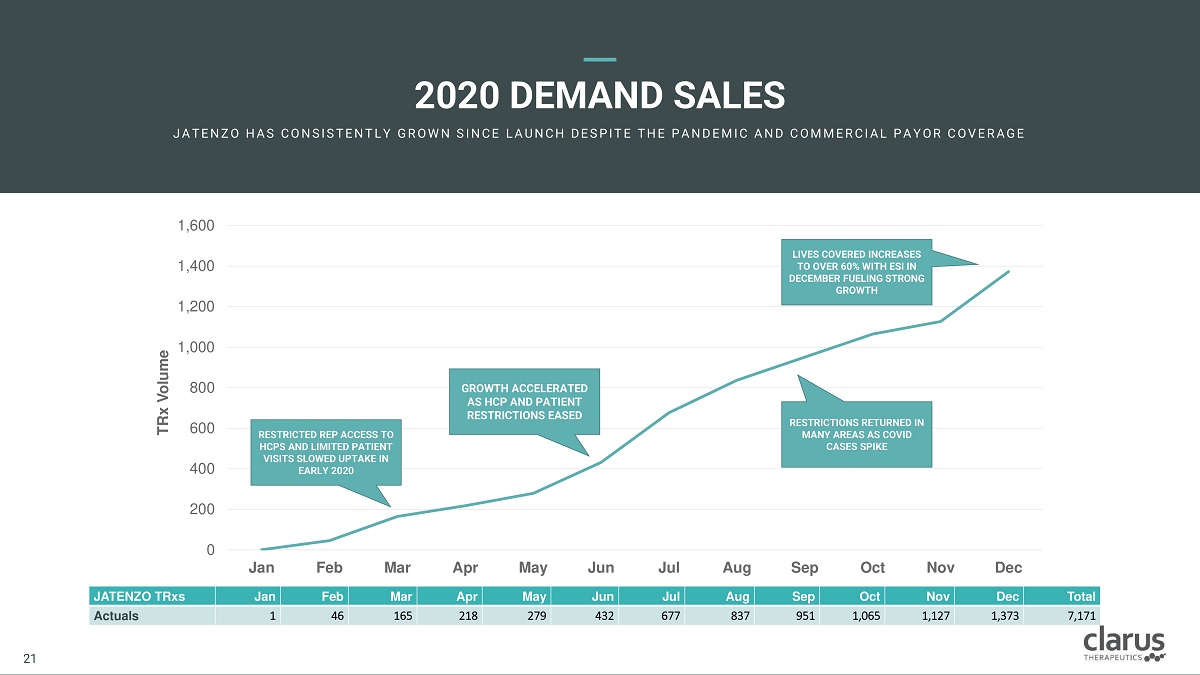

2020 DEMAND SALES JA T E N Z O H A S C O N SI ST E N T L Y G R O W N SI N C E L A U N C H D E SPI T E T H E PA N D E M I C A N D C O M M E R C I A L PA Y O R C O V E R A G E JATENZO TRxs Jan Feb Mar Apr May Jun Jul Aug Sep Oct Nov Dec Total Actuals 1 46 165 218 279 432 677 837 951 1,065 1,127 1,373 7,171 200 0 400 600 800 1,200 1,000 1,400 1,600 Jan Feb Mar Apr May Jun Jul Aug Sep Oct No v Dec TRx Volume RES T RIC T ED REP ACCESS T O HCP S AND LIMI T ED PA TIENT VIS I T S SLO WED U P T AKE IN EAR LY 2 0 20 G R O W TH ACC E L E RATED AS HC P AND PA TIENT R E ST R ICTION S EAS E D RES T RIC T I O NS RE T URNE D IN M ANY A RE A S A S COVID CASE S SPI K E LIVE S CO V ERED INCREASES T O O VE R 6 0 % WIT H ESI IN 21 21 D ECEMBER FUELING ST R O N G GROWTH

DTC • Launch Date: Q4/2021 21 22 Spokesperson • Launch Date: Q4/2021 • In Active Negotiations EMPOWER THE P ATIENT: DTC AND SPOKES P ERSON A C C E L E R A T E JA T E N Z O PA T I E N T A W A R E N E SS T O D R I V E SW I T C H R A T E

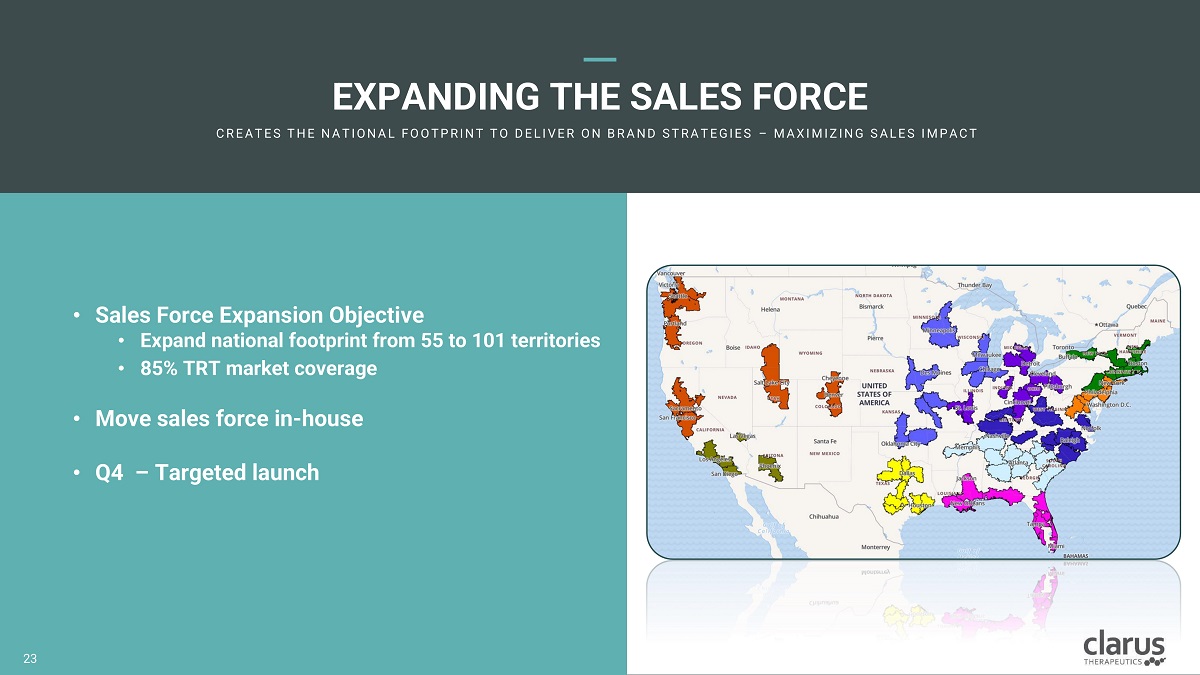

EXPANDING THE SALES FORCE C R E A T E S T H E N A T I O N A L F O O T PR I N T T O D E L I V E R O N B R A N D ST R A T E G I E S – M A X I M I Z I N G SA L E S I M PA C T • Sales Force Expansion Objective • Ex p an d national fo o tprin t fr o m 55 t o 101 territor i es • 85% TRT marke t coverage • Move sales force in - house • Q4 – Targeted launch 21 23

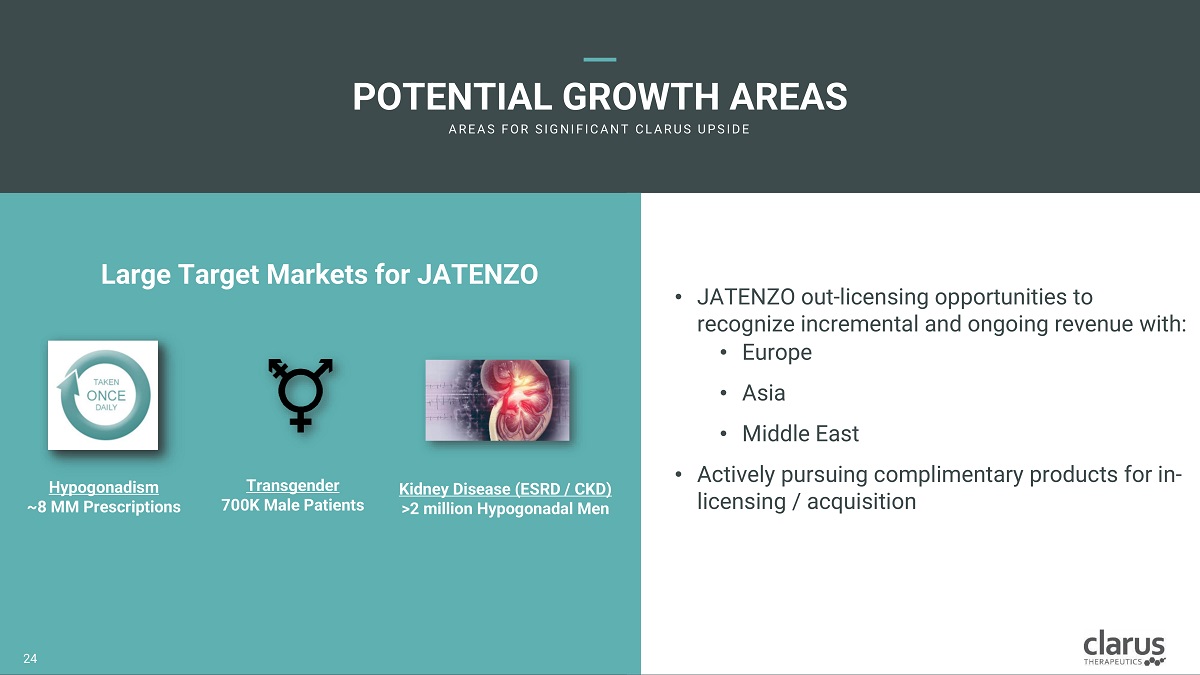

• JATENZO out - licensing opportunities to recognize incremental and ongoing revenue with: • Europe • Asia • Middle East • Actively pursuing complimentary products for in - licensing / acquisition POTENTIAL GROWTH A R EAS A R E A S F O R S I G N I F I C A N T C L A R U S U P S I D E Ki d ne y Dis ea s e (ESR D / CKD) >2 million Hypogonadal Men Transgender 700K Male Patients Hypogonadism ~8 MM Prescriptions Large Target Markets for JATENZO 21 24

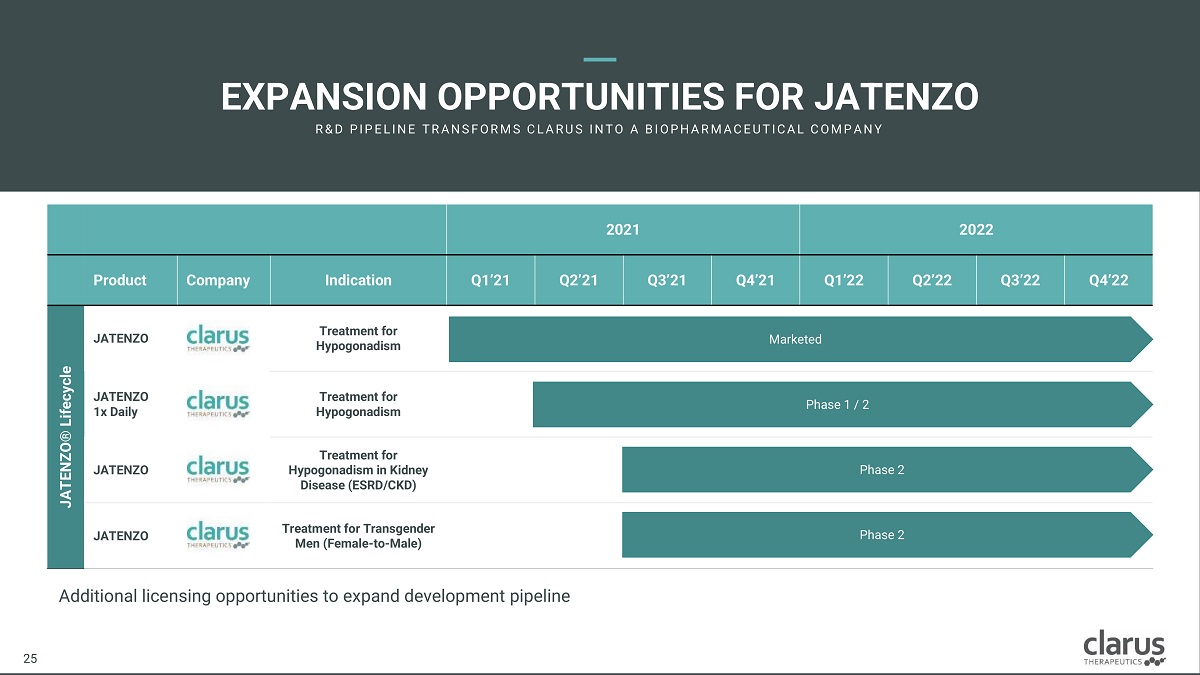

Additional licensing opportunities to expand development pipeline EXPANSION OPPORTUNITIE S FOR J ATENZO R & D PI PE L I N E T R A N SF O R M S C L A R U S I N T O A B I O PH A R M A C E U T I C A L C O M PA N Y 2021 2022 Product Company Indication Q1’21 Q2’21 Q3’21 Q4’21 Q1’22 Q2’22 Q3’22 Q4’22 JATENZO® Lifecycle JATENZO Tre a t me nt for Hypog o nadis m Ma rke ted JATENZO 1x Daily T re a t m en t for Hypogonadism Phase 1 / 2 JATENZO Tre a t me nt for Hypog o nadism in Kidney Disease (ESRD/CKD) Phase 2 JATENZO Tre a t me nt for Transg e nder Men (Female - to - Male) Phase 2 21 25

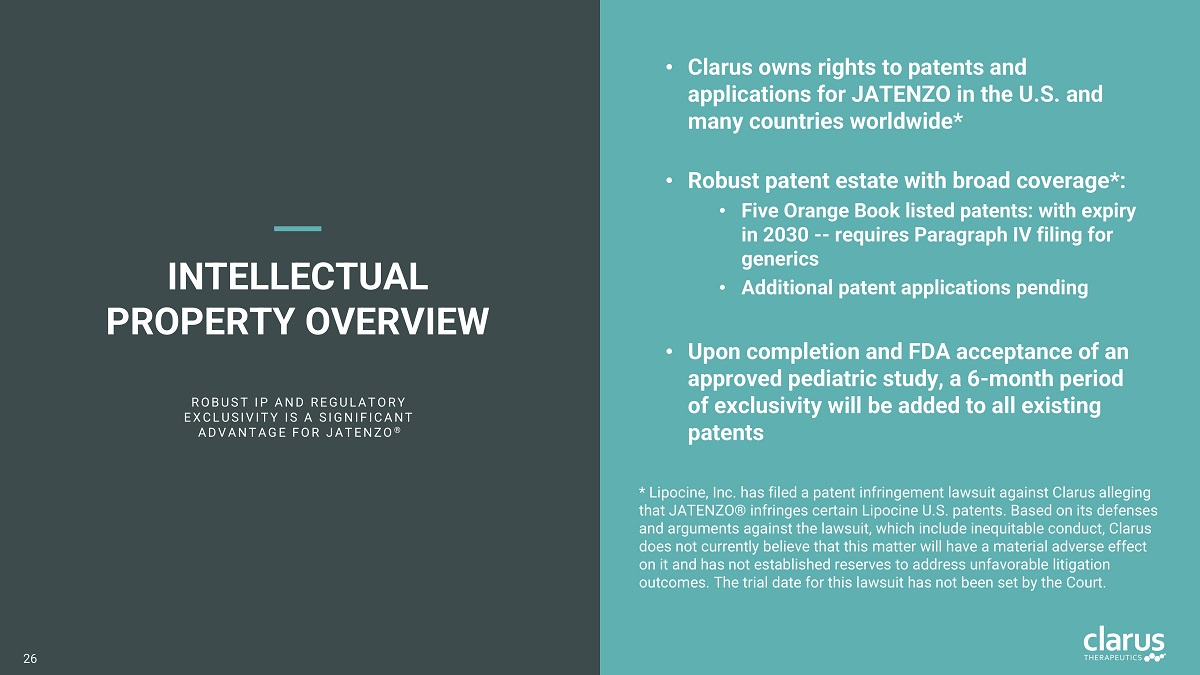

R O B U S T I P A N D R E G U L A T O R Y E X C L U S I V I T Y I S A S I G N I F I C A N T A D V A N T A G E F O R J A T E N Z O ® INTELLECTUAL PROPE R TY OVERVIEW • Claru s own s rig h t s t o pa t ent s and application s for JATENZO i n th e U.S . and many countries worldwide* • Robust patent estate with broad coverage*: • Five Oran g e Boo k listed patents : wit h expiry in 2030 - - re q u i re s Pa r a g r a ph I V fili n g for generics • Additional patent applications pending • Upo n completion a nd FDA accept a nce o f a n approved pediatric study, a 6 - month period of exclusivity will be added to all existing patents * Lipocine, Inc. has filed a patent infringement lawsuit against Clarus alleging that JATENZO® infringes certain Lipocine U.S. patents. Based on its defenses and arguments against the lawsuit, which include inequitable conduct, Clarus does not currently believe that this matter will have a material adverse effect on it and has not established reserves to address unfavorable litigation outcomes. The trial date for this lawsuit has not been set by the Court. 26

27 Transaction Summary

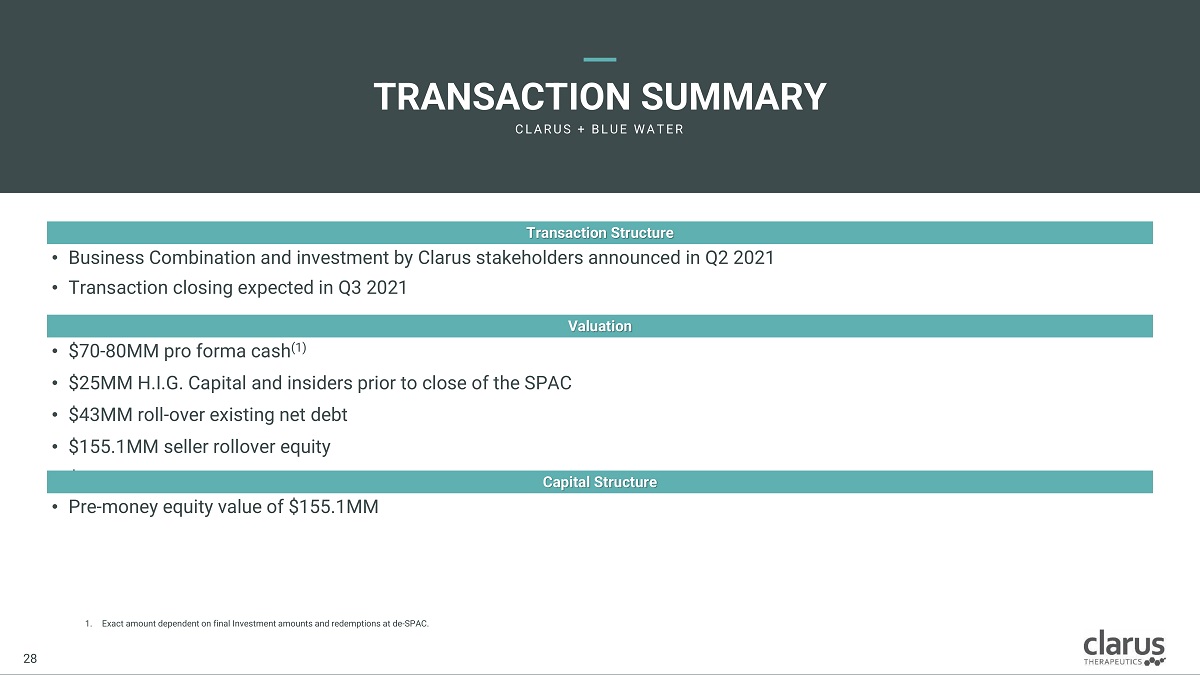

1. Exact amount dependent on final Investment amounts and redemptions at de - SPAC. • Business Combination and investment by Clarus stakeholders announced in Q2 2021 • Transaction closing expected in Q3 2021 Transaction Structure • $70 - 80MM pro forma cash (1) • $25MM H.I.G. Capital and insiders prior to close of the SPAC • $43MM roll - over existing net debt • $155.1MM seller rollover equity • $57.5M BWAC cash in trust Valuation • Pre - money equity value of $155.1MM Capital Structure Clarus Therapeutics Confidential & Proprietary Information: Internal Use Only – Do Not Copy or Distribute / Contains Draft Proposals Subject to Internal Review and Change 28 28 TRANSACTION SU M MARY C L A R U S + B L U E W A T E R

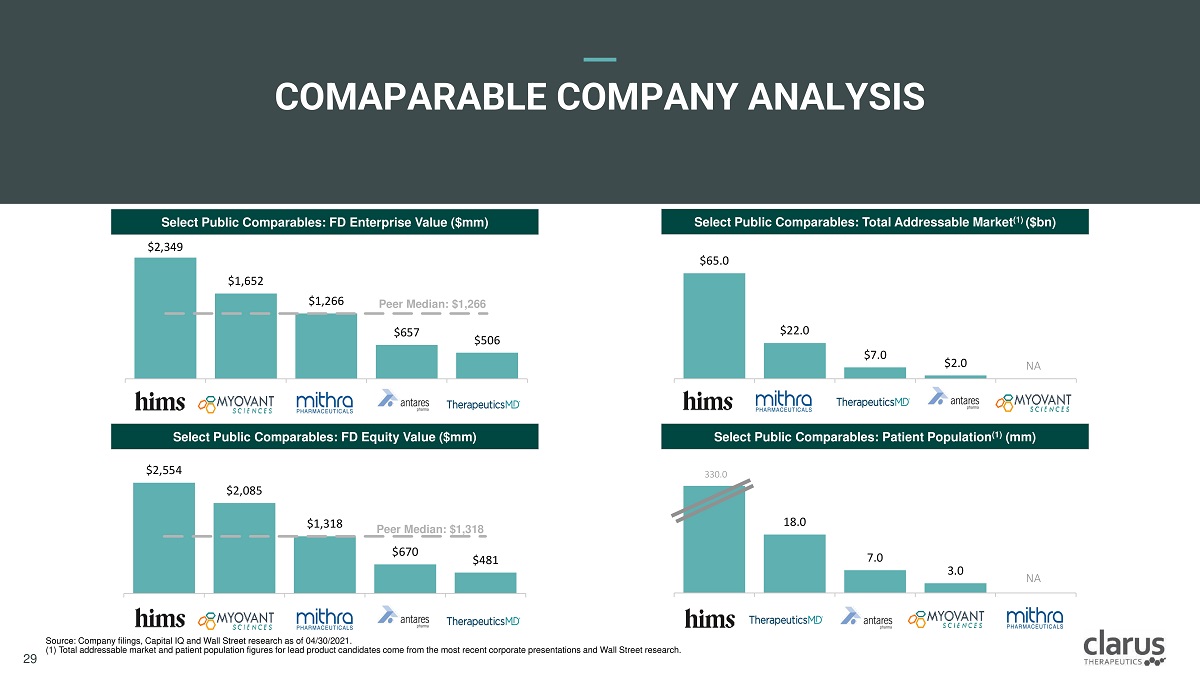

$ 6 5.0 $22 .0 $7 .0 $ 2 .0 $ 2 ,5 5 4 $2 , 08 5 $ 1 ,3 1 8 $670 $481 $2 , 34 9 $1 , 65 2 $1 , 26 6 $657 $506 COMAPARABL E CO M PANY ANALYSIS Source: Company filings, Capital IQ and Wall Street research as of 04/30/2021. (1) Total addressable market and patient population figures for lead product candidates come from the most recent corporate presentations and Wall Street research. Select Public Comparables: FD Enterprise Value ($mm) Select Public Comparables: Total Addressable Market (1) ($bn) Select Public Comparables: FD Equity Value ($mm) Select Public Comparables: Patient Population (1) (mm) Peer Median: $1,266 Peer Median: $1,318 NA 18 .0 7 .0 3.0 NA 330 .0 Clarus Therapeutics Confidential & Proprietary Information: Internal Use Only – Do Not Copy or Distribute / Contains Draft Proposals Subject to Internal Review and Change 28 29

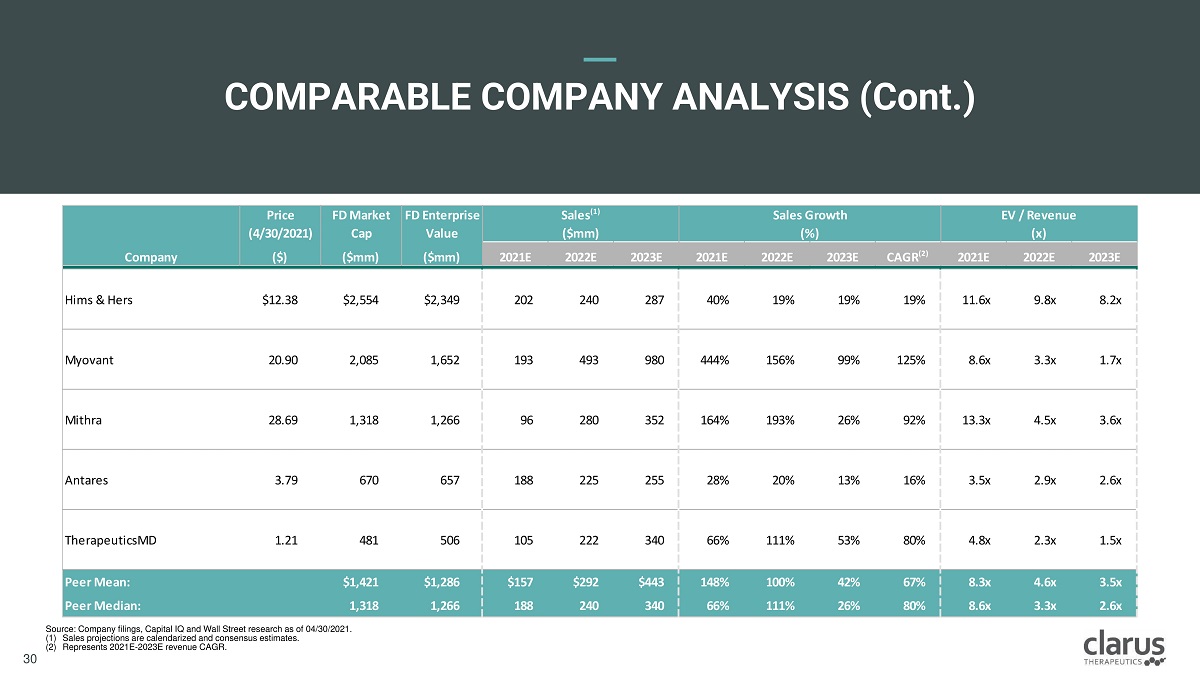

COMPARABL E CO M PANY ANALYSIS ( Cont . ) Price (4/30/2021) F D M a r k e t Cap F D E n t e r p r i se Value Sales (1) ($mm) Sales Growth (%) E V / R e v e nu e (x) Company ($) ($mm) ($mm) 2021E 2022E 2023E 2021E 2022E 2023E CAGR (2) 2021E 2022E 2023E Hims & Hers $12.38 $2,554 $2,349 202 240 287 40% 19% 19% 19% 11.6x 9.8x 8.2x Myovant 20.90 2,085 1,652 193 493 980 444% 156% 99% 125% 8.6x 3.3x 1.7x Mithra 28.69 1,318 1,266 96 280 352 164% 193% 26% 92% 13.3x 4.5x 3.6x Antares 3.79 670 657 188 225 255 28% 20% 13% 16% 3.5x 2.9x 2.6x TherapeuticsMD 1.21 481 506 105 222 340 66% 111% 53% 80% 4.8x 2.3x 1.5x P e e r M e a n : $1,421 $1,286 $157 $292 $443 148% 100% 42% 67% 8.3x 4.6x 3.5x P e e r M e d i a n : 1,318 1,266 188 240 340 66% 111% 26% 80% 8.6x 3.3x 2.6x Clarus Therapeutics Confidential & Proprietary Information: Internal Use Only – Do Not Copy or Distribute / Contains Draft Proposals Subject to Internal Review and Change 30 30 Source: Company filings, Capital IQ and Wall Street research as of 04/30/2021. (1) Sales projections are calendarized and consensus estimates. (2) Represents 2021E - 2023E revenue CAGR.

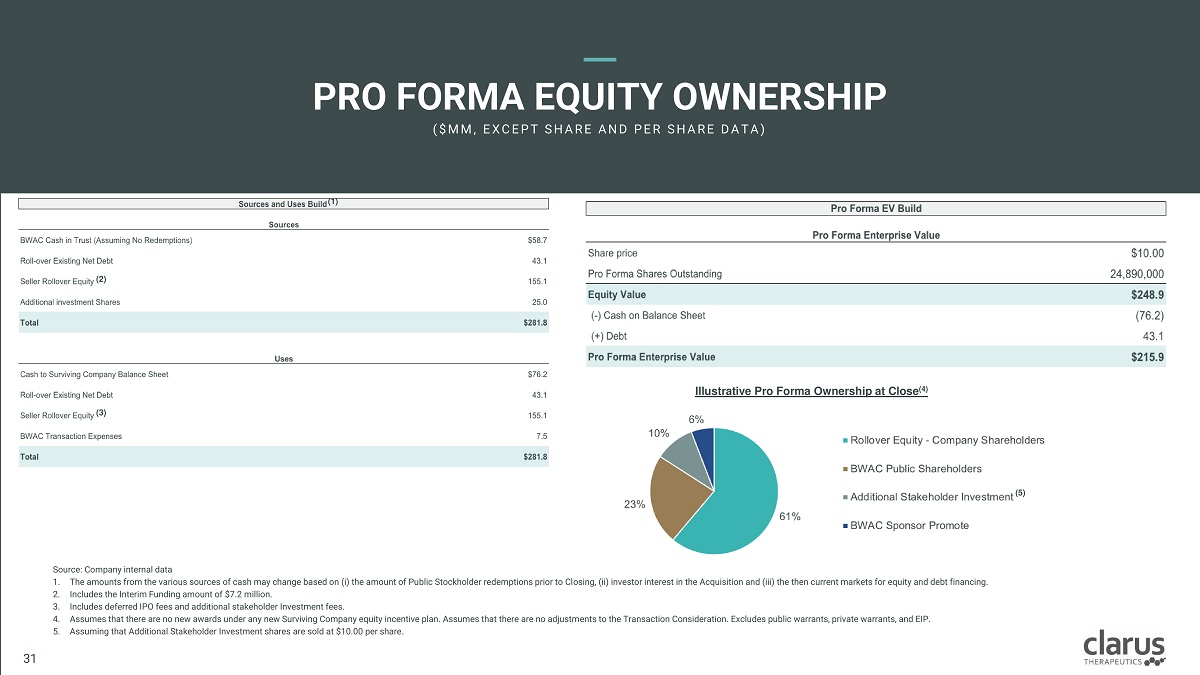

Source: Company internal data 1. The amounts from the various sources of cash may change based on (i) the amount of Public Stockholder redemptions prior to Closing, (ii) investor interest in the Acquisition and (iii) the then current markets for equity and debt financing. 2. Includes the Interim Funding amount of $7.2 million. 3. Includes deferred IPO fees and additional stakeholder Investment fees. 4. Assumes that there are no new awards under any new Surviving Company equity incentive plan. Assumes that there are no adjustments to the Transaction Consideration. Excludes public warrants, private warrants, and EIP. 5. Assuming that Additional Stakeholder Investment shares are sold at $10.00 per share . Illustrative Pro Forma Ownership at Close (4) PRO FORMA EQUITY OWNERSHIP ( $ M M , E X C E P T S H A R E A N D P E R S H A R E D A T A ) (1) (2) (3) (5) Clarus Therapeutics Confidential & Proprietary Information: Internal Use Only – Do Not Copy or Distribute / Contains Draft Proposals Subject to Internal Review and Change 30 31

RIGH T TEAM Highly relevant TRT experience with a track record of success NOVE L TECH N OLOGY JATE N ZO – First an d o n ly FD A - app r ove d ora l T product o f its ki n d in a l arge an d g row i ng TRT marke t * AT T RACT I V E OPPORT U NI T Y A high - growth category with attractive net revenue potential KEY TAKEAWAYS *Lipocine’s TLANDO® has received tentative FDA approval pending expiration of JATENZO’s Hatch - Waxman exclusivity on 3/27/22 32