Attached files

| file | filename |

|---|---|

| 8-K - 8-K - ANNALY CAPITAL MANAGEMENT INC | nly-20210519.htm |

Annual Meeting Presentation May 19, 2021

Important Notices 2 This presentation is issued by Annaly Capital Management, Inc. ("Annaly"), an internally-managed, publicly traded company that has elected to be taxed as a real estate investment trust for federal income tax purposes and is being furnished in connection with Annaly’s 2021 Annual Meeting. This presentation is provided for investors in Annaly for informational purposes only and is not an offer to sell, or a solicitation of an offer to buy, any security or instrument. Forward-Looking Statements This presentation, other written or oral communications, and our public documents to which we refer contain or incorporate by reference certain forward-looking statements which are based on various assumptions (some of which are beyond our control) and may be identified by reference to a future period or periods or by the use of forward-looking terminology, such as “may,” “will,” “believe,” “expect,” “anticipate,” “continue,” or similar terms or variations on those terms or the negative of those terms. Such statements include those relating to the Company’s future performance, macro outlook, the interest rate and credit environments, tax reform and future opportunities. Actual results could differ materially from those set forth in forward-looking statements due to a variety of factors, including, but not limited to, risks and uncertainties related to the COVID-19 pandemic, including as related to adverse economic conditions on real estate-related assets and financing conditions; changes in interest rates; changes in the yield curve; changes in prepayment rates; the availability of mortgage-backed securities (“MBS”) and other securities for purchase; the availability of financing and, if available, the terms of any financing; changes in the market value of the Company’s assets; changes in business conditions and the general economy; the Company’s ability to grow its residential credit business; the Company’s ability to grow its middle market lending business; credit risks related to the Company’s investments in credit risk transfer securities, residential mortgage-backed securities and related residential mortgage credit assets, commercial real estate assets and corporate debt; risks related to investments in mortgage servicing rights; the Company’s ability to consummate any contemplated investment opportunities; changes in government regulations or policy affecting the Company’s business; the Company’s ability to maintain its qualification as a REIT for U.S. federal income tax purposes; the Company’s ability to maintain its exemption from registration under the Investment Company Act of 1940; and the timing and ultimate completion of the sale of our commercial real estate business. For a discussion of the risks and uncertainties which could cause actual results to differ from those contained in the forward-looking statements, see “Risk Factors” in our most recent Annual Report on Form 10-K and any subsequent Quarterly Reports on Form 10-Q. The Company does not undertake, and specifically disclaims any obligation, to publicly release the result of any revisions which may be made to any forward-looking statements to reflect the occurrence of anticipated or unanticipated events or circumstances after the date of such statements, except as required by law. We routinely post important information for investors on our website, www.annaly.com. We intend to use this webpage as a means of disclosing material information, for complying with our disclosure obligations under Regulation FD and to post and update investor presentations and similar materials on a regular basis. Annaly encourages investors, analysts, the media and others interested in Annaly to monitor the Investors section of our website, in addition to following our press releases, SEC filings, public conference calls, presentations, webcasts and other information we post from time to time on our website. To sign-up for email-notifications, please visit the “Email Alerts” section of our website, www.annaly.com, under the “Investors” section and enter the required information to enable notifications. The information contained on, or that may be accessed through, our webpage is not incorporated by reference into, and is not a part of, this document. Past performance is no guarantee of future results. There is no guarantee that any investment strategy referenced herein will work under all market conditions. Prior to making any investment decision, you should evaluate your ability to invest for the long-term, especially during periods of downturns in the market. You alone assume the responsibility of evaluating the merits and risks associated with any potential investment or investment strategy referenced herein. To the extent that this material contains reference to any past specific investment recommendations or strategies which were or would have been profitable to any person, it should not be assumed that recommendations made in the future will be profitable or will equal the performance of such past investment recommendations or strategies. The information contained herein is not intended to provide, and should not be relied upon for accounting, legal or tax advice or investment recommendations for Annaly or any of its affiliates. Regardless of source, information is believed to be reliable for purposes used herein, but Annaly makes no representation or warranty as to the accuracy or completeness thereof and does not take any responsibility for information obtained from sources outside of Annaly. Certain information contained in the presentation discusses general market activity, industry or sector trends, or other broad-based economic, market or political conditions and should not be construed as research or investment advice.

About Our Company Annaly Capital Management, Inc. (“Annaly”) is a leading diversified capital manager that invests in two fundamental pillars of the American economy: housing and business 3 $14bn Permanent Capital(1) 970% Total Shareholder Return Since IPO(2) $20bn+ Common and Preferred Dividends Declared(3) ~700k American Homes Financed(4) ~$295mm Investments Supporting Communities(5) ~180 Talented Professionals Note: Company filings. Financial data as of March 31, 2021. Employee composition as of December 31, 2020. Detailed endnotes are included at the end of this presentation. We are internally managed and have elected to be taxed as a real estate investment trust, or REIT, for federal income tax purposes

– $2,000 $4,000 $6,000 $8,000 $10,000 $12,000 $14,000 A nn al y P ee r 1 P ee r 2 P ee r 3 P ee r 4 P ee r 5 P ee r 6 P ee r 7 P ee r 8 P ee r 9 P ee r 1 0 P ee r 1 1 P ee r 1 2 P ee r 1 3 P ee r 1 4 P ee r 1 5 P ee r 1 6 P ee r 1 7 P ee r 1 8 P ee r 1 9 P ee r 2 0 P ee r 2 1 P ee r 2 2 P ee r 2 3 P ee r 2 4 P ee r 2 5 P ee r 2 6 P ee r 2 7 P ee r 2 8 P ee r 2 9 P ee r 3 0 P ee r 3 1 P ee r 3 2 P ee r 3 3 P ee r 3 4 P ee r 3 5 Power of Annaly | The Industry Leader With a Differentiated Investing Model 4 Source: Company filings and Bloomberg. Financial data as of March 31, 2021. Market data as of April 15, 2021. Detailed endnotes are included at the end of this presentation. $8.9bn Unencumbered Assets Market Cap ($mm) | Annaly vs. mREIT Peers Peer Median Market Cap: $899mm Annaly Market Cap: $12.3bn Liquid Our diversified, lower leveraged strategy results in greater liquidity - $8.9bn of total unencumbered assets and $6.2bn of cash and unencumbered Agency MBS Scale Annaly uses its size and scale to support two fundamental pillars of the American economy: housing and business ~14x Size of Median mREIT by Market Cap(1) $100bn Total Assets(2) Diversified Annaly is able to efficiently diversify investments across its businesses through a rigorous shared capital model and capital allocation process 10 Financing Options Financing Annaly’s deep and diverse financing sources include traditional repo, warehouse lines and financing through our own broker dealer

Proven Results | Delivering Outsized Returns Over 20+ Years Since inception, Annaly has delivered ~$21bn in dividends to shareholders(1) 5 Source: Company filings and Bloomberg. Financial data as of March 31, 2021. Market data as of April 15, 2021. Detailed endnotes are included at the end of this presentation. 970% 566% Since our IPO in October 1997, Annaly has delivered total returns of ~970%, outperforming the broader market by ~1.75x – $4,500 $9,000 $13,500 $18,000 $22,500 19 97 19 98 19 99 20 00 20 01 20 02 20 03 20 04 20 05 20 06 20 07 20 08 20 09 20 10 20 11 20 12 20 13 20 14 20 15 20 16 20 17 20 18 20 19 20 20 20 21 Y TD Prior Cumulative Dividends Declared Dividends Declared During Year (200%) – 200% 400% 600% 800% 1,000% 1,200% O ct -9 7 A pr -9 8 O ct -9 8 A pr -9 9 O ct -9 9 A pr -0 0 O ct -0 0 A pr -0 1 O ct -0 1 A pr -0 2 O ct -0 2 A pr -0 3 O ct -0 3 A pr -0 4 O ct -0 4 A pr -0 5 O ct -0 5 A pr -0 6 O ct -0 6 A pr -0 7 O ct -0 7 A pr -0 8 O ct -0 8 A pr -0 9 O ct -0 9 A pr -1 0 O ct -1 0 A pr -1 1 O ct -1 1 A pr -1 2 O ct -1 2 A pr -1 3 O ct -1 3 A pr -1 4 O ct -1 4 A pr -1 5 O ct -1 5 A pr -1 6 O ct -1 6 A pr -1 7 O ct -1 7 A pr -1 8 O ct -1 8 A pr -1 9 O ct -1 9 A pr -2 0 O ct -2 0 A pr -2 1 Annaly S&P 500

People First | Our Greatest Asset is Our Employees 6 Source: Company filings. Employee composition statistics as of December 31, 2020, unless otherwise noted. Note: Diversity data based on self-identified diversity characteristics disclosed by Directors and employees. Detailed endnotes and a glossary of defined terms are included at the end of this presentation. Employee Gender and Racial/Ethnic Diversity of employees identify as women of employees identify as racially / ethnically diverse of new hires in 2020 identify as racially / ethnically diverse of promoted employees in 2020 identify as women or racially / ethnically diverse Diversity in Leadership of Continuing Directors identify as women or racially / ethnically diverse 7 out of 11 of Board Committee Chairs identify as women 5 out of 5 of Executive Officers identify as women 1 out of 6 of Operating Committee members identify as women(1) 4 out of 12 32% 32% 45% 38% 64% 17% 33%100% Our greatest asset is our employees – highly skilled individuals with varying sets of professional experience across sectors, credit cycles and functions – who work every day committed to the long-term success and growth of our Company We are driven by the belief that having a diverse group of employees is a business imperative, a social value and helps us generate stronger returns for our shareholders The deep and varied expertise of Annaly’s employees has supported our successful evolution to the diversified capital manager we are today Our People

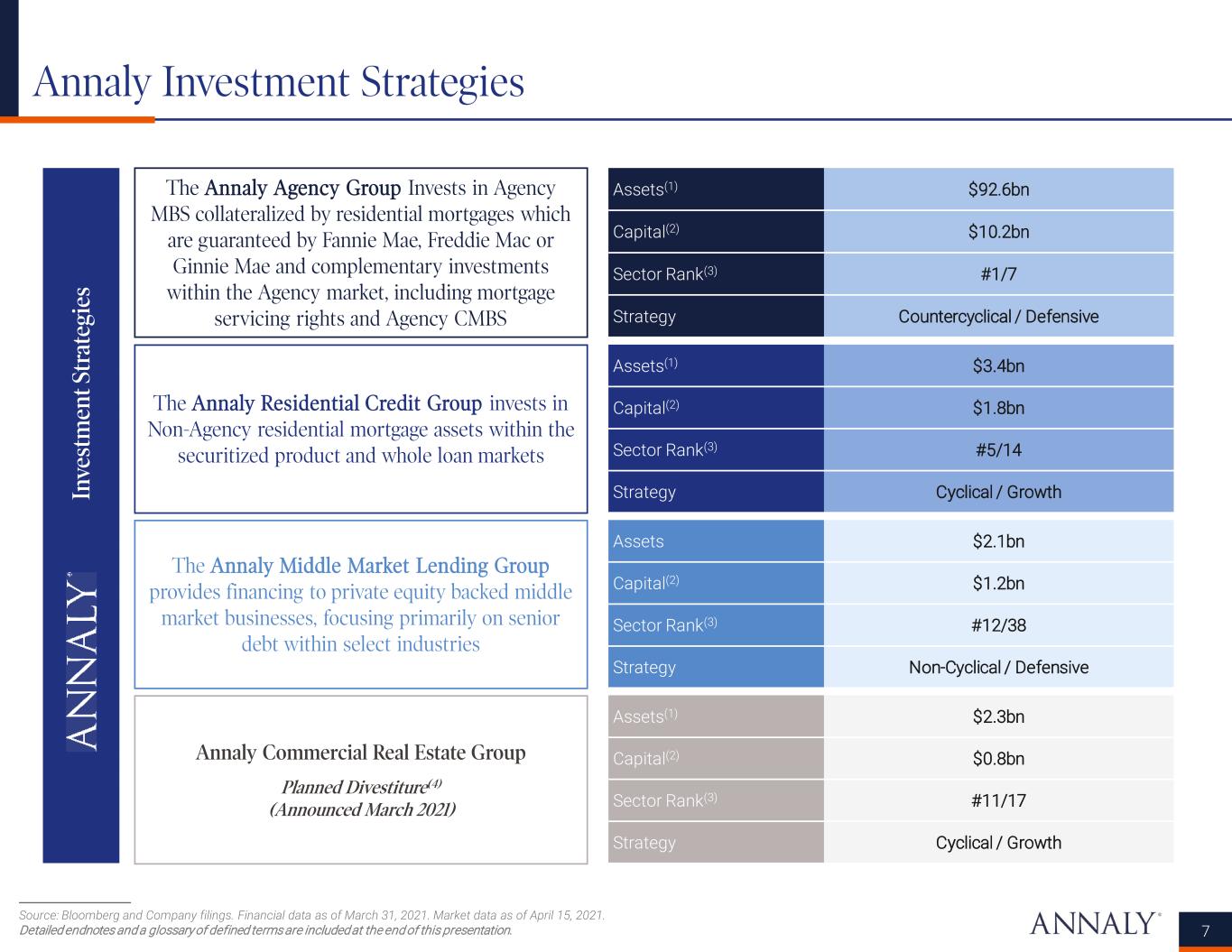

Annaly Investment Strategies 7 Source: Bloomberg and Company filings. Financial data as of March 31, 2021. Market data as of April 15, 2021. Detailed endnotes and a glossary of defined terms are included at the end of this presentation. Assets(1) $92.6bn Capital(2) $10.2bn Sector Rank(3) #1/7 Strategy Countercyclical / Defensive Assets(1) $3.4bn Capital(2) $1.8bn Sector Rank(3) #5/14 Strategy Cyclical / Growth Assets(1) $2.3bn Capital(2) $0.8bn Sector Rank(3) #11/17 Strategy Cyclical / Growth Assets $2.1bn Capital(2) $1.2bn Sector Rank(3) #12/38 Strategy Non-Cyclical / Defensive The Annaly Agency Group Invests in Agency MBS collateralized by residential mortgages which are guaranteed by Fannie Mae, Freddie Mac or Ginnie Mae and complementary investments within the Agency market, including mortgage servicing rights and Agency CMBS The Annaly Middle Market Lending Group provides financing to private equity backed middle market businesses, focusing primarily on senior debt within select industries Annaly Commercial Real Estate Group Planned Divestiture(4) (Announced March 2021) The Annaly Residential Credit Group invests in Non-Agency residential mortgage assets within the securitized product and whole loan markets In ve st m en t S tr at eg ie s

Annaly’s Planned Divestiture of Our Commercial Real Estate Business 8 Transaction Overview $2,330,000,000 Planned Divestiture to March 25, 2021 On March 25, 2021, Annaly entered into a definitive agreement to sell substantially all of the assets that comprise the Annaly Commercial Real Estate business to Slate Asset Management, L.P. (“Slate”) for $2.33 billion Certain Annaly employees who primarily support the Commercial Real Estate business are expected to join Slate upon completion of the sale, including Timothy Gallagher, Head of Commercial Real Estate, and Michael Quinn, Head of Commercial Investments Upon closing of the transaction, the Company intends to use proceeds from the sale to: – Repay financing facilities (not assumed by Slate) related to the commercial real estate assets being sold – Purchase targeted assets in accordance with its capital allocation policy Subject to customary closing conditions, including applicable regulatory approvals, the transaction is expected to be completed by Q3 2021 Commercial Real Estate Business Strategic Evolution 2013 20192014 2015 2016 2017 2018 2020+ Annaly acquired CreXus Investment Corp. and entered into the commercial mortgage market Expanded business with new team that joined from a leading real estate company Established strategic partnership with Pearlmark Real Estate Partners Closed first $857mm managed CRE CLO Announced agreement to sell Commercial Real Estate business to Slate Asset Management Diversified into healthcare CRE with acquisition of MTGE Investment Corp.

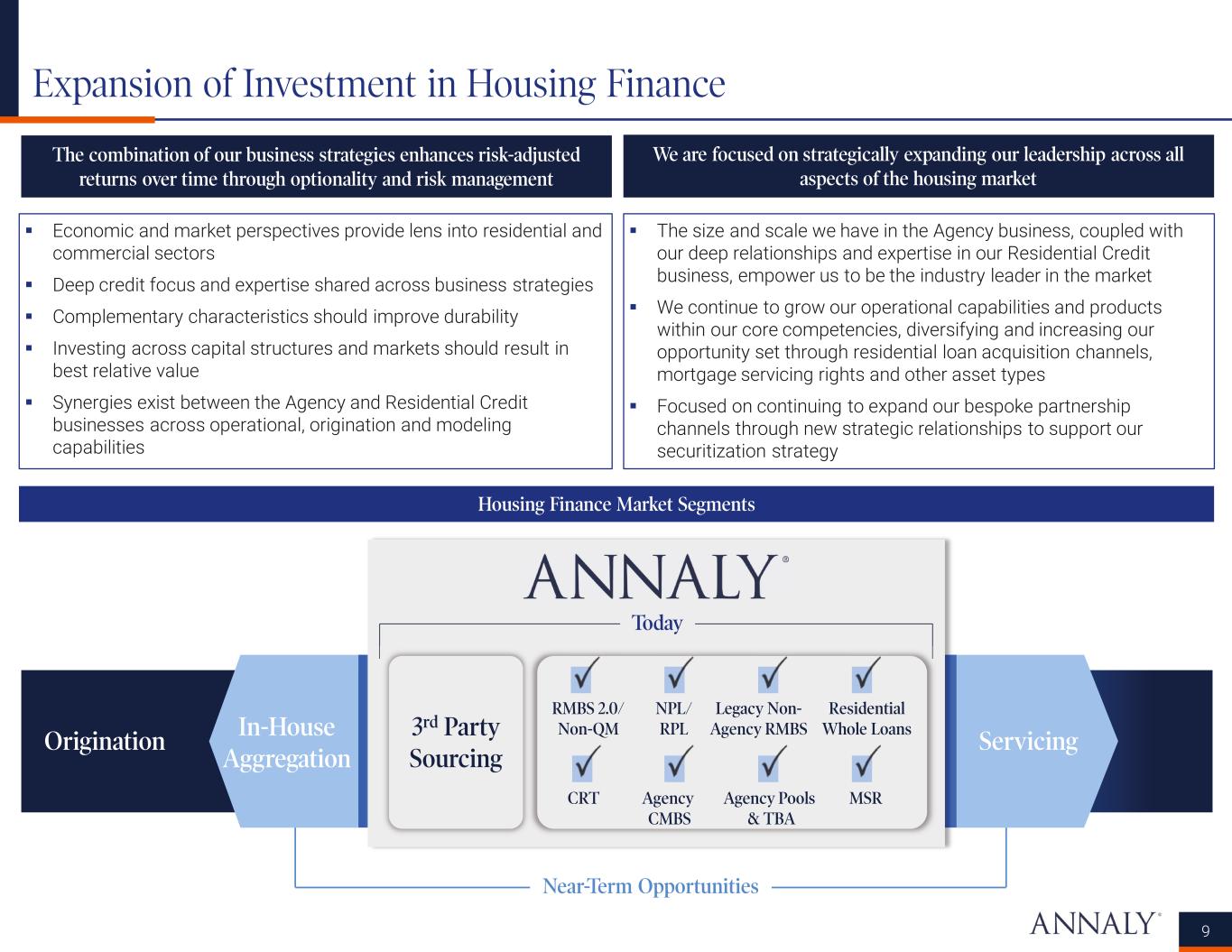

Expansion of Investment in Housing Finance Economic and market perspectives provide lens into residential and commercial sectors Deep credit focus and expertise shared across business strategies Complementary characteristics should improve durability Investing across capital structures and markets should result in best relative value Synergies exist between the Agency and Residential Credit businesses across operational, origination and modeling capabilities 9 We are focused on strategically expanding our leadership across all aspects of the housing market Near-Term Opportunities Origination In-House Aggregation Servicing Today 3rd Party Sourcing Legacy Non- Agency RMBS Residential Whole Loans RMBS 2.0/ Non-QM NPL/ RPL Agency Pools & TBA MSRAgency CMBS CRT The size and scale we have in the Agency business, coupled with our deep relationships and expertise in our Residential Credit business, empower us to be the industry leader in the market We continue to grow our operational capabilities and products within our core competencies, diversifying and increasing our opportunity set through residential loan acquisition channels, mortgage servicing rights and other asset types Focused on continuing to expand our bespoke partnership channels through new strategic relationships to support our securitization strategy Housing Finance Market Segments The combination of our business strategies enhances risk-adjusted returns over time through optionality and risk management

Financing, Capital & Liquidity We believe that Annaly’s deep and diverse financing sources provide the Company with unique competitive advantages 10 Financing, Capital & Liquidity Highlights Since the Beginning of 2020 Annaly’s Approach to Leverage Overall Risk Profile Capital Structure Leverage Balance Sheet Leverage Asset-Level Structural Leverage Consider structural leverage relative to balance sheet leverage Focus on synchronizing our financing with the liquidity of our investments Utilize prudent balance sheet leverage for higher spread duration, more structurally levered instruments Evaluate the relative benefits and considerations of all forms of capital and financing Includes unsecured debt and preferred equity, which we view as implicit leverage Monitor the relative attractiveness of capital structure leverage compared to balance sheet leverage Evaluate capital markets opportunities through this holistic lens Note: Company filings. Financial data as of March 31, 2021, unless otherwise noted. Detailed endnotes are included at the end of this presentation. Closed six residential whole loan securitizations totaling $2.5 billion(1) Record-low financing costs with average economic cost of interest bearing liabilities of 0.87% as of Q1 2021 Added $1.125 billion of capacity for our ARC business across two new credit facilities and $180 million of capacity for our AMML business(2) $8.9 billion of unencumbered assets, including cash and unencumbered Agency MBS of $6.2 billion Redeemed all outstanding shares of the $460 million 7.50% Series D preferred stock in December 2020 Repurchased $209 million of common stock in 2020 and authorized new $1.5 billion common stock repurchase program in December 2020(3)

Operational Efficiency Annaly’s Internalization and planned divestiture of the Commercial Real Estate business provide an opportunity for incremental cost control 11 Annaly’s Long-Term Target(1): 1.45%–1.60% (2) (2) Operating Expense as % of Equity(1) 6.81% 3.34% 1.45% -1.60% 1.84% 1.62% External mREIT Avg. (YE 2020) Internal mREIT Avg. (YE 2020) Annaly (2019 Actual) Annaly (2020 Actual) Annaly (Long-Term Target) Annaly operates a highly institutionalized platform and has benefited from its scale and efficiency, operating at lower cost levels than peer averages The Internalization provides an opportunity for incremental cost control and operating flexibility Following the announcement of the planned Commercial Real Estate Business disposition, we adjusted long-term target operating expense ratio to a range of 1.45% to 1.60% (reduction of ~10%) to incorporate additional expected cost savings(1) Source: Company filings. Financial data as of December 31, 2020. Detailed endnotes and a glossary of defined terms are included at the end of this presentation.

2020 | Leading with Purpose and Impact During this time of considerable global challenges, Annaly has chosen to lead with purpose and impact 12 Completed Management Internalization Published Inaugural Corporate Responsibility Report Expanded Support for Corporate Philanthropy Initiatives Increased Focus on Diversity & Inclusion The report, published on the 23rd anniversary of our IPO, demonstrates our commitment to transparency and robust ESG practices Introduced supplemental disclosures under the Sustainability Accounting Standards Board (“SASB”) and Global Reporting Initiative (“GRI”) frameworks and outlined goals and commitments across our five key ESG areas: Annaly’s corporate giving has focused on combatting homelessness and advancing the professional development of women and underrepresented groups Considering new challenges in 2020, we responded with specific actions: In response to the COVID-19 pandemic, supporting vulnerable New Yorkers in three areas: housing, food security and workforce development Helping to build a pipeline of gender, racially and socioeconomically diverse professionals through our work with Girls Who Invest and a new partnership with Project Destined We have prioritized diversity efforts, which have long been a business imperative at Annaly as we believe it helps us generate stronger returns for our shareholders Some of our 2020 inclusion efforts include: Identified our first Head of Inclusion with support from a cross- functional team Developed an Inclusion Support Committee of Executive Sponsors Conducted unconscious bias training for all employees to establish foundational knowledge, language and understanding to support Annaly’s diversity and inclusion initiatives Organized meetings with business heads and staff to discuss employees’ views and concerns followed by an employee inclusion survey CORPORATE GOVERNANCE HUMAN CAPITAL RESPONSIBLE INVESTMENTS RISK MANAGEMENT ENVIRONMENT In Q2 2020, we completed our management internalization, which provides numerous business and governance enhancements, including: Improved cost efficiency from economies of scale and incremental cost control leading to potential long-term earnings accretion Strategic flexibility to pursue more operationally-intensive businesses Greater transparency and disclosure for Annaly shareholders Stronger alignment of incentives between management and shareholders

Annaly Has Taken Significant Steps to Advance Corporate Governance & Responsibility Practices Annaly has made several important corporate governance and responsibility enhancements to promote shareholder value and support transparency over the last few years 13 2017 2018 Publication of Board Skills Matrix in Proxy Established Corporate Responsibility Committee of the Board Adopted an enhanced self- evaluation process for the Board and comprehensive Director refreshment policy Initiated an energy audit to track and monitor impact and energy usage Appointed Head of Corporate Responsibility and Government Relations Adopted bylaw amendment to declassify the Board Added extensive disclosure on the Company’s Corporate Responsibility and ESG efforts to our corporate website Elected two new, highly qualified independent directors Separated the roles of CEO and Chair of the Board; appointed the Company’s first independent Board Chair Internalized management structure 2019 2020 Published Inaugural Corporate Responsibility Report Redesigned Executive Compensation Program to reflect internally- managed structure Elected two new, highly qualified independent directors Elected a new, highly qualified independent Director Disclosed racial/ethnic diversity of our Directors in our Board skills and experiences matrix 2021

We Believe Annaly Continues to Provide an Attractive Value Proposition Source: Bloomberg. Market data as of April 15, 2021, unless otherwise noted. Detailed endnotes and a glossary of defined terms are included at the end of this presentation. While interest rates have begun to slowly rise, the search for responsible yield persists 14 Yield Compression Broadly U.S. Aggregate Index Yield (%) and Duration (Years)(1) NLY vs. S&P 500: Price-to-Equity Ratio and Dividend Yield Spread (bps) P /E M ul tip le D ividend Y ield S pread (bps) Y ie ld Duration Annaly’s Relative Value vs. Broader Equity Market Annaly has continued to trade at a meaningful valuation discount despite consistently delivering an outsized yield – 1 2 3 4 5 6 7 – 1.0% 2.0% 3.0% 4.0% 5.0% 6.0% 7.0% 8.0% 2000 2001 2002 2003 2004 2005 2006 2007 2008 2009 2010 2011 2012 2013 2014 2015 2016 2017 2018 2019 2020 2021 Yield (%) Duration (Years) - 500 1,000 1,500 2,000 2,500 – 5x 10x 15x 20x 25x 30x 35x 12/31/15 12/31/16 12/31/17 12/31/18 12/31/19 12/31/20 NLY - SPX Dividend Yield (bps) P/E NLY P/E SPX

Glossary and Endnotes

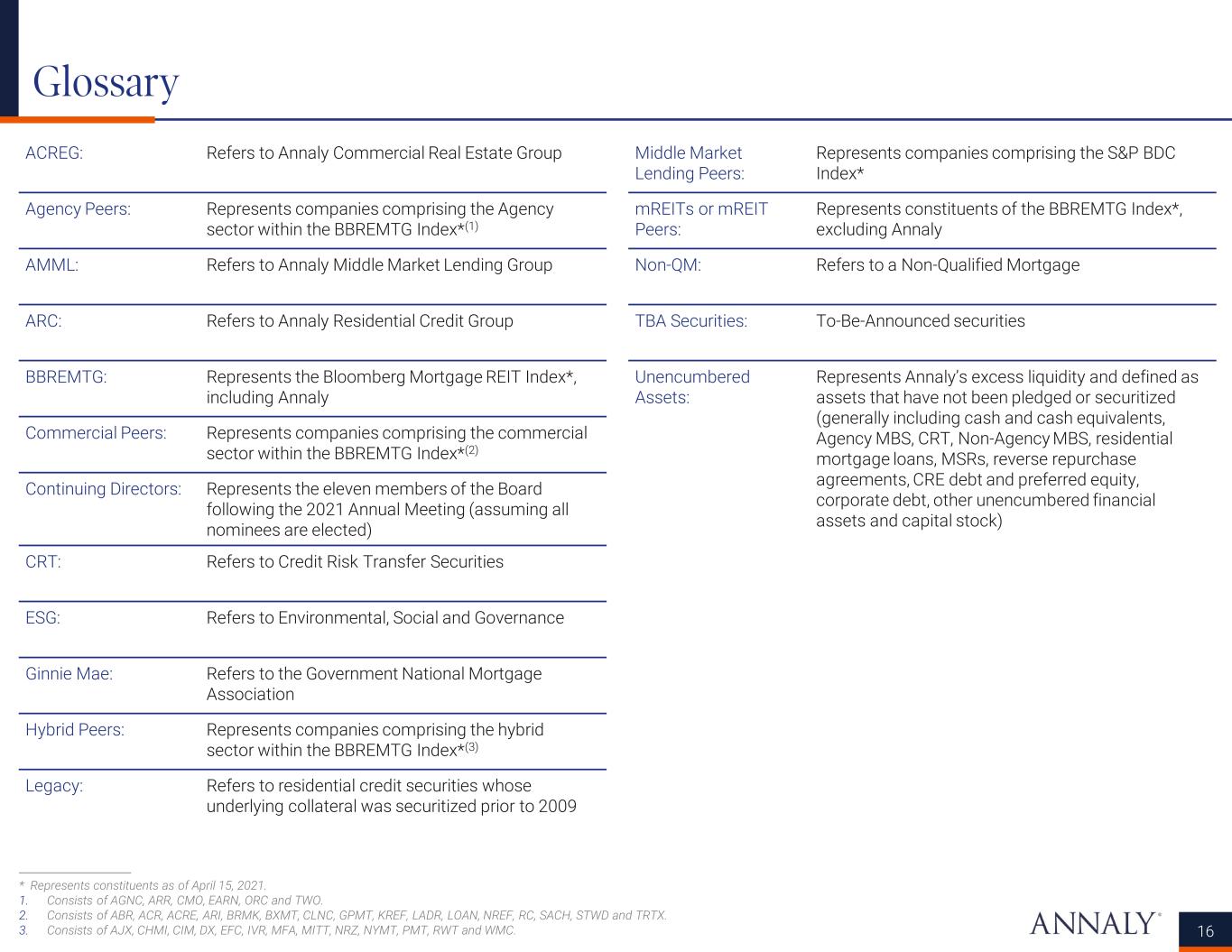

Glossary 16 ACREG: Refers to Annaly Commercial Real Estate Group Agency Peers: Represents companies comprising the Agency sector within the BBREMTG Index*(1) AMML: Refers to Annaly Middle Market Lending Group ARC: Refers to Annaly Residential Credit Group BBREMTG: Represents the Bloomberg Mortgage REIT Index*, including Annaly Commercial Peers: Represents companies comprising the commercial sector within the BBREMTG Index*(2) Continuing Directors: Represents the eleven members of the Board following the 2021 Annual Meeting (assuming all nominees are elected) CRT: Refers to Credit Risk Transfer Securities ESG: Refers to Environmental, Social and Governance Ginnie Mae: Refers to the Government National Mortgage Association Hybrid Peers: Represents companies comprising the hybrid sector within the BBREMTG Index*(3) Legacy: Refers to residential credit securities whose underlying collateral was securitized prior to 2009 Middle Market Lending Peers: Represents companies comprising the S&P BDC Index* mREITs or mREIT Peers: Represents constituents of the BBREMTG Index*, excluding Annaly Non-QM: Refers to a Non-Qualified Mortgage TBA Securities: To-Be-Announced securities Unencumbered Assets: Represents Annaly’s excess liquidity and defined as assets that have not been pledged or securitized (generally including cash and cash equivalents, Agency MBS, CRT, Non-Agency MBS, residential mortgage loans, MSRs, reverse repurchase agreements, CRE debt and preferred equity, corporate debt, other unencumbered financial assets and capital stock) * Represents constituents as of April 15, 2021. 1. Consists of AGNC, ARR, CMO, EARN, ORC and TWO. 2. Consists of ABR, ACR, ACRE, ARI, BRMK, BXMT, CLNC, GPMT, KREF, LADR, LOAN, NREF, RC, SACH, STWD and TRTX. 3. Consists of AJX, CHMI, CIM, DX, EFC, IVR, MFA, MITT, NRZ, NYMT, PMT, RWT and WMC.

Endnotes 17 Page 3 1. Permanent capital represents Annaly’s total stockholders’ equity. 2. Total return represents total shareholder return for the period beginning October 7, 1997 through April 15, 2021. 3. Data shown since Annaly’s initial public offering in October 1997 through April 15, 2021 and includes common and preferred dividends declared. 4. Represents the estimated number of homes financed by Annaly’s holdings of Agency MBS, residential whole loans and securities, as well as multi-family commercial real estate loans, securities and equity investments. The number includes all homes related to securities and loans wholly-owned by Annaly and a pro-rata share of homes in securities or equity investments that are partially owned by Annaly. 5. Represents the cumulative commitment value of Annaly’s commercial investments, including current and prior investments since Annaly’s initial public offering. Page 4 1. Representative of the BBREMTG Index. Excludes Annaly. 2. Total assets represents Annaly’s investments that are on balance sheet, net of debt issued by securitization vehicles, as well as investments that are off-balance sheet in which Annaly has economic exposure. Assets include TBA purchase contracts (market value) of $22.8bn and CMBX derivatives (market value) of $500.5mm and are shown net of debt issued by securitization vehicles of $5.6bn. Page 5 1. Data shown since Annaly’s initial public offering in October 1997 through April 15, 2021 and includes common and preferred dividends declared. Page 6 1. Data as of May 2021. Page 7 1. Assets represent Annaly’s investments that are on balance sheet, net of debt issued by securitization vehicles, as well as investments that are off-balance sheet in which the Company has economic exposure. Agency assets include TBA purchase contracts (market value) of $22.8bn and are shown net of debt issued by securitization vehicles of $0.5bn. Residential Credit assets are shown net of debt issued by securitization vehicles of $2.5bn. 2. Represents the capital allocation for each of the four investment strategies and is calculated as the difference between each investment strategy’s allocated assets, which include TBA purchase contracts, and liabilities. 3. Sector rank compares Annaly dedicated capital in each of Agency, Commercial Real Estate, Residential Credit and Middle Market Lending as of March 31, 2021 (adjusted for P/B as of April 15, 2021) to the market capitalization of the companies that comprise the Agency, commercial and hybrid sectors of the BBREMTG Index and the S&P BDC Index, respectively, as of April 15, 2021. 4. Annaly announced the sale of its Commercial Real Estate Business on March 25, 2021. Subject to customary closing conditions, including applicable regulatory approvals, the transfer of the Commercial Real Estate business is expected to be completed by the third quarter of 2021. For more information, please see the 8-K filing. Page 10 1. Residential whole loan securitizations since the beginning of 2020 include: (1) a $375mm residential whole loan securitization in January 2020; (2) a $468mm residential whole loan securitization in February 2020; (3) a $489mm residential whole loan securitization in July 2020; (4) a $515mm residential whole loan securitization in September 2020; (5) a $257mm residential whole loan securitization in March 2021; and (6) a $354mm residential whole loan securitization in April 2021. 2. Represents an $875mm ARC credit facility closed during Q2 2020, a $250mm ARC credit facility closed during Q3 2020 and a $180mm AMML credit facility closed during Q1 2021. 3. Amount excludes fees and commissions. Annaly’s current authorized share repurchase program expires in December 2021. Page 11 1. Represents management’s estimates of long-term operating expense projections for the Company’s management internalization, which was completed on June 30, 2020, and planned divestiture of the Commercial Real Estate business based on historical experience and other factors, including expectations of future operational events and obligations, that are believed to be reasonable. The Company’s actual operating expenses and timeframe for achieving any operating expense savings may differ materially from management’s projections. Management’s projections are based on a number of factors and uncertainties and actual results may vary based on changes to our expected general and administrative expenses, changes to the Company’s equity base, changes to the Company’s business composition and strategy, and other circumstances which may be out of management’s control. 2. Represents operating expense as a percentage of average equity for the year ended December 31, 2020. Operating expense is defined as: (i) for internally-managed peers, the sum of compensation and benefits, G&A and other operating expenses, less any one-time or transaction related expenses and (ii) for externally-managed peers, the sum of net management fees, compensation and benefits (if any), G&A and other operating expenses, less any one-time or transaction related expenses. Page 14 1. Represents the Yield to Worst and Duration for the Bloomberg Barclays U.S. Aggregate Index, which measures the investment grade, U.S.-dollar denominated, fixed-rate taxable bond market. The index includes Treasuries, government and corporate securities, MBS, ABS and CMBS. Yield to Worst is a measure of the lowest possible yield that can be received on a bond.