Attached files

| file | filename |

|---|---|

| 8-K - 8-K - Spirit of Texas Bancshares, Inc. | d157037d8k.htm |

Spirit of Texas Bancshares, Inc. 2021 Virtual KBW Texas Field Trip May 18, 2021 Exhibit 99.1

Important Information ABOUT SPIRIT OF TEXAS BANCSHARES, INC. Spirit of Texas Bancshares, Inc. (“Spirit,” “STXB,” “Company,” “we,” “our” or “us”), through its wholly-owned subsidiary, Spirit of Texas Bank (the “Bank”), provides a wide range of relationship-driven commercial banking products and services tailored to meet the needs of businesses, professionals and individuals. Spirit of Texas Bank has 36 branch locations in the Houston, Dallas/Fort Worth, Bryan/College Station, San Antonio-New Braunfels, Austin, Tyler and Corpus Christi metropolitan areas, as well as in North Central and North East Texas. Please visit www.sotb.com for more information. Our website is an inactive textual reference only. FORWARD-LOOKING STATEMENTS This presentation contains, and future oral and written statements of the Company and its management may contain, forward-looking statements within the meaning of the Private Securities Litigation Reform Act of 1995 that are subject to risks and uncertainties and are made pursuant to the safe harbor provisions of Section 27A of the Securities Act of 1933, as amended, and Section 21E of the Securities Exchange Act of 1934, as amended. Any statements about our expectations, beliefs, plans, predictions, protections, forecasts, objectives, assumptions or future events or performance are not historical facts and may be forward-looking. Forward-looking statements are typically, but not exclusively, identified by the use of forward-looking terminology such as “believes,” “expects,” “could,” “may,” “will, “should,” “seeks,” “likely,” “intends” “plans,” “pro forma,” “projects,” “estimates” or “anticipates” or the negative of these words and phrases or similar words or phrases that are predictions of or indicate future events or trends and that do not relate solely to historical matters. You can also identify forward-looking statements by discussions of strategy, plans or intentions. Forward-looking statements involve numerous risks and uncertainties and you should not rely on them as predictions of future events. The following factors, among others, could cause actual results and future events to differ materially from those set forth or contemplated in the forward-looking statements: the impact of the ongoing COVID-19 pandemic on our business, including the impact of actions taken by governmental and regulatory authorities in response to the COVID-19 pandemic, such as the Coronavirus Aid, Relief, and Economic Security Act (“CARES Act”) and the programs established thereunder, and the Bank’s participation in such programs; business and economic conditions generally and in the bank and non-bank financial services industries, nationally and within our local market areas; our ability to mitigate our risk exposures; our ability to maintain our historical earnings trends; risks related to the integration of acquired businesses and any future acquisitions; the inability to realize expected cost savings or achieve other anticipated benefits in connection with business combinations or other acquisitions; our ability to successfully identify and address the risks associated with our recent, pending and possible future acquisitions; changes in management personnel; interest rate risk; credit risk associated with our loan portfolio; deteriorating asset quality and higher loan charge-offs; time and effort necessary to resolve nonperforming assets; adequacy of loan loss reserves; inaccuracy of the assumptions and estimates we make in establishing reserves for probable loan losses and other estimates and projections; lack of liquidity; fluctuations in the fair value and liquidity of the securities we hold for sale; impairment of investment securities, goodwill, other intangible assets or deferred tax assets; our risk management strategies; increased competition in the bank and non-bank financial services industries, nationally, regionally or locally, which may adversely affect pricing and terms; the accuracy of our financial statements and related disclosures and those of companies we acquire; material weaknesses in our internal control over financial reporting; system failures or failures to prevent breaches of our network security; other economic, competitive, governmental, or technological factors affecting our operation, markets, products, services, and prices; the institution and outcome of litigation and other legal proceedings against us or to which we become subject; unanticipated regulatory or judicial proceedings and liabilities and other costs; changes in any applicable law, rule, regulation, policy, guideline, or practice governing or affecting bank holding companies and their subsidiaries, or with respect to tax or accounting principles, securities or otherwise, and their application by our regulators; governmental monetary and fiscal policies; increases in our capital requirements; and other risks identified in the “Risk Factors” section of our most recent Annual Report on Form 10-K, Quarterly Reports on Form 10-Q, Current Reports on Form 8-K and other documents Spirit files or furnishes with the Securities and Exchange Commission (the “SEC”) from time to time, which are available on the SEC’s website, www.sec.gov. While forward-looking statements reflect our good-faith beliefs, they are not guarantees of future performance. All forward-looking statements are necessarily only estimates of future results. Accordingly, actual results may differ materially from those expressed in or contemplated by the particular forward-looking statement due to additional risk and uncertainties of which Spirit is not currently aware and does not currently view as, but in the future may become, material to its business and operating results. Therefore, you are cautioned not to place undue reliance on the forward-looking statements contained in this presentation. Further, any forward-looking statement speaks only as of the date on which it is made, and we undertake no obligation to update any forward-looking statement to reflect events or circumstances after the date on which the statement is made or to reflect the occurrence of unanticipated events or circumstances, except as required by applicable law. All forward-looking statements, express or implied, included in this presentation are qualified in their entirety by this cautionary statement.

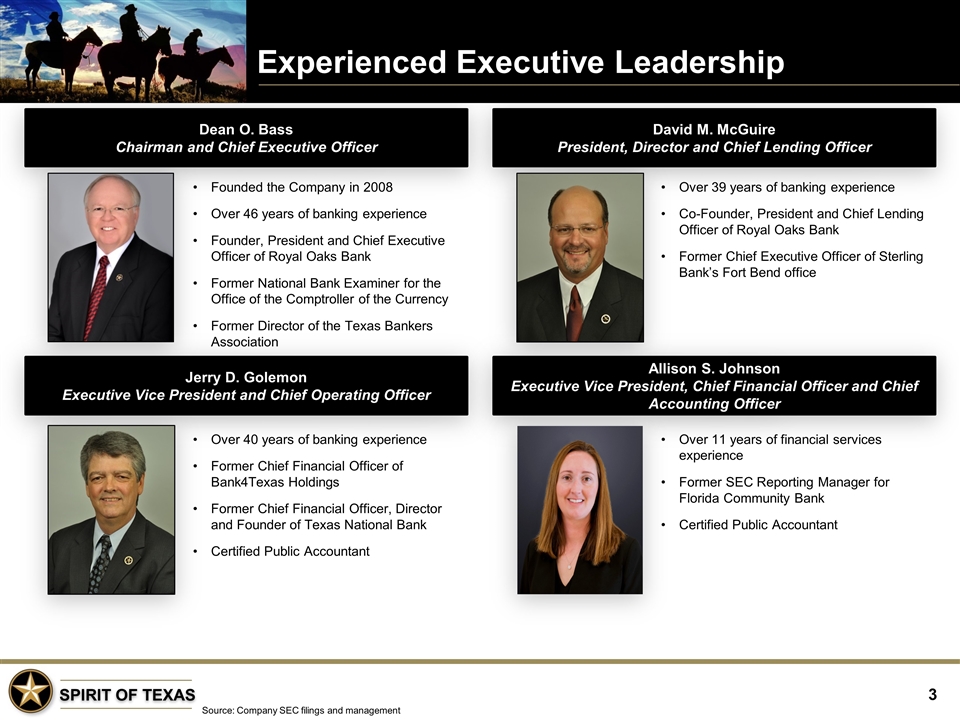

Experienced Executive Leadership Dean O. Bass Chairman and Chief Executive Officer David M. McGuire President, Director and Chief Lending Officer Founded the Company in 2008 Over 46 years of banking experience Founder, President and Chief Executive Officer of Royal Oaks Bank Former National Bank Examiner for the Office of the Comptroller of the Currency Former Director of the Texas Bankers Association Over 39 years of banking experience Co-Founder, President and Chief Lending Officer of Royal Oaks Bank Former Chief Executive Officer of Sterling Bank’s Fort Bend office Jerry D. Golemon Executive Vice President and Chief Operating Officer Over 40 years of banking experience Former Chief Financial Officer of Bank4Texas Holdings Former Chief Financial Officer, Director and Founder of Texas National Bank Certified Public Accountant Allison S. Johnson Executive Vice President, Chief Financial Officer and Chief Accounting Officer Over 11 years of financial services experience Former SEC Reporting Manager for Florida Community Bank Certified Public Accountant Source: Company SEC filings and management

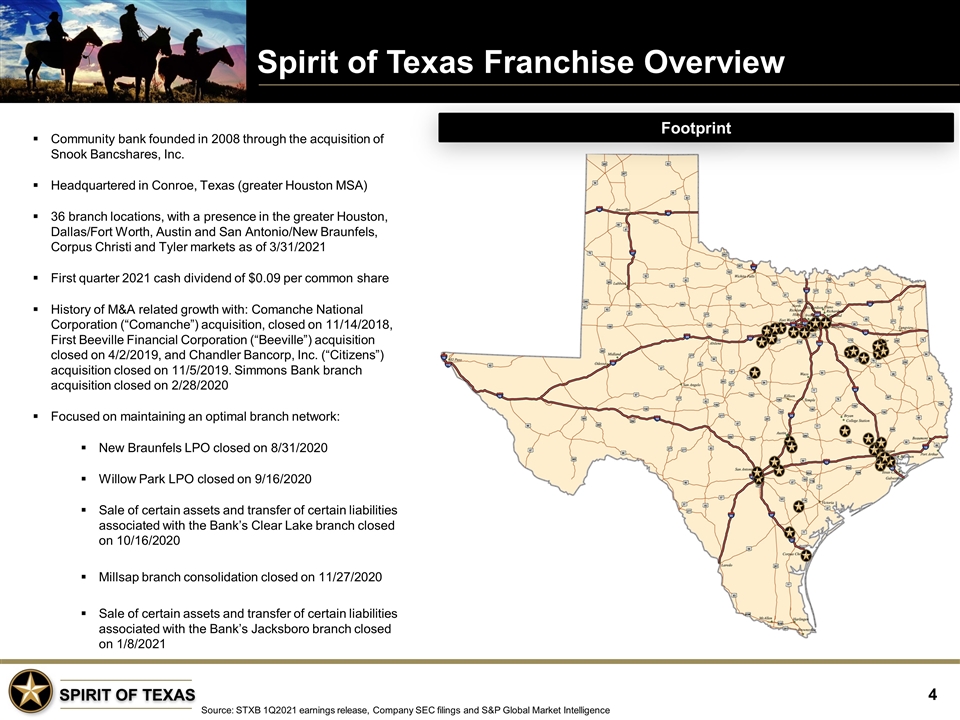

Spirit of Texas Franchise Overview Source: STXB 1Q2021 earnings release, Company SEC filings and S&P Global Market Intelligence Community bank founded in 2008 through the acquisition of Snook Bancshares, Inc. Headquartered in Conroe, Texas (greater Houston MSA) 36 branch locations, with a presence in the greater Houston, Dallas/Fort Worth, Austin and San Antonio/New Braunfels, Corpus Christi and Tyler markets as of 3/31/2021 First quarter 2021 cash dividend of $0.09 per common share History of M&A related growth with: Comanche National Corporation (“Comanche”) acquisition, closed on 11/14/2018, First Beeville Financial Corporation (“Beeville”) acquisition closed on 4/2/2019, and Chandler Bancorp, Inc. (“Citizens”) acquisition closed on 11/5/2019. Simmons Bank branch acquisition closed on 2/28/2020 Focused on maintaining an optimal branch network: New Braunfels LPO closed on 8/31/2020 Willow Park LPO closed on 9/16/2020 Sale of certain assets and transfer of certain liabilities associated with the Bank’s Clear Lake branch closed on 10/16/2020 Millsap branch consolidation closed on 11/27/2020 Sale of certain assets and transfer of certain liabilities associated with the Bank’s Jacksboro branch closed on 1/8/2021 Footprint

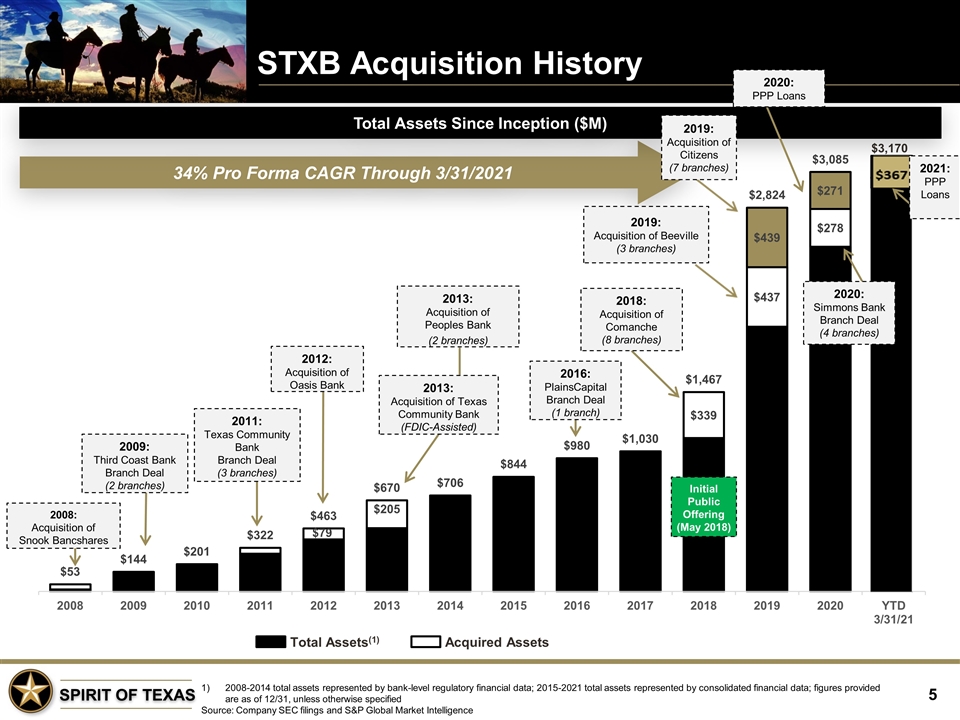

34% Pro Forma CAGR Through 3/31/2021 STXB Acquisition History 2008-2014 total assets represented by bank-level regulatory financial data; 2015-2021 total assets represented by consolidated financial data; figures provided are as of 12/31, unless otherwise specified Source: Company SEC filings and S&P Global Market Intelligence Total Assets Since Inception ($M) 2009: Third Coast Bank Branch Deal (2 branches) 2011: Texas Community Bank Branch Deal (3 branches) 2012: Acquisition of Oasis Bank 2013: Acquisition of Peoples Bank (2 branches) 2016: PlainsCapital Branch Deal (1 branch) 2013: Acquisition of Texas Community Bank (FDIC-Assisted) Total Assets(1) Acquired Assets 2018: Acquisition of Comanche (8 branches) 2019: Acquisition of Citizens (7 branches) 2019: Acquisition of Beeville (3 branches) 2008: Acquisition of Snook Bancshares Initial Public Offering (May 2018) 2020: Simmons Bank Branch Deal (4 branches) 2020: PPP Loans 2021: PPP Loans

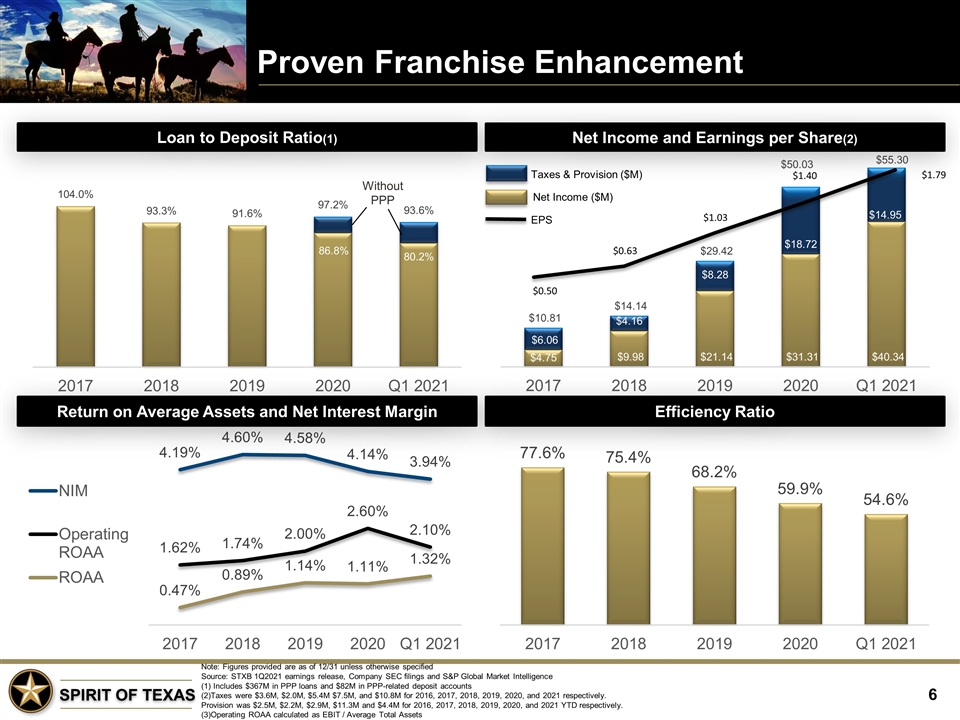

Net Income and Earnings per Share(2) Proven Franchise Enhancement Note: Figures provided are as of 12/31 unless otherwise specified Source: STXB 1Q2021 earnings release, Company SEC filings and S&P Global Market Intelligence (1) Includes $367M in PPP loans and $82M in PPP-related deposit accounts (2)Taxes were $3.6M, $2.0M, $5.4M $7.5M, and $10.8M for 2016, 2017, 2018, 2019, 2020, and 2021 respectively. Provision was $2.5M, $2.2M, $2.9M, $11.3M and $4.4M for 2016, 2017, 2018, 2019, 2020, and 2021 YTD respectively. (3)Operating ROAA calculated as EBIT / Average Total Assets Efficiency Ratio Loan to Deposit Ratio(1) Return on Average Assets and Net Interest Margin EPS Net Income ($M) Taxes & Provision ($M) Without PPP

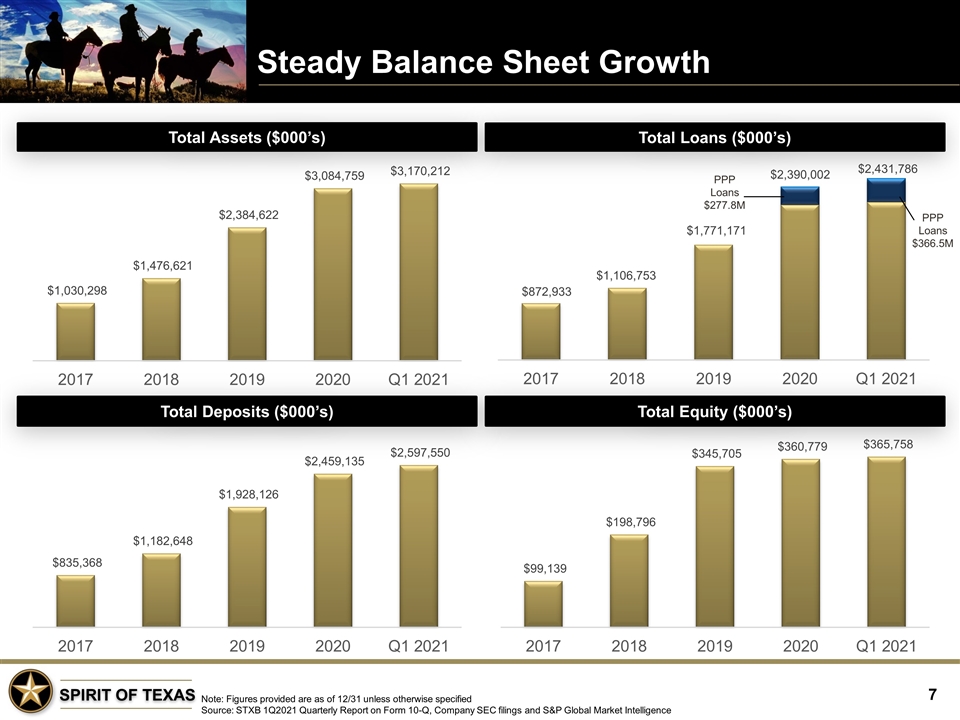

Steady Balance Sheet Growth Note: Figures provided are as of 12/31 unless otherwise specified Source: STXB 1Q2021 Quarterly Report on Form 10-Q, Company SEC filings and S&P Global Market Intelligence Total Equity ($000’s) Total Assets ($000’s) Total Deposits ($000’s) Total Loans ($000’s) PPP Loans $366.5M

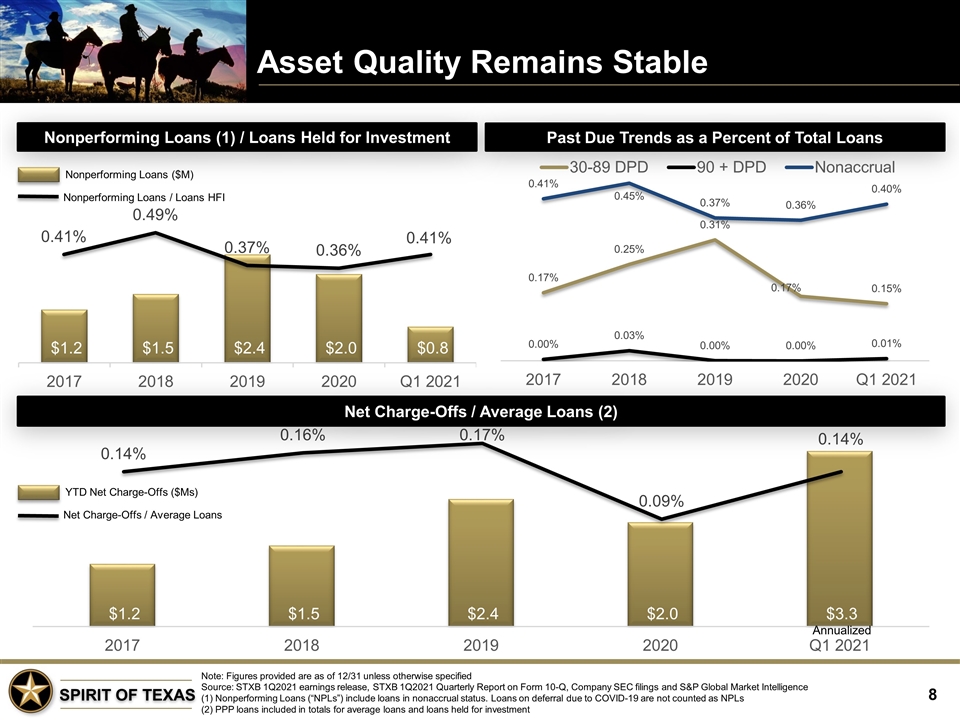

Asset Quality Remains Stable Note: Figures provided are as of 12/31 unless otherwise specified Source: STXB 1Q2021 earnings release, STXB 1Q2021 Quarterly Report on Form 10-Q, Company SEC filings and S&P Global Market Intelligence (1) Nonperforming Loans (“NPLs”) include loans in nonaccrual status. Loans on deferral due to COVID-19 are not counted as NPLs (2) PPP loans included in totals for average loans and loans held for investment Net Charge-Offs / Average Loans (2) Nonperforming Loans (1) / Loans Held for Investment Past Due Trends as a Percent of Total Loans Net Charge-Offs / Average Loans YTD Net Charge-Offs ($Ms) Nonperforming Loans / Loans HFI Nonperforming Loans ($M) Annualized

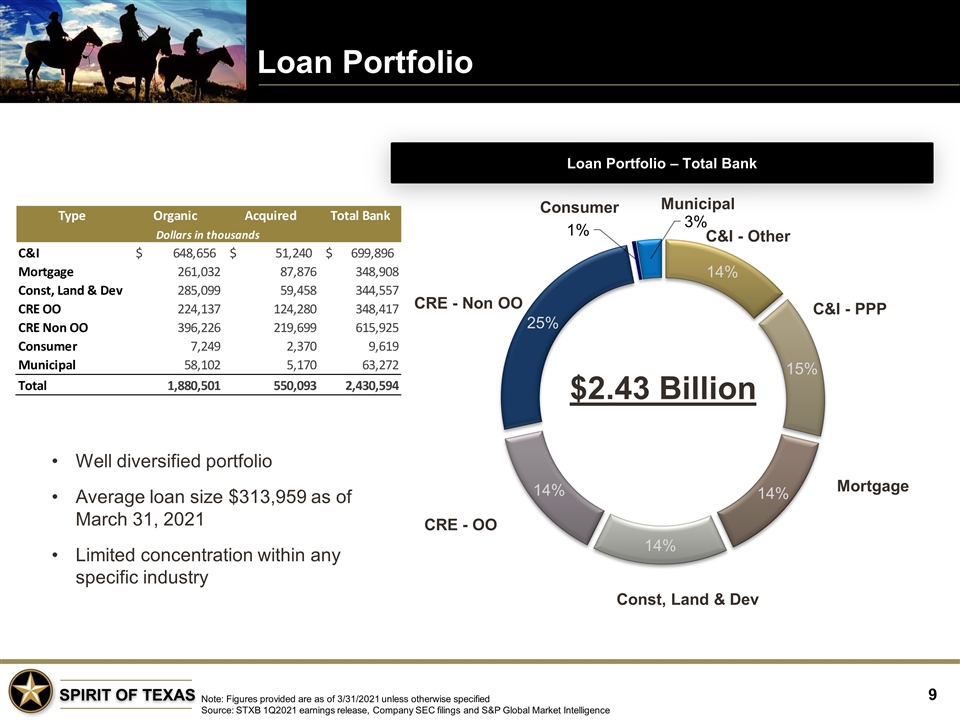

Loan Portfolio Note: Figures provided are as of 3/31/2021 unless otherwise specified Source: STXB 1Q2021 earnings release, Company SEC filings and S&P Global Market Intelligence Well diversified portfolio Average loan size $313,959 as of March 31, 2021 Limited concentration within any specific industry Loan Portfolio – Total Bank Municipal CRE - Non OO C&I - Other C&I - PPP Mortgage Const, Land & Dev CRE - OO Consumer $2.43 Billion

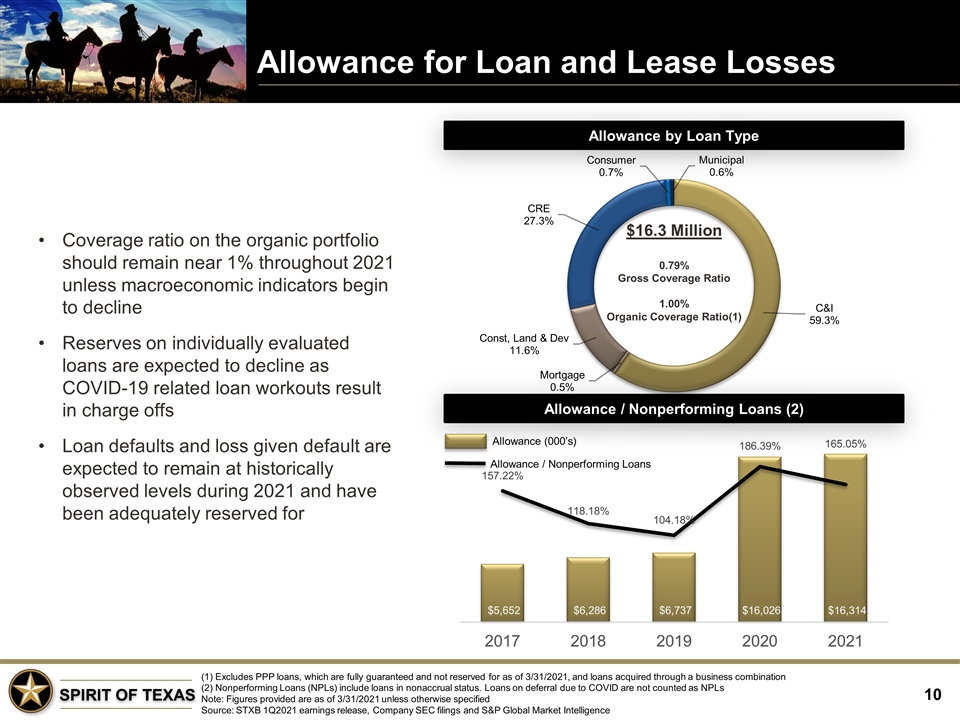

Allowance for Loan and Lease Losses (1) Excludes PPP loans, which are fully guaranteed and not reserved for as of 3/31/2021, and loans acquired through a business combination (2) Nonperforming Loans (NPLs) include loans in nonaccrual status. Loans on deferral due to COVID are not counted as NPLs Note: Figures provided are as of 3/31/2021 unless otherwise specified Source: STXB 1Q2021 earnings release, Company SEC filings and S&P Global Market Intelligence Coverage ratio on the organic portfolio should remain near 1% throughout 2021 unless macroeconomic indicators begin to decline Reserves on individually evaluated loans are expected to decline as COVID-19 related loan workouts result in charge offs Loan defaults and loss given default are expected to remain at historically observed levels during 2021 and have been adequately reserved for Allowance by Loan Type Allowance / Nonperforming Loans (2) Allowance / Nonperforming Loans Allowance (000’s)

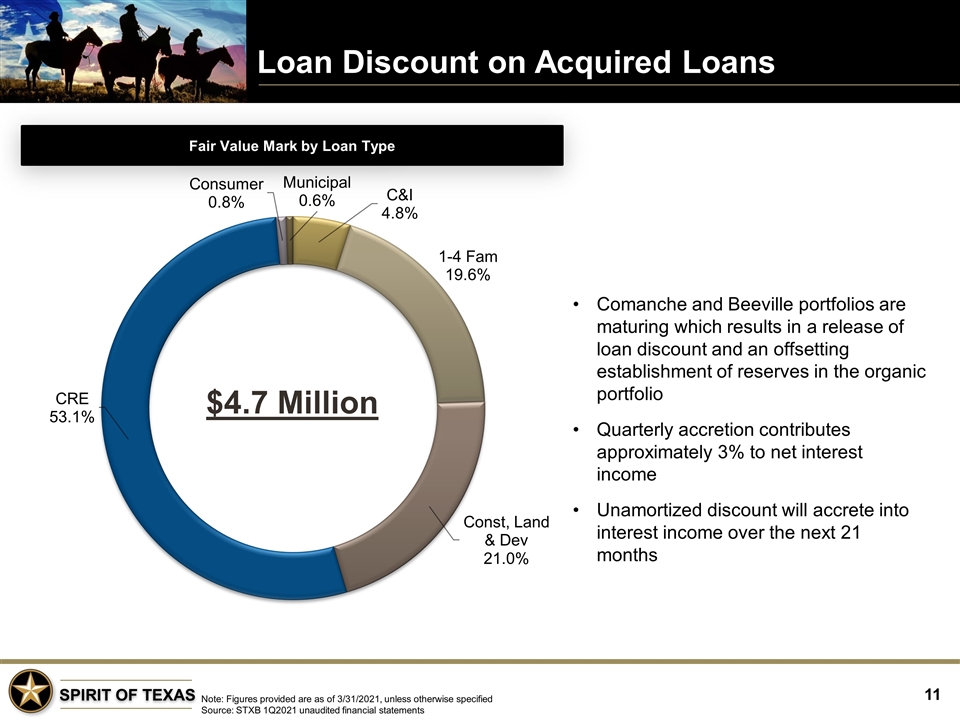

Loan Discount on Acquired Loans Note: Figures provided are as of 3/31/2021, unless otherwise specified Source: STXB 1Q2021 unaudited financial statements Comanche and Beeville portfolios are maturing which results in a release of loan discount and an offsetting establishment of reserves in the organic portfolio Quarterly accretion contributes approximately 3% to net interest income Unamortized discount will accrete into interest income over the next 21 months Fair Value Mark by Loan Type $4.7 Million

Paycheck Protection Program (“PPP”) Source: STXB 1Q2021 unaudited financial statements PPP Rounds 1 and 2 As of March 31, 2021 remaining PPP fee income to be recognized, net of deferred costs is $1.9 million PPP fee income net of deferred costs recognized during the first quarter of 2021 was $1.8 million Remaining PPP loans originated in Rounds 1 and 2 are expected to receive forgiveness during the second quarter of 2021 PPP Round 3 Approved and funded $148.9 million or 1,301 PPP loans during the three months ended March 31, 2021 under the CARES Act Recorded deferred costs of $2.2 million and deferred fees of $7.0 million which will be recognized over the earlier of 5 years or at loan forgiveness Forgiveness of PPP loans originated in Round 3 is expected to begin in the fourth quarter of 2021

Oil and Gas Exposure Note: Figures provided are as of 3/31/21 Source: STXB 1Q2021 unaudited financial statements Direct Exposure Direct exposure on a funded basis was $50.4 million, or 2.1% of the total loan portfolio Direct exposure on committed basis was $55.7 million No loans remain in active deferment period Indirect Exposure Indirect exposure on a funded basis was $24.5 million, or 1.0% of the total loan portfolio Indirect exposure on a committed basis was $24.7 million No loans remain in active deferment period

Focus on Noninterest Income Source: STXB 1Q2021 unaudited financial statements and SEC Filings Swap Fees Launched off-balance sheet swap referral program and on-balance sheet swap offerings during 2020 which generated $1.9 million and $1.7 million of non-interest income for the year then ended, respectively Both programs are anticipated to grow in 2021 Gain on Sale of SBA Loans Department restructuring completed during the first quarter of 2021 Overhaul of incentive structure designed to drive quality growth in 2021 and beyond Premiums on loan sales are stable and have expanded slightly