Attached files

| file | filename |

|---|---|

| 8-K - 8-K - SOUTH PLAINS FINANCIAL, INC. | brhc10024829_8k.htm |

Exhibit 99.1

South Plains Financial Investor Presentation May 2021 1

Safe Harbor Statement and Other Disclosures FORWARD-LOOKING STATEMENTSThis presentation contains, and

future oral and written statements of South Plains Financial, Inc. (“South Plains” or the “Company”) and City Bank (“City Bank” or the “Bank”) may contain, statements about future events that constitute forward-looking statements within the

meaning of the Private Securities Litigation Reform Act of 1995. These forward-looking statements reflect South Plains’ current views with respect to, among other things, future events and South Plains’ financial performance. Any statements

about South Plains’ expectations, beliefs, plans, predictions, forecasts, objectives, assumptions or future events or performance are not historical facts and may be forward-looking. These statements are often, but not always, made through

the use of words or phrases such as “anticipate,” “believes,” “can,” “could,” “may,” “predicts,” “potential,” “should,” “will,” “estimate,” “plans,” “projects,” “continuing,” “ongoing,” “expects,” “intends” and similar words or phrases.

Forward-looking statements include, but are not limited to: (i) projections and estimates of revenues, expenses, income or loss, earnings or loss per share, and other financial items, (ii) statements of plans, objectives and expectations of

South Plains or its management, (iii) statements of future economic performance, and (iv) statements of assumptions underlying such statements. Forward-looking statements should not be relied on because they involve known and unknown risks,

uncertainties and other factors, some of which are beyond the control of South Plains and City Bank. These risks, uncertainties and other factors may cause the actual results, performance, and achievements of South Plains and City Bank to be

materially different from the anticipated future results, performance or achievements expressed in, or implied by, the forward-looking statements. Factors that could cause such differences include, but are not limited to, local, regional,

national and international economic conditions, the extent of the impact of the COVID-19 pandemic, including the impact of actions taken by governmental and regulatory authorities in response to such pandemic, such as the Coronavirus Aid,

Relief, and Economic Security Act and subsequent related legislations, and the programs established thereunder, and City Bank’s participation in such programs, volatility of the financial markets, changes in interest rates, regulatory

considerations, competition and market expansion opportunities, changes in non-interest expenditures or in the anticipated benefits of such expenditures, the receipt of required regulatory approvals, changes in non-performing assets and

charge-offs, adequacy of loan loss reserves, changes in tax laws, current or future litigation, regulatory examinations or other legal and/or regulatory actions, the impact of any tariffs, terrorist threats and attacks, acts of war or threats

thereof or other pandemics. Therefore, South Plains can give no assurance that the results contemplated in the forward-looking statements will be realized and readers are cautioned not to place undue reliance on the forward-looking statements

contained in this presentation. For more information about these factors, please see South Plains’ reports filed with or furnished to the U.S. Securities and Exchange Commission (the “SEC”), including South Plains’ most recent Annual Report

on Form 10-K and Quarterly Reports on Form 10-Q on file with the SEC, including the sections entitled "Risk Factors" and "Management's Discussion and Analysis of Financial Condition and Results of Operations." Further, any forward-looking

statement speaks only as of the date on which it is made and South Plains undertakes no obligation to update or revise any forward-looking statement to reflect events or circumstances after the date on which the statement is made or to

reflect the occurrence of unanticipated events, except as required by law. All forward-looking statements, express or implied, herein are qualified in their entirety by this cautionary statement.NON-GAAP FINANCIAL MEASURESManagement believes

that certain non-GAAP performance measures used in this presentation provide meaningful information about underlying trends in its business and operations. Non-GAAP financial measures should be viewed in addition to, and not as an alternative

for, SPFI’s reported results prepared in accordance with GAAP. Numbers in this presentation may not sum due to rounding. 2

A Leading West Texas Franchise 3 Financial Snapshot (As of March 31, 2021) Our Company Bank

holding company headquartered in Lubbock, Texas with $3.7 billion in total assetsOne of the largest independent banks headquartered in West TexasExecuted a successful IPO in May 2019; now one of two publicly-traded Texas institutions west of

I-35Repeatedly recognized as an outstanding place to work, including being on American Banker’s Best Banks to Work For list six consecutive times Balance Sheet (Dollars in thousands) 1Q’21 Total Assets $3,732,894 Total Loans Held for

Investment $2,242,676 Allowance for Loan Losses $45,019 Total Deposits $3,155,632 Interest-bearing Deposits $2,193,427 Noninterest-bearing Deposits $962,205 Total Stockholders’ Equity $374,671 Profitability (Dollars in

thousands) 1Q’21 Net Income $15,160 Return on Average Assets (annualized) 1.66% Return on Average Equity (annualized) 16.51% Net Interest Margin 3.52% Efficiency Ratio 65.76% Capital Ratios 1Q’21 Total Stockholders’

Equity to Total Assets 10.04% Tangible Common Equity to Tangible Assets 9.39% Common Equity Tier 1 to Risk-Weighted Assets 13.23% Tier 1 Capital to Average Assets 10.35% Total Capital to Risk-Weighted Assets 19.24% Asset

Quality 1Q’21 Nonperforming Loans to Total Loans Held for Investment 0.64% Nonperforming Assets to Total Assets 0.42% Allowance for Loan Losses to Total Loans Held for Investment 2.01% Net Charge-Offs to Average Loans Outstanding

(annualized) 0.11% Unless otherwise stated, financial data as of March 31, 2021 as complied and reported by South PlainsNote: Tangible common equity is a non-GAAP measure. See appendix for the reconciliation to GAAP Recent

Events Approximately $90 million in new Paycheck Protection Program (“PPP”) loans since January 1, 2021 (as of April 27, 2021)Active loan modifications equal less than 2.8% of loans held for investmentMortgage loan originations in the month

of April 2021 totaled approximately $140 million

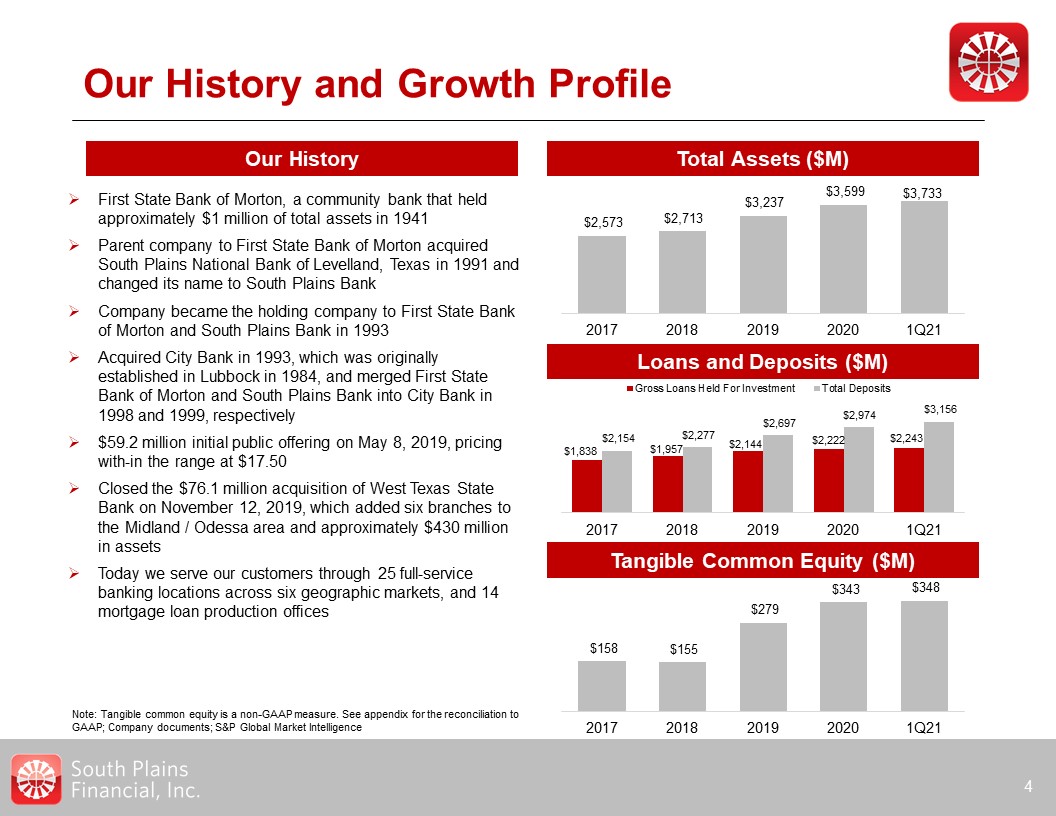

Our History and Growth Profile 4 Our History Loans and Deposits ($M) First State Bank of Morton,

a community bank that held approximately $1 million of total assets in 1941Parent company to First State Bank of Morton acquired South Plains National Bank of Levelland, Texas in 1991 and changed its name to South Plains BankCompany became

the holding company to First State Bank of Morton and South Plains Bank in 1993Acquired City Bank in 1993, which was originally established in Lubbock in 1984, and merged First State Bank of Morton and South Plains Bank into City Bank in 1998

and 1999, respectively$59.2 million initial public offering on May 8, 2019, pricing with-in the range at $17.50Closed the $76.1 million acquisition of West Texas State Bank on November 12, 2019, which added six branches to the Midland /

Odessa area and approximately $430 million in assetsToday we serve our customers through 25 full-service banking locations across six geographic markets, and 14 mortgage loan production offices Note: Tangible common equity is a non-GAAP

measure. See appendix for the reconciliation toGAAP; Company documents; S&P Global Market Intelligence Tangible Common Equity ($M) Total Assets ($M)

Investment Highlights 5 Improving Profitability Organic Growth Strong Credit Culture Enterprise

Risk Management Experienced Management Team Emphasize Community Banking Capital Allocation to Drive Value 1 2 3 4 5 6 7

Experienced Management Team 6 Curtis C. GriffithChairman & Chief Executive Officer Elected to

the board of directors of First State Bank of Morton, Texas, in 1972 and employed by it in 1979Elected Chairman of the First State Bank of Morton board in 1984Chairman of the Board of City Bank and the Company since 1993 Steven B.

CrockettChief Financial Officer & Treasurer Began his career in public accounting in 1994 by serving for seven years with a local firm in Lubbock, TexasAppointed Chief Financial Officer in 2015Controller of the Bank and The Company for

14 and 5 years respectively Mikella D. NewsomChief Risk Officer & Secretary Appointed Chief Risk Officer of the Company in 2019Chief Risk Officer of the Bank for 5 years Appointed Secretary of the Company in 2013More than 20 years with

the Bank and its predecessors Cory T. NewsomPresident Entire banking career with the Company focused on lending and operationsAppointed President and Chief Executive Officer of the Bank in 2008Joined the Board in 2008 Brent A. BatesCity

Bank’s Chief Credit Officer Joined City Bank in February 2020Division Credit Officer for Simmons First National CorpEVP and Chief Credit Officer of Southwest Bancorp, Inc. 1

Significant Insider Share Ownership Stakeholders / Insiders currently own approximately 39.7% of the

Company 7 Shares1 Name Title Position % Outstanding Market Value ($000’s) South Plains Financial ESOP ESOP 2,501,523 13.87% $57,135 Curtis C. Griffith Chairman & CEO 2,485,991 13.78% 56,780 Henry Taw, L.P.

* Individual 1,703,787 9.45% 38,914 Cory T. Newsom President & Director 220,111 1.22% 5,027 Noe G. Valles Director 84,466 0.47% 1,929 Steven B. Crockett CFO & Treasurer 51,237 0.28% 1,170 Richard D. Campbell Lead

Director 45,093 0.25% 1,030 Kelly L. Deterding Pres. Insur Division & SVP of Insur Dev (Bank) 22,812 0.13% 521 Mikella D. Newsom Chief Risk Officer and Secretary 18,527 0.10% 423 Kyle R.

Wargo Director 8,866 0.05% 202 Allison S. Navitskas Director 4,866 0.03% 111 Cynthia B. Keith Director 4,866 0.03% 111 Total 7,152,145 39.65% $163,355 Market data as of December 31, 2020; Shareholder information

as of April 30, 2021. Source: Company filings and documents; S&P Global Market Intelligence 1 * - Voting power for shares is with Richard D. Campbell

Emphasis on Community Banking 8 2 Our strategy - deliver best-in-class customer service and

achieve our goal of becoming the preferred community bank in our market areasTo achieve our goal - we build long-lasting relationships with our customers by delivering high quality products and services Our focus on providing “big bank”

products with the personal attention of a community bank resonates with our customers and drives market shareOur customer service-driven, community-focused business model differentiates our company from competitors, many of which are larger

out-of-market banks Our Goal We measure success by the support that we can provide to our local communities, not the level of business that we can achieveProviding service and aid to our communities is, ultimately, how we have succeeded

over our long historyOur dedication and commitment is at the core of City Bank’s culture as we encourage our employees to volunteer, including as part of their workOur employees have partnered with Meals on Wheels to help care for senior

citizens in Lubbock and the Bank has also been a long time supporter of the South Plains Food Bank and have made a five year, $150,000 pledge Dedicated to Supporting our Communities

Market Branches1 Deposits($ millions)1 Market Highlights 10 $2,055 Population in excess of

310,000 with major industries in agribusiness, education, and trade among othersHome of Texas Tech University – enrollment of 40,000 students 6 $273 Responsible for the production of over four million barrels of crude oil per day, or

roughly 39% of Total U.S. oil productionGrowing expansion of alternative energy resources, creating a solar and wind production hub 3 $408 DFW is the largest MSA in Texas and fourth largest in the nationResponsible for producing 28% of

Texas GDP in 2019Home to 23 Fortune 500 Companies 2 $160 Population of 840,000+ with major military presence through Fort BlissAdjacent to Juarez, Mexico, which has a growing industrial center, and an estimated population of 1.5 million

peopleHome to four universities including The University of Texas at El Paso 2 $156 Serves as a regional economic hubLarge investments from developers over the past ten years – housing subdivisions, condominiums, retail establishments,

etc.Growing retirement community 1 $69 Home to Texas A&M University – enrollment of 71,000 studentsRanked first in Texas and second nationwide for Best Small Places for Business and Careers in 2019 by Forbes 1 $35 Second largest

MSA in Texas and fifth largest in the nationHome to 22 Fortune 500 CompaniesCalled the “Energy Capital of the World,” the area also boasts the world’s largest medical center and second busiest port in the U.S. Ruidoso /Eastern New Mexico El

Paso Our Markets of Operation 9 2 Source: Company documents; FRED; S&P Global Market Intelligence; Respective university websites; Branch and deposit data as of March 31, 2021 Permian Basin Dallas /Ft. Worth Bryan /College

Station Houston /The Woodlands Lubbock /South Plains Find a stat

Our Markets of Operation (Cont’d) 10 Deposit Market Share: Lubbock MSA Lubbock, Texas – Our

Home Market Major industries include agriculture – primarily cotton, corn, and grain sorghum – as well as education, trade and transportation, health services and governmentHome to Texas Tech University – enrollment ranks within the top 10

for universities in Texas as of Fall 2020 at 40,000+ studentsThe Lubbock MSA reports unemployment of 5.8% for 2020Forbes listed Lubbock as one of its ‘‘Best Places for Business and Careers’’ during

2019 Headquarters In-Market Rank Institution City State Branches Deposits (Millions)(1) Market Share 1 Hilltop Holdings Dallas TX 10 $1,972 19.4% 2 South Plans

Financial Lubbock TX 8 $1,631 16.1% 3 Wells Fargo San Francisco CA 9 $905 8.9% 4 Prosperity Bancshares Houston TX 16 $817 8.1% 5 Amarillo National Bancorp Amarillo TX 9 $767 7.6% 6 Heartland Financial

USA Dubuque IA 7 $744 7.3% 7 Peoples Bancorp Lubbock TX 6 $499 4.9% 8 Bank of America Charlotte NC 2 $432 4.3% 9 Vista Bancshares Dallas TX 7 $330 3.3% 10 Americo

Bancshares Wolfforth TX 5 $268 2.7% 11 AIM Bancshares Levelland TX 4 $239 2.4% 12 Happy Bancshares Amarillo TX 2 $211 2.1% 13 Plains Bancorp Dimmitt TX 3 $207 2.0% 14 First Bancshares of

Texas Midland TX 2 $191 1.9% 15 Lone Star State Bancshares Lubbock TX 1 $187 1.8% Top 1 - 15 Total 91 $9,400 92.8% Total For Market (27) 113 $10,147 100.0% 2 Deposit data as of June

30, 2020 as complied and reported by S&P Global Market Intelligence. Source: BLS; FDIC; S&P Global Market Intelligence; Lubbock Chamber of Commerce; Forbes

Enterprise Risk Management 11 3 We implemented a rigorous enterprise risk management (“ERM”)

system in the aftermath of the financial crisis, and view this development as a defining event for our institution This system delivers a systematic approach to risk measurement and enhances the effectiveness of risk management across the

institution Integrating this system into our culture and strategic decision making has improved all functional areas of the business Significantly improved asset quality by enhancing our underwriting process, and establishing a specific

credit appetite that aligns to the broader enterprise risk management framework Has provided a process to quickly detect and address potential problems in our loan portfolio, greatly improving our ability to manage through the COVID-19

pandemic We have also implemented monitoring and controls for other functional areas such as:Information security and technology, vendor management, liquidity, interest rate risk, compliance, and company reputation The ERM program has

positioned our Company to better consummate acquisitions with less risk and increased cost savings We believe we are the only community bank of our size and in our market area to implement such a comprehensive risk management system

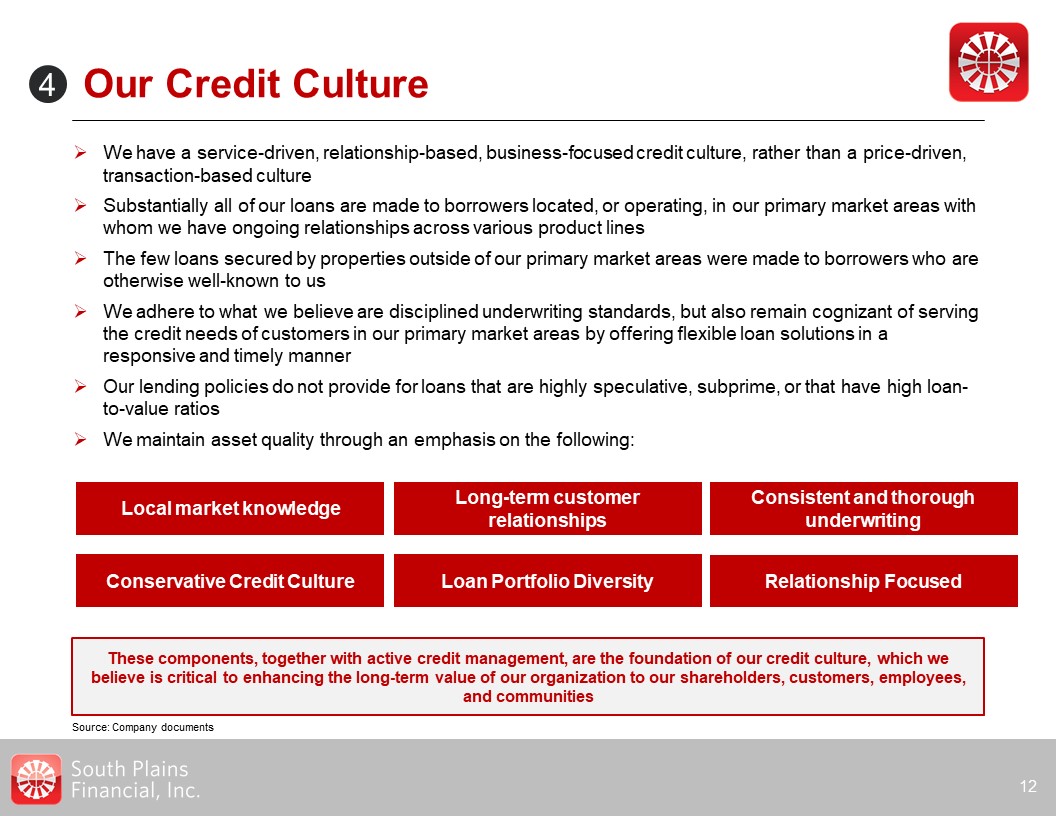

Our Credit Culture 12 We have a service-driven, relationship-based, business-focused credit

culture, rather than a price-driven, transaction-based cultureSubstantially all of our loans are made to borrowers located, or operating, in our primary market areas with whom we have ongoing relationships across various product linesThe few

loans secured by properties outside of our primary market areas were made to borrowers who are otherwise well-known to usWe adhere to what we believe are disciplined underwriting standards, but also remain cognizant of serving the credit

needs of customers in our primary market areas by offering flexible loan solutions in a responsive and timely mannerOur lending policies do not provide for loans that are highly speculative, subprime, or that have high loan-to-value ratiosWe

maintain asset quality through an emphasis on the following: These components, together with active credit management, are the foundation of our credit culture, which we believe is critical to enhancing the long-term value of our

organization to our shareholders, customers, employees, and communities 4 Local market knowledge Long-term customer relationships Consistent and thorough underwriting Conservative Credit Culture Loan Portfolio Diversity

Relationship Focused Source: Company documents

Loan Approval Process 13 Striking a Balance Between: In Our Decision Making and Responsiveness

to Customers Prudence Disciplined Underwriting Flexibility Loan relationships in excess of an individual officers lending authority up to $3 million may be approved with joint authorities of the market president and senior credit

officer.Loan relationships over $3 million are approved by our Executive Loan Committee.New loans over $5 million to a relationship over $20 million are reported to the Board Credit Risk Committee. These limits are reviewed periodically by

the Company’s Board of DirectorsWe believe that our credit approval process provides for thorough underwriting and efficient decision making 4 Source: Company documents

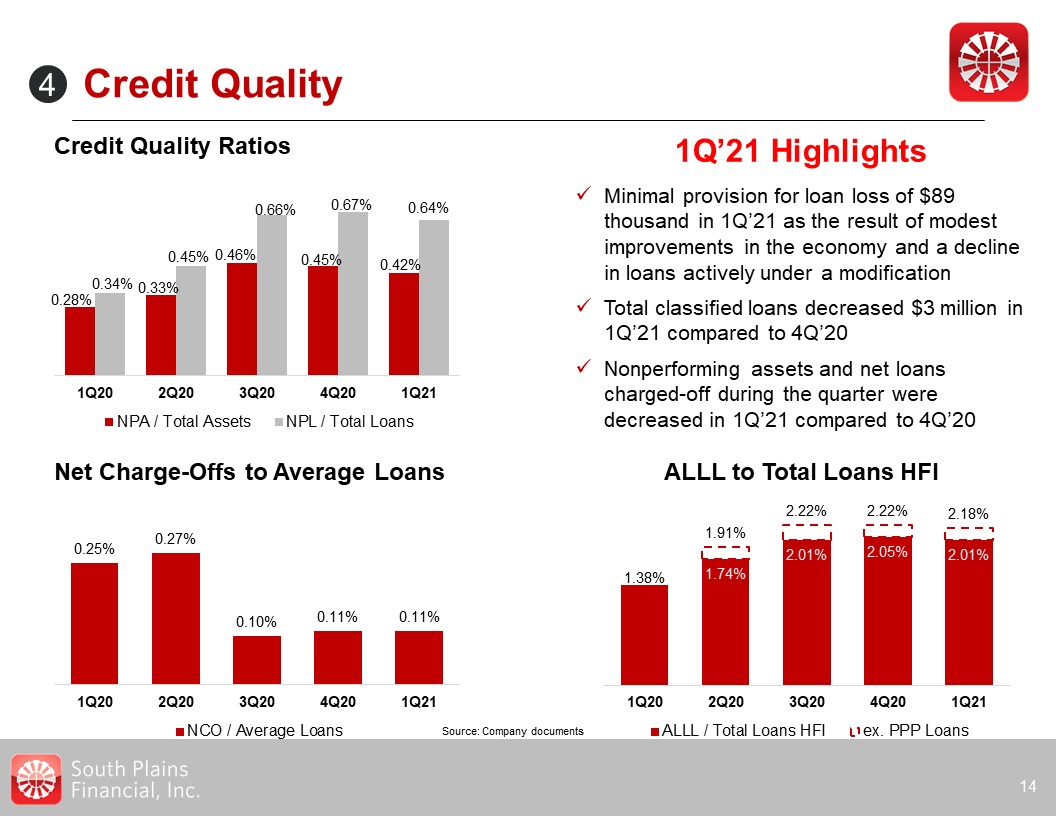

Credit Quality 14 1Q’21 Highlights Credit Quality Ratios Minimal provision for loan loss of $89

thousand in 1Q’21 as the result of modest improvements in the economy and a decline in loans actively under a modificationTotal classified loans decreased $3 million in 1Q’21 compared to 4Q’20Nonperforming assets and net loans charged-off

during the quarter were decreased in 1Q’21 compared to 4Q’20 Net Charge-Offs to Average Loans ALLL to Total Loans HFI Source: Company documents 4

We are actively recruiting additional lenders and employees from other institutions. We have had

success in this area which we believe is attributable to our employee ownership, long-standing market presence and desirable culture in which our employees can thrive We also cross-sell our various banking products, including our deposits and

treasury wealth management to our commercial loan customers, which we believe provides a basis for expanding our banking relationships Organic Growth Strategy Homegrown Returns We focus on leveraging our banking platform in our

metropolitan markets of Dallas, Houston and El Paso, where we target customers looking for our relationship-based approach to banking and our sophisticated products and services Our strategy is to continue gathering low-cost deposits in

smaller, non-metropolitan markets and deploy our excess funds in larger, more dynamic lending markets, where we have had strong success 15 Includes three Dallas, TX branches, two El Paso, TX branches, and one Houston, TX branchIncludes

ten branches in the Lubbock/South Plains, TX market area, six branches in the Permian Basin, TX, two branches in Ruidoso/Eastern, NM, and one branch in Bryan/College Station, TXDeposit and Loan data as of March 31, 2021 (Dollars in

thousands) Deposits(3) Loans(3) Amount Overall % Amount Overall % Loans/Deposits Metropolitan Markets(1) $ 602,903 19.1% $ 668,317 29.8% 110.8% Community

Markets(2) $ 2,552,729 80.9% $ 1,574,359 70.2% 61.7% 5

Organic Growth Markets 16 El Paso Adjacent to Juarez, Mexico, which has a growing industrial

center and an estimated population of 1.5 million people, and has contributed to significant growth in the El Paso MSAHome to Fort Bliss, which houses the 1st Armored Division, the 32nd Army Air and Missile Defense Command and the 402nd Field

Artillery Brigade, among other major units, and has almost 50,000 military and civilian employeesOther large employers include El Paso Healthcare System, Tenet Hospitals, The University of Texas at El Paso, The Texas Tech School of Medicine,

El Paso Community College, Southwest University and Vista College 5 New Mexico Texas Dallas Bryan /College Station Houston Midland Odessa El Paso Lubbock Ruidoso SanAntonio Ft. Worth Austin Albuquerque Santa Fe SPFI Branch

Locations Dallas / Ft. Worth1 Largest MSA in Texas, responsible for a total GDP of almost $524 Billion in 2019Estimated population of around 7.5 million as of 2019, which is a little over 26% of the state’s populationPopulation has

steadily expanded over the past decade, with an increase of over 1.2 million residentsCompetitive cost of living, provides an attractive location for companies interested in relocating to more efficient economic environments Major U.S.

Airport hub, responsible for 35.8 million enplaned passengers in 2019Home to 23 Fortune 500 companies, in notable sectors including energy, financial services, transportation, and technology Source: Bureau of Transportation Statistics;

Federal Reserve of Dallas; FRED; Texas Demographic Center

Capital Allocation to Drive Value 17 Growth Through Accretive M&A We plan to take advantage

of acquisition opportunities, and use a combination of public stock and cash to become the acquirer of choice in our core markets of West Texas and New MexicoCatalysts for acquisition activity include management succession, shareholder

liquidity needs, scale, and excessive regulationThere are 25 banks located in the West Texas market area with total assets between $250 million and $2.0 billion, which provides us with ample opportunities to drive growth and increase

shareholder valueManagement employs a strict framework for analyzing potential acquisition opportunities including:Substantial earnings accretionReasonable tangible book value dilutionAcceptable earn-back periodStrong Internal Rate of

ReturnCompleted the acquisition of West Texas State Bank on November 12, 2019 6 Most Recent Acquisition Metric Promised? Delivered? Contiguous West Texas Market Manageable Size Attractively Priced Substantial EPS

Accretion TBV Earnback < 4 Years TBV Dilution Under 10% Strong IRR

Improving Profitability 18 We have invested heavily into our infrastructure including:Our

Enterprise Risk Management system State-of-the-art operations center which houses the Bank’s back-office processing for deposit operations, loan operations, mortgage operations, and corporate trainingDigital and payment technologies including

improved remote deposit capture software for business customers, expanded usage of electronic signatures, online account tools, and technologies that facilitate more efficient item processing These investments position the Bank to scale to

more than $5 billion in assets through both organic growth and accretive, strategic M&A without commensurate additional expenses Long Term Goal: Deliver peer average or better ROA’s and ROE’s 7

Investment Highlights 19 Improving Profitability Organic Growth Strong Credit Culture Enterprise

Risk Management Experienced Management Team Emphasize Community Banking Capital Allocation to Drive Value 1 2 3 4 5 6 7

Financial Update 20

First Quarter 2021 Highlights 21 Note: Tangible book value per share and pre-tax, pre-provision

income are non-GAAP measures. See appendix for the reconciliation to GAAP Source: Company documents Net Income of $15.2 million, compared to $15.9 million in 4Q’20 and $7.1 million in 1Q’20Diluted earnings per share of $0.82, compared to

$0.87 in 4Q’20 and $0.38 in 1Q’20Pre-Tax, Pre-Provision income of $19.0 million, compared to $20.0 million in 4Q’20 and $15.1 million in 1Q’20Average cost of deposits declined to 29 bps, compared to 31 bps in 4Q’20 and 65 bps in

1Q’20Provision for loan loss of $89 thousand, compared to $141 thousand in 4Q’20 and $6.2 million in 1Q’20Net Interest Margin of 3.52%, compared to 3.64% in 4Q’20 and 4.13% in 1Q’20 Efficiency ratio was 65.76%, compared to 64.19% in 4Q’20 and

69.10% in 1Q’20Tangible book value per share of $19.28, compared to $18.97 at 12/31/20 and $16.54 at 3/31/20Return on Average Assets (annualized) of 1.66%, compared to 1.76% in 4Q’20 and 0.89% in 1Q’20

Loan Portfolio 22 Total loans increased $21.1 million in 1Q’21, compared to 4Q’20Increase in total

loans during the quarter was due primarily to:$46.5 million in organic net growth; including $3.5 million in PPP loan net growthPartially offset by $25.4 million in pay downs on seasonal agricultural production loans1Q’21 loan yield of 4.93%;

a decrease of 18 bps compared to 4Q’20 excluding PPP loans 1Q’21 Highlights Total Loans Held for Investment$ in Millions Source: Company documents

Loan Portfolio 23 Portfolio Composition Loan Portfolio ($ in

millions) 3/31/21 Commercial C&D $ 100.4 Residential C&D 172.2 CRE Owner/Occ. 220.7 Other CRE Non Owner/Occ. 438.7 Multi-Family 70.5 C&I 268.6 Agriculture 147.9 1-4 Family 362.6

Auto 220.0 Other Consumer 67.6 PPP 173.5 Total $ 2,242.7 Source: Company documents PPP loans totaled $173.5 million at 3/31/21; includes $77.6 million in new PPP loans during 1Q’21Active loan modifications

were 2.1%, or $46.9 million, of total loans at 3/31/21:Decrease from 2.9%, or $64.1 million, at 12/31/20Approximately 95% of these modifications are in the hotel industry 1Q’21 Highlights

DirectEnergy Select Loan Industry Concentration Detail 24 As of March 31,

2021 Hospitality Total operating hospitality loans of $123 million*$17 million in hotels under construction, with unfunded commitments of $7 million84% of balances are to limited service hotels43% of operating hospitality classified; 2% is

nonaccrual; < 2.5% are 30 days or more past dueAllowance for Loan and Lease Losses (“ALLL”) on operating hospitality is 8.8%** Does not include loans reported in construction and development Total direct energy loans of $63 million92%

support services, 8% upstreamNearly 100% are located in Permian and Palo Duro Basins12% of energy sector classifiedALLL on energy sector is 5.2% Hotels by Geography Source: Company documents Energy Support Services by Type

Noninterest Income 25 Noninterest Income$ in Millions 1Q’21 Highlights Noninterest income of

$26.5 million in 1Q’21, compared to $18.9 million in 1Q’20Revenue from mortgage banking activities of $18.8 million in 1Q’21, compared to $8.8 million in 1Q’20Fee income primarily driven by mortgage operations, debit card and other bank

service charge income, and income from insurance, trust and investment services business Source: Company documents

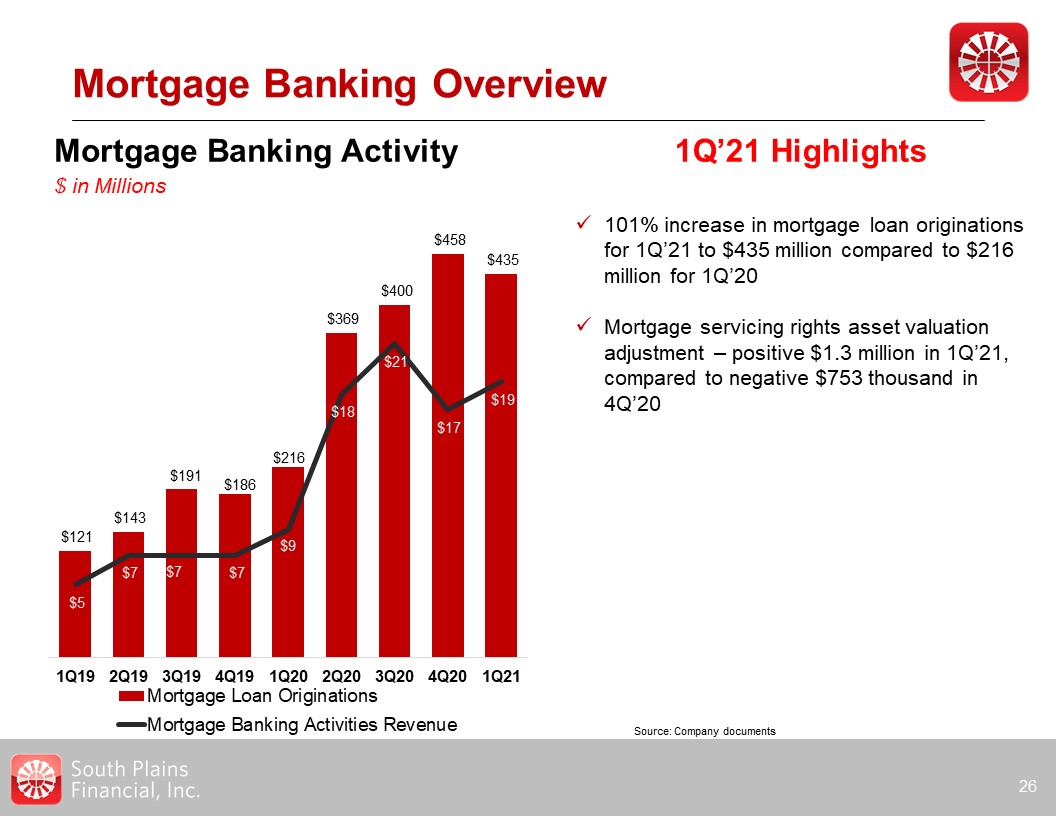

Mortgage Banking Overview 26 Mortgage Banking Activity$ in Millions 1Q’21 Highlights 101% increase

in mortgage loan originations for 1Q’21 to $435 million compared to $216 million for 1Q’20Mortgage servicing rights asset valuation adjustment – positive $1.3 million in 1Q’21, compared to negative $753 thousand in 4Q’20 Source: Company

documents

Diversified Revenue Stream Three Months Ended March 31, 2021 27 Total Revenues$56.0

million Noninterest Income$26.5 million Source: Company documents

Net Interest Income and Margin 28 Net Interest Income & Margin$ in Millions 1Q’21

Highlights Net interest income of $29.5 million in 1Q’21, compared to $30.2 million in 1Q’20The decline as compared to 1Q’20 was a result of:Decrease of 69 bps in loan ratesInterest expense for $50 million of subordinated notes issued in

3Q’20 Partially offset by a decrease of 50 bps in the cost of interest-bearing deposits1Q’21 net interest margin (“NIM”) of 3.52% - decrease of 12 bps compared to 4Q’20:18 bps decline in non-PPP loan yieldExcess liquidity - $90 million growth

in average deposits negatively affected NIM 9 bps Source: Company documents

Deposit Portfolio 29 Total Deposits$ in Millions 1Q’21 Highlights Total Deposits of $3.16 billion

at 1Q’21, an increase of $181.3 million from 4Q’20Increase in total deposits primarily a result of organic growth as well as existing customers depositing funds received from PPP loan advances, stimulus checks, and generally maintaining

higher liquidity in response to the ongoing COVID-19 pandemicCost of interest-bearing deposits declined in 1Q’21 to 41bps from 91bps in 1Q’20Noninterest-bearing deposits represented 30.5% of deposits in 1Q’21, compared to 30.8% in 4Q’20 and

27.8% in 1Q’20 Source: Company documents

Investment Securities 30 1Q’21 Highlights Investment Securities totaled $777.2 million at 1Q’21,

a decrease of $25.9 million from 4Q’20; primarily from a decrease in the fair value of securities of $18.5 million due to market conditions All municipal bonds are in TexasAll MBS, CMO, and Asset Backed securities are U.S. Government or

GSE 1Q’21 Securities Composition $777.2mm Securities & Cash$ in Millions Source: Company documents

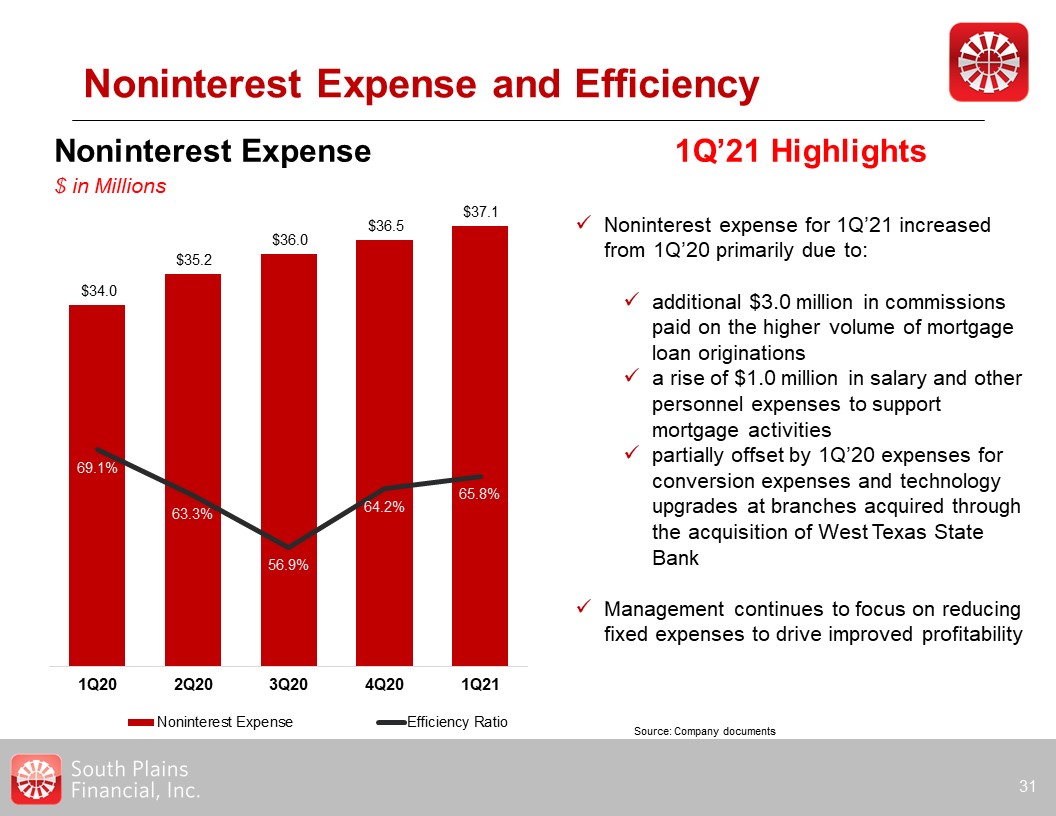

Noninterest Expense and Efficiency 31 Noninterest Expense$ in Millions 1Q’21

Highlights Noninterest expense for 1Q’21 increased from 1Q’20 primarily due to:additional $3.0 million in commissions paid on the higher volume of mortgage loan originationsa rise of $1.0 million in salary and other personnel expenses to

support mortgage activitiespartially offset by 1Q’20 expenses for conversion expenses and technology upgrades at branches acquired through the acquisition of West Texas State BankManagement continues to focus on reducing fixed expenses to

drive improved profitability Source: Company documents

Balance Sheet Highlights$ in Millions Balance Sheet Growth and Development 32 Tangible Book Value

Per Share Note: Tangible book value per share is a non-GAAP measure. See appendix for the reconciliation to GAAP Source: Company documents

Strong Capital Base 33 Tangible Common Equity to Tangible Assets Ratio Common Equity Tier 1

Ratio Tier 1 Capital to Average Assets Ratio Total Capital to Risk-Weighted Assets Ratio Source: Company documents Note: Tangible common equity to tangible assets is a non-GAAP measure. See appendix for the reconciliation to GAAP

Appendix 34

Non-GAAP Financial Measures 35 As of and for the quarter ended

March 31,2021 December 31,2020 September 30,2020 June 30,2020 March 31,2020 Efficiency Ratio Noninterest expense $ 37,057 $ 36,504 $ 35,993 $ 35,207

$ 34,011 Net interest income $ 29,544 $ 30,365 $ 31,273 $ 30,448 $ 30,199 Tax equivalent yield adjustment 312 336 322 290 145 Noninterest

income 26,500 26,172 31,660 24,896 18,875 Total income $ 56,356 $ 56,873 $ 63,255 $ 55,634 $ 49,219 Efficiency ratio

65.76% 64.19% 56.90% 63.28% 69.10% Noninterest expense $ 37,057 $ 36,504 $ 35,993 $ 35,207 $ 34,011 Less: net loss on sale of securities - -

- - - Adjusted noninterest expense 37,057 36,504 35,993 35,207 34,011 Total income $ 56,356 $ 56,873 $ 63,255 $ 55,634 $

49,219 Less: net gain on sale of securities - - - - (2,318) Adjusted total income $ 56,356 $ 56,873 $ 63,255 $ 53,634 $ 46,901 Adjusted

efficiency ratio 65.76% 64.19% 56.90% 63.28% 72.52% Unaudited$ in Thousands Pre-Tax, Pre-Provision Income Net income $ 15,160 $ 15,924 $ 16,731

$ 5,615 $ 7,083 Income tax expense 3,738 3,968 4,147 1,389 1,746 Provision for loan losses 89 141 6,062 13,133 6,234 Pre-tax,

pre-provision income $ 18,987 $ 20,033 $ 26,940 $ 20,137 $ 15,063 Source: Company documents

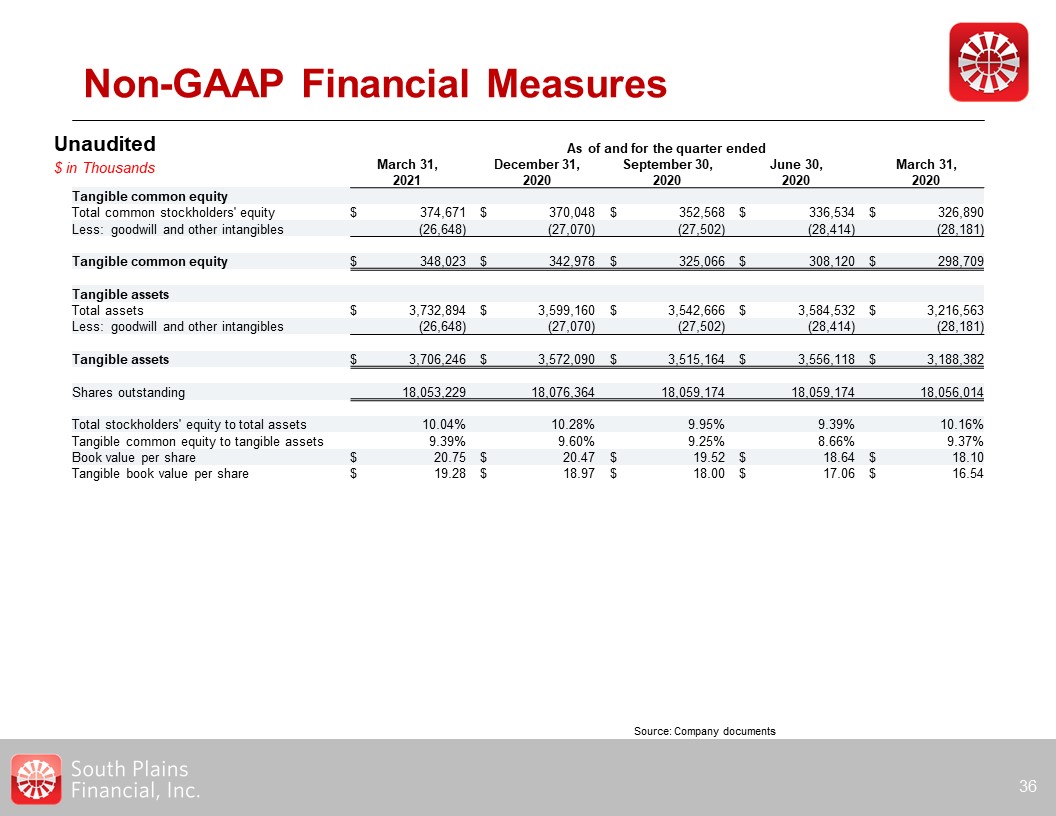

Non-GAAP Financial Measures 36 As of and for the quarter

ended March 31,2021 December 31,2020 September 30,2020 June 30,2020 March 31,2020 Tangible common equity Total common stockholders'

equity $ 374,671 $ 370,048 $ 352,568 $ 336,534 $ 326,890 Less: goodwill and other intangibles (26,648) (27,070) (27,502) (28,414) (28,181)

Tangible common equity $ 348,023 $ 342,978 $ 325,066 $ 308,120 $ 298,709 Tangible assets Total assets $ 3,732,894 $ 3,599,160

$ 3,542,666 $ 3,584,532 $ 3,216,563 Less: goodwill and other intangibles (26,648) (27,070) (27,502) (28,414) (28,181) Tangible assets $ 3,706,246

$ 3,572,090 $ 3,515,164 $ 3,556,118 $ 3,188,382 Shares outstanding 18,053,229 18,076,364 18,059,174 18,059,174 18,056,014

Total stockholders' equity to total assets 10.04% 10.28% 9.95% 9.39% 10.16% Tangible common equity to tangible assets 9.39% 9.60% 9.25% 8.66% 9.37% Book value per

share $ 20.75 $ 20.47 $ 19.52 $ 18.64 $ 18.10 Tangible book value per share $ 19.28 $ 18.97 $ 18.00 $ 17.06 $ 16.54 Unaudited$ in Thousands Source: Company documents