Attached files

| file | filename |

|---|---|

| 8-K - 8-K - Performance Food Group Co | d166334d8k.htm |

| EX-99.1 - EX-99.1 - Performance Food Group Co | d166334dex991.htm |

| EX-2.1 - EX-2.1 - Performance Food Group Co | d166334dex21.htm |

Exhibit 99.2

Acquisition of Core-Mark May 18, 2021

Forward-Looking Statements This communication contains forward-looking statements within the meaning of Section 27A of the Securities Act of 1933, as amended, and Section 21E of the Securities Exchange Act of 1934, as amended. These statements include, but are not limited to, statements related to our expectations regarding the performance of our business, our financial results, our liquidity and capital resources, integration of our acquisition of Reinhart and other non-historical statements. You can identify these forward-looking statements by the use of words such as “outlook,” “believes,” “expects,” “potential,” “continues,” “may,” “will,” “should,” “could,” “seeks,” “projects,” “predicts,” “intends,” “plans,” “estimates,” “anticipates” or the negative version of these words or other comparable words. Such forward-looking statements are subject to various risks and uncertainties. The following factors, in addition to those discussed under the section entitled Item 1A. Risk Factors in the PFG’s Annual Report on Form 10-K for the fiscal year ended June 27, 2020 filed with the Securities and Exchange Commission (the “SEC”) on August 18, 2020, as such factors may be updated from time to time in our periodic filings with the SEC, which are accessible on the SEC’s website at www.sec.gov, could cause actual future results to differ materially from those expressed in any forward-looking statements: the material adverse impact the COVID-19 pandemic has had and is expected to continue to have on the global markets, the restaurant industry, and our business specifically; competition in our industry is intense, and we may not be able to compete successfully; we operate in a low margin industry, which could increase the volatility of our results of operations; we may not realize anticipated benefits from our operating cost reduction and productivity improvement efforts; our profitability is directly affected by cost inflation and deflation and other factors; we do not have long-term contracts with certain of our customers; group purchasing organizations may become more active in our industry and increase their efforts to add our customers as members of these organizations; changes in eating habits of consumers; extreme weather conditions; our reliance on third-party suppliers; labor relations and cost risks and availability of qualified labor; volatility of fuel and other transportation costs; inability to adjust cost structure where one or more of our competitors successfully implement lower costs; we may be unable to increase our sales in the highest margin portion of our business; changes in pricing practices of our suppliers; our growth strategy may not achieve the anticipated results; risks relating to acquisitions, including the risk that we are not able to realize benefits of acquisitions or successfully integrate the businesses we acquire; environmental, health, and safety costs; the risk that we fail to comply with requirements imposed by applicable law or government regulations; a portion of our sales volume is dependent upon the distribution of cigarettes and other tobacco products, sales of which are generally declining; if the products we distribute are alleged to cause injury or illness or fail to comply with governmental regulations, we may need to recall our products and may experience product liability claims; our reliance on technology and risks associated with disruption or delay in implementation of new technology; costs and risks associated with a potential cybersecurity incident or other technology disruption; product liability claims relating to the products we distribute and other litigation; adverse judgements or settlements; negative media exposure and other events that damage our reputation; decrease in earnings from amortization charges associated with acquisitions; impact of uncollectibility of accounts receivable; difficult economic conditions affecting consumer confidence; risks relating to federal, state, and local tax rules; the cost and adequacy of insurance coverage; risks relating to our outstanding indebtedness; our ability to raise additional capital; our ability to maintain an effective system of disclosure controls and internal control over financial reporting; the possibility that the expected synergies and value creation from the acquisition of Reinhart will not be realized or will not be realized within the expected time period; and the following risks related to the proposed acquisition of Core-Mark ( the “Core-Mark Transaction”): the risk that U.S. federal antitrust clearance or other approvals required for the Core-Mark Transaction may be delayed or not obtained or are obtained subject to conditions that are not anticipated that could require the exertion of management’s time and the Company’s resources or otherwise have an adverse effect on the Company; the possibility that conditions to the consummation of the Core-Mark Transaction, including approval by Core-Mark shareholders, will not be satisfied or completed on a timely basis and accordingly the Core-Mark Transaction may not be consummated on a timely basis or at all; uncertainty as to the expected financial performance of the combined company following completion of the Core-Mark Transaction; the possibility that the expected synergies and value creation from the Core-Mark Transaction will not be realized or will not be realized within the expected time period; the exertion of the Company management’s time and the Company’s resources, and other expenses incurred and business changes required, in connection with complying with the undertakings in connection with U.S. federal antitrust clearance or other third-party consents or approvals for the Core-Mark Transaction; the risk that unexpected costs will be incurred in connection with the completion and/or integration of the Core-Mark Transaction or that the integration of Core-Mark will be more difficult or time consuming than expected; availability of debt financing for the Core-Mark Transaction and our refinancing plans on terms that are favorable to us; a downgrade of the credit rating of the Company’s indebtedness, which could give rise to an obligation to redeem existing indebtedness; potential litigation in connection with the Core-Mark Transaction may affect the timing or occurrence of the Core-Mark Transaction or result in significant costs of defense, indemnification and liability; the inability to retain key personnel; the possibility that competing offers will be made to acquire Core-Mark; disruption from the announcement, pendency and/or completion of the Core-Mark Transaction, including potential adverse reactions or changes to business relationships with customers, employees, suppliers or regulators, making it more difficult to maintain business and operational relationships; and the risk that, following the Core-Mark Transaction, the combined company may not be able to effectively manage its expanded operations. Accordingly, there are or will be important factors that could cause actual outcomes or results to differ materially from those indicated in these statements. These factors should not be construed as exhaustive and should be read in conjunction with the other cautionary statements that are included in this release and in our filings with the SEC. Any forward-looking statement, including any contained herein, speaks only as of the time of this release or as of the date they were made and we do not undertake to update or revise them as more information becomes available or to disclose any facts, events, or circumstances after the date of this release or our statement, as applicable, that may affect the accuracy of any forward-looking statement, except as required by law.

Important Additional Information and Where to Find It In connection with the proposed transaction, PFG intends to file with the SEC a registration statement on Form S-4 (the “Registration Statement”), which will include a prospectus with respect to the shares of PFG’s common stock to be issued in the proposed transaction and a proxy statement for Core-Mark’s stockholders (the “Proxy Statement”). Core-Mark will send the Proxy Statement to its stockholders, and each party may file other documents regarding the proposed transaction with the SEC. This communication is not a substitute for the Form S-4, the Proxy Statement or any other document that Core-Mark may send to its stockholders in connection with the proposed transaction. INVESTORS AND SECURITY HOLDERS OF PFG AND CORE-MARK ARE URGED TO READ THE FORM S-4, THE PROXY STATEMENT AND ANY OTHER RELEVANT DOCUMENTS (INCLUDING ANY AMENDMENTS OR SUPPLEMENTS THERETO) THAT WILL BE FILED WITH THE SEC CAREFULLY AND IN THEIR ENTIRETY WHEN THEY BECOME AVAILABLE BECAUSE THEY WILL CONTAIN IMPORTANT INFORMATION ABOUT PFG, Core-Mark, THE PROPOSED TRANSACTION AND RELATED MATTERS. Investors and security holders of PFG and Core-Mark will be able to obtain free copies of the Form S-4, the Proxy Statement and other documents (including any amendments or supplements thereto) containing important information about PFG and Core-Mark once those documents are filed with the SEC, through the website maintained by the SEC at www.sec.gov. Copies of the documents filed with the SEC by PFG will be available free of charge on PFG’s website at www.investors.pfgc.com or by contacting PFG’s Investor Relations department at investor@pfgc.com. Copies of the documents filed with the SEC by Core-Mark will be available free of charge on Core-Mark’s website at ir.core-mark.com/investors or by contacting Core-Mark’s Investor Relations department at david.lawrence@core-mark.com. Participants In The Solicitation PFG and its directors, executive officers and employees may be deemed to be participants in the solicitation of proxies from the stockholders of Core-Mark in connection with the proposed transaction. Information about the directors and executive officers of PFG is set forth in its (i) Form 10-K for the fiscal year ended June 27, 2020, which was filed with the SEC on August 18, 2020 and (ii) proxy statement for its 2020 annual meeting of stockholders, which was filed with the SEC on October 9, 2020, and on its website at www.pfgc.com. Investors may obtain additional information regarding the interest of such participants by reading the Form S-4, the Proxy Statement and other materials to be filed with the SEC in connection with proposed transaction when they become available. No Offer or Solicitation This communication is for informational purposes only and does not constitute, or form a part of, an offer to sell or the solicitation of an offer to sell or an offer to buy or the solicitation of an offer to buy any securities, and there shall be no sale of securities, in any jurisdiction in which such offer, solicitation or sale would be unlawful prior to registration or qualification under the securities laws of any such jurisdiction. No offer of securities shall be made except by means of a prospectus meeting the requirements of Section 10 of the Securities Act of 1933, as amended, and otherwise in accordance with applicable law.

Today’s Presenters George Holm Chairman, President & Chief Executive Officer Jim Hope Executive Vice President and Chief Financial Officer Bill Marshall, CFA Vice President, Investor Relations Core-Mark Acquisition 4

Core-Mark Strategic Rationale ï,§ Expands geographic reach, market diversification, and overall scale—Enhances PFG’s distribution platform and C-Store opportunities—Combined LTM net sales of ~$44 billion ï,§ Complementary customer-centric operating models—Consistent go-to-market approach with selling cultures focused on customer success ï,§ Enhances attractive customer base and product offerings—Convenience channel is an attractive opportunity and builds on Eby-Brown—Combined portfolio of brands broadens PFG’s offering, particularly in Fresh ï,§ Significant synergy opportunities—Estimated $40 million in run-rate net cost synergies in the 3rd year—Identified significant net cost synergies primarily from a combination of procurement, warehouse and route consolidation and SG&A reduction ï,§ Compelling financial impact—The transaction is expected to be accretive to Adjusted Diluted EPS in the first full fiscal year following the close, not including expected synergies ï,§ Brings together the best talent in convenience—Strong leadership and high-caliber associates complement Eby-Brown’s talented team—Aligned culture supports collaboration and continuing innovation Core-Mark Acquisition 5

Convenience Poised for Continued Growth In 2020 total convenience industry sales increased 1.5% to a record $255.6 billion(1) This includes an 18.4%(1) increase in basket size shopping compared trips to 2019 as consumers consolidated changes C-Store product in consumer mix continues preference to evolve with towards Product mix higher within margin convenience products, is including shifting food, which profile aligns well with PFG’s current business (1) Source: NACS Core-Mark Acquisition 6

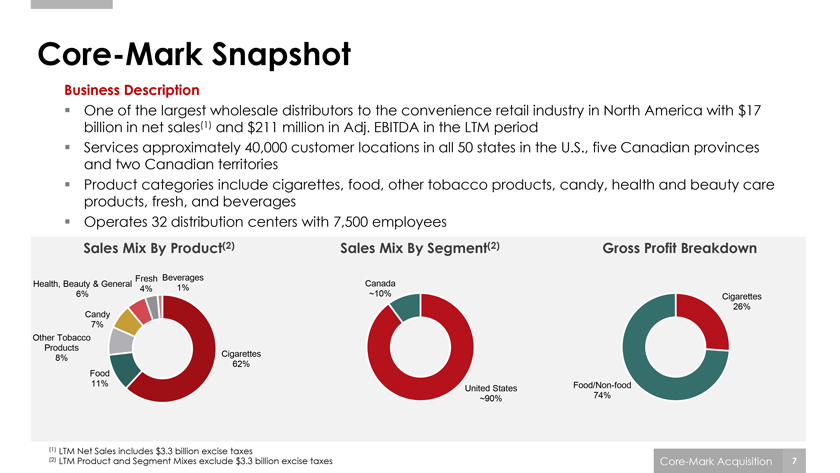

Core-Mark Snapshot Business Description ï,§ One of the largest wholesale distributors to the convenience retail industry in North America with $17 billion in net sales(1) and $211 million in Adj. EBITDA in the LTM periodï,§ Services approximately 40,000 customer locations in all 50 states in the U.S., five Canadian provinces and two Canadian territoriesï,§ Product categories include cigarettes, food, other tobacco products, candy, health and beauty care products, fresh, and beveragesï,§ Operates 32 distribution centers with 7,500 employees Sales Mix By Product(2) Sales Mix By Segment(2) Gross Profit Breakdown Fresh Beverages Health, Beauty & General 1% Canada 4% 6% ~10% Cigarettes 26% Candy 7% Other Tobacco Products 8% Cigarettes Food 62% 11% Food/Non-food United States ~90% 74% (1) LTM Net Sales includes $3.3 billion excise taxes (2) LTM Product and Segment Mixes exclude $3.3 billion excise taxes Core-Mark Acquisition 7

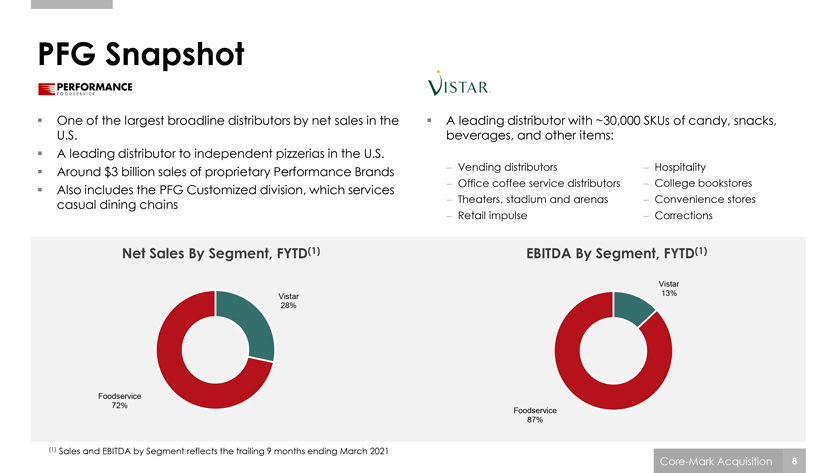

PFG Snapshot ï,§ One of the largest broadline distributors by net sales in the ï,§ A leading distributor with ~30,000 SKUs of candy, snacks, U.S. beverages, and other items:ï,§ A leading distributor to independent pizzerias in the U.S. ï,§ Around $3 billion sales of proprietary Performance Brands—Vending distributors—Hospitality Also includes PFG Customized—Office coffee service distributors—College bookstores ï,§ the division, which services casual dining chains—Theaters, stadium and arenas—Convenience stores—Retail impulse—Corrections Net Sales By Segment, FYTD(1) EBITDA By Segment, FYTD(1) Vistar Vistar 13% 28% Foodservice 72% Foodservice 87% (1) Sales and EBITDA by Segment reflects the trailing 9 months ending March 2021 Core-Mark Acquisition 8

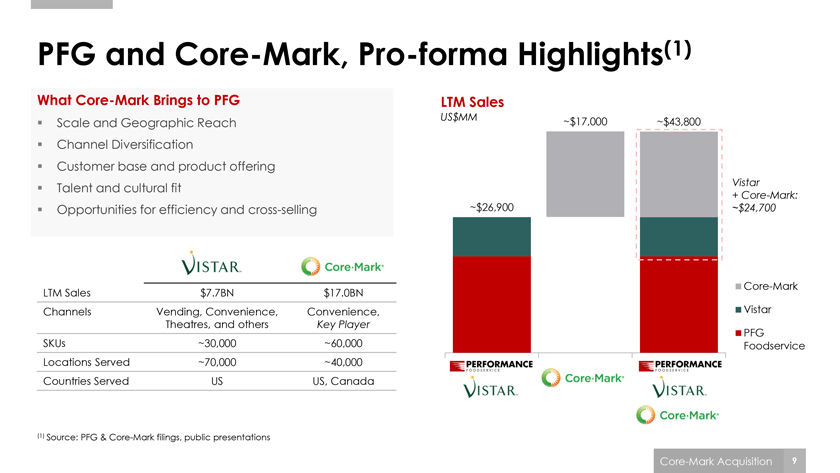

PFG and Core-Mark, Pro-forma Highlights(1) What Core-Mark Brings to PFG LTM Sales US$MM ~$17,000 ~$43,800 ï,§ Scale and Geographic Reachï,§ Channel Diversificationï,§ Customer base and product offering Vistar ï,§ Talent and cultural fit + Core-Mark: ï,§ Opportunities for efficiency and cross-selling ~$26,900 ~$24,700 Core-Mark LTM Sales $7.7BN $17.0BN Channels Vending, Convenience, Convenience, Vistar Theatres, and others Key Player PFG SKUs ~30,000 ~60,000 Foodservice Locations Served ~70,000 ~40,000 Countries Served US US, Canada (1) Source: PFG & Core-Mark filings, public presentations Core-Mark Acquisition 9

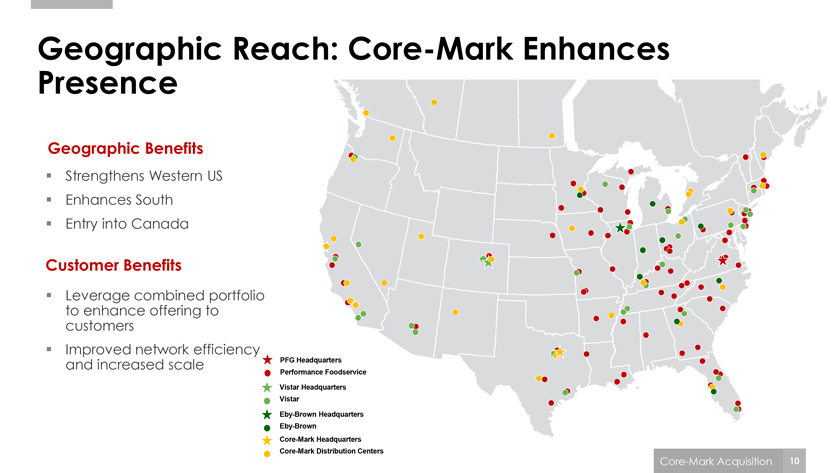

Geographic Reach: Core-Mark Enhances Presence Geographic Benefits Strengthens Western US Enhances South Entry into Canada Customer Benefits Leverage to enhance combined offering to portfolio customers Improved network efficiency and increased scale PFG Headquarters Performance Foodservice Vistar Headquarters Vistar Eby-Brown Headquarters Eby-Brown Core-Mark Headquarters Core-Mark Distribution Centers Core-Mark Acquisition 10 $$/BREAK/$$END Geographic Reach: Core-Mark Enhances Presence Geographic Benefits Strengthens Western US Enhances South Entry into Canada Customer Benefits Leverage to enhance combined offering to portfolio customers Improved network efficiency and increased scale PFG Headquarters Performance Foodservice Vistar Headquarters Vistar Eby-Brown Headquarters Eby-Brown Core-Mark Headquarters Core-Mark Distribution Centers Core-Mark Acquisition 10

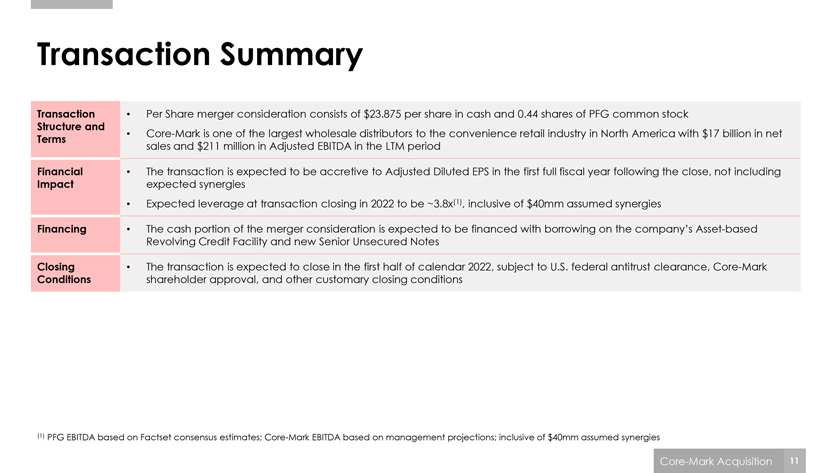

Transaction Summary Transaction Per Share merger consideration consists of $23.875 per share in cash and 0.44 shares of PFG common stock Structure and Terms Core-Mark is one of the largest wholesale distributors to the convenience retail industry in North America with $17 billion in net sales and $211 million in Adjusted EBITDA in the LTM period Financial The transaction is expected to be accretive to Adjusted Diluted EPS in the first full fiscal year following the close, not including Impact expected synergies Expected leverage at transaction closing in 2022 to be ~3.8x(1), inclusive of $40mm assumed synergies Financing The cash portion of the merger consideration is expected to be financed with borrowing on the company’s Asset-based Revolving Credit Facility and new Senior Unsecured Notes Closing The transaction is expected to close in the first half of calendar 2022, subject to U.S. federal antitrust clearance, Core-Mark Conditions shareholder approval, and other customary closing conditions (1) PFG EBITDA based on Factset consensus estimates; Core-Mark EBITDA based on management projections; inclusive of $40mm assumed synergies Core-Mark Acquisition 11

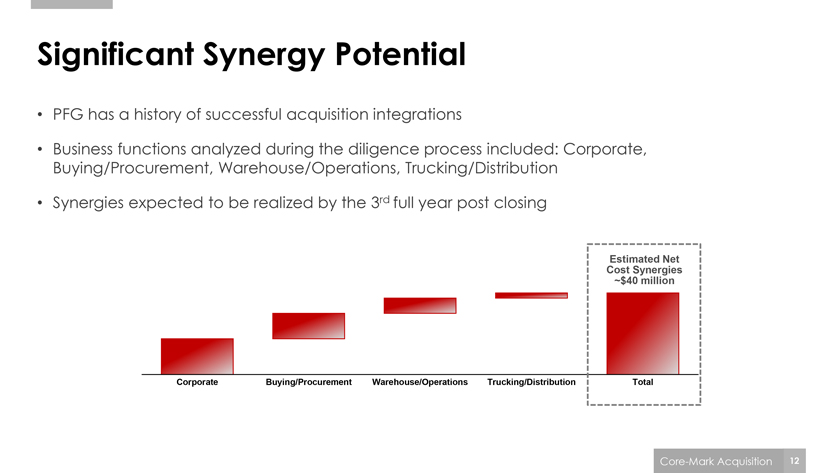

Significant Synergy Potential PFG has a history of successful acquisition integrations Business functions analyzed during the diligence process included: Corporate, Buying/Procurement, Warehouse/Operations, Trucking/Distribution Synergies expected to be realized by the 3rd full year post closing Cost Estimated Synergies Net ~$40 million Corporate Buying/Procurement Warehouse/Operations Trucking/Distribution Total Core-Mark Acquisition 12

Key Takeaways Increases Enhances Expands Overall Customer Significant Accretive to Geographic Scale in C- Base and Net Cost Adjusted Reach Store Product Synergies Diluted EPS Distribution Offerings  Core-Mark Acquisition 13

Q&A