Attached files

| file | filename |

|---|---|

| EX-32.1 - CERTIFICATION - BioNexus Gene Lab Corp | bion_ex321.htm |

| EX-31.2 - CERTIFICATION - BioNexus Gene Lab Corp | bion_ex312.htm |

| EX-31.1 - CERTIFICATION - BioNexus Gene Lab Corp | bion_ex311.htm |

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

WASHINGTON, DC 20549

FORM 10-Q

(Mark One)

☒ QUARTERLY REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934

For the quarterly period ended March 31, 2021

OR

☐ TRANSACTION REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934

For the transition period from _____________

Commission File Number: 333-229399

| BIONEXUS GENE LAB CORP. |

| (Exact name of registrant as specified in its charter) |

| Wyoming |

| 35-2604830 |

| (State or Other Jurisdiction of |

| (I.R.S. Employer Identification No.) |

|

|

|

|

| Unit 02, Level 10 Tower B, Avenue 3, The Vertical Business Suite II Bangsar South No. 8 Jalan Kerinchi Kuala Lumpur, Malaysia |

| 59200 |

| (Address of Principal Executive Offices) |

| (Zip Code) |

+60 1221-26512

(Registrant’s telephone number, including area code)

Securities registered pursuant to Section 12(b) of the Act: None

Indicate by check mark whether the registrant (1) has filed all reports required to be filed by Section 13 or 15(d) of the Securities Exchange Act of 1934 during the preceding 12 months (or for such shorter period that the registrant was required to file such reports), and (2) has been subject to such filing requirements for the past 90 days. Yes ☒ No ☐

Indicate by check mark whether the registrant has submitted electronically every Interactive Data File required to be submitted pursuant to Rule 405 of Regulation S-T (§232.405 of this chapter) during the preceding 12 months (or for such shorter period that the registrant was required to submit such files). Yes ☒ No ☐

Indicate by check mark whether the registrant is a large accelerated filer, an accelerated filer, a non-accelerated filer, a smaller reporting company or an emerging growth company. See the definitions of “large accelerated filer, ” “ accelerated filer, ” “non-accelerated filer ,” “ smaller reporting company, ” and “ emerging growth company ” in Rule 12b-2 of the Exchange Act. (Check one):

| Large accelerated filer | ☐ | Accelerated filer | ☐ |

| Non-accelerated filer | ☒ | Smaller reporting company | ☒ |

|

|

| Emerging growth company | ☒ |

If an emerging growth company, indicate by check mark if the registrant has elected not to use the extended transition period for complying with any new or revised financial accounting standards provided pursuant to Section 13(a) of the Exchange Act. ☐

Indicate by check mark whether the registrant is a shell company (as defined in Rule 12b-2 of the Exchange Act). Yes ☐ No ☒

As of April 30, 2021, there were 171,218,152 shares of common stock, no par value, outstanding.

|

|

|

| Page |

|

|

|

|

| ||

|

|

|

|

|

|

|

| 3 |

| ||

| Management’s Discussion and Analysis of Financial Condition and Results of Operations |

| 24 |

| |

|

| 33 |

| ||

|

| 33 |

| ||

|

|

|

|

|

|

|

|

|

| ||

|

|

|

|

|

|

|

| 36 |

| ||

|

| 36 |

| ||

|

| 36 |

| ||

|

| 36 |

| ||

|

| 36 |

| ||

|

| 36 |

| ||

|

| 37 |

| ||

|

|

|

|

|

|

|

| 38 |

| ||

| 2 |

| Table of Contents |

PART I — FINANCIAL INFORMATION

BIONEXUS GENE LAB CORP.

CONDENSED CONSOLIDATED BALANCE SHEETS

AS OF MARCH 31, 2021 AND DECEMBER 31, 2020

(Currency expressed in United States Dollars (“US$”))

|

|

|

|

|

| As of |

| ||||||

|

|

|

|

|

|

| March 31, |

|

| December 31, |

| ||

|

|

|

| Note |

|

| 2021 |

|

| 2020 |

| ||

|

|

|

|

|

| (Unaudited) |

|

| (Audited) |

| |||

| ASSETS |

|

|

|

|

|

|

|

|

| |||

| CURRENT ASSETS |

|

|

|

|

|

|

|

|

| |||

| Cash and bank balances |

|

|

|

|

| 853,198 |

|

|

| 699,585 |

| |

| Fixed deposits placed with financial institutions |

|

|

|

|

| 1,621,461 |

|

|

| 2,088,107 |

| |

| Trade receivables |

|

| 4 |

|

|

| 3,593,663 |

|

|

| 3,996,802 |

|

| Other receivables, deposits and prepayments |

|

|

|

|

|

| 22,933 |

|

|

| 22,640 |

|

| Tax Recoverable |

|

| 5 |

|

|

| 2,624 |

|

|

| 2,190 |

|

| Inventories |

|

|

|

|

|

| 1,469,192 |

|

|

| 1,176,170 |

|

| Total current assets |

|

|

|

|

|

| 7,563,071 |

|

|

| 7,985,494 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| NON-CURRENT ASSETS |

|

|

|

|

|

|

|

|

|

|

|

|

| Operating lease right of use asset, net |

|

| 6 |

|

|

| 55,747 |

|

|

| 62,529 |

|

| Property, plant and equipment, net |

|

| 7 |

|

|

| 1,708,104 |

|

|

| 1,785,602 |

|

| Other investments |

|

| 8 |

|

|

| 571,609 |

|

|

| 281,668 |

|

| Total non-current assets |

|

|

|

|

|

| 2,335,460 |

|

|

| 2,129,799 |

|

| TOTAL ASSETS |

|

|

|

|

| $ | 9,898,531 |

|

| $ | 10,115,293 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| LIABILITIES AND STOCKHOLDERS’ EQUITY |

|

|

|

|

|

|

|

|

|

|

|

|

| CURRENT LIABILITIES |

|

|

|

|

|

|

|

|

|

|

|

|

| Trade payables |

|

| 9 |

|

|

| 2,928,650 |

|

|

| 3,170,653 |

|

| Other payables and accrued liabilities |

|

|

|

|

|

| 38,269 |

|

|

| 95,882 |

|

| Current portion of obligation under finance lease |

|

| 10 |

|

|

| 22,843 |

|

|

| 25,048 |

|

| Current portion of operating lease liabilities |

|

| 6 |

|

|

| 16,793 |

|

|

| 20,702 |

|

| Tax payables |

|

| 5 |

|

|

| 28,874 |

|

|

| 61,313 |

|

| Total current liabilities |

|

|

|

|

|

| 3,035,429 |

|

|

| 3,373,598 |

|

| 3 |

| Table of Contents |

| PART I — FINANCIAL INFORMATION

ITEM 1. FINANCIAL STATEMENTS (CONT’D) |

BIONEXUS GENE LAB CORP.

CONDENSED CONSOLIDATED BALANCE SHEETS

AS OF MARCH 31, 2021 AND DECEMBER 31, 2020

(Currency expressed in United States Dollars (“US$”))

|

|

|

|

| As of |

| |||||||

| NON-CURRENT LIABILITIES |

| Note |

|

| March 31, 2021 (Unaudited) |

|

| December 31, 2020 (Audited) |

| |||

| Non-current portion of operating lease liabilities |

|

| 6 |

|

|

| 39,911 |

|

|

| 42,377 |

|

| Non-current portion of obligation under finance lease |

|

| 10 |

|

|

| 28,948 |

|

|

| 35,292 |

|

| Deferred tax liabilities |

|

| 5 |

|

|

| 1,813 |

|

|

| 1,872 |

|

| Total non-current liabilities |

|

|

|

|

|

| 70,672 |

|

|

| 79,541 |

|

| TOTAL LIABILITIES |

|

|

|

|

| $ | 3,106,101 |

|

| $ | 3,453,139 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| STOCKHOLDERS’ EQUITY |

|

|

|

|

|

|

|

|

|

|

|

|

| As at March 31, 2021, common stock, no par value; 300,000,000 shares authorized and 171,218,152 shares outstanding, and preferred stock, no par value; 30,000,000 shares authorized and no shares outstanding. As at December 31, 2020, common stock, no par value; 300,000,000 shares authorized and 171,218,152 shares outstanding, and preferred stock, no par value; 30,000,000 shares authorized and no shares outstanding. |

|

| 11 |

|

|

| 10,779,574 |

|

|

| 10,779,574 |

|

| Additional paid in capital |

|

|

|

|

|

| (5,011,891 | ) |

|

| (5,011,891 | ) |

| Accumulated surplus |

|

|

|

|

|

| 1,099,531 |

|

|

| 760,787 |

|

| Other comprehensive (losses) /income |

|

|

|

|

|

| (74,784 | ) |

|

| 133,684 |

|

| TOTAL STOCKHOLDERS’ EQUITY |

|

|

|

|

|

| 6,792,430 |

|

|

| 6,662,154 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| TOTAL LIABILITIES AND STOCKHOLDERS’ EQUITY |

|

|

|

|

| $ | 9,898,531 |

|

| $ | 10,115,293 |

|

| See accompanying notes to the condensed consolidated financial statements. |

| 4 |

| Table of Contents |

| BIONEXUS GENE LAB CORP. |

| CONDENSED CONSOLIDATED STATEMENTS OF OPERATIONS AND COMPREHENSIVE LOSS |

| FOR THE THREE MONTHS ENDED MARCH 31, 2021 AND 2020 |

| (Currency expressed in United States Dollars (“US$”)) (Unaudited) |

|

|

| Three months ended |

| |||||

|

|

| March 31, |

| |||||

|

|

| 2021 |

|

| 2020 |

| ||

|

|

|

|

|

|

|

| ||

| REVENUE |

| $ | 3,449,159 |

|

| $ | 3,070,026 |

|

|

|

|

|

|

|

|

|

|

|

| COST OF REVENUE |

|

| (2,866,594 | ) |

|

| (2,414,719 | ) |

|

|

|

|

|

|

|

|

|

|

| GROSS PROFIT |

|

| 582,565 |

|

|

| 655,307 |

|

|

|

|

|

|

|

|

|

|

|

| OTHER INCOME |

|

| 62,388 |

|

|

| 746,641 |

|

|

|

|

|

|

|

|

|

|

|

| OPERATING EXPENSES |

|

|

|

|

|

|

|

|

| General and administrative |

|

| (302,851 | ) |

|

| (328,418 | ) |

|

|

|

|

|

|

|

|

|

|

| PROFIT FROM OPERATIONS |

|

| 342,102 |

|

|

| 1,073,530 |

|

|

|

|

|

|

|

|

|

|

|

| FINANCE COSTS |

|

| (3,358 | ) |

|

| (3,026 | ) |

|

|

|

|

|

|

|

|

|

|

| PROFIT BEFORE TAX |

|

| 338,744 |

|

|

| 1,070,504 |

|

|

|

|

|

|

|

|

|

|

|

| Tax expense |

|

| 0 |

|

|

| (860 | ) |

|

|

|

|

|

|

|

|

|

|

| NET PROFIT |

| $ | 338,744 |

|

| $ | 1,069,644 |

|

|

|

|

|

|

|

|

|

|

|

| Other comprehensive income: |

|

|

|

|

|

|

|

|

| Foreign currency translation loss |

|

| (208,468 | ) |

|

| (294,696 | ) |

|

|

|

|

|

|

|

|

|

|

| COMPREHENSIVE INCOME |

| $ | 130,276 |

|

| $ | 774,948 |

|

|

|

|

|

|

|

|

|

|

|

| Earnings per share - Basic and diluted |

|

| 0 |

|

|

| 0 |

|

|

|

|

|

|

|

|

|

|

|

| Weighted average number of common shares outstanding – Basic and diluted |

|

| 171,218,152 |

|

|

| 102,730,891 |

|

See accompanying notes to the condensed consolidated financial statements.

| 5 |

| Table of Contents |

| BIONEXUS GENE LAB CORP | |

| CONSOLIDATED STATEMENTS OF CHANGES IN STOCKHOLDERS’ EQUITY | |

| AS OF MARCH 31, 2021 AND 2020 | |

| (Amount expressed in United States Dollars (“US$)) | |

|

|

| Common stock |

|

| Additional |

|

|

|

|

| Accumulated other comprehensive |

|

|

|

| |||||||||

|

|

| Number of shares |

|

| Amount |

|

| paid in capital |

|

| Accumulated surplus/(loss) |

|

| income/ |

|

| Total Equity |

| ||||||

| Balance as of January 1, 2020 |

|

| 102,730,891 |

|

| $ | 6,484,669 |

|

| $ | (5,011,891 | ) |

| $ | (333,311 | ) |

| $ | (17,103 | ) |

| $ | 1,122,364 |

|

| Issuance of shares |

|

| 68,487,261 |

|

|

| 4,294,905 |

|

|

| - |

|

|

| - |

|

|

| - |

|

|

| 4,294,905 |

|

| Net profit for the period |

|

| - |

|

|

| - |

|

|

| - |

|

|

| 1,069,644 |

|

|

| - |

|

|

| 1,069,644 |

|

| Foreign currency translation gain |

|

| - |

|

|

| - |

|

|

| - |

|

|

| - |

|

|

| (294,696 | ) |

|

| (294,696 | ) |

| Balance as of March 31, 2020 |

|

| 171,218,152 |

|

| $ | 10,779,574 |

|

| $ | (5,011,891 | ) |

| $ | 736,333 |

|

| $ | (311,799 | ) |

| $ | 6,192,217 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| Balance as of December 31, 2020 |

|

| 171,218,152 |

|

| $ | 10,779,574 |

|

| $ | (5,011,891 | ) |

| $ | 760,787 |

|

| $ | 133,684 |

|

| $ | 6,662,154 |

|

| Net profit for the period |

|

| - |

|

|

| - |

|

|

| - |

|

|

| 338,744 |

|

|

| - |

|

|

| 338,744 |

|

| Foreign currency translation loss |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| - |

|

|

| - |

|

|

| - |

|

|

| - |

|

|

| (208,468 | ) |

|

| (208,468 | ) |

| Balance as of March 31, 2021 |

|

| 171,218,152 |

|

| $ | 10,779,574 |

|

| $ | (5,011,891 | ) |

| $ | 1,099,531 |

|

| $ | (74,784 | ) |

| $ | 6,792,430 |

|

See accompanying notes to the condensed consolidated financial statements.

| 6 |

| Table of Contents |

BIONEXUS GENE LAB CORP.

CONDENSED CONSOLIDATED STATEMENTS OF CASH FLOWS

FOR THE THREE MONTHS ENDED MARCH 31, 2021 AND 2020

(Currency expressed in United States Dollars (“US$”))

(Unaudited)

|

|

| Three months ended |

| |||||

|

|

| March 31, |

| |||||

|

|

| 2021 |

|

| 2020 |

| ||

| Cash flows from operating activities: |

|

|

|

|

|

| ||

| Net profit |

| $ | 338,744 |

|

| $ | 1,069,644 |

|

|

|

|

|

|

|

|

|

|

|

| Adjustments to reconcile net profit to net cash generated from operating activities: |

|

|

|

|

|

|

|

|

| Amortization of right of use asset |

|

| 4,434 |

|

|

| 2,865 |

|

| Depreciation of property, plant and equipment |

|

| 10,622 |

|

|

| 10,278 |

|

| Dividend income |

|

| (1,006 | ) |

|

| (179 | ) |

| Fair value gain on other investments |

|

| (8,264 | ) |

|

| - |

|

| Gain on disposal of property, plant and equipment |

|

| - |

|

|

| (710,172 | ) |

| Operating profit before working capital changes |

|

| 344,530 |

|

|

| 372,436 |

|

|

|

|

|

|

|

|

|

|

|

| Changes in operating assets and liabilities: |

|

|

|

|

|

|

|

|

| Inventories |

|

| (293,022 | ) |

|

| 1,258 |

|

| Trade and other receivables |

|

| 402,845 |

|

|

| 163,791 |

|

| Trade and other payables |

|

| (299,619 | ) |

|

| (1,470,936 | ) |

| Operating lease liabilities |

|

| (6,375 | ) |

|

| (3,944 | ) |

| Tax recoverable |

|

| (32,931 | ) |

|

| (39,953 | ) |

| Cash generated from/(used in) operating activities |

|

| 115,428 |

|

|

| (977,348 | ) |

|

|

|

|

|

|

|

|

|

|

| Cash flows from investing activities: |

|

|

|

|

|

|

|

|

| Acquisition of other investment |

|

| (296,025 | ) |

|

| (101,498 | ) |

| Dividend income |

|

| 1,006 |

|

|

| 179 |

|

| Net cash from acquisition of business under common control |

|

| - |

|

|

| 346,008 |

|

| Purchase of plant and equipment |

|

| (807 | ) |

|

| (307 | ) |

| Proceeds from disposal of property, plant and equipment |

|

| - |

|

|

| 1,467,865 |

|

| Net cash (used in)/ generated from investing activities |

|

| (295,826 | ) |

|

| 1,712,247 |

|

|

|

|

|

|

|

|

|

|

|

| Cash flows from financing activities: |

|

|

|

|

|

|

|

|

| Repayment of finance lease |

|

| (8,550 | ) |

|

| (6,399 | ) |

| Net cash used in from financing activities |

|

| (8,550 | ) |

|

| (6,399 | ) |

| 7 |

| Table of Contents |

ITEM 1. FINANCIAL STATEMENTS (CONT’D)

BIONEXUS GENE LAB CORP.

CONDENSED CONSOLIDATED STATEMENTS OF CASH FLOWS

FOR THE THREE MONTHS ENDED MARCH 31, 2021 AND 2020

(Currency expressed in United States Dollars (“US$”))

(Unaudited)

|

|

| Three months ended |

| |||||

|

|

| March 31, |

| |||||

|

|

| 2021 |

|

| 2020 |

| ||

|

|

|

|

|

|

|

| ||

| Foreign currency translation adjustment |

|

| (124,085 | ) |

|

| (190,829 | ) |

| NET CHANGE IN CASH AND CASH EQUIVALENTS |

|

| (313,033 | ) |

|

| 537,671 |

|

| CASH AND CASH EQUIVALENTS, BEGINNING OF FINANCIAL YEAR |

|

| 2,787,692 |

|

|

| 859,076 |

|

|

|

|

|

|

|

|

|

|

|

| CASH AND CASH EQUIVALENTS, END OF FINANCIAL YEAR |

| $ | 2,474,659 |

|

| $ | 1,396,747 |

|

|

|

|

|

|

|

|

|

|

|

| CASH AND CASH EQUIVALENTS INFORMATION: |

|

|

|

|

|

|

|

|

| Fixed deposits placed with financial institutions |

| $ | 1,621,461 |

|

| $ | 503,188 |

|

| Cash at bank |

|

| 853,198 |

|

|

| 893,559 |

|

| Cash and cash equivalents, end of financial year |

|

| 2,474,659 |

|

|

| 1,396,747 |

|

|

|

|

|

|

|

|

|

|

|

| Supplementary cash flow information: |

|

|

|

|

|

|

|

|

| Interest paid |

| $ | (3,358 | ) |

| $ | (3,026 | ) |

| Income taxes paid |

|

| (36,438 | ) |

|

| (57,069 | ) |

See accompanying notes to the condensed consolidated financial statements.

| 8 |

| Table of Contents |

BIONEXUS GENE LAB CORP.

NOTES TO CONDENSED CONSOLIDATED FINANCIAL STATEMENTS

FOR THE THREE MONTHS ENDED MARCH 31, 2021

(Currency expressed in United States Dollars (“US$”))

(Unaudited)

NOTE 1 - BASIS OF PREPARATION

The accompanying unaudited condensed consolidated financial statements have been prepared in accordance with accounting principles generally accepted in the United States (“GAAP”) for interim financial reporting and the rules and regulations of the Securities and Exchange Commission that permit reduced disclosure for interim periods. Therefore, certain information and footnote disclosures normally included in financial statements prepared in accordance with GAAP have been condensed or omitted.

In the opinion of management, the consolidated balance sheet as of March 31, 2021 which has been derived from unaudited financial statements and these unaudited condensed consolidated financial statements reflect all normal and recurring adjustments considered necessary to state fairly the results for the periods presented. The results for the three months ended March 31, 2021 are not necessarily indicative of the results to be expected for the entire fiscal year ending December 31, 2021 or for any future period.

These unaudited condensed consolidated financial statements and notes thereto should be read in conjunction with the Management’s Discussion and the audited financial statements and notes thereto included in the Annual Report on Form 10-K for the fiscal year ended December 31, 2020.

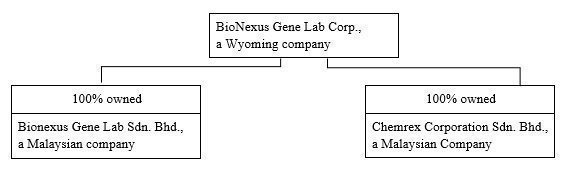

NOTE 2 - ORGANIZATION AND BUSINESS BACKGROUND

BioNexus Gene Lab Corp. was incorporated in the State of Wyoming on May 12, 2017. On August 23, 2017, the Company acquired all of the outstanding capital stock of Bionexus Gene Lab Sdn. Bhd., a Malaysian corporation (“Subsidiary”). The Subsidiary was incorporated in Malaysia on April 7, 2015 which it then subsequently changed its name to Bionexus Gene Lab Sdn. Bhd.

On December 31, 2020, the Company consummated a Share Exchange Agreement with Chemrex Corporation Sdn. Bhd. (“Chemrex”) and the Chemrex shareholders pursuant to which we acquired all of the issued and outstanding shares of capital stock of Chemrex from the Chemrex shareholders in exchange for 68,487,261 shares of common stock of the Company issued to the Chemrex shareholders.

The acquisition of Chemrex has been accounted for as a common control transaction as there is no change in the control over the assets acquired and liabilities assumed. The net assets are derecognized by the transferring entity (i.e. Chemrex) and recognized by the receiving entity (i.e. the Company). The difference between the consideration transferred and the carrying amounts of the net assets is recognized in equity.

The principal office address is Unit 02 Level 10, Tower B, Vertical Business Suite, No. 8 Jalan Kerinchi, Bangsar South, 59200 Kuala Lumpur, Malaysia, our lab is located at Lab 353, Chemical Science Centre, University Science Malaysia, George Town, Penang, Malaysia. We also have a blood collection center located at 1st floor, Lifecare Medical Centre, Kuala Lumpur, Malaysia. Chemrex offices and supply hub is located at 4 Jalan CJ 1/6 Kawasan Perusahaan Cheras Jaya, Selangor, Malaysia.

| 9 |

| Table of Contents |

BIONEXUS GENE LAB CORP.

NOTES TO CONDENSED CONSOLIDATED FINANCIAL STATEMENTS

FOR THE THREE MONTHS ENDED MARCH 31, 2021

(Currency expressed in United States Dollars (“US$”))

(Unaudited)

The financial statements of the receiving entity report the results of operations for the period in which the transfer occurs as though the transfer of net assets or exchange of equity interests had occurred at the beginning of the period. Results of operations for that period will thus comprise those of the previously separate entities combined from the beginning of the period to the date the transfer is completed and those of the combined operations from that date to the end of the period. The comparative financial statements were not adjusted retrospectively as Chemrex Corporation Sdn. Bhd. was not under common control during the comparative period.

The corporate structure as at March 31, 2021 is depicted below:

NOTE 3 - SUMMARY OF SIGNIFICANT ACCOUNTING POLICIES

The accompanying unaudited condensed consolidated financial statements reflect the application of certain significant accounting policies as described in this note and elsewhere in the accompanying consolidated financial statements and notes.

| • | Basis of presentation |

The accompanying condensed consolidated financial statements are prepared in accordance with generally accepted accounting principles in the United States of America (“US GAAP”).

| • | Basis of consolidation |

The condensed consolidated financial statements include the accounts of Bionexus Gene Lab Corp. and its subsidiaries. All significant inter-company balances and transactions within the Company have been eliminated upon consolidation.

| • | Use of estimates |

In preparing these condensed consolidated financial statements, management makes estimates and assumptions that affect the reported amounts of assets and liabilities in the balance sheets and revenues and expenses during the periods reported. Actual results may differ from these estimates.

| 10 |

| Table of Contents |

BIONEXUS GENE LAB CORP.

NOTES TO CONDENSED CONSOLIDATED FINANCIAL STATEMENTS

FOR THE THREE MONTHS ENDED MARCH 31, 2021

(Currency expressed in United States Dollars (“US$”))

(Unaudited)

| • | Cash and cash equivalents |

Cash and cash equivalents represent cash on hand, demand deposits placed with banks or other financial institutions and all highly liquid investments with an original maturity of three months or less as of the purchase date of such investments.

| • | Trade receivables |

Trade receivables are recorded at the invoiced amount and do not bear interest. Management reviews the adequacy of the allowance for expected credit losses on an ongoing basis, using historical collection trends and aging of receivables. Management also periodically evaluates individual customer’s financial condition, credit history, and the current economic conditions to make adjustments in the allowance when it is considered necessary. Trade balances are charged off against the allowance after all means of collection have been exhausted and the potential for recovery is considered remote.

| • | Inventories |

Inventories consisting of products available for sell, are stated at the lower of cost or market value. Cost of inventory is determined using the first-in, first-out (FIFO) method. Inventory reserve is recorded to write down the cost of inventory to the estimated market value due to slow-moving merchandise and damaged goods, which is dependent upon factors such as historical and forecasted consumer demand, and promotional environment. The Company takes ownership, risks and rewards of the products purchased. Write downs are recorded in cost of revenues in the Statement of Operations and Comprehensive Income

| • | Leases |

In February 2016, the Financial Accounting Standards Board (FASB) issued Accounting Standards Update (ASU) No. 2016-02, Leases, which was subsequently amended in 2018 by ASU 2018-10, ASU 2018-11 and ASU 2018-20 (collectively, Topic 842). Topic 842 will require the recognition of a right-of-use asset and a corresponding lease liability, initially measured at the present value of the lease payments, for all leases with terms longer than 12 months. For operating leases, the asset and liability will be expensed over the lease term on a straight-line basis, with all cash flows included in the operating section of the statement of cash flows. For finance leases, interest on the lease liability will be recognized separately from the amortization of the right-of-use asset in the statement of comprehensive income and the repayment of the principal portion of the lease liability will be classified as a financing activity while the interest component will be included in the operating section of the statement of cash flows. Topic 842 is effective for annual and interim reporting periods beginning after December 15, 2018. Early adoption is permitted. Upon adoption, leases will be recognized and measured at the beginning of the earliest period presented using a modified retrospective approach. Topic 842 allows for a cumulative-effect adjustment in the period the new lease standard is adopted and will not require restatement of prior periods.

| 11 |

| Table of Contents |

BIONEXUS GENE LAB CORP.

NOTES TO CONDENSED CONSOLIDATED FINANCIAL STATEMENTS

FOR THE THREE MONTHS ENDED MARCH 31, 2021

(Currency expressed in United States Dollars (“US$”))

(Unaudited)

Prior to January 1, 2019, the Company accounted for leases under ASC 840, Accounting for Leases. Effective January 1, 2019, the Company adopted the guidance of ASC 842, Leases, which requires an entity to recognize a right-of-use asset and a lease liability for virtually all leases. The Company adopted ASC 842 using a modified retrospective approach. As a result, the comparative financial information has not been updated and the required disclosures prior to the date of adoption have not been updated and continue to be reported under the accounting standards in effect for those periods.

| • | Property, plant and equipment |

Property, plant and equipment are stated at cost less accumulated depreciation and accumulated impairment losses, if any. Depreciation is calculated on the straight-line basis to write off the cost over the following expected useful lives of the assets concerned.

The principal annual rates used are as follows:

| Categories |

|

| Principal Annual Rates |

| Air conditioner |

|

| 20% |

| Buildings |

|

| 2% |

| Computer and software |

|

| 33% |

| Equipment |

|

| 20% |

| Furniture and fittings |

|

| 10% to 20% |

| Lab Equipment |

|

| 10% |

| Motor vehicle |

|

| 10% to 20% |

| Office equipment |

|

| 20% |

| Renovation |

|

| 10% to 20% |

| Signboard |

|

| 10% |

Leasehold lands are depreciated over the period of lease term. Leased assets are depreciated over the shorter of the lease term and their useful lives unless it is reasonably certain that the Company will obtain ownership by the end of the lease term. Freehold land is not depreciated. Property, plant and equipment under construction are not depreciated until the assets are ready for their intended use

Maintenance and repairs are charged to operations as incurred. Expenditures which substantially increase the useful lives of the related assets are capitalized. When properties are disposed of, the related costs and accumulated depreciation are removed from the accounts and any gain or loss is reported in the period the transaction takes place.

Fully depreciated plant and equipment are retained in the financial statements until they are no longer in use.

| 12 |

| Table of Contents |

BIONEXUS GENE LAB CORP.

NOTES TO CONDENSED CONSOLIDATED FINANCIAL STATEMENTS

FOR THE THREE MONTHS ENDED MARCH 31, 2021

(Currency expressed in United States Dollars (“US$”))

(Unaudited)

| • | Impairment of long-lived assets |

Long-lived assets primarily include goodwill, intangible assets and property, plant and equipment. In accordance with the provision of ASC Topic 360, “Impairment or Disposal of Long-Lived Assets”, the Company generally conducts its annual impairment evaluation to its long-lived assets, usually in the fourth quarter of each fiscal year, or more frequently if indicators of impairment exist, such as a significant sustained change in the business climate. The recoverability of long-lived assets is measured at the lowest level group. If the total of the expected undiscounted future net cash flows is less than the carrying amount of the asset, a loss is recognized for the difference between the fair value and carrying amount of the asset. There has been no impairment charge for the years presented.

| • | Revenue recognition |

Revenues are recognized when control of the promised goods or services are transferred to a customer, in an amount that reflects the consideration that the Company expects to receive in exchange for those goods or services.

The Company applies the following five steps in order to determine the appropriate amount of revenue to be recognized as it fulfills its obligations under each of its agreements:

Revenues are recognized when control of the promised goods or services are transferred to a customer, in an amount that reflects the consideration that the Company expects to receive in exchange for those goods or services.

The Company applies the following five steps in order to determine the appropriate amount of revenue to be recognized as it fulfills its obligations under each of its agreements:

| · | identify the contract with a customer; |

|

|

|

| · | identify the performance obligations in the contract; |

|

|

|

| · | determine the transaction price; |

|

|

|

| · | allocate the transaction price to performance obligations in the contract; and |

|

|

|

| · | recognize revenue as the performance obligation is satisfied. |

The Company records revenue at point in time which is recognized upon goods delivered or services rendered.

| • | Cost of revenues |

Cost of revenue includes the purchase cost of retail goods for re-sale to customers and packing materials (such as boxes). It excludes purchasing and receiving costs, inspection costs, warehousing costs, internal transfer costs and other costs of distribution network in cost of revenues.

| 13 |

| Table of Contents |

BIONEXUS GENE LAB CORP.

NOTES TO CONDENSED CONSOLIDATED FINANCIAL STATEMENTS

FOR THE THREE MONTHS ENDED MARCH 31, 2021

(Currency expressed in United States Dollars (“US$”))

(Unaudited)

| • | Comprehensive income |

ASC Topic 220, “Comprehensive Income” establishes standards for reporting and display of comprehensive income, its components and accumulated balances. Comprehensive income as defined includes all changes in equity during a period from non-owner sources. Accumulated other comprehensive income, as presented in the accompanying statements of stockholders’ equity consists of changes in unrealized gains and losses on foreign currency translation and cumulative net change in the fair value of available-for-sale investments held at the balance sheet date. This comprehensive income is not included in the computation of income tax expense or benefit.

| • | Income taxes |

Income taxes are determined in accordance with the provisions of ASC Topic 740, “Income Taxes” (“ASC Topic 740”). Under this method, deferred tax assets and liabilities are recognized for the future tax consequences attributable to differences between the financial statement carrying amounts of existing assets and liabilities and their respective tax basis. Deferred tax assets and liabilities are measured using enacted income tax rates expected to apply to taxable income in the years in which those temporary differences are expected to be recovered or settled. Any effect on deferred tax assets and liabilities of a change in tax rates is recognized in income in the period that includes the enactment date.

ASC 740 prescribes a comprehensive model for how companies should recognize, measure, present, and disclosed in their financial statements uncertain tax positions taken or expected to be taken on a tax return. Under ASC 740, tax positions must initially be recognized in the financial statements when it is more likely than not the position will be sustained upon examination by the tax authorities. Such tax positions must initially and subsequently be measured as the largest amount of tax benefit that has a greater than 50% likelihood of being realized upon ultimate settlement with the tax authority assuming full knowledge of the position and relevant facts.

The Company conducts major businesses in Malaysia and is subject to tax in their own jurisdictions. As a result of its business activities, the Company will file separate tax returns that are subject to examination by the foreign tax authorities.

| • | Net earnings or loss per share |

The Company calculates net earning or loss per share in accordance with ASC Topic 260 “Earnings per share”. Basic earning or loss per share is computed by dividing the net loss by the weighted average number of common shares outstanding during the period. Diluted earning or loss per share is computed similar to basic earning or loss per share except that the denominator is increased to include the number of additional common shares that would have been outstanding if the potential common stock equivalents had been issued and if the additional common shares were dilutive.

| 14 |

| Table of Contents |

BIONEXUS GENE LAB CORP.

NOTES TO CONDENSED CONSOLIDATED FINANCIAL STATEMENTS

FOR THE THREE MONTHS ENDED MARCH 31, 2021

(Currency expressed in United States Dollars (“US$”))

(Unaudited)

| • | Foreign currencies translation |

Transactions denominated in currencies other than the functional currency are translated into the functional currency at the exchange rates prevailing at the dates of the transaction. Monetary assets and liabilities denominated in currencies other than the functional currency are translated into the functional currency using the applicable exchange rates at the balance sheet dates. The resulting exchange differences are recorded in the statement of operations.

The functional currency of the Company is the United States Dollars (“US$”) and the accompanying financial statements have been expressed in US$. In addition, the subsidiaries maintain its books and record in a local currency, Malaysian Ringgit (“MYR” or “RM”), which is functional currency as being the primary currency of the economic environment in which the subsidiaries operate.

In general, for consolidation purposes, assets and liabilities of its subsidiaries whose functional currency is not US$ are translated into US$, in accordance with ASC Topic 830-30, “Translation of Financial Statement”, using the exchange rate on the balance sheet date. Revenues and expenses are translated at average rates prevailing during the period. The gains and losses resulting from translation of financial statements of foreign subsidiary are recorded as a separate component of accumulated other comprehensive income.

Translation of amounts from MYR into US$1.00 has been made at the following exchange rates for the respective years:

|

|

| March 31, 2021 |

|

| December 31, 2020 |

| ||

|

|

|

|

|

|

|

| ||

| Year-end US$1 : MYR exchange rate |

|

| 4.1460 |

|

|

| 4.0170 |

|

|

|

|

|

|

|

|

|

|

|

|

|

| January 1, 2021 to March 31, 2021 |

|

| January 1, 2020 to March 31, 2020 |

| ||

|

|

|

|

|

|

|

|

|

|

| 3 months average US$1 : MYR exchange rate |

|

| 4.0678 |

|

|

| 4.1820 |

|

| • | Related parties |

Parties, which can be a corporation or individual, are considered to be related if the Company has the ability, directly or indirectly, to control the other party or exercise significant influence over the other party in making financial and operating decisions. Companies are also considered to be related if they are subject to common control or common significant influence.

| 15 |

| Table of Contents |

BIONEXUS GENE LAB CORP.

NOTES TO CONDENSED CONSOLIDATED FINANCIAL STATEMENTS

FOR THE THREE MONTHS ENDED MARCH 31, 2021

(Currency expressed in United States Dollars (“US$”))

(Unaudited)

| • | Fair value of financial instruments |

The carrying value of the Company’s financial instruments: cash and cash equivalents, trade receivable, deposits and other receivables, amount due to related parties and other payables approximate at their fair values because of the short-term nature of these financial instruments.

The Company also follows the guidance of the ASC Topic 820-10, “Fair Value Measurements and Disclosures” ("ASC 820-10"), with respect to financial assets and liabilities that are measured at fair value. ASC 820-10 establishes a three-tier fair value hierarchy that prioritizes the inputs used in measuring fair value as follows:

| · | Level 1 : Observable inputs such as quoted prices in active markets; | |

|

|

| |

| · | Level 2 : Inputs, other than the quoted prices in active markets, that are observable either directly or indirectly; and | |

| · | Level 3 : Unobservable inputs in which there is little or no market data, which require the reporting entity to develop its own assumptions |

As of March 31, 2021, and December 31, 2020, the Company did not have any nonfinancial assets and liabilities that are recognized or disclosed at fair value in the financial statements, at least annually, on a recurring basis, nor did the Company have any assets or liabilities measured at fair value on a non-recurring basis.

| ● | Recent accounting pronouncements |

The Company has reviewed all recently issued, but not yet effective, accounting pronouncements and does not believe the future adoption of any such pronouncements may be expected to cause a material impact on its financial condition or the results of its operations.

NOTE 4 – TRADE RECEIVABLES

The Company has performed an analysis on all its trade receivables and determined that all amounts are collectible by the Company. As such, trade receivables are reflected as a current asset and no allowance for expected credit loss has been recorded as of March 31, 2021 and December, 31, 2020. The Company’s trade receivables consist of receivable from customers which are unrelated to the Company. The account receivables are non-interest bearing and is generally on 30 days to 90 days term.

| 16 |

| Table of Contents |

BIONEXUS GENE LAB CORP.

NOTES TO CONDENSED CONSOLIDATED FINANCIAL STATEMENTS

FOR THE THREE MONTHS ENDED MARCH 31, 2021

(Currency expressed in United States Dollars (“US$”))

(Unaudited)

NOTE 5 - INCOME TAXES

The Company provides for income taxes under ASC 740, “Income Taxes. ASC 740 requires the use of an asset and liability approach in accounting for income taxes. Deferred tax assets and liabilities are recorded based on the differences between the financial statements and tax basis of assets and liabilities and the tax rates in effect when these differences are expected to reverse. It also requires the reduction of deferred tax assets by a valuation allowance if, based on the weight of available evidence, it is more likely than not that some or all of the deferred tax assets will not be realized.

Provision for income taxes consisted of the following:

United States of America

The Company is registered in the State of Wyoming and is subject to the tax laws of the United States of America.

Malaysia

Bionexus Gens Lab Sdn. Bhd. and Chemrex Corporation Sdn. Bhd. are subject to Malaysia Corporate Tax, which is charged at the statutory income tax rate range is 24% on its assessable income. Under the amendment of Income Tax Act 1967 by the Finance Act 2019 and with effect from year of assessment 2021, companies with paid-up capital of MYR2.5 million or less, and with annual business income of not more than RM50 million are subject to Small and Medium Enterprise Corporate Tax at 17% on chargeable income up to MYR600,000 except for companies with investment holding nature or companies does not have gross income from business sources are subject to corporate tax at 24% on chargeable income.

|

|

| As of |

| |||||

|

|

| March 31, |

|

| December 31, |

| ||

|

|

| 2021 |

|

| 2020 |

| ||

| Tax Recoverable |

|

|

|

|

|

| ||

| Local |

| $ | - |

|

| $ | - |

|

| Foreign, representing Malaysia |

|

| (2,624 | ) |

|

| (2,190 | ) |

| Tax Recoverable |

|

| (2,624 | ) |

|

| (2,190 | ) |

|

|

|

|

|

|

|

|

|

|

| Income tax liabilities: |

|

|

|

|

|

|

|

|

| Local |

| $ | - |

|

| $ | - |

|

| Foreign, representing Malaysia |

|

| 28,874 |

|

|

| 61,313 |

|

| Income tax liabilities |

|

| 28,874 |

|

|

| 61,313 |

|

|

|

|

|

|

|

|

|

|

|

| Deferred tax liabilities: |

|

|

|

|

|

|

|

|

| Local |

| $ | - |

|

| $ | - |

|

| Foreign, representing Malaysia |

|

| 1,813 |

|

|

| 1,872 |

|

| Deferred tax liabilities |

|

| 1,813 |

|

|

| 1,872 |

|

| Total |

|

| 28,063 |

|

|

| 60,995 |

|

| 17 |

| Table of Contents |

BIONEXUS GENE LAB CORP.

NOTES TO CONDENSED CONSOLIDATED FINANCIAL STATEMENTS

FOR THE THREE MONTHS ENDED MARCH 31, 2021

(Currency expressed in United States Dollars (“US$”))

(Unaudited)

NOTE 6 –LEASE RIGHT OF USE ASSET AND LEASE LIABILITY

Operating lease right of use as follow:

|

|

| As of |

| |||||

|

|

| March 31, |

|

| December 31, |

| ||

|

|

| 2021 |

|

| 2020 |

| ||

| Balance as of beginning of the year |

| $ | 62,529 |

|

| $ | 23,542 |

|

| Add: Addition of right of use assets |

|

| - |

|

|

| 61,128 |

|

| Less: accumulated amortization |

|

| (5,214 | ) |

|

| (22,587 | ) |

| Foreign translation differences |

|

| (1,568 | ) |

|

| 446 |

|

| Balance |

| $ | 55,747 |

|

| $ | 62,529 |

|

|

|

|

|

|

|

|

|

|

|

| Operating lease liability as follow: |

| As of |

| |||||

|

|

| March 31, |

|

| December 31, |

| ||

|

|

| 2021 |

|

| 2020 |

| ||

| Balance as of beginning of the year |

| $ | 63,079 |

|

| $ | 24,148 |

|

| Add: Addition of lease liabilities |

|

| - |

|

|

| 61,128 |

|

| Less: gross repayment |

|

| (4,705 | ) |

|

| (26,036 | ) |

| Add: imputed interest |

|

| 795 |

|

|

| 3,380 |

|

| Foreign translation differences |

|

| (2,465 | ) |

|

| 459 |

|

| Balance as of end of the year |

|

| 56,704 |

|

|

| 63,079 |

|

| Less: lease liability current portion |

|

| (16,793 | ) |

|

| (20,702 | ) |

| Lease liability non-current portion |

| $ | 39,911 |

|

| $ | 42,377 |

|

The amortization of the operating lease right of use asset for the three months’ period ended March 31, 2021 and the year ended December 31, 2020 were $2,637 and $10,816 respectively.

| Other information: |

| As of |

| |||||

|

|

| March 31, |

|

| December 31, |

| ||

|

|

| 2021 |

|

| 2020 |

| ||

| Cash paid for amounts included in the measurement of lease liabilities: |

|

|

|

|

|

| ||

| Operating cash flow from operating lease |

| $ | 6,375 |

|

| $ | 38,931 |

|

| Right of use assets obtained in exchange for operating lease liabilities |

|

| 55,747 |

|

|

| 65,529 |

|

| Remaining lease term for operating lease (years) |

|

| 3.75 |

|

|

| 4 |

|

| Weighted average discount rate for operating lease |

|

| 5.40 | % |

|

| 5.40 | % |

| 18 |

| Table of Contents |

BIONEXUS GENE LAB CORP.

NOTES TO CONDENSED CONSOLIDATED FINANCIAL STATEMENTS

FOR THE THREE MONTHS ENDED MARCH 31, 2021

(Currency expressed in United States Dollars (“US$”))

(Unaudited)

NOTE 7 - PROPERTY, PLANT AND EQUIPMENT

Property, plant and equipment consisted of the following:

|

|

| As of |

| |||||

|

|

| March 31, |

|

| December 31, |

| ||

|

|

| 2021 |

|

| 2020 |

| ||

|

|

|

|

|

|

|

| ||

| Air conditioner |

| $ | 1,124 |

|

| $ | 1,124 |

|

| Computer and software |

|

| 1,371 |

|

|

| 1,371 |

|

| Equipment |

|

| 43,010 |

|

|

| 42,830 |

|

| Furniture and fittings |

|

| 86,961 |

|

|

| 86,961 |

|

| Lab equipment |

|

| 284,822 |

|

|

| 284,822 |

|

| Land and buildings |

|

| 1,506,969 |

|

|

| 1,506,969 |

|

| Motor vehicle |

|

| 137,914 |

|

|

| 137,914 |

|

| Office equipment |

|

| 35,787 |

|

|

| 35,160 |

|

| Renovation |

|

| 107,414 |

|

|

| 107,414 |

|

| Signboard |

|

| 704 |

|

|

| 704 |

|

|

|

|

| 2,206,074 |

|

|

| 2,205,269 |

|

| (Less): Accumulated depreciation |

|

| (473,961 | ) |

|

| (441,541 | ) |

| Add: Foreign translation differences |

|

| (24,009 | ) |

|

| 21,874 |

|

| Property, plant and equipment, net |

| $ | 1,708,104 |

|

| $ | 1,785,602 |

|

Depreciation expense for the three months’ period ended March 31, 2021 and 2020 were $10,622 and $10,278, respectively.

NOTE 8 – OTHER INVESTMENTS

|

|

|

| As of |

| ||||||

|

|

|

| March 31, |

|

| December 31, |

| |||

|

|

|

| 2021 |

|

| 2020 |

| |||

| As of beginning of the year |

|

| $ | 281,668 |

|

| $ | 12,215 |

| |

| Acquisition of business under common control |

|

|

| - |

|

|

| 147,882 |

| |

| Addition during the year |

|

|

| 296,025 |

|

|

| 108,631 |

| |

| Disposal during the year |

|

|

| - |

|

|

| (34,923 | ) | |

| Fair value gain |

|

|

| 8,264 |

|

|

| 38,742 |

| |

| Foreign exchange translation |

|

|

| (14,348 | ) |

|

| 9,121 |

| |

| As of end of the year |

|

| $ | 571,609 |

|

| $ | 281,668 |

| |

The other investments consist of investment in quoted and unquoted shares in Malaysia of $569,725 and $1,884 as at March 31, 2021 and December 31, 2020 were $279,724 and $1,944, respectively.

| 19 |

| Table of Contents |

BIONEXUS GENE LAB CORP.

NOTES TO CONDENSED CONSOLIDATED FINANCIAL STATEMENTS

FOR THE THREE MONTHS ENDED MARCH 31, 2021

(Currency expressed in United States Dollars (“US$”))

(Unaudited)

NOTE 9 – TRADE PAYABLES

Trade payables are amounts billed to the Company by suppliers for goods and services in the ordinary course of business. All amounts have short-term repayment terms and vary by supplier.

NOTE 10 – FINANCE LEASE

The Company purchased motor vehicles under finance lease agreements with the effective interest rate 5.70% of per annum, with principal and interest payable monthly. The obligations under the finance lease are as follows:

|

|

| As of |

| |||||

|

|

| March 31, |

|

| December 31, |

| ||

|

|

| 2021 |

|

| 2020 |

| ||

|

|

|

|

|

|

|

| ||

| Finance lease |

| $ | 54,440 |

|

| $ | 63,703 |

|

| Less: interest expense |

|

| (2,649 | ) |

|

| (3,363 | ) |

| Net present value of finance lease |

|

| 51,791 |

|

|

| 60,340 |

|

|

|

|

|

|

|

|

|

|

|

| Current portion |

|

| 22,843 |

|

|

| 25,048 |

|

| Non-current portion |

|

| 28,948 |

|

|

| 35,292 |

|

| Total |

| $ | 51,791 |

|

| $ | 60,340 |

|

NOTE 11 – STOCK HOLDERS’ EQUITY

As at March 31, 2021, the Company issued and outstanding common stock is 171,218,152 shares.

NOTE 12 – SEGMENTED INFORMATION

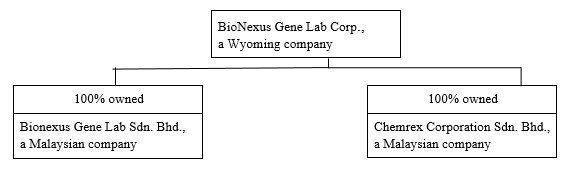

At March 31, 2021, the Company (“BGLC”) operates in biochemical industry segment through its two Malaysian subsidiaries, BioNexus Malaysia and Chemrex.

| 20 |

| Table of Contents |

The corporate structure as at March 31, 2021 is depicted below:

For the quarter ended March 31, 2021, segmented (unaudited) revenue and net profit/(loss) (Currency expressed in United States Dollars (“US$”) are as follows:

|

|

| BioNexus Malaysia |

|

| Chemrex |

|

| Total |

|

| Consolidated with BGLC |

| ||||

|

|

| Three months ended March 31, 2021 |

| |||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| REVENUE |

| $ | 97,363 |

|

| $ | 3,351,796 |

|

| $ | 3,449,159 |

|

| $ | 3,449,159 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| COST OF REVENUE |

|

| (67,707 | ) |

|

| (2,798,887 | ) |

|

| (2,866,594 | ) |

|

| (2,866,594 | ) |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| GROSS PROFIT |

|

| 29,656 |

|

|

| 552,909 |

|

|

| 582,565 |

|

|

| 582,565 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| OTHER INCOME |

|

| 763 |

|

|

| 61,625 |

|

|

| 62,388 |

|

|

| 62,388 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| OPERATING EXPENSES |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| General and administrative |

|

| (22,511 | ) |

|

| (233,152 | ) |

|

| (255,663 | ) |

|

| (302,851 | ) |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| FINANCE COSTS |

|

| (1,207 | ) |

|

| (2,151 | ) |

|

| (3,358 | ) |

|

| (3,358 | ) |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| PROFIT BEFORE TAX |

|

| 6,701 |

|

|

| 379,231 |

|

|

| 385,932 |

|

|

| 338,744 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| Tax expense: |

|

| 0 |

|

|

| 0 |

|

|

| 0 |

|

|

| 0 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| NET PROFIT |

| $ | 6,701 |

|

| $ | 379,231 |

|

| $ | 385,932 |

|

| $ | 338,744 |

|

| 21 |

| Table of Contents |

|

|

| BioNexus Malaysia |

|

| Chemrex |

|

| Total |

|

| Consolidated with BGLC |

| ||||

|

|

| Three months ended March 31, 2020 |

| |||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| REVENUE |

| $ | 0 |

|

| $ | 3,070,026 |

|

| $ | 3,070,026 |

|

| $ | 3,070,026 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| COST OF REVENUE |

|

| (12,992 | ) |

|

| (2,401,727 | ) |

|

| (2,414,719 | ) |

|

| (2,414,719 | ) |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| GROSS (LOSS)/PROFIT |

|

| (12,992 | ) |

|

| 668,299 |

|

|

| 655,307 |

|

|

| 655,307 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| OTHER INCOME |

|

| 4,745 |

|

|

| 741,896 |

|

|

| 746,641 |

|

|

| 746,641 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| OPERATING EXPENSES |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| General and administrative |

|

| (20,149 | ) |

|

| (290,635 | ) |

|

| (310,784 | ) |

|

| (328,418 | ) |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| FINANCE COSTS |

|

| (1,063 | ) |

|

| (1,963 | ) |

|

| (3,026 | ) |

|

| (3,026 | ) |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| (LOSS)/PROFIT BEFORE TAX |

|

| (29,459 | ) |

|

| 1,117,597 |

|

|

| 1,088,138 |

|

|

| 1,070,504 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| Tax expense: |

|

| (860 | ) |

|

| 0 |

|

|

| (860 | ) |

|

| (860 | ) |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| NET (LOSS)/PROFIT |

| $ | (30,319 | ) |

| $ | 1,117,597 |

|

| $ | 1,087,278 |

|

| $ | 1,069,644 |

|

|

|

| As Of March 31, 2021 and December 31, 2020 |

| |||||||||||||

|

|

| Total Assets |

|

| Total Liabilities |

| ||||||||||

|

|

| 2021 |

|

| 2020 |

|

| 2021 |

|

| 2020 |

| ||||

|

|

|

|

|

|

|

|

|

|

|

|

|

| ||||

| Bionexus (M) |

| $ | 816,893 |

|

| $ | 902,552 |

|

| $ | 711,549 |

|

| $ | 800,610 |

|

| Chemrex |

|

| 8,894,730 |

|

|

| 9,008,245 |

|

|

| 2,976,336 |

|

|

| 3,283,814 |

|

| TOTAL |

|

| 9,711,623 |

|

|

| 9,910,797 |

|

|

| 3,687,885 |

|

|

| 4,084,424 |

|

| 22 |

| Table of Contents |

BIONEXUS GENE LAB CORP.

NOTES TO CONDENSED CONSOLIDATED FINANCIAL STATEMENTS

FOR THE THREE MONTHS ENDED MARCH 31, 2021

(Currency expressed in United States Dollars (“US$”))

(Unaudited)

NOTE 13 - SUBSEQUENT EVENTS

In accordance with ASC Topic 855, “Subsequent Events”, which establishes general standards of accounting for and disclosure of events that occur after the balance sheet date but before financial statements are issued, the Company has evaluated all events or transactions that occurred after March 31, 2021 up through April 30, 2021 of these consolidated financial statements.

NOTE 14 – SIGNIFICANT EVENTS

On March 11, 2020, the World Health Organization declared the Coronavirus (“Covid-19”) outbreak to be a pandemic, which has caused severe global social and economic disruptions and uncertainties, including markets where the Company operates or intends to operate. The Company is actively monitoring and managing its operations to respond to these changes, the Company does not consider it practicable to provide any quantitative estimate on the potential impact it may have on the Company as the outbreak continue to evolve as of the date of this report.

NOTE 15 - CONCENTRATION OF RISKS

a) Major customers

During the period, the Company did not have any material recognizable major customers accounted for 10% or more of the Company’s revenue for the financial year ended Dec 31, 2020 and quarterly financial period ended March 31, 2021 and 2020.

b) Major suppliers

There were 3 major suppliers who accounted for 10% or more of the Company’s cost of revenue and their balance at the end of 1st quarter ended March 31, 2021 are presented as below:

|

Major Suppliers |

| Purchases |

|

| Percentage of cost of revenue |

|

| Payable balance |

| |||

| (1st quarter ended March 31, 2021) |

|

|

|

|

|

|

|

|

| |||

| Singapore Highpolymer Chemical Products |

| $ | 776,469 |

|

|

| 27.09 | % |

| $ | 1,324,528 |

|

| Changzhou Pro-Tech Trade Co. Ltd |

| $ | 451,074 |

|

|

| 15.74 | % |

| $ | 382,658 |

|

| Luxchem Trading Sdn Bhd |

| $ | 404,056 |

|

|

| 14.09 | % |

| $ | 404,056 |

|

|

|

| $ | 1,631,599 |

|

|

| 56.92 | % |

| $ | 2,111,242 |

|

There were 3 major suppliers who accounted for 10% or more of the Company’s cost of revenue and their balance at the end of 1st quarter ended December 31, 2020 are presented as below:

| Major Suppliers |

| Purchases |

|

| Percentage of cost of revenue |

|

| Payable balance |

| |||

| (Financial year ended Dec 31, 2020) |

|

|

|

|

|

|

|

| ||||

| Singapore Highpolymer Chemical Products |

| $ | 2,090,090 |

|

|

| 21.62 | % |

| $ | 1,031,417 |

|

| Luxchem Trading Sdn Bhd |

| $ | 1,350,069 |

|

|

| 13.96 | % |

| $ | 572,938 |

|

| Changzhou Pro-Tech Trade Co. Ltd |

| $ | 1,319,232 |

|

|

| 13.64 | % |

| $ | 335,215 |

|

|

|

| $ | 4,759,391 |

|

|

| 49.22 | % |

| $ | 1,939,570 |

|

| 23 |

| Table of Contents |

Item 2. Management’s Discussion and Analysis of Financial Condition and Results of Operations.

Forward-Looking Statements

Certain statements made in this quarterly report on Form 10-Q are “forward-looking statements” (within the meaning of the Private Securities Litigation Reform Act of 1995) in regard to the plans and objectives of management for future operations. Such statements involve known and unknown risks, uncertainties and other factors that may cause actual results, performance or achievements of the registrant to be materially different from any future results, performance or achievements expressed or implied by such forward-looking statements. The forward-looking statements included herein are based on current expectations that involve numerous risks and uncertainties. The Company’s plans and objectives are based, in part, on assumptions involving the continued expansion of business. Assumptions relating to the foregoing involve judgments with respect to, among other things, future economic, competitive and market conditions and future business decisions, all of which are difficult or impossible to predict accurately and many of which are beyond the control of the Company. Although the Company believes its assumptions underlying the forward-looking statements are reasonable, any of the assumptions could prove inaccurate and, therefore, there can be no assurance the forward-looking statements included in this quarterly report will prove to be accurate. In light of the significant uncertainties inherent in the forward-looking statements included herein, the inclusion of such information should not be regarded as a representation by the registrant or any other person that the objectives and plans of the registrant will be achieved.

Substantial risks exist with respect to an investment in the Company. These risks include but are not limited to, those factors discussed in our Annual Report on Form 10-K filed with the Securities and Exchange Commission on March 30, 2021. More broadly, these factors include, but are not limited to:

|

| • | We have limited operating history and limited business growth; |

|

| • | The efficacy of our blood screening process; |

|

| • | We may face product liability claims and we have no insurance to cover such claims; and |

|

| • | There are risks associated with our business operations in Malaysia, including enforcing judgements against our operating subsidiary and management. |

The results of operations for BioNexus described below have been adversely impacted by the onset of the Covid-19 pandemic, which commenced in late December 2019 in Malaysia. We believe that most people are reluctant to visit hospitals and clinics for fear of transmission from other patients or medical staff. Since our RNA screening is administered at hospitals and clinics, our business has been adversely affected as a result. Furthermore, on March 18, 2020, the Malaysian government had declared Movement Control Order for the entire nation which restricted movement of all people except for those who were working for essential services. This order has been extended to June 7, 2021.

| 24 |

| Table of Contents |

Description of Business

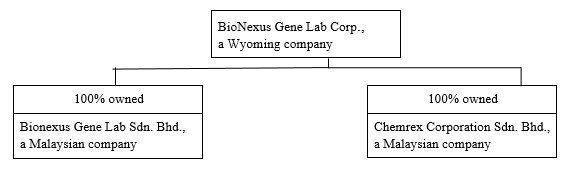

We have two operating subsidiaries located in Malaysia, Bionexus Gene Lab Sdn. Bhd. (“Bionexus Malaysia”) and Chemrex Corporation Sdn. Bhd. (“Chemrex”).

BioNexus Malaysia is an emerging molecular diagnostics company focused on the application of functional genomics to enable early diagnosis and personalized health management. It was incorporated in the State of Wyoming on May 12, 2017. On August 23, 2017, we acquired all of the outstanding capital stock of BioNexus Malaysia, which was incorporated in Malaysia on April 7, 2015. BioNexus Malaysia owns algorithm software, technology and know-how related to the detection of common diseases through blood analysis which we use in our business.

Our corporate and principal office address of BioNexus Malaysia is Unit 02, Level 10, Tower B, Avenue 3, The Vertical Business Suite II, Bangar South, No. 8 Jalan Kerinchi, Kuala Lumpur, Malaysia., our lab is located at Lab 353, Chemical Science Centre, University Science Malaysia, George Town, Penang, Malaysia. We also have a blood collection center located at 1st floor, Lifecare Medical Centre, Kuala Lumpur, Malaysia. Our telephone number is (+60) 1221-26512 and our web-site is www.bionexusgenelab.com.

Chemrex is a wholesaler of industrial chemicals for the manufacture of industrial, medical, appliance, aero, automotive, mechanical and electronic industries in Asia Pacific region. On December 31, 2020, we acquired all of the outstanding capital stock of Chemrex, which was incorporated in Malaysia on September 29, 2004.

Chemrex’s corporate offices and distribution and storage center is located at 4 Jalan CJ 1/6 Kawasan Perusahaan Cheras Jaya, Selangor, Malaysia. Its phone number is (+60) 1922-23815 and web-site is www.chemrex.com.my.

Our corporate structure is depicted below:

| 25 |

| Table of Contents |

BIONEXUS GENE LAB CORP.

NOTES TO CONDENSED CONSOLIDATED FINANCIAL STATEMENTS

FOR THE THREE MONTHS ENDED MARCH 31, 2021

(Currency expressed in United States Dollars (“US$”))

(Unaudited)

Results of Operations

The following table sets forth key selected financial data for the three months ended March 31, 2021 and 2020.

|

|

| Three months ended |

| |||||

|

|

| March 31, |

| |||||

|

|

| 2021 |

|

| 2020 |

| ||

|

|

|

|

|

|

|

| ||

| REVENUE |

| $ | 3,449,159 |

|

| $ | 3,070,026 |

|

|

|

|

|

|

|

|

|

|

|

| COST OF REVENUE |

|

| (2,866,594 | ) |

|

| (2,414,719 | ) |

|

|

|

|

|

|

|

|

|

|

| GROSS PROFIT |

|

| 590,235 |

|

|

| 655,307 |

|

|

|

|

|

|

|

|

|

|

|

| OTHER INCOME |

|

| 62,388 |

|

|

| 746,641 |

|

|

|

|

|

|

|

|

|

|

|

| OPERATING EXPENSES |

|

|

|

|

|

|

|

|

| General and administrative |

|

| (302,851 | ) |

|

| (328,418 | ) |

|

|

|

|

|

|

|

|

|

|

| PROFIT FROM OPERATIONS |

|

| 349,102 |

|

|

| 1,073,530 |

|

|

|

|

|

|

|

|

|

|

|

| FINANCE COSTS |

|

| (3,358 | ) |

|

| (3,026 | ) |

|

|

|

|

|

|

|

|

|

|

| PROFIT BEFORE TAX |

|

| 338,744 |

|

|

| 1,070,504 |

|

|

|

|

|

|

|

|

|

|

|

| Tax expense |

|

| - |

|

|

| (860 | ) |

|

|

|

|

|

|

|

|

|

|

| NET PROFIT |

| $ | 338,744 |

|

| $ | 1,069,644 |

|

|

|

|

|

|

|

|

|

|

|

| Other comprehensive income: |

|

|

|

|

|

|

|

|

| Foreign currency loss |

|

| (208,468 | ) |

|

| (294,696 | ) |

|

|

|

|

|

|

|

|

|

|

| COMPREHENSIVE INCOME |

| $ | 130,276 |

|

| $ | 774,948 |

|

Revenues. For the quarterly period ended March 31, 2021, we had revenue of $3,449,159 as compared to revenues of $3,070,026 for the quarterly period ended March 31, 2020, an increase of approximately 12% from the prior period. For the current quarterly period, Chemrex contributed 97% of total revenues compared to its contribution of 100% of total revenues for the quarterly period last year. Chemrex’s revenues increased from $3,070,026 in the prior quarter to $3,449,159 for the current quarter, an increase of 12.3%. The increase was due to the easing of the governmental movement control restrictions during the current periods allowing business sectors to resume operations. BioNexus had revenues of $97,363 for the current quarter compared with no revenues from the same quarterly period last year. BioNexus’ revenues for the current quarter resulted from sale of its cancers screening services to clinics and hospitals as the governmental movement control restrictions eased during the current quarter.

| 26 |

| Table of Contents |