Attached files

| file | filename |

|---|---|

| 8-K - FORM 8-K - ALLIANCE DATA SYSTEMS CORP | form_8k.htm |

Alliance DataInvestor Event May 18, 2021 Ralph AndrettaPresident & CEO Tim King EVP & CFO ©

2021 ADS Alliance Data Systems, Inc. Exhibit 99.1

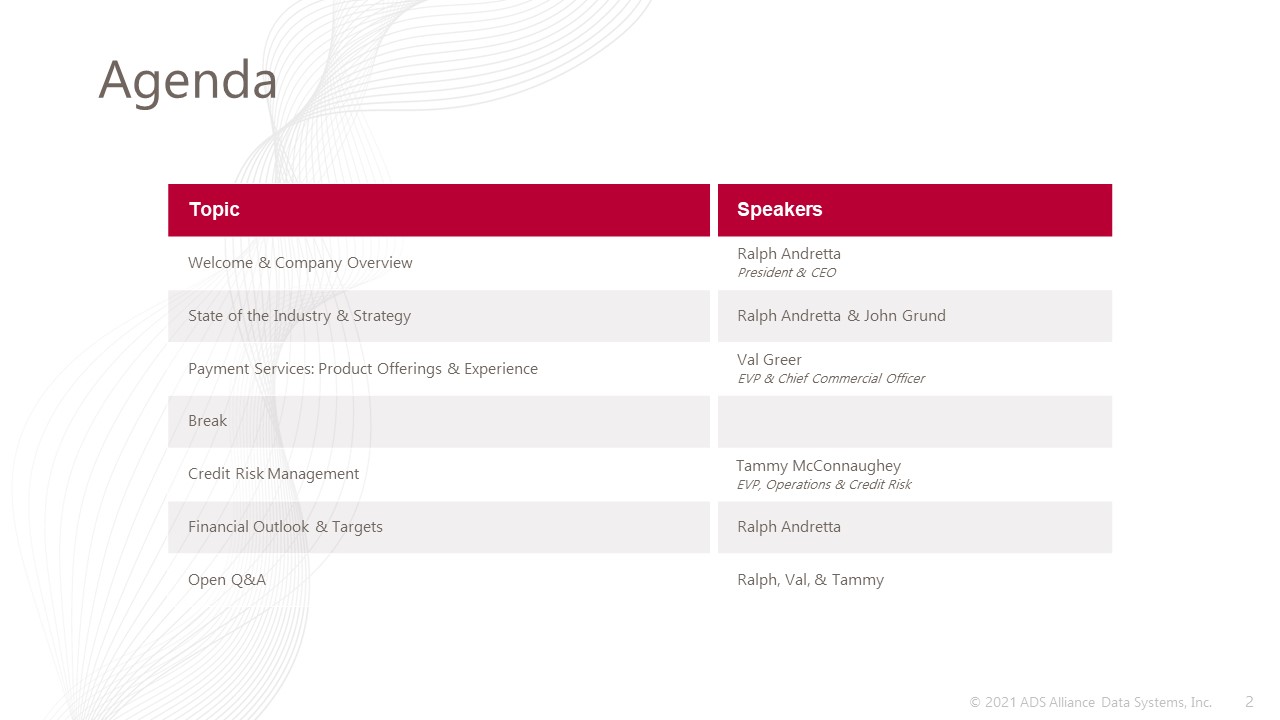

Agenda Topic Speakers Welcome & Company Overview Ralph Andretta President & CEO State of the

Industry & Strategy Ralph Andretta & John Grund Payment Services: Product Offerings & Experience Val Greer EVP & Chief Commercial Officer Break Credit Risk Management Tammy McConnaughey EVP, Operations & Credit

Risk Financial Outlook & Targets Ralph Andretta Open Q&A Ralph, Val, & Tammy 2

This release contains forward-looking statements within the meaning of Section 27A of the Securities Act

of 1933 and Section 21E of the Securities Exchange Act of 1934. Forward-looking statements give our expectations or forecasts of future events and can generally be identified by the use of words such as "believe," "expect," "anticipate,"

"estimate," "intend," "project," "plan," "likely," "may," "should" or other words or phrases of similar import. Similarly, statements that describe our business strategy, outlook, objectives, plans, intentions or goals also are forward-looking

statements. Examples of forward-looking statements include, but are not limited to, statements we make regarding, and the guidance we give with respect to, our anticipated operating or financial results, initiation or completion of strategic

initiatives including the proposed spinoff of our LoyaltyOne segment, future dividend declarations, and future economic conditions, including, but not limited to, fluctuation in currency exchange rates, market conditions and COVID-19 impacts

related to relief measures for impacted borrowers and depositors, labor shortages due to quarantine, reduction in demand from clients, supply chain disruption for our reward suppliers and disruptions in the airline or travel industries.We

believe that our expectations are based on reasonable assumptions. Forward-looking statements, however, are subject to a number of risks and uncertainties that could cause actual results to differ materially from the projections, anticipated

results or other expectations expressed in this release, and no assurances can be given that our expectations will prove to have been correct. These risks and uncertainties include, but are not limited to, factors set forth in the Risk Factors

section in our Annual Report on Form 10-K for the most recently ended fiscal year, which may be updated in Item 1A of, or elsewhere in, our Quarterly Reports on Form 10-Q filed for periods subsequent to such Form 10-K. Our forward-looking

statements speak only as of the date made, and we undertake no obligation, other than as required by applicable law, to update or revise any forward-looking statements, whether as a result of new information, subsequent events, anticipated or

unanticipated circumstances or otherwise. Forward-Looking Statements 3

Welcome & Company OverviewRalph Andretta © 2021 ADS Alliance Data Systems, Inc.

Board of Directors Roger Ballou John Gerspach Rajesh “Nat” Natarajan Timothy Theriault Laurie

Tucker Sharen Turney Ralph Andretta Karin Kimbrough(Board Nominee) 5

Leadership Team Ralph AndrettaPresident & CEO Val GreerEVP & Chief Commercial Officer Perry

BebermanEVP & CFO(Effective July 6, 2021) Tammy McConnaugheyEVP, Operations & Credit Risk Nick BarnesSVP, Chief Info & Tech Officer Greg BetchkalSVP, Chief Risk Officer Jeff ChesnutSVP, Treasurer Calvin HiltonSVP, Global Human

Resources Joe MotesEVP, CAO & General Counsel Wes HuntSVP, Enterprise Data Science & Analytics 6

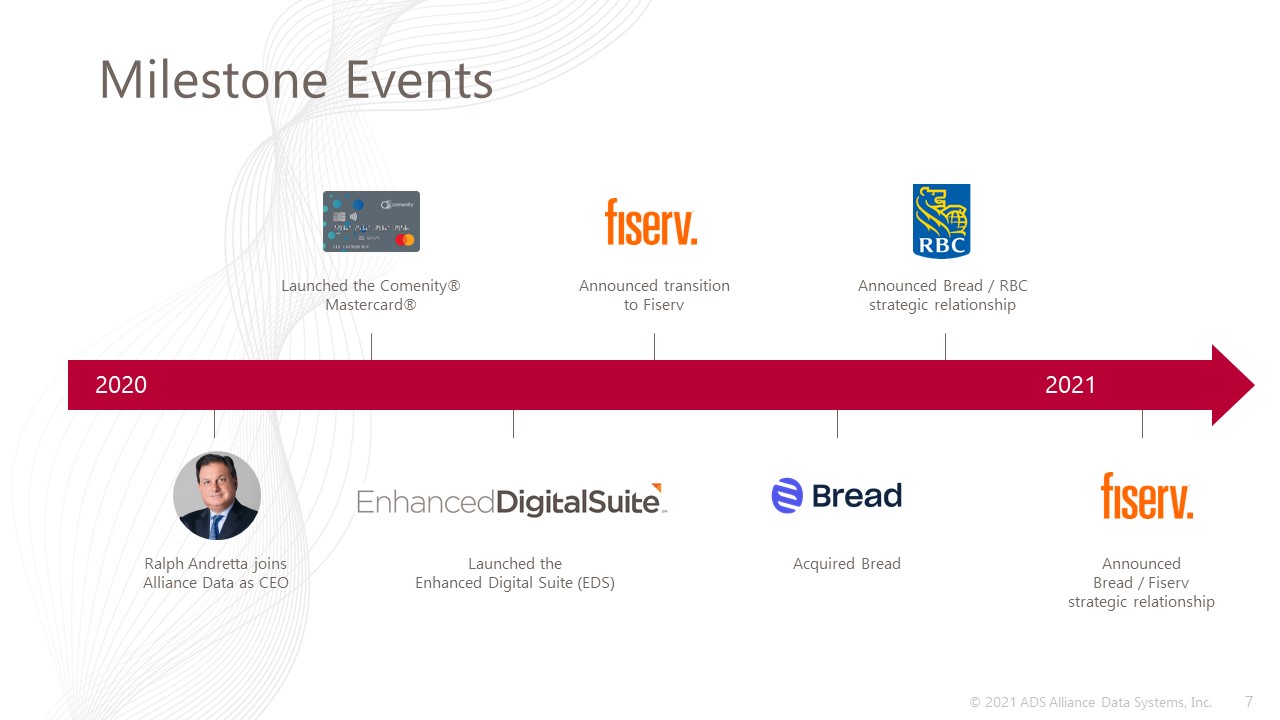

Milestone Events Ralph Andretta joins Alliance Data as CEO Launched the Comenity® Mastercard® Launched

the Enhanced Digital Suite (EDS) Announced transition to Fiserv Acquired Bread Announced Bread / Fiserv strategic relationship Announced Bread / RBC strategic relationship 2020 2021 7

Recover Readied the business for COVID-19 and beyond Rebuild Regrow Digital offerings, technology

and talent Customer and product choice, profitable growth and shareholder value 8

Offer broad product suite focused on customer's choice 1 Provide full-spectrum lending capabilities to

drive sales 2 Enhance capabilities with an emphasis on digital 3 Drive sustainable, repeatable, profitable growth 4 Go-Forward Strategy 9

To think outside the bank as a leading tech-forward financial solutions provider, serving people in their

everyday lives and passions. Vision

Payment Services: Product Offerings & ExperienceVal Greer © 2021 ADS Alliance Data Systems, Inc.

Data and Analytics + + 12

Differentiated Product Suite Expanding our product offering and creating a seamless customer experience

Co-brand credit card Private label credit card Buy now, pay later Installment loan Budget/Cash Flow Rewards/Convenience Gen Z Millennial Gen X Baby boomer 13

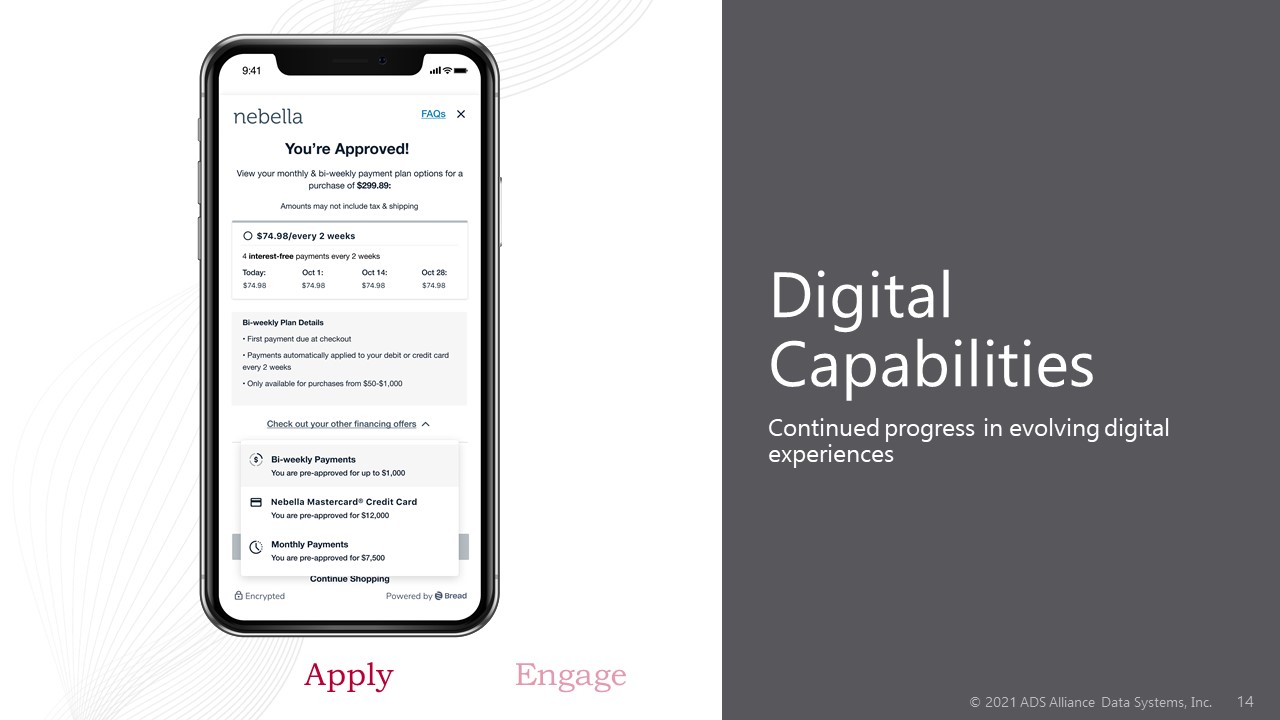

Digital Capabilities Continued progress in evolving digital experiences Apply Engage 14

Digital Capabilities Continued progress in evolving digital experiences Engage Apply Pay 15

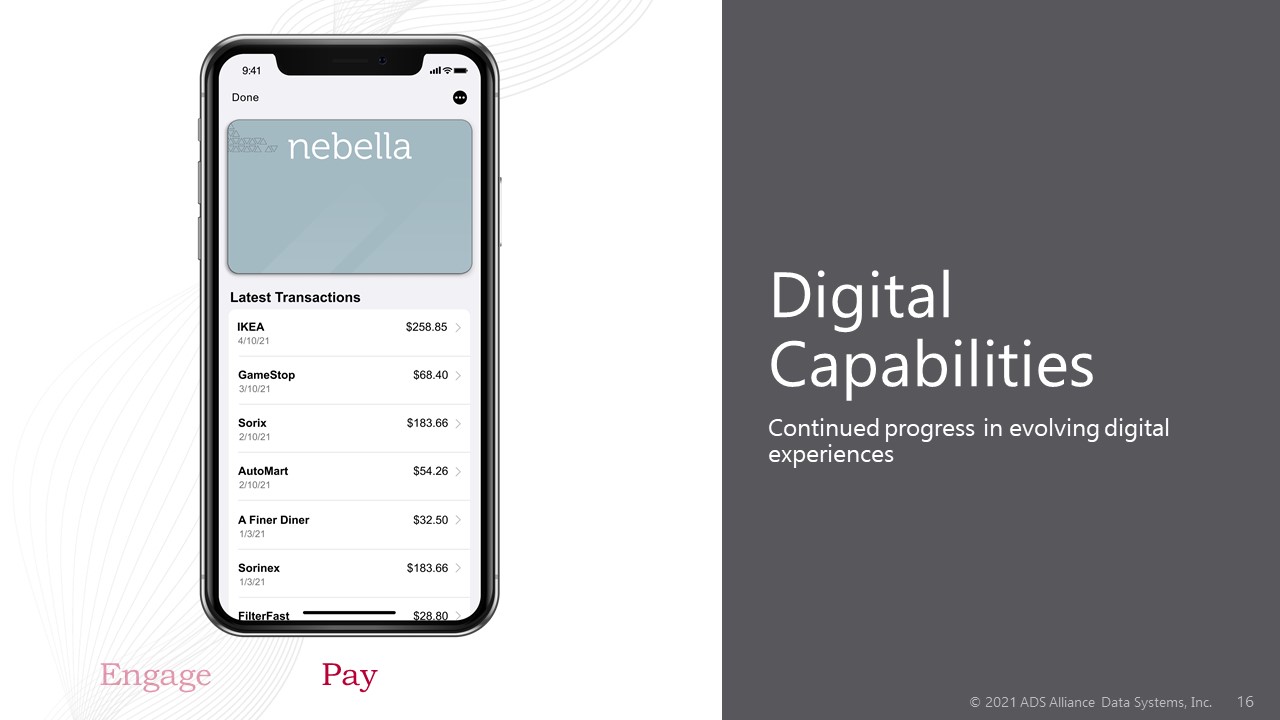

Digital Capabilities Continued progress in evolving digital experiences Pay Engage 16

Direct Acquisition Distribution Technology Platform Merchant Acquirer Network /

Platform(Always Bread) Issuer / Loan Originator(Owns consumer relationship) Value Pools Merchant feesFinance charges Merchant feesFinance charges Gateway feesServicing fees Bread Business Models Leading technology and

white-labeled pay-over-time solutions 17

Total Addressable Market $539B $3.6T $6.2T $7.7T Specialty Retail & Department

Stores General + Specialty Retail & Total Retail Total Retail & E-commerce Total Consumer Spending Total Addressable Market Source: US Census Retail Sales, Nilson Report, Bureau of Economic Analysis $539B $3.6T $6.2T

Specialty Retail & Department Stores General + Specialty Retail & Total Retail Total Retail & E-commerce 18

First Quarter 2021 Credit Sales Representative clients in sales category 19 © 2021 ADS Alliance Data

Systems, Inc.

Consumer Focus Seamless engagement and increased buying power Product Browsing Getting an

Offer Finding a Product Financing the Product Loving the Product & Rewards 20 © 2021 ADS Alliance Data Systems, Inc.

Credit Risk ManagementTammy McConnaughey

Profitable, Fair, and Responsible Full-Spectrum Lending Flexible technology & multiple scores Grow

and expand approach Well-established risk appetite metrics 22

VantageScore 4.0 1 Platform upgrades 2 Future-focused data model 3 Underwriting Process

Investments 23

Optimal Risk-Adjusted Return* Baseline 2.0x 2.4x 2.1x 1.9x Deep

Sub-Prime *Risk-Adjusted Return equals accountholder revenue less gross losses as of 24 months on book per open account Targeted Segments Yield Higher Returns Sub-Prime Near Prime Prime Prime+ Super Prime 24 © 2021 ADS Alliance Data

Systems, Inc.

*Distribution of receivables based on VantageScore Emphasis Around Prime Enables Broad Growth, a

Manageable Loss Rate, and Strong Profitability +900 bp -200 bp -700 bp 25

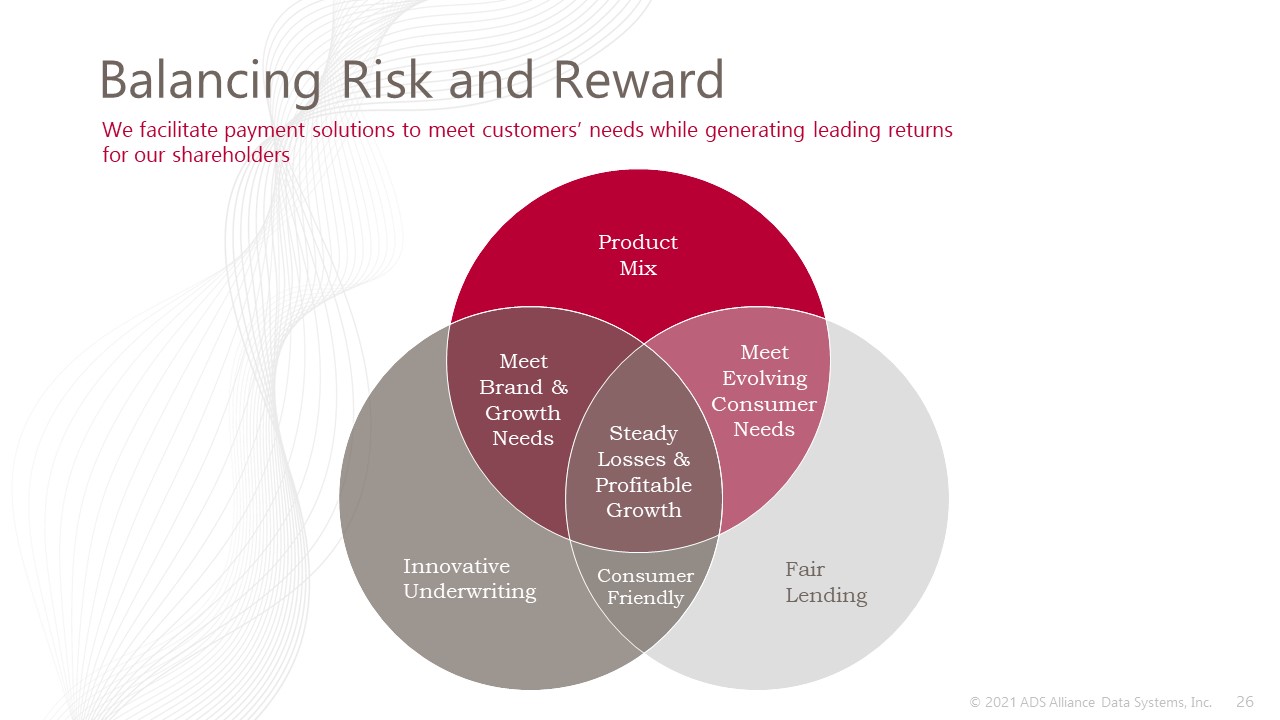

Product Mix Innovative Underwriting Fair Lending Steady Losses & Profitable Growth Consumer

Friendly Meet Brand & Growth Needs Meet Evolving Consumer Needs Balancing Risk and Reward We facilitate payment solutions to meet customers’ needs while generating leading returns for our shareholders 26

Financial Outlook & TargetsRalph Andretta © 2021 ADS Alliance Data Systems, Inc.

Long-Term Financial Targets Targeting TCE and leverage ratios in-line with peers High-single-digit

annual receivable growth Exceed $20 billion in 2023 Positive operating leverage In 2022 and beyond Net loss rate less than 6% Average through-the-cycle net loss rate target range Return on Equitymid-to-high ‘20s 28

Building Momentum Sales at inflection point for receivable growth Improving revenue yields- Bread

yields above portfolio Appropriate expense management 29

2 – 3% 2 – 3% 2 – 3% Drivers of Receivable Growth 30

Card Services Funding Mix & Costs Secured Funding Retail Deposits Wholesale Deposits 31

Capital Allocation / Priorities Improve enterprise capital metrics Organic growth Maintain

dividend Future investments Efficient return of capital to shareholders 32

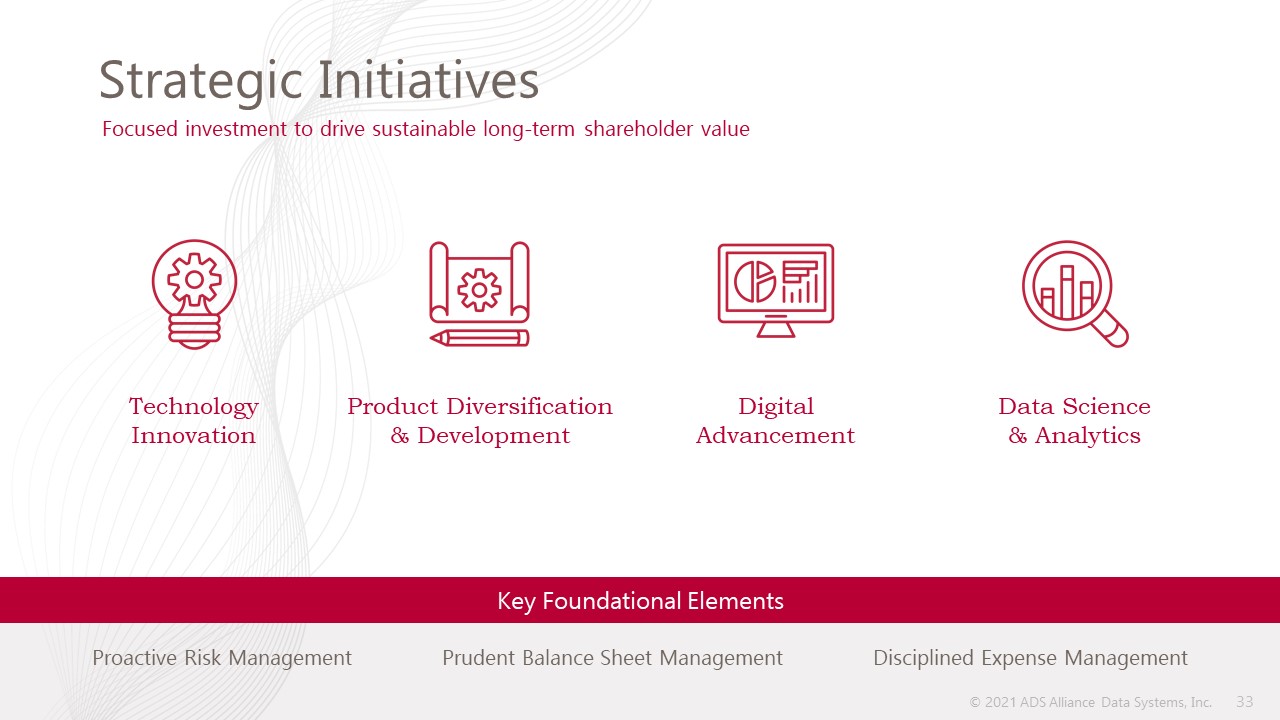

Focused investment to drive sustainable long-term shareholder value Prudent Balance Sheet

Management Disciplined Expense Management Proactive Risk Management TechnologyInnovation Key Foundational Elements Product Diversification & Development DigitalAdvancement Data Science & Analytics Strategic Initiatives 33

In addition to the results presented in accordance with generally accepted accounting principles, or

GAAP, the Company may present financial measures that are non-GAAP measures, such as constant currency financial measures, pre-provision earnings before taxes. Similarly, core earnings and core EPS eliminate non-cash or non-operating items,

including, but not limited to, stock compensation expense, amortization of purchased intangibles, non-cash interest, gain (loss) on the sale of a business, strategic transaction costs, asset impairments, restructuring and other charges, and the

loss on extinguishment of debt. The Company believes that these non-GAAP financial measures, viewed in addition to and not in lieu of the Company’s reported GAAP results, provide useful information to investors regarding the Company’s

performance and overall results of operations. Financial Measures 34