Attached files

| file | filename |

|---|---|

| 8-K - 8-K - Porch Group, Inc. | prch-20210517x8k.htm |

| EX-99.1 - EX-99.1 - Porch Group, Inc. | prch-20210517xex99d1.htm |

Exhibit 99.2

| Copyright 2021 Porch Group, Inc. All rights reserved 1 Q1 2021 Earnings Presentation May 17, 2021 Group Love your home. For moving and improving and everything in between. |

| Copyright 2021 Porch Group, Inc. All rights reserved 2 DISCLAIMERS 2 Forward-Looking Statements Certain statements in this presentation may be considered “forward-looking statements” within the meaning of the “safe harbor” provisions of the United States Private Securities Litigation Reform Act of 1995. Forward-looking statements generally relate to future events or Porch Group, Inc.’s (“Porch”) future financial or operating performance. For example, projections of future revenue, contribution margin, Adjusted EBITDA and other metrics, business strategy and plans, and anticipated impacts from pending or completed acquisitions, are forward-looking statements. In some cases, you can identify forward-looking statements by terminology such as “may,” “should,” “expect,” “intend,” “will,” “estimate,” “anticipate,” “believe,” “predict,” “potential” or “continue,” or the negatives of these terms or variations of them or similar terminology. Such forward-looking statements are subject to risks, uncertainties, and other factors which could cause actual results to differ materially from those expressed or implied by such forward looking statements. These forward-looking statements are based upon estimates and assumptions that, while considered reasonable by Porch and its management, are inherently uncertain. Factors that may cause actual results to differ materially from current expectations include, but are not limited to:(1) the ability to recognize the anticipated benefits of Porch’s December 2020 business combination (the “Merger”) with PropTech Acquisition Corporation (“PropTech”), which may be affected by, among other things, competition and the ability of the combined company to grow and manage growth profitably, maintain key commercial relationships and retain its management and key employees;(2) expansion plans and opportunities, including future and pending acquisitions or additional business combinations;(3) costs related to the Merger and being a public company;(4) litigation, complaints, and/or adverse publicity;(5) the impact of changes in consumer spending patterns, consumer preferences, local, regional and national economic conditions, crime, weather, demographic trends and employee availability;(6) privacy and data protection laws, privacy or data breaches, or the loss of data;(7) the impact of the COVID-19 pandemic and its effect on the business and financial conditions of Porch; and (8) other risks and uncertainties described in Porch’s most recent Form 10-K and quarterly report on Form 10-Q, filed with the Securities and Exchange Commission (“SEC”), which are available on the SEC’s website at www.sec.gov. Nothing in this presentation should be regarded as a representation by any person that the forward-looking statements set forth herein will be achieved or that any of the contemplated results of such forward-looking statements will be achieved. You should not place undue reliance on forward-looking statements, which speak only as of the date of this presentation. Porch does not undertake any duty to update these forward-looking statements, whether as a result of changed circumstances, new information, future events or otherwise, except as may be required by law. 2020 Financial Information; Non-GAAP Financial Measures Some of the financial information and data contained in this presentation, such as Adjusted EBITDA, Adjusted EBITDA Margin, Contribution Margin, and Gross Written Premium have not been prepared in accordance with United States generally accepted accounting principles (“GAAP”). Porch defines Adjusted EBITDA as net income (loss) plus interest expense, net, income tax expense (benefit), other expense, net, and depreciation and amortization, certain non-cash long-lived asset impairment charges, stock- based compensation expense and acquisition-related impacts, including compensation to the sellers that requires future service, amortization of intangible assets, gains (losses) recognized on changes in the value of contingent consideration arrangements, if any, gain or loss on divestures and certain transaction costs. Adjusted EBITDA Margin is defined as Adjusted EBITDA as a percentage of total revenue. Contribution Margin is defined as revenue less all variable expenses, including cost of revenue, marketing and sales. Gross Written Premium represents the total dollars of insurance premium sales based on date of contract execution. The effects of these excluded items may be significant. Porch is not providing reconciliations of expected Adjusted EBITDA, Adjusted EBITDA Margin, Contribution Margin, or Gross Written Premium for future periods to the most directly comparable measures prepared in accordance with GAAP because Porch is unable to provide these reconciliations without unreasonable effort because certain information necessary to calculate such measures on a GAAP basis is unavailable or dependent on the timing of future events outside of our control. Porch uses these non-GAAP measures to compare Porch’s performance to that of prior periods for budgeting and planning purposes. Porch believes these non-GAAP measures of financial results provide useful information to management and investors regarding certain financial and business trends relating to Porch’s results of operations. Porch believes that the use of these non-GAAP financial measures provides an additional tool for investors to use in evaluating projected operating results and trends in and in comparing Porch’s financial measures with other similar companies, many of which present similar non-GAAP financial measures to investors. Porch's method of determining these non-GAAP measures may be different from other companies' methods and, therefore, may not be comparable to those used by other companies and Porch does not recommend the sole use of these non-GAAP measures to assess its financial performance. Porch management does not consider these non-GAAP measures in isolation or as an alternative to financial measures determined in accordance with GAAP. The principal limitation of these non-GAAP financial measures is that they exclude significant expenses and income that are required by GAAP to be recorded in Porch’s financial statements. In addition, they are subject to inherent limitations as they reflect the exercise of judgments by management about which expense and income are excluded or included in determining these non-GAAP financial measures. In order to compensate for these limitations, management presents non-GAAP financial measures in connection with GAAP results. |

| Copyright 2021 Porch Group, Inc. All rights reserved Presenters Matt Ehrlichman CEO & Founder, Porch Group Marty Heimbigner CFO, Porch Group Matthew Neagle COO, Porch Group 3 Nicole Pelley VP Product, Porch Group |

| Copyright 2021 Porch Group, Inc. All rights reserved Software & Services for Companies Access to Consumers Deliver Services Porch has a unique strategy in the home services industry. 1. Porch provides software and services to home services companies such as home inspection and moving and helps these companies grow. 2. Through these companies, Porch gains early access to homebuyers and helps save time, stress, and money during the move. 3. Porch generates B2B2C transactional revenues by facilitating the purchase of key services such as insurance. Porch, the Vertical Software Platform for the Home 4 |

| Copyright 2021 Porch Group, Inc. All rights reserved 5 |

| Copyright 2021 Porch Group, Inc. All rights reserved 6 Key Focus Areas for 2021 1. Increase number of companies using our vertical software 2. Increase access to consumers from software companies 3. Increase B2B2C transaction revenue per consumer 4. Continue to scale our InsurTech business 5. Help brands and advertisers improve their mover marketing 6. Pursue strategic and accretive M&A opportunities 6 |

| Copyright 2021 Porch Group, Inc. All rights reserved 7 Q1 2021 Results & 2021E Guidance Group |

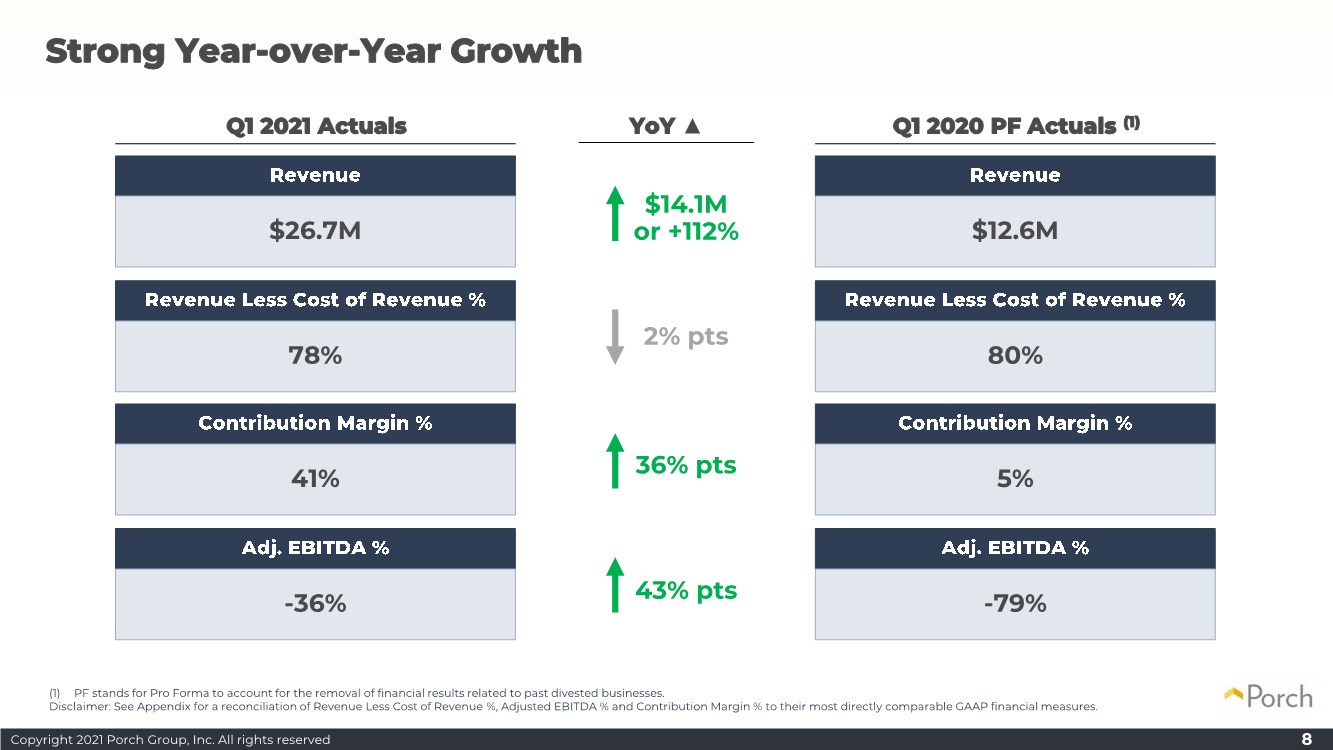

| Copyright 2021 Porch Group, Inc. All rights reserved 8 Strong Year-over-Year Growth (1) PF stands for Pro Forma to account for the removal of financial results related to past divested businesses. Disclaimer: See Appendix for a reconciliation of Revenue Less Cost of Revenue %, Adjusted EBITDA % and Contribution Margin % to their most directly comparable GAAP financial measures. $26.7M 78% 41% -36% Q1 2021 Actuals $12.6M 80% 5% -79% Q1 2020 PF Actuals (1) YoY ▲ $14.1M or +112% 2% pts 36% pts 43% pts |

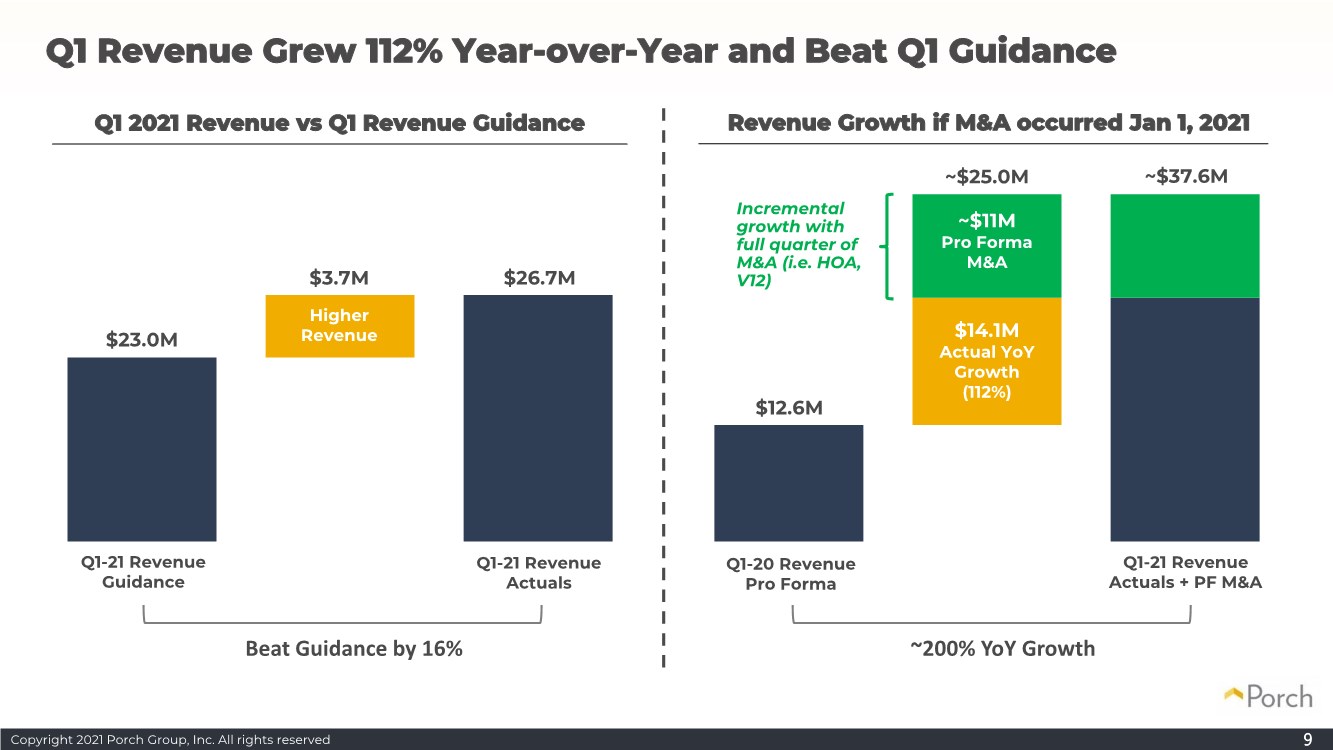

| Copyright 2021 Porch Group, Inc. All rights reserved 9 Q1 Revenue Grew 112% Year-over-Year and Beat Q1 Guidance Q1 2021 Revenue vs Q1 Revenue Guidance Revenue Growth if M&A occurred Jan 1, 2021 $23.0M Beat Guidance by 16% $3.7M $26.7M Q1-21 Revenue Guidance Higher Revenue Q1-21 Revenue Actuals $12.6M ~$25.0M ~$37.6M ~200% YoY Growth Incremental growth with full quarter of M&A (i.e. HOA, V12) $14.1M Actual YoY Growth (112%) ~$11M Pro Forma M&A Q1-21 Revenue Actuals + PF M&A Q1-20 Revenue Pro Forma |

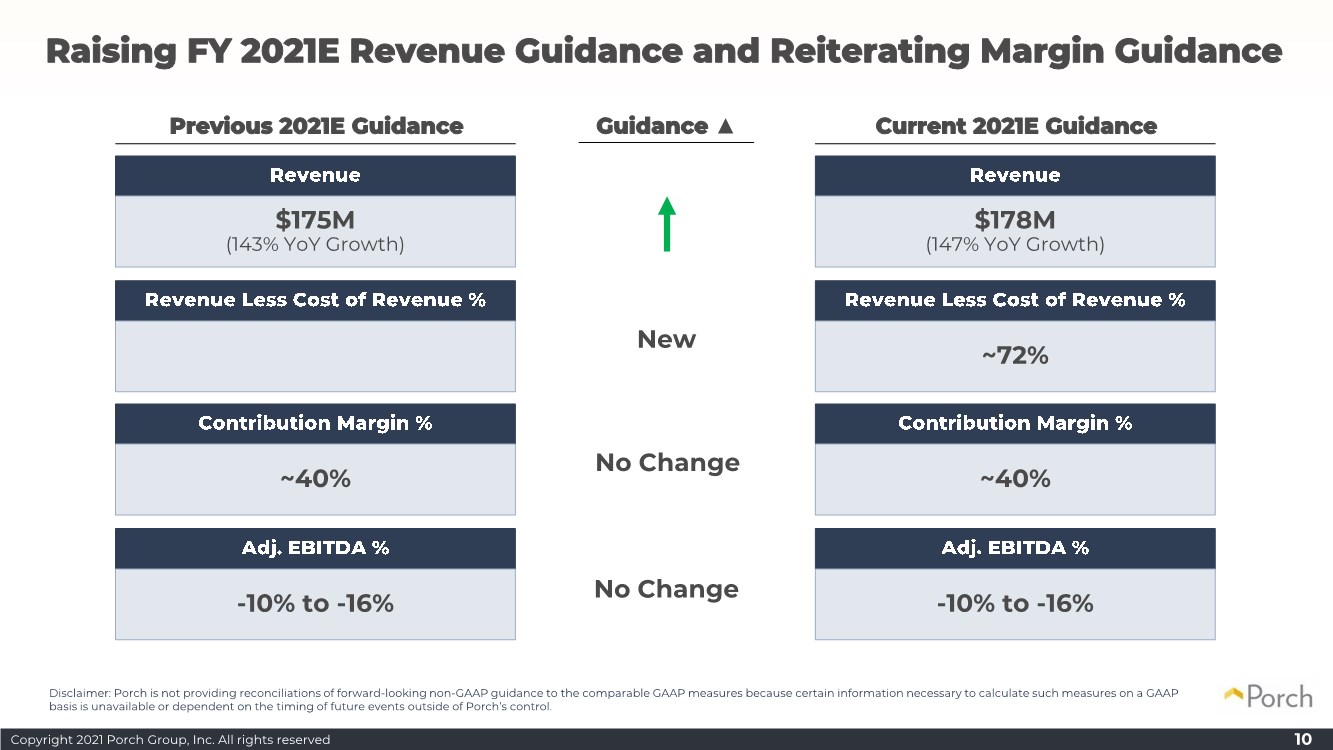

| Copyright 2021 Porch Group, Inc. All rights reserved 10 Raising FY 2021E Revenue Guidance and Reiterating Margin Guidance $175M (143% YoY Growth) ~40% -10% to -16% Previous 2021E Guidance $178M (147% YoY Growth) ~72% ~40% -10% to -16% Current 2021E Guidance Guidance ▲ New No Change No Change Disclaimer: Porch is not providing reconciliations of forward-looking non-GAAP guidance to the comparable GAAP measures because certain information necessary to calculate such measures on a GAAP basis is unavailable or dependent on the timing of future events outside of Porch’s control. |

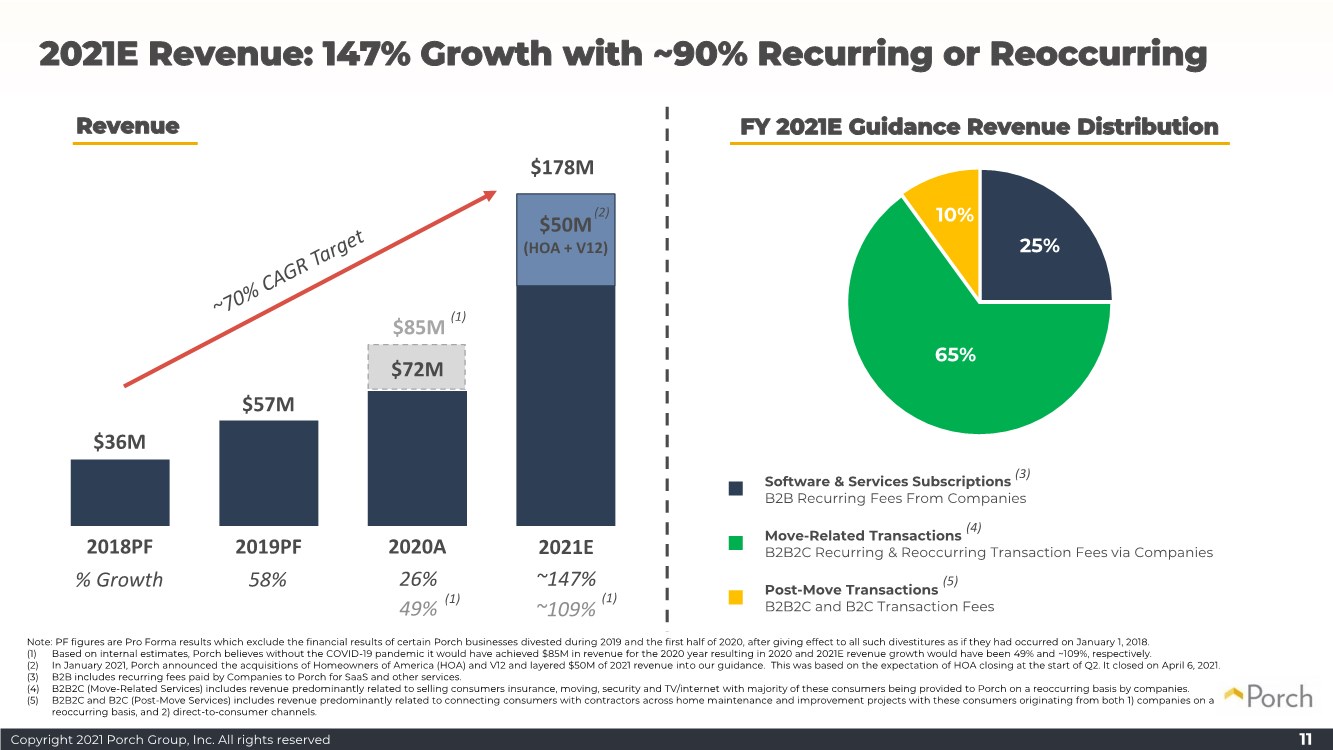

| Copyright 2021 Porch Group, Inc. All rights reserved 25% 65% 10% Note: PF figures are Pro Forma results which exclude the financial results of certain Porch businesses divested during 2019 and the first half of 2020, after giving effect to all such divestitures as if they had occurred on January 1, 2018. (1) Based on internal estimates, Porch believes without the COVID-19 pandemic it would have achieved $85M in revenue for the 2020 year resulting in 2020 and 2021E revenue growth would have been 49% and ~109%, respectively. (2) In January 2021, Porch announced the acquisitions of Homeowners of America (HOA) and V12 and layered $50M of 2021 revenue into our guidance. This was based on the expectation of HOA closing at the start of Q2. It closed on April 6, 2021. (3) B2B includes recurring fees paid by Companies to Porch for SaaS and other services. (4) B2B2C (Move-Related Services) includes revenue predominantly related to selling consumers insurance, moving, security and TV/internet with majority of these consumers being provided to Porch on a reoccurring basis by companies. (5) B2B2C and B2C (Post-Move Services) includes revenue predominantly related to connecting consumers with contractors across home maintenance and improvement projects with these consumers originating from both 1) companies on a reoccurring basis, and 2) direct-to-consumer channels. 11 2021E Revenue: 147% Growth with ~90% Recurring or Reoccurring Revenue 2018PF 2019PF 2020A 2021E $36M $57M $178M % Growth 58% 26% ~147% 49% ~109% (1) (1) Software & Services Subscriptions B2B Recurring Fees From Companies Move-Related Transactions B2B2C Recurring & Reoccurring Transaction Fees via Companies Post-Move Transactions B2B2C and B2C Transaction Fees (3) (4) (5) $72M $85M (1) FY 2021E Guidance Revenue Distribution $50M (HOA + V12) (2) |

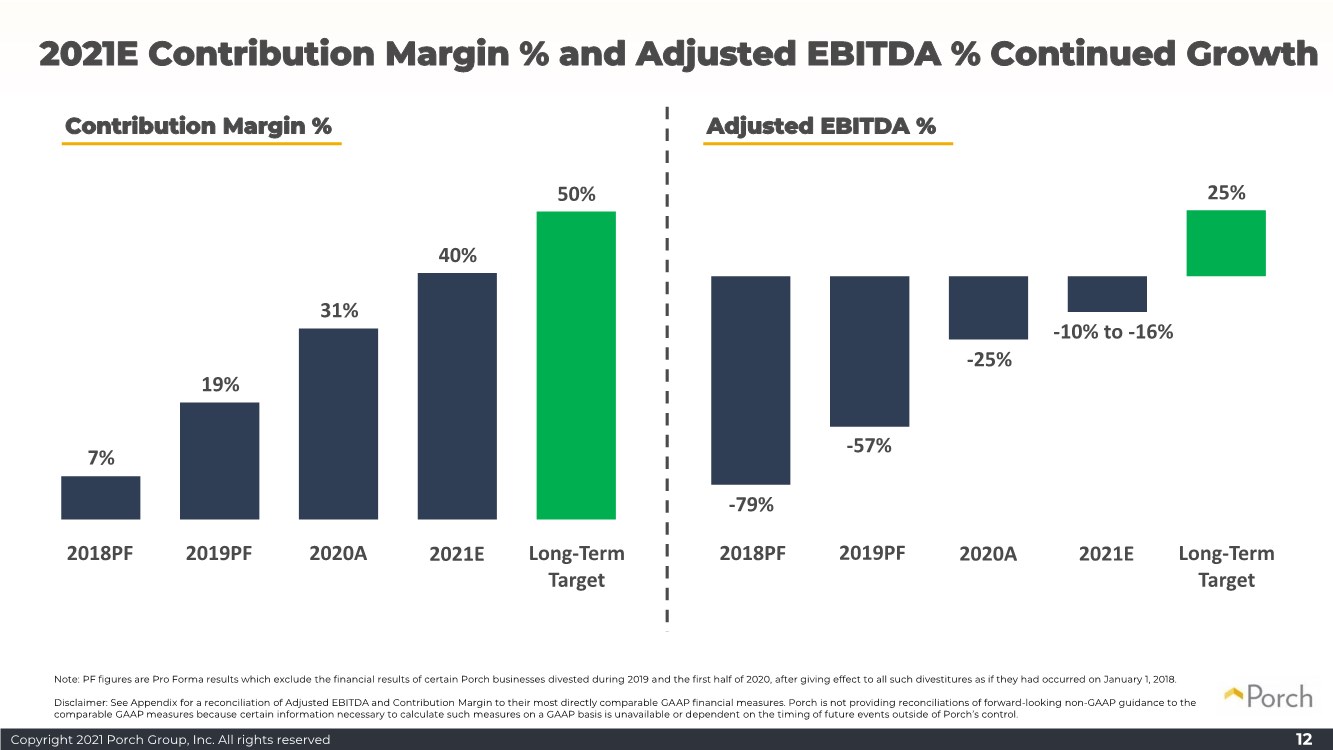

| Copyright 2021 Porch Group, Inc. All rights reserved Note: PF figures are Pro Forma results which exclude the financial results of certain Porch businesses divested during 2019 and the first half of 2020, after giving effect to all such divestitures as if they had occurred on January 1, 2018. Disclaimer: See Appendix for a reconciliation of Adjusted EBITDA and Contribution Margin to their most directly comparable GAAP financial measures. Porch is not providing reconciliations of forward-looking non-GAAP guidance to the comparable GAAP measures because certain information necessary to calculate such measures on a GAAP basis is unavailable or dependent on the timing of future events outside of Porch’s control. 12 2021E Contribution Margin % and Adjusted EBITDA % Continued Growth Contribution Margin % 2018PF 2019PF 2020A 2021E 7% 19% 40% 31% Long-Term Target 50% Adjusted EBITDA % 2018PF 2019PF 2020A 2021E -79% -57% -25% -10% to -16% 25% Long-Term Target |

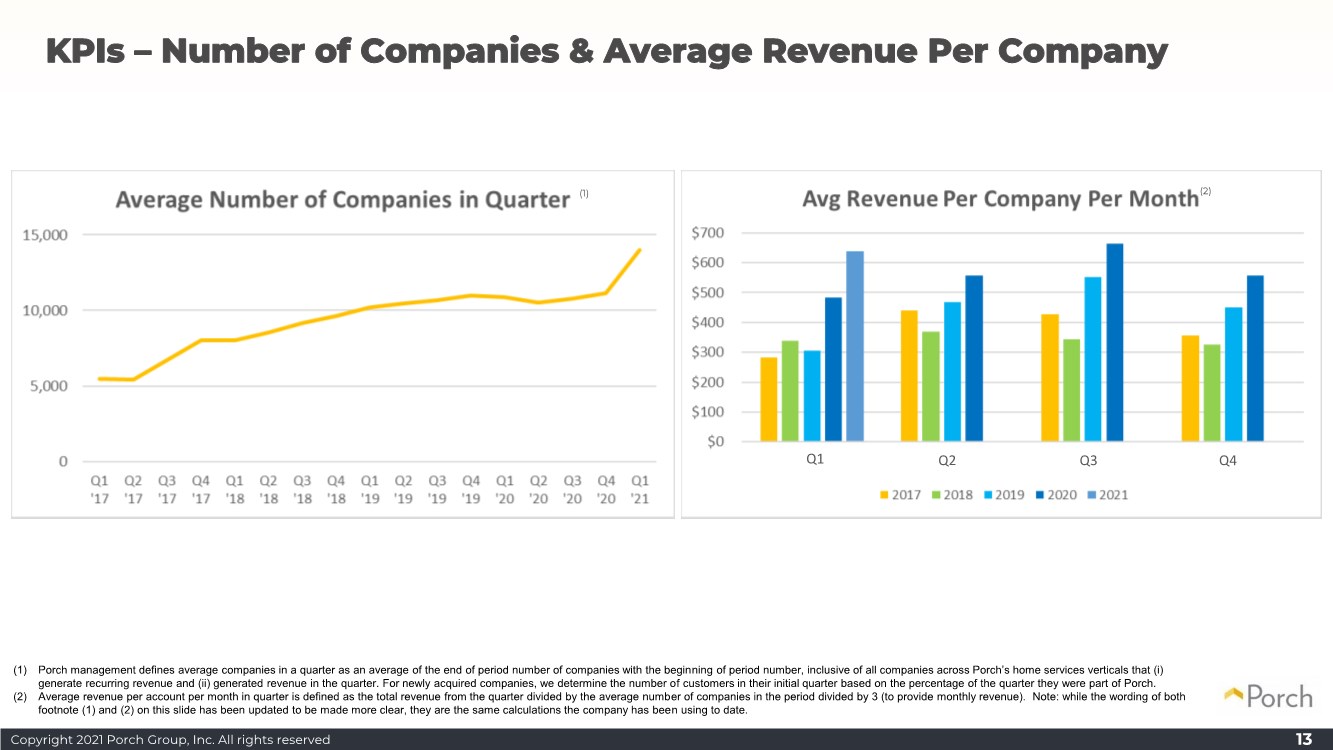

| Copyright 2021 Porch Group, Inc. All rights reserved 13 KPIs – Number of Companies & Average Revenue Per Company (1) Porch management defines average companies in a quarter as an average of the end of period number of companies with the beginning of period number, inclusive of all companies across Porch’s home services verticals that (i) generate recurring revenue and (ii) generated revenue in the quarter. For newly acquired companies, we determine the number of customers in their initial quarter based on the percentage of the quarter they were part of Porch. (2) Average revenue per account per month in quarter is defined as the total revenue from the quarter divided by the average number of companies in the period divided by 3 (to provide monthly revenue). Note: while the wording of both footnote (1) and (2) on this slide has been updated to be made more clear, they are the same calculations the company has been using to date. Q1 Q2 Q3 Q4 (1) (2) |

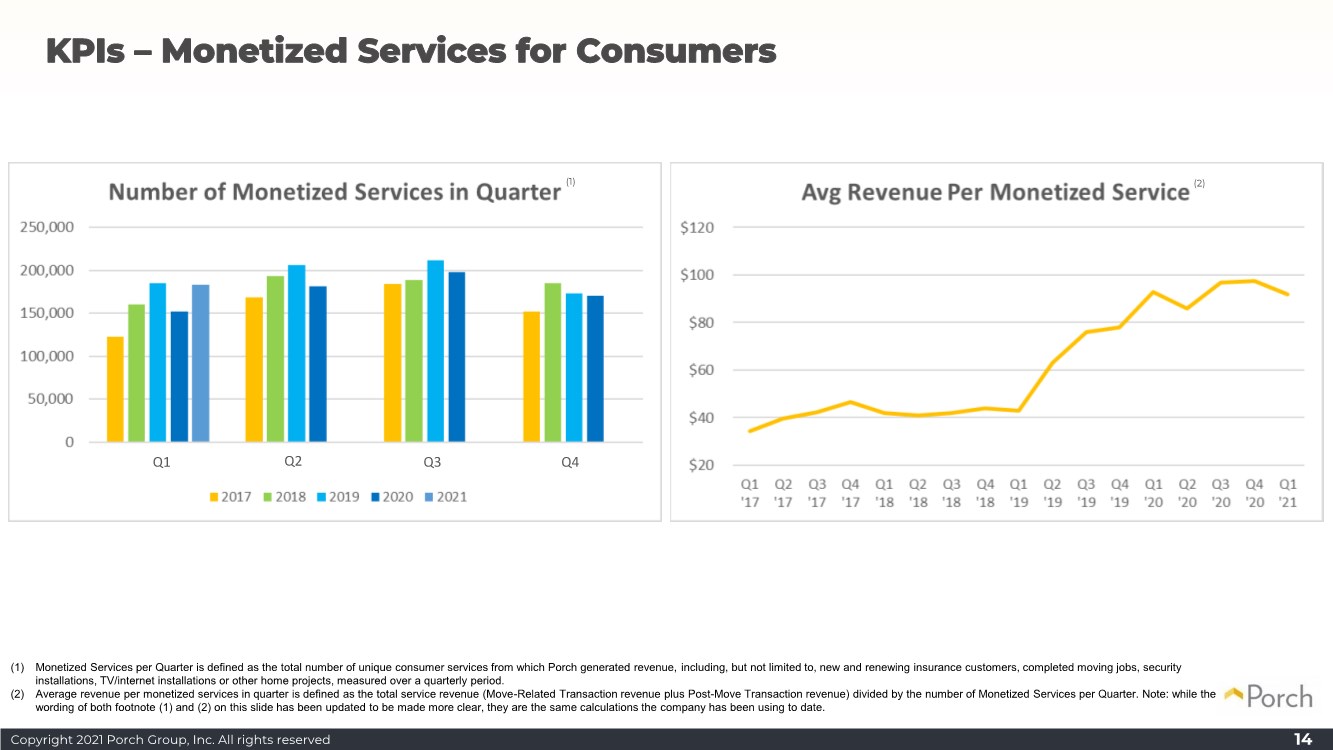

| Copyright 2021 Porch Group, Inc. All rights reserved 14 KPIs – Monetized Services for Consumers (1) Monetized Services per Quarter is defined as the total number of unique consumer services from which Porch generated revenue, including, but not limited to, new and renewing insurance customers, completed moving jobs, security installations, TV/internet installations or other home projects, measured over a quarterly period. (2) Average revenue per monetized services in quarter is defined as the total service revenue (Move-Related Transaction revenue plus Post-Move Transaction revenue) divided by the number of Monetized Services per Quarter. Note: while the wording of both footnote (1) and (2) on this slide has been updated to be made more clear, they are the same calculations the company has been using to date. Q1 Q2 Q3 Q4 (1) (2) |

| Copyright 2021 Porch Group, Inc. All rights reserved 15 Deep Dives Group |

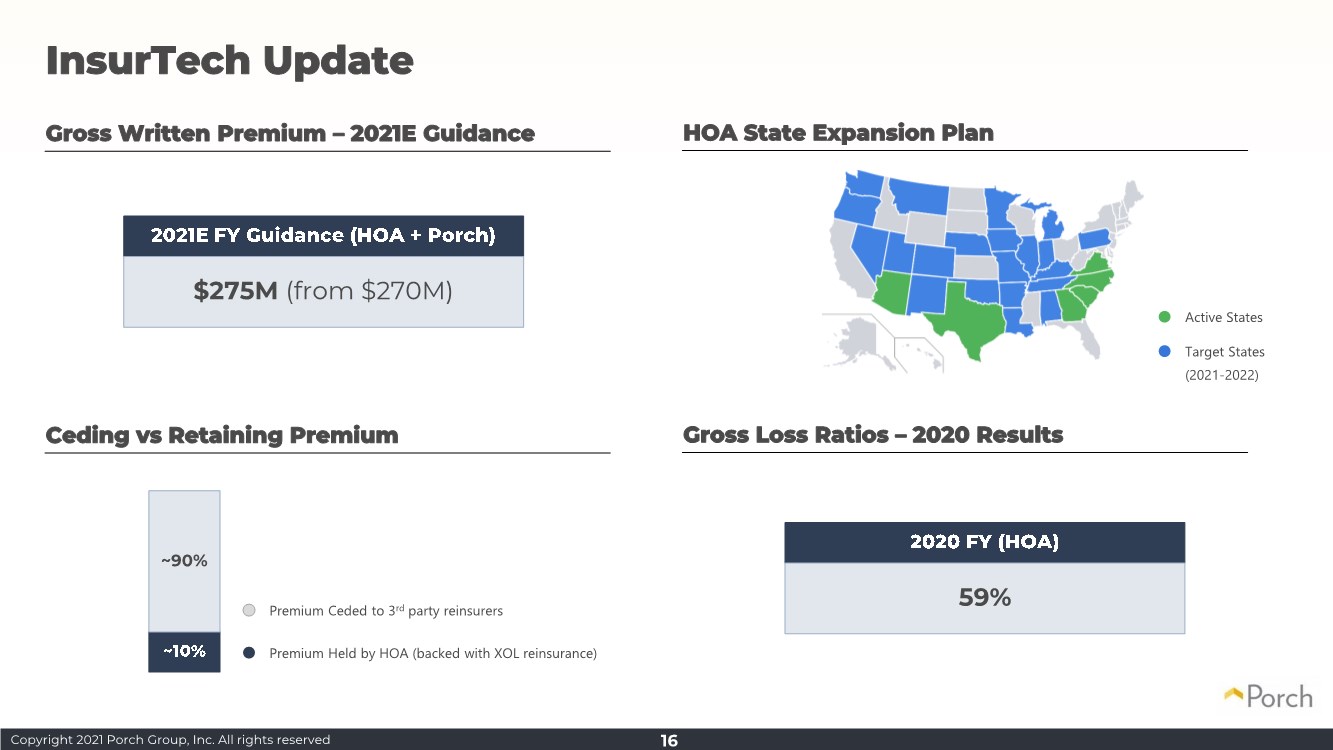

| Copyright 2021 Porch Group, Inc. All rights reserved InsurTech Update Gross Written Premium – 2021E Guidance HOA State Expansion Plan Gross Loss Ratios – 2020 Results Active States Target States (2021-2022) $275M (from $270M) 59% 16 Ceding vs Retaining Premium ~90% Premium Ceded to 3rd party reinsurers Premium Held by HOA (backed with XOL reinsurance) |

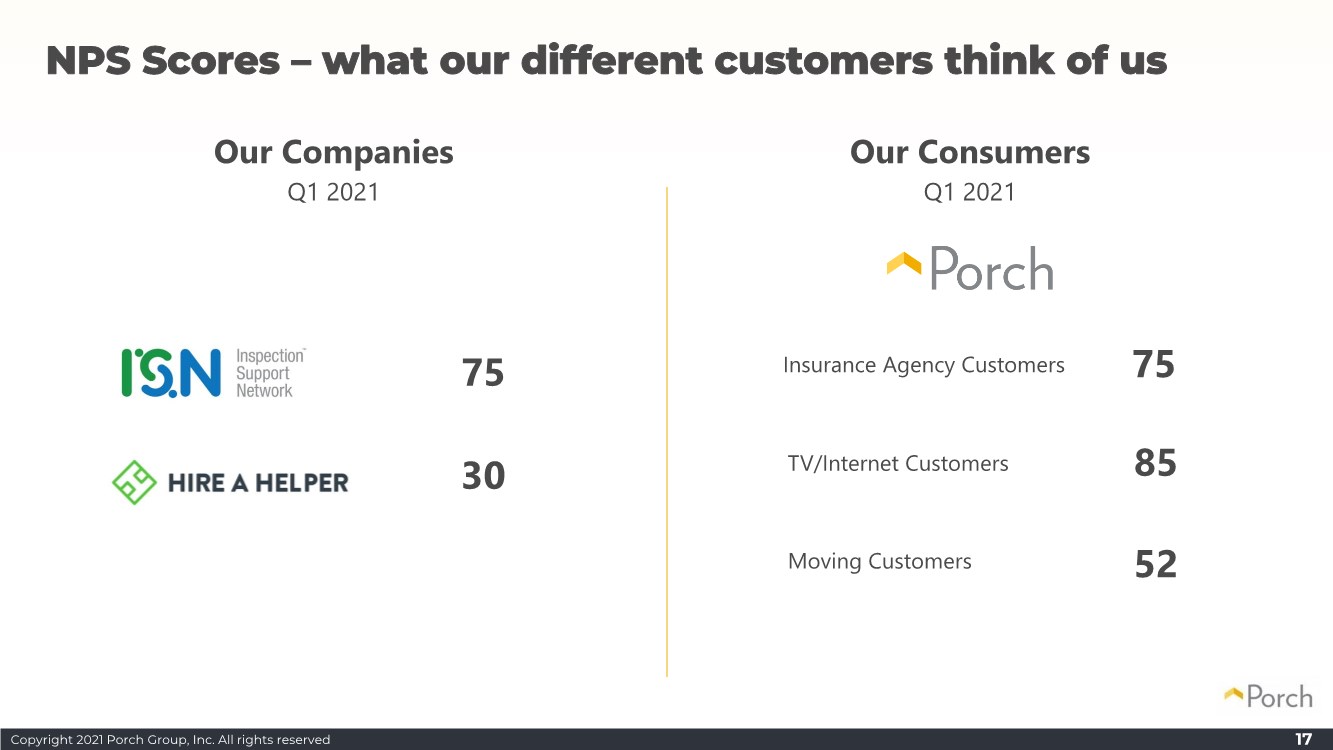

| Copyright 2021 Porch Group, Inc. All rights reserved NPS Scores – what our different customers think of us 17 Our Companies Q1 2021 Our Consumers Q1 2021 75 30 85 TV/Internet Customers Moving Customers 52 Insurance Agency Customers 75 |

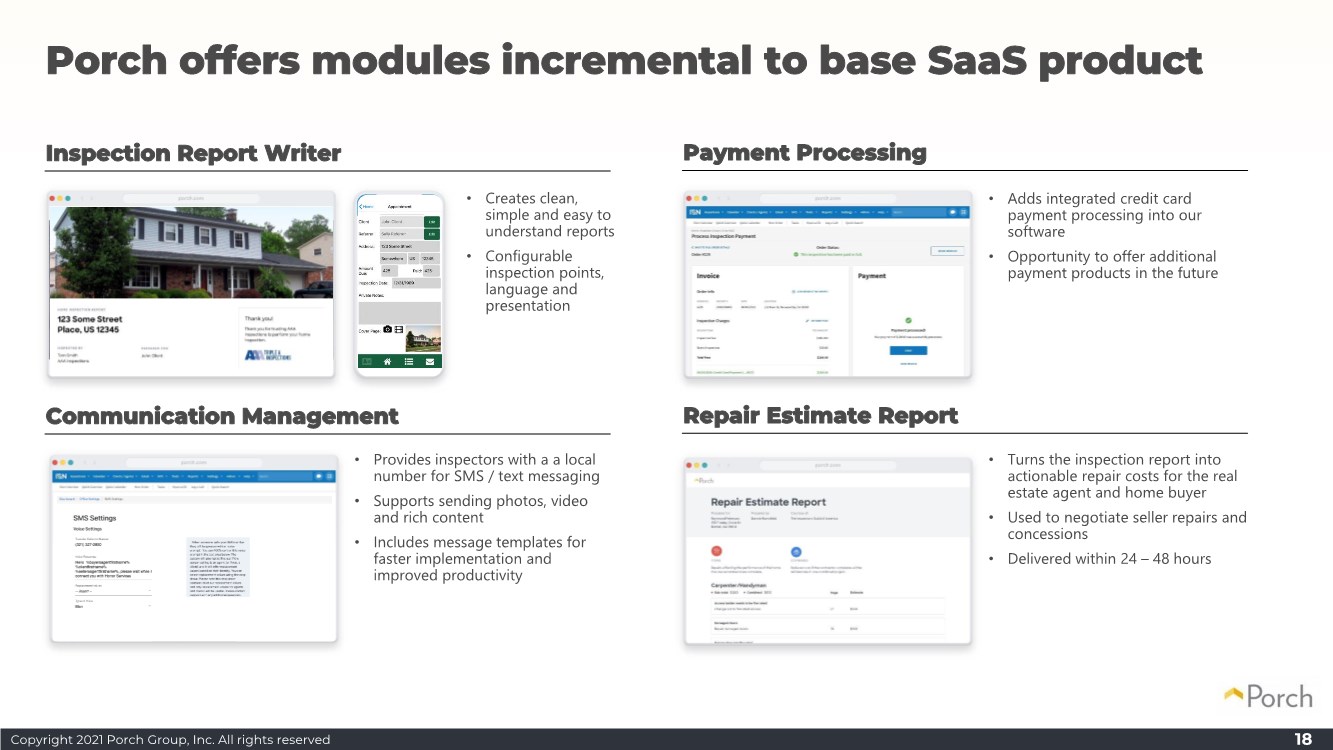

| Copyright 2021 Porch Group, Inc. All rights reserved Porch offers modules incremental to base SaaS product 18 Inspection Report Writer Payment Processing Communication Management Repair Estimate Report • Adds integrated credit card payment processing into our software • Opportunity to offer additional payment products in the future • Turns the inspection report into actionable repair costs for the real estate agent and home buyer • Used to negotiate seller repairs and concessions • Delivered within 24 – 48 hours • Provides inspectors with a a local number for SMS / text messaging • Supports sending photos, video and rich content • Includes message templates for faster implementation and improved productivity • Creates clean, simple and easy to understand reports • Configurable inspection points, language and presentation |

| Copyright 2021 Porch Group, Inc. All rights reserved Product & Technology Investment Areas 19 Vertical Software systems InsurTech Data Platform Consumer Experience • Simplifying the quoting and binding process for consumers • Optimizing pricing based on best data available • Improving the move experience for consumers while increasing conversion rates of services. • Building long-term relationships by helping with moving to improving and everything in between • A best-in-class data platform that brings together data on homeowners and movers, their homes, and the all the projects that have been done. |

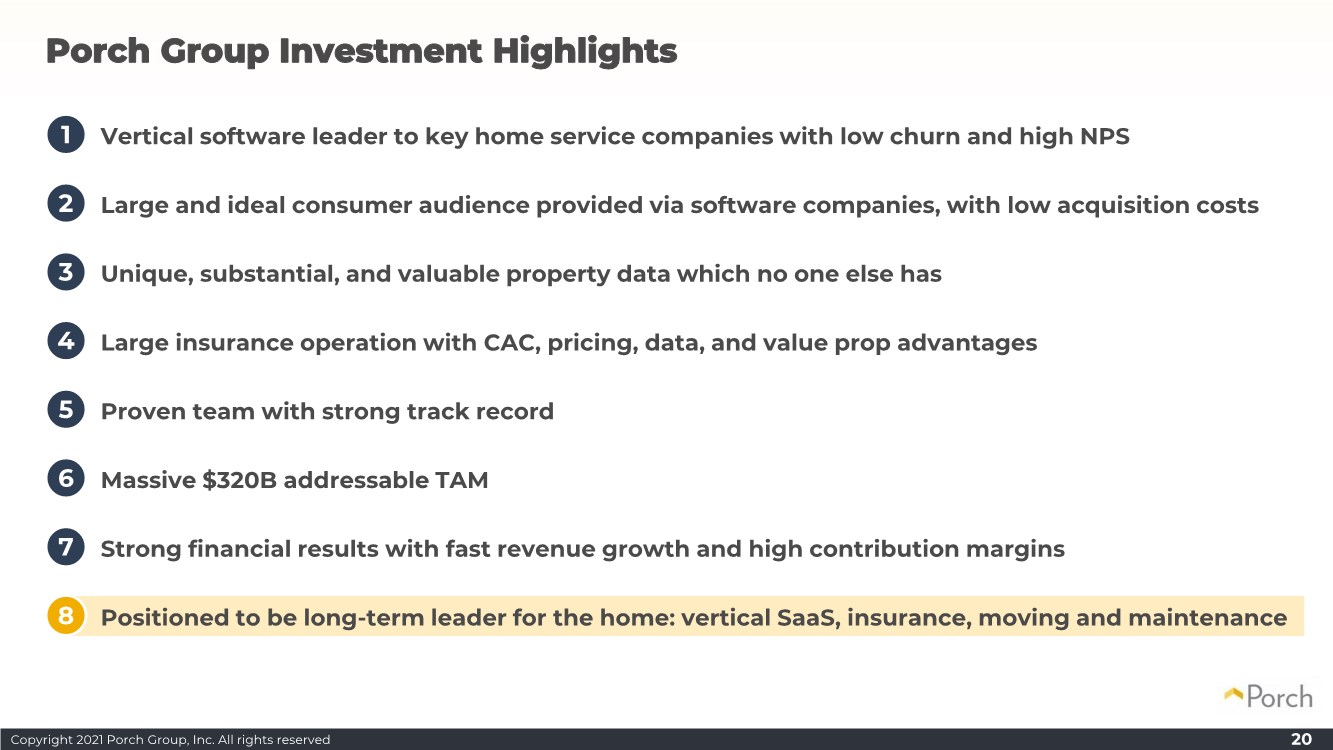

| Copyright 2021 Porch Group, Inc. All rights reserved 20 Porch Group Investment Highlights 1. Vertical software leader to key home service companies with low churn and high NPS 2. Large and ideal consumer audience provided via software companies, with low acquisition costs 3. Unique, substantial, and valuable property data which no one else has 4. Large insurance operation with CAC, pricing, data, and value prop advantages 5. Proven team with strong track record 6. Massive $320B addressable TAM 7. Strong financial results with fast revenue growth and high contribution margins 8. Positioned to be long-term leader for the home: vertical SaaS, insurance, moving and maintenance 1 2 3 4 5 6 7 8 |

| Copyright 2021 Porch Group, Inc. All rights reserved 21 Thank you Group |

| Copyright 2021 Porch Group, Inc. All rights reserved 22 Q&A Group |

| Copyright 2021 Porch Group, Inc. All rights reserved 23 Appendix Group |

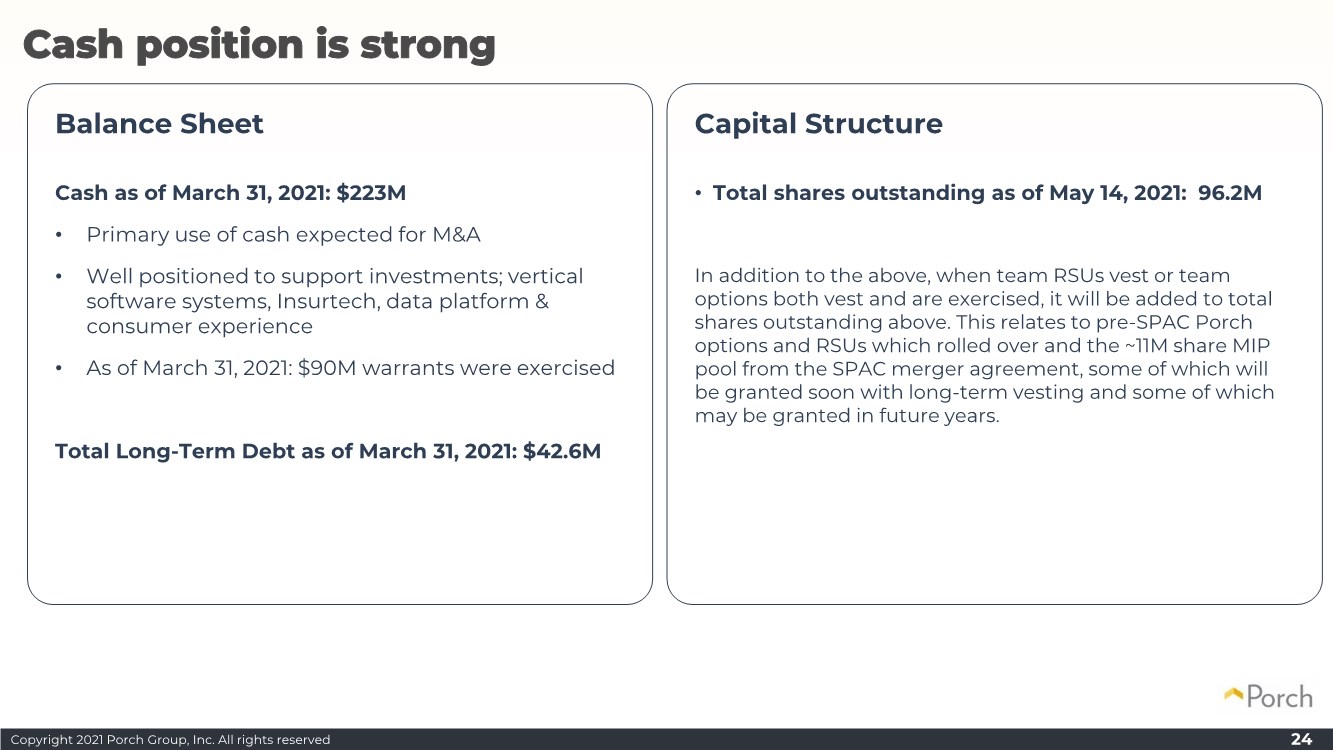

| Copyright 2021 Porch Group, Inc. All rights reserved 24 Balance Sheet Cash as of March 31, 2021: $223M • Primary use of cash expected for M&A • Well positioned to support investments; vertical software systems, Insurtech, data platform & consumer experience • As of March 31, 2021: $90M warrants were exercised Total Long-Term Debt as of March 31, 2021: $42.6M Capital Structure • Total shares outstanding as of May 14, 2021: 96.2M In addition to the above, when team RSUs vest or team options both vest and are exercised, it will be added to total shares outstanding above. This relates to pre-SPAC Porch options and RSUs which rolled over and the ~11M share MIP pool from the SPAC merger agreement, some of which will be granted soon with long-term vesting and some of which may be granted in future years. Cash position is strong |

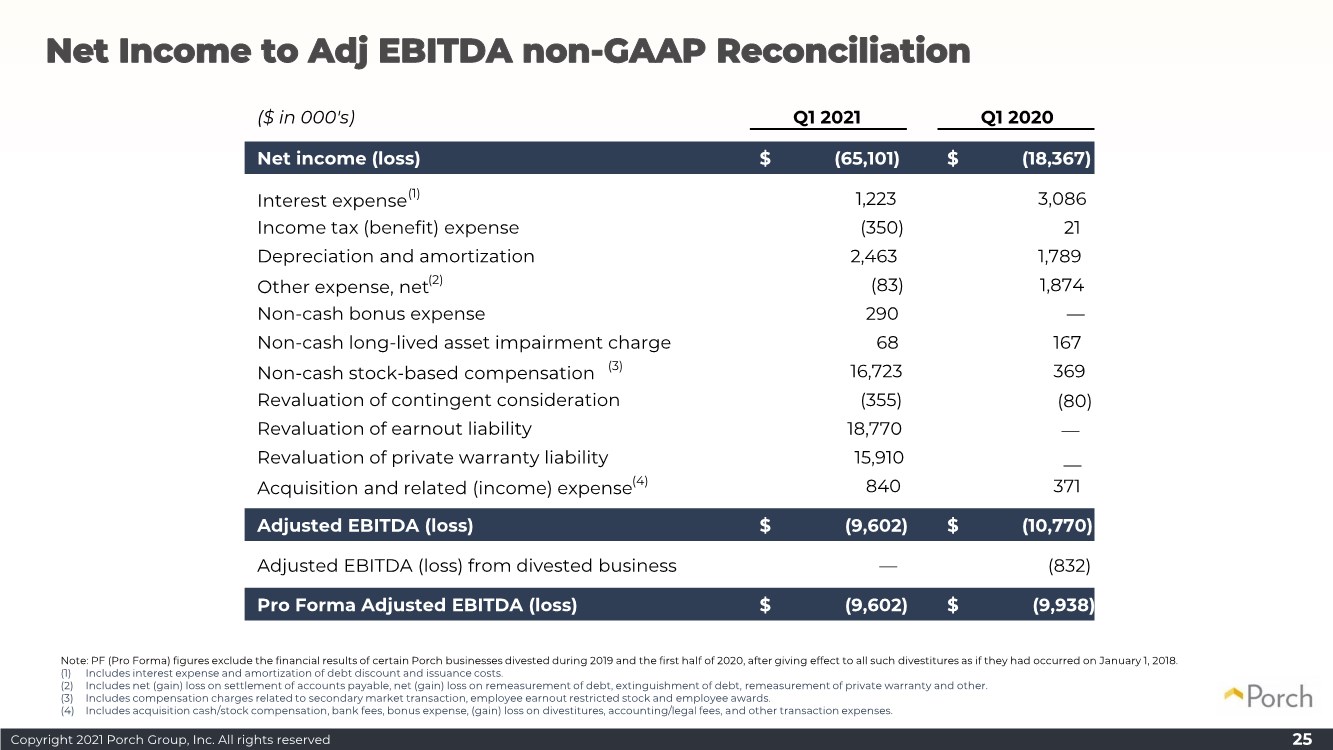

| Copyright 2021 Porch Group, Inc. All rights reserved 25 Net Income to Adj EBITDA non-GAAP Reconciliation Note: PF (Pro Forma) figures exclude the financial results of certain Porch businesses divested during 2019 and the first half of 2020, after giving effect to all such divestitures as if they had occurred on January 1, 2018. (1) Includes interest expense and amortization of debt discount and issuance costs. (2) Includes net (gain) loss on settlement of accounts payable, net (gain) loss on remeasurement of debt, extinguishment of debt, remeasurement of private warranty and other. (3) Includes compensation charges related to secondary market transaction, employee earnout restricted stock and employee awards. (4) Includes acquisition cash/stock compensation, bank fees, bonus expense, (gain) loss on divestitures, accounting/legal fees, and other transaction expenses. ($ in 000's) Q1 2021 Q1 2020 Net income (loss) (65,101) $ (18,367) $ Interest expense(1) 1,223 3,086 Income tax (benefit) expense (350) 21 Depreciation and amortization 2,463 1,789 Other expense, net(2) (83) 1,874 Non-cash bonus expense 290 — Non-cash long-lived asset impairment charge 68 167 Non-cash stock-based compensation (3) 16,723 369 Revaluation of contingent consideration (355) (80) Revaluation of earnout liability 18,770 — Revaluation of private warranty liability 15,910 Acquisition and related (income) expense(4) 840 371 Adjusted EBITDA (loss) (9,602) $ (10,770) $ Adjusted EBITDA (loss) from divested business —(832) Pro Forma Adjusted EBITDA (loss) (9,602) $ (9,938) $ — |

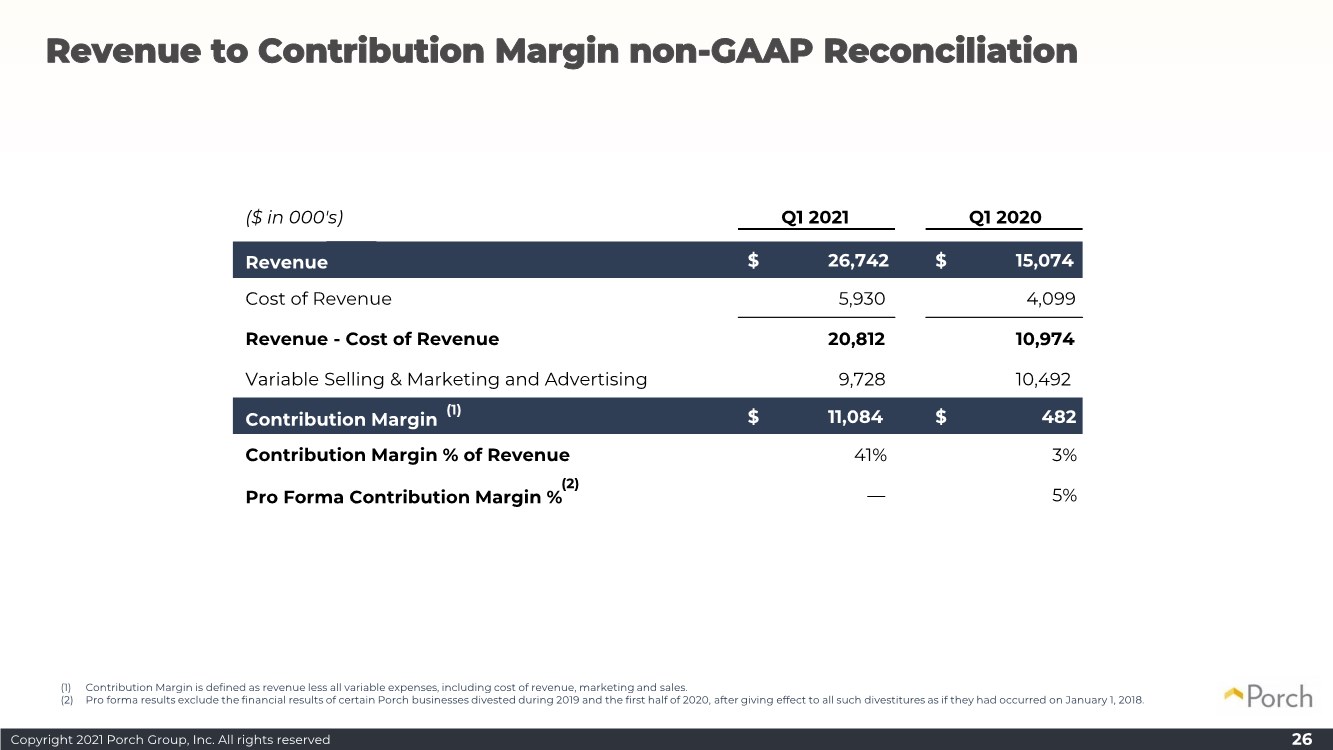

| Copyright 2021 Porch Group, Inc. All rights reserved 26 Revenue to Contribution Margin non-GAAP Reconciliation (1) Contribution Margin is defined as revenue less all variable expenses, including cost of revenue, marketing and sales. (2) Pro forma results exclude the financial results of certain Porch businesses divested during 2019 and the first half of 2020, after giving effect to all such divestitures as if they had occurred on January 1, 2018. ($ in 000's) Q1 2021 Q1 2020 Revenue 26,742 $ 15,074 $ Cost of Revenue 5,930 4,099 Revenue - Cost of Revenue 20,812 10,974 Variable Selling & Marketing and Advertising 9,728 10,492 Contribution Margin (1) 11,084 $ 482 $ Contribution Margin % of Revenue 41% 3% Pro Forma Contribution Margin % (2) — 5% |

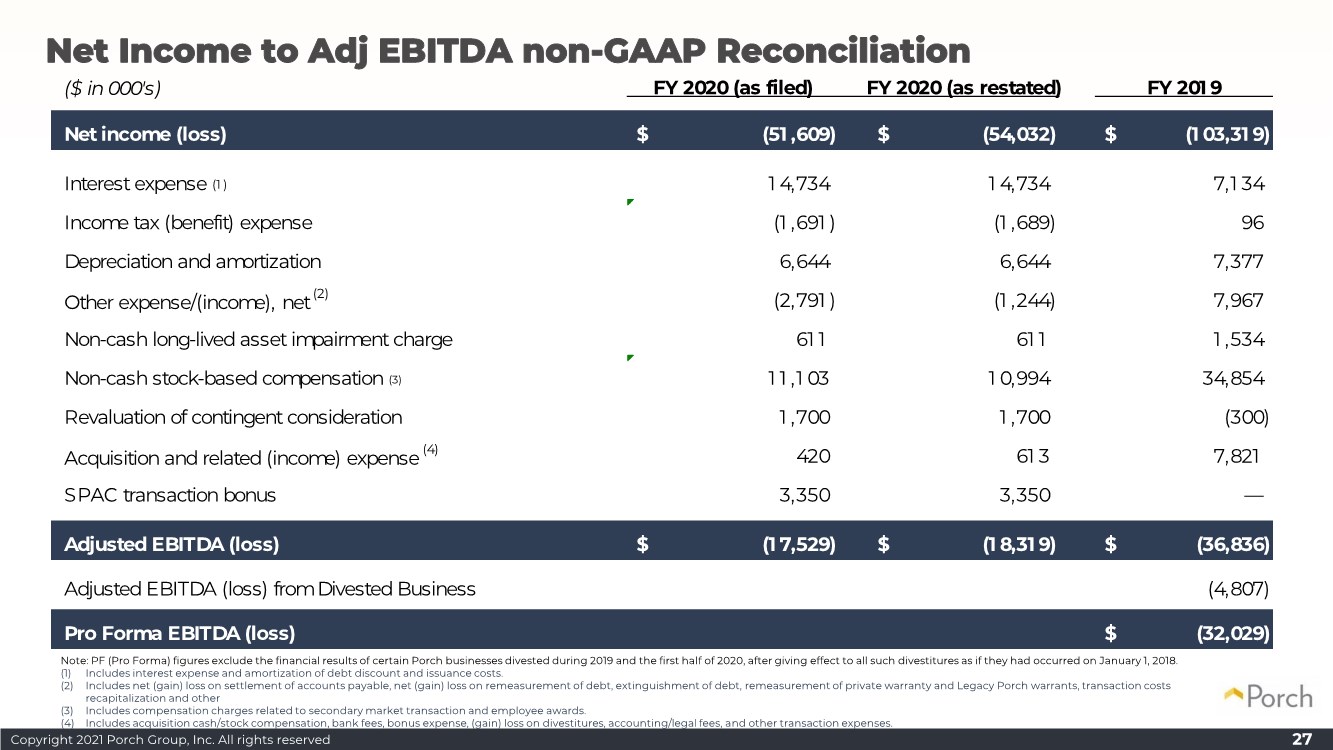

| Copyright 2021 Porch Group, Inc. All rights reserved 27 Net Income to Adj EBITDA non-GAAP Reconciliation Note: PF (Pro Forma) figures exclude the financial results of certain Porch businesses divested during 2019 and the first half of 2020, after giving effect to all such divestitures as if they had occurred on January 1, 2018. (1) Includes interest expense and amortization of debt discount and issuance costs. (2) Includes net (gain) loss on settlement of accounts payable, net (gain) loss on remeasurement of debt, extinguishment of debt, remeasurement of private warranty and Legacy Porch warrants, transaction costs recapitalization and other (3) Includes compensation charges related to secondary market transaction and employee awards. (4) Includes acquisition cash/stock compensation, bank fees, bonus expense, (gain) loss on divestitures, accounting/legal fees, and other transaction expenses. ($ in 000's) FY 2020 (as filed) FY 2020 (as restated) FY 201 9 Net income (loss) (51 ,609) $ (54,032) $ (1 03,31 9) $ Interest expense (1 ) 1 4,734 1 4,734 7,1 34 Income tax (benefit) expense (1 ,691 ) (1 ,689) 96 Depreciation and amortization 6,644 6,644 7,377 Other expense/(income), net (2) (2,791 ) (1 ,244) 7,967 Non-cash long-lived asset impairment charge 61 1 61 1 1 ,534 Non-cash stock-based compensation (3) 1 1 ,1 03 1 0,994 34,854 Revaluation of contingent consideration 1 ,700 1 ,700 (300) Acquisition and related (income) expense (4) 420 61 3 7,821 SPAC transaction bonus 3,350 3,350 — Adjusted EBITDA (loss) (1 7,529) $ (1 8,31 9) $ (36,836) $ Adjusted EBITDA (loss) from Divested Business (4,807) Pro Forma EBITDA (loss) (32,029) $ |

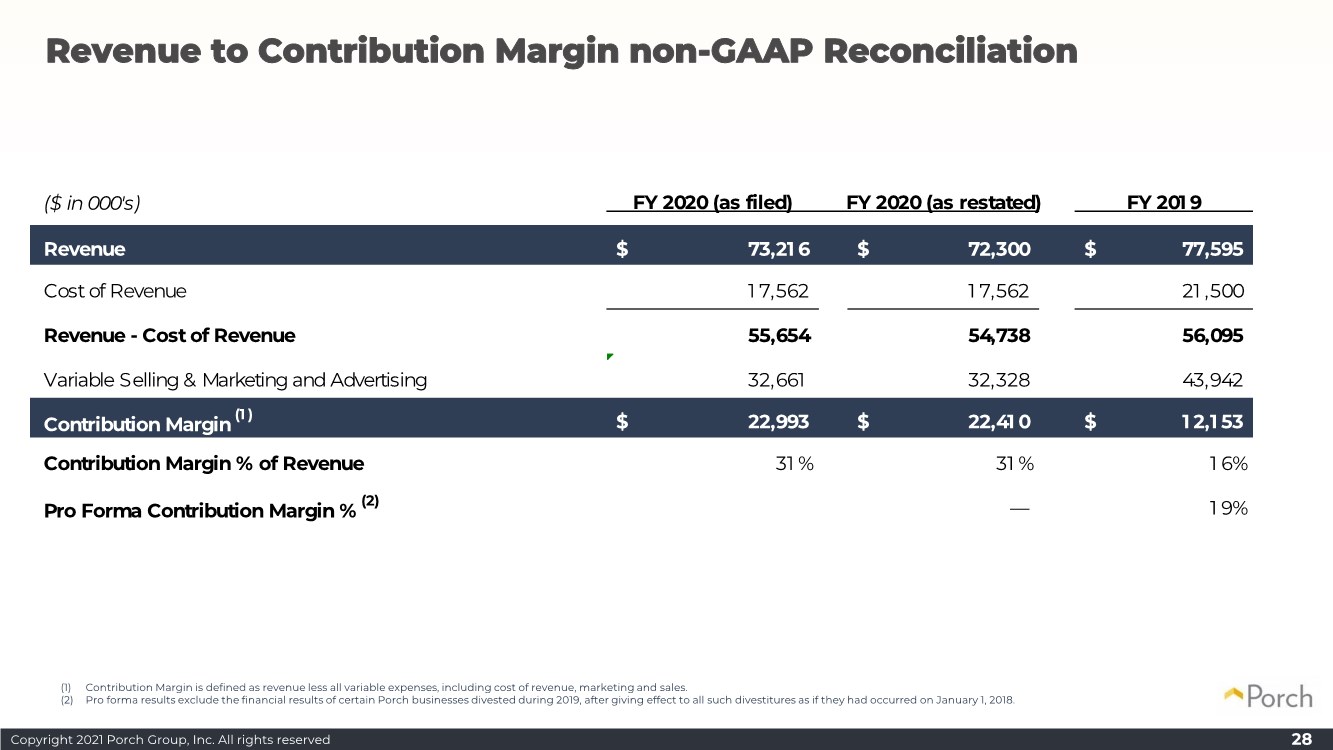

| Copyright 2021 Porch Group, Inc. All rights reserved 28 Revenue to Contribution Margin non-GAAP Reconciliation (1) Contribution Margin is defined as revenue less all variable expenses, including cost of revenue, marketing and sales. (2) Pro forma results exclude the financial results of certain Porch businesses divested during 2019, after giving effect to all such divestitures as if they had occurred on January 1, 2018. ($ in 000's) FY 2020 (as filed) FY 2020 (as restated) FY 201 9 Revenue 73,21 6 $ 72,300 $ 77,595 $ Cost of Revenue 1 7,562 1 7,562 21 ,500 Revenue - Cost of Revenue 55,654 54,738 56,095 Variable Selling & Marketing and Advertising 32,661 32,328 43,942 Contribution Margin (1 ) 22,993 $ 22,410 $ 1 2,1 53 $ Contribution Margin % of Revenue 31 % 31 % 1 6% Pro Forma Contribution Margin % (2) — 1 9% |

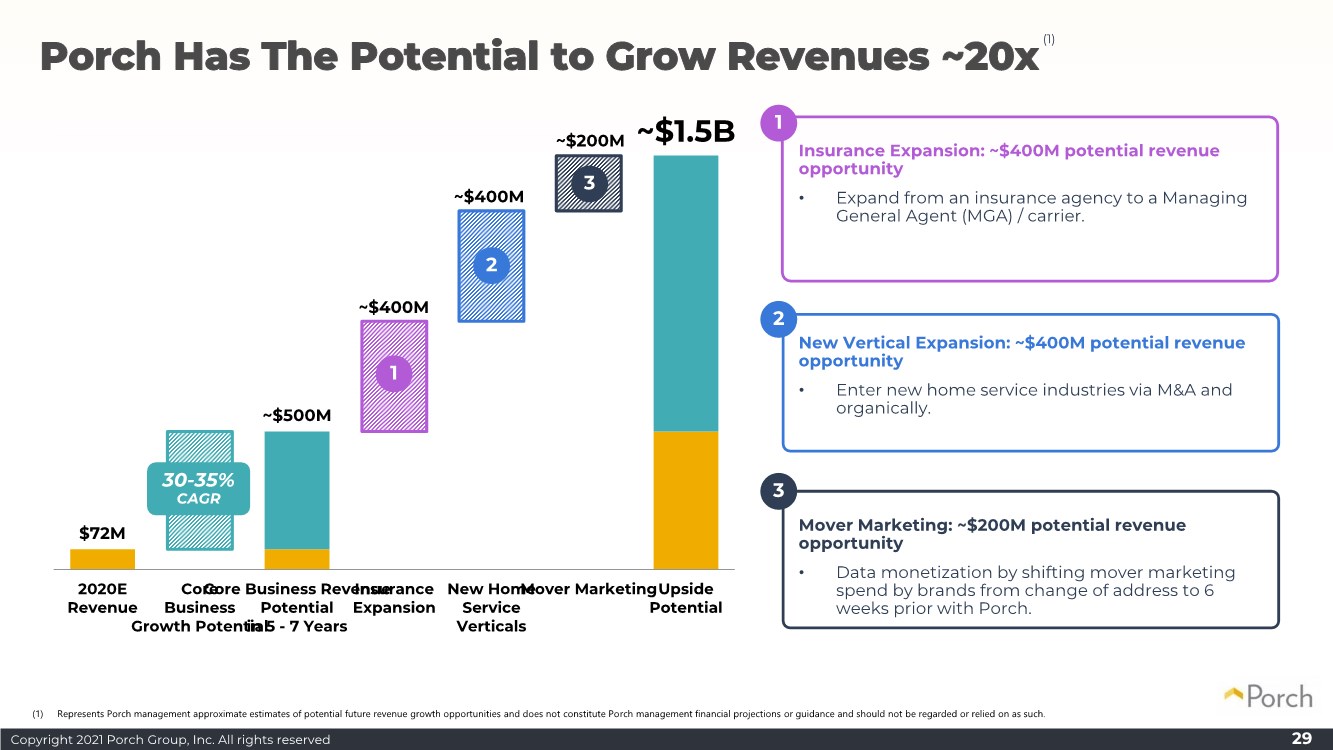

| Copyright 2021 Porch Group, Inc. All rights reserved $72M ~$500M ~$1.5B - $200 $400 $600 $800 $1000 $1200 $1400 $1600 2020E Revenue Core Business Growth Potential Core Business Revenue Potential in 5 - 7 Years Insurance Expansion New Home Service Verticals Mover MarketingUpside Potential ~$400M ~$200M ~$400M Porch Has The Potential to Grow Revenues ~20x 29 Mover Marketing: ~$200M potential revenue opportunity • Data monetization by shifting mover marketing spend by brands from change of address to 6 weeks prior with Porch. 30-35% CAGR New Vertical Expansion: ~$400M potential revenue opportunity • Enter new home service industries via M&A and organically. Insurance Expansion: ~$400M potential revenue opportunity • Expand from an insurance agency to a Managing General Agent (MGA) / carrier. 3 2 1 1 2 3 (1) (1) Represents Porch management approximate estimates of potential future revenue growth opportunities and does not constitute Porch management financial projections or guidance and should not be regarded or relied on as such. |

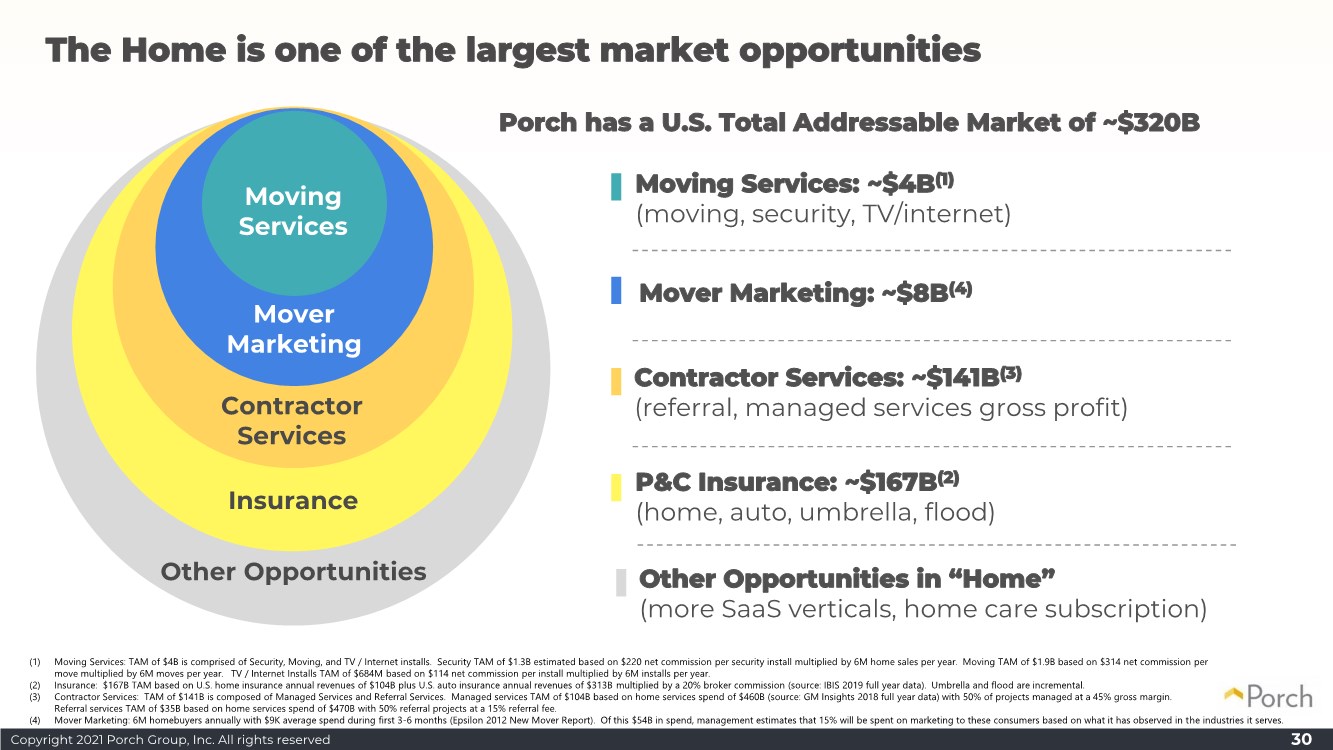

| Copyright 2021 Porch Group, Inc. All rights reserved 30 Contractor Services: ~$141B(3) (referral, managed services gross profit) Contractor Services Moving Services Mover Marketing Moving Services: ~$4B(1) (moving, security, TV/internet) Porch has a U.S. Total Addressable Market of ~$320B The Home is one of the largest market opportunities Other Opportunities Mover Marketing: ~$8B(4) (1) Moving Services: TAM of $4B is comprised of Security, Moving, and TV / Internet installs. Security TAM of $1.3B estimated based on $220 net commission per security install multiplied by 6M home sales per year. Moving TAM of $1.9B based on $314 net commission per move multiplied by 6M moves per year. TV / Internet Installs TAM of $684M based on $114 net commission per install multiplied by 6M installs per year. (2) Insurance: $167B TAM based on U.S. home insurance annual revenues of $104B plus U.S. auto insurance annual revenues of $313B multiplied by a 20% broker commission (source: IBIS 2019 full year data). Umbrella and flood are incremental. (3) Contractor Services: TAM of $141B is composed of Managed Services and Referral Services. Managed services TAM of $104B based on home services spend of $460B (source: GM Insights 2018 full year data) with 50% of projects managed at a 45% gross margin. Referral services TAM of $35B based on home services spend of $470B with 50% referral projects at a 15% referral fee. (4) Mover Marketing: 6M homebuyers annually with $9K average spend during first 3-6 months (Epsilon 2012 New Mover Report). Of this $54B in spend, management estimates that 15% will be spent on marketing to these consumers based on what it has observed in the industries it serves. Other Opportunities in “Home” (more SaaS verticals, home care subscription) Insurance P&C Insurance: ~$167B(2) (home, auto, umbrella, flood) |