Attached files

| file | filename |

|---|---|

| EX-99.2 - PRESS RELEASE ANNOUNCING PROPOSED TRANSACTION - Nuvve Holding Corp. | ea141039ex99-2_nuvveholding.htm |

| EX-99.1 - PRESS RELEASE ANNOUNCING QUARTERLY RESULTS - Nuvve Holding Corp. | ea141039ex99-1_nuvveholding.htm |

| EX-10.3 - REGISTRATION RIGHTS AGREEMENT - Nuvve Holding Corp. | ea141039ex10-3_nuvveholding.htm |

| EX-10.2 - SECURITIES PURCHASE AGREEMENT - Nuvve Holding Corp. | ea141039ex10-2_nuvveholding.htm |

| EX-10.1 - FORM OF WARRANTS - Nuvve Holding Corp. | ea141039ex10-1_nuvveholding.htm |

| 8-K - CURRENT REPORT - Nuvve Holding Corp. | ea141039-8k_nuvveholdingcorp.htm |

Exhibit 99.3

Investor Presentation – May 2021 Q1 2021 Earnings | Announcement of Agreement to Form $750 Million Infrastructure JV

2 Legal Disclaimer This presentation (this “Presentation”) is provided for information purposes only. No representations or warranties, express or implied are given in, or in respect of, this Presentation. To the fullest extent permitted by law in no circumstances will Nuvve Holding Corp. (“Nuvve”) or any it’s respective subsidiaries, stockholders, affiliates, repre sentatives, partners, directors, officers, employees, advisers or agents be responsible or liable for any direct, indirect or consequential loss or loss of profit arising from the use of this Presentation, its conten ts, its omissions, reliance on the information contained within it, or on opinions communicated in relation thereto or otherwise arising in connection therewith. Industry and market data used in this Presentation have been o bta ined from third - party industry publications and sources as well as from research reports prepared for other purposes. Nuvve has noy independently verified the data obtained from these sources and cannot ass ure you of the data’s accuracy or completeness. This data is subject to change. In addition, this Presentation does not purport to be all - inclusive or to contain all of the information that may be required to ma ke a full analysis of Nuvve. Viewers of this Presentation should each make their own evaluation of Nuvve and of the relevance and adequacy of the information and should make such other investigations as they de em necessary. Forward Looking Statements Certain statements included in this Presentation that are not historical facts are forward - looking statements for purposes of th e safe harbor provisions under the United States Private Securities Litigation Reform Act of 1995. Forward - looking statements generally are accompanied by words such as “believe,” “may,” “will,” “estimate,” “continue,” “anticipate,” “intend,” “expect,” “should,” “would,” “plan,” “predict,” “potential,” “seem,” “seek,” “future,” “outlook,” “model,” “target,” “goal,” and similar expressions are intended to identify forward - looking statements, although not all forward - looking statements contain these identifying words. Forward - looking statements include statements regarding estimates and forecasts of other financial and performance metrics and p rojections of market opportunity, as well as any other statements that are not related to present factors or current conditions or that are not purely historical. These statements are based on various assumptions , w hether or not identified in this Presentation, and on the current expectations of Nuvve’s management. These forward - looking statements are provided for illustrative purposes only and are not intended to serve as, and m ust not be relied on by any investor as, a guarantee, an assurance, a prediction or a definitive statement of fact or probability. Actual events and circumstances are difficult or impossible to predict and will dif fer from those expressed or implied by these forward looking statements. Many actual events and circumstances are beyond the control of Nuvve. These forward - looking statements are subject to a number of risks and uncerta inties, including changes in domestic and foreign business, market, financial, political and legal conditions; failure to realize the anticipated benefits of the business combination with Newborn Acquisition Corp.; ri sks relating to the uncertainty of Nuvve’s projected financial information; risks related to the organic and inorganic growth of Nuvve’s business and the timing of expected business milestones; the effects of competiti on on Nuvve’s future business; the ability of Nuvve to obtain any necessary additional financing in the future; and those factors discussed in Nuvve’s final prospectus dated February 16, 2021 under the heading “R isk Factors” and in the other documents filed, or to be filed, by Nuvve with the Securities and Exchange Commission (“SEC”). If any of these risks materialize or Nuvve’s management’s assumptions prove incorrect, actua l r esults could differ materially from the results implied by these forward - looking statements. There may be additional risks that presently are unknown to Nuvve or that Nuvve currently believes are immaterial th at could also cause actual results to differ from those contained in the forward - looking statements. In addition, forward - looking statements reflect Nuvve’s expectations, plans or forecasts of future events and views as of the date of this Presentation. Nuvve anticipates that subsequent events and developments will cause Nuvve’s assessments to change. However, while Nuvve may elect to update these forward - looking statements at some point in the future, Nuvve specifically disclaim any obligation to do so, except as required by law. These forward - looking statements should not be relied upon as representing Nuvve’s assessments as of any date subsequent to the date of this Presentation. Accordingly, undue reliance should not be placed upon the forward - looking statements. SM1

3 Legal Disclaimer (Cont’d) Use of Projections This Presentation contains projected financial information with respect to Nuvve. Such projected financial information consti tut es forward - looking information, and is for illustrative purposes only and should not be relied upon as necessarily being indicative of future results. The assumptions and estimates underlying such financial foreca st information are inherently uncertain and are subject to a wide variety of significant business, economic, competitive and other risks and uncertainties. See “Forward - Looking Statements” above. Actual results may di ffer materially from the results contemplated by the financial forecast information contained in this Presentation, and the inclusion of such information in this Presentation should not be regarded as a repres ent ation by any person that the results reflected in such forecasts will be achieved. Non - GAAP Financial Measures Some of the financial information and data contained in this Presentation has not been prepared in accordance with United Sta tes generally accepted accounting principles (“GAAP”). NBAC and Nuvve believe that the use of these non - GAAP financial measures provides an additional tool for investors to use in evaluating historical or projected operating results and trends in and in comparing Nuvve’s financial measures with other similar companies, many of which present similar non - GAAP financial measures to investors. Management does not consider these no n - GAAP measures in isolation or as an alternative to financial measures determined in accordance with GAAP. The principal limitation of these non - GAAP financial measures is that they exclude significa nt expenses and revenue that are required by GAAP to be recorded in Nuvve’s financial statements. In addition, they are subject to inherent limitations as they reflect the exercise of judgments by management abo ut which expense and revenue items are excluded or included in determining these non - GAAP financial measures. In order to compensate for these limitations, management presents historical non - GAAP financial measure s in connection with GAAP results. You should review Nuvve’s audited financial statements, which are included in Nuvve’s SEC filings. Trademarks This presentation contains trademarks, service marks, trade names and copyrights of NBAC, Nuvve Holding Corp. and other companies, which are the property of their respective owners. © 2021 Nuvve Holding Corp. All Rights Reserved. SM2

4 Introductions & Presenters Gregory Poilasne, PhD Co - Founder, Chairman & CEO Ted Smith President, COO, and Director David Robson Chief Financial Officer Who We Are Nasdaq: “NVVE” Completed IPO and began trading March 23, 2021 Leader in proprietary vehicle - to - grid (“V2G”) technology Founded in 2010 , patented technology under development since 1996 © 2021 Nuvve Holding Corp. All Rights Reserved.

5 Why Nuvve? Opportunity to capitalize on a transformational megatrend Differentiated and proprietary technology Highly experienced team Compelling turnkey offering ESG (Environmental, Social, Governance) multiplier © 2021 Nuvve Holding Corp. All Rights Reserved.

6 The transition to electric mobility is among the largest macroeconomic shifts in our lifetime and an opportunity to accelerate solutions to climate change OUR MISSION Lower the cost of electric vehicle ownership while supporting the integration of renewable energy for a scalable and sustainable green society © 2021 Nuvve Holding Corp. All Rights Reserved.

7 Source: EPA 2018. Greenhouse gas emissions from transportation sources include carbon dioxide (CO2), methane (CH4), nitrous o xid e (N2O), and various hydrofluorocarbons (HFCs). U.S. GHG Emissions by Sector U.S. Transportation Sector GHG Emissions by Source 28% 27% 22% 10% 7% 6% Transportation Electricity Industry Agriculture Commercial Residential 59% 23% 9% 5% 2% 1% Light-Duty Vehicles Medium- and Heavy-Duty Trucks Aircraft Other Rail Ships and Boats Road Vehicles ~23% of U.S. GHG Emissions © 2021 Nuvve Holding Corp. All Rights Reserved.

8 0 100 200 300 400 500 600 2015 2020 2025 2030 2035 2040 Source: Bloomberg New Energy Finance: Electric Vehicle Outlook 2020, does not include two - wheelers. Various newspapers. (1) US D epartment of Energy, forecast through 2050. (2) Global grid investment requirement implied based upon grid upgrade costs per EV added to the California vehicle fleet implied by SCE “Reimagining the Grid” Dec. 2020 whitepaper. Global Electric Vehicle Sales Rising Rapidly (in millions) 27.5 % CAGR 40% Increase in Power Demand (1) $2.0T Required Grid Investment (2) Projected to Create To Meet Increased Power Demand EVs Help Solve GHG Problem but Create Another © 2021 Nuvve Holding Corp. All Rights Reserved.

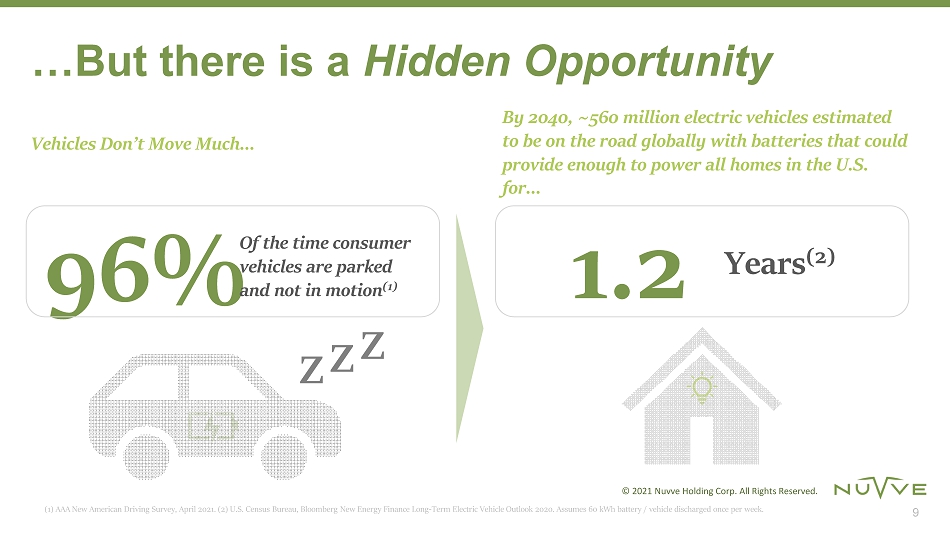

9 (1) AAA New American Driving Survey, April 2021. (2) U.S. Census Bureau, Bloomberg New Energy Finance Long - Term Electric Vehicle Outlook 2020. Assumes 60 kWh battery / vehicle discharged once per week. Z Z Z 96% Of the time consumer vehicles are parked and not in motion (1) Years (2) 1.2 Vehicles Don’t Move Much… By 2040, ~560 million electric vehicles estimated to be on the road globally with batteries that could provide enough to power all homes in the U.S. for… …But there is a Hidden Opportunity © 2021 Nuvve Holding Corp. All Rights Reserved.

10 WE TURN s INTO POWER PLANTS © 2021 Nuvve Holding Corp. All Rights Reserved.

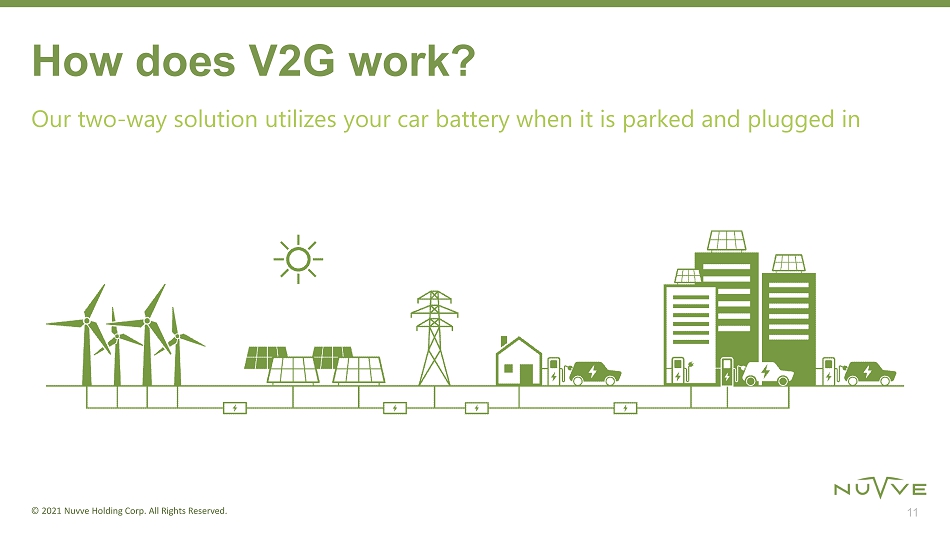

11 How does V2G work? Our two - way solution utilizes your car battery when it is parked and plugged in © 2021 Nuvve Holding Corp. All Rights Reserved.

12 Nuvve Turns EVs into Power Plants © 2021 Nuvve Holding Corp. All Rights Reserved. Grid Load kW kW kW kW MW

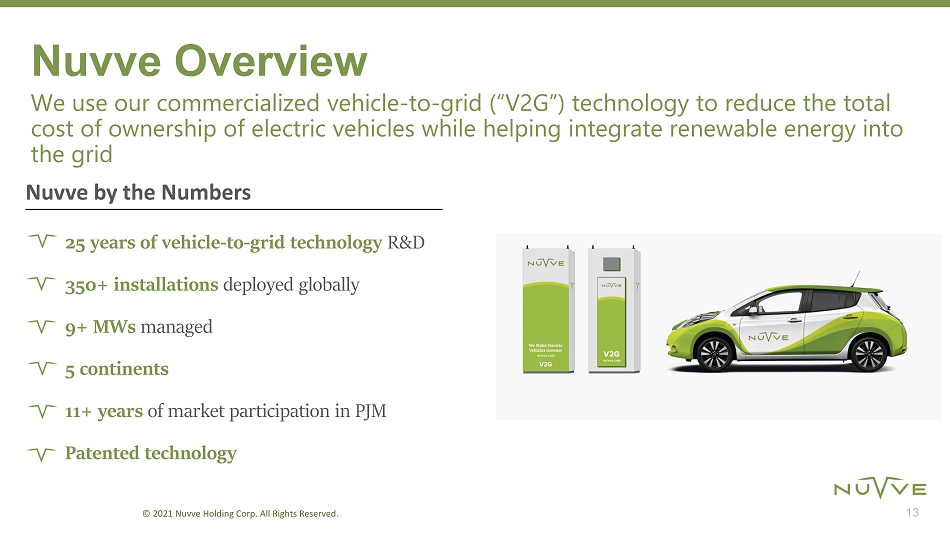

13 25 years of vehicle - to - grid technology R&D 350+ installations deployed globally 9+ MWs managed 5 continents 11+ years of market participation in PJM Patented technology Nuvve Overview We use our commercialized vehicle - to - grid (“V2G”) technology to reduce the total cost of ownership of electric vehicles while helping integrate renewable energy into the grid Nuvve by the Numbers © 2021 Nuvve Holding Corp. All Rights Reserved.

14 Accelerate EV penetration by monetizing increased utilization Improve grid resiliency with virtual power plants Accelerate renewables penetration 1 2 3 MAJOR BENEFITS OF NUVVE V2G © 2021 Nuvve Holding Corp. All Rights Reserved.

15 U.S. Only School Bus Fleet ~480,000 buses TAM: ~$96B Postal Service Fleet ~225,000 vehicles TAM: ~$27B Military Fleet ~170,000 vehicles TAM: ~$17B Mass Transit ~160,000 vehicles TAM: ~$36B Fleet Total Addressable Market: ~$176B+ | Passenger Vehicle Total Addressable Market: ~$6.4T Immediate Market Opportunity for V2G Our initial focus is on large fleets Sources: New York School Bus Contractors Association, U.S. Postal Service, American Public Transit Association, other public rec ords. TAM figures assume an average approximate cost per electric vehicle type. © 2021 Nuvve Holding Corp. All Rights Reserved.

16 Why School Buses? Largest mass transit fleet in the U.S. Consistent route - based transport with known energy needs Parked and unused most of the time 95%+ diesel today – bad for student and driver health and the planet Reduction of ~88mm tons of carbon emissions with the electrification of the entire U.S. school bus fleet (1) – equivalent to planting ~108 million acres of trees Source: EPA. (1) Assumes 12 - year asset life.

17 School Bus Electrification Gaining Momentum © 2021 Nuvve Holding Corp. All Rights Reserved.

18 Challenges with Electrifying School Buses Today Cost High upfront cost of purchasing an electric school bus is currently cost - prohibitive Complexity Managing the transition to a fleet of electric school buses requires specialized expertise Unique Needs Each school district requires a customized solution © 2021 Nuvve Holding Corp. All Rights Reserved.

19 While Levo will pursue electric vehicle fleet electrification solutions broadly, initially the company is focusing upon electrification of the school bus market in the United States Upon closing, Stonepeak is planning to commit up to $750 million structured as preferred equity in Levo; Nuvve will receive 51% of Levo’s common equity with Stonepeak retaining 44.1% and Evolve retaining 4.9% common equity In connection with the proposed transaction, Nuvve granted 6mm warrants to Stonepeak & Evolve at various strike prices ranging from $10 - 40/share and each has been granted the right to purchase 5mm shares in Nuvve at $50/share (1) The joint venture would be entered into between Nuvve and investment vehicles managed by Stonepeak Partners LP, and Evolv e T ransition Infrastructure LP (SNMP, “Evolve”). (2) 49% includes Evolve. For further details regarding our announced agreement, please refer to our press release and 8 - K SEC filings. There can be no guarantee that a closi ng will be consummated, and no guarantee that terms will remain consistent with those described herein if consummated. On May 17, 2021, Nuvve announced plans to pursue formation of a joint venture with Stonepeak Infrastructure Partners (“Stonep eak ”) (1) – Upon closing, Stonepeak will initially commit up to $750 million as 8% Preferred Equity (with an ability to upsize over time) to d epl oy fleet vehicles (including school buses) and charging infrastructure utilizing Nuvve’s proprietary V2G technology $750 MILLION Levo Mobility – Joint Venture Transaction Details Transportation & Charging as - a - Service with Large - Scale, Charging Hubs + Infrastructure PROPRIETARY V2G TECHNOLOGY Sustainable Infrastructure Assets + Fully - integrated Charging Solutions Upon closing, Levo Mobility plans to offer customers flexible options including 100% fully financed vehicle & charging infrastructure solutions with Nuvve V2G 51% Common Equity Ownership 49% Common Equity Ownership (2) 8% PREFERRED EQUITY 2011 Founded in ~$33B AUM Team 116 Invests in Long - Lived Hard Assets in Energy Transition, Transportation & Communications Sectors Upon closing, Stonepeak plans to provide up to a $750 million commitment to form a joint venture called Levo Mobility (“Levo”) Nuvve & Stonepeak Announce “ Levo ” $750MM INFRASTRUCTURE EXPERIENCE + CAPITAL Preferred Equity V2G Infrastructure Investor

20 Customized maintenance solutions to suit customer needs Levo plans to provide a turnkey zero - emission electric vehicle offering to customers Your vehicle is ready to go when you need it Flexible financing solution eliminating up - front capital cost for vehicles and related infrastructure Our vehicle - to - grid technology harnesses your battery when you’re not using it Fully equipped electric vehicle fleet Easy - to - access tools to monitor and manage fleet charging and performance Electric Vehicle Turnkey Charging Solutions Maintenance V2G Technology 100% Financing Seamless Customer Experience V2G Levo’s Transportation - as - a - Service © 2021 Nuvve Holding Corp. All Rights Reserved.

21 Enabling Increased Penetration of Renewables “Energy Equity ” Distributed Solution Higher Asset Utilization Increasing Power Grid Resiliency and Reducing Required Grid Investment to Integrate Electric Vehicles The ESG (Environmental, Social, Governance) Multiplier © 2021 Nuvve Holding Corp. All Rights Reserved.

22 Vehicle - to - Grid Barcelona, Spain Newark, Delaware Manila, Philippines CDG Airport, Paris Windhoek, Namibia Nagoya, Japan Culver City, CA London, UK UCSD, San Diego CA El Cajon, San Diego CA Torrance, CA Nice, France Frederiksberg, Denmark Corsica, France EVS32 Lyon, France San Jose, CA Bornholm, Denmark