Attached files

| file | filename |

|---|---|

| 8-K - 8-K - ROVER GROUP, INC. | d175082d8k.htm |

Exhibit 99.1

Rover Reports First Quarter 2021 Financial Results

| • | Recent Data Shows Signs of Rapid Acceleration and Post-Pandemic Recovery |

| • | Strong Q1 Gross Bookings Value of $65 million |

| • | Q1 New Bookings of ~102,000 at $7 Average Customer Acquisition Cost |

| • | March Gross Bookings Value increased 67% Year-Over-Year |

SEATTLE, WA – May 17, 2021 – A Place for Rover, Inc. (“Rover” or the “Company”), the world’s largest online marketplace for pet care, today announced financial results for the first quarter ended March 31, 2021.

“We are pleased with our first quarter results and are very encouraged by recent data and the signs we are seeing in the market,” said Rover co-founder and CEO, Aaron Easterly. “In the first quarter and continuing into May, we have seen an uptick in both Gross Bookings Value (GBV) and bookings as COVID vaccines roll out. We believe Rover is well positioned to capture the resurgence in pet care demand as people resume traveling and return to work.”

First Quarter 2021 Financial Highlights:

(Unless otherwise noted, all comparisons are relative to the first quarter of 2020):

| • | Total revenue of $12.2 million, compared to $17.0 million. |

| • | Total bookings of ~643,000, compared to ~925,000. During the last week of March 2021, Rover had its highest volume week of new bookings since the week prior to Christmas 2019, and significantly more new bookings than any week in 2020. |

| • | Customer Acquisition Cost (CAC) of $7, compared to $39 on new bookings of ~102,000, compared to ~109,000. |

| • | GBV of $64.7 million, compared to $86.8 million. |

| • | GAAP net income/(loss) of ($10.6) million, compared to ($20.5) million. |

| • | Adjusted EBITDA of ($4.4) million, compared to ($12.3) million. |

First Quarter 2021 Business Highlights:

| • | For all bookings, California, Florida, New York and Texas are up 45%, 42%, 44% and 69% respectively month-over-month from February to March 2021. Historically, the seasonal trend has been a ~20% increase during the same timeframe. Rover expects the exact rate of recovery to continue to vary by locale. |

| • | Stay length for overnight services began to return to historical seasonal norms: the average stay length in the first quarter of 2021 and 2019 was ~4 nights. |

| • | Requests for services are being made further in advance: the median lead time for pet care requests in March 2021 was up ~15% over March 2019. |

| • | The “pandemic puppy” boom is a real phenomenon: of all new pet profiles added on Rover, the percentage of puppies is up 38% over the first quarter 2019. |

| • | Existing Rover pet parents added ~30% more puppies to their profiles than they did in the first quarter of 2019. |

| • | New customer daycare bookings for puppies was up 64% over the first quarter of 2019, a historic high. |

| • | On February 10, 2021, Rover entered into a definitive business combination agreement with Nebula Caravel Acquisition Corp. (Nasdaq: NEBC) (“Caravel”). Caravel is a publicly traded special purpose acquisition company sponsored by True Wind Capital. The transaction values Rover at an enterprise value of approximately $1.350 billion. |

“In the first quarter, we improved Adjusted EBITDA 64% year-over-year as we leveraged our organic customer acquisition efforts and streamlined cost structure,” said Rover CFO, Tracy Knox. “Looking ahead, consistent with our operating plan for the year, we plan to drive growth with targeted and increased investments in marketing as we capitalize on the expanded market opportunity and influx of new pet parents. The improvements in our booking trends over the past few weeks, including April, combined with our more efficient cost structure gives us confidence in delivering our full year targets.”

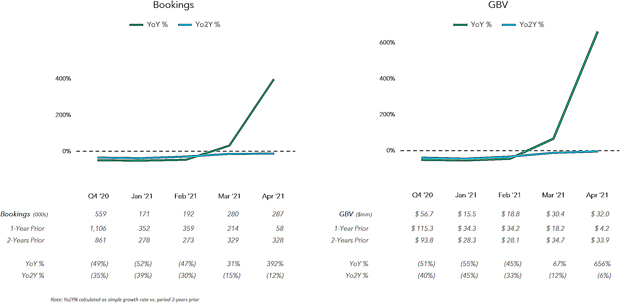

600% 400% 400% 200% 200% 0% 0% Q4 ‘20 559 1,106 861 (49%) (35%) Jan ‘21 171 352 278 (52%) (39%) Feb ‘21 192 359 273 (47%) (30%) Mar ‘21 280 214 329 31% (15%) Bookings (000s) 1-Year Prior 2-Years Prior YOY % Yo2Y % Apr 21 287 58 328 392% (12%) $ GBV (Smm) 1-Year Prior 2-Years Prior YoY % YoZY % 200% 04 20 $ 56.7 $115.3 $93.8 (51%) (40%) Jan ‘21 $15.5 $34.3 $28.3 (55%) (45%) Feb ‘21 $ 18.8 $34.2 $ 28.1 (45%) (33%) Mar ‘21 $ 30.4 $18.2 $ 34.7 67% (12%) GBV ($mm) 1-Year Prior 2-Years Prior YOY % Yo2Y % Apr 21 $ 32.0 $4.2 $33.9 656% (6%)

Growth in GBV represents increasing activity on our platform from repeat and new pet parents and may differ slightly from bookings growth depending on the mix of daytime and overnight services for each period.

About Rover

Founded in 2011 and based in Seattle, Rover is the world’s largest online marketplace for pet care. Rover connects pet parents with pet care providers who offer overnight services, including boarding and in-home pet sitting, as well as daytime services, including doggy daycare, dog walking, drop-in visits, and grooming. Millions of pet parents have booked a service on Rover, with more than 500,000 pet care providers across North America and Europe.

About True Wind Capital

True Wind Capital is a San Francisco-based private equity firm focused on investing in leading technology companies. True Wind has a broad investing mandate, with deep industry expertise across software, data analytics, tech-enabled services, internet, financial technology, and hardware. Rover will be True Wind’s 8th platform investment.

About Nebula Caravel Acquisition Corp.

Caravel (Nasdaq: NEBC) is a blank check company sponsored by True Wind and led by Adam H. Clammer and James H. Greene, Jr., who serve as Chief Executive Officer and Chairman, respectively, formed for the purpose of partnering with one high-quality technology business. Caravel follows Nebula Acquisition Corporation’s successful merger with Open Lending in June 2020.

Important Information and Where to Find It

This press release relates to the proposed merger involving Caravel Rover. Caravel has filed a Registration Statement on Form S-4 with the SEC, which includes a proxy statement and prospectus of Caravel and an information statement of Rover, and each party will file other documents with the SEC regarding the proposed transaction. A definitive proxy statement/prospectus/information statement will also be sent to the stockholders of Caravel and Rover, seeking any required stockholder approvals. Before making any voting or investment decision, investors and securityholders of Caravel and Rover are urged to carefully read the entire registration statement and proxy statement/prospectus/information statement, when they become available, and any other relevant documents filed with the SEC, as well as any amendments or supplements to these documents, because they will contain important information about the proposed transaction. The documents filed by Caravel with the SEC may be obtained free of charge at the SEC’s website at www.sec.gov. Alternatively, these documents, when available, can be obtained free of charge from Caravel upon written request to Nebula Caravel Acquisition Corp., Four Embarcadero Center, Suite 2100, San Francisco, California 94111.

Participants in the Solicitation

Caravel, Rover and certain of their respective directors and executive officers may be deemed to be participants in the solicitation of proxies from the stockholders of Caravel, in favor of the approval of the merger. Information regarding Caravel’s directors and executive officers is contained in the section of Caravel’s Registration Statement on Form S-4 titled “Information About Carvel”, which was filed with the SEC on March 29, 2021. Additional information regarding the interests of those participants and other persons who may be deemed participants in the transaction may be obtained by reading the registration statement and the proxy statement/prospectus/information statement and other relevant documents filed with the SEC when they become available. Free copies of these documents may be obtained as described in the preceding paragraph.

No Offer or Solicitation

This press release does not constitute a solicitation of a proxy, consent or authorization with respect to any securities or in respect of the proposed transaction. This press release also does not constitute an offer to sell or the solicitation of an offer to buy any securities or a solicitation of any vote or approval, nor will there be any sale of any securities in any state or jurisdiction in which such offer, solicitation or sale would be unlawful prior to registration or qualification under the securities laws of such other jurisdiction. No offering of securities will be made except by means of a prospectus meeting the requirements of section 10 of the Securities Act of 1933, as amended, or an exemption therefrom.

Forward Looking Statements

This press release contains forward-looking statements within the meaning of the Private Securities Litigation Reform Act of 1995 including, but not limited to, Caravel’s and Rover’s expectations or predictions of future financial or business performance or conditions. Forward-looking statements are inherently subject to risks, uncertainties and assumptions. Generally, statements that are not historical facts, including statements concerning possible or assumed future actions, business strategies, events or results of operations, are forward-looking statements. These statements may be preceded by, followed by or include the words “believes,” “estimates,” “expects,” “projects,” “forecasts,” “may,” “will,” “should,” “seeks,” “plans,” “scheduled,” “anticipates” or “intends” or similar expressions, and include statements regarding COVID recovery, changes in travel and working behavior and the impact on Rover’s business and operating results as well as the closing of the business combination between Caravel and Rover. Such forward-looking statements involve risks and uncertainties that may cause actual events, results or performance to differ materially from those indicated by such statements. Certain of these risks are identified and discussed in the section of Caravel’s Registration Statement Form S-4 titled “Risk Factors” which was filed with the SEC on March 29, 2021. These risk factors will be important to consider in determining future results and should be reviewed in their entirety. These forward-looking statements are based on Caravel’s or Rover’s management’s current expectations and beliefs, as well as a number of assumptions concerning future events. However, there can be no assurance that the events, results or trends identified in these forward-looking statements will occur or be achieved. Forward-looking statements speak only as of the date they are made, and neither Caravel nor Rover is under any obligation, and expressly disclaim any obligation, to update, alter or otherwise revise any forward-looking statement, whether as a result of new information, future events or otherwise, except as required by law. Readers should carefully review the statements set forth in the reports, which Caravel has filed or will file from time to time with the SEC.

In addition to factors previously disclosed in Caravel’s reports filed with the SEC and those identified elsewhere in this press release, the following factors, among others, could cause actual results to differ materially from forward-looking statements or historical performance: risks and uncertainties related to the inability of the parties to successfully or timely consummate the merger, including the risk that any required regulatory approvals or stockholder approvals of Caravel or Rover are not obtained, are delayed or are subject to unanticipated conditions that could adversely affect the combined company or the expected benefits of the merger is not obtained, failure to realize the anticipated benefits of the merger, risks related to Rover’s ability to execute on its business strategy, attract and retain users, develop new offerings, enhance existing offerings, compete effectively, and manage growth and costs, the duration and global impact of COVID-19, the number of redemption requests made by Caravel’s public stockholders, the ability of the combined company to meet Nasdaq’s listing standards (or the standards of any other securities exchange on which securities of the public entity are listed) following the merger, the inability to complete the private placement of common stock of Caravel to certain institutional accredited investors, the risk that the announcement and consummation of the transactions disrupts Rover’s current plans and operations, costs related to the transactions, the outcome of any legal proceedings that may be instituted against Caravel, Rover, or any of their respective directors or officers, regarding the proposed transaction, the ability of Caravel’s or the combined company to issue equity or equity-linked securities in connection with the proposed business combination or in the future, the failure to realize anticipated pro forma results and underlying assumptions, including with respect to estimated stockholder redemptions and purchase price and other adjustments; and those factors discussed in documents of Caravel filed, or to be filed, with SEC.

Additional factors that could cause actual results to differ materially from those expressed or implied in forward-looking statements can be found in Caravel’s most recent filings with the SEC which are available, free of charge, at the SEC’s website at www.sec.gov, and in the Registration Statement on Form S-4 and Caravel’s proxy statement/prospectus/information statement when available.

This press release is not intended to be all-inclusive or to contain all the information that a person may desire in considering an investment in Caravel and is not intended to form the basis of an investment decision in Caravel. All subsequent written and oral forward-looking statements concerning Caravel and Rover, the proposed transaction or other matters and attributable to Caravel and Rover or any person acting on their behalf are expressly qualified in their entirety by the cautionary statements above.

Definitions

| • | Adjusted EBITDA is defined as net loss excluding depreciation and amortization, stock-based compensation expense, income tax expense or benefit, interest expense, interest income, other income (expense), net, and non-routine items such as restructuring, impairment, and certain acquisition costs. |

| • | A booking is defined as a single arrangement, prior to cancellation, between a pet parent and pet care provider, which can be for a single night or multiple nights for our overnight services, or for a single walk/day/drop-in/groom or multiple walks/days/drop-ins for our daytime services. New bookings is defined as the total number of first-time bookings that new users, which Rover refers to as pet parents, book on our platform in a period. Repeat bookings are defined as the total number of bookings from pet parents who have had a previous booking on Rover. |

| • | CAC for any period is defined as advertising expenses less brand, content and marketing tools divided by in period new bookings. |

| • | Gross Booking Value, or GBV, represents the dollar value of bookings on our platform in a period and is inclusive of pet care provider earnings, service fees, add-ons, taxes and alterations that occurred during that period. |

| • | Please refer to Caravel’s registration statement on Form S-4 filed with the SEC on March 29, 2021 for definitions of Adjusted EBITDA, a non-GAAP metric, and GBV, total bookings, new bookings. |

| A Place for Rover, Inc. Key Business Metrics |

Three Months Ended March 31, |

|||||||

| (unaudited) | 2020 | 2021 | ||||||

| (bookings in thousands) (GBV in millions) |

||||||||

| Bookings: |

||||||||

| New bookings |

109 | 102 | ||||||

| Repeat bookings |

816 | 541 | ||||||

| Total bookings |

925 | 643 | ||||||

|

|

|

|

|

|||||

| GBV |

$ | 86.8 | $ | 64.7 | ||||

|

|

|

|

|

|||||

GAAP Financial Statements

A Place for Rover, Inc.

Balance Sheet

(unaudited)

| December 31, | March 31, | |||||||

| 2020 | 2021 | |||||||

| (in thousands) | ||||||||

| Assets |

||||||||

| Current assets |

||||||||

| Cash and cash equivalents |

$ | 80,848 | $ | 81,833 | ||||

| Accounts receivable, net |

2,992 | 6,878 | ||||||

| Prepaid expenses and other current assets |

3,629 | 5,973 | ||||||

|

|

|

|

|

|||||

| Total current assets |

87,469 | 94,684 | ||||||

| Property and equipment, net |

24,923 | 23,835 | ||||||

| Operating lease right-of-use assets |

— | 22,363 | ||||||

| Intangible assets, net |

7,967 | 7,064 | ||||||

| Goodwill |

33,159 | 33,159 | ||||||

| Deferred tax asset, net |

1,235 | 1,228 | ||||||

| Other noncurrent assets |

134 | 97 | ||||||

|

|

|

|

|

|||||

| Total assets |

$ | 154,887 | $ | 182,430 | ||||

|

|

|

|

|

|||||

| Liabilities, Redeemable Convertible Preferred Stock and Stockholders’ Deficit |

||||||||

| Current liabilities |

||||||||

| Accounts payable |

$ | 1,301 | $ | 1,633 | ||||

| Accrued compensation and related expenses |

3,269 | 4,039 | ||||||

| Accrued expenses and other current liabilities |

2,747 | 5,397 | ||||||

| Deferred revenue |

751 | 3,378 | ||||||

| Pet parent deposits |

7,931 | 14,754 | ||||||

| Pet service provider liabilities |

6,140 | 6,435 | ||||||

| Debt, current portion |

4,128 | 6,840 | ||||||

| Operating lease liabilities, current portion |

— | 2,236 | ||||||

|

|

|

|

|

|||||

| Total current liabilities |

26,267 | 44,712 | ||||||

| Deferred rent, net of current portion |

2,248 | — | ||||||

| Debt, net of current portion |

33,398 | 30,781 | ||||||

| Operating lease liabilities, net of current portion |

— | 26,802 | ||||||

| Other noncurrent liabilities |

4,659 | 723 | ||||||

|

|

|

|

|

|||||

| Total liabilities |

66,572 | 103,018 | ||||||

|

|

|

|

|

|||||

| Commitments and contingencies |

||||||||

| Redeemable convertible preferred stock |

290,427 | 290,427 | ||||||

| Stockholders’ deficit: |

||||||||

| Common stock, par value |

— | — | ||||||

| Additional paid-in capital |

53,912 | 55,579 | ||||||

| Accumulated other comprehensive income (loss) |

253 | 274 | ||||||

| Accumulated deficit |

(256,277 | ) | (266,868 | ) | ||||

|

|

|

|

|

|||||

| Total stockholders’ deficit |

(202,112 | ) | (211,015 | ) | ||||

|

|

|

|

|

|||||

| Total liabilities, redeemable convertible preferred stock and stockholders’ deficit |

$ | 154,887 | $ | 182,430 | ||||

|

|

|

|

|

|||||

A Place for Rover, Inc.

Statement of Operations

(unaudited)

| Three Months Ended March 31, |

||||||||

| 2020 | 2021 | |||||||

| (in thousands) | ||||||||

| Revenue |

$ | 16,991 | $ | 12,196 | ||||

| Costs and expenses: |

||||||||

| Cost of revenue |

5,418 | 4,176 | ||||||

| Service operations |

5,055 | 2,233 | ||||||

| Marketing |

9,350 | 2,666 | ||||||

| Technology |

8,811 | 4,468 | ||||||

| General and administrative |

6,202 | 6,636 | ||||||

| Depreciation and amortization |

2,762 | 1,850 | ||||||

|

|

|

|

|

|||||

| Total costs and expenses |

37,598 | 22,030 | ||||||

|

|

|

|

|

|||||

| Loss from operations |

(20,607 | ) | (9,833 | ) | ||||

|

|

|

|

|

|||||

| Other income (expense), net: |

||||||||

| Interest income |

332 | 4 | ||||||

| Interest expense |

(249 | ) | (697 | ) | ||||

| Other expense, net |

(44 | ) | (51 | ) | ||||

|

|

|

|

|

|||||

| Total other income (expense), net |

39 | (744 | ) | |||||

|

|

|

|

|

|||||

| Loss before provision for income taxes |

(20,568 | ) | (10,577 | ) | ||||

| Benefit from (provision for) income taxes |

23 | (14 | ) | |||||

|

|

|

|

|

|||||

| Net loss |

$ | (20,545 | ) | $ | (10,591 | ) | ||

|

|

|

|

|

|||||

| Net loss per share attributable to common stockholders, basic and diluted |

$ | (0.72 | ) | $ | (0.36 | ) | ||

|

|

|

|

|

|||||

| Weighted-average shares used in computing net loss per share, basic and diluted |

28,621 | 29,482 | ||||||

|

|

|

|

|

|||||

A Place for Rover, Inc.

Statements of Cash Flows

(unaudited)

| Three Months Ended March 31, |

||||||||

| 2020 | 2021 | |||||||

| (in thousands) | ||||||||

| OPERATING ACTIVITIES |

||||||||

| Net loss |

$ | (20,545 | ) | $ | (10,591 | ) | ||

| Adjustments to reconcile net loss to net cash used in operating activities: |

||||||||

| Stock-based compensation |

1,585 | 1,001 | ||||||

| Depreciation and amortization |

4,644 | 3,569 | ||||||

| Non-cash operating lease costs |

— | 477 | ||||||

| Net amortization (accretion) of investment premiums (discounts) |

(6 | ) | — | |||||

| Amortization of debt issuance costs |

68 | 120 | ||||||

| Deferred income taxes |

(58 | ) | 12 | |||||

| Loss on disposal of property and equipment |

8 | 17 | ||||||

| Changes in operating assets and liabilities: |

||||||||

| Accounts receivable |

196 | (3,878 | ) | |||||

| Prepaid expenses and other current assets |

206 | 928 | ||||||

| Other noncurrent assets |

693 | (9 | ) | |||||

| Accounts payable |

(1,612 | ) | 332 | |||||

| Accrued expenses and other current liabilities |

(1,184 | ) | 1,034 | |||||

| Deferred revenue and pet parent deposits |

(16,862 | ) | 9,449 | |||||

| Pet service provider liabilities |

(2,153 | ) | 295 | |||||

| Operating lease liabilities |

— | (530 | ) | |||||

| Other noncurrent liabilities |

682 | 54 | ||||||

|

|

|

|

|

|||||

| Net cash (used in) provided by operating activities |

(34,338 | ) | 2,280 | |||||

|

|

|

|

|

|||||

| INVESTING ACTIVITIES |

||||||||

| Purchase of property and equipment |

(369 | ) | (49 | ) | ||||

| Capitalization of internal-use software |

(2,492 | ) | (1,543 | ) | ||||

| Proceeds from disposal of property and equipment |

— | 8 | ||||||

| Purchases of available-for-sale securities |

(4,725 | ) | — | |||||

| Proceeds from sales of available-for-sale securities |

5,367 | — | ||||||

| Maturities of available-for-sale securities |

10,278 | — | ||||||

|

|

|

|

|

|||||

| Net cash provided by (used in) investing activities |

8,059 | (1,584 | ) | |||||

|

|

|

|

|

|||||

| FINANCING ACTIVITIES |

||||||||

| Proceeds from exercise of common stock options |

134 | 666 | ||||||

| Payment of deferred transaction costs |

— | (375 | ) | |||||

| Proceeds from borrowing on credit facilities |

55,185 | — | ||||||

|

|

|

|

|

|||||

| Net cash provided by financing activities |

55,319 | 291 | ||||||

|

|

|

|

|

|||||

| Effect of exchange rate changes on cash and cash equivalents |

(56 | ) | (2 | ) | ||||

| Net increase (decrease) in cash and cash equivalents |

28,984 | 985 | ||||||

|

|

|

|

|

|||||

| Cash and cash equivalents, beginning of period |

$ | 67,654 | $ | 80,848 | ||||

|

|

|

|

|

|||||

| Cash and cash equivalents, end of period |

$ | 96,638 | $ | 81,833 | ||||

| SUPPLEMENTAL DISCLOSURE OF CASH FLOW INFORMATION |

||||||||

| Cash paid for income taxes |

$ | 3 | $ | — | ||||

| Cash paid for interest |

— | 563 | ||||||

| NON-CASH INVESTING AND FINANCING ACTIVITIES |

||||||||

| Issuance of common stock warrants under credit facility and subordinated credit facility agreements |

$ | 657 | $ | — | ||||

| Issuance of Series G redeemable convertible preferred stock to settle Barking Dog Ventures, Ltd. Holdback |

62 | — | ||||||

| Deferred transaction costs included in accrued expenses and other current liabilities |

— | 2,887 | ||||||

Reconciliation to Financial Statements

A Place for Rover, Inc.

Adjusted EBITDA Reconciliation

(unaudited)

| Three Months Ended March 31, |

||||||||

| 2020 | 2021 | |||||||

| (in thousands) | ||||||||

| Adjusted EBITDA reconciliation: |

||||||||

| Net loss |

$ | (20,545 | ) | $ | (10,591 | ) | ||

| Add (deduct): |

||||||||

| Depreciation and amortization(1) |

4,644 | 3,569 | ||||||

| Stock-based compensation expense(2) |

1,585 | 1,001 | ||||||

| Interest expense |

249 | 697 | ||||||

| Interest income |

(332 | ) | (4 | ) | ||||

| Other expense, net |

44 | 51 | ||||||

| Income tax benefit |

(23 | ) | 14 | |||||

| Restructuring expense(3) |

2,080 | — | ||||||

| Acquisition-related costs(4) |

28 | 905 | ||||||

|

|

|

|

|

|||||

| Adjusted EBITDA |

$ | (12,270 | ) | $ | (4,358 | ) | ||

|

|

|

|

|

|||||

| (1) | Depreciation and amortization include amortization expense related to capitalized internal use software, which is recognized as cost of revenue in the consolidated statements of operations. |

| (2) | Stock-based compensation expense includes equity granted to employees as well as for professional services to non-employees. |

| (3) | Restructuring costs include expenses for severance-related and legal costs incurred during the implementation of our restructuring plan. |

| (4) | Acquisition-related costs include accounting, legal, consulting and travel related expenses incurred in connection with business combinations. |

###

Contacts:

MEDIA

pr@rover.com

Kristin Sandberg

(360) 510-6365

INVESTORS

brinlea@blueshirtgroup.com

Brinlea Johnson

(415) 269-2645

True Wind Capital

press@truewindcapital.com

Stephanie Portillo