Attached files

| file | filename |

|---|---|

| EX-2.1 - EX-2.1 - EQUITY BANCSHARES INC | d116927dex21.htm |

| EX-99.1 - EX-99.1 - EQUITY BANCSHARES INC | d116927dex991.htm |

| EX-10.2 - EX-10.2 - EQUITY BANCSHARES INC | d116927dex102.htm |

| EX-10.1 - EX-10.1 - EQUITY BANCSHARES INC | d116927dex101.htm |

| 8-K - 8-K - EQUITY BANCSHARES INC | d116927d8k.htm |

Exhibit 99.2

Merger with American State Bancshares, Inc. May 17, 2021

Disclaimers Special Note Concerning Forward-Looking Statements This press release contains “forward-looking statements” within the meaning of Section 27A of the Securities Act of 1933, as amended, and Section 21E of the Securities Exchange Act of 1934, as amended. These forward-looking statements reflect the current views of Equity’s management with respect to, among other things, future events and Equity’s financial performance. These statements are often, but not always, made through the use of words or phrases such as “may,” “should,” “could,” “predict,” “potential,” “believe,” “will likely result,” “expect,” “assumes,” “continue,” “will,” “anticipate,” “seek,” “estimate,” “intend,” “plan,” “project,” “forecast,” “goal,” “target,” “would” and “outlook,” or the negative variations of those words or other comparable words of a future or forward-looking nature. These forward-looking statements are not historical facts, and are based on current expectations, estimates and projections about Equity’s industry, management’s beliefs and certain assumptions made by management, many of which, by their nature, are inherently uncertain and beyond Equity’s control. Accordingly, Equity cautions you that any such forward-looking statements are not guarantees of future performance and are subject to risks, assumptions and uncertainties that are difficult to predict. Although Equity believes that the expectations reflected in these forward-looking statements are reasonable as of the date made, actual results may prove to be materially different from the results expressed or implied by the forward-looking statements. Factors that could cause actual results to differ materially from Equity’s expectations include COVID-19 related impacts; competition from other financial institutions and bank holding companies; the effects of and changes in trade, monetary and fiscal policies and laws, including interest rate policies of the Federal Reserve Board; changes in the demand for loans; fluctuations in value of collateral and loan reserves; inflation, interest rate, market and monetary fluctuations; changes in consumer spending, borrowing and savings habits; and acquisitions and integration of acquired businesses; and similar variables. The foregoing list of factors is not exhaustive. For discussion of these and other risks that may cause actual results to differ from expectations, please refer to “Cautionary Note Regarding Forward-Looking Statements” and “Risk Factors” in Equity’s Annual Report on Form 10-K filed with the Securities and Exchange Commission on March 9, 2021, and any updates to those risk factors set forth in Equity’s subsequent Quarterly Reports on Form 10-Q or Current Reports on Form 8-K. If one or more events related to these or other risks or uncertainties materialize, or if Equity’s underlying assumptions prove to be incorrect, actual results may differ materially from what Equity anticipates. Accordingly, you should not place undue reliance on any such forward-looking statements. Any forward-looking statement speaks only as of the date on which it is made, and Equity does not undertake any obligation to publicly update or review any forward-looking statement, whether as a result of new information, future developments or otherwise. New risks and uncertainties arise from time to time, such as COVID-19, and it is not possible for us to predict those events or how they may affect us. In addition, Equity cannot assess the impact of each factor on Equity’s business or the extent to which any factor, or combination of factors, may cause actual results to differ materially from those contained in any forward-looking statements. All forward-looking statements, expressed or implied, included in this press release are expressly qualified in their entirety by this cautionary statement. This cautionary statement should also be considered in connection with any subsequent written or oral forward-looking statements that Equity or persons acting on Equity’s behalf may issue. NON-GAAP FINANCIAL MEASURES This presentation contains certain non-GAAP financial measures intended to supplement, not substitute for, comparable GAAP measures. Reconciliations of non- GAAP financial measures to GAAP financial measures are provided at the end of this presentation. Numbers in the presentation may not sum due to rounding.

Disclaimers Important Additional Information The information contained herein does not constitute an offer to sell or a solicitation of an offer to buy any securities or a solicitation of any vote or approval. In connection with the proposed transaction, Equity intends to file with the Securities and Exchange Commission (“SEC”) a registration statement on Form S-4 to register the shares of Equity common stock to be issued to ASB stockholders. The registration statement will include a proxy statement/prospectus, which will be sent to the stockholders of ASB seeking their approval of the proposed transaction. WE URGE INVESTORS AND SECURITY HOLDERS TO READ THE REGISTRATION STATEMENT ON FORM S-4, THE PROXY STATEMENT/PROSPECTUS INCLUDED WITHIN THE REGISTRATION STATEMENT ON FORM S-4 AND ANY OTHER RELEVANT DOCUMENTS TO BE FILED WITH THE SEC IN CONNECTION WITH THE PROPOSED TRANSACTION BECAUSE THEY CONTAIN IMPORTANT INFORMATION ABOUT EQUITY, ASB AND THE PROPOSED TRANSACTION. The documents filed by Equity with the SEC may be obtained free of charge at Equity’s investor relations website at investor.equitybank.com or at the SEC’s website at www.sec.gov. Alternatively, these documents, when available, can be obtained free of charge from Equity upon written request to Equity Bancshares, Inc., Attn: Investor Relations, 7701 East Kellogg Drive, Suite 300, Wichita, Kansas 67207 or by calling (316) 612-6000. Participants in the Transaction Equity, ASB and certain of their respective directors and executive officers may be deemed to be participants in the solicitation of proxies from ASB’s stockholders in connection with the proposed transaction under the rules of the SEC. Information about the directors and executive officers of Equity is set forth in the proxy statement for Equity’s 2021 annual meeting of stockholders filed with the SEC on Schedule 14A on March 18, 2021, and Equity’s annual report on Form 10-K for the year ended December 31, 2020 filed with the SEC on March 9, 2021. Free copies of these documents may be obtained free of charge as described in the preceding paragraph. Additional information regarding the interests of these participants and other persons who may be deemed participants in the transaction may be obtained by reading the proxy statement/prospectus regarding the proposed transaction when it becomes available.

EQBK’s Value Proposition Market Diversification and Strategy for Growth Conservative Credit Culture and Effective Risk Management and Mitigation Robust Funding Capacity, Anchored by a Diverse, Low-Cost Deposit Base Focus on Efficient Performance Throughout our Diversified Business Lines Experienced and Invested Management Team 3

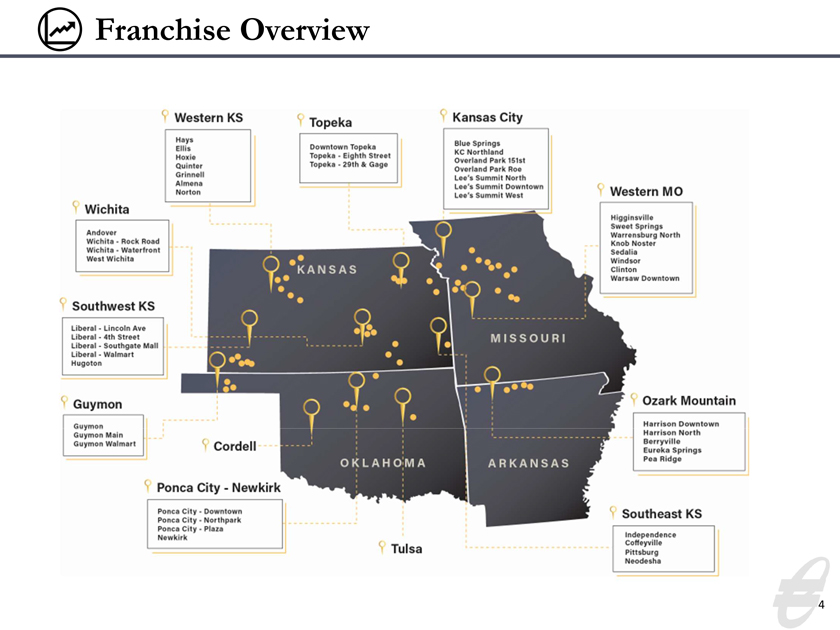

4 Franchise Overview

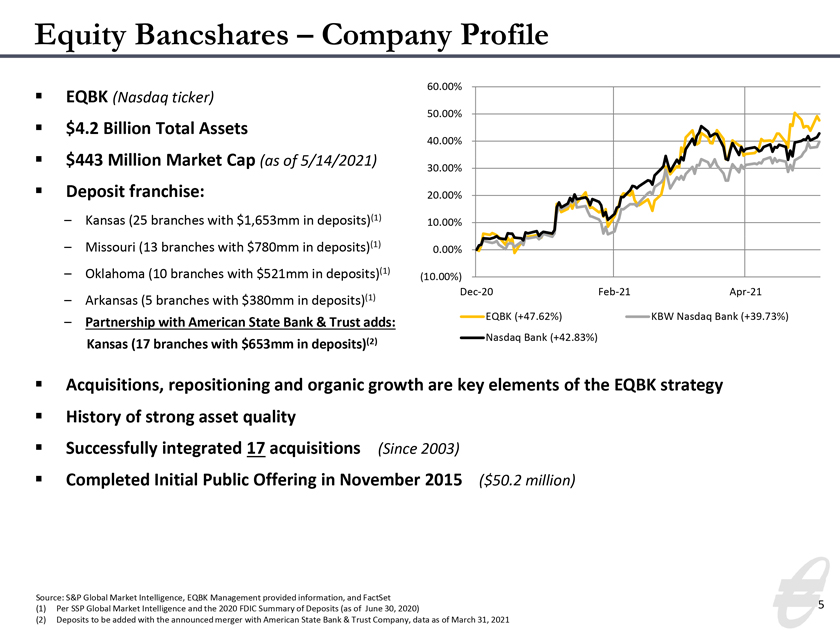

Equity Bancshares – Company Profile EQBK (Nasdaq ticker) $4.2 Billion Total Assets $443 Million Market Cap (as of 5/14/2021) Deposit franchise: – Kansas (25 branches with $1,653mm in deposits)(1) – Missouri (13 branches with $780mm in deposits)(1) – Oklahoma (10 branches with $521mm in deposits)(1) – Arkansas (5 branches with $380mm in deposits)(1) – Partnership with American State Bank & Trust adds: Kansas (17 branches with $653mm in deposits)(2) Acquisitions, repositioning and organic growth are key elements of the EQBK strategy History of strong asset quality Successfully integrated 17 acquisitions (Since 2003) Completed Initial Public Offering in November 2015 ($50.2 million) 5 Source: S&P Global Market Intelligence, EQBK Management provided information, and FactSet (1) Per SSP Global Market Intelligence and the 2020 FDIC Summary of Deposits (as of June 30, 2020) (2) Deposits to be added with the announced merger with American State Bank & Trust Company, data as of March 31, 2021 (10.00%) 0.00% 10.00% 20.00% 30.00% 40.00% 50.00% 60.00% Dec-20 Feb-21 Apr-21 EQBK (+47.62%) KBW Nasdaq Bank (+39.73%) Nasdaq Bank (+42.83%)

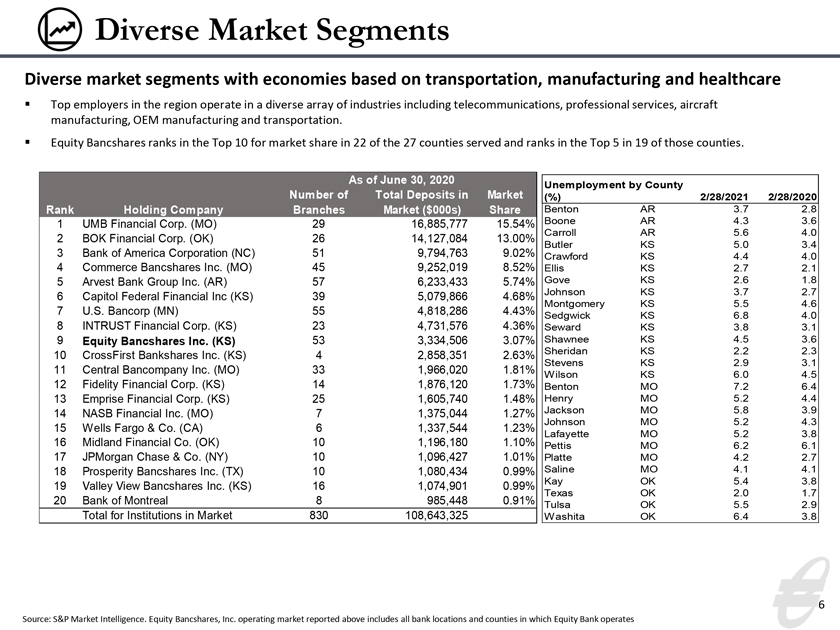

6 Source: S&P Market Intelligence. Equity Bancshares, Inc. operating market reported above includes all bank locations and counties in which Equity Bank operates Diverse market segments with economies based on transportation, manufacturing and healthcare Top employers in the region operate in a diverse array of industries including telecommunications, professional services, aircraft manufacturing, OEM manufacturing and transportation. Equity Bancshares ranks in the Top 10 for market share in 22 of the 27 counties served and ranks in the Top 5 in 19 of those counties. 2/28/2021 2/28/2020 Benton AR 3.7 2.8 Boone AR 4.3 3.6 Carroll AR 5.6 4.0 Butler KS 5.0 3.4 Crawford KS 4.4 4.0 Ellis KS 2.7 2.1 Gove KS 2.6 1.8 Johnson KS 3.7 2.7 Montgomery KS 5.5 4.6 Sedgwick KS 6.8 4.0 Seward KS 3.8 3.1 Shawnee KS 4.5 3.6 Sheridan KS 2.2 2.3 Stevens KS 2.9 3.1 Wilson KS 6.0 4.5 Benton MO 7.2 6.4 Henry MO 5.2 4.4 Jackson MO 5.8 3.9 Johnson MO 5.2 4.3 Lafayette MO 5.2 3.8 Pettis MO 6.2 6.1 Platte MO 4.2 2.7 Saline MO 4.1 4.1 Kay OK 5.4 3.8 Texas OK 2.0 1.7 Tulsa OK 5.5 2.9 Washita OK 6.4 3.8 Unemployment by County (%) Diverse Market Segments Rank Holding Company Number of Branches Total Deposits in Market ($000s) Market Share 1 UMB Financial Corp. (MO) 29 16,885,777 15.54% 2 BOK Financial Corp. (OK) 26 14,127,084 13.00% 3 Bank of America Corporation (NC) 51 9,794,763 9.02% 4 Commerce Bancshares Inc. (MO) 45 9,252,019 8.52% 5 Arvest Bank Group Inc. (AR) 57 6,233,433 5.74% 6 Capitol Federal Financial Inc (KS) 39 5,079,866 4.68% 7 U.S. Bancorp (MN) 55 4,818,286 4.43% 8 INTRUST Financial Corp. (KS) 23 4,731,576 4.36% 9 Equity Bancshares Inc. (KS) 53 3,334,506 3.07% 10 CrossFirst Bankshares Inc. (KS) 4 2,858,351 2.63% 11 Central Bancompany Inc. (MO) 33 1,966,020 1.81% 12 Fidelity Financial Corp. (KS) 14 1,876,120 1.73% 13 Emprise Financial Corp. (KS) 25 1,605,740 1.48% 14 NASB Financial Inc. (MO) 7 1,375,044 1.27% 15 Wells Fargo & Co. (CA) 6 1,337,544 1.23% 16 Midland Financial Co. (OK) 10 1,196,180 1.10% 17 JPMorgan Chase & Co. (NY) 10 1,096,427 1.01% 18 Prosperity Bancshares Inc. (TX) 10 1,080,434 0.99% 19 Valley View Bancshares Inc. (KS) 16 1,074,901 0.99% 20 Bank of Montreal 8 985,448 0.91% Total for Institutions in Market 830 108,643,325 As of June 30, 2020

7 Founded Equity Bank in 2002 2018 EY Entrepreneur of the Year National Finalist 2014 Most Influential CEO, Wichita Business Journal Served as Regional President of Sunflower Bank prior to forming Equity Bank Served as Director of Sales and Marketing for Koch Industries Brad Elliott Chairman & CEO Years at Equity: 19 | Years in Banking: 32 Greg Kossover EVP, COO & CFO Became COO in April 2020 Served as CFO from 2013 to 2020 EQBK Board of Directors, 2011-current Served as president of Physicians Development Group Served as CEO of Value Place, LLC, growing the franchise to more than 150 locations in 25 states Greg Kossover Chief Operating Officer Years at Equity: 8 | Years in Banking: 21 Eric Newell Chief Financial Officer Years at Equity 1 | Years in Banking: 19 Craig Anderson President Years at Equity: 3 | Years in Banking: 39 Became President in April 2020 Served as COO from 2018 to 2020 Joined Equity Bank in March 2018 Served as President of UMBF Commercial Banking More than 38 years of banking experience, concentrated in commercial lending roles Joined Equity Bank in April 2020 Served as CFO at United Bank in Hartford, CT ($7.3B assets) Served as CFO and head of Treasury at Rockville Bank, Glastonbury, Conn. Served as Analyst for AllianceBernstein and Fitch Began career as examiner with FDIC Executive Leadership

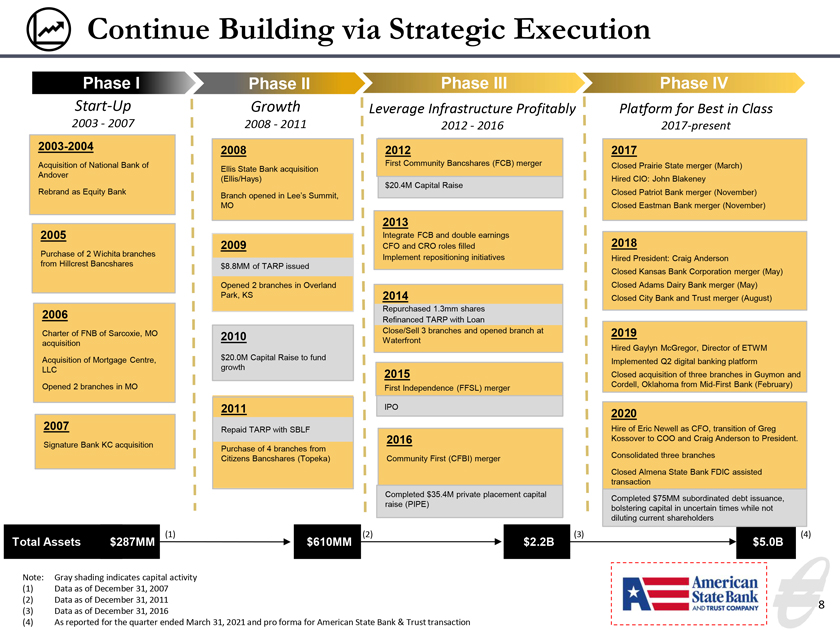

8 2009 $8.8MM of TARP issued Opened 2 branches in Overland Park, KS 2014 Repurchased 1.3mm shares Refinanced TARP with Loan Close/Sell 3 branches and opened branch at Waterfront 2012 First Community Bancshares (FCB) merger $20.4M Capital Raise 2011 Repaid TARP with SBLF Purchase of 4 branches from Citizens Bancshares (Topeka) 2003-2004 Acquisition of National Bank of Andover Rebrand as Equity Bank 2005 Purchase of 2 Wichita branches from Hillcrest Bancshares 2006 Charter of FNB of Sarcoxie, MO acquisition Acquisition of Mortgage Centre, LLC Opened 2 branches in MO 2008 Ellis State Bank acquisition (Ellis/Hays) Branch opened in Lee’s Summit, MO 2010 $20.0M Capital Raise to fund growth 2013 Integrate FCB and double earnings CFO and CRO roles filled Implement repositioning initiatives 2007 Signature Bank KC acquisition Phase I Phase II Phase III Start-Up 2003—2007 Growth 2008—2011 Leverage Infrastructure Profitably 2012—2016 2015 First Independence (FFSL) merger IPO 2016 Community First (CFBI) merger Completed $35.4M private placement capital raise (PIPE) Phase IV Platform for Best in Class 2017-present 2017 Closed Prairie State merger (March) Hired CIO: John Blakeney Closed Patriot Bank merger (November) Closed Eastman Bank merger (November) Total Assets $287MM $610MM $2.2B (1) (2) (3) $5.0B (4) 2018 Hired President: Craig Anderson Closed Kansas Bank Corporation merger (May) Closed Adams Dairy Bank merger (May) Closed City Bank and Trust merger (August) 2019 Hired Gaylyn McGregor, Director of ETWM Implemented Q2 digital banking platform Closed acquisition of three branches in Guymon and Cordell, Oklahoma from Mid-First Bank (February) 2020 Hire of Eric Newell as CFO, transition of Greg Kossover to COO and Craig Anderson to President. Consolidated three branches Closed Almena State Bank FDIC assisted transaction Note: Gray shading indicates capital activity (1) Data as of December 31, 2007 (2) Data as of December 31, 2011 (3) Data as of December 31, 2016 (4) As reported for the quarter ended March 31, 2021 and pro forma for American State Bank & Trust transaction Completed $75MM subordinated debt issuance, bolstering capital in uncertain times while not diluting current shareholders Continue Building via Strategic Execution

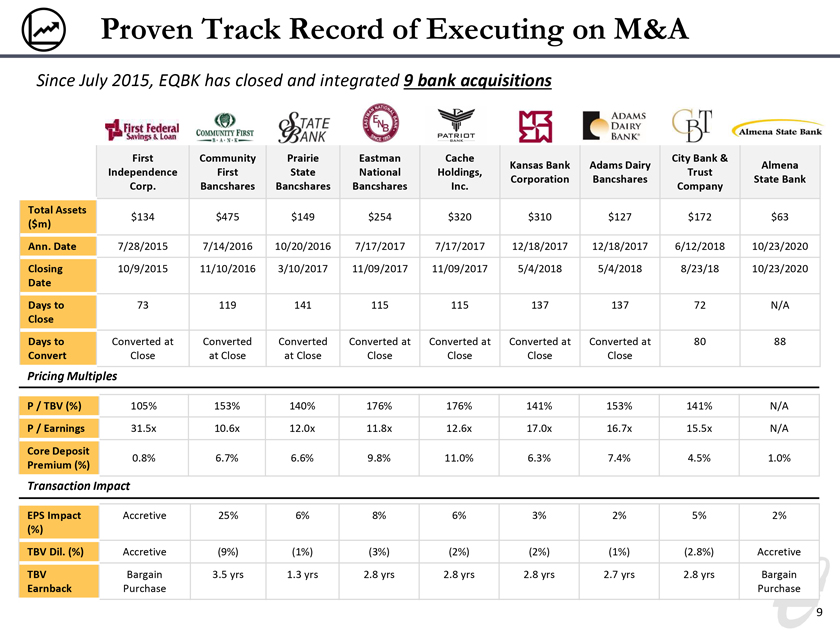

Proven Track Record of Executing on M&A Since July 2015, EQBK has closed and integrated 9 bank acquisitions First Independence Corp. Community First Bancshares Prairie State Bancshares Eastman National Bancshares Cache Holdings, Inc. Kansas Bank Corporation Adams Dairy Bancshares City Bank & Trust Company Almena State Bank Total Assets ($m) $134 $475 $149 $254 $320 $310 $127 $172 $63 Ann. Date 7/28/2015 7/14/2016 10/20/2016 7/17/2017 7/17/2017 12/18/2017 12/18/2017 6/12/2018 10/23/2020 Closing Date 10/9/2015 11/10/2016 3/10/2017 11/09/2017 11/09/2017 5/4/2018 5/4/2018 8/23/18 10/23/2020 Days to Close 73 119 141 115 115 137 137 72 N/A Days to Convert Converted at Close Converted at Close Converted at Close Converted at Close Converted at Close Converted at Close Converted at Close 80 88 P / TBV (%) 105% 153% 140% 176% 176% 141% 153% 141% N/A P / Earnings 31.5x 10.6x 12.0x 11.8x 12.6x 17.0x 16.7x 15.5x N/A Core Deposit Premium (%) 0.8% 6.7% 6.6% 9.8% 11.0% 6.3% 7.4% 4.5% 1.0% Pricing Multiples EPS Impact (%) Accretive 25% 6% 8% 6% 3% 2% 5% 2% TBV Dil. (%) Accretive (9%) (1%) (3%) (2%) (2%) (1%) (2.8%) Accretive TBV Earnback Bargain Purchase 3.5 yrs 1.3 yrs 2.8 yrs 2.8 yrs 2.8 yrs 2.7 yrs 2.8 yrs Bargain Purchase Transaction Impact 9

Merger with American State Bank & Trust Company (American State Bancshares, Inc.)

Creating Shareholder Value 11 Retention of key local management team members Chairman of ASB to join the EQBK board Similar customer approach, credit culture & operating style Comprehensive due diligence, no concentration concerns Structured within EQBK’s proven merger metrics and through a consistently disciplined approach to maximize value for stakeholders of both companies Leverages EQBK’s operating platform and back-office support Expansions of Wichita MSA market and entry into the Salina, Garden City MSAs and Great Bend via a franchise with high-quality, low-cost stable core deposits

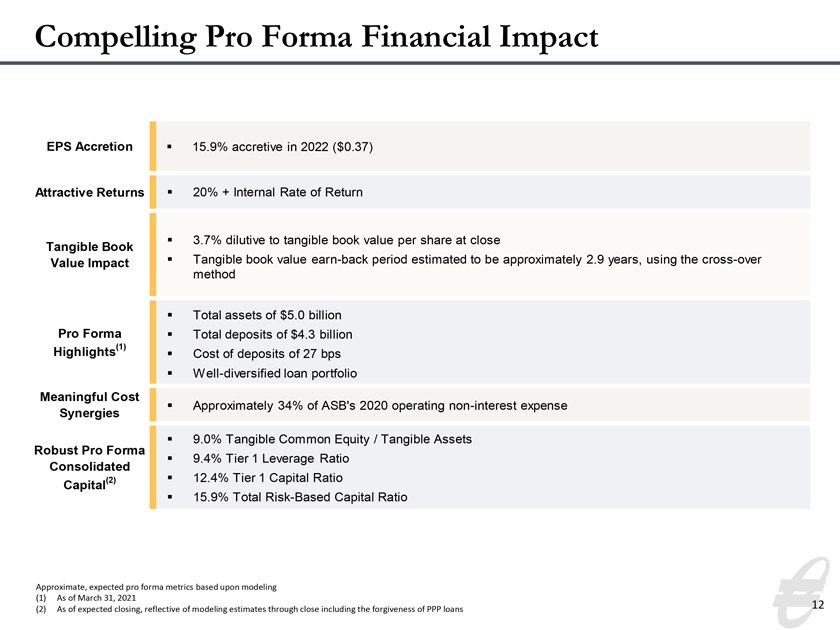

12 Compelling Pro Forma Financial Impact Approximate, expected pro forma metrics based upon modeling (1) As of March 31, 2021 (2) As of expected closing, reflective of modeling estimates through close including the forgiveness of PPP loans Tangible Book Value Impact EPS Accretion Attractive Returns Robust Pro Forma Consolidated Capital(2) Pro Forma Highlights(1) Meaningful Cost Synergies 3.7% dilutive to tangible book value per share at close Tangible book value earn-back period estimated to be approximately 2.9 years, using the cross-over method 15.9% accretive in 2022 ($0.37) 9.0% Tangible Common Equity / Tangible Assets 9.4% Tier 1 Leverage Ratio 12.4% Tier 1 Capital Ratio 15.9% Total Risk-Based Capital Ratio Total assets of $5.0 billion Total deposits of $4.3 billion Cost of deposits of 27 bps Well-diversified loan portfolio 20% + Internal Rate of Return Approximately 34% of ASB’s 2020 operating non-interest expense

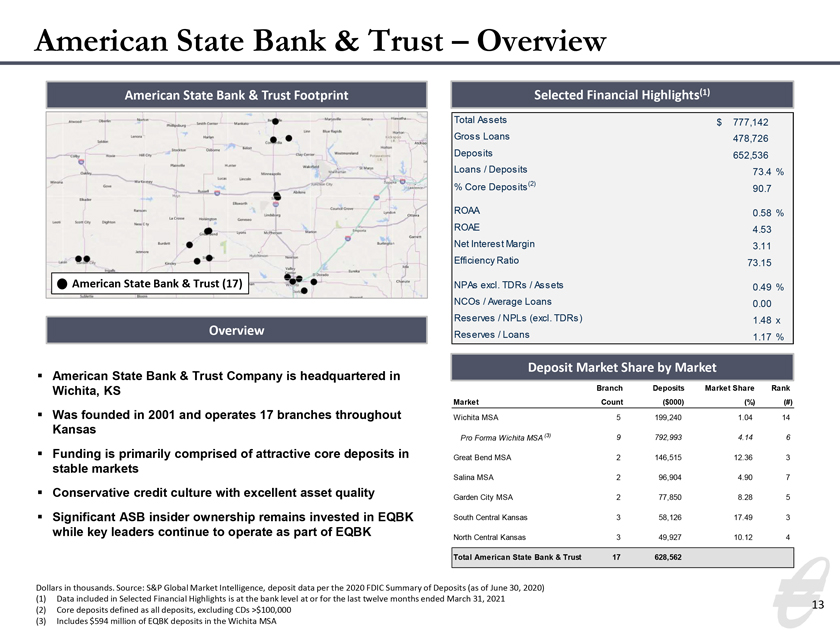

13 Total Assets $ 777,142 Gross Loans 4 78,726 Deposits 6 52,536 Loans / Deposits 73.4 % % Core Deposits(2) 90.7 ROAA 0.58 % ROAE 4.53 Net Interest Margin 3.11 Efficiency Ratio 73.15 NPAs excl. TDRs / Assets 0.49 % NCOs / Average Loans 0.00 Reserves / NPLs (excl. TDRs) 1.48 x Reserves / Loans 1.17 % American State Bank & Trust – Overview Dollars in thousands. Source: S&P Global Market Intelligence, deposit data per the 2020 FDIC Summary of Deposits (as of June 30, 2020) (1) Data included in Selected Financial Highlights is at the bank level at or for the last twelve months ended March 31, 2021 (2) Core deposits defined as all deposits, excluding CDs >$100,000 (3) Includes $594 million of EQBK deposits in the Wichita MSA American State Bank & Trust Company is headquartered in Wichita, KS Was founded in 2001 and operates 17 branches throughout Kansas Funding is primarily comprised of attractive core deposits in stable markets Conservative credit culture with excellent asset quality Significant ASB insider ownership remains invested in EQBK while key leaders continue to operate as part of EQBK American State Bank & Trust (17) Branch Deposits Market Share Rank Market Count ($000) (%) (#) Wichita MSA 5 199,240 1.04 14 Pro Forma Wichita MSA (3) 9 792,993 4.14 6 Great Bend MSA 2 146,515 1 2.36 3 Salina MSA 2 9 6,904 4.90 7 Garden City MSA 2 7 7,850 8.28 5 South Central Kansas 3 5 8,126 1 7.49 3 North Central Kansas 3 4 9,927 1 0.12 4 Total American State Bank & Trust 17 628,562 American State Bank & Trust Footprint Selected Financial Highlights(1) Overview Deposit Market Share by Market

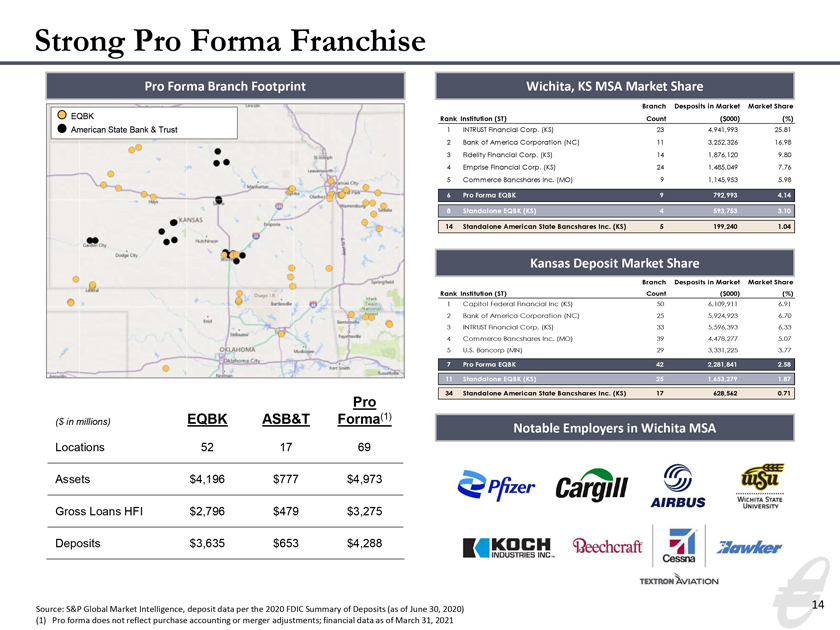

Branch Desposits in Market Market Share Rank Institution (ST) Count ($000) (%) 1 INTRUST Financial Corp. (KS) 23 4,941,993 25.81 2 Bank of America Corporation (NC) 11 3,252,326 16.98 3 Fidelity Financial Corp. (KS) 14 1,876,120 9.80 4 Emprise Financial Corp. (KS) 24 1,485,049 7.76 5 Commerce Bancshares Inc. (MO) 9 1,145,953 5.98 6 Pro Forma EQBK 9 792,993 4.14 8 Standalone EQBK (KS) 4 593,753 3.10 14 Standalone American State Bancshares Inc. (KS) 5 199,240 1.04 14 Strong Pro Forma Franchise Source: S&P Global Market Intelligence, deposit data per the 2020 FDIC Summary of Deposits (as of June 30, 2020) (1) Pro forma does not reflect purchase accounting or merger adjustments; financial data as of March 31, 2021 EQBK American State Bank & Trust ($ in millions) EQBK ASB&T Pro Forma(1) Locations 52 17 69 Assets $4,196 $777 $4,973 Gross Loans HFI $2,796 $479 $3,275 Deposits $3,635 $653 $4,288 Branch Desposits in Market Market Share Rank Institution (ST) Count ($000) (%) 1 Capitol Federal Financial Inc (KS) 50 6,109,911 6.91 2 Bank of America Corporation (NC) 25 5,924,923 6.70 3 INTRUST Financial Corp. (KS) 33 5,596,393 6.33 4 Commerce Bancshares Inc. (MO) 39 4,478,277 5.07 5 U.S. Bancorp (MN) 29 3,331,225 3.77 7 Pro Forma EQBK 42 2,281,841 2.58 11 Standalone EQBK (KS) 2 5 1,653,279 1.87 34 Standalone American State Bancshares Inc. (KS) 1 7 628,562 0.71 Pro Forma Branch Footprint Wichita, KS MSA Market Share Kansas Deposit Market Share Notable Employers in Wichita MSA

Salina MSA Salina is located at the Junction of I-135 and I-70 and serves as the economic, educational, and logistical hub of central Kansas The Salina MSA enjoys a diverse economy with strengths in the manufacturing, agricultural, educational, aviation, and alternative energy sectors Home to Kansas Wesleyan University, Salina Area Technical College, and Kansas State Polytechnic College, which hosts one of only 12 Federal Aviation Administration research facilities in the United States Regional aviation hub serving as a civilian and military training area and with regular commercial passenger service from United Airlines Garden City MSA Garden city serves as an agricultural and manufacturing hub The city boasts a strong beef industry presence with Tyson employing over 3,000 people in its Garden City meat packing plant and with several large feedlots located in the area Great Bend MSA Great Bend is the historic center of the Kansas oil & gas industry; Great Bend has a strong economy with strengths in the energy, manufacturing, agriculture, and government sectors Nearby Barton Community College has an enrollment of over 6,000 students North Central & South Central Kansas Cloud, Pawnee, Republic, and Stafford counties These rural communities are representative of Kansas’ strong agricultural sector and boast a vibrant network of small businesses 15 American State Bank & Trust – Market Expansion Sources: S&P Global Market Intelligence, Salina Economic Development, Garden City Economic Development, Great Bend Chamber of Commerce, Cloud County, Pawnee County, Republic County, and Stafford County Market Overview Notable Employers

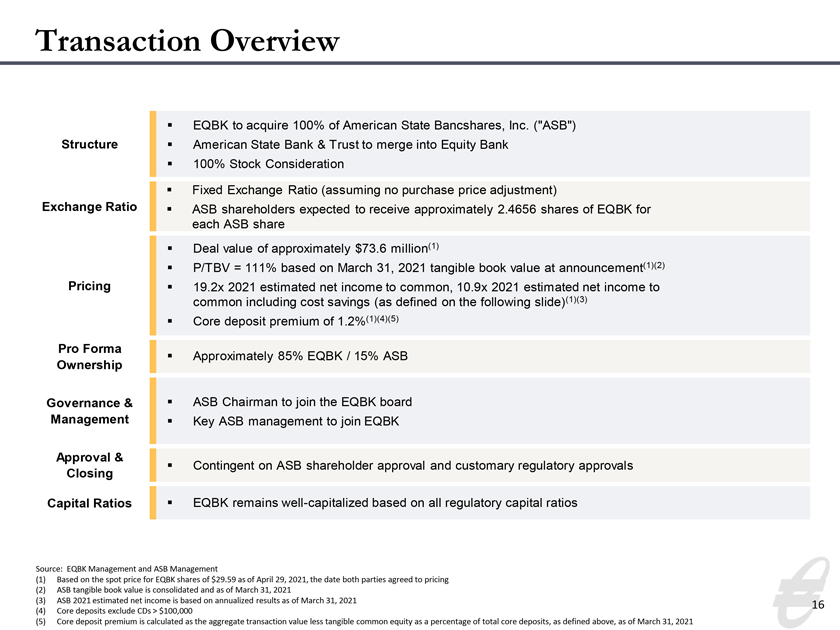

16 Transaction Overview Source: EQBK Management and ASB Management (1) Based on the spot price for EQBK shares of $29.59 as of April 29, 2021, the date both parties agreed to pricing (2) ASB tangible book value is consolidated and as of March 31, 2021 (3) ASB 2021 estimated net income is based on annualized results as of March 31, 2021 (4) Core deposits exclude CDs > $100,000 (5) Core deposit premium is calculated as the aggregate transaction value less tangible common equity as a percentage of total core deposits, as defined above, as of March 31, 2021 Structure Exchange Ratio Pricing Capital Ratios Pro Forma Ownership Governance & Management Approval & Closing EQBK to acquire 100% of American State Bancshares, Inc. (“ASB”) American State Bank & Trust to merge into Equity Bank 100% Stock Consideration Fixed Exchange Ratio (assuming no purchase price adjustment) ASB shareholders expected to receive approximately 2.4656 shares of EQBK for each ASB share Approximately 85% EQBK / 15% ASB ASB Chairman to join the EQBK board Key ASB management to join EQBK Deal value of approximately $73.6 million(1) P/TBV = 111% based on March 31, 2021 tangible book value at announcement(1)(2) 19.2x 2021 estimated net income to common, 10.9x 2021 estimated net income to common including cost savings (as defined on the following slide)(1)(3) Core deposit premium of 1.2%(1)(4)(5) Contingent on ASB shareholder approval and customary regulatory approvals EQBK remains well-capitalized based on all regulatory capital ratios

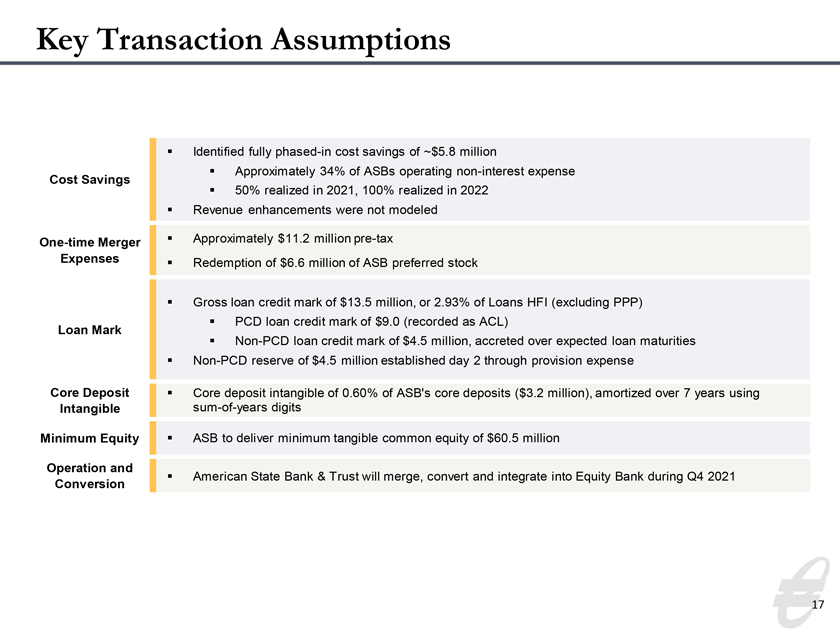

Key Transaction Assumptions 17 Cost Savings One-time Merger Expenses Loan Mark Minimum Equity Core Deposit Intangible Operation and Conversion Identified fully phased-in cost savings of ~$5.8 million Approximately 34% of ASBs operating non-interest expense 50% realized in 2021, 100% realized in 2022 Revenue enhancements were not modeled Approximately $11.2 million pre-tax Core deposit intangible of 0.60% of ASB’s core deposits ($3.2 million), amortized over 7 years using sum-of-years digits Gross loan credit mark of $13.5 million, or 2.93% of Loans HFI (excluding PPP) PCD loan credit mark of $9.0 (recorded as ACL) Non-PCD loan credit mark of $4.5 million, accreted over expected loan maturities Non-PCD reserve of $4.5 million established day 2 through provision expense American State Bank & Trust will merge, convert and integrate into Equity Bank during Q4 2021 ASB to deliver minimum tangible common equity of $60.5 million Redemption of $6.6 million of ASB preferred stock

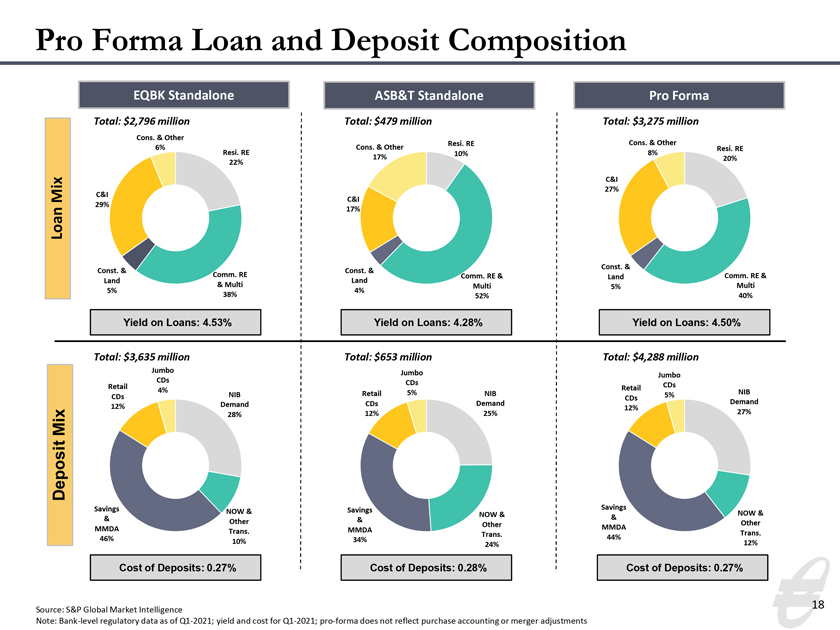

NIB Demand 28% NOW & Other Trans. 10% Savings & MMDA 46% Retail CDs 12% Jumbo CDs 4% NIB Demand 25% NOW & Other Trans. 24% Savings & MMDA 34% Retail CDs 12% Jumbo CDs 5% NIB Demand 27% NOW & Other Trans. 12% Savings & MMDA 44% Retail CDs 12% Jumbo CDs 5% Resi. RE 22% Comm. RE & Multi 38% Const. & Land 5% C&I 29% Cons. & Other 6% Resi. RE 10% Comm. RE & Multi 52% Const. & Land 4% C&I 17% Cons. & Other 17% Resi. RE 20% Comm. RE & Multi 40% Const. & Land 5% C&I 27% Cons. & Other 8% Pro Forma Loan and Deposit Composition 18 Deposit Mix Loan Mix Total: $2,796 million Total: $479 million Total: $3,275 million Total: $3,635 million Total: $653 million Total: $4,288 million Yield on Loans: 4.53% Yield on Loans: 4.28% Cost of Deposits: 0.27% Cost of Deposits: 0.28% Source: S&P Global Market Intelligence Note: Bank-level regulatory data as of Q1-2021; yield and cost for Q1-2021; pro-forma does not reflect purchase accounting or merger adjustments Yield on Loans: 4.50% Cost of Deposits: 0.27% EQBK Standalone ASB&T Standalone Pro Forma

19 Benefits to the Combined Stakeholders Shareholders Customers Employees Strategically and financially attractive transaction Successful board and management teams with strong community ties Improved liquidity for ASB shareholders Opportunity for increased shareholder value for both companies Community banking model with a focus on serving clients Addition of branch presence in Wichita and throughout Kansas Ability to provide enhanced products and services with larger lending limits Community bank market leader in Kansas, Missouri, Arkansas and Oklahoma Similar cultures and markets allows for a simplified employee transition Long-term dedicated management and leadership teams Larger size increases public identity and recruiting capability

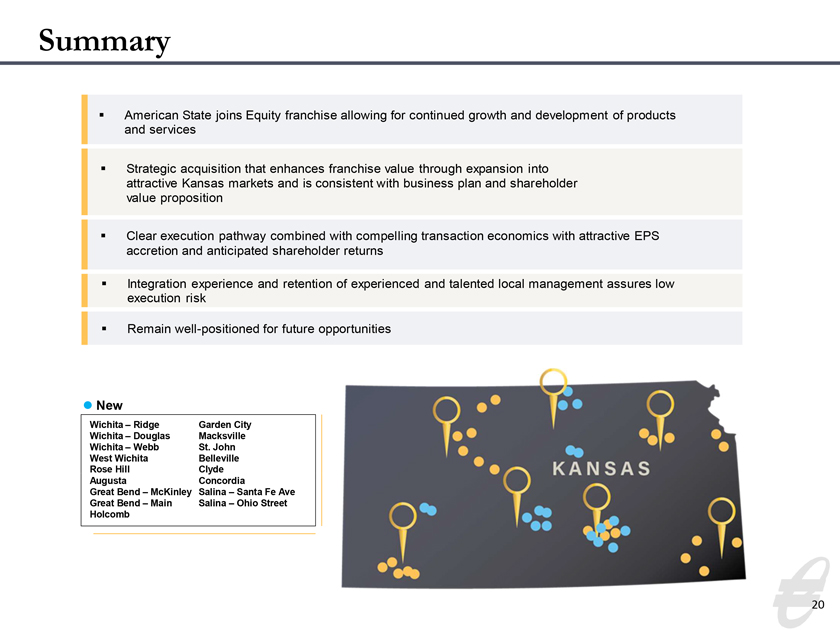

Summary 20 American State joins Equity franchise allowing for continued growth and development of products and services Strategic acquisition that enhances franchise value through expansion into attractive Kansas markets and is consistent with business plan and shareholder value proposition Integration experience and retention of experienced and talented local management assures low execution risk Remain well-positioned for future opportunities Clear execution pathway combined with compelling transaction economics with attractive EPS accretion and anticipated shareholder returns Wichita – Ridge Wichita – Douglas Wichita – Webb West Wichita Rose Hill Augusta Great Bend – McKinley Great Bend – Main Holcomb Garden City Macksville St. John Belleville Clyde Concordia Salina – Santa Fe Ave Salina – Ohio Street New

investor.equitybank.com