Attached files

| file | filename |

|---|---|

| EX-99.1A - EX-99.1A - AbCellera Biologics Inc. | abcl-ex991a_7.htm |

| 8-K/A - 8-K/A - AbCellera Biologics Inc. | abcl-8ka_20210513.htm |

May 13, 2021 Q1 2021 BUSINESS UPDATE

This presentation contains forward-looking statements, including statements made pursuant to the safe harbor provisions of the Private Securities Litigation Reform Act of 1995. The forward-looking statements are based on management’s beliefs and assumptions and on information currently available to management. All statements contained in this presentation other than statements of historical fact are forward-looking statements, including statements regarding our ability to develop, commercialize and achieve market acceptance of our current and planned products and services, our research and development efforts, and other matters regarding our business strategies, use of capital, results of operations and financial position, and plans and objectives for future operations. In some cases, you can identify forward-looking statements by the words “may,” “will,” “could,” “would,” “should,” “expect,” “intend,” “plan,” “anticipate,” “believe,” “estimate,” “predict,” “project,” “potential,” “continue,” “ongoing” or the negative of these terms or other comparable terminology, although not all forward-looking statements contain these words. These statements involve risks, uncertainties and other factors that may cause actual results, levels of activity, performance, or achievements to be materially different from the information expressed or implied by these forward-looking statements. These risks, uncertainties and other factors are described under "Risk Factors," "Management's Discussion and Analysis of Financial Condition and Results of Operations" and elsewhere in the documents we file with the Securities and Exchange Commission from time to time. We caution you that forward-looking statements are based on a combination of facts and factors currently known by us and our projections of the future, about which we cannot be certain. As a result, the forward-looking statements may not prove to be accurate. The forward-looking statements in this presentation represent our views as of the date hereof. We undertake no obligation to update any forward-looking statements for any reason, except as required by law. DISCLAIMER

Q1 2021 BUSINESS UPDATE. VISION TO BUILD THE WORLD’S MOST TECHNOLOGICALLY ADVANCED ANTIBODY DRUG DISCOVERY ENGINE, DEFINING THE STATE-OF-THE-ART FOR THE INDUSTRY, NOT JUST TODAY, BUT FOR DECADES TO COME. We have a bold vision –

Q1 2021 BUSINESS UPDATE. GROWTH STRATEGY Increase programs under contract EXPAND CAPABILITIES. BUILD CAPACITY. EXTEND COMMERCIAL REACH. 4 COPYRIGHT © ABCELLERA Our key growth strategies for achieving our long-term objectives include: Forward integration of our tech stack Scale teams and facilities 1 2 3 Further technology differentiation Improve speed, increase predictive power 4 5

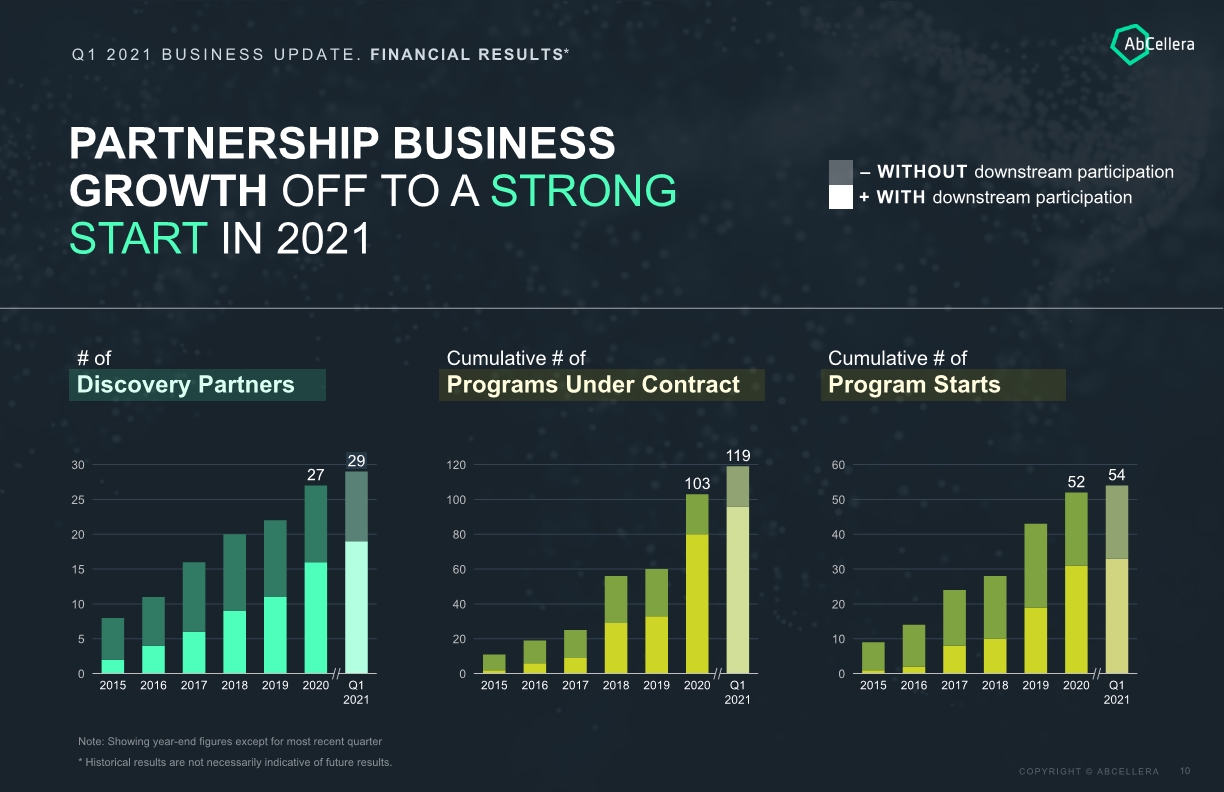

Q1 2021 BUSINESS UPDATE. HIGHLIGHTS 16 NEW PROGRAMS UNDER CONTRACT 119 CUMULATIVE PROGRAMS UNDER CONTRACT $203M IN REVENUE $680 million in cash and $190 million in accrued accounts receivable at quarter end. Expanded existing & new partnerships Diversified program portfolio Positioned for growth with strong liquidity Intention to generate a portfolio of hundreds of royalty positions, forging new partnerships and expanding our work with existing ones. 16 new programs under contract (PUCs) across one existing partner and two new partners, including the expansion of a single target deal with Gilead Sciences into a new multi-year, multi-target agreement.

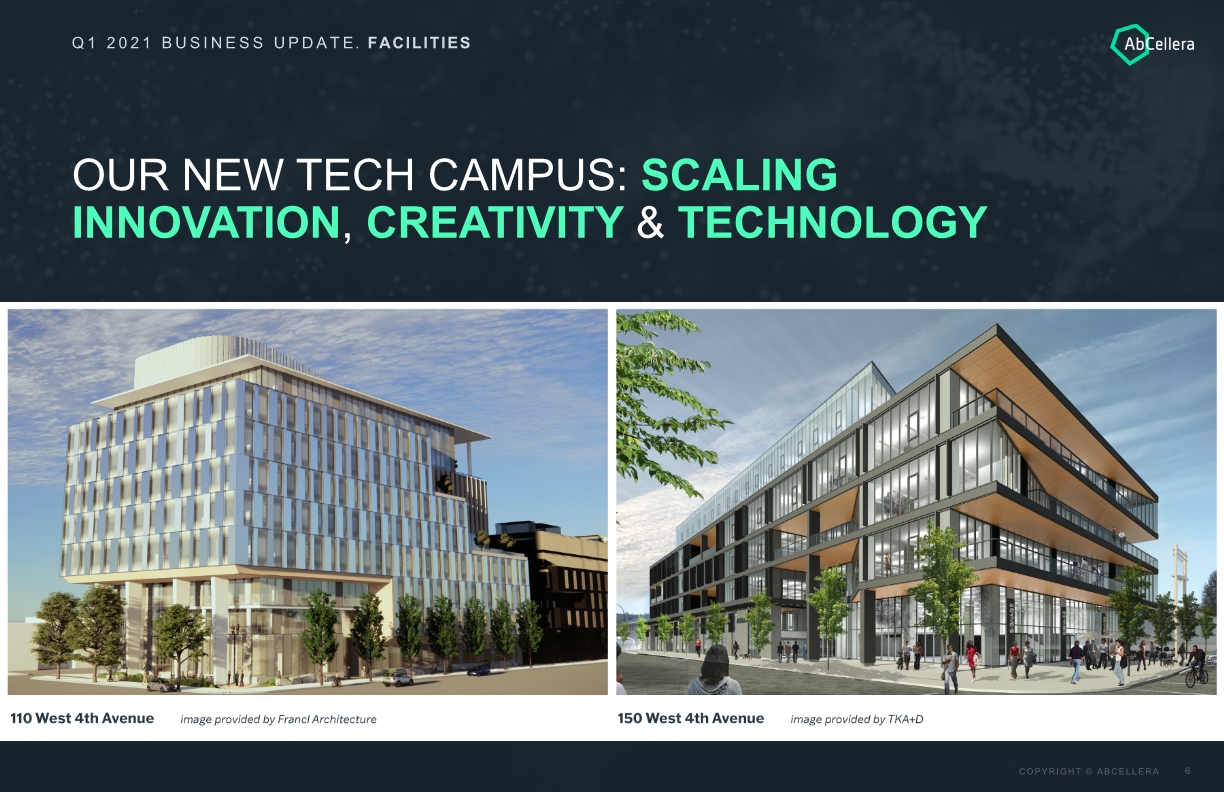

OUR NEW TECH CAMPUS: SCALING INNOVATION, CREATIVITY & TECHNOLOGY Q1 2021 BUSINESS UPDATE. FACILITIES

BAMLANIVIMAB:THE MOST BROADLY USED COVID-19 ANTIBODY IN THE WORLD Since being authorized for emergency use by the US FDA in November 2020, bamlanivimab has prevented hospitalizations and death: Lilly recently transitioned to the combination of bamlanivimab and etesevimab in the US. 400K+ patients treated 20K+ patients kept out of hospital 11K+ lives saved To address emerging variants, bamlanivimab has been evaluated in clinical trials with two other antibodies, including etesevimab and VIR-7831. Q1 2021 BUSINESS UPDATE. COVID-19 PROGRAM

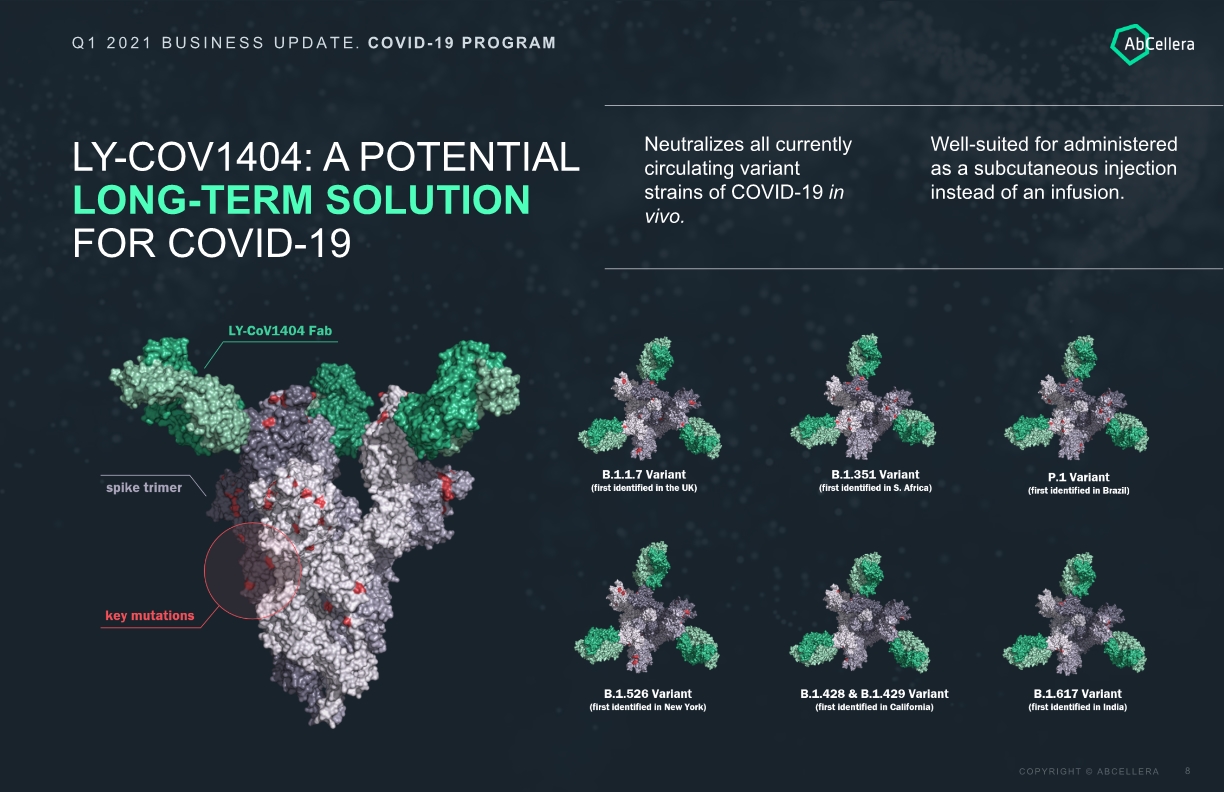

LY-COV1404: A POTENTIAL LONG-TERM SOLUTION FOR COVID-19 Q1 2021 BUSINESS UPDATE. COVID-19 PROGRAM Neutralizes all currently circulating variant strains of COVID-19 in vivo. Well-suited for administered as a subcutaneous injection instead of an infusion.

PARTNERSHIP BUSINESS GROWTH OFF TO A STRONG START IN 2021 Q1 2021 BUSINESS UPDATE. FINANCIAL RESULTS* Note: Showing year-end figures except for most recent quarter * Historical results are not necessarily indicative of future results. Discovery Partners Programs Under Contract Program Starts # of Cumulative # of Cumulative # of + WITH downstream participation – WITHOUT downstream participation 10 30 25 0 5 20 15 2018 2016 Q1 2021 2015 2017 2019 2020 27 29 0 20 120 40 60 80 100 2016 2015 Q1 2021 119 2018 2020 2019 103 2017 30 20 50 0 40 10 60 2017 Q1 2021 2015 2018 54 2019 2016 2020 52

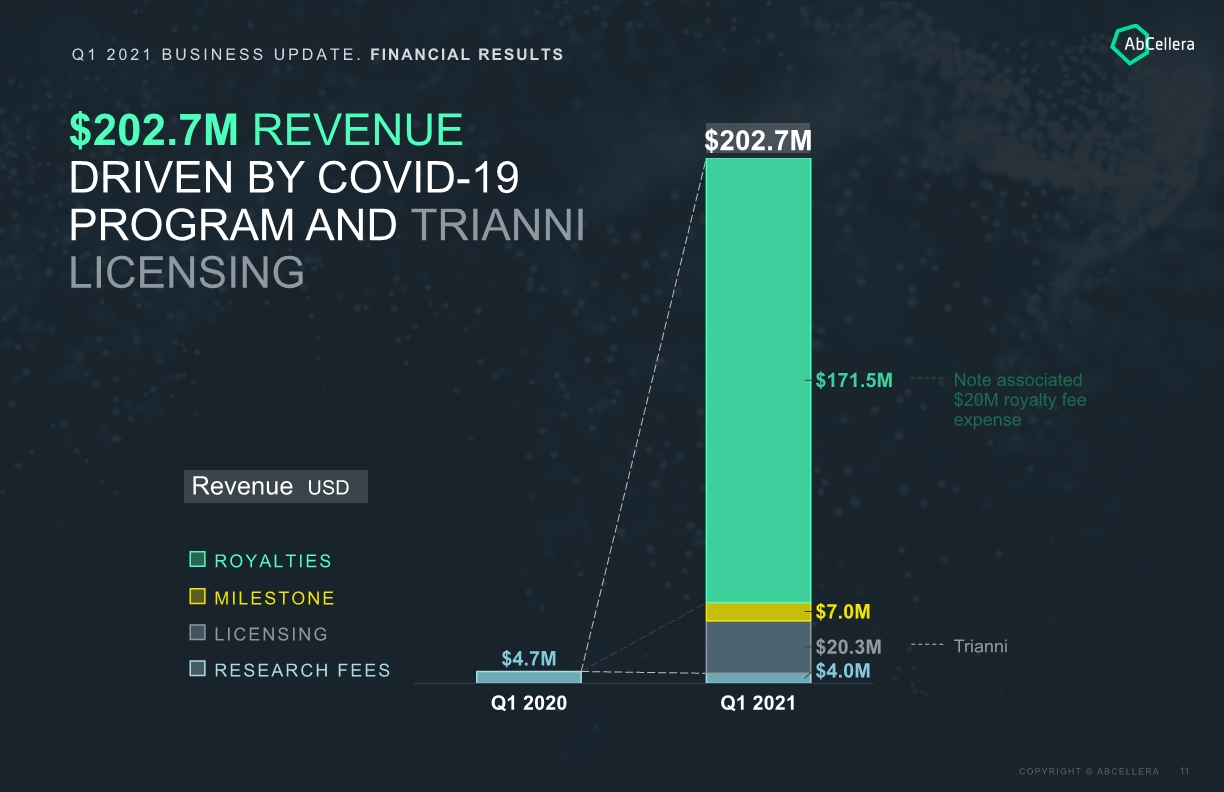

Q1 2021 BUSINESS UPDATE. FINANCIAL RESULTS Revenue USD $202.7M REVENUE DRIVEN BY COVID-19 PROGRAM AND TRIANNI LICENSING $4.7M $20.3M Q1 2020 $4.0M $171.5M $7.0M $202.7M Q1 2021 Trianni Note associated $20M royalty fee expense

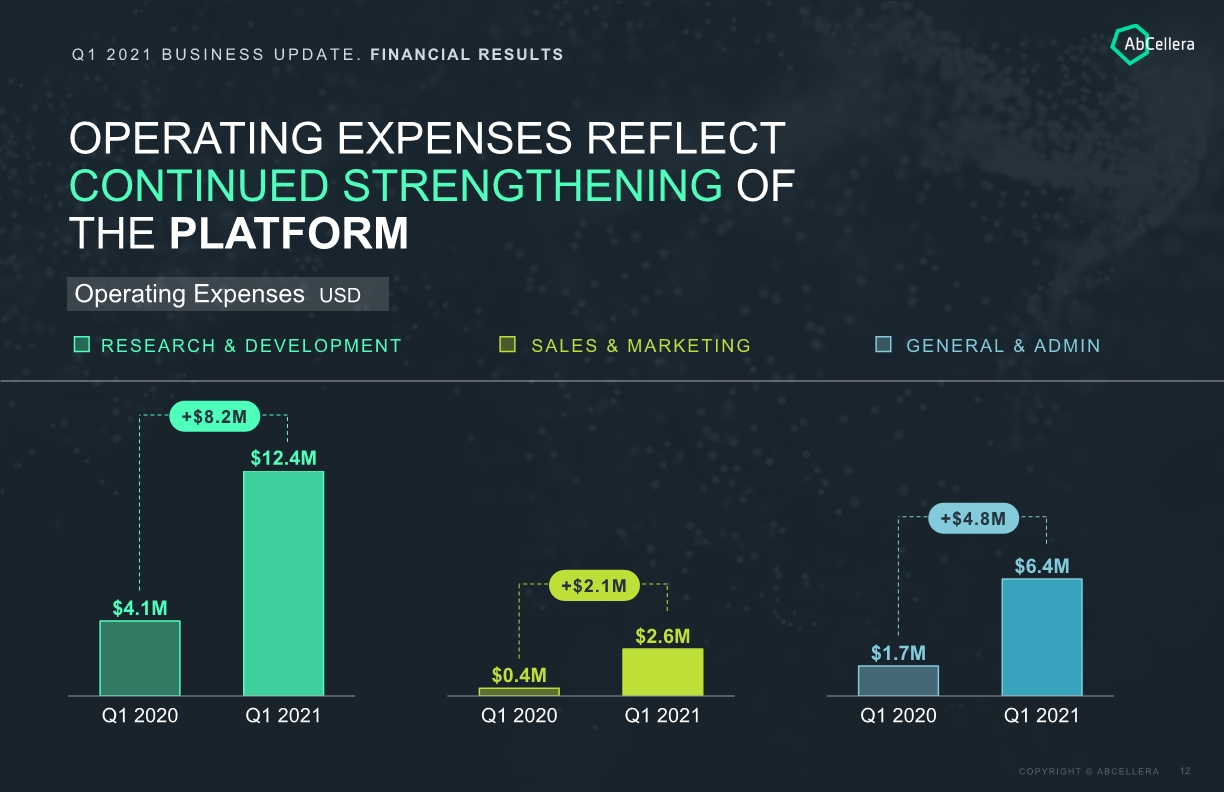

$6.4M $1.7M Q1 2020 Q1 2021 Q1 2021 BUSINESS UPDATE. FINANCIAL RESULTS OPERATING EXPENSES REFLECT CONTINUED STRENGTHENING OF THE PLATFORM Operating Expenses USD RESEARCH & DEVELOPMENT SALES & MARKETING GENERAL & ADMIN $12.4M $4.1M Q1 2021 Q1 2020 $0.4M $2.6M Q1 2020 Q1 2021

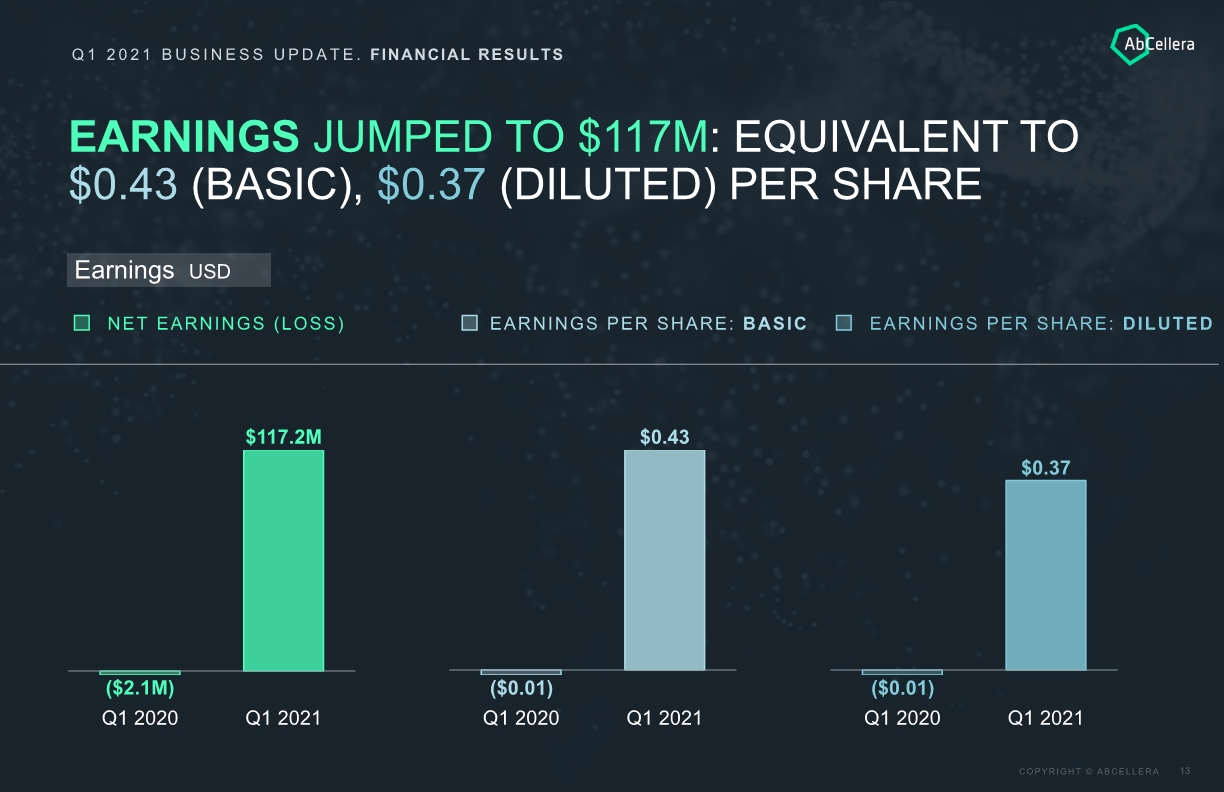

Q1 2021 Q1 2020 Q1 2021 BUSINESS UPDATE. FINANCIAL RESULTS EARNINGS JUMPED TO $117M: EQUIVALENT TO $0.43 (BASIC), $0.37 (DILUTED) PER SHARE NET EARNINGS (LOSS) EARNINGS PER SHARE: BASIC Earnings USD EARNINGS PER SHARE: DILUTED $117.2M ($2.1M) Q1 2021 Q1 2020 Q1 2021 Q1 2020

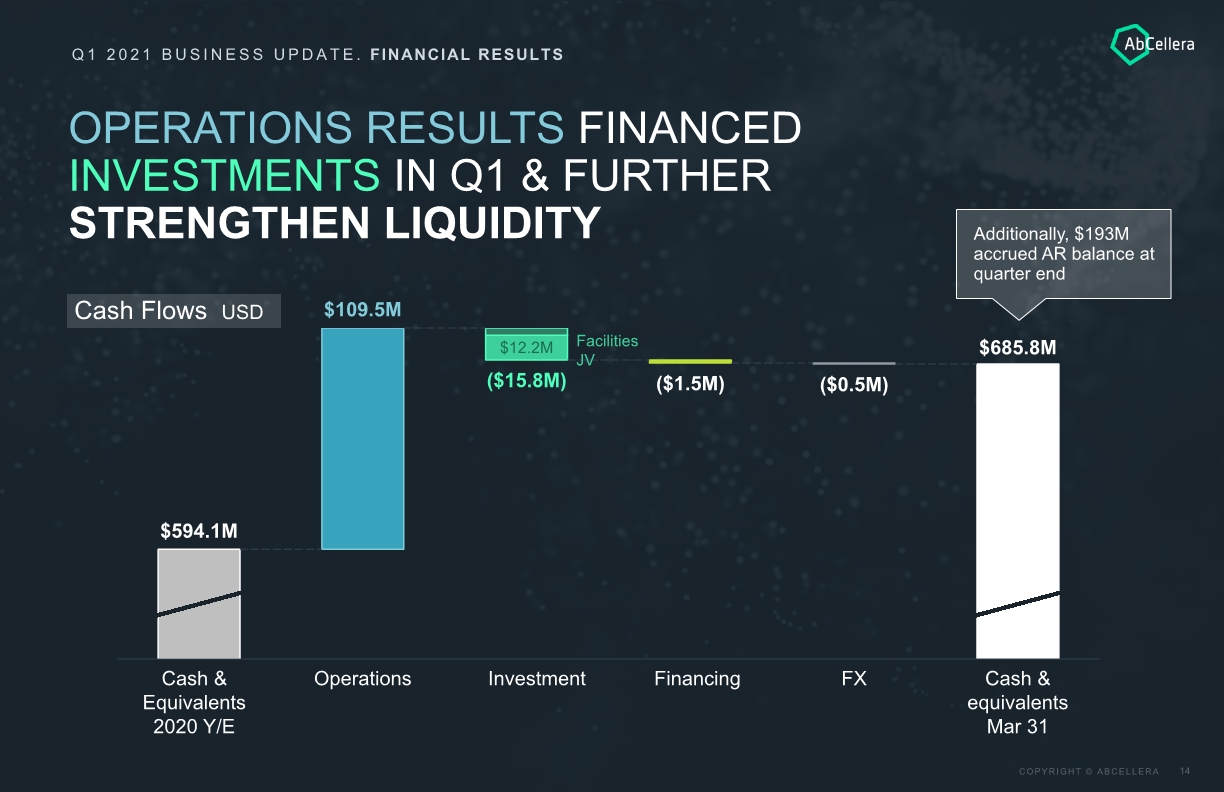

Q1 2021 BUSINESS UPDATE. FINANCIAL RESULTS OPERATIONS RESULTS FINANCED INVESTMENTS IN Q1 & FURTHER STRENGTHEN LIQUIDITY Cash Flows USD $594.1M $109.5M Financing $685.8M ($1.5M) Investment Cash & equivalents Mar 31 ($0.5M) $12.2M Operations ($15.8M) Cash & Equivalents 2020 Y/E FX Facilities JV Additionally, $193M accrued AR balance at quarter end

THANK YOU