Attached files

| file | filename |

|---|---|

| EX-99.1 - EX-99.1 - AT&T INC. | d176202dex991.htm |

| 8-K - 8-K - AT&T INC. | d176202d8k.htm |

Exhibit 99.2 Discovery and WarnerMedia to Combine May 17, 2021 © 2021 AT&T Intellectual Property. AT&T and AT&T Globe logo are registered trademarks and service marks of AT&T Intellectual Property and/or AT&T affiliated companies. All other marks are the property of their respective owners.Exhibit 99.2 Discovery and WarnerMedia to Combine May 17, 2021 © 2021 AT&T Intellectual Property. AT&T and AT&T Globe logo are registered trademarks and service marks of AT&T Intellectual Property and/or AT&T affiliated companies. All other marks are the property of their respective owners.

Call Participants John Stankey Chief Executive Officer, AT&T Pascal Desroches Chief Financial Officer, AT&T David Zaslav President and CEO, Discovery Dr. Gunnar Wiedenfels Chief Financial Officer, DiscoveryCall Participants John Stankey Chief Executive Officer, AT&T Pascal Desroches Chief Financial Officer, AT&T David Zaslav President and CEO, Discovery Dr. Gunnar Wiedenfels Chief Financial Officer, Discovery

Cautionary Language Concerning Forward-looking Statements Information set forth in this communication, including financial estimates and statements as to the expected timing, completion and effects of the proposed transaction between AT&T, Magallanes, Inc. (“Spinco”), and Discovery, Inc. (“Discovery”) constitute forward-looking statements within the meaning of the safe harbor provisions of the Private Securities Litigation Reform Act of 1995. These estimates and statements are subject to risks and uncertainties, and actual results might differ materially. Such estimates and statements include, but are not limited to, statements about the benefits of the transaction, including future financial and operating results, the combined Spinco and Discovery company’s plans, objectives, expectations and intentions, and other statements that are not historical facts. Such statements are based upon the current beliefs and expectations of the management of AT&T and Discovery and are subject to significant risks and uncertainties outside of our control. Among the risks and uncertainties that could cause actual results to differ from those described in the forward-looking statements are the following: the occurrence of any event, change or other circumstances that could give rise to the termination of the proposed transaction; the risk that Discovery stockholders may not approve the transaction proposals; the risk that the necessary regulatory approvals may not be obtained or may be obtained subject to conditions that are not anticipated; risks that any of the other closing conditions to the proposed transaction may not be satisfied in a timely manner; risks that the anticipated tax treatment of the proposed transaction is not obtained; risks related to potential litigation brought in connection with the proposed transaction; uncertainties as to the timing of the consummation of the proposed transaction; risks and costs related to the implementation of the separation of Spinco, including timing anticipated to complete the separation, any changes to the configuration of the businesses included in the separation if implemented; the risk that the integration of Discovery and Spinco being more difficult, time consuming or costly than expected; risks related to financial community and rating agency perceptions of each of AT&T and Discovery and its business, operations, financial condition and the industry in which it operates; risks related to disruption of management time from ongoing business operations due to the proposed merger; failure to realize the benefits expected from the proposed merger; effects of the announcement, pendency or completion of the proposed merger on the ability of AT&T, Spinco or Discovery to retain customers and retain and hire key personnel and maintain relationships with their suppliers, and on their operating results and businesses generally; and risks related to the potential impact of general economic, political and market factors on the companies or the proposed transaction. The effects of the COVID-19 pandemic may give rise to risks that are currently unknown or amplify the risks associated with the foregoing factors. These risks, as well as other risks associated with the proposed transaction, will be more fully discussed in the proxy statement/prospectus that will be included in the registration statements that will be filed with the SEC in connection with the proposed transaction. Discussions of additional risks and uncertainties are contained in AT&T’s and Discovery’s filings with the Securities and Exchange Commission. Neither AT&T nor Discovery is under any obligation, and each expressly disclaims any obligation, to update, alter, or otherwise revise any forward-looking statements, whether written or oral, that may be made from time to time, whether as a result of new information, future events, or otherwise. Persons reading this announcement are cautioned not to place undue reliance on these forward-looking statements which speak only as of the date hereof. This presentation may contain certain non-GAAP financial measures. Reconciliations between the non-GAAP financial measures and the GAAP financial measures are available on slide 17 of this presentation, and respective company websites (AT&T’s investor relations website: https://investors.att.com. Discovery’s investor relations website: https://ir.corporate.discovery.com/investor-relations) Additional Information and Where to Find It This communication may be deemed to be solicitation material in respect of the proposed transaction between AT&T, Spinco, and Discovery. In connection with the proposed transaction, AT&T, Spinco and Discovery intend to file relevant materials with the Securities and Exchange Commission (“SEC”), including a registration statement on Form S-4 by Discovery that will contain a prospectus of Discovery and Spinco that also constitutes a proxy statement of Discovery, and a registration statement by Spinco. This communication is not a substitute for the registration statements, proxy statement/prospectus or any other document which AT&T, Spinco or Discovery may file with the SEC. STOCKHOLDERS OF AT&T AND DISCOVERY ARE URGED TO READ ALL RELEVANT DOCUMENTS FILED WITH THE SEC, INCLUDING THE REGISTRATION STATEMENT AND PROXY STATEMENT/PROSPECTUS, BECAUSE THEY WILL CONTAIN IMPORTANT INFORMATION ABOUT THE PROPOSED TRANSACTION. Investors and security holders will be able to obtain copies of the proxy statement/prospectus (when available) as well as other filings containing information about AT&T, Spinco and Discovery, without charge, at the SEC’s website, http://www.sec.gov. Copies of documents filed with the SEC by AT&T or Spinco will be made available free of charge on AT&T’s investor relations website at https://investors.att.com. Copies of documents filed with the SEC by Discovery will be made available free of charge on Discovery’s investor relations website at https://ir.corporate.discovery.com/investor-relations. No Offer or Solicitation This communication is for informational purposes only and is not intended to and does not constitute an offer to sell, or the solicitation of an offer to subscribe for or buy, or a solicitation of any vote or approval in any jurisdiction, nor shall there be any sale, issuance or transfer of securities in any jurisdiction in which such offer, sale or solicitation would be unlawful, prior to registration or qualification under the securities laws of any such jurisdiction. No offer of securities shall be made except by means of a prospectus meeting the requirements of Section 10 of the Securities Act of 1933, as amended, and otherwise in accordance with applicable law. Participants in Solicitation AT&T and its directors and executive officers, and Discovery and its directors and executive officers, may be deemed to be participants in the solicitation of proxies from the holders of Discovery capital stock and/or the offering of Discovery securities in respect of the proposed transaction. Information about the directors and executive officers of AT&T is set forth in the proxy statement for AT&T’s 2021 Annual Meeting of Stockholders, which was filed with the SEC on March 11, 2021. Information about the directors and executive officers of Discovery is set forth in the proxy statement for Discovery’s 2021 Annual Meeting of Stockholders, which was filed with the SEC on April 30, 2021. Investors may obtain additional information regarding the interest of such participants by reading the proxy statement/prospectus regarding the proposed transaction when it becomes available.Cautionary Language Concerning Forward-looking Statements Information set forth in this communication, including financial estimates and statements as to the expected timing, completion and effects of the proposed transaction between AT&T, Magallanes, Inc. (“Spinco”), and Discovery, Inc. (“Discovery”) constitute forward-looking statements within the meaning of the safe harbor provisions of the Private Securities Litigation Reform Act of 1995. These estimates and statements are subject to risks and uncertainties, and actual results might differ materially. Such estimates and statements include, but are not limited to, statements about the benefits of the transaction, including future financial and operating results, the combined Spinco and Discovery company’s plans, objectives, expectations and intentions, and other statements that are not historical facts. Such statements are based upon the current beliefs and expectations of the management of AT&T and Discovery and are subject to significant risks and uncertainties outside of our control. Among the risks and uncertainties that could cause actual results to differ from those described in the forward-looking statements are the following: the occurrence of any event, change or other circumstances that could give rise to the termination of the proposed transaction; the risk that Discovery stockholders may not approve the transaction proposals; the risk that the necessary regulatory approvals may not be obtained or may be obtained subject to conditions that are not anticipated; risks that any of the other closing conditions to the proposed transaction may not be satisfied in a timely manner; risks that the anticipated tax treatment of the proposed transaction is not obtained; risks related to potential litigation brought in connection with the proposed transaction; uncertainties as to the timing of the consummation of the proposed transaction; risks and costs related to the implementation of the separation of Spinco, including timing anticipated to complete the separation, any changes to the configuration of the businesses included in the separation if implemented; the risk that the integration of Discovery and Spinco being more difficult, time consuming or costly than expected; risks related to financial community and rating agency perceptions of each of AT&T and Discovery and its business, operations, financial condition and the industry in which it operates; risks related to disruption of management time from ongoing business operations due to the proposed merger; failure to realize the benefits expected from the proposed merger; effects of the announcement, pendency or completion of the proposed merger on the ability of AT&T, Spinco or Discovery to retain customers and retain and hire key personnel and maintain relationships with their suppliers, and on their operating results and businesses generally; and risks related to the potential impact of general economic, political and market factors on the companies or the proposed transaction. The effects of the COVID-19 pandemic may give rise to risks that are currently unknown or amplify the risks associated with the foregoing factors. These risks, as well as other risks associated with the proposed transaction, will be more fully discussed in the proxy statement/prospectus that will be included in the registration statements that will be filed with the SEC in connection with the proposed transaction. Discussions of additional risks and uncertainties are contained in AT&T’s and Discovery’s filings with the Securities and Exchange Commission. Neither AT&T nor Discovery is under any obligation, and each expressly disclaims any obligation, to update, alter, or otherwise revise any forward-looking statements, whether written or oral, that may be made from time to time, whether as a result of new information, future events, or otherwise. Persons reading this announcement are cautioned not to place undue reliance on these forward-looking statements which speak only as of the date hereof. This presentation may contain certain non-GAAP financial measures. Reconciliations between the non-GAAP financial measures and the GAAP financial measures are available on slide 17 of this presentation, and respective company websites (AT&T’s investor relations website: https://investors.att.com. Discovery’s investor relations website: https://ir.corporate.discovery.com/investor-relations) Additional Information and Where to Find It This communication may be deemed to be solicitation material in respect of the proposed transaction between AT&T, Spinco, and Discovery. In connection with the proposed transaction, AT&T, Spinco and Discovery intend to file relevant materials with the Securities and Exchange Commission (“SEC”), including a registration statement on Form S-4 by Discovery that will contain a prospectus of Discovery and Spinco that also constitutes a proxy statement of Discovery, and a registration statement by Spinco. This communication is not a substitute for the registration statements, proxy statement/prospectus or any other document which AT&T, Spinco or Discovery may file with the SEC. STOCKHOLDERS OF AT&T AND DISCOVERY ARE URGED TO READ ALL RELEVANT DOCUMENTS FILED WITH THE SEC, INCLUDING THE REGISTRATION STATEMENT AND PROXY STATEMENT/PROSPECTUS, BECAUSE THEY WILL CONTAIN IMPORTANT INFORMATION ABOUT THE PROPOSED TRANSACTION. Investors and security holders will be able to obtain copies of the proxy statement/prospectus (when available) as well as other filings containing information about AT&T, Spinco and Discovery, without charge, at the SEC’s website, http://www.sec.gov. Copies of documents filed with the SEC by AT&T or Spinco will be made available free of charge on AT&T’s investor relations website at https://investors.att.com. Copies of documents filed with the SEC by Discovery will be made available free of charge on Discovery’s investor relations website at https://ir.corporate.discovery.com/investor-relations. No Offer or Solicitation This communication is for informational purposes only and is not intended to and does not constitute an offer to sell, or the solicitation of an offer to subscribe for or buy, or a solicitation of any vote or approval in any jurisdiction, nor shall there be any sale, issuance or transfer of securities in any jurisdiction in which such offer, sale or solicitation would be unlawful, prior to registration or qualification under the securities laws of any such jurisdiction. No offer of securities shall be made except by means of a prospectus meeting the requirements of Section 10 of the Securities Act of 1933, as amended, and otherwise in accordance with applicable law. Participants in Solicitation AT&T and its directors and executive officers, and Discovery and its directors and executive officers, may be deemed to be participants in the solicitation of proxies from the holders of Discovery capital stock and/or the offering of Discovery securities in respect of the proposed transaction. Information about the directors and executive officers of AT&T is set forth in the proxy statement for AT&T’s 2021 Annual Meeting of Stockholders, which was filed with the SEC on March 11, 2021. Information about the directors and executive officers of Discovery is set forth in the proxy statement for Discovery’s 2021 Annual Meeting of Stockholders, which was filed with the SEC on April 30, 2021. Investors may obtain additional information regarding the interest of such participants by reading the proxy statement/prospectus regarding the proposed transaction when it becomes available.

AT&T to merge WarnerMedia with Discovery • WarnerMedia and Discovery to combine operations to create a global entertainment leader • David Zaslav to be CEO of new company Transaction Rationale – Unlocks significant value for AT&T shareholders – Positions Discovery shareholders with enhanced long-term growth – Accelerates HBO Max and discovery+’s global plans for direct-to-consumer – Creates one of the deepest content libraries in the world – Unites complementary content and brands across the most popular programming categories – Expects to generate $3B+/year in synergies that can be reinvested into content and DTC 4AT&T to merge WarnerMedia with Discovery • WarnerMedia and Discovery to combine operations to create a global entertainment leader • David Zaslav to be CEO of new company Transaction Rationale – Unlocks significant value for AT&T shareholders – Positions Discovery shareholders with enhanced long-term growth – Accelerates HBO Max and discovery+’s global plans for direct-to-consumer – Creates one of the deepest content libraries in the world – Unites complementary content and brands across the most popular programming categories – Expects to generate $3B+/year in synergies that can be reinvested into content and DTC 4

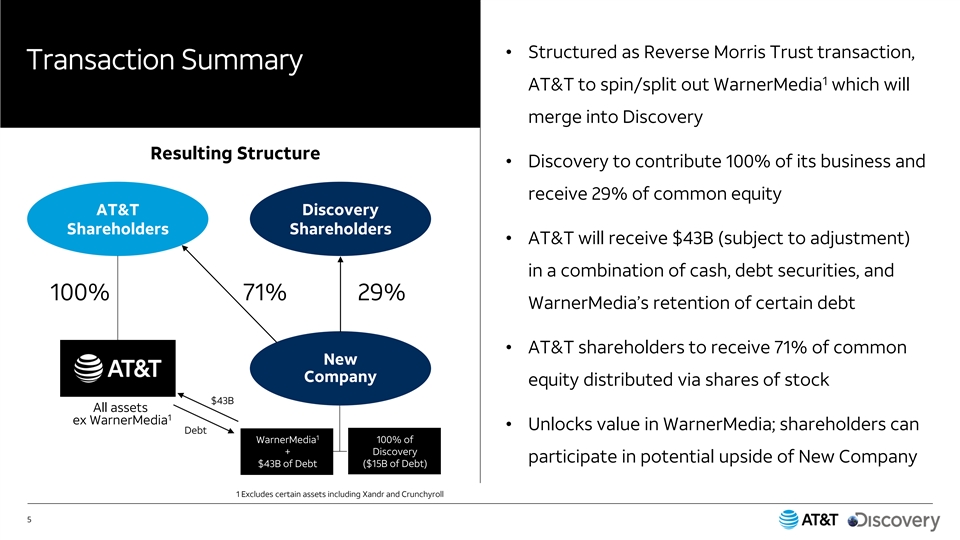

• Structured as Reverse Morris Trust transaction, Transaction Summary 1 AT&T to spin/split out WarnerMedia which will merge into Discovery Resulting Structure • Discovery to contribute 100% of its business and receive 29% of common equity AT&T Discovery Shareholders Shareholders • AT&T will receive $43B (subject to adjustment) in a combination of cash, debt securities, and 100% 71% 29% WarnerMedia’s retention of certain debt • AT&T shareholders to receive 71% of common New Company equity distributed via shares of stock $43B All assets 1 ex WarnerMedia • Unlocks value in WarnerMedia; shareholders can Debt 1 WarnerMedia 100% of + Discovery participate in potential upside of New Company $43B of Debt ($15B of Debt) 1 Excludes certain assets including Xandr and Crunchyroll 5• Structured as Reverse Morris Trust transaction, Transaction Summary 1 AT&T to spin/split out WarnerMedia which will merge into Discovery Resulting Structure • Discovery to contribute 100% of its business and receive 29% of common equity AT&T Discovery Shareholders Shareholders • AT&T will receive $43B (subject to adjustment) in a combination of cash, debt securities, and 100% 71% 29% WarnerMedia’s retention of certain debt • AT&T shareholders to receive 71% of common New Company equity distributed via shares of stock $43B All assets 1 ex WarnerMedia • Unlocks value in WarnerMedia; shareholders can Debt 1 WarnerMedia 100% of + Discovery participate in potential upside of New Company $43B of Debt ($15B of Debt) 1 Excludes certain assets including Xandr and Crunchyroll 5

Discovery + WarnerMedia David Zaslav and Dr. Gunnar Wiedenfels † See notes slide for details 6 Presentation title / Month XX, 2021 / © 2021 AT&T Intellectual Property - AT&T Proprietary (Internal Use Only) Discovery + WarnerMedia David Zaslav and Dr. Gunnar Wiedenfels † See notes slide for details 6 Presentation title / Month XX, 2021 / © 2021 AT&T Intellectual Property - AT&T Proprietary (Internal Use Only)

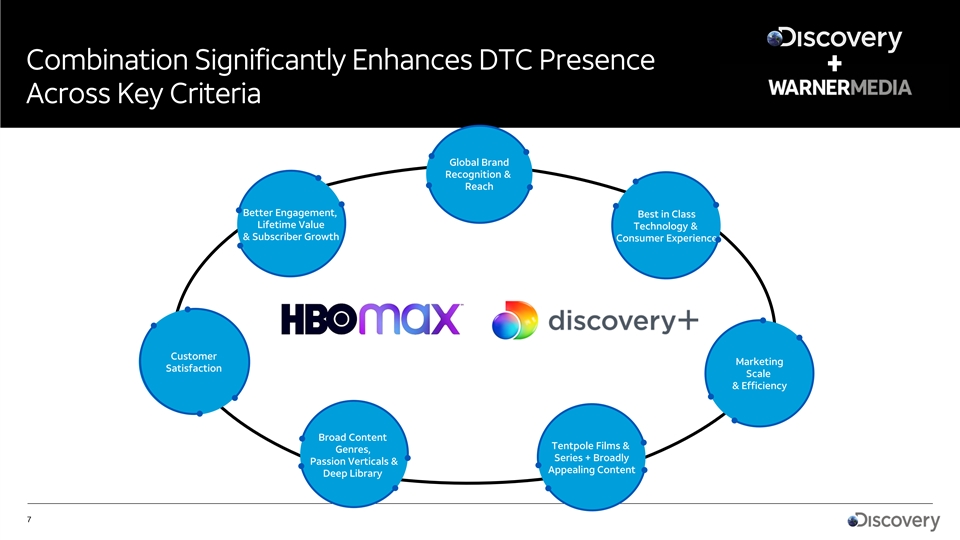

Combination Significantly Enhances DTC Presence Across Key Criteria Global Brand Recognition & Reach Better Engagement, Best in Class Lifetime Value Technology & & Subscriber Growth Consumer Experience Customer Marketing Satisfaction Scale & Efficiency Broad Content Tentpole Films & Genres, Series + Broadly Passion Verticals & Appealing Content Deep Library 7 7Combination Significantly Enhances DTC Presence Across Key Criteria Global Brand Recognition & Reach Better Engagement, Best in Class Lifetime Value Technology & & Subscriber Growth Consumer Experience Customer Marketing Satisfaction Scale & Efficiency Broad Content Tentpole Films & Genres, Series + Broadly Passion Verticals & Appealing Content Deep Library 7 7

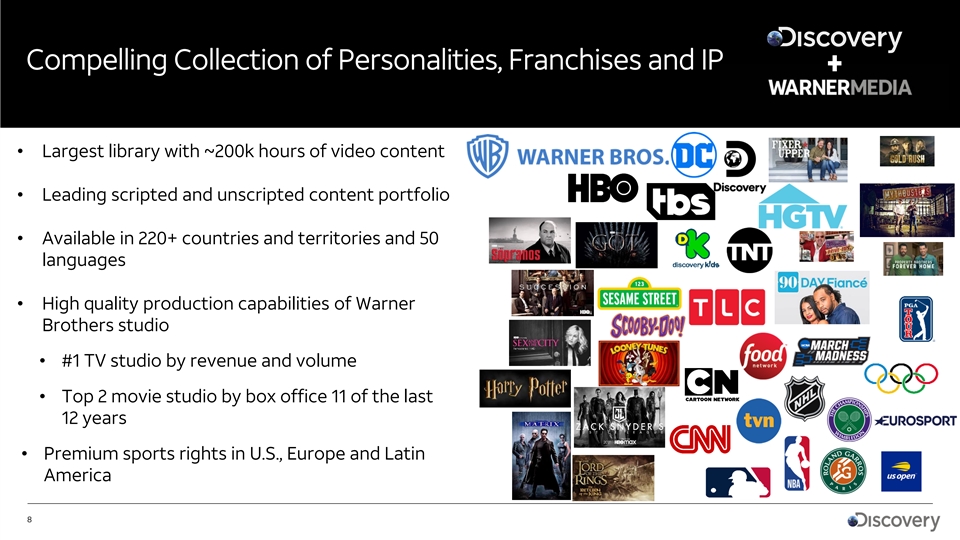

Compelling Collection of Personalities, Franchises and IP • Largest library with ~200k hours of video content • Leading scripted and unscripted content portfolio • Available in 220+ countries and territories and 50 languages • High quality production capabilities of Warner Brothers studio • #1 TV studio by revenue and volume • Top 2 movie studio by box office 11 of the last 12 years • Premium sports rights in U.S., Europe and Latin America 8Compelling Collection of Personalities, Franchises and IP • Largest library with ~200k hours of video content • Leading scripted and unscripted content portfolio • Available in 220+ countries and territories and 50 languages • High quality production capabilities of Warner Brothers studio • #1 TV studio by revenue and volume • Top 2 movie studio by box office 11 of the last 12 years • Premium sports rights in U.S., Europe and Latin America 8

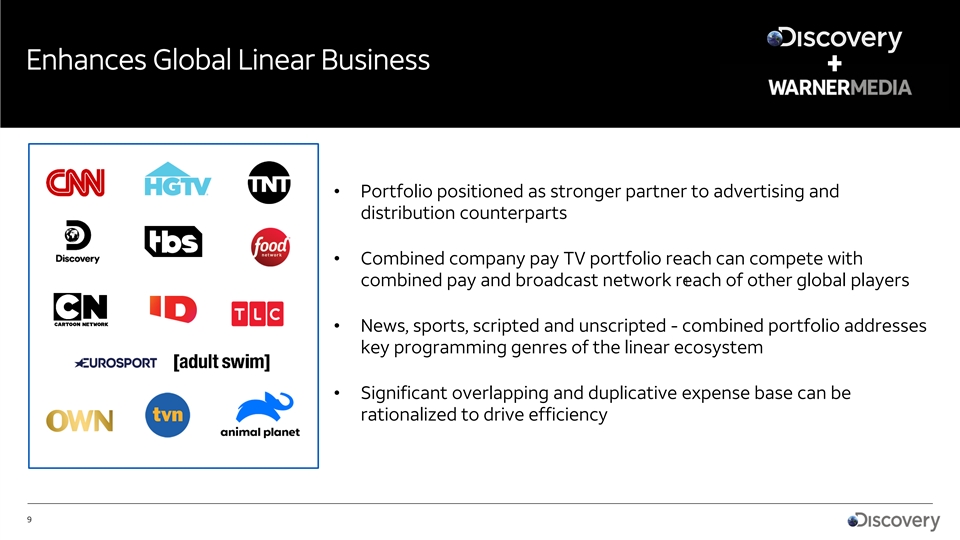

Enhances Global Linear Business • Portfolio positioned as stronger partner to advertising and distribution counterparts • Combined company pay TV portfolio reach can compete with 1 combined pay and broadcast network reach of other global players • News, sports, scripted and unscripted - combined portfolio addresses key programming genres of the linear ecosystem • Significant overlapping and duplicative expense base can be rationalized to drive efficiency 9Enhances Global Linear Business • Portfolio positioned as stronger partner to advertising and distribution counterparts • Combined company pay TV portfolio reach can compete with 1 combined pay and broadcast network reach of other global players • News, sports, scripted and unscripted - combined portfolio addresses key programming genres of the linear ecosystem • Significant overlapping and duplicative expense base can be rationalized to drive efficiency 9

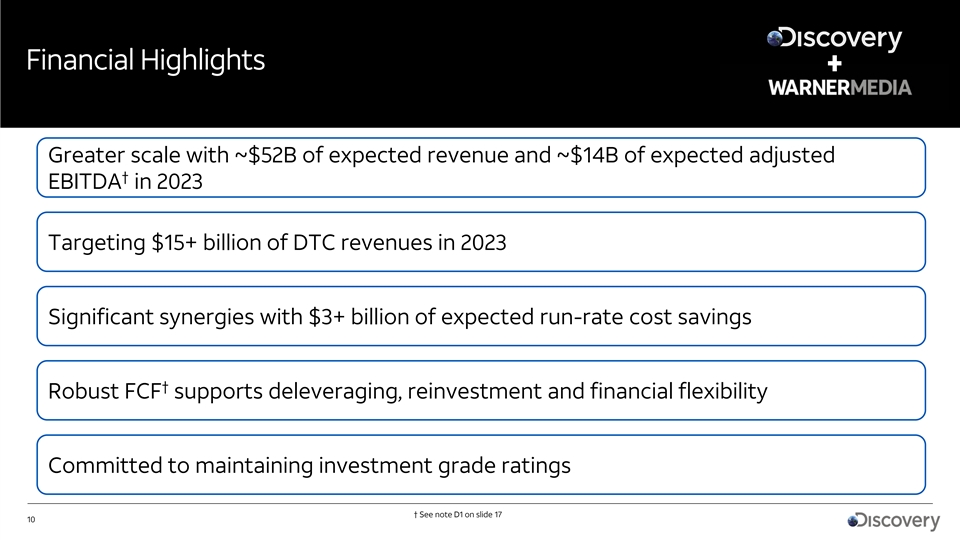

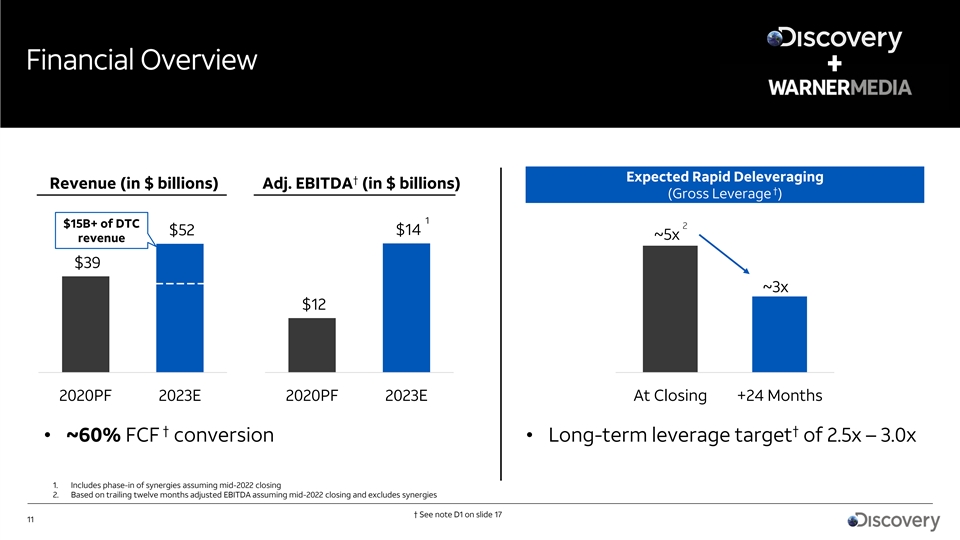

Financial Highlights Greater scale with ~$52B of expected revenue and ~$14B of expected adjusted † EBITDA in 2023 Targeting $15+ billion of DTC revenues in 2023 Significant synergies with $3+ billion of expected run-rate cost savings † Robust FCF supports deleveraging, reinvestment and financial flexibility Committed to maintaining investment grade ratings † See note D1 on slide 17 10Financial Highlights Greater scale with ~$52B of expected revenue and ~$14B of expected adjusted † EBITDA in 2023 Targeting $15+ billion of DTC revenues in 2023 Significant synergies with $3+ billion of expected run-rate cost savings † Robust FCF supports deleveraging, reinvestment and financial flexibility Committed to maintaining investment grade ratings † See note D1 on slide 17 10

Financial Overview Expected Rapid Deleveraging † Revenue (in $ billions) Adj. EBITDA (in $ billions) † (Gross Leverage ) 1 $15B+ of DTC 2 $52 $14 ~5x revenue $39 ~3x $12 2020PF 2023E 2020PF 2023E At Closing +24 Months † † • ~60% FCF conversion• Long-term leverage target of 2.5x – 3.0x 1. Includes phase-in of synergies assuming mid-2022 closing 2. Based on trailing twelve months adjusted EBITDA assuming mid-2022 closing and excludes synergies † See note D1 on slide 17 11Financial Overview Expected Rapid Deleveraging † Revenue (in $ billions) Adj. EBITDA (in $ billions) † (Gross Leverage ) 1 $15B+ of DTC 2 $52 $14 ~5x revenue $39 ~3x $12 2020PF 2023E 2020PF 2023E At Closing +24 Months † † • ~60% FCF conversion• Long-term leverage target of 2.5x – 3.0x 1. Includes phase-in of synergies assuming mid-2022 closing 2. Based on trailing twelve months adjusted EBITDA assuming mid-2022 closing and excludes synergies † See note D1 on slide 17 11

AT&T Post Transaction John Stankey and Pascal Desroches † See notes slide for details 12 Presentation title / Month XX, 2021 / © 2021 AT&T Intellectual Property - AT&T Proprietary (Internal Use Only) AT&T Post Transaction John Stankey and Pascal Desroches † See notes slide for details 12 Presentation title / Month XX, 2021 / © 2021 AT&T Intellectual Property - AT&T Proprietary (Internal Use Only)

AT&T AT&T’s Going Forward Deliberate Market Focus This transaction is the right move for our shareholders 5G Wireless Provides financial flexibility required to be the leader in broadband connectivity across all the U.S. Expect 200M POPs covered with C-Band by end of 2023 Focuses our management team to execute on AT&T’s efficiency and effectiveness transformation AT&T Fiber Simplifies AT&T investment thesis and aligns Plan to expand reach to 30 million assets with appropriate investor base customer locations by end of 2025 Positions AT&T for revenue growth, margin expansion, and earnings growth 13AT&T AT&T’s Going Forward Deliberate Market Focus This transaction is the right move for our shareholders 5G Wireless Provides financial flexibility required to be the leader in broadband connectivity across all the U.S. Expect 200M POPs covered with C-Band by end of 2023 Focuses our management team to execute on AT&T’s efficiency and effectiveness transformation AT&T Fiber Simplifies AT&T investment thesis and aligns Plan to expand reach to 30 million assets with appropriate investor base customer locations by end of 2025 Positions AT&T for revenue growth, margin expansion, and earnings growth 13

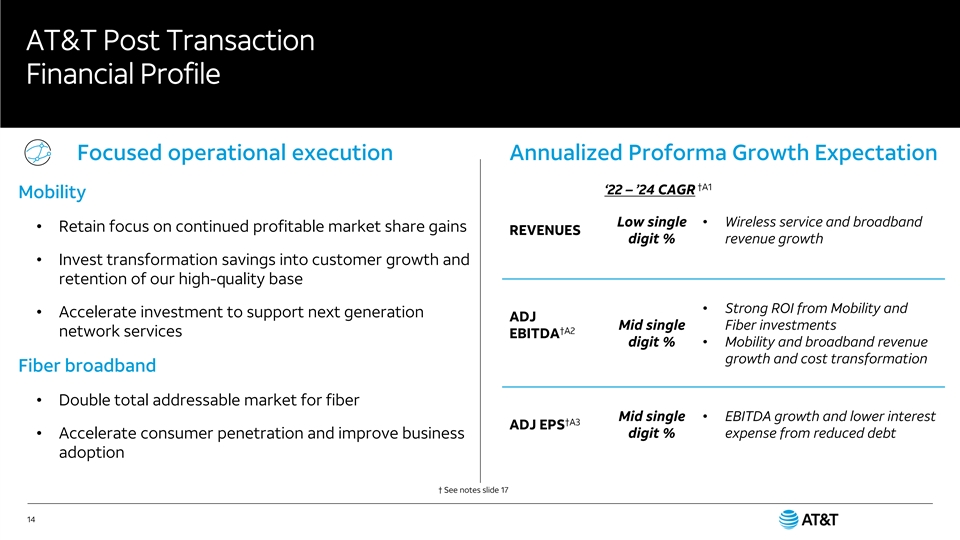

AT&T Post Transaction Financial Profile Focused operational execution Annualized Proforma Growth Expectation †A1 ‘22 – ’24 CAGR Mobility Low single • Wireless service and broadband • Retain focus on continued profitable market share gains REVENUES digit % revenue growth • Invest transformation savings into customer growth and retention of our high-quality base • Strong ROI from Mobility and • Accelerate investment to support next generation ADJ Mid single Fiber investments †A2 network services EBITDA digit %• Mobility and broadband revenue growth and cost transformation Fiber broadband • Double total addressable market for fiber Mid single • EBITDA growth and lower interest †A3 ADJ EPS digit % expense from reduced debt • Accelerate consumer penetration and improve business adoption † See notes slide 17 14AT&T Post Transaction Financial Profile Focused operational execution Annualized Proforma Growth Expectation †A1 ‘22 – ’24 CAGR Mobility Low single • Wireless service and broadband • Retain focus on continued profitable market share gains REVENUES digit % revenue growth • Invest transformation savings into customer growth and retention of our high-quality base • Strong ROI from Mobility and • Accelerate investment to support next generation ADJ Mid single Fiber investments †A2 network services EBITDA digit %• Mobility and broadband revenue growth and cost transformation Fiber broadband • Double total addressable market for fiber Mid single • EBITDA growth and lower interest †A3 ADJ EPS digit % expense from reduced debt • Accelerate consumer penetration and improve business adoption † See notes slide 17 14

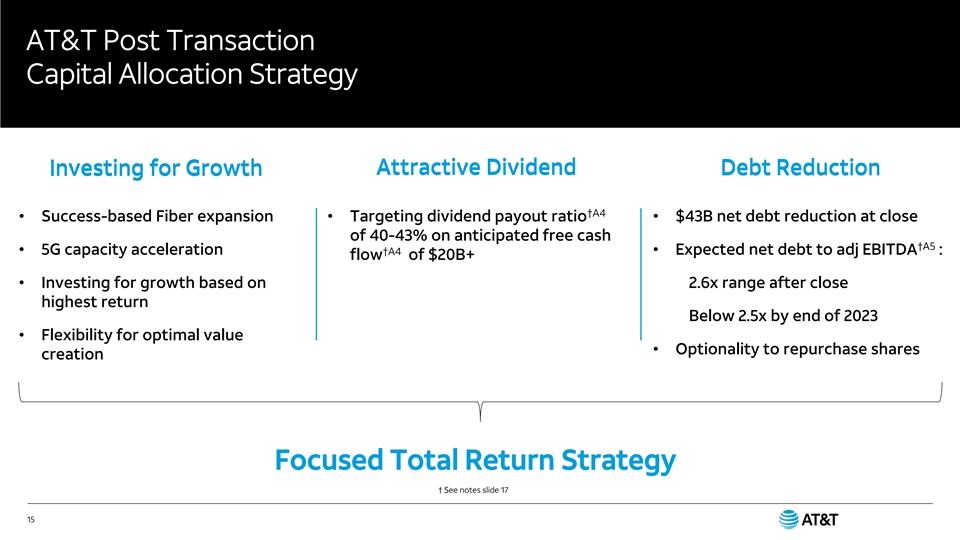

AT&T Post Transaction Capital Allocation Strategy Attractive Dividend Debt Reduction Investing for Growth Attractive Dividend Debt Reduction Investing for Growth †A4 • Success-based Fiber expansion• Targeting dividend payout ratio• $43B net debt reduction at close of 40-43% on anticipated free cash †A5 • 5G capacity acceleration †A4• Expected net debt to adj EBITDA : flow of $20B+ • Investing for growth based on 2.6x range after close highest return Below 2.5x by end of 2023 • Flexibility for optimal value • Optionality to repurchase shares creation Focused Total Return Strategy † See notes slide 17 15AT&T Post Transaction Capital Allocation Strategy Attractive Dividend Debt Reduction Investing for Growth Attractive Dividend Debt Reduction Investing for Growth †A4 • Success-based Fiber expansion• Targeting dividend payout ratio• $43B net debt reduction at close of 40-43% on anticipated free cash †A5 • 5G capacity acceleration †A4• Expected net debt to adj EBITDA : flow of $20B+ • Investing for growth based on 2.6x range after close highest return Below 2.5x by end of 2023 • Flexibility for optimal value • Optionality to repurchase shares creation Focused Total Return Strategy † See notes slide 17 15

Q&A 16Q&A 16

Notes A1. CAGR is Compound annual growth rate. D1. Free cash flow, gross leverage, net leverage and adjusted EBITDA are non-GAAP financial measures frequently used by investors and credit rating agencies to provide A2. EBITDA is operating income before depreciation and amortization. relevant and useful information. Free cash flow is cash from operating activities minus capital expenditures. Due to high variability and difficulty in predicting items that impact A3. The company (AT&T) expects adjustments to 2021-2024 reported diluted EPS to include merger- cash from operating activities and capital expenditures, we are not able to provide a related amortization ($4.3 billion for 2021 and approximately $1 billion per quarter in 2022 until reconciliation between projected free cash flow and the most comparable GAAP metric closing of the transaction) and other adjustments, a non-cash mark-to-market benefit plan without unreasonable effort. Gross leverage is calculated by dividing total debt by the sum gain/loss, and other items. The company expects the mark-to-market adjustment, which is driven by of the most recent four quarters Adjusted EBITDA. Net leverage is calculated by dividing interest rates and investment returns that are not reasonably estimable at this time, to be a net debt (total debt less cash) by the sum of the most recent four quarters Adjusted significant item. AT&T’s 2021 EPS depends on future levels of revenues and expenses which are not EBITDA. Adjusted EBITDA estimates depend on future levels of revenues and expenses reasonably estimable at this time. Accordingly, we cannot provide a reconciliation between these which are not reasonably estimable at this time. Accordingly, we are not able to provide a projected non-GAAP metrics and the reported GAAP metrics without unreasonable effort. reconciliation between adjusted EBITDA and the most comparable GAAP metric without unreasonable effort. In addition, pro forma free cash flow, net leverage and adjusted A4. Dividend payout ratio is total dividends paid divided by free cash flow. Free cash flow is a non- EBITDA for the combined entity are estimates only and we are not able to provide a GAAP financial measure that is frequently used by investors and credit rating agencies to provide reconciliation between the most comparable GAAP metrics without unreasonable effort. relevant and useful information. Free cash flow is cash from operating activities minus capital . expenditures. Due to high variability and difficulty in predicting items that impact cash from operating activities and capital expenditures, the company is not able to provide a reconciliation between projected free cash flow and the most comparable GAAP metric without unreasonable effort. A5. Net Debt is calculated by subtracting cash and cash equivalents from the sum of debt maturing within one year and long-term debt. Net Debt to adjusted EBITDA ratios are non-GAAP financial measures that are frequently used by investors and credit rating agencies to provide relevant and useful information. Our Net Debt to Adjusted EBITDA ratio is calculated by dividing the Net Debt by the sum of the most recent four quarters of Adjusted EBITDA. Adjusted EBITDA estimates depend on future levels of revenues and expenses which are not reasonably estimable at this time. Accordingly, we cannot provide a reconciliation between Adjusted EBITDA and the and the most comparable GAAP metric without unreasonable effort. 17Notes A1. CAGR is Compound annual growth rate. D1. Free cash flow, gross leverage, net leverage and adjusted EBITDA are non-GAAP financial measures frequently used by investors and credit rating agencies to provide A2. EBITDA is operating income before depreciation and amortization. relevant and useful information. Free cash flow is cash from operating activities minus capital expenditures. Due to high variability and difficulty in predicting items that impact A3. The company (AT&T) expects adjustments to 2021-2024 reported diluted EPS to include merger- cash from operating activities and capital expenditures, we are not able to provide a related amortization ($4.3 billion for 2021 and approximately $1 billion per quarter in 2022 until reconciliation between projected free cash flow and the most comparable GAAP metric closing of the transaction) and other adjustments, a non-cash mark-to-market benefit plan without unreasonable effort. Gross leverage is calculated by dividing total debt by the sum gain/loss, and other items. The company expects the mark-to-market adjustment, which is driven by of the most recent four quarters Adjusted EBITDA. Net leverage is calculated by dividing interest rates and investment returns that are not reasonably estimable at this time, to be a net debt (total debt less cash) by the sum of the most recent four quarters Adjusted significant item. AT&T’s 2021 EPS depends on future levels of revenues and expenses which are not EBITDA. Adjusted EBITDA estimates depend on future levels of revenues and expenses reasonably estimable at this time. Accordingly, we cannot provide a reconciliation between these which are not reasonably estimable at this time. Accordingly, we are not able to provide a projected non-GAAP metrics and the reported GAAP metrics without unreasonable effort. reconciliation between adjusted EBITDA and the most comparable GAAP metric without unreasonable effort. In addition, pro forma free cash flow, net leverage and adjusted A4. Dividend payout ratio is total dividends paid divided by free cash flow. Free cash flow is a non- EBITDA for the combined entity are estimates only and we are not able to provide a GAAP financial measure that is frequently used by investors and credit rating agencies to provide reconciliation between the most comparable GAAP metrics without unreasonable effort. relevant and useful information. Free cash flow is cash from operating activities minus capital . expenditures. Due to high variability and difficulty in predicting items that impact cash from operating activities and capital expenditures, the company is not able to provide a reconciliation between projected free cash flow and the most comparable GAAP metric without unreasonable effort. A5. Net Debt is calculated by subtracting cash and cash equivalents from the sum of debt maturing within one year and long-term debt. Net Debt to adjusted EBITDA ratios are non-GAAP financial measures that are frequently used by investors and credit rating agencies to provide relevant and useful information. Our Net Debt to Adjusted EBITDA ratio is calculated by dividing the Net Debt by the sum of the most recent four quarters of Adjusted EBITDA. Adjusted EBITDA estimates depend on future levels of revenues and expenses which are not reasonably estimable at this time. Accordingly, we cannot provide a reconciliation between Adjusted EBITDA and the and the most comparable GAAP metric without unreasonable effort. 17