Attached files

| file | filename |

|---|---|

| 8-K - FORM 8-K - Nemaura Medical Inc. | nmra_8k.htm |

Exhibit 99.1

Corporate Presentation Benzinga Global Small Cap Conference Dr Faz Chowdhury, CEO 14 th May 2021 Nasdaq : NMRD

| |

Forward Looking Statements This presentation includes forward - looking statements that are subject to many risks and uncertainties. These forward - looking statements, such as statements about Nemaura’s short - term and long - term growth strategies, can sometimes be identified by use of terms such as “intend,” “expect,” “plan,” “estimate,” “future,” “strive,” and similar words. These statements involve many risks and uncertainties that may cause actual results to differ from what may be expressed or implied in these statements. These risks are discussed in Nemaura’s filings with the Securities and Exchange Commission (the “Commission”), including the risks identified under the section captioned “Risk Factors” in Nemaura’s Annual Report on Form 10 - K filed with the Commission in June 2019 as the same may be updated from time to time. Nemaura disclaims any obligation to update information contained in these forward - looking statements whether as a result of new information, future events, or otherwise.

| |

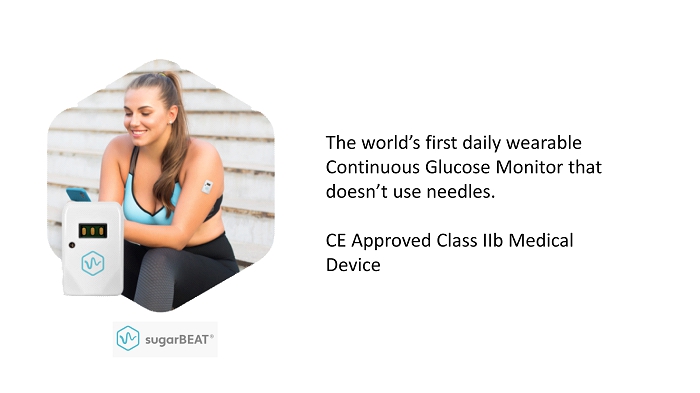

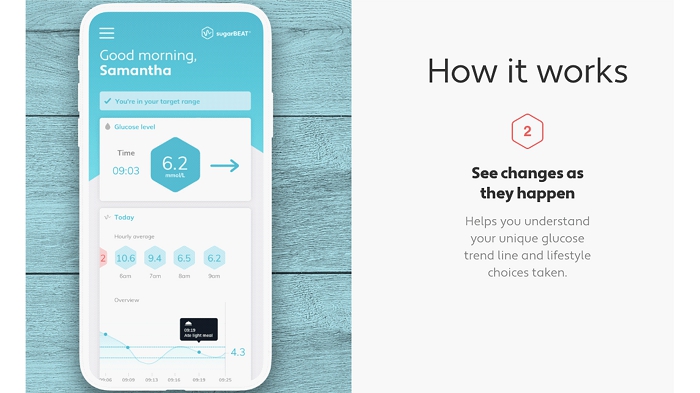

Introduction We developed the world’s first Daily - Wear non - invasive Continuous Glucose Monitor (CGM) – Class 2b CE approved Medical Device. Launched: sugarBEAT ® and BEAT ® diabetes , supporting Diabetes prevention, management and reversal. Planned Launch in 2021: Mass Market consumer metabolic health application.

| |

The Problem… There are over 463 million people living with diabetes worldwide, and over $ 760 Billion was spent in the US alone in 2019 for diabetes related healthcare expenditure 1 . The total addressable market exceeds $ 150 Billion 2 , 3 , 4 . Obesity and Diabetes are two of the major drivers of the chronic disease epidemic

| |

Our Objective: Prevent, Manage, or Reverse Type 2 Diabetes

| |

UNIQUE The world’s first daily wear CGM: no other sensor technology is currently available allowing non - invasive daily use. LIFESTYLE Other competing sensors are worn for 10 - 14 days consecutively. Nemaura’s BEAT® sensors are designed for daily use – any day you choose. Our Unique Solution KNOWLEDGE Glucose sensors based on sugarBEAT provide guidance and insights into the extent of control over sugar levels. ENGAGEMENT A world class digital program [and ecosystem] keeping the user engaged for the long term. OUTCOME Improvements in HbA1C, blood cholesterol, blood pressure, and sustainable weight loss. Real results . Sustainable . Affordable. PRICING Highly competitive pricing will yield broader adoption to address unmet clinical needs. $

| |

Our Approach 1. sugarBEAT ® CGM – real time glucose monitoring. 1. BEAT ® diabetes – Digital program for diabetes management and reversal, with intermittent glucose profiling. 1. Mass market consumer metabolic health program, targeting obesity, pre - diabetes and Type 2 diabetes.

| |

Total Addressable Market UK 4.8 million people with diabetes 8 One person diagnosed every 2 minutes Germany 9.5 million have diabetes 9 . 4.5 million of these 9.5 million are undiagnosed and, as a result, may be particularly at risk. U.S. 34.2 million have diabetes 6 88 million people have pre - diabetes 28,000 people diagnosed with diabetes EVERY WEEK in the U.S. alone 7 in a market worth nearly $150B

| |

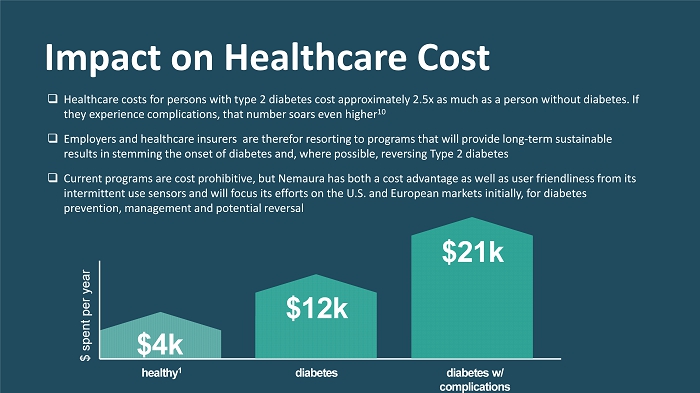

Impact on Healthcare Cost □ Healthcare costs for persons with type 2 diabetes cost approximately 2.5x as much as a person without diabetes. If they experience complications, that number soars even higher 10 □ Employers and healthcare insurers are therefor resorting to programs that will provide long - term sustainable results in stemming the onset of diabetes and, where possible, reversing Type 2 diabetes □ Current programs are cost prohibitive, but Nemaura has both a cost advantage as well as user friendliness from its intermittent use sensors and will focus its efforts on the U.S. and European markets initially, for diabetes prevention, management and potential reversal healthy 1 diabetes w/ complications $ spent per year $4k diabetes $12k $21k

| |

Product Portfolio sugarBEAT® CGM BEAT®diabetes Program Consumer Metabolic Health Program

| |

CE approved Class IIB Medical Device US FDA PMA approval and launch in the US anticipated by end of 2021 The world’s first daily wearable Continuous Glucose Monitor that doesn’t use needles. CE Approved Class IIb Medical Device

| |

Core Technology

| |

| |

| |

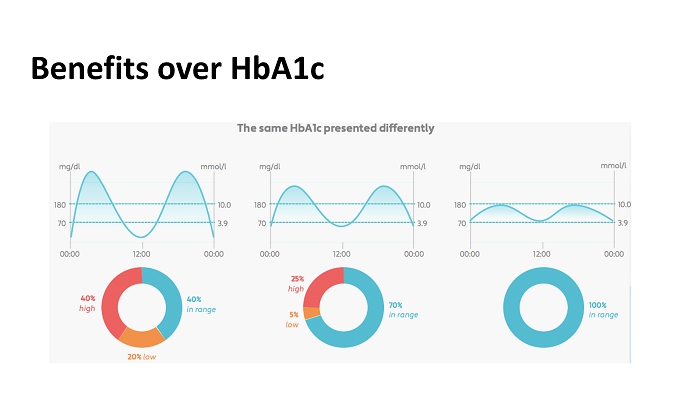

Benefits over HbA1c

| |

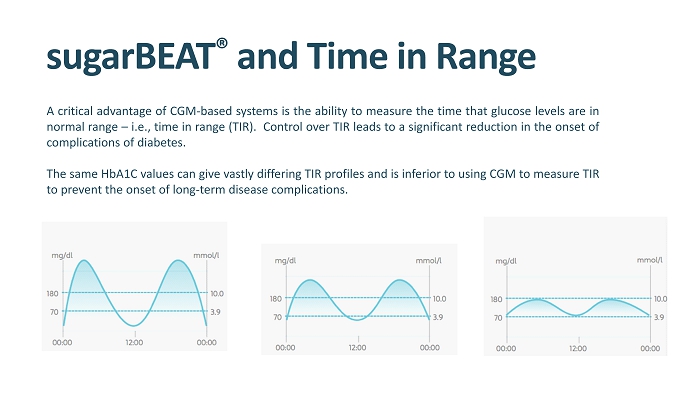

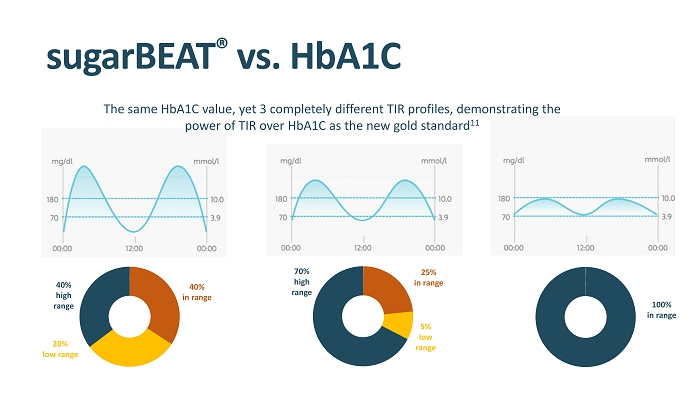

sugarBEAT ® and Time in Range A critical advantage of CGM - based systems is the ability to measure the time that glucose levels are in normal range – i . e . , time in range (TIR) . Control over TIR leads to a significant reduction in the onset of complications of diabetes . The same HbA 1 C values can give vastly differing TIR profiles and is inferior to using CGM to measure TIR to prevent the onset of long - term disease complications .

| |

sugarBEAT ® vs. HbA1C 40% high range 40% in range 20% low range 70% high range 25% in range 5% low range 100% in range The same HbA1C value, yet 3 completely different TIR profiles, demonstrating the power of TIR over HbA1C as the new gold standard 11

| |

sugarBEAT ® Sales status UK UK: 200,000 Sensors ordered by licensee following soft launch success Purchase order forecast for (approximately) a further 100,000 per month for the next 2 years, totalling over 2 million sensors. Licensee selling these based on a diabetes management subscription service.

| |

sugarBEAT ® Germany Partnership/Collaboration discussions ongoing Submission for reimbursement made to GBA, the German Regulatory Authority. GBA confirmed they do not need to review this and it is now progressing straight to the National Association of Statutory Health Insurance Funds, thus we expect the process to be a lot quicker. Plan to launch as soon as partnership agreement is signed .

| |

sugarBEAT ® MENA Partnered with TPMENA Registration for Saudi Arabia and UAE in progress Plan to launch on completion of registration

| |

Type 2 Diabetes prevention and management program launched in the U.S.

| |

BEAT ® diabetes – 3 Components 1. Weight loss program originally developed at the Joslin Diabetes Centre – over 12 years of clinical evidence (based on an in - clinic program, subsequently replicated using a virtual program). Sustained long term weight loss achieved without loss of muscle mass 1. proBEAT Ρ Intermittent glucose profiling – using world’s first daily - wearable glucose sensor, developed in - house 2. Coaching: digital 24/7 using app, and specialist 1 to 1 coaching

| |

BEAT ® diabetes – Glucose Profiling Intermittent Glucose Profiling: Benefits 7 - point glucose profiles every 4 weeks. Patients received guidance for diet and exercise adjustments based on SMBG. Outcome: Significant reductions in HbA1c, weight, BMI, systolic BP, diastolic BP, and LDL Cholesterol Kempf et. al., Diabetes Technol Ther (2010)

| |

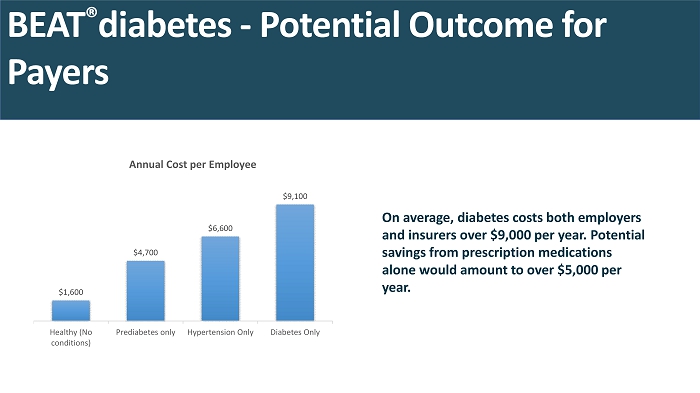

BEAT ® diabetes - Potential Outcome for Payers Healthier Employees = Healthier Business $1,600 $4,700 $6,600 $9,100 Healthy (No conditions) Prediabetes only Hypertension Only Diabetes Only Annual Cost per Employee On average, diabetes costs both employers and insurers over $9,000 per year. Potential savings from prescription medications alone would amount to over $5,000 per year.

| |

BEAT Metabolic Health Metabolism is life.

| |

Metabolic Health A mass - market consumer product A new program leveraging off the BEAT® wearable sensor platform to address improvements in metabolic health and well - being. Launching in 2021. Applicable to over 80 million people in the US with pre - diabetes as well as general health - conscious individuals, and obesity market.

| |

CONTINUOUS LACTATE MONITORING Assists in threshold maximization in performance athletes Early identification of tissue hypoperfusion or shock for aggressive early resuscitation of critically ill patients to improve the their chances of survival BODY TEMPERATURE MONITORING Gives a more accurate and large data set. For monitoring viral infections and lower limb blood circulation tracking the effectiveness of drugs Wearable temperature sensors market is expected to register a CAGR of 8.3% during the forecast period 2021 - 2026 22 Future Product Opportunities Leveraging the BEAT ® Technology A rich portfolio of additional products to complement existing offering and contribute to increased revenues

| |

ALCOHOL MONITORING Support personal health goals and provide warnings prior to driving. Provide physicians with individual’s drinking habits. Prevention of progression - to - alcohol - related disease DRUG MONITORING Monitoring the impact of drugs and personalized treatment plan for patients. Global therapeutic drug monitoring device market to reach $3.37B by 2024 23 Future Product Opportunities Leveraging the BEAT ® Technology

| |

BIG DATA Predictive analytics based on logic drawn from wearable medical devices using algorithms to seek patterns and structure in data and cluster them into groups or insights. Improving efficiencies per patient’s management of health care. Accuracy of diagnosis and treatment in personal medicine. ARTIFICIAL INTELLIGENCE Empowering users & industry with interpretations of SugarBEAT ® data to enhance treatment & develop personalized therapy The U.S. National Institutes of Health is working with IBM to connect a wide variety of clinical and research datasets to the IBM Watson system. Big Data is potentially the next ‘killer application’ in the healthcare tech space. The market is expected to grow to over $68 Billion by 2024 24 Future Product Opportunities Leveraging the BEAT ® Technology

| |

Summary 1. UK Launch in Full Swing with over 2.1 Million sensor forecast for next 2 years 1. Expect licensees/Partnership for Germany and other key EU territories 1. Targeting broad adoption of BEAT ® diabetes program by insurers and Employers in the USA 2. Expect FDA PMA update 3. Launch of metabolic health program targeted at the B to C market, in metabolic health backed with the sugarBEAT ® platform. 1. Strong balance sheet (>$31M, and <$2M quarterly cash burn)

| |

References

| |