Attached files

| file | filename |

|---|---|

| EX-99.2 - EX-99.2 - Griffin Realty Trust, Inc. | exhibit992unauditedproform.htm |

| EX-23.1 - EX-23.1 - Griffin Realty Trust, Inc. | exhibit231consentofdeloitt.htm |

| 8-K/A - 8-K/A - Griffin Realty Trust, Inc. | gcearformaxcombinedfinanci.htm |

COLE OFFICE & INDUSTRIAL REIT (CCIT II), INC. INDEX TO CONSOLIDATED FINANCIAL STATEMENTS Independent Auditors' Report 2 Consolidated Balance Sheet as of December 31, 2020 3 Consolidated Statement of Operations for the Year Ended December 31, 2020 4 Consolidated Statement of Comprehensive Loss for the Year Ended December 31, 2020 5 Consolidated Statement of Stockholders’ Equity for the Year Ended December 31, 2020 6 Consolidated Statement of Cash Flows for the Year Ended December 31, 2020 7 Notes to Consolidated Financial Statements 8 Table of Contents 1 Exhibit 99.1

INDEPENDENT AUDITORS’ REPORT To the Board of Directors and Shareholders of Griffin Capital Essential Asset REIT, Inc. We have audited the accompanying financial statements of Cole Office & Industrial REIT (CCIT II), Inc. and subsidiaries (the “Company”), which comprise the consolidated balance sheet as of December 31, 2020, and the related statements of operations, comprehensive loss, stockholders’ equity, and cash flows for the year then ended, and the related notes to the consolidated financial statements. Management’s Responsibility for the Financial Statements Management is responsible for the preparation and fair presentation of these consolidated financial statements in accordance with accounting principles generally accepted in the United States of America; this includes the design, implementation, and maintenance of internal control relevant to the preparation and fair presentation of consolidated financial statements that are free from material misstatement, whether due to fraud or error. Auditors’ Responsibility Our responsibility is to express an opinion on these consolidated financial statements based on our audit. We conducted our audit in accordance with auditing standards generally accepted in the United States of America. Those standards require that we plan and perform the audit to obtain reasonable assurance about whether the consolidated financial statements are free from material misstatement. An audit involves performing procedures to obtain audit evidence about the amounts and disclosures in the consolidated financial statements. The procedures selected depend on the auditor’s judgment, including the assessment of the risks of material misstatement of the consolidated financial statements, whether due to fraud or error. In making those risk assessments, the auditor considers internal control relevant to the Company’s preparation and fair presentation of the consolidated financial statements in order to design audit procedures that are appropriate in the circumstances, but not for the purpose of expressing an opinion on the effectiveness of the Company’s internal control. Accordingly, we express no such opinion. An audit also includes evaluating the appropriateness of accounting policies used and the reasonableness of significant accounting estimates made by management, as well as evaluating the overall presentation of the consolidated financial statements. We believe that the audit evidence we have obtained is sufficient and appropriate to provide a basis for our audit opinion. Opinion In our opinion, the consolidated financial statements referred to above present fairly, in all material respects, the financial position of Cole Office & Industrial REIT (CCIT II), Inc. and subsidiaries as of December 31, 2020, and the results of its operations and its cash flows for the year then ended in accordance with accounting principles generally accepted in the United States of America. Emphasis of Matter As discussed in Note 15 to the financial statements, the Company completed its merger with Griffin Capital Essential Asset REIT, Inc. on March 1, 2021. Our opinion is not modified with respect to this matter. /s/ Deloitte & Touche LLP Phoenix, Arizona March 24, 2021 Table of Contents 2

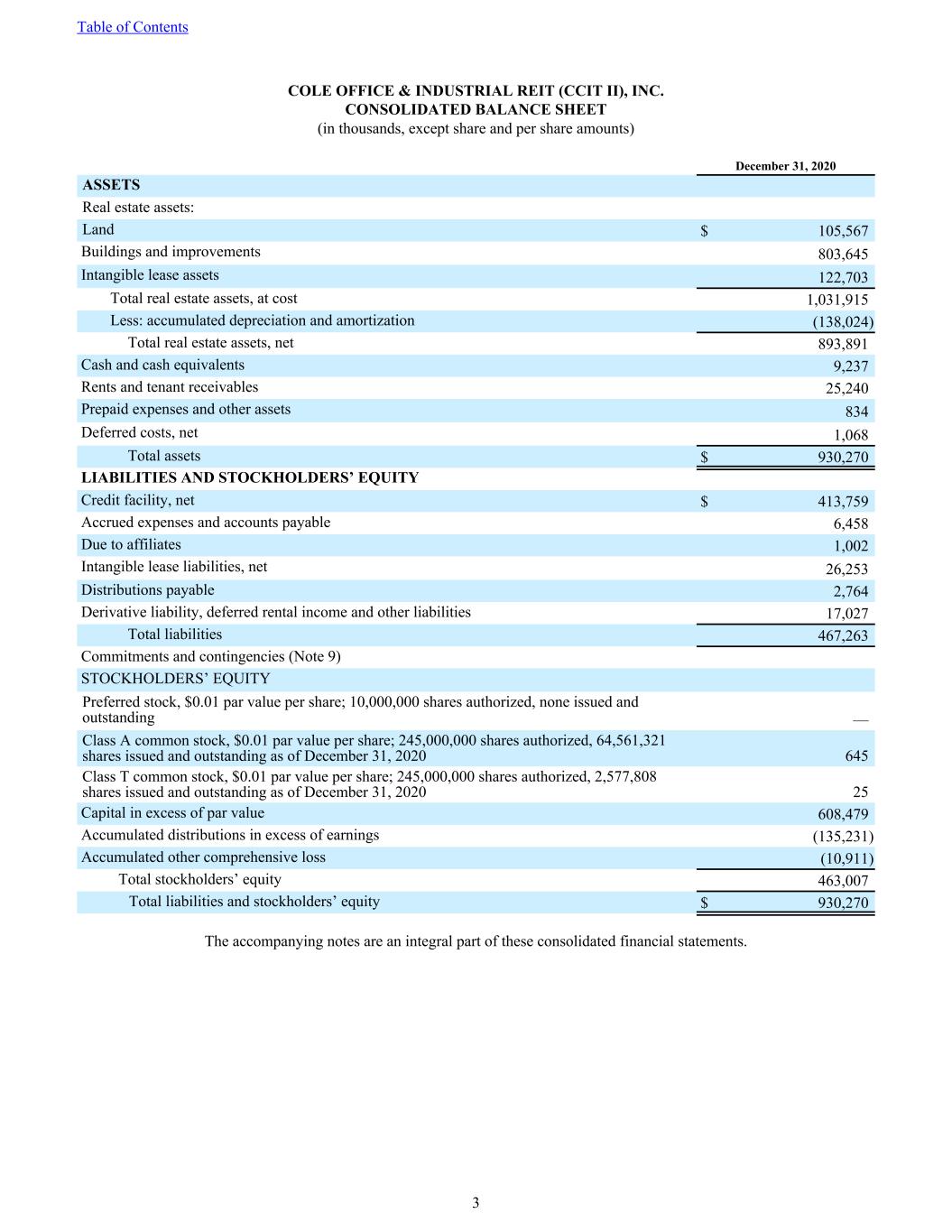

COLE OFFICE & INDUSTRIAL REIT (CCIT II), INC. CONSOLIDATED BALANCE SHEET (in thousands, except share and per share amounts) December 31, 2020 ASSETS Real estate assets: Land $ 105,567 Buildings and improvements 803,645 Intangible lease assets 122,703 Total real estate assets, at cost 1,031,915 Less: accumulated depreciation and amortization (138,024) Total real estate assets, net 893,891 Cash and cash equivalents 9,237 Rents and tenant receivables 25,240 Prepaid expenses and other assets 834 Deferred costs, net 1,068 Total assets $ 930,270 LIABILITIES AND STOCKHOLDERS’ EQUITY Credit facility, net $ 413,759 Accrued expenses and accounts payable 6,458 Due to affiliates 1,002 Intangible lease liabilities, net 26,253 Distributions payable 2,764 Derivative liability, deferred rental income and other liabilities 17,027 Total liabilities 467,263 Commitments and contingencies (Note 9) STOCKHOLDERS’ EQUITY Preferred stock, $0.01 par value per share; 10,000,000 shares authorized, none issued and outstanding — Class A common stock, $0.01 par value per share; 245,000,000 shares authorized, 64,561,321 shares issued and outstanding as of December 31, 2020 645 Class T common stock, $0.01 par value per share; 245,000,000 shares authorized, 2,577,808 shares issued and outstanding as of December 31, 2020 25 Capital in excess of par value 608,479 Accumulated distributions in excess of earnings (135,231) Accumulated other comprehensive loss (10,911) Total stockholders’ equity 463,007 Total liabilities and stockholders’ equity $ 930,270 The accompanying notes are an integral part of these consolidated financial statements. Table of Contents 3

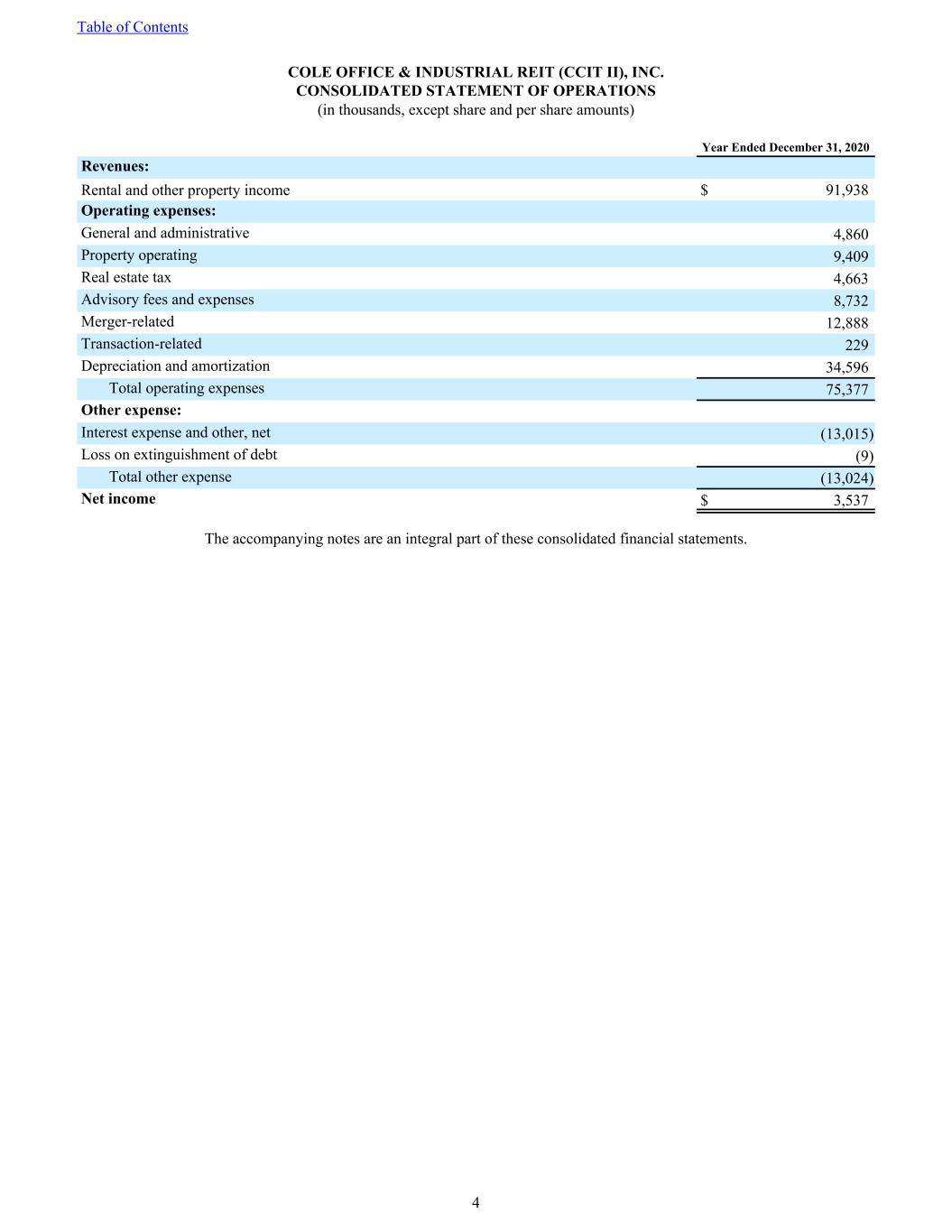

COLE OFFICE & INDUSTRIAL REIT (CCIT II), INC. CONSOLIDATED STATEMENT OF OPERATIONS (in thousands, except share and per share amounts) Year Ended December 31, 2020 Revenues: Rental and other property income $ 91,938 Operating expenses: General and administrative 4,860 Property operating 9,409 Real estate tax 4,663 Advisory fees and expenses 8,732 Merger-related 12,888 Transaction-related 229 Depreciation and amortization 34,596 Total operating expenses 75,377 Other expense: Interest expense and other, net (13,015) Loss on extinguishment of debt (9) Total other expense (13,024) Net income $ 3,537 The accompanying notes are an integral part of these consolidated financial statements. Table of Contents 4

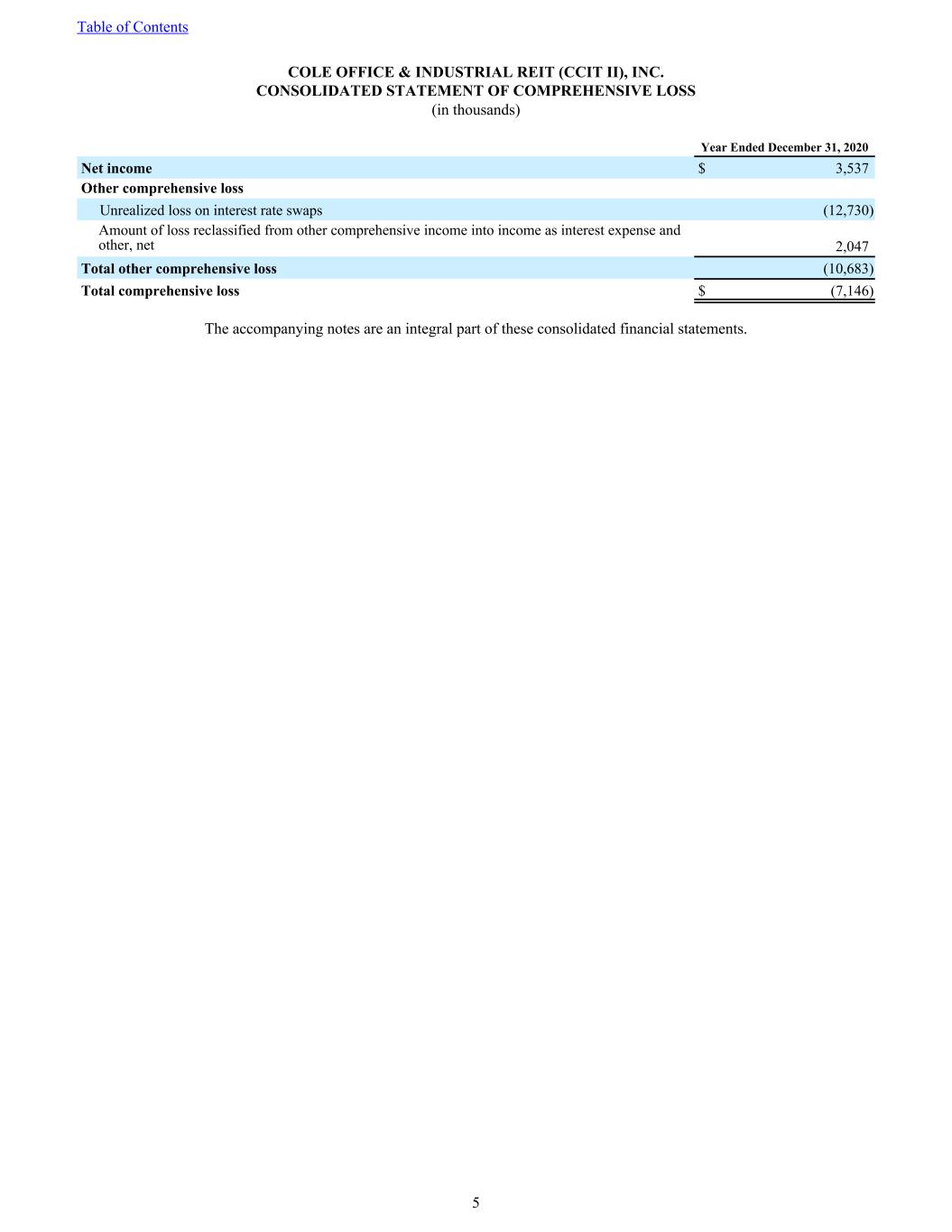

COLE OFFICE & INDUSTRIAL REIT (CCIT II), INC. CONSOLIDATED STATEMENT OF COMPREHENSIVE LOSS (in thousands) Year Ended December 31, 2020 Net income $ 3,537 Other comprehensive loss Unrealized loss on interest rate swaps (12,730) Amount of loss reclassified from other comprehensive income into income as interest expense and other, net 2,047 Total other comprehensive loss (10,683) Total comprehensive loss $ (7,146) The accompanying notes are an integral part of these consolidated financial statements. Table of Contents 5

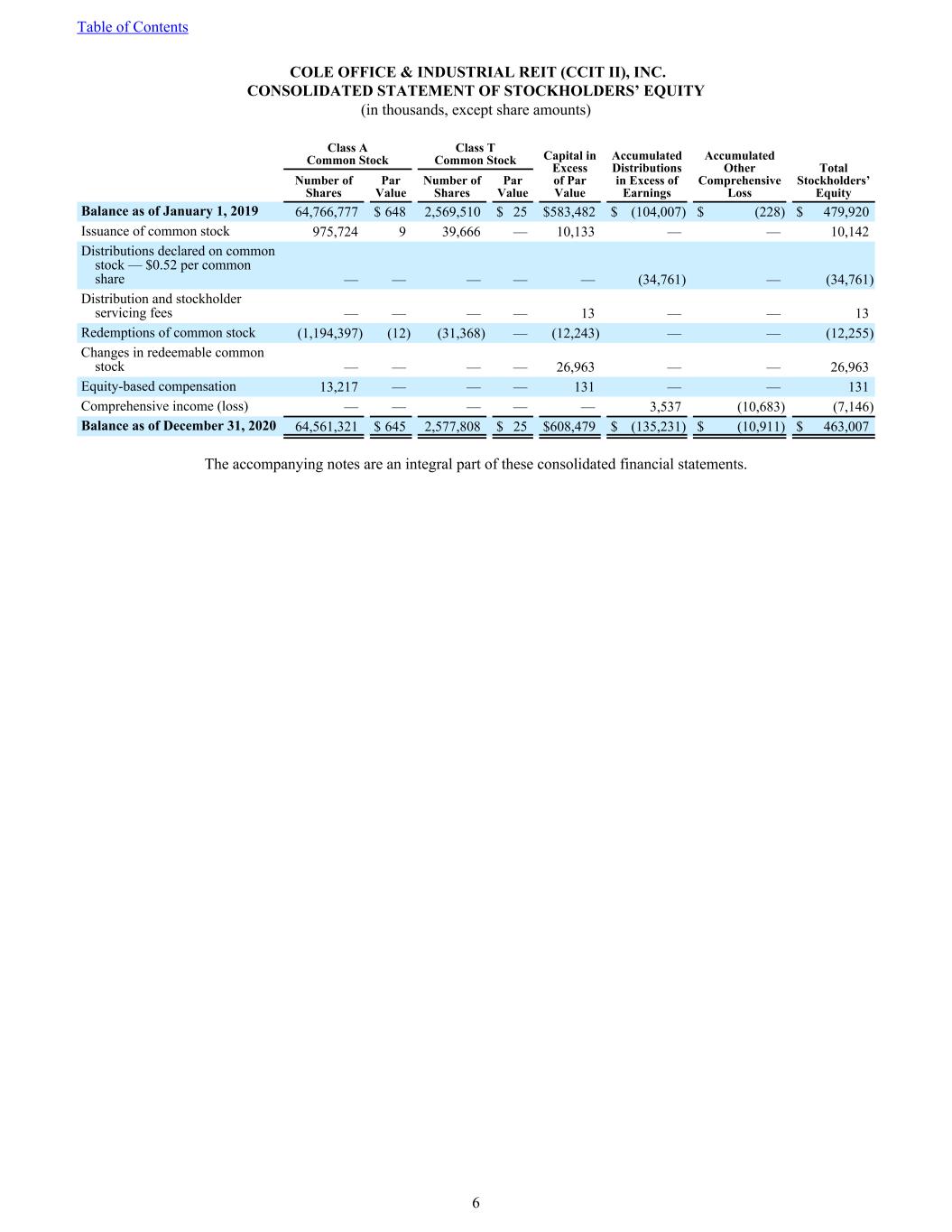

COLE OFFICE & INDUSTRIAL REIT (CCIT II), INC. CONSOLIDATED STATEMENT OF STOCKHOLDERS’ EQUITY (in thousands, except share amounts) Class A Common Stock Class T Common Stock Capital in Excess of Par Value Accumulated Distributions in Excess of Earnings Accumulated Other Comprehensive Loss Total Stockholders’ Equity Number of Shares Par Value Number of Shares Par Value Balance as of January 1, 2019 64,766,777 $ 648 2,569,510 $ 25 $ 583,482 $ (104,007) $ (228) $ 479,920 Issuance of common stock 975,724 9 39,666 — 10,133 — — 10,142 Distributions declared on common stock — $0.52 per common share — — — — — (34,761) — (34,761) Distribution and stockholder servicing fees — — — — 13 — — 13 Redemptions of common stock (1,194,397) (12) (31,368) — (12,243) — — (12,255) Changes in redeemable common stock — — — — 26,963 — — 26,963 Equity-based compensation 13,217 — — — 131 — — 131 Comprehensive income (loss) — — — — — 3,537 (10,683) (7,146) Balance as of December 31, 2020 64,561,321 $ 645 2,577,808 $ 25 $ 608,479 $ (135,231) $ (10,911) $ 463,007 The accompanying notes are an integral part of these consolidated financial statements. Table of Contents 6

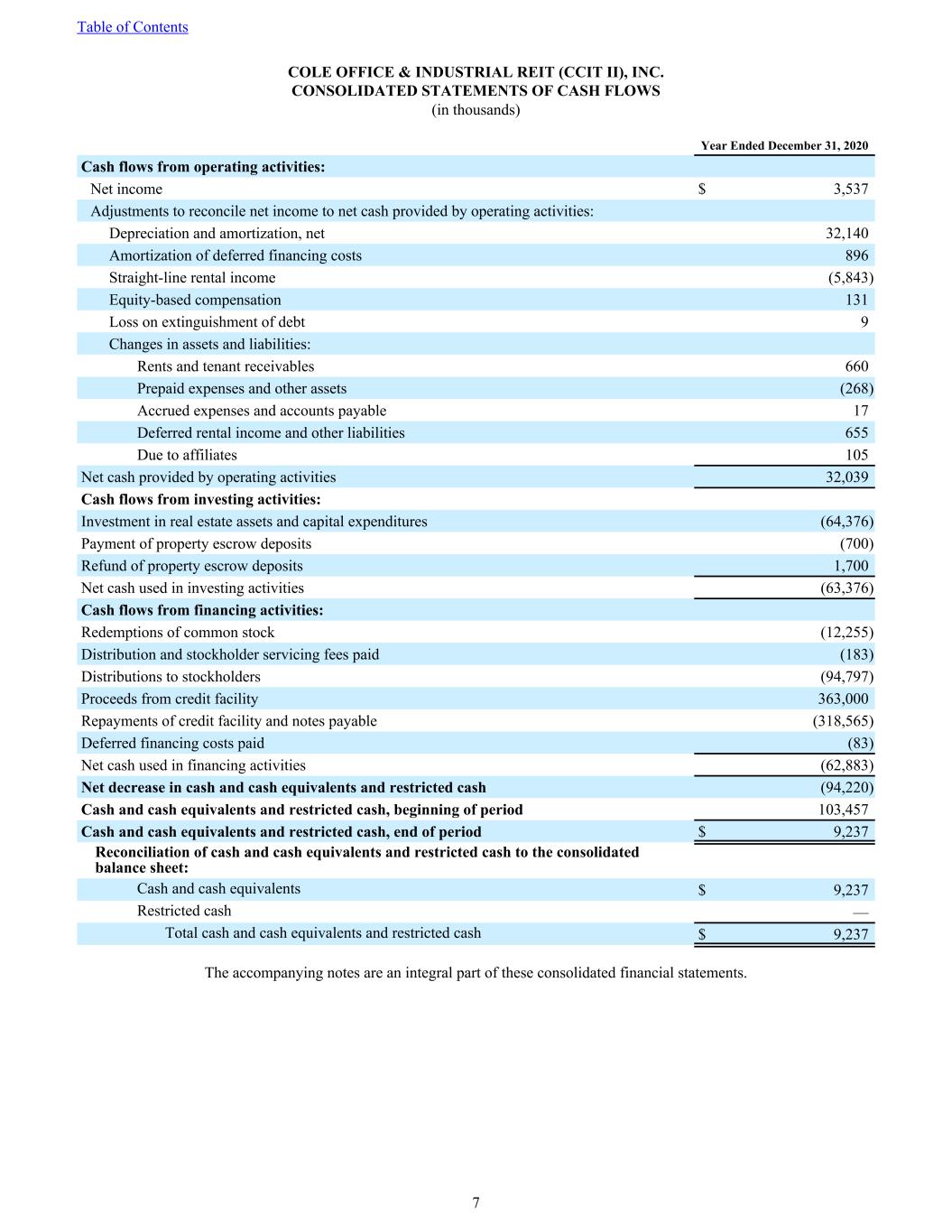

COLE OFFICE & INDUSTRIAL REIT (CCIT II), INC. CONSOLIDATED STATEMENTS OF CASH FLOWS (in thousands) Year Ended December 31, 2020 Cash flows from operating activities: Net income $ 3,537 Adjustments to reconcile net income to net cash provided by operating activities: Depreciation and amortization, net 32,140 Amortization of deferred financing costs 896 Straight-line rental income (5,843) Equity-based compensation 131 Loss on extinguishment of debt 9 Changes in assets and liabilities: Rents and tenant receivables 660 Prepaid expenses and other assets (268) Accrued expenses and accounts payable 17 Deferred rental income and other liabilities 655 Due to affiliates 105 Net cash provided by operating activities 32,039 Cash flows from investing activities: Investment in real estate assets and capital expenditures (64,376) Payment of property escrow deposits (700) Refund of property escrow deposits 1,700 Net cash used in investing activities (63,376) Cash flows from financing activities: Redemptions of common stock (12,255) Distribution and stockholder servicing fees paid (183) Distributions to stockholders (94,797) Proceeds from credit facility 363,000 Repayments of credit facility and notes payable (318,565) Deferred financing costs paid (83) Net cash used in financing activities (62,883) Net decrease in cash and cash equivalents and restricted cash (94,220) Cash and cash equivalents and restricted cash, beginning of period 103,457 Cash and cash equivalents and restricted cash, end of period $ 9,237 Reconciliation of cash and cash equivalents and restricted cash to the consolidated balance sheet: Cash and cash equivalents $ 9,237 Restricted cash — Total cash and cash equivalents and restricted cash $ 9,237 The accompanying notes are an integral part of these consolidated financial statements. Table of Contents 7

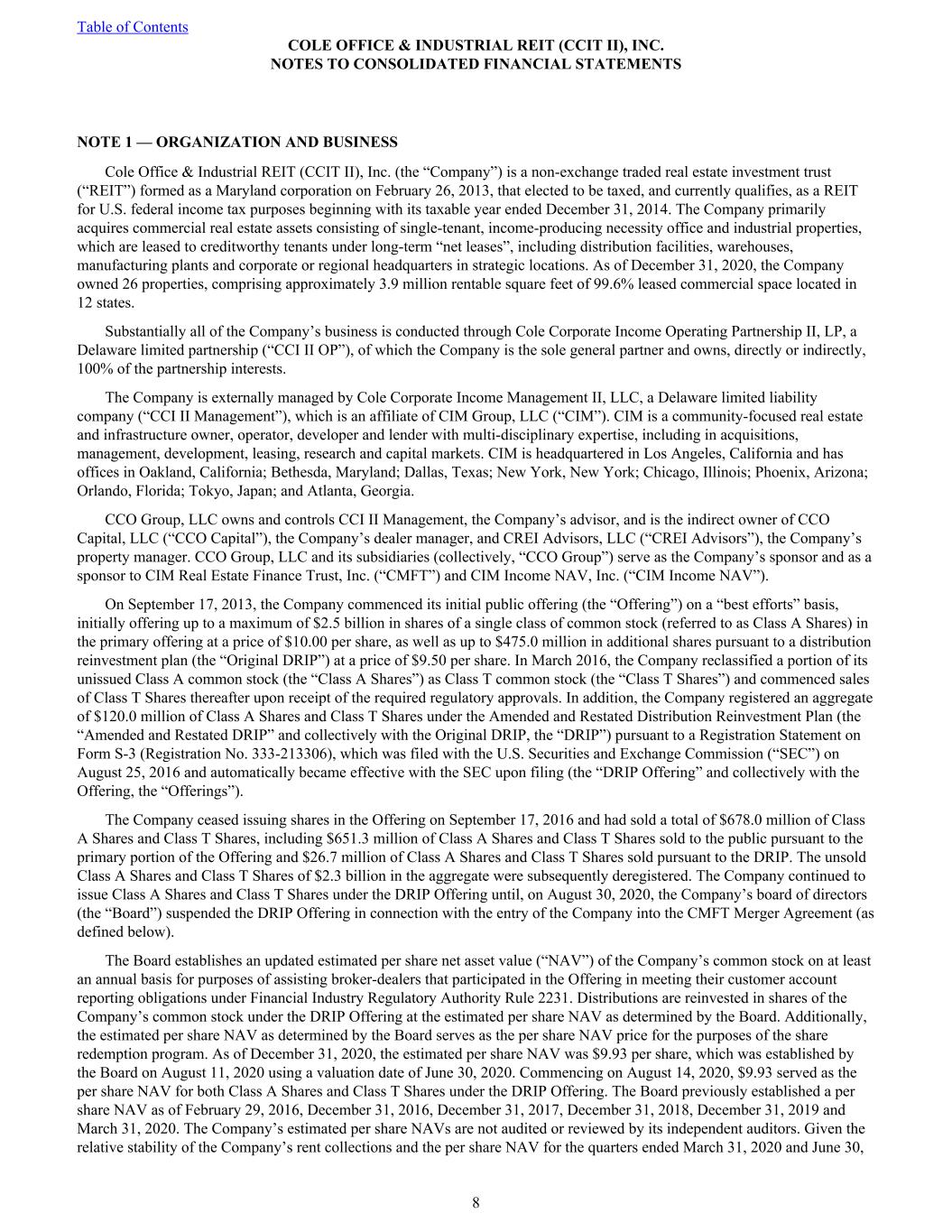

NOTE 1 — ORGANIZATION AND BUSINESS Cole Office & Industrial REIT (CCIT II), Inc. (the “Company”) is a non-exchange traded real estate investment trust (“REIT”) formed as a Maryland corporation on February 26, 2013, that elected to be taxed, and currently qualifies, as a REIT for U.S. federal income tax purposes beginning with its taxable year ended December 31, 2014. The Company primarily acquires commercial real estate assets consisting of single-tenant, income-producing necessity office and industrial properties, which are leased to creditworthy tenants under long-term “net leases”, including distribution facilities, warehouses, manufacturing plants and corporate or regional headquarters in strategic locations. As of December 31, 2020, the Company owned 26 properties, comprising approximately 3.9 million rentable square feet of 99.6% leased commercial space located in 12 states. Substantially all of the Company’s business is conducted through Cole Corporate Income Operating Partnership II, LP, a Delaware limited partnership (“CCI II OP”), of which the Company is the sole general partner and owns, directly or indirectly, 100% of the partnership interests. The Company is externally managed by Cole Corporate Income Management II, LLC, a Delaware limited liability company (“CCI II Management”), which is an affiliate of CIM Group, LLC (“CIM”). CIM is a community-focused real estate and infrastructure owner, operator, developer and lender with multi-disciplinary expertise, including in acquisitions, management, development, leasing, research and capital markets. CIM is headquartered in Los Angeles, California and has offices in Oakland, California; Bethesda, Maryland; Dallas, Texas; New York, New York; Chicago, Illinois; Phoenix, Arizona; Orlando, Florida; Tokyo, Japan; and Atlanta, Georgia. CCO Group, LLC owns and controls CCI II Management, the Company’s advisor, and is the indirect owner of CCO Capital, LLC (“CCO Capital”), the Company’s dealer manager, and CREI Advisors, LLC (“CREI Advisors”), the Company’s property manager. CCO Group, LLC and its subsidiaries (collectively, “CCO Group”) serve as the Company’s sponsor and as a sponsor to CIM Real Estate Finance Trust, Inc. (“CMFT”) and CIM Income NAV, Inc. (“CIM Income NAV”). On September 17, 2013, the Company commenced its initial public offering (the “Offering”) on a “best efforts” basis, initially offering up to a maximum of $2.5 billion in shares of a single class of common stock (referred to as Class A Shares) in the primary offering at a price of $10.00 per share, as well as up to $475.0 million in additional shares pursuant to a distribution reinvestment plan (the “Original DRIP”) at a price of $9.50 per share. In March 2016, the Company reclassified a portion of its unissued Class A common stock (the “Class A Shares”) as Class T common stock (the “Class T Shares”) and commenced sales of Class T Shares thereafter upon receipt of the required regulatory approvals. In addition, the Company registered an aggregate of $120.0 million of Class A Shares and Class T Shares under the Amended and Restated Distribution Reinvestment Plan (the “Amended and Restated DRIP” and collectively with the Original DRIP, the “DRIP”) pursuant to a Registration Statement on Form S-3 (Registration No. 333-213306), which was filed with the U.S. Securities and Exchange Commission (“SEC”) on August 25, 2016 and automatically became effective with the SEC upon filing (the “DRIP Offering” and collectively with the Offering, the “Offerings”). The Company ceased issuing shares in the Offering on September 17, 2016 and had sold a total of $678.0 million of Class A Shares and Class T Shares, including $651.3 million of Class A Shares and Class T Shares sold to the public pursuant to the primary portion of the Offering and $26.7 million of Class A Shares and Class T Shares sold pursuant to the DRIP. The unsold Class A Shares and Class T Shares of $2.3 billion in the aggregate were subsequently deregistered. The Company continued to issue Class A Shares and Class T Shares under the DRIP Offering until, on August 30, 2020, the Company’s board of directors (the “Board”) suspended the DRIP Offering in connection with the entry of the Company into the CMFT Merger Agreement (as defined below). The Board establishes an updated estimated per share net asset value (“NAV”) of the Company’s common stock on at least an annual basis for purposes of assisting broker-dealers that participated in the Offering in meeting their customer account reporting obligations under Financial Industry Regulatory Authority Rule 2231. Distributions are reinvested in shares of the Company’s common stock under the DRIP Offering at the estimated per share NAV as determined by the Board. Additionally, the estimated per share NAV as determined by the Board serves as the per share NAV price for the purposes of the share redemption program. As of December 31, 2020, the estimated per share NAV was $9.93 per share, which was established by the Board on August 11, 2020 using a valuation date of June 30, 2020. Commencing on August 14, 2020, $9.93 served as the per share NAV for both Class A Shares and Class T Shares under the DRIP Offering. The Board previously established a per share NAV as of February 29, 2016, December 31, 2016, December 31, 2017, December 31, 2018, December 31, 2019 and March 31, 2020. The Company’s estimated per share NAVs are not audited or reviewed by its independent auditors. Given the relative stability of the Company’s rent collections and the per share NAV for the quarters ended March 31, 2020 and June 30, Table of Contents COLE OFFICE & INDUSTRIAL REIT (CCIT II), INC. NOTES TO CONSOLIDATED FINANCIAL STATEMENTS 8

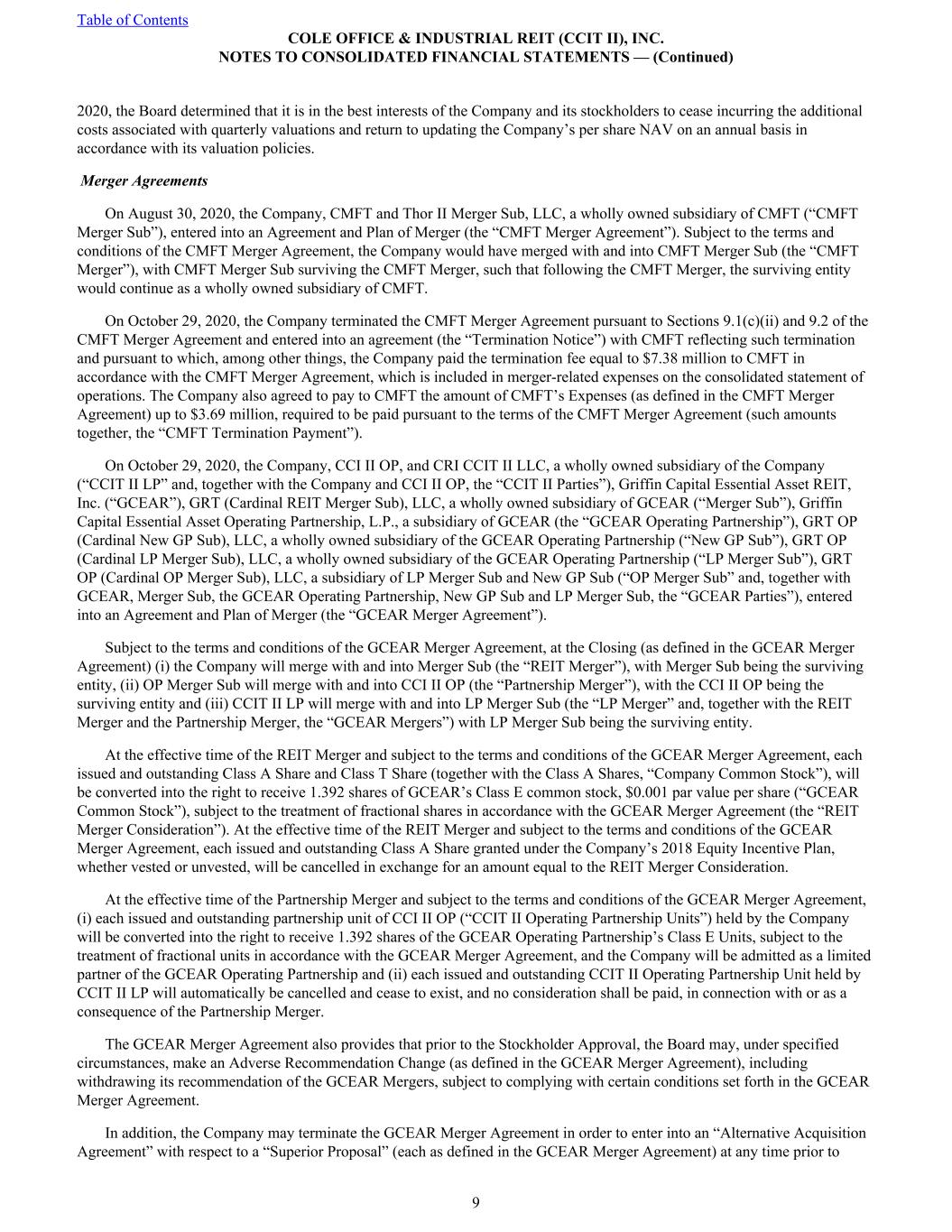

2020, the Board determined that it is in the best interests of the Company and its stockholders to cease incurring the additional costs associated with quarterly valuations and return to updating the Company’s per share NAV on an annual basis in accordance with its valuation policies. Merger Agreements On August 30, 2020, the Company, CMFT and Thor II Merger Sub, LLC, a wholly owned subsidiary of CMFT (“CMFT Merger Sub”), entered into an Agreement and Plan of Merger (the “CMFT Merger Agreement”). Subject to the terms and conditions of the CMFT Merger Agreement, the Company would have merged with and into CMFT Merger Sub (the “CMFT Merger”), with CMFT Merger Sub surviving the CMFT Merger, such that following the CMFT Merger, the surviving entity would continue as a wholly owned subsidiary of CMFT. On October 29, 2020, the Company terminated the CMFT Merger Agreement pursuant to Sections 9.1(c)(ii) and 9.2 of the CMFT Merger Agreement and entered into an agreement (the “Termination Notice”) with CMFT reflecting such termination and pursuant to which, among other things, the Company paid the termination fee equal to $7.38 million to CMFT in accordance with the CMFT Merger Agreement, which is included in merger-related expenses on the consolidated statement of operations. The Company also agreed to pay to CMFT the amount of CMFT’s Expenses (as defined in the CMFT Merger Agreement) up to $3.69 million, required to be paid pursuant to the terms of the CMFT Merger Agreement (such amounts together, the “CMFT Termination Payment”). On October 29, 2020, the Company, CCI II OP, and CRI CCIT II LLC, a wholly owned subsidiary of the Company (“CCIT II LP” and, together with the Company and CCI II OP, the “CCIT II Parties”), Griffin Capital Essential Asset REIT, Inc. (“GCEAR”), GRT (Cardinal REIT Merger Sub), LLC, a wholly owned subsidiary of GCEAR (“Merger Sub”), Griffin Capital Essential Asset Operating Partnership, L.P., a subsidiary of GCEAR (the “GCEAR Operating Partnership”), GRT OP (Cardinal New GP Sub), LLC, a wholly owned subsidiary of the GCEAR Operating Partnership (“New GP Sub”), GRT OP (Cardinal LP Merger Sub), LLC, a wholly owned subsidiary of the GCEAR Operating Partnership (“LP Merger Sub”), GRT OP (Cardinal OP Merger Sub), LLC, a subsidiary of LP Merger Sub and New GP Sub (“OP Merger Sub” and, together with GCEAR, Merger Sub, the GCEAR Operating Partnership, New GP Sub and LP Merger Sub, the “GCEAR Parties”), entered into an Agreement and Plan of Merger (the “GCEAR Merger Agreement”). Subject to the terms and conditions of the GCEAR Merger Agreement, at the Closing (as defined in the GCEAR Merger Agreement) (i) the Company will merge with and into Merger Sub (the “REIT Merger”), with Merger Sub being the surviving entity, (ii) OP Merger Sub will merge with and into CCI II OP (the “Partnership Merger”), with the CCI II OP being the surviving entity and (iii) CCIT II LP will merge with and into LP Merger Sub (the “LP Merger” and, together with the REIT Merger and the Partnership Merger, the “GCEAR Mergers”) with LP Merger Sub being the surviving entity. At the effective time of the REIT Merger and subject to the terms and conditions of the GCEAR Merger Agreement, each issued and outstanding Class A Share and Class T Share (together with the Class A Shares, “Company Common Stock”), will be converted into the right to receive 1.392 shares of GCEAR’s Class E common stock, $0.001 par value per share (“GCEAR Common Stock”), subject to the treatment of fractional shares in accordance with the GCEAR Merger Agreement (the “REIT Merger Consideration”). At the effective time of the REIT Merger and subject to the terms and conditions of the GCEAR Merger Agreement, each issued and outstanding Class A Share granted under the Company’s 2018 Equity Incentive Plan, whether vested or unvested, will be cancelled in exchange for an amount equal to the REIT Merger Consideration. At the effective time of the Partnership Merger and subject to the terms and conditions of the GCEAR Merger Agreement, (i) each issued and outstanding partnership unit of CCI II OP (“CCIT II Operating Partnership Units”) held by the Company will be converted into the right to receive 1.392 shares of the GCEAR Operating Partnership’s Class E Units, subject to the treatment of fractional units in accordance with the GCEAR Merger Agreement, and the Company will be admitted as a limited partner of the GCEAR Operating Partnership and (ii) each issued and outstanding CCIT II Operating Partnership Unit held by CCIT II LP will automatically be cancelled and cease to exist, and no consideration shall be paid, in connection with or as a consequence of the Partnership Merger. The GCEAR Merger Agreement also provides that prior to the Stockholder Approval, the Board may, under specified circumstances, make an Adverse Recommendation Change (as defined in the GCEAR Merger Agreement), including withdrawing its recommendation of the GCEAR Mergers, subject to complying with certain conditions set forth in the GCEAR Merger Agreement. In addition, the Company may terminate the GCEAR Merger Agreement in order to enter into an “Alternative Acquisition Agreement” with respect to a “Superior Proposal” (each as defined in the GCEAR Merger Agreement) at any time prior to Table of Contents COLE OFFICE & INDUSTRIAL REIT (CCIT II), INC. NOTES TO CONSOLIDATED FINANCIAL STATEMENTS — (Continued) 9

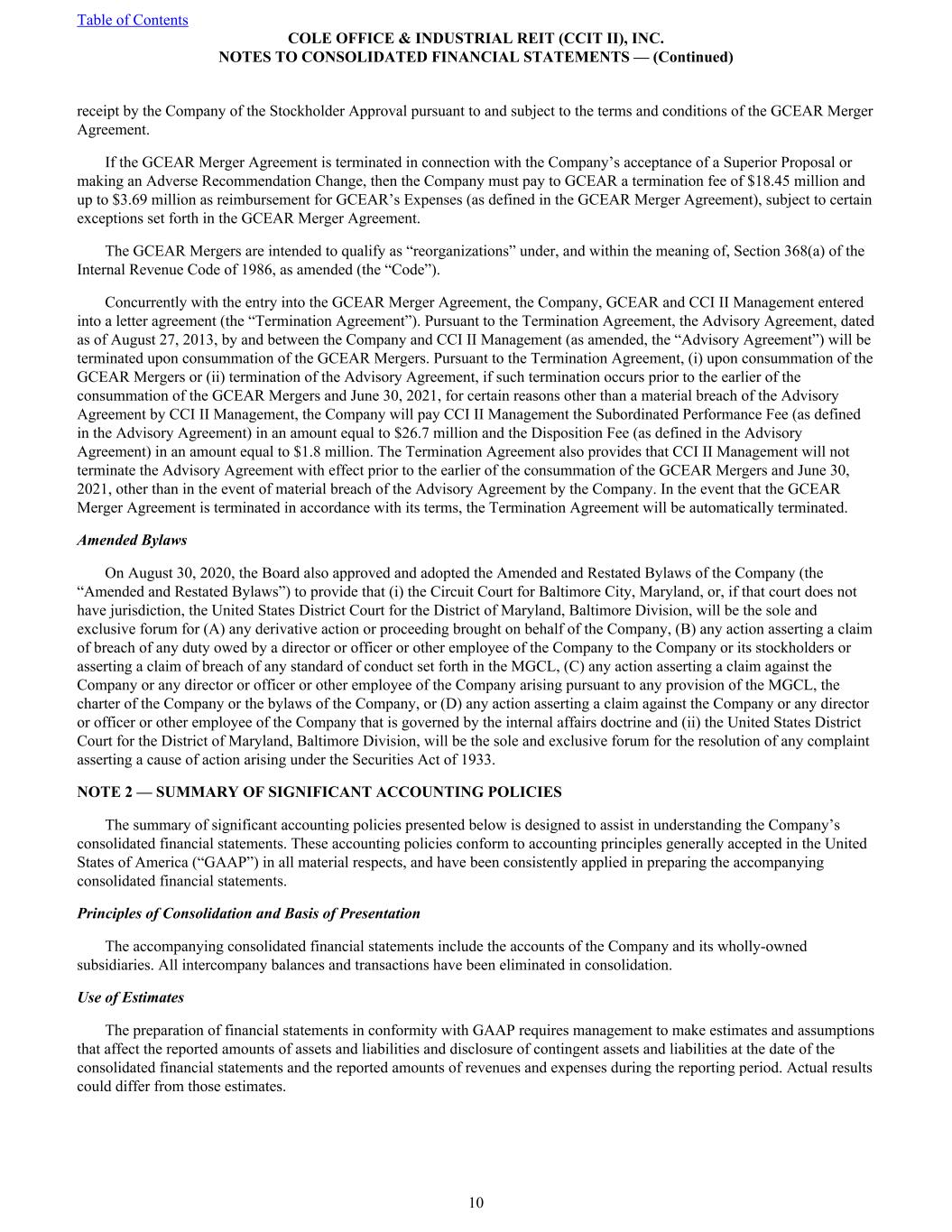

receipt by the Company of the Stockholder Approval pursuant to and subject to the terms and conditions of the GCEAR Merger Agreement. If the GCEAR Merger Agreement is terminated in connection with the Company’s acceptance of a Superior Proposal or making an Adverse Recommendation Change, then the Company must pay to GCEAR a termination fee of $18.45 million and up to $3.69 million as reimbursement for GCEAR’s Expenses (as defined in the GCEAR Merger Agreement), subject to certain exceptions set forth in the GCEAR Merger Agreement. The GCEAR Mergers are intended to qualify as “reorganizations” under, and within the meaning of, Section 368(a) of the Internal Revenue Code of 1986, as amended (the “Code”). Concurrently with the entry into the GCEAR Merger Agreement, the Company, GCEAR and CCI II Management entered into a letter agreement (the “Termination Agreement”). Pursuant to the Termination Agreement, the Advisory Agreement, dated as of August 27, 2013, by and between the Company and CCI II Management (as amended, the “Advisory Agreement”) will be terminated upon consummation of the GCEAR Mergers. Pursuant to the Termination Agreement, (i) upon consummation of the GCEAR Mergers or (ii) termination of the Advisory Agreement, if such termination occurs prior to the earlier of the consummation of the GCEAR Mergers and June 30, 2021, for certain reasons other than a material breach of the Advisory Agreement by CCI II Management, the Company will pay CCI II Management the Subordinated Performance Fee (as defined in the Advisory Agreement) in an amount equal to $26.7 million and the Disposition Fee (as defined in the Advisory Agreement) in an amount equal to $1.8 million. The Termination Agreement also provides that CCI II Management will not terminate the Advisory Agreement with effect prior to the earlier of the consummation of the GCEAR Mergers and June 30, 2021, other than in the event of material breach of the Advisory Agreement by the Company. In the event that the GCEAR Merger Agreement is terminated in accordance with its terms, the Termination Agreement will be automatically terminated. Amended Bylaws On August 30, 2020, the Board also approved and adopted the Amended and Restated Bylaws of the Company (the “Amended and Restated Bylaws”) to provide that (i) the Circuit Court for Baltimore City, Maryland, or, if that court does not have jurisdiction, the United States District Court for the District of Maryland, Baltimore Division, will be the sole and exclusive forum for (A) any derivative action or proceeding brought on behalf of the Company, (B) any action asserting a claim of breach of any duty owed by a director or officer or other employee of the Company to the Company or its stockholders or asserting a claim of breach of any standard of conduct set forth in the MGCL, (C) any action asserting a claim against the Company or any director or officer or other employee of the Company arising pursuant to any provision of the MGCL, the charter of the Company or the bylaws of the Company, or (D) any action asserting a claim against the Company or any director or officer or other employee of the Company that is governed by the internal affairs doctrine and (ii) the United States District Court for the District of Maryland, Baltimore Division, will be the sole and exclusive forum for the resolution of any complaint asserting a cause of action arising under the Securities Act of 1933. NOTE 2 — SUMMARY OF SIGNIFICANT ACCOUNTING POLICIES The summary of significant accounting policies presented below is designed to assist in understanding the Company’s consolidated financial statements. These accounting policies conform to accounting principles generally accepted in the United States of America (“GAAP”) in all material respects, and have been consistently applied in preparing the accompanying consolidated financial statements. Principles of Consolidation and Basis of Presentation The accompanying consolidated financial statements include the accounts of the Company and its wholly-owned subsidiaries. All intercompany balances and transactions have been eliminated in consolidation. Use of Estimates The preparation of financial statements in conformity with GAAP requires management to make estimates and assumptions that affect the reported amounts of assets and liabilities and disclosure of contingent assets and liabilities at the date of the consolidated financial statements and the reported amounts of revenues and expenses during the reporting period. Actual results could differ from those estimates. Table of Contents COLE OFFICE & INDUSTRIAL REIT (CCIT II), INC. NOTES TO CONSOLIDATED FINANCIAL STATEMENTS — (Continued) 10

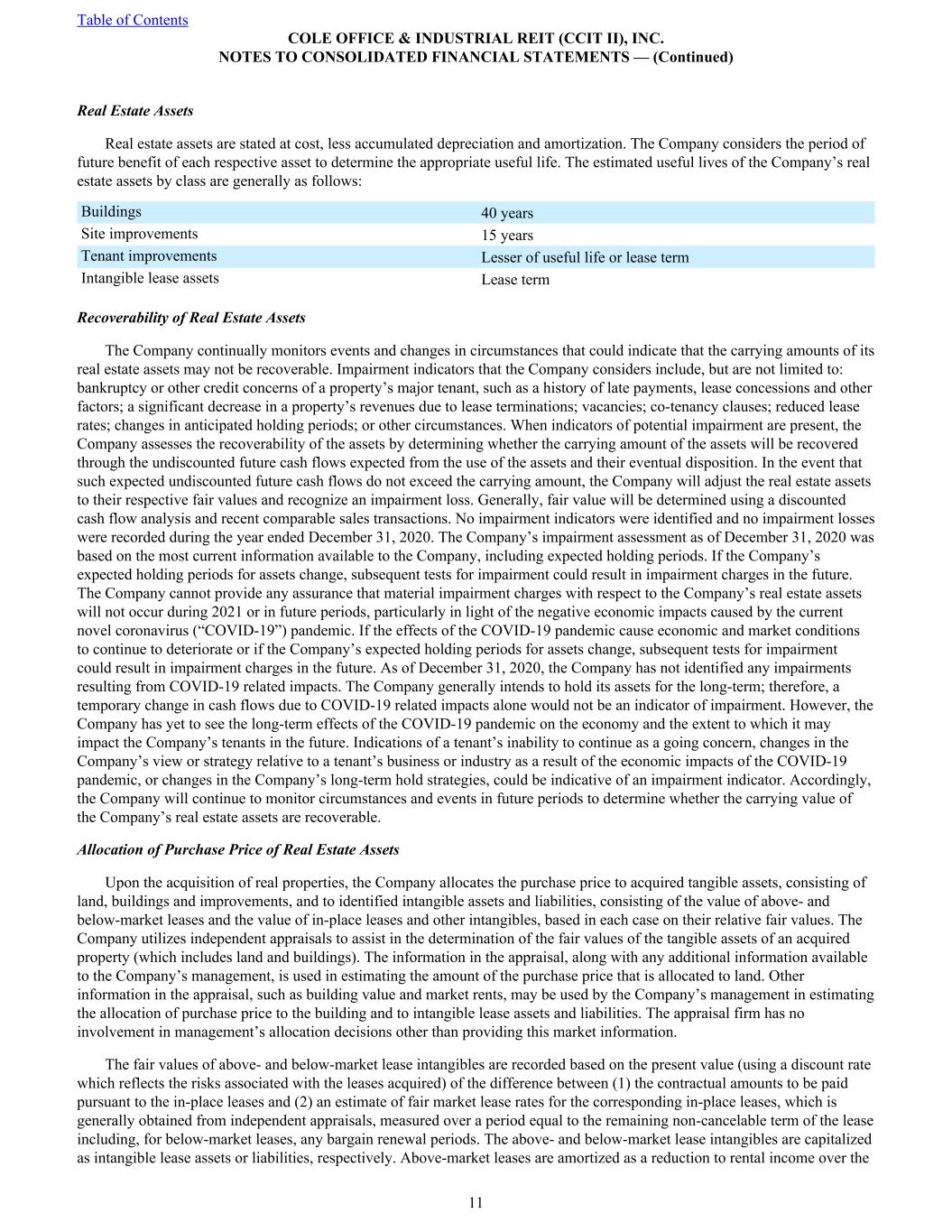

Real Estate Assets Real estate assets are stated at cost, less accumulated depreciation and amortization. The Company considers the period of future benefit of each respective asset to determine the appropriate useful life. The estimated useful lives of the Company’s real estate assets by class are generally as follows: Buildings 40 years Site improvements 15 years Tenant improvements Lesser of useful life or lease term Intangible lease assets Lease term Recoverability of Real Estate Assets The Company continually monitors events and changes in circumstances that could indicate that the carrying amounts of its real estate assets may not be recoverable. Impairment indicators that the Company considers include, but are not limited to: bankruptcy or other credit concerns of a property’s major tenant, such as a history of late payments, lease concessions and other factors; a significant decrease in a property’s revenues due to lease terminations; vacancies; co-tenancy clauses; reduced lease rates; changes in anticipated holding periods; or other circumstances. When indicators of potential impairment are present, the Company assesses the recoverability of the assets by determining whether the carrying amount of the assets will be recovered through the undiscounted future cash flows expected from the use of the assets and their eventual disposition. In the event that such expected undiscounted future cash flows do not exceed the carrying amount, the Company will adjust the real estate assets to their respective fair values and recognize an impairment loss. Generally, fair value will be determined using a discounted cash flow analysis and recent comparable sales transactions. No impairment indicators were identified and no impairment losses were recorded during the year ended December 31, 2020. The Company’s impairment assessment as of December 31, 2020 was based on the most current information available to the Company, including expected holding periods. If the Company’s expected holding periods for assets change, subsequent tests for impairment could result in impairment charges in the future. The Company cannot provide any assurance that material impairment charges with respect to the Company’s real estate assets will not occur during 2021 or in future periods, particularly in light of the negative economic impacts caused by the current novel coronavirus (“COVID-19”) pandemic. If the effects of the COVID-19 pandemic cause economic and market conditions to continue to deteriorate or if the Company’s expected holding periods for assets change, subsequent tests for impairment could result in impairment charges in the future. As of December 31, 2020, the Company has not identified any impairments resulting from COVID-19 related impacts. The Company generally intends to hold its assets for the long-term; therefore, a temporary change in cash flows due to COVID-19 related impacts alone would not be an indicator of impairment. However, the Company has yet to see the long-term effects of the COVID-19 pandemic on the economy and the extent to which it may impact the Company’s tenants in the future. Indications of a tenant’s inability to continue as a going concern, changes in the Company’s view or strategy relative to a tenant’s business or industry as a result of the economic impacts of the COVID-19 pandemic, or changes in the Company’s long-term hold strategies, could be indicative of an impairment indicator. Accordingly, the Company will continue to monitor circumstances and events in future periods to determine whether the carrying value of the Company’s real estate assets are recoverable. Allocation of Purchase Price of Real Estate Assets Upon the acquisition of real properties, the Company allocates the purchase price to acquired tangible assets, consisting of land, buildings and improvements, and to identified intangible assets and liabilities, consisting of the value of above- and below-market leases and the value of in-place leases and other intangibles, based in each case on their relative fair values. The Company utilizes independent appraisals to assist in the determination of the fair values of the tangible assets of an acquired property (which includes land and buildings). The information in the appraisal, along with any additional information available to the Company’s management, is used in estimating the amount of the purchase price that is allocated to land. Other information in the appraisal, such as building value and market rents, may be used by the Company’s management in estimating the allocation of purchase price to the building and to intangible lease assets and liabilities. The appraisal firm has no involvement in management’s allocation decisions other than providing this market information. The fair values of above- and below-market lease intangibles are recorded based on the present value (using a discount rate which reflects the risks associated with the leases acquired) of the difference between (1) the contractual amounts to be paid pursuant to the in-place leases and (2) an estimate of fair market lease rates for the corresponding in-place leases, which is generally obtained from independent appraisals, measured over a period equal to the remaining non-cancelable term of the lease including, for below-market leases, any bargain renewal periods. The above- and below-market lease intangibles are capitalized as intangible lease assets or liabilities, respectively. Above-market leases are amortized as a reduction to rental income over the Table of Contents COLE OFFICE & INDUSTRIAL REIT (CCIT II), INC. NOTES TO CONSOLIDATED FINANCIAL STATEMENTS — (Continued) 11

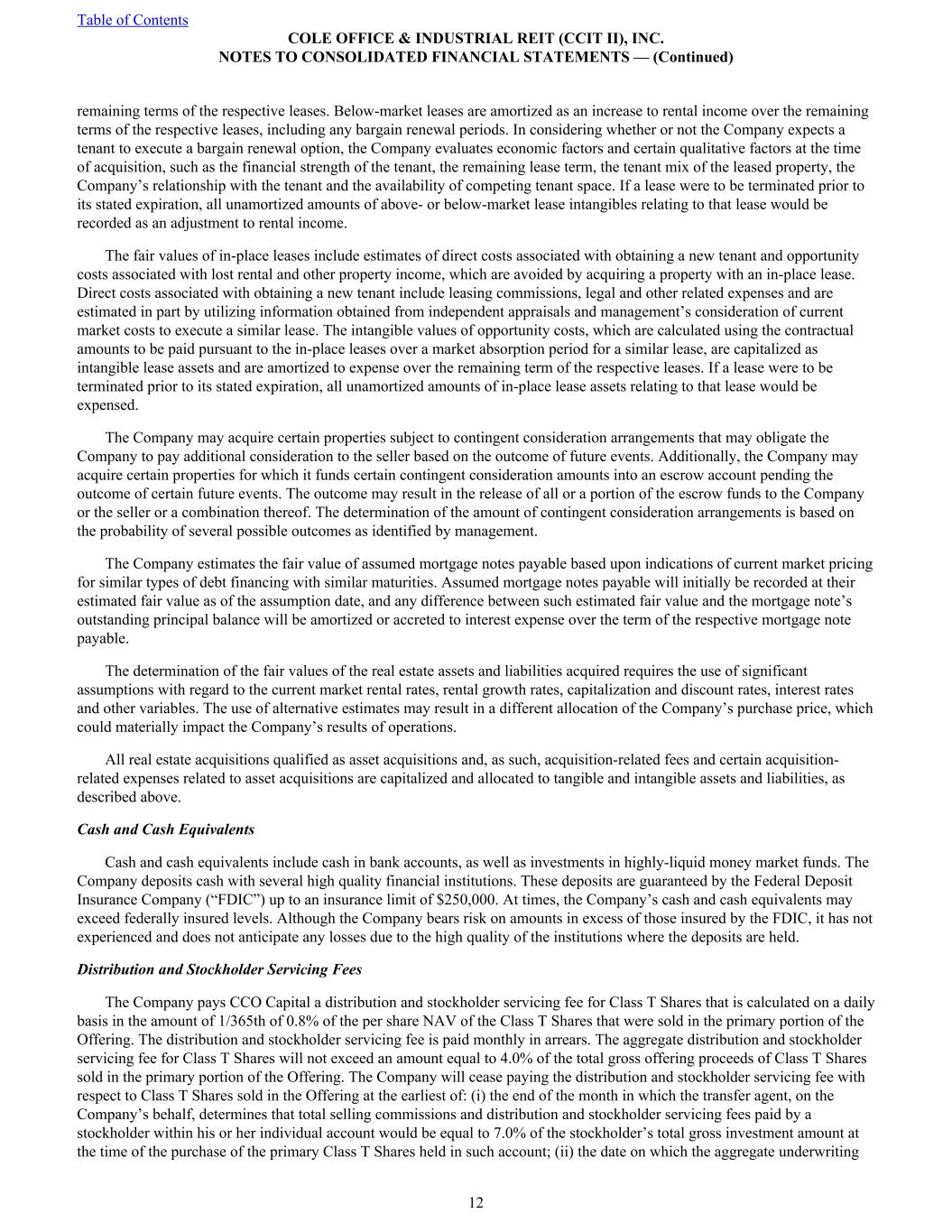

remaining terms of the respective leases. Below-market leases are amortized as an increase to rental income over the remaining terms of the respective leases, including any bargain renewal periods. In considering whether or not the Company expects a tenant to execute a bargain renewal option, the Company evaluates economic factors and certain qualitative factors at the time of acquisition, such as the financial strength of the tenant, the remaining lease term, the tenant mix of the leased property, the Company’s relationship with the tenant and the availability of competing tenant space. If a lease were to be terminated prior to its stated expiration, all unamortized amounts of above- or below-market lease intangibles relating to that lease would be recorded as an adjustment to rental income. The fair values of in-place leases include estimates of direct costs associated with obtaining a new tenant and opportunity costs associated with lost rental and other property income, which are avoided by acquiring a property with an in-place lease. Direct costs associated with obtaining a new tenant include leasing commissions, legal and other related expenses and are estimated in part by utilizing information obtained from independent appraisals and management’s consideration of current market costs to execute a similar lease. The intangible values of opportunity costs, which are calculated using the contractual amounts to be paid pursuant to the in-place leases over a market absorption period for a similar lease, are capitalized as intangible lease assets and are amortized to expense over the remaining term of the respective leases. If a lease were to be terminated prior to its stated expiration, all unamortized amounts of in-place lease assets relating to that lease would be expensed. The Company may acquire certain properties subject to contingent consideration arrangements that may obligate the Company to pay additional consideration to the seller based on the outcome of future events. Additionally, the Company may acquire certain properties for which it funds certain contingent consideration amounts into an escrow account pending the outcome of certain future events. The outcome may result in the release of all or a portion of the escrow funds to the Company or the seller or a combination thereof. The determination of the amount of contingent consideration arrangements is based on the probability of several possible outcomes as identified by management. The Company estimates the fair value of assumed mortgage notes payable based upon indications of current market pricing for similar types of debt financing with similar maturities. Assumed mortgage notes payable will initially be recorded at their estimated fair value as of the assumption date, and any difference between such estimated fair value and the mortgage note’s outstanding principal balance will be amortized or accreted to interest expense over the term of the respective mortgage note payable. The determination of the fair values of the real estate assets and liabilities acquired requires the use of significant assumptions with regard to the current market rental rates, rental growth rates, capitalization and discount rates, interest rates and other variables. The use of alternative estimates may result in a different allocation of the Company’s purchase price, which could materially impact the Company’s results of operations. All real estate acquisitions qualified as asset acquisitions and, as such, acquisition-related fees and certain acquisition- related expenses related to asset acquisitions are capitalized and allocated to tangible and intangible assets and liabilities, as described above. Cash and Cash Equivalents Cash and cash equivalents include cash in bank accounts, as well as investments in highly-liquid money market funds. The Company deposits cash with several high quality financial institutions. These deposits are guaranteed by the Federal Deposit Insurance Company (“FDIC”) up to an insurance limit of $250,000. At times, the Company’s cash and cash equivalents may exceed federally insured levels. Although the Company bears risk on amounts in excess of those insured by the FDIC, it has not experienced and does not anticipate any losses due to the high quality of the institutions where the deposits are held. Distribution and Stockholder Servicing Fees The Company pays CCO Capital a distribution and stockholder servicing fee for Class T Shares that is calculated on a daily basis in the amount of 1/365th of 0.8% of the per share NAV of the Class T Shares that were sold in the primary portion of the Offering. The distribution and stockholder servicing fee is paid monthly in arrears. The aggregate distribution and stockholder servicing fee for Class T Shares will not exceed an amount equal to 4.0% of the total gross offering proceeds of Class T Shares sold in the primary portion of the Offering. The Company will cease paying the distribution and stockholder servicing fee with respect to Class T Shares sold in the Offering at the earliest of: (i) the end of the month in which the transfer agent, on the Company’s behalf, determines that total selling commissions and distribution and stockholder servicing fees paid by a stockholder within his or her individual account would be equal to 7.0% of the stockholder’s total gross investment amount at the time of the purchase of the primary Class T Shares held in such account; (ii) the date on which the aggregate underwriting Table of Contents COLE OFFICE & INDUSTRIAL REIT (CCIT II), INC. NOTES TO CONSOLIDATED FINANCIAL STATEMENTS — (Continued) 12

compensation from all sources equals 10.0% of the gross offering proceeds (i.e., excluding proceeds from sales pursuant to the DRIP portion of the Offering); (iii) the fifth anniversary of the last day of the month in which such Class T Shares were purchased (excluding the offering of shares pursuant to DRIP portion of the Offering) terminates; (iv) the date such Class T Share is no longer outstanding; and (v) the date the Company effects a liquidity event (such as the sale of the Company, the sale of all or substantially all of the Company’s assets, a merger or similar transaction, the listing of the Company’s shares of common stock for trading on a national securities exchange or an alternative strategy that would result in a significant increase in the opportunities for stockholders to dispose of their shares). CCO Capital may, in its discretion, reallow to participating broker-dealers all or a portion of the distribution and stockholder servicing fee for services that such participating broker- dealers perform in connection with the distribution of Class T Shares. An estimated liability for future distribution and stockholder servicing fees payable to CCO Capital was recognized at the time each Class T Share was sold and included in due to affiliates in the consolidated balance sheets with a corresponding decrease to capital in excess of par value. Deferred Financing Costs Deferred financing costs represent commitment fees, legal fees and other costs associated with obtaining commitments for financing. These costs are amortized to interest expense over the terms of the respective financing agreements using the straight-line method, which approximates the effective interest method. Unamortized deferred financing costs are written off when the associated debt is extinguished or repaid before maturity. The presentation of all deferred financing costs, other than those associated with the revolving loan portion of the credit facility, are classified such that the debt issuance costs related to a recognized debt liability are presented on the consolidated balance sheets as a direct deduction from the carrying amount of the related debt liability rather than as an asset. Debt issuance costs related to securing a revolving line of credit are presented as an asset and amortized ratably over the term of the line of credit arrangement. As such, the Company’s current and corresponding prior period total deferred financing costs, net in the accompanying consolidated balance sheets relate only to the revolving loan portion of the credit facility and the historical presentation, amortization and treatment of unamortized costs are still applicable. As of December 31, 2020, the Company had $1.1 million of deferred financing costs, net of accumulated amortization, related to the revolving loan portion of the credit facility. Costs incurred in seeking financing transactions that do not close are expensed in the period in which it is determined the financing will not close. Due to Affiliates CCI II Management, and certain of its affiliates, received and will continue to receive fees, reimbursements, and compensation in connection with services provided relating to the Offerings and the acquisition, management, financing, and leasing of the properties of the Company. Derivative Instruments and Hedging Activities The Company accounts for its derivative instruments at fair value. Accounting for changes in the fair value of a derivative instrument depends on the intended use of the derivative instrument and the designation of the derivative instrument. The change in fair value of the derivative instrument that is designated as a hedge is recorded as other comprehensive income. The changes in fair value for derivative instruments that are not designated as hedges or that do not meet the hedge accounting criteria are recorded as a gain or loss to operations. Leases The Company adopted ASU No. 2016-02, Leases (Topic 842) (“ASC 842”), on January 1, 2019 using the optional alternative transition method for financial information and related disclosures. The Company elected the “package of practical expedients,” which permits the Company to not reassess under the new standard prior conclusions about lease identification, lease classification and initial direct costs. The Company has lease agreements with lease and non-lease components. The Company has elected to not separate non-lease components from lease components for all classes of underlying assets (primarily real estate assets) and will account for the combined components as rental and other property income. Non-lease components included in rental and other property income include certain tenant reimbursements for maintenance services (including common-area maintenance services or “CAM”), real estate taxes, insurance and utilities paid for by the lessor but consumed by the lessee. As a lessor, the Company has further determined that this policy will be effective only on a lease that has been classified as an operating lease and the revenue recognition pattern and timing is the same for both types of components. The Company is not a party to any material leases where it is the lessee. Significant judgments and assumptions are inherent in not only determining if a contract contains a lease, but also the lease classification, terms, payments, and, if needed, discount rates. Judgments include the nature of any options, including if they Table of Contents COLE OFFICE & INDUSTRIAL REIT (CCIT II), INC. NOTES TO CONSOLIDATED FINANCIAL STATEMENTS — (Continued) 13

will be exercised, evaluation of implicit discount rates and the assessment and consideration of “fixed” payments for straight- line rent revenue calculations. The Company has an investment in a real estate property that is subject to a ground lease, for which a lease liability and right of use (“ROU”) asset was recorded. See Note 14 — Leases for a further discussion regarding this ground lease. Lease costs represent the initial direct costs incurred in the origination, negotiation and processing of a lease agreement. Such costs include outside broker commissions and other independent third-party costs and are amortized over the life of the lease on a straight-line basis. Costs related to salaries and benefits, supervision, administration, unsuccessful origination efforts and other activities not directly related to completed lease agreements are expensed as incurred. Upon successful lease execution, leasing commissions are capitalized. Revenue Recognition Rental and other property income is primarily derived from fixed contractual payments from operating leases and, therefore, is generally recognized on a straight-line basis over the term of the lease, which typically begins the date the tenant takes control of the space. When the Company acquires a property, the terms of existing leases are considered to commence as of the acquisition date for the purpose of this calculation. Variable rental and other property income consists primarily of tenant reimbursements for recoverable real estate taxes and operating expenses which are included in rental and other property income in the period when such costs are incurred, with offsetting expenses in real estate taxes and property operating expenses, respectively, within the consolidated statements of operations. The Company defers the recognition of variable rental and other property income, such as percentage rents, until the specific target that triggers the contingent rental income is achieved. The Company continually reviews whether collection of lease-related receivables, including any straight-line rent, and current and future operating expense reimbursements from tenants are probable. The determination of whether collectability is probable takes into consideration the tenant’s payment history, the financial condition of the tenant, business conditions in the industry in which the tenant operates and economic conditions in the area in which the property is located. Upon the determination that the collectability of a receivable is not probable, the Company will record a reduction to rental and other property income for amounts previously recorded and a decrease in the outstanding receivable. Revenue from leases where collection is deemed to be not probable is recorded on a cash basis until collectability becomes probable. Management’s estimate of the collectability of lease-related receivables is based on the best information available at the time of estimate. The Company does not use a general reserve approach and lease-related receivables are adjusted and taken against rental and other property income only when collectability becomes not probable. There were no lease-related receivable write-offs during the year ended December 31, 2020. Income Taxes The Company elected to be taxed, and currently qualifies, as a REIT for federal income tax purposes under Sections 856 through 860 of the Code, commencing with its taxable year ended December 31, 2014. The Company will generally not be subject to federal corporate income tax to the extent it distributes its taxable income to its stockholders, and so long as it, among other things, distributes at least 90% of its annual taxable income (computed without regard to the dividends paid deduction and excluding net capital gains). REITs are subject to a number of other organizational and operational requirements. Even if the Company maintains its qualification for taxation as a REIT, it or its subsidiaries may be subject to certain state and local taxes on its income and property, and federal income and excise taxes on its undistributed income. Distributions Per Share Distributions per share are calculated based on the authorized monthly distribution rate. Prior to April 1, 2020, distributions were calculated based on the authorized daily distribution rate. Recent Accounting Pronouncements From time to time, new accounting pronouncements are issued by various standard setting bodies that may have an impact on the Company’s accounting and reporting. Except as otherwise stated below, the Company is currently evaluating the effect that certain new accounting requirements may have on the Company’s accounting and related reporting and disclosures in the Company’s consolidated financial statements. In June 2016, the Financial Accounting Standards Board (the “FASB”) issued Accounting Standards Update (“ASU”) No. 2016-13, Financial Instruments - Credit Losses (Topic 326) (“ASU 2016-13”), which was subsequently amended by ASU No. 2018-19, Codification Improvements to Topic 326, Financial Instruments - Credit Losses (“ASU 2018-19”), in November Table of Contents COLE OFFICE & INDUSTRIAL REIT (CCIT II), INC. NOTES TO CONSOLIDATED FINANCIAL STATEMENTS — (Continued) 14

2018. Subsequently, the FASB issued ASU No. 2019-04, ASU No. 2019-05, ASU No. 2019-10, ASU No. 2019-11 and ASU No. 2020-02 to provide additional guidance on the credit losses standard. ASU 2016-13 and the related updates are intended to improve financial reporting requiring more timely recognition of credit losses on loans and other financial instruments that are not accounted for at fair value through net income, including loans held-for-investment, held-to-maturity debt securities, net investment in leases and other such commitments. ASU 2016-13 requires that financial assets measured at amortized cost be presented at the net amount expected to be collected, through an allowance for credit losses that is deducted from the amortized cost basis. The amendments in ASU 2016-13 require the Company to measure all expected credit losses based upon historical experience, current conditions, and reasonable and supportable forecasts that affect the collectability of the financial assets and eliminates the “incurred loss” methodology under current GAAP. ASU 2018-19 clarified that receivables arising from operating leases are not within the scope of Topic 326. Instead, impairment of receivables arising from operating leases should be accounted for in accordance with ASC 842. ASU 2016-13 and ASU 2018-19 are effective for fiscal years, and interim periods within those years, beginning after December 15, 2019. The Company adopted ASU 2016-13 during the first quarter of fiscal year 2020, and has concluded that there is no material impact on its consolidated financial statements. In August 2018, the FASB issued ASU No. 2018-13, Changes to the Disclosure Requirements for Fair Value Measurement (“ASU 2018-13”). This ASU amends and removes several disclosure requirements including the valuation processes for Level 3 fair value measurements. ASU 2018-13 also modifies some disclosure requirements and requires additional disclosures for changes in unrealized gains and losses included in other comprehensive income for recurring Level 3 fair value measurements and requires the range and weighted average of significant unobservable inputs used to develop Level 3 fair value measurements. The provisions of ASU 2018-13 are effective January 1, 2020 using a prospective transition method for amendments effecting changes in unrealized gains and losses, significant unobservable inputs used to develop Level 3 fair value measurements and narrative description on uncertainty of measurements. The remaining provisions of ASU 2018-13 are to be applied retrospectively, and early adoption is permitted. The Company adopted ASU 2018-13 during the first quarter of fiscal year 2020, and has concluded that there is no material impact on its consolidated financial statements. In October 2018, the FASB issued ASU No. 2018-16, Inclusion of the Secured Overnight Financing Rate (“SOFR”) Overnight Index Swap (“OIS”) Rate as a Benchmark Interest Rate for Hedge Accounting Purposes (“ASU 2018-16”). The amendments in this ASU permit the use of the OIS rate based on SOFR as a U.S. benchmark interest rate for hedge accounting purposes, or another acceptable benchmark interest rate. The SOFR is a volume-weighted median interest rate that is calculated daily based on overnight transactions from the prior day’s activity in specified segments of the U.S. Treasury repo market. It has been selected as the preferred replacement for the U.S. dollar London Interbank Offered Rate (“LIBOR”), which will be phased out by the end of 2021. ASU 2018-16 is effective for public entities for fiscal years beginning after December 15, 2018, including interim periods within those fiscal years. ASU 2018-16 is required to be adopted on a prospective basis for qualifying new or redesignated hedging relationships entered into on or after the date of adoption. The Company currently uses LIBOR as its benchmark interest rate in the Company’s interest rate swaps associated with the Company’s LIBOR-based variable rate borrowings. The Company has not entered into any new or redesignated hedging relationships on or after the date of adoption of ASU 2018-16. The Company has evaluated the effect of this new benchmark interest rate option, and does not believe this ASU will have a material impact on its consolidated financial statements. In October 2018, the FASB issued ASU 2018-17, Consolidation (Topic 810): Targeted Improvements to Related Party Guidance for Variable Interest Entities (“ASU 2018-17”). The guidance changes the guidance for determining whether a decision-making fee is a variable interest. Under the new ASU, indirect interests held through related parties under common control will now be considered on a proportional basis when determining whether fees paid to decision makers and service providers are variable interests. Such indirect interests were previously treated the same as direct interests. ASU 2018-17 is effective for fiscal years beginning after December 15, 2019 and interim periods within those fiscal years. The Company adopted ASU 2018-17 during the first quarter of fiscal year 2020, and has concluded that there is no material impact on its consolidated financial statements. In April 2020, the FASB issued a question and answer document (the “Lease Modification Q&A”) focused on the application of lease accounting guidance to lease concessions provided as a result of the COVID-19 pandemic. Due to the business disruptions and challenges severely affecting the global economy caused by the COVID-19 pandemic, many lessors may be required to provide rent deferrals and other lease concessions to lessees. While the lease modification guidance in ASC 842 addresses routine changes to lease terms resulting from negotiations between the lessee and the lessor, this guidance did not contemplate concessions being so rapidly executed to address the sudden liquidity constraints of some lessees arising from COVID-19 related impacts. Under existing lease guidance, the Company would have to determine, on a lease by lease basis, if a lease concession was the result of a new arrangement reached with the tenant (treated within the lease modification accounting framework) or if a lease concession was under the enforceable rights and obligations within the existing lease agreement (precluded from applying the lease modification accounting framework). The Lease Modification Q&A allows the Table of Contents COLE OFFICE & INDUSTRIAL REIT (CCIT II), INC. NOTES TO CONSOLIDATED FINANCIAL STATEMENTS — (Continued) 15

Company, if certain criteria have been met, to bypass the lease by lease analysis, and instead elect to either apply the lease modification accounting framework or not, with such election applied consistently to leases with similar characteristics and similar circumstances. The future impact of the Lease Modification Q&A is dependent upon the extent of lease concessions granted to tenants as a result of the COVID-19 pandemic in future periods and the elections made by the Company at the time of entering into such concessions. As of December 31, 2020, the Company has collected 100% of rental payments originally contracted for during the year ended December 31, 2020. In January 2021, the FASB issued ASU No. 2021-01, Reference Rate Reform (Topic 848) (“ASU 2021-01”). The amendments in ASU 2021-01 clarify that certain optional expedients and exceptions for contract modifications and hedge accounting apply to derivative instruments that use an interest rate for margining, discounting, or contract price alignment that is modified as a result of the discontinuation of the use of LIBOR as a benchmark interest rate due to reference rate reform. ASU 2021-01 is effective immediately for all entities with the option to apply retrospectively as of any date from the beginning of an interim period that includes or is subsequent to March 12, 2020, and can be applied prospectively to any new contract modifications made on or after January 7, 2021. The Company currently uses LIBOR as its benchmark interest rate for its derivative instruments, and has not entered into any new contracts on or after the effective date of ASU 2021-01. The Company is evaluating the impact of this ASU’s adoption, and does not believe this ASU will have a material impact on its consolidated financial statements. NOTE 3 — FAIR VALUE MEASUREMENTS GAAP defines fair value, establishes a framework for measuring fair value and requires disclosures about fair value measurements. GAAP emphasizes that fair value is intended to be a market-based measurement, as opposed to a transaction- specific measurement. Fair value is defined as the price that would be received to sell an asset or paid to transfer a liability in an orderly transaction between market participants at the measurement date under current market conditions. Depending on the nature of the asset or liability, various techniques and assumptions can be used to estimate the fair value. Assets and liabilities are measured using inputs from three levels of the fair value hierarchy, as follows: Level 1 — Inputs are quoted prices (unadjusted) in active markets for identical assets or liabilities that the Company has the ability to access at the measurement date. An active market is defined as a market in which transactions for the assets or liabilities occur with sufficient frequency and volume to provide pricing information on an ongoing basis. Level 2 — Inputs include quoted prices for similar assets and liabilities in active markets, quoted prices for identical or similar assets or liabilities in markets that are not active (markets with few transactions), inputs other than quoted prices that are observable for the asset or liability (i.e., interest rates, yield curves, etc.), and inputs that are derived principally from or corroborated by observable market data correlation or other means (market corroborated inputs). Level 3 — Unobservable inputs, which are only used to the extent that observable inputs are not available, reflect the Company’s assumptions about the pricing of an asset or liability. The following describes the methods the Company uses to estimate the fair value of the Company’s financial assets and liabilities: Derivative instruments — The Company’s derivative instruments are comprised of interest rate swaps. All derivative instruments are carried at fair value and are valued using Level 2 inputs. The fair value of these instruments is determined using interest rate market pricing models. In addition, credit valuation adjustments are incorporated into the fair values to account for the Company’s potential nonperformance risk and the performance risk of the respective counterparties. Although the Company has determined that the majority of the inputs used to value its derivatives fall within Level 2 of the fair value hierarchy, the credit valuation adjustments associated with those derivatives utilize Level 3 inputs, such as estimates of current credit spreads, to evaluate the likelihood of default by the Company and its counterparties. However, as of December 31, 2020, the Company assessed the significance of the impact of the credit valuation adjustments on the overall valuation of its derivative positions and determined that the credit valuation adjustments are not significant to the overall valuation of the Company’s derivatives. As a result, the Company has determined that its derivative valuations in their entirety are classified in Level 2 of the fair value hierarchy. Table of Contents COLE OFFICE & INDUSTRIAL REIT (CCIT II), INC. NOTES TO CONSOLIDATED FINANCIAL STATEMENTS — (Continued) 16

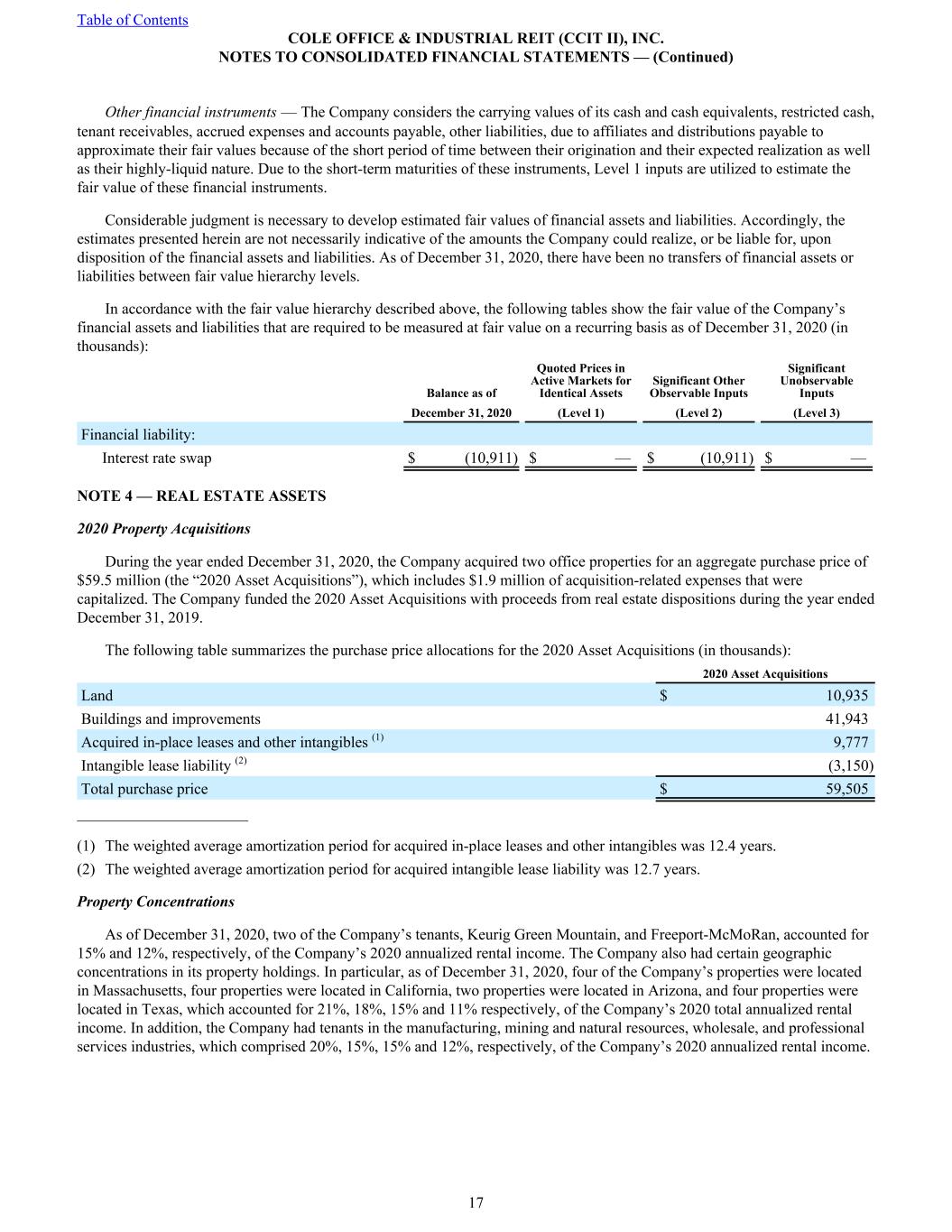

Other financial instruments — The Company considers the carrying values of its cash and cash equivalents, restricted cash, tenant receivables, accrued expenses and accounts payable, other liabilities, due to affiliates and distributions payable to approximate their fair values because of the short period of time between their origination and their expected realization as well as their highly-liquid nature. Due to the short-term maturities of these instruments, Level 1 inputs are utilized to estimate the fair value of these financial instruments. Considerable judgment is necessary to develop estimated fair values of financial assets and liabilities. Accordingly, the estimates presented herein are not necessarily indicative of the amounts the Company could realize, or be liable for, upon disposition of the financial assets and liabilities. As of December 31, 2020, there have been no transfers of financial assets or liabilities between fair value hierarchy levels. In accordance with the fair value hierarchy described above, the following tables show the fair value of the Company’s financial assets and liabilities that are required to be measured at fair value on a recurring basis as of December 31, 2020 (in thousands): Quoted Prices in Active Markets for Identical Assets Significant Other Observable Inputs Significant Unobservable InputsBalance as of December 31, 2020 (Level 1) (Level 2) (Level 3) Financial liability: Interest rate swap $ (10,911) $ — $ (10,911) $ — NOTE 4 — REAL ESTATE ASSETS 2020 Property Acquisitions During the year ended December 31, 2020, the Company acquired two office properties for an aggregate purchase price of $59.5 million (the “2020 Asset Acquisitions”), which includes $1.9 million of acquisition-related expenses that were capitalized. The Company funded the 2020 Asset Acquisitions with proceeds from real estate dispositions during the year ended December 31, 2019. The following table summarizes the purchase price allocations for the 2020 Asset Acquisitions (in thousands): 2020 Asset Acquisitions Land $ 10,935 Buildings and improvements 41,943 Acquired in-place leases and other intangibles (1) 9,777 Intangible lease liability (2) (3,150) Total purchase price $ 59,505 ______________________ (1) The weighted average amortization period for acquired in-place leases and other intangibles was 12.4 years. (2) The weighted average amortization period for acquired intangible lease liability was 12.7 years. Property Concentrations As of December 31, 2020, two of the Company’s tenants, Keurig Green Mountain, and Freeport-McMoRan, accounted for 15% and 12%, respectively, of the Company’s 2020 annualized rental income. The Company also had certain geographic concentrations in its property holdings. In particular, as of December 31, 2020, four of the Company’s properties were located in Massachusetts, four properties were located in California, two properties were located in Arizona, and four properties were located in Texas, which accounted for 21%, 18%, 15% and 11% respectively, of the Company’s 2020 total annualized rental income. In addition, the Company had tenants in the manufacturing, mining and natural resources, wholesale, and professional services industries, which comprised 20%, 15%, 15% and 12%, respectively, of the Company’s 2020 annualized rental income. Table of Contents COLE OFFICE & INDUSTRIAL REIT (CCIT II), INC. NOTES TO CONSOLIDATED FINANCIAL STATEMENTS — (Continued) 17

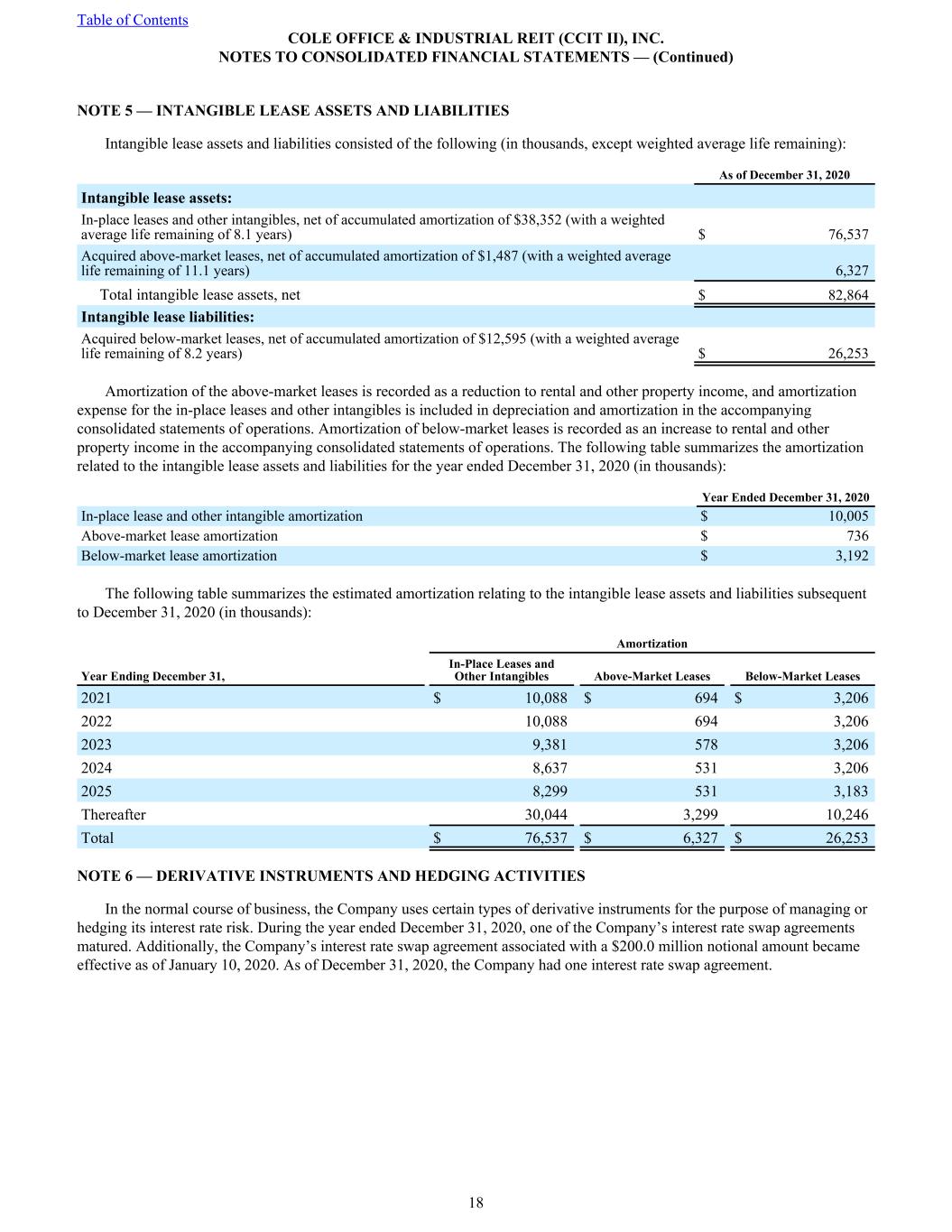

NOTE 5 — INTANGIBLE LEASE ASSETS AND LIABILITIES Intangible lease assets and liabilities consisted of the following (in thousands, except weighted average life remaining): As of December 31, 2020 Intangible lease assets: In-place leases and other intangibles, net of accumulated amortization of $38,352 (with a weighted average life remaining of 8.1 years) $ 76,537 Acquired above-market leases, net of accumulated amortization of $1,487 (with a weighted average life remaining of 11.1 years) 6,327 Total intangible lease assets, net $ 82,864 Intangible lease liabilities: Acquired below-market leases, net of accumulated amortization of $12,595 (with a weighted average life remaining of 8.2 years) $ 26,253 Amortization of the above-market leases is recorded as a reduction to rental and other property income, and amortization expense for the in-place leases and other intangibles is included in depreciation and amortization in the accompanying consolidated statements of operations. Amortization of below-market leases is recorded as an increase to rental and other property income in the accompanying consolidated statements of operations. The following table summarizes the amortization related to the intangible lease assets and liabilities for the year ended December 31, 2020 (in thousands): Year Ended December 31, 2020 In-place lease and other intangible amortization $ 10,005 Above-market lease amortization $ 736 Below-market lease amortization $ 3,192 The following table summarizes the estimated amortization relating to the intangible lease assets and liabilities subsequent to December 31, 2020 (in thousands): Amortization Year Ending December 31, In-Place Leases and Other Intangibles Above-Market Leases Below-Market Leases 2021 $ 10,088 $ 694 $ 3,206 2022 10,088 694 3,206 2023 9,381 578 3,206 2024 8,637 531 3,206 2025 8,299 531 3,183 Thereafter 30,044 3,299 10,246 Total $ 76,537 $ 6,327 $ 26,253 NOTE 6 — DERIVATIVE INSTRUMENTS AND HEDGING ACTIVITIES In the normal course of business, the Company uses certain types of derivative instruments for the purpose of managing or hedging its interest rate risk. During the year ended December 31, 2020, one of the Company’s interest rate swap agreements matured. Additionally, the Company’s interest rate swap agreement associated with a $200.0 million notional amount became effective as of January 10, 2020. As of December 31, 2020, the Company had one interest rate swap agreement. Table of Contents COLE OFFICE & INDUSTRIAL REIT (CCIT II), INC. NOTES TO CONSOLIDATED FINANCIAL STATEMENTS — (Continued) 18

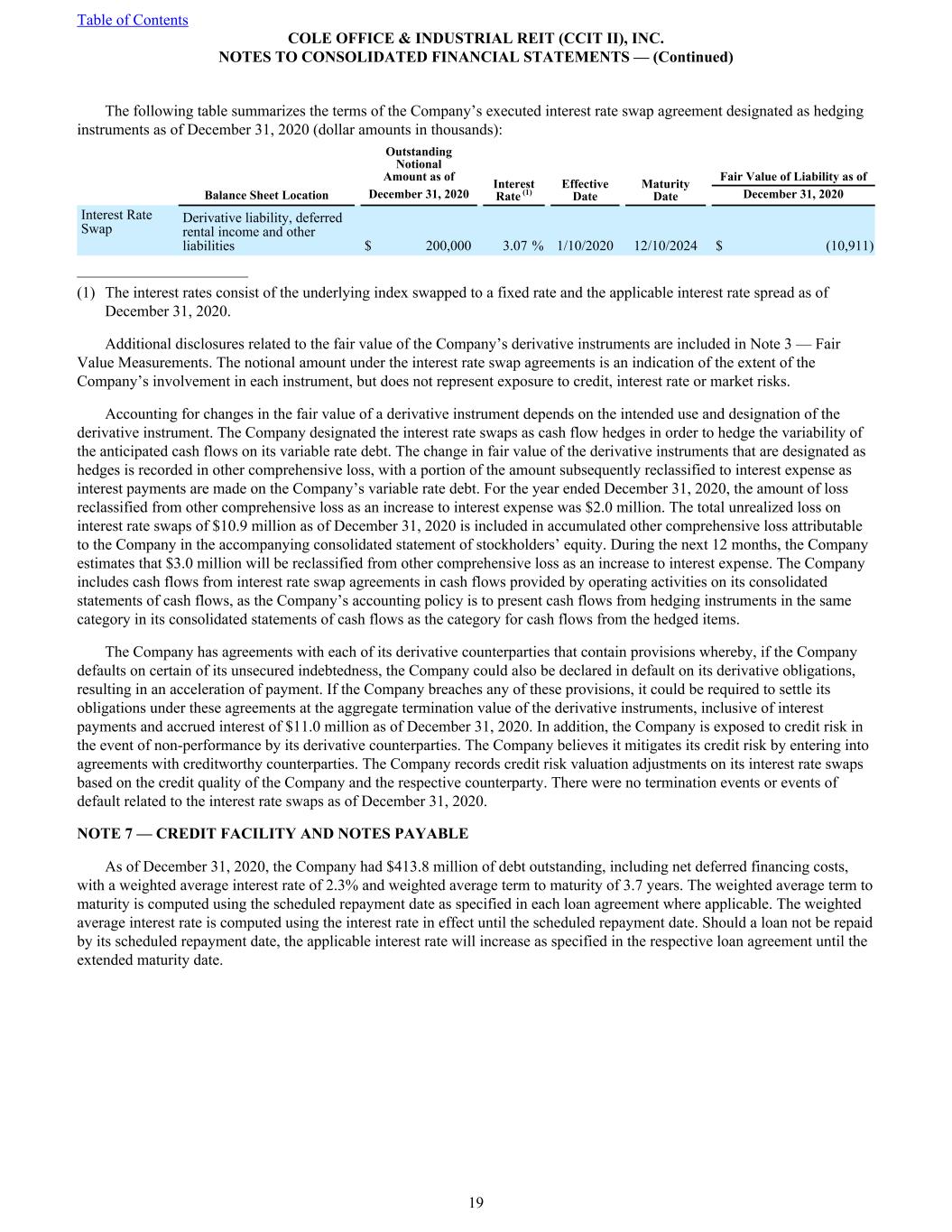

The following table summarizes the terms of the Company’s executed interest rate swap agreement designated as hedging instruments as of December 31, 2020 (dollar amounts in thousands): Outstanding Notional Amount as of Interest Rate (1) Effective Date Maturity Date Fair Value of Liability as of Balance Sheet Location December 31, 2020 December 31, 2020 Interest Rate Swap Derivative liability, deferred rental income and other liabilities $ 200,000 3.07 % 1/10/2020 12/10/2024 $ (10,911) ______________________ (1) The interest rates consist of the underlying index swapped to a fixed rate and the applicable interest rate spread as of December 31, 2020. Additional disclosures related to the fair value of the Company’s derivative instruments are included in Note 3 — Fair Value Measurements. The notional amount under the interest rate swap agreements is an indication of the extent of the Company’s involvement in each instrument, but does not represent exposure to credit, interest rate or market risks. Accounting for changes in the fair value of a derivative instrument depends on the intended use and designation of the derivative instrument. The Company designated the interest rate swaps as cash flow hedges in order to hedge the variability of the anticipated cash flows on its variable rate debt. The change in fair value of the derivative instruments that are designated as hedges is recorded in other comprehensive loss, with a portion of the amount subsequently reclassified to interest expense as interest payments are made on the Company’s variable rate debt. For the year ended December 31, 2020, the amount of loss reclassified from other comprehensive loss as an increase to interest expense was $2.0 million. The total unrealized loss on interest rate swaps of $10.9 million as of December 31, 2020 is included in accumulated other comprehensive loss attributable to the Company in the accompanying consolidated statement of stockholders’ equity. During the next 12 months, the Company estimates that $3.0 million will be reclassified from other comprehensive loss as an increase to interest expense. The Company includes cash flows from interest rate swap agreements in cash flows provided by operating activities on its consolidated statements of cash flows, as the Company’s accounting policy is to present cash flows from hedging instruments in the same category in its consolidated statements of cash flows as the category for cash flows from the hedged items. The Company has agreements with each of its derivative counterparties that contain provisions whereby, if the Company defaults on certain of its unsecured indebtedness, the Company could also be declared in default on its derivative obligations, resulting in an acceleration of payment. If the Company breaches any of these provisions, it could be required to settle its obligations under these agreements at the aggregate termination value of the derivative instruments, inclusive of interest payments and accrued interest of $11.0 million as of December 31, 2020. In addition, the Company is exposed to credit risk in the event of non-performance by its derivative counterparties. The Company believes it mitigates its credit risk by entering into agreements with creditworthy counterparties. The Company records credit risk valuation adjustments on its interest rate swaps based on the credit quality of the Company and the respective counterparty. There were no termination events or events of default related to the interest rate swaps as of December 31, 2020. NOTE 7 — CREDIT FACILITY AND NOTES PAYABLE As of December 31, 2020, the Company had $413.8 million of debt outstanding, including net deferred financing costs, with a weighted average interest rate of 2.3% and weighted average term to maturity of 3.7 years. The weighted average term to maturity is computed using the scheduled repayment date as specified in each loan agreement where applicable. The weighted average interest rate is computed using the interest rate in effect until the scheduled repayment date. Should a loan not be repaid by its scheduled repayment date, the applicable interest rate will increase as specified in the respective loan agreement until the extended maturity date. Table of Contents COLE OFFICE & INDUSTRIAL REIT (CCIT II), INC. NOTES TO CONSOLIDATED FINANCIAL STATEMENTS — (Continued) 19

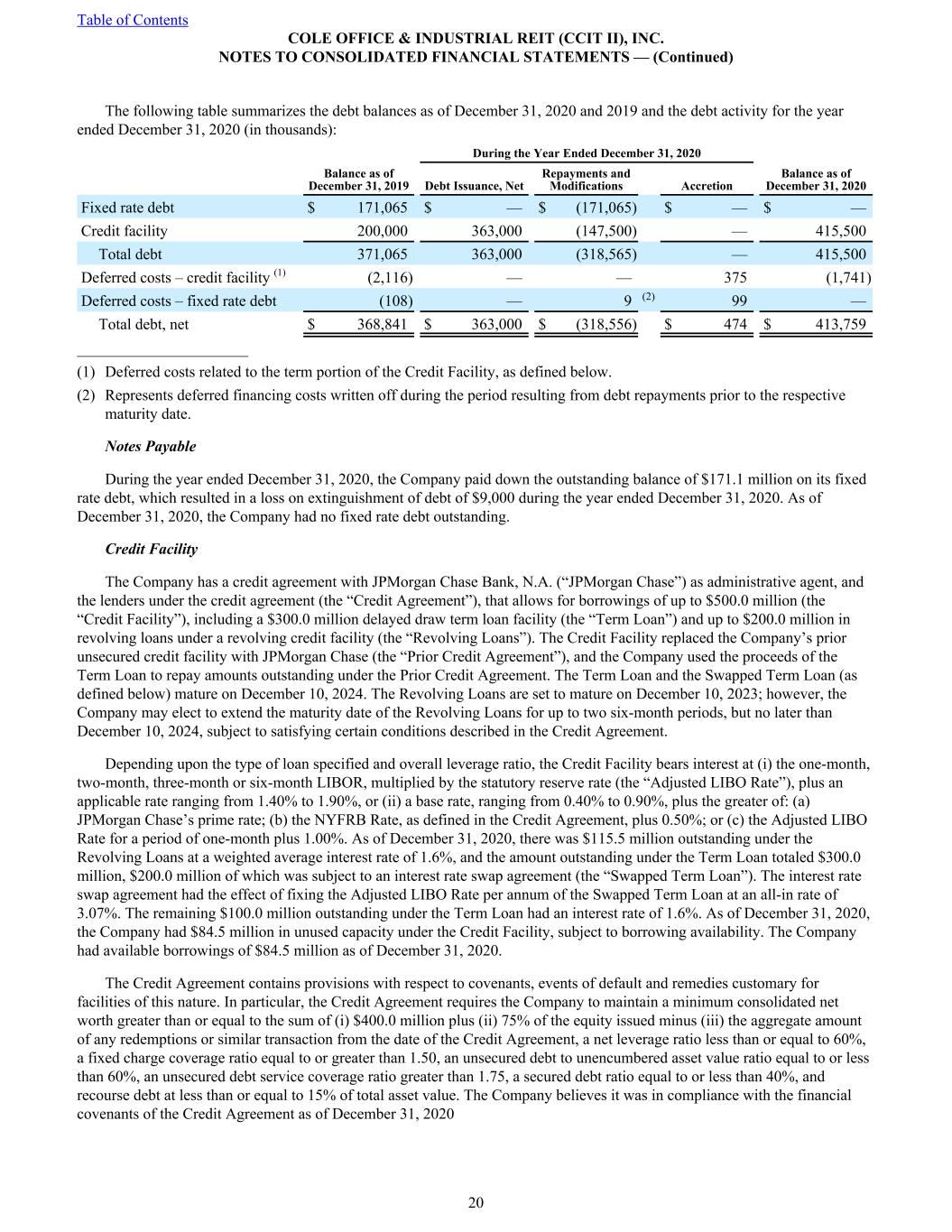

The following table summarizes the debt balances as of December 31, 2020 and 2019 and the debt activity for the year ended December 31, 2020 (in thousands): During the Year Ended December 31, 2020 Balance as of December 31, 2019 Debt Issuance, Net Repayments and Modifications Accretion Balance as of December 31, 2020 Fixed rate debt $ 171,065 $ — $ (171,065) $ — $ — Credit facility 200,000 363,000 (147,500) — 415,500 Total debt 371,065 363,000 (318,565) — 415,500 Deferred costs – credit facility (1) (2,116) — — 375 (1,741) Deferred costs – fixed rate debt (108) — 9 (2) 99 — Total debt, net $ 368,841 $ 363,000 $ (318,556) $ 474 $ 413,759 ______________________ (1) Deferred costs related to the term portion of the Credit Facility, as defined below. (2) Represents deferred financing costs written off during the period resulting from debt repayments prior to the respective maturity date. Notes Payable During the year ended December 31, 2020, the Company paid down the outstanding balance of $171.1 million on its fixed rate debt, which resulted in a loss on extinguishment of debt of $9,000 during the year ended December 31, 2020. As of December 31, 2020, the Company had no fixed rate debt outstanding. Credit Facility The Company has a credit agreement with JPMorgan Chase Bank, N.A. (“JPMorgan Chase”) as administrative agent, and the lenders under the credit agreement (the “Credit Agreement”), that allows for borrowings of up to $500.0 million (the “Credit Facility”), including a $300.0 million delayed draw term loan facility (the “Term Loan”) and up to $200.0 million in revolving loans under a revolving credit facility (the “Revolving Loans”). The Credit Facility replaced the Company’s prior unsecured credit facility with JPMorgan Chase (the “Prior Credit Agreement”), and the Company used the proceeds of the Term Loan to repay amounts outstanding under the Prior Credit Agreement. The Term Loan and the Swapped Term Loan (as defined below) mature on December 10, 2024. The Revolving Loans are set to mature on December 10, 2023; however, the Company may elect to extend the maturity date of the Revolving Loans for up to two six-month periods, but no later than December 10, 2024, subject to satisfying certain conditions described in the Credit Agreement. Depending upon the type of loan specified and overall leverage ratio, the Credit Facility bears interest at (i) the one-month, two-month, three-month or six-month LIBOR, multiplied by the statutory reserve rate (the “Adjusted LIBO Rate”), plus an applicable rate ranging from 1.40% to 1.90%, or (ii) a base rate, ranging from 0.40% to 0.90%, plus the greater of: (a) JPMorgan Chase’s prime rate; (b) the NYFRB Rate, as defined in the Credit Agreement, plus 0.50%; or (c) the Adjusted LIBO Rate for a period of one-month plus 1.00%. As of December 31, 2020, there was $115.5 million outstanding under the Revolving Loans at a weighted average interest rate of 1.6%, and the amount outstanding under the Term Loan totaled $300.0 million, $200.0 million of which was subject to an interest rate swap agreement (the “Swapped Term Loan”). The interest rate swap agreement had the effect of fixing the Adjusted LIBO Rate per annum of the Swapped Term Loan at an all-in rate of 3.07%. The remaining $100.0 million outstanding under the Term Loan had an interest rate of 1.6%. As of December 31, 2020, the Company had $84.5 million in unused capacity under the Credit Facility, subject to borrowing availability. The Company had available borrowings of $84.5 million as of December 31, 2020. The Credit Agreement contains provisions with respect to covenants, events of default and remedies customary for facilities of this nature. In particular, the Credit Agreement requires the Company to maintain a minimum consolidated net worth greater than or equal to the sum of (i) $400.0 million plus (ii) 75% of the equity issued minus (iii) the aggregate amount of any redemptions or similar transaction from the date of the Credit Agreement, a net leverage ratio less than or equal to 60%, a fixed charge coverage ratio equal to or greater than 1.50, an unsecured debt to unencumbered asset value ratio equal to or less than 60%, an unsecured debt service coverage ratio greater than 1.75, a secured debt ratio equal to or less than 40%, and recourse debt at less than or equal to 15% of total asset value. The Company believes it was in compliance with the financial covenants of the Credit Agreement as of December 31, 2020 Table of Contents COLE OFFICE & INDUSTRIAL REIT (CCIT II), INC. NOTES TO CONSOLIDATED FINANCIAL STATEMENTS — (Continued) 20

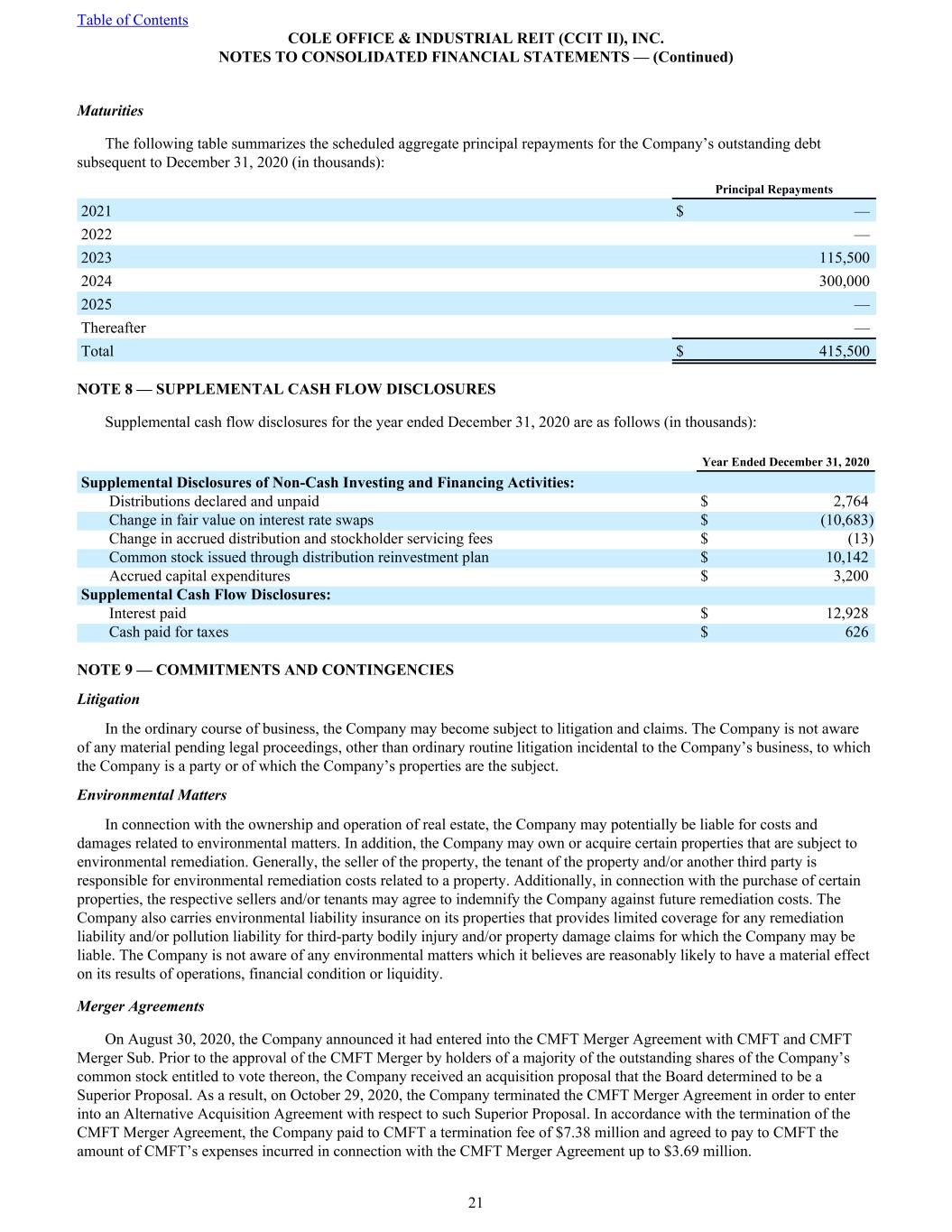

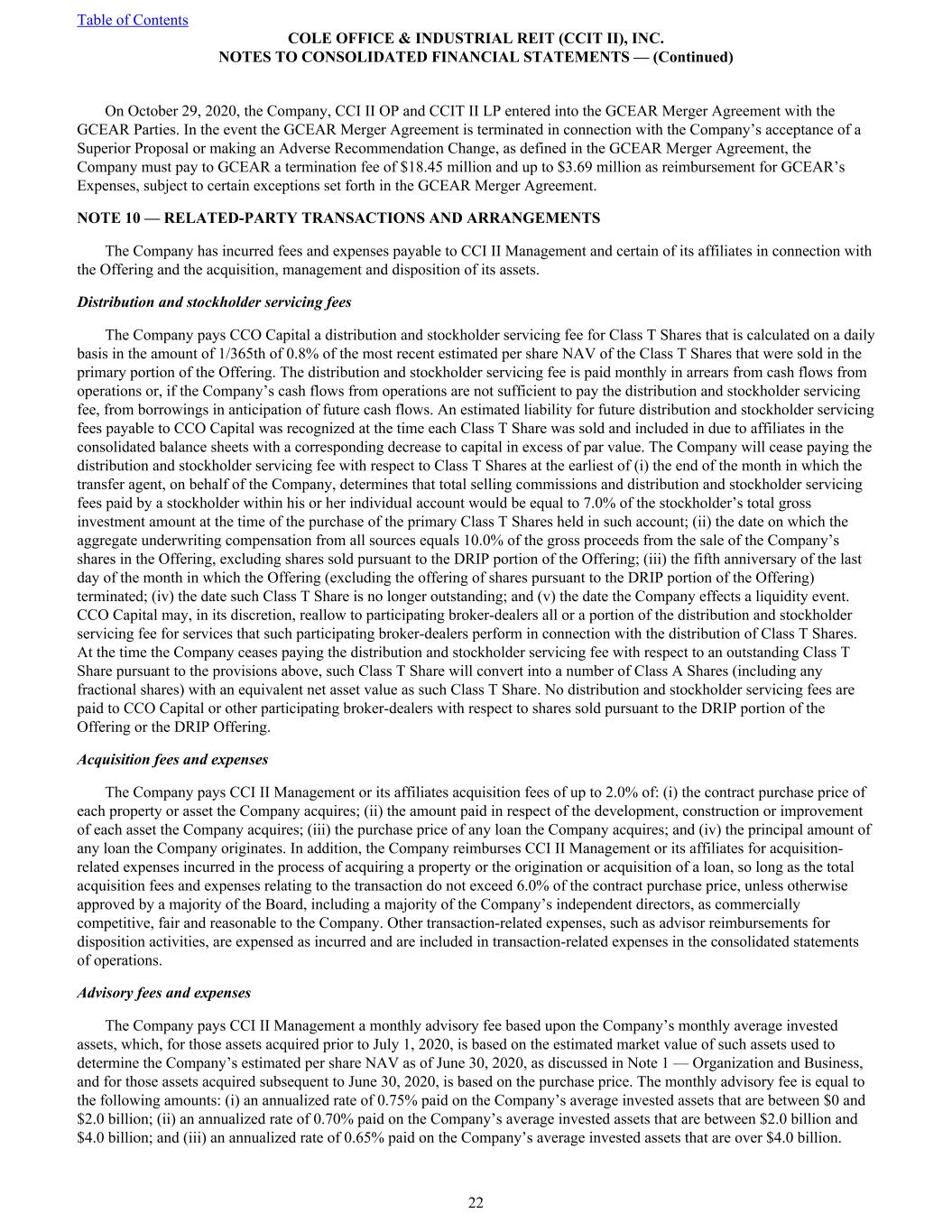

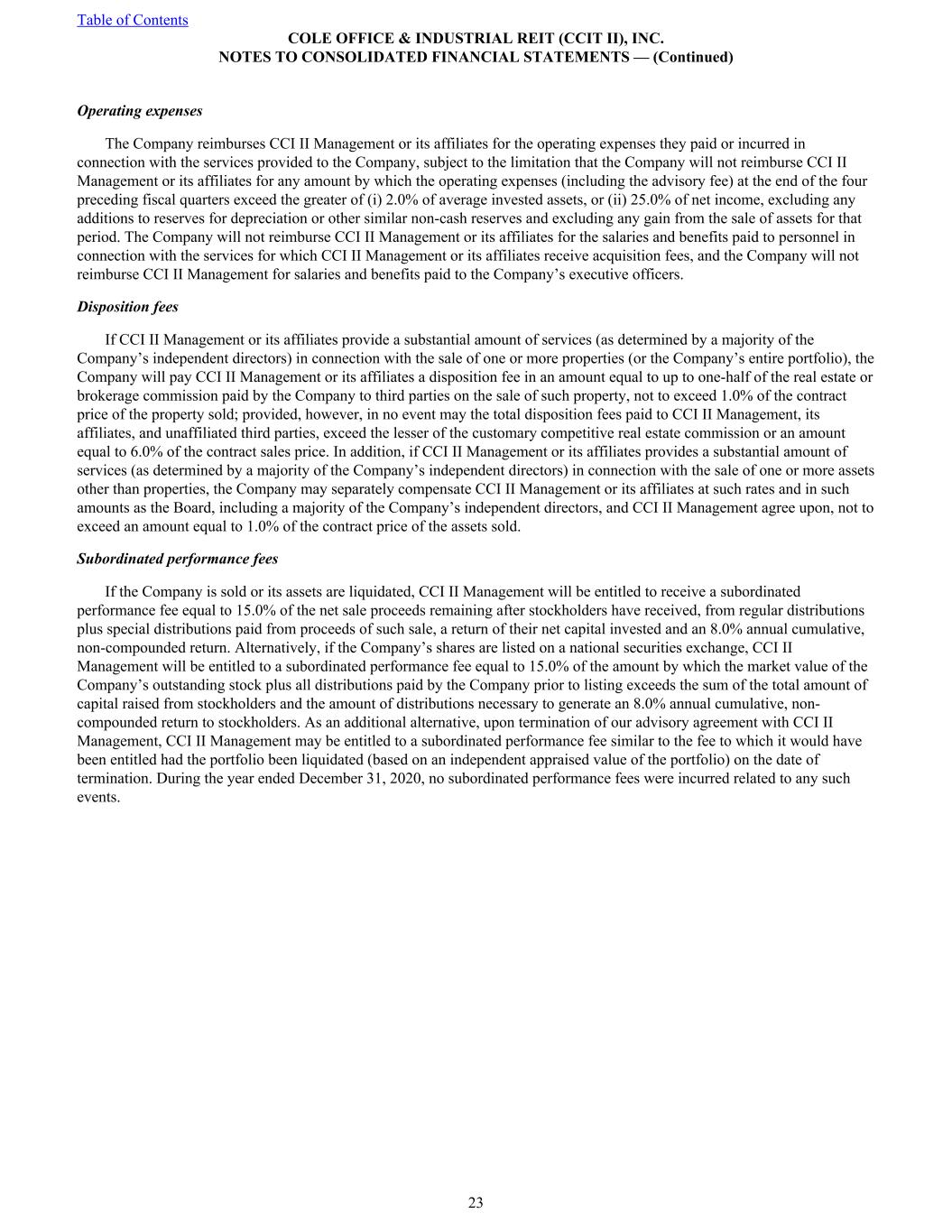

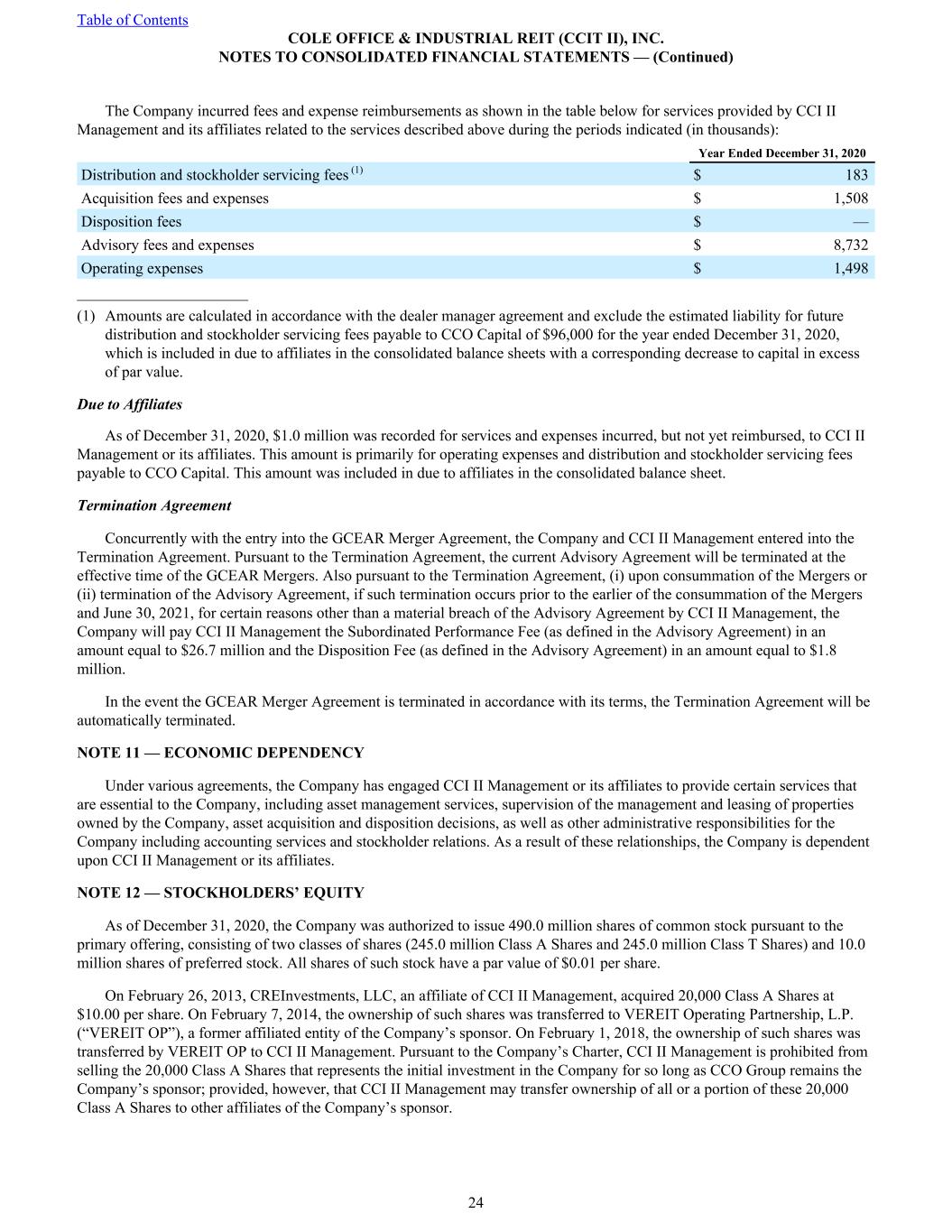

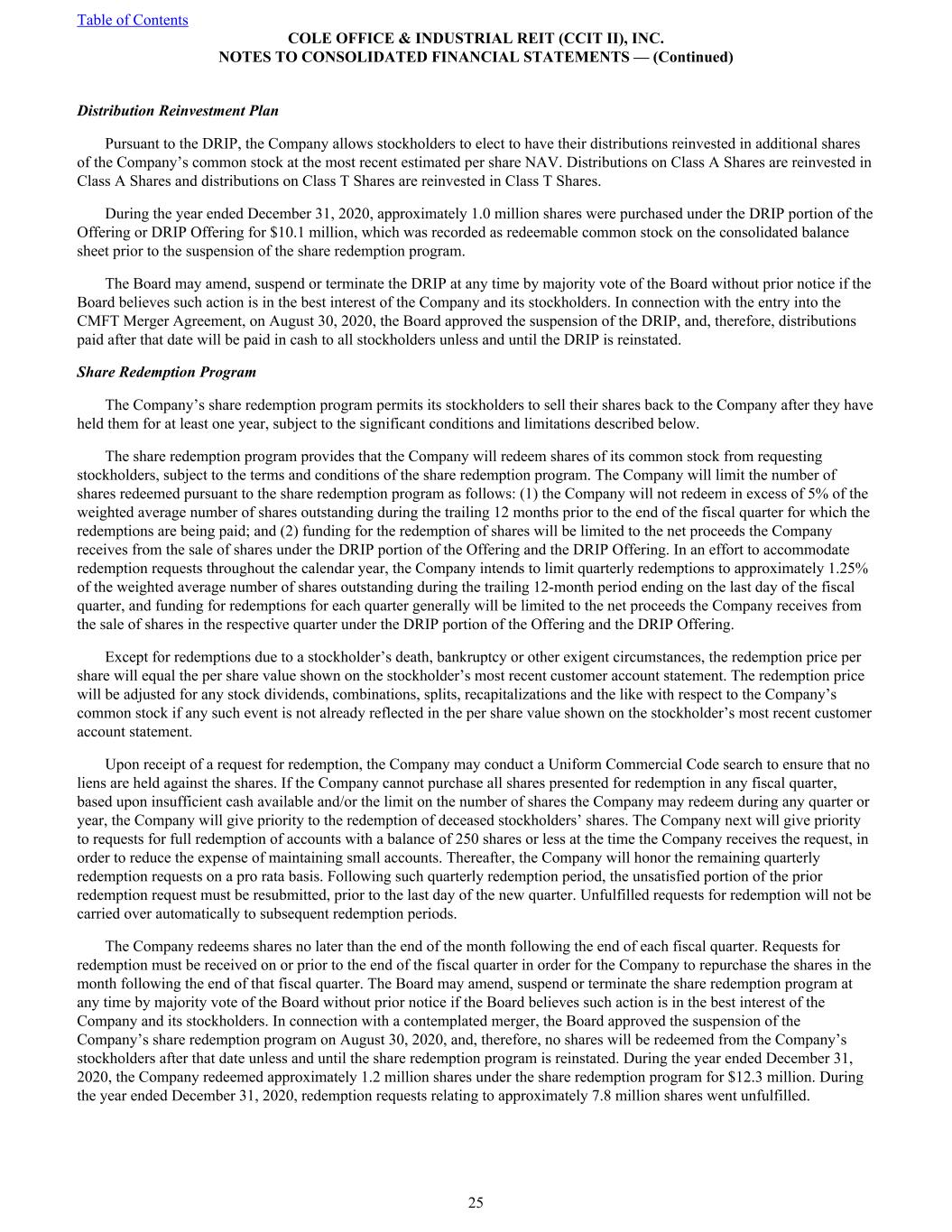

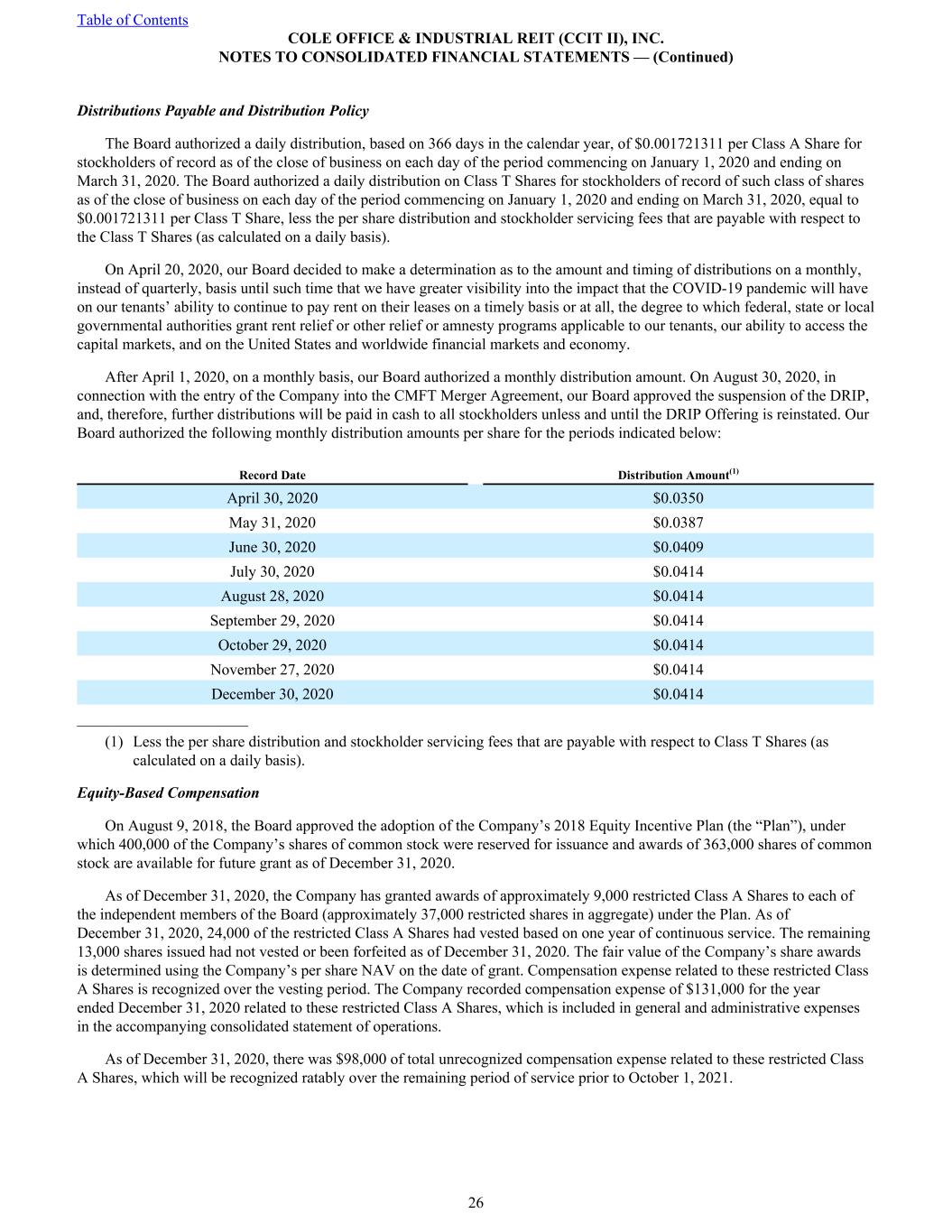

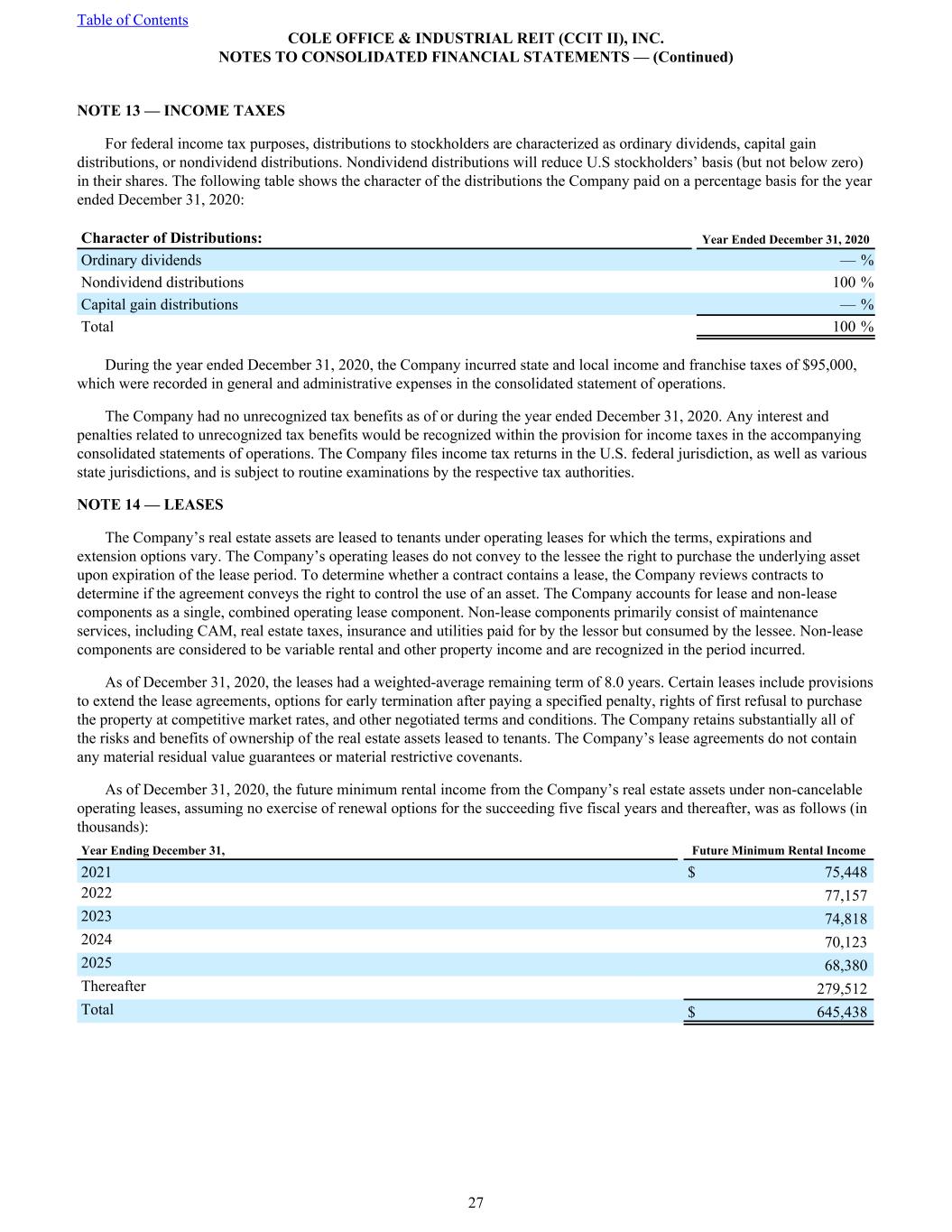

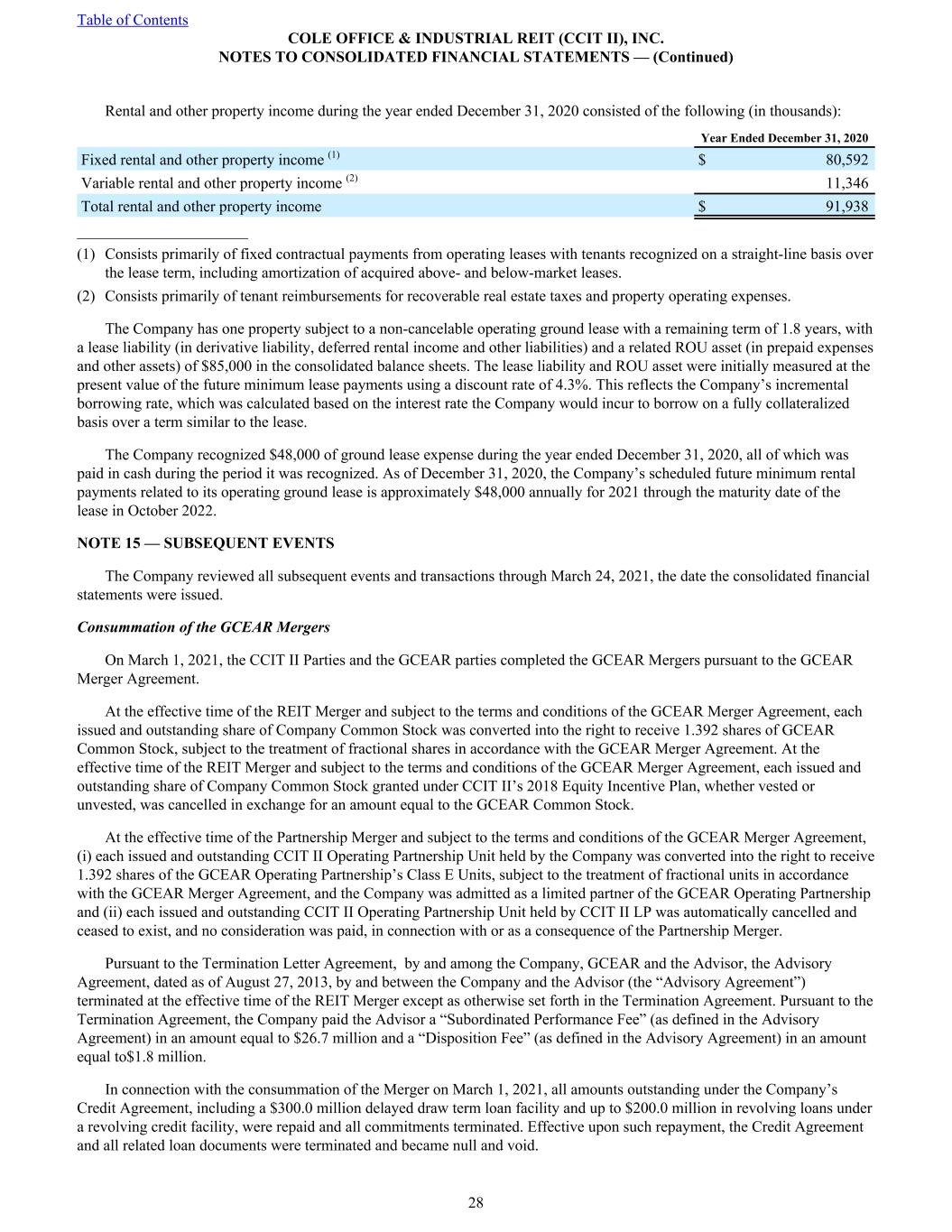

Maturities The following table summarizes the scheduled aggregate principal repayments for the Company’s outstanding debt subsequent to December 31, 2020 (in thousands): Principal Repayments 2021 $ — 2022 — 2023 115,500 2024 300,000 2025 — Thereafter — Total $ 415,500 NOTE 8 — SUPPLEMENTAL CASH FLOW DISCLOSURES Supplemental cash flow disclosures for the year ended December 31, 2020 are as follows (in thousands): Year Ended December 31, 2020 Supplemental Disclosures of Non-Cash Investing and Financing Activities: Distributions declared and unpaid $ 2,764 Change in fair value on interest rate swaps $ (10,683) Change in accrued distribution and stockholder servicing fees $ (13) Common stock issued through distribution reinvestment plan $ 10,142 Accrued capital expenditures $ 3,200 Supplemental Cash Flow Disclosures: Interest paid $ 12,928 Cash paid for taxes $ 626 NOTE 9 — COMMITMENTS AND CONTINGENCIES Litigation In the ordinary course of business, the Company may become subject to litigation and claims. The Company is not aware of any material pending legal proceedings, other than ordinary routine litigation incidental to the Company’s business, to which the Company is a party or of which the Company’s properties are the subject. Environmental Matters In connection with the ownership and operation of real estate, the Company may potentially be liable for costs and damages related to environmental matters. In addition, the Company may own or acquire certain properties that are subject to environmental remediation. Generally, the seller of the property, the tenant of the property and/or another third party is responsible for environmental remediation costs related to a property. Additionally, in connection with the purchase of certain properties, the respective sellers and/or tenants may agree to indemnify the Company against future remediation costs. The Company also carries environmental liability insurance on its properties that provides limited coverage for any remediation liability and/or pollution liability for third-party bodily injury and/or property damage claims for which the Company may be liable. The Company is not aware of any environmental matters which it believes are reasonably likely to have a material effect on its results of operations, financial condition or liquidity. Merger Agreements On August 30, 2020, the Company announced it had entered into the CMFT Merger Agreement with CMFT and CMFT Merger Sub. Prior to the approval of the CMFT Merger by holders of a majority of the outstanding shares of the Company’s common stock entitled to vote thereon, the Company received an acquisition proposal that the Board determined to be a Superior Proposal. As a result, on October 29, 2020, the Company terminated the CMFT Merger Agreement in order to enter into an Alternative Acquisition Agreement with respect to such Superior Proposal. In accordance with the termination of the CMFT Merger Agreement, the Company paid to CMFT a termination fee of $7.38 million and agreed to pay to CMFT the amount of CMFT’s expenses incurred in connection with the CMFT Merger Agreement up to $3.69 million. Table of Contents COLE OFFICE & INDUSTRIAL REIT (CCIT II), INC. NOTES TO CONSOLIDATED FINANCIAL STATEMENTS — (Continued) 21