Attached files

| file | filename |

|---|---|

| EX-99.1 - EX-99.1 - GCM Grosvenor Inc. | gcmgrosvenorfirstquarter20.htm |

| 8-K - 8-K - GCM Grosvenor Inc. | gcm-20210513.htm |

May 13, 2021 2021 First Quarter Results Earnings Presentation

2 Presenters Jonathan Levin President Stacie Selinger Head of Investor Relations Pamela Bentley Chief Financial Officer Michael Sacks Chairman and Chief Executive Officer

Business Update

4 First Quarter 2021 Results $ million March 31, 2020 December 31, 2020 March 31, 2021 % Change vs 4Q 20 % Change vs 1Q 20 AUM $ 55,779 $ 61,943 $ 64,862 5 % 16 % FPAUM 47,769 51,969 53,362 3 % 12 % CNYFPAUM 5,395 7,057 7,454 6 % 38 % $ million unless otherwise noted Three Months Ended March 31, 2021 % Change vs 1Q 20 GAAP Results GAAP Revenue $ 103.2 25 % GAAP net income attributable to GCM Grosvenor Inc. 2.5 N/A Non-GAAP Results Management Fees, net1 80.3 6 % Adjusted Revenue1 100.9 25 % Net fees attributable to GCM Grosvenor 87.1 12 % Fee Related Earnings 25.2 43 % Adjusted EBITDA 30.2 56 % Adjusted net income2 18.9 97 % 1. Excludes fund reimbursement revenue of $2.4 million for the three months ended March 31, 2021. 2. Reflects a 25% blended statutory effective tax rate applied to pre-tax adjusted net income for all periods presented.

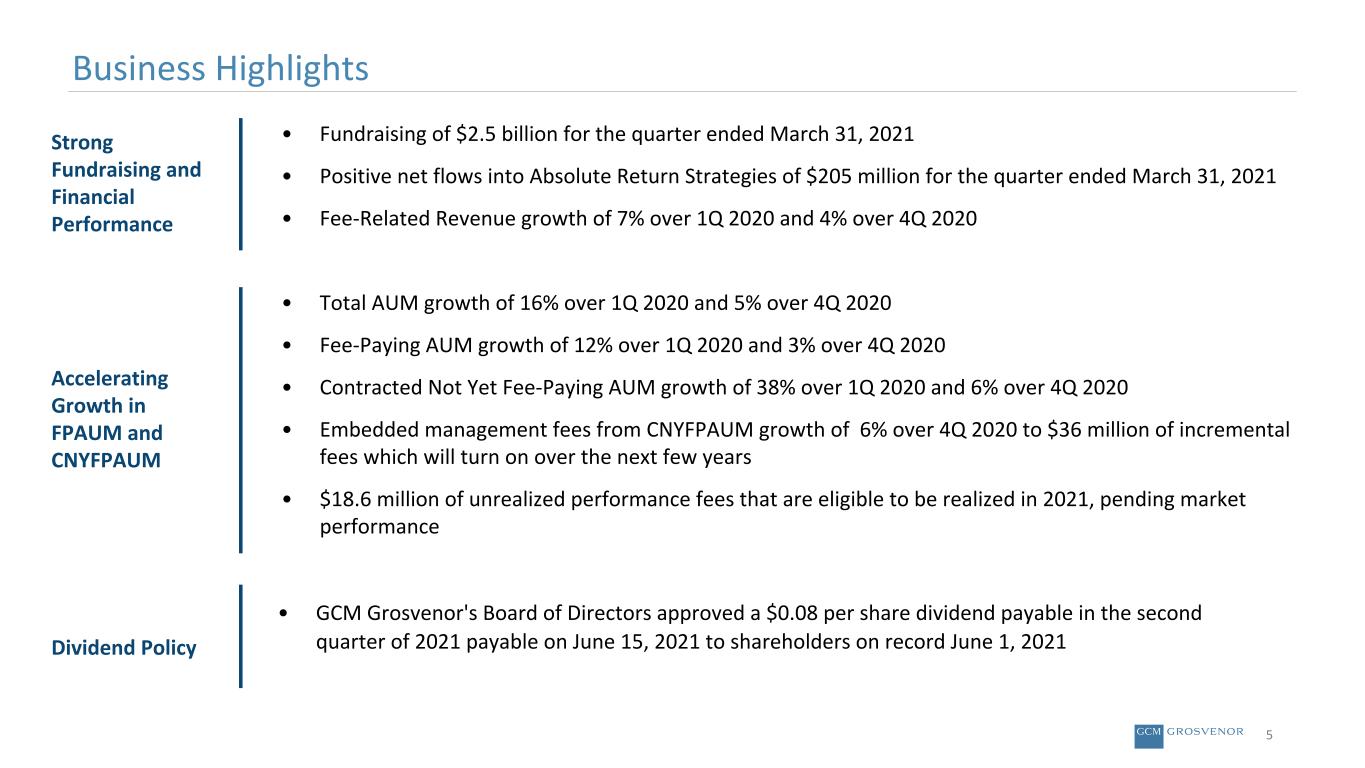

5 • Fundraising of $2.5 billion for the quarter ended March 31, 2021 • Positive net flows into Absolute Return Strategies of $205 million for the quarter ended March 31, 2021 • Fee-Related Revenue growth of 7% over 1Q 2020 and 4% over 4Q 2020 • Total AUM growth of 16% over 1Q 2020 and 5% over 4Q 2020 • Fee-Paying AUM growth of 12% over 1Q 2020 and 3% over 4Q 2020 • Contracted Not Yet Fee-Paying AUM growth of 38% over 1Q 2020 and 6% over 4Q 2020 • Embedded management fees from CNYFPAUM growth of 6% over 4Q 2020 to $36 million of incremental fees which will turn on over the next few years • $18.6 million of unrealized performance fees that are eligible to be realized in 2021, pending market performance Business Highlights Strong Fundraising and Financial Performance Accelerating Growth in FPAUM and CNYFPAUM • GCM Grosvenor's Board of Directors approved a $0.08 per share dividend payable in the second quarter of 2021 payable on June 15, 2021 to shareholders on record June 1, 2021Dividend Policy

6 Strong Growth in Fees and Earnings Adjusted Revenue1 1. Excludes fund reimbursement revenue of $2.0 million and $2.4 million for the three months ended March 31, 2020 and March 31, 2021, respectively. 6% $ million 75.7 80.3 36.5 40.4 39.2 39.9 Private Markets Absolute Return Strategies Q1 20 Q1 21 3.2 18.2 Q1 20 Q1 21 Incentive Fees 469% 25% Management Fees, net1 80.6 100.9 Q1 20 Q1 21 56% 97% Adjusted EBITDA Adjusted Net Income 17.6 25.2 Q1 20 Q1 21 19.4 30.2 Q1 20 Q1 21 9.6 18.9 Q1 20 Q1 21 43% Fee-Related Earnings

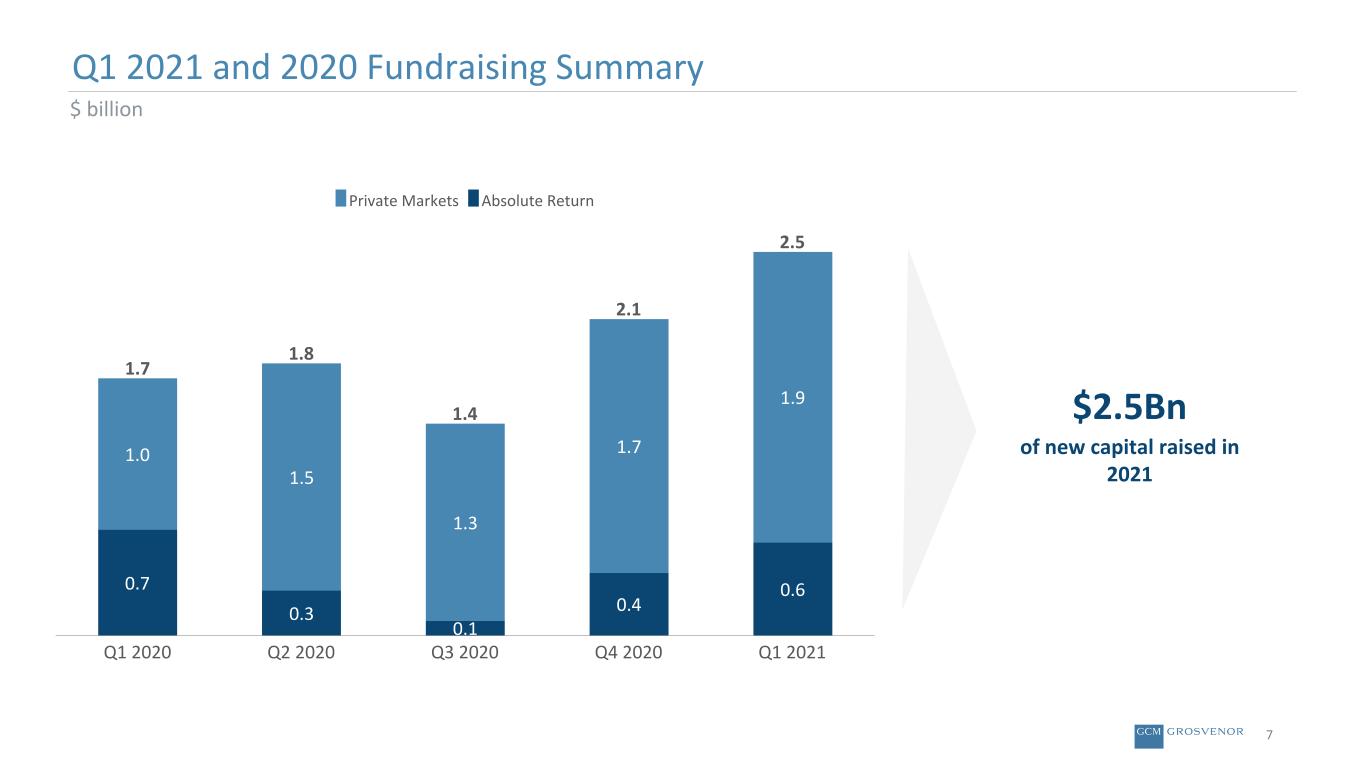

Q1 2021 and 2020 Fundraising Summary 7 $ billion 1.7 1.8 1.4 2.1 2.5 0.7 0.3 0.1 0.4 0.6 1.0 1.5 1.3 1.7 1.9 Private Markets Absolute Return Q1 2020 Q2 2020 Q3 2020 Q4 2020 Q1 2021 $2.5Bn of new capital raised in 2021

Scheduled Ramp-in $2.5 0.5 1.4 0.6 2021 2022 2023+ $51.2 $55.3 $59.0 $60.8 24.0 23.6 24.1 24.4 24.9 26.5 27.8 28.9 2.3 5.2 7.1 7.5 2018 2019 2020 Q1 2021 Absolute return strategies FPAUM Private markets FPAUM Contracted not yet FPAUM ("CNYFPAUM") FPAUM and CNYFPAUM ($bn) Increased Earnings Power From Growing AUM 1. Includes mark to market, insider capital and non fee-paying AUM. 8 8% ‘18–’Q1 21 CAGR Estimated incremental management fees from 2021 CNYFPAUM: $36 million Total AUM1 $61.9 9%$53.8 $57.7 CNYFPAUM Invested Capital $5.0 $64.9

Significant Embedded Growth and Strong Business Momentum ~$36mm Incremental management fees from $7.5 billion of Contracted Not Yet Fee Paying AUM as of March 31, 2021 Incremental run rate carry earnings from contracted funds and growth in AUM eligible for annual performance fees, increasing run-rate incentive fee potential Management fee growth Incentive fee growth 9 Significant upside opportunity from carried interest in 6 specialized funds ~$68mm Revenue from approximately $7.5 billion of 6 specialized funds planned to be raised between 2021–2023 Visible pipeline of re-up opportunities Significant upside opportunity from carried interest in re-ups ~$104mm management fee growth over next few years

$21.1 $41.2 2017 Run rate 10 Incentive Fee Earnings Power Gross Unrealized Carried Interest2 29% Unrealized carry by vintage 2016+ 32% 2013-2015 25% 2009-2012 23% 2008 or Earlier 20% $381m $491m 113 121 Gross unrealized carried interest Programs in unrealized carry Q1 20 Q1 21 1. The run rate on annual performance fees reflect a 8% gross return for both multi-strategy and credit strategies, and a 10% gross return for specialized opportunity strategies. 2. Represents consolidated view, including all NCI and compensation related awards; unrealized carry age is calculated assuming a FYE look back date of March 31, 2021. 95% Run rate annual performance fees1 ($mm)

Financial Results

12 GAAP Statements of Income (unaudited) Three Months Ended $000, except per share amounts Mar 31, 2020 Dec 31, 2020 (restated) Mar 31, 2021 % Change vs 4Q 20 % Change vs 1Q 20 Revenues Management fees $ 77,701 $ 79,639 $ 82,625 4 % 6 % Incentive fees 3,233 73,602 18,214 (75) % 463 % Other operating income 1,683 2,247 2,380 6 % 41 % Total operating revenues 82,617 155,488 103,219 (34) % 25 % Expenses Employee compensation and benefits 55,477 202,006 83,353 (59) % 50 % General, administrative and other 24,596 26,530 24,532 (8) % — % Total operating expenses 80,073 228,536 107,885 (53) % 35 % Operating income (loss) 2,544 (73,048) (4,666) (94) % (283) % Investment income 3,373 9,042 13,048 44 % 287 % Interest expense (5,867) (5,931) (4,491) (24) % (23) % Other income (expense) (9,733) 1,075 1,317 23 % (114) % Change in fair value of warrant liabilities — (13,315) 14,057 (206) % NM Net other income (expense) (12,227) (9,129) 23,931 (362) % (296) % Income (loss) before income taxes (9,683) (82,177) 19,265 (123) % (299) % Provision (benefit) for income taxes 643 2,796 (663) (124) % (203) % Net income (loss) (10,326) (84,973) 19,928 (123) % (293) % Less: Net income attributable to redeemable noncontrolling interest 2,093 8,469 8,089 (4) % 286 % Less: Net income attributable to noncontrolling interests in subsidiaries 2,536 7,744 8,589 11 % 239 % Less: Net income (loss) attributable to noncontrolling interests in GCMH (14,955) (105,235) 703 (101) % (105) % Net income (loss) attributable to GCM Grosvenor Inc. $ — $ 4,049 $ 2,547 (37) % NM Earnings (loss) per share of Class A common stock 1 : Basic — $ 0.10 $ 0.06 (40) % NM Diluted — $ (0.58) $ (0.05) (91) % NM Weighted average shares of Class A common stock outstanding 1 : Basic — 39,985 42,084 5 % NM Diluted — 184,220 188,872 3 % NM 1. There were no shares of Class A common stock outstanding prior to November 17, 2020, therefore no earnings (loss) per share information has been presented for any period prior to that date. .

13 1. Adjusted EBITDA and Adjusted Net Income per share are non-GAAP financial measures. See Appendix for the reconciliations of our non-GAAP financial measures to the most comparable GAAP metric. 2. Excludes fund reimbursement revenue of $2.0 million, $2.4 million and $2.4 million for the three months ended March 31, 2020, December 31, 2020 and March 31, 2021, respectively. 3. Excludes severance expenses of $2.3 million, $4.6 million and $0.6 million for the three months ended March 31, 2020, December 31, 2020 and March 31, 2021, respectively. 4. Includes corporate transaction related costs of $3.4 million, $7.8 million and $5.3 million for the three months ended March 31, 2020, December 31, 2020 (restated) and March 31, 2021, respectively. 5. Excludes the impact of non-cash carried interest expense of $1.0 million, $1.5 million and $0.6 million for the three months ended March 31, 2020, December 31, 2020 and March 31, 2021, respectively. 6. Represents corporate income taxes at a blended statutory rate of 25.0% applied to adjusted pre-tax income for all periods presented. The 25.0% is based on a federal statutory rate of 21.0% and a combined state, local and foreign rate net of federal benefits of 4.0%. As we were not subject to U.S. federal and state income taxes prior to the Transaction, the blended statutory rate of 25.0% has been applied to all periods presented for comparability purposes. 7. As Class A common stock did not exist prior to the Transaction, the computation of Adjusted Net Income per Share assumes the same number of adjusted shares outstanding as of December 31, 2020 for all periods prior to the Transaction. Three Months Ended $000 Mar 31, 2020 Dec 31, 2020 (restated) Mar 31, 2021 % Change vs 4Q 20 % Change vs 1Q 20 Adjusted EBITDA Revenues Private markets strategies $ 36,464 $ 38,390 $ 40,373 5 % 11 % Absolute return strategies 39,263 38,808 39,892 3 % 2 % Management fees, net2 75,727 77,198 80,265 4 % 6 % Administrative fees and other operating income 1,683 2,247 2,380 6 % 41 % Fee-Related Revenue 77,410 79,445 82,645 4 % 7 % Less: Cash-based employee compensation and benefits, net3 (42,022) (38,467) (41,192) 7 % (2) % General, administrative and other, net2 (22,619) (24,089) (22,171) (8) % (2) % Plus: Amortization of intangibles 1,876 1,876 583 (69) % (69) % Non-core items4 2,916 8,011 5,328 (33) % 83 % Fee-Related Earnings 17,561 26,776 25,193 (6) % 43 % Fee-Related Earnings Margin 23 % 34 % 30 % Incentive fees: Performance fees 605 51,105 6,113 (88) % 910 % Carried interest 2,628 22,497 12,101 (46) % 360 % Incentive fee related compensation and NCI: Cash-based incentive fee related compensation — (11,454) (1,833) (84) % NM Carried interest compensation, net5 (1,201) (13,795) (7,503) (46) % 525 % Carried interest attributable to noncontrolling interests (1,333) (7,764) (4,430) (43) % 232 % Interest income 296 10 7 (30) % (98) % Other (income) expense 118 (36) 51 (242) % (57) % Depreciation 696 542 473 (13) % (32) % Adjusted EBITDA 19,370 67,881 30,172 (56) % 56 % Adjusted EBITDA Margin 24 % 44 % 30 % Adjusted Net Income Per Share Adjusted EBITDA 19,370 67,881 30,172 (56) % 56 % Depreciation (696) (542) (473) (13) % (32) % Interest expense (5,867) (5,931) (4,491) (24) % (23) % Adjusted Pre-tax Income 12,807 61,408 25,208 (59) % 97 % Adjusted income taxes6 (3,202) (15,351) (6,302) (59) % 97 % Adjusted Net Income 9,605 46,057 18,906 (59) % 97 % Adjusted shares outstanding (000)7 185,117 185,117 188,872 Adjusted Net Income per Share $ 0.05 $ 0.25 $ 0.10 (60) % 100 % Summary of Non-GAAP Financial Measures1

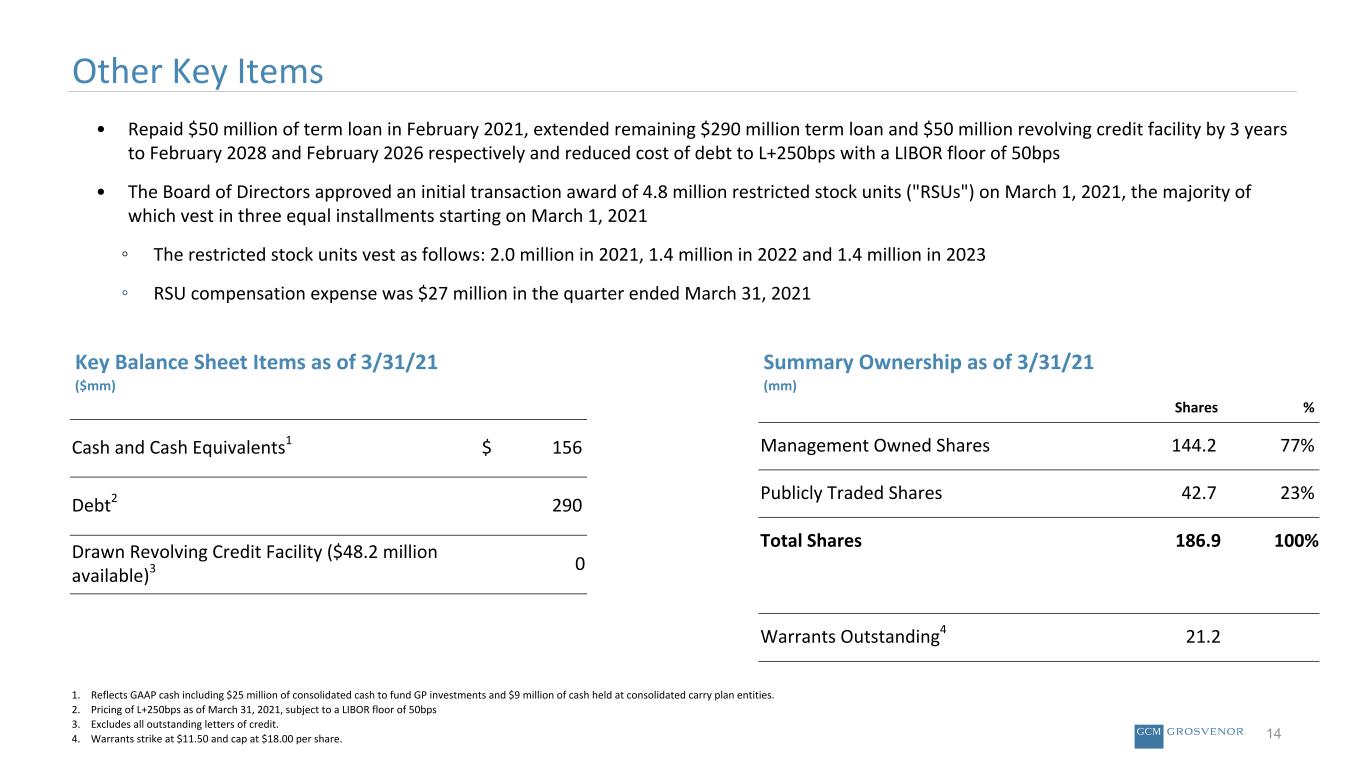

Other Key Items 14 • Repaid $50 million of term loan in February 2021, extended remaining $290 million term loan and $50 million revolving credit facility by 3 years to February 2028 and February 2026 respectively and reduced cost of debt to L+250bps with a LIBOR floor of 50bps • The Board of Directors approved an initial transaction award of 4.8 million restricted stock units ("RSUs") on March 1, 2021, the majority of which vest in three equal installments starting on March 1, 2021 ◦ The restricted stock units vest as follows: 2.0 million in 2021, 1.4 million in 2022 and 1.4 million in 2023 ◦ RSU compensation expense was $27 million in the quarter ended March 31, 2021 Key Balance Sheet Items as of 3/31/21 ($mm) 1. Reflects GAAP cash including $25 million of consolidated cash to fund GP investments and $9 million of cash held at consolidated carry plan entities. 2. Pricing of L+250bps as of March 31, 2021, subject to a LIBOR floor of 50bps 3. Excludes all outstanding letters of credit. 4. Warrants strike at $11.50 and cap at $18.00 per share. Cash and Cash Equivalents1 $ 156 Debt2 290 Drawn Revolving Credit Facility ($48.2 million available)3 0 Shares % Management Owned Shares 144.2 77 % Publicly Traded Shares 42.7 23 % Total Shares 186.9 100 % Warrants Outstanding4 21.2 Summary Ownership as of 3/31/21 (mm)

About GCM Grosvenor

Strong economic value proposition ◦ Fee savings and preferential terms ◦ Access to hard to access managers ◦ Proprietary deal flow Deeply embedded with our clients ◦ Cornerstone of clients’ alternative programs ◦ Clients leverage our full investment and operational infrastructure ◦ 95%+ of top clients added capital in last 3 years2 Unparalleled flexibility ◦ Customized solutions and specialized funds ◦ Primary, secondary, co-invest, and direct ◦ 45%+ of top 50 clients by AUM in multiple investment strategies1 CLIENT VALUE PROPOSITION STRONG BUSINESS MOMENTUM 1 AUM as of March 31, 2021; ESG and Alternative Credit investments overlap with investments in other strategies. 2 Represents top 25 clients by AUM. 3 From December 31, 2017 through March 31, 2021. Management Fee centricity reflects net management fees and admin fees relative to Net Fees Attributable to GCM Grosvenor. 4 Estimated incremental management fees from CNYFPAUM. 5 From six Private Markets specialized funds raised through 2023. 6 For Private Markets customized separate accounts from December 31, 2015 through March 31, 2021. 7 The run rate on annual performance fees reflect an 8% gross return for both multi-strategy and credit strategies, and a 10% gross return for specialized opportunity strategies. 8 Represents consolidated view, excluding all NCI and compensation related awards; unrealized carry age is calculated assuming a FYE look back date of March 31, 2021. Only Alternative Asset Solutions Provider Covering the Full Range of Strategies Stable and diversified revenue base ◦ Management and administrative fees are ~90% of revenue, no client makes up >5% of management fees3 ◦ Diversified income streams Highly visible incremental revenue ◦ $7.5b CNYFPAUM = $36m annual revenue4 ◦ $7.5b specialized funds pipeline = $68m annual revenue5 ◦ 90%+ re-up success6 Upside from incentive fees ◦ $41.2m run-rate performance fees7 ◦ $491m gross unrealized carried interest8 16

17 Note: AUM as of March 31, 2021. Management fees for the twelve months ended March 31, 2021. Strong Value Proposition Drives Diversified, Long Tenured Client Base % of AUM 42% 14% 8% 16% 6% 7% 6% 1% 23% 9% 4% Our client base is institutional and stable % of management fees 64% 24% 12% Our client base is diversified % AUM 64% Our client base is global No single client contributes more than 5% of our management fees $65B of AUM across over 500+ institutional clients Average relationship of 12 years across our 25 largest clients by AUM 96% of 25 largest clients by AUM have expanded investment relationship in the last 3 years Sovereign Entities Union Pensions Corporate Pensions Financial Institutions Other Institutional High Net Worth/ Family Office Endowments & Foundations 42% 16% 15% 8% 7% 5% 6% 63%23% 10% 4% AmericasAPAC EMEA Rest of world 24% 13% 63% Other Top 1-10 Top 11-20 Public Pensions

18 ESG and Impact Investments AUM ($bn) Clean Energy Invested / Committed: $3.4bn Labor Impact Invested / Committed: $0.9bn Regionally Targeted Invested / Committed: $3.4bn 13% CAGR ESG and Investing with an Impact are Core Values Diverse Managers Invested / Committed: $8.1bn Other ESG Invested / Committed: $3.8bn A+ rating From UN Principles of Responsible Investing (PRI)¹ Approx. $17.9 billion Committed and invested in ESG and Impact Approx. $13.3 billion Of ESG and Impact AUM Note: Total invested/committed and category breakdown includes Absolute Return Strategies data as of March 31, 2021 and Private Markets data as of December 31, 2020; Some investments are counted in more than one ESG category. 1. We received an A+ rating from PRI for our approach to strategy and governance, and an A+ rating for ESG integration in private equity manager selection, approval, and monitoring. For the full GCM Grosvenor PRI Transparency Report and assessment methodology, visit the Principles for Responsible Investment website. $8.9 $9.0 $11.2 $12.8 $13.3 2017 2018 2019 2020 Q1 21

13.9% 14.2% 22.5% 24.0% 11.2% 21.8% 9.3% 10.1% 14.8% 12.5% 6.4% 11.5% Investment Net IRR PME IRR Primary Fund Investment Secondary Investment Co-Investment / Direct Investment Diverse Managers Infrastructure Real Estate 19 Note: AUM as of March 31, 2021 1. Multi-Strategy Absolute Return Strategies reflects GCMLP Diversified Multi-Strategy Composite. 2. Performance for Private Equity, Infrastructure and Real Estate as of December 31, 2020; “PMEs” are the S&P 500, the MSCI World Infrastructure, and the FTSE Nareit All REITS indices we present for comparison calculated on a Public Market Equivalent basis. We believe these indices are commonly used by private markets investors to evaluate performance. Strong Investment Performance Driven by Proven Investment Process Absolute Return Strategies $25.5bn Private Equity $23.8bn Real Estate $3.2bn Infrastructure $7.3bn 2021 Year to Date Performance1 Primaries Secondaries Co-Invest/Directs Diverse Managers Inception to Date Performance (Realized and Partially Realized Investments)2 ESG and Impact Strategies 0.5% (0.6)% 0.3% (0.8)% Gross Net Absolute Return Strategies (Overall) Multi- Strategy Absolute Return Strategies Total Assets Under Management $64.9bn Fee-Paying AUM $53.4bn Contracted Not Yet Fee-Paying AUM $7.5bn

Appendix

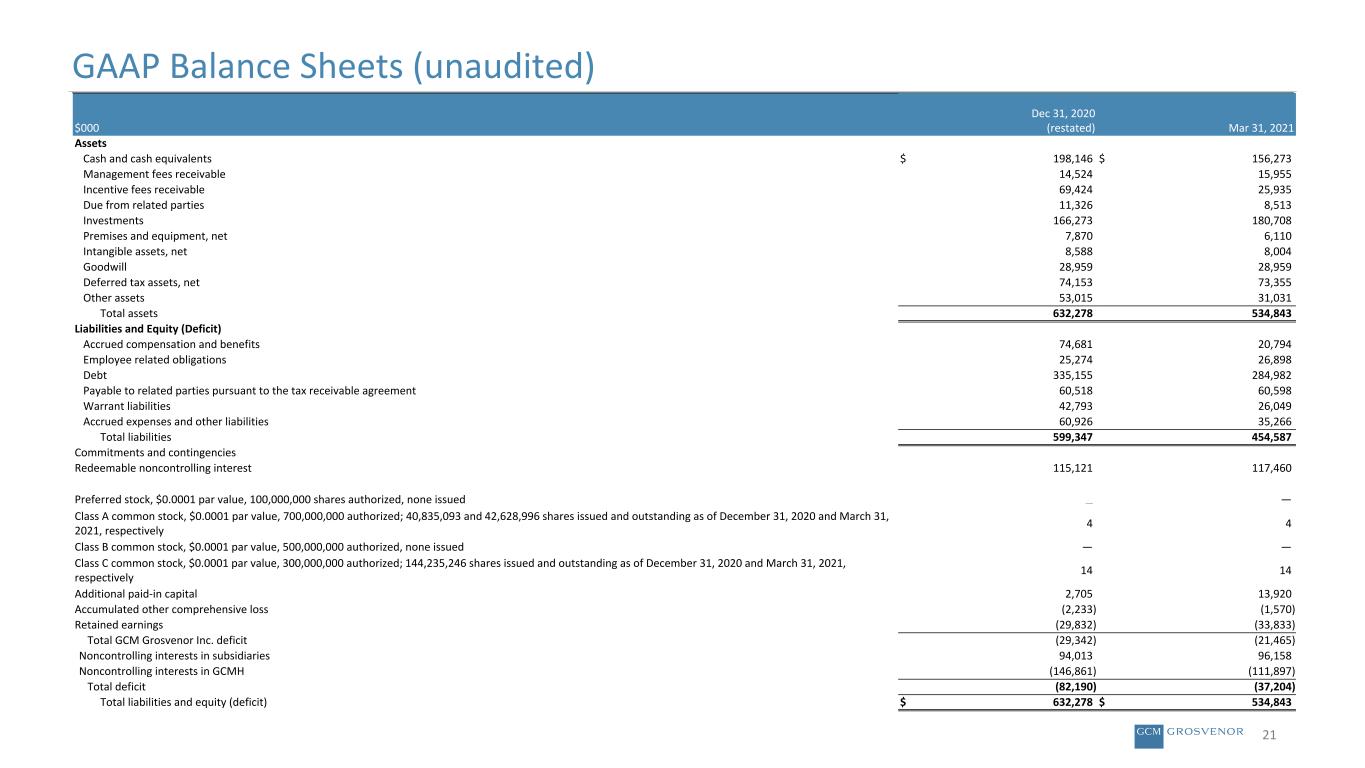

21 GAAP Balance Sheets (unaudited) $000 Dec 31, 2020 (restated) Mar 31, 2021 Assets Cash and cash equivalents $ 198,146 $ 156,273 Management fees receivable 14,524 15,955 Incentive fees receivable 69,424 25,935 Due from related parties 11,326 8,513 Investments 166,273 180,708 Premises and equipment, net 7,870 6,110 Intangible assets, net 8,588 8,004 Goodwill 28,959 28,959 Deferred tax assets, net 74,153 73,355 Other assets 53,015 31,031 Total assets 632,278 534,843 Liabilities and Equity (Deficit) Accrued compensation and benefits 74,681 20,794 Employee related obligations 25,274 26,898 Debt 335,155 284,982 Payable to related parties pursuant to the tax receivable agreement 60,518 60,598 Warrant liabilities 42,793 26,049 Accrued expenses and other liabilities 60,926 35,266 Total liabilities 599,347 454,587 Commitments and contingencies Redeemable noncontrolling interest 115,121 117,460 Preferred stock, $0.0001 par value, 100,000,000 shares authorized, none issued — — Class A common stock, $0.0001 par value, 700,000,000 authorized; 40,835,093 and 42,628,996 shares issued and outstanding as of December 31, 2020 and March 31, 2021, respectively 4 4 Class B common stock, $0.0001 par value, 500,000,000 authorized, none issued — — Class C common stock, $0.0001 par value, 300,000,000 authorized; 144,235,246 shares issued and outstanding as of December 31, 2020 and March 31, 2021, respectively 14 14 Additional paid-in capital 2,705 13,920 Accumulated other comprehensive loss (2,233) (1,570) Retained earnings (29,832) (33,833) Total GCM Grosvenor Inc. deficit (29,342) (21,465) Noncontrolling interests in subsidiaries 94,013 96,158 Noncontrolling interests in GCMH (146,861) (111,897) Total deficit (82,190) (37,204) Total liabilities and equity (deficit) $ 632,278 $ 534,843

22 Reconciliation to Non-GAAP Metrics Three Months Ended $000 Mar 31, 2020 Dec 31, 2020 Mar 31, 2021 Components of GAAP Employee Compensation and Benefits Cash-based employee compensation and benefits, net1 $ 42,022 $ 38,467 $ 41,192 Cash-based incentive fee related compensation — 11,454 1,833 Carried interest compensation, net2 1,201 13,795 7,503 Partnership interest-based compensation 7,920 133,977 4,903 Equity-based compensation — — 27,036 Severance 2,280 4,588 588 Other non-cash compensation 1,065 1,204 941 Non-cash carried interest compensation 989 (1,479) (643) GAAP Employee Compensation and Benefits $ 55,477 $ 202,006 $ 83,353 1. Excludes severance expenses of $2.3 million, $4.6 million and $0.6 million for the three months ended March 31, 2020, December 31, 2020 and March 31, 2021, respectively. 2. Excludes the impact of non-cash carried interest expense of $1.0 million, $1.5 million and $0.6 million for the three months ended March 31, 2020, December 31, 2020 and March 31, 2021, respectively.

23 Reconciliation to Non-GAAP Metrics Three Months Ended $000 Mar 31, 2020 Dec 31, 2020 Mar 31, 2021 Net Incentive Fees Attributable to GCM Grosvenor Incentive fees Performance fees $ 605 $ 51,105 $ 6,113 Carried interest 2,628 22,497 12,101 Less: Cash-based incentive fee related compensation — (11,454) (1,833) Cash carried interest compensation (2,190) (12,316) (6,860) Non-cash carried interest compensation 989 (1,479) (643) Carried interest expense attributable to redeemable noncontrolling interest holder (865) (4,451) (1,905) Carried interest expense attributable to other noncontrolling interest holders, net (468) (3,313) (2,525) Net incentive fees attributable to GCM Grosvenor $ 699 $ 40,589 $ 4,448 Net Fees Attributable to GCM Grosvenor Total operating revenues $ 82,617 $ 155,488 $ 103,219 Less: Fund expense reimbursement revenue (1,974) (2,441) (2,360) Cash-based incentive fee related compensation — (11,454) (1,833) Cash carried interest compensation (2,190) (12,316) (6,860) Non-cash carried interest compensation 989 (1,479) (643) Carried interest expense attributable to redeemable noncontrolling interest holder (865) (4,451) (1,905) Carried interest expense attributable to other noncontrolling interest holders, net (468) (3,313) (2,525) Net fees attributable to GCM Grosvenor $ 78,109 $ 120,034 $ 87,093

24 Reconciliation to Non-GAAP Metrics Three Months Ended $000 Mar 31, 2020 Dec 31, 2020 (restated) Mar 31, 2021 Adjusted Pre-Tax Income & Adjusted Net Income Net income (loss) attributable to GCM Grosvenor Inc. $ — $ 4,049 $ 2,547 Plus: Net income (loss) attributable to GCMH (14,955) (105,235) 703 Income taxes 643 2,796 (663) Change in fair value of derivatives 8,634 (1,101) (1,934) Change in fair value of warrants — 13,315 (14,057) Amortization expense 1,876 1,876 583 Severance 2,280 4,588 588 Transaction expenses1 3,355 7,829 5,300 Loss on extinguishment of debt 1,032 — 675 Other — 10 8 Partnership interest-based compensation 7,920 133,977 4,903 Equity-based compensation — — 27,036 Other non-cash compensation 1,065 1,204 941 Less: Investment income, net of noncontrolling interests (32) (421) (779) Non-cash carried interest compensation 989 (1,479) (643) Adjusted pre-tax income 12,807 61,408 25,208 Less: Adjusted Income taxes2 (3,202) (15,351) (6,302) Adjusted net income $ 9,605 $ 46,057 $ 18,906 1. Represents 2020 expenses related to the Mosaic transaction and the public offering Transaction, and 2021 expenses related to a debt offering, other contemplated corporate transactions, and other public company readiness expenses. 2. Represents corporate income taxes at a blended effective tax rate of 21% and an estimated combined state, local and foreign income tax rate net of federal benefits of 4%. As we were not subject to U.S. federal and state income taxes prior to the Transaction, the blended statutory tax rate of 25% has been applied to all prior periods presented for comparability purposes.

25 Reconciliation to Non-GAAP Metrics Three Months Ended $000 Mar 31, 2020 Dec 31, 2020 Mar 31, 2021 Adjusted EBITDA Adjusted net income $ 9,605 $ 46,057 $ 18,906 Plus: Adjusted Income taxes1 3,202 15,351 6,302 Depreciation expense 696 542 473 Interest expense 5,867 5,931 4,491 Adjusted EBITDA $ 19,370 $ 67,881 $ 30,172 Fee-Related Earnings Adjusted EBITDA 19,370 67,881 30,172 Less: Incentive fees (3,233) (73,602) (18,214) Depreciation expense (696) (542) (473) Other non-operating income/(expense) (414) 26 (58) Plus: Incentive fee related compensation 1,201 25,249 9,336 Carried interest expense attributable to redeemable noncontrolling interest holder 865 4,451 1,905 Carried interest expense attributable to other noncontrolling interest holders, net 468 3,313 2,525 Fee-Related Earnings $ 17,561 $ 26,776 $ 25,193 1. Represents corporate income taxes at a blended effective tax rate of 21% and an estimated combined state, local and foreign income tax rate net of federal benefits of 4%. As we were not subject to U.S. federal and state income taxes prior to the Transaction, the blended statutory tax rate of 25% has been applied to all prior periods presented for comparability purposes.

26 Reconciliation to adjusted net income per share Three Months Ended $000, except per share amounts Mar 31, 2020 1 Mar 31, 2021 Adjusted net income $ 9,605 $ 18,906 Weighted-average shares of Class A common stock outstanding - basic (000) 39,985 42,084 Exercise of private warrants - incremental shares under the treasury stock method (000) — 308 Exercise of public warrants - incremental shares under the treasury stock method (000) — 2,245 Exchange of partnership units (000) 144,235 144,235 Weighted-average shares of Class A common stock outstanding - diluted (000) 184,220 188,872 Effective dilutive warrants, if antidilutive for GAAP 897 — Adjusted shares - diluted (000) 185,117 188,872 Adjusted net income per share - diluted $ 0.05 $ 0.10 1. As Class A common stock did not exist prior to the Transaction, the computation of Adjusted net income per share assumes the same weighted average shares of Class A common stock outstanding, dilutive warrants, and number of adjusted shares outstanding as of December 31, 2020 for all periods prior to the Transaction.

27 Quarterly Growth in FPAUM and AUM $mm Private Markets Strategies Absolute Return Strategies Total FPAUM Contracted Not Yet FPAUM Total AUM Fee-Paying AUM Beginning of Period (January 1, 2021) $ 27,839 $ 24,130 $ 51,969 $ 7,057 $ 61,943 Contributions from CNYFPAUM 1,163 92 1,255 Contributions from New Capital Raised 572 567 1,139 Withdrawals — (450) (450) Distributions (907) (4) (911) Change in Market Value 223 123 346 Foreign Exchange, Other (1) 15 14 End of Period Balance (March 31, 2021) $ 28,889 $ 24,473 $ 53,362 $ 7,454 $ 64,862 % Change 4 % 1 % 3 % 6 % 5 % Quarter Ended March 31, 2021

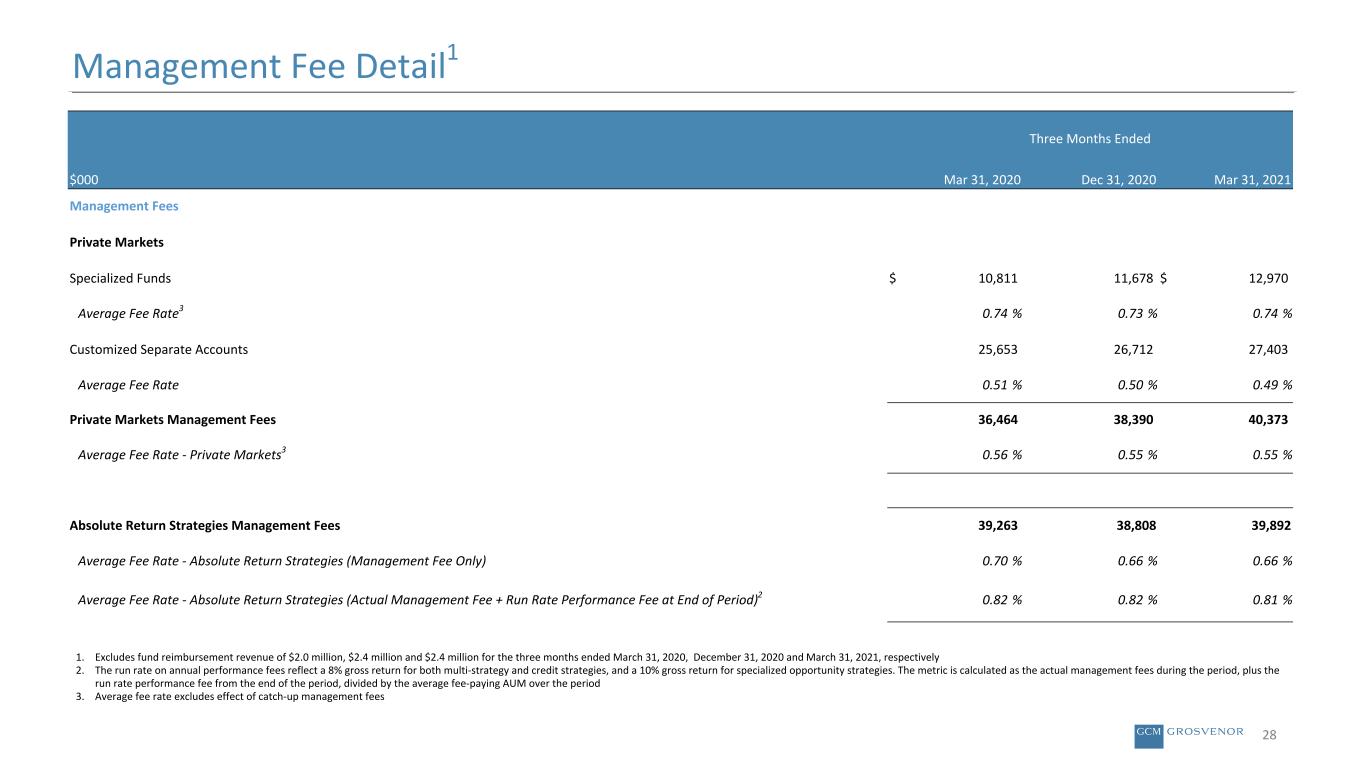

28 Management Fee Detail1 Three Months Ended $000 Mar 31, 2020 Dec 31, 2020 Mar 31, 2021 Management Fees Private Markets Specialized Funds $ 10,811 11,678 $ 12,970 Average Fee Rate3 0.74 % 0.73 % 0.74 % Customized Separate Accounts 25,653 26,712 27,403 Average Fee Rate 0.51 % 0.50 % 0.49 % Private Markets Management Fees 36,464 38,390 40,373 Average Fee Rate - Private Markets3 0.56 % 0.55 % 0.55 % Absolute Return Strategies Management Fees 39,263 38,808 39,892 Average Fee Rate - Absolute Return Strategies (Management Fee Only) 0.70 % 0.66 % 0.66 % Average Fee Rate - Absolute Return Strategies (Actual Management Fee + Run Rate Performance Fee at End of Period)2 0.82 % 0.82 % 0.81 % 1. Excludes fund reimbursement revenue of $2.0 million, $2.4 million and $2.4 million for the three months ended March 31, 2020, December 31, 2020 and March 31, 2021, respectively 2. The run rate on annual performance fees reflect a 8% gross return for both multi-strategy and credit strategies, and a 10% gross return for specialized opportunity strategies. The metric is calculated as the actual management fees during the period, plus the run rate performance fee from the end of the period, divided by the average fee-paying AUM over the period 3. Average fee rate excludes effect of catch-up management fees

29 Private Markets Strategies Performance Metrics – Realized and Partially Realized Investments Strategy Commitments Contributions Distributions Current Value Investment Net TVPI Investment Net IRR PME IRR PME Index Private Equity Primary Fund Investments1 $ 10,762 $ 11,785 $ 18,898 $ 2,186 1.79 13.9 % 9.3 % S&P 500 Secondaries Investments2 337 220 232 63 1.34 14.2 % 10.1 % S&P 500 Co-Investments/Direct Investments3 2,368 2,275 3,975 380 1.91 22.5 % 14.8 % S&P 500 Infrastructure4 2,505 2,339 3,133 461 1.54 11.2 % 6.4 % MSCI World Infrastructure Real Estate5 262 291 474 12 1.67 21.8 % 11.5 % FNERTR Index ESG and Impact Strategies Diverse Managers6 1,167 1,276 2,039 348 1.87 24.0 % 12.5 % S&P 500 Labor Impact Investments 0 0 0 0 n/a n/a n/a MSCI World Infrastructure Note: Returns for each strategy are presented from the date the firm established a dedicated team focused on such strategy through December 31, 2020. Investment net returns are net of investment-related fees and expenses, including fees paid to underlying managers, but do not reflect management fees, incentive compensation, or carried interest to GCM Grosvenor or any expenses of any account or vehicle GCM Grosvenor manages. Data does not include investments that were transferred at the request of investors prior to liquidation and are no longer managed by GCM Grosvenor. Past performance is not necessarily indicative of future results. (1) Reflects primary fund investments since 2000. Excludes certain private markets credit fund investments outside of private equity programs. (2) Reflects secondaries investments since 2014. In September 2014, GCM Grosvenor established a dedicated private equity secondaries vertical. (3) Reflects co-investments/direct investments since 2009. In December 2008, GCM Grosvenor established a dedicated Private Equity Co-Investment Sub-Committee and adopted a more targeted, active co-investment strategy. (4) Reflects infrastructure investments since 2003. Infrastructure investments exclude labor impact investments. (5) Reflects real estate investments since 2010. In 2010, GCM Grosvenor established a dedicated Real Estate team and adopted a more targeted, active real estate strategy. (6) Since 2007.

30 Private Markets Strategies Performance Metrics – All Investments Strategy Commitments Contributions Distributions Current Value Investment Net TVPI Investment Net IRR PME IRR PME Index Private Equity Primary Fund Investments1 $ 20,981 $ 18,867 $ 22,105 $ 8,050 1.60 12.4 % 10.7 % S&P 500 Secondary Investments2 1,175 863 386 718 1.28 13.3 % 14.1 % S&P 500 Co-Investments/Direct Investments3 5,448 5,114 4,153 3,578 1.51 17.6 % 15.3 % S&P 500 Infrastructure4 5,953 5,277 3,895 3,357 1.37 9.9 % 6.6 % MSCI World Infrastructure Real Estate5 2,086 1,557 888 978 1.20 11.0 % 7.3 % FNERTR Index Multi-Asset Class Programs 1,513 1,487 526 1,550 1.40 29.2 % n/a n/a ESG and Impact Strategies Diverse Managers6 6,200 4,834 2,974 4,190 1.48 17.6 % 14.9 % S&P 500 Labor Impact Investments 372 220 1 233 1.06 7.6 % 4.1 % MSCI World Infrastructure Note: Returns for each strategy are presented from the date the firm established a dedicated team focused on such strategy through December 31, 2020. Investment net returns are net of investment-related fees and expenses, including fees paid to underlying managers, but do not reflect management fees, incentive compensation, or carried interest to GCM Grosvenor or any expenses of any account or vehicle GCM Grosvenor manages. Data does not include investments that were transferred at the request of investors prior to liquidation and are no longer managed by GCM Grosvenor. Past performance is not necessarily indicative of future results. (1) Reflects primary fund investments since 2000. Excludes certain private markets credit fund investments outside of private equity programs. (2) Reflects secondaries investments since 2014. In September 2014, GCM Grosvenor established a dedicated private equity secondaries vertical. (3) Reflects co-investments/direct investments since 2009. In December 2008, GCM Grosvenor established a dedicated Private Equity Co-Investment Sub-Committee and adopted a more targeted, active co-investment strategy. (4) Reflects infrastructure investments since 2003. Infrastructure investments exclude labor impact investments. (5) Reflects real estate investments since 2010. In 2010, GCM Grosvenor established a dedicated Real Estate team and adopted a more targeted, active real estate strategy. (6) Since 2007.

31 Absolute Return Strategies Performance Assets Under Management as of March 31, 2021 ($Bn) Year to Date Returns Ending March 31, 2021 Annualized Returns Since Inception Through March 31, 2021 Gross Net Gross Net Absolute Return Strategies (Overall) $ 25.5 0.45 % 0.28 % 7.20 % 6.08 % GCMLP Diversified Multi-Strategy Composite $ 12.3 (0.60) % (0.77) % 8.15 % 6.78 % Note: Absolute Return Strategies (Overall) is since 1996. GCMLP Diversified Multi-Strategy Composite is since 1993.

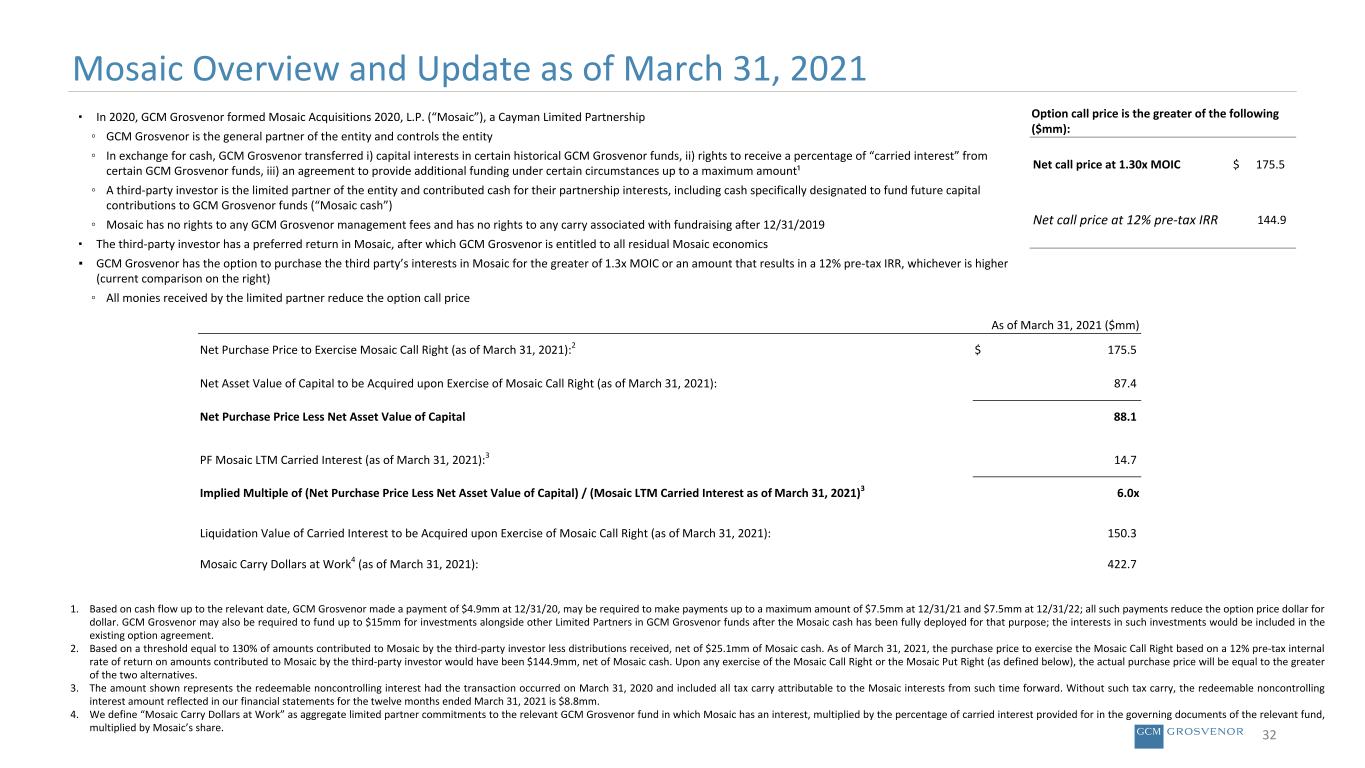

1. Based on cash flow up to the relevant date, GCM Grosvenor made a payment of $4.9mm at 12/31/20, may be required to make payments up to a maximum amount of $7.5mm at 12/31/21 and $7.5mm at 12/31/22; all such payments reduce the option price dollar for dollar. GCM Grosvenor may also be required to fund up to $15mm for investments alongside other Limited Partners in GCM Grosvenor funds after the Mosaic cash has been fully deployed for that purpose; the interests in such investments would be included in the existing option agreement. 2. Based on a threshold equal to 130% of amounts contributed to Mosaic by the third-party investor less distributions received, net of $25.1mm of Mosaic cash. As of March 31, 2021, the purchase price to exercise the Mosaic Call Right based on a 12% pre-tax internal rate of return on amounts contributed to Mosaic by the third-party investor would have been $144.9mm, net of Mosaic cash. Upon any exercise of the Mosaic Call Right or the Mosaic Put Right (as defined below), the actual purchase price will be equal to the greater of the two alternatives. 3. The amount shown represents the redeemable noncontrolling interest had the transaction occurred on March 31, 2020 and included all tax carry attributable to the Mosaic interests from such time forward. Without such tax carry, the redeemable noncontrolling interest amount reflected in our financial statements for the twelve months ended March 31, 2021 is $8.8mm. 4. We define “Mosaic Carry Dollars at Work” as aggregate limited partner commitments to the relevant GCM Grosvenor fund in which Mosaic has an interest, multiplied by the percentage of carried interest provided for in the governing documents of the relevant fund, multiplied by Mosaic’s share. 32 ▪ In 2020, GCM Grosvenor formed Mosaic Acquisitions 2020, L.P. (“Mosaic”), a Cayman Limited Partnership ◦ GCM Grosvenor is the general partner of the entity and controls the entity ◦ In exchange for cash, GCM Grosvenor transferred i) capital interests in certain historical GCM Grosvenor funds, ii) rights to receive a percentage of “carried interest” from certain GCM Grosvenor funds, iii) an agreement to provide additional funding under certain circumstances up to a maximum amount¹ ◦ A third-party investor is the limited partner of the entity and contributed cash for their partnership interests, including cash specifically designated to fund future capital contributions to GCM Grosvenor funds (“Mosaic cash”) ◦ Mosaic has no rights to any GCM Grosvenor management fees and has no rights to any carry associated with fundraising after 12/31/2019 ▪ The third-party investor has a preferred return in Mosaic, after which GCM Grosvenor is entitled to all residual Mosaic economics ▪ GCM Grosvenor has the option to purchase the third party’s interests in Mosaic for the greater of 1.3x MOIC or an amount that results in a 12% pre-tax IRR, whichever is higher (current comparison on the right) ◦ All monies received by the limited partner reduce the option call price Mosaic Overview and Update as of March 31, 2021 Option call price is the greater of the following ($mm): Net call price at 1.30x MOIC $ 175.5 Net call price at 12% pre-tax IRR 144.9 As of March 31, 2021 ($mm) Net Purchase Price to Exercise Mosaic Call Right (as of March 31, 2021):2 $ 175.5 Net Asset Value of Capital to be Acquired upon Exercise of Mosaic Call Right (as of March 31, 2021): 87.4 Net Purchase Price Less Net Asset Value of Capital 88.1 PF Mosaic LTM Carried Interest (as of March 31, 2021):3 14.7 Implied Multiple of (Net Purchase Price Less Net Asset Value of Capital) / (Mosaic LTM Carried Interest as of March 31, 2021)3 6.0x Liquidation Value of Carried Interest to be Acquired upon Exercise of Mosaic Call Right (as of March 31, 2021): 150.3 Mosaic Carry Dollars at Work4 (as of March 31, 2021): 422.7

33 Adjusted net income is a non-GAAP measure that we present on a pre-tax and after-tax basis to evaluate our profitability. Adjusted pre-tax income represents net income attributable to GCM Grosvenor Inc. including (a) net income attributable to GCMH, excluding (b) income taxes, (c) changes in fair value of derivatives and warrants, (d) partnership interest-based and non-cash compensation, (e) equity-based compensation, (f) unrealized investment income, and (g) certain other items that we believe are not indicative of our core performance, including charges related to corporate transactions and employee severance. We believe adjusted pre-tax income is useful to investors because it provides additional insight into the operating profitability of our business. Adjusted net income represents adjusted pre-tax income minus income taxes, which represent corporate income taxes at a blended effective tax rate of 21% and an estimated combined state, local and foreign income tax rate net of federal benefits of 4%. As we were not subject to U.S. federal and state income taxes prior to November 17, 2020, the blended statutory tax rate of 25% has been applied to all prior periods presented for comparability purposes. Adjusted Earnings Per Share (“EPS”) is a non-GAAP measure that is calculated by dividing adjusted net income by adjusted shares outstanding. Adjusted shares outstanding assumes the hypothetical full exchange of limited partnership interests in GCMH into Class A common stock of GCM Grosvenor Inc. Adjusted EBITDA is a non-GAAP measure which represents adjusted net income excluding (a) income taxes, (b) depreciation expense and (c) interest expense on our outstanding debt. We believe Adjusted EBITDA is useful to investors because it enables them to better evaluate the performance of our core business across reporting periods. Adjusted EBITDA Margin represents Adjusted EBITDA as a percentage of our total operating revenues, net of Fund expense reimbursements. Fee-Related Earnings (“FRE”) is a non-GAAP measure used to highlight earnings from recurring management fees and administrative fees. Fee-Related earnings represents Adjusted EBITDA further adjusted to exclude (a) incentive fees and related compensation and (b) other non-operating income, and to include depreciation expense. We believe Fee-Related Earnings is useful to investors because it provides additional insights into the management fee driven operating profitability of our business. FRE Margin represents Adjusted FRE as a percentage of our management fee and other operating revenue, net of Fund expense reimbursements. Adjusted Revenue represents total operating revenues excluding reimbursement of expenses paid on behalf of GCM Funds and affiliates. Net incentive fees attributable to GCM Grosvenor is a non-GAAP measure used to highlight fees earned from incentive fees that are attributable to GCM Grosvenor. Net incentive fees represent incentive fees excluding (a) incentive fee related compensation and (b) carried interest attributable to noncontrolling interest holder(s). Net fees attributable to GCM Grosvenor is a non-GAAP measure used to highlight revenues attributable to GCM Grosvenor. Net fees attributable to GCM Grosvenor represent total operating revenues fees excluding (a) reimbursement of expenses paid on behalf of GCM Funds and affiliates, (b) incentive fee related compensation and (c) carried interest attributable to noncontrolling interest holder(s). Fee-Paying Assets Under Management (“FPAUM” or “Fee-Paying AUM") is a key performance indicator we use to measure the assets from which we earn management fees. Our FPAUM comprises the assets in our customized separate accounts and specialized funds from which we derive management fees. We classify customized separate account revenue as management fees if the client is charged an asset-based fee, which includes the vast majority of our discretionary AUM accounts. The FPAUM for our private market strategies typically represents committed, invested or scheduled capital during the investment period and invested capital following the expiration or termination of the investment period. Substantially all of our private markets strategies funds earn fees based on commitments or net invested capital, which are not affected by market appreciation or depreciation. Our FPAUM for our absolute return strategy is based on net asset value. Our calculations of FPAUM may differ from the calculations of other asset managers, and as a result, this measure may not be comparable to similar measures presented by other asset managers. Our definition of FPAUM is not based on any definition that is set forth in the agreements governing the customized separate accounts or specialized funds that we manage. Contracted, not yet fee-paying AUM (“CNYFPAUM”) represents limited partner commitments during or prior to the initial commitment or investment period where fees are expected to be charged in the future based on invested capital (capital committed to underlying investments) or on a scheduled ramp-in of total commitments. New Capital Raised is new limited partner commitments where fees are charged immediately at the initial commitment date. Certain Definitions and Use of Non-GAAP Financials and Key Performance Indicators

34 Assets Under Management (“AUM”) reflects the sum of (a) FPAUM, (b) CNYFPAUM and (c) other mark-to-market, insider capital and non-fee-paying assets under management. GCM Grosvenor refers to the combined accounts of (a) Grosvenor Capital Management Holdings, LLLP ("LLLP" or "GCMH"), an Delaware limited liability limited partnership, and its consolidated subsidiaries and (b) GCM, L.L.C., a Delaware limited liability company. Transaction refers to the business combination announced August 3, 2020 and completed on November 17, 2020 through which CFAC merged with and into GCM Grosvenor Inc., ceasing the separate corporate existence of CFAC with GCM Grosvenor Inc. becoming the surviving corporation. Following the business combination, the financial statements of GCM Grosvenor Inc. will represent a continuation of the financial statements of GCM Grosvenor with the transaction being treated as the equivalent of GCM Grosvenor issuing stock for the net assets of GCM Grosvenor, Inc., accompanied by a recapitalization. CF Finance Acquisition Corp. (“CFAC”) (NASDAQ: CFFA) was a special purpose acquisition company sponsored by Cantor Fitzgerald, a leading global financial services firm. GCM Grosvenor Inc. was incorporated in Delaware as a wholly owned subsidiary of Grosvenor Capital Management Holdings, LLLP, formed for the purpose of completing the Transaction. Pursuant to the Transaction, Grosvenor Capital Management Holdings, LLLP cancelled its shares in GCM Grosvenor Inc. no longer making GCM Grosvenor Inc. a wholly owned subsidiary of Grosvenor Capital Management Holdings, LLLP. NM Not Meaningful Certain Definitions and Use of Non-GAAP Financials and Key Performance Indicators (continued)

35 Forward-Looking Statements This presentation contains certain forward-looking statements within the meaning of the Private Securities Litigation Reform Act of 1995, including statements regarding the expected future performance of GCM Grosvenor’s business, including anticipated incremental revenue from fundraising for specialized funds. These forward-looking statements generally are identified by the words “believe,” “project,” “expect,” “anticipate,” “estimate,” “intend,” “strategy,” “future,” “opportunity,” “plan,” “may,” “should,” “will,” “would” and similar expressions. Forward-looking statements are predictions, projections and other statements about future events that are based on current expectations and assumptions and, as a result, are subject to risks and uncertainties. These statements are neither promises nor guarantees, but involve known and unknown risks, uncertainties and other important factors that may cause our actual results, performance or achievements to be materially different from any future results, performance or achievements expressed or implied by the forward-looking statements, including, but not limited to, the historical performance of our funds may not be indicative of our future results; risks related to redemptions and termination of engagements; effect of the COVID-19 pandemic on our business; the variable nature of our revenues; competition in our industry; effects of domestic and foreign government regulation or compliance failures; operational risks and data security breaches; our ability to deal appropriately with conflicts of interest; market, geopolitical and economic conditions; identification and availability of suitable investment opportunities; risks relating to our internal control over financial reporting; and risks related to our ability to grow AUM and the performance of our investments. You should carefully consider the foregoing factors and the other risks and uncertainties described in the “Risk Factors” sections of the Annual Report on Form 10-k/a filed by GCM Grosvenor on May 10, 2021 and its other filings from time to time with the U.S. Securities and Exchange Commission. These filings identify and address other important risks and uncertainties that could cause actual events and results to differ materially from those contained in the forward-looking statements. Forward-looking statements speak only as of the date they are made. Readers are cautioned not to put undue reliance on forward-looking statements, and GCM Grosvenor assumes no obligation and does not intend to update or revise these forward-looking statements, whether as a result of new information, future events, or otherwise, except as required by law. Non-GAAP Financial Measures The non-GAAP financial measures contained in this presentation are not GAAP measures of GCM Grosvenor’s financial performance or liquidity and should not be considered as alternatives to net income (loss) as a measure of financial performance or cash flows from operations as measures of liquidity, or any other performance measure derived in accordance with GAAP. A reconciliation of such non-GAAP measures to their most directly comparable GAAP measure is included elsewhere in this presentation. You are encouraged to evaluate each adjustment to non-GAAP financial measures and the reasons management considers it appropriate for supplemental analysis. Our presentation of these measures should not be construed as an inference that our future results will be unaffected by unusual or non-recurring items. In addition, these measures may not be comparable to similarly titled measures used by other companies in our industry or across different industries. This presentation includes certain projections of non-GAAP financial measures including fee-related earnings. Due to the high variability and difficulty in making accurate forecasts and projections of some of the information excluded from these projected measures, together with some of the excluded information not being ascertainable or accessible, GCM Grosvenor is unable to quantify certain amounts that would be required to be included in the most directly comparable GAAP financial measures without unreasonable effort. Consequently, no disclosure of estimated comparable GAAP measures is included and no reconciliation of the forward looking non GAAP financial measures is included. Disclaimer