Attached files

| file | filename |

|---|---|

| EX-32.1 - EX-32.1 - Aptinyx Inc. | aptx-20210331ex32143005b.htm |

| EX-31.2 - EX-31.2 - Aptinyx Inc. | aptx-20210331ex3126bcbc8.htm |

| EX-31.1 - EX-31.1 - Aptinyx Inc. | aptx-20210331ex3119f9d9b.htm |

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

WASHINGTON, DC 20549

FORM 10-Q

(Mark One)

☒ | QUARTERLY REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934 |

For the quarterly period ended March 31, 2021

OR

☐ | TRANSITION REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934 |

For the transition period from to

Commission File No. 001-38535

Aptinyx Inc.

(Exact name of registrant as specified in its charter)

Delaware | | 47-4626057 |

(State or other jurisdiction of | | (I.R.S. Employer |

909 Davis Street, Suite 600

Evanston, IL 60201

(847) 871-0377

(Address, including zip code, and telephone number, including area code, of registrant’s principal executive offices)

Securities registered pursuant to Section 12(b) of the Act:

Title of each class | Trading symbol(s) | Name of each exchange on which registered |

Common Stock, par value $0.01 per share | APTX | The Nasdaq Global Select Market |

Indicate by check mark whether the registrant (1) has filed all reports required to be filed by Section 13 or 15(d) of the Securities Exchange Act of 1934 during the preceding 12 months (or for such shorter period that the registrant was required to file such reports), and (2) has been subject to such filing requirements for the past 90 days. Yes ☒ No ☐

Indicate by check mark whether the registrant has submitted electronically every Interactive Data File required to be submitted pursuant to Rule 405 of Regulation S-T (§ 232.405 of this chapter) during the preceding 12 months (or for such shorter period that the registrant was required to submit such files). Yes ☒ No ☐

Indicate by check mark whether the registrant is a large accelerated filer, an accelerated filer, a non-accelerated filer, smaller reporting company, or an emerging growth company. See the definitions of “large accelerated filer,” “accelerated filer,” “smaller reporting company,” and “emerging growth company” in Rule 12b-2 of the Exchange Act.

Large accelerated filer | ☐ | | Accelerated filer | ☐ |

Non-accelerated filer | ☒ | | Smaller reporting company | ☒ |

| | | Emerging growth company | ☒ |

If an emerging growth company, indicate by check mark if the registrant has elected not to use the extended transition period for complying with any new or revised financial accounting standards provided pursuant to Section 13(a) of the Exchange Act. ☐

Indicate by check mark whether the registrant is a shell company (as defined in Rule 12b-2 of the Exchange Act). Yes ☐ No ☒

As of May 10, 2021 the registrant had 68,173,736 shares of common stock, $0.01 par value per share, outstanding.

Table of Contents

| | Page |

5 | ||

5 | ||

| 5 | |

| 6 | |

| 7 | |

| 8 | |

| 9 | |

Management’s Discussion and Analysis of Financial Condition and Results of Operations | 18 | |

25 | ||

25 | ||

27 | ||

27 | ||

27 | ||

27 | ||

27 | ||

27 | ||

27 | ||

27 | ||

29 | ||

2

SPECIAL NOTE REGARDING FORWARD-LOOKING STATEMENTS

This Quarterly Report on Form 10-Q contains forward-looking statements that involve risks, uncertainties, and other factors that may cause actual results, levels of activity, performance, or achievements to be materially different from the information expressed or implied by these forward-looking statements. All statements, other than statements of historical facts, contained in this Quarterly Report on Form 10-Q, including statements regarding our strategy, future operations, future financial position, future revenue, projected costs, prospects, plans and objectives of management and expected market growth are forward-looking statements. The words “anticipate,” “believe,” “continue,” “could,” “estimate,” “expect,” “intend,” “may,” “plan,” “potential,” “predict,” “project,” “should,” “target,” “would,” and similar expressions are intended to identify forward-looking statements, although not all forward-looking statements contain these identifying words.

These forward-looking statements include, among other things, statements about:

| ● | the timing, progress, and results of preclinical studies and clinical trials for NYX-2925, NYX-783, NYX-458, and any future product candidates we may develop, including statements regarding the timing of initiation, recommencement, and completion of studies or trials and related preparatory work, and costs associated therewith, the period during which the results of the studies will become available, our research and development programs, and our ability to demonstrate safety and efficacy of our product candidates to the satisfaction of applicable regulatory authorities; |

| ● | the impacts of the current COVID-19 pandemic on our continuing operations, clinical development plans, including the timing of initiation, recommencement and completion of studies or trials, financial forecasts and expectations, and other matters related to our business and operations; |

| ● | the existence or absence of side effects or other properties relating to our product candidates that could delay or prevent their regulatory approval, limit their commercial potential, or result in significant negative consequences following any potential marketing approval; |

| ● | the potential for our identified research priorities to advance our technologies; |

| ● | the potential benefits of our ability to establish or maintain future collaborations or strategic relationships or obtain additional funding in connection with these relationships; |

| ● | our ability to obtain and maintain regulatory approval of our product candidates, NYX-2925, NYX-783, NYX-458, and any other future product candidates, and any statements regarding the label of an approved product candidate, including any restrictions, limitations, and/or warnings therein; |

| ● | our intellectual property position, including the scope of protection we are able to establish and maintain for intellectual property rights covering NYX-2925, NYX-783, NYX-458, and any additional product candidates we may develop, and any statements as to whether we do or do not infringe, misappropriate, or otherwise violate any third-party intellectual property rights; |

| ● | our ability and the potential to successfully manufacture our product candidates for clinical studies and for commercial use, if approved; |

| ● | our ability to commercialize our products in light of the intellectual property rights of others; |

| ● | our ability to obtain funding for our operations, including funding necessary to complete further development and commercialization of our product candidates; |

| ● | our plans to research, develop, and commercialize our product candidates; |

| ● | our ability to attract collaborators with development, regulatory, and commercialization expertise; |

| ● | the size and growth potential of the markets for our product candidates and our ability to serve those markets; |

| ● | the rate and degree of market acceptance and clinical utility of NYX-2925, NYX-783, NYX-458, and any future product candidates we may develop, if approved; |

| ● | the pricing and reimbursement of NYX-2925, NYX-783, NYX-458, and any future product candidates we may develop, if approved; |

| ● | regulatory developments in the United States and foreign countries; |

| ● | our ability to contract with third-party suppliers and manufacturers and their ability to perform adequately; |

| ● | the success of competing therapies that are or may become available; |

| ● | our ability to retain the continued service of our key professionals and to identify, hire, and retain additional qualified professionals; |

3

| ● | the accuracy of our estimates regarding expenses, future revenue, capital requirements, and needs for additional financing; |

| ● | our financial performance; |

| ● | our expectations related to the use of our cash reserves; |

| ● | the impact of laws and regulations, including, without limitation, recently enacted tax reform legislation; |

| ● | our expectations regarding the time during which we will be an “emerging growth company” under the Jumpstart Our Business Startups Act; |

| ● | our use of proceeds from the initial and follow-on public offerings; and |

| ● | other risks and uncertainties, including those listed under “Risk Factors” in our Annual Report on Form 10-K for the year ended December 31, 2020, or Annual Report. |

We may not actually achieve the plans, intentions or expectations disclosed in our forward-looking statements, and you should not place undue reliance on our forward-looking statements. Actual results or events could differ materially from the plans, intentions and expectations disclosed in the forward-looking statements we make. We have included important factors in the cautionary statements included in this Quarterly Report on Form 10-Q and our Annual Report filed with the Securities and Exchange Commission, or the SEC, on March 24, 2021, particularly in the “Risk Factors” section, that could cause actual results or events to differ materially from the forward-looking statements that we make. Our forward-looking statements do not reflect the potential impact of any future acquisitions, mergers, dispositions, collaborations, joint ventures or investments that we may make or into which we may enter.

You should read this Quarterly Report on Form 10-Q and the documents that we reference herein and have filed or incorporated by reference as exhibits hereto completely and with the understanding that our actual future results may be materially different from what we expect. We do not assume any obligation to update any forward-looking statements, whether as a result of new information, future events or otherwise, except as required by law.

4

Item 1. Condensed Financial Statements.

Aptinyx Inc.

Condensed Balance Sheets

(unaudited)

(in thousands, except per share data)

|

| March 31, |

| December 31, | ||

| | 2021 | | 2020 | ||

Assets | |

|

|

| |

|

Current assets: | |

|

|

| |

|

Cash and cash equivalents | | $ | 146,810 | | $ | 141,028 |

Restricted cash | | | 179 | | | 179 |

Accounts receivable | | | — |

|

| 257 |

Prepaid expenses and other current assets | | | 5,421 |

|

| 8,140 |

Total current assets | | | 152,410 |

|

| 149,604 |

Other assets | | | 92 | | | 92 |

Property and equipment, net | | | 388 |

|

| 910 |

Total assets | | $ | 152,890 | | $ | 150,606 |

Liabilities and stockholders’ equity | | |

|

|

|

|

Current liabilities: | | |

|

|

|

|

Accounts payable | | $ | 1,674 | | $ | 1,209 |

Accrued expenses and other current liabilities | | | 2,204 |

|

| 3,374 |

Total current liabilities | | | 3,878 |

|

| 4,583 |

Other long-term liabilities | | | 71 |

|

| 114 |

Total liabilities | | $ | 3,949 |

| $ | 4,697 |

Commitments and contingencies (see Note 10) | | |

|

|

|

|

Stockholders’ equity: | | |

|

|

|

|

Preferred stock, $0.01 par value, 10,000 shares authorized and no shares issued and outstanding as of March 31, 2021 and December 31, 2020 | | | — | |

| — |

Common stock, $0.01 par value, 150,000 shares authorized as of March 31, 2021 and December 31, 2020, 66,930 and 63,257 issued and outstanding as of March 31, 2021 and December 31, 2020 | | | 669 |

|

| 633 |

Additional paid-in capital | | | 375,499 |

|

| 358,277 |

Accumulated deficit | | | (227,227) |

|

| (213,001) |

Total stockholders’ equity | | $ | 148,941 |

| $ | 145,909 |

Total liabilities and stockholders’ equity | | $ | 152,890 | | $ | 150,606 |

See accompanying notes to these unaudited condensed financial statements.

5

Aptinyx Inc.

Condensed Statements of Operations

(unaudited)

(in thousands, except per share data)

| | Three Months Ended March 31, |

| ||||

|

| 2021 |

| 2020 |

| ||

Revenues: | | | | | | | |

Collaboration revenue |

| $ | 1,000 | | $ | 818 | |

Operating expenses: | | | |

|

|

| |

Research and development | | | 10,314 |

|

| 11,055 | |

General and administrative | | | 4,976 |

|

| 4,899 | |

Total operating expenses | | | 15,290 |

|

| 15,954 | |

Loss from operations | | | (14,290) |

|

| (15,136) | |

Other income | | | 64 |

|

| 426 | |

Net loss and comprehensive loss |

| $ | (14,226) | | $ | (14,710) | |

Net loss per share attributable to common stockholders, basic and diluted |

| $ | (0.22) | | $ | (0.34) | |

Weighted-average number of common shares outstanding, basic and diluted | |

| 66,043 |

|

| 43,835 | |

See accompanying notes to these unaudited condensed financial statements.

6

Aptinyx Inc.

Condensed Statements of Cash Flows

(unaudited)

(in thousands)

| | Three Months Ended | ||||

| | March 31, | ||||

|

| 2021 |

| 2020 | ||

Cash flows from operating activities: |

| |

|

| |

|

Net loss |

| $ | (14,226) | | $ | (14,710) |

Adjustments to reconcile net loss to net cash used in operating activities: | | | |

| |

|

Depreciation and amortization expense | | | 412 |

| | 108 |

Stock-based compensation expense | | | 2,655 |

| | 2,331 |

Changes in operating assets and liabilities: | | | |

| | |

Prepaid expenses and other assets | | | 2,703 |

| | 1,470 |

Accounts receivable | | | 257 |

| | (375) |

Accounts payable | | | 405 |

| | 134 |

Accrued expenses and other liabilities | | | (1,190) |

| | (511) |

Net cash used in operating activities | | | (8,984) |

| | (11,553) |

Cash flows from investing activities: | | |

|

| |

|

Purchases of property and equipment | | | — |

| | (11) |

Proceeds from sale of property and equipment | | | 90 | | | — |

Net cash provided by (used in) investing activities | | | 90 |

| | (11) |

Cash flows from financing activities: | | |

|

| |

|

Proceeds from stock options exercised | | | 72 | | | 244 |

Repurchase of shares for tax withholdings | | | (7) | | | — |

Proceeds from public offering, net of underwriters' discounts | | | — |

| | 33,672 |

Proceeds from at the market offering, net of sales commission | | | 14,615 | | | — |

Payment of offering costs | | | (4) |

| | (181) |

Net cash provided by financing activities | | | 14,676 |

| | 33,735 |

Net increase in cash, cash equivalents and restricted cash | | | 5,782 |

| | 22,171 |

Cash, cash equivalents and restricted cash, at beginning of period | | | 141,299 |

| | 99,194 |

Cash, cash equivalents and restricted cash, at end of period |

| $ | 147,081 | | $ | 121,365 |

Supplemental disclosure of non-cash investing and financing activities: | | |

|

| |

|

Deferred offering costs not yet paid | | $ | 60 | | $ | 148 |

Property and equipment in accounts payable |

| $ | — | | $ | 25 |

See accompanying notes to these unaudited condensed financial statements.

7

Aptinyx Inc.

Condensed Statements of Stockholders’ Equity

(unaudited)

(in thousands)

| | | | | | | | | | | | | | |

| | | | | | | Additional | | | | | Total | ||

| | Common stock | | paid-in | | Accumulated | | stockholders’ | ||||||

| | Shares |

| Amount |

| capital |

| deficit |

| equity | ||||

Balance at December 31, 2019 | | 33,739 | | $ | 337 | | $ | 263,922 | | $ | (162,948) | | $ | 101,311 |

Issuance of common stock upon vesting of restricted stock | | 11 | |

| — | |

| — | |

| — | |

| — |

Stock-based compensation | | — | |

| — | |

| 2,331 | |

| — | |

| 2,331 |

Issuance of common stock upon public offering, net of underwriters’ discount and other offering costs of $1,733 | | 11,692 | | | 117 | | | 33,225 | | | — | | | 33,342 |

Issuance of common stock upon exercise of stock options | | 104 | | | 1 | | | 243 | | | — | | | 244 |

Net loss | | — | |

| — | |

| — | |

| (14,710) | |

| (14,710) |

Balance at March 31, 2020 | | 45,546 | | $ | 455 | | $ | 299,721 | | $ | (177,658) | | $ | 122,518 |

| | | | | | | | | | | | | | |

Balance at December 31, 2020 |

| 63,257 | | $ | 633 | | $ | 358,277 | | $ | (213,001) | | $ | 145,909 |

Issuance of common stock upon vesting of restricted stock |

| 5 | | | — | | | — | | | | | | — |

Repurchase of shares for tax withholdings | | (2) | | | — | | | (7) | | | — | | | (7) |

Stock-based compensation |

| — | | | — | | | 2,655 | | | — | | | 2,655 |

Issuance of common stock upon at the market offering, net of sales commissions and other offering costs of $529 | | 3,630 | | | 36 | | | 14,502 | | | — | | | 14,538 |

Issuance of common stock upon exercise of stock options | | 40 | | | — | | | 72 | | | — | | | 72 |

Net loss |

| — | | | — | | | — | | | (14,226) | | | (14,226) |

Balance at March 31, 2021 |

| 66,930 | | $ | 669 | | $ | 375,499 | | $ | (227,227) | | $ | 148,941 |

| | | | | | | | | | | | | | |

See accompanying notes to the unaudited condensed financial statements.

8

Aptinyx Inc.

Notes to Condensed Financial Statements

(unaudited)

1. Organization

Description of business

Aptinyx Inc. (the “Company” or “Aptinyx”) was incorporated in Delaware on June 24, 2015 and maintains its headquarters in Evanston, Illinois.

Aptinyx is a clinical-stage biopharmaceutical company focused on the discovery, development, and commercialization of novel, proprietary, synthetic small molecules for the treatment of brain and nervous system disorders. Aptinyx has a platform for discovering proprietary compounds that work through a novel mechanism: modulation of N-methyl-D-aspartate receptors (“NMDAr”), which are vital to normal and effective brain and nervous system functions. This mechanism has applicability across numerous brain and nervous system disorders.

Liquidity and capital resources

On July 1, 2019, the Company entered into a Sales Agreement with Cowen and Company, LLC (“Cowen”) pursuant to which the Company may offer and sell shares of its common stock with an aggregate offering price of up to $50.0 million under an “at the market” offering program (the “ATM Offering”). The Sales Agreement provides that Cowen will be entitled to a sales commission equal to 3.0% of the gross sales price per share of all shares sold under the ATM Offering. To date, the Company has sold an aggregate of 5,120,940 shares at a weighted-average price of $3.99 per share for net proceeds of $20.4 million after deducting sales commission and other offering expenses, including 3,629,458 shares for net proceeds of $14.5 million during the three months ended March 31, 2021.

On January 14, 2020, the Company completed a follow-on public offering of its common stock pursuant to an effective registration statement on Form S-3. The Company sold an aggregate of 11,691,666 shares of common stock, which included the exercise in full of the underwriters’ option to purchase additional shares, at a public offering price of $3.00 per share. Net proceeds from the offering were approximately $33.3 million after deducting underwriting discounts and commissions as well as other offering expenses.

On October 26, 2020, the Company completed a follow-on public offering of its common stock pursuant to an effective registration statement on Form S-3. The Company sold an aggregate of 16,100,000 shares of common stock, which included the exercise in full of the underwriters’ option to purchase additional shares, at a public offering price of $3.00 per share. Net proceeds from the offering were approximately $45.1 million after deducting underwriting discounts and commissions as well as estimated offering expenses.

As of March 31, 2021, the Company had cash and cash equivalents of $146.8 million, which the Company believes will be sufficient to funds its planned operations for a period of at least twelve months from the date of issuance of these condensed financial statements.

2.Summary of significant accounting policies

Basis of presentation

The condensed financial statements of the Company included herein have been prepared pursuant to the rules and regulations of the Securities and Exchange Commission (the “SEC”). Certain information and footnote disclosures normally included in financial statements prepared in accordance with accounting principles generally accepted in the United States of America (“GAAP”) have been condensed or omitted from this report, as is permitted by such rules and regulations. The accompanying condensed financial statements reflect all adjustments consisting of normal, recurring adjustments that are necessary for a fair presentation of the financial position, results of operations and cash flows for the interim periods presented. Interim results are not necessarily indicative of results for a full year. Accordingly, these

9

condensed financial statements should be read in conjunction with the financial statements included in the Company’s Annual Report on Form 10-K for the year ended December 31, 2020 (the “Annual Report”) filed with the SEC on March 24, 2021.

From time to time, new accounting pronouncements are issued by the Financial Accounting Standards Board (“FASB”), or other standard setting bodies and adopted by the Company as of the specified effective date. Unless otherwise discussed, the impact of recently issued standards that are not yet effective will not have a material impact on the Company’s financial statements upon adoption. Under the Jumpstart Our Business Startups Act of 2012, as amended (the “JOBS Act”), the Company meets the definition of an emerging growth company, and has elected the extended transition period for complying with new or revised accounting standards, which delays the adoption of these accounting standards until they would apply to private companies.

Use of estimates

The condensed financial statements are prepared in conformity with GAAP. This process requires management to make estimates and assumptions that affect the reported amounts of assets and liabilities and the disclosure of contingent assets and liabilities as of the date of the financial statements and the reported amounts of expenses during the reporting period. Actual results could differ from those estimates.

Risk and uncertainties

The Company’s future results of operations involve a number of risks and uncertainties. Factors that could affect the Company’s future operating results and cause actual results to vary materially from expectations include, but are not limited to, uncertainty of: the impact of COVID-19 on future clinical study results, the scope, timing, rate of progress, and expense of the Company’s ongoing as well as any additional preclinical studies, clinical studies, and other research and development activities, clinical study enrollment rate or design, the manufacturing of the Company’s product candidates, significant and changing government regulation, and the timing and receipt of any regulatory approvals.

A novel strain of coronavirus (COVID-19) was first identified in December 2019, and subsequently declared a global pandemic by the World Health Organization on March 11, 2020. As a result of the outbreak, many companies have experienced disruptions in their operations and in markets served. On March 27, 2020, the Company suspended patient enrollment for certain ongoing Phase 2 clinical studies, including its NYX-2925 studies in painful diabetic peripheral neuropathy and fibromyalgia and its NYX-483 study in Parkinson’s disease cognitive impairment and Lewy body dementia. The Company began re-enrollment in its NYX-2925 study in fibromyalgia in September 2020 and painful diabetic peripheral neuropathy in January 2021 and its NYX-483 study in Parkinson’s disease cognitive impairment and Lewy body dementia in March 2021. The Company has initiated some and may take additional temporary precautionary measures intended to help ensure the well-being of its employees and minimize business disruption. The Company considered the impact of COVID-19 on the assumptions and estimates used and determined that there were no material adverse impacts on the Company’s results of operations and financial position as of and for the three months ended March 31, 2021. The full extent of the future impacts of COVID-19 on the Company’s operations is uncertain. A prolonged outbreak could have a material adverse impact on financial results and business operations of the Company, including the availability of capital, timing and ability of the Company to complete certain clinical studies, and other efforts required to advance the development of its targets.

Significant accounting policies

The Company’s significant accounting policies are described in Note 3, “Summary of significant accounting policies,” in the Annual Report. There have been no material changes to the significant accounting policies during the three months ended March 31, 2021.

Recently issued accounting pronouncement

In February 2016, the FASB issued ASU No. 2016-02, Leases (“ASU 2016-02”), as amended, which requires a lessee to recognize assets and liabilities on the balance sheet for operating leases and changes many key definitions, including the

10

definition of a lease. The new standard includes a short-term lease exception for leases with a term of 12 months or less, as part of which a lessee can make an accounting policy election not to recognize lease assets and lease liabilities. Lessees will continue to differentiate between finance leases (previously referred to as capital leases) and operating leases using classification criteria that are substantially similar to the previous guidance. The new standard will be effective for the Company for annual reporting periods beginning after December 15, 2021 and interim periods within fiscal years beginning after December 15, 2022, and early adoption is permitted. The Company anticipates that the adoption of this standard will have an impact on its balance sheet due to the recognition of right-of-use assets and lease liabilities; however, the Company is currently evaluating the impact that the adoption of ASU 2016-02 may have on its condensed financial statements.

3. Supplemental financial information

Cash, cash equivalents and restricted cash

Cash and cash equivalents consist of cash and, if applicable, highly liquid investments with an original maturity of three months or less when purchased. The following table provides a reconciliation of cash, cash equivalents, and restricted cash reported within the balance sheets that sum to the total of the same such amounts shown in the condensed statements of cash flows (amounts in thousands).

| | As of | | As of | | ||

| | March 31, | | December 31, | | ||

|

| 2021 |

| 2020 |

| ||

Cash and cash equivalents | | $ | 146,810 | | $ | 141,028 | |

Short-term and long-term restricted cash | |

| 271 | |

| 271 | |

Total cash, cash equivalents, and restricted cash shown in the statements of cash flows | | $ | 147,081 | | $ | 141,299 | |

Prepaid expenses and other current assets

Prepaid expenses and other current assets consist of the following (in thousands):

| | As of | | As of | | ||

| | March 31, | | December 31, | | ||

|

| 2021 |

| 2020 |

| ||

Prepaid clinical |

| $ | 2,216 | | $ | 6,052 |

|

Prepaid insurance | | | 636 | | | 1,177 | |

Prepaid manufacturing costs | | | 2,240 | | | 613 | |

Other prepaid expenses and current assets |

|

| 329 | |

| 298 |

|

Total prepaid expenses and other current assets |

| $ | 5,421 | | $ | 8,140 |

|

Accrued expenses and other current liabilities

Accrued expenses and other current liabilities consist of the following (in thousands):

| | As of | | As of | | ||

| | March 31, | | December 31, | | ||

|

| 2021 |

| 2020 |

| ||

Employee-related expenses | | $ | 631 | | $ | 2,039 | |

Development costs and sponsored research | |

| 584 | |

| 897 | |

Clinical trials | |

| 601 | |

| 195 | |

Other | |

| 388 | |

| 243 | |

Total accrued expenses and other current liabilities | | $ | 2,204 | | $ | 3,374 | |

11

4. Research collaboration agreement with Allergan

On July 24, 2015, the Company entered into a Research Collaboration Agreement (“RCA”) with Naurex Inc., a subsidiary of Allergan plc (“Allergan”), which became a wholly owned subsidiary of AbbVie Inc. in May 2020. The RCA is focused on the research and discovery of small molecules that modulate NMDArs. The collaboration is supervised by a Joint Steering Committee (“JSC”) comprising an equal number of representatives from both the Company and Allergan. Under the terms of the agreement, the RCA will terminate upon the earlier of (i) 180 days after a predetermined anniversary of the effective date of the RCA and (ii) the date on which Allergan exercises the last of three options to acquire molecules from a pool of eligible compounds in both cases (clauses (i) and (ii)) subject to potential extension if and as required for the Company to transfer to Allergan information and technology related to compounds that were licensed by Allergan. The jointly funded research activities and option exercise period under the RCA, including the associated payments by Allergan to the Company, came to their contractual conclusion in accordance with the agreement in August 2020 and February 2021, respectively. Under the terms of the agreement, Allergan will pay the Company $1.0 million for each option exercised by Allergan. On February 23, 2021, Allergan exercised its option to acquire exclusive rights to develop and commercialize AGN-281705 within a predefined set of indications. For the three months ended March 31, 2021, the Company recognized the $1.0 million non-refundable milestone payment within collaboration revenue in the statements of operations as there were no remaining performance obligations associated with the optioned compound.

The Company concluded that Allergan meets the definition of a customer, and therefore concluded that the RCA represents a contract with a customer that falls within the scope of ASC 606.

Performance obligations

The Company identified the following promised goods or services within the RCA:

| ● | Research Licenses – the Company provides access to exclusive licenses under all of the Company’s NMDAr technologies, during the research term for the sole purpose of conducting research and development activities (the “Research Licenses”). Historically, the Company’s licenses have held no value to the customer on a standalone basis, as the research compounds were in the early discovery phase and required the Company’s expertise for further development. Accordingly, the Research Licenses are not considered distinct. |

| ● | Research and Development Services – the Company provides research and development services that are performed on behalf of, or with, Allergan (the “Research and Development Services”). As discussed within Research Licenses above, the Company’s licenses have historically held no value without the specialized Research and Development Services. As the Company generally only provides Research and Development Services for internally generated small molecules that modulate NMDArs which require a license to be utilized by a third party, the Research and Development Services are not considered distinct. |

| ● | Joint Steering Committee – the Company actively participates in a joint steering committee, which allows the Company and its collaboration partner to direct the progression and prioritization of the joint discovery programs. As the JSC would not occur or benefit the customer without the use of the Research Licenses and the related Research and Development Services, and given the Company’s proprietary knowledge of the Research Licenses and the NMDAr technologies, this is not considered distinct. |

The Company also evaluated whether the option granted to the customer to acquire additional goods or services represented a material right at contract inception. Upon Allergan’s exercise of one of its options, the Company is obligated to transfer control of all intellectual property relating to the optioned compound to Allergan, after which the Company has no further interest in, or continuing involvement with, such optioned compound. The Company evaluated the customer options for material rights, that is, whether the option was to acquire additional goods or services for free or at a discount, and concluded that the options are priced, at contract inception, at standalone selling price. Consequently, the customer options do not represent a performance obligation at the outset of the arrangement since they are contingent upon the option exercise which is outside of the Company’s control.

The Company has concluded that there is a single combined performance obligation (comprising the Research Licenses, Research and Development Services, and participation in the JSC) which is satisfied over time, as the Research and

12

Development Services are performed. The exercise of the option to acquire exclusive rights to develop and commercialize AGN-241751 or AGN-281705 are not considered a performance obligation until the time of option exercise.

Transaction price

The RCA includes both fixed and variable consideration. Fixed payments, such as contractually defined fees per full-time employee (“FTE”), are included in the transaction price at contract inception, while variable consideration, such as reimbursement for Research and Development Services, are estimated and then evaluated for constraints upon inception of the contract and evaluated on a quarterly basis thereafter. Research and Development Services are updated for actual invoices. There were no capitalized costs associated with obtaining the contract.

The Company uses an input method to measure proportional performance and to calculate the corresponding amount of revenue to recognize. The Company uses fixed FTE efforts and variable out-of-pocket costs as actual costs incurred relative to the annual budget research plan to measure progress towards fulfillment of the performance obligation. An input method of revenue recognition requires management to make estimates of costs to complete the Company’s performance obligations. In making such estimates, significant judgment is required to evaluate assumptions related to cost estimates. The cumulative effect of revisions to estimated costs to complete the Company’s performance obligations will be recorded in the period in which changes are identified and amounts can be reasonably estimated. The Company does not anticipate significant changes as the research plan is reviewed and adjusted annually and approved by the JSC. There are no significant financing components in the contract.

The Company has determined that the option fee is representative of standalone selling price and concluded that it will recognize revenue for the option fee at a point in time, on the date of exercise, due to the significant uncertainty of whether or not Allergan would exercise the option. The Company recognizes the option fee at a point in time because control of the underlying intellectual property transfers to the customer, and the customer is able to use and benefit from the license. The Company has no further rights, interests, or remaining performance obligations associated with any optioned compound, once exercised.

During the three months ended March 31, 2021 and 2020, the Company recorded expenses of $0.0 million and $1.6 million, respectively, for certain development activities in accordance with the terms of the RCA, of which 50% was reimbursed by Allergan. The Company received reimbursements of $0.0 million and $0.8 million during the three months ended March 31, 2021 and 2020, respectively. Such reimbursements were reported within collaboration revenue in the condensed statements of operations. All of the Company’s accounts receivable as of December 31, 2020 relate to amounts owed by Allergan under the RCA.

5. Fair value measurements

ASC 820, Fair Value Measurement (“ASC 820”), establishes a fair value hierarchy for instruments measured at fair value that distinguishes between assumptions based on market data (observable inputs) and the Company’s own assumptions (unobservable inputs). ASC 820 identifies fair value as the exchange price, or exit price, representing the amount that would be received to sell an asset or paid to transfer a liability in an orderly transaction between market participants. As a basis for considering market participant assumptions in fair value measurements, ASC 820 establishes a three-tier fair value hierarchy that distinguishes between the following:

| ● | Level 1 inputs are quoted prices (unadjusted) in active markets for identical assets or liabilities; |

| ● | Level 2 inputs are inputs other than quoted prices included within Level 1 that are observable for the asset or liability, either directly or indirectly; and |

| ● | Level 3 inputs are unobservable inputs that reflect the Company’s own assumptions about the assumptions market participants would use in pricing the asset or liability. Financial assets and liabilities are classified in their entirety based on the lowest level of input that is significant to the fair value measurement. |

13

To the extent that the valuation is based on models or inputs that are less observable or unobservable in the market, the determination of fair value requires more judgment. Accordingly, the degree of judgment exercised by the Company in determining fair value is greatest for instruments categorized in Level 3. A financial instrument’s level within the fair value hierarchy is based on the lowest level of any input that is significant to the fair value measurement.

The carrying values reported in the Company’s balance sheets for cash and cash equivalents, restricted cash, accounts receivable, accounts payable, and accrued expenses are reasonable estimates of their fair values due to the short-term nature of these items.

Assets measured at fair value as of March 31, 2021 are as follows (in thousands):

| | | | | | | | | ||||

| | | | | | | | | | |||

| | | | | | | | | | |||

| | | | | | | | | | |||

| | March 31, | | | | | | | ||||

|

| 2021 |

| Level 1 |

| Level 2 |

| Level 3 | ||||

Assets | | | | | | | | | | | | |

Money market funds, included in cash and cash equivalents | | $ | 144,347 | | $ | 144,347 | | $ | — | | $ | — |

Money market funds, included in restricted cash | | | 179 | | | 179 | |

| — | |

| — |

Money market funds, included in other assets | |

| 92 | |

| 92 | |

| — | |

| — |

| | $ | 144,618 | | $ | 144,618 | | $ | — | | $ | — |

Assets measured at fair value as of December 31, 2020 are as follows (in thousands):

| | | | | | | | | | |||

| | | | | | | | | | | ||

| | | | | | | | | | |||

| | | | | | | | | | |||

| | December 31, | | | | | | | ||||

|

| 2020 |

| Level 1 |

| Level 2 |

| Level 3 | ||||

Assets |

| |

|

| |

|

| |

|

| |

|

Money market funds, included in cash and cash equivalents | | $ | 140,283 | | $ | 140,283 | | $ | — | | $ | — |

Money market funds, included in restricted cash | | | 179 | | | 179 | |

| — | |

| — |

Money market funds, included in other assets | | | 92 | |

| 92 | |

| — | |

| — |

| | $ | 140,554 | | $ | 140,554 | | $ | — | | $ | — |

6. Property and equipment, net

Property and equipment are as follows (in thousands):

| | As of | | As of | | ||

| | March 31, | | December 31, | | ||

| | 2021 |

| 2020 |

| ||

Computer software and equipment | | $ | — |

| $ | 15 | |

Office equipment and furniture | |

| 152 | |

| 176 | |

Laboratory equipment | |

| 541 | |

| 1,801 | |

Leasehold improvements | |

| 979 | |

| 1,062 | |

Less accumulated depreciation | |

| (1,284) | |

| (2,144) | |

Property and equipment, net | | $ | 388 | | $ | 910 | |

Depreciation expense was $0.4 million and $0.1 million for each of the three months ended March 31, 2021 and 2020, respectively. The Company disposed of certain laboratory equipment during the three months ended March 31, 2021 that were fully depreciated at the time of disposal.

14

7. Stock incentive plans

On June 5, 2018, the Company’s stockholders approved the 2018 Stock Option and Incentive Plan (the “2018 Plan”), which became effective on June 20, 2018. The 2018 Plan provides for an annual increase, to be added on the first day of each fiscal year, of up to 4% of the Company’s outstanding shares of common stock as of the last day of the prior year. On January 1, 2021, 2,530,267 shares of common stock were added to the 2018 Plan. The number of shares available for grant under the Company’s 2018 Plan as of March 31, 2021 was 2,481,006.

Stock-based compensation expense

Non-cash stock-based compensation expense recognized in the accompanying condensed statements of operations relating to stock options, restricted stock awards, and restricted stock units for the three months ended March 31, 2021 and 2020 was as follows (in thousands):

| | Three months ended | | ||||

| | March 31, | | ||||

|

| 2021 |

| 2020 |

| ||

Research and development | | $ | 737 | | $ | 456 | |

General and administrative | |

| 1,918 | |

| 1,875 | |

Total stock‑based compensation expense | | $ | 2,655 | | $ | 2,331 | |

Stock options

The table below summarizes activity related to stock options (in thousands, except per share amounts):

|

| |

| | |

| Weighted‑ |

| | |

| | | | Weighted‑ | | average | | | | |

| | | | average | | remaining | | Aggregate | ||

| | | | exercise | | contractual | | intrinsic | ||

Options | | Shares | | price | | term | | value | ||

Outstanding, December 31, 2020 |

| 6,684 | | $ | 6.88 |

| 7.96 | | $ | 1,582 |

Granted |

| 2,342 | |

| 3.80 |

|

| |

|

|

Exercised | | (40) | | | 1.79 | | | | | |

Forfeited and canceled |

| (47) | |

| 6.14 |

|

| |

|

|

Outstanding, March 31, 2021 | | 8,939 | | $ | 6.10 | | 8.34 | | $ | 374 |

Vested and expected to vest at March 31, 2021 | | 8,939 | | $ | 6.10 | | 8.34 | | $ | 374 |

Exercisable at March 31, 2021 |

| 3,881 | | $ | 7.06 |

| 7.24 | | $ | 374 |

During the three months ended March 31, 2021 and 2020, the Company granted 2.3 million and 1.9 million stock options, respectively and these options had a weighted-average grant-date fair value of $2.98 and $2.04 per share, respectively. The weighted-average grant-date fair value of options was determined using the Black-Scholes option-pricing model. The assumptions used in the Black-Scholes option-pricing model for options granted during the three months ended March 31, 2021 were similar to those as described in the Annual Report, except for the manner in which the expected volatility was determined. The expected volatility for the Company’s options granted during the three months ended March 31, 2021 is based on a weighted-average of the historical volatility of share values of publicly traded companies within the biotechnology industry which includes the historical volatility of the Company’s stock since the IPO. As of March 31, 2021, there was $18.5 million of total unrecognized stock-based compensation expense related to non-vested stock options which is expected to be recognized over a weighted-average period of 2.7 years. The options have a ten-year life and generally vest over a period of four years, subject to continuous employment.

15

Restricted stock units

In June 2020 and May 2019, the Company issued an aggregate of 205,200 and 1,183,400 restricted stock units, respectively, to employees. The restricted stock units issued in 2020 vest ten months from the date of grant. The restricted stock units issued in 2019 vest two years from the date of grant. The Company at any time may accelerate the vesting of the restricted stock units. Such shares are not accounted for as outstanding until they vest.

The table below summarizes activity related to restricted stock units (in thousands, except per share amounts):

|

| |

| Weighted‑ | |

| | | | average | |

| | | | grant date | |

| | | | fair value | |

| | Shares | | per share | |

Unvested as of December 31, 2020 |

| 1,091 | | $ | 3.63 |

Issued |

| — | | $ | — |

Vested |

| (5) | | | 3.63 |

Forfeited and canceled |

| (1) | |

| 3.63 |

Unvested as of March 31, 2021 |

| 1,085 | | $ | 3.63 |

Non-cash restricted stock unit award expense recognized in the accompanying condensed statements of operations was $0.6 million and $0.4 million for the three months ended March 31, 2021 and 2020, respectively. At March 31, 2021, there was $0.2 million of unrecognized stock-based compensation related to 1,084,700 unvested restricted stock units that will be recognized as expense over a weighted-average period of 0.1 years.

8. Net loss per share

Basic and diluted net loss per share attributable to common stockholders was calculated as follows for the three months ended March 31, 2021 and 2020 (in thousands, except per share data):

| | Three months ended | | ||||

| | March 31, | | ||||

|

| 2021 |

| 2020 |

| ||

Numerator: | | | | | | | |

Net loss attributable to common stockholders | | $ | (14,226) | | $ | (14,710) | |

Denominator: | |

|

| |

|

| |

Weighted-average common shares outstanding—basic and diluted | |

| 66,043 | |

| 43,835 | |

Net loss per share attributable to common stockholders—basic and diluted | | $ | (0.22) | | $ | (0.34) | |

The following common stock equivalents outstanding as of March 31, 2021 and 2020, were excluded from the computation of diluted net loss per share attributable to common stockholders for the periods presented because including them would have been anti-dilutive (in thousands):

| | As of | ||

| | March 31, | ||

|

| 2021 |

| 2020 |

Stock options issued and outstanding |

| 8,939 |

| 6,419 |

Unvested restricted stock | | 1,085 | | 967 |

Total |

| 10,024 |

| 7,386 |

16

9. Income taxes

Deferred tax assets and liabilities are determined based on the difference between the financial statement and tax bases of assets and liabilities using enacted tax rates in effect for the year in which the differences are expected to reverse. Valuation allowances are provided if based upon the weight of available evidence, it is more likely than not that some or all of the deferred tax assets will not be realized. The Company has evaluated the positive and negative evidence bearing upon the realizability of its deferred tax assets, including its net operating losses. Based on its history of operating losses, the Company believes that it is more likely than not that the benefit of its deferred tax assets will not be realized. Accordingly, the Company has provided a full valuation allowance for deferred tax assets as of March 31, 2021 and December 31, 2020.

10. Commitments and contingencies

Contingencies

From time to time, the Company may be subject to occasional lawsuits, investigations, and claims arising out of the normal conduct of business. The Company has no significant pending or threatened litigation as of March 31, 2021.

Indemnifications

In the normal course of business, the Company enters into contracts that contain a variety of indemnifications with its employees, licensors, suppliers and service providers. Further, the Company indemnifies its directors and officers who are, or were, serving at the Company’s request in such capacities. The Company’s maximum exposure under these arrangements is unknown at March 31, 2021. The Company does not anticipate recognizing any significant losses relating to these arrangements.

Leases

The Company enters into various non-cancelable, operating lease agreements for its facilities and equipment in order to conduct its operations. The Company expenses rent on a straight-line basis over the life of the lease and has recorded deferred rent on the Company’s balance sheets within both accrued expenses and other current liabilities and other long-term liabilities.

Total rent expense, inclusive of lease incentives, under all the operating lease agreements amounted to $0.2 million for each of the three months ended March 31, 2021 and 2020, respectively.

17

Item 2. Management’s Discussion and Analysis of Financial Condition and Results of Operations.

The following discussion should be read in conjunction with our condensed financial statements and accompanying footnotes appearing elsewhere in this Quarterly Report on Form 10-Q and our audited financial statements and related footnotes included in our Annual Report on Form 10-K for the year ended December 31, 2020, or Annual Report, filed with the Securities and Exchange Commission, or the SEC, on March 24, 2021.

Some of the information contained in this discussion and analysis or set forth elsewhere in this Quarterly Report on Form 10-Q, including information with respect to our plans and strategy for our business, includes forward-looking statements that involve risks and uncertainties. See “Special Note Regarding Forward-Looking Statements.” Because of many factors, including those factors set forth in the “Risk Factors” section of our Annual Report, our actual results could differ materially from the results described in or implied by the forward-looking statements contained in the following discussion and analysis. We do not assume any obligation to update any forward-looking statements, whether as a result of new information, future events, or otherwise, except as required by law.

Overview

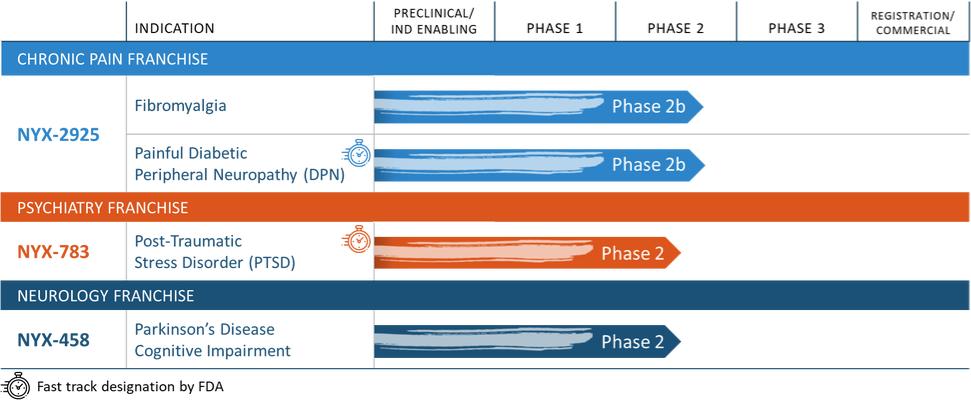

We are a clinical-stage biopharmaceutical company focused on the discovery, development, and commercialization of novel, proprietary, synthetic small molecules for the treatment of brain and nervous system disorders. We focus our efforts on targeting and modulating N-methyl-D-aspartate receptors, or NMDArs, which are vital to normal and effective function of the brain and nervous system. We believe leveraging the therapeutic advantages of the differentiated modulatory mechanism of our compounds will drive a paradigm shift in the treatment of disorders of the brain and nervous system. We are advancing a pipeline of distinct product candidates derived from our NMDAr modulator discovery platform, or the discovery platform. The following table summarizes the current status of our development programs as of the date of this quarterly report.

18

NYX-2925 is in clinical development for the treatment of chronic pain. NYX-2925 is being evaluated in two Phase 2b studies in two chronic pain conditions: one evaluating the efficacy and safety in approximately 200 patients with painful diabetic peripheral neuropathy, or painful DPN, and the other evaluating the efficacy and safety in approximately 300 patients with fibromyalgia. NYX-783 is in clinical development for the treatment of post-traumatic stress disorder, or PTSD. Based on the findings from our recently completed exploratory Phase 2 study of NYX-783 in patients with PTSD, and following a Type C meeting with the U.S. Food and Drug Adminisration, we plan to advance NYX-783 into a Phase 2b study. NYX-458 is in Phase 2 clinical development for the treatment of cognitive impairment associated with Parkinson’s disease and dementia with Lewy bodies. We recently recommenced a Phase 2 exploratory study following its suspension in March of 2020 due to challenges introduced by the COVID-19 pandemic.

We do not expect to generate revenue from product sales unless and until we successfully complete clinical development and obtain regulatory approval for a product candidate, which we expect will take a number of years and the outcome of which is uncertain, or enter into collaborative agreements with third parties, the timing of which is largely beyond our control and may never occur. To fund our current and future operating plans, we will need additional capital, which we may obtain through one or more equity offerings, debt financings, or other third-party funding, including potential strategic alliances and licensing or collaboration arrangements. We may, however, be unable to raise additional funds or enter into such other arrangements when needed on favorable terms or at all, including as a result of COVID-19. Our failure to raise capital or enter into such other arrangements as and when needed would have a negative impact on our financial condition and our ability to develop our current product candidates, or any additional product candidates, if developed. The amount and timing of our future funding requirements will depend on many factors, including the impacts of COVID-19, our ability to successfully enroll subjects in a timely way for the clinical studies, and the pace and results of our preclinical and clinical development efforts. We cannot assure you that we will ever be profitable or generate positive cash flow from operating activities.

The COVID-19 pandemic has and could further adversely impact our clinical and/or preclinical studies, as well as our business operations. We continue to evaluate the impact of the COVID-19 pandemic on patients and our employees, as well as our operations and the operations of our business partners and healthcare communities. In response to the COVID-19 pandemic, we have implemented policies to mitigate the risk of exposure to COVID-19 by our personnel, including restrictions on the number of staff in any given research and development laboratory or manufacturing facility, a work-from-home policy applicable to the majority of our personnel, and a phased approach to bringing personnel back to our locations over time. However, the ultimate impact of the COVID-19 pandemic on our business operations is highly uncertain and subject to change and will depend on future developments which are difficult to predict.

Since our inception in June 2015, we have never generated revenue from the sale of our products and have incurred significant net losses. Our nominal revenues have been primarily derived from a research collaboration agreement with Allergan plc, or Allergan, a development services agreement with Allergan, and research and development grants from the U.S. government. While these revenues offset a small portion of the costs associated with our early stage research and discovery efforts, we do not rely on these revenues to fund our operations. In connection with the natural conclusion of our research collaboration with Allergan in August 2020, we do not expect to continue to receive revenues from this collaboration.

From our inception through March 31, 2021, we have raised an aggregate of $135.0 million of gross proceeds from sales of our convertible preferred stock, $117.8 million of gross proceeds from our initial public offering, or IPO and $104.4 million of gross proceeds from our follow-on public offerings and our “at the market” offering program, or the ATM Offering. See “Liquidity and capital resources.” Our net losses were $50.1 million and $57.4 million for the years ended December 31, 2020 and 2019, respectively, and $14.2 million and $14.7 million for the three months ended March 31, 2021 and 2020, respectively. As of March 31, 2021, we had an accumulated deficit of $227.2 million. Our net losses may fluctuate significantly from quarter to quarter and year to year. We expect to continue to incur significant expenses and operating losses for the foreseeable future. We anticipate that our expenses will continue to increase in connection with our ongoing activities.

We believe that our available funds will be sufficient to fund our operations for at least the next twelve months. We have based this estimate on assumptions that may prove to be wrong, and we could utilize our available capital resources sooner than we currently expect. We do not expect to generate revenue from product sales unless and until we

19

successfully complete clinical development and obtain regulatory approval for a product candidate, which we expect will take a number of years and the outcome of which is uncertain, or enter into collaborative agreements with third parties, the timing of which is largely beyond our control and may never occur. To fund our current and future operating plans, we will need additional capital, which we may obtain through one or more equity offerings, debt financings, or other third-party funding, including potential strategic alliances and licensing or collaboration arrangements. We may, however, be unable to raise additional funds or enter into such other arrangements when needed on favorable terms or at all, including as a result of COVID-19. Our failure to raise capital or enter into such other arrangements as and when needed would have a negative impact on our financial condition and our ability to develop our current product candidates, or any additional product candidates, if developed. The amount and timing of our future funding requirements will depend on many factors, including the impacts of COVID-19, our ability to timely and successfully enroll subjects in our clinical studies, and the pace and results of our preclinical and clinical development efforts. We cannot assure you that we will ever be profitable or generate positive cash flow from operating activities.

Financial operations overview

Revenues

We have not generated any revenue from product sales. We are unable to predict when, if ever, material net cash inflows will commence from sales of our products, if approved. Our revenue to date has been primarily derived from a research collaboration agreement with Allergan (now a subsidiary of AbbVie), under which the jointly funded research activities and option exercise period, including the associated payments by Allergan, came to their contractual conclusion in August 2020 and February 2021, respectively; a development services agreement with Allergan, which was put in place to continue certain development activities for a pre-determined period of time following Allergan's acquisition of Naurex Inc.; and research and development grants from the U.S. government that have no repayment or royalty obligations and none of which are currently outstanding.

Operating expenses

Research and development expenses

Research and development activities account for a significant portion of our operating expenses. We expense research and development costs as incurred. Research and development expenses consist of costs incurred in connection with the development of our product candidates, including:

| ● | fees paid to consultants, sponsored researchers, contract manufacturing organizations, or CMOs, and contract research organizations, or CROs, including in connection with our preclinical and clinical studies, and other related clinical study fees, such as for investigator grants, patient screening, laboratory work, clinical study database management, and statistical compilation and analysis; |

| ● | costs related to acquiring and maintaining preclinical and clinical study materials and facilities; |

| ● | costs related to compliance with regulatory requirements; and |

| ● | costs related to salaries, bonuses, and other compensation for employees in research and development functions. |

At this time, we cannot reasonably estimate or know the nature, timing, and costs of the efforts that will be necessary to complete the development of our product candidates. This is due to the numerous risks and uncertainties associated with developing such product candidates, including the uncertainty related to:

| ● | the impacts of COVID-19; |

| ● | future clinical study results; the scope, rate of progress, and expense of our ongoing as well as any additional preclinical studies, clinical studies and other research and development activities; |

| ● | clinical study enrollment rate or design; |

| ● | the manufacturing of our product candidates; |

| ● | our ability to obtain and maintain intellectual property protection for our product candidates; |

| ● | significant and changing government regulation; |

20

| ● | establishing commercial manufacturing capabilities or making arrangements with third-party manufacturers, developing and timely delivery of commercial-grade drug formulations that can be used in our clinical trials and for commercial launch; |

| ● | the timing and receipt of regulatory approvals, if any; and |

| ● | the risks disclosed in the section entitled “Risk Factors” of our Annual Report. |

A change in the outcome of any of these variables with respect to the development of any of our product candidates could significantly change the costs, timing, and viability associated with the development of that product candidate.

We expect our research and development expenses to increase over the next several years as we continue to implement our business strategy, which includes advancing our product candidates into and through clinical development, expanding our research and development efforts, seeking regulatory approvals for any product candidates for which we successfully complete clinical studies, accessing and developing additional product candidates, and hiring additional personnel to support our research and development efforts. In addition, product candidates in later stages of clinical development generally incur higher development costs than those in earlier stages of clinical development, primarily due to the increased size and duration of later-stage clinical studies. As such, we expect our research and development expenses to increase as our product candidates advance into later stages of clinical development.

General and administrative expenses

General and administrative expenses consist primarily of salaries and related costs, including stock-based compensation. General and administrative expenses also include rent as well as professional fees for legal, consulting, accounting, and audit services.

In the future, we expect that our general and administrative expenses will increase as we continue to support our research and development and the potential commercialization of our product candidates, if approved. We also anticipate that we will incur increased accounting, audit, legal, tax, regulatory, compliance, and director and officer insurance costs, as well as investor and public relations expenses associated with maintaining compliance with exchange listing and SEC requirements.

Other income

Other income consists primarily of the interest income earned on our cash and cash equivalents.

Comparison of the three months ended March 31, 2021 and 2020

The following table summarizes our results of operations for the three months ended March 31, 2021 and 2020 (in thousands):

|

| Three months |

| | | ||||

| | ended March 31, | | Increase | |||||

|

| 2021 |

| 2020 |

| (Decrease) | |||

Revenues: | | | | | | | | | |

Collaboration revenue | | $ | 1,000 | | $ | 818 | | $ | 182 |

Operating expenses: | |

|

| |

| | |

|

|

Research and development | |

| 10,314 | |

| 11,055 | |

| (741) |

General and administrative | |

| 4,976 | |

| 4,899 | |

| 77 |

Total operating expenses | |

| 15,290 | |

| 15,954 | |

| (664) |

Loss from operations | |

| (14,290) | |

| (15,136) | |

| (846) |

Other income | |

| 64 | |

| 426 | |

| (362) |

Net loss and comprehensive loss | | $ | (14,226) | | $ | (14,710) | | $ | (484) |

21

Collaboration revenue

Collaboration revenue was $1.0 million and $0.8 million for the three months ended March 31, 2021 and 2020 and was attributable to our research collaboration with Allergan. The jointly funded research activities and option exercise period under the research collaboration and the associated payments by Allergan came to their contractual conclusion in August 2020 and February 2021, respectively.

Research and development expenses

The following table summarizes our research and development expenses incurred during the three months ended March 31, 2021 and 2020 (in thousands):

|

| Three months |

| | | ||||

| | ended March 31, | | Increase | |||||

|

| 2021 |

| 2020 |

| (Decrease) | |||

NYX-2925 | | $ | 5,779 | | $ | 4,607 | | $ | 1,172 |

NYX-783 | |

| 777 | |

| 1,820 | |

| (1,043) |

NYX-458 | |

| 536 | |

| 1,451 | |

| (915) |

Preclinical research and discovery programs | |

| 893 | |

| 1,078 | |

| (185) |

Personnel and related costs | |

| 2,329 | |

| 2,099 | |

| 230 |

Total research and development expenses | | $ | 10,314 | | $ | 11,055 | | $ | (741) |

Research and development expenses were $10.3 million for the three months ended March 31, 2021, compared to $11.1 million for the three months ended March 31, 2020. The decrease of $0.7 million was primarily due to the following:

| ● | approximately $1.2 million increase related to enrollment in our two chronic pain studies of NYX-2925 – in September 2020 and January 2021, we recommenced study activities in our Phase 2b clinical study in patients with fibromyalgia and in our Phase 2b clinical study in patients with painful DPN; |

| ● | approximately $1.0 million decrease for clinical, regulatory, and drug product costs related to the ongoing development of NYX-783 due to the conclusion of the Phase 2 study in October 2020; and |

| ● | approximately $0.9 million decrease related to the ongoing development of NYX-458 for the treatment of Lewy body dementia – in March 2021 we recommenced our Phase 2 exploratory study of NYX-458 in patients with Lewy body dementia. |

General and administrative expenses

General and administrative expenses were $5.0 million for the three months ended March 31, 2021, compared to $4.9 million for the three months ended March 31, 2020.

Other income

We recorded $0.1 million and $0.4 million of other income for the three months ended March 31, 2021 and 2020, respectively. This decrease was primarily driven by a decrease in interest income earned on our cash and cash equivalents.

Liquidity and capital resources

From our inception through March 31, 2021, we have incurred significant operating losses and have funded our operations to date through proceeds from collaborations, grants, sales of convertible preferred stock, IPO and follow-on public offerings and our ATM Offering. We have generated limited revenue to date from a research collaboration agreement with Allergan, a development services agreement with Allergan, and research and development grants from the U.S. government. The jointly funded research activities and option exercise period under the research collaboration

22

agreement with Allergan, as well as associated payments by Allergan to us, came to their contractual conclusion in August 2020 and February 2021, respectively.

On June 25, 2018, we completed our IPO, pursuant to which we issued and sold 7,359,998 shares of our common stock at a price of $16.00 per share, which included 959,999 shares sold pursuant to the exercise of the underwriters’ option to purchase additional shares. We received $106.5 million of proceeds, net of underwriting discounts and commissions and other offering expenses.

On July 1, 2019, we entered into a Sales Agreement, or the Sales Agreement, with Cowen and Company, LLC, or Cowen, pursuant to which we may issue and sell, from time to time, shares of our common stock having an aggregate offering price of up to $50.0 million through Cowen as sales agent. Cowen may sell common stock by any method permitted by law deemed to be an “at the market offering” as defined in Rule 415(a)(4) of the Securities Act, including sales made directly on or through the Nasdaq Global Select Market or any other existing trade market for the common stock, in negotiated transactions at market prices prevailing at the time of sale or at prices related to prevailing market prices, or any other method permitted by law. Cowen will be entitled to receive 3.0% of the gross sales price per share of common stock sold under the Sales Agreement. To date, we have issued and sold an aggregate of 5,120,910 shares of common stock pursuant to the Sales Agreement at a weighted-average price of $3.99 per share with net proceeds of approximately $20.4 million after deducting sales commissions and other offering expenses, including $14.5 million of net proceeds from the sale of 3,629,458 shares at a weighted-average price of $4.03 per share during the three months ended March 31, 2021.

On January 14, 2020, we completed a follow-on public offering of our common stock pursuant to an effective registration statement on Form S-3. We sold an aggregate of 11,691,666 shares of common stock, which included the exercise in full of the underwriters’ option to purchase additional shares, at a public offering price of $3.00 per share. Net proceeds from the offering were approximately $33.3 million after deducting underwriting discounts and commissions as well as other offering expenses.

On October 26, 2020, we completed a follow-on public offering of its common stock pursuant to an effective registration statement on Form S-3. We sold an aggregate of 16,100,000 shares of common stock, which included the exercise in full of the underwriters’ option to purchase additional shares, at a public offering price of $3.00 per share. Net proceeds from the offering were approximately $45.1 million after deducting underwriting discounts and commissions as well as estimated offering expenses.

As of March 31, 2021, we had cash and cash equivalents of $146.8 million. We invest our cash equivalents in liquid money market accounts.

Funding requirements

Our primary uses of capital are, and we expect will continue to be, research and development activities, compensation and related expenses, product manufacturing, laboratory and related supplies, legal, and other regulatory expenses, patent prosecution filing and maintenance costs for our licensed intellectual property, and general overhead costs. We expect to continue incurring significant expenses and operating losses for the foreseeable future. In addition, since the closing of our IPO, we have incurred, and expect to incur, additional costs associated with operating as a public company. We anticipate that our expenses will increase in connection with our ongoing activities, as we:

| ● | seek to address and recover from impacts of the COVID-19 pandemic, including delays to our product development timelines; |

| ● | advance the clinical development of our lead product candidates; |

| ● | continue to improve the manufacturing process for our product candidates and manufacture clinical supplies as our development progresses; |

| ● | continue the research and development of our preclinical product candidates; |

| ● | seek to identify and develop additional product candidates; |

| ● | maintain, expand, and protect our intellectual property portfolio; and |

23

| ● | improve our operational, financial, and management systems to support our clinical development and other operations. |

Outlook

Based on our research and development plans and our timing expectations related to the progress of our programs, we expect that our cash and cash equivalents as of March 31, 2021 will be sufficient to fund our operations for at least the next 12 months. We have based this estimate on assumptions that may prove to be wrong, and we could utilize our available capital resources sooner than we currently expect.

We do not expect to generate revenue from product sales unless and until we successfully complete clinical development and obtain regulatory approval for a product candidate, which we expect will take a number of years and the outcome of which is uncertain, or enter into collaborative agreements with third parties, the timing of which is largely beyond our control and may never occur. We will continue to require additional capital to develop our product candidates and fund operations for the foreseeable future, which we may obtain through one or more equity offerings, debt financings, or other third-party funding, including potential strategic alliances and licensing or collaboration arrangements. We may, however, be unable to raise additional funds or enter into such other arrangements when needed on favorable terms or at all, including as a result of the COVID-19 pandemic. Our failure to raise capital or enter into such other arrangements as and when needed would have a negative impact on our financial condition and our ability to develop our current product candidates, or any additional product candidates, if developed. The amount and timing of our future funding requirements will depend on many factors, including the effects of the COVID-19 pandemic, our ability to timely and successfully enroll subjects in our clinical studies and the pace and results of our preclinical and clinical development efforts. We cannot assure you that we will ever be profitable or generate positive cash flow from operating activities.

Cash flows

The following table summarizes our sources and uses of cash for each of the three months ended March 31, 2021 and 2020 (in thousands):

| | Three months ended | ||||

| | March 31, | ||||

|

| 2021 |

| 2020 | ||

Net cash provided by (used in): | | | | | | |

Operating activities | | $ | (8,984) | | $ | (11,553) |

Investing activities | |

| 90 | | | (11) |

Financing activities | |

| 14,676 | | | 33,735 |

Net increase in cash, cash equivalents and restricted cash | | $ | 5,782 | | $ | 22,171 |

Operating activities

For the three months ended March 31 2021, compared to the same period in 2020, the $2.6 million decrease in net cash used in operating activities was primarily due to a $0.5 million decrease in our net loss year over year, driven mostly by lower research and development expenses, a decrease in the use of cash of $1.5 million due to changes in working capital largely driven by timing of cash paid to support our clinical research programs, offset by a $0.6 million increase in non-cash expenses related to depreciation and stock-based compensation.

Investing activities

For the three months ended March 31, 2021, compared to the same period in 2020, the $0.1 million increase in net cash provided by investing activities was primarily due to proceeds from disposal of lab equipment.

24

Financing activities

For the three months ended March 31, 2021, compared to the same period in 2020, the $19.1 million decrease in net cash provided by financing activities was primarily due to $33.5 million of net proceeds received from our January 2020 follow-on public compared to $14.6 million of net proceeds received from our January 2021 ATM Offering, respectively, net of underwriting discounts and commissions and other offering expenses.

Critical accounting policies and significant judgments and estimates

This discussion and analysis of our financial condition and results of operations is based on our financial statements, which we have prepared in accordance with United States generally accepted accounting principles. The preparation of our financial statements and related disclosures requires us to make estimates, assumptions and judgments that affect the reported amount of assets, liabilities, revenue, costs and expenses, and related disclosures. Our critical accounting policies are described under the heading “Management’s Discussion and Analysis of Financial Condition and Results of Operations— Critical Accounting Policies and Significant Judgments and Estimates” in our Annual Report. There were no material changes to our critical accounting policies through March 31, 2021 from those discussed in our Annual Report.

Recent accounting pronouncements

See Note 2 to our condensed financial statements included elsewhere in this Quarterly Report on Form 10-Q.

JOBS Act accounting election