Attached files

| file | filename |

|---|---|

| 8-K - 8-K - Sonos Inc | sono-20210512.htm |

Sonos Reports Record Second Quarter Fiscal 2021 Results Raises Fiscal 2021 Outlook Santa Barbara, CA - May 12, 2021 - Sonos, Inc. (Nasdaq: SONO) today reported record second quarter fiscal 2021 results. Second Quarter 2021 Financial Highlights (unaudited) ● GAAP net income (loss) increased to $17.2 million from ($52.3) million last year; non-GAAP net income (loss) excluding stock-based compensation, restructuring and legal and transaction related fees increased to $44.6 million from ($37.2) million last year. ● GAAP diluted earnings per share (EPS) increased to $0.12 from ($0.48) last year; non-GAAP diluted earnings per share (EPS) excluding stock-based compensation, restructuring, and legal and transaction related fees increased to $0.31 from ($0.34) last year. ● Adjusted EBITDA increased to $48.5 million from ($28.4) million last year. ● Adjusted EBITDA margin increased to 14.6% from (16.2%) last year. ● Gross margin increased 810 basis points to 49.8% from 41.7% last year. ● Revenue increased 90% year-over-year to $332.9 million; on a constant-currency basis, revenue increased approximately 83% year-over-year. Sonos CEO Patrick Spence commented, “We are thrilled to report another record quarter at Sonos, as demand for our products continues to exceed even our heightened expectations. The power of our model is that customers can start with one product and expand to more over time, and our customers continue to prove they do just that. Based on our outstanding second quarter performance, the continued strong demand for our products, and the power and profitability of our unique business model, we are raising our outlook for fiscal 2021 again.” Mr. Spence continued, “Our increased fiscal 2021 revenue outlook still assumes Sonos will account for only approximately 9% of the total spend in the $18 billion premium home audio market1, and an even smaller fraction of the broader $89 billion global audio market2 we expect to expand into over the long-term. We are truly just scratching the surface toward realizing our long-term opportunity. The future is bright for Sonos.” Mr. Spence concluded, “We remain focused on our key three strategic initiatives - the expansion of our brand, the expansion of our offerings, and driving operational excellence - and continue to see a clear path toward achieving our fiscal 2024 targets of $2.25 billion revenue, 45% to 47% gross margin, and 15% to 18% adjusted EBITDA margin. We are

extremely well positioned to deliver significant free cash flow and increased shareholder value over the long-term.” Fiscal 2021 Outlook ● Adjusted EBITDA increased to a range of $225 million to $250 million representing growth in the range of 107% to 130%. ○ This compares to our prior outlook of $195 million to $225 million, representing growth in the range of 80% to 107% and our initial fiscal 2021 outlook provided at the start of the fiscal year of $170 million to $205 million, representing growth in the range of 57% to 89%. ● Adjusted EBITDA margin increased to a range of 13.8% to 14.9%, representing a 560 to 670 basis point improvement year-over-year. ○ This compares to our prior outlook range of 12.8% to 14.3%, representing a 460 to 610 basis point improvement and our initial fiscal 2021 outlook of 12% to 14%, representing a 380 to 580 basis point improvement. ● Gross margin in the range of 46.0% to 46.5%, representing a 288 to 338 basis point improvement year-over-year. ○ Our fiscal 2021 gross margin outlook reflects minimal impact from ongoing tariffs and does not include the $27.5 million in tariff refunds expected due to timing uncertainty. ○ This is consistent with our prior guidance range of 46.0% to 46.5% and compares to our initial fiscal 2021 outlook of 45.3% to 45.8%. ● Revenue increased to a range of $1.625 billion to $1.675 billion, representing growth in the range of 23% to 26% year-over-year (25% to 29% on a comparable basis excluding the 53rd week in fiscal 2020). ○ This compares to our prior guidance range of $1.525 billion to $1.575 billion, representing growth in the range of 15% to 19% from fiscal 2020 (17% to 21% excluding the 53rd week in fiscal 2020) and our initial fiscal 2021 outlook of $1.44 billion to $1.5 billion, or 9% to 13% growth (11% to 15% excluding the 53rd week in fiscal 2020). 1 “Premium” defined as $100+ wireless speakers, $200+ soundbars, $300+ Hi-Fi systems, $250+ in-wall/in-ceiling speakers, $250+ bookshelf speakers (pairs), and all AV receivers, Floor standing speakers, home theater speakers and home theater in a box products and Hi-Fi separates. Source: Futuresource. 2 Source: Futuresource. Supplemental Earnings Presentation The Company has posted a supplemental earnings presentation accompanying its second quarter fiscal 2021 results to the Earnings Reports section of its investor relations website at https://investors.sonos.com/reports-and-filings/default.aspx#section=earningsreports. Conference Call, Webcast and Transcript

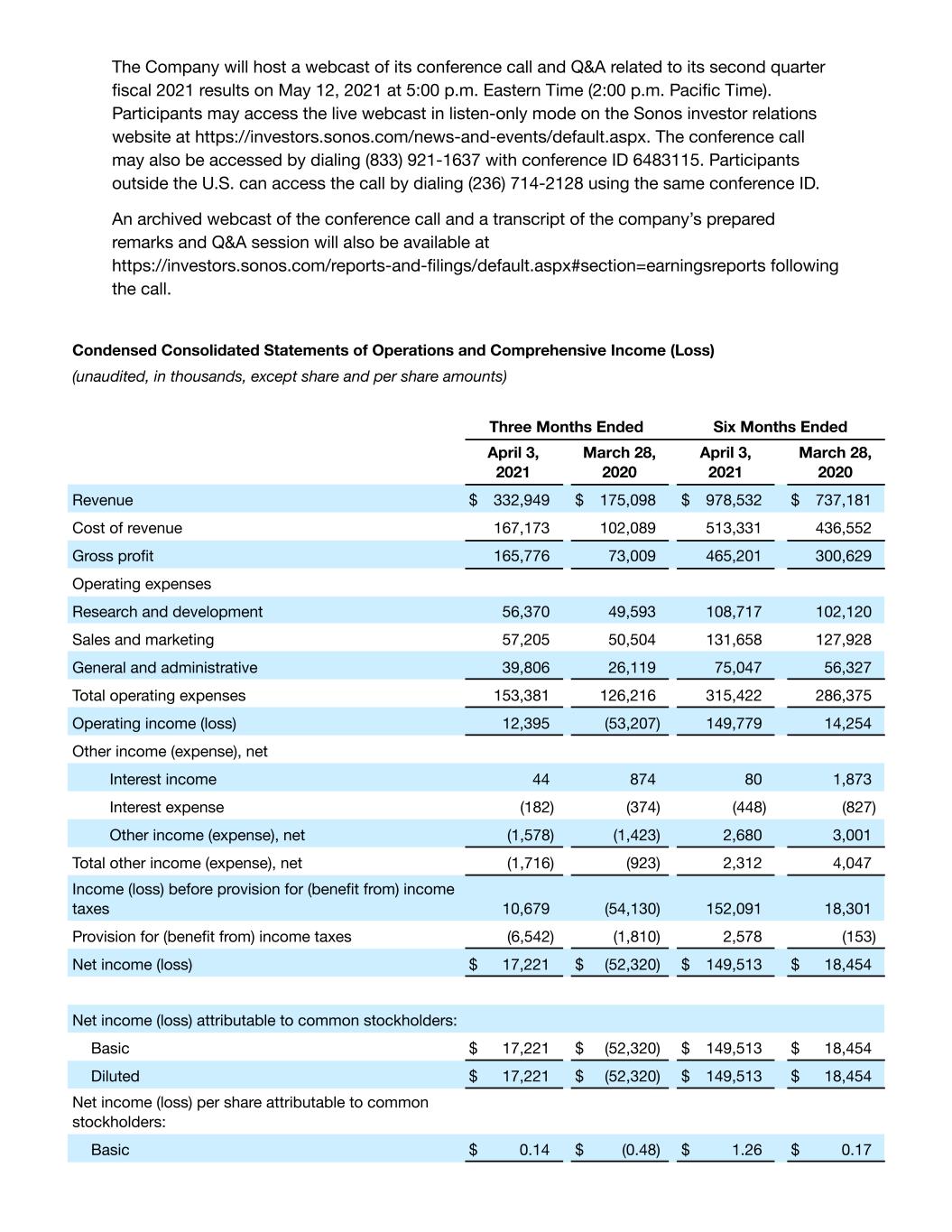

The Company will host a webcast of its conference call and Q&A related to its second quarter fiscal 2021 results on May 12, 2021 at 5:00 p.m. Eastern Time (2:00 p.m. Pacific Time). Participants may access the live webcast in listen-only mode on the Sonos investor relations website at https://investors.sonos.com/news-and-events/default.aspx. The conference call may also be accessed by dialing (833) 921-1637 with conference ID 6483115. Participants outside the U.S. can access the call by dialing (236) 714-2128 using the same conference ID. An archived webcast of the conference call and a transcript of the company’s prepared remarks and Q&A session will also be available at https://investors.sonos.com/reports-and-filings/default.aspx#section=earningsreports following the call. Condensed Consolidated Statements of Operations and Comprehensive Income (Loss) (unaudited, in thousands, except share and per share amounts) Three Months Ended Six Months Ended April 3, 2021 March 28, 2020 April 3, 2021 March 28, 2020 Revenue $ 332,949 $ 175,098 $ 978,532 $ 737,181 Cost of revenue 167,173 102,089 513,331 436,552 Gross profit 165,776 73,009 465,201 300,629 Operating expenses Research and development 56,370 49,593 108,717 102,120 Sales and marketing 57,205 50,504 131,658 127,928 General and administrative 39,806 26,119 75,047 56,327 Total operating expenses 153,381 126,216 315,422 286,375 Operating income (loss) 12,395 (53,207) 149,779 14,254 Other income (expense), net Interest income 44 874 80 1,873 Interest expense (182) (374) (448) (827) Other income (expense), net (1,578) (1,423) 2,680 3,001 Total other income (expense), net (1,716) (923) 2,312 4,047 Income (loss) before provision for (benefit from) income taxes 10,679 (54,130) 152,091 18,301 Provision for (benefit from) income taxes (6,542) (1,810) 2,578 (153) Net income (loss) $ 17,221 $ (52,320) $ 149,513 $ 18,454 Net income (loss) attributable to common stockholders: Basic $ 17,221 $ (52,320) $ 149,513 $ 18,454 Diluted $ 17,221 $ (52,320) $ 149,513 $ 18,454 Net income (loss) per share attributable to common stockholders: Basic $ 0.14 $ (0.48) $ 1.26 $ 0.17

Diluted $ 0.12 $ (0.48) $ 1.09 $ 0.16 Weighted-average shares used in computing net income (loss) per share attributable to common stockholders: Basic 121,880,615 109,515,049 118,745,569 109,249,866 Diluted 143,055,546 109,515,049 136,849,846 117,819,569 Total comprehensive income (loss) Net income (loss) $ 17,221 $ (52,320) $ 149,513 $ 18,454 Change in foreign currency translation adjustment 199 (431) 1,046 (950) Comprehensive income (loss) $ 17,420 $ (52,751) $ 150,559 $ 17,504

Condensed Consolidated Balance Sheets (unaudited, dollars in thousands, except par values) As of April 3, 2021 October 3, 2020 Assets Current assets: Cash and cash equivalents $ 638,927 $ 407,100 Restricted cash 192 191 Accounts receivable, net of allowances 69,690 54,935 Inventories 139,581 180,830 Prepaids and other current assets 31,763 17,321 Total current assets 880,153 660,377 Property and equipment, net 65,509 60,784 Operating lease right-of-use assets 39,061 42,342 Goodwill 15,545 15,545 Intangible assets, net 25,434 26,394 Deferred tax assets 1,984 1,800 Other noncurrent assets 20,600 8,809 Total assets $ 1,048,286 $ 816,051 Liabilities and stockholders’ equity Current liabilities: Accounts payable $ 203,585 $ 250,328 Accrued expenses 61,659 45,049 Accrued compensation 46,665 44,517 Short-term debt — 6,667 Deferred revenue, current 18,392 15,304 Other current liabilities 40,770 31,150 Total current liabilities 371,071 393,015 Operating lease liabilities, noncurrent 39,361 50,360 Long-term debt — 18,251 Deferred revenue, noncurrent 52,497 47,085 Deferred tax liabilities 2,394 2,434 Other noncurrent liabilities 3,695 7,067 Total liabilities 469,018 518,212 Stockholders’ equity: Common stock, $0.001 par value 126 114 Treasury stock (26,023) (20,886) Additional paid-in capital 684,988 548,993

Accumulated deficit (78,979) (228,492) Accumulated other comprehensive loss (844) (1,890) Total stockholders’ equity 579,268 297,839 Total liabilities and stockholders’ equity $ 1,048,286 $ 816,051

Condensed Consolidated Statements of Cash Flows (unaudited, dollars in thousands) Six Months Ended April 3, 2021 March 28, 2020 Cash flows from operating activities Net income $ 149,513 $ 18,454 Adjustments to reconcile net income to net cash provided by operating activities Depreciation and amortization 16,725 18,831 Stock-based compensation expense 31,207 26,598 Other 344 2,989 Deferred income taxes (146) 74 Foreign currency transaction gain (1,047) (420) Changes in operating assets and liabilities: Accounts receivable, net (13,260) 63,344 Inventories 39,631 106,245 Other assets (21,982) (9,690) Accounts payable and accrued expenses (36,485) (191,070) Accrued compensation 2,087 (14,443) Deferred revenue 8,374 3,729 Other liabilities 992 10,727 Net cash provided by operating activities 175,953 35,368 Cash flows from investing activities Purchases of property and equipment, intangible and other assets (19,927) (25,800) Cash paid for acquisition, net of acquired cash — (36,289) Net cash used in investing activities (19,927) (62,089) Cash flows from financing activities Repayments of borrowings (25,000) (3,333) Payments for repurchase of common stock (682) (33,216) Proceeds from exercise of common stock options 119,166 12,585 Payments for repurchase of common stock related to shares withheld for tax in connection with vesting of restricted stock units (18,821) (4,596) Net cash provided by (used in) financing activities 74,663 (28,560) Effect of exchange rate changes on cash, cash equivalents and restricted cash 1,139 (107) Net increase (decrease) in cash, cash equivalents and restricted cash 231,828 (55,388) Cash, cash equivalents and restricted cash Beginning of period 407,291 338,820 End of period $ 639,119 $ 283,432 Supplemental disclosure

Cash paid for interest $ 357 $ 851 Cash paid for taxes, net of refunds 3,255 1,025 Cash paid for amounts included in the measurement of lease liabilities 11,683 7,346 Supplemental disclosure of non-cash investing and financing activities Purchases of property and equipment in accounts payable and accrued expenses $ 8,910 $ 3,270 Right-of-use assets obtained in exchange for new operating lease liabilities 1,622 75,642

Reconciliation of Net Income (Loss) to Adjusted EBITDA (unaudited, dollars in thousands) Three Months Ended Six Months Ended April 3, 2021 March 28, 2020 April 3, 2021 March 28, 2020 Net income (loss) $ 17,221 $ (52,320) $ 149,513 $ 18,454 Add (deduct): Depreciation and amortization 8,742 9,726 16,725 18,831 Stock-based compensation expense 16,363 13,394 31,207 26,598 Interest income (44) (874) (80) (1,873) Interest expense 182 374 448 827 Other (income) expense, net 1,578 1,423 (2,680) (3,001) Provision for (benefit from) income taxes (6,542) (1,810) 2,578 (153) Restructuring and related expenses (1) — — (2,611) — Legal and transaction related costs (2) 11,013 1,705 19,679 5,153 Adjusted EBITDA $ 48,513 $ (28,382) $ 214,779 $ 64,836 Revenue $ 332,949 $ 175,098 $ 978,532 $ 737,181 Adjusted EBITDA margin 14.6 % (16.2) % 21.9 % 8.8 % (1) Restructuring and related expenses for the six months ended April 3, 2021 includes a gain of $2.8 million, related to our negotiation for the early termination of a facility lease that was part of the 2020 restructuring plan. The gain represents the difference between the related operating lease liability and previously accrued restructuring expenses versus the early termination payment. For a description of the 2020 restructuring plan, see “Restructuring and Related Costs” below. (2) Legal and transaction related costs consist of expenses related to our intellectual property ("IP") litigation against Alphabet Inc. and Google LLC as well as legal and transaction costs associated with our acquisition activity, which we do not consider representative of our underlying operating performance.

Reconciliation of Cash Flows Provided by Operating Activities to Free Cash Flow (unaudited, dollars in thousands) Six Months Ended April 3, 2021 March 28, 2020 Cash flows provided by operating activities $ 175,953 $ 35,368 Less: Purchases of property and equipment, intangible and other assets (19,927) (25,800) Free cash flow $ 156,026 $ 9,568 Revenue by Product Category (unaudited, dollars in thousands) Three Months Ended Six Months Ended April 3, 2021 March 28, 2020 April 3, 2021 March 28, 2020 Sonos speakers $ 267,534 $ 116,367 $ 795,050 $ 583,044 Sonos system products 52,062 47,202 149,820 108,723 Partner products and other revenue 13,353 11,529 33,662 45,414 Total revenue $ 332,949 $ 175,098 $ 978,532 $ 737,181 Revenue by Geographical Region (unaudited, dollars in thousands) Three Months Ended Six Months Ended April 3, 2021 March 28, 2020 April 3, 2021 March 28, 2020 Americas $ 193,938 $ 101,964 $ 561,177 $ 405,158 Europe, Middle East and Africa ("EMEA") 114,306 57,252 354,313 269,990 Asia Pacific ("APAC") 24,705 15,882 63,042 62,033 Total revenue $ 332,949 $ 175,098 $ 978,532 $ 737,181

Stock-based Compensation (unaudited, dollars in thousands) Three Months Ended Six Months Ended April 3, 2021 March 28, 2020 April 3, 2021 March 28, 2020 Cost of revenue $ 261 $ 278 $ 474 $ 561 Research and development 6,683 5,427 12,942 10,543 Sales and marketing 3,632 3,407 7,040 6,948 General and administrative 5,787 4,282 10,751 8,546 Total stock-based compensation expense $ 16,363 $ 13,394 $ 31,207 $ 26,598 Restructuring and Related Costs(1) (unaudited, dollars in thousands) Three Months Ended Six Months Ended April 3, 2021 April 3, 2021 Research and development $ — $ 25 Sales and marketing — (2,636 ) Total restructuring and related costs $ — $ (2,611 ) (1) On June 23, 2020, we initiated a restructuring plan as part of our efforts to reduce operating expenses and preserve liquidity due to the uncertainty and challenges stemming from the COVID-19 pandemic. As part of the 2020 restructuring plan, we eliminated approximately 12% of our global headcount and closed our New York retail store and six satellite offices. We believe these initiatives will better align our resources to provide further operating flexibility and more efficiently position our business for our long-term strategy. Activities under the 2020 restructuring plan were substantially completed in the first quarter of fiscal 2021. In the first quarter of fiscal 2021, we negotiated the early termination of a facility lease that was part of the 2020 restructuring and recorded a gain of $2.8 million, representing the difference between the related operating lease liability and previously accrued restructuring expenses versus the early termination payment. The gain was recognized as a credit in sales and marketing expenses on the condensed consolidated statements of operations and comprehensive income. Use of Non-GAAP Measures We have provided in this press release financial information that has not been prepared in accordance with generally accepted accounting principles (“U.S. GAAP”), including adjusted EBITDA, adjusted EBITDA margin, free cash flow, net income excluding stock-based compensation, restructuring, and legal and transaction related fees, and diluted earnings per share (EPS) excluding stock-based compensation, restructuring, and legal and transaction related fees. These non-GAAP financial measures are not based on any standardized methodology prescribed by U.S. GAAP and are not necessarily comparable to similarly titled measures presented by other companies. We use these non-GAAP financial measures to evaluate our operating performance and trends and make planning decisions. We believe that these non-GAAP financial measures help identify underlying trends in our business that could

otherwise be masked by the effect of the expenses and other items that we exclude in these non-GAAP financial measures. Accordingly, we believe that these non-GAAP financial measures provide useful information to investors and others in understanding and evaluating our operating results, enhancing the overall understanding of our past performance and future prospects, and allowing for greater transparency with respect to a key financial metric used by our management in its financial and operational decision-making. Non-GAAP financial measures should not be considered in isolation of, or as an alternative to, measures prepared in accordance with U.S. GAAP. Investors are encouraged to review the reconciliation of these financial measures to their nearest U.S. GAAP financial equivalents provided in the financial statement tables above. We define adjusted EBITDA as net income adjusted to exclude the impact of depreciation, stock-based compensation expense, interest income, interest expense, other income (expense), income taxes and other items that we do not consider representative of our underlying operating performance. We define adjusted EBITDA margin as adjusted EBITDA divided by revenue. We define free cash flow as net cash from operations less purchases of property and equipment and intangible assets. We calculate non-GAAP net income excluding stock-based compensation, restructuring and legal and transaction related fees as net income less stock-based compensation, restructuring fees and legal and transaction related fees. We calculate non-GAAP diluted earnings per share (EPS) excluding stock-based compensation, restructuring, and legal and transaction related fees as net income less stock-based compensation, restructuring costs and legal and transaction related fees divided by our number of shares at fiscal year end. We do not provide a reconciliation of forward-looking non-GAAP financial measures to their comparable GAAP financial measures because we cannot do so without unreasonable effort due to unavailability of information needed to calculate reconciling items and due to the variability, complexity and limited visibility of the adjusting items that would be excluded from the non-GAAP financial measures in future periods. When planning, forecasting and analyzing future periods, we do so primarily on a non-GAAP basis without preparing a GAAP analysis as that would require estimates for items such as stock-based compensation, which is inherently difficult to predict with reasonable accuracy. Stock-based compensation expense is difficult to estimate because it depends on our future hiring and retention needs, as well as the future fair market value of our common stock, all of which are difficult to predict and subject to constant change. In addition, for purposes of setting annual guidance, it would be difficult to quantify stock-based compensation expense for the year with reasonable accuracy in the current quarter. As a result, we do not believe that a GAAP reconciliation would provide meaningful supplemental information about our outlook. Forward Looking Statements This press release contains forward-looking statements that involve risks and uncertainties. These forward-looking statements include statements regarding our outlook for the fiscal year ended October 2, 2021, our long-term focus, financial, growth and business strategies and opportunities, growth metrics and targets, our business model, new products, services and partnerships, profitability and gross margins, our direct-to-consumer efforts, our market share,and other factors affecting variability in our financial results. These forward-looking statements are only predictions and may differ materially from actual results due to a variety of factors, including, but not limited to the duration and impact of the COVID-19 pandemic and related mitigation efforts on our industry and our supply chain; supply chain challenges, including shipping and logistics challenges and significant limits on component supplies; changes in general economic or market conditions that could affect consumer income and

overall consumer spending; our ability to successfully introduce new products and services and maintain or expand the success of our existing products; the success of our efforts to expand our direct-to-consumer channel; the success of our financial, growth and business strategies; our ability to meet and accurately forecast product demand and manage any product availability delays; and the other risk factors set forth under the caption “Risk Factors” in our Quarterly Report on Form 10-Q for the quarter ended January 2, 2021 and our other filings filed with the Securities and Exchange Commission (the “SEC”), copies of which are available free of charge at the SEC’s website at www.sec.gov or upon request from our investor relations department. All forward-looking statements herein reflect our opinions only as of the date of this press release, and we undertake no obligation, and expressly disclaim any obligation, to update forward-looking statements herein in light of new information or future events. Sonos and Sonos product names are trademarks or registered trademarks of Sonos, Inc. All other product names and services may be trademarks or service marks of their respective owners. About Sonos Sonos (Nasdaq: SONO) is one of the world’s leading sound experience brands. As the inventor of multi-room wireless home audio, Sonos’ innovation helps the world listen better by giving people access to the content they love and allowing them to control it however they choose. Known for delivering an unparalleled sound experience, thoughtful home design aesthetic, simplicity of use and an open platform, Sonos makes the breadth of audio content available to anyone. Sonos is headquartered in Santa Barbara, California. Learn more at www.sonos.com. Investor Contact Cammeron McLaughlin IR@ sonos.com Press Contact Tom Lodge PR@sonos.com Source: Sonos