Attached files

| file | filename |

|---|---|

| 8-K - CURRENT REPORT - Western New England Bancorp, Inc. | wneb-8k_051121.htm |

Exhibit 99.1

1 2021 Annual Shareholders’ Meeting May 11, 2021

Board of Directors James C . Hagan, President & Chief Executive Officer Lisa G . McMahon , Chairperson of the Board Laura Benoit , Director Donna J . Damon , Director Gary G . Fitzgerald , Director William D . Masse , Director Gregg F . Orlen , Director Paul C . Picknelly , Director Steven G . Richter , Director Philip R . Smith , Director 47 Palomba Drive, Enfield, CT 2

Welcome to the Western New England Bancorp 2021 Annual Shareholders’ Meeting James C. Hagan President Chief Executive Officer 3

4 Board of Directors Western New England Bancorp

Board of Directors 5 In 2020 , we proudly announced that Lisa G . McMahon was elected Chairperson of Western New England Bancorp’s Board of Directors . Ms . McMahon’s historic appointment makes her the first female Chairperson in the organization’s 168 - year history . A WNEB board member since 2014 , Ms . McMahon is currently the Director of Institutional Advancement and Stewardship at Westfield State University . Prior to joining Westfield State University, she was employed by Merrill Lynch where she obtained both her general securities license and license to become a registered investment advisor representative . Ms . McMahon currently serves as President of the Westfield Academy Foundation . Ms . McMahon is past President of the executive board of the Genesis Center, a division of the Sisters of Providence Health Systems . From 2007 - 2012 , Ms . McMahon has served on multiple community boards and committees in various leadership roles . Ms . McMahon received a Bachelor of Science degree from Our Lady of the Elms College .

Introduction of Guests Paul M. Maleck , Law Offices of Doherty, Wallace, Pillsbury & Murphy, Inspector of Elections John J. Doherty, CPA, CGMA, Wolf & Company, Independent Auditor Richard Quad, Griffin Financial, Investment Banker 655 Main Street, Agawam, MA 6

Senior Management Team James C . Hagan, President & Chief Executive Officer Guida R . Sajdak, Executive Vice President & Chief Financial Officer Allen J . Miles, III, Executive Vice President & Chief Lending Officer Kevin C . O’Connor, Executive Vice President & Chief Banking Officer John E . Bonini , Senior Vice President & General Counsel Louis O . Gorman, Senior Vice President & Chief Credit Officer Cidalia Inacio , Senior Vice President, Retail Banking & Wealth Management Darlene Libiszewski , Senior Vice President & Chief Information Officer Deborah J . McCarthy, Senior Vice President, Deposit Operations & Electronic Banking Christine Phillips, Senior Vice President, Human Resources Director Leo R . Sagan, Jr . , Senior Vice President & Chief Risk Officer 7

Senior Management Team 8 Christine Phillips, Senior Vice President, Human Resources Director . Christine is a member of the Society of Human Resources Management and earned her BA from the University of Massachusetts and is currently enrolled in the MBA program at the Isenberg School of Management at the University of Massachusetts . John E . Bonini, Senior Vice President, General Counsel . John earned his BA from Wesleyan University and graduated cum laude with a JD from Suffolk University Law School . In 2020 , we welcomed two new Senior Officers :

Proposals Proposal 1: Election of Directors to serve a three year term: • James C. Hagan • William D. Masse • Gregg F. Orlen • Phillip R. Smith Proposal 2: An Advisory, Non - Binding Vote on Executive Compensation “ Say on Pay” Proposal 3: Ratification of Independent Registered Public Accounting Firm for the year ending December 31, 2021: • Wolf & Company, P.C. Proposal 4: Approval of the 2021 Omnibus Plan 9 599 Memorial Drive, Chicopee, MA

Voting Results Paul M. Maleck Inspector of Elections 300 Southampton Road, Westfield, MA 10

Financial Results for 2020 and First Quarter 2021 Guida R. Sajdak Executive Vice President Chief Financial Officer 11

We may, from time to time, make written or oral “forward - looking statements” within the meaning of the Private Securities Litigation Reform Act of 1995 , including statements contained in our filings with the Securities and Exchange Commission (the “SEC”), our reports to shareholders and in other communications by us . This presentation contains “forward - looking statements” with respect to the Company’s financial condition, liquidity, results of operations, future performance, business, measures being taken in response to the coronavirus disease 2019 (“COVID - 19 ") pandemic and the impact of COVID - 19 on the Company’s business . Forward - looking statements may be identified by the use of such words as “believe,” “expect,” “anticipate,” “should,” “planned,” “estimated,” and “potential . ” Examples of forward - looking statements include, but are not limited to, estimates with respect to our financial condition, results of operations and business that are subject to various factors which could cause actual results to differ materially from these estimates . These factors include, but are not limited to : the duration and scope of the COVID - 19 pandemic and the local, national and global impact of COVID - 19 ; actions governments, businesses and individuals take in response to the COVID - 19 pandemic ; the speed and effectiveness of vaccine and treatment developments and their deployment, including public adoption rates of COVID - 19 vaccines ; the pace of recovery when the COVID - 19 pandemic subsides ; changes in the interest rate environment that reduce margins ; the effect on our operations of governmental legislation and regulation, including changes in accounting regulation or standards, the nature and timing of the adoption and effectiveness of new requirements under the Dodd - Frank Act Wall Street Reform and Consumer Protection Act of 2010 (“Dodd - Frank Act”), Basel guidelines, capital requirements and other applicable laws and regulations ; the highly competitive industry and market area in which we operate ; general economic conditions, either nationally or regionally, resulting in, among other things, a deterioration in credit quality ; changes in business conditions and inflation ; changes in credit market conditions ; the inability to realize expected cost savings or achieve other anticipated benefits in connection with business combinations and other acquisitions ; changes in the securities markets which affect investment management revenues ; increases in Federal Deposit Insurance Corporation deposit insurance premiums and assessments ; changes in technology used in the banking business ; the soundness of other financial services institutions which may adversely affect our credit risk ; certain of our intangible assets may become impaired in the future ; our controls and procedures may fail or be circumvented ; new lines of business or new products and services, which may subject us to additional risks ; changes in key management personnel which may adversely impact our operations ; severe weather, natural disasters, acts of war or terrorism and other external events which could significantly impact our business ; and other factors detailed from time to time in our SEC filings . Although we believe that the expectations reflected in such forward - looking statements are reasonable, actual results may differ materially from the results discussed in these forward - looking statements. You are cautioned not to place undue reliance on these forward - looki ng statements, which speak only as of the date hereof. We do not undertake any obligation to republish revised forward - looking statements to r eflect events or circumstances after the date hereof or to reflect the occurrence of unanticipated events, except to the extent required by la w. Forward Looking Statements 12

2020 Quarterly Earnings 13 4Q2020 3Q2020 2Q2020 1Q2020 Net interest income $ 18,795 $ 15,990 $ 15,092 $ 14,553 Provision for loan losses 500 2,725 2,450 2,100 Non - interest income 2,462 2,177 2,087 2,525 Non - interest expense 14,338 12,853 12,245 12,314 Income before taxes 6,419 2,589 2,484 2,664 Income tax expense 1,406 488 463 584 Net income $ 5,013 $ 2,101 $ 2,021 $ 2,080 Diluted earnings per share $ 0.20 $ 0.08 $ 0.08 $ 0.08 Return on average assets 0.83% 0.35% 0.35% 0.38% Return on average equity 8.62% 3.61% 3.54% 3.62% Pre - Provision Net Revenue (PPNR) $6,919 $5,314 $4,934 $4,764 PPNR/Average Assets 1.14% 0.88% 0.84% 0.88% 1 1 Pre - provision net revenue equals net interest income plus total non - interest income less total non - interest expense ($ in thousands, except EPS)

Balance Sheet Transformation 55% 37% Loans and Securities (% of Total Assets) 2014 Loans Securities (1) Includes $167 million in Small Business Administration Paycheck Protection Program Loans (“PPP”) (2) Data as of December 31 st 81% 9% Loans and Securities (% of Total Assets) 2020 Loans (1) Securities 23% 63% 2% Deposits & Borrowings (% of Total Assets) 2020 Demand Interest-Bearing Borrowings 10% 53% 25% Deposits & Borrowings (% of Total Assets) 2014 Demand Interest-Bearing Borrowings 14

Growing and Strengthening Balance Sheet 54.8% 60.8% 75.2% 78.1% 80.1% 81.4% 81.5% 45% 55% 65% 75% 85% 95% Loan to Asset Ratio 86.7% 90.4% 102.9% 108.3% 106.3% 105.9% 94.6% 80% 90% 100% 110% 120% Loan to Deposit Ratio 37.4% 31.4% 14.5% 13.8% 12.3% 10.8% 9.0% 5% 15% 25% 35% 45% Securities to Asset Ratio 24.7% 21.0% 14.3% 14.9% 12.6% 11.0% 2.5% 0% 5% 10% 15% 20% 25% 30% Borrowings to Total Assets ** Chicopee Bancorp, Inc. acquisition completed on October 21, 2016 Data as of December 31 st 15

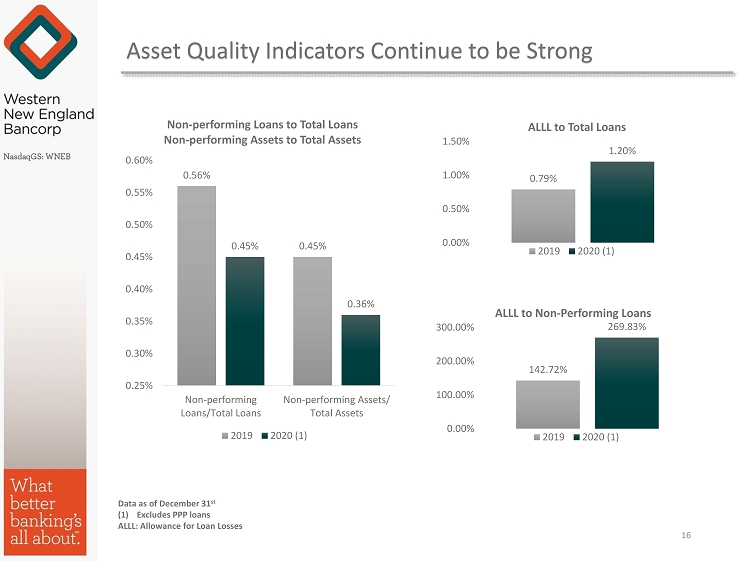

Asset Quality Indicators Continue to be Strong 0.56% 0.45% 0.45% 0.36% 0.25% 0.30% 0.35% 0.40% 0.45% 0.50% 0.55% 0.60% Non-performing Loans/Total Loans Non-performing Assets/ Total Assets Non - performing Loans to Total Loans Non - performing Assets to Total Assets 2019 2020 (1) Data as of December 31 st (1) Excludes PPP loans ALLL: Allowance for Loan Losses 16 0.79% 1.20% 0.00% 0.50% 1.00% 1.50% ALLL to Total Loans 2019 2020 (1) 142.72% 269.83% 0.00% 100.00% 200.00% 300.00% ALLL to Non - Performing Loans 2019 2020 (1)

COVID - 19 Update 17 At the beginning of the pandemic, the Executive Management Team immediately created a COVID - 19 Task Force to execute a pandemic response and take action to address the initial and ongoing needs of impacted customers and employees. EMPLOYEES • Focused on employee well - being, p hysical w orkspaces , t raining & o n - going communication and education; • Implemented health and safety protocols to protect staff; • Introduced full - time remote and hybrid work arrangements to minimize exposure to COVID - 19; and • Continue to encouraged vaccination for employees by granting “paid time off”. CUSTOMERS • Fully re - opened lobbies to customers on March 15, 2021 (previously open through appointment and drive - up service); • Participated in the PPP loan program and funded $295 million, or 2,046 loans to new and existing customers ; • Provided loan deferrals under the CARES Act to consumers and businesses; and • Waived late charges on consumer and business loans from April 2020 through September 2020.

COVID - 19 Update 18 SBA PAYCHECK PROTECTION PROGRAM • The Company started accepting applications from current and new customers on April 6 , 2020 ; • As of March 31 , 2021 , the Company received SBA funding approval for 2 , 046 applications totaling $ 294 . 7 million ; • As of March 31 , 2021 , the Company processed 1 , 046 loan forgiveness applications totaling $ 124 . 6 million . The outstanding balance as of March 31 , 2021 was $ 170 . 1 million ; • The average PPP balance was $ 142 , 000 with an average fee of 3 . 4 % ; • $ 10 . 1 million in fee income generated from PPP ( $ 3 . 3 million earned in 2020 and $ 2 . 0 million earned in 1 Q 2021 ) ; • Approximately $ 60 . 0 million, or 20 % of the PPP applications, were from new customers, representing 373 new relationships . $150K or less 18% $150 - $350K 14% $350K - $500K 7% $500K - $1.0M 16% $1.0M - $2.0M 14% +$2.0M 31% $150K or less $150-$350K $350K-$500K $500K-$1.0M $1.0M-$2.0M +$2.0M $ of Remaining PPP Loans by Size as of March 31, 2021 $150K or less 80% $150 - $350K 11% $350K - $500K , 3% $500K - $1.0M 4% $1.0M - $2.0M 1% +$2.0M 1% $150K or less $150-$350K $350K-$500K $500K-$1.0M $1.0M-$2.0M +$2.0M # of Remaining PPP Loans by Size a s of March 31, 2021

1 st Quarter of 2021 1Q2021 4Q2020 1Q2020 EPS $0.24 $0.20 $0.08 Earnings per Share 1Q2021 4Q2020 1Q2020 ROAA 0.98% 0.83% 0.38% Return on Average Assets Return on Average Equity 1Q2021 4Q2020 1Q2020 ROAE 10.35% 8.62% 3.62% 1Q2021 4Q2020 1Q2020 Net Interest Margin, tax - equivalent basis 3.26% 3.32% 2.89% Net Interest Margin March 31, 2021 March 31, 2020 Change in $ Change in % Total Loans $1.925 billion $1.804 billion $120.7 million 6.7% Total Deposits $2.154 billion $1,706 billion $448.1 million 26.3% Loan/Deposit Ratio 89% 106% 19 March 31, 2021 includes $170.1 million in PPP loans.

Who We Are Every day, we focus on showing Westfield Bank customers “ what better banking is all about . ” For us, the idea of better banking starts with putting customers first, while adhering to our core values . Our Core Values : • Integrity • Enhance Shareholder Value • Customer Focus • Community Focus Our Core Mission : The Company’s purpose drives the outcome we envision for Western New England Bancorp . Our purpose is to help customers succeed in our community, while creating and increasing shareholder value . 20 70 Center Street, Chicopee, MA.

Connecticut Strategy 21

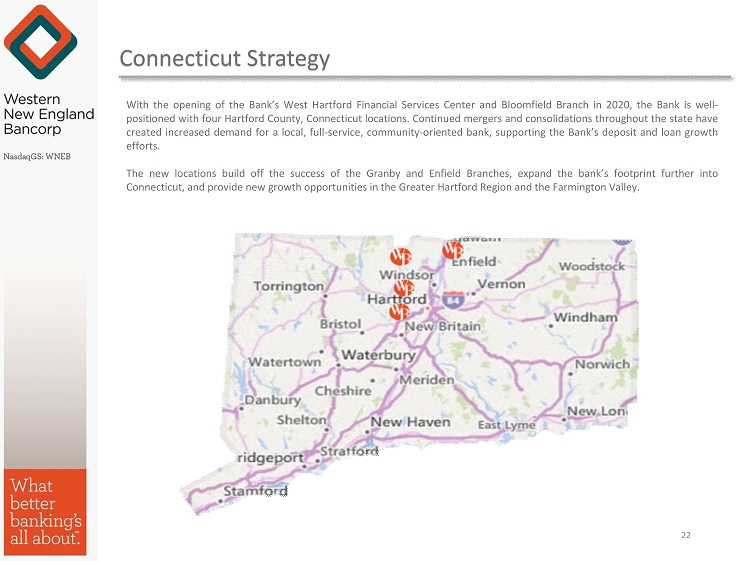

Connecticut Strategy 22 With the opening of the Bank’s West Hartford Financial Services Center and Bloomfield Branch in 2020 , the Bank is well - positioned with four Hartford County, Connecticut locations . Continued mergers and consolidations throughout the state have created increased demand for a local, full - service, community - oriented bank, supporting the Bank’s deposit and loan growth efforts . The new locations build off the success of the Granby and Enfield Branches, expand the bank’s footprint further into Connecticut, and provide new growth opportunities in the Greater Hartford Region and the Farmington Valley .

Connecticut Strategy 23 The West Hartford Financial Services Center, located in West Hartford Center, will serve as the Bank’s regional hub in Connecticut . In addition to a full - service branch, it includes a suite of offices to support Residential Lending, Commercial Lending, Business & Government Deposit Services, and Westfield Investment Services . The Bank has assembled an experienced team of bankers to run the West Hartford Financial Services Center . Vice President and Connecticut Area Manager Matthew Cuddy will manage the branch office . Todd Navin will serve as Senior Vice President and Commercial Lender . John Pember will serve as Vice President and Commercial Lender . Cathy Turowsky will serve as Vice President and Business & Government Deposit Services Officer, and Daniel Danillowicz will serve as Assistant Vice President and Mortgage Loan Officer . The West Hartford Financial Services Center team has decades of retail and commercial banking experience in West Hartford and throughout the Capital Region, and is very familiar with the economic landscape and subtleties of the market .

Connecticut Strategy 24 The Bloomfield branch , located in the Copaco Shopping Center, is a full - service branch and includes drive - through teller and safe deposit services . The Copaco Shopping Center is composed of national and local brands and is a major shopping destination for the greater Bloomfield area, which offers both retail and commercial banking opportunities . The Bank has hired Assistant Vice President and Branch Manager Lindsay Allen to manage the Bloomfield branch . Lindsay has extensive banking and branch management experience, having worked for both national and community banks, and is a Bloomfield resident . The Bloomfield branch, along with the Granby and Enfield locations, will be supported by the West Hartford Financial Services Center and its expanded team .

25

26 “ As an essential business in our community, over the past year, we have adapted and greatly changed the way we service our customers and support our staff . Virtually every industry has been adversely affected by the global health crisis caused by the spread of COVID - 19 . Despite the economic challenges that were presented, we increased core deposits by 41 . 0 % since December 31 , 2019 . We supported our small business and funded 2 , 046 loans totaling $ 295 million in PPP loans to new and existing customers . In addition we supported our customers, both retail and business, by providing payment deferrals under the CARES Act and waiving late charges for a period of time . These actions demonstrate our commitment to supporting our customers and the communities we serve during these unprecedented times . In July of 2020 , we announced the opening of our Bloomfield, Connecticut branch, and our Financial Services Center in West Hartford, Connecticut . The West Hartford Financial Services Center serves as our Connecticut hub, housing Commercial Lending, Cash Management and a Mortgage Loan Officer . In addition, on February 25 , 2020 , we opened our branch in Huntington, Massachusetts . These milestones were all accomplished while the branches remained closed while servicing customers by appointment only . Lastly, we were also very proud to announce Lisa G . McMahon as the first female Board Chairperson in the organization's 168 - year history . I would like to personally thank our employees and the Board of Directors for their exceptional work and commitment over the last year . Westfield Bank remains committed to supporting our staff, customers and the communities we serve . ” President’s Message

Westfield Bank “What better banking’s all about” Thank you! James C. Hagan , President and Chief Executive Officer Guida R. Sajdak , Executive Vice President and Chief Financial Officer Meghan Hibner , Vice President and Investor Relations Officer 27 141 Elm Street, Westfield, MA