Attached files

| file | filename |

|---|---|

| 8-K - 8-K - Open Lending Corp | lpro-20210511.htm |

| EX-99.1 - EX-99.1 - Open Lending Corp | a20210331-ex991.htm |

Earnings Supplement Q1 2021

2 Financial Highlights Q1 2021 (1) Defined as Adj. EBITDA, minus CAPEX, plus or minus change in contract assets Q1 2020 Revenue $44.0 million $17.4 million Adj. EBITDA $30.3 million $9.6 million Adj. Operating Cash Flow1 $22.4 million $13.7 million Total Certs 33,318 28,024

3 Recent Accomplishments Open Lending and Partners Strongly Positioned Credit union and bank lenders are well capitalized with ample liquidity Insurers modestly impacted relative to other industries and profitable in 2020 Low interest rate environment, traditional lenders retrenching, and commuters shifting away from public modes of transportation are driving positive trends Partnered with 7 new refinance lenders in Q1 Executed 14 contracts with new customers in Q1 10 active implementations with “go live” dates in the next 60 days Continue to make progress on additional insurance carriers Recent Business Highlights OEM Opportunity OEM #1 Experienced certification growth of 164% as compared to Q1 2020 Expanded credit score offering (619 – 679) in all four regions OEM #2 Ramping up since coming back online in October 2020 Experienced certification growth of 60% as compared to Q4 2020 Active in all dealerships for both new and used Building out pipeline with other OEMs for the future

4 Well Defined Growth Plan Expand Core Business1 OEM Opportunity2 CECL Relief 3 4 6 5 Broaden Our Offerings Launch into New Channels Refinance Opportunities Near Term Grow th Strategy Longer Term Grow th Strategy Drive Loan Volume through Further Wallet-Share Increase and Customer Penetration Expansion of Lender Base Increase OEM Captive Penetration by Addressing Broader Credit Spectrum and Deployment of Subvention Capabilities Leverage Significant Traction in Discussions with OEMs Enhanced Value Proposition to Lenders Provided via CECL Relief Increased Profitability for Financial Institutions in Near Prime Auto Enhanced Focus on Refinance Program to Drive Additional Cert Volume Ease of Customer Access in Reduced Interaction Environment Expansion into Adjacent Asset Classes (e.g., leases) Establish Broader Auto Platform (e.g., hub and spoke) Prime Decisioning SaaS Solution Expansion into Other Consumer Asset Classes

5 Q1 2021 Key Performance Indicators Three Months Ended March 31, 2021 2020 Certs CU & Bank Certs 21,927 18,862 OEM Certs 11,391 9,162 Total Certs 33,318 28,024 Unit Economics Avg. Profit Share Revenue per Cert (1) 680$ 564$ Avg. Program Fee Revenue per Cert 448$ 454$ Originations Facilitated Loan Origination Volume ($ in 000) 780,341$ 627,054$ Average Loan Size 23,421 22,376 Channel Overview New Vehicle Certs as a % of Total 15.9% 16.1% Used Vehicle Certs as a % of Total 84.1% 83.9% Indirect Certs as a % of Total 83.2% 78.1% Direct Certs as a % of Total 16.8% 21.9% (1) Represents average profit share revenue per certified loan originated in the period and excludes the impact of profit share revenue recognized in the period associated with historical vintages. The profit share revenue impact related to change in estimates of historical vintages was $5.1 million and ($12.0) million, for the three months ended March 31, 2021 and 2020, respectively.

6 Q1 2021 Financial Update 2021 2020 Revenue Program fees 14,911$ 12,712$ Profit share 27,730 3,774 Claims administration service fees 1,367 944 Total revenue 44,008 17,430 Cost of services 3,362 2,495 Gross profit 40,646 14,935 Operating expenses General and administrative (1) 8,212 3,569 Selling and marketing 2,397 2,078 Research and development 591 359 Operating income 29,446 8,929 Other income/expense Interest expense (3,289) (764) Interest income 84 17 Loss on extinguishment of debt (8,778) - Other (expense) income (131) 1 Income before income taxes 17,332 8,183 Provision for income taxes 4,470 11 Net income and comprehensive income 12,862$ 8,172$ Adjusted EBITDA 30,293$ 9,556$ ($ in 000) Three Months Ended March 31, (1) General and administrative expenses reflects an increase in employee compensation and benefits, as we build out our organization, in addition to professional and consulting fees, as we continue to implement the internal control, compliance and reporting requirements of public companies.

7 2021 2020 Net income 12,862$ 8,172$ Non-GAAP adjustments: Interest expense 3,289 764 Provision for income taxes 4,470 11 Depreciation and amortization expense 193 122 Share-based compensation 701 487 Loss on extinguishment of debt (1) 8,778 - Total adjustments 17,431 1,384 Adjusted EBITDA 30,293 9,556 Total revenue 44,008$ 17,430$ Adjusted EBITDA margin 68.8% 54.8% Three Months Ended March 31, (1) Reflects unamortized deferred financing costs which were written off in connection with the refinancing of our debt on March 19, 2021. Reconciliation of Net Income to Consolidated Adjusted EBITDA ($ in 000)

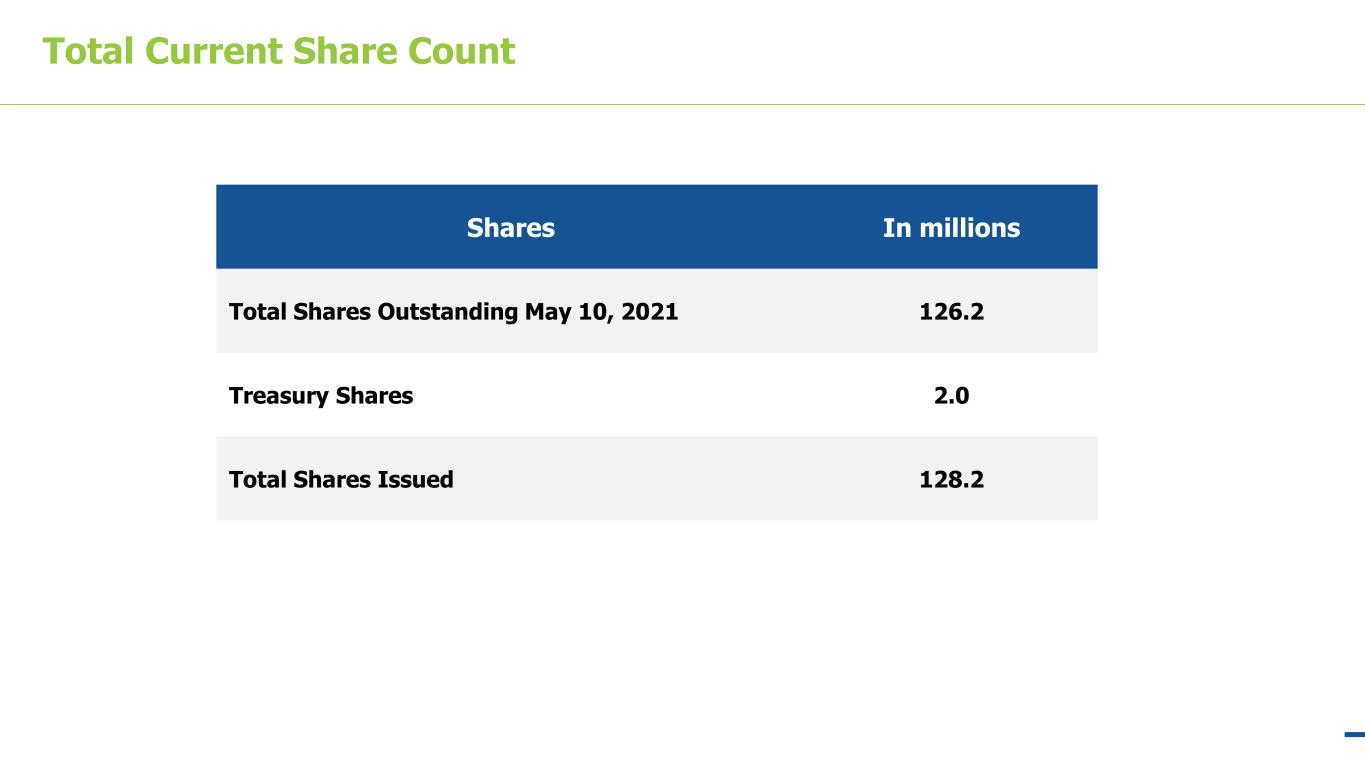

8 Total Current Share Count Shares In millions Total Shares Outstanding May 10, 2021 126.2 Treasury Shares 2.0 Total Shares Issued 128.2