Attached files

| file | filename |

|---|---|

| 8-K - 8-K - Lemonade, Inc. | lmnd-20210511.htm |

Shareholder Letter Q1 2021

2

Dear Shareholders, During our Q4 2020 earnings call, we hinted at a yet-to-be-announced product that is occupying a larger proportion of the Lemonade team than any of our existing products. We’ve since revealed that - you guessed it - this mystery product is Lemonade Car. This marks the third new product we have announced in less than a year, and the fourth major category of insurance we will offer our customers. The car insurance industry in the United States is estimated to be a $300 billion market, with more than 9 out of 10 American households owning at least one car. The addition of car insurance to our product suite dramatically increases our total addressable market, as the car insurance market is ~70x renters, ~80x pet health, ~3x homeowners1. While we have not yet announced a launch date, we note that our FY 2021 in force premium (IFP) guidance currently contemplates no material contribution from car insurance. Shai provided the following context for our Lemonade Car announcement: “We’re seeing an overwhelming demand for a Lemonade car insurance product from our customers. And so, since last year, a large part of our team has been working on what we believe will become one of the best car insurance products on the market. Lemonade Car will use technology to handle emergencies and pay claims fast, will offer great prices to safe drivers, and will be attractive to drivers of EVs and environment-friendly cars.” 3 1 Management estimate based on total gross written premium for specified insurance products as reported by various third party sources, including NAIC and IBISWorld, between 2018-2020.

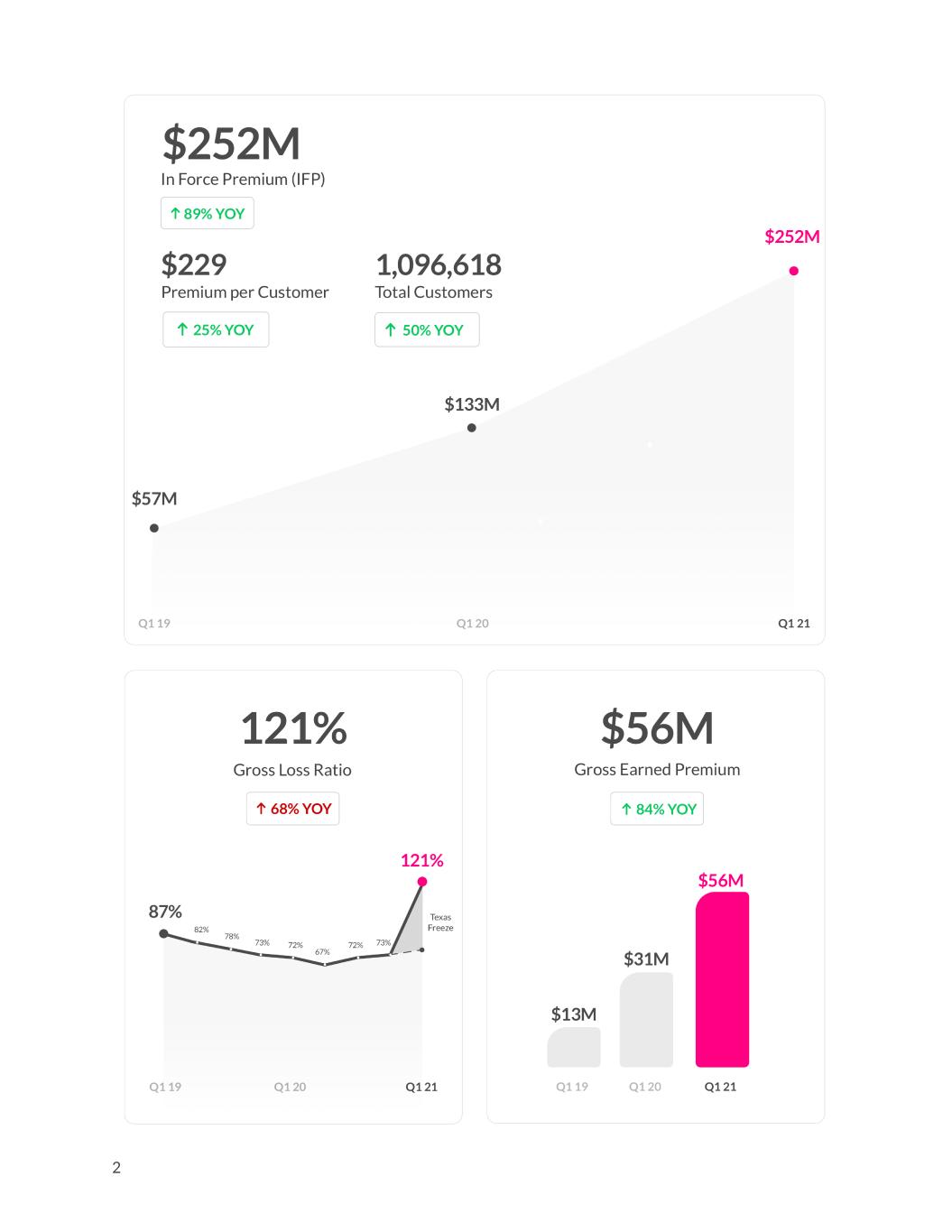

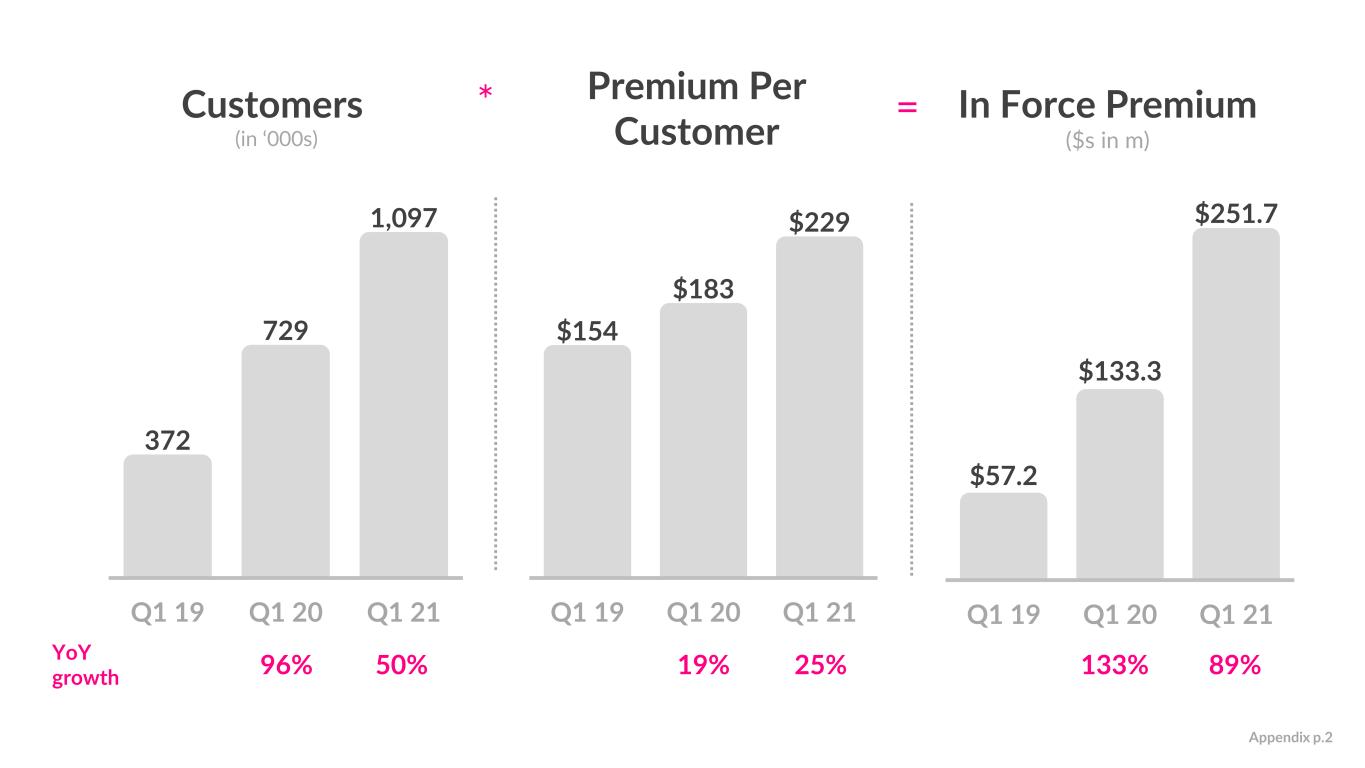

Shifting gears to our existing lines of business: in our Q4 letter, we spoke at length about compelling and improving unit economics giving us confidence to lean in. That’s exactly what we’ve done, with a significant year-over-year increase in advertising investment levels in Q1 2021. The result has been accelerating growth. IFP growth accelerated to 89% year-over-year (relative to 87% in Q4 2020). We concluded Q1 2021 with IFP of $252 million, and about 1.1 million customers. Separately, for the third consecutive quarter, we saw accelerating growth in premium per customer. This metric increased 25% year-over-year to $229. This acceleration is primarily driven by the sustained diversification of our business mix across products. This is enabled by both (1) shifting new business mix beyond renters, and (2) the monetization of our existing customer base via cross sales and graduation events. Diversification This pillar of our growth strategy has played a critical role in the agility and effectiveness of our growth engine. Diversification begins with the Lemonade product offering, which we’ve greatly expanded to meet customer needs. This, in turn, enables the parallel broadening of marketing channels. In the past, our growth relied heavily on a few large channel partners. This is changing, primarily due to (a) new products unlocking new channel opportunities, and (b) our sustained commitment to new channel testing and iteration. In Q1 2019, our five largest partners accounted for roughly 90% of our advertising spend. This declined to the mid-80%s in Q1 2020, and declined further still in Q1 2021 to the mid-70%s. Increasing channel diversity allows us to reach wider concentric circles of potential users than ever before, and 4

also allows us to lower our dependence on a small group of large technology companies. These dynamics have led to a quickly diversifying product mix of new business acquired. Non-renters products, including homeowners, pet health, and term life insurance, represented about 1/2 of our new business in Q1 2021, up from about 1/3 in Q1 2020. When allocating advertising spend, for each dollar of customer acquisition cost (“CAC”) that we invest, we focus on maximizing two metrics: lifetime value (“LTV”) and IFP. Our systems have become increasingly sophisticated at optimizing where and what we sell to ensure the maximum ROI. This ability smooths our growth trajectory. If we perceive a seasonal trough in demand for product A, we divert dollars to product B to sustain growth. We believe that our LTV / CAC ratios today are healthy and stable, reflecting our conviction that each customer, campaign and product should be profitable2. With the exception of new products or geographies in their ‘infancy,’ this statement generally holds true across all of our products. And our newborn products are graduating from infancy ever faster. It took several years to achieve profitable unit economics for our home insurance products, but for Lemonade Pet it took just a few months. This acceleration is largely enabled by channel diversification, improving brand awareness, and a machine-learning-driven growth engine that constantly iterates to improve each step of our onboarding funnel. As we look ahead to scaling our term life and car insurance products, we are heartened by our recent track record of launching new products that achieve compelling unit economics while driving topline growth in short order. After a Lemonade customer is onboarded, there is an additional layer of diversification that continues to drive growth: multiple user journeys. At the 5 2 As measured on the basis of estimated lifetime value exceeding customer acquisition cost.

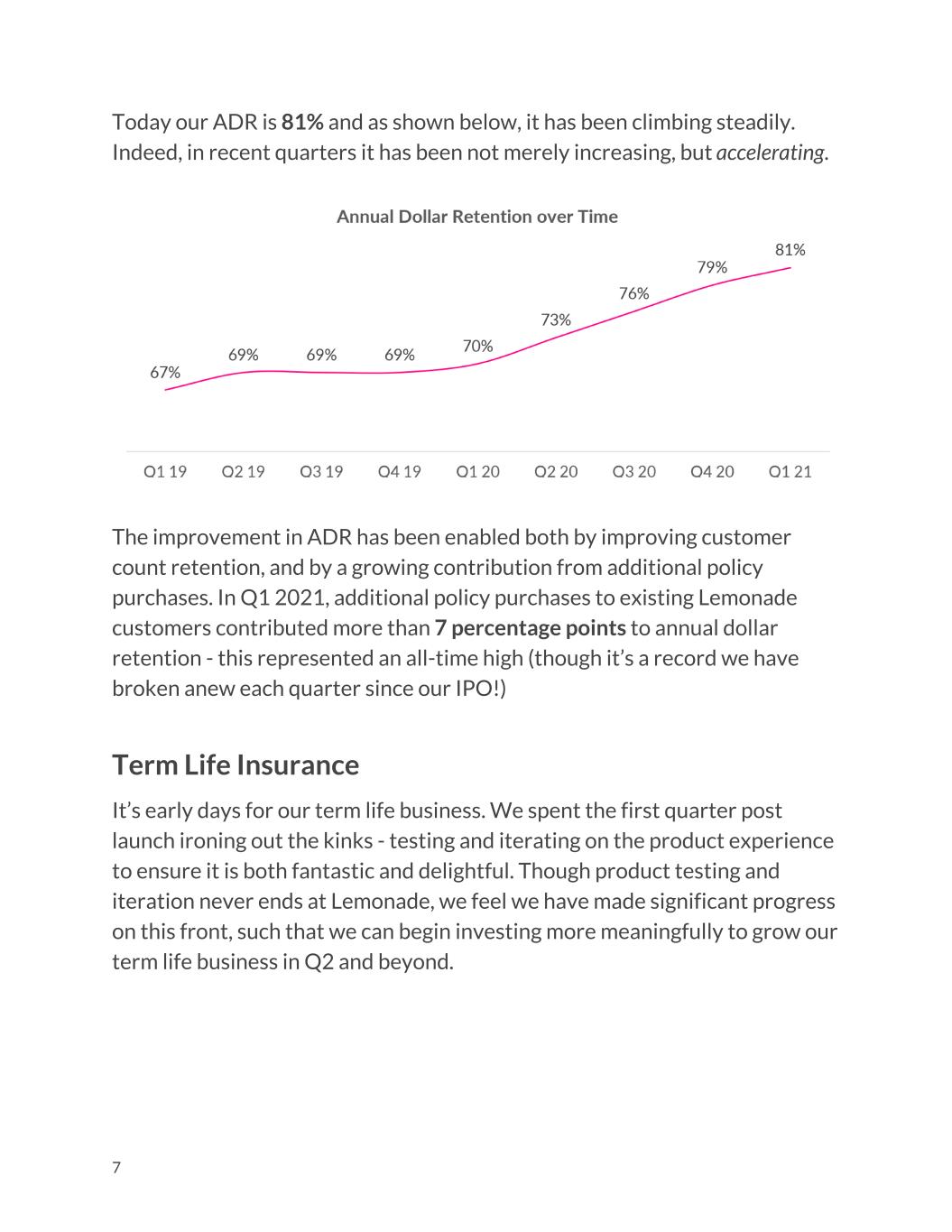

time of our initial public offering in July 2020, Lemonade customers could buy renters or homeowners insurance and... that’s it. From there, a common customer behavior was to graduate from renters to homeowners insurance, but the number of discrete user journeys was limited. Today, there are a multitude of entry points to Lemonade - renters, homeowners, pet health, and term life, with car next on the roadmap. After each customer joins us, there are again a multitude of potential pathways - for example, a renter-first customer may add pet health insurance, then graduate to homeowners, while a homeowner-first customer may add term life and then bundle car insurance before too long. Given our rapidly expanding product suite, the number of customer pathways has grown geometrically. This increases the prevalence of customers with multiple policies, who tend to demonstrate stronger retention rates and higher premiums. To enable you to track this dynamic and its impact on our business, we are introducing a new key performance indicator (“KPI”): annual dollar retention (“ADR”). Annual Dollar Retention We plan to present this KPI moving forward to provide more granularity around retention rates and trends, and to support the analysis of our ability to retain customers and sell additional products to them over time. We define annual dollar retention as follows: ADR is the percentage of IFP retained over a twelve month period, inclusive of changes in policy value, changes in number of policies, changes in policy type, and churn. To calculate ADR we first aggregate the IFP from all active customers at the beginning of the period and then aggregate the IFP from those same customers at the end of the period. ADR is then equal to the ratio of ending IFP to beginning IFP. 6

Today our ADR is 81% and as shown below, it has been climbing steadily. Indeed, in recent quarters it has been not merely increasing, but accelerating. The improvement in ADR has been enabled both by improving customer count retention, and by a growing contribution from additional policy purchases. In Q1 2021, additional policy purchases to existing Lemonade customers contributed more than 7 percentage points to annual dollar retention - this represented an all-time high (though it’s a record we have broken anew each quarter since our IPO!) Term Life Insurance It’s early days for our term life business. We spent the first quarter post launch ironing out the kinks - testing and iterating on the product experience to ensure it is both fantastic and delightful. Though product testing and iteration never ends at Lemonade, we feel we have made significant progress on this front, such that we can begin investing more meaningfully to grow our term life business in Q2 and beyond. 7

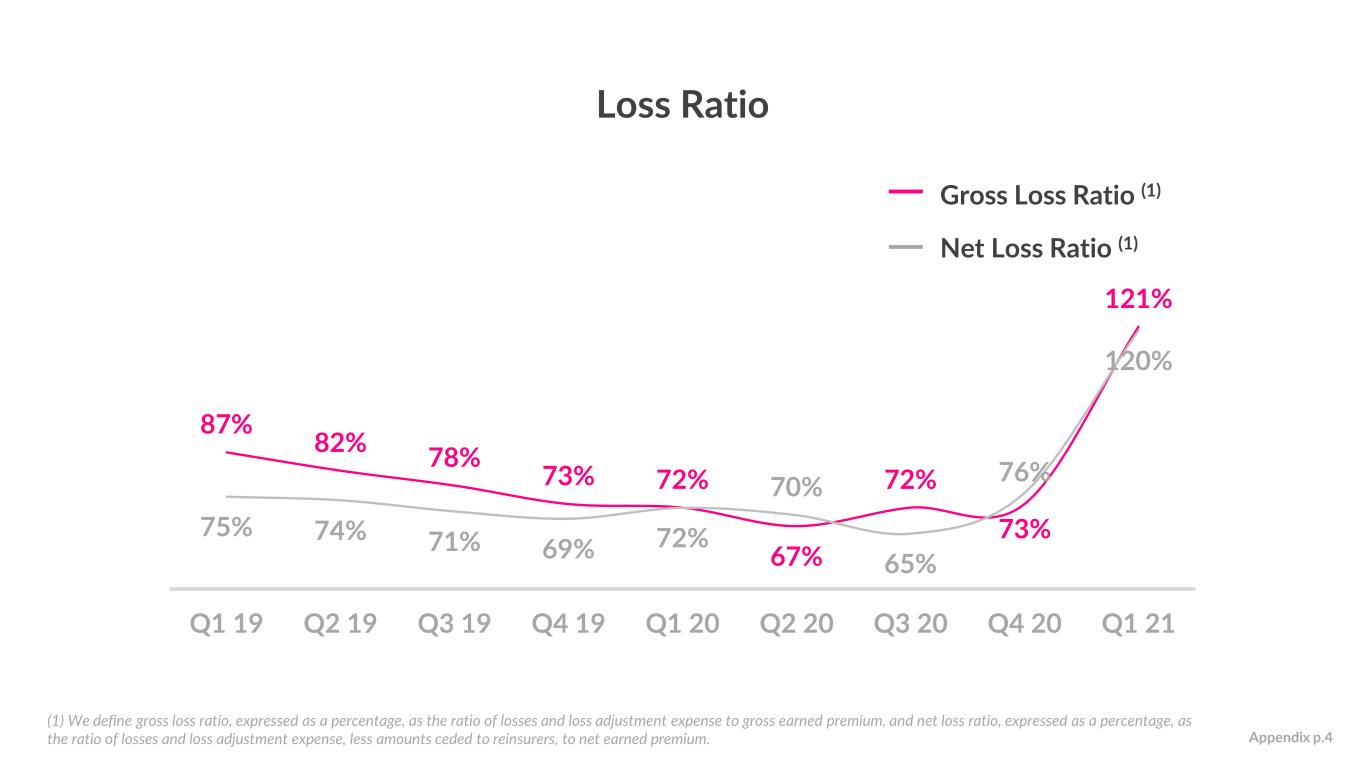

Texas Freeze (AKA: “Uri”) & Loss Ratio The severe winter storm that hit Texas in February impacted millions, causing power outages, icy roads, frozen pipes, and heartbreakingly, a lot of suffering. We received about a year’s worth of claims in its first few days, providing an extreme stress test for both our operations and financial model. The results - we believe - should be very reassuring to our team, our customers and our investors. Operational Stress Test At the onset of Uri our Claims Experience (CLX) team activated our catastrophe (CAT) operational process. Our people and technology rose to the occasion and a majority of claims were fully resolved within a week of the storm’s onset. As always, we put our customers first and are proud to have delivered a best-in-class, delightful experience to them in their time of need. Net Promoter Scores, a generally accepted measure of customer satisfaction, were nearly 70 for Uri-related-claims, in line with our typical non-CAT experience. We believe this is without parallel in our industry. Financial Stress Test Claims due to CAT added 50 percentage points to our gross loss ratio in the quarter, yet our EBITDA guidance for the year remains substantially in line with analyst consensus prior to the storm. The explanation is simple: we have extensive reinsurance programs in place for just such eventualities, and they worked very much as designed. Loss Ratio Excluding the Impact of CAT In Q1 2021, our 121% gross loss ratio included 50 percentage points of total CAT impact, while in Q1 2020, our 72% gross loss ratio included 2 percentage points of CAT impact. Excluding CAT impact, we are encouraged by the stability of our underwriting performance during a period characterized by the dramatic growth and meaningful diversification of our book of business. 8

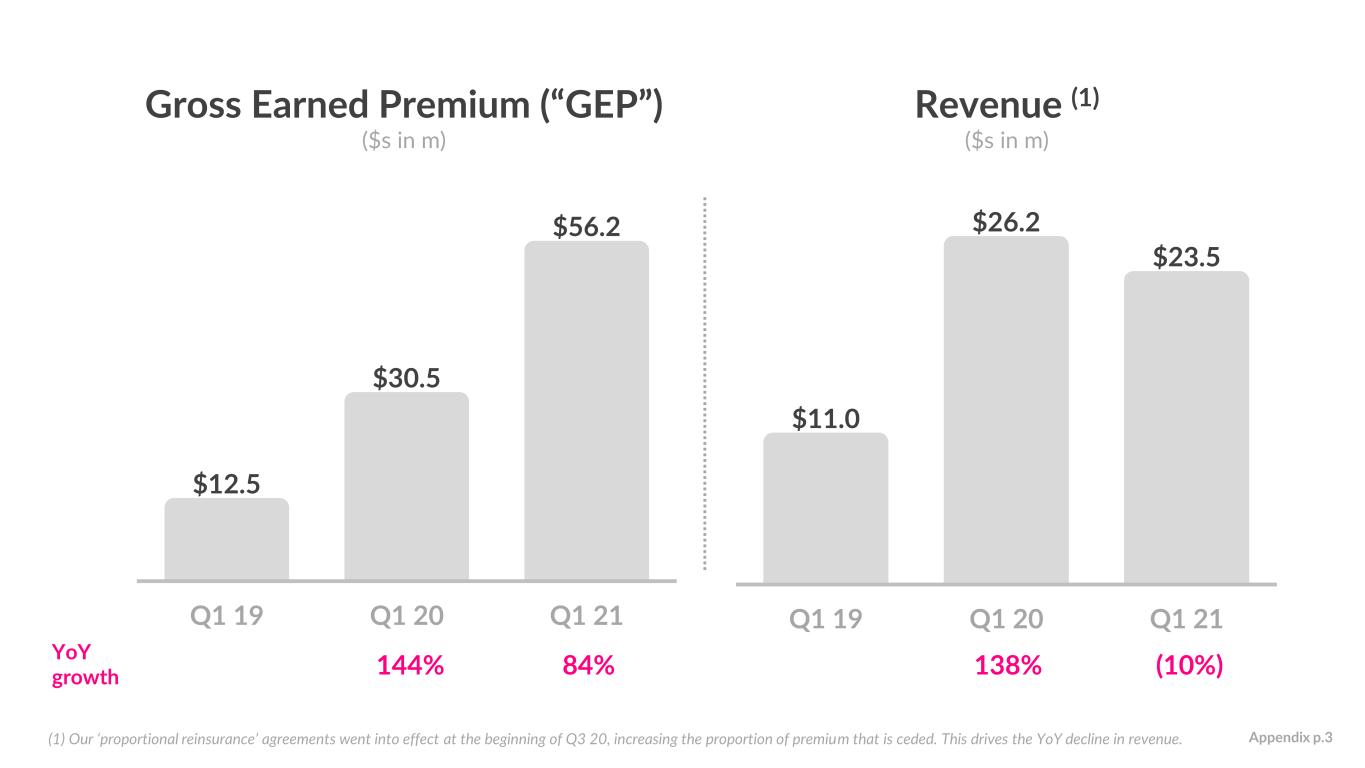

Q1 2021 Results, KPIs and Non-GAAP Financial Measures In Force Premium IFP, defined as the aggregate annualized premium for customers as of the period end date, increased by 89% to $251.7 million as compared to the first quarter of 2020, primarily due to a 50% increase in the number of customers as well as a 25% increase in premium per customer. Customers Customer count increased by 50% to 1,096,618 as compared to the first quarter of 2020. Premium per Customer Premium per customer, defined as in force premium divided by customers, was $229 at the end of the first quarter, up 25% from the first quarter of 2020. This is primarily due to the continued shift of our business mix toward products with higher average policy values, an increasing prevalence of multiple policies per customer, and growth in the overall average policy value. Gross Earned Premium First quarter gross earned premium of $56.2 million increased by $25.7 million or 84% as compared to the first quarter of 2020, primarily due to the increase of in force premium earned during the quarter. 9

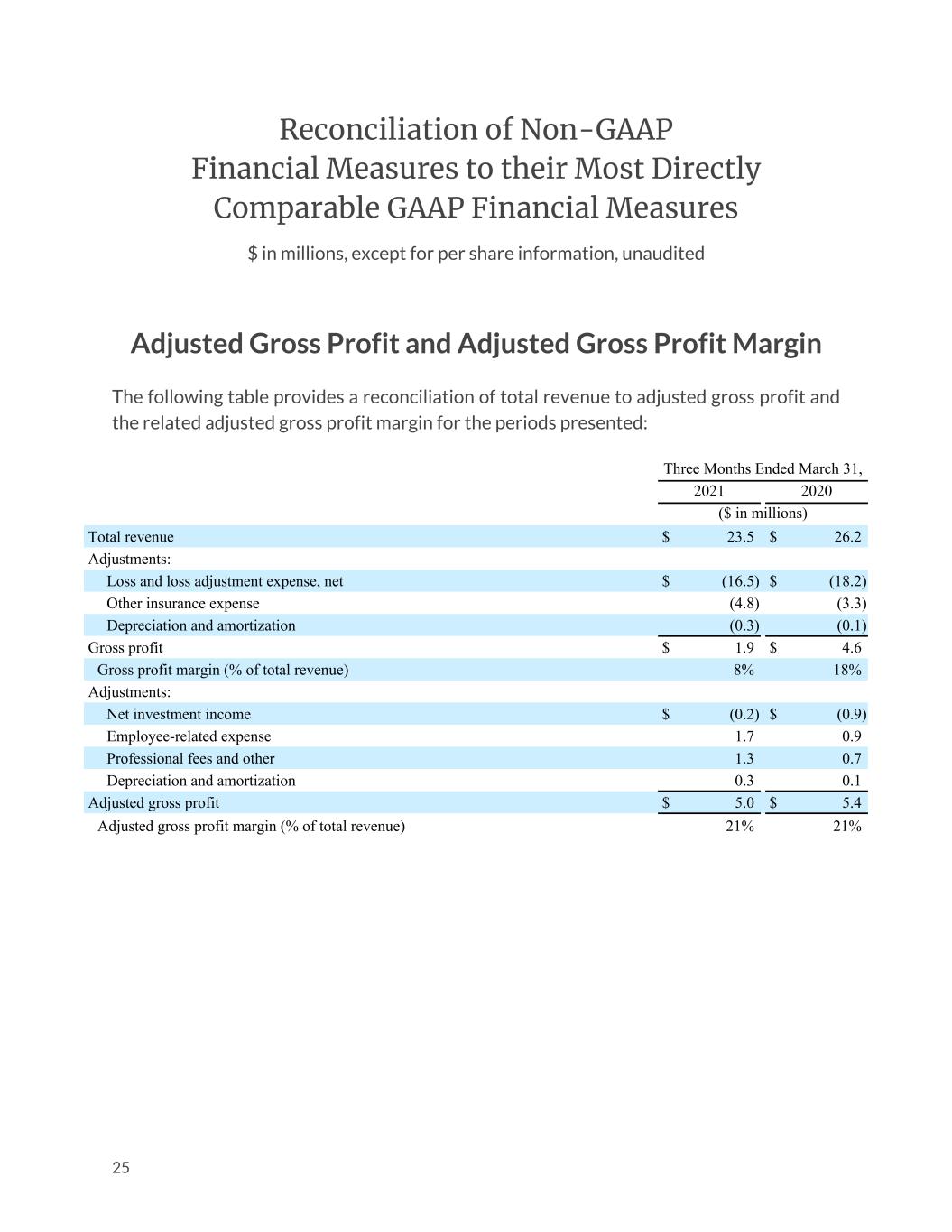

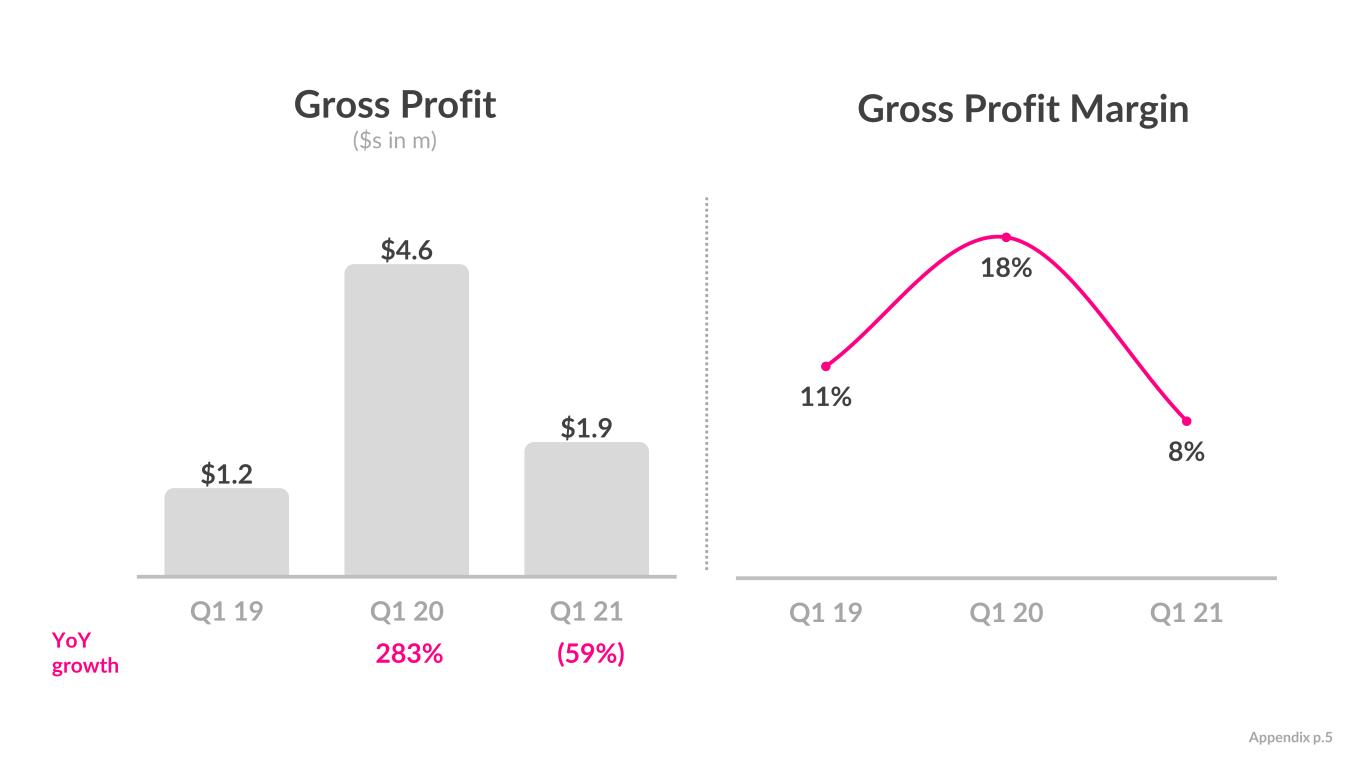

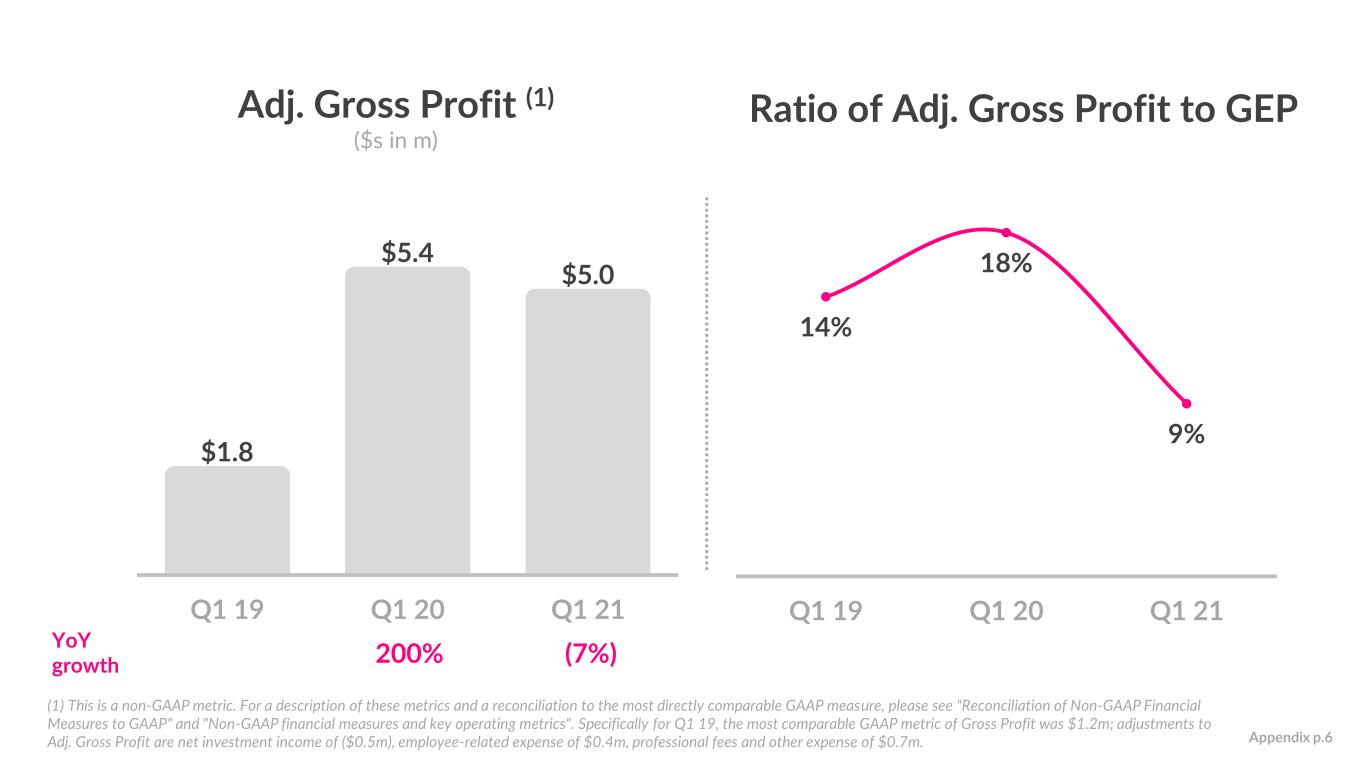

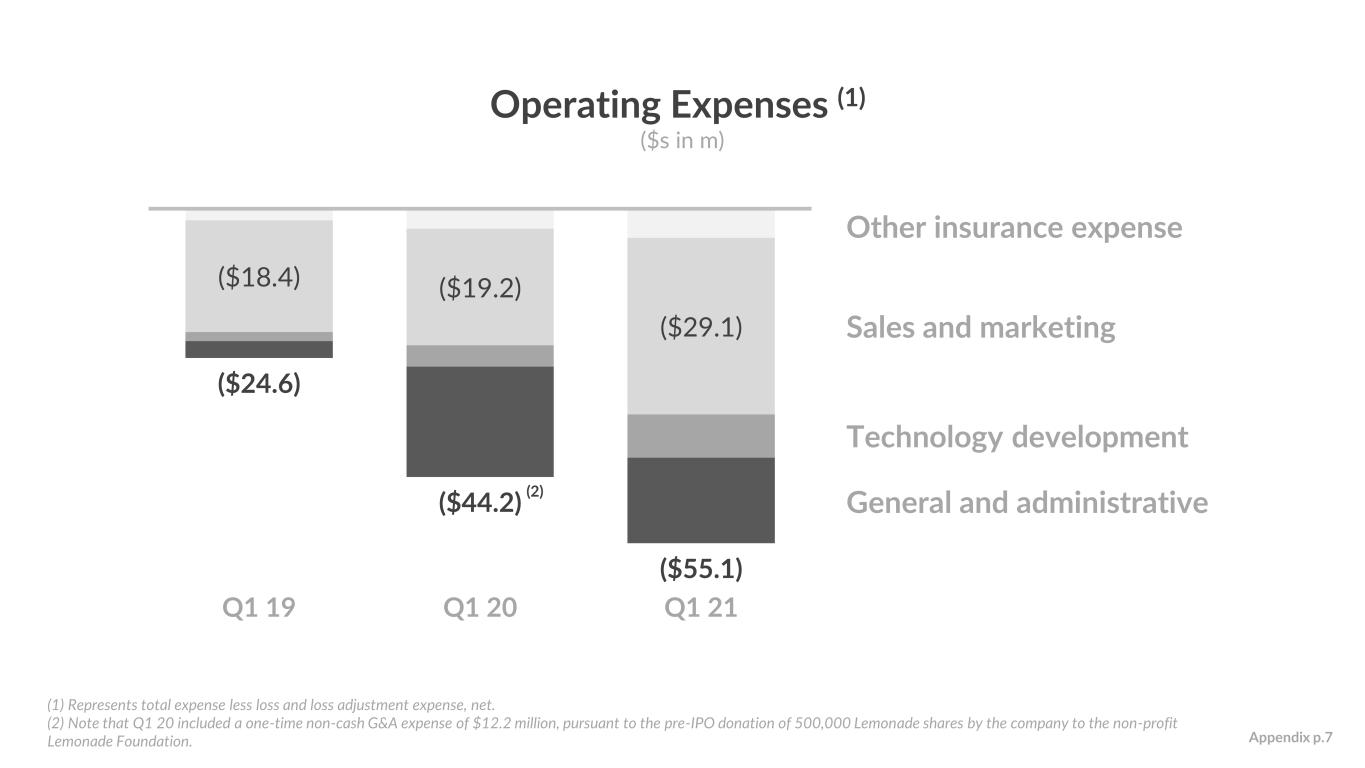

Revenue First quarter total revenue was $23.5 million. Note that our ‘proportional reinsurance’ agreements went into effect at the beginning of the third quarter of 2020, increasing the proportion of premium that is ceded to 75%. This meaningfully improves the capital efficiency of our business, but can create difficulty in making year-on-year comparisons of revenue. Gross Profit First quarter gross profit of $1.9 million decreased by $2.7 million or 59% as compared to the first quarter of 2020, primarily due to the impact of Uri, which resulted in $6.5 million of net incurred losses during the current period. Adjusted Gross Profit First quarter adjusted gross profit of $5.0 million decreased $0.4 million or 7% as compared to the first quarter of 2020, as the increase in gross earned premium was offset by the impact of Uri. Adjusted gross profit is a non-GAAP metric. Reconciliations of GAAP to non- GAAP financial measures, as well as definitions for the non-GAAP financial measures included in this letter and the reasons for their use, are presented at the end of this letter. Operating Expense Total operating expense, excluding net loss and loss adjustment expense, in Q1 increased 25% to $55.1 million as compared to the $44.2 million in the first quarter of 2020, driven primarily by increases in other insurance expense, technology development, sales and marketing expense, and general and administrative expense due to personnel growth (to support customer 10

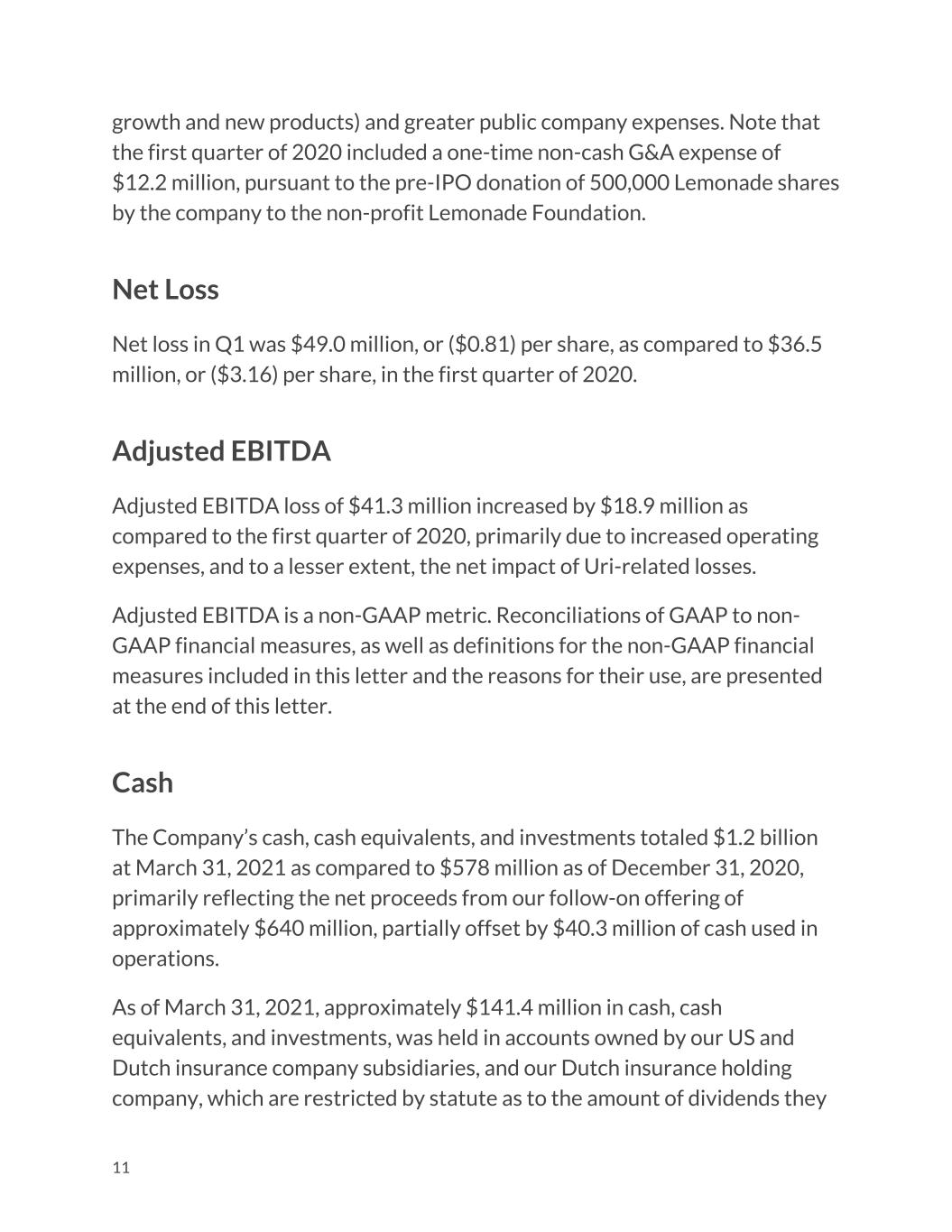

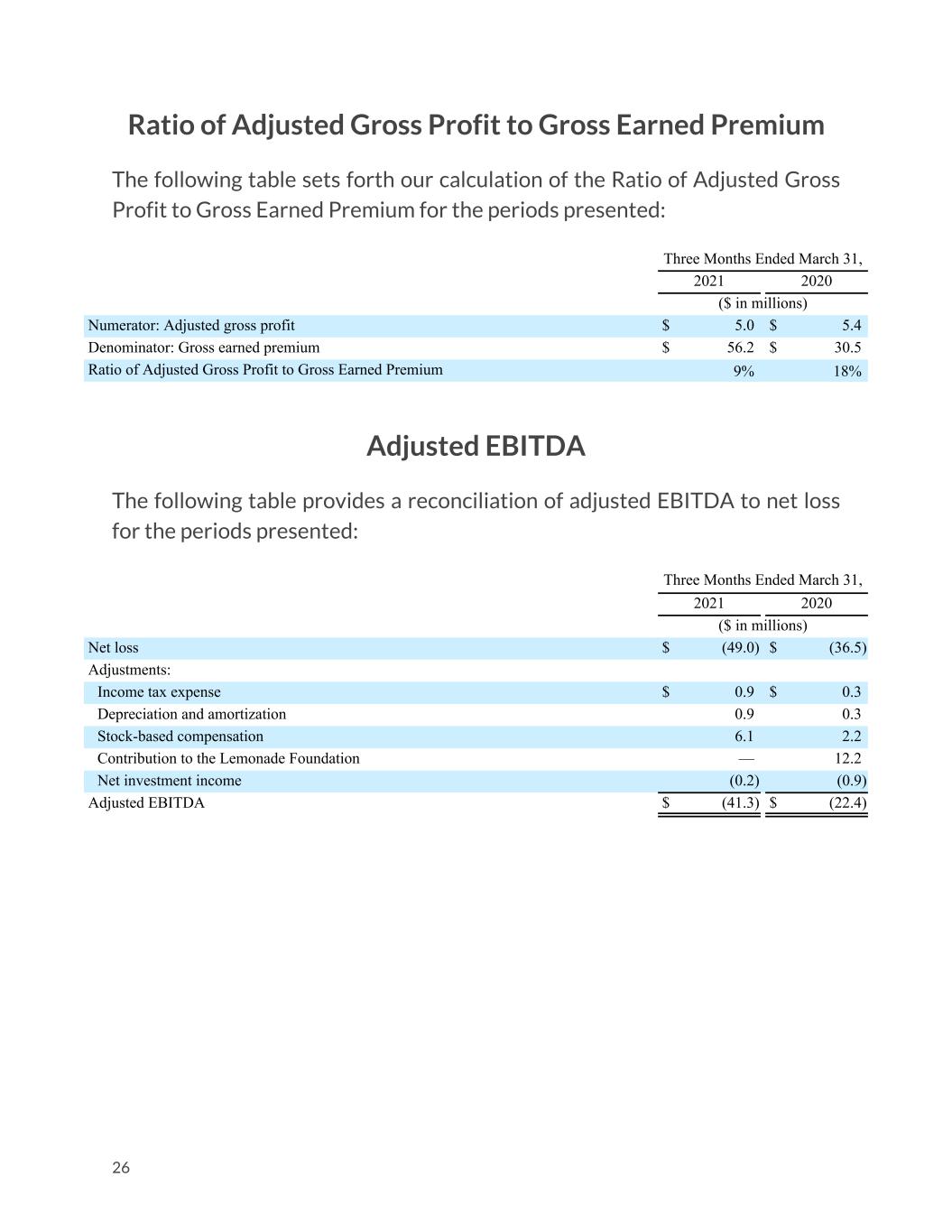

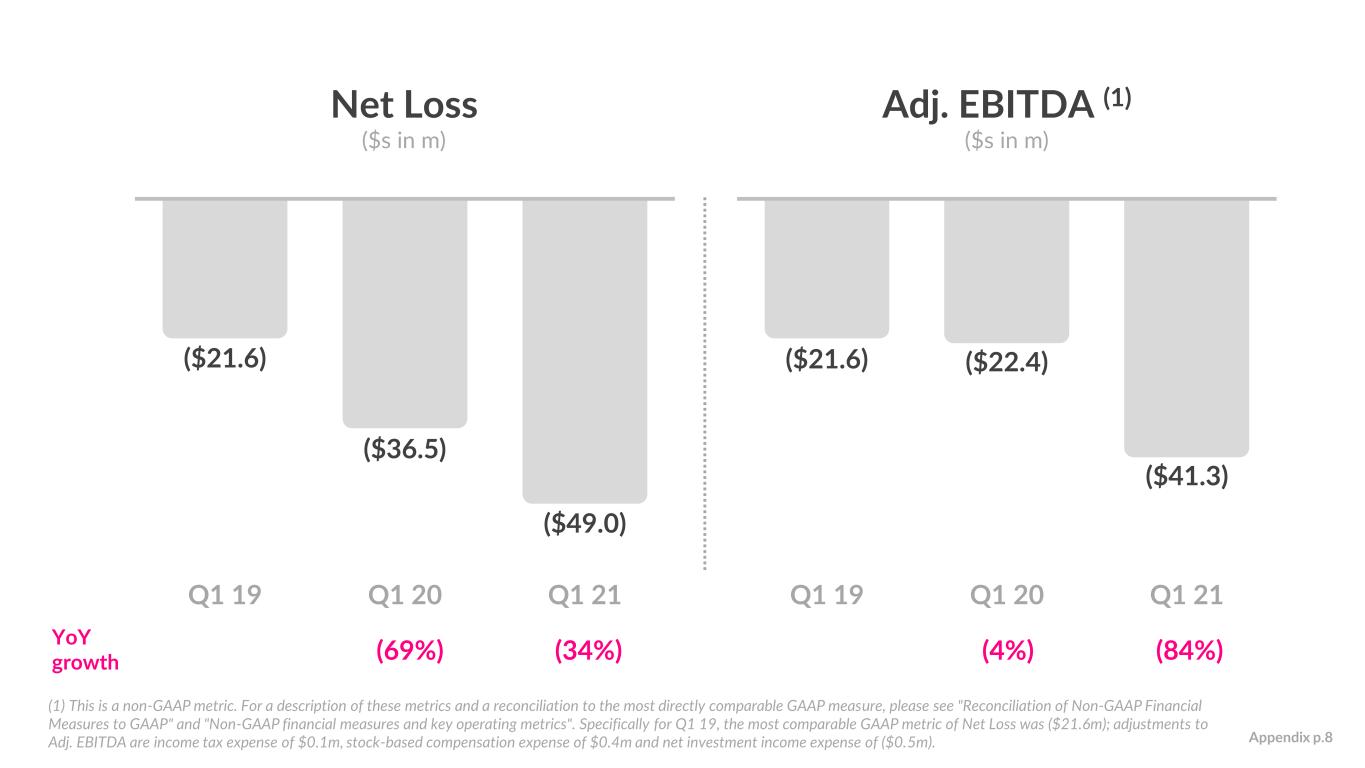

growth and new products) and greater public company expenses. Note that the first quarter of 2020 included a one-time non-cash G&A expense of $12.2 million, pursuant to the pre-IPO donation of 500,000 Lemonade shares by the company to the non-profit Lemonade Foundation. Net Loss Net loss in Q1 was $49.0 million, or ($0.81) per share, as compared to $36.5 million, or ($3.16) per share, in the first quarter of 2020. Adjusted EBITDA Adjusted EBITDA loss of $41.3 million increased by $18.9 million as compared to the first quarter of 2020, primarily due to increased operating expenses, and to a lesser extent, the net impact of Uri-related losses. Adjusted EBITDA is a non-GAAP metric. Reconciliations of GAAP to non- GAAP financial measures, as well as definitions for the non-GAAP financial measures included in this letter and the reasons for their use, are presented at the end of this letter. Cash The Company’s cash, cash equivalents, and investments totaled $1.2 billion at March 31, 2021 as compared to $578 million as of December 31, 2020, primarily reflecting the net proceeds from our follow-on offering of approximately $640 million, partially offset by $40.3 million of cash used in operations. As of March 31, 2021, approximately $141.4 million in cash, cash equivalents, and investments, was held in accounts owned by our US and Dutch insurance company subsidiaries, and our Dutch insurance holding company, which are restricted by statute as to the amount of dividends they 11

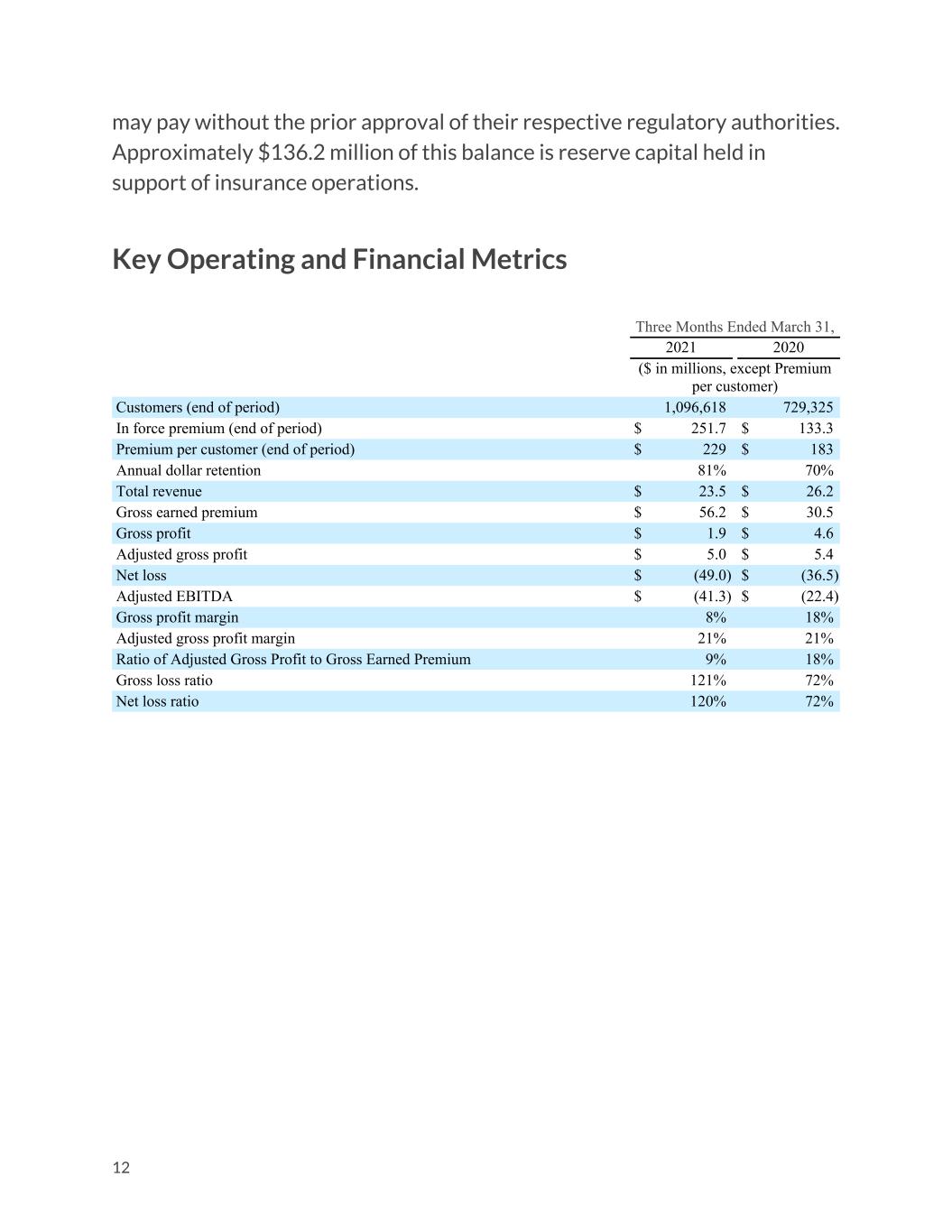

may pay without the prior approval of their respective regulatory authorities. Approximately $136.2 million of this balance is reserve capital held in support of insurance operations. Key Operating and Financial Metrics Three Months Ended March 31, 2021 2020 ($ in millions, except Premium per customer) Customers (end of period) 1,096,618 729,325 In force premium (end of period) $ 251.7 $ 133.3 Premium per customer (end of period) $ 229 $ 183 Annual dollar retention 81% 70% Total revenue $ 23.5 $ 26.2 Gross earned premium $ 56.2 $ 30.5 Gross profit $ 1.9 $ 4.6 Adjusted gross profit $ 5.0 $ 5.4 Net loss $ (49.0) $ (36.5) Adjusted EBITDA $ (41.3) $ (22.4) Gross profit margin 8% 18% Adjusted gross profit margin 21% 21% Ratio of Adjusted Gross Profit to Gross Earned Premium 9% 18% Gross loss ratio 121% 72% Net loss ratio 120% 72% 12

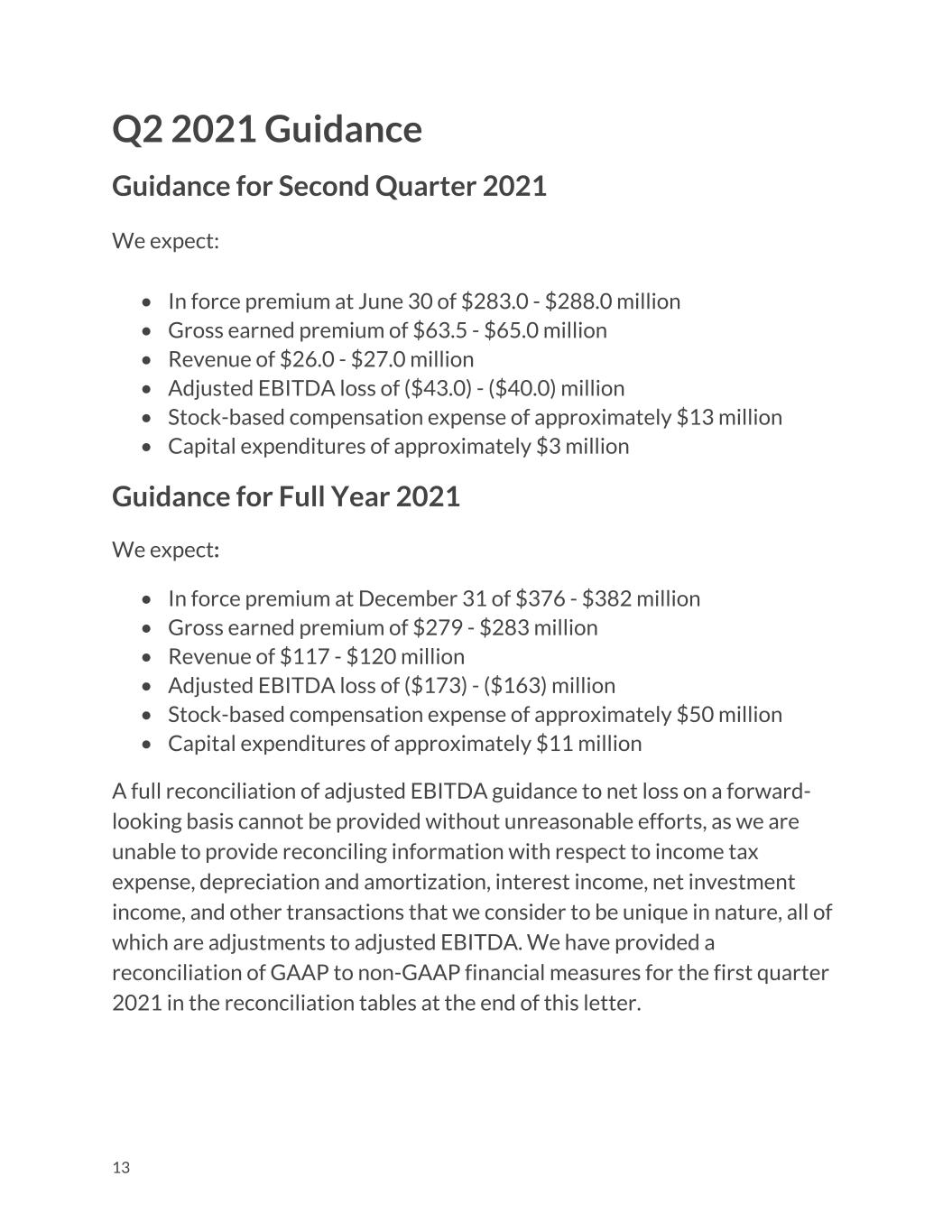

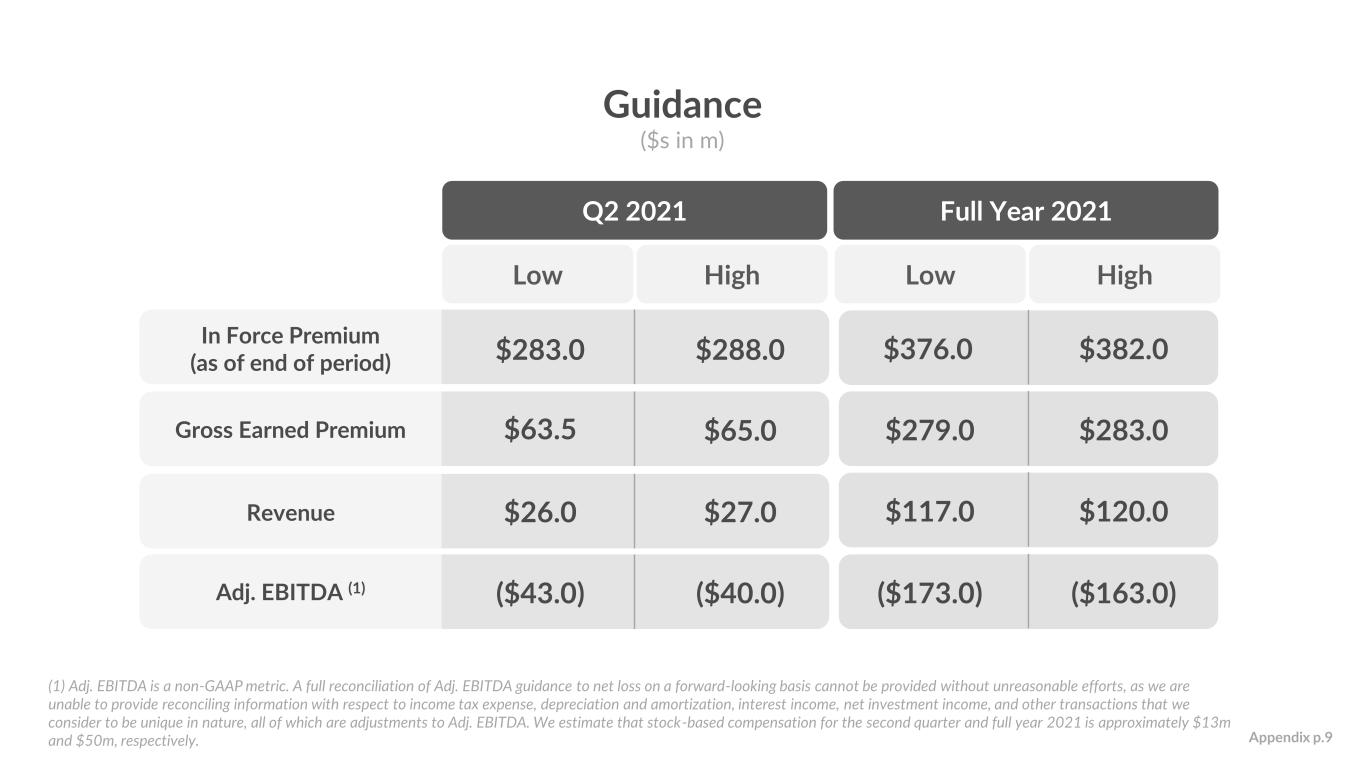

Q2 2021 Guidance Guidance for Second Quarter 2021 We expect: • In force premium at June 30 of $283.0 - $288.0 million • Gross earned premium of $63.5 - $65.0 million • Revenue of $26.0 - $27.0 million • Adjusted EBITDA loss of ($43.0) - ($40.0) million • Stock-based compensation expense of approximately $13 million • Capital expenditures of approximately $3 million Guidance for Full Year 2021 We expect: • In force premium at December 31 of $376 - $382 million • Gross earned premium of $279 - $283 million • Revenue of $117 - $120 million • Adjusted EBITDA loss of ($173) - ($163) million • Stock-based compensation expense of approximately $50 million • Capital expenditures of approximately $11 million A full reconciliation of adjusted EBITDA guidance to net loss on a forward- looking basis cannot be provided without unreasonable efforts, as we are unable to provide reconciling information with respect to income tax expense, depreciation and amortization, interest income, net investment income, and other transactions that we consider to be unique in nature, all of which are adjustments to adjusted EBITDA. We have provided a reconciliation of GAAP to non-GAAP financial measures for the first quarter 2021 in the reconciliation tables at the end of this letter. 13

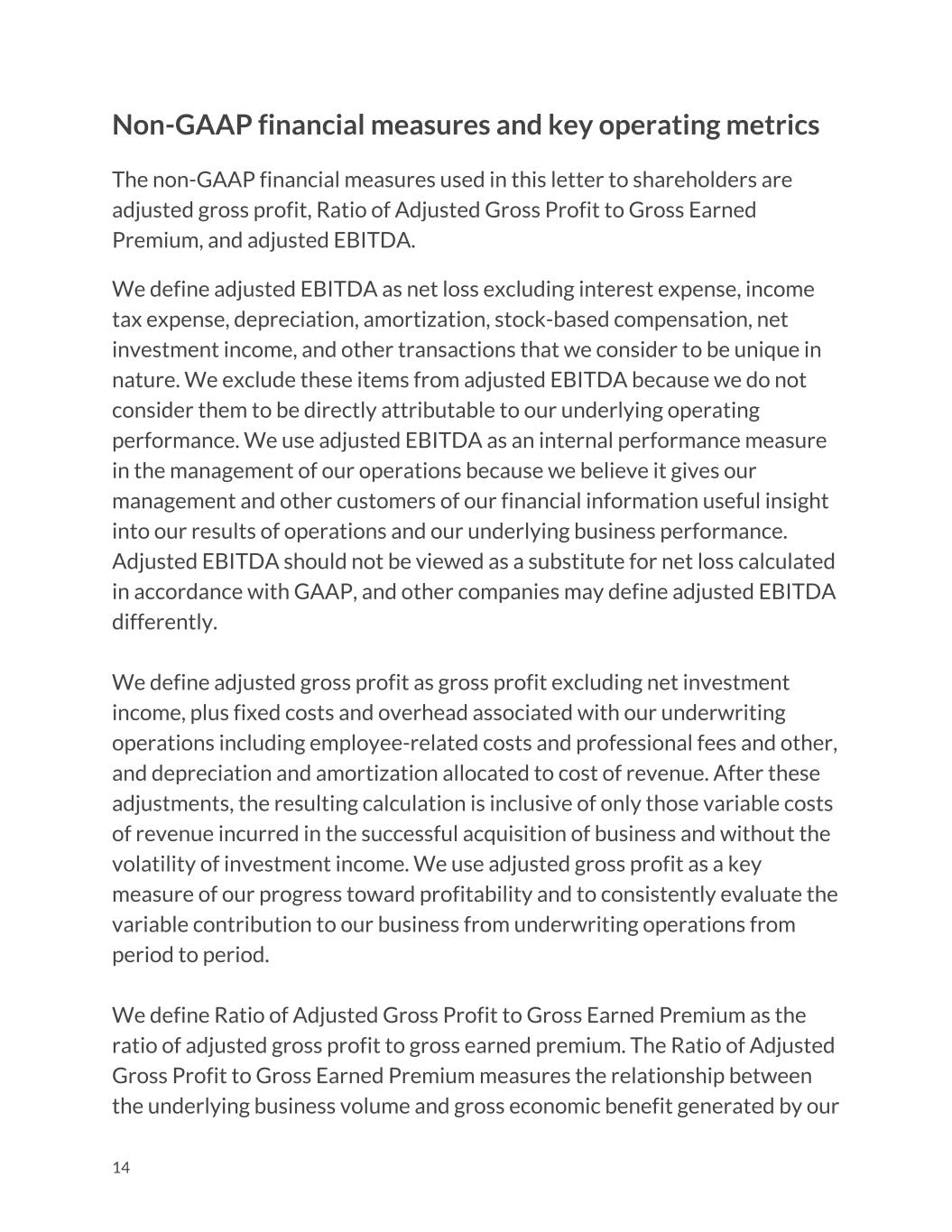

Non-GAAP financial measures and key operating metrics The non-GAAP financial measures used in this letter to shareholders are adjusted gross profit, Ratio of Adjusted Gross Profit to Gross Earned Premium, and adjusted EBITDA. We define adjusted EBITDA as net loss excluding interest expense, income tax expense, depreciation, amortization, stock-based compensation, net investment income, and other transactions that we consider to be unique in nature. We exclude these items from adjusted EBITDA because we do not consider them to be directly attributable to our underlying operating performance. We use adjusted EBITDA as an internal performance measure in the management of our operations because we believe it gives our management and other customers of our financial information useful insight into our results of operations and our underlying business performance. Adjusted EBITDA should not be viewed as a substitute for net loss calculated in accordance with GAAP, and other companies may define adjusted EBITDA differently. We define adjusted gross profit as gross profit excluding net investment income, plus fixed costs and overhead associated with our underwriting operations including employee-related costs and professional fees and other, and depreciation and amortization allocated to cost of revenue. After these adjustments, the resulting calculation is inclusive of only those variable costs of revenue incurred in the successful acquisition of business and without the volatility of investment income. We use adjusted gross profit as a key measure of our progress toward profitability and to consistently evaluate the variable contribution to our business from underwriting operations from period to period. We define Ratio of Adjusted Gross Profit to Gross Earned Premium as the ratio of adjusted gross profit to gross earned premium. The Ratio of Adjusted Gross Profit to Gross Earned Premium measures the relationship between the underlying business volume and gross economic benefit generated by our 14

underwriting operations, on the one hand, and our underlying profitability trends, on the other. We rely on this measure, which supplements our gross profit ratio as calculated in accordance with GAAP, because it provides management with insight into our underlying profitability trends over time. The non-GAAP financial measures used in this letter to shareholders have not been calculated in accordance with GAAP and should be considered in addition to results prepared in accordance with GAAP and should not be considered as a substitute for, or superior to, GAAP results. In addition, adjusted gross profit and adjusted EBITDA should not be construed as indicators of our operating performance, liquidity or cash flows generated by operating, investing and financing activities, as there may be significant factors or trends that they fail to address. We caution investors that non- GAAP financial information, by its nature, departs from traditional accounting conventions. Therefore, its use can make it difficult to compare our current results with our results from other reporting periods and with the results of other companies. Our management uses these non-GAAP financial measures, in conjunction with GAAP financial measures, as an integral part of managing our business and to, among other things: (i) monitor and evaluate the performance of our business operations and financial performance; (ii) facilitate internal comparisons of the historical operating performance of our business operations; (iii) facilitate external comparisons of the results of our overall business to the historical operating performance of other companies that may have different capital structures and debt levels; (iv) review and assess the operating performance of our management team; (v) analyze and evaluate financial and strategic planning decisions regarding future operating investments; and (vi) plan for and prepare future annual operating budgets and determine appropriate levels of operating investments. 15

Investors are encouraged to review the reconciliation of these non-GAAP financial measures to their most directly comparable GAAP financial measures as provided in the tables accompanying this letter to shareholders. This letter to shareholders also includes key performance indicators, including customers, in force premium, premium per customer, annual dollar retention, gross earned premium, gross loss ratio and net loss ratio. We define customers as the number of current policyholders underwritten by us or placed by us with third-party insurance partners (who pay us recurring commissions) as of the period end date. A customer that has more than one policy counts as a single customer for the purposes of this metric. We view customers as an important metric to assess our financial performance because customer growth drives our revenue, expands brand awareness, deepens our market penetration, creates additional upsell and cross-sell opportunities and generates additional data to continue to improve the functioning of our platform. We define in force premium ("IFP") as the aggregate annualized premium for customers as of the period end date. At each period end date, we calculate IFP as the sum of: (i) In force written premium — the annualized premium of in force policies underwritten by us; and (ii) In force placed premium — the annualized premium of in force policies placed with third party insurance companies for which we earn a recurring commission payment. In force placed premium currently reflects less than 1% of IFP. The annualized value of premiums is a legal and contractual determination made by assessing the contractual terms with our customers. The annualized value of contracts is not determined by reference to historical revenues, deferred revenues or any other GAAP financial measure over any period. IFP is not a forecast of future revenues nor is it a reliable indicator of revenue expected to be earned in any given period. We believe that our calculation of IFP is useful to analysts and investors because it captures the impact of growth in customers and premium per customer at the end of each reported period, without 16

adjusting for known or projected policy updates, cancellations, rescissions and non-renewals. We use IFP because we believe it gives our management useful insight into the total reach of our platform by showing all in force policies underwritten and placed by us. Other companies, including companies in our industry, may calculate IFP differently or not at all, which reduces the usefulness of IFP as a tool for comparison. We define premium per customer as the average annualized premium customers pay for products underwritten by us or placed by us with third- party insurance partners. We calculate premium per customer by dividing IFP by customers. We view premium per customer as an important metric to assess our financial performance because premium per customer reflects the average amount of money our customers spend on our products, which helps drive strategic initiatives. We define annual dollar retention ("ADR"), as the percentage of IFP retained over a twelve month period, inclusive of changes in policy value, changes in number of policies, changes in policy type, and churn. To calculate ADR we first aggregate the IFP from all active customers at the beginning of the period and then aggregate the IFP from those same customers at the end of the period. ADR is then equal to the ratio of ending IFP to beginning IFP. We believe that our calculation of ADR is useful to analysts and investors because it captures our ability to retain customers and sell additional products and coverage to them over time. We view ADR as an important metric to measure our ability to provide a delightful end-to-end customer experience, satisfy our customers’ evolving insurance needs and maintain our customers’ trust in our products. Our customers become more valuable to us every year they continue to subscribe to our products. Other companies, including companies in our industry, may calculate ADR differently or not at all, which reduces the usefulness of ADR as a tool for comparison. Gross earned premium is the earned portion of our gross written premium. We use this operating metric as we believe it gives our management and 17

other users of our financial information useful insight into the gross economic benefit generated by our business operations and allows us to evaluate our underwriting performance without regard to changes in our underlying reinsurance structure. Unlike net earned premium, gross earned premium excludes the impact of premiums ceded to reinsurers, and therefore should not be used as a substitute for net earned premium, total revenue, or any other measure presented in accordance with GAAP. We define gross loss ratio, expressed as a percentage, as the ratio of losses and loss adjustment expense to gross earned premium. We define net loss ratio, expressed as a percentage, as the ratio of losses and loss adjustment expense, less amounts ceded to reinsurers, to net earned premium. Links The information contained on, or that can be accessed through, hyperlinks included herein is deemed not to be incorporated in or part of this shareholder letter. Earnings teleconference information The Company will discuss its first quarter 2021 financial results during a teleconference on May 12, 2021, at 8:00 AM ET. The conference call can be accessed in the U.S. at (844) 850-0549 or outside the U.S. at (412) 902-4201 with the conference ID: 10155431. A live audio webcast of the call will also be available simultaneously at https://investor.lemonade.com 18

Following completion of the call, a recorded replay of the webcast will be available on the investor relations section of Lemonade’s website. Additional investor information can be accessed at https://investor.lemonade.com About Lemonade Lemonade offers renters, homeowners, pet, and life insurance. Powered by artificial intelligence and behavioral economics, Lemonade’s full stack insurance carriers in the US and the EU replace brokers and bureaucracy with bots and machine learning, aiming for zero paperwork and instant everything. A Certified B-Corp, Lemonade gives unused premiums to nonprofits selected by its community, during its annual Giveback. Lemonade is currently available in the United States, Germany, the Netherlands, and France, and continues to expand globally. For more information, please visit www.lemonade.com, and follow Lemonade on Twitter or Instagram. Media inquiries: press@lemonade.com Investor contact: ir@lemonade.com Forward-looking statement safe harbor This letter to shareholders contains forward-looking statements within the meaning of the Private Securities Litigation Reform Act of 1995. All statements contained in this letter to shareholders that do not relate to matters of historical fact should be considered forward-looking statements, including statements regarding our anticipated financial performance, including our financial outlook for the second quarter of 2021 and the full year 2021, our industry, business strategy, plans, goals and expectations concerning our market position, future operations and other financial and operating information. 19

These statements are neither promises nor guarantees, but involve known and unknown risks, uncertainties and other important factors that may cause our actual results, performance or achievements to be materially different from any future results, performance or achievements expressed or implied by the forward-looking statements, including, but not limited to, the following: Our history of losses and the fact that we may not achieve or maintain profitability in the future; our ability to retain and expand our customer base; the fact that the “Lemonade” brand may not become as widely known as incumbents’ brands or the brand may become tarnished; the denial of claims or our failure to accurately and timely pay claims; our ability to attain greater value from each user; the novelty of our business model and its unpredictable efficacy and susceptibility to unintended consequences; the possibility that we could be forced to modify or eliminate our Giveback, which could undermine our business model; the examinations and other targeted investigations by our primary and other state insurance regulators that could result in adverse examination findings and necessitate remedial actions; our limited operating history; our ability to manage our growth effectively; the impact of intense competition in the segments of the insurance industry in which we operate on our ability to attain or increase profitability; the unavailability of reinsurance at current levels and prices, which could limit our ability to write new business; our ability to renew reinsurance contracts on comparable duration and terms to those currently in effect; our exposure to counterparty risks as a result of reinsurance; the loss of personal customer information, damage to our reputation and brand, or harm to our business and operating results as a result of security incidents or real or perceived errors, failures or bugs in our systems, website or app; our actual or perceived failure to protect customer information and other data, respect customers’ privacy, or comply with data privacy and security laws and regulations; our ability to comply with extensive insurance industry regulations and the need to incur additional costs or devote additional 20

resources to comply with changes to existing regulations; our exposure to additional regulatory requirements specific to other vertical markets that we enter or have entered, including auto, pet and life insurance, and the need to devote additional resources to comply with these regulations; and our inability to predict the lasting impacts of COVID-19 to our business in particular, and the global economy generally. These and other important factors are discussed under the caption “Risk Factors” in our Form 10-K filed with the SEC on March 8, 2021 and in our other filings with the SEC could cause actual results to differ materially from those indicated by the forward-looking statements made in this shareholder letter. Any such forward-looking statements represent management’s beliefs as of the date of this press release. While we may elect to update such forward-looking statements at some point in the future, we disclaim any obligation to do so, even if subsequent events cause our views to change. 21

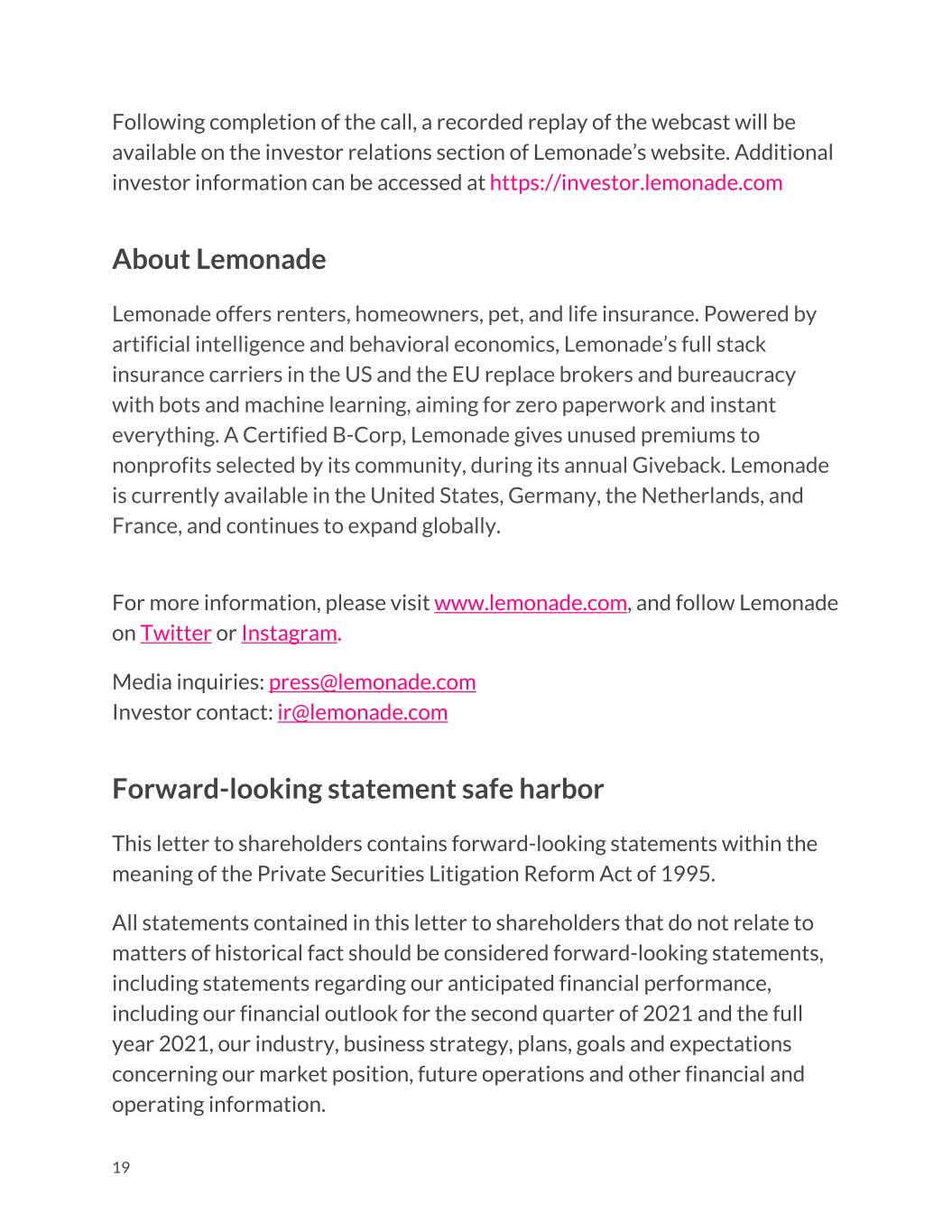

Condensed Consolidated Statements of Operations and Comprehensive Loss $ in millions, except per share amounts, unaudited Three Months Ended March 31, 2021 2020 Revenue Net earned premium $ 13.8 $ 25.3 Ceding commission income 9.0 — Net investment income 0.2 0.9 Commission and other income 0.5 — Total revenue 23.5 26.2 Expense Loss and loss adjustment expense, net 16.5 18.2 Other insurance expense 4.8 3.3 Sales and marketing 29.1 19.2 Technology development 7.1 3.5 General and administrative 14.1 18.2 Total expense 71.6 62.4 Loss before income taxes (48.1) (36.2) Income tax expense 0.9 0.3 Net loss $ (49.0) $ (36.5) Other comprehensive income, net of tax Unrealized gain on investments 0.1 — Foreign currency translation adjustment 0.7 — Comprehensive loss $ (48.2) $ (36.5) Per share data: Net loss per share attributable to common stockholders—basic and diluted $ (0.81) $ (3.16) Weighted average common shares outstanding—basic and diluted 60,218,652 11,542,042 22

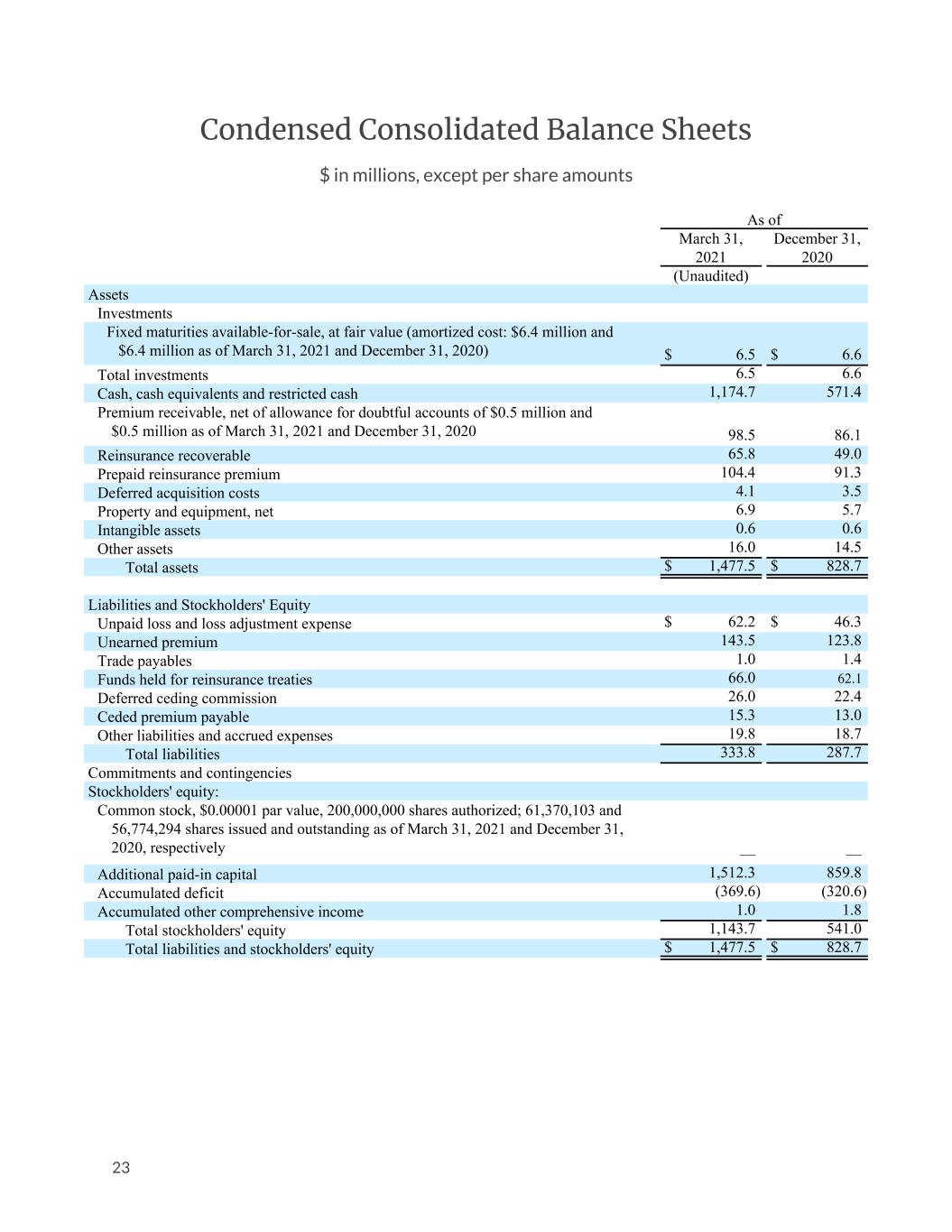

Condensed Consolidated Balance Sheets $ in millions, except per share amounts As of March 31, December 31, 2021 2020 (Unaudited) Assets Investments Fixed maturities available-for-sale, at fair value (amortized cost: $6.4 million and $6.4 million as of March 31, 2021 and December 31, 2020) $ 6.5 $ 6.6 Total investments 6.5 6.6 Cash, cash equivalents and restricted cash 1,174.7 571.4 Premium receivable, net of allowance for doubtful accounts of $0.5 million and $0.5 million as of March 31, 2021 and December 31, 2020 98.5 86.1 Reinsurance recoverable 65.8 49.0 Prepaid reinsurance premium 104.4 91.3 Deferred acquisition costs 4.1 3.5 Property and equipment, net 6.9 5.7 Intangible assets 0.6 0.6 Other assets 16.0 14.5 Total assets $ 1,477.5 $ 828.7 Liabilities and Stockholders' Equity Unpaid loss and loss adjustment expense $ 62.2 $ 46.3 Unearned premium 143.5 123.8 Trade payables 1.0 1.4 Funds held for reinsurance treaties 66.0 62.1 Deferred ceding commission 26.0 22.4 Ceded premium payable 15.3 13.0 Other liabilities and accrued expenses 19.8 18.7 Total liabilities 333.8 287.7 Commitments and contingencies Stockholders' equity: Common stock, $0.00001 par value, 200,000,000 shares authorized; 61,370,103 and 56,774,294 shares issued and outstanding as of March 31, 2021 and December 31, 2020, respectively — — Additional paid-in capital 1,512.3 859.8 Accumulated deficit (369.6) (320.6) Accumulated other comprehensive income 1.0 1.8 Total stockholders' equity 1,143.7 541.0 Total liabilities and stockholders' equity $ 1,477.5 $ 828.7 23

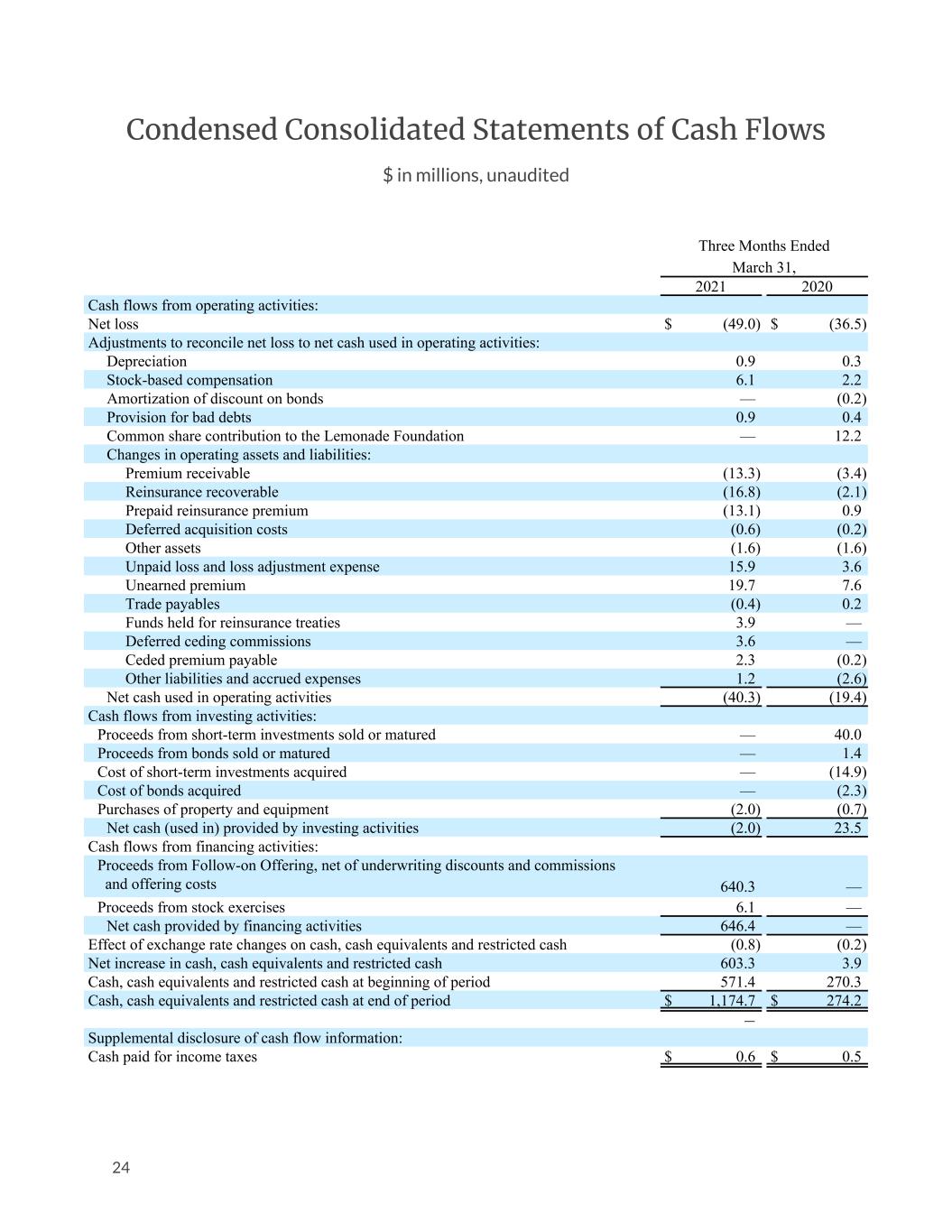

Condensed Consolidated Statements of Cash Flows $ in millions, unaudited Three Months Ended March 31, 2021 2020 Cash flows from operating activities: Net loss $ (49.0) $ (36.5) Adjustments to reconcile net loss to net cash used in operating activities: Depreciation 0.9 0.3 Stock-based compensation 6.1 2.2 Amortization of discount on bonds — (0.2) Provision for bad debts 0.9 0.4 Common share contribution to the Lemonade Foundation — 12.2 Changes in operating assets and liabilities: Premium receivable (13.3) (3.4) Reinsurance recoverable (16.8) (2.1) Prepaid reinsurance premium (13.1) 0.9 Deferred acquisition costs (0.6) (0.2) Other assets (1.6) (1.6) Unpaid loss and loss adjustment expense 15.9 3.6 Unearned premium 19.7 7.6 Trade payables (0.4) 0.2 Funds held for reinsurance treaties 3.9 — Deferred ceding commissions 3.6 — Ceded premium payable 2.3 (0.2) Other liabilities and accrued expenses 1.2 (2.6) Net cash used in operating activities (40.3) (19.4) Cash flows from investing activities: Proceeds from short-term investments sold or matured — 40.0 Proceeds from bonds sold or matured — 1.4 Cost of short-term investments acquired — (14.9) Cost of bonds acquired — (2.3) Purchases of property and equipment (2.0) (0.7) Net cash (used in) provided by investing activities (2.0) 23.5 Cash flows from financing activities: Proceeds from Follow-on Offering, net of underwriting discounts and commissions and offering costs 640.3 — Proceeds from stock exercises 6.1 — Net cash provided by financing activities 646.4 — Effect of exchange rate changes on cash, cash equivalents and restricted cash (0.8) (0.2) Net increase in cash, cash equivalents and restricted cash 603.3 3.9 Cash, cash equivalents and restricted cash at beginning of period 571.4 270.3 Cash, cash equivalents and restricted cash at end of period $ 1,174.7 $ 274.2 — Supplemental disclosure of cash flow information: Cash paid for income taxes $ 0.6 $ 0.5 24

Reconciliation of Non-GAAP Financial Measures to their Most Directly Comparable GAAP Financial Measures $ in millions, except for per share information, unaudited Adjusted Gross Profit and Adjusted Gross Profit Margin The following table provides a reconciliation of total revenue to adjusted gross profit and the related adjusted gross profit margin for the periods presented: Three Months Ended March 31, 2021 2020 ($ in millions) Total revenue $ 23.5 $ 26.2 Adjustments: Loss and loss adjustment expense, net $ (16.5) $ (18.2) Other insurance expense (4.8) (3.3) Depreciation and amortization (0.3) (0.1) Gross profit $ 1.9 $ 4.6 Gross profit margin (% of total revenue) 8% 18% Adjustments: Net investment income $ (0.2) $ (0.9) Employee-related expense 1.7 0.9 Professional fees and other 1.3 0.7 Depreciation and amortization 0.3 0.1 Adjusted gross profit $ 5.0 $ 5.4 Adjusted gross profit margin (% of total revenue) 21% 21% 25

Ratio of Adjusted Gross Profit to Gross Earned Premium The following table sets forth our calculation of the Ratio of Adjusted Gross Profit to Gross Earned Premium for the periods presented: Three Months Ended March 31, 2021 2020 ($ in millions) Numerator: Adjusted gross profit $ 5.0 $ 5.4 Denominator: Gross earned premium $ 56.2 $ 30.5 Ratio of Adjusted Gross Profit to Gross Earned Premium 9% 18% Adjusted EBITDA The following table provides a reconciliation of adjusted EBITDA to net loss for the periods presented: Three Months Ended March 31, 2021 2020 ($ in millions) Net loss $ (49.0) $ (36.5) Adjustments: Income tax expense $ 0.9 $ 0.3 Depreciation and amortization 0.9 0.3 Stock-based compensation 6.1 2.2 Contribution to the Lemonade Foundation — 12.2 Net investment income (0.2) (0.9) Adjusted EBITDA $ (41.3) $ (22.4) 26

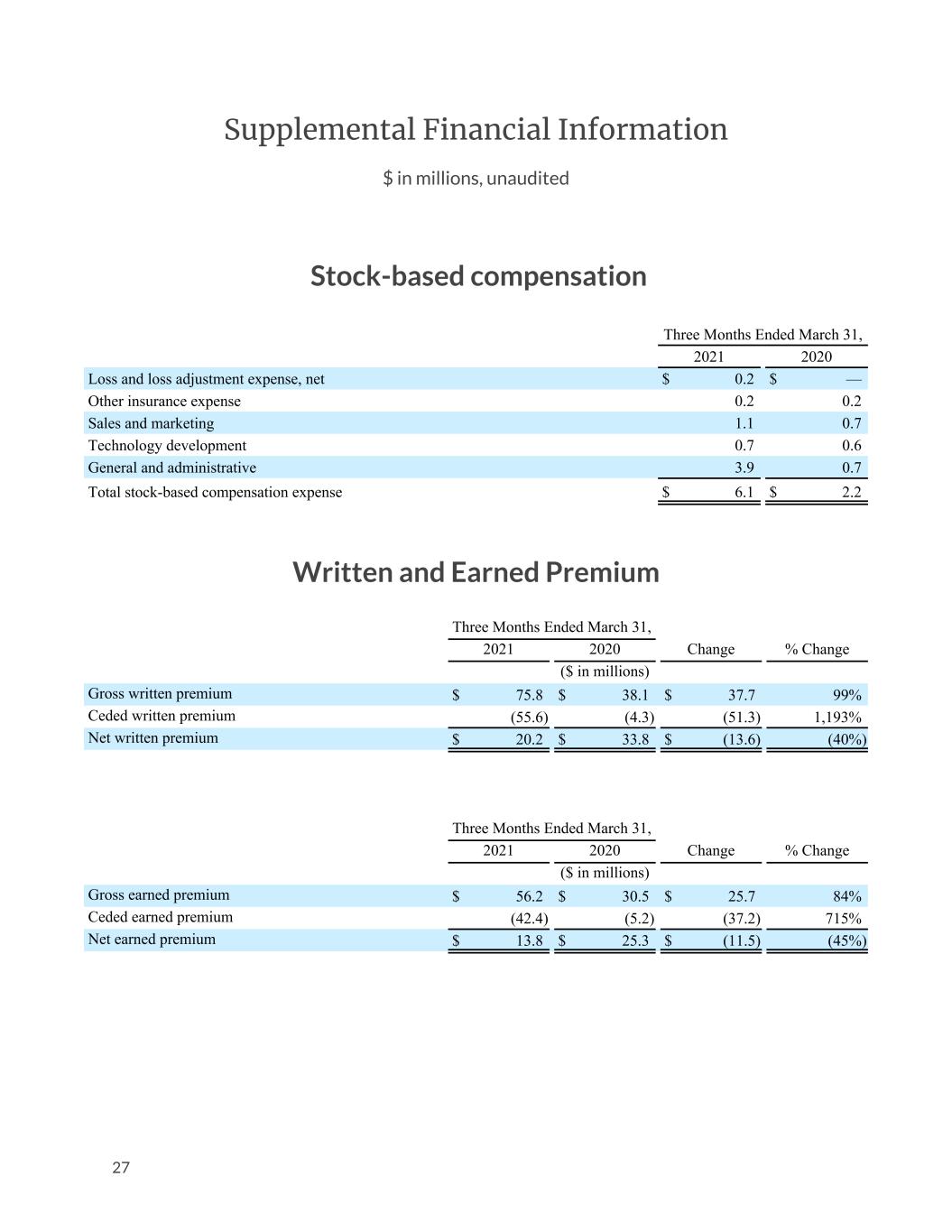

Supplemental Financial Information $ in millions, unaudited Stock-based compensation Three Months Ended March 31, 2021 2020 Loss and loss adjustment expense, net $ 0.2 $ — Other insurance expense 0.2 0.2 Sales and marketing 1.1 0.7 Technology development 0.7 0.6 General and administrative 3.9 0.7 Total stock-based compensation expense $ 6.1 $ 2.2 Written and Earned Premium Three Months Ended March 31, 2021 2020 Change % Change ($ in millions) Gross written premium $ 75.8 $ 38.1 $ 37.7 99% Ceded written premium (55.6) (4.3) (51.3) 1,193% Net written premium $ 20.2 $ 33.8 $ (13.6) (40%) Three Months Ended March 31, 2021 2020 Change % Change ($ in millions) Gross earned premium $ 56.2 $ 30.5 $ 25.7 84% Ceded earned premium (42.4) (5.2) (37.2) 715% Net earned premium $ 13.8 $ 25.3 $ (11.5) (45%) 27

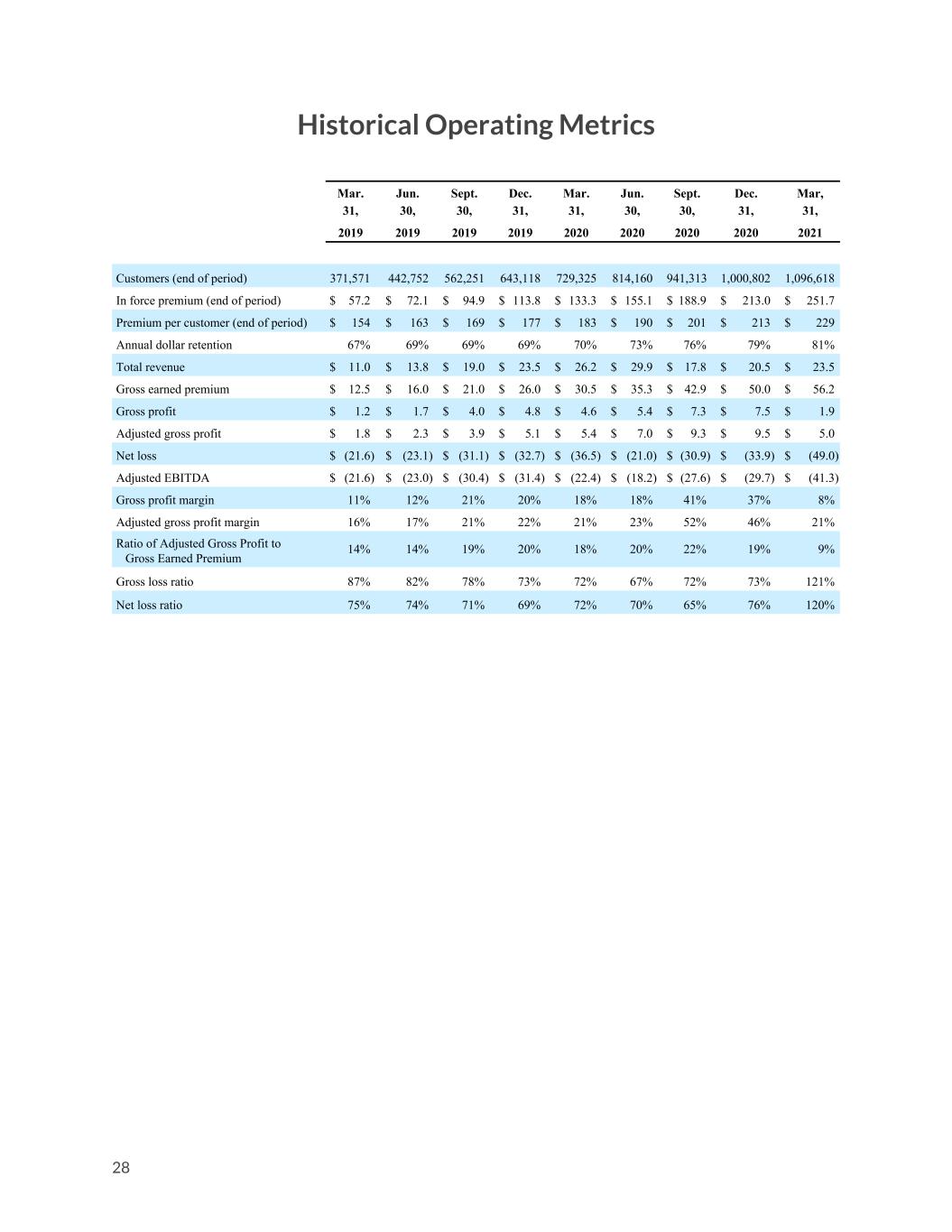

Historical Operating Metrics Mar. 31, Jun. 30, Sept. 30, Dec. 31, Mar. 31, Jun. 30, Sept. 30, Dec. 31, Mar, 31, 2019 2019 2019 2019 2020 2020 2020 2020 2021 Customers (end of period) 371,571 442,752 562,251 643,118 729,325 814,160 941,313 1,000,802 1,096,618 In force premium (end of period) $ 57.2 $ 72.1 $ 94.9 $ 113.8 $ 133.3 $ 155.1 $ 188.9 $ 213.0 $ 251.7 Premium per customer (end of period) $ 154 $ 163 $ 169 $ 177 $ 183 $ 190 $ 201 $ 213 $ 229 Annual dollar retention 67% 69% 69% 69% 70% 73% 76% 79% 81% Total revenue $ 11.0 $ 13.8 $ 19.0 $ 23.5 $ 26.2 $ 29.9 $ 17.8 $ 20.5 $ 23.5 Gross earned premium $ 12.5 $ 16.0 $ 21.0 $ 26.0 $ 30.5 $ 35.3 $ 42.9 $ 50.0 $ 56.2 Gross profit $ 1.2 $ 1.7 $ 4.0 $ 4.8 $ 4.6 $ 5.4 $ 7.3 $ 7.5 $ 1.9 Adjusted gross profit $ 1.8 $ 2.3 $ 3.9 $ 5.1 $ 5.4 $ 7.0 $ 9.3 $ 9.5 $ 5.0 Net loss $ (21.6) $ (23.1) $ (31.1) $ (32.7) $ (36.5) $ (21.0) $ (30.9) $ (33.9) $ (49.0) Adjusted EBITDA $ (21.6) $ (23.0) $ (30.4) $ (31.4) $ (22.4) $ (18.2) $ (27.6) $ (29.7) $ (41.3) Gross profit margin 11% 12% 21% 20% 18% 18% 41% 37% 8% Adjusted gross profit margin 16% 17% 21% 22% 21% 23% 52% 46% 21% Ratio of Adjusted Gross Profit to Gross Earned Premium 14% 14% 19% 20% 18% 20% 22% 19% 9% Gross loss ratio 87% 82% 78% 73% 72% 67% 72% 73% 121% Net loss ratio 75% 74% 71% 69% 72% 70% 65% 76% 120% 28

Appendix to the Q1 2021 Shareholder Letter

Customers (in ‘000s) In Force Premium ($s in m) 50% 96% YoY growth 89%133% 372 729 1,097 Q1 19 Q1 20 Q1 21 $57.2 $133.3 $251.7 Q1 19 Q1 20 Q1 21 $154 $183 $229 Q1 19 Q1 20 Q1 21 Premium Per Customer 25% 19% * = Appendix p.2

Gross Earned Premium (“GEP”) ($s in m) Revenue (1) ($s in m) $11.0 $26.2 $23.5 Q1 19 Q1 20 Q1 21 (10%)138% YoY growth $12.5 $30.5 $56.2 Q1 19 Q1 20 Q1 21 84% 144% (1) Our ‘proportional reinsurance’ agreements went into effect at the beginning of Q3 20, increasing the proportion of premium that is ceded. This drives the YoY decline in revenue. Appendix p.3

Loss Ratio Gross Loss Ratio (1) Net Loss Ratio (1) (1) We define gross loss ratio, expressed as a percentage, as the ratio of losses and loss adjustment expense to gross earned premium, and net loss ratio, expressed as a percentage, as the ratio of losses and loss adjustment expense, less amounts ceded to reinsurers, to net earned premium. Appendix p.4 87% 82% 78% 73% 72% 67% 72% 73% 121% 75% 74% 71% 69% 72% 70% 65% 76% 120% Q1 19 Q2 19 Q3 19 Q4 19 Q1 20 Q2 20 Q3 20 Q4 20 Q1 21

Gross Profit ($s in m) Gross Profit Margin (59%)283% 11% 18% 8% Q1 19 Q1 20 Q1 21 YoY growth Appendix p.5 $1.2 $4.6 $1.9 Q1 19 Q1 20 Q1 21

Adj. Gross Profit (1) ($s in m) Ratio of Adj. Gross Profit to GEP $1.8 $5.4 $5.0 Q1 19 Q1 20 Q1 21 (7%)200% (1) This is a non-GAAP metric. For a description of these metrics and a reconciliation to the most directly comparable GAAP measure, please see "Reconciliation of Non-GAAP Financial Measures to GAAP" and "Non-GAAP financial measures and key operating metrics". Specifically for Q1 19, the most comparable GAAP metric of Gross Profit was $1.2m; adjustments to Adj. Gross Profit are net investment income of ($0.5m), employee-related expense of $0.4m, professional fees and other expense of $0.7m. 14% 18% 9% Q1 19 Q1 20 Q1 21 YoY growth Appendix p.6

($18.4) ($19.2) ($29.1) ($24.6) ($44.2) ($55.1) Q1 19 Q1 20 Q1 21 Other insurance expense Sales and marketing Technology development General and administrative Operating Expenses (1) ($s in m) (1) Represents total expense less loss and loss adjustment expense, net. (2) Note that Q1 20 included a one-time non-cash G&A expense of $12.2 million, pursuant to the pre-IPO donation of 500,000 Lemonade shares by the company to the non-profit Lemonade Foundation. Appendix p.7 (2)

Net Loss ($s in m) Adj. EBITDA (1) ($s in m) (84%)(4%) YoY growth (34%) (69%) (1) This is a non-GAAP metric. For a description of these metrics and a reconciliation to the most directly comparable GAAP measure, please see "Reconciliation of Non-GAAP Financial Measures to GAAP" and "Non-GAAP financial measures and key operating metrics". Specifically for Q1 19, the most comparable GAAP metric of Net Loss was ($21.6m); adjustments to Adj. EBITDA are income tax expense of $0.1m, stock-based compensation expense of $0.4m and net investment income expense of ($0.5m). Appendix p.8 ($21.6) ($36.5) ($49.0) Q1 19 Q1 20 Q1 21 ($21.6) ($22.4) ($41.3) Q1 19 Q1 20 Q1 21

Guidance ($s in m) Q2 2021 Full Year 2021 $283.0 $288.0 $63.5 $65.0 $26.0 $27.0 ($43.0) ($40.0) ($173.0) ($163.0) $117.0 $120.0 $279.0 $283.0 $376.0 $382.0 Low High Low High In Force Premium (as of end of period) Gross Earned Premium Revenue Adj. EBITDA (1) (1) Adj. EBITDA is a non-GAAP metric. A full reconciliation of Adj. EBITDA guidance to net loss on a forward-looking basis cannot be provided without unreasonable efforts, as we are unable to provide reconciling information with respect to income tax expense, depreciation and amortization, interest income, net investment income, and other transactions that we consider to be unique in nature, all of which are adjustments to Adj. EBITDA. We estimate that stock-based compensation for the second quarter and full year 2021 is approximately $13m and $50m, respectively. Appendix p.9