Attached files

| file | filename |

|---|---|

| EX-99.1 - EX-99.1 PRESS RELEASE - DARLING INGREDIENTS INC. | exh991-pressreleaseq12021.htm |

| 8-K - 8-K - DARLING INGREDIENTS INC. | dar-20210511.htm |

First Quarter 2021 Conference Call Exhibit 99.2

Safe Harbor Statement This presentation contains “forward-looking” statements that are subject to risks and uncertainties that could cause the actual results of Darling Ingredients Inc. (the “Company”) to differ materially from those expressed or implied in the statements. Statements that are not statements of historical facts are forward-looking statements and are made pursuant to the safe harbor provisions of the Private Securities Litigation Reform Act of 1995. Words such as “estimate,” “project,” “planned,” “contemplate,” “potential,” “possible,” “proposed,” “intend,” “believe,” “anticipate,” “expect,” “may,” “will,” “would,” “should,” “could” “combined adjusted EBITDA” and similar expressions are intended to identify forward-looking statements. Forward-looking statements are based on the Company’s current expectations and assumptions regarding its business, the economy and other future conditions. The Company cautions readers that any such forward-looking statements it makes are not guarantees of future performance and that actual results may differ materially from anticipated results or expectations expressed in its forward-looking statements as a result of a variety of factors, including many that are beyond the Company’s control. These factors include, among others, existing and unknown future limitations on the ability of the Company's direct and indirect subsidiaries to make their cash flow available to the Company for payments on the Company's indebtedness or other purposes; global demands for bio-fuels and grain and oilseed commodities, which have exhibited volatility, and can impact the cost of feed for cattle, hogs and poultry, thus affecting available rendering feedstock and selling prices for the Company’s products; reductions in raw material volumes available to the Company due to weak margins in the meat production industry as a result of higher feed costs, reduced consumer demand or other factors, reduced volume from food service establishments, or otherwise; reduced demand for animal feed; reduced finished product prices, including a decline in fat and used cooking oil finished product prices; changes to worldwide government policies relating to renewable fuels and greenhouse gas(“GHG”) emissions that adversely affect programs like the U.S. government’s renewable fuel standard, low carbon fuel standards (“LCFS”) and tax credits for biofuels both in the United States and abroad; possible product recall resulting from developments relating to the discovery of unauthorized adulterations to food or food additives; the occurrence of 2009 H1N1 flu (initially known as “Swine Flu”), Highly pathogenic strains of avian influenza (collectively known as “Bird Flu”), severe acute respiratory syndrome (“SARS”), bovine spongiform encephalopathy (or "BSE"), porcine epidemic diarrhea ("PED") or other diseases associated with animal origin in the United States or elsewhere, such as the outbreak of African Swine Fever (“ASF”) in China and elsewhere; the occurrence of pandemics, epidemics or disease outbreaks, such as the current COVID-19 outbreak; unanticipated costs and/or reductions in raw material volumes related to the Company’s compliance with the existing or unforeseen new U.S. or foreign (including, without limitation, China) regulations (including new or modified animal feed, Bird Flu, SARS, PED, BSE, ASF or similar or unanticipated regulations) affecting the industries in which the Company operates or its value added products; risks associated with the DGD Joint Venture, including possible unanticipated operating disruptions and issues relating to the announced expansion projects; risks and uncertainties relating to international sales and operations, including imposition of tariffs, quotas, trade barriers and other trade protections imposed by foreign countries; difficulties or a significant disruption in our information systems or failure to implement new systems and software successfully, risks relating to possible third party claims of intellectual property infringement; increased contributions to the Company’s pension and benefit plans, including multiemployer and employer-sponsored defined benefit pension plans as required by legislation, regulation or other applicable U.S. or foreign law or resulting from a U.S. mass withdrawal event; bad debt write-offs; loss of or failure to obtain necessary permits and registrations; continued or escalated conflict in the Middle East, North Korea, Ukraine or elsewhere; uncertainty regarding the exit of the U.K. from the European Union; and/or unfavorable export or import markets. These factors, coupled with volatile prices for natural gas and diesel fuel, climate conditions, currency exchange fluctuations, general performance of the U.S. and global economies, disturbances in world financial, credit, commodities and stock markets, and any decline in consumer confidence and discretionary spending, including the inability of consumers and companies to obtain credit due to lack of liquidity in the financial markets, among others, could cause actual results to vary materially from the forward looking statements included in this release or negatively impact the Company's results of operations. Among other things, future profitability may be affected by the Company’s ability to grow its business, which faces competition from companies that may have substantially greater resources than the Company. The Company’s announced share repurchase program may be suspended or discontinued at any time and purchases of shares under the program are subject to market conditions and other factors, which are likely to change from time to time. Other risks and uncertainties regarding Darling Ingredients Inc., its business and the industries in which it operates are referenced from time to time in the Company’s filings with the Securities and Exchange Commission. Darling Ingredients Inc. is under no obligation to (and expressly disclaims any such obligation to) update or alter its forward-looking statements whether as a result of new information, future events or otherwise. Page 2 | First Quarter 2021 Financial Results | 05.12.2021

Summary Highlights First Quarter 2021 Business Update • Record first quarter global ingredients EBITDA of $176.6 million • Q1 2021 combined adjusted EBITDA totaled a record $284.8 million • Substantial growth in net income increasing $66.3 million or 77.5% for Q1 2021 when compared to the prior year • DGD reported a record $2.77 EBITDA/gallon, generating $108.2 million EBITDA – Darling’s share • Raising 2021 EBITDA guidance to a range of $1.075 billion to $1.150 billion, representing 28% to 37% increase in EBITDA over 2020 results • DGD renewable diesel projects at both Norco, LA and Port Arthur, TX remain on track • Darling Ingredients was announced in April as one of the 50 Sustainability and Climate Leaders by Bloomberg and TB Media Group Page 3 | First Quarter 2021 Financial Results | 05.12.2021

Financial Highlights Financials (in millions, except per share data) Q1-2021 Q1-2020 % Variance Net sales $1,046.7 $852.8 22.7% Gross margin 273.9 205.9 33.0% Gross margin % 26.2% 24.1% 8.7% Net income $151.8 $85.5 77.5% EPS diluted $0.90 $0.51 76.5% $110 $126 $122 $146 $177 $104 $69 $96 $68 $108 $0 $150 $300 Q1 2020 Q2 2020 Q3 2020 Q4 2020 Q1 2021 Global Ingredients DGD $213.3 $195.2 $218.5 (In millions) Trailing 5 Quarters Combined adjusted EBITDA $214.5 $284.8 (1) Leverage ratio calculated per bank covenantPage 4 | First Quarter 2021 Financial Results | 05.12.2021 17.0% 19.0% 21.0% 23.0% 25.0% 27.0% Darling Ingredients Quarterly Gross Margin % Gross Margin % Balance Sheet (in millions, except ratio data) As of 04/03/2021 As of 01/02/2021 Cash (including restricted) $71.4 $81.7 Revolver availability $879.9 $893.9 Net working capital $258.7 $257.5 Total debt $1,444.5 $1,508.1 Leverage ratio (1) 1.67x 1.90x Capital expenditures $60.8 $61.6

Financial Highlights Financials (in millions) Q1-2021 Q1-2020 % Variance Segment EBITDA Feed $124.4 $70.2 77.2% Food 46.4 39.4 17.8% Fuel 128.7 118.8 8.4% Corporate (14.7) (15.1) 2.6% Total Combined adjusted EBITDA $284.8 $213.3 33.5% Feed 42% Food 15% Fuel 43% Q1 2021 % of Total EBITDA by Segment (before corporate) 2021 EBITDA Guidance Revised May 2021 Low High (in millions) By Segment Feed $475 $510 Food 180 190 Fuel* 480 510 Corporate (60.0) (60.0) Total Combined adjusted EBITDA $1.075 $1.150 *(Estimating DGD @ 365 mmg @ $2.25 to $2.40/EBITDA gal. for '21) Page 5 | First Quarter 2021 Financial Results | 05.12.2021 Avg Price Avg Price 1st Quarter 4th Quarter 2021 2020 Chg % Chg Jacobsen Index: MBM (Ill inois) $ 386.97 $ 305.29 $ 81.68 26.8% Feed Grade PM (Mid-South) 357.79$ 283.65$ 74.14$ 26.1% Pet Food PM (Mid-South) $ 845.08 $ 733.12 $ 111.96 15.3% Feathermeal (Mid-South) 539.02$ 405.49$ 133.53$ 32.9% BFT (Chicago) $ 46.42 $ 34.24 $ 12.18 35.6% YG (Il l inois) 34.45$ 25.22$ 9.23$ 36.6% Corn (Il l inois) $ 5.56 $ 4.29 $ 1.27 29.6% Thomson Reuters: Palm Oil (CIF Rotterdam) Ton $ 1,084.00 $ 850.00 $ 234.00 27.5% Soy meal (CIF Rotterdam) Ton 535.0$ 485.0$ 50.0$ 10.3%

Feed Segment Key Drivers: • Higher protein and animal fat prices drove the overall feed segment sales up 27.1% quarter over quarter on flat raw materials processed. Gross margin increased $52.7 million or 42.4% quarter over quarter led by higher commodity prices across all products sold. • UCO volumes continue to run approximately 5% below historical levels and the northeast U.S. and California still lag as a result of COVID 19 restrictions behind the rest of North America. • Fat prices (BFT & YG) are up for 2021 compared to a year ago. BFT average price is 42% higher than 2020 and YG was up 50.3% in Q1 2021 compared to the prior year. Protein pricing (MBM) was also higher for Q1 2021 by 63.2% compared to 2020 Page 6 | First Quarter 2021 Financial Results | 05.12.2021 US$ (in millions) 1Q 2021 1Q2020 Net Sa les 651,444$ 512,625$ Cost of sa les and operating expenses 474,581 388,453 Gross Margin 176,863$ 124,172$ Loss/(ga in) on sa le of assets (139) 50 Sel l ing, genera l and adminis trative expenses 52,620 53,947 Depreciation and amortization 54,609 53,521 Segment operating income 69,773$ 16,654$ Equity in net income of unconsol idated subs idiaries 612$ 869$ Segment Income 70,385$ 17,523$ Segment EBITDA 124,382$ 70,175$ Raw material processed (mmts) 2.23 2.24 Fats Proteins Other Rendering Total Rendering Used Cooking Oil Bakery Other Total Net Sales Three Months Ended March 28, 2020 163.3$ 196.0$ 47.1$ 406.4$ 47.6$ 47.1$ 11.5$ 512.6$ Changes: Increase in sales volumes 4.9 0.8 - 5.7 (6.1) (0.9) - (1.3) Increase in finished product prices 58.2 52.3 - 110.5 9.5 16.9 - 136.9 Increase/(Decrease) due to currency exchange rates 2.6 6.4 0.1 9.1 - - - 9.1 Other change - - (4.2) (4.2) - - (1.7) (5.9) Total Change: 65.7 59.5 (4.1) 121.1 3.4 16.0 (1.7) 138.8 Net Sales Three Months Ended April 3, 2021 229.0$ 255.5$ 43.0$ 527.5$ 51.0$ 63.1$ 9.8$ 651.4$ Feed Segment Sales Change in Net Sales - 2020 to 2021 Three Months Ended

Food Segment • Net sales for the food segment grew $27.8 million or 10.3% in Q1 2021 compared to the prior year, driven by higher collagen volume sales and higher edible fat prices. • Segment income improved $12.4 million or was 65.2% higher driven by higher sales and by a reduction of depreciation and amortization expenses of 26.7% quarter over quarter as certain assets became fully depreciated at the end of 2020. • Peptan product sales continue to show strength into 2021. • Continue to expand bio-medical product offerings with our collagen peptides. Key Drivers: 80% 12% 8% 2021 % of Sales Breakdown Collagen Edible fats Other products 1) FY 2019 excludes the $13.1 million gain on an asset sale in ChinaPage 7 | First Quarter 2021 Financial Results | 05.12.2021 $100 $120 $140 $160 $180 $200 Food Segment Trailing 4Q adjusted EBITDA Trailing 4 Q's US$ (in millions) 1Q 2021 1Q2020 Net Sa les 298,065$ 270,294$ Cost of sa les and operating expenses 226,413 205,430 Gross Margin 71,652$ 64,864$ Loss on sa le of assets 55 2 Sel l ing, genera l and adminis trative expenses 25,191 25,476 Depreciation and amortization 14,883 20,305 Segment operating income 31,523$ 19,081$ Equity in net income of unconsol idated subs idiaries -$ -$ Segment Income 31,523$ 19,081$ Segment EBITDA 46,406$ 39,386$ Raw material processed (mmts) 0.3 0.3

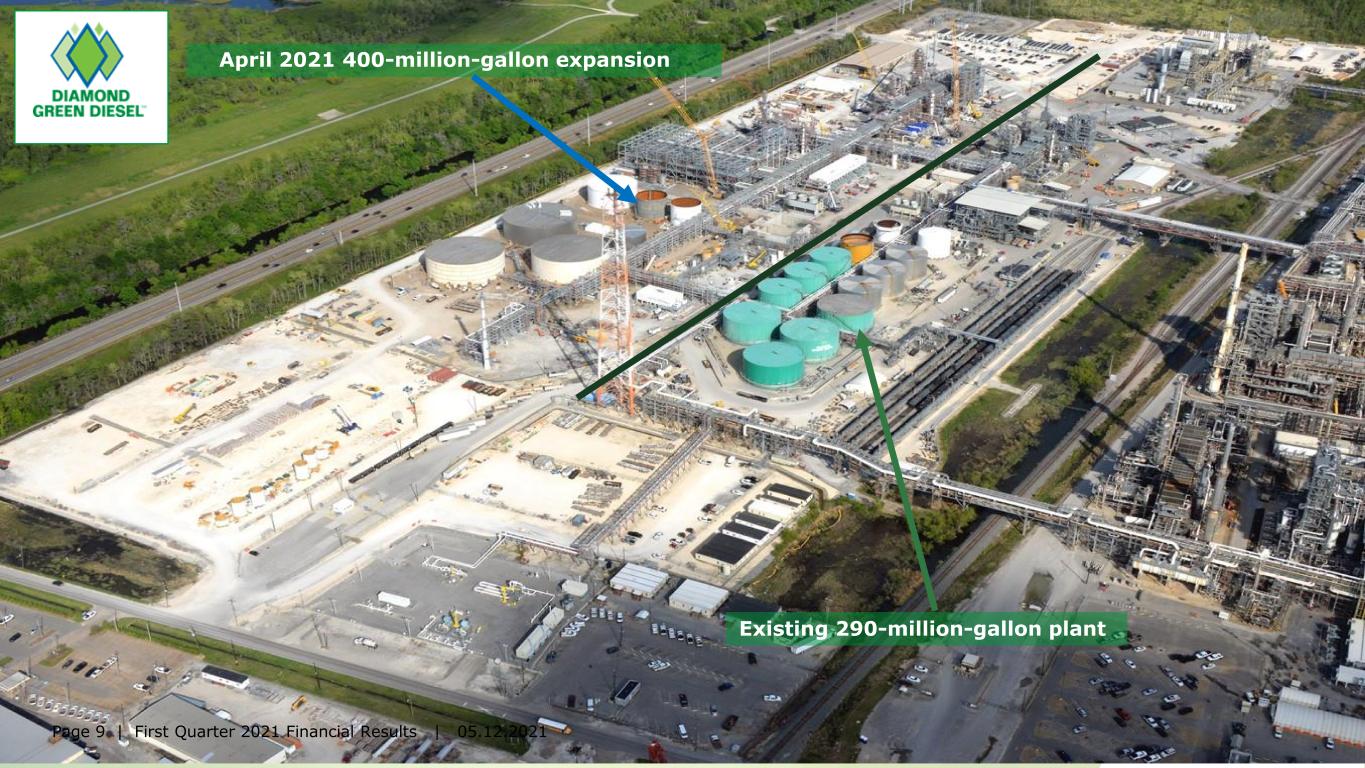

Fuel Segment (Includes Diamond Green Diesel JV consolidated EBITDA) Key Drivers: • Q1-2021 Combined adjusted EBITDA of $128.7 million, with DGD earning $2.77 per gallon on 78.0 million gallons sold • Fuel segment incurred $778,000 of additional restructuring charges related primarily to severance expenses as a result of shuttering the Company’s two biodiesel facilities at year-end. • DGD – Norco, LA expansion remains on track and is scheduled to be at full production in the middle of Q4-2021. This expansion will add 400 million gallons of renewable diesel production and add approximately 30 million gallons of renewable naphtha. • DGD Port Arthur location construction is underway. This new 470- million-gallon facility is expected to be operational in the second half of 2023. (1) Includes Fuel Segment EBITDA and Darling's share of DGD EBITDA. • Excludes feed stock (raw material) processed at the DGD joint venture. (2) Quarterly average prices source is The Jacobson Page 8 | First Quarter 2021 Financial Results | 05.12.2021 $0.15 $0.20 $0.25 $0.30 $0.35 $0.40 $0.30 $0.50 $0.70 $0.90 $1.10 Q1-19 Q2-19 Q3-19 Q4-19 Q1-20 Q2-20 Q3-20 Q4-20 Q1-21 Quarterly Avg. Prices D4 RINS & Yellow Grease2 D4 RIN Qtrly Avg YG Avg Qtrly Price Diamond Green Diesel US$ and gallons (in millions) 1Q 2021 1Q2020 EBITDA (Enti ty) - in quarter recorded w/no BTC 137.4$ 127.3$ EBITDA (Enti ty) - BTC adjusted to when earned 216.4$ 207.3$ Pro forma Adjusted EBITDA (Darl ing's share) 108.2$ 103.6$ Tota l ga l lons produced 78.6 77.0 Tota l ga l lons sold/shipped 78.0 78.9 EBITDA per gallon sold 2.77 2.63 US$ (in millions) 1Q 2021 1Q2020 Net Sa les 97,207$ 69,923$ Cost of sa les and operating expenses 71,790 53,025 Gross Margin 25,417$ 16,898$ Loss on sa le of assets 20 9 Sel l ing, genera l and adminis trative expenses 4,867 1,654 Restructuring and asset impairment charges 778 - Depreciation and amortization 6,155 8,092 Equity in net income of Diamond Green Diesel 102,225 97,820 Segment operating income 115,822$ 104,963$ Equity in net income of unconsol idated subs idiaries -$ -$ Segment Income 115,822$ 104,963$ Segment EBITDA 20,530$ 15,235$ DGD adjusted EBITDA (Darl ing's Share) 108,200$ 103,634$ Segment EBITDA (1) 128,730$ 118,869$ Raw material processed (mmts) * 0.3 0.3

April 2021 400-million-gallon expansion Existing 290-million-gallon plant Page 9 | First Quarter 2021 Financial Results | 05.12.2021

April 2021 Port Arthur, TX 470-million-gallon facility Page 10 | First Quarter 2021 Financial Results | 05.12.2021

Appendix Additional Information

California LCFS & RIN value history Source: The Jacobson and StoneX Page 12 | First Quarter 2021 Financial Results | 05.12.2021 $0 $50 $100 $150 $200 $250 1 / 1 / 2 0 1 6 4 / 1 / 2 0 1 6 7 / 1 / 2 0 1 6 1 0 / 1 / 2 0 1 6 1 / 1 / 2 0 1 7 4 / 1 / 2 0 1 7 7 / 1 / 2 0 1 7 1 0 / 1 / 2 0 1 7 1 / 1 / 2 0 1 8 4 / 1 / 2 0 1 8 7 / 1 / 2 0 1 8 1 0 / 1 / 2 0 1 8 1 / 1 / 2 0 1 9 4 / 1 / 2 0 1 9 7 / 1 / 2 0 1 9 1 0 / 1 / 2 0 1 9 1 / 1 / 2 0 2 0 4 / 1 / 2 0 2 0 7 / 1 / 2 0 2 0 1 0 / 1 / 2 0 2 0 1 / 1 / 2 0 2 1 4 / 1 / 2 0 2 1 Monthly Average LCFS Carbon Credit Price (USD/MT)

Feed Segment - Historical (1) Does not include Unconsolidated Subsidiaries EBITDAPage 13 | First Quarter 2021 Financial Results | 05.12.2021 US$ (in millions) Q1-2019 Q2-2019 Q3-2019 Q4-2019 Total 2019 Q1-2020 Q2-2020 Q3-2020 Q4-2020 Total 2020 Q1-2021 Net Sales 495.8$ 487.4$ 497.0$ 490.4$ 1,970.6$ 512.6$ 503.7$ 483.0$ 572.8$ 2,072.1$ 651.4$ Gross Margin 109.0 110.5 117.2 114.3 451.0 124.2 135.8 121.4 146.2 527.6 176.9 Gross Margin % 22.0% 22.7% 23.6% 23.3% 22.9% 24.2% 27.0% 25.1% 25.5% 25.5% 27.1% Loss/(gain) on sale of assets (4.4) (0.5) (2.4) (0.4) (7.7) 0.1 0.1 0.2 (0.3) - (0.1) SG&A 48.8 46.5 47.3 57.9 200.5 53.9 50.5 49.0 56.3 209.7 52.6 SG&A Margin % 9.8% 9.5% 9.5% 11.8% 10.2% 10.5% 10.0% 10.2% 9.8% 10.1% 8.1% Operating Income 15.2 15.8 22.1 1.6 54.7 16.7 32.5 18.5 28.9 96.6 69.8 Adj. EBITDA (1) 64.5$ 64.5$ 72.3$ 56.8$ 258.2$ 70.2$ 85.2$ 72.3$ 90.2$ 317.8$ 124.4$ Adj. EBITDA Margin % 13.0% 13.2% 14.5% 11.5% 13.2% 13.7% 16.9% 15.0% 15.7% 15.3% 19.1% Raw Material Processed (mmts) 2.18 2.16 2.19 2.21 8.74 2.24 2.15 2.18 2.37 8.95 2.23

Historical Pricing Jacobson, Wall Street Journal and Thomson Reuters Page 14 | First Quarter 2021 Financial Results | 05.12.2021 2021 Avg. Jacobsen Prices January February March Q1Avg. April May June Q2 Avg. July August September Q3 Avg. October November December Q4 Avg. BFT - Chicago Renderer / cwt $39.74 $44.68 $51.98 $45.47 YG - IL / cwt $29.01 $34.36 $39.02 $34.13 Choice White Grease - IL / cwt $36.21 $39.37 $50.43 $42.00 Poultry Fat - Southeast / cwt $39.87 $43.13 $47.70 $43.57 Poultry Grease - Mid South / cwt $39.71 $43.74 $48.04 $43.83 Distiller's Corn Oil - IL / cwt $39.92 $43.50 $51.25 $44.89 Corn - Decatur, IL / bushel $5.04 $5.35 $5.65 $5.35 MBM - IL / ton $355.5 $380.5 $418.3 $384.77 MBM - CA / ton $294.7 $346.1 $365.0 $335.26 Pork Meal - IA IL / ton $363.9 $397.4 $413.0 $391.45 Feed Grade PM - Carolina / ton $369.5 $427.1 $450.0 $415.53 Feed Grade PM - Mid South / ton $326.6 $386.6 $359.8 $357.65 Pet Food PM - SE / ton $877.0 $831.7 $818.5 $842.39 Pet Food PM - Mid South / ton $877.0 $845.4 $818.5 $846.95 Feather meal - AL GA / ton $463.7 $477.6 $512.5 $484.61 Feather meal - Mid South / ton $512.1 $563.2 $541.3 $538.87 Blood Meal - Ruminant MO River / ton $939.5 $1,047.4 $1,082.6 $1,023.2 D4 RINs (B21) $1.03 $1.10 $1.38 $1.17 Comparison Q4-2020 Q1-2021 % Q1-2020 Q1-2021 % FY 2020 FY 2021 % Q1Avg. Q2 Avg. Q3 Avg. Q4 Avg. Avg. Avg. Change Avg. Avg. Change Avg. Avg. Change BFT - Chicago Renderer / cwt $45.47 $34.24 $45.47 32.79% $32.70 $45.47 39.04% $31.48 $0.00 -100.00% YG - IL / cwt $34.13 $25.22 $34.13 35.33% $22.92 $34.13 48.90% $21.95 $0.00 -100.00% Choice White Grease - IL / cwt $42.00 $31.44 $42.00 33.59% $27.02 $42.00 55.45% $31.48 $0.00 -100.00% Poultry Grease - SE / cwt $43.57 $33.39 $43.57 30.49% $28.32 $43.57 53.83% $29.43 $0.00 -100.00% Poultry Grease - Mid South / cwt $43.83 $30.03 $43.83 45.98% $25.90 $43.83 69.23% $29.88 $0.00 -100.00% Distiller's Corn Oil - IL / cwt $44.89 $33.10 $44.89 35.61% $26.91 $44.89 66.82% $28.82 $0.00 -100.00% Corn - Decatur, IL / bushel $5.35 $4.29 $5.35 24.67% $3.90 $5.35 37.14% $3.75 $0.00 -100.00% MBM - IL / ton $384.77 $305.29 $384.77 26.04% $237.10 $384.77 62.28% $261.43 $0.00 -100.00% MBM - CA / ton $335.26 $253.48 $335.26 32.26% $188.11 $335.26 78.23% $211.77 $0.00 -100.00% Pork Meal - IA IL / ton $391.45 $306.81 $391.45 27.59% $208.51 $391.45 87.74% $257.79 $0.00 -100.00% Feed Grade PM - Carolina / ton $415.53 $311.66 $415.53 33.33% $227.02 $415.53 83.04% $267.70 $0.00 -100.00% Feed Grade PM - Mid South / ton $357.65 $283.65 $357.65 26.09% $225.73 $357.65 58.44% $251.13 $0.00 -100.00% Pet Food PM - SE / ton $842.39 $718.30 $842.39 17.27% $502.62 $842.39 67.60% $607.65 $0.00 -100.00% Pet Food PM - Mid South / ton $846.95 $733.12 $846.95 15.53% $540.44 $846.95 56.71% $633.61 $0.00 -100.00% Feathermeal - AL GA / ton $484.61 $362.64 $484.61 33.63% $272.60 $484.61 77.77% $289.51 $0.00 -100.00% Feathermeal - Mid South / ton $538.87 $405.58 $538.87 32.86% $282.50 $538.87 90.75% $314.20 $0.00 -100.00% Blood Meal - Ruminant MO River / ton $1,023.2 $800.35 $1,023.2 27.84% $886.30 $1,023.2 15.44% $771.37 $0.00 -100.00% D4 Rins $1.17 $0.88 $1.17 32.83% $0.50 $1.17 133.94% $0.64 $0.00 -100.00% 2021

Food Segment - Historical (1) Adjusted for the $13.1 million gain on the asset sale in China for Q2-19 and FY-19 Page 15 | First Quarter 2021 Financial Results | 05.12.2021 US$ (in millions) Q1-2019 Q2-2019 Q3-2019 Q4-2019 Total 2019 Q1-2020 Q2-2020 Q3-2020 Q4-2020 Total 2020 Q1-2021 Net Sales 279.2$ 274.8$ 276.5$ 288.6$ 1,119.1$ 270.3$ 278.9$ 291.8$ 344.6$ 1,185.7$ 298.1$ Gross Margin 65.1 60.4 61.8 67.2 254.5 64.9 58.8 65.1 76.3 265.0 71.7 Gross Margin % 23.3% 22.0% 22.4% 23.3% 22.7% 24.0% 21.1% 22.3% 22.1% 22.4% 24.0% Loss/(gain) on sale of assets 0.1 (13.4) (0.2) 0.3 (13.2) - - 0.0 0.5 0.5 0.1 SG&A 21.9 23.4 22.8 29.3 97.4 25.5 22.6 23.4 26.0 97.4 25.2 SG&A Margin % 7.8% 8.5% 8.2% 10.2% 8.7% 9.4% 8.1% 8.0% 7.5% 8.2% 8.5% Operating Income 23.6 30.5 19.5 17.0 90.6 19.1 16.3 21.1 26.9 83.4 31.5 Adj. EBITDA (1) 43.2$ 37.1$ 39.3$ 37.5$ 157.1$ 39.4$ 36.3$ 41.7$ 49.8$ 167.1$ 46.4$ Adj. EBITDA Margin % 15.5% 13.5% 14.2% 13.0% 14.0% 14.6% 13.0% 14.3% 14.4% 14.1% 15.6% Raw Material Processed (mmts) 0.3 0.3 0.3 0.3 1.1 0.3 0.3 0.3 0.3 1.1 0.3

Fuel Segment - Historical (1) Includes Fuel Segment EBITDA and Darling's share of DGD EBITDA. * Excludes feed stock (raw material) processed at the DGD joint venture. Page 16 | First Quarter 2021 Financial Results | 05.12.2021 Diamond Green Diesel (50% Joint Venture) US$ and gallons (in millions) Q1-2019 Q2-2019 Q3-2019 Q4-2019 Total 2019 Q1-2020 Q2-2020 Q3-2020 Q4-2020 Total 2020 Q1-2021 EBITDA (Entity) - in quarter recorded w/no BTC 59.7$ 87.8$ 79.1$ 121.7$ 348.3$ 127.3$ 66.0$ 112.9$ 79.5$ 385.7$ 137.4$ EBITDA (Entity) - BTC adjusted to when earned 130.2$ 157.2$ 137.3$ 198.2$ 623.0$ 207.3$ 138.2$ 192.9$ 136.3$ 674.7$ 216.4$ Pro forma Adjusted EBITDA (Darling's share) 65.1$ 78.6$ 68.6$ 99.1$ 311.5$ 103.6$ 69.1$ 96.4$ 68.2$ 337.3$ 108.2$ Total gallons produced 67.6 73.2 55.9 77.9 274.6 77.0 74.5 77.3 60.5 289.3 78.6 Total gallons sold/shipped 71.1 70.0 58.7 77.1 276.9 78.9 72.3 80.0 56.8 288.0 78.0 EBITDA per gallon sold/shipped 1.83$ 2.25$ 2.34$ 2.57$ 2.25$ 2.63$ 1.91$ 2.41$ 2.40$ 2.34$ 2.77$ US$ (in millions) Q1-2019 Q2-2019 Q3-2019 Q4-2019 Total 2019 Q1-2020 Q2-2020 Q3-2020 Q4-2020 Total 2020 Q1-2021 Net Sales 60.1$ 65.0$ 68.6$ 80.6$ 274.3$ 69.9$ 66.0$ 75.7$ 102.4$ 314.1$ 97.2$ Gross Margin 10.0 11.7 10.1 37.6 69.4 16.9 21.8 25.7 26.2 90.5 25.4 Gross Margin % 16.7% 18.0% 14.7% 46.7% 25.3% 24.2% 32.9% 33.9% 25.6% 28.8% 26.1% Loss/(gain) on sale of assets - - - 0.3 0.3 - (0.0) (0.1) (0.0) (0.1) 0.0 SG&A (0.8) 0.4 0.9 2.3 2.8 1.6 4.0 5.0 5.4 16.0 4.9 Restructuring and asset impairment charges - - - - - - - - 38.2 38.2 0.8 Depreciation and amortization 7.8 8.4 7.9 7.8 31.9 8.1 8.0 8.6 9.5 34.2 6.2 Equity in net income of DGD 24.3 38.1 32.0 270.1 364.5 97.8 63.5 91.1 62.7 315.1 102.2 Segment Income 27.3 41.1 33.3 297.2 398.8 105.0 73.3 103.1 35.9 317.3 115.8 Segment EBITDA 10.8 11.4 9.2 35.0 66.3 15.3 17.8 20.7 20.8 74.6 20.5 DGD adjusted EBITDA (Darling's Share) 29.8 43.8 39.5 276.2 389.4 103.6 69.1 96.4 68.2 337.3 108.2 Combined Adj. EBITDA (1) 40.6$ 55.2$ 48.7$ 311.2$ 455.7$ 118.9$ 86.9$ 117.1$ 89.0$ 411.9$ 128.7$ Raw Material Processed*(mmts) 0.3 0.3 0.3 0.3 1.3 0.3 0.3 0.3 0.4 1.3 0.3

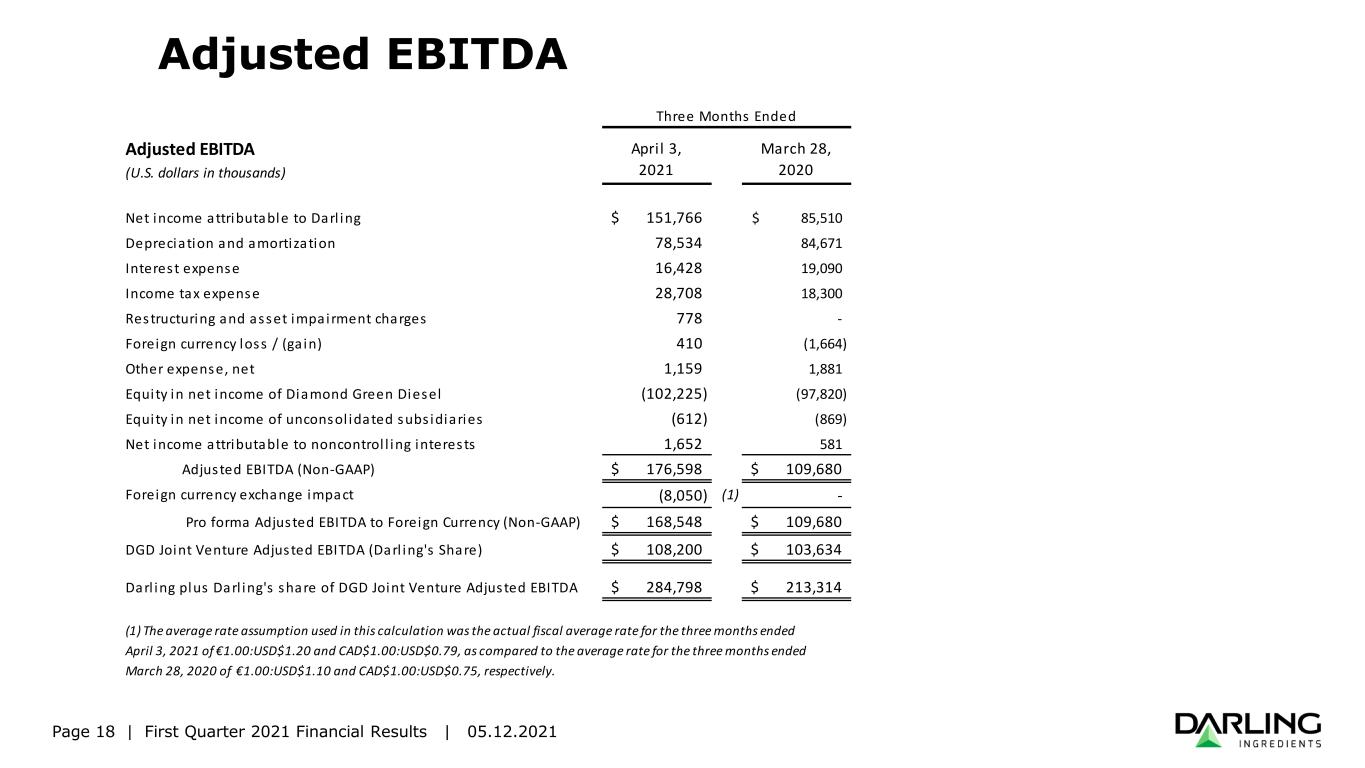

Non-U.S. GAAP Measures Adjusted EBITDA is not a recognized accounting measurement under GAAP; it should not be considered as an alternative to net income, as a measure of operating results, or as an alternative to cash flow as a measure of liquidity and is not intended to be a presentation in accordance with GAAP. Adjusted EBITDA is presented here not as an alternative to net income, but rather as a measure of the Company’s operating performance. Since EBITDA (generally, net income plus interest expenses, taxes, depreciation and amortization) is not calculated identically by all companies, this presentation may not be comparable to EBITDA or Adjusted EBITDA presentations disclosed by other companies. Adjusted EBITDA is calculated in this presentation and represents, for any relevant period, net income/(loss) plus depreciation and amortization, goodwill and long-lived asset impairment, interest expense, (income)/loss from discontinued operations, net of tax, income tax provision, other income/(expense) and equity in net loss of unconsolidated subsidiary. Management believes that Adjusted EBITDA is useful in evaluating the Company’s operating performance compared to that of other companies in its industry because the calculation of Adjusted EBITDA generally eliminates the effects of financing, income taxes and certain non-cash and other items that may vary for different companies for reasons unrelated to overall operating performance. As a result, the Company’s management uses Adjusted EBITDA as a measure to evaluate performance and for other discretionary purposes. In addition to the foregoing, management also uses or will use Adjusted EBITDA to measure compliance with certain financial covenants under the Company’s Senior Secured Credit Facilities and 5.25% Notes and 3.625% Notes that were outstanding at April 3, 2021. However, the amounts shown in this presentation for Adjusted EBITDA differ from the amounts calculated under similarly titled definitions in the Company’s Senior Secured Credit Facilities and 5.25% Notes and 3.625% Notes, as those definitions permit further adjustments to reflect certain other non- recurring costs, non-cash charges and cash dividends from the DGD Joint Venture. Additionally, the Company evaluates the impact of foreign exchange impact on operating cash flow, which is defined as segment operating income (loss) plus depreciation and amortization. Page 17 | First Quarter 2021 Financial Results | 05.12.2021

Adjusted EBITDA Page 18 | First Quarter 2021 Financial Results | 05.12.2021 Adjusted EBITDA April 3, March 28, (U.S. dollars in thousands) 2021 2020 Net income attributable to Darl ing 151,766$ 85,510$ Depreciation and amortization 78,534 84,671 Interest expense 16,428 19,090 Income tax expense 28,708 18,300 Restructuring and asset impairment charges 778 - Foreign currency loss / (ga in) 410 (1,664) Other expense, net 1,159 1,881 Equity in net income of Diamond Green Diesel (102,225) (97,820) Equity in net income of unconsol idated subs idiaries (612) (869) Net income attributable to noncontrol l ing interests 1,652 581 Adjusted EBITDA (Non-GAAP) 176,598$ 109,680$ Foreign currency exchange impact (8,050) (1) - Pro forma Adjusted EBITDA to Foreign Currency (Non-GAAP) 168,548$ 109,680$ DGD Joint Venture Adjusted EBITDA (Darl ing's Share) 108,200$ 103,634$ Darl ing plus Darl ing's share of DGD Joint Venture Adjusted EBITDA 284,798$ 213,314$ (1) The average rate assumption used in this calculation was the actual fiscal average rate for the three months ended April 3, 2021 of €1.00:USD$1.20 and CAD$1.00:USD$0.79, as compared to the average rate for the three months ended March 28, 2020 of €1.00:USD$1.10 and CAD$1.00:USD$0.75, respectively. Three Months Ended

Upcoming IR Events • BMO FTM Conference- 5.19.21 • Baird Global Consumer Conference– 6.08.21 • Tudor, Pickering Holt Hotter ‘N Hell Conference – 6.10.21 • Roth Capital Virtual London Conference – 6.22.21 Page 19 | First Quarter 2021 Financial Results | 05.12.2021

Thank you