Attached files

| file | filename |

|---|---|

| 8-K - 8-K - Braemar Hotels & Resorts Inc. | bhr-20210510.htm |

May 2021

Company Presentation | May 2021 2 Forward Looking Statements and Non-GAAP Measures In keeping with the SEC's "Safe Harbor" guidelines, certain statements made during this presentation could be considered forward-looking and subject to certain risks and uncertainties that could cause results to differ materially from those projected. When we use the words "will likely result," "may," "anticipate," "estimate," "should," "expect," "believe," "intend," or similar expressions, we intend to identify forward-looking statements. Such forward-looking statements include, but are not limited to, our business and investment strategy, our understanding of our competition, current market trends and opportunities, projected operating results, and projected capital expenditures. These forward-looking statements are subject to known and unknown risks and uncertainties, which could cause actual results to differ materially from those anticipated including, without limitation: general volatility of the capital markets and the market price of our common stock; changes in our business or investment strategy; availability, terms and deployment of capital; availability of qualified personnel; changes in our industry and the market in which we operate, interest rates or the general economy, the degree and nature of our competition, legislative and regulatory changes, including changes to the Internal Revenue Code of 1986, as amended (the “Code”), and related rules, regulations and interpretations governing the taxation of REITs; and limitations imposed on our business and our ability to satisfy complex rules in order for us to qualify as a REIT for federal income tax purposes. These and other risk factors are more fully discussed in the company's filings with the Securities and Exchange Commission. EBITDA is defined as net income (loss) before interest expense and amortization of loan costs, depreciation and amortization, income taxes, equity in (earnings) loss of unconsolidated entity and after the Company’s portion of EBITDA of OpenKey. In addition, we excluded impairment on real estate, (gain) loss on insurance settlement and disposition of assets and Company’s portion of EBITDA of OpenKey from EBITDA to calculate EBITDA for real estate, or EBITDAre, as defined by NAREIT. EBITDA yield is defined as trailing twelve month EBITDA divided by the purchase price or debt amount. A capitalization rate is determined by dividing the property's net operating income by the purchase price. Net operating income is the property's Hotel EBITDA minus a capital expense reserve of either 4% or 5% of gross revenues. Hotel EBITDA flow-through is the change in Hotel EBITDA divided by the change in total revenues. EBITDA, FFO, AFFO, CAD and other terms are non-GAAP measures, reconciliations of which have been provided in prior earnings releases and filings with the SEC or in the appendix to this presentation. The calculation of implied equity value is derived from an estimated blended capitalization rate (“Cap Rate”) for the entire portfolio using the capitalization rate method. The estimated Cap Rate is based on recent Cap Rates of publically traded peers involving a similar blend of asset types found in the portfolio, which is then applied to Net Operating Income (“NOI”) of the company’s assets to calculate a Total Enterprise Value (“TEV”) of the company. From the TEV, we deduct debt and preferred equ ity and then add back working capital to derive an equity value. The capitalization rate method is one of several valuation methods for estimating asset value and implied equity value. Among the limitations of using the capitalization rate method for determining an implied equity value are that it does not take into account the potential change or variability in future cash flows, potential significant future capital expenditures, the intended hold period of the asset, or a change in the future risk profile of an asset. This overview is for informational purposes only and is not an offer to sell, or a solicitation of an offer to buy or sell, any securities of Braemar Hotels & Resorts Inc. or any of its respective affiliates, and may not be relied upon in connection with the purchase or sale of any such security. Our business has been and will continue to be materially adversely affected by the impact of, and the public perception of a risk of, a pandemic disease. In December 2019, a novel strain of coronavirus (COVID-19) was identified in Wuhan, China, which has subsequently spread to other regions of the world, and has resulted in increased travel restrictions and extended shutdown of certain businesses in affected regions, including in nearly every state in the United States. Since late February, we have experienced a significant decline in occupancy and RevPAR and we expect the significant occupancy and RevPAR reduction associated with the novel coronavirus (COVID-19) to likely continue as we are recording significant reservation cancellations as well as a significant reduction in new reservations relative to prior expectations. The continued outbreak of the virus in the U.S. has and will likely continue to further reduce travel and demand at our hotels. The prolonged occurrence of the virus has resulted in health or other government authorities imposing widespread restrictions on travel or other market impacts. The hotel industry and our portfolio have and we expect will continue to experience the postponement or cancellation of a significant number of business conferences and similar events. At this time those restrictions are very fluid and evolving. We have been and will continue to be negatively impacted by those restrictions. Given that the type, degree and length of such restrictions are not known at this time, we cannot predict the overall impact of such restrictions on us or the overall economic environment. In addition, even after the restrictions are lifted, the propensity of people to travel and for businesses to hold conferences will likely remain below historical levels for an additional period of time that is difficult to predict. We may also face increased risk of litigation if we have guests or employees who become ill due to COVID-19. As such, the impact these restrictions may have on our financial position, operating results and liquidity cannot be reasonably estimated at this time, but the impact will likely be material. Additionally, the public perception of a risk of a pandemic or media coverage of these diseases, or public perception of health risks linked to perceived regional food and beverage safety has materially further adversely affected us by reducing demand for our hotels. These events have resulted in a sustained, significant drop in demand for our hotels and could have a material adverse effect on us. Prior to investing in Braemar, potential investors should carefully review Braemar’s periodic filings with the Securities and Exchange Commission, including, but not limited to, Braemar’s most current Form 10-K, Form 10-Q and Form 8-K’s, including the risk factors included therein.

Company Presentation | May 2021 3 Management Team 23 years of hospitality experience 4 years with the Company 15 years with Morgan Stanley Cornell School of Hotel Administration BS University of Pennsylvania MBA RICHARD J. STOCKTON Chief Executive Officer & President 20 years of hospitality experience 17 years with the Company 3 years with ClubCorp CFA charterholder Southern Methodist University BBA DERIC S. EUBANKS, CFA Chief Financial Officer 15 years of hospitality experience 10 years with the Company (5 years with the Company’s predecessor) 5 years with Stephens Investment Bank Oklahoma State University BS JEREMY J. WELTER Chief Operating Officer

Company Presentation | May 2021 4 Post COVID-19 Strategic Initiatives Conserve Liquidity Manage the Balance Sheet Return to Profitability Grow the Portfolio Ritz-Carlton Sarasota

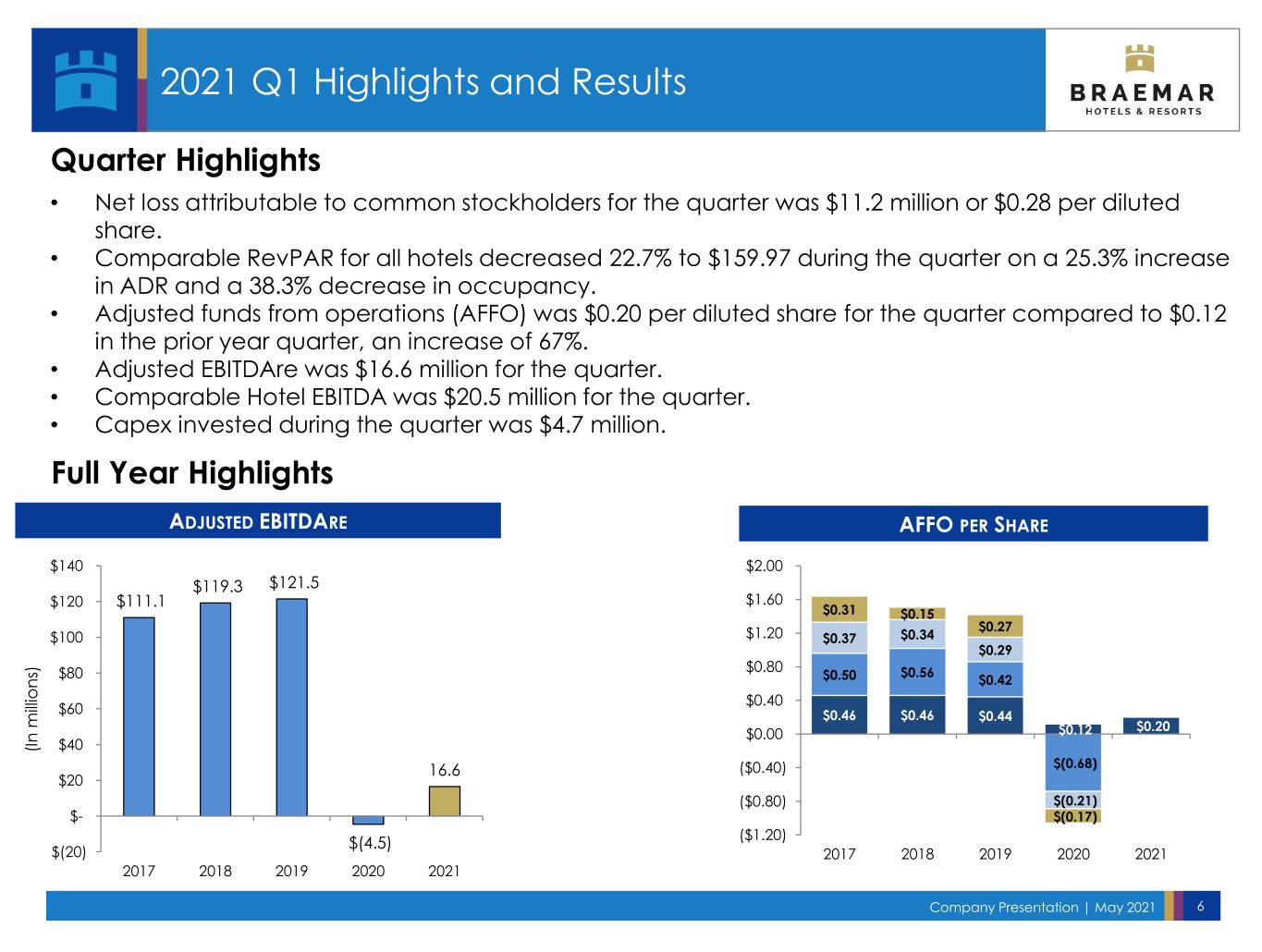

Company Presentation | May 2021 5 2021 Q1 Hotel Operating Results Comparable Hotel Operating Results(1)(4)(5) 2021 Q1 2020 Q1 % Variance ADR $ 433.43 $ 345.88 25.3% Occupancy 36.9% 59.8% (38.3)% RevPAR $ 159.97 $ 206.90 (22.7)% Total Hotel Revenue(2) $ 83,848 $ 117,382 (28.6)% Hotel EBITDA(2) $ 20,499 $30,306 (24.9)% Hotel EBITDA Margin 24.5% 23.3% 1.2% (1) Includes: Bardessono, Hotel Yountville, Ritz-Carlton St. Thomas, Pier House, Marriott Seattle Waterfront, Capital Hilton, Sofitel Chicago, Hilton Torrey Pines, The Clancy, The Notary Hotel, Park Hyatt Beaver Creek, Ritz-Carlton Lake Tahoe and Ritz-Carlton Sarasota (2) In thousands (3) As reported in Earnings Releases: 2017 as reported on 2/28/2018; 2018 as reported on 2/27/2019; 2019 as reported on 2/26/2020 ; as reported on 02/25/2021 (4) Due to the economic effects of the COVID-19 pandemic on the Company, the lodging industry and the broader economy, the information provided should not be relied upon as an accurate representation of the current or future financial condition or performance of the Company (5) Total Hotel Revenue, RevPAR, Occupancy and ADR do not include the operations of ten condominium units not owned by the Lake Tahoe Ritz-Carlton COMPARABLE HOTEL EBITDA(3)(4)COMPARABLE REVPAR(3)(4) $219 $226 $233 $99 $87 $- $50 $100 $150 $200 $250 2017 2018 2019 2020 2021 TTM $126.9 $136.7 $142.1 $13.4 $6.6 $- $20 $40 $60 $80 $100 $120 $140 $160 2017 2018 2019 2020 2021 TTM (I n m ill io n s)

Company Presentation | May 2021 6 2021 Q1 Highlights and Results AFFO PER SHAREADJUSTED EBITDARE Quarter Highlights Full Year Highlights • Net loss attributable to common stockholders for the quarter was $11.2 million or $0.28 per diluted share. • Comparable RevPAR for all hotels decreased 22.7% to $159.97 during the quarter on a 25.3% increase in ADR and a 38.3% decrease in occupancy. • Adjusted funds from operations (AFFO) was $0.20 per diluted share for the quarter compared to $0.12 in the prior year quarter, an increase of 67%. • Adjusted EBITDAre was $16.6 million for the quarter. • Comparable Hotel EBITDA was $20.5 million for the quarter. • Capex invested during the quarter was $4.7 million. $111.1 $119.3 $121.5 $(4.5) 16.6 $(20) $- $20 $40 $60 $80 $100 $120 $140 2017 2018 2019 2020 2021 (I n m ill io n s) $0.46 $0.46 $0.44 $0.12 $0.20 $0.50 $0.56 $0.42 $(0.68) $0.37 $0.34 $0.29 $(0.21) $0.31 $0.15 $0.27 $(0.17) ($1.20) ($0.80) ($0.40) $0.00 $0.40 $0.80 $1.20 $1.60 $2.00 2017 2018 2019 2020 2021

Company Presentation | May 2021 7 Pier House Resort Key West, FL The Ritz-Carlton Lake Tahoe Truckee, CA Hotel Yountville Yountville, CA Marriott Seattle Waterfront Seattle, WA Sofitel Chicago Magnificent Mile Chicago, IL The Notary Hotel Philadelphia, PA Bardessono Hotel & Spa Yountville, CA The Clancy San Francisco, CA Hilton La Jolla Torrey Pines La Jolla, CA Park Hyatt Beaver Creek Beaver Creek, CO Pier House Resort & Spa Key West, FL The Ritz-Carlton St. Thomas St. Thomas, USVI The Ritz-Carlton Sarasota Sarasota, FL Capital Hilton Washington, D.C. High Quality Assets Situated in High Barrier to Entry Leisure and Urban Markets

Company Presentation | May 2021 8 Highest EBITDA Per Room & RevPAR $38 $37 $30 $30 $28 $27 $27 $23 $20 $19 $17 $15 $10 $15 $20 $25 $30 $35 $40 BHR PEB SHO XHR DRH HST PK HT RLJ INN CLDT APLE 2019 EBITDA Per Room $233 $211 $196 $189 $188 $184 $183 $171 $145 $134 $128 $106 $70 $100 $130 $160 $190 $220 $250 BHR PEB SHO DRH HT HST PK XHR RLJ CLDT INN APLE 2019 RevPAR

Company Presentation | May 2021 9 (1) Source: TripAdvisor, Raymond James Research (2) Room count-weighted average TripAdvisor Ratings by Lodging REIT(1) AVG ROOMS TOTAL TRIPADVISOR REVIEWS PER AVG TRIPADVISOR COMPANY (SYMBOL) HOTELS ROOMS PER HOTEL REVIEWS ROOM HOTEL RATING (2) Braemar (BHR) 13 3,722 286 26,884 7.2 2,068 84% Apple (APLE) 235 30,023 128 155,654 5.2 662 83% Xenia (XHR) 35 10,012 286 66,029 6.6 1,887 82% Summit (INN) 72 11,288 157 56,313 5.0 782 81% Pebblebrook (PEB) 53 13,226 250 117,744 8.9 2,222 81% Sunstone (SHO) 17 9,017 530 43,875 4.9 2,581 80% DiamondRock (DRH) 30 9,600 320 53,169 5.5 1,772 80% Host (HST) 74 44,639 603 218,650 4.9 2,955 79% Hersha (HT) 48 7,582 158 59,820 7.9 1,246 79% Chatham (CLDT) 133 18,260 137 74,239 4.1 558 77% Ashford (AHT) 103 22,619 220 96,951 4.3 941 75% RLJ (RLJ) 104 22,742 219 133,560 5.9 1,284 73% Park (PK) 60 33,228 554 208,078 6.3 3,468 72% Ryman (RHP) 7 10,110 1,444 30,225 3.0 4,318 67% CorePoint (CPLG) 220 29,113 132 162,851 5.6 740 63% TOTAL/AVG 1,204 275,181 229 1,504,042 5.5 1,249 77% TripAdvisor Rating by Company Braemar Tops the List – February 2021

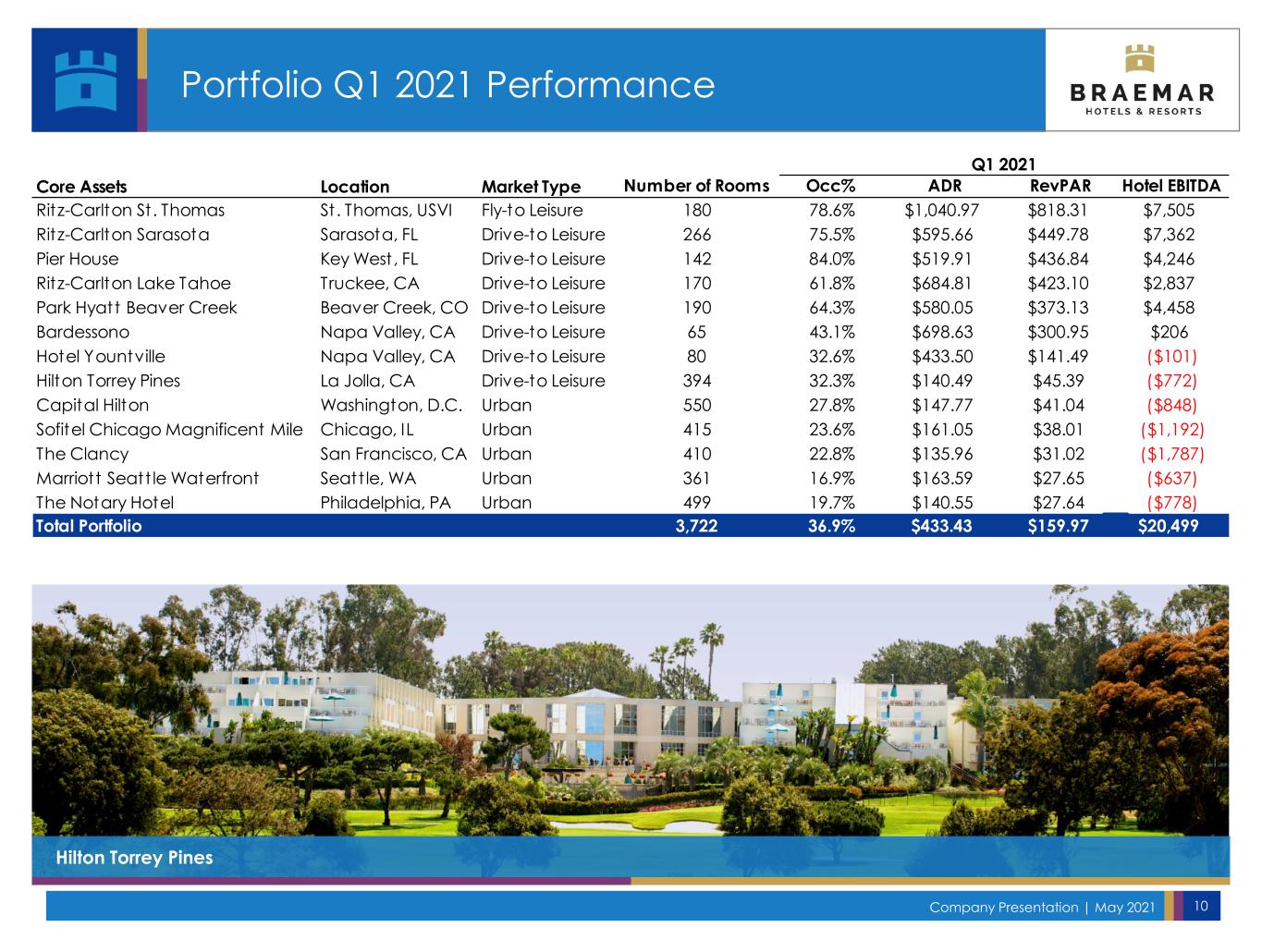

Company Presentation | May 2021 10 Portfolio Q1 2021 Performance Hilton Torrey Pines Q1 2021 Core Assets Location Market Type Number of Rooms Occ% ADR RevPAR Hotel EBITDA Ritz-Carlton St. Thomas St. Thomas, USVI Fly-to Leisure 180 78.6% $1,040.97 $818.31 $7,505 Ritz-Carlton Sarasota Sarasota, FL Drive-to Leisure 266 75.5% $595.66 $449.78 $7,362 Pier House Key West, FL Drive-to Leisure 142 84.0% $519.91 $436.84 $4,246 Ritz-Carlton Lake Tahoe Truckee, CA Drive-to Leisure 170 61.8% $684.81 $423.10 $2,837 Park Hyatt Beaver Creek Beaver Creek, CO Drive-to Leisure 190 64.3% $580.05 $373.13 $4,458 Bardessono Napa Valley, CA Drive-to Leisure 65 43.1% $698.63 $300.95 $206 Hotel Yountville Napa Valley, CA Drive-to Leisure 80 32.6% $433.50 $141.49 ($101) Hilton Torrey Pines La Jolla, CA Drive-to Leisure 394 32.3% $140.49 $45.39 ($772) Capital Hilton Washington, D.C. Urban 550 27.8% $147.77 $41.04 ($848) Sofitel Chicago Magnificent Mile Chicago, IL Urban 415 23.6% $161.05 $38.01 ($1,192) The Clancy San Francisco, CA Urban 410 22.8% $135.96 $31.02 ($1,787) Marriott Seatt le Waterfront Seatt le, WA Urban 361 16.9% $163.59 $27.65 ($637) The Notary Hotel Philadelphia, PA Urban 499 19.7% $140.55 $27.64 ($778) Total Portfolio 3,722 36.9% $433.43 $159.97 $20,499

Company Presentation | May 2021 11 EBITDA By Brand, Class, and Market 2021 Q1 TTM Hotel EBITDA by Brand(1) 2021 Q1 TTM Hotel EBITDA by Class(1) (1) Comparable TTM as of 3/31/2021, see appendix for a reconciliation of TTM hotel net income (loss) to hotel TTM EBITDA 2021 Q1 TTM Room Revenue(1) 2021 Q1 TTM Room Revenue by Location(1) 14% 86% Urban Resort 93.5% 5.4% 1.1% Transient Group Ritz-Carlton $23,125 Independent $8,088 Park Hyatt $3,883 Sofitel -$4,710 Hilton -$10,174 Marriott/ Autograph -$13,586 (20,000) (15,000) (10,000) (5,000) - 5,000 10,000 15,000 20,000 25,000 30,000 Luxury 30,386 Upper Upscale (23,760) (30,000) (20,000) (10,000) - 10,000 20,000 30,000 40,000 High Exposure to Luxury Asset Class and Resort Markets

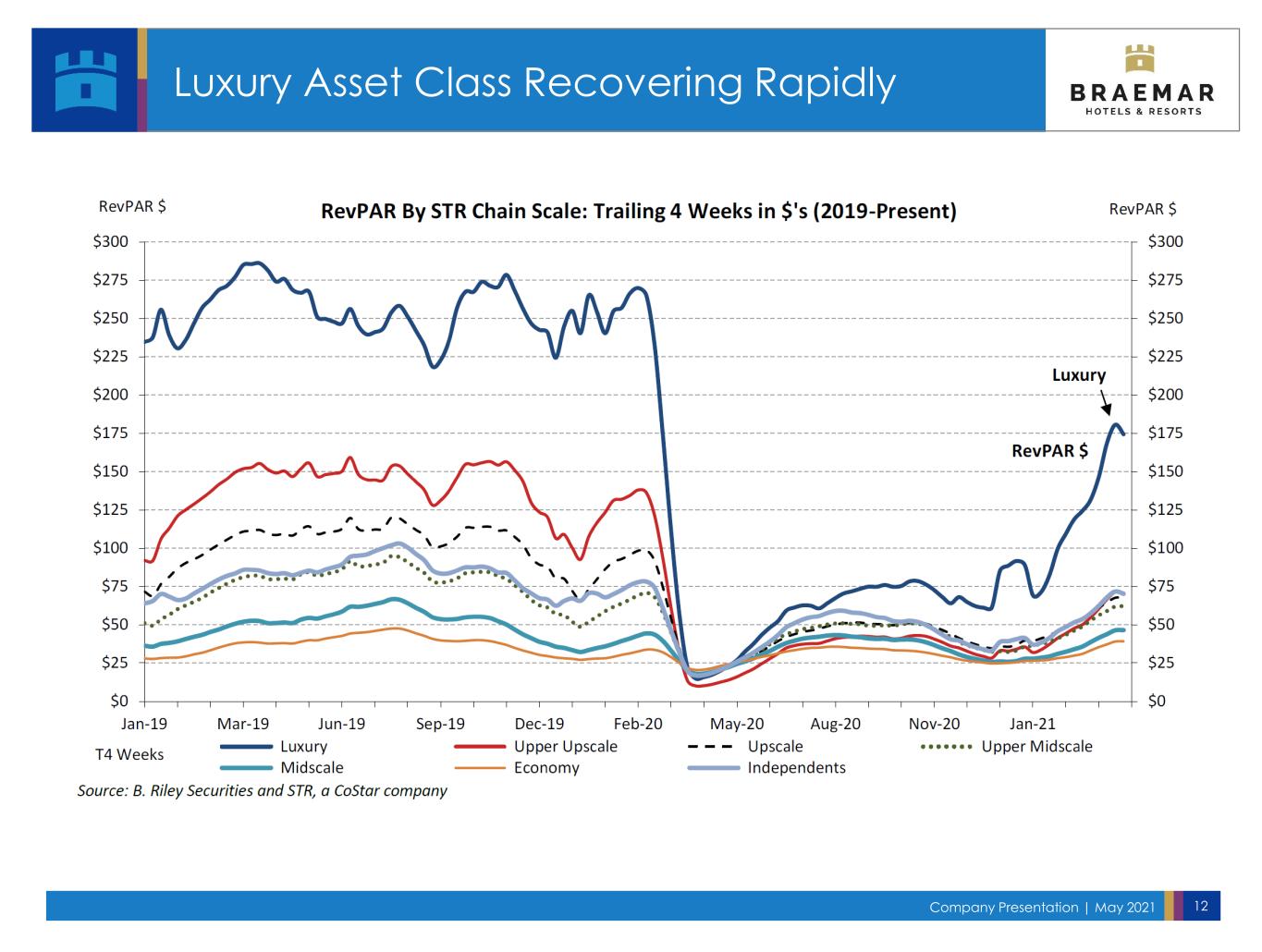

Company Presentation | May 2021 12 Luxury Asset Class Recovering Rapidly

Company Presentation | May 2021 13 Resort Markets Outperforming 7 of BHR’s 13 properties are drive-to Resort destinations Source: B. Riley Securities and STR, a Costar Company

Company Presentation | May 2021 14 Portfolio Resort Exposure Lifts Performance Occupancy and ADR Ramping Up – 03/1/20 to 04/24/21 Resort: Bardessono, Hotel Yountville, Ritz-Carlton St. Thomas, Pier House, Hilton Torrey Pines, Park Hyatt Beaver Creek, Ritz-Carlton Lake Tahoe and Ritz-Carlton Sarasota Urban: The Clancy, The Notary Hotel, Marriott Seattle Waterfront, Capital Hilton, and Sofitel Chicago 61.3% 27.0% 40.8% 0% 10% 20% 30% 40% 50% 60% 70% 80% 90% 100% 3/1 3/31 4/30 5/30 6/29 7/29 8/28 9/27 10/27 11/26 12/26 1/25 2/24 3/26 4/25 7-Day Avg. Occ (Resort) 7-Day Avg. Occ (Urban) 7-Day Avg. Occ (Total) $503.74 $157.32 $366.22 $0 $100 $200 $300 $400 $500 $600 $700 $800 $900 3/1 3/31 4/30 5/30 6/29 7/29 8/28 9/27 10/27 11/26 12/26 1/25 2/24 3/26 4/25 7-Day Avg. ADR % (Resort) 7-Day Avg. ADR (Urban) 7-Day Avg. ADR (Total) -2% +8% -26%

Company Presentation | May 2021 15 Rolling 7-Day RevPAR – 03/1/20 to 04/24/21 Resort: Bardessono, Hotel Yountville, Ritz-Carlton St. Thomas, Pier House, Hilton Torrey Pines, Park Hyatt Beaver Creek, Ritz-Carlton Lake Tahoe and Ritz-Carlton Sarasota Urban: The Clancy, The Notary Hotel, Marriott Seattle Waterfront, Capital Hilton, and Sofitel Chicago $312.07 $44.33 $151.73 $0 $100 $200 $300 $400 $500 $600 3/1 3/31 4/30 5/30 6/29 7/29 8/28 9/27 10/27 11/26 12/26 1/25 2/24 3/26 4/25 Rolling 7-Day Resort RevPAR Rolling 7-Day Rolling Urban RevPAR Rolling 7-Day TOTAL REVPAR -18% -37% -69% Portfolio Resort Exposure Lifts Performance

Company Presentation | May 2021 16 Strong Asset Class and Strategic Market Exposure Position Portfolio for Potential Rapid Recovery ($20,000) ($10,000) $0 $10,000 $20,000 $30,000 $40,000 2019 Q4 2020 Q1 2020 Q2 2020 Q3 2020 Q4 2021 Q1 Quarterly EBITDA ( In Thousands) $0 $50 $100 $150 $200 $250 2019 Q4 2020 Q1 2020 Q2 2020 Q3 2020 Q4 2021 Q1 Quarterly RevPAR Ritz-Carlton Lake Tahoe

Company Presentation | May 2021 17 Reduced New Supply Estimates +2.3% NEXT 12 MONTHS NEXT 13-24 MONTHS DECLINING ESTIMATED GROSS SUPPLY GROWTH(1)(2) (1) Source: Smith Travel Research (2) Weighted by revenue exposure by market (3) Weighted by revenue exposure by tract PRE-COVID As of Feb-2020 +2.0% CURRENT As of Mar-2021 +1.5% +2.0% +0.3%(3) +0.3%(3) The Clancy

Company Presentation | May 2021 18 Current Liquidity(1) $85.7M CASH & CASH EQUIVALENTS $39.3MRESTRICTED CASH 73% CAD PAYOUT RATIO(3) 44% AFFO PAYOUT RATIO(1)(3) TOTAL CASH $143.6M CASH POSITION (1) As of 3/31/21 (2) Q1 2021 $16.6MADJ. EBITDARE ($6.0M)INTEREST EXPENSE POSITIVE OPERATING CASH FLOW(2) CASH FLOW ~$3.5M $18.6M DUE FROM 3RD PARTY MANAGERS ($7.1M) PREFERRED DIVIDENDS + CAPEX Sofitel Chicago

Company Presentation | May 2021 19 Floating-rate debt provides a natural hedge to hotel cash flows and maximizes flexibility in all economic environments Long-standing lender relationships Proactive strategy to opportunistically refinance loans and extend maturities Overview Leverage Strategy Well Designed to Handle Pandemic Impact (1) The use of debt potentially increases BHR’s returns, as well as the risk of losses associated with the investment Hold 10% of Gross Debt Balance as cash on the balance sheet Delever to 35% Net Debt to Gross Assets 0.00% 1.00% 2.00% 3.00% 4.00% 5.00% 6.00% 2018 2019 2020 1Q21 Weighted Avg. Interest rate

Company Presentation | May 2021 20 Laddered debt maturities(1)(2) Debt Maturities 2022 NEXT HARD DEBT MATURITY OVERVIEW (1) As of 3/31/2021 (2) Assumes extension options are exercised. There can be no guaranty that extension options are exercisable on or before maturity. In the event one or more extensions are not exercisable we will be subject to the prevailing conditions of the debt markets at that time, which could result in increased or decreased borrowing cost or the inability to borrow at all. In such case, our ability to repay the amounts owed under the legaly debt arrangements may not be feasible or could have a negative impact on our financial performance 2.5% WEIGHTED AVG. INTEREST RATE(1) The Notary Hotel $179.7 $98.0 $371.5 $435.0 $17.2 $16.0 $0.5 $0.0 $50.0 $100.0 $150.0 $200.0 $250.0 $300.0 $350.0 $400.0 $450.0 $500.0 2021 2022 2023 2024 2025 2026 (i n m ill io n s) Maturities Amortization

Company Presentation | May 2021 21 Villa Construction Completed 2019 Autograph Conversion Completed Q3 2020 Hurricane Recovery Completed 2019 Lobby Renovation Completed 2019 Autograph Conversion Completed 2019 Beach Improvement Completed 2019 Portfolio Well Positioned for Ramp Up Ritz-Carlton Sarasota Bardessono Hotel & Spa Park Hyatt Beaver Creek Ritz-Carlton St. Thomas The Clancy Strategic Initiatives Position Braemar for Ramp Up in 2021 The Notary Hotel

Company Presentation | May 2021 22 Highly Aligned Management Team Management has significant personal wealth invested in the Company11.0% Insider ownership 2.9x higher than public lodging REIT industry average2.9x Total dollar value of insider ownership (as of 05/03/2020)$36.4M REIT Avg includes: AHT, HT, APLE, CLDT, CHSP, RLJ, PEB, INN, HST, DRH, SHO, XHR, PK Source: Latest Proxy and Company filings Highly-aligned management team is among highest insider equity ownership of publicly- traded Hotel REITs 18.2% 11.0% 7.0% 4.7% 3.8% 3.1% 2.4% 2.0% 1.9% 1.6% 1.5% 1.4% 1.2% 1.0% 0% 2% 4% 6% 8% 10% 12% 14% 16% 18% 20% HT BHR APLE CLDT Peer Avg. INN XHR AHT PEB RLJ SHO DRH HST PK

Company Presentation | May 2021 23 Key Takeaways Conserve Liquidity Manage the Balance Sheet Return to Profitability Grow the Portfolio The Ritz-Carlton Sarasota Sarasota, FL

Appendix

Company Presentation | May 2021 25 Reconciliation of Net Income (Loss) to Comparable Hotel EBITDA In thousands

Company Presentation | May 2021 26 Reconciliation of Net Income (Loss) to EBITDAre and Adjusted EBITDAre In thousands

Company Presentation | May 2021 27 Reconciliation of Net Income (Loss) to Adjusted FFO In thousands

Company Presentation | May 2021 28 Indebtedness In thousands (1) This mortgage loan has five one-year extension options subject to satisfaction of certain conditions, of which the first was exercised in June 2020. This mortgage loan is secured by the Chicago Sofitel Magnificent Mile, The Clancy, Seattle Marriott Waterfront and The Notary Hotel. (2) This mortgage loan has three one-year extension options subject to satisfaction of certain conditions. This mortgage loan has a LIBOR floor of 1.00%. (3) This mortgage loan has three one-year extension options subject to satisfaction of certain conditions, of which the third was exercised in April 2021. (4) Base Rate, as defined in the term loan agreement, is the greater of (i) the prime rate set by Bank of America, or (ii) federal funds rate + 0.5%, or (iii) LIBOR + 1.0%. (5) This mortgage loan has a LIBOR floor of 0.25%. (6) This mortgage loan has a LIBOR floor of 0.50%. (7) See pg. 21 for reconciliation of net income (loss) to hotel EBITDA.

Company Presentation | May 2021 29 Indebtedness In thousands (1) This mortgage loan is secured by the Chicago Sofitel Magnificent Mile, The Clancy, Seattle Marriott Waterfront and The Notary Hotel.

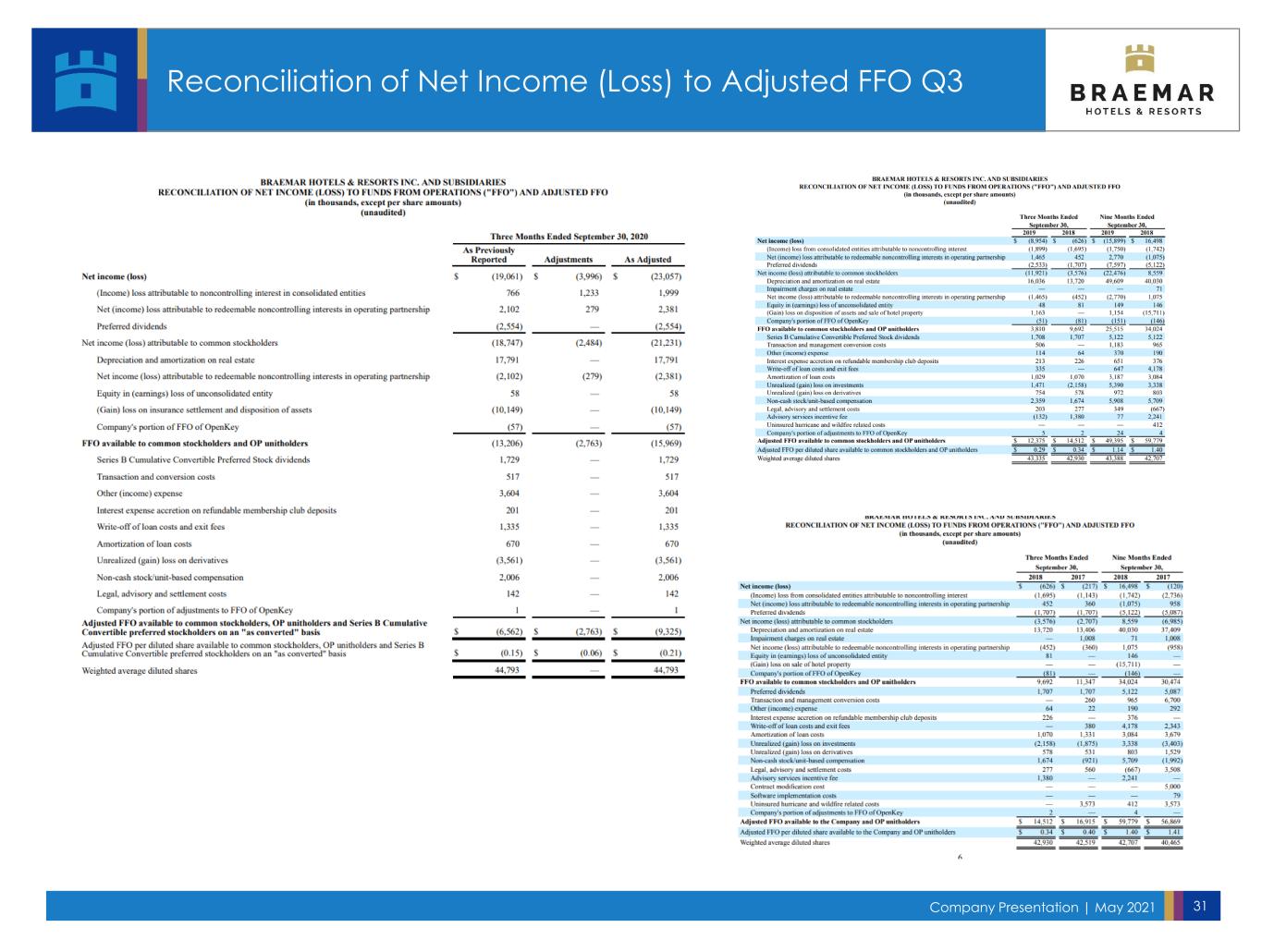

Company Presentation | May 2021 30 Reconciliation of Net Income (Loss) to Adjusted FFO Q4

Company Presentation | May 2021 31 Reconciliation of Net Income (Loss) to Adjusted FFO Q3

Company Presentation | May 2021 32 Reconciliation of Net Income (Loss) to Adjusted FFO Q2

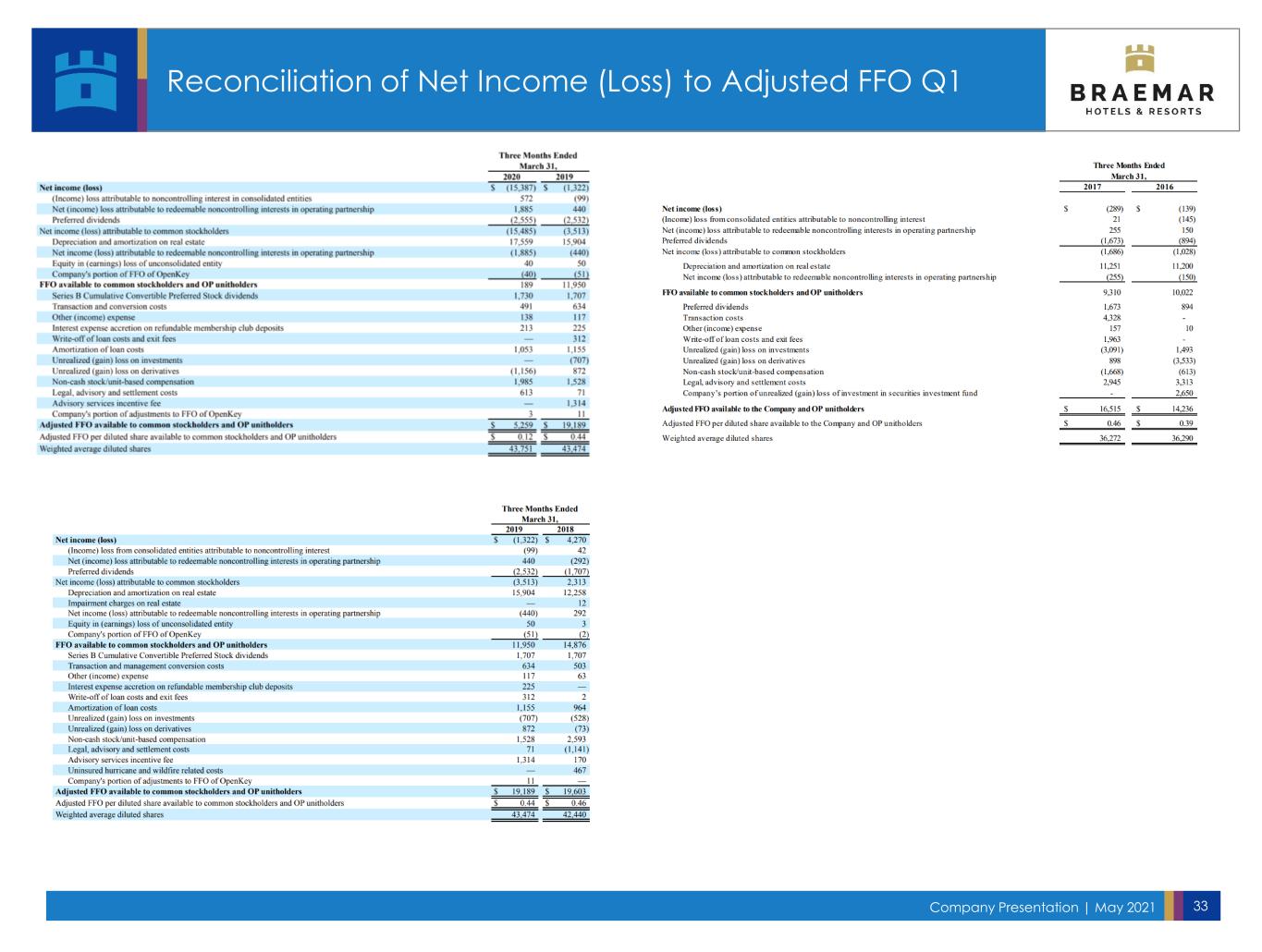

Company Presentation | May 2021 33 Reconciliation of Net Income (Loss) to Adjusted FFO Q1