Attached files

| file | filename |

|---|---|

| EX-99.2 - EX-99.2 - Trulieve Cannabis Corp. | d69678dex992.htm |

| 8-K - FORM 8-K - Trulieve Cannabis Corp. | d69678d8k.htm |

Investor Presentation | May 2021 & Creation of the Most Profitable MSO Exhibit 99.1

Forward Looking Statement Forward-looking statements made in this document are made only as of the date of their initial publication, and the Company undertakes no obligation to publicly update any of these forward-looking statements as actual events unfold. Unless the context otherwise requires, the terms “Trulieve,” “Harvest,” “we,” “us” and “our” in this prospectus refer to Trulieve Cannabis Corp. and Harvest Health & Recreation Inc. as a combined company. This investor presentation includes forward-looking information and statements within the meaning of the Private Securities Litigation Reform Act of 1995. These forward-looking statements relate to each party’s expectations or forecasts of business, operations, financial performance, prospects, and other plans, intentions, expectations, estimates, and beliefs and include statements regarding Trulieve and Harvest’s expected financial performance for fiscal 2021, the combined operations and prospects of Trulieve and Harvest, the current and projected market and growth opportunities for the combined company, and the timing and completion of the Transaction, including all the required conditions thereto. Words such as "expects", "continue", "will", "anticipates" and "intends" or similar expressions are intended to identify forward-looking statements. These forward-looking statements are based on Trulieve and Harvest's current projections and expectations about future events and financial trends that they believe might affect their financial condition, results of operations, prospects, business strategy and financial needs, and on certain assumptions and analysis made by each party in light of the experience and perception of historical trends, current conditions and expected future developments and other factors each party believes are appropriate. Forward-looking information and statements involve and are subject to assumptions and known and unknown risks, uncertainties, and other factors which may cause actual events, results, performance, or achievements to be materially different from future events, results, performance, and achievements expressed or implied by forward-looking information and statements herein, including, without limitation, the risks discussed under the heading "Risk Factors" in Trulieve and Harvest’s Annual Reports on Form 10-K for the year ended December 31, 2020 filed with the United Sates Securities and Exchange Commission and on SEDAR at www.sedar.com(the “SEC”) on EDGAR and with certain Canadian regulators on SEDAR at www.sedar.com and in other periodic reports and filings made by Trulieve and Harvest with the SEC on EDGAR and with such Canadian securities regulators on SEDAR. Although Trulieve and Harvest believe that any forward-looking information and statements herein are reasonable, in light of the use of assumptions and the significant risks and uncertainties inherent in such information and statements, there can be no assurance that any such forward-looking information and statements will prove to be accurate, and accordingly readers are advised to rely on their own evaluation of such risks and uncertainties and should not place undue reliance upon such forward-looking information and statements. Any forward-looking information and statements herein are made as of the date hereof and, except as required by applicable laws, Trulieve and Harvest assume no obligation and disclaim any intention to update or revise any forward-looking information and statements herein or to update the reasons that actual events or results could or do differ from those projected in any forward-looking information and statements herein, whether as a result of new information, future events or results, or otherwise. Please note that MARIJUANA IS ILLEGAL UNDER U.S. FEDERAL LAW, including its consumption, possession, cultivation, distribution, manufacturing, dispensing, and possession with intent to distribute . Use of Non-GAAP Financial Measures This investor presentation contains certain non-GAAP financial measures as defined by the SEC. Reconciliations of these non-GAAP financial measures to the most directly comparable financial measures calculated and presented in accordance with GAAP are not included herein because all such non-GAAP financial measures have been obtained from third party sources unrelated to the parties, which do not publish the information necessary for such reconciliation. These non-GAAP financial measures are based on the analysis of non-GAAP financial measures of various financial analysts, each of whom may not be calculating such financial measures in the same manner as each other or Trulieve or Harvest. This information should be considered as supplemental in nature and not as a substitute for, or superior to, any measure of performance prepared in accordance with GAAP. Our management teams use adjusted EBITDA to evaluate our operating performance and trends and make planning decisions. Our management teams believe adjusted EBITDA helps identify underlying trends in our business that could otherwise be masked by the effect of the items that we exclude. Accordingly, we believe that adjusted EBITDA provides useful information to investors and others in understanding and evaluating our operating results, enhancing the overall understanding of our past performance and future prospects of the combined company, and allowing for greater transparency with respect to key financial metrics used by our management teams in its financial and operational decision-making.

Creation of the Most Profitable MSO This combination allows us to accelerate our national expansion strategy and go deeper in the markets we operate in to support our mutual vision of increasing access to cannabis through industry-leading retail stores, innovative high-quality products and brands and delivering optimal customer experiences. The Trulieve and Harvest combination expands the most profitable MSO. Our regional hub strategy provides leading market positions in the most attractive markets.

An Unparalleled Platform for Continued Growth Trajectory Industry Leading Scale Largest retail and cultivation footprint across the U.S. Combined 2021E consensus revenue of $1.2 Billion¹ The Most Profitable US MSO Combined 2021E Adjusted EBITDA of $461 million¹ will be the largest based on consensus estimates Combined 2021E consensus Adjusted EBITDA margin of 37% Capital IQ consensus estimates, as at May 7, 2021, and prior to release of Harvest’s Q1 results Combined Footprint Provides National Scale with a Regional Focus Footprint across 11 states in 3 regional hubs Hub strategy deepens presence in core markets, with expansion into new Southwest hub Expanded Runway for Growth Expansion into new Southwest hub, anchored in Arizona Continued penetration across all hubs Total addressable market increases 53% & Best in Class Management Established track record, with regional success driven by experienced, proven management teams

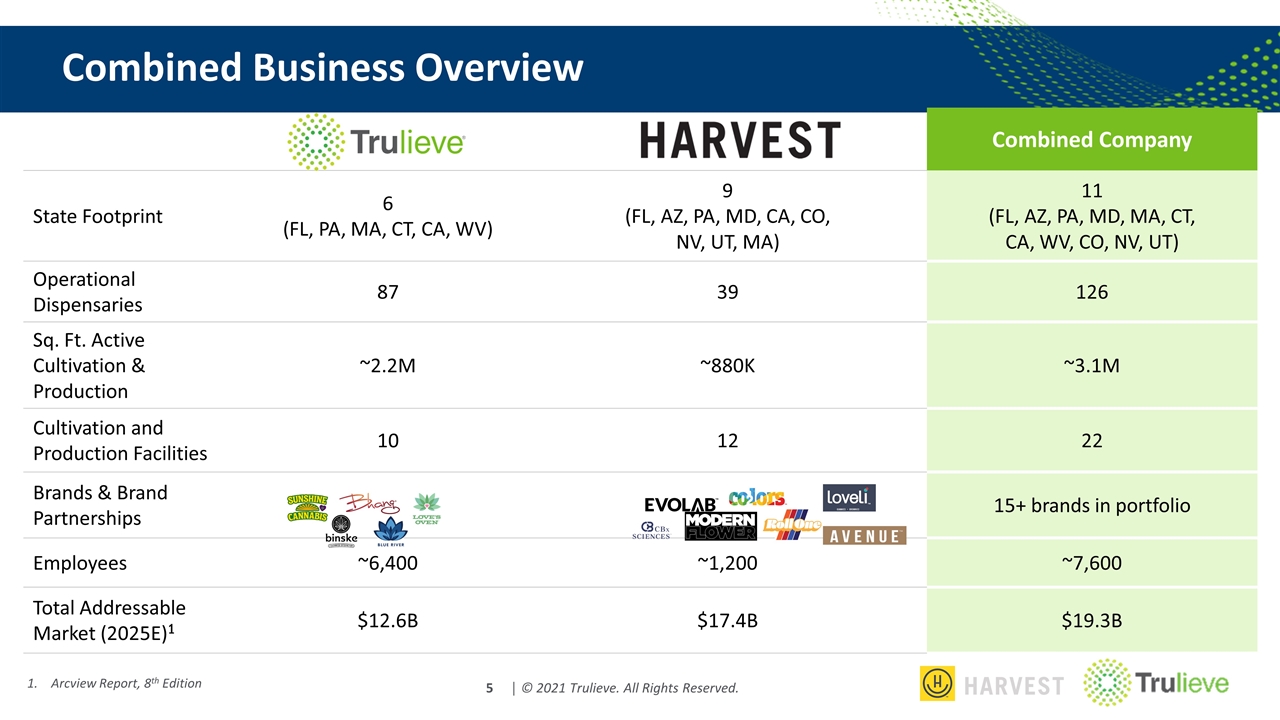

Combined Business Overview Arcview Report, 8th Edition Combined Company State Footprint 6 (FL, PA, MA, CT, CA, WV) 9 (FL, AZ, PA, MD, CA, CO, NV, UT, MA) 11 (FL, AZ, PA, MD, MA, CT, CA, WV, CO, NV, UT) Operational Dispensaries 87 39 126 Sq. Ft. Active Cultivation & Production ~2.2M ~880K ~3.1M Cultivation and Production Facilities 10 12 22 Brands & Brand Partnerships 15+ brands in portfolio Employees ~6,400 ~1,200 ~7,600 Total Addressable Market (2025E)1 $12.6B $17.4B $19.3B

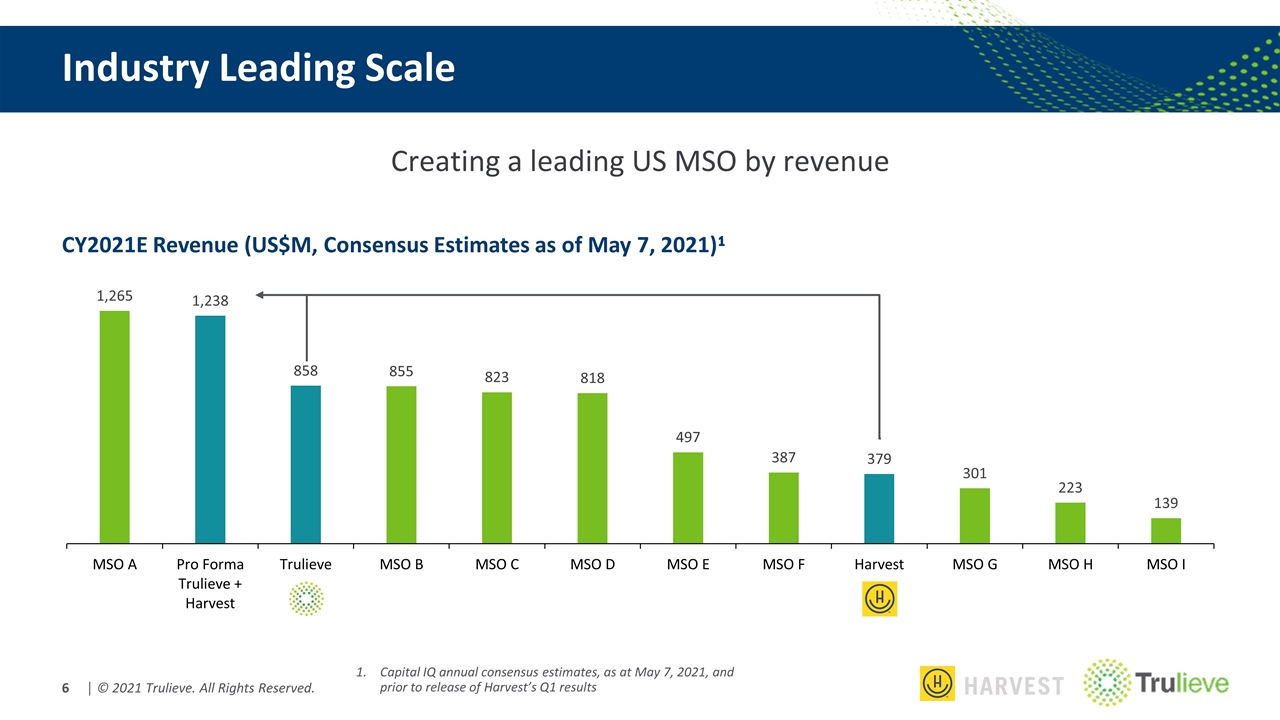

Creating a leading US MSO by revenue Industry Leading Scale CY2021E Revenue (US$M, Consensus Estimates as of May 7, 2021)¹ Capital IQ annual consensus estimates, as at May 7, 2021, and prior to release of Harvest’s Q1 results

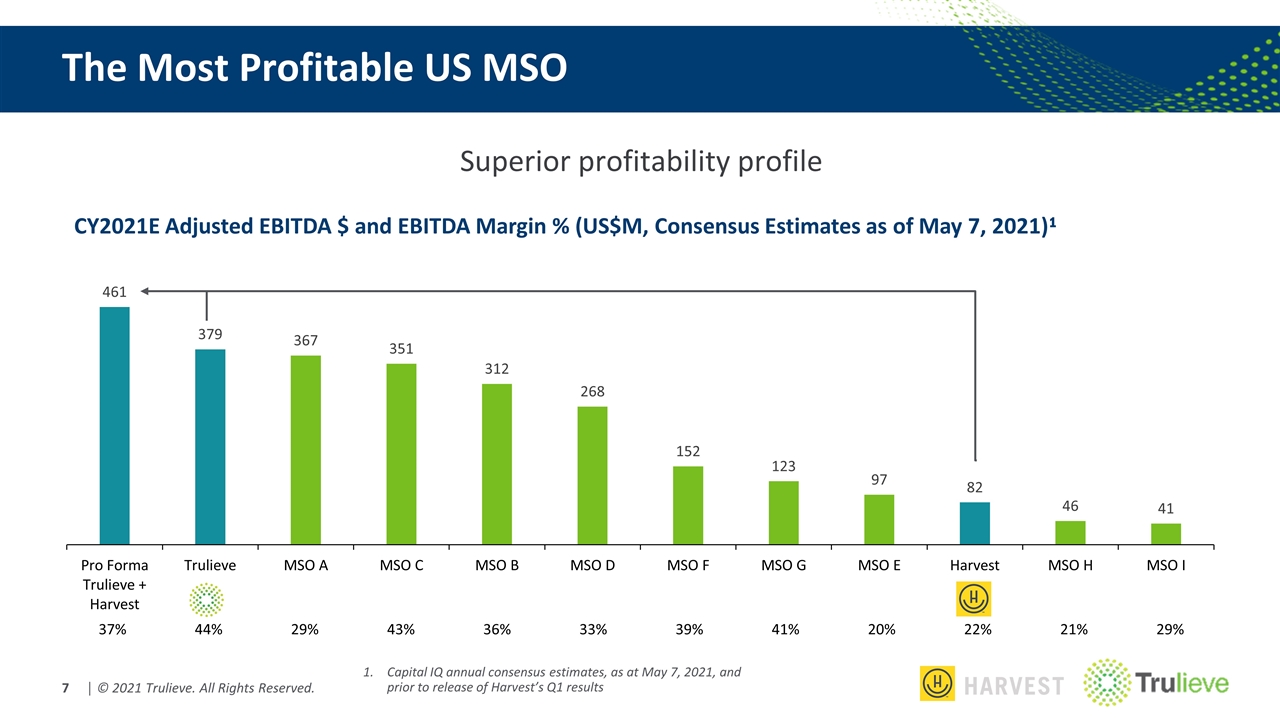

Superior profitability profile The Most Profitable US MSO CY2021E Adjusted EBITDA $ and EBITDA Margin % (US$M, Consensus Estimates as of May 7, 2021)¹ Capital IQ annual consensus estimates, as at May 7, 2021, and prior to release of Harvest’s Q1 results 37% 44% 29% 43% 36% 33% 39% 41% 20% 22% 21% 29%

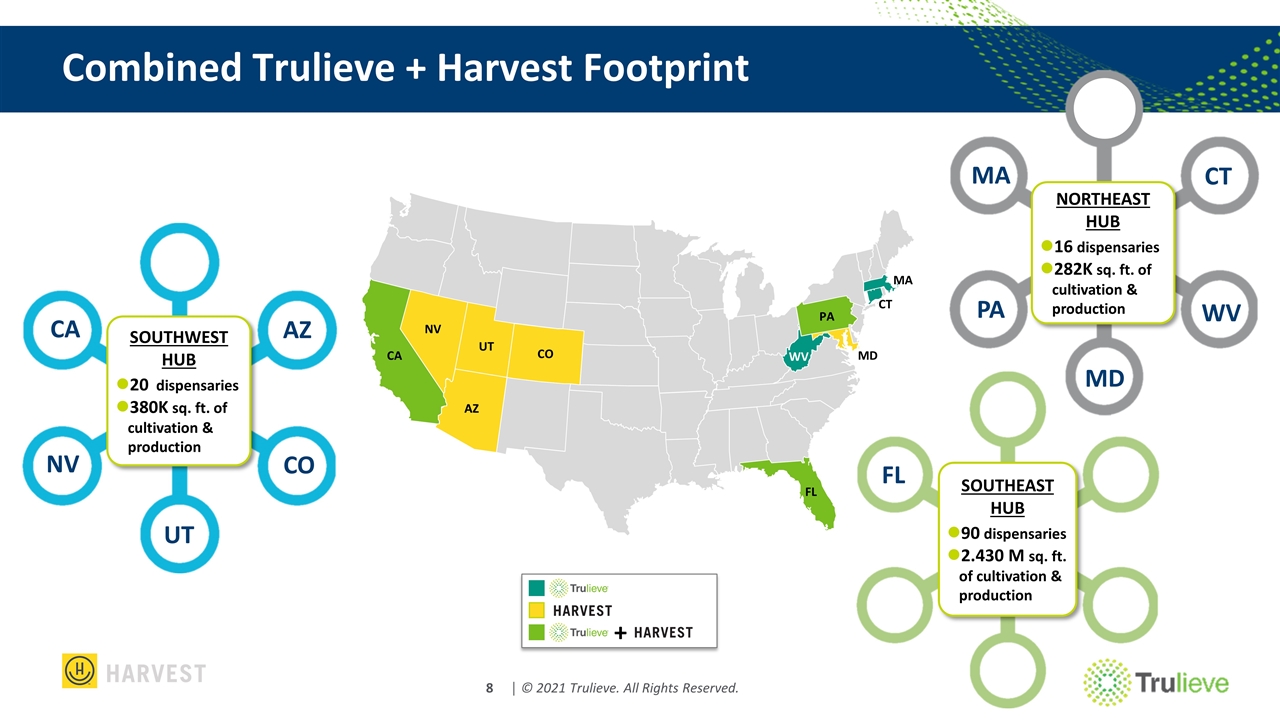

Combined Trulieve + Harvest Footprint FL CA MA PA AZ MD WV NV CT AZ CO + SOUTHWEST HUB 20 dispensaries 380K sq. ft. of cultivation & production SOUTHEAST HUB 90 dispensaries 2.430 M sq. ft. of cultivation & production NORTHEAST HUB 16 dispensaries 282K sq. ft. of cultivation & production MA PA CT WV MD NV CA AZ CO FL UT UT

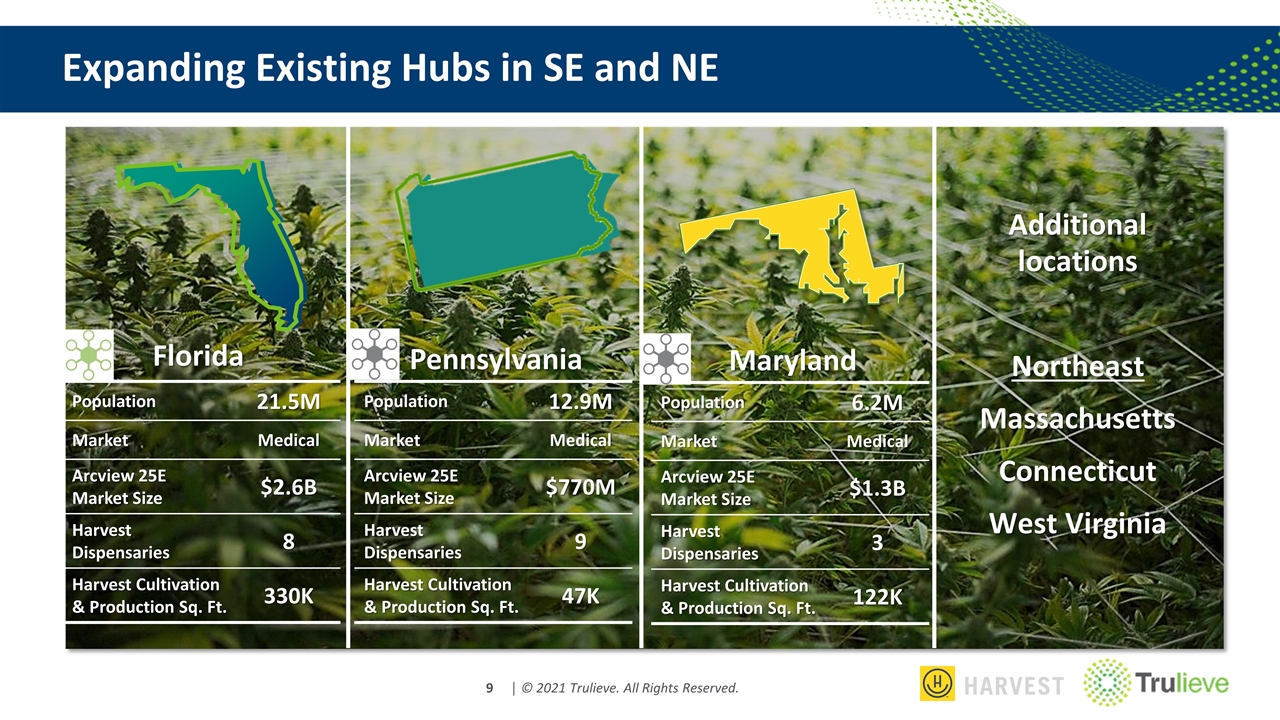

Expanding Existing Hubs in SE and NE Florida Population 21.5M Market Medical Arcview 25E Market Size $2.6B Harvest Dispensaries 8 Harvest Cultivation & Production Sq. Ft. 330K Pennsylvania Population 12.9M Market Medical Arcview 25E Market Size $770M Harvest Dispensaries 9 Harvest Cultivation & Production Sq. Ft. 47K Additional locations Northeast Massachusetts Connecticut West Virginia Maryland Population 6.2M Market Medical Arcview 25E Market Size $1.3B Harvest Dispensaries 3 Harvest Cultivation & Production Sq. Ft. 122K

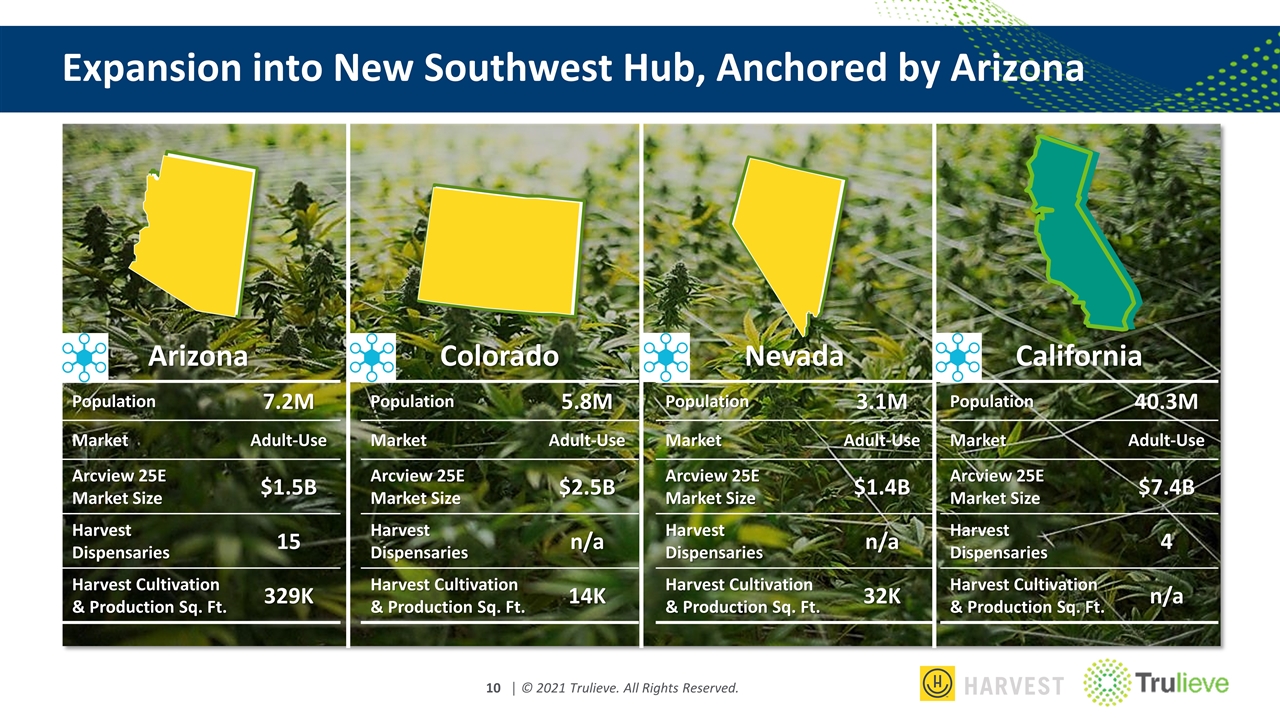

Expansion into New Southwest Hub, Anchored by Arizona Arizona Population 7.2M Market Adult-Use Arcview 25E Market Size $1.5B Harvest Dispensaries 15 Harvest Cultivation & Production Sq. Ft. 329K Colorado Population 5.8M Market Adult-Use Arcview 25E Market Size $2.5B Harvest Dispensaries n/a Harvest Cultivation & Production Sq. Ft. 14K Nevada Population 3.1M Market Adult-Use Arcview 25E Market Size $1.4B Harvest Dispensaries n/a Harvest Cultivation & Production Sq. Ft. 32K California Population 40.3M Market Adult-Use Arcview 25E Market Size $7.4B Harvest Dispensaries 4 Harvest Cultivation & Production Sq. Ft. n/a

Market leader with 15 open locations – nearly double the footprint as the closest competitor Licenses for 4 more locations 5 cultivation and processing sites Adult sales started January 22 – Harvest recorded first adult use sale in state Recreational sales drove average revenue increases of 100% per store during February March sales were further favorably influenced by the issuance of stimulus checks Arizona Market Heats Up with Adult Use

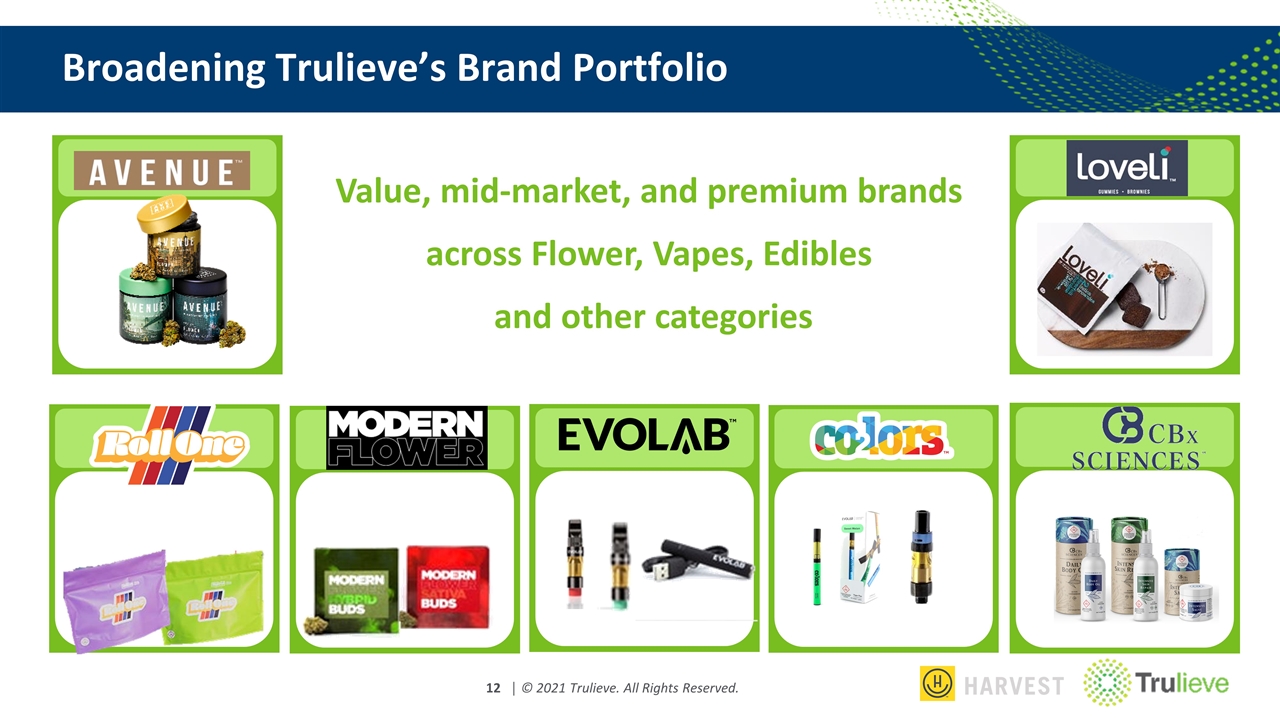

Broadening Trulieve’s Brand Portfolio Value, mid-market, and premium brands across Flower, Vapes, Edibles and other categories

Management Team Alex D’Amico Chief Financial Officer Tim Morey Chief Sales Officer Eric Powers Chief Legal Officer Kim Rivers Chief Executive Officer Valda Coryat Chief Marketing Officer Kyle Landrum Chief Production Officer Ronda Sheffield Chief Human Resources Officer Steve White Chief Executive Officer, Founder Deborah Keeley Chief Financial Officer Elroy Sailor Chief Strategy Officer Nicole Stanton VP, General Counsel

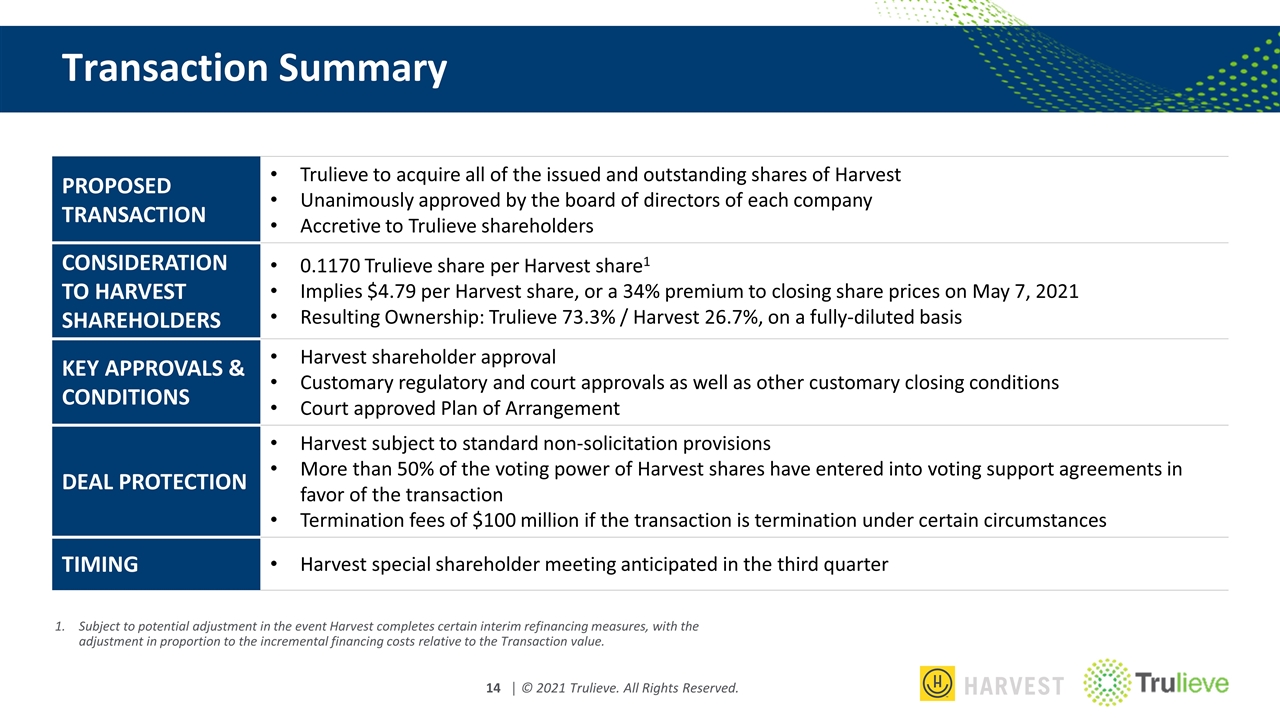

Transaction Summary PROPOSED TRANSACTION Trulieve to acquire all of the issued and outstanding shares of Harvest Unanimously approved by the board of directors of each company Accretive to Trulieve shareholders CONSIDERATION TO HARVEST SHAREHOLDERS 0.1170 Trulieve share per Harvest share1 Implies $4.79 per Harvest share, or a 34% premium to closing share prices on May 7, 2021 Resulting Ownership: Trulieve 73.3% / Harvest 26.7%, on a fully-diluted basis KEY APPROVALS & CONDITIONS Harvest shareholder approval Customary regulatory and court approvals as well as other customary closing conditions Court approved Plan of Arrangement DEAL PROTECTION Harvest subject to standard non-solicitation provisions More than 50% of the voting power of Harvest shares have entered into voting support agreements in favor of the transaction Termination fees of $100 million if the transaction is termination under certain circumstances TIMING Harvest special shareholder meeting anticipated in the third quarter Subject to potential adjustment in the event Harvest completes certain interim refinancing measures, with the adjustment in proportion to the incremental financing costs relative to the Transaction value.

Questions?