Attached files

| file | filename |

|---|---|

| 8-K - 8-K - MUFG Americas Holdings Corp | ub-20210507.htm |

MUFG Americas Holdings Corporation (MUAH) MUFG Americas Holdings Corporation Investor Presentation for the Quarter Ended March 31, 2021

MUFG Americas Holdings Corporation Investor Presentation, 1Q21 This presentation describes activities of MUFG Americas Holdings Corporation and its consolidated subsidiaries (the Company) unless otherwise specified. This presentation should be read in conjunction with the financial statements, notes and other information contained in the Company’s most recent annual report on Form 10-K and Quarterly Reports on Forms 10-Q and in any subsequent filings with the Securities and Exchange Commission (SEC). The following appears in accordance with the Private Securities Litigation Reform Act. This presentation includes forward-looking statements that involve risks and uncertainties. Forward-looking statements can be identified by the fact that they do not relate strictly to historical or current facts. Often, they include the words “believe,” “expect," “target,” “anticipate,” “intend,” “plan,” “seek," "estimate,” “potential,” “project,” "forecast," "outlook," or words of similar meaning, or future or conditional verbs such as “will,” “would,” “should,” “could,” "might," or “may.” They may also consist of annualized amounts based on historical interim period results. There are numerous risks and uncertainties that could and will cause actual results to differ materially from those discussed in the Company’s forward-looking statements. Many of these factors are beyond the Company’s ability to control or predict and could have a material adverse effect on the Company’s financial condition, and results of operations or prospects. For more information about factors that could cause actual results to differ materially from our expectations, refer to our reports filed with the SEC, including the discussions under “Management’s Discussion & Analysis of Financial Condition and Results of Operations” and “Risk Factors” in the Company’s most recent Annual Report on Form 10-K and Quarterly Reports on Forms 10-Q and in any subsequent filings with the SEC and available on the SEC’s website at www.sec.gov. In addition to the aforementioned factors, the COVID-19 global pandemic is adversely affecting us, our clients, and our third-party service providers, among others, and its impact may adversely affect our business and results of operations over a period of time. Any factor described above, in this presentation, or in our SEC reports could, by itself or together with one or more other factors, adversely affect our financial condition, results of operations and prospects. All forward-looking statements contained herein are based on information available at the time of this presentation, and the Company assumes no obligation to update any forward-looking statements. This investor presentation includes the tangible common equity capital ratio to facilitate the understanding of the Company’s capital structure and for use in assessing and comparing the quality and composition of the Company's capital structure to other financial institutions. This investor presentation also includes the adjusted efficiency ratio to enhance the comparability of MUAH's efficiency ratio when compared with other financial institutions. Please refer to our separate reconciliation of non-GAAP financial measures in our 10-Q for the quarter ended March 31, 2021. This investor presentation also includes adjusted net income, a non-GAAP financial measure, which adjusts noninterest income and noninterest expense for the fees and costs associated with services provided to MUFG Bank, Ltd. branches in the U.S. to enhance comparability with other financial institutions. This presentation should not be viewed as a substitute for results determined in accordance with GAAP, nor is it necessarily comparable to non-GAAP financial measures presented by other companies. Forward-Looking Statements and Non-GAAP Financial Measures 2

MUFG Americas Holdings Corporation Investor Presentation, 1Q21 MUFG has a Significant Presence in the U.S. Significant presence in the United States through MUFG Americas Holdings Corp. (MUAH), its Intermediate Holding Company, as well as through MUFG branches, collectively referred to as Combined U.S. Operations (CUSO) • Assets: $3.4 trillion, 6th largest globally • Loans: $1.0 trillion • Deposits: $2.0 trillion • Locations: ~2,600 • Employees: ~180,000 across 50+ countries • Assets: $344 billion3 • Loans: $169 billion3 • Deposits: $212 billion3 • Locations: 313 branches • Employees: ~13,900 FTE4 MUFG2 MUFG U.S. 3/31/21 assets: $134.8B 3 3/31/21 assets: $32.3B 3/31/21 assets: $2.9B1 3/31/21 assets: $2.9B 3/31/21 assets: $134.4B 3/31/21 assets: $6.7B 3/31/21 assets: $15.9B

MUFG Americas Holdings Corporation Investor Presentation, 1Q21 Strength of U.S. Presence 4 • Client centric strategy built on long standing relationships in affluent West Coast and select national footprints • MUB serves 2.0 million clients and is committed to forging long-standing relationships that enable us to provide strong solutions to our clients • MUFG Americas serves ~1,200 U.S. mid-to-large cap corporate and financial institution clients nationwide, aligned by industry verticals Financial Strength and Value Clients ColleaguesShareholders To be a foundation of strength and trust committed to meeting the needs of our customers, colleagues, communities and shareholders, fostering shared and sustainable growth. MUFG Vision • Experienced, stable, and diverse local management team and a majority of independent board members • MUFG Americas is committed to Inclusion and Diversity. Workforce is comprised of 48.6% women, 58.4% people of color, and 66.6% of women or people of color at the VP level and above2 MUAH & MUFG Americas Mission Be the world’s most trusted financial group. • Owned by and strategically important to Mitsubishi UFJ Financial Group (MUFG), one of the world’s largest financial organizations • MUFG traces its history back over 360 years and emphasizes a conservative risk culture with a focus on safety and soundness • First Japanese financial institution to set long-term goals for sustainable finance (increased to ¥35 trillion, or ~$324 billion1, from FY2019 to FY2030) • MUFG Union Bank (MUB) was formed over 150 years ago • Strong balance sheet with historically highly-rated credit loan portfolio, high quality capital base (Tier 1 risk-based capital ratio of 15.81%) and strong liquidity • Solid investment grade credit ratings (MUB is rated A/A3/A)

MUFG Americas Holdings Corporation Investor Presentation, 1Q21 ESG Commitments • $72 billion exceeded $41 billion CY2016-2020 Community Service Action Plan goal for environmental and social finance New ESG Product • Launched in February 2021 one of the first Green Deposits in the U.S. Advancing Sustainable Growth and Financial Opportunity 5 Addressing climate change and combating social and racial inequality is crucial to achieving a sustainable environment and society. MUFG Americas will support this progress by focusing on environmental, social, governance (ESG) goals. Sustainable Business Office for the Americas (SBOA) Five Program Pillars: Social License to Operate 1 Embed ESG in Risk Framework 2 Carbon Neutral By 2030 3 ESG Products / Business Promotion 4 ESG Disclosures 5 ESG Commitments • ¥35 trillion FY2019 – 2030 Global sustainable finance goal (~$324 billion¹) • MUFG Environmental and Social Policy Framework in place • Aim for 100% renewable in- house electricity by 2030 Awards • #2 Renewable energy lead arranger (Bloomberg New Energy Finance) • #6 Sustainability linked loans (Refinitiv) • #10 Green & social corporate bonds (Dealogic) • 2019 Lead Manager of the Year Social bonds (Environmental Finance) Restricted transactions sectors listed within MUFG Environmental and Social Policy Framework, last updated April 2021 Balance of financing and reduction target of coal-fired power generation projects² FY19 FY30 (Target) Targeting FY40 Zero vs. FY19 By 50% Balance $3.58 billion Coal-fired power generation Mining (coal) Oil & Gas (oil sand, development of the Arctic) Large hydropower Forestry Palm oil Cluster munitions manufacturing Inhumane weapons -- Environmental and Social -- Social MUFG Global MUFG Americas Exceeded environmental finance sub-goal by $25 bn Exceeded social finance sub-goal by $6 bn

MUFG Americas Strategic Plan 6

MUFG Americas Holdings Corporation Investor Presentation, 1Q21 Commercialize Trade Payable Services Differentiate & Win (CB) Differentiate & Win (SB, BB) 7 Strategic Plan Customers Create a client-centric business model Controls Effectively manage risks People Foster a diverse, inclusive, winning culture Profitability Deliver competitive results ◦ MUB is dedicated to a client-centric, relationship-based, “back to basics” approach ◦ Global Corporate & Investment Banking will continue to focus on key client segments and differentiating through innovative credit structures ◦ Rationalize and exit non-client centric businesses and products ◦ Committed to increasing diverse representation through hiring, development and retention practices ◦ Focused on increasing sustainable employee engagement Strategic framework including Objectives and Key Results (OKRs) and Corporate Priority Initiatives (CPIs) are focused on remediating our earnings issues, technology deficit and effectively managing risks ◦ Advance the firm’s information security control framework ◦ As part of Transformation, replace the Core Banking platform and implement the Risk and Regulatory Data program ◦ Maintain effective oversight of compliance matters and enhance internal control framework ◦ Rewiring will structurally change the way we operate and reduce our cost base ◦ Simplify operating model to position the platform for growth ◦ Transformation will bring a client-first, customer centric operating model to support our business and technology opportunities Americas OKRs What are we doing Corporate Priority Initiatives Transform- ation Gathering & Optimization of Quality Deposits Sponsor Coverage Secured Asset Finance Regional Bank Restructure Mortgage – Relationship Program1 Rewiring MUFG Balance Sheet Optimization Safety & Soundness 1 2 3 4 5 6 7 98 10 11 12 Enterprise Global Corporate & Investment Banking and MUSA Regional Bank

MUFG Americas Holdings Corporation Investor Presentation, 1Q21 Deepen relationships with value-add capital markets, FX, investment banking and wealth management products and advice Profitably deploy personal lending for acquisition and primacy 8 Lead with credit and team-based collaboration to win clients and grow core deposits Lead relationship with mortgage and deepen with deposits and investments Organize around client segments, align performance measurement & appropriate incentives, maintain safety and soundness Enhance client-facing and internal digital capabilities around segment-specific needs Optimize the branch network for efficiency and fit-for-purpose segment objectives Prioritize efficiency and simplification across segments and supporting operations Leverage home lending strength as a key relationship driver and acquisition engine Fund the bank efficiently with low-cost core deposits and enhanced collaboration with Transaction Banking Foundational Strategies Product Strategies Home Lending Deposits & Treasury Management Capital Markets and Advisory Services Personal Lending Organization Digital Platform Physical Distribution Efficiencies MUFG Union Bank Segment Strategy Overview Lead with ideas and bespoke solutions Commercial Real Estate Leverage deep commercial lending expertise to drive growth in key segments and verticals #5-8 CPIs High Net Worth / Affluent Global Corporate & Investment Banking-US Segment Strategy Lead with simple, everyday banking to efficiently grow low- cost deposits Commercial Banking, Business Banking & Small Business Regional Bank Mass Affluent / Mass Market MUB

MUFG Americas Holdings Corporation Investor Presentation, 1Q21 “Back to Basics” approach aimed at differentiating among Commercial, Business, and High Net Worth segments, while efficiently serving the Mass Affluent and Mass Market 9 Regional Bank Strategic Approach by Core Segment Credit and team-based collaboration to win clients and grow deposits Market Share | Depth | Core Deposits Core Deposits | Primacy | Efficiency Wallet Share | Depth | Core Deposits Target Segments Lead With Key Success Measures Approach • Relationship-based approach to client engagement across business and personal • Talented and collaborative sales force, with specialty focus in key growth areas • Competitively priced products and services across credit, deposits and investments Strategy Commercial Banking, Business Banking & Small Business Mortgage to opportunistically grow deposits and investments Simple everyday banking to efficiently grow low-cost deposits High Net Worth / Affluent Mass Affluent / Mass Market • Easy, simple everyday banking, i.e., Bank FreelyTM • Efficiently offer conforming mortgage and personal loans • Reliable self-service and basic digital functionality • A fit-for-purpose branch network • We will not be everything to everyone #5-8 CPIs

MUFG Americas Holdings Corporation Investor Presentation, 1Q21 10 Global Corporate & Investment Banking-US Strategy and Initiatives Strategy Target Segments Initiatives Lead with clients Drive accretive asset growth at MUB Accelerate Pivot from mature IG to Leveraged Finance Increase relevancy to FI Clients Large Cap Investment Grade Institutional Investors Private Equity Sponsors • Up and Left Leverage Capital Markets • Asset-Based Lending / Distressed Debt • Working Capital for Sponsor Owned Companies • Leasing Transformation and Growth • Trade Receivable Expansion • ESG (renewables, debt fund alternatives, sell to Japan) • Drive Originate to Distribute Strategy • Build Leverage Finance Sales & Trading – Loans/ Bonds • Structured Secured Asset Financing • Financing Solutions: ABS/ CLO/Esoteric • Align FX strategy to support Global Top 15 aspiration • Unlocking Japan – Rates and IG Credit • Balance Sheet Optimization • Working Capital Solutions • Selective Mid-Corporate Expansion • Global Subsidiary Banking • Defend Top 10 IG Capital Markets • Increase share of wallet of FX / Rates Mission Statement Clients are the foundation of MUFG Global Corporate & Investment Banking and MUSA strategy. We lead by being a trusted advisor, provide access to Capital Markets, and flawless execution across our product offering. It is our culture to be inclusive and ensure our teams deliver through a one MUFG mindset. Mid-Corporate, incl. Sponsor- owned Alternative Asset Managers #9-12 CPIs

MUFG Americas Holdings Corporation Investor Presentation, 1Q21 • Instill customer- first culture • Empower employees • Fill capability gaps with strategic hires • Improve business processes and make innovation the cultural norm • Improve technology operations • Drive rapid evolution by identifying and eliminating bottlenecks Transformation Program Alignment with Technology Strategy #3 CPI Strategy Operation & Technology strategy will create the solid foundation MUB needs to transform and grow its business in a hyper-competitive marketplace. Initiatives Run the Bank Risk Weighted Management • Mature First Line processes, risk and controls to reduce risk and meet regulatory requirements • Ensure robust, effective issue management • Build an innovative, industry- standard security program • Address application End-of-Life risk holistically • Implement processes that fix the problem “at the left” TRANSFORMATION ALIGNMENT Replace Legacy & End of Life Platforms Data-as-a-Service Strategy 21st Century Infrastructure • Address End-of-Life backlog and enable move to cloud, ex. Core Banking & Enterprise Data Platforms • Decrease risk of non- compliance, and reduce cost of compliance • Deliver prerequisite for improved customer experience/reduced attrition • Leverage Integrated regulatory compliance • Increase proportion of open platform applications • Establish and maintain an enterprise-wide data strategy and common data governance standards • Drive prioritization of data consumption requirements • Set priorities for building common data infrastructure services • Make data available to support decision making • Enable 'Fit for growth' Ops & Tech • Operate securely in the cloud • Drive reduction in operating costs • Increase speed-to- market • Ensure security and compliance • Focus on automation and development, security and operations to drive safety and soundness & efficiency Approach 11

MUFG Americas Holdings Corporation Investor Presentation, 1Q21 1. Simplify our operations and automate manual processes 2. Enhance infrastructure automation and technology delivery Rewiring MUFG 12 #2 CPI Strategy Structural Initiatives To effectively compete and meet our clients' needs, we are pursuing a multi-year effort to reduce our cost base and drive continuous improvement. We are targeting a range of $250-$300 million in benefits for the first phase of the Rewiring Program by 20231, some of which will be offset by reinvestment in technology, regulatory compliance and growth initiatives. Value Workforce Geographic Distribution ProcurementOrganization Design Process Simplification & Better Ways of Working Approach Effort launched at the end of 2018 to drive value to the bottom line with implementation and rigorous tracking; accompanied by change management to sustain lower cost base over time; objective is to close cost gap to US peers. a cb d 1. Increase workforce in target on-shore metros 2. Increase activities offshore that can be performed efficiently and safely by third- party centers of excellence 1. Optimize span of control and organizational design 2. Combine centers of excellence to drive scale 1. Consolidate office space 2. Reduce spend on consultants, travel, and other third-party spend 3. Rationalize number of suppliers and drive more favorable pricing terms

MUFG Americas Holdings Corporation Investor Presentation, 1Q21 13 FY2020 Wins ◦ MUB strategic plan focused on a client centric, relationship-based model and balance sheet remix emphasizing core business elements ◦ Remix of MUB balance sheet continues towards a more attractive mix of loans funded by stable core deposits, with MUAH NIM relatively consistent despite challenging external rate environment ◦ COVID 19 Response quickly mobilized a direct response to our colleagues, clients and communities ◦ Key New Hires across platform aligned to augment strategy and add new capabilities ◦ GCIB business shows continued strength in capital markets, global markets, and project finance, while building momentum in sponsor coverage and direct lending ◦ Operationalizing enterprise Objectives and Key Results (OKRs) to further align with our strategic initiatives, prioritization, and performance assessments and better drive outcomes ◦ Business Portfolio Evaluations of non-core aspects of the business model continues, with recent exits and divestitures (executed sale of select Global Trust Services business; announced sale of Homeowners Association business) MUAH navigated a challenging year during a global pandemic and was able to develop and execute on several key areas, including: Strategic Expense ◦ Rewiring is on track to deliver $250-300 million of savings by 20231 and helped curtail expense growth as well as offset elevated technology spend ◦ Regional Bank Branch Restructuring will provide additional expense savings driven by Branch consolidations

MUFG Americas Holdings Corporation Investor Presentation, 1Q21 14 • End to End Credit Simplification • Capability Center • Infrastructure Automation • Reg. & Risk Report Automation (tracked separately though Transformation) • Rationalize management reporting in Treasury (demand management) • Consolidate Quality Engineering vendors to a single offshore vendor • Consolidate Production Support vendors and move offshore • Operations location strategy (offshore and onshore site optimization) • Migration to Phoenix • Offshoring • Consolidate office space • Contingent labor direct sourcing • Contingent labor supplier rationalization • Travel Demand pre-COVID • Integrate RB Ops to Integrated Services for the Americas Ops • Integrate Global Trust Services (TB) • Integrate Bank & Branch Treasury • Reorganized Chief Efficiency & Development office Rewiring MUFG - Wins #2 CPI Through more effective and efficient organizational design, adopting better ways of working, redistributing workforce, rationalizing number of suppliers and better rates => we simplify our operating model, speed up delivery/decision making (e.g. fewer layers) and drive “sustainable” savings Workforce Geographic Distribution Organization Design Procurement (Suppliers) Process Simplification & Better Ways of Working d• Standardize Offshore Delivery Center rate card • Reduce unit price of travel • Renegotiate rate card and volume rebate for Big 4 firms Procurement (Rate Card) ba c

MUFG Americas Holdings Corporation Investor Presentation, 1Q21 15 Expense & Technology Initiative - Wins • Enabled Core Banking Data Gateway solution using modern architecture with flows and processes, integrated with Enterprise Data Platform in Amazon Web Services • Initial set up of cloud environment allows for rapid deployment of business capabilities • Completed automated delivery capabilities • Delivered foundation technology to improve data controls and improved data quality • Delivered modern workplace tools to improve employee productivity and collaboration during the pandemic as well as increased cloud managed solutions • Completed modern integration platform in the cloud supporting new business solutions • Optimizing the MUB branch network ▪ During 1Q21, MUB consolidated 39 branches and will close 2 additional branches in FY21 (approximately 12% of the network in total) ▪ MUB converted nearly 50 branches to Universal Branch locations, increasing the total to over 100 • Run rate savings expected in FY21 Regional Bank Restructuring Transformation #5 CPI #3 CPI

Financial Summary for MUAH This section only includes financials and other disclosures for MUAH and excludes MUFG Americas operations outside of MUAH 16

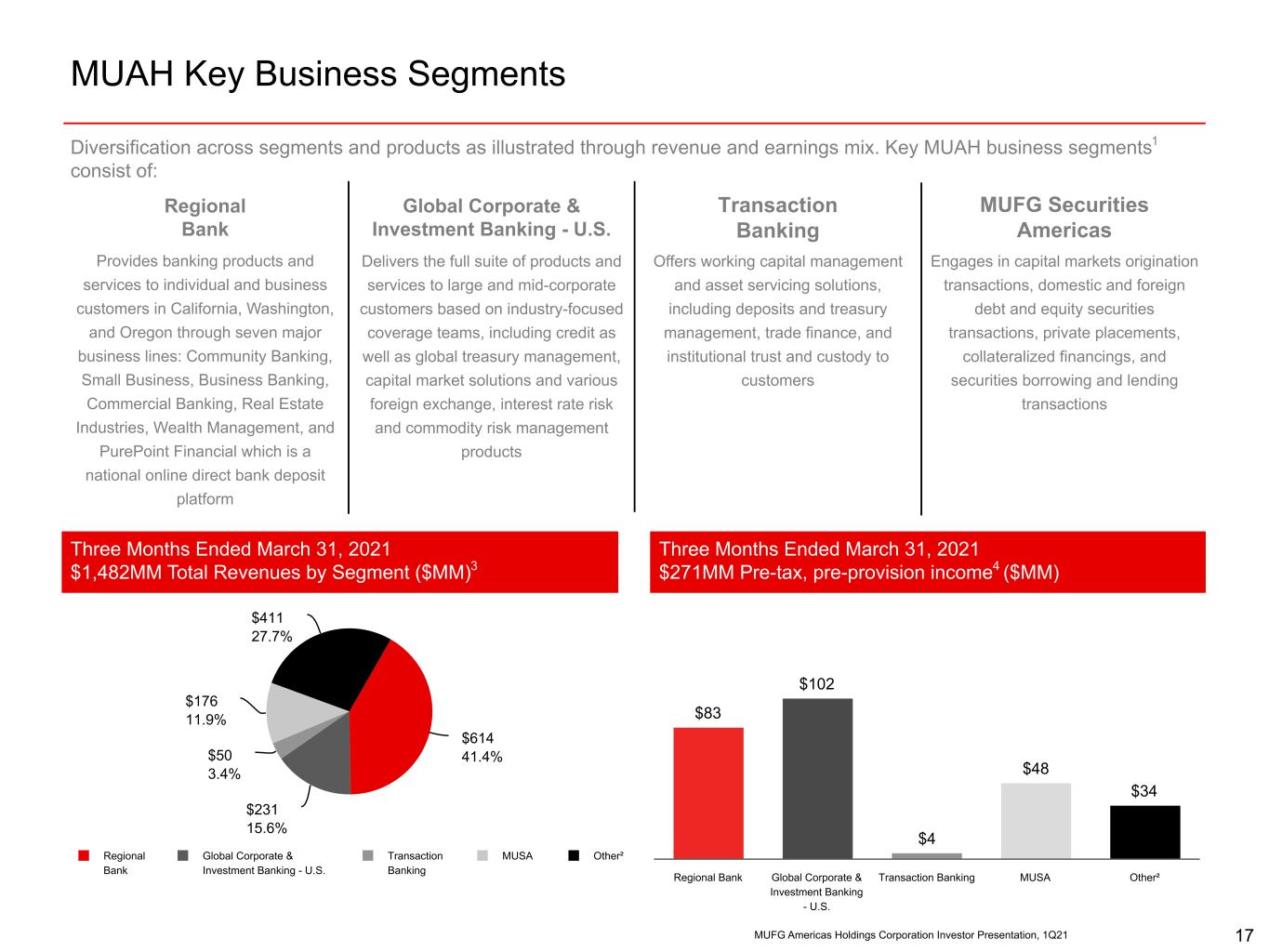

MUFG Americas Holdings Corporation Investor Presentation, 1Q21 Regional Bank Provides banking products and services to individual and business customers in California, Washington, and Oregon through seven major business lines: Community Banking, Small Business, Business Banking, Commercial Banking, Real Estate Industries, Wealth Management, and PurePoint Financial which is a national online direct bank deposit platform Global Corporate & Investment Banking - U.S. Delivers the full suite of products and services to large and mid-corporate customers based on industry-focused coverage teams, including credit as well as global treasury management, capital market solutions and various foreign exchange, interest rate risk and commodity risk management products Transaction Banking Offers working capital management and asset servicing solutions, including deposits and treasury management, trade finance, and institutional trust and custody to customers MUFG Securities Americas Engages in capital markets origination transactions, domestic and foreign debt and equity securities transactions, private placements, collateralized financings, and securities borrowing and lending transactions Diversification across segments and products as illustrated through revenue and earnings mix. Key MUAH business segments1 consist of: MUAH Key Business Segments 17 $614 41.4% $231 15.6% $50 3.4% $176 11.9% $411 27.7% Regional Bank Global Corporate & Investment Banking - U.S. Transaction Banking MUSA Other² $83 $102 $4 $48 $34 Regional Bank Global Corporate & Investment Banking - U.S. Transaction Banking MUSA Other² Three Months Ended March 31, 2021 $1,482MM Total Revenues by Segment ($MM)3 Three Months Ended March 31, 2021 $271MM Pre-tax, pre-provision income4 ($MM)

MUFG Americas Holdings Corporation Investor Presentation, 1Q21 (321) 55 28 645 (45) 362 Adj Net Income YTD 03/31/2020 Adj Net Income YTD 03/31/2021 For the Three Months Ended (Dollars in millions) March 31, December 31, March 31, Results of operations: 2021 2020 2020 Net interest income $ 750 $ 757 $ 774 Noninterest income 732 717 612 Total revenue 1,482 1,474 1,386 Noninterest expense 1,211 1,119 1,201 Pre-tax, pre-provision income2 271 355 185 (Reversal of) provision for credit losses (175) (43) 470 Income before income taxes and including noncontrolling interests 446 398 (285) Income tax expense (benefit) 70 73 25 Net income including noncontrolling interests 376 325 (310) Deduct: Net loss (income) from noncontrolling interests 3 4 4 Net (loss) income attributable to MUAH $ 379 $ 329 $ (306) 2021 Quarter-End MUAH Income Statement Results 18 A. Total revenue increased primarily due to higher noninterest income, which included a gain on the disposition of Transaction Banking's debt servicing and securities custody services business, partially offset by lower net interest income B. Noninterest expense C. Reversal of provision for credit losses was largely due to an improvement in our economic forecast, compared with prior period provision for credit losses which was substantially driven by the impact of COVID-19 and the corresponding deterioration in the economic environment. D. Income tax expense and other A B $ in millions (may not total due to rounding) C D Compared to the first quarter of 2020, net income increased by $685 million 1 1

MUFG Americas Holdings Corporation Investor Presentation, 1Q21 $(471) 35 52 7 (1,984) (305) 218 Net Loans as of 12/31/2020 Net Loans as of 03/31/2021 MUAH Net Loans as of Period End 19 A. Commercial and industrial loans decreased $471 million or 1.5% from $31,212 million to $30,741 million with an average annualized YTD yield of 2.87%2 B. Commercial mortgage loans increased $35 million or 0.2% from $16,244 million to $16,279 million with an average annualized YTD yield of 3.04%2 C. Construction loans increased $52 million or 3.1% from $1,655 million to $1,707 million with an average annualized YTD yield of 3.14%2 D. Lease financing increased $7 million or 0.7% from $1,038 million to $1,045 million with an average annualized YTD yield of 4.16%2 E. Residential mortgage and home equity loans decreased $1,984 million or 6.8% from $29,034 million to $27,050 million with an average annualized YTD yield of 2.93%2 F. Other consumer loans decreased $305 million or 10.2% from $2,983 million to $2,678 million with an average annualized YTD yield of 9.46%2 G. Allowance for loan losses decreased $218 million or 17.1% from $(1,273) million to $(1,055) million A $ in millions B C D E F E G 80,893 78,445 1Q21 total net loans held for investment decreased $2,448 million or 3.0% vs prior year end largely due to a reduction in residential mortgage and home equity loans due to pay downs as borrowers refinance in a lower rate environment and C&I loans due to seasonal fluctuations 1

MUFG Americas Holdings Corporation Investor Presentation, 1Q21 (293) (188) 233 (611) 3,779 Total deposits as of 12/31/2020 Total deposits as of 03/31/2021 A. Interest checking deposits decreased $293 million or 4.3% from $6,831 million to $6,538 million B. Money Market accounts decreased $188 million or 0.5% from $38,336 million to $38,148 million C. Saving deposits increased $233 million or 2.4% from $9,710 million to $9,943 million with an average annualized YTD rate of 0.14%2 D. Time deposits decreased $611 million or 8.2% from $7,419 million to $6,808 million with an average annualized YTD rate of 0.79%2 E. Noninterest bearing deposits increased $3,779 million or 9.4% from $40,130 million to $43,909 million MUAH Deposits as of Period End 20 A B C D E 102,426 105,346 $ in millions 1Q21 total deposits increased $2,920 million or 2.9% vs prior year end largely due to an increase in noninterest bearing deposits from our consumer and business clients. Increase in balances driven by a combination of core growth and surge balances resulting from government stimulus and changes to client spending behaviors in response to the COVID-19 pandemic Interest-bearing deposits 1

MUFG Americas Holdings Corporation Investor Presentation, 1Q21 39 38 37 38 38 9 10 9 10 10 2 5 7 7 7 14 10 8 7 7 34 39 40 40 44 Money Market Savings Interest Checking Time Deposit Non-Interest Bearing 1Q20 2Q20 3Q20 4Q20 1Q21 88 88 88 86 81 26 25 24 24 27 21 18 18 18 17 12 12 12 12 15 9 12 13 13 16 Loans Securities Securities Purchased under Repo and Borrowed Trading Assets & Other Cash and Cash Equivalents 1Q20 2Q20 3Q20 4Q20 1Q21 Earning Assets3 ($B) Deposit Growth4 ($B) Balance Sheet Composition and Trends Loan Portfolio Composition2Earning Asset Mix1 21 +7.0%(0.4)% Loans, 52.1% Securities, 17.2% Securities Purchased under Repo and Borrowed, 11.0% Trading Assets & Other, 9.5% Cash and Cash Equivalents, 10.1% Commercial & Industrial, 38.3% Commercial Mortgage, 20.1% Construction, 2.1% Lease Financing, 1.3% Residential Mortgage & Home Equity, 34.7% Other Consumer, 3.5%

MUFG Americas Holdings Corporation Investor Presentation, 1Q21 Strong Deposit Base Major Deposit Share in Key California Locations1,2 Metropolitan Statistical Area (MSA) / State Rank Share (%) San Diego-Chula Vista-Carlsbad, CA 4 14.01 Santa Maria-Santa Barbara, CA 3 13.71 Salinas, CA 5 8.37 Los Angeles-Long Beach-Anaheim, CA 4 7.78 Fresno, CA 4 6.86 Oxnard-Thousand Oaks-Ventura, CA 5 5.76 Sacramento-Roseville-Folsom, CA 6 5.07 Riverside-San Bernardino-Ontario, CA 6 3.96 San Francisco-Oakland-Berkeley, CA 7 2.09 San Jose-Sunnyvale-Santa Clara, CA 10 1.89 Overall California 4 5.36 Commercial DepositsRetail Deposits • Grow and retain core, low-cost deposits while optimizing bank-wide funding costs • Drive primacy and quality of deposits through product simplification and innovation, analytics, and sales and delivery model refinements • Align product and platform build-outs to increase PxV and drive core balance growth • Focus on key customer segments and relationships, deposit quality, and applying appropriate pricing strategies to maintain a high quality deposit book Deposit Breakdown ($B)3 22 $44.7 42% $9.9 9% $6.8 6% $43.9 42% Transaction & Money Market Savings Time Noninterest Bearing $105.3 Total Deposits

MUFG Americas Holdings Corporation Investor Presentation, 1Q21 103 222 176 182 270 16 147 178 317 262 55 45 44 28 27 146 206 191 183 162 3 1 2 1 1 0.20% 0.37% 0.36% 0.42% 0.42% NPA / Total Assets OREO Other Consumer Residential Mortgage & Home Equity Construction Commercial Mortgage Commercial & Industrial 1Q20 2Q20 3Q20 4Q20 1Q21 $0 $100 $200 $300 $400 $500 $600 $700 Nonaccrual Loans / Total Loans1,2 0.36% 0.72% 0.70% 0.87% 0.91% 0.61% 0.71% 0.83% 0.79% 0.84% MUAH Reference Banks' Average³ 1Q20 2Q20 3Q20 4Q20 1Q21 0.0% 0.5% 1.0% Asset Quality Trends Nonperforming Assets by Loan Type ($MM) Net Charge-offs (Recoveries) / Average Loans1,4 Criticized Loans5 & ACL / Total Loans 0.29% 0.24% 0.60% 0.42% 0.14% 0.57% 0.59% 0.52% 0.48% 0.36% MUAH Reference Banks' Average³ 1Q20 2Q20 3Q20 4Q20 1Q21 -0.5% 0% 0.5% 1% 23 1 $89,786 $86,535 $84,974 $82,166 $79,500 2.87% 4.43% 4.44% 4.80% 4.59% 1.40% 1.80% 1.73% 1.63% 1.43% ACL % Criticized % Loans Held for Investment 1Q20 2Q20 3Q20 4Q20 1Q21 0% 2% 4% 6% 8% $ in millions Criticized Loans 2,579 3,831 3,771 3,994 3,651 Total Allowance for Credit Losses 1,253 1,561 1,472 1,338 1,136

MUFG Americas Holdings Corporation Investor Presentation, 1Q21 COVID-19 Loan Modifications All Consumer and Commercial loan portfolios had a reduction in active COVID-19 loan modifications, which were largely payment deferrals, from 12/31/2020 to 3/31/2021 The significant decline in the Commercial portfolio with COVID-19 loan modifications, which were largely payment deferrals, can be attributed to the expiration of the maximum 6-month timeframe from the original forbearance date As of 12/31/2020 As of 3/31/2021 Consumer1 $ Millions % of Portfolio $ Millions % of Portfolio % Change in Balance QoQ Residential Mortgage $1,289 5% $987 4% (23)% Home Equity $51 3% $43 3% (16)% Other Consumer $46 2% $22 1% (52)% Total Consumer Portfolio $1,386 4% $1,052 4% (24)% 24 As of 12/31/2020 As of 3/31/2021 Commercial $ Millions % of Portfolio $ Millions % of Portfolio % Change in Balance QoQ C&I $572 2% $30 0.1% (95)% CRE $449 2% $38 0.2% (92)% Total Commercial Portfolio $1,021 2% $68 0.1% (93)%

MUFG Americas Holdings Corporation Investor Presentation, 1Q21 Residential Mortgage and Home Equity Portfolio Period-end Loan Balances and Net Charge-Offs ($MM) Consumer Loan Portfolio 25 Decreased residential mortgage and home equity portfolio reflects accelerated mortgage prepayments, while consumer portfolio continues to exhibit strong credit quality Other Consumer Loans1 Period-end Loan Balances and Net Charge-offs ($MM) $36,036 $33,794 $31,619 $29,034 $27,050 Residential Mortgage and Home Equity 1Q20 2Q20 3Q20 4Q20 1Q21 1Q20 2Q20 3Q20 4Q20 1Q21 Net Charge-Offs $ (1) $ (1) $ — $ (1) $ (2) $39 $43 $27 $35 $29 $4,372 $3,854 $3,374 $2,983 $2,678 Marketplace Lender Originated Consumer Card Other Net Charge-offs 1Q20 2Q20 3Q20 4Q20 1Q21 1Q20 2Q20 3Q20 4Q20 1Q21 Other Consumer Loans $ 4,372 $ 3,854 $ 3,374 $ 2,983 $ 2,678 Other 71 63 59 57 52 Consumer Card 269 245 229 227 209 Marketplace Lender Originated 4,032 3,547 3,085 2,699 2,417 Net Charge-offs 39 43 27 35 29

MUFG Americas Holdings Corporation Investor Presentation, 1Q21 0.74% 0.67% 0.51% 0.49% 0.39% 0.09% 0.05% 0.08% 0.08% 0.06% Residential and Home Equity Other Consumer 1Q20 2Q20 3Q20 4Q20 1Q21 0.0% 0.3% 0.5% 0.8% 0.14% 0.21% 0.25% 0.20% 0.15% 0.04% 0.04% 0.05% 0.04% 0.04% Residential and Home Equity Other Consumer 1Q20 2Q20 3Q20 4Q20 1Q21 0.0% 0.3% 0.5% 0.8% 90+ Days Past Due30 to 89 days Past Due Residential Mortgage and Home Equity Loans In response to the pandemic the Bank has offered payment relief options to customers that include the option to select an initial three-month forbearance plan for our mortgage and home equity line of credit clients impacted by the COVID-19 outbreak, and flexible relief programs for our consumer and business credit card clients, including payment deferral, delinquency removal and late fee waivers for our consumer and business deposit product customers. Residential Mortgage Portfolio as of March 31, 2021: a. 42% interest-only (non-amortizing) i. 63% weighted average LTV1 for the I/O portfolio b. No subprime programs or option ARM loans c. 82% of the consumer portfolio has a refreshed FICO score of 720 and above2 d. 98% has an LTV less than or equal to 80% 26

MUFG Americas Holdings Corporation Investor Presentation, 1Q21 Commercial Loan Portfolio Commercial loan balance remains stable in 1Q21; net charge-offs continue to illustrate strong credit quality Period-end Loan Balances and Net Charge-offs (Recoveries) ($MM) $49,378 $48,886 $49,981 $50,149 $49,772 $25 $11 $103 $57 $— 1Q20 2Q20 3Q20 4Q20 1Q21 27 Period Total Commercial Portfolio $49,378 $48,886 $49,981 $50,149 $49,772 Lease Financing 980 1,027 961 1,038 1,045 Construction 1,583 1,712 1,550 1,655 1,707 Commercial Mortgage 16,943 16,683 16,600 16,244 16,279 Commercial & Industrial 29,872 29,464 30,870 31,212 30,741 Total Net Charge-offs (Recoveries) $25 $11 $103 $57 $—

MUFG Americas Holdings Corporation Investor Presentation, 1Q21 Multi-Family 42.0% Office 13.8%Retail 13.2% Industrial 12.5% Other 13.7% Unsecured 4.8% Los Angeles 22.4% San Diego 10.7% Orange 9.6% Santa Clara 4.1% Alameda 3.4% San Francisco 1.9% Other (CA) 15.4% New York 4.7% Washington 6.7% Illinois 2.8% Oregon 3.3% Other 15.0% Q1 2021 Geographic Distribution3Q1 2021 Property Type Breakdown2 Commercial Real Estate Overview Secured 95.2% Commercial Real Estate Statistics4 (Dollars in millions) March 31, 2021 December 31, 2020 March 30, 2020 Commitments $ 23,676 $ 23,565 $ 24,514 Commercial and Industrial 4,574 4,321 4,336 Commercial Mortgage 16,546 16,549 17,191 Construction 2,555 2,696 2,987 Outstandings 19,956 19,994 20,910 Commercial and Industrial 1,976 2,101 2,395 Commercial Mortgage 16,274 16,238 16,933 Construction 1,707 1,654 1,582 Nonperforming Loans 337 344 70 California 67.6% Largely secured, California-focused commercial real estate-purposed loans1 with strong credit performance 28

MUFG Americas Holdings Corporation Investor Presentation, 1Q21 6.5 4.6 3.1 0.2 0.4 TLAC FHLB Unsecured Term Debt CP & Other ST Borrowings Other Wholesale Funding Strong Liquidity Position and Diverse Funding Mix 1. Under the joint agency Tailoring Rules, Category IV firms (such as MUAH) are required to maintain a liquidity buffer that is sufficient to meet the projected net stress cash-flow need over a 30-day planning horizon under the firm's internal liquidity stress test and subject to monthly tailored liquidity reporting requirements 2. Unpledged securities of $25.3 billion; ability to meet expected obligations for at least 18 months without access to funding 3. Key sources of funding consist primarily of deposits ($105.3 billion), supplemented by wholesale funding ($14.7 billion) 4. Diversified wholesale funding mix, primarily including borrowings from the Federal Home Loan Bank (FHLB) of San Francisco, the parent (Total Loss Absorbing Capacity debt), and unsecured term debt in the capital markets 5. Unused FHLB capacity is $15.5 billion MUAH Wholesale Funding Profile $ in billions 29 MUAH Total Funding Profile Deposits 72.4% Repos 17.4% Other LT Borrowings¹ 0.1% Wholesale Funding 10.1%

MUFG Americas Holdings Corporation Investor Presentation, 1Q21 $27.7 $25.8 $5.7 $4.5 $6.3 $5.9 $0.6 $0.5 $4.3 $4.5 $1.2 $1.4 $0.8 $0.9 $0.5 $0.5 $3.6 $2.3 $4.5 $5.3 U.S. Agency MBS HTM U.S. Treasury and Govt-Agency HTM Other AFS Direct Bank Purchase Bonds AFS CLOs AFS Non-Agency CMBS AFS Non-Agency RMBS AFS U.S. Agency MBS AFS U.S. Treasury and Govt-Agency AFS 1Q21 4Q20 Investment Portfolio Distribution2 High Quality Investment Portfolio Commentary • Agency residential and commercial mortgage-backed securities consist of securities guaranteed by a U.S. government corporation, such as Ginnie Mae, or a government-sponsored agency such as Freddie Mac or Fannie Mae • Commercial mortgage-backed securities are collateralized by commercial mortgage loans and are generally subject to prepayment penalties • CLOs consist of structured finance products that securitize a diversified pool of loan assets into multiple classes of notes • Other debt securities primarily consist of direct bank purchase bonds, which are not rated by external credit rating agencies Investment Portfolio1 ($ in billions) 30 Agency MBS: 39.2% US Treasury and Govt- Agency: 33.6% Non-Agency RMBS: 2.3% Non-Agency CMBS: 15.6% CLOs: 4.5% Direct Bank Purchase Bonds: 3.0% Other: 1.9%

MUFG Americas Holdings Corporation Investor Presentation, 1Q21 Securities Financing Maturity Profile High Quality Securities Financing Portfolio (MUSA) $ (M ill io ns ) $11,250 $8,521 $2,995 $2,154 $18,072 $4,038 $9,305 $600 Assets Liabilities O/N and Continuous¹ 2-30 days 31-90 days > 90 days 0 5,000 10,000 15,000 20,000 63.4% 22.2% 4.2% 0.7% 9.5% 47.3% 38.5% 4.2% 1.7% 8.3% Assets2 Liabilities2 • Securities financing activity largely conducted through MUSA • Securities financing portfolio is primarily collateralized by high quality, liquid assets • Approximately 86% is collateralized by U.S. Treasuries and Agency MBS and 14% is backed by equities, credit and other • Robust risk management framework governs secured financing profile including guidelines and limits for tenor gaps, counterparty concentration and stressed liquidity outflows U.S. Treasury & Government Agencies Agency MBS Corporate Bonds Other Debt Equities 31

MUFG Americas Holdings Corporation Investor Presentation, 1Q21 $(81.3) $(80.9) $(85.9) $(76.4) $(83.0) (2.87)% (2.89)% (3.16)% (2.96)% (3.02)% Effect on NII % of Base Case NII 1Q20 2Q20 3Q20 4Q20 1Q21 $82.0 $81.6 $124.6 $113.1 $106.4 2.90% 2.92% 4.59% 4.38% 3.87% Effect on NII % of Base Case NII Interest Rate Risk Management of exposures other than trading Net Interest Income (NII) Sensitivity ($MM) +100 bps -100 bps G ra du al p ar al le l y ie ld c ur ve s hi ft o ve r 12 -m on th h or iz on 32 For additional information regarding estimates and assumptions used in our net interest income sensitivity analysis see “Market Risk Management - Interest Rate Risk Management” in Part II, Item 7. “Management’s Discussion and Analysis of Financial Condition and Results of Operations” in our 2020 Form 10-K.

MUFG Americas Holdings Corporation Investor Presentation, 1Q21 Strong and High Quality Capital Base MUAH's capital ratios exceed the average of the Reference Banks1 Capital ratios: Reference Banks' Average1 MUAH Capital Ratios March 31, 2021 March 31, 2021 December 31, 2020 September 30, 2020 June 30, 2020 Regulatory: Common Equity Tier 1 risk-based capital ratio 11.18 % 15.81 % 15.28 % 15.03 % 14.48 % Tier 1 risk-based capital ratio 12.82 15.81 15.28 15.03 14.48 Total risk-based capital ratio 15.13 16.65 16.29 16.14 15.65 Tier 1 leverage ratio 8.90 9.68 9.56 9.44 8.94 Other: Tangible common equity ratio2 7.41 9.20 9.38 9.39 8.88 33 • MUAH reports its regulatory capital ratios under the standardized approach of the U.S. Basel III Rules. Under the revised Enhanced Prudential Standards (EPS) and joint agency capital Tailoring Rules, MUAH is subject to Category IV requirements • MUAH’s 1Q21 Common Equity Tier 1 and Tier 1 Capital Ratios increased to 15.81% over the 4Q20 reported 15.28% result; the increase in CET1/Tier 1 was primarily driven by 1Q21 net income of $379 million • MUAH is currently subject to a firm specific 4.4% Standardized Capital Conservation Buffer (CCB) (Stress Capital Buffer); MUAH’s capital distributions would be subject to limitation should its CET1, Tier 1 Capital and/or Total Capital ratios fall respectively below 8.9%, 10.4% and 12.4% • MUAH submitted its 2021 Annual Capital Plan to the FRB on April 2, 2021 and opted into FRB 2021 supervisory stress testing. MUAH’s and other participating firms’ 2021 supervisory stress testing results are expected to be released in June 2021 to be followed by updates to Standardized CCBs to become effective October 1, 2021

MUFG Americas Holdings Corporation Investor Presentation, 1Q21 MUFG Union Bank, N.A. OpCo Strong Credit Ratings 34 Senior Unsecured LT / ST Moody’s1 Fitch2S&P A A-1 A F1 A3 P-2 MUFG Securities Americas Inc. Broker Dealer A A-1 A F1N/R MUFG Americas Holdings Corporation Intermediate Holding Co. A- A-2 A F1 A3 N/R MUFG Bank, Ltd. OpCo A A-1 A- F1 A1 P-1 Mitsubishi UFJ Financial Group, Inc. Parent A- N/R A- F1 A1 P-1 For the rating agencies, strong capital and conservative asset quality help offset MUAH’s lower profitability and a higher level of wholesale funding relative to peers Reference Banks’ Credit Ratings (4/26/2021) Holding Company Ratings Bank Ratings Long-term ratings S&P Moody's Fitch S&P Moody's Fitch U.S. Bancorp A+ A1 AA- AA- A1 AA- Wells Fargo & Company BBB+ A2 A+ A+ Aa2 AA- Bank of America Corp. A- A2 A+ A+ Aa2 AA- JPMorgan Chase & Co. A- A2 AA- A+ Aa2 AA Truist Financial Corp. A- A3 A+ A A2 A+ PNC Financial Services A- A3 A+ A A2 A+ MUAH A- A3 A A A3 A M&T Bank Corp. A- A3 A A A3 A Citigroup BBB+ A3 A A+ Aa3 A+ Comerica BBB+ A3 A- A- A3 A- Fifth Third Bancorp BBB+ Baa1 A- A- A3 A- KeyCorp BBB+ Baa1 A- A- A3 A- Huntington Bancshares BBB+ Baa1 A- A- A3 A- Capital One Financial Corp. BBB Baa1 A- BBB+ Baa1 A- Citizens Financial Group BBB+ NR BBB+ A- Baa1 BBB+ Regions Financial Corp. BBB+ Baa2 BBB+ A- Baa2 BBB+ Zions Bancorp. - - - BBB+ Baa2 BBB+ N/RMUFG Union Bank, N.A. OpCo A+ F1 Aa3 P-1 Deposits LT / ST Moody’s1 Fitch2S&P

35 Appendix

MUFG Americas Holdings Corporation Investor Presentation, 1Q21 MUFG's Journey in the Americas 1864 1970s 2008 2014 2015 Union Bank, formerly known as Bank of California, is formed MUFG builds global network of overseas bases comparable to major banks of Europe and U.S. Corporate and Investment banking formed Union Bank becomes wholly owned subsidiary of MUFG Integration of U.S. Banking Operations under MUAH/ MUFG Union Bank 1880 1988 2017 MUFG, formerly known as Yokohama Specie Bank, Bank of Tokyo, is formed MUFG acquires Union Bank Acquired: • Tamalpais Bancorp (2010) ~$600 million assets • Frontier Bank (2010) ~$3 billion assets • Pacific Capital Bancorp (2012) ~$6 billion assets • Smartstreet (2012) ~$1 billion assets • First Bank (2013) ~$550 million assets • PB Capital (2013) ~$3.5 billion assets 2016 MUAH as Intermediate Holding Company Consolidates MUFG U.S. Subsidiaries, including MUFG Securities Americas (Enhanced Prudential Standards Implementation) Formation of Regional Bank under Single Leadership We serve our corporate and investment banking clients under the MUFG Brand; our consumer, wealth, and commercial banking clients under the Union Bank brand; and our direct banking business under the PurePoint brand 2019 Acquired Intrepid Investment Bankers Acquired Trade Payable Services (TPS), a leading supply chain finance platform, from GE Capital Acquired First State Investments (US) LLC as subsidiary of MUFG Fund Services, a direct subsidiary of MUAH Today 36 2010 - 2013 2020 Union Bank will use the FIS Modern Banking Platform to co- develop and co- engineer systems that will be core to the banking transformation program Union Bank committed $10 million to launch a Community Recovery Program aimed at addressing social and racial injustices 2021 Kevin Cronin is named CEO for the Americas

MUFG Americas Holdings Corporation Investor Presentation, 1Q21 Leadership Team and Board of Directors 37 Ranjana Clark Head of Transaction Banking TRANSACTION BANKING Mark Thumser Chief Strategy Officer STRATEGY Michael Coyne General Counsel Johannes Worsoe Chief Financial Officer Masatoshi Komoriya Chief of Staff Greg Seibly Head of Regional Banking Donna Dellosso Chief Risk Officer RISKREGIONAL BANK FINANCE LEGAL Francesca Lindner Chief Operational Effectiveness Officer OPERATIONAL EFFECTIVENESS Amy Ward Chief Human Resources Officer HUMAN RESOURCES MEO, REA, Deputy Chief Executive, GCIB Business Unit and CEO for MUAH President & CEO MEO, REA and MEO of GCIB Business Group Kevin Cronin Jonathan Lindenberg Head of Corporate & Investment Banking - Americas GLOBAL CORPORATE & INVESTMENT BANKING (GCIB) CHIEF OF STAFF William Mansfield Regional Head of Global Markets / CEO MUSA MUFG SECURITIES AMERICAS (MUSA) MUAH/MUB Board Members Independent Board Members Shareholder Appointees • Kazuo Koshi • Kevin Cronin • Masahiro Kuwahara • Hiroshi Masaki • Kazuto Uchida • Robin Bienfait • John R. Elmore • Michael D. Fraizer • Ann F. Jaedicke • Suneel Kamlani1 • Barbara L. Rambo • Toby S. Myerson • Dean A. Yoost Christopher Higgins Chief Information & Operations Officer Head of the Transformation Program OPERATIONS & TECHNOLOGY MUFG MUFG Bank MUAH /MUB MEO, Deputy COO-I Deputy Chief Executive, GCIB Business Unit Executive Chairman MEO, Group Deputy COO-I Deputy Group Head, GCIB Business Group Kazuo Koshi MUFG MUFG Bank MUAH /MUB MEO, Deputy REA, with oversight of Canada and Latin America operations Deputy REA MEO, Deputy REA Ryoichi Shinke MUFG MUFG Bank MUAH /MUB Daisuke Bito Head of Japanese Corporate Banking for the Americas JAPANESE CORPORATE BANKING

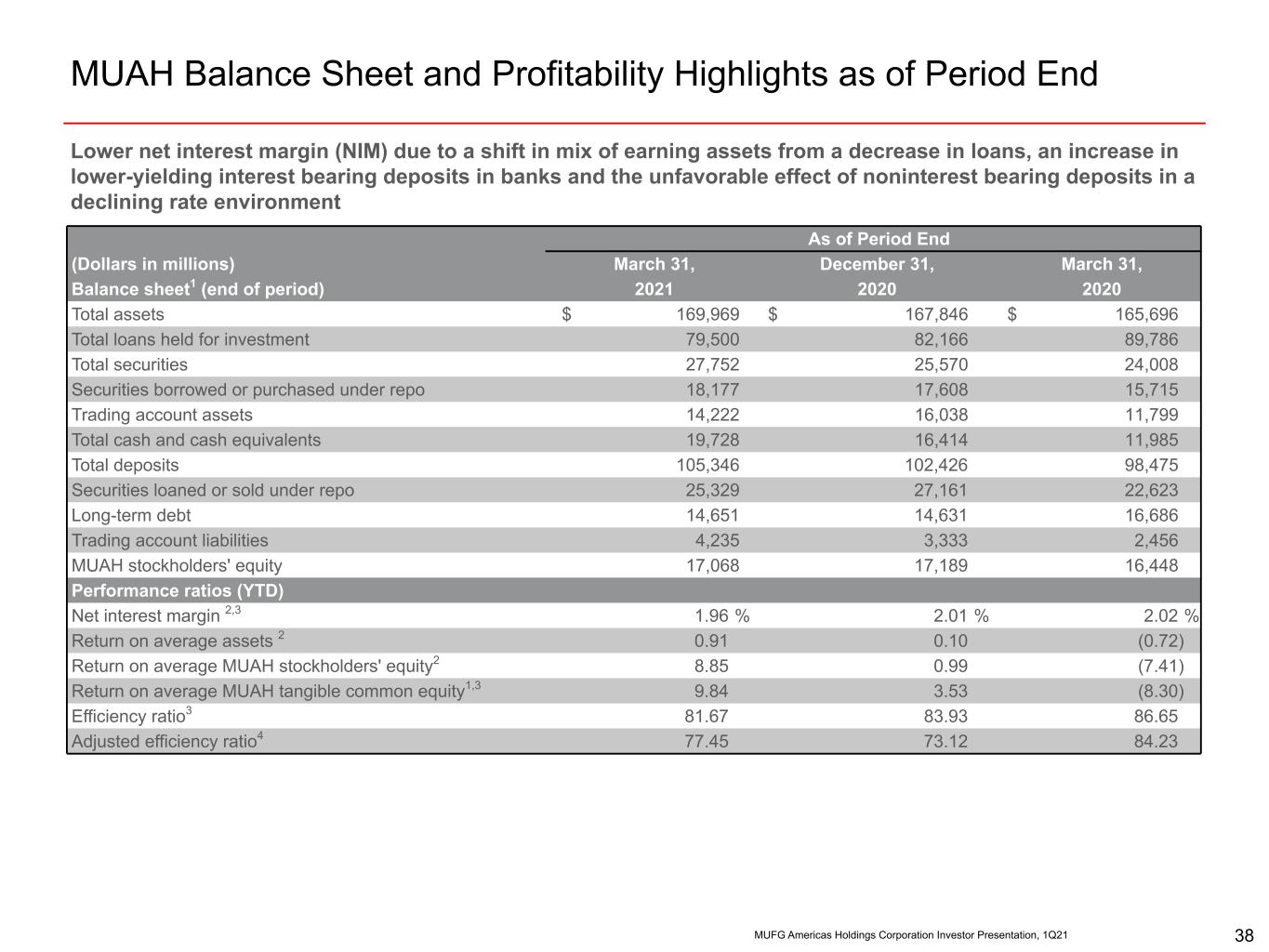

MUFG Americas Holdings Corporation Investor Presentation, 1Q21 MUAH Balance Sheet and Profitability Highlights as of Period End 38 As of Period End (Dollars in millions) March 31, December 31, March 31, Balance sheet1 (end of period) 2021 2020 2020 Total assets $ 169,969 $ 167,846 $ 165,696 Total loans held for investment 79,500 82,166 89,786 Total securities 27,752 25,570 24,008 Securities borrowed or purchased under repo 18,177 17,608 15,715 Trading account assets 14,222 16,038 11,799 Total cash and cash equivalents 19,728 16,414 11,985 Total deposits 105,346 102,426 98,475 Securities loaned or sold under repo 25,329 27,161 22,623 Long-term debt 14,651 14,631 16,686 Trading account liabilities 4,235 3,333 2,456 MUAH stockholders' equity 17,068 17,189 16,448 Performance ratios (YTD) Net interest margin 2,3 1.96 % 2.01 % 2.02 % Return on average assets 2 0.91 0.10 (0.72) Return on average MUAH stockholders' equity2 8.85 0.99 (7.41) Return on average MUAH tangible common equity1,3 9.84 3.53 (8.30) Efficiency ratio3 81.67 83.93 86.65 Adjusted efficiency ratio4 77.45 73.12 84.23 Lower net interest margin (NIM) due to a shift in mix of earning assets from a decrease in loans, an increase in lower-yielding interest bearing deposits in banks and the unfavorable effect of noninterest bearing deposits in a declining rate environment

MUFG Americas Holdings Corporation Investor Presentation, 1Q21 • Materially de-risked Oil & Gas portfolio from 2016-2021: • Strategically reduced $4.6 billion (66%) of exposure through loan sales and exits • Reduction focused in the highest risk sectors • Exploration and Production (E&P) exposure reduced by $4.4 billion (79%) • $605 million (51%) of the remaining $1.2 billion E&P exposure is Reserve Based Lending Materially De-Risked Oil & Gas Portfolio from 2016-2021 Total Exposure Trends Criticized Assets / NCO Trends 2016 vs. 2021 O&G Exposure by Subsectors 39

MUFG Americas Holdings Corporation Investor Presentation, 1Q21 Supporting Clients, Communities, and Colleagues during COVID-19 We have seen overwhelming economic suffering across our country as a result of COVID-19. We believe it is our responsibility to be part of the solution. • SBA Paycheck Protection Program (PPP) Loan Origination • Provided ~$2.7 billion of loans to ~14,000 clients under initial two phases of SBA PPP • Received ~7,500 applications totaling ~$800 million1 under phase 3 • PPP Loan Forgiveness • Received ~8,600 applications for ~$1.5 billion1 • Business and Consumer Relief Programs Clients • Throughout 2020, MUB's Community Reinvestment Act (CRA) group funded $15 million in capital, leveraging $313 million in investments, into small business across the country • Extended a loan to 'Access to Capital for Entrepreneurs', a Community Development Financial Institution (CDFI) in Atlanta, GA, to provide loans to small businesses directly impacted by COVID-19 • Provided a low-cost loan to 'CDC Small Business' to support small businesses throughout CA with micro-loans Communities • Quickly ramped up technology to enable 80%+ MUFG Americas2 colleagues to work from home • Employee Relief Funding of $410,000 for employees in the US • All Union Bank branch staff in CA, WA, and OR received relief pay of up to $2,000 • MUFG Americas U.S. colleagues received additional time off to support their family's needs in the form of up to 10 days of fully paid time away (Crisis Relief Time Off) and up to an additional 8 weeks of partial paid time off (Pandemic Leave) Colleagues 40

MUFG Americas Holdings Corporation Investor Presentation, 1Q21 MUFG Americas Takes Pride in our Achievements in Banking and Serving Our Communities CRA Rating of Outstanding Community Service Action Plan1 Results MUFG Inclusion & Diversity Achievements Philanthropic Commitment to Communities $3.0 million Commitment to support local communities affected by COVID-19 $10.0 million Community Recovery Program commitment aimed at addressing social and racial inequalities in the U.S. $18.0 million In philanthropic grants and investments2 The MUFG Union Bank Foundation directed 90% of contributions to strategic focus areas and 86% to benefit low- and moderate-income communities. $71.9 billion In financing provided under the 5- year Community Service Action Plan, exceeding the goal of $41 billion3 $50.2 billion In environmental financing and investment3 36% Reduced our greenhouse gas emissions from our own operations3 $3.6 billion In lending and investments to support multi-family affordable housing3 41 Corporate Social Responsibility for the Americas Strategic Partnerships We support and partner with professional development and community organizations that align with our inclusion and diversity strategy, including: 1. Asian Pacific Islander Scholarship Fund (APIASF) 2. DiversityInc Best Practices 3. Elevate Enterprise Resource Group (ERG), by Spectrum Knowledge 4. Equality California Institute 5. Financial Women Association, NY 6. National Latina Business Women Association 7. National Veterans Transition Services 8. Prism International, Inc. - Association of ERGs & Councils 9. United Negro College Fund (UNCF) Bloomberg: Gender Equality Index, 2017-2020 Human Rights Campaign: 100% Corporate Equality Index, 2014-2020 DiversityInc. Noteworthy Company, 2020 25 Women to Watch and 25 Most Powerful Women in Banking, 2011-2019 U.S. Veterans Magazine: Best of the Best, 2017-2020 Black EOE Journal: Top Employer, Top LGBT- Friendly Employer, and Top Financial & Banking Company, 2010-2020

MUFG Americas Holdings Corporation Investor Presentation, 1Q21 MUB Term Debt MUAH Term Debt Other MUAH Subs² 1Q22 2Q22 3Q22 4Q22 1Q23 2Q23 3Q23 4Q23 1Q24 2Q24 3Q24 4Q24 1Q25 ... 3Q27 $0.0 $500.0 $1,000.0 $1,500.0 $2,000.0 $2,500.0 $3,000.0 $3,500.0 MUAH Unsecured Long-Term Debt Outstanding and Maturity Schedule1 As of March 31, 2021 42 MUFG Americas Holdings Corp. Senior External Amt ($mm) CPN (%) Maturity Date3 400 3.500 Jun-22 400 3.000 Feb-25 Issued to MUFG Bank 1,625 3-month LIBOR+99 bps Dec-23 1,765 3-month LIBOR+94 bps Dec-23 €21.7 3-month EURIBOR+76 bps Dec-23 775 3-month LIBOR+76 bps Mar-24 90 3-month LIBOR+66 bps Mar-24 750 3-month LIBOR+79 bps Jun-24 750 3-month LIBOR+82 bps Sep-24 750 3-month LIBOR+84 bps Dec-24 Long-Term Debt Redemption Schedule ($B) MUFG Union Bank, N.A. Senior External Amt ($mm) CPN (%) Maturity Date 300 3-month LIBOR+60 bps Mar-22 1,000 3.150 Apr-22 700 2.100 Dec-22 300 3-month LIBOR+71 bps Dec-22 Other MUAH Subsidiaries Senior Issued to MUFG Bank / Affiliates Amt ($mm) CPN (%) Maturity Date 316 Various Aug-21 to Sep-27

MUFG Americas Holdings Corporation Investor Presentation, 1Q21 Notes 43 Slide 3 - MUFG has a Significant Presence in the U.S. 1. Net of intercompany eliminations 2. MUFG: Total Assets, Loans, and Deposits as of 12/31/2020 using an exchange rate of USD 1.00 = JPY 103.50; global rankings for Total Assets are as of 6/30/2020; locations and countries are as of 9/30/2020; employees are as of 12/31/2019 3. MUFG U.S.: Total Assets of $344 billion, Loans of $169 billion, and Deposits of $212 billion; including intercompany adjustments as of 12/31/2020 4. Source: MUAH's 12/31/2020 10-K filing, number of full-time equivalent (FTE) employees for MUAH only Slide 4 - Strength of U.S. Presence 1. Using an exchange rate of USD 1.00 = JPY 108.02 as of 4/26/21, the date the increased goal was announced 2. As of 3/31/2021 Slide 5 - Advancing Sustainable Growth and Financial Opportunity 1. Using an exchange rate of USD 1.00 = JPY 108.02 as of 4/26/21, the date the increased goal was announced 2. Excludes projects that are designed to contribute to transition to a decarbonized society according to the MUFG Environmental and Social Policy Framework; announced in October 2020 Slide 7 - Strategic Plan 1. Includes Conforming Gain on Sale Slide 12 - Rewiring MUFG 1. Not including any potential reductions in expenses and associated fees transfer-priced to MUFG U.S. branches that may also result from the program Slide 13 - FY2020 Wins 1. Not including any potential reductions in expenses and associated fees transfer-priced to MUFG U.S. branches that may also result from the program Slide 17 - MUAH Key Business Segments 1. Source: Form 10-Q for the quarter ended March 31, 2021 2. "Other" includes the MUFG Fund Services segment, Markets segment, Japanese Corporate Banking segment and Corporate Treasury 3. Numbers may not add to 100% due to rounding 4. Pre-tax, pre-provision income is total revenue less noninterest expense. Management believes that this is a useful financial measure because it enables investors and others to assess the Company's ability to generate capital to cover credit losses through a credit cycle

MUFG Americas Holdings Corporation Investor Presentation, 1Q21 Notes 44 Slide 18 - 2021 Quarter-End MUAH Income Statement Results 1. Adjusted net income, a non-GAAP financial measure, adjusts noninterest income and noninterest expense for the fees and costs associated with services provided to MUFG Bank, Ltd. branches in the U.S. 03/31/2021 YTD adjusted net income is net income ($379 million) minus the net of fees from affiliates ($380 million) and costs ($357 million) associated with services provided to MUFG Bank, Ltd. branches in the U.S., net of tax ($6 million) equals $362 million. 03/31/2019 YTD adjusted net income is net loss ($306 million) minus the net of fees from affiliates ($339 million) and costs ($319 million) associated with services provided to MUFG Bank, Ltd. branches in the U.S., net of tax ($5 million) equals a loss of $321 million. Management believes adjusting net income for the fees and costs associated with services provided to MUFG Bank, Ltd. branches in the U.S. enhances the comparability of MUAH's net income when compared with other financial institutions 2. Pre-tax, pre-provision income is total revenue less noninterest expense. Management believes that this is a useful financial measure because it enables investors and others to assess the Company's ability to generate capital to cover credit losses through a credit cycle Slide 19 - MUAH Net Loans as of Period End 1. Numbers in billions and may not add up due to rounding 2. Annualized based on year to date activity Slide 20 - MUAH Deposits as of Period End 1. Numbers may not add up due to rounding 2. Annualized based on year to date activity Slide 21 - Balance Sheet Composition and Trends 1. Average balance for the year ended March 31, 2021. May not total 100% due to rounding 2. Average balance total loans held for investment, including all nonperforming loans for the year ended March 31, 2021. May not total 100% due to rounding 3. Average balance for the year ended March 31, 2021. May not total 100% due to rounding 4. Ending quarterly balances and growth rate may not total due to rounding Slide 22 - Strong Deposit Base 1. Source: SNL Financial as of 6/30/20, “Pro Forma” ownership which captures any known M&A or branch closure activity up to the current date, no deposit cap applied 2. The above balances do not include PurePoint deposits which are primarily placed with customers outside MUB's West Coast markets 3. Period-end total deposits may not total 100% due to rounding

MUFG Americas Holdings Corporation Investor Presentation, 1Q21 Notes 45 Slide 23 - Asset Quality Trends 1. Source: SNL Financial and company reports 2. Total Loans for MUAH is based on Total Loans Held for Investment; Total Loans for Reference Banks' Average is based on gross loans which includes loans held for sale 3. Reference banks consist of 12 CCAR-filing public regional banks (CFG, CMA, COF, FITB, HBAN, KEY, MTB, PNC, RF, TFC, USB, ZION) plus the four largest U.S. money center banks (BAC, C, JPM, WFC). Reference Banks’ average based on reporting through May 7, 2021 (Source: SNL Financial) 4. Annualized ratio 5. Criticized loans held for investment reflect loans in the commercial portfolio segment that are monitored for credit quality based on regulatory ratings. Amounts exclude small business loans, which are monitored by business credit score and delinquency status Slide 24 - COVID-19 Loan Modifications 1. The Consumer portfolio tracks active payment deferrals only. The balance continues to decline quarter-over-quarter, but the original 6-month forbearance has increased to an 18-month total forbearance allowed with the passage of additional stimulus packages by the U.S. government Slide 25 - Consumer Loan Portfolio 1. Quarterly balances may not total due to rounding Slide 26 - Residential Mortgage and Home Equity Loans 1. At origination 2. Excluding loans serviced by third-party service providers Slide 28 - Commercial Real Estate Overview 1. Commercial real estate-purposed loans are comprised of commercial mortgage loans, construction loans and C&I loans to borrowers with real estate-exposed businesses; does not include CMBS in the investment or trading portfolios 2. May not add to 100% due to rounding 3. Excludes loans not secured by real estate; subsets of California reported by Metropolitan Statistical Area (MSA); may not add to 100% due to rounding 4. Figures may not add due to rounding Slide 29 - Strong Liquidity Position and Diverse Funding Mix 1. Includes non-recourse debt Slide 30 - High Quality Investment Portfolio 1. Source: Fair value of securities in MUAH 10-Q/K Filing as of March 31, 2021 and December 31, 2020 respectively 2. Source: MUAH 10-Q Filing as of March 31, 2021; may not total 100% due to rounding Slide 31 - High Quality Securities Financing Portfolio (MUSA) 1. Includes continuous maturities which include open trades and term evergreen transactions that are primarily used to fund inventory 2. Total assets and liabilities may not total 100% due to rounding

MUFG Americas Holdings Corporation Investor Presentation, 1Q21 Notes 46 Slide 33 - Strong and High Quality Capital Base 1. Reference Banks consist of 12 CCAR-filing public regional banks listed on slide 23 Notes plus the four largest U.S. money center banks. Reference Banks’ average based on reporting through May 7, 2021 (Source: SNL Financial) 2. Non-GAAP financial measures. Refer to our separate reconciliation of non-GAAP financial measures in our 10-K and 10-Q for year/quarter ended March 31, 2021, December 31, 2020, September 30, 2020 and June 30, 2020 Slide 34 - Strong Credit Ratings 1. On October 15, 2020, Moody's downgraded MUAH's long-term rating to A3 from A2 and MUB's long and short-term ratings to A3/P-2 from A2/P-1. MUB's long-term deposit rating was downgraded to Aa3 from Aa2 and the short-term deposit rating of P-1 was affirmed 2. On October 23, 2020, Fitch affirmed MUAH, MUB, and MUSA's long and short-term ratings of A/F1 outlook negative Slide 37 - Leadership Team and Board of Directors MEO: Managing Executive Officer REA: Regional Executive for the Americas 1. Mr. Kamlani serves only on the Board of Directors of MUFG Americas Holdings Corporation Slide 38 - MUAH Balance Sheet and Profitability Highlights as of Period End 1. Annualized based on year to date activity 2. Net interest margin is presented on a taxable-equivalent basis using the federal statutory tax rate of 21% for 2020 and 2021 3. The efficiency ratio is total noninterest expense as a percentage of total revenue (net interest income and noninterest income) 4. Non-GAAP financial measure in our 10-Q/K for quarter- and year-ended March 31, 2021, December 31, 2020 and March 31, 2020 Slide 40 - Supporting Clients, Communities, and Colleagues during COVID-19 1. As of 4/29/2021 2. Colleagues from the U.S., Canada, and Latin America Slide 41 - MUFG Americas Takes Pride in our Achievements in Banking and Serving Our Communities 1. MUAH's 5-year Community Service Action Plan ("CSAP") ended on December 31, 2020. A new CSAP is expected to be implemented in Q1 2022 2. For the year ended 12/31/2020 3. For the five-year period from 1/1/2016 to 12/31/2020 Slide 42 - MUAH Unsecured Long-Term Debt Outstanding and Maturity Schedule 1. Excludes non-recourse debt, FHLB Loans and capital leases 2. Based on various fixed rate borrowings due between 2021 and 2027 3. Based on contractual maturity

MUFG Americas Holdings Corporation Investor Presentation, 1Q21 Contacts Contacts Daniel Weidman Stanley Cecala Managing Director, Corporate Communications Director, Investor Relations (213) 236-4050 (212) 782-5629 daniel.weidman@unionbank.com stanley.cecala@unionbank.com Investor Relations MUFG Americas Holdings Corporation (212) 782-6872 debtcapitalmarketsir@unionbank.com 47