Attached files

| file | filename |

|---|---|

| 8-K - FORM 8-K - Lifesci Acquisition II Corp. | tm2115351d1_8k.htm |

| EX-99.3 - EXHIBIT 99.3 - Lifesci Acquisition II Corp. | tm2115351d1_ex99-3.htm |

| EX-99.1 - EXHIBIT 99.1 - Lifesci Acquisition II Corp. | tm2115351d1_ex99-1.htm |

| EX-10.3 - EXHIBIT 10.3 - Lifesci Acquisition II Corp. | tm2115351d1_ex10-3.htm |

| EX-10.1 - EXHIBIT 10.1 - Lifesci Acquisition II Corp. | tm2115351d1_ex10-1.htm |

| EX-2.1 - EXHIBIT 2.1 - Lifesci Acquisition II Corp. | tm2115351d1_ex2-1.htm |

Exhibit 99.2

The Clinical Trial Operating System .

This presentation (this “Presentation”) is provided for informational purposes only and has been prepared to assist intereste d p arties in making their own evaluation with respect to a potential business combination between Science 37, Inc. (“Science 37” ) a nd LifeSci Acquisition II Corp. (“LSAQ”) and related transactions (the “Potential Business Combination”) and for no other purpose. By re vi ewing or reading this Presentation, you will be deemed to have agreed to the obligations and restrictions set out below. Without the express prior written consent of LSAQ and Science 37, this Presentation and any information contained within it m ay not be ( i ) reproduced (in whole or in part), (ii) copied at any time, (iii) used for any purpose other than your evaluation of Science 37 and the Potential Business Combination or (iv) provided to any other person, except your employees and advisors with a nee d t o know who are advised of the confidentiality of the information. This Presentation supersedes and replaces all previous oral or written communications between the parties hereto relating to the subject matter hereof. This Presentation and any oral statements made in connection with this Presentation do not constitute an offer to sell, or a sol icitation of an offer to buy, or a recommendation to purchase, any securities in any jurisdiction, or the solicitation of any pr oxy, vote, consent or approval in any jurisdiction in connection with the Potential Business Combination or any related transactions, no r s hall there be any sale, issuance or transfer of any securities in any jurisdiction where, or to any person to whom, such offe r, solicitation or sale may be unlawful under the laws of such jurisdiction. This Presentation does not constitute either advice or a recommendation regarding any securities. Any offer to sell securities will be made only pursuant to a definitive subscripti on agreement and will be made in reliance on an exemption from registration under the Securities Act of 1933, as amended, for of fer s and sales of securities that do not involve a public offering. LSAQ and Science 37 reserve the right to withdraw or amend f or any reason any offering and to reject any subscription agreement for any reason. The communication of this Presentation is re str icted by law; it is not intended for distribution to, or use by any person in, any jurisdiction where such distribution or us e w ould be contrary to local law or regulation. No representations or warranties, express or implied are given in, or in respect of, this Presentation. To the fullest extent pe rmitted by law, in no circumstances will LSAQ, Science 37 or any of their respective subsidiaries, stockholders, affiliates, representatives, partners, directors, officers, employees, advisers or agents be responsible or liable for any direct, indire ct or consequential loss or loss of profit arising from the use of this Presentation, its contents (including the internal econo mic models), its omissions, reliance on the information contained within it, or on opinions communicated in relation thereto or otherwise aris ing in connection therewith. Industry and market data used in this Presentation have been obtained from third - party industry public ations and sources as well as from research reports prepared for other purposes. Neither LSAQ nor Science 37 has independently verif ied the data obtained from these sources and cannot assure you of the data’s accuracy or completeness. This data is subject to change. Recipients of this Presentation are not to construe its contents, or any prior or subsequent communications from or w ith LSAQ, Science 37 or their respective representatives as investment, legal or tax advice. In addition, this Presentation does no t purport to be all - inclusive or to contain all of the information that may be required to make a full analysis of Science 37 or t he Potential Business Combination. Recipients of this Presentation should each make their own evaluation of Science 37 and th e Potential Business Combination and of the relevance and adequacy of the information and should make such other investigations as they deem necessary. Forward - Looking Statements This Presentation contains certain forward - looking statements within the meaning of the federal securities laws with respect to the proposed transaction between Science 37 and LSAQ, including statements regarding the benefits of the transaction, the anticipated timing of the transaction, the services offered by Science 37 and the markets in which it operates, and Science 3 7’s projected future results. These forward - looking statements generally are identified by the words “believe,” “project,” “expect, ” “anticipate,” “estimate,” “intend,” “strategy,” “future,” “opportunity,” “plan,” “may,” “should,” “will,” “would,” “will be,” “w ill continue,” “will likely result” and similar expressions. Forward - looking statements are predictions, projections and other s tatements about future events that are based on current expectations and assumptions and, as a result, are subject to risks and uncertainties . M any factors could cause actual future events to differ materially from the forward - looking statements in this Presentation, incl uding but not limited to: ( i ) the risk that the transaction may not be completed in a timely manner or at all, which may adversely affect the price of LS AQ’ s securities, (ii) the risk that the transaction may not be completed by LSAQ’s business combination deadline and the potential failure to obtain an extension of the business combination deadline if sought by LSAQ, (iii) the failure to sat isf y the conditions to the consummation of the transaction, including the adoption of the agreement and plan of merger by the st ock holders of LSAQ and Science 37, the satisfaction of the minimum trust account amount following redemptions by LSAQ’s public stockhold ers and the receipt of certain governmental and regulatory approvals, (iv) the lack of a third party valuation in determining whether or not to pursue the proposed transaction, (v) the occurrence of any event, change or other circumstance that could g ive rise to the termination of the agreement and plan of merger, (vi) the effect of the announcement or pendency of the transacti on on Science 37’s business relationships, performance, and business generally, (vii) risks that the proposed transaction disrup ts current plans of Science 37 and potential difficulties in Science 37 employee retention as a result of the proposed transacti on, (viii) the outcome of any legal proceedings that may be instituted against Science 37 or against LSAQ related to the agreement and p lan of merger or the proposed transaction, (ix) the ability to maintain the listing of LSAQ’s securities on the Nasdaq Capital Ma rk et (“Nasdaq”), (x) the price of LSAQ’s securities may be volatile due to a variety of factors, including changes in the competit ive and highly regulated industries in which Science 37 plans to operate, variations in performance across competitors, changes i n laws and regulations affecting Science 37’s business and changes in the combined capital structure (xi) the ability to implement b usi ness plans, forecasts, and other expectations after the completion of the proposed transaction, and identify and realize addi tio nal opportunities, and (xii) the potential adverse effects of the ongoing global COVID - 19 pandemic. The foregoing list of factors is not exhaustive. You should carefully consider the foregoing factors and the other risks and uncertainties described in the “R is k Factors” section of LSAQ’s Registration Statement on Form S - 1, the registration statement on Form S - 4 and proxy statement/consen t solicitation statement/prospectus described below and other documents filed by LSAQ from time to time with the U.S. Securities and Exchange Commission (the “SEC”). These filings identify and address other important risks and uncertainties th at could cause actual events and results to differ materially from those contained in the forward - looking statements. Forward - looki ng statements speak only as of the date they are made. Readers are cautioned not to put undue reliance on forward - looking statement s, and Science 37 and LSAQ assume no obligation and do not intend to update or revise these forward - looking statements, whether as a result of new information, future events, or otherwise. Neither Science 37 nor LSAQ gives any assurance that eit her Science 37 or LSAQ will achieve its expectations. Disclaimers and Other Important Information 2

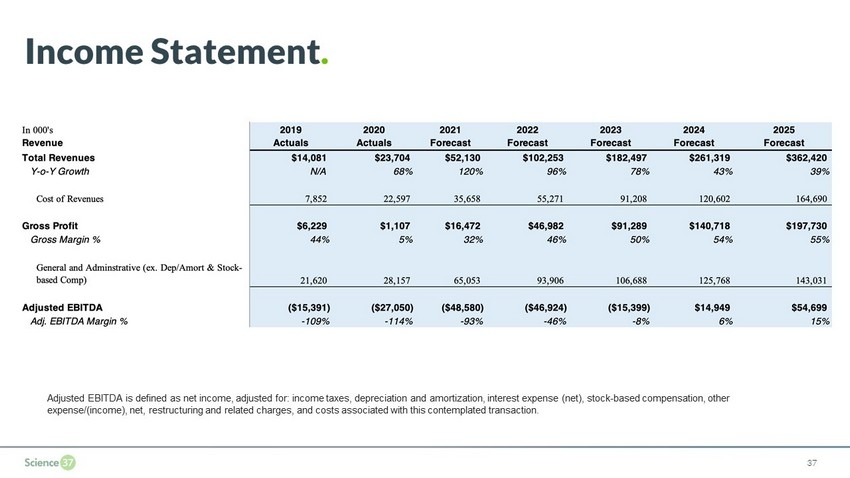

Use of Projections This Presentation contains projected financial information with respect to Science 37. Such projected financial information c ons titutes forward - looking information and is for illustrative purposes only and should not be relied upon as necessarily being ind icative of future results. The assumptions and estimates underlying such financial forecast information are inherently uncertain and are subject to a wide variety of significant business, economic, competitive and other risks and uncertainties. See “Forward - Lookin g Statements” above. Actual results may differ materially from the results contemplated by the financial forecast information c ont ained in this Presentation, and the inclusion of such information in this Presentation should not be regarded as a representa tio n by any person that the results reflected in such forecasts will be achieved. Financial Information; Non - GAAP Financial Terms The financial information and data contained this Presentation is unaudited and does not conform to Regulation S - X promulgated b y the SEC. Accordingly, such information and data may not be included in, may be adjusted in, or may be presented differently in, any proxy statement/consent solicitation statement/prospectus or registration statement or other report or document to be fi led or furnished by LSAQ with the SEC. Furthermore, some of the projected financial information and data contained in this Presentation, such as Adjusted EBITDA (an d r elated measures), has not been prepared in accordance with United States generally accepted accounting principles (“GAAP”). Science 37 and LSAQ believe these non - GAAP measures of financial results provide useful information to management and investors regarding certain financial and business trends relating to Science 37’s financial condition and results of operations. Scien ce 37’s management uses these non - GAAP measures for trend analyses and for budgeting and planning purposes. Science 37 and LSAQ bel ieve that the use of these non - GAAP financial measures provides an additional tool for investors to use in evaluating projected operating results and trends in and in comparing Science 37’s financial measures with other similar companies, many of which present similar non - GAAP financial measures to investors. Management of Science 37 does not consider these non - GAAP measures in isolation or as an alternative to financial measures determined in accordance with GAAP. The principal limit ati on of these non - GAAP financial measures is that they exclude significant expenses and income that are required by GAAP to be recorded in Science 37’s financial statements. In addition, they are subject to inherent limitations as they reflect the exer cis e of judgments by management about which expense and income are excluded or included in determining these non - GAAP financial measures. You should review Science 37’s audited financial statements, which will be presented in LSAQ’s proxy statement/cons ent solicitation statement/prospectus to be filed with the SEC, and not rely on any single financial measure to evaluate Science 37’s business. A reconciliation of non - GAAP financial measures in this Presentation to the most directly comparable GAAP financi al measures is not included, because, without unreasonable effort, Science 37 is unable to predict with reasonable certainty the amount or timing of non - GAAP adjustments that are used to calculate these Non - GAAP financial measures. Trademarks This Presentation contains trademarks, service marks, trade names, and copyrights of Science 37, LSAQ and other companies, wh ich are the property of their respective owners. Additional Information and Where to Find It This document relates to a proposed transaction between Science 37 and LSAQ. This document does not constitute an offer to se ll or exchange, or the solicitation of an offer to buy or exchange, any securities, nor shall there be any sale of securities in an y jurisdiction in which such offer, sale or exchange would be unlawful prior to registration or qualification under the securit ies laws of any such jurisdiction. LSAQ intends to file a registration statement on Form S - 4 that will include a proxy statement of LSAQ, a consent solicitation statement of Science 37 and a prospectus of LSAQ. The proxy statement/consent solicitation statement/pro spe ctus will be sent to all LSAQ and Science 37 stockholders. LSAQ also will file other documents regarding the proposed transaction with the SEC. Before making any voting decision, investors and security holders of LSAQ and Science 37 are urged to read the registration statement, the proxy statement/consent solicitation statement/prospectus and all other relevant documen ts filed or that will be filed with the SEC in connection with the proposed transaction as they become available because they wi ll contain important information about the proposed transaction. Investors and security holders will be able to obtain free copies of the proxy statement/consent solicitation statement/prosp ect us and all other relevant documents filed or that will be filed with the SEC by LSAQ through the website maintained by the SE C a t www.sec.gov . In addition, the documents filed by LSAQ may be obtained free of charge from LSAQ’s website at www.lifesciacquisition.com /spac - 2/ or by written request to LSAQ at LifeSci Acquisition II Corp., 250 West 55th Street, Suite 34, New York, NY 10019. Participants in Solicitation LSAQ and Science 37 and their respective directors and officers may be deemed to be participants in the solicitation of proxi es from LSAQ’s stockholders in connection with the proposed transaction. Information about LSAQ’s directors and executive office rs and their ownership of LSAQ’s securities is set forth in LSAQ’s filings with the SEC, including LSAQ’s Registration Statement on Form S - 1, which was filed with the SEC on October 14, 2020. To the extent that holdings of LSAQ’s securities have changed since the amounts printed in LSAQ’s Registration Statement on Form S - 1, such changes have been or will be reflected on Statement s of Change in Ownership on Form 4 filed with the SEC. Additional information regarding the interests of those persons and other persons who may be deemed participants in the proposed transaction may be obtained by reading the proxy statement/prosp ect us regarding the proposed transaction when it becomes available. You may obtain free copies of these documents as described in the preceding paragraph. Disclaimers and Other Important Information (continued) 3

Risks related to our limited operating history and early stage of growth 1. We have a limited operating history on which to assess the prospects for our business and we have incurred losses since incep tio n. We anticipate that we will continue to incur significant losses for at least the next several years. 2. We have incurred significant losses since inception. As such, you cannot rely upon our historical operating performance to ma ke an investment or voting decision regarding the company. 3. We have experienced rapid growth and expect to invest in growth for the foreseeable future. If we fail to manage growth effec tiv ely, our business, operating results and financial condition would be adversely affected. 4. We may need to raise additional funding to expand the commercialization of our products and services and to expand our resear ch and development efforts. This additional financing may not be available on acceptable terms, or at all. Failure to obtain thi s necessary capital when needed may force us to delay, limit or terminate our product commercialization or development efforts or other operations. 5. A failure to identify and successfully close and integrate strategic acquisition targets could adversely impact our ongoing b usi ness and financial results. 6. Unfavorable general economic conditions could negatively affect our business, results of operations and financial condition. 7. Our actual operating results may differ significantly from guidance provided by our management. Risks related to our business and operations 1. Our forecasts and projections are based upon assumptions, analyses and internal estimates developed by our management. If the se assumptions, analyses or estimates prove to be incorrect or inaccurate, our actual operating results may differ materially from those forecasted or projected. 2. The potential loss, delay, or non - renewal of our contracts or any delay in our clients’ clinical trials or non - payment by our cl ients for services that we have performed, could negatively affect our business, results of operations and financial results. 3. Our backlog may not convert to revenue at the historical conversion rate. 4. If we are unable to successfully develop and market new services or enter new markets, our growth, results of operations or f ina ncial condition could be adversely affected. 5. Our relationships with existing or potential clients who are in competition with each other may adversely impact the degree t o w hich other clients or potential clients use our services, which may adversely affect our results of operations. 6. If we are unable to attract suitable investigators and patients for our clinical trials, our clinical development business ma y s uffer. 7. We rely on third parties for important products and services. 8. If we lose the services of key personnel or are unable to recruit and retain experienced personnel, our business could be adv ers ely affected. 9. Failure to meet productivity objectives under our internal business transformation initiatives could adversely impact our com pet itiveness and harm our operating results. 10. Our insurance may not cover all of our indemnification obligations and other liabilities associated with our operations. 11. We derive a significant percentage of our revenues from a concentrated group of clients and the loss of one or more major cli ent s could materially and adversely affect our business, results of operations or financial condition. 12. Current and future litigation against us, which may arise in the ordinary course of our business, could be costly and time co nsu ming to defend. 13. We expect to incur increased costs and obligations as a result of being a public company. 14. While we to date have not made material acquisitions, should we pursue acquisitions in the future, we would be subject to ris ks associated with acquisitions. Risk Factors 4

Risks related to the general economic and financial market conditions and the industries in which we operate 1. The effects of the COVID - 19 pandemic could adversely affect our business, results of operations, and financial condition. 2. We depend entirely on the clinical trial market, and a downturn in this market could cause our revenues to decrease. 3. Consolidation among our clients could cause us to lose clients, decrease the market for our products and result in a reductio n o f our revenues. 4. Our estimate of the market size for our services may prove to be inaccurate, and even if the market size is accurate, we cann ot assure you that our business will serve a significant portion of the market. Risks related to technology and intellectual property 1. Our business depends on the continued effectiveness and availability of our information systems, including the information sy ste ms we use to provide our services to our clients, and failures of these systems may materially limit our operations. 2. A failure or breach of our IT systems or technology could result in sensitive client information being compromised or otherwi se significantly disrupt our business operations, which would negatively materially affect our reputation and/or results of operations. 3. Computer malware, viruses, ransomware, hacking, phishing attacks and other network disruptions could result in security and p riv acy breaches and interruption in service, which would harm our business. 4. Our services are subject to evolving industry standards and rapid technological changes. If we do not keep pace with rapid te chn ological changes, our services may become less competitive or obsolete, which could have a material adverse effect on our business, results of operations and financial condition. 5. We rely on third parties to provide certain data and other information to us. Our suppliers or providers might increase our c ost to obtain, restrict our use of, or refuse to license data, which could lead to our inability to access certain data or provid e certain services and, as a result, materially and adversely affect our operating results and financial condition. 6. We rely on third parties for important products, services and licenses to certain technology and intellectual property rights an d we might not be able to continue to obtain such products, services and licenses. 7. We have only a limited ability to protect our intellectual property rights, both domestically and internationally, and these rig hts are important to our success. 8. Our cloud - based solutions and services utilize open source software, and any failure to comply with the terms of one or more of these open source licenses could adversely affect our business. Risks related to political, legal and regulatory environment 1. We may face political, legal and compliance, operational, regulatory, economic and other risks associated with the internatio nal expansion of our operations that we do not currently face or that are more significant than in our domestic operations. 2. Due to the global nature of our business, we may be exposed to liabilities under anti - corruption laws, including the United Stat es Foreign Corrupt Practices Act, the United Kingdom Bribery Act and various international anti - corruption laws, and any allegation or determination that we violated these laws could have a material adverse effect on our business. 3. Our employees may engage in misconduct or other improper activities, including noncompliance with regulatory standards and re qui rements, which could have a material adverse effect on our business. 4. If we fail to comply with certain healthcare laws, including fraud and abuse laws, we could face substantial penalties and ou r b usiness, results of operations, financial condition, and prospects could be adversely affected. 5. Extensive governmental regulation of the clinical trial process and our products and services could require significant compl ian ce costs and have a material adverse effect on the demand for our solutions. 6. Data protection laws and regulations may limit the use of our platform and give rise to operational interruption, liabilities , a nd reputational harm, which could have a materially adverse impact on our business. 7. The enactment of legislation implementing changes in the U.S. taxation of international business activities, the adoption of oth er tax reform policies or changes in tax legislation or policies in jurisdictions outside of the United States could material ly impact our results of operations and financial condition. Risk Factors (continued) 5

Risk related to our common stock 1. Future sales of our stock in the public market could cause the market price of our stock to decrease significantly. 2. If we fail to maintain an effective system of internal control over financial reporting, we may not be able to accurately rep ort our financial results or prevent fraud. As a result, our stockholders could lose confidence in our financial and other public r eporting, which would harm its business and the trading price of our common stock. 3. Since we have no current plans to pay regular cash dividends on our common stock, stockholders may not receive any return on inv estment unless they sell their common stock for a price greater than that which they paid for it. 4. If securities analysts or industry analysts do not publish reports about our business or if they downgrade our stock or our s ect or, our stock price and trading volumes could decline. 5. Delaware law and provisions in our certificate of incorporation and bylaws could make a takeover proposal more difficult. 6. Our bylaws designate the Court of Chancery of the State of Delaware as the sole and exclusive forum for certain types of acti ons and proceedings and the federal district courts as the sole and exclusive forum for other types of actions and proceedings, i n each case, that may be initiated by our stockholders, which could limit our stockholders’ ability to obtain what such stockho lde rs believe to be a favorable judicial forum for disputes with the company or our directors, officers or other employees. Risk Factors (continued) 6

Today’s Presenters Dave Dobkin Life Sci Acquisition II CFO David Coman Science 37 CEO Mike Zaranek Science 37 CFO 7

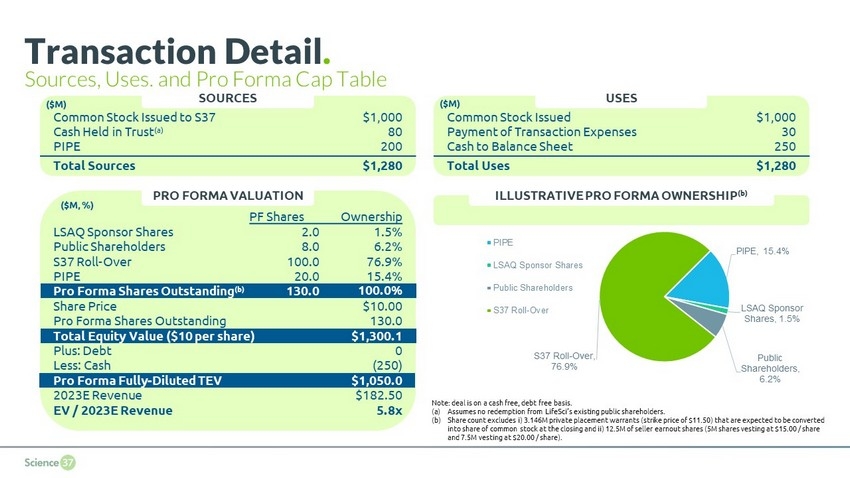

Transaction Overview . Science 37 has agreed to key terms of a potential business combination with LifeSci Acquisition II Corp. ( LifeSci ) Transaction Structure: $80.1M cash in trust (a) ; $200.0M PIPE proceeds Selling shareholders of the company to receive newly issued shares of SPAC common stock at $10.00 per share and an additional 12.5 million shares subject to a price - based earnout (b) Use of Proceeds: The company intends to use the net proceeds from the transaction for geographic expansion, to expand its tech platform to further service pharma and to pursue M&A opportunities Valuation: $1,300 pro forma equity value; $1,050 pro forma fully - diluted TEV with no debt outstanding at closing Timeline: Proposed transaction announcement date during the week of May 3 rd 8 (a) Assumes no redemption from LifeSci’s existing public shareholders. (b) 5 million earnout shares at $15.00 and 7.5 million earnout shares at $20.00 (for 20 trading days of any consecutive 30 tr adi ng day period following closing)

PIPE , 15.4% LSAQ Sponsor Shares , 1.5% Public Shareholders , 6.2% S37 Roll - Over , 76.9% PIPE LSAQ Sponsor Shares Public Shareholders S37 Roll-Over Transaction Detail . Sources, Uses, and Pro Forma Cap Table Common Stock Issued to S37 $1,000 Cash Held in Trust (a) 80 PIPE 200 Total Sources $1,280 SOURCES Common Stock Issued $1,000 Payment of Transaction Expenses 30 Cash to Balance Sheet 250 Total Uses $1,280 USES PRO FORMA VALUATION ILLUSTRATIVE PRO FORMA OWNERSHIP (b) Note: deal is on a cash free, debt free basis. (a) Assumes no redemption from LifeSci’s existing public shareholders. (b) Share count excludes i) 3.146M private placement warrants (strike price of $11.50) that are expected to be converted into share of common stock at the closing and ii) 12.5M of seller earnout shares (5M shares vesting at $15.00 / share and 7.5M vesting at $20.00 / share). PF Shares Ownership LSAQ Sponsor Shares 2.0 1.5% Public Shareholders 8.0 6.2% S37 Roll - Over 100.0 76.9% PIPE 20.0 15.4% Pro Forma Shares Outstanding (b) 130.0 100.0% Share Price $10.00 Pro Forma Shares Outstanding 130.0 Total Equity Value ($10 per share) $1,300.1 Plus: Debt 0 Less: Cash (250) Pro Forma Fully - Diluted TEV $1,050.0 2023E Revenue $182.50 EV / 2023E Revenue 5.8x ($M) ($M, %) ($M)

Highly Experienced in Technology and Science . 10 David Coman Chief Executive Officer Steven Geffon Chief Commercial Officer Darcy Forman Chief Delivery Officer Mike Zaranek Chief Financial Officer Jim Young Chief HR Officer Jonathan Cotliar Chief Medical Officer Chris Ceppi Chief Product Officer Laura Podolsky General Counsel Anita Modi VP Business Transformation Drew Bustos Chief Strategy and Marketing Officer 10

Investing in our Foundation of Success . 11 Board of Directors John Hubbard Rob Faulkner Neil Tiwari Bhooshi Desilva Scott Jordan Adam Goulburn Chairman Independent Observer Investors: 11

Science 37 Investment Highlights . 12 ▪ Up to 15x faster than traditional clinical trials ▪ Up to 28x greater patient/participant retention ▪ Up to 3x more diverse participants ▪ Unifying technology platform to enable workflow, evidence generation and data harmonization ▪ On - demand telemedicine investigators and gig - economy nursing for home visits ▪ Integrations into networks (EHR and EDC) and connected devices to expedite trial operations ▪ $444M net bookings in 2025 expected to increase from $119M in 2021 ▪ $362M revenue in 2025 expected to increase from $52M in 2021 ▪ Gross profit margin expected to increase to 55% in 2025 ▪ Model expansion: commercial, geographic, technology ▪ Expanded offerings: rapidly growing adjacencies ▪ Potential M&A opportunities Disrupting the $60b Clinical Trial Industry Category - Defining Clinical Trial Operating System Strong Financial Performance Significant Growth Opportunities Ahead

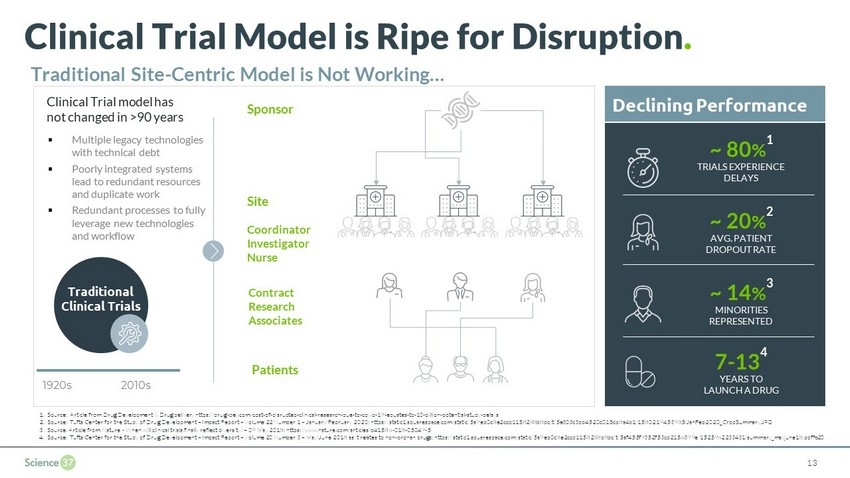

Clinical Trial Model is Ripe for Disruption . Traditional Site - Centric Model is Not Working… Traditional Clinical Trials Clinical Trial model has not changed in >90 years 1920s 2010s Sponsor Site Patients ▪ Multiple legacy technologies with technical debt ▪ Poorly integrated systems lead to redundant resources and duplicate work ▪ Redundant processes to fully leverage new technologies and workflow Contract Research Associates Declining Performance 7 - 13 4 YEARS TO LAUNCH A DRUG ~ 80 % 1 TRIALS EXPERIENCE DELAYS ~ 20 % 2 AVG. PATIENT DROPOUT RATE ~ 14 % 3 MINORITIES REPRESENTED 13 Coordinator Investigator Nurse 1. Source: Article from Drug Development & Drug delivery https://drug - dev.com/cost - of - disrupted - clinical - research - due - to - covid - 19 - equates - to - 10 - billion - potential - study - delays / 2. Source: Tufts Center for the Study of Drug Development – Impact Report – Volume 22 Number 1 – January/February 2020: https://st atic1.squarespace.com/static/5a9eb0c8e2ccd1158288d8dc/t/5e303c3dd4520c015cb8a4b1/1580219453985/JanFeb2020_CropSummary.JPG 3. Source: Article from Nature - When will clinical trials finally reflect diversity? – 09 May 2018: https://www.nature.com/articl es/d41586 - 018 - 05049 - 5 4. Source: Tufts Center for the Study of Drug Development – Impact Report – Volume 20 Number 3 – May/June 2018 as it relates to no n - orphan drugs: https://static1.squarespace.com/static/5a9eb0c8e2ccd1158288d8dc/t/5af455f9352f53cd2156399e/1525962233431/summar y _mayjune18.pdf%20

Science 37 Pioneered Decentralized Clinical Trials . Science 37 Pioneers Virtual Trials in 2014 Patient Centric Model Generates Better Outcomes Outcomes 15 x faster than sites in same study Enroll Patients Faster 28 % longer than industry average Retain Patients Longer 3 x Higher enrollment from diverse communities Represent the Real Population Patient Centric Model ▪ Unified platform ▪ Proven processes ▪ Differentiated Services We’ve conducted more fully virtual trials . decentralized clinical trials (DCTs) 95 + engaged patients 366,000 + 7 Years of insights in DCT Potential of > $ 54 M 3 months average trial acceleration Pharma Gain in revenue Decentralized Clinical Trials Sponsor Meta site Patients 14 Up to Up to Up to Source: Science 37 Internal case study, reports, and estimates

Our Vision To be the category - defining Operating System that powers every clinical trial . 15

Remote Coordinators Mobile Nurses Connected Devices Patient Communities Full - Stack, E - 2 - E Technology & Network Enables Trial Orchestration . Telemedicine Investigators DATA HARMONIZATION EVIDENCE GENERATION WORKFLOW ORCHESTRATION Technology Platform ▪ Social media and association networks ▪ Provider, pharmacy and payer networks ▪ FASTER PATIENT RECRUITMENT ▪ On - demand, experience rated ▪ All therapeutic areas; any geography ▪ ACCESS TO ANY PATIENT, ANYWHERE ▪ Flexibility to integrate with virtually any device ▪ New clinical data (cardiac, activity, sleep, lung function, etc ) ▪ ROBUST, REAL - TIME EVIDENCE GENERATION ▪ On - demand, gig - economy motivated ▪ Managed via one set of SOPs ▪ PATIENT - CENTRIC FOCUSED EXPERIENCE ▪ Highly scalable ▪ Measurable utilization rates ▪ REPEATABLE PROCESSES 16

This material is confidential and proprietary to Science 37 ® and shall not be distributed, edited, or modified in any way without written consent from Science 37. 17 Full - Stack, E - 2 - E Technology Platform . 17 DCT Operating System This material is confidential and proprietary to Science 37 ® and shall not be distributed, edited, or modified in any way without written consent from Science 37. 17 Connected Devices Telemedicine Investigators Patient Communities Remote Coordinators Mobile Nurses

This material is confidential and proprietary to Science 37 ® and shall not be distributed, edited, or modified in any way without written consent from Science 37. Connected Devices Mobile Nurses Patient Communities Remote Coordinators Telemedicine Investigators Evidence Generation Workflow Orchestration Data Harmonization REAL - WORLD EVIDENCE DEVICE WEARABLES PATIENT EXPERIENCE COORDINATOR EXPERIENCE INVESTIGATOR EXPERIENCE NURSE EXPERIENCE INTERNAL EXTERNAL CLINICAL CONDUCT PATIENT REPORTED Full - Stack, E - 2 - E Technology Platform . This material is confidential and proprietary to Science 37 ® and shall not be distributed, edited, or modified in any way without written consent from Science 37. Connected Devices Telemedicine Investigators Patient Communities Remote Coordinators Mobile Nurses 18

Trial Landing Pages Recruitment CRM Patient Concierge Investigator Support Logistics Mgmt Retention CRM S37 Patient App Mobile Nurse Mgmt Data Review and Approval Telemedicine SAE/ AE Tracking Scheduling IMP Mgmt Labs Data Collection Medical Record Review Clinical Coordination PATIENT EXPERIENCE COORDINATOR EXPERIENCE INVESTIGATOR EXPERIENCE NURSE EXPERIENCE INTERNAL EXTERNAL Remote eConsent eSource ClinROs Lab Data Sleep Monitoring Lung Function Cardiac Safety Activity Monitor Post Marketing Safety Longitudinal Data Aggregation ObsRO Long - term Follow - up ePRO QOL Health Status Symptom Reporting Open APIs EDC Integrations Tokenization Performance Analytics Remote Monitoring Query Management Rapid Trial Builder UAT Validation REAL - WORLD EVIDENCE DEVICE WEARABLES CLINICAL CONDUCT PATIENT REPORTED Data Harmonization Evidence Generation Workflow Orchestration Connected Devices Mobile Nurses Patient Communities Remote Coordinators This material is confidential and proprietary to Science 37 ® and shall not be distributed, edited, or modified in any way without written consent from Science 37. Telemedicine Investigators Full - Stack, E - 2 - E Technology Platform . 19

Creating Optimal Trial Orchestration . Patient Communities DCT Operating System 20

Creating Optimal Trial Orchestration . Telemedicine Investigators DCT Operating System 21

Remote Coordinators Remote Coordinators Connected Devices DCT Operating System Creating Optimal Trial Orchestration . Mobile Nurses Patient Communities Telemedicine Investigators 22

Creating Optimal Trial Orchestration . DCT Operating System Connected Devices Remote Coordinators Mobile Nurses Patient Communities Telemedicine Investigators Patient Communities Telemedicine Investigators 23

Mobile Nurses Creating Optimal Trial Orchestration . DCT Operating System Connected Devices Remote Coordinators Mobile Nurses Patient Communities Telemedicine Investigators 24

This material is confidential and proprietary to Science 37 ® and shall not be distributed, edited, or modified in any way without written consent from Science 37. 25 DCT Configurations to Enable Any Study . Science 37 Platform Trial Orchestration Sole Provider Full DCT Metasite TM Technology Technology Configurations Patient Engagement Remote eConsent eSource ( eCOA , eCRF) Telemedicine 3rd - Party Integration Network Configurations Patient Recruitment Coordinator Network Mobile Nurse Network Investigator Network Connected Devices Study Configurations Early Phase Pivotal Studies Long - Term Follow - up Real - World Evidence Any Indications

This material is confidential and proprietary to Science 37 ® and shall not be distributed, edited, or modified in any way without written consent from Science 37. 26 Science 37 is a Pioneer & Leader in DCT . Press & Awards Large Pharma Customers Mid - Size Pharma Customers Biotech Customers Academic/Gov’t Customers Partnerships

• Rescued top - CRO traditional brick & mortar study with enrollment challenges • Patient enrollment • Phlebotomist visit • Follow - up after colonoscopy Customer Success Stories . 27 Oncology Diagnostic Pivotal Trial Situation Approach Outcomes 5,380 + enrolled in just half of the total recruitment period 2,000 + Enrolled in a month Decentralization on Massive Scale . • Needed a means to continue intravenous treatments for cancer study • Enrolled at site • Telemedicine visit • Chemotherapy delivered in - home by mobile nurse Situation Approach Outcomes 4 x faster study start - up All clinical trials are special but this one… is above and beyond anything I have seen in my oncology career. Executive Group Medical Director Top 10 Pharma Company “ ” Faster Start - up and Greater Continuity of Care . Breast Cancer Study 27

This material is confidential and proprietary to Science 37 ® and shall not be distributed, edited, or modified in any way without written consent from Science 37. 28 Why Science 37 Wins 1 . TRIAL ORCHESTRATION None Complete TECHNOLOGY Site - Centric Fully Decentralized CROs Clinical Home Health Patient Recruitment eClinical Providers Decentralization Tech The Clinical Trial Operating System Site - Based Recruitment • Tech is not in our competitors’ DNA • DCT model requires different SOPs • DCT would cannibalize competitors’ core business • Little to minimal ability to orchestrate • User Experience (UX) not informed by their own users 1. Science 37 management team assessment based on competitor public announcements.

This material is confidential and proprietary to Science 37 ® and shall not be distributed, edited, or modified in any way without written consent from Science 37. 29 Why Science 37 Wins 1 in the Future . TRIAL ORCHESTRATION None Complete TECHNOLOGY Site - Centric Fully Decentralized CROs Clinical Home Health Patient Recruitment eClinical Providers Decentralization Tech The Clinical Trial Operating System Site - Based Recruitment • Continue to extend E2E, OS of the future • Partnering with key point solutions • Own tech workflow experience as competitive moat ▪ The CRO Clinical Trial Operating System (OS) 1. Science 37 management team assessment based on competitor public announcements.

Traditional, site - based trial Future Clinical Trials Decentralized trial ( DCT ) To win in this new era, leaders will need the following: ▪ Ability to activate any Provider and any Patient – regardless of premises ▪ A network of traditional providers, telemedicine providers, mobile nurses and remote coordinators ▪ A flexible operating system to seamlessly navigate between on - site and off - site Sponsor Site Patients Contract Research Associates Study Coordinator Investigator Nurse Site Sponsors Home Science 37 Defines the Standard Clinical Trial OS . Empowers Clinical Trials and Optimizes the Experience & Outcomes for Participants Patients Providers PoC Telemedicine Sponsor Metasite Patients 30

50% 17% 33% CRO Home Health Recruitment & eClinical Large Market Opportunity . 2021 Total Available Market (TAM) ~ $ 195 Billion R&D Spend CAGR ~6% ’21 – ’26 Global pharma R&D spend ($B) 136 139 145 149 159 168 181 186 188 195 202 211 221 2015 2012 2014 2020F 2017 2018 2019 2021F 2022F 2013 2023F 2024F 2016 4 - 5% R&D Spend: 2012 – 2019 Forecast 1 R&D Spend: 2020 – 2024 Annual growth in R&D spend $ 60 Billion 31 2021F Serviceable Available Market (SAM) 2 1. Pre - COVID forecast. Source: EvaluatePharma ; BCG Analysis 2. Serviceable Available Market: Management estimates as of April 2021

01 02 Science 37 Growth Drivers . Expand Extend ▪ CRO ▪ eCOA ▪ RWE ▪ Clinical Care ▪ Diversity ▪ Provider Tech Enablement ▪ Provider Network Sources ▪ Performance & Risk Mgmt. Core 03 ▪ SaaS and aPaaS ▪ Patient Platform (Recruitment, Enrollment, & Engagement) ▪ Globalization of Metasite ▪ Connected Devices at Scale ▪ Expanded Commercial Presence 02 01 03 Disrupting a $60b 1 Market Constructing the category - defining Clinical Trial Operating System 32 1. Serviceable Available Market: Management estimates as of April 2021

$- $20 $40 $60 $80 $100 $120 Q1 '20 Q2 '20 Q3-20 Q4-20 Q1-21 Net Bookings Gross Bookings $- $50 $100 $150 $200 $250 $300 Q1 - 2020 Q2 - 2020 Q3 - 2020 Q4 -2020 Q1 - 2021 Qualified Funnel Over Time Top - Line Growth Acceleration . $61 4 x Growth Y/Y $175 $144 $175 $248 Millions ($) Millions ($) $55.7 TTM Gross and Net Bookings $95.4 *Q1 - 2021 Preliminary Bookings 33 * $41.7 $32.9 $13.9 $102.7 $61.2 $45.1 $33.1 $14

Representative Bookings in Past 12 Months . Value Indication Phase First Patient Contract Biotech $4.1M Infectious Disease III Apr 2021 18 Months Top 5 pharma $5.1M Respiratory III May 2021 39 Months Top 5 Pharma $2.2M Neurology II Apr 2021 9 Months Biotech $1.4M Gastrointestinal II Jan 2021 24 Months Biotech $1.1M Huntington’s II Apr 2021 38 Months Government $22.6M COVID III Apr 2021 36 Months Biotech $18.5M Oncology III Jul 2020 12 Months Top 5 pharma $6.3M Nephrology III May 2021 21 Months Biotech $2.7M Nephrology III May 2021 8 Months Biotech $1.4M Adrenal Hyperplasia II Mar 2021 12 Months Biotech $1.5M CSID IV Jul 2021 19 Months Top 5 pharma $4.8M Oncology II Nov 2020 36 Months Biotech $3.8M FNAD II Jul 2021 8 Months Biotech $1.5M CSID IV Jul 2021 19 Months Biotech $0.8M Respiratory IV May 2021 8 Months Tech+ Metasite Full DCT Global 34

Top - Line Acceleration . 35 $0 $100 $200 $300 $400 $500 2019 2020 2021F 2022F 2023F 2024F 2025F Net Bookings thru 2025 $12 $218 $338 $258 $119 $56 52 % CAGR ‘20 - ‘25 $444 Millions ($) Net Promoter Score 1 (NPS): $- $1.0 $2.0 $3.0 Q1 2020 Q2 2020 Q3 2020 Q4 2020 Q1 2021 $1.4 $2.5 Millions ($) $1.8 $2.1 $1.9 0 4 8 12 Q1 2020 Q2 2020 Q3 2020 Q4 2020 Q1 2021 Average Contract Value 2 Net New Logos 2 7 6 3 9 27 New Logos in 2020 79% Growth Q1 ‘20 vs. Q1 ‘21 Science 37 NPS 40 1. Source: Science 37 Net Promoter Score Survey – Q4 2020 based on a limited number of survey responses 2. Based on Request for Proposals (RFPs) sent

4.7% 31.6% 45.9% 50.0% 53.8% 54.5% 0% 10% 20% 30% 40% 50% 60% $0 $50 $100 $150 $200 2020 2021 F 2022 F 2023 F 2024 F 2025 $0 $50 $100 $150 $200 $250 $300 $350 $400 2020 2021 2022 2023 2024 2025 Income Statement . 36 Significant Revenue Scaling Gross Margin 3 Expansion ’20 – ’25 F CAGR 73% F $24 $52 $362 $102 $182 $261 F $1.1 $16.5 $47.0 $91.3 $140.7 $197.7 81 % Revenue Coverage 2 in ’21F 55 % Gross margin in ’25F 1 Millions ($) Millions ($) 1. 2020 Figures are unaudited 2. As of April 12, 2021 3. Gross Margin excludes stock - based comp 1 ’ F F F F

Income Statement . 37 Adjusted EBITDA is defined as net income, adjusted for: income taxes, depreciation and amortization, interest expense (net), sto ck - based compensation, other expense/(income), net, restructuring and related charges, and costs associated with this contemplated transaction.

Comparable Company Benchmarking . Revenue CAGR 2021 - 2023 Enterprise Value / 2023E Revenue Source: Company internal data, public filings, and CapitalIQ as of 4/15/21. Disruptive Healthcare Technology Platforms Vertical Software Drug Development Technology 14% 20% 32% 20% 23% 29% 36% 74% 9% 10% 10% 17% 20% 25% 87% 0% 10% 20% 30% 40% 50% 60% 70% 80% 90% 100% CERT SLP MXCT HCAT PHR TDOC GDRX BFLY TYL BSY GWRE DCT VEEV NCNO S37 5.8x 11.2x 16.8x 17.2x 6.6x 9.1x 10.5x 10.6x 15.6x 9.2x 12.3x 12.7x 15.5x 19.3x 20.0x 0.0x 5.0x 10.0x 15.0x 20.0x 25.0x S37 CERT SLP MXCT HCAT TDOC PHR GDRX BFLY GWRE TYL BSY DCT VEEV NCNO

EV/Revenue 2023E (a) Revenue CAGR 2021 - 2023E (a) Disruptive Healthcare Technology Platforms 10.5x 37% Drug Discovery Enablement 15.1x 22% Vertical Software 14.8x 15% Selected Comparable Companies . 87% (a) Figures presented are the mean for each category. Source: Company internal data, public filings, and CapitalIQ as of 4/15/21. 5.8x

Science 37 Investment Highlights . 40 ▪ Up to 15x faster than traditional clinical trials ▪ Up to 28x greater patient/participant retention ▪ Up to 3x more diverse participants ▪ Unifying technology platform to enable workflow, evidence generation and data harmonization ▪ On - demand telemedicine investigators and gig - economy nursing for home visits ▪ Integrations into networks (EHR and EDC) and connected devices to expedite trial operations ▪ $444M net bookings in 2025 expected to increase from $119M in 2021 ▪ $362M revenue in 2025 expected to increase from $52M in 2021 ▪ Gross profit margin expected to increase to 55% in 2025 ▪ Model expansion: commercial, geographic, technology ▪ Expanded offerings: rapidly growing adjacencies ▪ Potential M&A opportunities Disrupting the $60b Clinical Trial Industry Category - Defining Clinical Trial Operating System Strong Financial Performance Significant Growth Opportunities Ahead