Attached files

| file | filename |

|---|---|

| 8-K - 8-K - OP Bancorp | opbk-8k_20210506.htm |

D.A. Davison 23rd Annual Financial Institutions Conference May 5 - 6, 2021

Certain matters set forth herein constitute “forward-looking statements” within the meaning of the Private Securities Litigation Reform Act of 1995, including forward-looking statements relating to the Company’s current business plans and expectations regarding future operating results. These forward-looking statements are subject to risks and uncertainties that could cause actual results, performance or achievements to differ materially from those projected. These risks and uncertainties, some of which are beyond our control, include, but are not limited to: the uncertainties related to the coronavirus pandemic including, but not limited to, the potential adverse effect of the pandemic on the economy, our employees and customers, and our financial performance; the impact of the federal CARES Act and the significant additional lending activities undertaken by the Company in connection with the Small Business Administration’s Paycheck Protection Program enacted thereunder, including risks to the Company with respect to the uncertain application by the Small Business Administration of new borrower and loan eligibility, forgiveness and audit criteria; business and economic conditions, particularly those affecting the financial services industry and our primary market areas; our ability to successfully manage our credit risk and the sufficiency of our allowance for loan losses; factors that can impact the performance of our loan portfolio, including real estate values and liquidity in our primary market areas, the financial health of our commercial borrowers, the success of construction projects that we finance, including any loans acquired in acquisition transactions; our ability to effectively execute our strategic plan and manage our growth; interest rate fluctuations, which could have an adverse effect on our profitability; liquidity issues, including fluctuations in the fair value and liquidity of the securities we hold for sale and our ability to raise additional capital, if necessary; external economic and/or market factors, such as changes in monetary and fiscal policies and laws, including the interest rate policies of the Federal Reserve, inflation or deflation, changes in the demand for loans, and fluctuations in consumer spending, borrowing and savings habits, which may have an adverse impact on our financial condition; continued or increasing competition from other financial institutions, credit unions, and non-bank financial services companies, many of which are subject to different regulations than we are; challenges arising from unsuccessful attempts to expand into new geographic markets, products, or services; restraints on the ability of Open Bank to pay dividends to us, which could limit our liquidity; increased capital requirements imposed by banking regulators, which may require us to raise capital at a time when capital is not available on favorable terms or at all; a failure in the internal controls we have implemented to address the risks inherent to the business of banking; inaccuracies in our assumptions about future events, which could result in material differences between our financial projections and actual financial performance; changes in our management personnel or our inability to retain motivate and hire qualified management personnel; disruptions, security breaches, or other adverse events, failures or interruptions in, or attacks on, our information technology systems; disruptions, security breaches, or other adverse events affecting the third-party vendors who perform several of our critical processing functions; an inability to keep pace with the rate of technological advances due to a lack of resources to invest in new technologies; risks related to potential acquisitions; political developments, uncertainties or instability, catastrophic events, acts of war or terrorism, or natural disasters, such as earthquakes, fires, drought, pandemic diseases (such as the coronavirus) or extreme weather events, any of which may affect services we use or affect our customers, employees or third parties with which we conduct business; incremental costs and obligations associated with operating as a public company; the impact of any claims or legal actions to which we may be subject, including any effect on our reputation; compliance with governmental and regulatory requirements, including the Dodd-Frank Act and others relating to banking, consumer protection, securities and tax matters, and our ability to maintain licenses required in connection with commercial mortgage origination, sale and servicing operations; changes in federal tax law or policy; and our ability the manage the foregoing and other factors set forth in the Company’s public reports. We describe these and other risks that could affect our results in Item 1A. “Risk Factors,” of our latest Annual Report on Form 10-K for the year ended December 31, 2020 and in our other subsequent filings with the Securities and Exchange Commission. Cautionary Note Regarding Forward-Looking Statements 2

Key Investment Highlights 3 Proven Track Record of Organic and Profitable Growth Experienced Management Team Personal Relationship-Based Service Strong Community Relationships Strong Risk Management Practices and Disciplined Credit Quality Management Efficient and Scalable Banking Platform

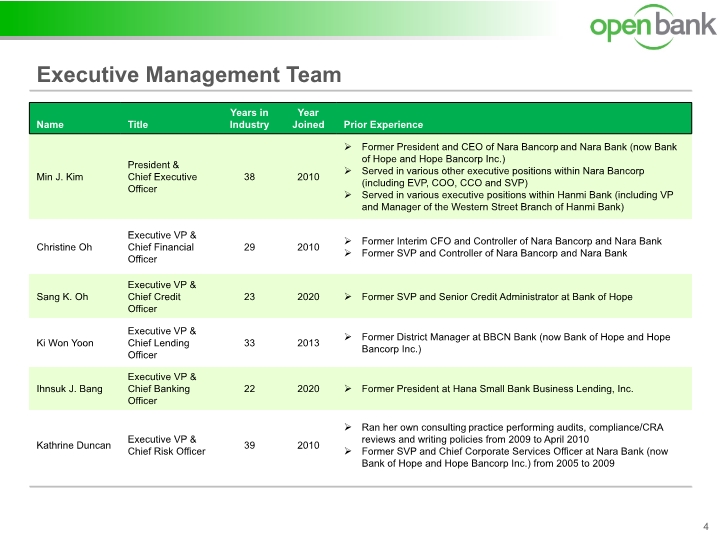

Executive Management Team 4

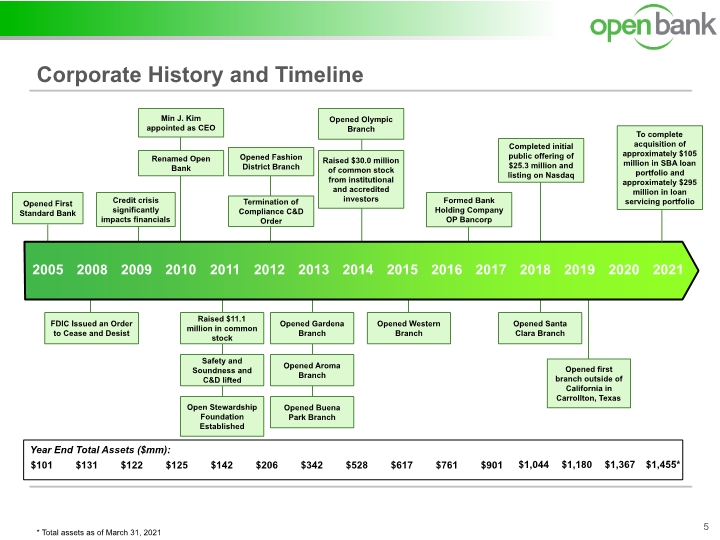

Corporate History and Timeline 5 Credit crisis significantly impacts financials FDIC Issued an Order to Cease and Desist 2005 2008 2009 2010 2011 2012 2013 2014 2015 2016 2017 Opened First Standard Bank Min J. Kim appointed as CEO Renamed Open Bank Safety and Soundness and C&D lifted Raised $11.1 million in common stock Open Stewardship Foundation Established Opened Fashion District Branch Termination of Compliance C&D Order Opened Aroma Branch Opened Gardena Branch Opened Buena Park Branch Opened Olympic Branch Raised $30.0 million of common stock from institutional and accredited investors Opened Western Branch Formed Bank Holding Company OP Bancorp 2018 Opened Santa Clara Branch $101 $131 $122 $125 $142 $206 $342 $528 $617 $761 $901 Year End Total Assets ($mm): Completed initial public offering of $25.3 million and listing on Nasdaq $1,044 * Total assets as of March 31, 2021 2019 Opened first branch outside of California in Carrollton, Texas $1,180 2020 $1,367 2021 To complete acquisition of approximately $105 million in SBA loan portfolio and approximately $295 million in loan servicing portfolio $1,455*

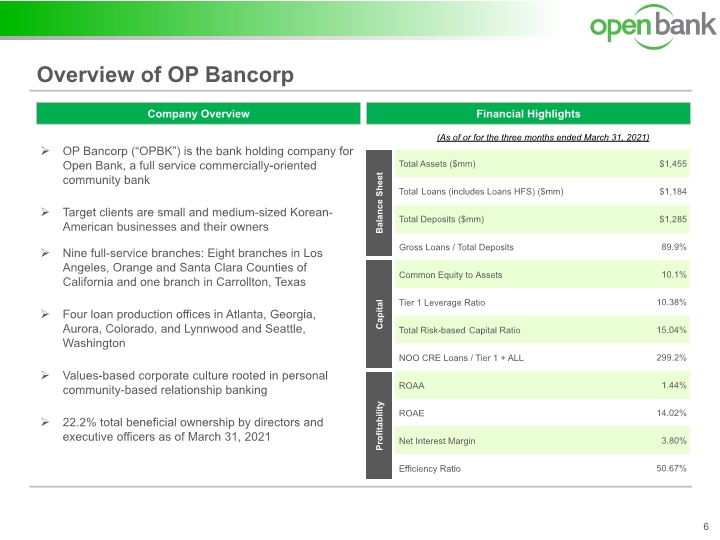

Overview of OP Bancorp 6 Company Overview OP Bancorp (“OPBK”) is the bank holding company for Open Bank, a full service commercially-oriented community bank Target clients are small and medium-sized Korean-American businesses and their owners Nine full-service branches: Eight branches in Los Angeles, Orange and Santa Clara Counties of California and one branch in Carrollton, Texas Four loan production offices in Atlanta, Georgia, Aurora, Colorado, and Lynnwood and Seattle, Washington Values-based corporate culture rooted in personal community-based relationship banking 22.2% total beneficial ownership by directors and executive officers as of March 31, 2021 Financial Highlights Balance Sheet Capital Profitability (As of or for the three months ended March 31, 2021)

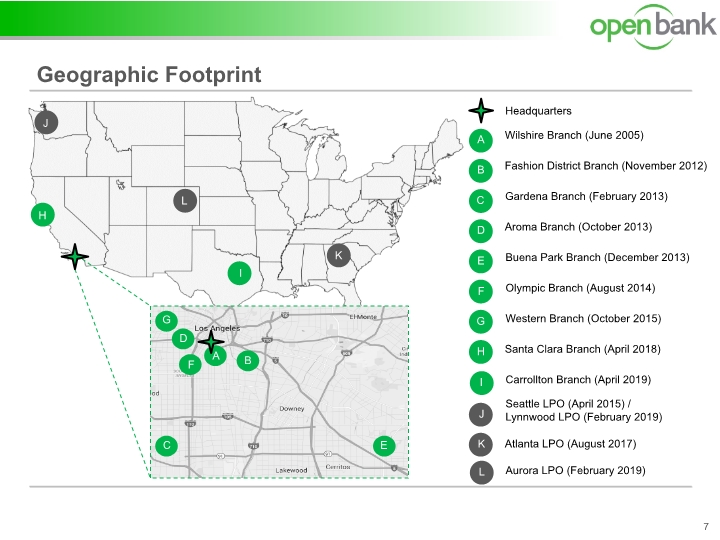

Geographic Footprint Headquarters Wilshire Branch (June 2005) Fashion District Branch (November 2012) Gardena Branch (February 2013) Aroma Branch (October 2013) Buena Park Branch (December 2013) Olympic Branch (August 2014) Western Branch (October 2015) Carrollton Branch (April 2019) Seattle LPO (April 2015) / Lynnwood LPO (February 2019) Atlanta LPO (August 2017) Santa Clara Branch (April 2018) 7 Aurora LPO (February 2019)

Operating Strategies 1. 2. 3. 4. 5. 6. 8

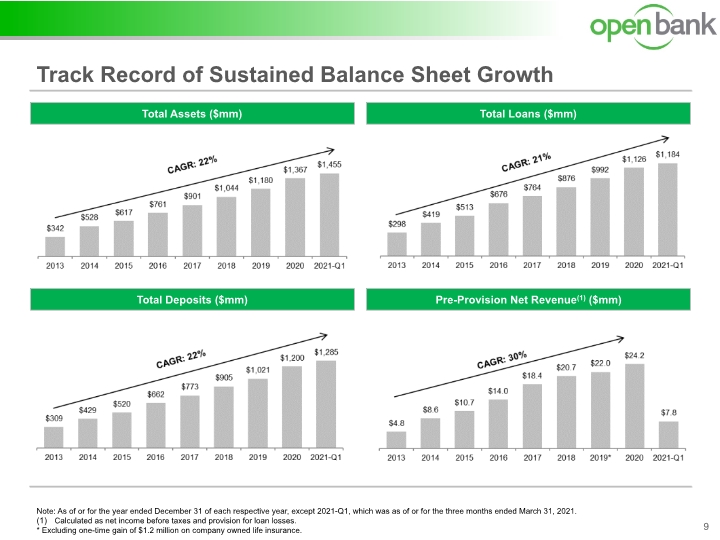

Track Record of Sustained Balance Sheet Growth 9 Total Loans ($mm) Total Assets ($mm) Pre-Provision Net Revenue(1) ($mm) Total Deposits ($mm) Note: As of or for the year ended December 31 of each respective year, except 2021-Q1, which was as of or for the three months ended March 31, 2021. Calculated as net income before taxes and provision for loan losses. * Excluding one-time gain of $1.2 million on company owned life insurance.

Commitment and Involvement in the Community 10 The Open Stewardship Foundation was established in October 2011 Committed to contributing 10% of OPBK’s annual consolidated net income after taxes to the Foundation OPBK has donated approximately $7.4 million to the Foundation, aiding over 190 local non-profits Management has strong ties and relationships within the Korean-American communities OPBK’s community commitment distinguishes the Company from competitors Enhances and expands business relationships within the Korean-American communities “To become the leading Korean-American community-based commercial bank in the Korean-American communities we serve, to meet the financial needs of underserved small and medium-sized business and individuals and to give back to these communities.”

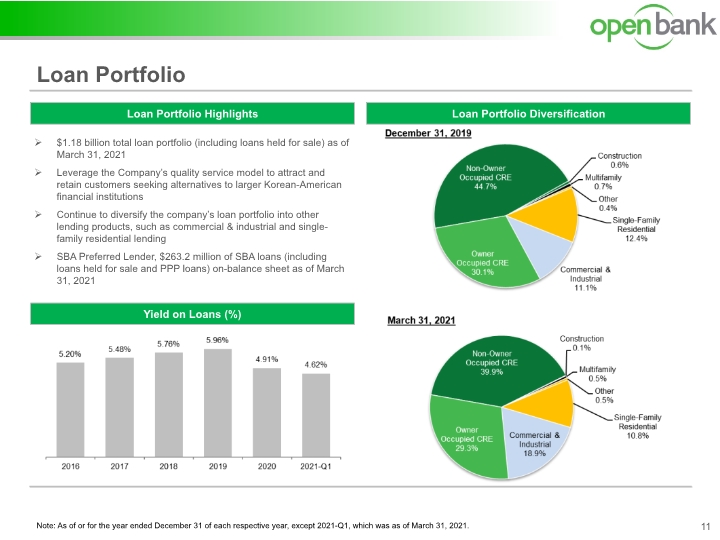

Note: As of or for the year ended December 31 of each respective year, except 2021-Q1, which was as of March 31, 2021. Loan Portfolio 11 Loan Portfolio Diversification Loan Portfolio Highlights Yield on Loans (%) $1.18 billion total loan portfolio (including loans held for sale) as of March 31, 2021 Leverage the Company’s quality service model to attract and retain customers seeking alternatives to larger Korean-American financial institutions Continue to diversify the company’s loan portfolio into other lending products, such as commercial & industrial and single-family residential lending SBA Preferred Lender, $263.2 million of SBA loans (including loans held for sale and PPP loans) on-balance sheet as of March 31, 2021

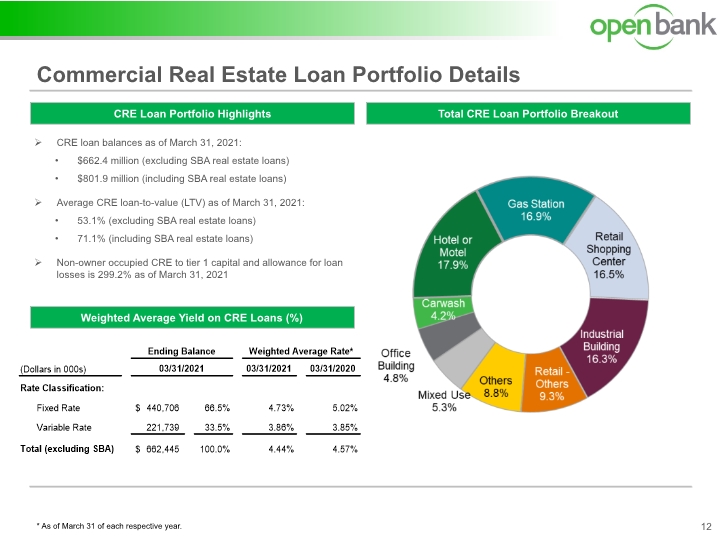

* As of March 31 of each respective year. Commercial Real Estate Loan Portfolio Details 12 Total CRE Loan Portfolio Breakout CRE Loan Portfolio Highlights CRE loan balances as of March 31, 2021: $662.4 million (excluding SBA real estate loans) $801.9 million (including SBA real estate loans) Average CRE loan-to-value (LTV) as of March 31, 2021: 53.1% (excluding SBA real estate loans) 71.1% (including SBA real estate loans) Non-owner occupied CRE to tier 1 capital and allowance for loan losses is 299.2% as of March 31, 2021 Weighted Average Yield on CRE Loans (%)

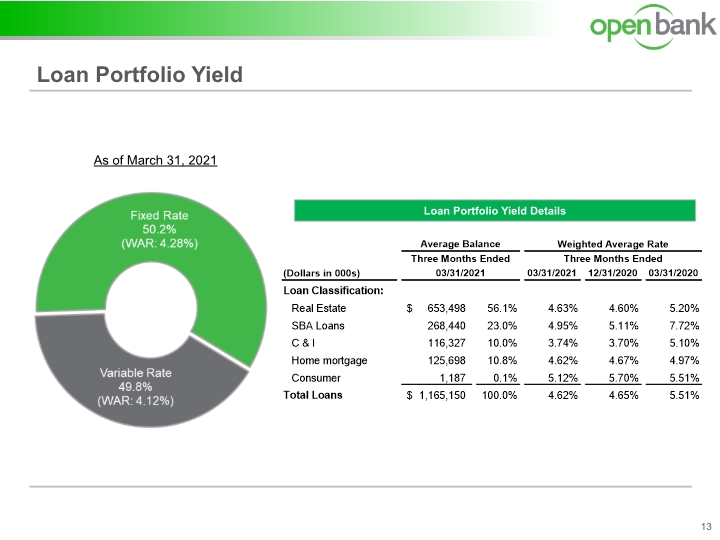

Loan Portfolio Yield Loan Portfolio Yield Details 13 As of March 31, 2021

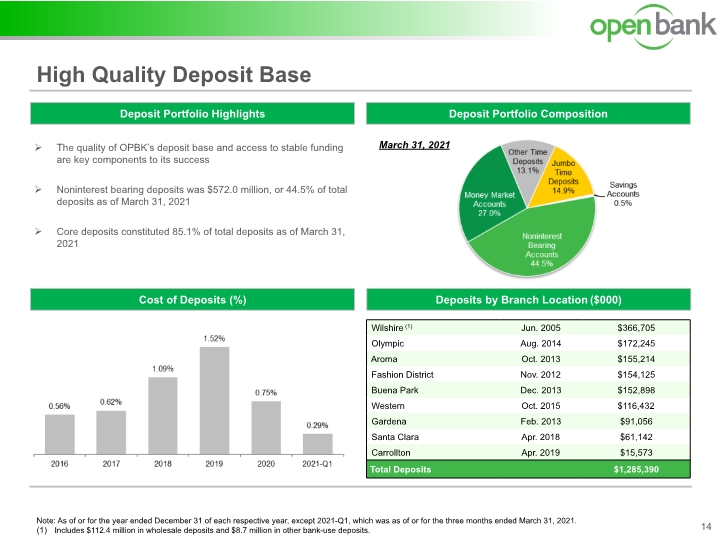

March 31, 2021 Note: As of or for the year ended December 31 of each respective year, except 2021-Q1, which was as of or for the three months ended March 31, 2021. Includes $112.4 million in wholesale deposits and $8.7 million in other bank-use deposits. High Quality Deposit Base 14 Deposit Portfolio Composition Deposit Portfolio Highlights Cost of Deposits (%) The quality of OPBK’s deposit base and access to stable funding are key components to its success Noninterest bearing deposits was $572.0 million, or 44.5% of total deposits as of March 31, 2021 Core deposits constituted 85.1% of total deposits as of March 31, 2021 Deposits by Branch Location ($000)

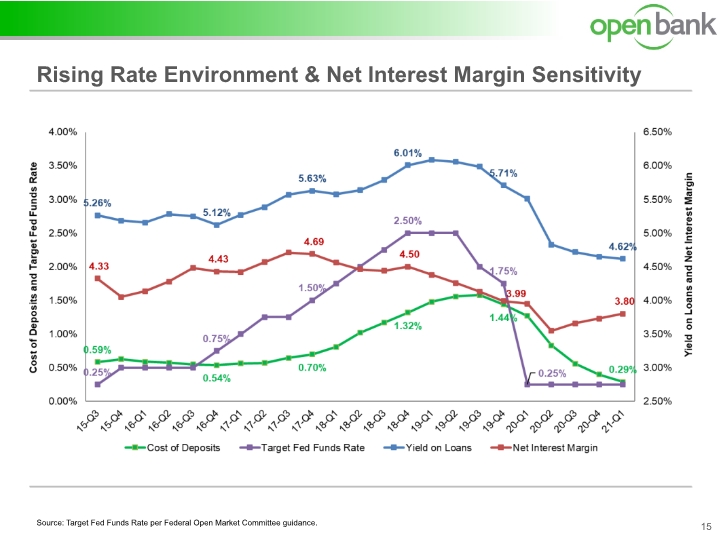

Source: Target Fed Funds Rate per Federal Open Market Committee guidance. Rising Rate Environment & Net Interest Margin Sensitivity 15

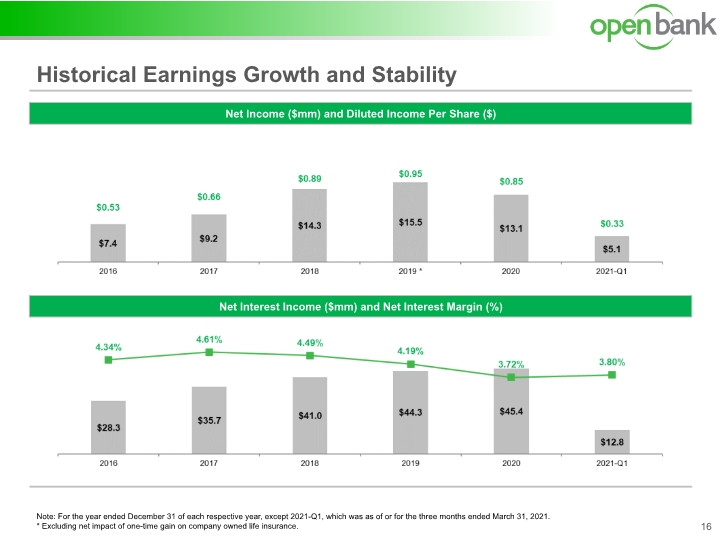

Note: For the year ended December 31 of each respective year, except 2021-Q1, which was as of or for the three months ended March 31, 2021. * Excluding net impact of one-time gain on company owned life insurance. Historical Earnings Growth and Stability 16 Net Income ($mm) and Diluted Income Per Share ($) Net Interest Income ($mm) and Net Interest Margin (%) $0.76

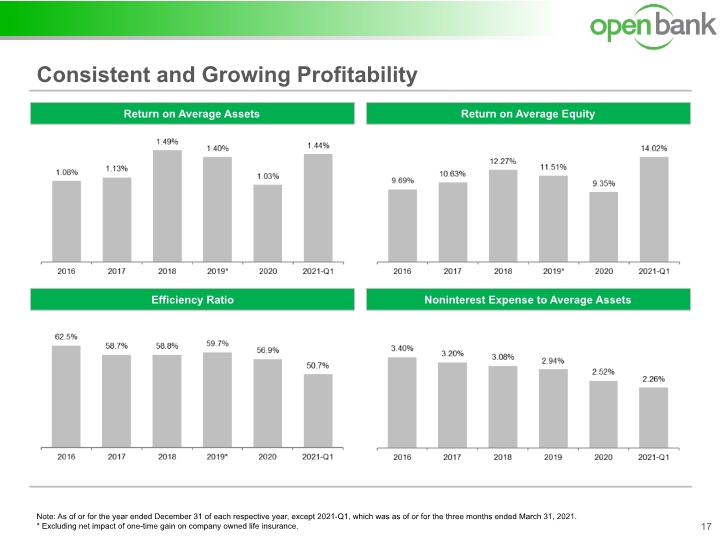

Consistent and Growing Profitability 17 Return on Average Equity Return on Average Assets Noninterest Expense to Average Assets Efficiency Ratio Note: As of or for the year ended December 31 of each respective year, except 2021-Q1, which was as of or for the three months ended March 31, 2021. * Excluding net impact of one-time gain on company owned life insurance.

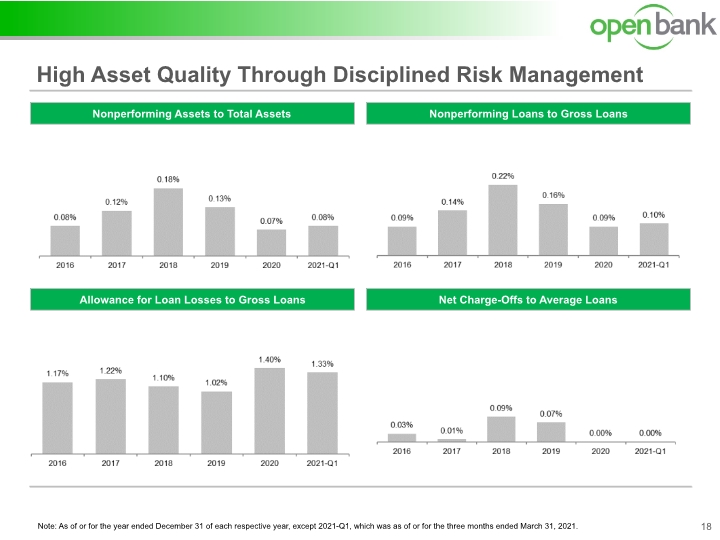

Note: As of or for the year ended December 31 of each respective year, except 2021-Q1, which was as of or for the three months ended March 31, 2021. High Asset Quality Through Disciplined Risk Management 18 Nonperforming Loans to Gross Loans Nonperforming Assets to Total Assets Net Charge-Offs to Average Loans Allowance for Loan Losses to Gross Loans

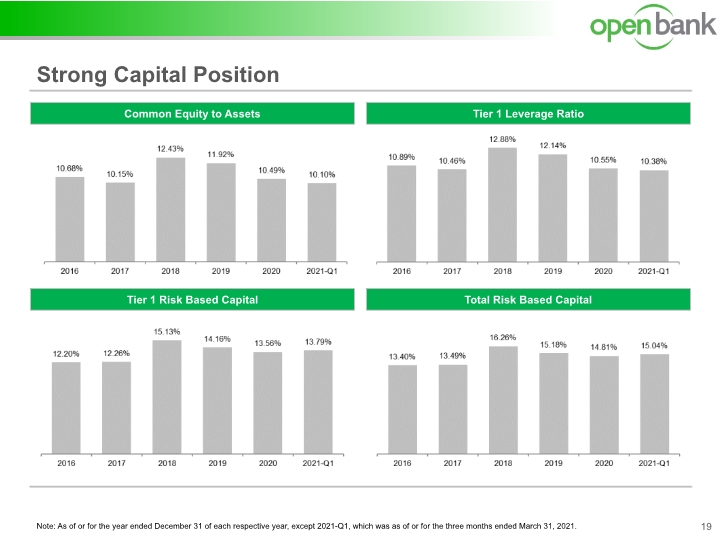

Note: As of or for the year ended December 31 of each respective year, except 2021-Q1, which was as of or for the three months ended March 31, 2021. Strong Capital Position 19 Tier 1 Leverage Ratio Common Equity to Assets Tier 1 Risk Based Capital Total Risk Based Capital

Investment Highlights 20 A growing force in Korean-American Banking Experienced and proven management team Undervalue of our stock Continuous strong organic growth