Attached files

| file | filename |

|---|---|

| EX-99.1 - EX-99.1 - Nielsen Holdings plc | nlsnnv-ex991_8.htm |

| 8-K - 8-K - Nielsen Holdings plc | nlsnnv-8k_20210506.htm |

May 6th, 2021 | 8:00 am ET NYSE: NLSN 1st QUARTER 2021 EARNINGS Copyright © 2021 The Nielsen Company (US), LLC. Confidential and proprietary. Do not distribute. Exhibit 99.2

FORWARD-LOOKING STATEMENTS This communication includes information that could constitute forward-looking statements made pursuant to the safe harbor provision of the Private Securities Litigation Reform Act of 1995. These statements include those set forth below relating to “2021 New Nielsen Full Year Guidance” as well as those that may be identified by words such as “will,” “intend,” “expect,” “anticipate,” “should,” “could” and similar expressions. These statements are subject to risks and uncertainties, and actual results and events could differ materially from what presently is expected. Factors leading thereto may include, without limitation, the risks related to the COVID-19 pandemic on the global economy and financial markets, the uncertainties relating to the impact of the COVID-19 pandemic on Nielsen’s business, the final calculation of gain on the sale with respect to our Global Connect business, which is currently pending finalization of various estimates, the failure of our new business strategy in accomplishing our objectives, conditions in the markets Nielsen is engaged in, behavior of customers, suppliers and competitors, technological developments, as well as legal and regulatory rules affecting Nielsen’s business and other specific risk factors that are outlined in our disclosure filings and materials, which you can find on http://www.nielsen.com/investors, such as our 10-K, 10-Q and 8-K reports that have been filed with the Securities and Exchange Commission. Please consult these documents for a more complete understanding of these risks and uncertainties. This list of factors is not intended to be exhaustive. Such forward-looking statements only speak as of the date of this communication, and we assume no obligation to update any written or oral forward-looking statement made by us or on our behalf as a result of new information, future events or other factors, except as required by law.

New Nielsen: Positioned for Growth Business Update Q1 2021 Results Raising 2021 Guidance TODAY’S DISCUSSION

NEW GROWTH FROM NEW SOLUTIONS NEW CULTURE—DRIVEN BY A GROWTH MINDSET COMPELLING FINANCIAL MODEL NEW NIELSEN: POSITIONED FOR GROWTH New Nielsen reflects Nielsen after giving effect to the sale of Global Connect Copyright © 2021 The Nielsen Company (US), LLC. Confidential and proprietary. Do not distribute.

Progressing towards a single cross-media currency for the global media industry with Nielsen One Industry engagement and client commitment across advertisers, agencies, platforms and networks Advancements on product roadmap, including always-on measurement of Roku Coverage expansion with well-received launch of Nielsen Streaming Video Ratings Growth in our solutions to plan, analyze and maximize marketing investments driven by new clients, new verticals and new products Advertiser wins across new verticals on scalable platform, including J&J, Florida Blue, WWE, and Hasbro Global launch of Nielsen Market Lift enables clients to evaluate the effectiveness of marketing campaigns Expanded partnership with Twitter highlights growth with digital players AUDIENCE MEASUREMENT AUDIENCE OUTCOMES GRACENOTE CONTENT SERVICES New products address evolving market needs as content and streaming platforms grow Growth in content and streaming platforms creates competition for audiences Launched Personalized Imagery service to drive engagement, enabling clients to maximize viewership NEW GROWTH FROM NEW SOLUTIONS Audience Measurement ~73% of 2020 revenue; Audience Outcomes ~20% of 2020 revenue; Gracenote Content Services ~7% of 2020 revenue

Q1 2021 RESULTS Copyright © 2020 The Nielsen Company (US), LLC. Confidential and proprietary. Do not distribute.

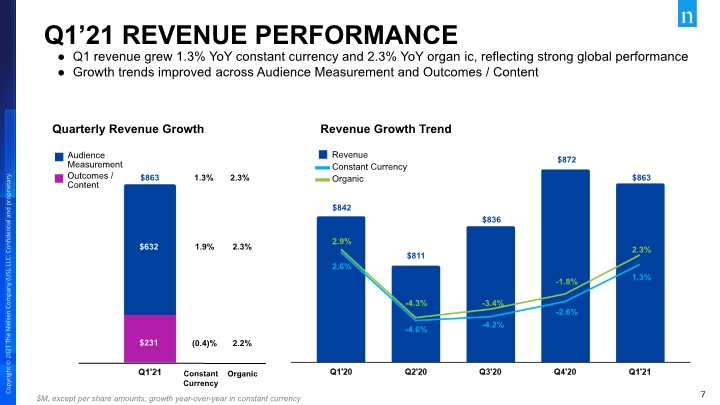

Q1 revenue grew 1.3% YoY constant currency and 2.3% YoY organic, reflecting strong global performance Growth trends improved across Audience Measurement and Outcomes / Content $M, except per share amounts; growth year-over-year in constant currency Q1’21 REVENUE PERFORMANCE Audience Measurement Outcomes / Content Quarterly Revenue Growth $863 Constant Currency Organic 2.3% 1.9% 2.2% (0.4)% $632 $231 1.3% 2.3% $836 $842 $811 $872 $863 Revenue Growth Trend 2.3% -1.8% -3.4% -4.3% 2.9% 1.3% -2.6% -4.2% -4.6% 2.6%

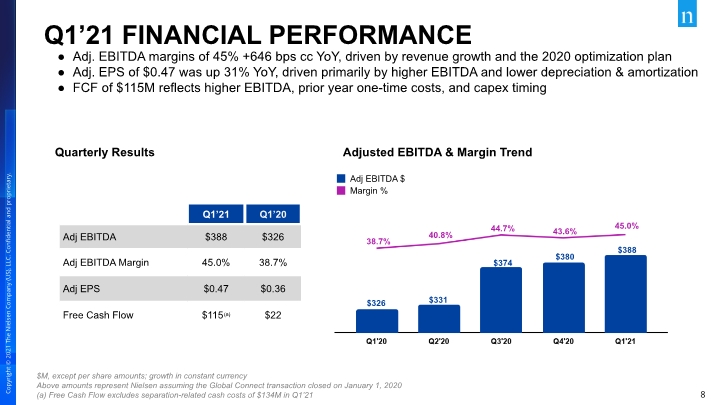

Adj. EBITDA margins of 45% +646 bps cc YoY, driven by revenue growth and the 2020 optimization plan Adj. EPS of $0.47 was up 31% YoY, driven primarily by higher EBITDA and lower depreciation & amortization FCF of $115M reflects higher EBITDA, prior year one-time costs, and capex timing $M, except per share amounts; growth in constant currency Above amounts represent Nielsen assuming the Global Connect transaction closed on January 1, 2020 (a) Free Cash Flow excludes separation-related cash costs of $134M in Q1’21 Q1’21 FINANCIAL PERFORMANCE Adjusted EBITDA & Margin Trend 45.0% 43.6% 44.7% 40.8% 38.7% $326 $331 $374 $380 $388 Quarterly Results

2021 GUIDANCE Copyright © 2020 The Nielsen Company (US), LLC. Confidential and proprietary. Do not distribute.

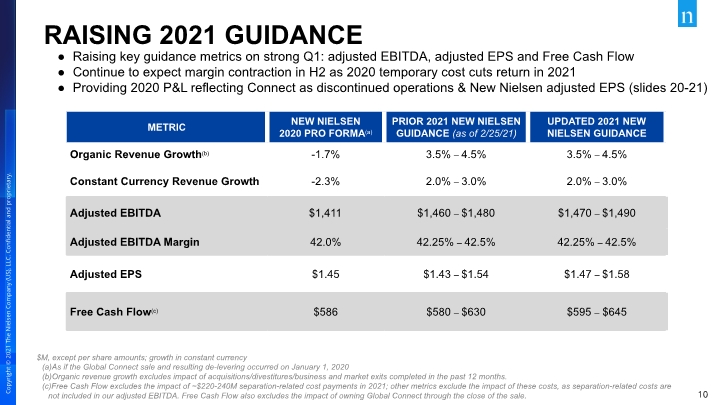

As if the Global Connect sale and resulting de-levering occurred on January 1, 2020 Organic revenue growth excludes impact of acquisitions/divestitures/business and market exits completed in the past 12 months. Free Cash Flow excludes the impact of ~$220-240M separation-related cost payments in 2021; other metrics exclude the impact of these costs, as separation-related costs are not included in our adjusted EBITDA. Free Cash Flow also excludes the impact of owning Global Connect through the close of the sale. $M, except per share amounts; growth in constant currency RAISING 2021 GUIDANCE Raising key guidance metrics on strong Q1: adjusted EBITDA, adjusted EPS and Free Cash Flow Continue to expect margin contraction in H2 as 2020 temporary cost cuts return in 2021 Providing 2020 P&L reflecting Connect as discontinued operations & New Nielsen adjusted EPS (slides 20-21)

Q&A Copyright © 2020 The Nielsen Company (US), LLC. Confidential and proprietary. Do not distribute.

CERTAIN NON-GAAP MEASURES Overview of Non-GAAP Presentations We use the non-GAAP financial measures discussed below to evaluate our results of operations, financial condition, liquidity and indebtedness. We believe that the presentation of these non-GAAP measures provides useful information to investors regarding financial and business trends related to our results of operations, cash flows and indebtedness and that, when this non-GAAP financial information is viewed with our GAAP financial information, investors are provided with valuable supplemental information regarding our results of operations, thereby facilitating period-to-period comparisons of our business performance. These non-GAAP measures are also consistent with how management evaluates the company’s operating performance and liquidity. In addition, these non-GAAP measures address questions the Company routinely receives from analysts and investors, and in order to assure that all investors have access to similar data, we have determined that it is appropriate to make this data available to all investors. None of the non-GAAP measures presented should be considered as an alternative to net income or loss, operating income or loss, cash flows from operating activities, total indebtedness or any other measures of operating performance and financial condition, liquidity or indebtedness derived in accordance with GAAP. These non-GAAP measures have important limitations as analytical tools and should not be considered in isolation or as substitutes for an analysis of our results as reported under GAAP. Our use of these terms may vary from the use of similarly-titled measures by others in our industry due to the potential inconsistencies in the method of calculation and differences due to items subject to interpretation. Constant Currency Presentation We evaluate our results of operations on both an as reported and a constant currency basis. The constant currency presentation, which is a non-GAAP measure, excludes the impact of fluctuations in foreign currency exchange rates. We believe providing constant currency information provides valuable supplemental information regarding our results of operations, thereby facilitating period-to-period comparisons of our business performance and is consistent with how management evaluates the Company’s performance. We calculate constant currency percentages by converting our prior-period local currency financial results using the current period exchange rates and comparing these adjusted amounts to our current period reported results. No adjustment has been made to foreign currency exchange transaction gains or losses in the calculation of constant currency net income.

CERTAIN NON-GAAP MEASURES (continued) Organic Constant Currency Presentation We define organic constant currency revenue as constant currency revenue excluding the net effect of business acquisitions and divestitures over the past 12 months. Refer to the Constant Currency Presentation section above for the definition of constant currency. We believe that this measure is useful to investors and management in understanding our ongoing operations and in analysis of ongoing operating trends. Adjusted EBITDA We define Adjusted EBITDA as net income or loss from continuing operations of our consolidated statements of operations before interest income and expense, income taxes, depreciation and amortization, restructuring charges, impairment of goodwill and other long-lived assets, share-based compensation expense and other non-operating items from our consolidated statements of operations, as well as certain other items that arise outside the ordinary course of our continuing operations. Adjusted EBITDA is not a presentation made in accordance with GAAP, and our use of the term Adjusted EBITDA may vary from the use of similarly-titled measures by others in our industry due to the potential inconsistencies in the method of calculation and differences due to items subject to interpretation. Adjusted EBITDA margin is Adjusted EBITDA for a particular period expressed as a percentage of revenues for that period. We use Adjusted EBITDA to measure our performance from period to period to evaluate and fund incentive compensation programs and to compare our results to those of our competitors. In addition to Adjusted EBITDA being a significant measure of performance for management purposes, we also believe that this presentation provides useful information to investors regarding financial and business trends related to our results of operations and that when non-GAAP financial information is viewed with GAAP financial information, investors are provided with a more meaningful understanding of our ongoing operating performance. Adjusted EBITDA should not be considered as an alternative to net income or loss, operating income, cash flows from operating activities or any other performance measures derived in accordance with GAAP as measures of operating performance or cash flows as measures of liquidity. Adjusted EBITDA has important limitations as an analytical tool and should not be considered in isolation or as a substitute for analysis of our results as reported under GAAP. In addition, our definition of Adjusted EBITDA may not be comparable to similarly titled measures of other companies and may, therefore, have limitations as a comparative analytical tool

Adjusted EPS We define Adjusted Earnings per Share as net income attributable to Nielsen shareholders from continuing operations per share (diluted) from our consolidated statements of operations, excluding depreciation and amortization associated with acquired tangible and intangible assets, restructuring charges, impairment of goodwill and other long-lived assets, share-based compensation expense, other non-operating items from our consolidated statements of operations, certain other items considered unusual or non-recurring in nature, adjusted for income taxes related to these items. Management believes that this non-GAAP measure is useful in providing period-to-period comparisons of the results of the Company’s ongoing operating performance. Free Cash Flow We define free cash flow as net cash provided by operating activities, less capital expenditures, net. We believe providing free cash flow information provides valuable supplemental liquidity information regarding the cash flow that may be available for discretionary use by us in areas such as the distributions of dividends, repurchase of common stock, voluntary repayment of debt obligations or to fund our strategic initiatives, including acquisitions, if any. However, free cash flow does not represent residual cash flows entirely available for discretionary purposes; for example, the repayment of principal amounts borrowed is not deducted from free cash flow. Key limitations of the free cash flow measure include the assumptions that we will be able to refinance our existing debt when it matures and meet other cash flow obligations from financing activities, such as principal payments on debt. Free cash flow is not a presentation made in accordance with GAAP. New Nielsen free cash flow is presented as if the Global Connect transaction and resulting de-levering occurred on January 1, 2020. Management believes that this non-GAAP measure is useful in providing period-to-period comparisons of the free cash flow results. Net Debt and Net Debt Leverage Ratio The net debt leverage ratio is defined as net debt (gross debt less cash and cash equivalents) as of the balance sheet date divided by Adjusted EBITDA for the 12 months then ended. Net debt and the net debt leverage ratio are commonly used metrics to evaluate and compare leverage between companies and are not presentations made in accordance with GAAP. CERTAIN NON-GAAP MEASURES (continued)

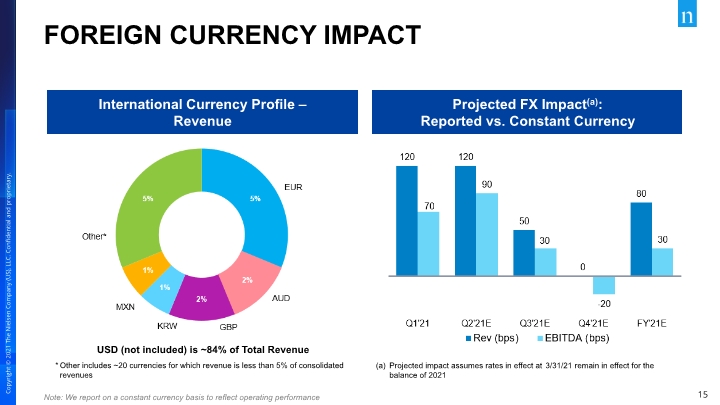

Projected FX Impact(a): Reported vs. Constant Currency Note: We report on a constant currency basis to reflect operating performance (a) Projected impact assumes rates in effect at 3/31/21 remain in effect for the balance of 2021 International Currency Profile – Revenue USD (not included) is ~84% of Total Revenue * Other includes ~20 currencies for which revenue is less than 5% of consolidated revenues FOREIGN CURRENCY IMPACT

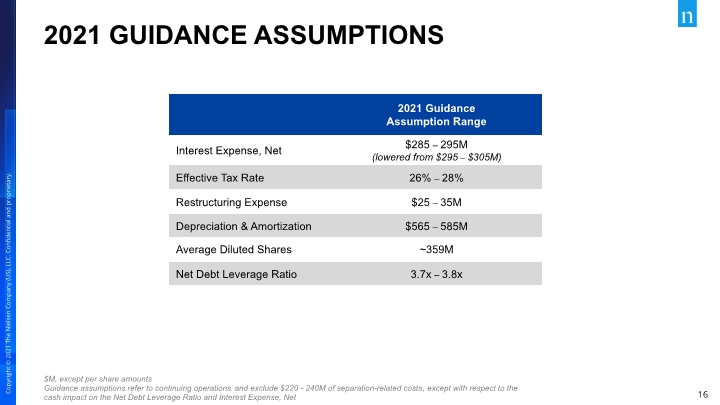

2021 GUIDANCE ASSUMPTIONS $M, except per share amounts Guidance assumptions refer to continuing operations and exclude $220 - 240M of separation-related costs, except with respect to the cash impact on the Net Debt Leverage Ratio and Interest Expense, Net

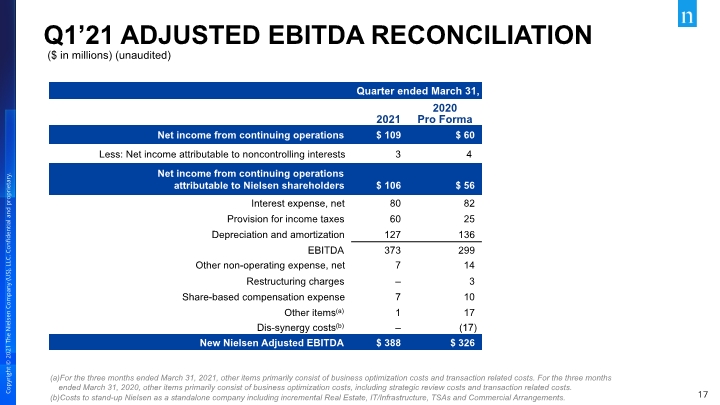

($ in millions) (unaudited) Q1’21 ADJUSTED EBITDA RECONCILIATION For the three months ended March 31, 2021, other items primarily consist of business optimization costs and transaction related costs. For the three months ended March 31, 2020, other items primarily consist of business optimization costs, including strategic review costs and transaction related costs. Costs to stand-up Nielsen as a standalone company including incremental Real Estate, IT/Infrastructure, TSAs and Commercial Arrangements.

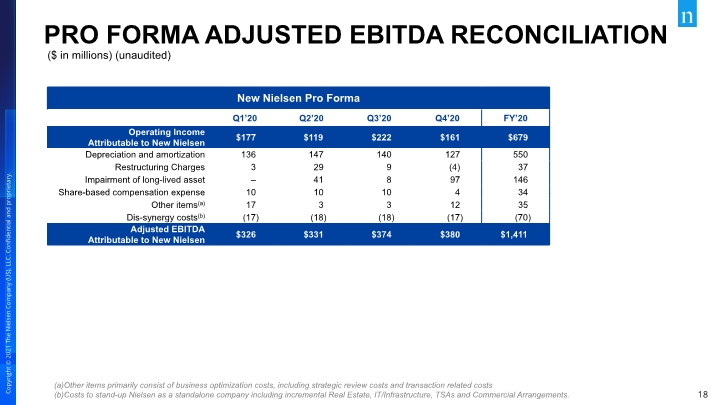

PRO FORMA ADJUSTED EBITDA RECONCILIATION Other items primarily consist of business optimization costs, including strategic review costs and transaction related costs Costs to stand-up Nielsen as a standalone company including incremental Real Estate, IT/Infrastructure, TSAs and Commercial Arrangements. ($ in millions) (unaudited)

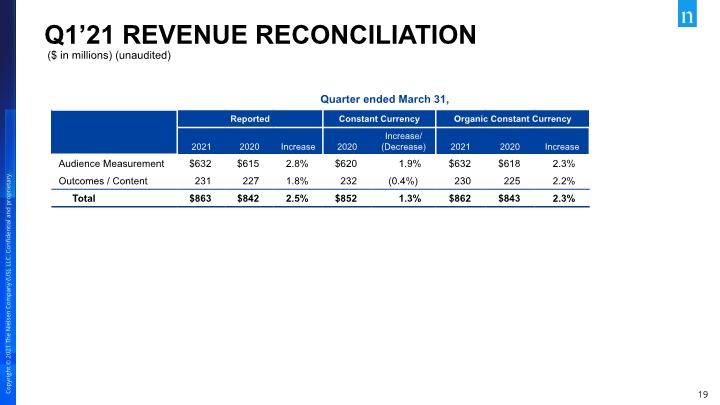

Q1’21 REVENUE RECONCILIATION Quarter ended March 31, ($ in millions) (unaudited)

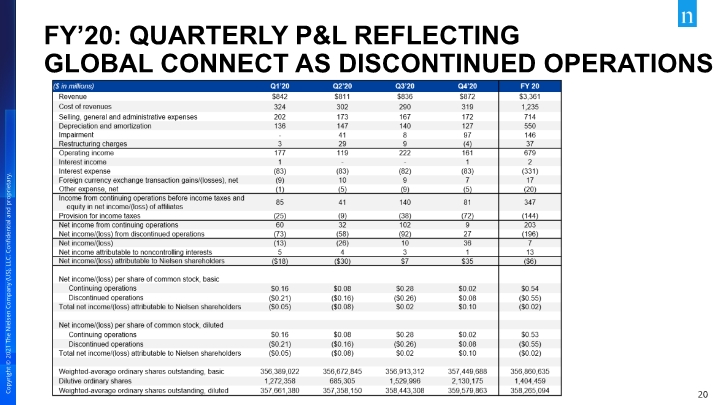

FY’20: QUARTERLY P&L REFLECTING GLOBAL CONNECT AS DISCONTINUED OPERATIONS

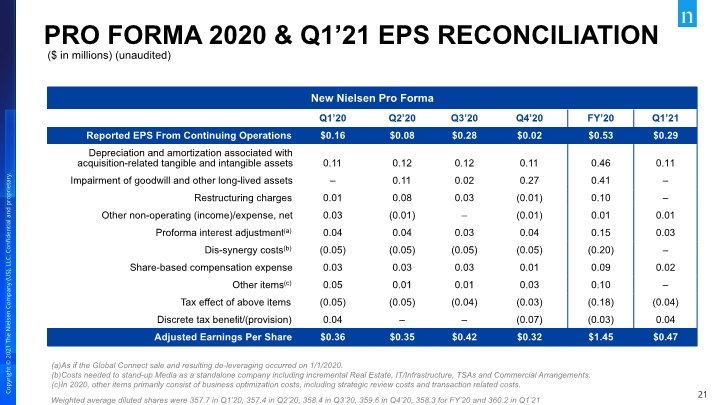

PRO FORMA 2020 & Q1’21 EPS RECONCILIATION As if the Global Connect sale and resulting de-leveraging occurred on 1/1/2020. Costs needed to stand-up Media as a standalone company including incremental Real Estate, IT/Infrastructure, TSAs and Commercial Arrangements. In 2020, other items primarily consist of business optimization costs, including strategic review costs and transaction related costs. Weighted average diluted shares were 357.7 in Q1’20, 357.4 in Q2’20, 358.4 in Q3’20, 359.6 in Q4’20, 358.3 for FY’20 and 360.2 in Q1’21 ($ in millions) (unaudited)

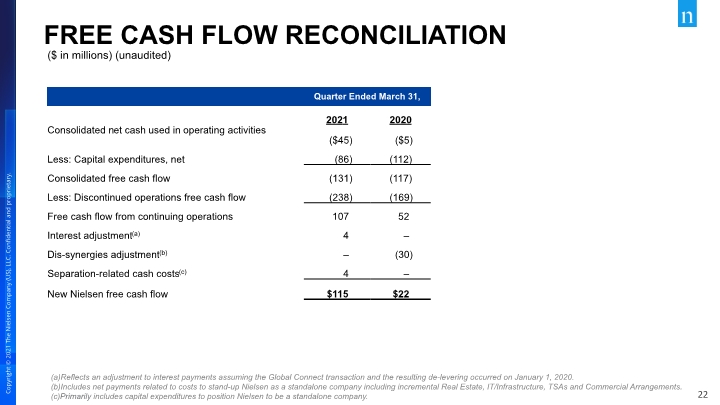

FREE CASH FLOW RECONCILIATION Reflects an adjustment to interest payments assuming the Global Connect transaction and the resulting de-levering occurred on January 1, 2020. Includes net payments related to costs to stand-up Nielsen as a standalone company including incremental Real Estate, IT/Infrastructure, TSAs and Commercial Arrangements. Primarily includes capital expenditures to position Nielsen to be a standalone company. ($ in millions) (unaudited)

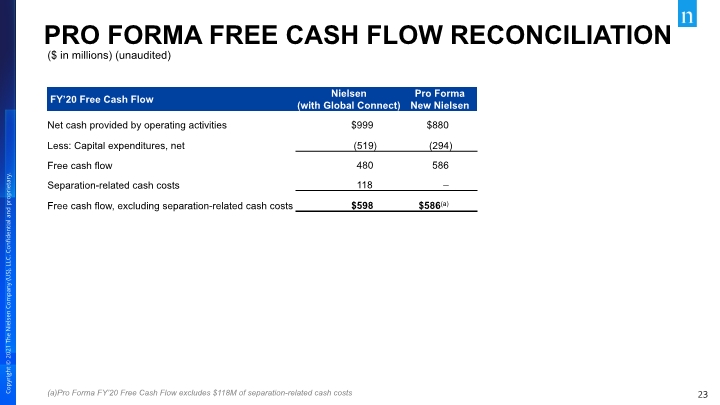

PRO FORMA FREE CASH FLOW RECONCILIATION Pro Forma FY’20 Free Cash Flow excludes $118M of separation-related cash costs ($ in millions) (unaudited)

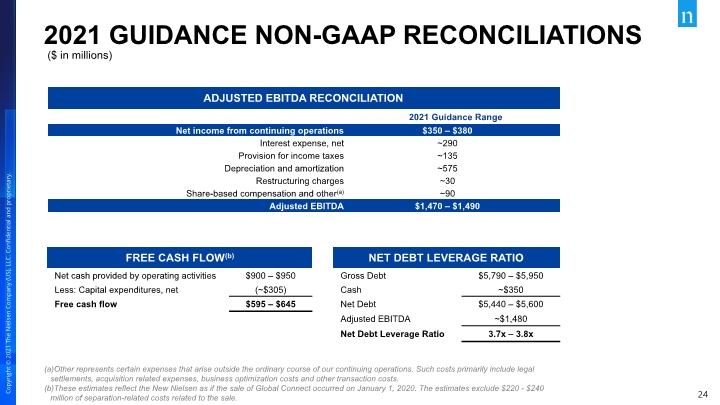

2021 GUIDANCE NON-GAAP RECONCILIATIONS Other represents certain expenses that arise outside the ordinary course of our continuing operations. Such costs primarily include legal settlements, acquisition related expenses, business optimization costs and other transaction costs. These estimates reflect the New Nielsen as if the sale of Global Connect occurred on January 1, 2020. The estimates exclude $220 - $240 million of separation-related costs related to the sale. ($ in millions)

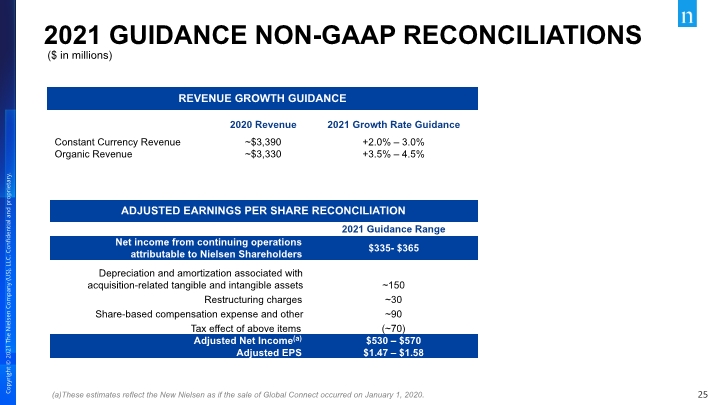

These estimates reflect the New Nielsen as if the sale of Global Connect occurred on January 1, 2020. 2021 GUIDANCE NON-GAAP RECONCILIATIONS ($ in millions)

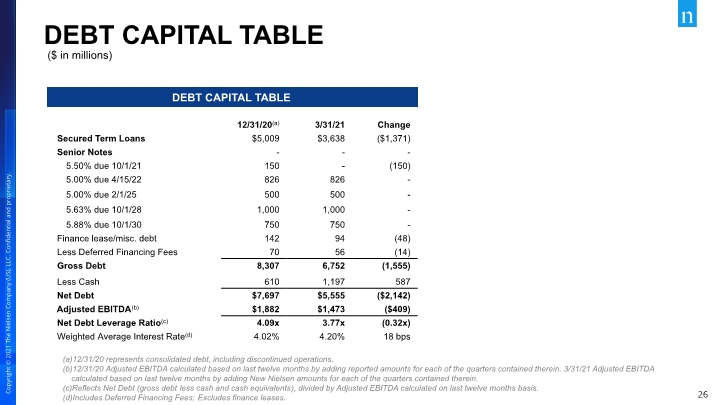

12/31/20 represents consolidated debt, including discontinued operations. 12/31/20 Adjusted EBITDA calculated based on last twelve months by adding reported amounts for each of the quarters contained therein. 3/31/21 Adjusted EBITDA calculated based on last twelve months by adding New Nielsen amounts for each of the quarters contained therein. Reflects Net Debt (gross debt less cash and cash equivalents), divided by Adjusted EBITDA calculated on last twelve months basis. Includes Deferred Financing Fees; Excludes finance leases. DEBT CAPITAL TABLE ($ in millions)

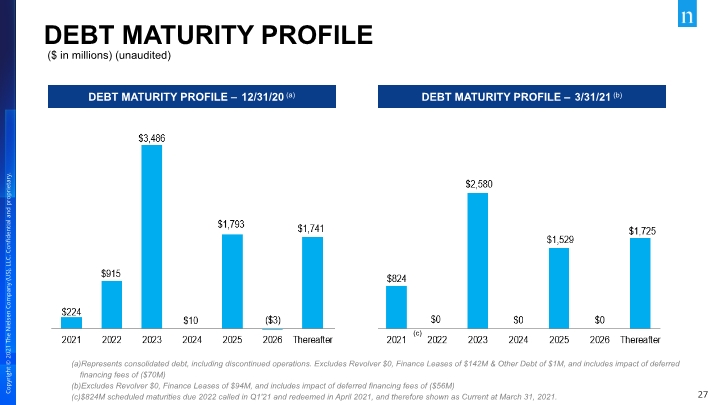

Represents consolidated debt, including discontinued operations. Excludes Revolver $0, Finance Leases of $142M & Other Debt of $1M, and includes impact of deferred financing fees of ($70M) Excludes Revolver $0, Finance Leases of $94M, and includes impact of deferred financing fees of ($56M) $824M scheduled maturities due 2022 called in Q1'21 and redeemed in April 2021, and therefore shown as Current at March 31, 2021. DEBT MATURITY PROFILE DEBT MATURITY PROFILE – 3/31/21 (b) DEBT MATURITY PROFILE – 12/31/20 (a) ($ in millions) (unaudited) (c)

NIELSEN INVESTOR RELATIONS ir@nielsen.com +1.646.654.8153 nielsen.com/investors

Copyright © 2021 The Nielsen Company (US), LLC. Confidential and proprietary.