Attached files

| file | filename |

|---|---|

| 8-K - 8-K - HUNTINGTON INGALLS INDUSTRIES, INC. | hii-20210506.htm |

| EX-99.1 - EX-99.1 - HUNTINGTON INGALLS INDUSTRIES, INC. | hii2021q1earningsrelease.htm |

Q1 2021 Earnings Presentation May 6, 2021 Mike Petters President and Chief Executive Officer Chris Kastner Executive Vice President and Chief Operating Officer Tom Stiehle Executive Vice President and Chief Financial Officer

HARD STUFF DONE RIGHT Forward-Looking Statements 2 HUNTINGTON INGALLS INDUSTRIES Statements in this presentation, other than statements of historical fact, constitute "forward-looking statements" within the meaning of the Private Securities Litigation Reform Act of 1995. Forward-looking statements involve risks and uncertainties that could cause our actual results to differ materially from those expressed in these statements. Factors that may cause such differences include: changes in government and customer priorities and requirements (including government budgetary constraints, shifts in defense spending, and changes in customer short-range and long-range plans); our ability to estimate our future contract costs and perform our contracts effectively; changes in procurement processes and government regulations and our ability to comply with such requirements; our ability to deliver our products and services at an affordable life cycle cost and compete within our markets; natural and environmental disasters and political instability; our ability to execute our strategic plan, including with respect to share repurchases, dividends, capital expenditures, and strategic acquisitions; adverse economic conditions in the United States and globally; health epidemics, pandemics and similar outbreaks, including the COVID-19 pandemic; changes in key estimates and assumptions regarding our pension and retiree health care costs; security threats, including cyber security threats, and related disruptions; and other risk factors discussed in our filings with the U.S. Securities and Exchange Commission. There may be other risks and uncertainties that we are unable to predict at this time or that we currently do not expect to have a material adverse effect on our business, and we undertake no obligation to update any forward-looking statements. You should not place undue reliance on any forward-looking statements that we may make. This presentation also contains non-GAAP financial measures and includes a GAAP reconciliation of these financial measures. Non-GAAP financial measures should not be construed as being more important than comparable GAAP measures.

HARD STUFF DONE RIGHT HII Q1 2021 Highlights 3 HUNTINGTON INGALLS INDUSTRIES Strong operating momentum to start 2021, record backlog provides great visibility Revenues were ~$2.3 billion in the quarter Diluted EPS was $3.68 in the quarter; Pension adjusted diluted EPS1 was $3.56 Total backlog at the end of the quarter was $48.8 billion Ingalls Shipbuilding o Began fabrication of guided-missile destroyer Jeremiah Denton (DDG 129) o Awarded Life-Cycle Engineering Contract on U.S. Navy’s LPD Program Newport News Shipbuilding o Launched Virginia-class submarine Montana (SSN 794) o Achieved pressure hull complete on Virginia-class submarine New Jersey (SSN 796) o Awarded $3 billion contract for USS John C. Stennis (CVN 74) RCOH o Awarded contract modification for construction of the 10th Virginia-class Block V submarine o John F. Kennedy (CVN 79) is approximately 81% complete o RCOH of USS George Washington (CVN 73) is approximately 87% complete Technical Solutions o Completed the first phase of Unmanned Systems Center of Excellence campus with the construction of a 22,000 square foot facility o Awarded position on a $250 million U.S. Navy Intelligence, Surveillance and Reconnaissance Support Contract o Awarded a contract to provide maintenance, training and planning support for U.S. Navy aircraft carriers Backlog ($B) 1Non-GAAP measure. See appendix for definition and reconciliation. Earnings Per Share $45.2 $48.8 $0 $10 $20 $30 $40 $50 Q1 2020 Q1 2021 $4.23 $3.68 $2.43 $3.56 $0.00 $0.50 $1.00 $1.50 $2.00 $2.50 $3.00 $3.50 $4.00 $4.50 Q1 2020 Q1 2021 Diluted EPS Pension Adjusted Diluted EPS1

HARD STUFF DONE RIGHT HII Q1 2021 Consolidated Results 4 HUNTINGTON INGALLS INDUSTRIES Consolidated Revenue ($M) Operating Income ($M) Operating Margin Revenues improved YoY due primarily to growth at Newport News and Ingalls Shipbuilding, largely offset by a decline at Technical Solutions due to the divestitures of UPI and San Diego Shipyard Operating income declined YoY due to a less favorable operating FAS/CAS adjustment, partially offset by stronger segment operating income $2,263 $2,278 $0 $500 $1,000 $1,500 $2,000 $2,500 Q1 2020 Q1 2021 $215 $147 $0 $50 $100 $150 $200 $250 Q1 2020 Q1 2021 9.5% 6.5% 0.0% 2.0% 4.0% 6.0% 8.0% 10.0% Q1 2020 Q1 2021

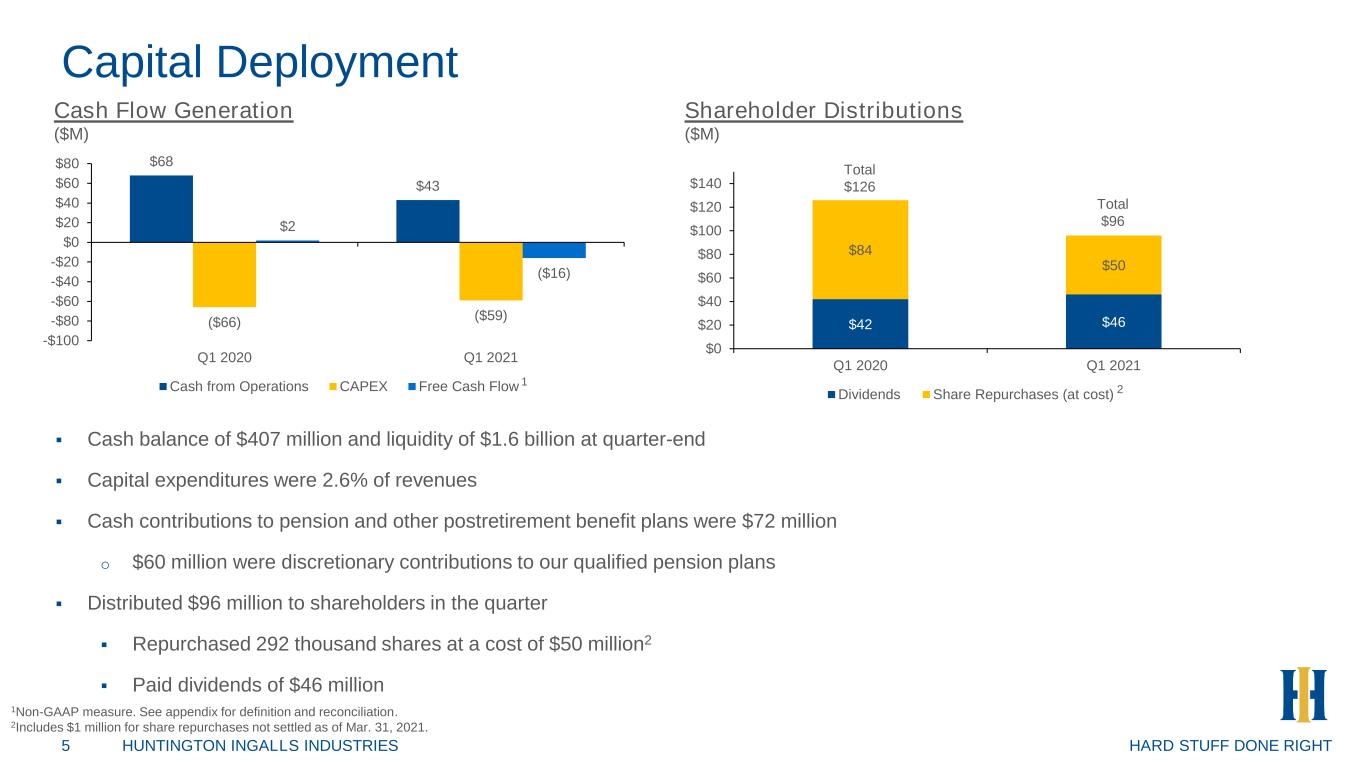

HARD STUFF DONE RIGHT Capital Deployment 5 HUNTINGTON INGALLS INDUSTRIES Shareholder Distributions ($M) 1Non-GAAP measure. See appendix for definition and reconciliation. 2Includes $1 million for share repurchases not settled as of Mar. 31, 2021. Cash Flow Generation ($M) Cash balance of $407 million and liquidity of $1.6 billion at quarter-end Capital expenditures were 2.6% of revenues Cash contributions to pension and other postretirement benefit plans were $72 million o $60 million were discretionary contributions to our qualified pension plans Distributed $96 million to shareholders in the quarter Repurchased 292 thousand shares at a cost of $50 million2 Paid dividends of $46 million $68 $43 ($66) ($59) $2 ($16) -$100 -$80 -$60 -$40 -$20 $0 $20 $40 $60 $80 Q1 2020 Q1 2021 Cash from Operations CAPEX Free Cash Flow 1 $42 $46 $84 $50 $0 $20 $40 $60 $80 $100 $120 $140 Q1 2020 Q1 2021 Dividends Share Repurchases (at cost) Total $126 Total $96 2

HARD STUFF DONE RIGHT Ingalls Shipbuilding Q1 2021 Results 6 HUNTINGTON INGALLS INDUSTRIES Revenues ($M) Segment Operating Income1 ($M) Segment Operating Margin1 Revenues improved YoY due primarily to growth on the DDG program Segment operating income and segment operating margin improved YoY primarily due to higher risk retirement on the LHA program $629 $649 $500 $520 $540 $560 $580 $600 $620 $640 $660 Q1 2020 Q1 2021 $68 $91 $0 $20 $40 $60 $80 $100 Q1 2020 Q1 2021 10.8% 14.0% 0.0% 2.0% 4.0% 6.0% 8.0% 10.0% 12.0% 14.0% 16.0% Q1 2020 Q1 2021 1Non-GAAP measure. See appendix for definition and reconciliation.

HARD STUFF DONE RIGHT Newport News Shipbuilding Q1 2021 Results 7 HUNTINGTON INGALLS INDUSTRIES Revenues ($M) Segment Operating Income1 ($M) Segment Operating Margin1 Revenues improved YoY due to growth in aircraft carriers, fleet support services and submarine construction Segment operating income and segment operating margin declined YoY primarily due to lower risk retirement for the refueling and complex overhaul of CVN 73, partially offset by higher risk retirement on Block IV boats of the Virginia-class submarine program $1,341 $1,407 $0 $500 $1,000 $1,500 Q1 2020 Q1 2021 $95 $93 $80 $85 $90 $95 $100 Q1 2020 Q1 2021 7.1% 6.6% 6.3% 6.4% 6.5% 6.6% 6.7% 6.8% 6.9% 7.0% 7.1% 7.2% Q1 2020 Q1 2021 1Non-GAAP measure. See appendix for definition and reconciliation.

HARD STUFF DONE RIGHT Technical Solutions Q1 2021 Results 8 HUNTINGTON INGALLS INDUSTRIES Revenues ($M) Segment Operating Income1 ($M) Segment Operating Margin1 Revenues declined YoY due primarily to the divestitures of our oil and gas business and the San Diego Shipyard in the quarter, partially offset by the acquisition of Hydroid Segment operating income and segment operating margin improved YoY due to stronger performance in Defense & Federal Solutions and Nuclear & Environmental Services, as well as a gain related to the sale of our oil and gas business $317 $259 $0 $50 $100 $150 $200 $250 $300 $350 Q1 2020 Q1 2021 -$7 $7 -$10 -$8 -$6 -$4 -$2 $0 $2 $4 $6 $8 $10 Q1 2020 Q1 2021 -2.2% 2.7% -3.0% -2.0% -1.0% 0.0% 1.0% 2.0% 3.0% Q1 2020 Q1 2021 1Non-GAAP measure. See appendix for definition and reconciliation.

HARD STUFF DONE RIGHT 2021 Outlook 9 HUNTINGTON INGALLS INDUSTRIES Prior 2021 guidance ranges for Shipbuilding and Technical Solutions remain appropriate Shipbuilding revenue1 between $8.2 - $8.4 billion Technical Solutions revenue of ~$1 billion Shipbuilding operating margin1 between 7% and 8% Expect shipbuilding margin for the first half of 2021 to be around the mid-point of our annual guidance range Significant remaining risk retirement events are weighted towards the end of the year Technical Solutions segment operating margin1 between 3% and 5%, Technical Solutions EBITDA margin1 between 7% and 9% No change to free cash flow1 outlook of between $150 - $250 million No change to long-term pension outlook Revising 2021 effective tax rate guidance from ~22% to ~18% 1Non-GAAP measure. See appendix for definition.

Appendix HUNTINGTON INGALLS INDUSTRIES PROPRIETARY

HARD STUFF DONE RIGHT Non-GAAP Measures Definitions 11 HUNTINGTON INGALLS INDUSTRIES We make reference to “segment operating income,” “segment operating margin,” “ pension adjusted diluted earnings per share,” “shipbuilding revenue,” “shipbuilding operating margin,” “Technical Solutions EBITDA margin” and “free cash flow.” We internally manage our operations by reference to segment operating income and segment operating margin, which are not recognized measures under GAAP. When analyzing our operating performance, investors should use segment operating income and segment operating margin in addition to, and not as alternatives for, operating income and operating margin or any other performance measure presented in accordance with GAAP. They are measures that we use to evaluate our core operating performance. We believe that segment operating income and segment operating margin reflect an additional way of viewing aspects of our operations that, when viewed with our GAAP results, provide a more complete understanding of factors and trends affecting our business. We believe these measures are used by investors and are a useful indicator to measure our performance. Because not all companies use identical calculations, our presentation of segment operating income and segment operating margin may not be comparable to similarly titled measures of other companies. Shipbuilding revenue, shipbuilding operating margin, Technical Solutions EBITDA margin and pension adjusted diluted earnings per share are not measures recognized under GAAP. They should be considered supplemental to and not a substitute for financial information prepared in accordance with GAAP. They may not be comparable to similarly titled measures of other companies. Free cash flow is not a measure recognized under GAAP. Free cash flow has limitations as an analytical tool and should not be considered in isolation from, or as a substitute for, analysis of our results as reported under GAAP. We believe free cash flow is an important measure for our investors because it provides them insight into our current and period-to-period performance and our ability to generate cash from continuing operations. We also use free cash flow as a key operating metric in assessing the performance of our business and as a key performance measure in evaluating management performance and determining incentive compensation. Free cash flow may not be comparable to similarly titled measures of other companies. Reconciliations of forward-looking non-GAAP measures are not provided because we are unable to provide such reconciliations without unreasonable effort due to the uncertainty and inherent difficulty of predicting the occurrence and financial impact of certain items.

HARD STUFF DONE RIGHT Non-GAAP Measures Definitions Cont’d 12 HUNTINGTON INGALLS INDUSTRIES Segment operating income (loss) is defined as operating income (loss) for the relevant segment(s) before the Operating FAS/CAS Adjustment and non-current state income taxes. Segment operating margin is defined as segment operating income (loss) as a percentage of sales and service revenues. Shipbuilding revenue is defined as the combined sales and service revenues from our Newport News Shipbuilding segment and Ingalls Shipbuilding segment. Shipbuilding operating margin is defined as the combined segment operating income of our Newport News Shipbuilding segment and Ingalls Shipbuilding segment as a percentage of shipbuilding revenue. Technical Solutions EBITDA margin is defined as Technical Solutions segment operating income before interest expense, income taxes, depreciation, and amortization as a percentage of Technical Solutions revenues. Pension adjusted diluted earnings per share is defined as diluted earnings per share excluding the impacts of the FAS/CAS adjustment. Free cash flow is defined as net cash provided by (used in) operating activities less capital expenditures net of related grant proceeds. Operating FAS/CAS Adjustment is defined as the difference between the service cost component of our pension and other postretirement expense determined in accordance with GAAP (FAS) and our pension and other postretirement expense under U.S. Cost Accounting Standards (CAS). Non-current state income taxes are defined as deferred state income taxes, which reflect the change in deferred state tax assets and liabilities and the tax expense or benefit associated with changes in state uncertain tax positions in the relevant period. These amounts are recorded within operating income. Current period state income tax expense is charged to contract costs and included in cost of sales and service revenues in segment operating income.

HARD STUFF DONE RIGHT13 HUNTINGTON INGALLS INDUSTRIES Non-GAAP Reconciliations – Segment Operating Income & Segment Operating Margin ($ in millions) 2021 2020 Ingalls revenues 649 629 Newport News revenues 1,407 1,341 Technical Solutions revenues 259 317 Intersegment eliminations (37) (24) Sales and Service Revenues 2,278 2,263 Operating Income 147 215 Operating FAS/CAS Adjustment 40 (63) Non-current state income taxes 4 4 Segment Operating Income 191 156 As a percentage of sales and service revenues 8.4 % 6.9 % Ingalls segment operating income 91 68 As a percentage of Ingalls revenues 14.0 % 10.8 % Newport News segment operating income 93 95 As a percentage of Newport News revenues 6.6 % 7.1 % Technical Solutions segment operating income 7 (7) As a percentage of Technical Solutions revenues 2.7 % (2.2)% March 31 Three Months Ended

HARD STUFF DONE RIGHT Non-GAAP Reconciliations – Shipbuilding Revenues & Operating Margin 14 HUNTINGTON INGALLS INDUSTRIES ($ in millions) 2021 2020 Sales and service revenues 2,278 2,263 Technical Solutions (259) (317) Intersegment eliminations 37 24 Shipbuilding Revenues 2,056 1,970 Operating Income 147 215 Operating FAS/CAS Adjustment 40 (63) Non-current state income taxes 4 4 Segment Operating Income 191 156 Technical Solutions (7) 7 Shipbuilding Operating Income 184 163 As a percentage of Shipbuilding revenues 8.9 % 8.3 % March 31 Three Months Ended

HARD STUFF DONE RIGHT Non-GAAP Reconciliations – Pension Adjusted Diluted Earnings per Share 15 HUNTINGTON INGALLS INDUSTRIES (in millions, except shares outstanding and per share amounts) 2021 2020 Pension Adjusted Net Earnings Net earnings 148 172 After-tax FAS/CAS adjustment (1) (5) (73) Pension Adjusted Net Earnings 143 99 Pension Adjusted Diluted EPS Diluted earnings per share $ 3.68 $ 4.23 After-tax FAS/CAS adjustment (1) $ (0.12) $ (1.79) Pension Adjusted Diluted EPS $ 3.56 $ 2.43 (1) FAS/CAS Adjustment (6) (93) Tax effect* (1) (20) After-tax effect (5) (73) Weighted-Average Diluted Shares Outstanding 40.2 40.7 Per share impact** $ (0.12) $ (1.79) **Amounts may not recalculate exactly due to rounding. March 31 Three Months Ended *The income tax impact is calculated using the tax rate in effect for the relevant non-GAAP adjustment.

HARD STUFF DONE RIGHT Non-GAAP Reconciliations – Free Cash Flow 16 HUNTINGTON INGALLS INDUSTRIES ($ in millions) 2021 2020 Net cash provided by (used in) operating activities 43 68 Less capital expenditures: Capital expenditure additions (60) (71) Grant proceeds for capital expenditures 1 5 Free cash flow (16) 2 Three Months Ended March 31

HARD STUFF DONE RIGHT17 HUNTINGTON INGALLS INDUSTRIES