Attached files

| file | filename |

|---|---|

| EX-99.2 - EXHIBIT 99.2 - ACNB CORP | tm2115327d1_ex99-2.htm |

| 8-K - FORM 8-K - ACNB CORP | tm2115327d1_8k.htm |

Exhibit 99.1

ACNB Corporation Annual Meeting of Shareholders May 4, 2021 1

Welcome & Introductions 2

Board of Directors 3 Alan J. Stock Chairman of the Board Todd L. Herring Vice Chairman of the Board Kimberly S. Chaney Frank Elsner, III James P. Helt Scott L. Kelley James J. Lott Donna M. Newell Daniel W. Potts Thomas A. Ritter Marian B. Schultz D. Arthur Seibel, Jr. David L. Sites James E. Williams

4 Subsidiary Executive Officers Front left to right: Lynda L. Glass, EVP/Secretary and Chief Risk & Governance Officer; David W. Cathell, EVP/Treasurer & Chief Financial Officer; Laurie A. Laub, EVP/Chief Credit & Operations Officer Back left to right: Douglas A. Seibel, EVP/Chief Lending & Revenue Officer; James P. Helt, President & Chief Executive Officer; Tom N. Rasmussen, EVP/Maryland Market President; Thomas R. Stone, EVP/Chief Community Banking Officer Mark A. Westcott President & Chief Executive Officer

5 Business Advisors Bybel Rutledge LLP: Partner Nicholas Bybel, Jr., Esquire RSM US LLP: Partner Patrick Mulloy

• Call to Order & Business Matters • President & CEO Presentation • Shareholder Questions & Answers • Voting Results from Judge of Election • Adjournment 6 Meeting Agenda

In the interest of an orderly Annual Meeting of Shareholders for ACNB Corporation, please honor the following basic Rules of Conduct and Procedures: • If you have joined the virtual meeting as a Shareholder using a proxy control number, you will be able to submit questions during the meeting using the message icon. These questions will be addressed, as possible, prior to adjournment. • If you have joined the virtual meeting as a Guest, using only the meeting password, you will not have the ability to ask questions. • ACNB Corporation reserves the right to not respond to any questions not related to today’s meeting agenda or if the matter is of specific individual concern. A representative of ACNB Corporation will follow up with the requestor after the meeting. • Additional questions can also be submitted after the meeting via investor.relations@acnb.com. • Full Rules of Conduct and Procedures for the Annual Meeting are posted and accessible via the Investor Relations page at acnb.com. 7 Rules of Conduct and Procedures

During the course of this presentation, there may be projections and forward - looking statements regarding events or the future financial performance of ACNB Corporation . We wish to caution you that these forward - looking statements involve certain risks and uncertainties, including a variety of factors that may cause actual results to differ materially from the anticipated results expressed in these forward - looking statements . ACNB Corporation assumes no duty to update the forward - looking statements made in this presentation . You are encouraged to review the risk factors and other cautionary statements regarding forward - looking information described in other documents ACNB Corporation files from time to time with the Securities and Exchange Commission including the Annual Reports on Form 10 - K, Quarterly Reports on Form 10 - Q, and any Current Reports on Form 8 - K . 8 Forward - Looking Statements

Call to Order & Business Matters 9

President & CEO Presentation James P. Helt 10

11 Bank Established: 1857 Headquarters: Gettysburg, PA Market Capitalization 1 : $259 Million Total Assets: $2.6 Billion Gross Loans: $1.6 Billion Deposits: $2.2 Billion TCE/TA: 8.32% ROAA 2 : 0.97% ROAE 2 : 9.25% LTM Net Interest Margin: 3.35% LTM Noninterest Income/Operating Revenue : 21.43% LTM Efficiency Ratio: 59.35% Total Capital Ratio 3 : 15.10% CET1 Ratio 3 : 13.86% Tier 1 Capital Ratio 3 : 13.86% Leverage Ratio 3 : 9.01% • Trades on the NASDAQ under the symbol “ACNB” • 16 th largest bank (out of 80) in Pennsylvania by asset size • 22 Bank office locations in Southcentral Pennsylvania and 12 Bank office location s in Central Maryland • Approximately $437 million in Wealth Management assets » Trust and Fiduciary: $277. 3 million in AUM » Retail Brokerage: $159. 4 million in AUM • Russell Insurance Group , Inc. » Approximately $47.9 million in gross premium volume and $6.1 million in gross commissions » 3 office locations in Maryland and 1 in Pennsylvania N o t es Executive Summary 1. As of March 18, 2021 2. Excludes one - time merger related charges associated with the Frederick County Bancorp, Inc. acquisition that closed in 1Q’20 (non - GAAP) 3. Reflects bank - level metrics Executive Summary • Named to Central Penn Business Journal’s list of the Top 50 Fastest Growing Companies in Central Pennsylvania for the third year in a row. • Voted #1 Bank for the ninth consecutive year in the Gettysburg Times Pick of the County annual award. • Voted #1 in the Hanover Evening Sun Readers Choice Awards for 2020. Accolades

• ACNB Bank is ranked #1 in Adams County market, with deposit market share of 57.9%¹. • ACNB Bank has the #1 deposit market share in 7 out of 13 defined market areas in Pennsylvania ². • Market footprint covers Southcentral Pennsylvania and Central Maryland. • The Southcentral Pennsylvania and Central Maryland markets have a diverse mix of businesses and industries, with an educated workforce and household income that is greater than both state and national averages³. • 34 Bank locations across Pennsylvania and Maryland » 13 branches located in Adams County, PA (excludes HQ Operations Center) » 5 branches and 1 loan production office located in York County, PA » 1 branch located in Franklin County, PA » 1 branch located in Cumberland County, PA » 1 loan production office located in Lancaster County, PA » 6 branches located in Carroll County, MD » 5 branches located in Frederick County, MD » 1 loan production office located in Baltimore County, MD • Solid historical deposit growth » 5 - Year (Total) CAGR⁴ = 19.1% » 5 - Year (Organic) CAGR⁴ = 14.6% » 2020 (Total) = 54.8% » 2020 (Organic) = 27.8% 12 Key Notes Market Overview Market Footprint 1. According to the June 30, 2020 FDIC Deposit Market Share Report 2. These market areas include Gettysburg, Upper Adams, Littlestown, McSherrystown, Carroll Valley, East Berlin, and Newville 3. Based on United States Census Bureau data 4. Compounded Annual Growth Rate (CAGR)

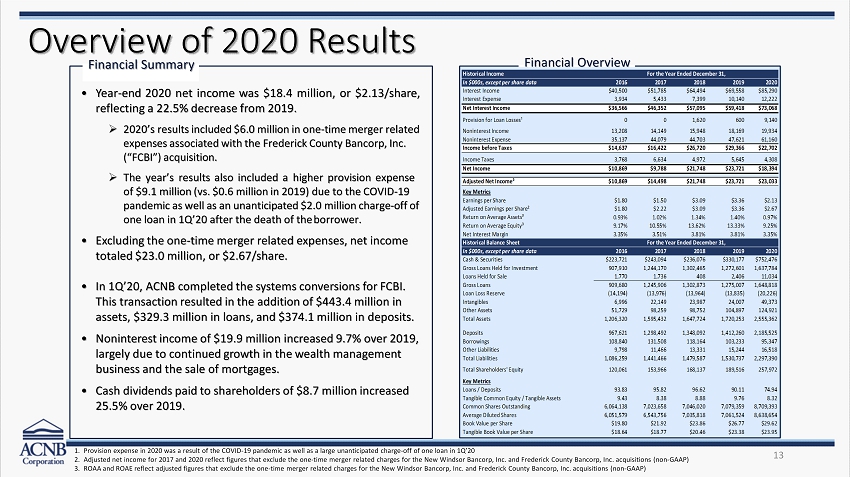

13 Overview of 2020 Results • Year - end 2020 net income was $18.4 million, or $2.13/share, reflecting a 22.5% decrease from 2019. » 2020’s results include d $6.0 million in one - time merger related expenses associated with the Frederick County Bancorp, Inc. (“FCBI”) acquisition. » The year’s results also included a higher provision expense of $9.1 million (vs. $0.6 million in 2019) due to the COVID - 19 pandemic as well as an unanticipated $2.0 million charge - off of one loan in 1Q’20 after the death of the borrower. • Excluding the one - time merger related expenses, net income totaled $23.0 million, or $2.67/share. • In 1Q’20, ACNB completed the systems conversions for FCBI. This transaction resulted in the addition of $443.4 million in assets, $329.3 million in loans, and $374.1 million in deposits. • Noninterest income of $19.9 million increased 9.7% over 2019, largely due to continued growth in the wealth management business and the sale of mortgages. • Cash dividends paid to shareholders of $8.7 million increased 25.5% over 2019. 1. Provision expense in 2020 was a result of the COVID - 19 pandemic as well as a large unanticipated charge - off of one loan in 1Q’20 2. Adjusted net income for 2017 and 2020 reflect figures that exclude the one - time merger related charges for the New Windsor Bancorp, Inc. and Frederick County Bancorp, Inc. acquisitions (non - GAAP) 3. ROAA and ROAE reflect adjusted figures that exclude the one - time merger related charges for the New Windsor Bancorp, Inc. and Frederick County Bancorp, Inc. acquisitions (non - GAAP) Financial Overview Financial Summary

14 Consistent Balance Sheet Growth Total Deposits ($MMs) Tangible Common Equity ($MMs) CAGR¹ (‘16 - ’20): 17.4% CAGR¹ (‘16 - ’20): 14.0% CAGR¹ (‘16 - ’20): 19.1% CAGR¹ (‘16 - ’20): 15.3% Total Assets ($MMs) Total Loans ($MMs) 1. Compounded Annual Growth Rate (CAGR)

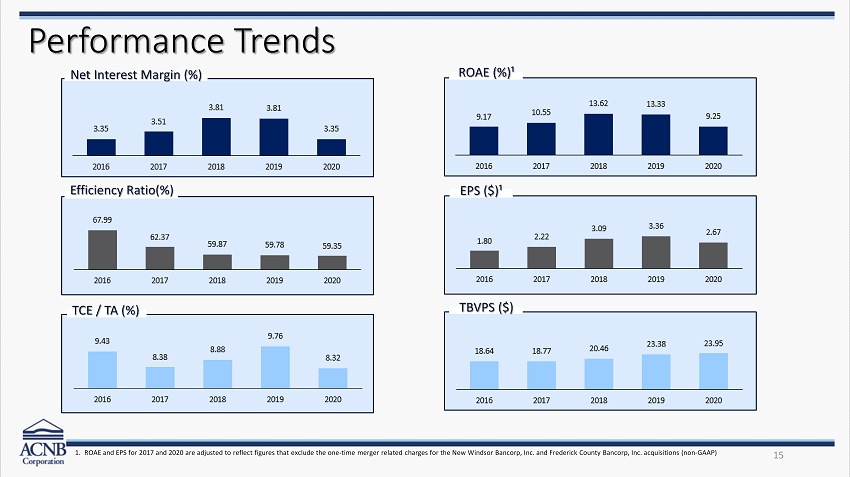

15 Performance Trends ROAE (%)¹ Efficiency Ratio(%) EPS ($)¹ TCE / TA (%) TBVPS ($) 1. ROAE and EPS for 2017 and 2020 are adjusted to reflect figures that exclude the one - time merger related charges for the New Windsor Bancorp, Inc. and Frederick County Bancorp, Inc. acquisitions (non - GAAP) Net Interest Margin (%)

16 Wealth Management At Year - End in Thousands of Dollars • ACNB’s W ealth M anagement business derives a majority of its revenue from noninterest income consisting of trust, investment advisory and brokerage, and other servicing fees. • Wealth Management clients are located largely within the Bank’s primary geographic markets. • Substantial revenues are generated from investment management contracts with clients. » Under these contracts, investment advisory fees are typically based on the market value of assets under management . 1. Securities and certain insurance products are offered through Cetera Investment Services, LLC, a registered broker - dealer and FI NRA member, and advisory services are offered through Cetera Investment Advisers, LLC. Neither firm is affiliated with ACNB.

17 Russell Insurance Group, Inc. At Year - End in Thousands of Dollars • ACNB Corporation's wholly - owned subsidiary, Russell Insurance Group, Inc., is a full - service insurance agency , with licenses in 44 states, that offers a broad range of property , casualty , health, life and disability insurance to both personal and commercial clients . • Based in Westminster, Maryland, Russell Insurance Group has served the needs of its clients since its founding as an independent insurance agency in 1978. The agency was purchased by ACNB Corporation in 2005. » RIG operates additional locations in Germantown and Jarrettsville, Maryland , as well as an office in Gettysburg, Pennsylvania. • Russell Insurance Group is managed separately from the banking and related financial services that ACNB Corporation offers and is reported as a separate segment.

18 Diversified and Growing Loan Portfolio • ACNB a sset q uality measures continue to reflect commitment to sound credit risk management, including conservative underwriting practices, timely credit administrati on processes, and proactive customer relationship management. • Independent loan review performed annually with a 60% penetration rate. • Fully integrated Enterprise Risk Management function. • Incentive plans in place to drive and reward behaviors that are in alignment with corporate objectives. Key Underwriting Notes Gross Loan Growth ($MMs) CAGR ¹ (’16 - ’20): 14.0% Loan Portfolio Composition as of 12/31/2020 1. Compounded Annual Growth Rate (CAGR)

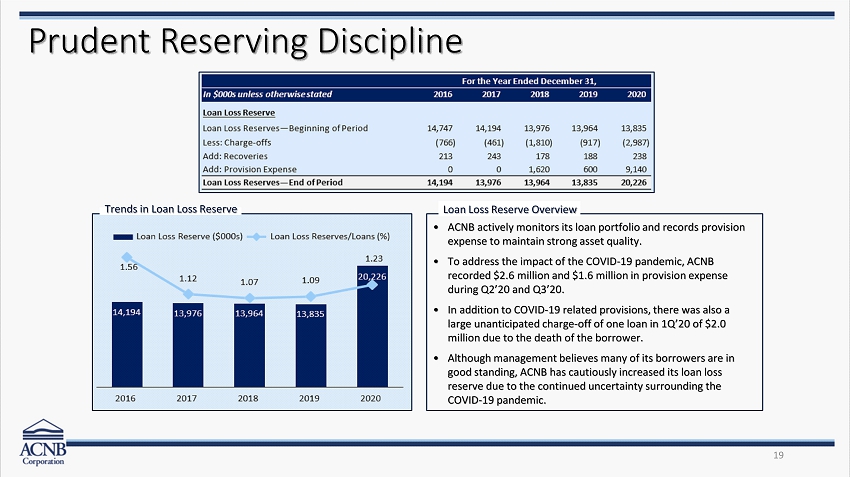

19 Prudent Reserving Discipline • ACNB actively monitors its loan portfolio and records provision expense to maintain strong asset quality. • To address the impact of the COVID - 19 pandemic, ACNB recorded $2.6 million and $1.6 million in provision expense during Q2’20 and Q3’20. • In addition to COVID - 19 related provisions, there was also a large unanticipated charge - off of one loan in 1Q’20 of $2.0 million due to the death of the borrower. • Although management believes many of its borrowers are in good standing, ACNB has cautiously increased its loan loss reserve due to the continued uncertainty surrounding the COVID - 19 pandemic. Loan Loss Reserve Overview Trends in Loan Loss Reserve

20 Healthy Deposit Portfolio • Year - end 2020 deposits of $2.2 billion increased 54.8% over 2019. » ACNB picked up $37 4 million in deposits through the Frederick County Bancorp , Inc. transaction that closed in 1Q’20. • ACNB grew organic deposits by approximately 27.8% in 2020, largely a factor of PPP proceeds deposited to customer accounts as well as increased balances in a broad base of accounts, a result of a lack of economic activity due to COVID - 19. • ACNB continues to have a strong core deposit base, with core deposits making up 95.7% of total deposits. • Noninterest - bearing deposits totaled $557 million at year - end 2020 and accounted for approximately 25% of the Bank’s total deposit portfolio. • ACNB ’s top 20 deposit relationships only account for 12.1% of total deposits. • ACNB’s cost of deposits for 2020 was 0.55%, down 7 basis points from 2019’s cost. Deposit Composition as of 12/31/2020 Deposit Portfolio

• To assist customers in managing deposit accounts , fees for account transfers conducted via the Customer Contact Center were waived and there was potential fee relief for overdraft services for a period of time. • For personal and business loan customers experiencing financial hardship, processes are in place to assist in loan payment deferrals or other accommodations. • For eligible business customers , the Bank is participating in available government loan programs through the Small Business Administration or otherwise, including the Paycheck Protection Program. • All ACNB Bank fees for customers using an ATM , regardless of the location, were waived for a period of time. • Free pharmacy, vision and hearing benefits, as well as identity theft protection , were extended to all customers with personal checking accounts until December 31, 2021. 21 Focused COVID - 19 Response • All community banking offices were limited to drive - up services for in - person banking transactions, with lobby access available via appointment in the case of critical needs for services such as safe deposit box access. • Additional staff were allocated to assist customers over the telephone and to handle new customer enrollments in Online Banking, Mobile Banking, and Bill Pay. • Operations are being conducted in compliance with current guidelines regarding social distancing, face masks, sanitation, and personal hygiene. • Staff members are working remotely when able to do so in order to complete their primary responsibilities. • Limits on Mobile Banking deposit transactions were raised so that customers can deposit checks in both higher dollar amounts and number. Operations & Employees Customers

22 COVID - 19 Loan Considerations • Despite no significant deterioration in its loan portfolio thus far throughout the pandemic, ACNB proactively increased its provision expense in 2020, an acknowledgement of the uncertainty in the broader economic environment. • Although many of the Bank’s borrowers have indicated they will be able to handle short - term interruptions, the Bank proactively increased deferred loan payments for many of its loan clients who were adversely impacted. • The Bank continues to actively analyze the loan portfolio and economic conditions in its markets. • As of December 31, 2020, the Bank had funded 1,440 PPP loans for a total of $160. 9 million , or 9.8% of the Bank’s total loan portfolio. • These PPP loans have generated $6.1 million in fee income, with $2.9 million recognized in 2020 and the remainder to be recognized either over the life of the loan or until loan forgiveness occurs. • For the second round of PPP , through the end of March 2021, ACNB has funded 609 new loans in the amount of $ 53.1 million, generating additional fee income of $2. 8 million. • As of December 31, 2020, the Bank had outstanding approvals for loan modifications and deferrals for 48 loans totaling $36.1 million in balances, or 2.2% of the Bank’s total loan portfolio. • The Bank’s management has also been very active in communicating with its deferred borrowers, as well as anticipates asset quality will remain relatively strong. COVID - 19 Response Paycheck Protection Program (PPP) Payment Deferrals

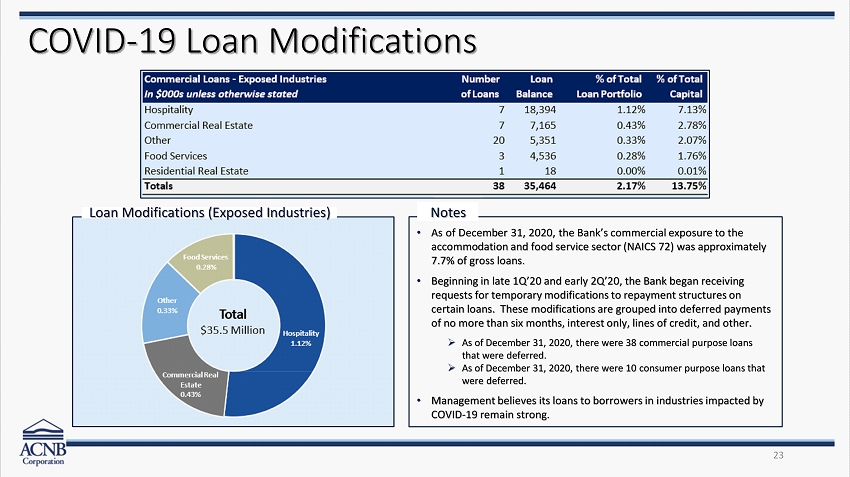

23 COVID - 19 Loan Modifications • As of December 31, 2020, the Bank’s commercial exposure to the accommodation and food service sector (NAICS 72) was approximately 7.7% of gross loans. • Beginning in late 1Q’20 and early 2Q’20, the Bank began receiving requests for temporary modifications to repayment structures on certain loans. These modifications are grouped into deferred payments of no more than six months, interest only, lines of credit, and other. » As of December 31, 2020, there were 38 commercial purpose loans that were deferred. » As of December 31, 2020, there were 10 consumer purpose loans that were deferred. • Management believes its loans to borrowers in industries impacted by COVID - 19 remain strong. Notes Loan Modifications (Exposed Industries)

24 ACNB Helping Hands was a special initiative launched in April 2020 that served to reinforce ACNB Bank’s ongoing commitment to community during the COVID - 19 pandemic. • This program was funded by ACNB Bank in the amount of $40,000 and supplemented by staff members and Directors affiliated with the Bank, who personally contributed another $13,250, for a total commitment of $53,250 to provide meals to those in need in our local communities. • 16 restaurant and catering businesses, which are Bank customers, partnered to prepare nearly 6,000 meals that were distributed through 16 local community organizations across the Bank’s footprint in Pennsylvania and Maryland.

25 Growth Opportunities • Acquisition of top tier and experienced HR talent due to market disruption • Focus on balance sheet expansion, driven by loan growth via commercial lending • Expansion into new markets » Loan Production Offices (Lancaster, PA and Hunt Valley, MD) » Full - Service Offices • Growth of Wealth Management platform » Trust & Fiduciary Services ($277 million in AUM) » Retail Brokerage Services ($159 million in AUM) • Russell Insurance Group, Inc. » 5 - Year Premium CAGR¹: 7.1% » 5 - Year Commissions CAGR¹: 6.2% • Strategically positioned in one of the fast - growing regions along the East Coast, within a short drive of Baltimore, Philadelphia, and Washington, D.C. • Southcentral Pennsylvania and Central Maryland markets are home to a diverse mix of businesses and industries • Expansion into new markets based on strong demographics and enhancement of long - term shareholder value » Growth Markets » Strategic Fit » Cultural Fit » Earnings Growth Opportunity Organic Strategies Inorganic Strategies 1. Compounded Annual Growth Rate (CAGR)

The Road Ahead As a community banking organization, we believe that we must consistently strive to maximize shareholder value by : 26 1. Addressing the challenges and opportunities facing our company due to the pandemic, keeping an eye on both short - term and long - term goals. 2. Utilizing a combination of tools, including both organic and inorganic growth models, to expand our customer base . 3. Focusing on enhancing our noninterest income revenue through the continued expansion of services provided by Russell Insurance Group and the Bank’s Wealth Management Division. 4. Continually improving our operating efficiency through the use of technology, as well as controlling expenses. 5. Executing on our digital banking transformation strategy to remain competitive and relevant in the marketplace.

27 In Conclusion • ACNB Corporation remains well capitalized and positioned to continue our growth trends to the benefit of our customers, employees, shareholders and communities. • Asset quality remains strong as we continue to work through the impacts of the pandemic. • ACNB Corporation remains focused on maximizing shareholder value by executing on our strategic initiatives, furthering our vision to be the independent financial services provider of choice in the core markets served by building relationships and finding solutions.

Shareholder Questions & Answers 28

Voting Results from Judge of Election 29

Thank You & Meeting Adjournment 30 Stock Symbol: ACNB (Nasdaq) www.acnb.com