Attached files

| file | filename |

|---|---|

| EX-99.1 - EX-99.1 - 22nd Century Group, Inc. | xxii-20210506xex99d1.htm |

| 8-K - 8-K - 22nd Century Group, Inc. | xxii-20210506x8k.htm |

Exhibit 99.2

| FIRST QUARTER 2021 EARNINGS PRESENTATION May 6, 2021 |

| CAUTIONARY NOTE ON FORWARD-LOOKING STATEMENTS This presentation contains forward-looking statements concerning our business operations, and financial performance and conditions, as well as our plans, objectives, and expectations for our business operations and financial performance and conditions that are subject to risks and uncertainties. All statements other than those of historical fact are forward-looking statements. These types of statements typically contain words such as “aim,” “anticipate,” “assume,” “believe,” “could,” “due,” “estimate,” “expect,” “goal,” “intend,” “may,” “objective,” “plan,” “potential,” “positioned,” “predict,” “should,” “target,” “will,” “would” and other similar expressions that are predictions of or indicate future events and future trends. Forward-looking statements are based on current expectations, estimates, forecasts, and projections about our business, the industry in which we operate, and our management’s beliefs and assumptions. 2 These statements are not guarantees of future performance or development and involve known and unknown risks, uncertainties, and other factors that are in some cases beyond our control. All forward-looking statements are subject to risks and uncertainties that could cause actual results to differ materially from those estimated. The contents of this presentation should be considered in conjunction with the risk factors, warnings, and cautionary statements contained in the Company’s annual, quarterly, and other reports filed with the U.S. Securities and Exchange Commission. We undertake no obligation to publicly update or revise any forward-looking statement as a result of new information, future events, or otherwise, except as required by law. |

| Q1 DEVELOPMENTS: SHIFT IN FEDERAL POLICY POSITION 3 CHANGES IN FEDERAL POLICY MAY ACCELERATE MARKET OPPORTUNITIES FOR 22ND CENTURY 1.https://www.wsj.com/articles/biden-administration-considering-rule-to-cut-nicotine-in-cigarettes-11618859564 2.https://www.nejm.org/doi/full/10.1056/NEJMsr1714617?query=featured_home 3.Center for Tobacco Products Reduced Nicotine Mandate Now at the Forefront Changing Federal Policy Priorities ▪ WSJ reports1 the Biden Administration is actively considering moving forward with the ANPRM that will require Big Tobacco to reduce the amount of nicotine in all combustible cigarettes to be “minimally or non-addictive” ▪ 22nd Century has the first and only reduced nicotine content combustible cigarette product authorized for sale by the FDA ▪ Extensive research – largely funded by U.S. government agencies – consistently confirms the benefits of a reduced nicotine mandate for adult smokers ▪ When implemented, FDA’s nicotine cap will help 5 million adult smokers quit within one year and save more than 8 million American lives by the end of the century2 ▪ New administration demonstrating commitment to advancing critical public health initiatives: • Xavier Becerra appointed head of Health and Human Services – long-time advocate of tougher cigarette industry regulation and reduced nicotine mandate • Acting FDA Commissioner Janet Woodcock has a strong history of support for divisional autonomy, including CTP3 ▪ FDA announced a decision to begin the rulemaking process to eliminate the use of menthol in highly addictive cigarettes ▪ Increasing momentum as 36 states have legalized medical use and 16 states have legalized recreational use of marijuana ▪ House passed SAFE Act and advanced to Senate; Senate Majority Leader Schumer (D-NY) proposing wider legalization legislation |

| Q1 DEVELOPMENTS: TOBACCO AND CANNABIS FRANCHISES 4 DISRUPTING THE +$1.3 TRILLION GLOBAL TOBACCO, HEMP/CANNABIS MARKETS, AND THIRD PLANT-BASED FRANCHISE (TO BE ANNOUNCED) Tobacco Franchise Hemp/Cannabis Franchise ▪ Steadily raising the intensity and frequency of communications to secure FDA Modified Risk Tobacco Product (MRTP) designation of VLN® across FDA, executive, congressional and state leadership ▪ Fully prepared for commercial launch of VLN® within 90 days of receiving MRTP designation ▪ Expanded VLN® tobacco growing program to support anticipated consumer demand ▪ Manufacturing capabilities geared for a strong commercial launch and growth; adding in-house test and measurement capabilities lowers cost, increases speed ▪ Willing to license reduced nicotine technology to facilitate a nicotine cap proposal to significantly reduce the harm caused by smoking ▪ Changing regulations driving market growth, capital investment and increased need for competitive differentiation ▪ Advancing development of end-to-end upstream cannabinoid value chain capabilities to create disruptive, valuable plant lines ▪ Key partnerships in place to accelerate commercialization of next-gen hemp/cannabis plant lines and IP in as little as two years from trait identification to viable plants ▪ Extended and expanded our exclusive partnership with KeyGene to lock in long-term strategic advantage and future development ▪ Advancing monetization for 2H 2021 from initial plants and IP; readying next generation of plants lines for prospective customers |

| 2021 PRIORITIES & AREAS OF FOCUS 5 Tobacco Franchise Hemp/Cannabis & Third Plant-based Franchise Financial ▪ Secure MRTP Authorization from FDA ▪ Fully prepared for commercial launch of VLN® within 90 days post authorization ▪ Execute on licensing and partnership initiatives 01 ▪ Target upstream segments of cannabinoid value chain ▪ Enable development of commercially valuable plant lines and related IP with stabilized genetics within two years ▪ Monetize our hemp/cannabis IP beginning in 2021 and continue to bring disruptive technology forward 03 04 ▪ Initial development of a third, plant-based franchise in process ▪ Operates in industry that is not as highly regulated and legislated; faster route to commercialization than first two franchises ▪ Pursue strategic partnerships to support development of this franchise ▪ Maintain diligent financial execution, efficient operating structure, and balance sheet strength to support growth initiatives 05 02 ▪ Support, advance, and advocate for FDA to enact its proposed nicotine cap mandate for all combustibles ▪ Favorable political climate for critical public health initiatives |

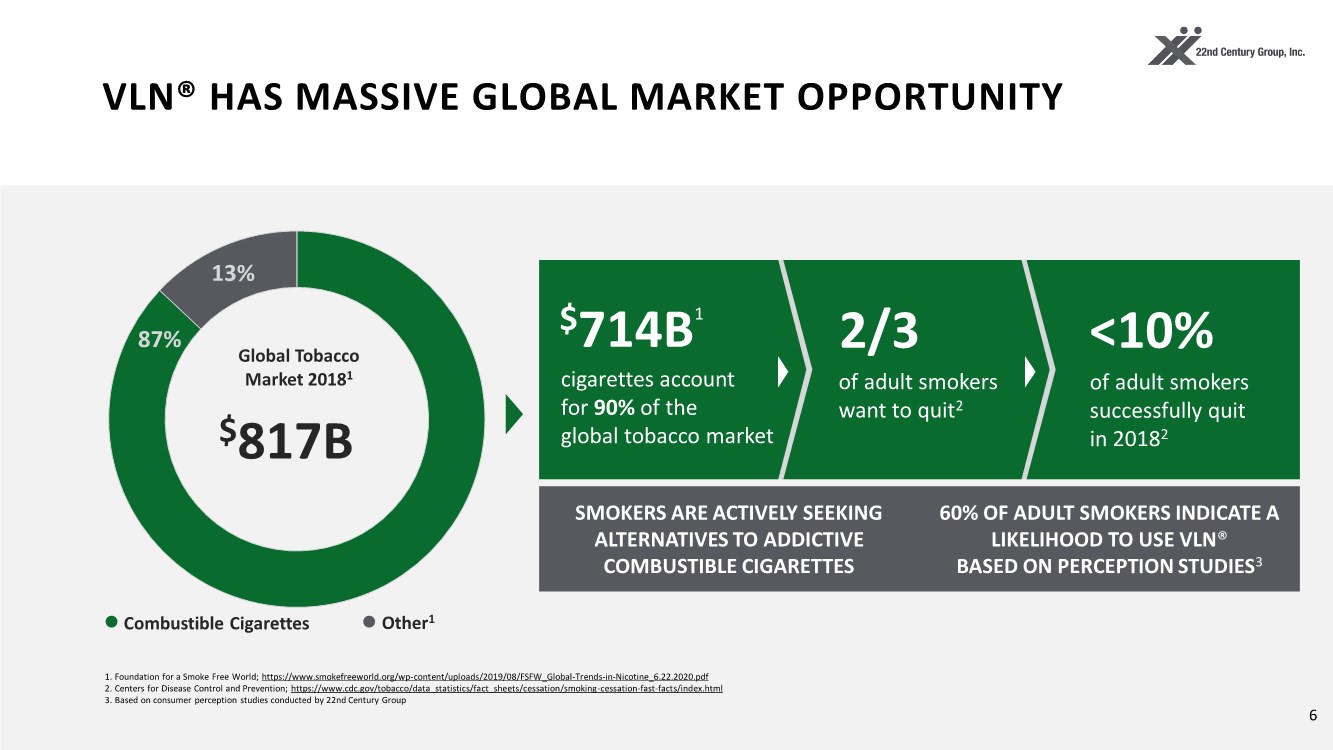

| 87% 13% Global Tobacco Market 20181 Combustible Cigarettes Other1 $817B VLN® HAS MASSIVE GLOBAL MARKET OPPORTUNITY 1. Foundation for a Smoke Free World; https://www.smokefreeworld.org/wp-content/uploads/2019/08/FSFW_Global-Trends-in-Nicotine_6.22.2020.pdf 2. Centers for Disease Control and Prevention; https://www.cdc.gov/tobacco/data_statistics/fact_sheets/cessation/smoking-cessation-fast-facts/index.html 3. Based on consumer perception studies conducted by 22nd Century Group 6 SMOKERS ARE ACTIVELY SEEKING ALTERNATIVES TO ADDICTIVE COMBUSTIBLE CIGARETTES 60% OF ADULT SMOKERS INDICATE A LIKELIHOOD TO USE VLN® BASED ON PERCEPTION STUDIES3 $714B1 cigarettes account for 90% of the global tobacco market 2/3 of adult smokers want to quit2 <10% of adult smokers successfully quit in 20182 |

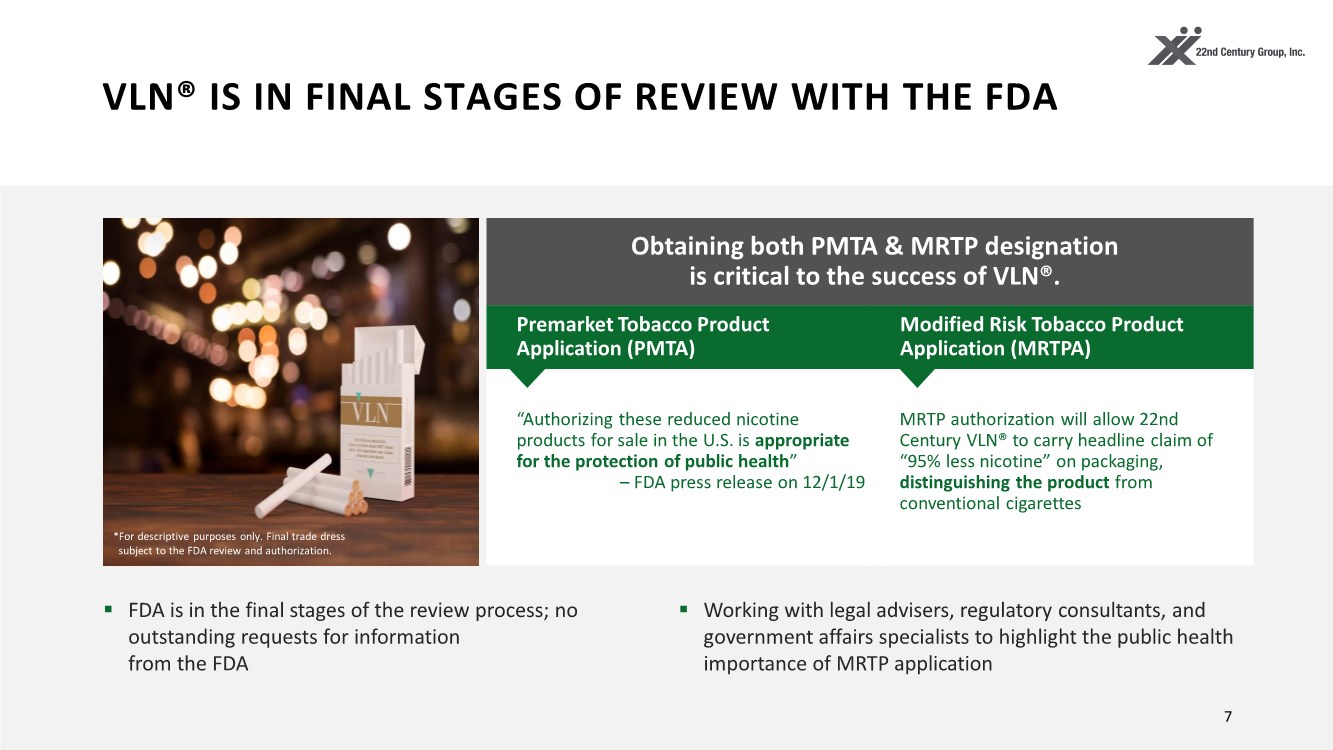

| VLN® IS IN FINAL STAGES OF REVIEW WITH THE FDA 7 ▪ FDA is in the final stages of the review process; no outstanding requests for information from the FDA ▪ Working with legal advisers, regulatory consultants, and government affairs specialists to highlight the public health importance of MRTP application “Authorizing these reduced nicotine products for sale in the U.S. is appropriate for the protection of public health” – FDA press release on 12/1/19 Obtaining both PMTA & MRTP designation is critical to the success of VLN®. Premarket Tobacco Product Application (PMTA) MRTP authorization will allow 22nd Century VLN® to carry headline claim of “95% less nicotine” on packaging, distinguishing the product from conventional cigarettes Modified Risk Tobacco Product Application (MRTPA) *For descriptive purposes only. Final trade dress subject to the FDA review and authorization. |

| PREPARED FOR LAUNCH AND MANUFACTURING RAMP 8 62,000 sq. ft. manufacturing facility in NC; expanded VLN® planting program in 2021 Manufacturing capacity ~1% of the U.S. tobacco market; increasing to ~3% with minimal investment FDA inspected and cleared as part of the Premarket Tobacco Application (PMTA) process Subsequent Participating Manufacturer of the Master Settlement Agreement Internalizing nicotine content test capabilities – 90% cost reduction, results in 1 day vs. 2 to 4 weeks 22nd Century is positioned to manufacture VLN® cigarettes in commercial quantities through existing facility footprint. Launch-ready for commercial sales within 90 days of FDA MRTP authorization Identified both initial and subsequent markets for launch Advanced discussions with multiple trade and retail partners Advancing marketing materials and other important aspects of the launch Test, measure, and refine to maximize commercial success of VLN® Fully Prepared For Commercial Launch of VLN® Manufacturing Geared For Strong Commercial Launch |

| MRTP DESIGNATION IS A CATALYST FOR ADDITIONAL GROWTH OPPORTUNITIES 9 ▪ MRTP designation opens multiple U.S. distribution, international licensing, and partnership opportunities for reduced nicotine tobacco technology and IP ▪ Advancing next-generation non-GMO plant research key to markets where non-GMO products are preferred, or GMO products are banned ▪ Successfully applied non-GMO technology to Bright and Burley varieties of tobacco and developed VLN® 2.0 cigarette prototype ▪ Introducing reduced nicotine traits into Oriental varieties of tobacco |

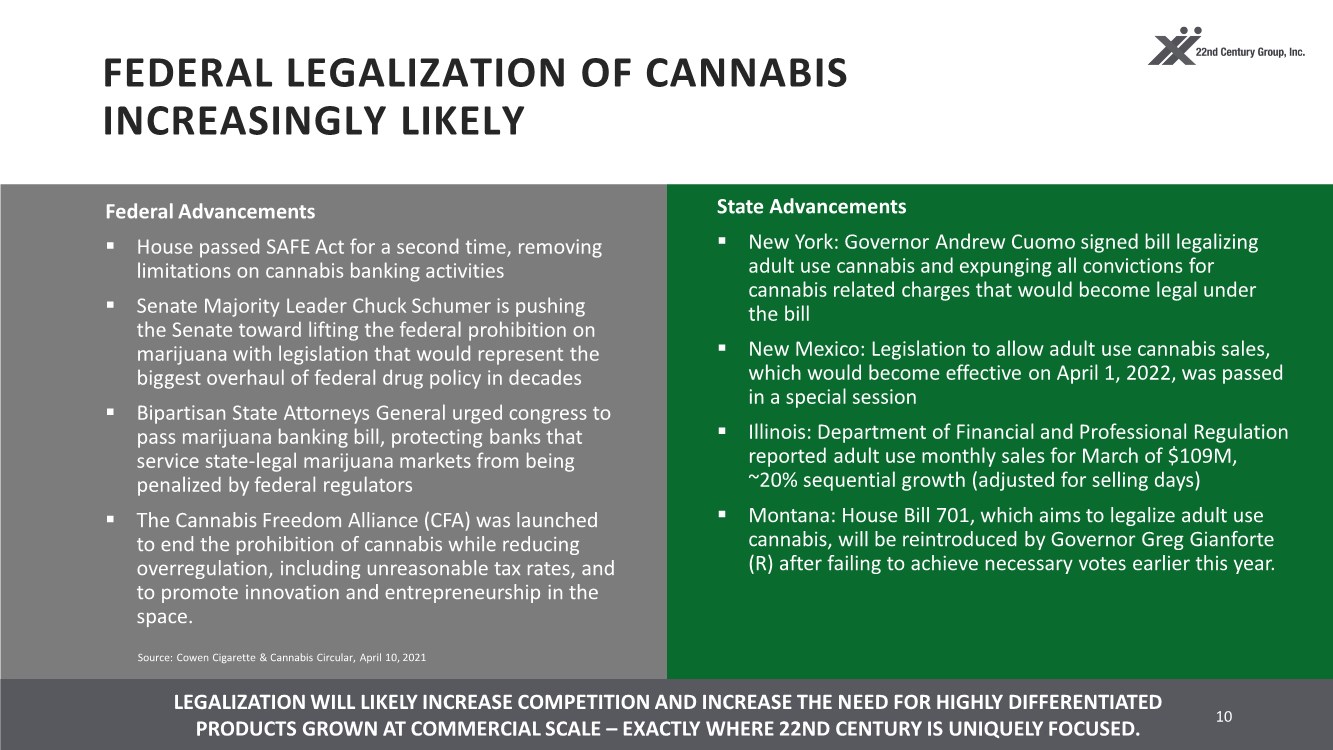

| Federal Advancements ▪ House passed SAFE Act for a second time, removing limitations on cannabis banking activities ▪ Senate Majority Leader Chuck Schumer is pushing the Senate toward lifting the federal prohibition on marijuana with legislation that would represent the biggest overhaul of federal drug policy in decades ▪ Bipartisan State Attorneys General urged congress to pass marijuana banking bill, protecting banks that service state-legal marijuana markets from being penalized by federal regulators ▪ The Cannabis Freedom Alliance (CFA) was launched to end the prohibition of cannabis while reducing overregulation, including unreasonable tax rates, and to promote innovation and entrepreneurship in the space. Source: Cowen Cigarette & Cannabis Circular, April 10, 2021 State Advancements ▪ New York: Governor Andrew Cuomo signed bill legalizing adult use cannabis and expunging all convictions for cannabis related charges that would become legal under the bill ▪ New Mexico: Legislation to allow adult use cannabis sales, which would become effective on April 1, 2022, was passed in a special session ▪ Illinois: Department of Financial and Professional Regulation reported adult use monthly sales for March of $109M, ~20% sequential growth (adjusted for selling days) ▪ Montana: House Bill 701, which aims to legalize adult use cannabis, will be reintroduced by Governor Greg Gianforte (R) after failing to achieve necessary votes earlier this year. FEDERAL LEGALIZATION OF CANNABIS INCREASINGLY LIKELY LEGALIZATION WILL LIKELY INCREASE COMPETITION AND INCREASE THE NEED FOR HIGHLY DIFFERENTIATED PRODUCTS GROWN AT COMMERCIAL SCALE – EXACTLY WHERE 22ND CENTURY IS UNIQUELY FOCUSED. 10 |

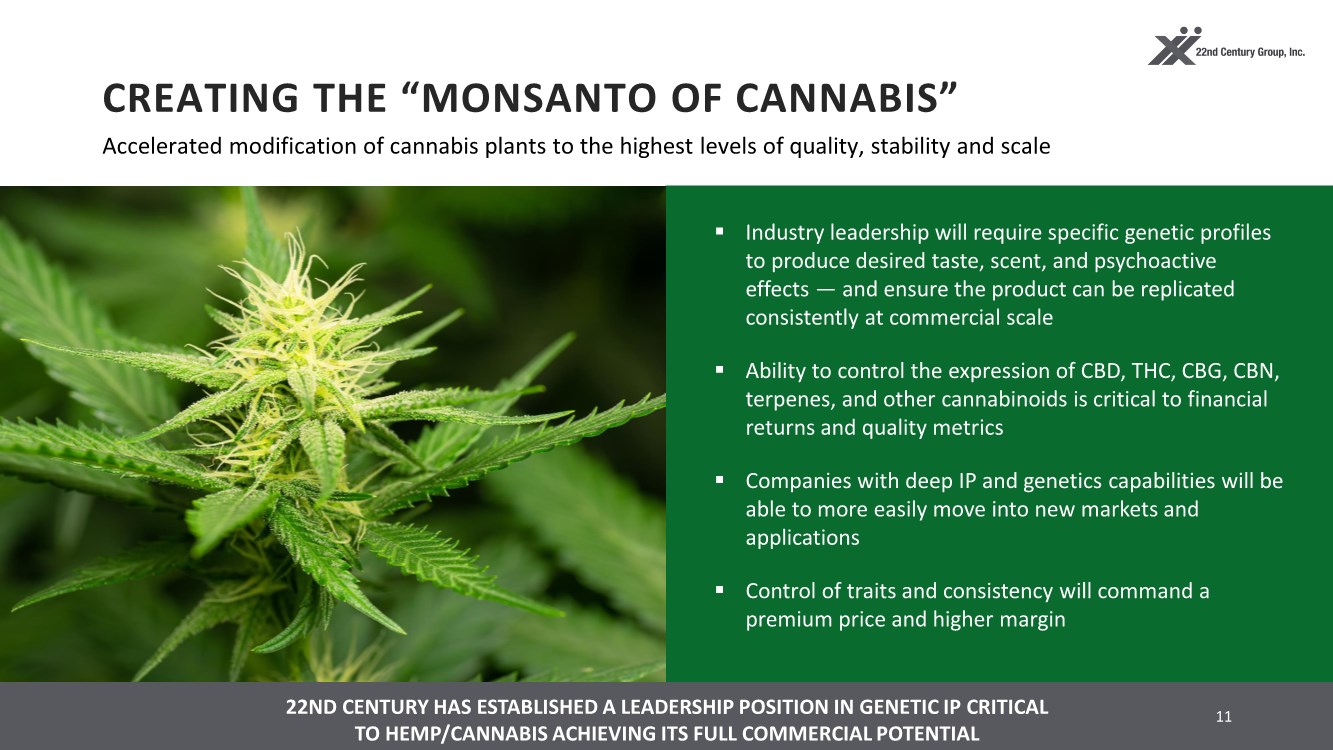

| ▪ Industry leadership will require specific genetic profiles to produce desired taste, scent, and psychoactive effects — and ensure the product can be replicated consistently at commercial scale ▪ Ability to control the expression of CBD, THC, CBG, CBN, terpenes, and other cannabinoids is critical to financial returns and quality metrics ▪ Companies with deep IP and genetics capabilities will be able to more easily move into new markets and applications ▪ Control of traits and consistency will command a premium price and higher margin 22ND CENTURY HAS ESTABLISHED A LEADERSHIP POSITION IN GENETIC IP CRITICAL TO HEMP/CANNABIS ACHIEVING ITS FULL COMMERCIAL POTENTIAL CREATING THE “MONSANTO OF CANNABIS” 11 Accelerated modification of cannabis plants to the highest levels of quality, stability and scale |

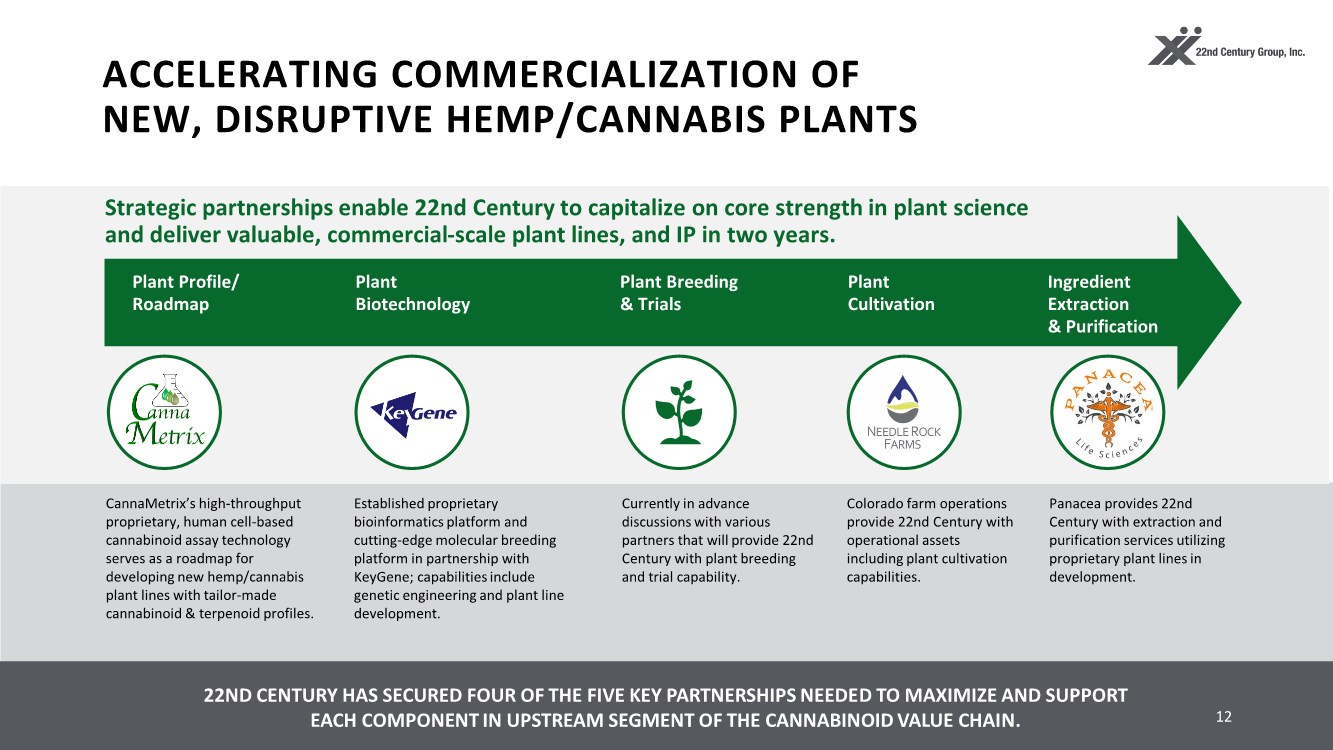

| 22ND CENTURY HAS SECURED FOUR OF THE FIVE KEY PARTNERSHIPS NEEDED TO MAXIMIZE AND SUPPORT EACH COMPONENT IN UPSTREAM SEGMENT OF THE CANNABINOID VALUE CHAIN. ACCELERATING COMMERCIALIZATION OF NEW, DISRUPTIVE HEMP/CANNABIS PLANTS 12 Plant Biotechnology Established proprietary bioinformatics platform and cutting-edge molecular breeding platform in partnership with KeyGene; capabilities include genetic engineering and plant line development. Plant Profile/ Roadmap CannaMetrix’s high-throughput proprietary, human cell-based cannabinoid assay technology serves as a roadmap for developing new hemp/cannabis plant lines with tailor-made cannabinoid & terpenoid profiles. Ingredient Extraction & Purification Panacea provides 22nd Century with extraction and purification services utilizing proprietary plant lines in development. Plant Breeding & Trials Currently in advance discussions with various partners that will provide 22nd Century with plant breeding and trial capability. Plant Cultivation Colorado farm operations provide 22nd Century with operational assets including plant cultivation capabilities. Strategic partnerships enable 22nd Century to capitalize on core strength in plant science and deliver valuable, commercial-scale plant lines, and IP in two years. |

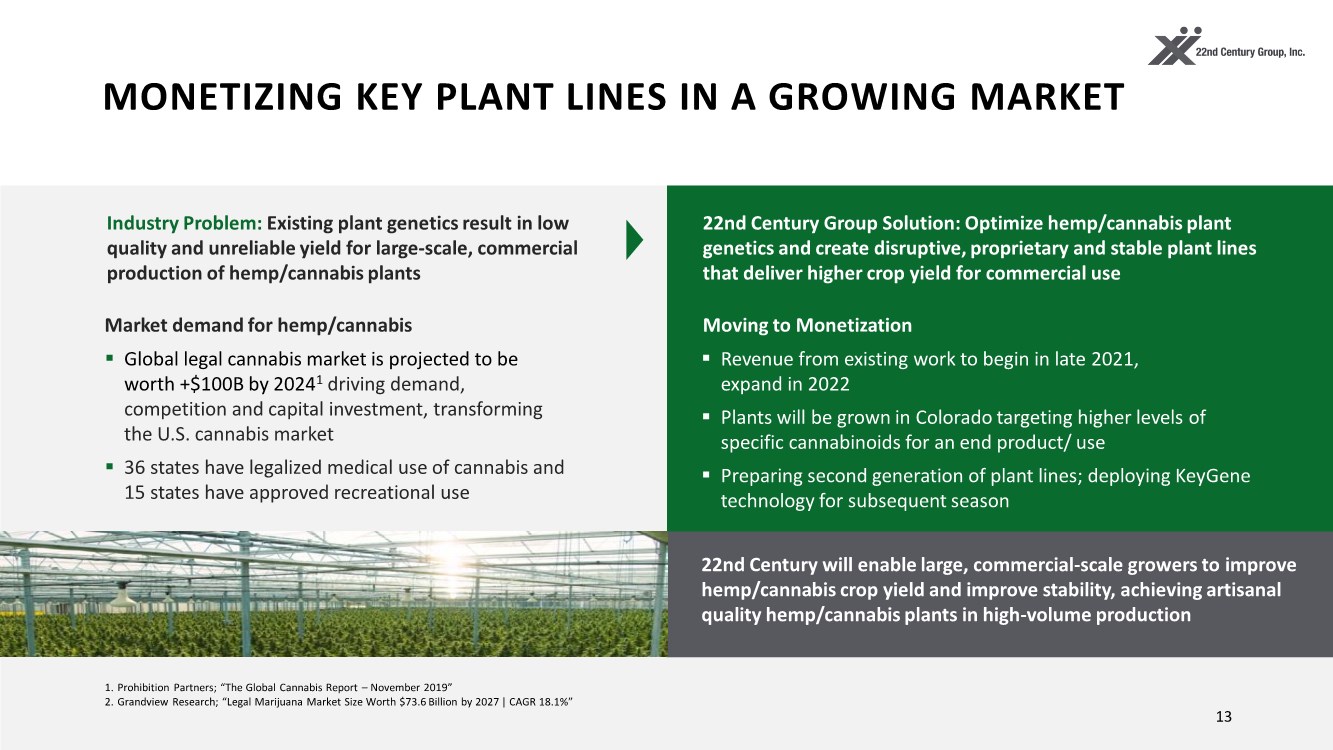

| Industry Problem: Existing plant genetics result in low quality and unreliable yield for large-scale, commercial production of hemp/cannabis plants Market demand for hemp/cannabis ▪ Global legal cannabis market is projected to be worth +$100B by 20241 driving demand, competition and capital investment, transforming the U.S. cannabis market ▪ 36 states have legalized medical use of cannabis and 15 states have approved recreational use MONETIZING KEY PLANT LINES IN A GROWING MARKET 13 ▪ Revenue from existing work to begin in late 2021, expand in 2022 ▪ Plants will be grown in Colorado targeting higher levels of specific cannabinoids for an end product/ use ▪ Preparing second generation of plant lines; deploying KeyGene technology for subsequent season 22nd Century will enable large, commercial-scale growers to improve hemp/cannabis crop yield and improve stability, achieving artisanal quality hemp/cannabis plants in high-volume production 22nd Century Group Solution: Optimize hemp/cannabis plant genetics and create disruptive, proprietary and stable plant lines that deliver higher crop yield for commercial use Moving to Monetization 1. Prohibition Partners; “The Global Cannabis Report – November 2019” 2. Grandview Research; “Legal Marijuana Market Size Worth $73.6 Billion by 2027 | CAGR 18.1%” |

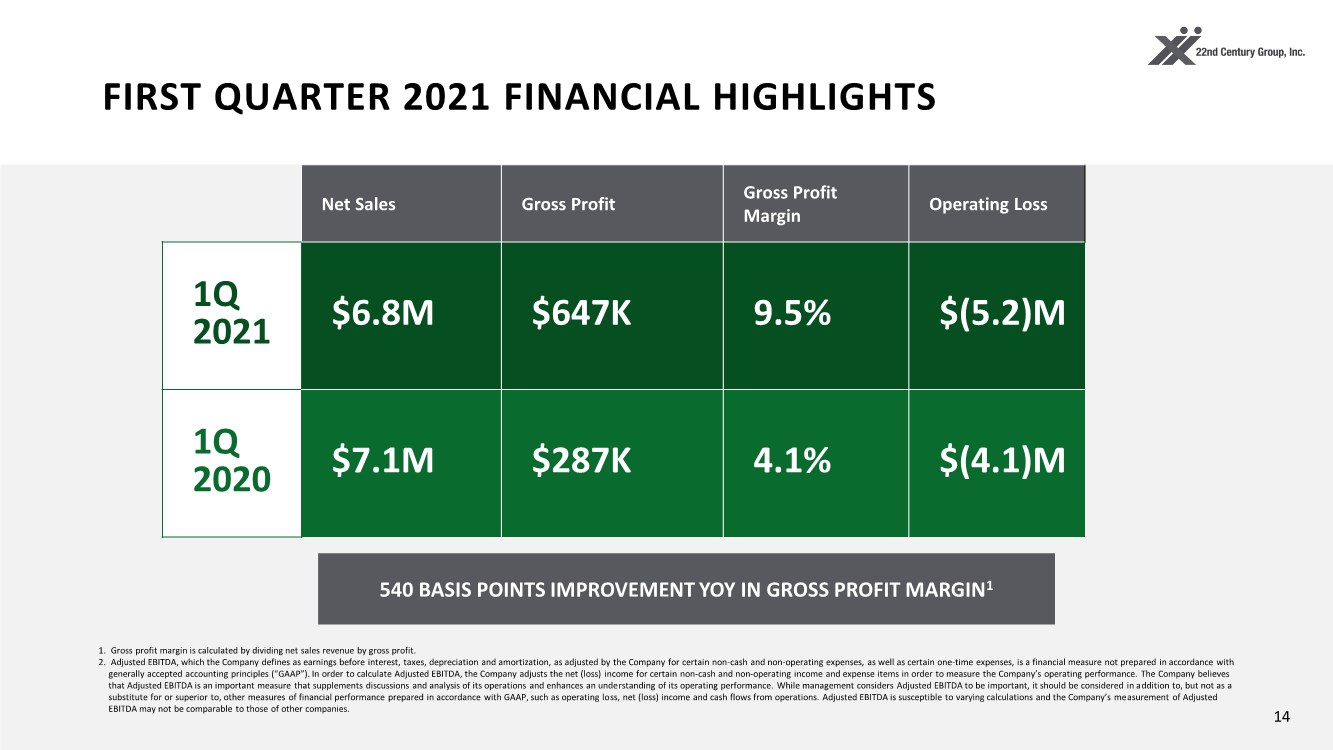

| FIRST QUARTER 2021 FINANCIAL HIGHLIGHTS 14 1. Gross profit margin is calculated by dividing net sales revenue by gross profit. 2. Adjusted EBITDA, which the Company defines as earnings before interest, taxes, depreciation and amortization, as adjusted by the Company for certain non-cash and non-operating expenses, as well as certain one-time expenses, is a financial measure not prepared in accordance with generally accepted accounting principles (“GAAP”). In order to calculate Adjusted EBITDA, the Company adjusts the net (loss) income for certain non-cash and non-operating income and expense items in order to measure the Company’s operating performance. The Company believes that Adjusted EBITDA is an important measure that supplements discussions and analysis of its operations and enhances an understanding of its operating performance. While management considers Adjusted EBITDA to be important, it should be considered in addition to, but not as a substitute for or superior to, other measures of financial performance prepared in accordance with GAAP, such as operating loss, net (loss) income and cash flows from operations. Adjusted EBITDA is susceptible to varying calculations and the Company’s measurement of Adjusted EBITDA may not be comparable to those of other companies. Net Sales Gross Profit Gross Profit Margin Operating Loss 1Q 2021 $6.8M $647K 9.5% $(5.2)M 1Q 2020 $7.1M $287K 4.1% $(4.1)M 540 BASIS POINTS IMPROVEMENT YOY IN GROSS PROFIT MARGIN1 |

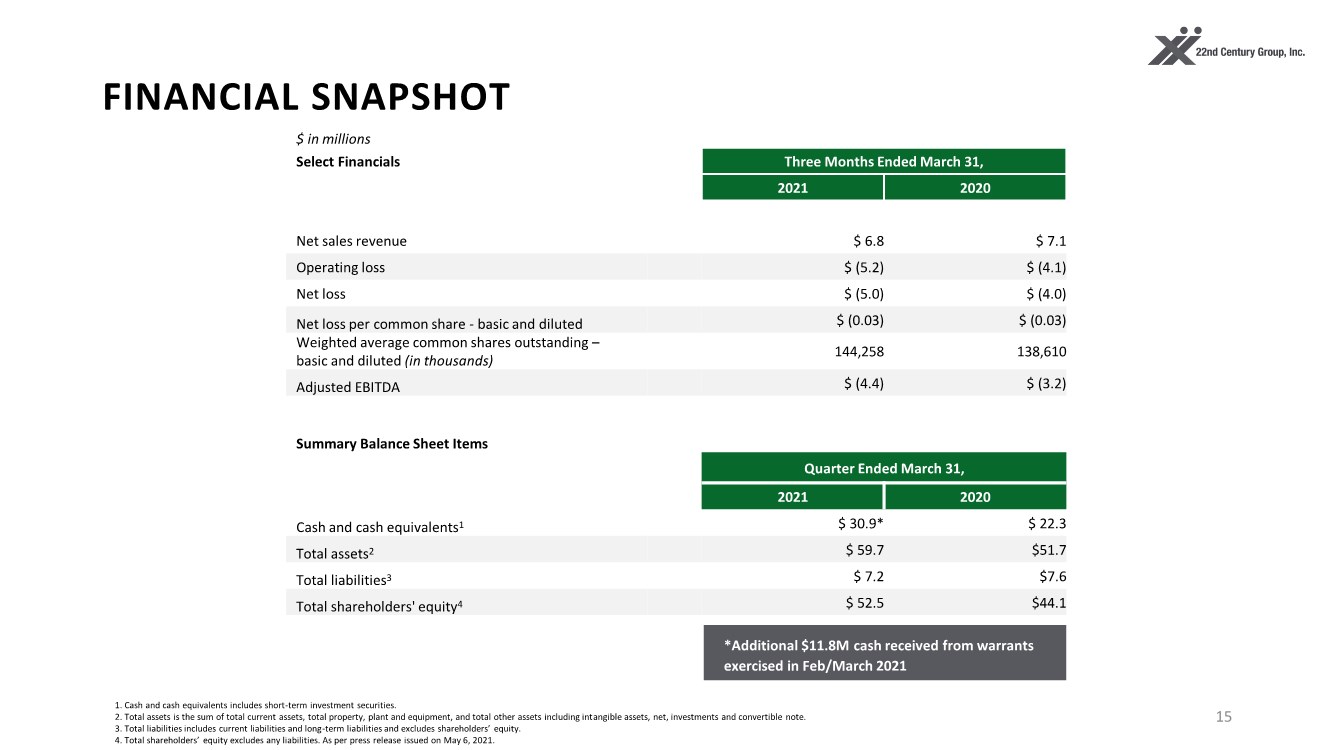

| FINANCIAL SNAPSHOT 15 $ in millions Select Financials Three Months Ended March 31, 2021 2020 Net sales revenue $ 6.8 $ 7.1 Operating loss $ (5.2) $ (4.1) Net loss $ (5.0) $ (4.0) Net loss per common share - basic and diluted $ (0.03) $ (0.03) Weighted average common shares outstanding – basic and diluted (in thousands) 144,258 138,610 Adjusted EBITDA $ (4.4) $ (3.2) Summary Balance Sheet Items Quarter Ended March 31, 2021 2020 Cash and cash equivalents1 $ 30.9* $ 22.3 Total assets2 $ 59.7 $51.7 Total liabilities3 $ 7.2 $7.6 Total shareholders' equity4 $ 52.5 $44.1 1. Cash and cash equivalents includes short-term investment securities. 2. Total assets is the sum of total current assets, total property, plant and equipment, and total other assets including intangible assets, net, investments and convertible note. 3. Total liabilities includes current liabilities and long-term liabilities and excludes shareholders’ equity. 4. Total shareholders’ equity excludes any liabilities. As per press release issued on May 6, 2021. *Additional $11.8M cash received from warrants exercised in Feb/March 2021 |

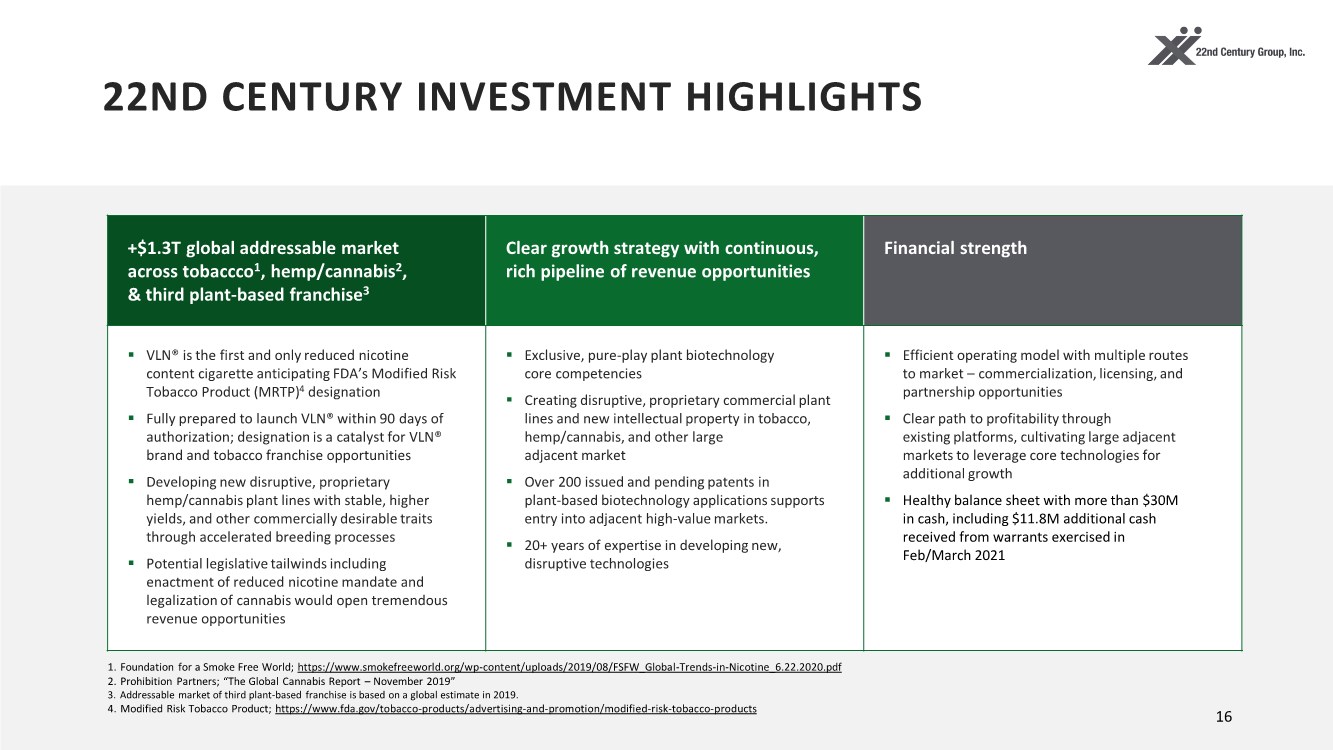

| 22ND CENTURY INVESTMENT HIGHLIGHTS 16 1. Foundation for a Smoke Free World; https://www.smokefreeworld.org/wp-content/uploads/2019/08/FSFW_Global-Trends-in-Nicotine_6.22.2020.pdf 2. Prohibition Partners; “The Global Cannabis Report – November 2019” 3. Addressable market of third plant-based franchise is based on a global estimate in 2019. 4. Modified Risk Tobacco Product; https://www.fda.gov/tobacco-products/advertising-and-promotion/modified-risk-tobacco-products Financial strength +$1.3T global addressable market across tobaccco1, hemp/cannabis2, & third plant-based franchise3 Clear growth strategy with continuous, rich pipeline of revenue opportunities Financial strength ▪ VLN® is the first and only reduced nicotine content cigarette anticipating FDA’s Modified Risk Tobacco Product (MRTP)4 designation ▪ Fully prepared to launch VLN® within 90 days of authorization; designation is a catalyst for VLN® brand and tobacco franchise opportunities ▪ Developing new disruptive, proprietary hemp/cannabis plant lines with stable, higher yields, and other commercially desirable traits through accelerated breeding processes ▪ Potential legislative tailwinds including enactment of reduced nicotine mandate and legalization of cannabis would open tremendous revenue opportunities ▪ Exclusive, pure-play plant biotechnology core competencies ▪ Creating disruptive, proprietary commercial plant lines and new intellectual property in tobacco, hemp/cannabis, and other large adjacent market ▪ Over 200 issued and pending patents in plant-based biotechnology applications supports entry into adjacent high-value markets. ▪ 20+ years of expertise in developing new, disruptive technologies ▪ Efficient operating model with multiple routes to market – commercialization, licensing, and partnership opportunities ▪ Clear path to profitability through existing platforms, cultivating large adjacent markets to leverage core technologies for additional growth ▪ Healthy balance sheet with more than $30M in cash, including $11.8M additional cash received from warrants exercised in Feb/March 2021 |

| 17 Q&A |

| FINANCIAL INFO |

| ADJUSTED EBITDA DEFINITION Adjusted EBITDA, which the Company defines as earnings before interest, taxes, depreciation and amortization, as adjusted by the Company for certain non-cash and non- operating expenses, as well as certain one-time expenses, is a financial measure not prepared in accordance with generally accepted accounting principles (“GAAP”). In order to calculate Adjusted EBITDA, the Company adjusts the net (loss) income for certain non-cash and non- operating income and expense items in order to measure the Company’s operating performance. The Company believes that Adjusted EBITDA is an important measure that supplements discussions and analysis of its operations and enhances an understanding of its operating performance. While management considers Adjusted EBITDA to be important, it should be considered in addition to, but not as a substitute for or superior to, other measures of financial performance prepared in accordance with GAAP, such as operating loss, net (loss) income and cash flows from operations. Adjusted EBITDA is susceptible to varying calculations and the Company’s measurement of Adjusted EBITDA may not be comparable to those of other companies. 19 |

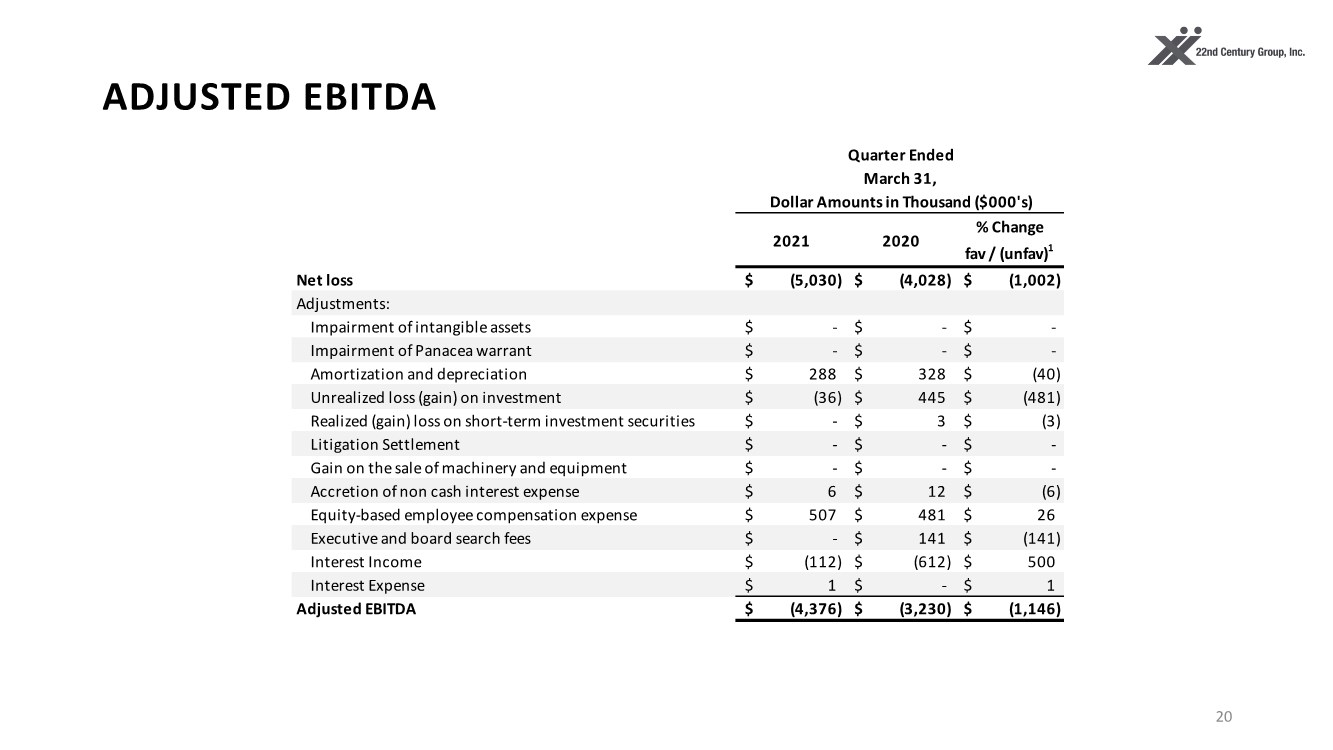

| ADJUSTED EBITDA 20 2021 2020 % Change fav / (unfav)1 Net loss (5,030) $ (4,028) $ (1,002) $ Adjustments: Impairment of intangible assets - $ - $ - $ Impairment of Panacea warrant - $ - $ - $ Amortization and depreciation 288 $ 328 $ (40) $ Unrealized loss (gain) on investment (36) $ 445 $ (481) $ Realized (gain) loss on short-term investment securities - $ 3 $ (3) $ Litigation Settlement - $ - $ - $ Gain on the sale of machinery and equipment - $ - $ - $ Accretion of non cash interest expense 6 $ 12 $ (6) $ Equity-based employee compensation expense 507 $ 481 $ 26 $ Executive and board search fees - $ 141 $ (141) $ Interest Income (112) $ (612) $ 500 $ Interest Expense 1 $ - $ 1 $ Adjusted EBITDA(4,376) $ (3,230) $ (1,146) $ Quarter Ended March 31, Dollar Amounts in Thousand ($000's) |

| CONTACT INFORMATION INVESTOR RELATIONS & MEDIA CONTACT Mei Kuo Director, Communications & Investor Relations 22nd Century Group, Inc. (716) 300-1221 investorrelations@xxiicentury.com |