Attached files

| file | filename |

|---|---|

| 8-K - 8-K - Western Asset Mortgage Capital Corp | wmc-20210505.htm |

| EX-99.1 - EX-99.1 - Western Asset Mortgage Capital Corp | a1q21ex991ng.htm |

First Quarter 2021 Investor Presentation May 5, 2021

We make forward-looking statements in this presentation that are subject to risks and uncertainties, many of which are difficult to predict and are generally beyond the Company's control. In particular, it is difficult to fully assess the impact of COVID-19 at this time due to, among other factors, uncertainty regarding the severity and duration of the outbreak domestically and internationally and the effectiveness of federal, state and local governments’ efforts to contain the spread of COVID-19 and respond to its direct and indirect impact on the U.S. economy and economic activity. These forward-looking statements include information about possible or assumed future results of our business, financial condition, liquidity, results of operations, plans and objectives. When we use the words "believe," "expect," "anticipate," "estimate," "plan," "continue," "intend," "should," "may" or similar expressions, we intend to identify forward-looking statements. Statements regarding the following subjects, among others, may be forward-looking: our business and investment strategy; our projected operating results; our ability to obtain financing arrangements; financing and advance rates for mortgage loans, MBS and our potential target assets; our expected leverage; general volatility of the securities markets in which we invest and the market price of our common stock; our expected investments; interest rate mismatches between mortgage loans, MBS and our potential target assets and our borrowings used to fund such investments; changes in interest rates and the market value of MBS and our potential target assets; changes in prepayment rates on mortgage loans, Agency MBS and Non-Agency MBS; effects of hedging instruments on MBS and our potential target assets; rates of default or decreased recovery rates on our potential target assets; the degree to which any hedging strategies may or may not protect us from interest rate volatility; impact of and changes in governmental regulations, tax law and rates, accounting guidance and similar matters; our ability to maintain our qualification as a REIT; our ability to maintain our exemption from registration under the Investment Company Act of 1940, as amended; availability of investment opportunities in mortgage-related, real estate-related and other securities; availability of qualified personnel; estimates relating to our ability to make distributions to our stockholders in the future; our understanding of our competition; and the uncertainty and economic impact of pandemics, epidemics or other public health emergencies, such as the COVID-19 pandemic. The forward-looking statements in this presentation are based on our beliefs, assumptions and expectations of our future performance, taking into account all information currently available to us. You should not place undue reliance on these forward-looking statements. These beliefs, assumptions and expectations can change as a result of many possible events or factors, not all of which are known to us. Some of these factors are described in our filings with the SEC under the headings "Summary," "Risk factors," "Management's discussion and analysis of financial condition and results of operations" and "Business." If a change occurs, our business, financial condition, liquidity and results of operations may vary materially from those expressed in our forward-looking statements. Any forward-looking statement speaks only as of the date on which it is made. New risks and uncertainties arise over time, and it is not possible for us to predict those events or how they may affect us. Except as required by law, we are not obligated to, and do not intend to, update or revise any forward- looking statements, whether as a result of new information, future events or otherwise. This presentation is not an offer to sell securities nor a solicitation of an offer to buy securities in any jurisdiction where the offer and sale is not permitted. 1 Safe Harbor Statement

Lisa Meyer Chief Financial Officer & Treasurer Jennifer W. Murphy Chief Executive Officer & President Greg Handler Interim Co-Chief Investment Officer 2 Sean Johnson Interim Co-Chief Investment Officer First Quarter 2021 WMC Earnings Call Presenters

3 Western Asset Mortgage Capital Corporation (“WMC”) is a public REIT that benefits from the leading fixed income management capabilities of Western Asset Management Company, LLC ("Western Asset") • One of the world’s leading global fixed income managers, known for team management, proprietary research, robust risk management and a long-term fundamental value approach • AUM of $476.3 billion(1) ◦ AUM of the Mortgage and Consumer Credit Group is $73.8 billion(1) ◦ Extensive mortgage and consumer credit investing track record • Publicly traded mortgage REIT positioned to capture attractive current and long-term investment opportunities in the residential and commercial mortgage markets • Completed Initial Public Offering in May 2012 Please refer to page 19 for footnote disclosures. Overview of Western Asset Mortgage Capital Corporation

4 Please refer to page 19 for footnote disclosures. During the first quarter we continued strengthening our balance sheet by reducing debt and leverage, while improving liquidity and shareholders' equity. First quarter financial results and highlights included the following: ▪ GAAP book value per share of $4.27 at March 31, 2021, an increase of $0.07 from $4.20 at December 31, 2020. ▪ Economic book value(4) per share of $4.02 at March 31, 2021. ▪ GAAP net income of $8.0 million, or $0.13 per basic and diluted share. ▪ Core earnings(2) of $6.1 million, or $0.10 per basic and diluted share. ▪ Economic return(3) on GAAP book value was 3.1% for the quarter. ▪ 2.19% annualized net interest margin(5) on our investment portfolio. ▪ Recourse leverage was 2.0x at March 31, 2021. ▪ On March 23, 2021 we declared a first quarter common dividend of $0.06 per share. ▪ Acquired and retired $6.7 million of convertible senior notes at a discount of approximately 6.3% to par value, reducing the outstanding balance to $168.3 million. ▪ The Company continued to see recovery in most asset values in the first quarter. The Company believes as the economy continues to reopen the investment portfolio is well positioned for further appreciation. First Quarter Financial Highlights

5 The following are the Company's key metrics as of March 31, 2021; Share Price Market Cap (in MMs) March 31, 2021 GAAP Book Value Per Share December 31, 2020 GAAP Book Value Per Share Q1 Book Value Change March 31, 2021 Economic Book Value(4) December 31, 2021 Economic Book Value(4) Q1 Economic Book Value Change $3.19 $194.0 $4.27 $4.20 1.7% $4.02 $4.19 (4.1)% Price to GAAP Book Value Q1 Dividend Q1 Dividend Yield Q1 Economic Return(3) Recourse Leverage Net Interest Margin(5) 74.7% $0.06 7.5% 3.1% 2.0x 2.19% Please refer to page 19 for footnote disclosures. Key Metric

Portfolio Summary ($ in thousands) March 31, 2021 No. of Investments Principal Balance Amortized Cost Fair Value Residential Whole Loans 2,296 $ 889,713 $ 910,115 $ 929,215 Commercial Loans 11 325,296 325,212 312,061 Non-Agency CMBS, including IOs 25 226,998 206,236 146,031 Agency and Non-Agency RMBS, including IOs 16 37,820 29,510 28,288 Securitized Commercial Loan(7) 2 1,688,625 1,559,302 1,636,127 Residential Bridge Loans(6) 26 13,445 13,446 12,315 Other Securities(8) 10 51,455 48,608 48,666 2,386 $ 3,233,352 $ 3,092,429 $ 3,112,703 57.0% 31.4% 4.9% 3.5%1.6% 1.6% Retail and Entertainment Residential Hotel Nursing Home/Assisted Living Facilities Office Other Property Type 6 52.6% 29.9% 10.0% 4.7%1.6% 0.9% 0.4% Securitized Commercial Loans Residential Whole-Loans Commercial Loans Non-Agency CMBS Other Securities Agency and Non-Agency RMBS Residential Bridge Loans Please refer to page 19 for footnote disclosures. Investment Portfolio Overview Investment Type

7 Overview ($ in thousands) March 31, 2021 Total number of loans 2,296 Principal $ 889,713 Fair value $ 929,215 Unrealized gain $ 19,100 Weighted average remaining term in years 27.2 Weighted average LTV 62.8 % Weighted average original FICO score(17) 743 Loan Performance Geographic Concentration 66.2% 24.6% 7.6%1.1% 0.5% West Northeast Southeast Southwest Midwest N um be r o f L oa ns 12 2,234 14 5 5 26 Loans in Forbearance Current 1-30 Days 31-60 Days 61-90 Days 90+ Days 0 250 500 750 1,000 1,250 1,500 1,750 2,000 2,250 2,500 2,750 3,000 Residential Whole Loans Please refer to page 19 for footnote disclosures.

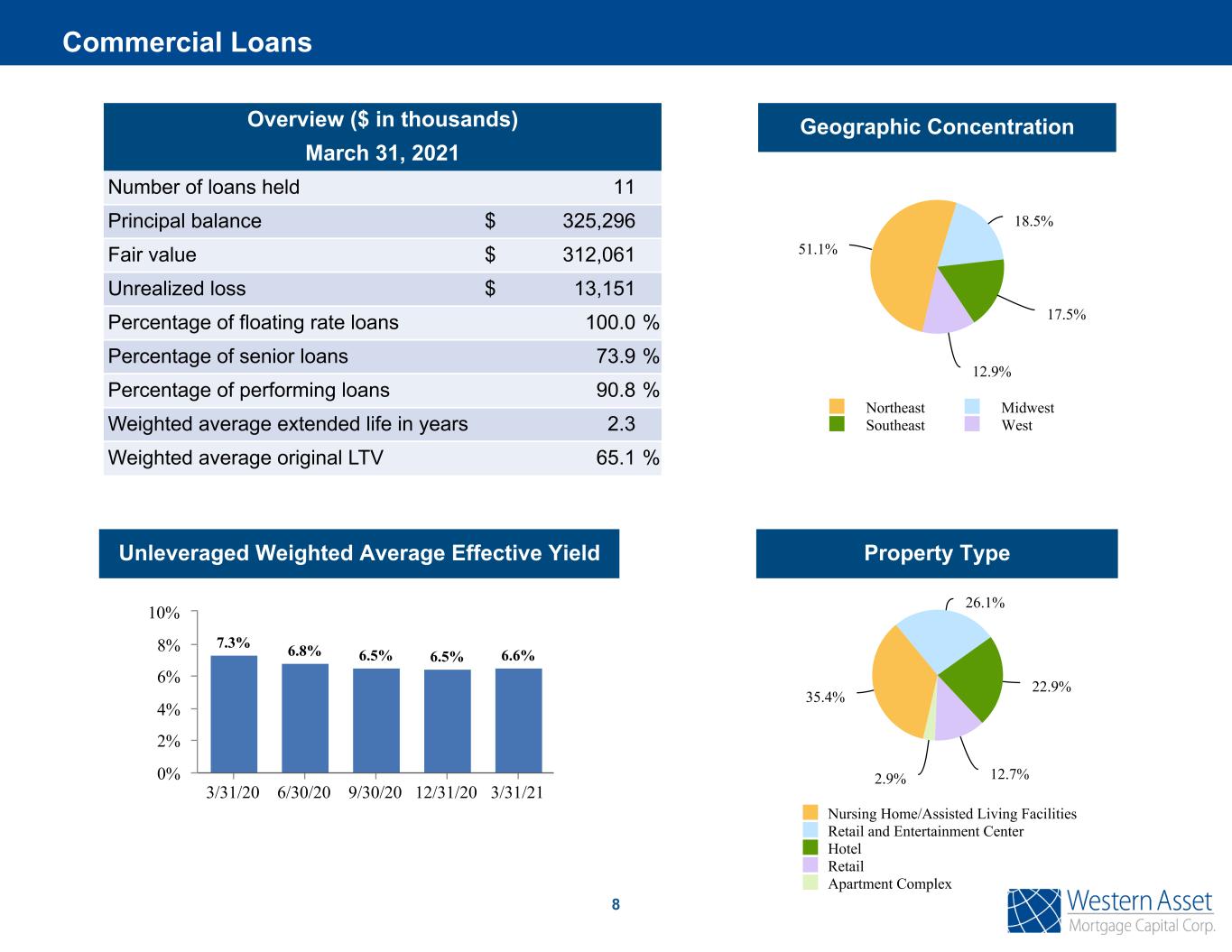

8 Overview ($ in thousands) March 31, 2021 Number of loans held 11 Principal balance $ 325,296 Fair value $ 312,061 Unrealized loss $ 13,151 Percentage of floating rate loans 100.0 % Percentage of senior loans 73.9 % Percentage of performing loans 90.8 % Weighted average extended life in years 2.3 Weighted average original LTV 65.1 % 35.4% 26.1% 22.9% 12.7%2.9% Nursing Home/Assisted Living Facilities Retail and Entertainment Center Hotel Retail Apartment Complex Property Type Geographic Concentration 51.1% 18.5% 17.5% 12.9% Northeast Midwest Southeast West Unleveraged Weighted Average Effective Yield 7.3% 6.8% 6.5% 6.5% 6.6% 3/31/20 6/30/20 9/30/20 12/31/20 3/31/21 0% 2% 4% 6% 8% 10% Commercial Loans

9 Overview ($ in thousands) March 31, 2021 Total number of investments 25 Principal $ 226,998 Fair value $ 146,031 Unrealized loss $ 60,205 Weighted average expected life in years 2.8 Weighted average original LTV 65.4 % 81.7% 17.4%0.9% Non-Investment Grade Investment Grade D/Not Rated 1.1% 0.8% 8.7% 0.3% 9.6% 7.7% 8.7% 3.1% 11.8% 46.0% 2.2% 2006 2007 2011 2012 2014 2015 2016 2017 2018 2019 2020 0% 5% 10% 15% 20% 25% 30% 35% 40% 45% 50% Ratings Category Vintage Vintage Year 54.8% 34.0% 11.2% Hotel Office Retail Property Type Geographic Concentration 44.1% 24.9% 10.8% 10.3% 6.5%3.4% West Midwest Northeast Bahamas Southeast Southwest Non-Agency CMBS Investments

10 Overview March 31, 2021 Total number of investments 2 Principal $ 1,688,625 Fair value $ 1,636,127 Unrealized gain $ 76,825 Weighted average expected life in years 3.8 Weighted average yield 6.3 % Geographic Concentration 84.6% 5.7% 4.0% 3.0%2.7% Midwest Northeast Southeast Southwest Puerto Rico Securitized Commercial Loan Portfolio Principal Amortized Cost Fair Value Property Type RETL 2019 - RVP $ 303,034 $ 303,092 $ 299,328 Retail CSMC Trust 2014 - USA 1,385,591 1,256,210 1,336,799 Retail and Entertainment Center $ 1,688,625 $ 1,559,302 $ 1,636,127 The Company had variable interests in two third party sponsored CMBS VIEs, RETL 2019-RVP and CSMC Trust 2014-USA. The Company determined that it was the primary beneficiary of these VIEs and was required to consolidate. The securitized commercial loans that serve as collateral for the securitized debt issued by these VIEs can only be used to settle the securitized debt. The following table represents the Company's economic exposure to these VIEs, which is limited to the fair value if its investments: Investments in CMBS VIEs Principal Amortized Cost Fair Value RETL 2019 - RVP - Class HRR $ 45,300 $ 45,300 $ 42,865 CSMC Trust 2014 - USA - Class F 14,900 13,824 10,821 $ 60,200 $ 59,124 $ 53,686 Securitized Commercial Loans ($ in thousands)

11 Please refer to page 19 for footnote disclosures. For Three Months Ended March 31, 2021 ($ in thousands - except per share data) Agency RMBS Non- Agency CMBS Non- Agency RMBS Residential Whole- Loans Residential Bridge Loans(6) Other Securities(8) Commercial Loans Securitized Commercial Loans(16) Total Interest income(12) $ 31 $ 4,768 355 $ 10,058 $ 229 $ 822 $ 5,217 $ 24,564 $ 46,044 Interest expense(13) (7) (1,293) (253) (9,703) (115) (310) (1,633) (23,455) (36,769) Miscellaneous interest income(14) — — — — (28) — — (28) Net interest income 24 3,475 102 355 114 484 3,584 1,109 9,247 Realized gain (loss) on investments — (5,929) — — (36) — — — (5,965) Unrealized gain (loss) on investments(15) 25 (13,973) 1,454 17,322 203 681 1,623 75,809 83,144 Securitized debt unrealized gain (loss) — — — — — — — (74,095) (74,095) Gain (loss) on derivative instruments, net — — — — — (1) — — (1) Portfolio income (loss) $ 49 $ (16,427) $ 1,556 $ 17,677 $ 281 $ 1,164 $ 5,207 $ 2,823 $ 12,330 BV per share increase (decrease) $ — $ (0.27) $ 0.02 $ 0.29 $ — $ 0.02 $ 0.09 $ 0.05 $ 0.20 First Quarter Portfolio Income Attribution(11)

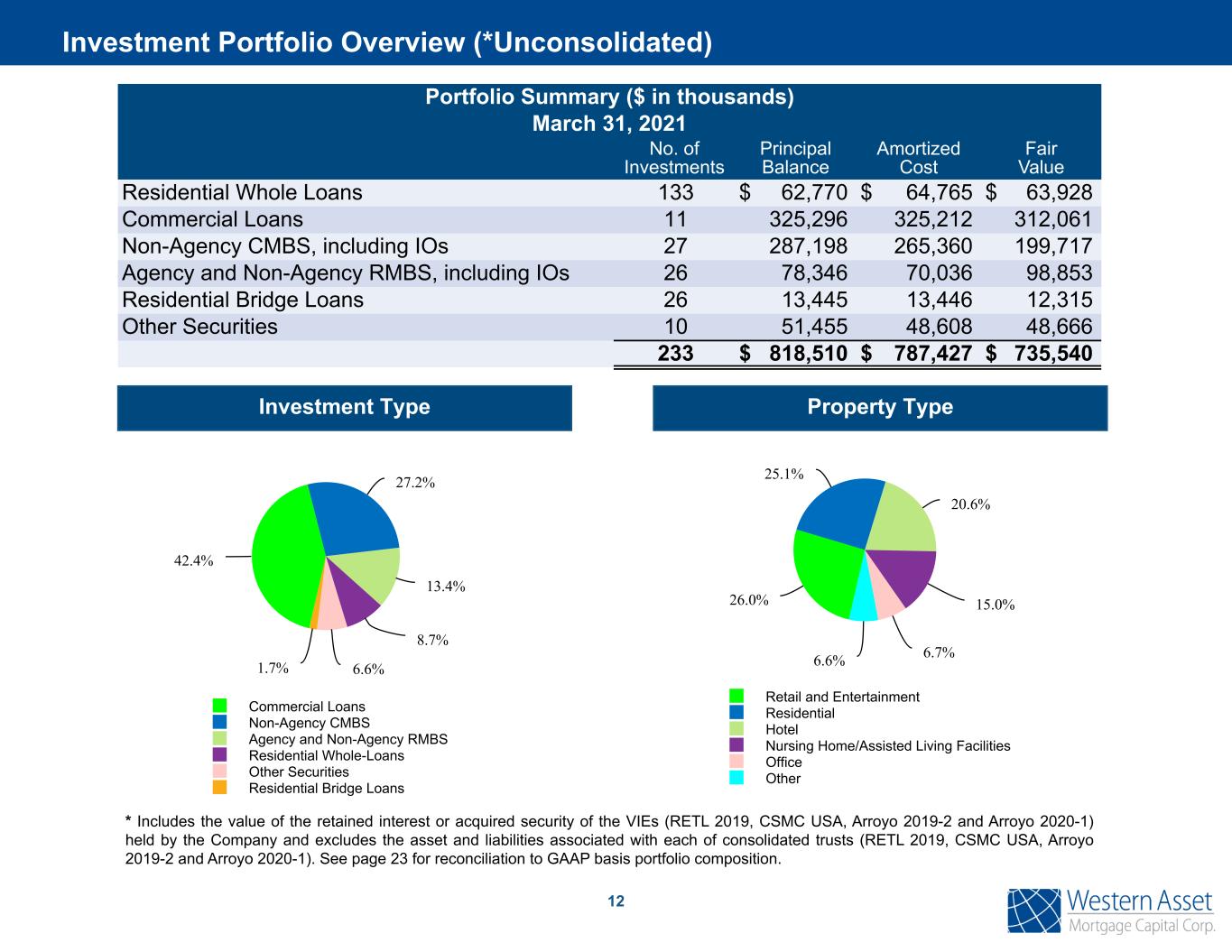

42.4% 27.2% 13.4% 8.7% 6.6%1.7% Commercial Loans Non-Agency CMBS Agency and Non-Agency RMBS Residential Whole-Loans Other Securities Residential Bridge Loans Portfolio Summary ($ in thousands) March 31, 2021 No. of Investments Principal Balance Amortized Cost Fair Value Residential Whole Loans 133 $ 62,770 $ 64,765 $ 63,928 Commercial Loans 11 325,296 325,212 312,061 Non-Agency CMBS, including IOs 27 287,198 265,360 199,717 Agency and Non-Agency RMBS, including IOs 26 78,346 70,036 98,853 Residential Bridge Loans 26 13,445 13,446 12,315 Other Securities 10 51,455 48,608 48,666 233 $ 818,510 $ 787,427 $ 735,540 26.0% 25.1% 20.6% 15.0% 6.7%6.6% Retail and Entertainment Residential Hotel Nursing Home/Assisted Living Facilities Office Other * Includes the value of the retained interest or acquired security of the VIEs (RETL 2019, CSMC USA, Arroyo 2019-2 and Arroyo 2020-1) held by the Company and excludes the asset and liabilities associated with each of consolidated trusts (RETL 2019, CSMC USA, Arroyo 2019-2 and Arroyo 2020-1). See page 23 for reconciliation to GAAP basis portfolio composition. 12 Investment Portfolio Overview (*Unconsolidated) Investment Type Property Type

Repurchase Agreement Financing March 31, 2021 Outstanding Borrowings Weighted Average Interest Rate Interest Rate Weighted Average Remaining Days to Maturity Short-Term Borrowings Agency RMBS $ 1,242 1.13% 59 Non-Agency CMBS 10,312 2.01% 42 Residential Whole Loans 29,373 3.17% 15 Residential Bridge Loans 10,097 2.70% 35 Commercial Loans 34,375 3.29% 77 Membership Interest 19,551 2.86% 1 Other Securities(8) 2,467 4.50% 19 Subtotal 107,417 3.00% 37 Long-Term Borrowings: Non-Agency CMBS 65,914 5.19% 36 Non-Agency RMBS 14,456 5.20% 36 Residential Whole Loans (9) 27,923 3.00% 188 Commercial Loans (9) 119,167 2.09% 202 Other Securities(8) 13,502 5.19% 36 Subtotal 240,962 3.41% 136 Repurchase agreements borrowings 348,379 3.28% 105 Less unamortized debt issuance costs 1,247 N/A N/A Repurchase agreements borrowings, net $ 347,132 3.28% 105 13 At March 31, 2021, the Company had borrowings under five master repurchase agreements. Of the $348.4 million in outstanding borrowings, $241.0 million of the borrowings are in long-term facilities with limited mark to market margin call exposure. Please refer to page 19 for footnote disclosures. Financing ($ in thousands)

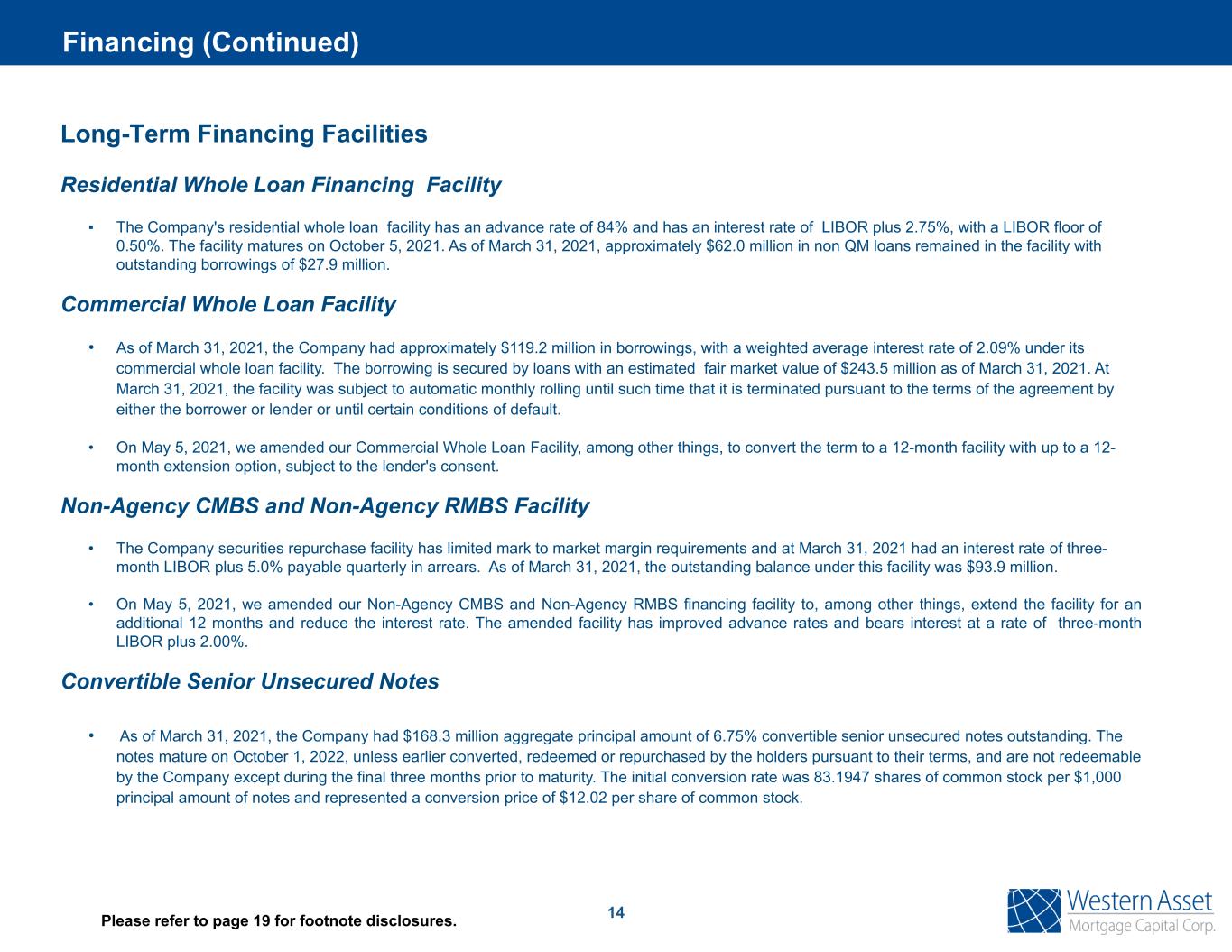

Long-Term Financing Facilities Residential Whole Loan Financing Facility ▪ The Company's residential whole loan facility has an advance rate of 84% and has an interest rate of LIBOR plus 2.75%, with a LIBOR floor of 0.50%. The facility matures on October 5, 2021. As of March 31, 2021, approximately $62.0 million in non QM loans remained in the facility with outstanding borrowings of $27.9 million. Commercial Whole Loan Facility • As of March 31, 2021, the Company had approximately $119.2 million in borrowings, with a weighted average interest rate of 2.09% under its commercial whole loan facility. The borrowing is secured by loans with an estimated fair market value of $243.5 million as of March 31, 2021. At March 31, 2021, the facility was subject to automatic monthly rolling until such time that it is terminated pursuant to the terms of the agreement by either the borrower or lender or until certain conditions of default. • On May 5, 2021, we amended our Commercial Whole Loan Facility, among other things, to convert the term to a 12-month facility with up to a 12- month extension option, subject to the lender's consent. Non-Agency CMBS and Non-Agency RMBS Facility • The Company securities repurchase facility has limited mark to market margin requirements and at March 31, 2021 had an interest rate of three- month LIBOR plus 5.0% payable quarterly in arrears. As of March 31, 2021, the outstanding balance under this facility was $93.9 million. • On May 5, 2021, we amended our Non-Agency CMBS and Non-Agency RMBS financing facility to, among other things, extend the facility for an additional 12 months and reduce the interest rate. The amended facility has improved advance rates and bears interest at a rate of three-month LIBOR plus 2.00%. Convertible Senior Unsecured Notes • As of March 31, 2021, the Company had $168.3 million aggregate principal amount of 6.75% convertible senior unsecured notes outstanding. The notes mature on October 1, 2022, unless earlier converted, redeemed or repurchased by the holders pursuant to their terms, and are not redeemable by the Company except during the final three months prior to maturity. The initial conversion rate was 83.1947 shares of common stock per $1,000 principal amount of notes and represented a conversion price of $12.02 per share of common stock. 14Please refer to page 19 for footnote disclosures. Financing (Continued)

Non-Recourse Financings Mortgage-Backed Notes The residential mortgage-backed notes issued by the Company for the Arroyo Trust 2019-2 and the Arroyo Trust 2020-1 securitizations can only be settled with the residential loans that serve as collateral for the securitized debt and are non-recourse to the Company. These notes are carried at amortized cost on the Company's Consolidated Balance Sheets. The Company retained the subordinate bonds, and these bonds had a fair market value of $40.5 million and $30.1 million, respectively, at March 31, 2021. The retained subordinate bonds for both securitizations are eliminated in consolidation. ▪ The following table summarizes the residential mortgage-backed notes issued by the Company's Arroyo Trust 2019 securitization at March 31, 2021 (dollars in thousands): ▪ The following table summarizes the residential mortgage-backed notes issued by the Company's Arroyo Trust 2020 securitization at March 31, 2021 (dollars in thousands): 15Please refer to page 19 for footnote disclosures. Classes Principal Balance Coupon Carrying Value Contractual Maturity Offered Notes:(10) Class A-1 $ 460,106 3.3% $ 460,104 4/25/2049 Class A-2 24,658 3.5% 24,657 4/25/2049 Class A-3 39,065 3.8% 39,064 4/25/2049 Class M-1 25,055 4.8% 25,055 4/25/2049 548,884 548,880 Less: Unamortized Deferred Financing Cost N/A 4,177 Total $ 548,884 $ 544,703 Classes Principal Balance Coupon Carrying Value Contractual Maturity Offered Notes:(10) Class A-1A $ 198,598 1.7% $ 198,593 3/25/2055 Class A-1B 23,566 2.1% 23,566 3/25/2055 Class A-2 13,518 2.9% 13,517 3/25/2055 Class A-3 17,963 3.3% 17,963 3/25/2055 Class M-1 11,739 4.3% 11,739 3/25/2055 Subtotal 265,384 265,378 Less: Unamortized Deferred Financing Costs N/A 2,399 Total $ 265,384 $ 262,979 Financing (Continued)

16 As of March 31, 2021, the Company had two consolidated commercial mortgage-backed variable interest entities that had an aggregate securitized debt balance of $1.6 billion. The securitized debt of the trusts can only be settled with the collateral held by the trusts and is non-recourse to the Company. The Company holds an interest in certain subordinate bonds of the RETL 2019 and CMSC 2014 USA securitzations and these bonds had a fair market value of $42.9 million and $10.8 million, respectively, at March 31, 2021. The retained subordinate bonds for both securitizations are not reflected in the below tables because they are eliminated in consolidation. The following table summarizes RETL 2019 Trust's commercial mortgage pass-through certificates at March 31, 2021 (dollars in thousands): The following table summarizes CSMC 2014 USA's commercial mortgage pass-through certificates at March 31, 2021 (dollars in thousands): Classes Principal Balance Coupon Carrying Value Contractual Maturity Class C $ 257,734 2.2% $ 256,436 3/15/2022 Class X-EXT (Interest Only) N/A 1.2% — 3/15/2022 $ 257,734 $ 256,462 Classes Principal Balance Coupon Carrying Value Contractual Maturity Class A-1 $ 120,391 3.3% $ 122,992 9/11/2025 Class A-2 531,700 4.0% 557,729 9/11/2025 Class B 136,400 4.2% 135,402 9/11/2025 Class C 94,500 4.3% 92,155 9/11/2025 Class D 153,950 4.4% 142,388 9/11/2025 Class E 180,150 4.4% 148,840 9/11/2025 Class F 153,600 4.4% 111,553 9/11/2025 Class X-1 (Interest Only) N/A 0.7% 12,347 9/11/2025 Class X-2 (Interest Only) N/A 0.2% 2,572 9/11/2025 $ 1,370,691 $ 1,325,978 Financing (Continued)

17 Economic • Global economy is recovering from pandemic-induced slowdown. • Fiscal and monetary policy is expected to remain supportive. • Second half should see meaningful pick-up in growth as economy “reopens.” • Global economic slack, debt burdens, labor market scarring, and Small and Mid-sized Enterprises/Business disruption will take years to absorb. • Central bank policy rates are expected to be very low for very long. • Inflation pick-up will prove transitory — not persistent. Cyclical vs. Secular • The near-term cyclical outlook is very strong. Longer-term, the recovery and inflation rates will downshift. Investment implications • Reopening driven spread products are expected to outperform Treasury and Sovereign bonds. • Interest rates are expected to be broadly range-bound. 2021 Outlook

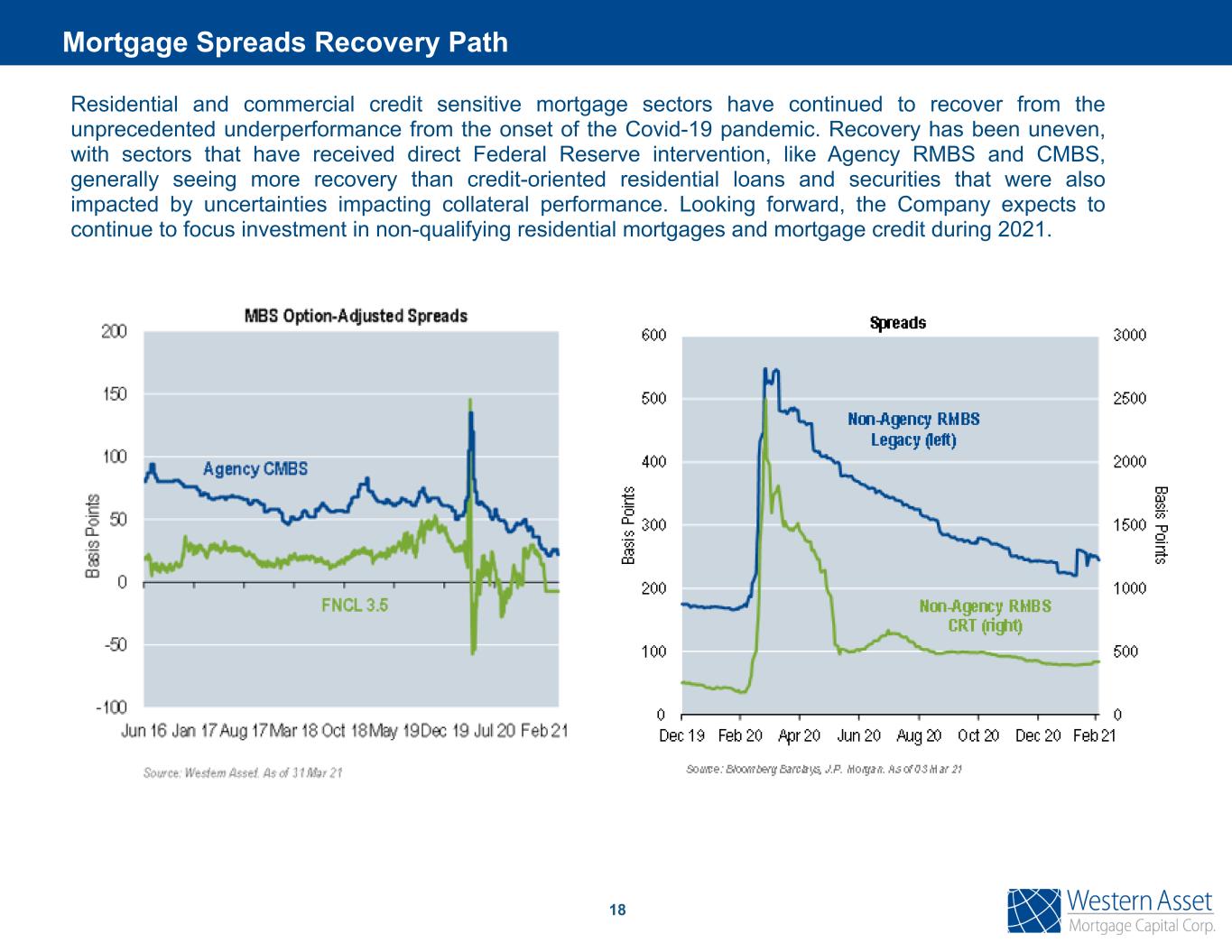

18 Residential and commercial credit sensitive mortgage sectors have continued to recover from the unprecedented underperformance from the onset of the Covid-19 pandemic. Recovery has been uneven, with sectors that have received direct Federal Reserve intervention, like Agency RMBS and CMBS, generally seeing more recovery than credit-oriented residential loans and securities that were also impacted by uncertainties impacting collateral performance. Looking forward, the Company expects to continue to focus investment in non-qualifying residential mortgages and mortgage credit during 2021. Mortgage Spreads Recovery Path

19 (1) As of March 31, 2021. (2) Core Earnings is a non-GAAP financial measure that is used by us to approximate cash yield or income associated with our portfolio and is defined as GAAP net income (loss) as adjusted, excluding, net realized gain (loss) on investments and termination of derivative contracts, net unrealized gain (loss) on investments and debt, net unrealized gain (loss) resulting from mark-to-market adjustments on derivative contracts, provision for income taxes, non-cash stock-based compensation expense, non-cash amortization of the convertible senior unsecured notes discount, one-time charges such as acquisition costs and impairment on loans and one-time events pursuant to changes in GAAP and certain other non-cash charges after discussions between us, our Manager and our Independent Directors and after approval by a majority of our independent directors. (3) Economic return, for any period, is calculated by taking the sum of (i) the total dividends declared and (ii) the change in net book value during the period and dividing by the beginning book value. (4) Economic book value is a non-GAAP financial measure of our financial position on an unconsolidated basis. The Company owns certain securities that represent a controlling variable interest, which under GAAP requires consolidation; however, the Company's economic exposure to these variable interests is limited to the fair value of the individual investments. Economic book value is calculated by taking the GAAP book value and 1) adding the fair value of the retained interest or acquired security of the VIEs held by the Company and 2) the removing the asset and liabilities associated with each of consolidated trusts (RETL 2019, CSMC 2014 USA, Arroyo 2019-2 and Arroyo 2020-1). Management considers that Economic book value provides investors with a useful supplemental measure to evaluate our financial position as it reflects the actual financial interest of these investments irrespective of the variable interest consolidation model applied for GAAP reporting purposes. Economic book value does not represent and should not be considered as a substitute for Stockholders' Equity, as determined in accordance with GAAP, and our calculation of this measure may not be comparable to similarly titled measures reported by other companies. (5) Non-GAAP measures which include interest income, interest expense, the cost of interest rate swaps and interest income on IOs and IIOs classified as derivatives, and are weighted averages for the period. Excludes the net income from the consolidation of VIE Trusts required under GAAP. (6) The bridge loans acquired prior to October 25, 2017 are carried at amortized costs, since we did not elect the fair value option for these loans. For the bridge loans acquired subsequent to October, 25, 2017, we elected the fair value option to be consistent with the accounting of other investments. Accordingly, the carrying amount of the bridge loans as of March 31, 2021 includes $11.2 million of residential bridge loans carried at fair value and $1.1 million of residential bridge loans carried at amortized costs. (7) At March 31, 2021, the Company held two Non-Agency CMBS securities with a total fair market value of a $53.7 million, which resulted in the consolidation of two variable interest entities. The Securitized Commercial loans value represents the estimated fair market value of two single loans within two variable interest entities. (8) Other investments include ABS and GSE Credit Risk Transfer securities. (9) Certain Residential Whole Loans and Commercial Loans were financed under two longer term repurchase agreements. These facilities automatically renew until such time as they are terminated or until certain conditions of default. The weighted average remaining maturity days was calculated using expected weighted life of the underlying collateral. (10) The subordinate notes were retained by the Company. (11) Non-GAAP measure which includes net interest margin (as defined in footnote 5) and realized and unrealized gains or losses in the portfolio. (12) Non-GAAP measure which includes interest income on IO's and IIO's accounted for as derivatives and other income. (13) Convertible senior notes interest expense has been allocated based on fair value of investments at March 31, 2021. (14) Includes miscellaneous fees and interest on cash investments. (15) Non-GAAP measure which includes net unrealized losses on IO's and IIO's accounted for as derivatives. (16) The portfolio income attribution for securitized commercial loan is presented on a consolidated basis. (17) The original FICO score is not available for 223 loans with a principal balance of approximately $69.7 million at March 31, 2021. The Company has excluded these loans from the weighted average computations. Footnotes

20 Supplemental Information

21 Please refer to page 19 for footnote disclosures. Amounts Per Share GAAP book value at December 31, 2020 $ 255,112 $ 4.20 Common dividend (3,649) (0.06) 251,463 4.14 Portfolio income Net interest margin 9,247 0.15 Realized gain (loss), net (5,950) (0.10) Unrealized gain (loss) on, net 9,033 0.15 Net portfolio income 12,330 0.20 Net realized gain (loss) on debt extinguishment 240 — Operating expenses (1,869) (0.03) General and administrative expenses, excluding equity based compensation (2,467) (0.04) Provision for taxes (98) — GAAP book value at March 31, 2021 $ 259,599 $ 4.27 Adjustments to deconsolidate VIEs and reflect the Company's interest in the securities owned Deconsolidation of the VIEs' assets (2,559,956) (42.09) Deconsolidation of the VIEs' liabilities 2,420,377 39.80 Interest in securities of VIEs owned, at fair value 124,250 2.04 Economic book(4) value at March 31, 2021 $ 244,270 $ 4.02 Book Value Roll Forward ($ in thousands)

22 *Excludes consolidation of VIE Trusts required under GAAP Please refer to page 19 for footnote disclosures. Total Investment Portfolio ($ in thousands) March 31, 2021 Consolidated (As Reported) Investments of Consolidated VIEs Interest in securities of VIEs owned Unconsolidated (Non GAAP) Residential Whole Loans $ 929,215 $ (865,287) $ — $ 63,928 Commercial Loans 312,061 — — 312,061 Non-Agency CMBS, including IOs 146,031 — 53,686 199,717 Agency and Non-Agency RMBS, including IOs 28,288 — 70,565 98,853 Securitized Commercial Loan(7) 1,636,127 (1,636,127) — — Residential Bridge Loans(6) 12,315 — — 12,315 Other Securities(8) 48,666 — — 48,666 Total $ 3,112,703 $ (2,501,414) $ 124,251 $ 735,540 Adjusted* Portfolio Composition

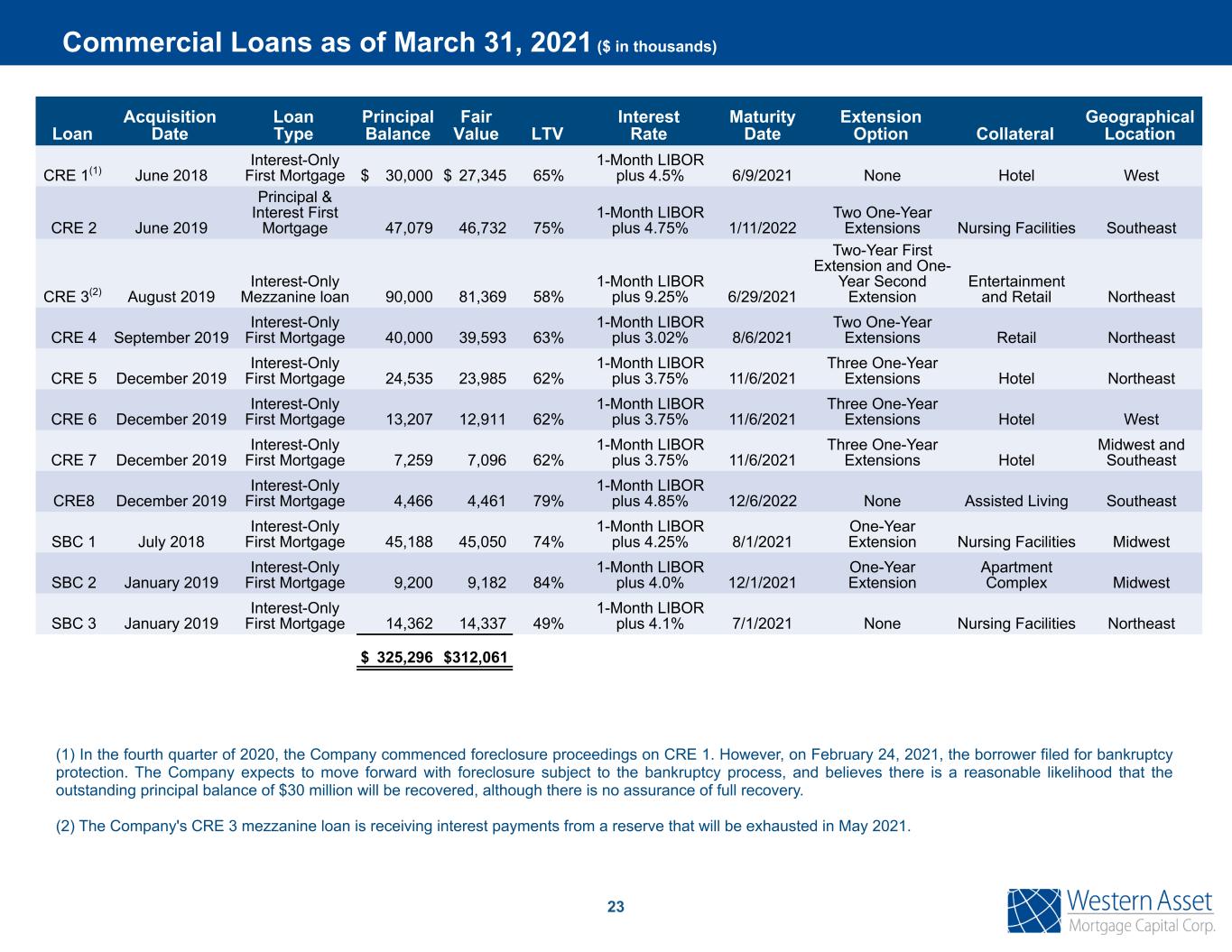

23 Loan Acquisition Date Loan Type Principal Balance Fair Value LTV Interest Rate Maturity Date Extension Option Collateral Geographical Location CRE 1(1) June 2018 Interest-Only First Mortgage $ 30,000 $ 27,345 65% 1-Month LIBOR plus 4.5% 6/9/2021 None Hotel West CRE 2 June 2019 Principal & Interest First Mortgage 47,079 46,732 75% 1-Month LIBOR plus 4.75% 1/11/2022 Two One-Year Extensions Nursing Facilities Southeast CRE 3(2) August 2019 Interest-Only Mezzanine loan 90,000 81,369 58% 1-Month LIBOR plus 9.25% 6/29/2021 Two-Year First Extension and One- Year Second Extension Entertainment and Retail Northeast CRE 4 September 2019 Interest-Only First Mortgage 40,000 39,593 63% 1-Month LIBOR plus 3.02% 8/6/2021 Two One-Year Extensions Retail Northeast CRE 5 December 2019 Interest-Only First Mortgage 24,535 23,985 62% 1-Month LIBOR plus 3.75% 11/6/2021 Three One-Year Extensions Hotel Northeast CRE 6 December 2019 Interest-Only First Mortgage 13,207 12,911 62% 1-Month LIBOR plus 3.75% 11/6/2021 Three One-Year Extensions Hotel West CRE 7 December 2019 Interest-Only First Mortgage 7,259 7,096 62% 1-Month LIBOR plus 3.75% 11/6/2021 Three One-Year Extensions Hotel Midwest and Southeast CRE8 December 2019 Interest-Only First Mortgage 4,466 4,461 79% 1-Month LIBOR plus 4.85% 12/6/2022 None Assisted Living Southeast SBC 1 July 2018 Interest-Only First Mortgage 45,188 45,050 74% 1-Month LIBOR plus 4.25% 8/1/2021 One-Year Extension Nursing Facilities Midwest SBC 2 January 2019 Interest-Only First Mortgage 9,200 9,182 84% 1-Month LIBOR plus 4.0% 12/1/2021 One-Year Extension Apartment Complex Midwest SBC 3 January 2019 Interest-Only First Mortgage 14,362 14,337 49% 1-Month LIBOR plus 4.1% 7/1/2021 None Nursing Facilities Northeast $ 325,296 $ 312,061 (1) In the fourth quarter of 2020, the Company commenced foreclosure proceedings on CRE 1. However, on February 24, 2021, the borrower filed for bankruptcy protection. The Company expects to move forward with foreclosure subject to the bankruptcy process, and believes there is a reasonable likelihood that the outstanding principal balance of $30 million will be recovered, although there is no assurance of full recovery. (2) The Company's CRE 3 mezzanine loan is receiving interest payments from a reserve that will be exhausted in May 2021. Commercial Loans as of March 31, 2021 ($ in thousands)

Western Asset Mortgage Capital Corporation c/o Financial Profiles, Inc. 11601 Wilshire Blvd., Suite 1920 Los Angeles, CA 90025 www.westernassetmcc.com Investor Relations Contact: Larry Clark Tel: (310) 622-8223 lclark@finprofiles.com Contact Information