Attached files

| file | filename |

|---|---|

| 8-K - 8-K - Murphy USA Inc. | musa-20210505.htm |

Murphy USA Inc. 1 Annual Shareholder Meeting May 2021

Murphy USA Inc. 2 Cautionary statement This presentation contains forward-looking statements. These statements, which express management’s current views concerning future events or results, are subject to inherent risks and uncertainties. Factors that could cause actual results to differ materially from those expressed or implied in our forward-looking statements include, but are not limited to, the volatility and level of crude oil and gasoline prices, the pace and success of our expansion plan, our relationship with Walmart, political and regulatory uncertainty, our ability to realize projected synergies from the acquisition of QuickChek and successfully expand our food and beverage offerings, uncontrollable natural hazards, and adverse market conditions or tax consequences, among other things. For further discussion of risk factors, see “Risk Factors” in the Murphy USA registration statement on our latest form 10-Q and 10-K. Murphy USA undertakes no duty to publicly update or revise any forward-looking statements. The Murphy USA financial information in this presentation is derived from the audited and unaudited consolidated financial statements of Murphy USA, Inc. for the years ended December 31, 2020, 2019, 2018, 2017, 2016, and 2015. Please reference our most recent 10-K, 10-Q, and 8-K filings for the latest information. If this presentation contains non-GAAP financial measures, we have provided a reconciliation of such non-GAAP financial measures to the most directly comparable measures prepared in accordance with U.S. GAAP in the Appendix to this presentation. Christian Pikul, CFA Vice President of Investor Relations and FP&A Christian.pikul@murphyusa.com

Murphy USA Inc. 3 2013 2019 Adjusted EBITDA $340 $423 Shares Outstanding (MM) 46.8 30.5 EV/EBITDA Multiple(3) 6 9 Raise the Bar 2021 to 2024 TSR: 15+% CAGR Another year of achieving record-high share price $46 $69 $73 $79 $81 $89 $121 $143 $155 $41 $50 $61 $67 $70 $77 $90 $119 $133 $36 $38 $49 $54 $61 $63 $74 $81 $122 $30 $50 $70 $90 $110 $130 $150 $170 2013 2014 2015 2016 2017 2018 2019 2020 2021 MUSA High and Low Closing Share Price with Annual Average by Year Since Spin As of 4/30/2021 High Avg Low 2021 2024 $550 ~$700 27.2(1) 23.2(2) 9 10+ Set the Bar Spin to 2019 TSR: 15% CAGR (1) Reflects outstanding shares as of 12/31/20 (non-diluted) (2) Assumes 1.0 mm shares repurchased annually 2021-2024 (3) High achieved at referenced year’s Adjusted EBITDA TSR 2013 2014 2015 2016 2017 2018 2019 2020 2021 CAGR(4) 16% 15% 14% 15% 17% 20% 21% 12% NA (4) Annual average to 2020 YTD average Spin to 2019 Average: 15% CAGR

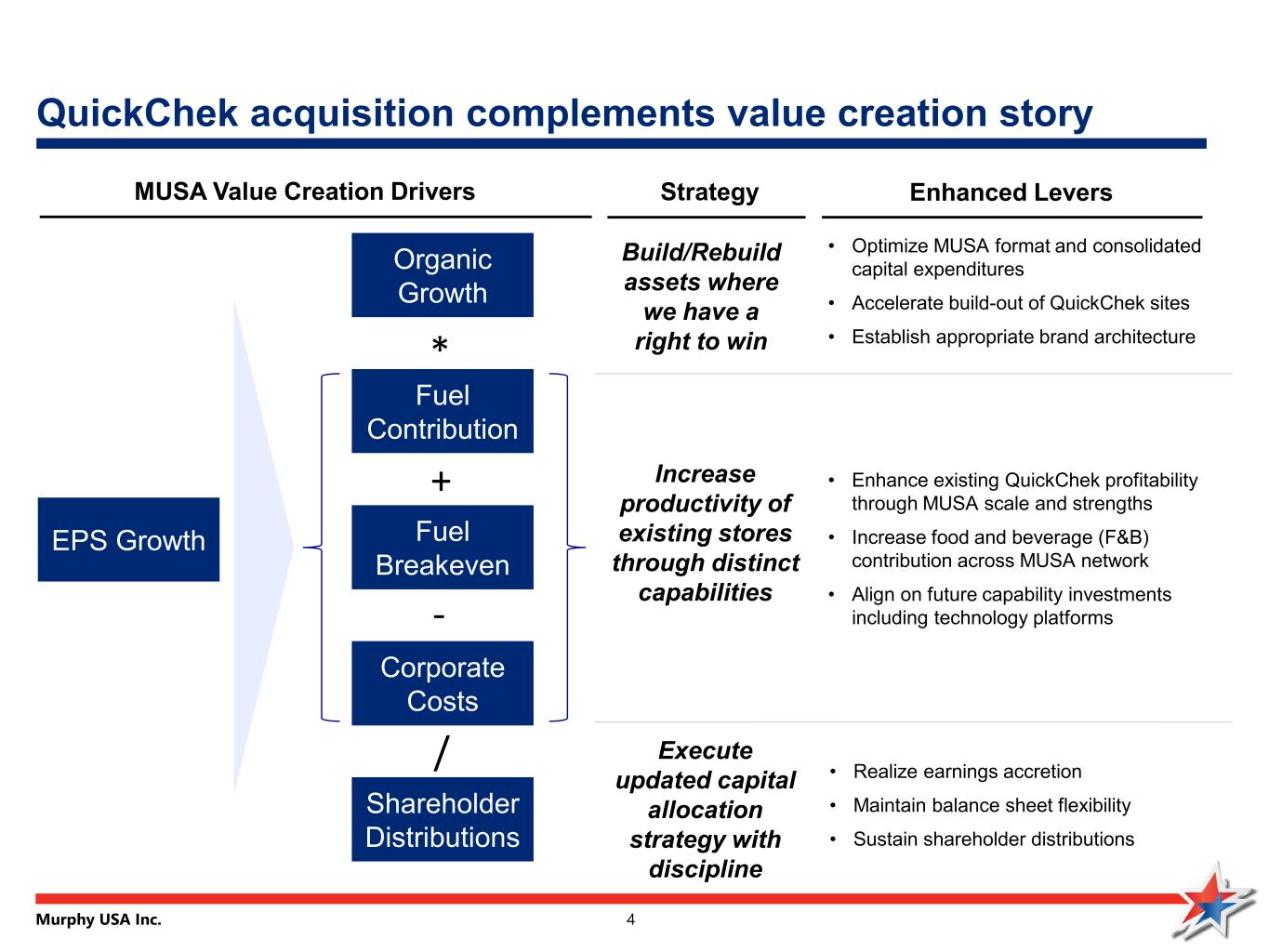

Murphy USA Inc. 4 QuickChek acquisition complements value creation story EPS Growth Organic Growth Fuel Contribution Fuel Breakeven Shareholder Distributions • Optimize MUSA format and consolidated capital expenditures • Accelerate build-out of QuickChek sites • Establish appropriate brand architecture Enhanced Levers Corporate Costs * + - MUSA Value Creation Drivers Strategy Build/Rebuild assets where we have a right to win • Enhance existing QuickChek profitability through MUSA scale and strengths • Increase food and beverage (F&B) contribution across MUSA network • Align on future capability investments including technology platforms • Realize earnings accretion • Maintain balance sheet flexibility • Sustain shareholder distributions Increase productivity of existing stores through distinct capabilities Execute updated capital allocation strategy with discipline /

Murphy USA Inc. 5 Acquiring critical food and beverage capabilities with QuickChek Note: QuickChek figures LTM as of 10/30/20 (unaudited); See appendix for Adjusted EBITDA reconciliation Fuel 57% Non-Fuel 43% Fuel 34% Merchandise 66% Total Stores: 157 LTM Gross Profit Fuel vs. Non-Fuel Stores Gross Profit Mix NACS Average Merchandise Gross Profit Per Store $ in thousands 60% 73% 74% 57% 52% 51% 37% Merchandise % of Total Gross Profit $1,396 $1,289 $674 $481 $475 $469 $282 Fuel Stores Company Overview Food & Beverage Menu Offering MACS & SNACKS ICED DRINKS SALADS & WRAPS BREAKFAST FRESH TO GO HOT DRINKS FROZEN DRINKS HOT DRINKS FRESH BAKERY FRESH FRIES FOUNTAIN BEVERAGES SUBS & SANDWICHES

Murphy USA Inc. 6 COVID highlighted MUSA’s resiliency, with sustainable benefits Q1 2019 Q1 2021 Change Fu el SSS Gallons (K) 234 213 ▼ 9.0% Total Fuel Contribution (MM) $128 $227 ▲ 77.3% M er ch an di se A cc el er at io n SSS Tobacco Contribution (K) $13.4 $15.6 ▲ 16.4% SSS Non-Tobacco Contribution (K) $9.0 $9.8 ▲ 8.9% Total Merchandise Contribution (MM) $98 $148 ▲ 51.0% E xp en se C on tro l APSM Station OPEX (K) $20.0 $20.7 ▲ 3.5% Total Operating Expense (MM) $133 $177 ▲ 33.1% Fi na nc ia l M et ric s Adj. EBITDA (MM) $58.8 $154.8 ▲ 163% Diluted Earnings Per Share $0.16 $2.01 ▲ 1,156% Durability and Resilience of MUSA Model: • Lower gallons offset by higher fuel contribution dollars • Category share gains directly resulted from targeted investments • Emphasis on employee well being allowed stores to continually serve customers COVID Impact on Consumers: . • Purchasing behaviors changed • Destination trips less frequent • Focus on value amplified Better Positioned to Win in 2021: • Higher expected fuel margins favor MUSA’s high-volume model • Opportunity to maintain and grow share gains in tobacco category • QuickChek acquisition highlights and accelerates food and beverage upside Key Metrics Table Note: APSM and SSS numbers exclude QuickChek sites

Murphy USA Inc. 7 Appendix

Murphy USA Inc. 8 2021 guidance 8 2020 Updated Guidance Range 2020 Actual Results 2021 Guidance Range Organic Growth New Stores 25-27 24 Up to 55 Raze and Rebuilds 28-30 33 Up to 25 Fuel Contribution Retail fuel volume per store (K gallons APSM) 217.5 to 222.5 220 245 to 255 Store Profitability Merchandise contribution ($ Millions) $455 to $460 $459 $680 to $700 Retail station Opex excluding credit cards (APSM % YOY change) Up 1-3% +3% N/A Retail station Opex excluding credit cards ($K, APSM) N/A N/A $27 to $28 Corporate Costs SG&A ($ Millions per year) $150 to $155 $171 $190 to $200 Effective Tax Rate 24% to 26% 24% 24% to 26% Capital Allocation Capital expenditures ($ Millions) $250 to $275 $227 $325 to $375 Note: 2020 guidance updated as of Q2 earnings on July 21, 2020

Murphy USA Inc. 9 Non-GAAP adjusted EBITDA reconciliation Year Ended December 31, (Millions of dollars) 2013 2014 2015 2016 2017 2018 2019 2020 Net Income $ 235.0 $ 243.9 $ 176.3 $ 221.5 $ 245.3 $ 213.6 $ 154.8 $ 386.1 Income taxes 100.1 116.4 80.7 130.5 (5.2) 60.3 47.6 123.0 Interest expense, net of interest income 13.4 36.4 31.4 39.1 45.4 51.4 51.7 50.2 Depreciation and amortization 74.1 79.1 86.6 98.6 116.9 134.0 152.2 161.0 EBITDA $ 422.6 $ 475.7 $ 375.0 $ 489.8 $ 402.4 $ 459.3 $ 406.3 $ 720.3 Net settlement proceeds - - - - - (50.4) (0.1) - Accretion of asset retirement obligations 1.1 1.2 1.5 1.7 1.8 2.0 2.1 2.3 (Gain) loss on sale of assets (6.0) (0.2) 4.7 (88.2) 3.9 1.1 (0.1) (1.3) Loss on early debt extinguishment - - - 14.8 - Other nonoperating (income) expense (0.2) (10.2) 0.5 (3.1) (2.2) (0.2) (0.4) 1.7 (Income) loss from discontinued operations, net of taxes (80.9) (20.9) (38.7) - - - - (0.3) Adjusted EBITDA $ 336.6 $ 445.7 $ 342.9 $ 400.1 $ 405.9 $ 411.8 $ 422.6 $ 722.7

Murphy USA Inc. 10 Non-GAAP Adjusted EBITDA Reconciliation For purposes of this reconciliation, the midpoint of a range for each reconciling item was used, and therefore actual results for each of these reconciling items is expected to be higher or lower than the amounts shown above. The size of the ranges varies based on the individual reconciling item and the assumptions made. 2021 and 2024 – GAAP to non-GAAP Reconciliation (Millions of dollars) Calendar Year 2021 Calendar Year 2024 Net Income $200 $263 Income taxes $65 $89 Interest expense, net of interest income $73 $73 Depreciation and amortization $211 $274 Other operating and nonoperating, net $1 $1 Adjusted EBITDA $550 $700