Attached files

| file | filename |

|---|---|

| 8-K - 8-K - Stagwell Inc | mdca-20210505.htm |

| EX-99.1 - EX-99.1 - Stagwell Inc | mdc2021331pr.htm |

Management Presentation First Quarter 2021 Results May 5, 2021

2 This presentation contains forward-looking statements. Statements in this presentation that are not historical facts, including without limitation the information under the heading "Financial Outlook" and statements about the Company’s beliefs and expectations, earnings (loss) guidance, recent business and economic trends, potential acquisitions, and estimates of amounts for redeemable noncontrolling interests and deferred acquisition consideration, constitute forward-looking statements. Words such as “estimates”, “expects”, “contemplates”, “will”, “anticipates”, “projects”, “plans”, “intends”, “believes”, “forecasts”, “may”, “should”, and variations of such words or similar expressions are intended to identify forward-looking statements. These statements are based on current plans, estimates and projections, and are subject to change based on a number of factors, including those outlined in this section. Forward-looking statements speak only as of the date they are made, and the Company undertakes no obligation to update publicly any of them in light of new information or future events, if any. Forward-looking statements involve inherent risks and uncertainties. A number of important factors could cause actual results to differ materially from those contained in any forward-looking statements. Such risk factors include, but are not limited to, the following: • risks associated with international, national and regional unfavorable economic conditions that could affect the Company or its clients, including as a result of the novel coronavirus pandemic (“COVID-19”); • the effects of the outbreak of COVID-19, including the measures to reduce its spread, and the impact on the economy and demand for our services, which may precipitate or exacerbate other risks and uncertainties; • an inability to realize expected benefits of the proposed redomiciliation of the Company from the federal jurisdiction of Canada to the State of Delaware (the “Redomiciliation”) and the subsequent combination of the Company’s business with the business of the subsidiaries of Stagwell Media LP (“Stagwell”) that own and operate a portfolio of marketing services companies (the “Business Combination” and, together with the Redomiciliation, the “Proposed Transactions”) or the occurrence of difficulties in connection with the Proposed Transaction; • adverse tax consequences in connection with the Proposed Transactions for the Company, its operations and its shareholders, that may differ from the expectations of the Company, including that future changes in tax law, potential increases to corporate tax rates in the United States and disagreements with the tax authorities on the Company’s determination of value and computations of its tax attributes may result in increased tax costs; • the occurrence of material Canadian federal income tax (including material “emigration tax”) as a result of the Proposed Transactions; • the impact of uncertainty associated with the Proposed Transactions on the Company’s businesses; • direct or indirect costs associated with the Proposed Transactions, which could be greater than expected; • the risk that a condition to completion of the Proposed Transactions may not be satisfied and the Proposed Transactions may not be completed; • the risk of parties challenging the Proposed Transactions or the impact of the Proposed Transactions on the Company’s debt arrangements; • the Company’s ability to attract new clients and retain existing clients; • reduction in client spending and changes in client advertising, marketing and corporate communications requirements; • financial failure of the Company’s clients; • the Company’s ability to retain and attract key employees; FORWARD LOOKING STATEMENTS & OTHER INFORMATION

3 • the Company’s ability to achieve the full amount of its stated cost saving initiatives; • the Company’s implementation of strategic initiatives; • the Company’s ability to remain in compliance with its debt agreements and the Company’s ability to finance its contingent payment obligations when due and payable, including but not limited to those relating to redeemable noncontrolling interests and deferred acquisition consideration; • the successful completion and integration of acquisitions which complement and expand the Company’s business capabilities; and • foreign currency fluctuations. Investors should carefully consider these risk factors and the additional risk factors outlined in more detail in the Company's Annual Report on Form 10-K and in the Company’s other SEC filings. FORWARD LOOKING STATEMENTS & OTHER INFORMATION (Cont.)

4 ----- DRAFT ----- • Revenue of $307.6 million versus $327.7 million in the prior year period, a decline of 6.2% • Organic revenue decreased by 6.9% versus the prior year period, continuing to narrow the year-over- year revenue decline amidst the pandemic recovery • Organic revenue was unfavorably impacted by 481 basis points from billable pass-through costs • Net revenue of $270.7 million in the first quarter vs. $274.4 million in the prior period, a decline of 1.4% • Organic net revenue decline of 2.1% against prior year • Net income attributable to MDC Partners Inc. common shareholders was $0.9 million in the first quarter of 2021 versus net loss of $2.4 million in the prior year period, MDC’s highest net income reported in 11 quarters • Adjusted EBITDA of $51.9 million versus $39.6 million in the prior year period, an increase of 31.3% and highest first quarter Adjusted EBITDA in company history • Adjusted EBITDA Margin of 16.9% vs. 12.1% in prior year period, an increase of 480 basis points, driven by strategic initiatives and cost actions taken in 2019 and 2020 • Covenant EBITDA (LTM) of $200.7 million, up from $190.1 million in the fourth quarter of 2020 and consistent with the first quarter of 2020 • Net new business wins of $10.2 million in the first quarter against $8.4 million a year ago and totaled $92.1 million over the last twelve months • Leverage of 4.1x, improved from 4.3x a year ago and 4.4x in the fourth quarter of 2020 FI ST QUARTER 2021 FINANCIAL HIGHLIGHTS Note: See appendix for definitions of Non-GAAP Financial Measures

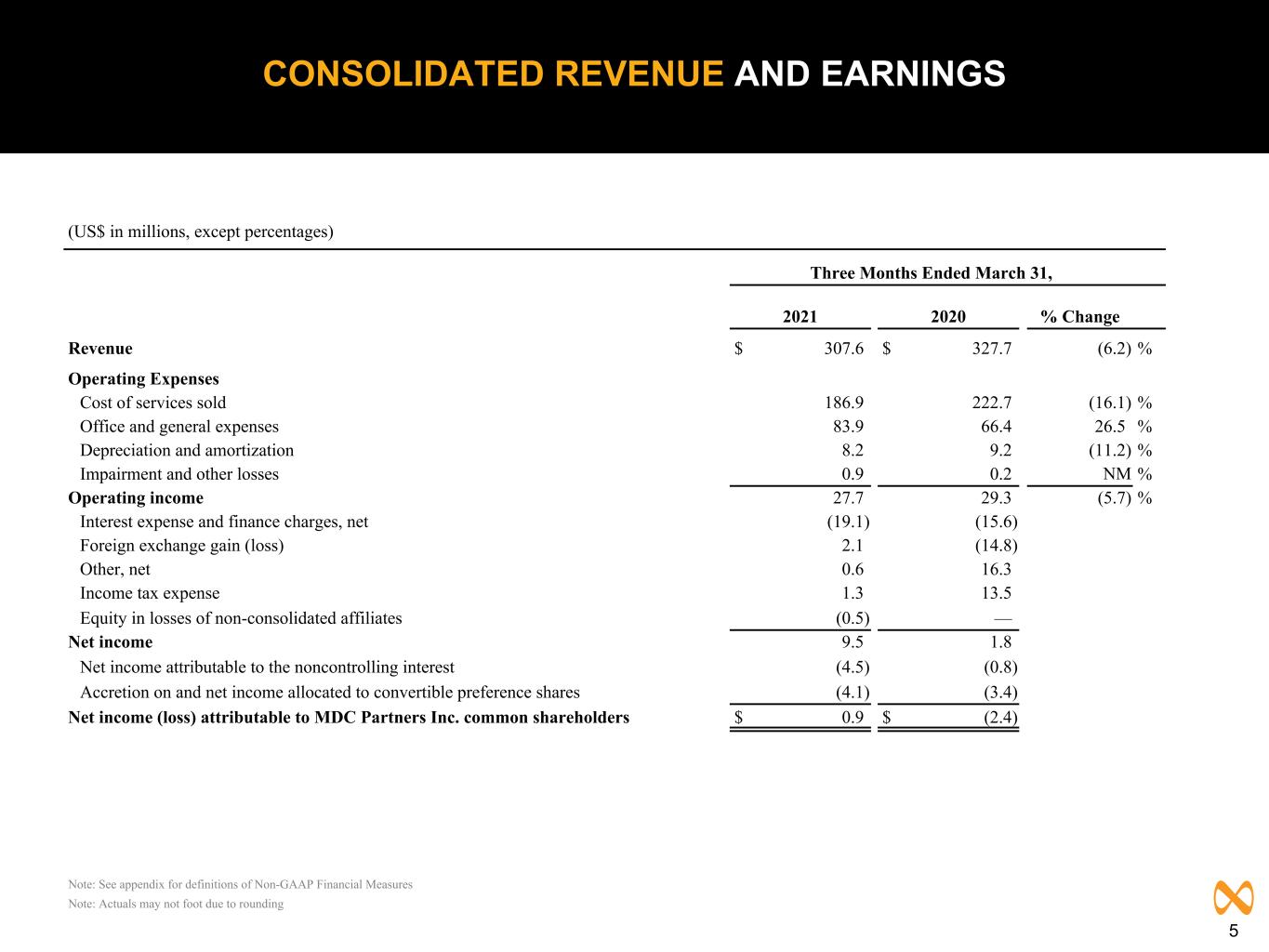

5 CONSOLIDATED REVENUE AND EARNINGS (US$ in millions, except percentages) Three Months Ended March 31, 2021 2020 % Change Revenue $ 307.6 $ 327.7 (6.2) % Operating Expenses Cost of services sold 186.9 222.7 (16.1) % Office and general expenses 83.9 66.4 26.5 % Depreciation and amortization 8.2 9.2 (11.2) % Impairment and other losses 0.9 0.2 NM % Operating income 27.7 29.3 (5.7) % Interest expense and finance charges, net (19.1) (15.6) Foreign exchange gain (loss) 2.1 (14.8) Other, net 0.6 16.3 Income tax expense 1.3 13.5 Equity in losses of non-consolidated affiliates (0.5) — Net income 9.5 1.8 Net income attributable to the noncontrolling interest (4.5) (0.8) Accretion on and net income allocated to convertible preference shares (4.1) (3.4) Net income (loss) attributable to MDC Partners Inc. common shareholders $ 0.9 $ (2.4) Note: See appendix for definitions of Non-GAAP Financial Measures Note: Actuals may not foot due to rounding

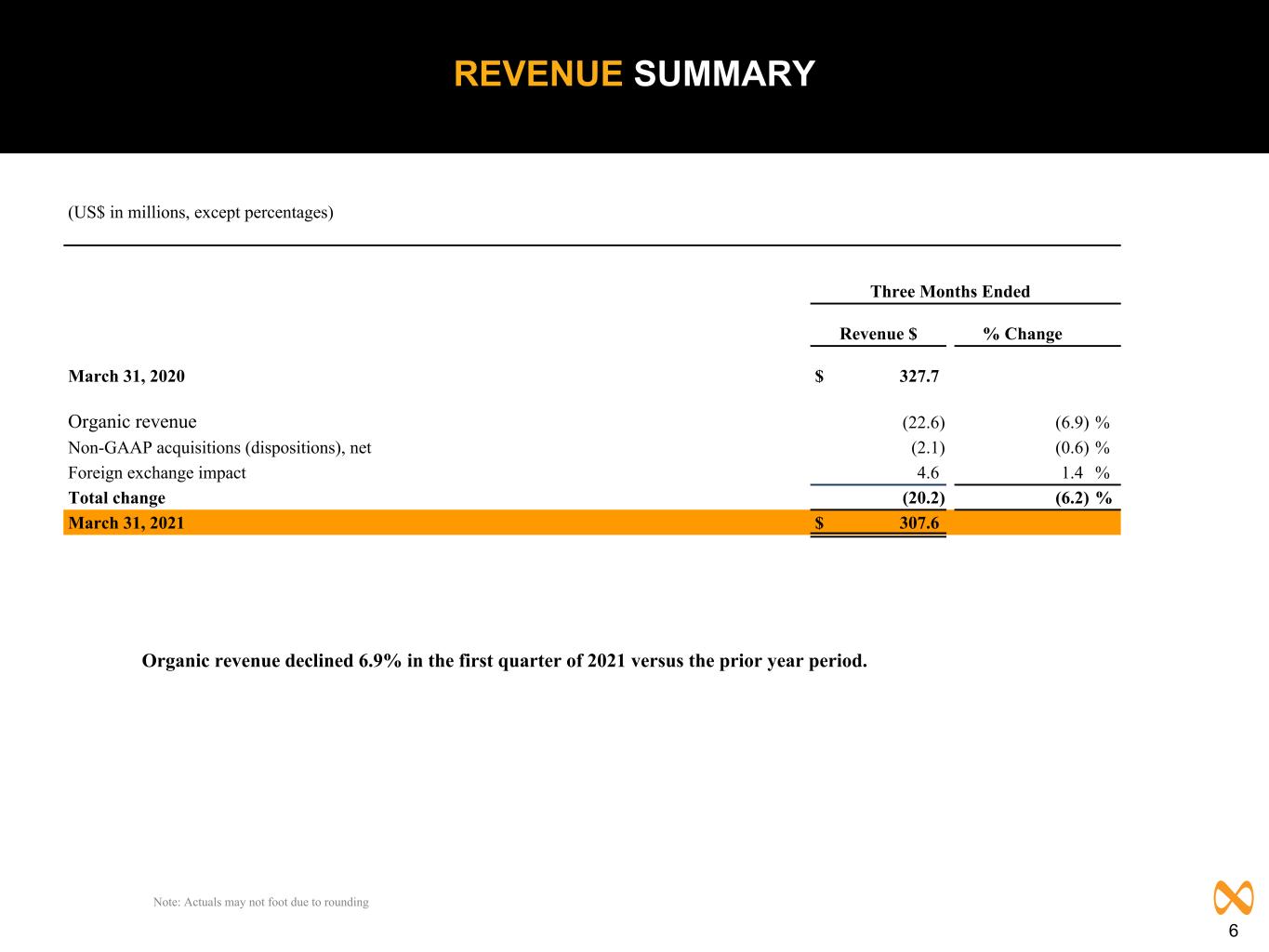

6 Organic revenue declined 6.9% in the first quarter of 2021 versus the prior year period. REVENUE SUMMARY (US$ in millions, except percentages) Three Months Ended Revenue $ % Change March 31, 2020 $ 327.7 Organic revenue (22.6) (6.9) % Non-GAAP acquisitions (dispositions), net (2.1) (0.6) % Foreign exchange impact 4.6 1.4 % Total change (20.2) (6.2) % March 31, 2021 $ 307.6 Note: Actuals may not foot due to rounding

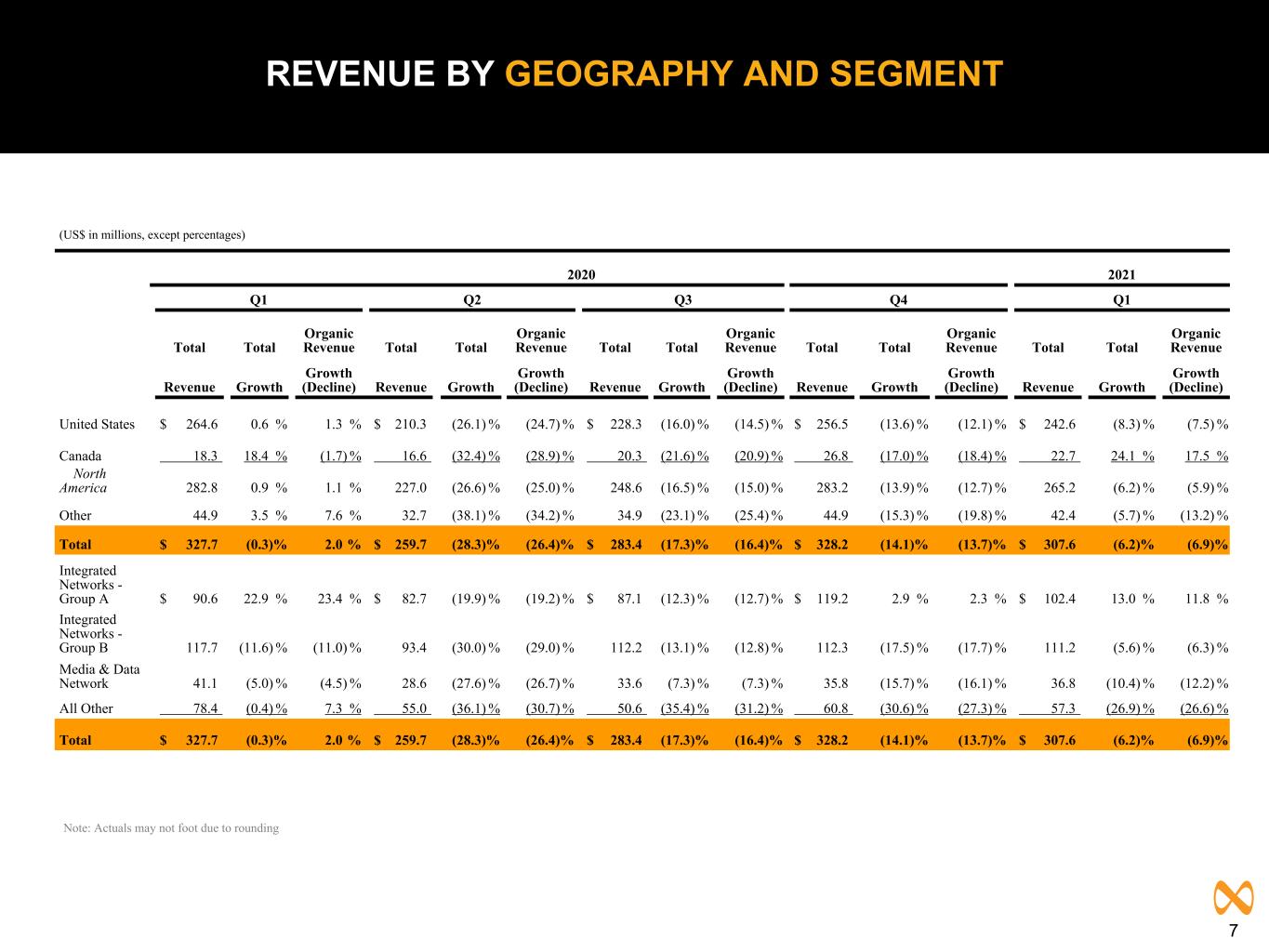

7 REVENUE BY GEOGRAPHY AND SEGMENT Note: Actuals may not foot due to rounding (US$ in millions, except percentages) 2020 2021 Q1 Q2 Q3 Q4 Q1 Total Total Organic Revenue Total Total Organic Revenue Total Total Organic Revenue Total Total Organic Revenue Total Total Organic Revenue Revenue Growth Growth (Decline) Revenue Growth Growth (Decline) Revenue Growth Growth (Decline) Revenue Growth Growth (Decline) Revenue Growth Growth (Decline) United States $ 264.6 0.6 % 1.3 % $ 210.3 (26.1) % (24.7) % $ 228.3 (16.0) % (14.5) % $ 256.5 (13.6) % (12.1) % $ 242.6 (8.3) % (7.5) % Canada 18.3 18.4 % (1.7) % 16.6 (32.4) % (28.9) % 20.3 (21.6) % (20.9) % 26.8 (17.0) % (18.4) % 22.7 24.1 % 17.5 % North America 282.8 0.9 % 1.1 % 227.0 (26.6) % (25.0) % 248.6 (16.5) % (15.0) % 283.2 (13.9) % (12.7) % 265.2 (6.2) % (5.9) % Other 44.9 3.5 % 7.6 % 32.7 (38.1) % (34.2) % 34.9 (23.1) % (25.4) % 44.9 (15.3) % (19.8) % 42.4 (5.7) % (13.2) % Total $ 327.7 (0.3) % 2.0 % $ 259.7 (28.3) % (26.4) % $ 283.4 (17.3) % (16.4) % $ 328.2 (14.1) % (13.7) % $ 307.6 (6.2) % (6.9) % Integrated Networks - Group A $ 90.6 22.9 % 23.4 % $ 82.7 (19.9) % (19.2) % $ 87.1 (12.3) % (12.7) % $ 119.2 2.9 % 2.3 % $ 102.4 13.0 % 11.8 % Integrated Networks - Group B 117.7 (11.6) % (11.0) % 93.4 (30.0) % (29.0) % 112.2 (13.1) % (12.8) % 112.3 (17.5) % (17.7) % 111.2 (5.6) % (6.3) % Media & Data Network 41.1 (5.0) % (4.5) % 28.6 (27.6) % (26.7) % 33.6 (7.3) % (7.3) % 35.8 (15.7) % (16.1) % 36.8 (10.4) % (12.2) % All Other 78.4 (0.4) % 7.3 % 55.0 (36.1) % (30.7) % 50.6 (35.4) % (31.2) % 60.8 (30.6) % (27.3) % 57.3 (26.9) % (26.6) % Total $ 327.7 (0.3) % 2.0 % $ 259.7 (28.3) % (26.4) % $ 283.4 (17.3) % (16.4) % $ 328.2 (14.1) % (13.7) % $ 307.6 (6.2) % (6.9) %

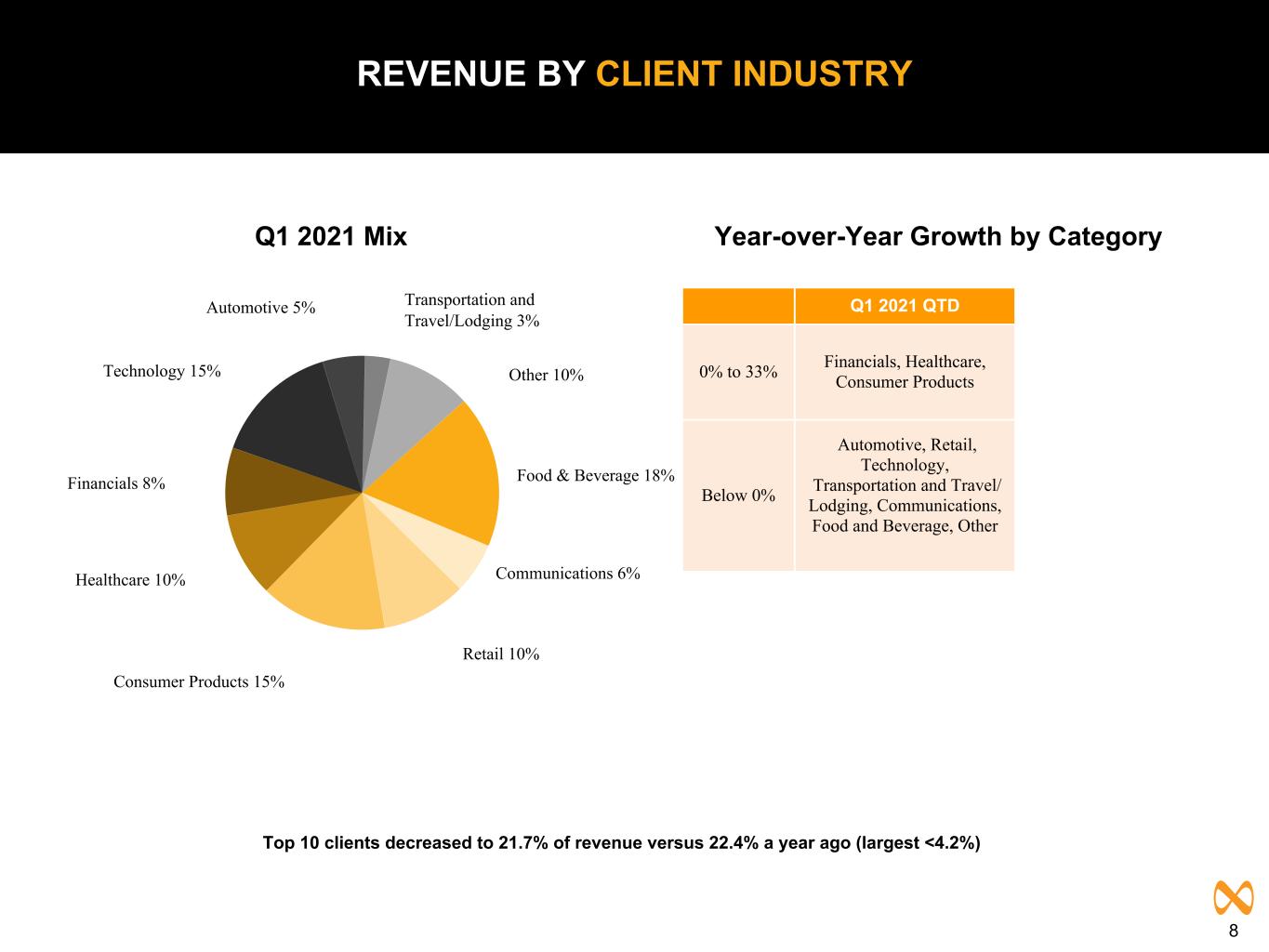

8 Top 10 clients decreased to 21.7% of revenue versus 22.4% a year ago (largest <4.2%) REVENUE BY CLIENT INDUSTRY Other 10% Food & Beverage 18% Communications 6% Retail 10% Consumer Products 15% Healthcare 10% Financials 8% Technology 15% Automotive 5% Transportation and Travel/Lodging 3% Q1 2021 QTD 0% to 33% Financials, Healthcare, Consumer Products Below 0% Automotive, Retail, Technology, Transportation and Travel/ Lodging, Communications, Food and Beverage, Other Year-over-Year Growth by CategoryQ1 2021 Mix

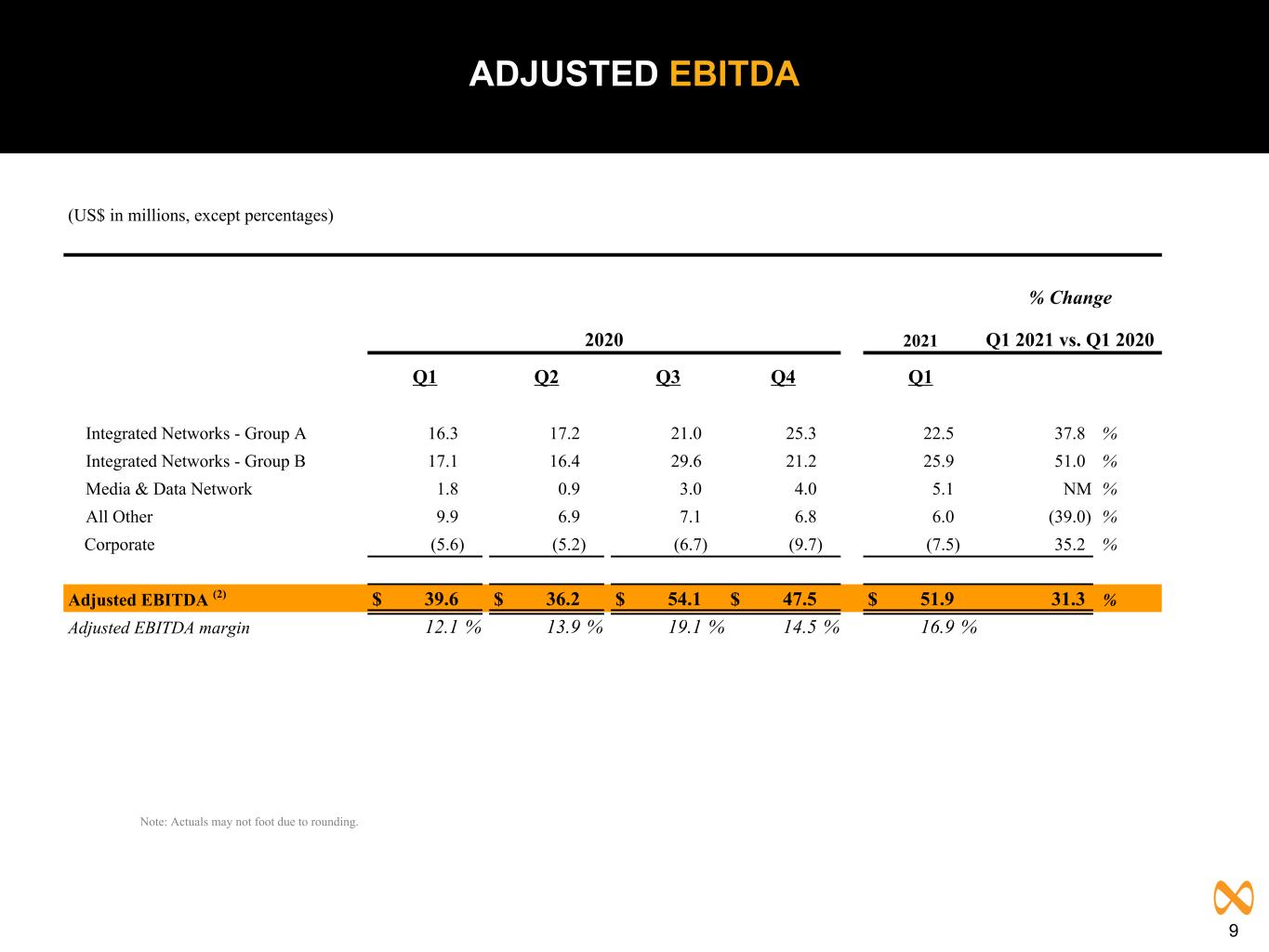

9 ADJUSTED EBITDA Note: Actuals may not foot due to rounding. (US$ in millions, except percentages) % Change 2020 2021 Q1 2021 vs. Q1 2020 Q1 Q2 Q3 Q4 Q1 Integrated Networks - Group A 16.3 17.2 21.0 25.3 22.5 37.8 % Integrated Networks - Group B 17.1 16.4 29.6 21.2 25.9 51.0 % Media & Data Network 1.8 0.9 3.0 4.0 5.1 NM % All Other 9.9 6.9 7.1 6.8 6.0 (39.0) % Corporate (5.6) (5.2) (6.7) (9.7) (7.5) 35.2 % Adjusted EBITDA (2) $ 39.6 $ 36.2 $ 54.1 $ 47.5 $ 51.9 31.3 % Adjusted EBITDA margin 12.1 % 13.9 % 19.1 % 14.5 % 16.9 %

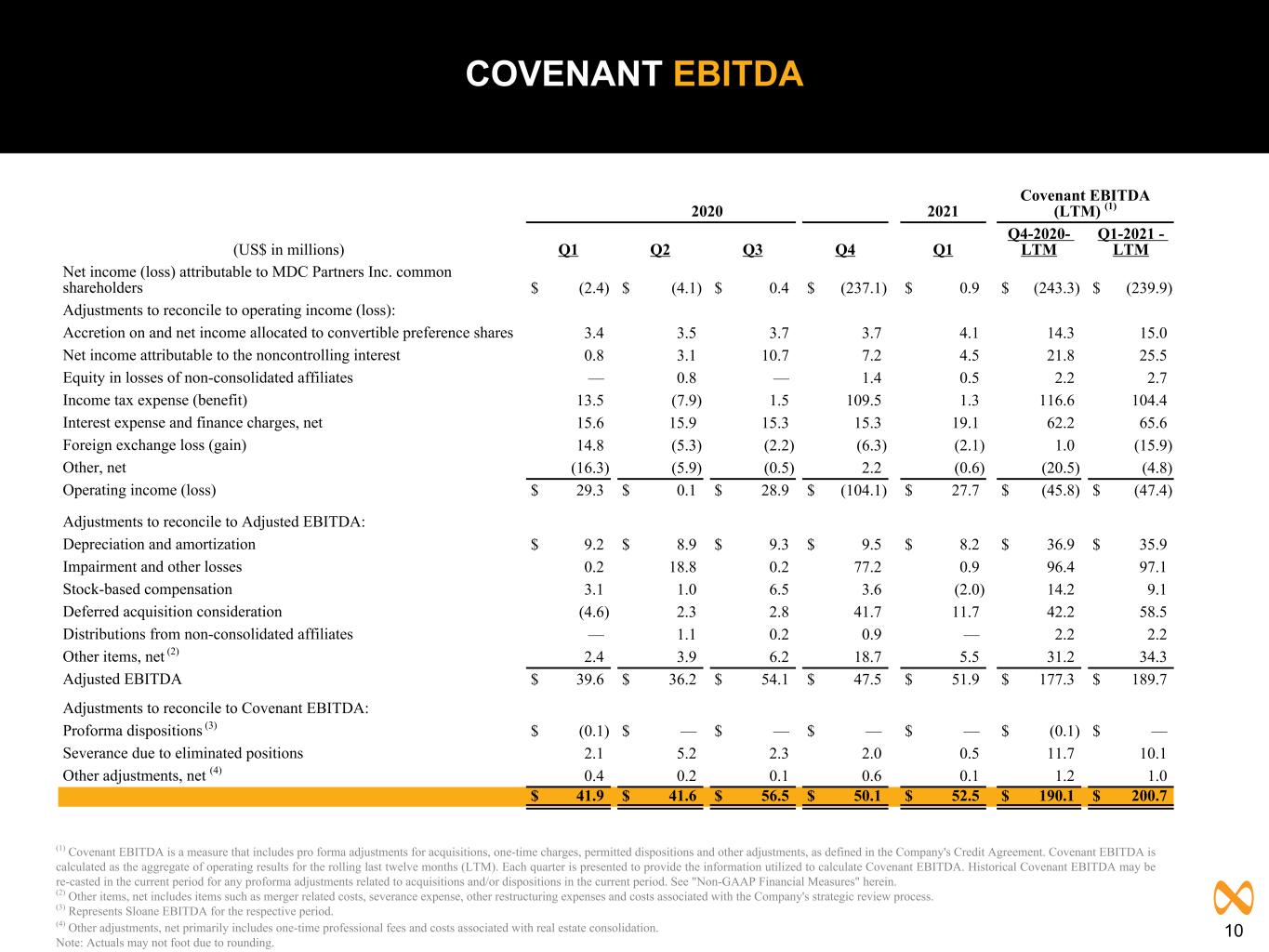

10 COVENANT EBITDA 2020 2021 Covenant EBITDA (LTM) (1) (US$ in millions) Q1 Q2 Q3 Q4 Q1 Q4-2020- LTM Q1-2021 - LTM Net income (loss) attributable to MDC Partners Inc. common shareholders $ (2.4) $ (4.1) $ 0.4 $ (237.1) $ 0.9 $ (243.3) $ (239.9) Adjustments to reconcile to operating income (loss): Accretion on and net income allocated to convertible preference shares 3.4 3.5 3.7 3.7 4.1 14.3 15.0 Net income attributable to the noncontrolling interest 0.8 3.1 10.7 7.2 4.5 21.8 25.5 Equity in losses of non-consolidated affiliates — 0.8 — 1.4 0.5 2.2 2.7 Income tax expense (benefit) 13.5 (7.9) 1.5 109.5 1.3 116.6 104.4 Interest expense and finance charges, net 15.6 15.9 15.3 15.3 19.1 62.2 65.6 Foreign exchange loss (gain) 14.8 (5.3) (2.2) (6.3) (2.1) 1.0 (15.9) Other, net (16.3) (5.9) (0.5) 2.2 (0.6) (20.5) (4.8) Operating income (loss) $ 29.3 $ 0.1 $ 28.9 $ (104.1) $ 27.7 $ (45.8) $ (47.4) Adjustments to reconcile to Adjusted EBITDA: Depreciation and amortization $ 9.2 $ 8.9 $ 9.3 $ 9.5 $ 8.2 $ 36.9 $ 35.9 Impairment and other losses 0.2 18.8 0.2 77.2 0.9 96.4 97.1 Stock-based compensation 3.1 1.0 6.5 3.6 (2.0) 14.2 9.1 Deferred acquisition consideration (4.6) 2.3 2.8 41.7 11.7 42.2 58.5 Distributions from non-consolidated affiliates — 1.1 0.2 0.9 — 2.2 2.2 Other items, net (2) 2.4 3.9 6.2 18.7 5.5 31.2 34.3 Adjusted EBITDA $ 39.6 $ 36.2 $ 54.1 $ 47.5 $ 51.9 $ 177.3 $ 189.7 Adjustments to reconcile to Covenant EBITDA: Proforma dispositions (3) $ (0.1) $ — $ — $ — $ — $ (0.1) $ — Severance due to eliminated positions 2.1 5.2 2.3 2.0 0.5 11.7 10.1 Other adjustments, net (4) 0.4 0.2 0.1 0.6 0.1 1.2 1.0 $ 41.9 $ 41.6 $ 56.5 $ 50.1 $ 52.5 $ 190.1 $ 200.7 (1) Covenant EBITDA is a measure that includes pro forma adjustments for acquisitions, one-time charges, permitted dispositions and other adjustments, as defined in the Company's Credit Agreement. Covenant EBITDA is calculated as the aggregate of operating results for the rolling last twelve months (LTM). Each quarter is presented to provide the information utilized to calculate Covenant EBITDA. Historical Covenant EBITDA may be re-casted in the current period for any proforma adjustments related to acquisitions and/or dispositions in the current period. See "Non-GAAP Financial Measures" herein. (2) Other items, net includes items such as merger related costs, severance expense, other restructuring expenses and costs associated with the Company's strategic review process. (3) Represents Sloane EBITDA for the respective period. (4) Other adjustments, net primarily includes one-time professional fees and costs associated with real estate consolidation. Note: Actuals may not foot due to rounding.

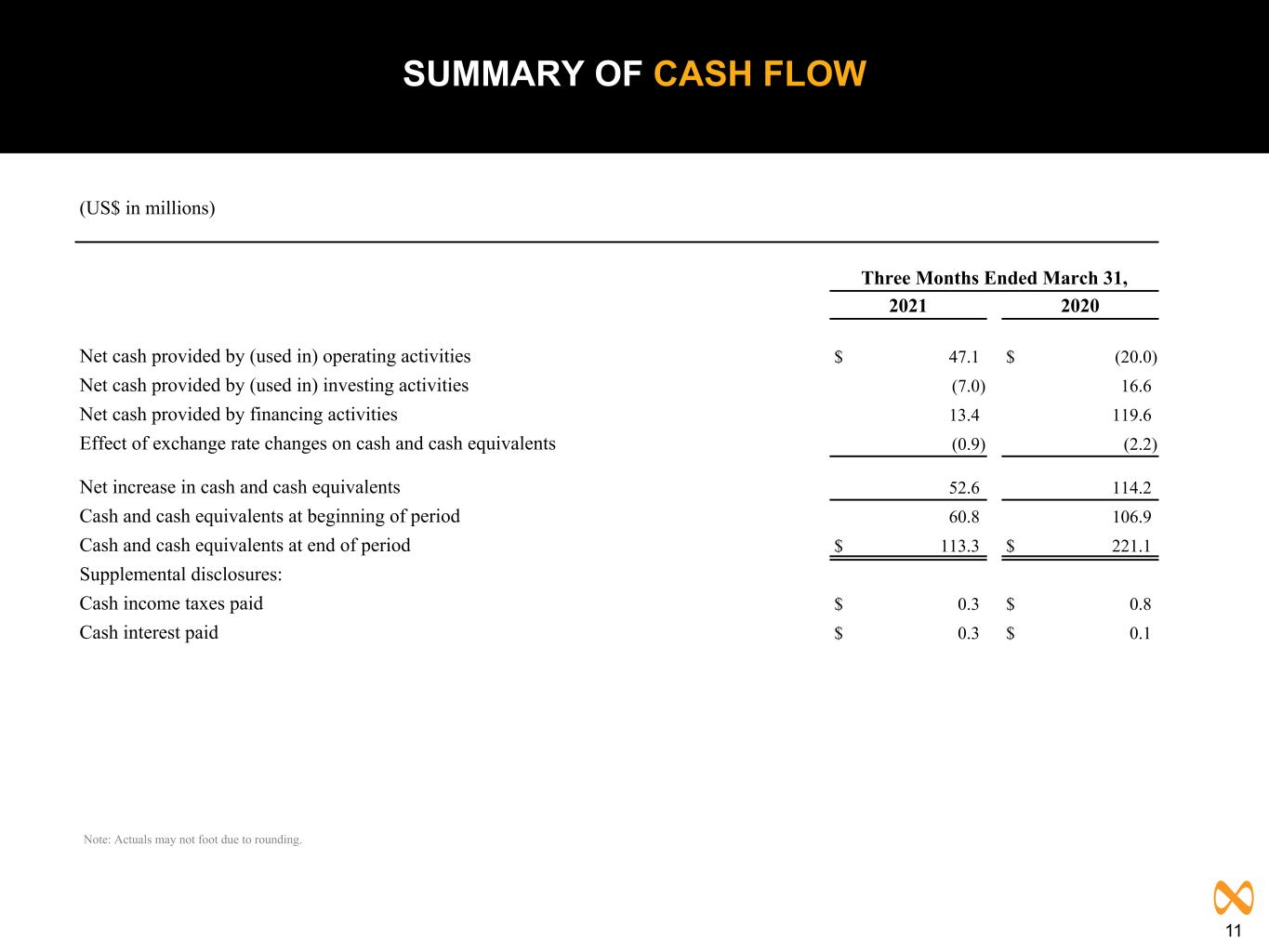

11 SUMMARY OF CASH FLOW (US$ in millions) Three Months Ended March 31, 2021 2020 Net cash provided by (used in) operating activities $ 47.1 $ (20.0) Net cash provided by (used in) investing activities (7.0) 16.6 Net cash provided by financing activities 13.4 119.6 Effect of exchange rate changes on cash and cash equivalents (0.9) (2.2) Net increase in cash and cash equivalents 52.6 114.2 Cash and cash equivalents at beginning of period 60.8 106.9 Cash and cash equivalents at end of period $ 113.3 $ 221.1 Supplemental disclosures: Cash income taxes paid $ 0.3 $ 0.8 Cash interest paid $ 0.3 $ 0.1 Note: Actuals may not foot due to rounding.

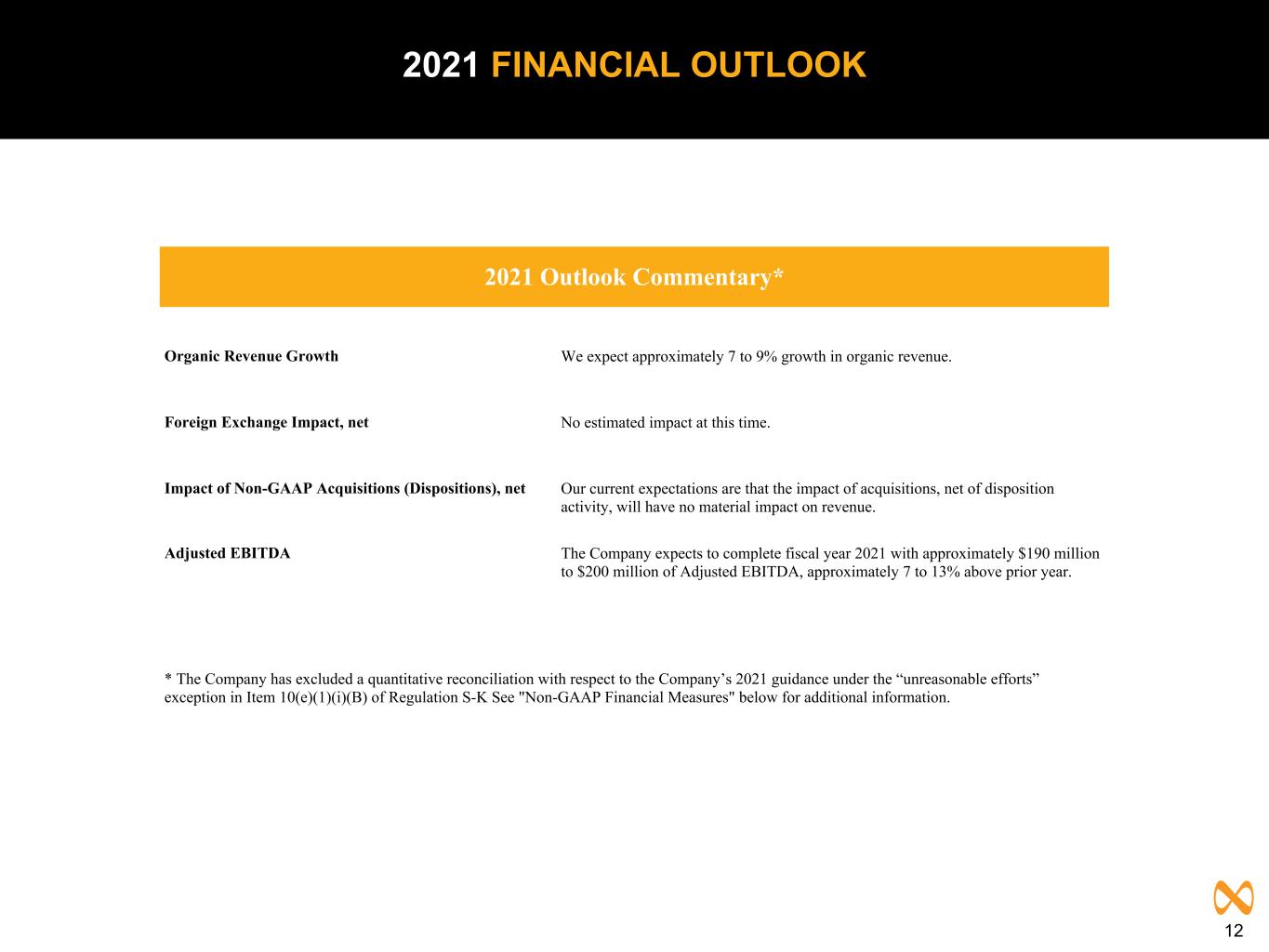

12 2021 FINANCIAL OUTLOOK Organic Revenue Growth We expect approximately 7 to 9% growth in organic revenue. Foreign Exchange Impact, net No estimated impact at this time. Impact of Non-GAAP Acquisitions (Dispositions), net Our current expectations are that the impact of acquisitions, net of disposition activity, will have no material impact on revenue. Adjusted EBITDA The Company expects to complete fiscal year 2021 with approximately $190 million to $200 million of Adjusted EBITDA, approximately 7 to 13% above prior year. * The Company has excluded a quantitative reconciliation with respect to the Company’s 2021 guidance under the “unreasonable efforts” exception in Item 10(e)(1)(i)(B) of Regulation S-K See "Non-GAAP Financial Measures" below for additional information. 2021 Outlook Commentary*

13 APPENDIX

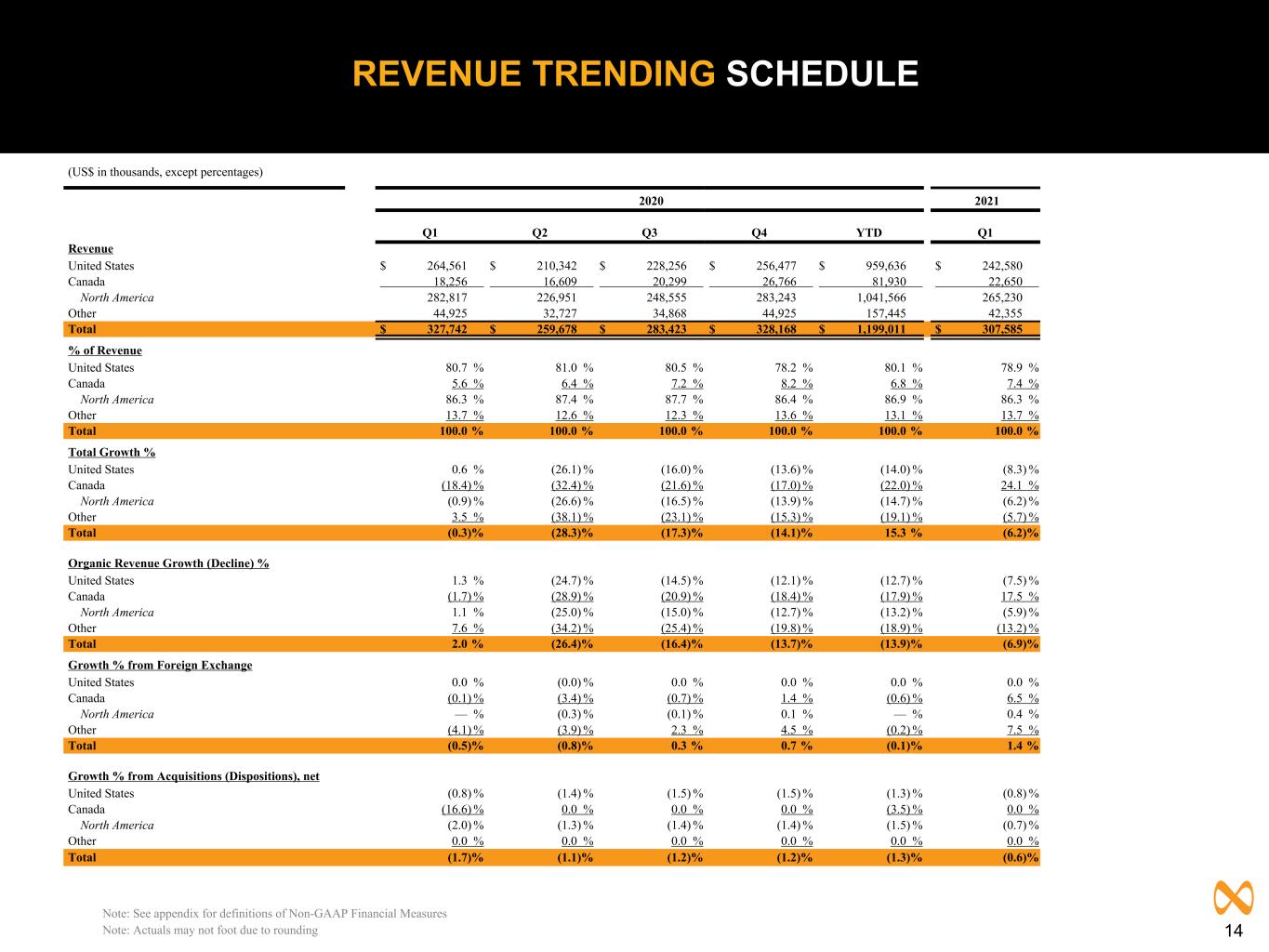

14 REVENUE TRENDING SCHEDULE Note: See appendix for definitions of Non-GAAP Financial Measures Note: Actuals may not foot due to rounding (US$ in thousands, except percentages) 2020 2021 Q1 Q2 Q3 Q4 YTD Q1 Revenue United States $ 264,561 $ 210,342 $ 228,256 $ 256,477 $ 959,636 $ 242,580 Canada 18,256 16,609 20,299 26,766 81,930 22,650 North America 282,817 226,951 248,555 283,243 1,041,566 265,230 Other 44,925 32,727 34,868 44,925 157,445 42,355 Total $ 327,742 $ 259,678 $ 283,423 $ 328,168 $ 1,199,011 $ 307,585 % of Revenue United States 80.7 % 81.0 % 80.5 % 78.2 % 80.1 % 78.9 % Canada 5.6 % 6.4 % 7.2 % 8.2 % 6.8 % 7.4 % North America 86.3 % 87.4 % 87.7 % 86.4 % 86.9 % 86.3 % Other 13.7 % 12.6 % 12.3 % 13.6 % 13.1 % 13.7 % Total 100.0 % 100.0 % 100.0 % 100.0 % 100.0 % 100.0 % Total Growth % United States 0.6 % (26.1) % (16.0) % (13.6) % (14.0) % (8.3) % Canada (18.4) % (32.4) % (21.6) % (17.0) % (22.0) % 24.1 % North America (0.9) % (26.6) % (16.5) % (13.9) % (14.7) % (6.2) % Other 3.5 % (38.1) % (23.1) % (15.3) % (19.1) % (5.7) % Total (0.3) % (28.3) % (17.3) % (14.1) % 15.3 % (6.2) % Organic Revenue Growth (Decline) % United States 1.3 % (24.7) % (14.5) % (12.1) % (12.7) % (7.5) % Canada (1.7) % (28.9) % (20.9) % (18.4) % (17.9) % 17.5 % North America 1.1 % (25.0) % (15.0) % (12.7) % (13.2) % (5.9) % Other 7.6 % (34.2) % (25.4) % (19.8) % (18.9) % (13.2) % Total 2.0 % (26.4) % (16.4) % (13.7) % (13.9) % (6.9) % Growth % from Foreign Exchange United States 0.0 % (0.0) % 0.0 % 0.0 % 0.0 % 0.0 % Canada (0.1) % (3.4) % (0.7) % 1.4 % (0.6) % 6.5 % North America — % (0.3) % (0.1) % 0.1 % — % 0.4 % Other (4.1) % (3.9) % 2.3 % 4.5 % (0.2) % 7.5 % Total (0.5) % (0.8) % 0.3 % 0.7 % (0.1) % 1.4 % Growth % from Acquisitions (Dispositions), net United States (0.8) % (1.4) % (1.5) % (1.5) % (1.3) % (0.8) % Canada (16.6) % 0.0 % 0.0 % 0.0 % (3.5) % 0.0 % North America (2.0) % (1.3) % (1.4) % (1.4) % (1.5) % (0.7) % Other 0.0 % 0.0 % 0.0 % 0.0 % 0.0 % 0.0 % Total (1.7) % (1.1) % (1.2) % (1.2) % (1.3) % (0.6) %

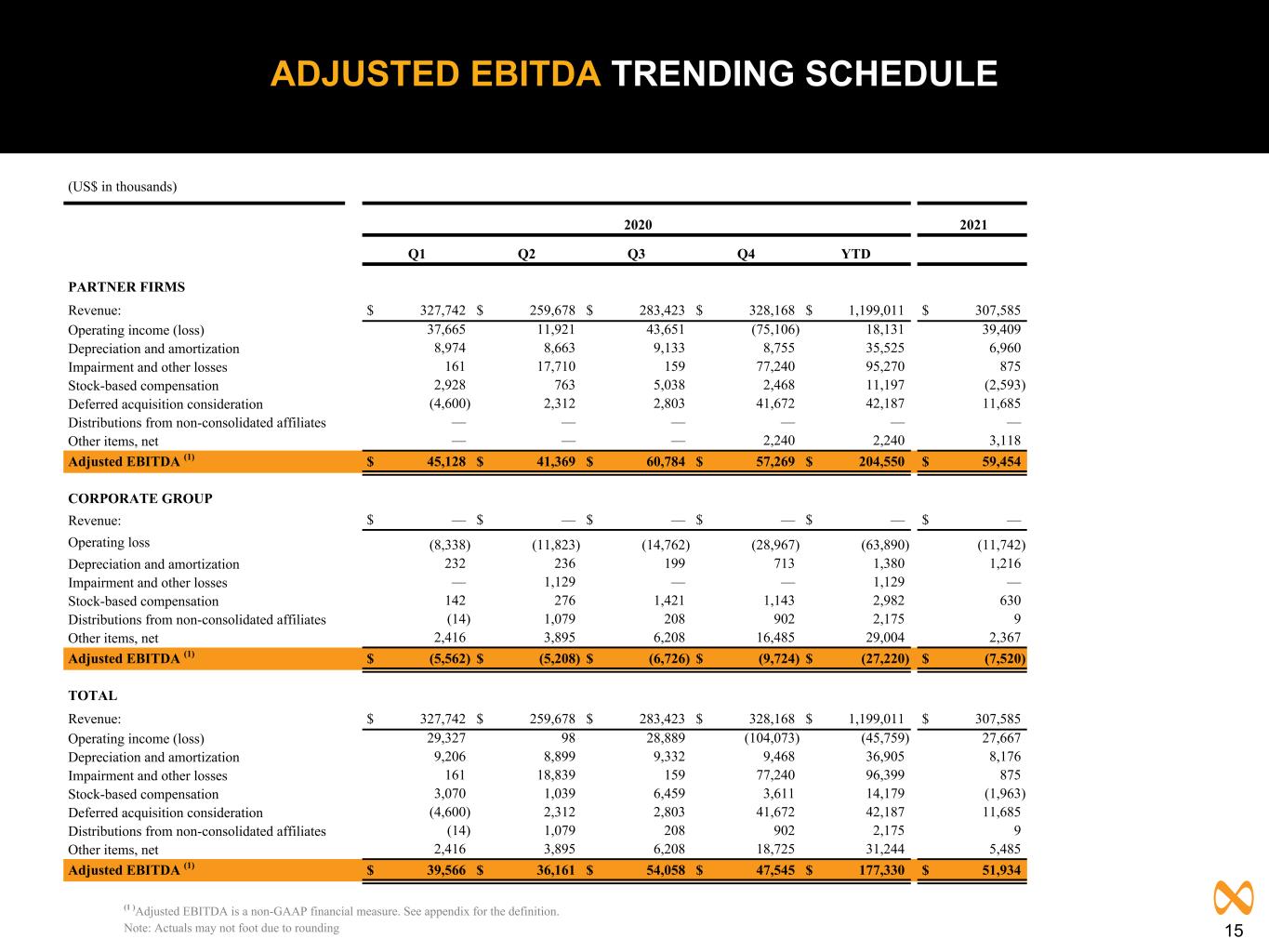

15 ADJUSTED EBITDA TRENDING SCHEDULE (1 )Adjusted EBITDA is a non-GAAP financial measure. See appendix for the definition. Note: Actuals may not foot due to rounding (US$ in thousands) 2020 2021 Q1 Q2 Q3 Q4 YTD PARTNER FIRMS Revenue: $ 327,742 $ 259,678 $ 283,423 $ 328,168 $ 1,199,011 $ 307,585 Operating income (loss) 37,665 11,921 43,651 (75,106) 18,131 39,409 Depreciation and amortization 8,974 8,663 9,133 8,755 35,525 6,960 Impairment and other losses 161 17,710 159 77,240 95,270 875 Stock-based compensation 2,928 763 5,038 2,468 11,197 (2,593) Deferred acquisition consideration (4,600) 2,312 2,803 41,672 42,187 11,685 Distributions from non-consolidated affiliates — — — — — — Other items, net — — — 2,240 2,240 3,118 Adjusted EBITDA (1) $ 45,128 $ 41,369 $ 60,784 $ 57,269 $ 204,550 $ 59,454 CORPORATE GROUP Revenue: $ — $ — $ — $ — $ — $ — Operating loss (8,338) (11,823) (14,762) (28,967) (63,890) (11,742) Depreciation and amortization 232 236 199 713 1,380 1,216 Impairment and other losses — 1,129 — — 1,129 — Stock-based compensation 142 276 1,421 1,143 2,982 630 Distributions from non-consolidated affiliates (14) 1,079 208 902 2,175 9 Other items, net 2,416 3,895 6,208 16,485 29,004 2,367 Adjusted EBITDA (1) $ (5,562) $ (5,208) $ (6,726) $ (9,724) $ (27,220) $ (7,520) TOTAL Revenue: $ 327,742 $ 259,678 $ 283,423 $ 328,168 $ 1,199,011 $ 307,585 Operating income (loss) 29,327 98 28,889 (104,073) (45,759) 27,667 Depreciation and amortization 9,206 8,899 9,332 9,468 36,905 8,176 Impairment and other losses 161 18,839 159 77,240 96,399 875 Stock-based compensation 3,070 1,039 6,459 3,611 14,179 (1,963) Deferred acquisition consideration (4,600) 2,312 2,803 41,672 42,187 11,685 Distributions from non-consolidated affiliates (14) 1,079 208 902 2,175 9 Other items, net 2,416 3,895 6,208 18,725 31,244 5,485 Adjusted EBITDA (1) $ 39,566 $ 36,161 $ 54,058 $ 47,545 $ 177,330 $ 51,934

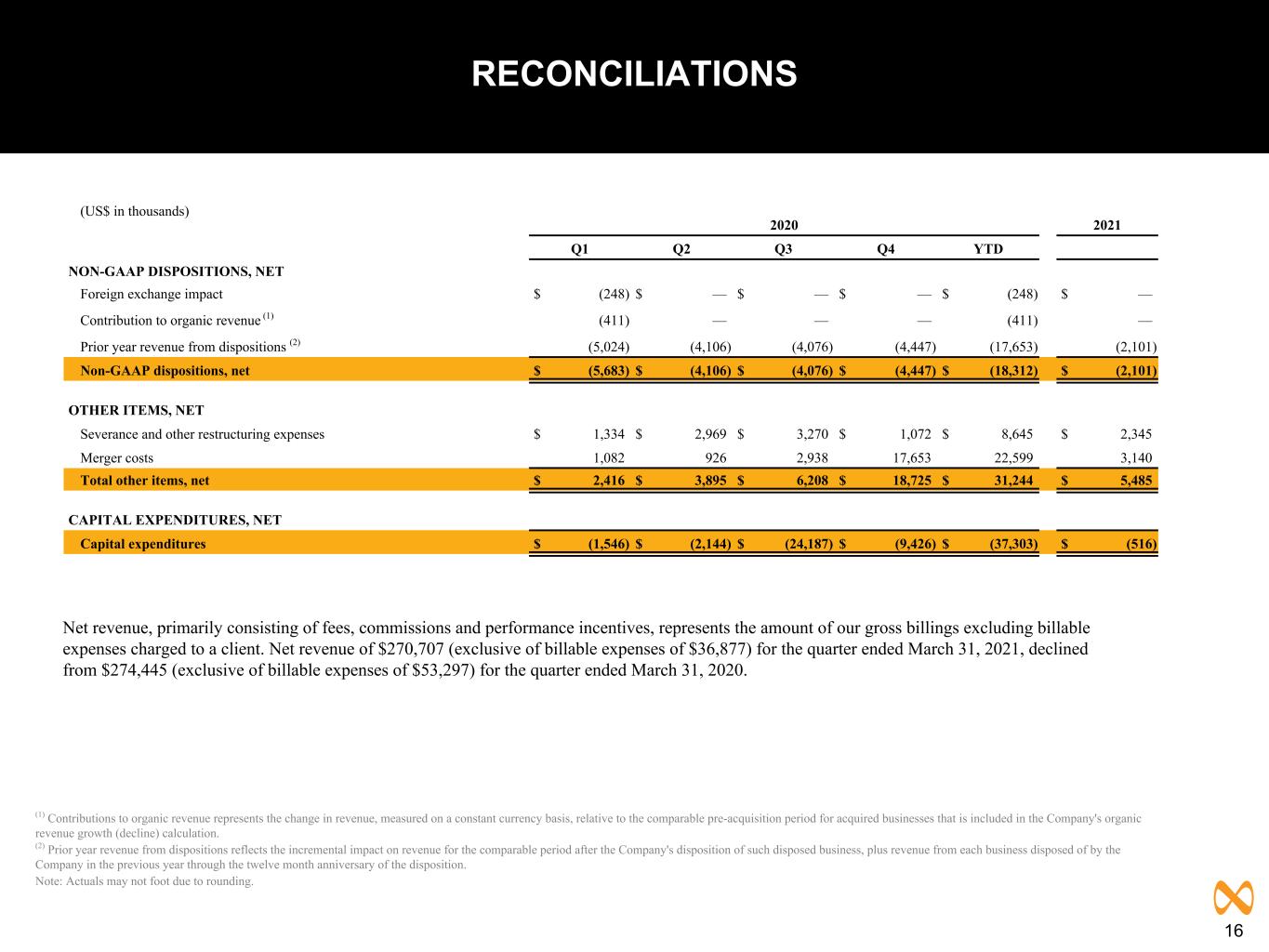

16 RECONCILIATIONS (1) Contributions to organic revenue represents the change in revenue, measured on a constant currency basis, relative to the comparable pre-acquisition period for acquired businesses that is included in the Company's organic revenue growth (decline) calculation. (2) Prior year revenue from dispositions reflects the incremental impact on revenue for the comparable period after the Company's disposition of such disposed business, plus revenue from each business disposed of by the Company in the previous year through the twelve month anniversary of the disposition. Note: Actuals may not foot due to rounding. (US$ in thousands) 2020 2021 Q1 Q2 Q3 Q4 YTD NON-GAAP DISPOSITIONS, NET Foreign exchange impact $ (248) $ — $ — $ — $ (248) $ — Contribution to organic revenue (1) (411) — — — (411) — Prior year revenue from dispositions (2) (5,024) (4,106) (4,076) (4,447) (17,653) (2,101) Non-GAAP dispositions, net $ (5,683) $ (4,106) $ (4,076) $ (4,447) $ (18,312) $ (2,101) OTHER ITEMS, NET Severance and other restructuring expenses $ 1,334 $ 2,969 $ 3,270 $ 1,072 $ 8,645 $ 2,345 Merger costs 1,082 926 2,938 17,653 22,599 3,140 Total other items, net $ 2,416 $ 3,895 $ 6,208 $ 18,725 $ 31,244 $ 5,485 CAPITAL EXPENDITURES, NET Capital expenditures $ (1,546) $ (2,144) $ (24,187) $ (9,426) $ (37,303) $ (516) Net revenue, primarily consisting of fees, commissions and performance incentives, represents the amount of our gross billings excluding billable expenses charged to a client. Net revenue of $270,707 (exclusive of billable expenses of $36,877) for the quarter ended March 31, 2021, declined from $274,445 (exclusive of billable expenses of $53,297) for the quarter ended March 31, 2020.

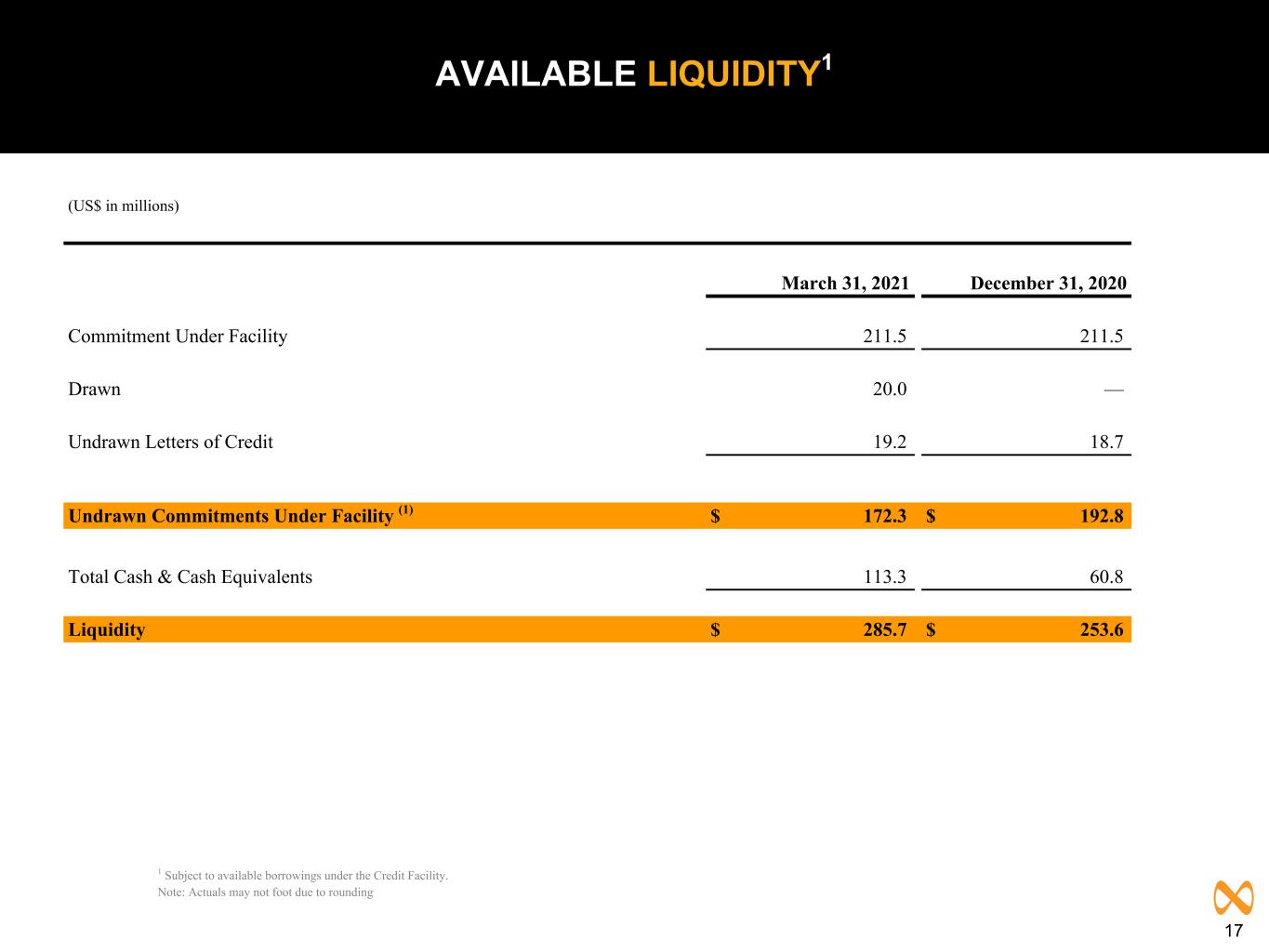

17 AVAILABLE LIQUIDITY1 1 Subject to available borrowings under the Credit Facility. Note: Actuals may not foot due to rounding (US$ in millions) March 31, 2021 December 31, 2020 Commitment Under Facility 211.5 211.5 Drawn 20.0 — Undrawn Letters of Credit 19.2 18.7 Undrawn Commitments Under Facility (1) $ 172.3 $ 192.8 Total Cash & Cash Equivalents 113.3 60.8 Liquidity $ 285.7 $ 253.6

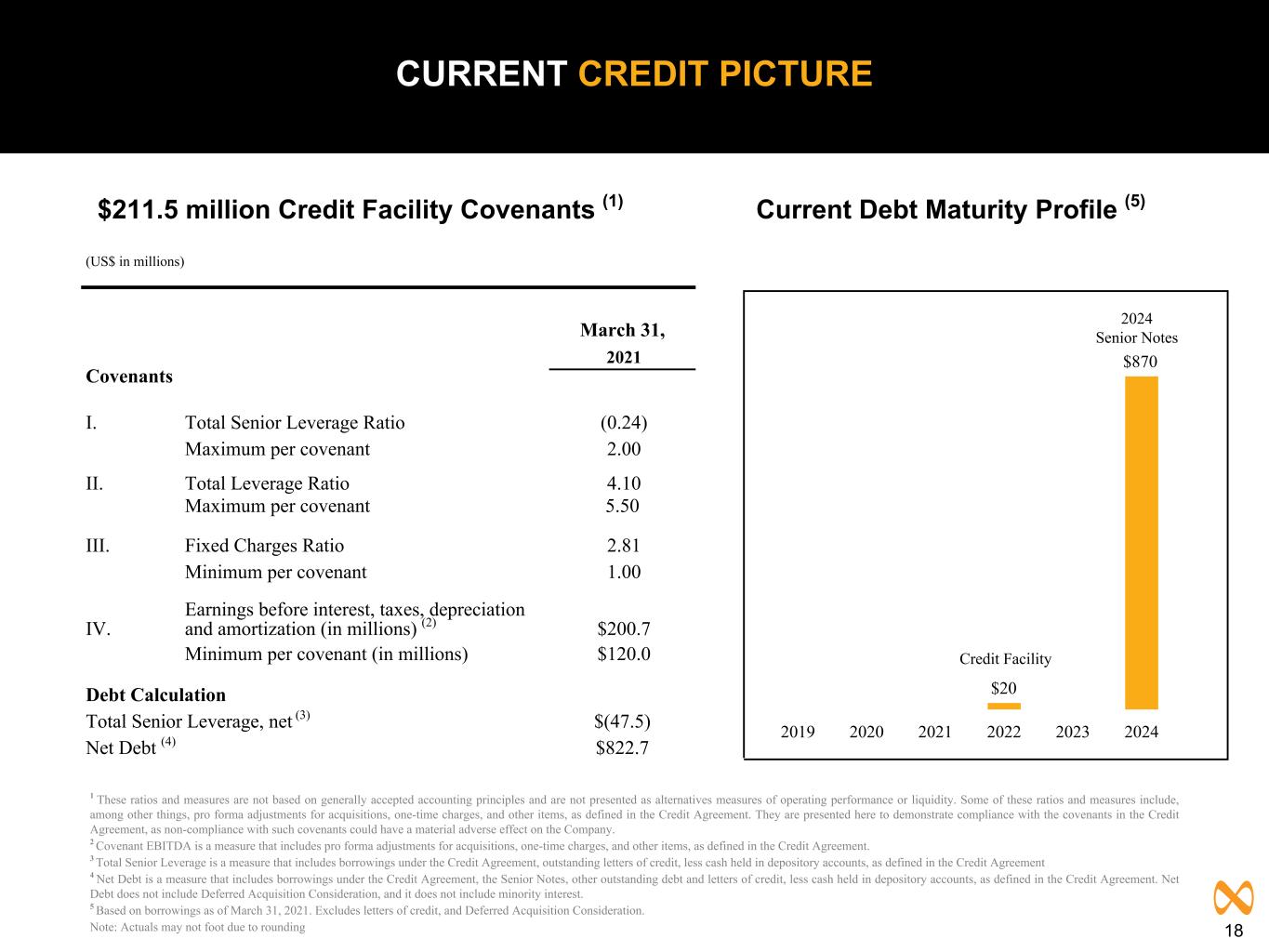

18 CURRENT CREDIT PICTURE 1 These ratios and measures are not based on generally accepted accounting principles and are not presented as alternatives measures of operating performance or liquidity. Some of these ratios and measures include, among other things, pro forma adjustments for acquisitions, one-time charges, and other items, as defined in the Credit Agreement. They are presented here to demonstrate compliance with the covenants in the Credit Agreement, as non-compliance with such covenants could have a material adverse effect on the Company. 2 Covenant EBITDA is a measure that includes pro forma adjustments for acquisitions, one-time charges, and other items, as defined in the Credit Agreement. 3 Total Senior Leverage is a measure that includes borrowings under the Credit Agreement, outstanding letters of credit, less cash held in depository accounts, as defined in the Credit Agreement 4 Net Debt is a measure that includes borrowings under the Credit Agreement, the Senior Notes, other outstanding debt and letters of credit, less cash held in depository accounts, as defined in the Credit Agreement. Net Debt does not include Deferred Acquisition Consideration, and it does not include minority interest. 5 Based on borrowings as of March 31, 2021. Excludes letters of credit, and Deferred Acquisition Consideration. Note: Actuals may not foot due to rounding Current Debt Maturity Profile (5)$211.5 million Credit Facility Covenants (1) (US$ in millions) March 31, 2021 Covenants I. Total Senior Leverage Ratio (0.24) Maximum per covenant 2.00 II. Total Leverage Ratio 4.10 Maximum per covenant 5.50 III. Fixed Charges Ratio 2.81 Minimum per covenant 1.00 IV. Earnings before interest, taxes, depreciation and amortization (in millions) (2) $200.7 Minimum per covenant (in millions) $120.0 Debt Calculation Total Senior Leverage, net (3) $(47.5) Net Debt (4) $822.7 $20 $870 2019 2020 2021 2022 2023 2024 Credit Facility 2024 Senior Notes

19 DEFINITION OF NON-GAAP FINANCIAL MEASURES In addition to its reported results, MDC Partners has included in its earnings release and supplemental management presentation certain financial results that the Securities and Exchange Commission defines as "non-GAAP financial measures." Management believes that such non-GAAP financial measures, when read in conjunction with the Company's reported results, can provide useful supplemental information for investors analyzing period to period comparisons of the Company's results. Such non-GAAP financial measures include the following: Organic Revenue: Organic Revenue: “Organic revenue growth” and “organic revenue decline” refer to the positive or negative results, respectively, of subtracting both the foreign exchange and acquisition (disposition) components from total revenue growth. The acquisition (disposition) component is calculated by aggregating prior period revenue for any acquired businesses, less the prior period revenue of any businesses that were disposed of during the current period. The organic revenue growth (decline) component reflects the constant currency impact of (a) the change in revenue of the partner firms which the Company has held throughout each of the comparable periods presented, and (b) “non- GAAP acquisitions (dispositions), net”. Non-GAAP acquisitions (dispositions), net consists of (i) for acquisitions during the current year, the revenue effect from such acquisitions as if the acquisition had been owned during the equivalent period in the prior year and (ii) for acquisitions during the previous year, the revenue effect from such acquisitions as if they had been owned during that entire year (or same period as the current reportable period), taking into account their respective pre-acquisition revenues for the applicable periods, and (iii) for dispositions, the revenue effect from such dispositions as if they had been disposed of during the equivalent period in the prior year. Net New Business: Estimate of annualized revenue for new wins less annualized revenue for losses incurred in the period. Adjusted EBITDA: Adjusted EBITDA is a non-GAAP financial measure that represents Net income (loss) attributable to MDC Partners Inc. common shareholders plus or minus non-operating items to operating income (loss) plus depreciation and amortization, stock-based compensation, deferred acquisition consideration adjustments, distributions from non-consolidated affiliates, and other items, net which includes items such as merger related costs, severance expense and other restructuring expenses, including costs for leases that will either be terminated or sublet in connection with the centralization of our New York real estate portfolio. Covenant EBITDA: Covenant EBITDA is a measure that includes pro forma adjustments for acquisitions, one-time charges, permitted dispositions and other items, as defined in the Credit Agreement. We believe that the presentation of Covenant EBITDA is useful to investors as it eliminates the effect of certain non-cash and other items not necessarily indicative of a company’s underlying operating performance. In addition, the presentation of Covenant EBITDA provides additional information to investors about the calculation of, and compliance with, certain financial covenants in the Credit Agreement. Included in the Company’s earnings release and supplemental management presentation are tables reconciling MDC Partners’ reported results to arrive at certain of these non-GAAP financial measures. Note: A reconciliation of non-GAAP to US GAAP reported results has been provided by the Company in the tables included herein.

MDC Partners One World Trade Center, Floor 65 New York, NY 10007 646-429-1800 www.mdc-partners.com