Attached files

| file | filename |

|---|---|

| EX-99.1 - EX-99.1 - Laredo Petroleum, Inc. | a5521laredopetroleumannoun.htm |

| 8-K - 8-K - Laredo Petroleum, Inc. | lpi-20210505.htm |

First-Quarter 2021 Earnings Presentation May 5, 2021 EXHIBIT 99.2

Forward-Looking / Cautionary Statements This presentation, including any oral statements made regarding the contents of this presentation, contains forward-looking statements as defined under Section 27A of the Securities Act of 1933, as amended, and Section 21E of the Securities Exchange Act of 1934, as amended. All statements, other than statements of historical facts, that address activities that Laredo Petroleum, Inc. (together with its subsidiaries, the “Company”, “Laredo” or “LPI”) assumes, plans, expects, believes, intends, projects, indicates, enables, transforms, estimates or anticipates (and other similar expressions) will, should or may occur in the future are forward-looking statements. The forward- looking statements are based on management’s current belief, based on currently available information, as to the outcome and timing of future events. General risks relating to Laredo include, but are not limited to, the decline in prices of oil, natural gas liquids and natural gas and the related impact to financial statements as a result of asset impairments and revisions to reserve estimates, oil production quotas or other actions that might be imposed by the Organization of Petroleum Exporting Countries and other producing countries (“OPEC+”), the outbreak of disease, such as the coronavirus (“COVID- 19”) pandemic, and any related government policies and actions, changes in domestic and global production, supply and demand for commodities, including as a result of the COVID-19 pandemic and actions by OPEC+, long-term performance of wells, drilling and operating risks, the increase in service and supply costs, tariffs on steel, pipeline transportation and storage constraints in the Permian Basin, the possibility of production curtailment, hedging activities, the impacts of severe weather, including the freezing of wells and pipelines in the Permian Basin due to cold weather, possible impacts of litigation and regulations, the impact of the Company’s transactions, if any, with its securities from time to time, the impact of new laws and regulations, including those regarding the use of hydraulic fracturing, the impact of new environmental, health and safety requirements applicable to the Company’s business activities, the possibility of the elimination of federal income tax deductions for oil and gas exploration and development and other factors, including those and other risks described in its Annual Report on Form 10-K for the year ended December 31, 2020, and those set forth from time to time in other filings with the Securities and Exchange Commission (“SEC”). These documents are available through Laredo’s website at www.laredopetro.com under the tab “Investor Relations” or through the SEC’s Electronic Data Gathering and Analysis Retrieval System at www.sec.gov. Any of these factors could cause Laredo’s actual results and plans to differ materially from those in the forward-looking statements. Therefore, Laredo can give no assurance that its future results will be as estimated. Any forward-looking statement speaks only as of the date on which such statement is made. Laredo does not intend to, and disclaims any obligation to, correct, update or revise any forward-looking statement, whether as a result of new information, future events or otherwise, except as required by applicable law. The SEC generally permits oil and natural gas companies, in filings made with the SEC, to disclose proved reserves, which are reserve estimates that geological and engineering data demonstrate with reasonable certainty to be recoverable in future years from known reservoirs under existing economic and operating conditions, and certain probable and possible reserves that meet the SEC’s definitions for such terms. In this presentation, the Company may use the terms “resource potential,” “resource play,” “estimated ultimate recovery,” or “EURs,” “type curve” and “standard ized measure,” each of which the SEC guidelines restrict from being included in filings with the SEC without strict compliance with SEC definitions. These terms refer to the Company’s internal estimates of unbooked hydrocarbon quantities that may be potentially discovered through exploratory drilling or recovered with additional drilling or recovery techniques. “Resource potential” is used by the Company to refer to the estimated quantities of hydrocarbons that may be added to proved reserves, largely from a specified resource play potentially supporting numerous drilling locations. A “resource play” is a term used by the Company to describe an accumulation of hydrocarbons known to exist over a large areal expanse and/or thick vertical section potentially supporting numerous drilling locations, which, when compared to a conventional play, typically has a lower geological and/or commercial development risk. “EURs” are based on the Company’s previous operating experience in a given area and publicly available information relating to the operations of producers who are conducting operations in these areas. Unbooked resource potential and “EURs” do not constitute reserves within the meaning of the Society of Petroleum Engineer’s Petroleum Resource Management System or SEC rules and do not include any proved reserves. Actual quantities of reserves that may be ultimately recovered from the Company’s interests may differ substantially from those presented herein. Factors affecting ultimate recovery include the scope of the Company’s ongoing drilling program, which will be directly affected by the availability of capital, decreases in oil, natural gas liquids and natural gas prices, well spacing, drilling and production costs, availability and cost of drilling services and equipment, lease expirations, transportation constraints, regulatory approvals, negative revisions to reserve estimates and other factors, as well as actual drilling results, including geological and mechanical factors affecting recovery rates. “EURs” from reserves may change significantly as development of the Company’s core assets provides additional data. In addition, the Company’s production forecasts and expectations for future periods are dependent upon many assumptions, including estimates of production decline rates from existing wells and the undertaking and outcome of future drilling activity, which may be affected by significant commodity price declines or drilling cost increases. “Type curve” refers to a production profile of a well, or a particular category of wells, for a specific play and/or area. The “standardized measure” of discounted future new cash flows is calculated in accordance with SEC regulations and a discount rate of 10%. Actual results may vary considerably and should not be considered to represent the fair market value of the Company’s proved reserves. This presentation includes financial measures that are not in accordance with generally accepted accounting principles (“GAAP”), such as Adjusted EBITDA, Cash Flow and Free Cash Flow. While management believes that such measures are useful for investors, they should not be used as a replacement for financial measures that are in accordance with GAAP. For a reconciliation of such non-GAAP financial measures to the nearest comparable measure in accordance with GAAP, please see the Appendix. Unless otherwise specified, references to “average sales price” refer to average sales price excluding the effects of the Company’s derivative transactions. All amounts, dollars and percentages presented in this presentation are rounded and therefore approximate. 2

Expand High- Margin Inventory Manage Risk ▪ Generated Free Cash Flow1 of $22 million and limited cost incurred to $70 million ▪ Sold 723,579 shares through ATM equity program at an average price of $38.75 ▪ Reduced net debt1 by $30 million Continuously Improve ▪ Reduced DC&E costs to $525 per foot and increased drilling efficiency while integrating a new drilling rig ▪ Held unit LOE to $2.66 per BOE ▪ Minimized flaring/venting to 0.22% of produced natural gas ▪ New Howard County wells drove 1Q-21 oil production growth of 11% versus prior quarter ▪ Completed Company’s second full-scale development package in Howard County Objectives Principles Successfully Executed Strategy in the First Quarter of 2021 31See Appendix for reconciliations and definitions of non-GAAP measures Improve Oil Cut Decrease Leverage Reduce GHG Emissions Target Free Cash Flow1

$220 $578 $361 $505 $0 $200 $400 $600 $800 FY-21 FY-22 FY-23 FY-24 FY-25 FY-26 FY-27 FY-28 D e b t ($ M M ) 78% 64% 53% 0% 20% 40% 60% 80% 100% Bal-21 % Product Hedged4 Actively Managing our Balance Sheet and Commodity Hedges 2.4x Net Debt to Adj. EBITDA1,2 2.6x Net Debt to Consolidated EBITDAX1,2 $44 MM Cash Balance3 4 Credit facility drawn3 Senior unsecured notes Credit facility undrawn3 Oil Natural Gas NGL • Reduced Net Debt1 by $30 million during 1Q-21 • Executed $26.9 million of $75 million ATM program • Reduced credit facility balance by $35 million from 4Q-20 1See Appendix for reconciliations and definitions of non-GAAP measures; 2Includes TTM Adjusted EBITDA/Consolidated EBITDAX and Net Debt as of 3-31-21; 3Amount shown as of 3-31-21; 4Open hedge positions as of 3-31-21; hedges executed through 4-30-21 utilizing midpoint of 2021 production guidance

Ambitious Emissions Reduction Targets 12019 calendar year as baseline; 2As a percentage of natural gas production 20% reduction in GHG intensity1 <0.20% methane emissions1,2 Zero routine flaring Emissions Reductions Targets for 2025 For the second consecutive year, flaring/venting reduction targets are part of executive compensation metrics 0.71% Produced gas flared/vented 1.95% Produced gas flared/vented 5 1.95% 0.71% 0.22% 0.00% 0.50% 1.00% 1.50% 2.00% 2.50% FY-19 FY-20 1Q-21 Percentage of Produced Natural Gas Flared/Vented

0 300 600 900 1,200 1,500 1,800 F e e t p e r D a y Drilling & Completions Efficiencies Drilled Feet/Day/Rig Fractured Feet/Day/Crew $788 $764 $675 $610 $525 $0 $200 $400 $600 $800 FY-17 FY-18 FY-19 FY-20 1Q-21 D & C C o s t ($ /f t) Maintaining Operational & Cost Advantages in Howard County 6 Consistently Reducing DC&E Costs 2017 2018 2019 2020

7 Laredo-Owned Sand Mine Saves on Completions Costs LPI Leasehold Mining Area Operated on Laredo-owned surface acreage 5+ years supply of sand Protects against sand cost inflation Reduces truck traffic by 300,000 miles per month Realized savings of $90,0001 per well ▪ Utilized in all 1Q-21 completions, 85% of all sand used ▪ Mine operated by a third party ▪ No additional capital investment beyond surface acreage acquisition 1For Howard County completions

0 20 40 60 80 100 120 140 0 50 100 150 200 250 300 350 400 C u m u la ti v e G ro s s O il 3 P ro d u c ti o n ( M B O ) Production Days Successfully Building Oily, High-Margin Inventory LPI Leasehold (127,345 net acres) 8 W. Glasscock County Total Net Acres 4,351 Targets LS/WC-A/WC-B Locations1 40 Howard County Total Net Acres 12,168 Targets LS/WC-A Locations1 105 - 140 ▪ FY-21 development entirely within Howard and W. Glasscock counties ▪ Company oil cut expected to rise from 30% at beginning of 2021 to almost 40% by year-end 2021 ▪ High oil productivity of acquired acreage drives forecasted oil production growth and Free Cash Flow2 generation in FY-21 1Locations as of January 2021 (adjusted for 2020 completions); 2See Appendix for reconciliations and definitions of non-GAAP measures 3Production data normalized to 10,000’ lateral length, downtime days excluded Map and acreage as of 4-30-21 Cook Wells (W. Glasscock) Gilbert/Passow Wells (Howard) Trentino/Whitmire Wells (Howard)

$325 $375 $425 $40 $45 $50 $55 $60 WTI ($/Bbl) FY-21E Cash Flow1,2 ($ MM) 9 Development of High-Margin Inventory Improves Capital Efficiency 26.8 15 20 25 30 FY-20A FY-21E O il P ro d u c ti o n ( M B O /d ) 27.3 - 29.3 87.8 40 60 80 100 FY-20A FY-21E T o ta l P ro d u c ti o n ( M B O E /d ) 80.0 - 85.0 2021 Capital and Production Guidance 1Open hedge positions as of 3-31-21; hedges executed through 4-30-21, utilizing natural gas price held flat at $2.75/Mcf; 2See Appendix for reconciliations and definitions of non-GAAP measures Cash Flow, Including Hedges 2021E Capital Reduce expenditures to operate within cash flow Excess cash flow to reduce net debt $351 $360 $0 $100 $200 $300 $400 FY-20A FY-21E T o ta l C a p it a l ($ M M )

10 Second-Quarter and Full-Year 2021 Guidance Production: 2Q-21 FY-21 Total production (MBOE/d) 83.0 - 86.0 80.0 - 85.0 Oil production (MBO/d) 26.5 - 27.5 27.3 - 29.3 Average sales price realizations: (excluding derivatives) 2Q-21 Oil (% of WTI) 100% NGL (% of WTI) 27% Natural gas (% of Henry Hub) 71% Other ($ MM): 2Q-21 Net income / (expense) of purchased oil ($4.3) Operating costs & expenses ($/BOE): 2Q-21 Lease operating expenses $2.85 Production and ad valorem taxes (% of oil, NGL and natural gas revenues) 7.00% Transportation and marketing expenses $1.55 General and administrative expenses (excluding LTIP) $1.50 General and administrative expenses (LTIP cash & non-cash) $0.40 Depletion, depreciation and amortization $5.75

L A R E D O P E T R O L E U M APPENDIX 11

Crude Oil Hedge Book Natural Gas Liquids Hedge Book Natural Gas Hedge Book Bal-2021 FY 2022 Bal-2021 FY 2022 Bal-2021 FY 2022 Brent Swaps (MBbl) 5,651 4,125 Ethane Swaps (MBbl) 688 0 Henry Hub Swaps (MMcf) 32,038 3,650 WTD Price (Bbl) $51.29 $48.34 WTD Price (Bbl) $12.01 $0.00 WTD Price (Mcf) $2.59 $2.73 Brent Collars (MBbl) 440 821 Propane Swaps (MBbl) 1,826 0 Waha Basis Swaps (MMcf) 42,680 18,068 WTD Floor Price (Bbl) $45.00 $53.67 WTD Price (Bbl) $22.90 $0.00 WTD Price (Mcf) ($0.47) ($0.41) WTD Ceiling Price (Bbl) $59.50 $62.40 Butane Swaps (MBbl) 609 0 Total Brent Swaps/Collars (MBbl) 6,091 4,946 WTD Price (Bbl) $25.87 $0.00 WTD Floor Price ($/Bbl) $50.83 $49.22 Isobutane Swaps (MBbl) 166 0 WTD Price (Bbl) $26.55 $0.00 Pentane Swaps (MBbl) 664 0 WTD Price (Bbl) $38.16 $0.00 Oil, NGL & Natural Gas Hedges 12 Bal-2021: April – December 2021, hedges executed through 4-30-21

13 FY-20A FY-21E Spuds 55 53 Completions 48 55 Working Interest 98.5% 100% Lateral Length 9,000’ 9,800’ Expect to complete 25% more lateral feet in 2021 vs 2020 for same DC&E expenditures 2020/2021 Capital Budget & Activity $300 $300 $16 $30 $35 $30 $0 $100 $200 $300 $400 FY-20A FY-21E Capital Budget ($ MM) DC&E Infrastructure Other $351 $360 Note: As of Feb-21

79.5 62.3 52.5 45.9 41.0 36.9 81.2 66.6 54.9 47.5 42.1 37.9 0 20 40 60 80 100 Dec-20 Dec-21 Dec-22 Dec-23 Dec-24 Dec-25 M B O E /D Total Production Decline1 Legacy Howard County YE-20 Base Production Decline Expectations 14 20.4 13.9 10.9 9.1 7.9 7.0 22.1 16.9 12.4 10.1 8.6 7.5 0 5 10 15 20 25 Dec-20 Dec-21 Dec-22 Dec-23 Dec-24 Dec-25 M B O /D Oil Production Decline1 Legacy Howard County 1Based only on wells categorized as Proved Developed as of YE-20 Note: All reserves as of 12-31-20, based on SEC benchmark pricing of: $36.04/Bbl for oil & $1.21/MMBtu for natural gas

Commodity Prices Used for 2Q-21 Average Sales Price Realization Guidance 15 Natural Gas: Natural Gas Liquids: Oil: Note: Pricing assumptions as of 5-3-21 WTI NYMEX Brent ICE ($/Bbl) ($/Bbl) Apr-21 $61.70 $65.30 May-21 $63.55 $66.71 Jun-21 $63.39 $66.26 2Q-21 Average $62.89 $66.10 C2 C3 IC4 NC4 C5+ Composite ($/Bbl) ($/Bbl) ($/Bbl) ($/Bbl) ($/Bbl) ($/Bbl) Apr-21 $9.93 $35.11 $35.47 $35.94 $58.50 $27.21 May-21 $10.50 $34.39 $37.28 $37.59 $59.38 $27.54 June-21 $10.50 $34.07 $37.17 $37.43 $58.64 $27.34 2Q-21 Average $10.31 $34.52 $36.65 $37.00 $58.84 $27.37 HH Waha ($/MMBtu) ($/MMBtu) Apr-21 $2.59 $2.37 May-21 $2.93 $2.68 Jun-21 $2.93 $2.84 2Q-21 Average $2.82 $2.63

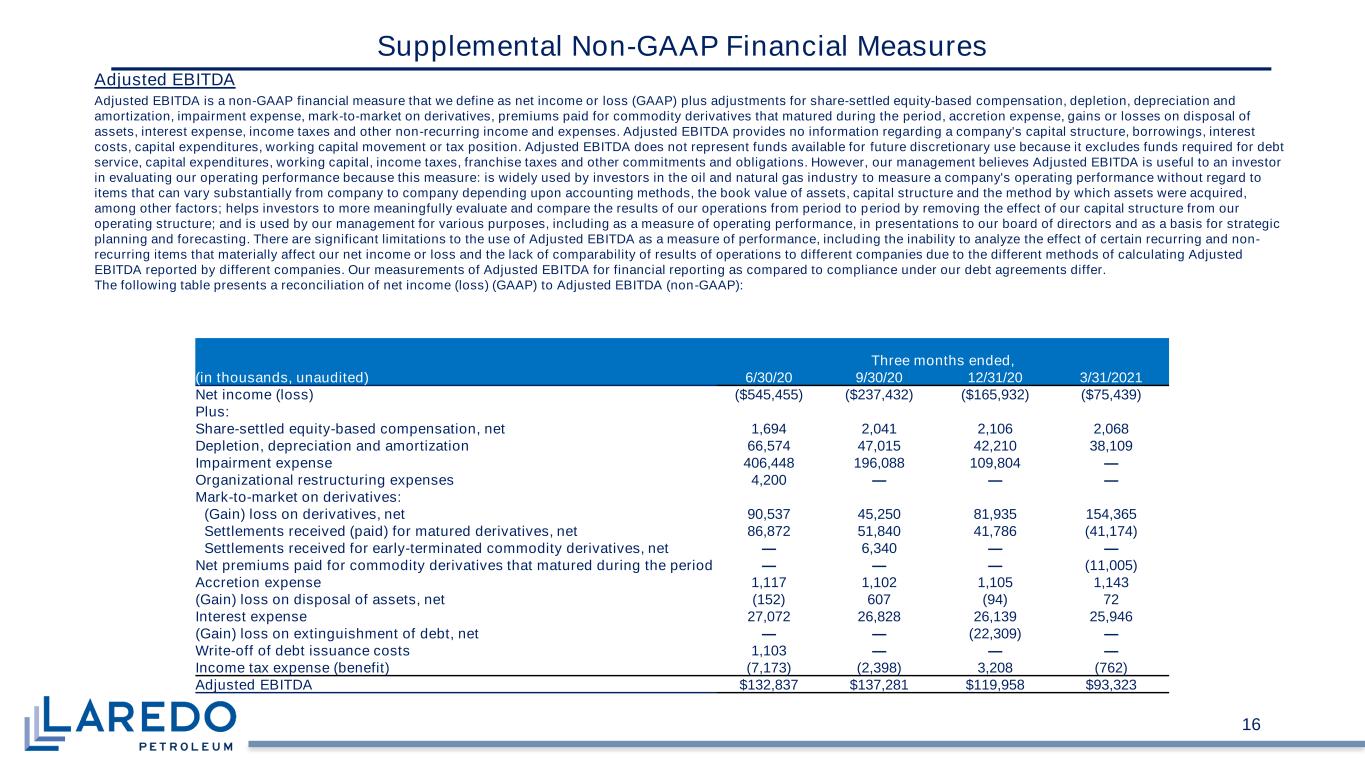

Supplemental Non-GAAP Financial Measures Adjusted EBITDA Adjusted EBITDA is a non-GAAP financial measure that we define as net income or loss (GAAP) plus adjustments for share-settled equity-based compensation, depletion, depreciation and amortization, impairment expense, mark-to-market on derivatives, premiums paid for commodity derivatives that matured during the period, accretion expense, gains or losses on disposal of assets, interest expense, income taxes and other non-recurring income and expenses. Adjusted EBITDA provides no information regarding a company's capital structure, borrowings, interest costs, capital expenditures, working capital movement or tax position. Adjusted EBITDA does not represent funds available for future discretionary use because it excludes funds required for debt service, capital expenditures, working capital, income taxes, franchise taxes and other commitments and obligations. However, our management believes Adjusted EBITDA is useful to an investor in evaluating our operating performance because this measure: is widely used by investors in the oil and natural gas industry to measure a company's operating performance without regard to items that can vary substantially from company to company depending upon accounting methods, the book value of assets, capital structure and the method by which assets were acquired, among other factors; helps investors to more meaningfully evaluate and compare the results of our operations from period to period by removing the effect of our capital structure from our operating structure; and is used by our management for various purposes, including as a measure of operating performance, in presentations to our board of directors and as a basis for strategic planning and forecasting. There are significant limitations to the use of Adjusted EBITDA as a measure of performance, including the inability to analyze the effect of certain recurring and non- recurring items that materially affect our net income or loss and the lack of comparability of results of operations to different companies due to the different methods of calculating Adjusted EBITDA reported by different companies. Our measurements of Adjusted EBITDA for financial reporting as compared to compliance under our debt agreements differ. The following table presents a reconciliation of net income (loss) (GAAP) to Adjusted EBITDA (non-GAAP): 16 Three months ended, (in thousands, unaudited) 6/30/20 9/30/20 12/31/20 3/31/2021 Net income (loss) ($545,455) ($237,432) ($165,932) ($75,439) Plus: Share-settled equity-based compensation, net 1,694 2,041 2,106 2,068 Depletion, depreciation and amortization 66,574 47,015 42,210 38,109 Impairment expense 406,448 196,088 109,804 — Organizational restructuring expenses 4,200 — — — Mark-to-market on derivatives: (Gain) loss on derivatives, net 90,537 45,250 81,935 154,365 Settlements received (paid) for matured derivatives, net 86,872 51,840 41,786 (41,174) Settlements received for early-terminated commodity derivatives, net — 6,340 — — Net premiums paid for commodity derivatives that matured during the period — — — (11,005) Accretion expense 1,117 1,102 1,105 1,143 (Gain) loss on disposal of assets, net (152) 607 (94) 72 Interest expense 27,072 26,828 26,139 25,946 (Gain) loss on extinguishment of debt, net — — (22,309) — Write-off of debt issuance costs 1,103 — — — Income tax expense (benefit) (7,173) (2,398) 3,208 (762) Adjusted EBITDA $132,837 $137,281 $119,958 $93,323

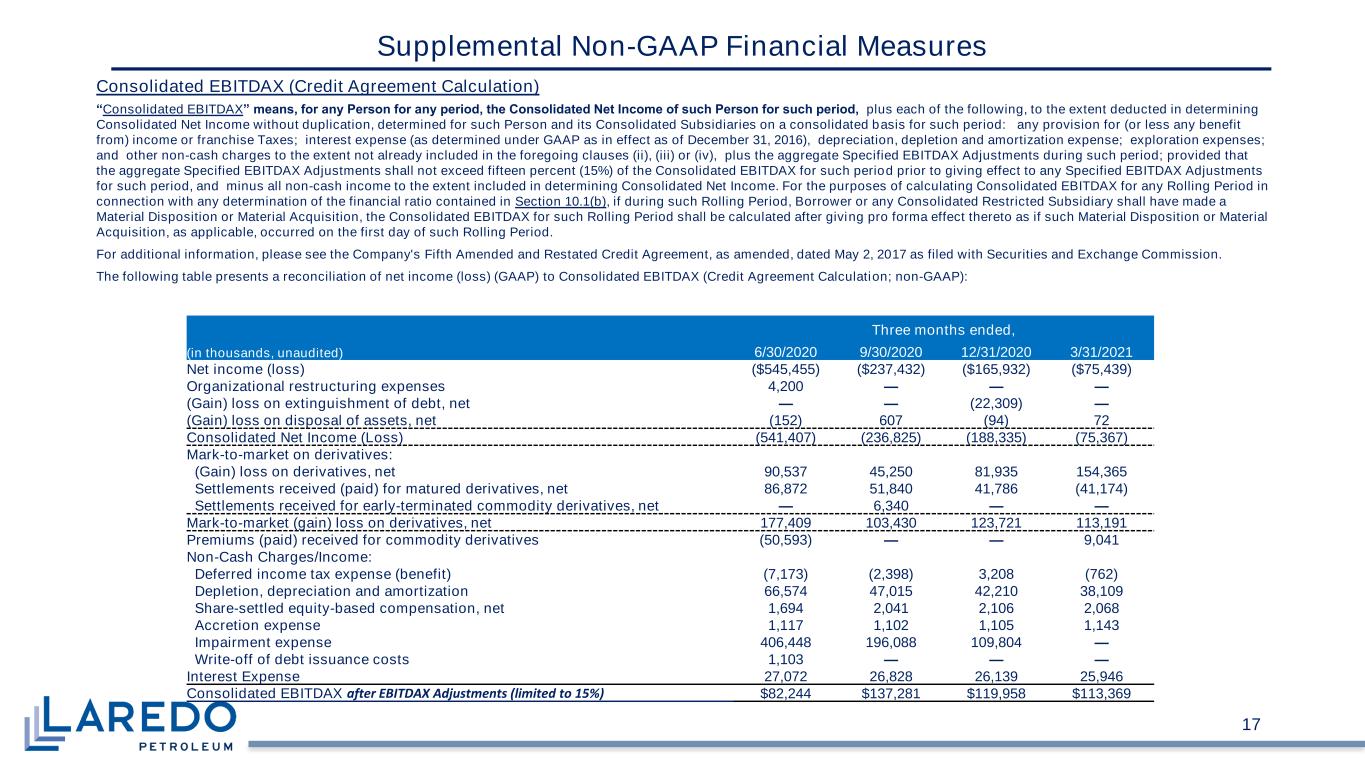

Supplemental Non-GAAP Financial Measures Consolidated EBITDAX (Credit Agreement Calculation) “Consolidated EBITDAX” means, for any Person for any period, the Consolidated Net Income of such Person for such period, plus each of the following, to the extent deducted in determining Consolidated Net Income without duplication, determined for such Person and its Consolidated Subsidiaries on a consolidated basis for such period: any provision for (or less any benefit from) income or franchise Taxes; interest expense (as determined under GAAP as in effect as of December 31, 2016), depreciation, depletion and amortization expense; exploration expenses; and other non-cash charges to the extent not already included in the foregoing clauses (ii), (iii) or (iv), plus the aggregate Specified EBITDAX Adjustments during such period; provided that the aggregate Specified EBITDAX Adjustments shall not exceed fifteen percent (15%) of the Consolidated EBITDAX for such period prior to giving effect to any Specified EBITDAX Adjustments for such period, and minus all non-cash income to the extent included in determining Consolidated Net Income. For the purposes of calculating Consolidated EBITDAX for any Rolling Period in connection with any determination of the financial ratio contained in Section 10.1(b), if during such Rolling Period, Borrower or any Consolidated Restricted Subsidiary shall have made a Material Disposition or Material Acquisition, the Consolidated EBITDAX for such Rolling Period shall be calculated after giving pro forma effect thereto as if such Material Disposition or Material Acquisition, as applicable, occurred on the first day of such Rolling Period. For additional information, please see the Company's Fifth Amended and Restated Credit Agreement, as amended, dated May 2, 2017 as filed with Securities and Exchange Commission. The following table presents a reconciliation of net income (loss) (GAAP) to Consolidated EBITDAX (Credit Agreement Calculation; non-GAAP): 17 Three months ended, (in thousands, unaudited) 6/30/2020 9/30/2020 12/31/2020 3/31/2021 Net income (loss) ($545,455) ($237,432) ($165,932) ($75,439) Organizational restructuring expenses 4,200 — — — (Gain) loss on extinguishment of debt, net — — (22,309) — (Gain) loss on disposal of assets, net (152) 607 (94) 72 Consolidated Net Income (Loss) (541,407) (236,825) (188,335) (75,367) Mark-to-market on derivatives: (Gain) loss on derivatives, net 90,537 45,250 81,935 154,365 Settlements received (paid) for matured derivatives, net 86,872 51,840 41,786 (41,174) Settlements received for early-terminated commodity derivatives, net — 6,340 — — Mark-to-market (gain) loss on derivatives, net 177,409 103,430 123,721 113,191 Premiums (paid) received for commodity derivatives (50,593) — — 9,041 Non-Cash Charges/Income: Deferred income tax expense (benefit) (7,173) (2,398) 3,208 (762) Depletion, depreciation and amortization 66,574 47,015 42,210 38,109 Share-settled equity-based compensation, net 1,694 2,041 2,106 2,068 Accretion expense 1,117 1,102 1,105 1,143 Impairment expense 406,448 196,088 109,804 — Write-off of debt issuance costs 1,103 — — — Interest Expense 27,072 26,828 26,139 25,946 Consolidated EBITDAX after EBITDAX Adjustments (limited to 15%) $82,244 $137,281 $119,958 $113,369

18 Free Cash Flow Free Cash Flow is a non-GAAP financial measure that we define as net cash provided by operating activities (GAAP) before changes in operating assets and liabilities, net, less costs incurred, excluding non-budgeted acquisition costs. Free Cash Flow does not represent funds available for future discretionary use because it excludes funds required for future debt service, capital expenditures, acquisitions, working capital, income taxes, franchise taxes and other commitments and obligations. However, management believes Free Cash Flow is useful to management and investors in evaluating operating trends in its business that are affected by production, commodity prices, operating costs and other related factors. There are significant limitations to the use of Free Cash Flow as a measure of performance, including the lack of comparability due to the different methods of calculating Free Cash Flow reported by different companies. The following table presents a reconciliation of net cash provided by operating activities (GAAP) to Free Cash Flow (non-GAAP) for the periods presented: Three months ended March 31, (in thousands, unaudited) 2021 2020 Net cash provided by operating activities $71,151 $109,589 Less: Change in current assets and liabilities, net (17,259) 18,708 Change in noncurrent assets and liabilities, net (3,275) (6,210) Cash flows from operating activities before changes in operating assets and liabilities, net 91,685 97,091 Less costs incurred, excluding non-budgeted acquisition costs: Oil and natural gas properties(1) 68,449 152,868 Midstream service assets(1) 876 923 Other fixed assets 600 823 Total costs incurred, excluding non-budgeted acquisition costs 69,925 154,614 Free Cash Flow (non-GAAP) $21,760 ($57,523) (1) Includes capitalized share-settled equity-based compensation and asset retirement costs. Supplemental Non-GAAP Financial Measures

Net Debt Net Debt, a non-GAAP financial measure, is calculated as the face value of long-term debt less cash and cash equivalents. Management believes Net Debt is useful to management and investors in determining the Company’s leverage position since the Company has the ability, and may decide, to use a portion of its cash and cash equivalents to reduce debt. Net Debt as of 3-31-21 was $1.115 B. Net Debt to TTM Adjusted EBITDA Net Debt to TTM Adjusted EBITDA is calculated as Net Debt divided by trailing twelve-month Adjusted EBITDA. Net Debt to Adjusted EBITDA is used by our management for various purposes, including as a measure of operating performance, in presentations to our board of directors and as a basis for strategic planning and forecasting. Net Debt to TTM Consolidated EBITDAX (Credit Agreement Calculation) Net Debt to TTM Consolidated EBITDAX is calculated as Net Debt divided by trailing twelve-month Consolidated EBITDAX. Net Debt to Consolidated EBITDAX is used by the banks in our Senior Secured Credit Agreement as a measure of indebtedness and as a calculation to measure compliance with the Company’s leverage covenant. Cash Flow Cash flow, a non-GAAP financial measure, represents cash flows from operating activities before changes in operating assets and liabilities, net. Free Cash Flow Free Cash Flow is a non-GAAP financial measure, that we define as net cash provided by operating activities (GAAP) to cash flows from operating activities before changes in operating assets and liabilities, net, less costs incurred, excluding non-budgeted acquisition costs. Free Cash Flow does not represent funds available for future discretionary use because it excludes funds required for future debt service, capital expenditures, acquisitions, working capital, income taxes, franchise taxes and other commitments and obligations. However, management believes Free Cash Flow is useful to management and investors in evaluating operating trends in our business that are affected by production, commodity prices, operating costs and other related factors. There are significant limitations to the use of Free Cash Flow as a measure of performance, including the lack of comparability due to the different methods of calculating Free Cash Flow reported by different companies. 19 Supplemental Non-GAAP Financial Measures