Attached files

| file | filename |

|---|---|

| EX-99.1 - EX-99.1 - Delek US Holdings, Inc. | dk-ex991earningsreleasex03.htm |

| 8-K - 8-K - Delek US Holdings, Inc. | dk-20210504.htm |

May 5, 2021 Delek US Holdings, Inc. First Quarter 2021 Earnings Call Exhibit 99.2

Disclaimers 2 Forward Looking Statements: Delek US Holdings, Inc. (“Delek US”) and Delek Logistics Partners, LP (“Delek Logistics”; and collectively with Delek US, “we” or “our”) are traded on the New York Stock Exchange in the United States under the symbols “DK” and ”DKL”, respectively. These slides and any accompanying oral and written presentations contain forward-looking statements within the meaning of federal securities laws that are based upon current expectations and involve a number of risks and uncertainties. Statements concerning current estimates, expectations and projections about future results, performance, prospects, opportunities, plans, actions and events and other statements, concerns, or matters that are not historical facts are “forward-looking statements,” as that term is defined under the federal securities laws. These forward-looking statements include, but are not limited to, the statements regarding the following: financial and operating guidance for future and uncompleted financial periods; financial strength and flexibility; potential for and projections of growth; return of cash to shareholders, stock repurchases and the payment of dividends, including the amount and timing thereof; cost reductions; crude oil throughput; crude oil market trends, including production, quality, pricing, demand, imports, exports and transportation costs; light production from shale plays and Permian growth; the performance of our joint venture investments, including Red River and Wink to Webster, and the benefits, flexibility, returns and EBITDA therefrom; the potential for, and estimates of cost savings and other benefits from, acquisitions, divestitures, dropdowns and financing activities; divestiture of non-core assets and matters pertaining thereto; the attainment of certain regulatory benefits; long-term value creation from capital allocation; execution of strategic initiatives and the benefits therefrom, including cash flow stability from business model transition; and access to crude oil and the benefits therefrom. Words such as "may," "will," "should," "could," "would," "predicts," "potential," "continue," "expects," "anticipates," "future," "intends," "plans," "believes," "estimates," "appears," "projects" and similar expressions, as well as statements in future tense, identify forward-looking statements. Investors are cautioned that the following important factors, among others, may affect these forward-looking statements: uncertainty related to timing and amount of value returned to shareholders; risks and uncertainties with respect to the quantities and costs of crude oil we are able to obtain and the price of the refined petroleum products we ultimately sell, including uncertainties regarding future decisions by OPEC regarding production and pricing disputes between OPEC members and Russia; uncertainty relating to the impact of the COVID-19 outbreak on the demand for crude oil, refined products and transportation and storage services; Delek US’ ability to realize cost reductions; risks related to Delek US’ exposure to Permian Basin crude oil, such as supply, pricing, production and transportation capacity; gains and losses from derivative instruments; management's ability to execute its strategy of growth through acquisitions and the transactional risks associated with acquisitions and dispositions; acquired assets may suffer a diminishment in fair value as a result of which we may need to record a write-down or impairment in carrying value of the asset; changes in the scope, costs, and/or timing of capital and maintenance projects; the ability of the Wink to Webster joint venture to construct the long-haul pipeline; the ability of the Red River joint venture to expand the Red River pipeline; the ability to grow the Big Spring Gathering System; operating hazards inherent in transporting, storing and processing crude oil and intermediate and finished petroleum products; our competitive position and the effects of competition; the projected growth of the industries in which we operate; general economic and business conditions affecting the geographic areas in which we operate; and other risks contained in Delek US’ and Delek Logistics’ filings with the United States Securities and Exchange Commission. Forward-looking statements should not be read as a guarantee of future performance or results, and will not be accurate indications of the times at, or by which such performance or results will be achieved. Forward-looking information is based on information available at the time and/or management’s good faith belief with respect to future events, and is subject to risks and uncertainties that could cause actual performance or results to differ materially from those expressed in the statements. Neither Delek US nor Delek Logistics undertakes any obligation to update or revise any such forward-looking statements. Non-GAAP Disclosures: Delek US and Delek Logistics believe that the presentation of adjusted net income (loss), adjusted net income (loss) per share (“adjusted EPS”), earnings before interest, taxes, depreciation and amortization ("EBITDA") and adjusted EBITDA provide useful information to investors in assessing their financial condition, results of operations and cash flow their business is generating. Adjusted net income (loss), adjusted EPS, EBITDA and adjusted EBITDA should not be considered as alternatives to net income (loss), operating income (loss), cash from operations or any other measure of financial performance or liquidity presented in accordance with U.S. GAAP. Adjusted net income (loss), adjusted EPS, EBITDA and adjusted EBITDA have important limitations as analytical tools because they exclude some, but not all, items that affect net income. Additionally, because adjusted net income (loss), adjusted EPS, EBITDA and adjusted EBITDA may be defined differently by other companies in its industry, Delek US' and Delek Logistics’ definitions may not be comparable to similarly titled measures of other companies, thereby diminishing their utility. Please see reconciliations of adjusted net income (loss), adjusted EPS, EBITDA and adjusted EBITDA to their most directly comparable financial measures calculated and presented in accordance with U.S. GAAP in the appendix.

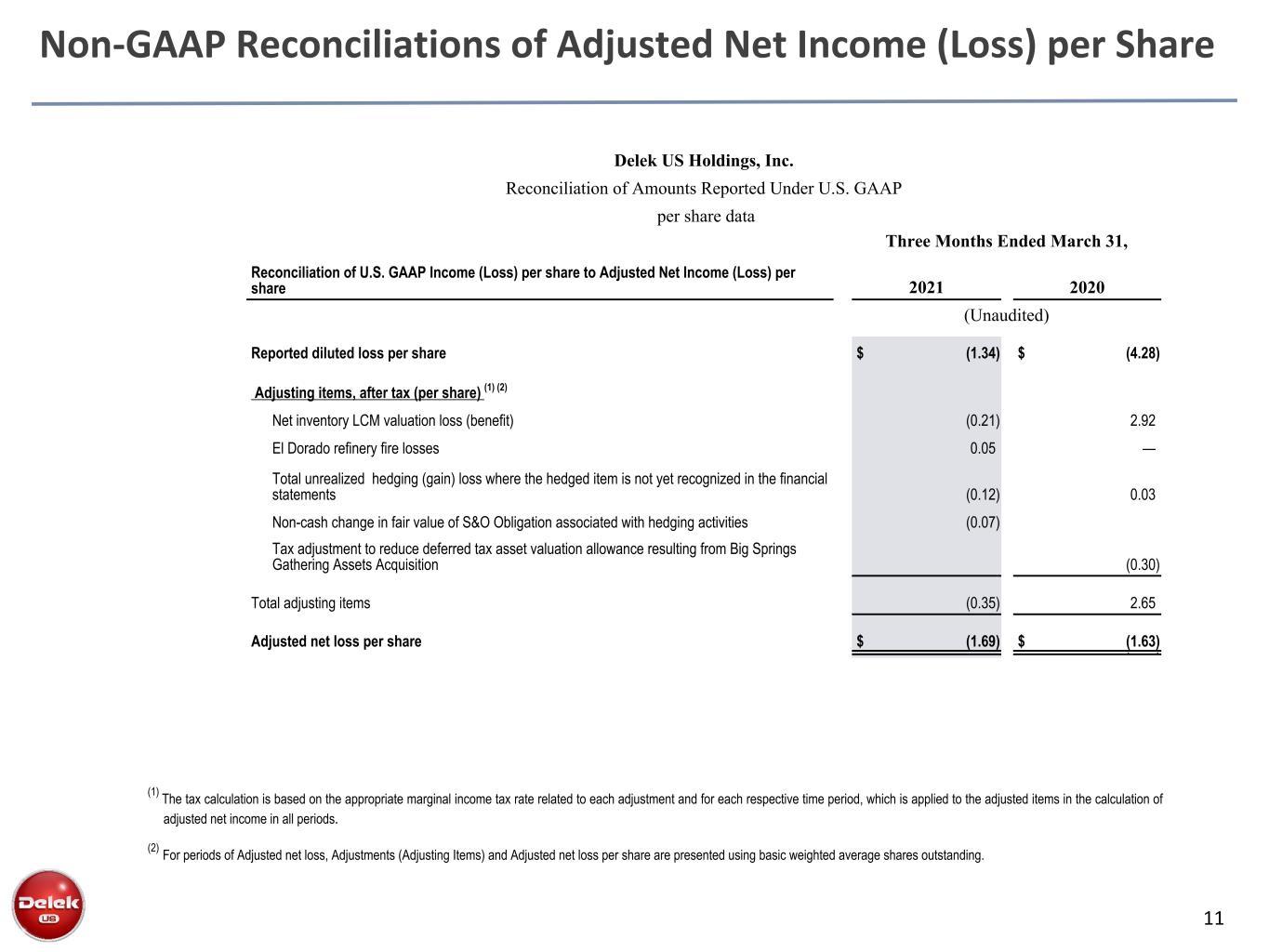

3 First Quarter 2021 1) See slides 10, 11 and 12 for a reconciliation of adjusted net income to net income, adjusted net income per share to net income per share, and adjusted EBITDA to net income. 2) See earnings release for composition of headwinds • Reported EPS of $(1.34) and adjusted EPS of $(1.69) (1) ◦ Adjusted net loss of $125 million and adjusted EBITDA loss of $41 million (1) ▪ Adjusted quarterly results were impacted by net headwinds totaling approximately $21 million (after-tax) or $(0.28) per share (2) • Improved sequential EBITDA despite various headwinds; headline earnings reflect a lower tax benefit attributable to a more favorable internal outlook and corresponding impact on estimated annual effective tax rates • Record first quarter retail segment results versus comparable periods providing stability and diversity • Improving crack spreads prompted a re-start of the Krotz Springs refinery • All major planned refinery turnaround activities for the year are now complete, paving the way for higher utilization rates • Maintain strong balance sheet with $794 million of cash as of March 31, 2021 Net after-tax unrealized hedging (gain) loss where the hedged item is not yet recognized in the financial statementsTax adjustment to reduce deferred tax asset valuation allowance resulting from Big Springs Gathering Assets AcquisitionTotal unrealized hedging (gain) loss where the hedged item is not yet recognized in the financial statements Transforming to More Diversified EBITDA Balance Sheet Flexibility

4 First Quarter 2021 • Strong financial position with $794 million of cash on the balance sheet • Cash flow from operating activities of approx. $(34) million • Cash flow from operating activities (excluding working capital) of approx. $(13) million • Working capital impacted cash flow by approx. $(21) million • Total investing activities of approx. $(46) million: ◦ Cash capital expenditures of approx. $67.0 million • Financing activities of approx. $86 million

5 Capitalization • Delek US Consolidated at March 31, 2021 ◦ Cash of $794 million ◦ Net debt of $1.57 billion • Excluding Delek Logistics at March 31, 2021 ◦ Cash of $781 million ◦ Net debt of $604 million • Balance sheet provides financial flexibility • Note: $156 million Federal Tax Income Tax Receivable ◦ $136 million federal income tax receivable expected in 2021 ◦ Remainder expected within 12-18 months ($ in millions) March 31, 2021 December 31, 2020 Current Portion of Long-Term Debt $13 $33 Long-Term Debt $2,354 $2,315 Total Debt $2,367 $2,348 Cash $794 $788 Net Debt Delek US Consolidated $1,573 $1,560 Delek Logistics Total Debt $983 $992 Cash $13 $4 Net Debt Delek Logistics $970 $988 Delek US, excel. Delek Logistics Total Debt $1,385 $1,356 Cash $781 $784 Net Debt Delek US excluding DKL $604 $572 Net Debt to Cap Delek US Consolidated 46% 45% Net Debt to Cap (excluding DKL Debt) 42% 38%

6 Guidance 2Q21 Guidance Range ($ in millions) Low High Consolidated Operating Expenses $140 $150 Consolidated G&A $54 $59 Consolidated Depreciation and Amort. $65 $70 Net interest expense $29 $32 Total Crude Throughput 270,000 280,000

7 Capital Expenditure • 2021 spending guidance of $175 to $185 million (including turnarounds) ◦ Net of estimated insurance proceeds • 2021 includes the following projects: ◦ Krotz Springs Turnaround ▪ Completed in March 2021 ◦ El Dorado Turnaround ▪ Completed in late April 2021 • No major planned turnaround activities for remainder of the year • Increase from original plan reflects a combination of freeze related damages, El Dorado fire, and capitalized costs from Krotz Springs restart Three Months Ended March 31, 2021 2021 Forecast Refining: Regulatory $0.4 $4.0 Maintenance/reliability $57.4 $115.3 Discretionary/business development $0.0 $0.9 Refining segment total $57.8 $120.2 Logistics: Regulatory $0.5 $8.4 Maintenance/reliability $0.0 $4.7 Discretionary/business development $7.3 $14.7 Logistics segment total $7.8 $27.8 Retail: Regulatory $0.0 $0.0 Maintenance/reliability $0.6 $2.5 Discretionary/business development $0.2 $2.4 Retail segment total $0.8 $4.9 Other: Regulatory $0.4 $4.2 Maintenance/reliability $0.2 $13.2 Discretionary/business development $0.0 $9.9 Other total $0.6 $27.3 Total Capital expenditures $67.0 $180.2

Path Forward 8

Complementary Logistics Systems Significant Organic Growth / Margin Improvement Opportunities Focus on Long-Term Shareholder Returns Financial Flexibility Permian Focused Refining System Questions and Answers An Integrated and Diversified Refining, Logistics and Marketing Company

10 Non-GAAP Reconciliations of Adjusted Net Income (Loss) Delek US Holdings, Inc. Reconciliation of Amounts Reported Under U.S. GAAP $ in millions Three Months Ended March 31, Reconciliation of Net Income (Loss) attributable to Delek to Adjusted Net Loss) 2021 2020 (Unaudited) Reported net loss attributable to Delek $ (98.6) $ (314.4) Adjustments, after tax Net after-tax inventory LCM valuation (benefit) loss (15.7) 214.6 Net after-tax El Dorado refinery fire losses 3.7 — Total unrealized hedging (gain) loss where the hedged item is not yet recognized in the financial statements (9.2) 2.4 Net after-tax non-cash change in fair value of S&O Obligation associated with hedging activities (5.4) Tax adjustment to reduce deferred tax asset valuation allowance resulting from Big Springs Gathering Assets Acquisition (22.3) Total after tax adjustments $ (26.6) $ 194.7 Adjusted net loss $ (125.2) $ (119.7) (1) Represents an adjustment to exclude the effect of non-cash changes in fair value related to economic hedges that were entered into as discrete amendments to the S&O Obligation (i.e., not contemplated in the April 2020 Amendment and Restatement to the S&O Obligation), as such fair value changes are hedges where the hedged item (a future fee) is not yet recognized in the financial statements.

11 Non-GAAP Reconciliations of Adjusted Net Income (Loss) per Share Delek US Holdings, Inc. Reconciliation of Amounts Reported Under U.S. GAAP per share data Three Months Ended March 31, Reconciliation of U.S. GAAP Income (Loss) per share to Adjusted Net Income (Loss) per share 2021 2020 (Unaudited) Reported diluted loss per share $ (1.34) $ (4.28) Adjusting items, after tax (per share) (1) (2) Net inventory LCM valuation loss (benefit) (0.21) 2.92 El Dorado refinery fire losses 0.05 — Total unrealized hedging (gain) loss where the hedged item is not yet recognized in the financial statements (0.12) 0.03 Non-cash change in fair value of S&O Obligation associated with hedging activities (0.07) Tax adjustment to reduce deferred tax asset valuation allowance resulting from Big Springs Gathering Assets Acquisition (0.30) Total adjusting items (0.35) 2.65 Adjusted net loss per share $ (1.69) $ (1.63) 1.21 (0.55) (1) The tax calculation is based on the appropriate marginal income tax rate related to each adjustment and for each respective time period, which is applied to the adjusted items in the calculation of adjusted net income in all periods. (2) For periods of Adjusted net loss, Adjustments (Adjusting Items) and Adjusted net loss per share are presented using basic weighted average shares outstanding.

12 Non-GAAP Reconciliations of Adjusted EBITDA Delek US Holdings, Inc. Reconciliation of Amounts Reported Under U.S. GAAP $ in millions Three Months Ended March 31, Reconciliation of Net Income (Loss) attributable to Delek to Adjusted EBITDA 2021 2020 (Unaudited) Reported net income (loss) attributable to Delek $ (98.6) $ (314.4) Add: Interest expense, net 29.4 34.6 Income tax (benefit) expense - continuing operations (12.4) (83.1) Depreciation and amortization 68.5 52.6 EBITDA (13.1) (310.3) Adjusting items Net inventory LCM valuation (benefit) loss (20.4) 280.8 El Dorado refinery fire - workers compensation loss 3.8 — Unrealized inventory/commodity hedging (gain) loss where the hedged item is not yet recognized in the financial statements (10.7) 3.1 Unrealized RINs and other hedging (gain) loss where the hedged item is not yet recognized in the financial statements (1.4) — Total unrealized hedging (gain) loss where the hedged item is not yet recognized in the financial statements (12.1) 3.1 Non-cash change in fair value of S&O Obligation associated with hedging activities (1) (6.9) — Net income attributable to non-controlling interest 7.3 7.4 Total Adjusting items (28.3) 291.3 Adjusted EBITDA $ (41.4) $ (19.0) (1) Represents an adjustment to exclude the effect of non-cash changes in fair value related to economic hedges that were entered into as discrete amendments to the S&O Obligation (i.e., not contemplated in the April 2020 Amendment and Restatement to the S&O Obligation), as such fair value changes are hedges where the hedged item (a future fee) is not yet recognized in the financial statements.