Attached files

| file | filename |

|---|---|

| EX-99.1 - EX-99.1 - WESTLAKE CHEMICAL CORP | ex991_20210331earningsrele.htm |

| 8-K - 8-K - WESTLAKE CHEMICAL CORP | wlk-20210504.htm |

First Quarter 2021 Earnings Presentation May 4, 2021

Westlake’s commitment to social responsibility and advancing sustainability is formed by the company’s longstanding core values: Health, Safety & Environmental - The vigilant stewardship of the environment and sustainability are of utmost importance and at the forefront of everything we do. Our People - Support, develop and inspire our people to achieve their personal best and treat them with dignity and respect. Quality & Continuous Improvement – An intensive practice of “never-ending process of improvement.” Competitiveness - Providing innovative and useful products, maintaining high standards of customer service and operational excellence with a constant focus on managing costs. Citizenship - Recognizing the importance of supporting the communities in which we work and live and make it a priority to take an active role in making these communities better. Westlake’s sustainability report can be found at https://www.westlake.com/sustainability Commitment to Social Responsibility and Advancing Sustainability Participating in Multi-Industry Associations for Environmental Protection Westlake is a proud partner with the following organizations to drive sustainable action to eliminate plastic waste, capture more flexible food packaging waste for recycling and support vinyls’ sustainable impact in the world, along with many other initiatives. Protecting the Environment Westlake has numerous programs designed to promote safe, ethical, environmentally and socially responsible practices including: a worldwide recycling program, operating in an energy efficient manner that stabilizes the power grids and reducing water usage and emissions. As discussed in our sustainability report, over a five year period, Westlake has reduced Sulphur Dioxide emissions to almost zero, reduced energy usage per ton of global production and achieved a nearly 30% reduction on CO2 emissions. 2

Westlake Chemical First Quarter 2021 Highlights 3 Business Highlights By quarter end, restored operations to all facilities after severe Winter Storm Uri, which had a significant impact on our business from reduced production and sales and additional maintenance expense Robust global demand and pricing environment continued for PVC, Polyethylene and downstream building products driving strong integrated margins from cross-section of industries including packaging, housing and automotive Generated $265 million cash flow provided by operating activities in the first quarter Business Hi lights Industry Outlook Continued strength in PVC and Polyethylene demand driven by globally strong demand in building products, packaging and automotive Recovering caustic soda demand driven by robust industrial, construction and automotive activity Focus on sustainability with Westlake launching green caustic soda, which has a reduced CO2 impact of more than 30% compared to conventional caustic soda Industry Outlook $242 MM $1.87 $1.4 B $553 MM

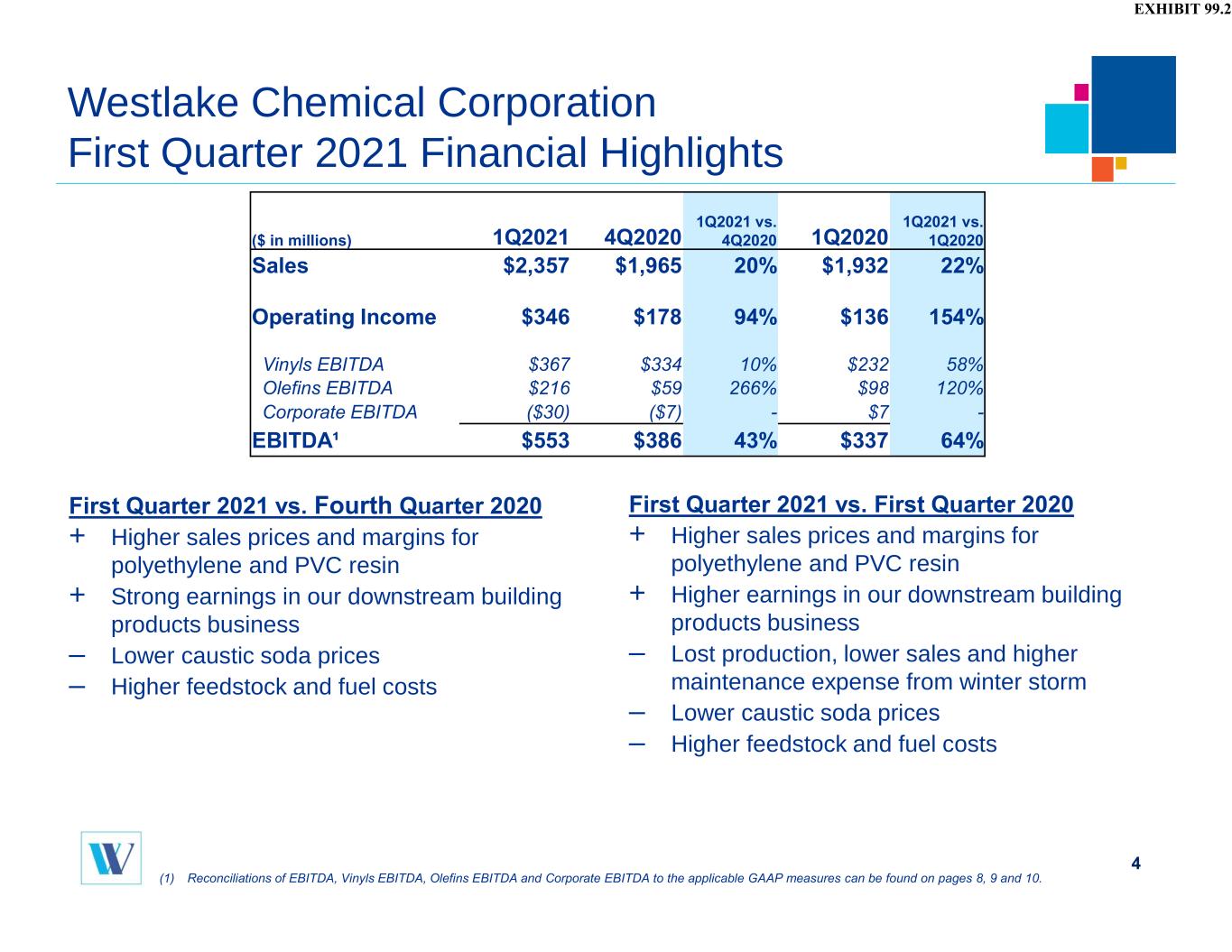

Westlake Chemical Corporation First Quarter 2021 Financial Highlights (1) Reconciliations of EBITDA, Vinyls EBITDA, Olefins EBITDA and Corporate EBITDA to the applicable GAAP measures can be found on pages 8, 9 and 10. First Quarter 2021 vs. Fourth Quarter 2020 + Higher sales prices and margins for polyethylene and PVC resin + Strong earnings in our downstream building products business – Lower caustic soda prices – Higher feedstock and fuel costs First Quarter 2021 vs. First Quarter 2020 + Higher sales prices and margins for polyethylene and PVC resin + Higher earnings in our downstream building products business – Lost production, lower sales and higher maintenance expense from winter storm – Lower caustic soda prices – Higher feedstock and fuel costs 4 ($ in millions) 1Q2021 4Q2020 1Q2021 vs. 4Q2020 1Q2020 1Q2021 vs. 1Q2020 Sales $2,357 $1,965 20% $1,932 22% Operating Income $346 $178 94% $136 154% Vinyls EBITDA $367 $334 10% $232 58% Olefins EBITDA $216 $59 266% $98 120% Corporate EBITDA ($30) ($7) - $7 - EBITDA¹ $553 $386 43% $337 64%

Vinyls Segment Performance 5 First Quarter 2021 vs. Fourth Quarter 2020 + Higher sales prices for PVC resin + Higher sales volumes for most of our major products + Strong earnings in our downstream building products business – Lower caustic soda prices – Higher feedstock costs First Quarter 2021 vs. First Quarter 2020 + Higher sales prices and margins for PVC resin + Higher earnings in building products business – Lost production, lower sales and higher maintenance expense from winter storm – Lower sales prices for caustic soda – Higher feedstock and fuel costs ($ in millions) 1Q2021 4Q2020 1Q2021 vs. 4Q2020 1Q2020 1Q2021 vs. 1Q2020 Sales $1,820 $1,590 14% $1,505 21% Operating Income $200 $166 20% $73 174% EBITDA $367 $334 10% $232 58% +7.3% +7.2% Vinyls Segment 1Q 2021 vs. 4Q 2020 +19.1% +1.8% Vinyls Segment 1Q 2021 vs. 1Q 2020

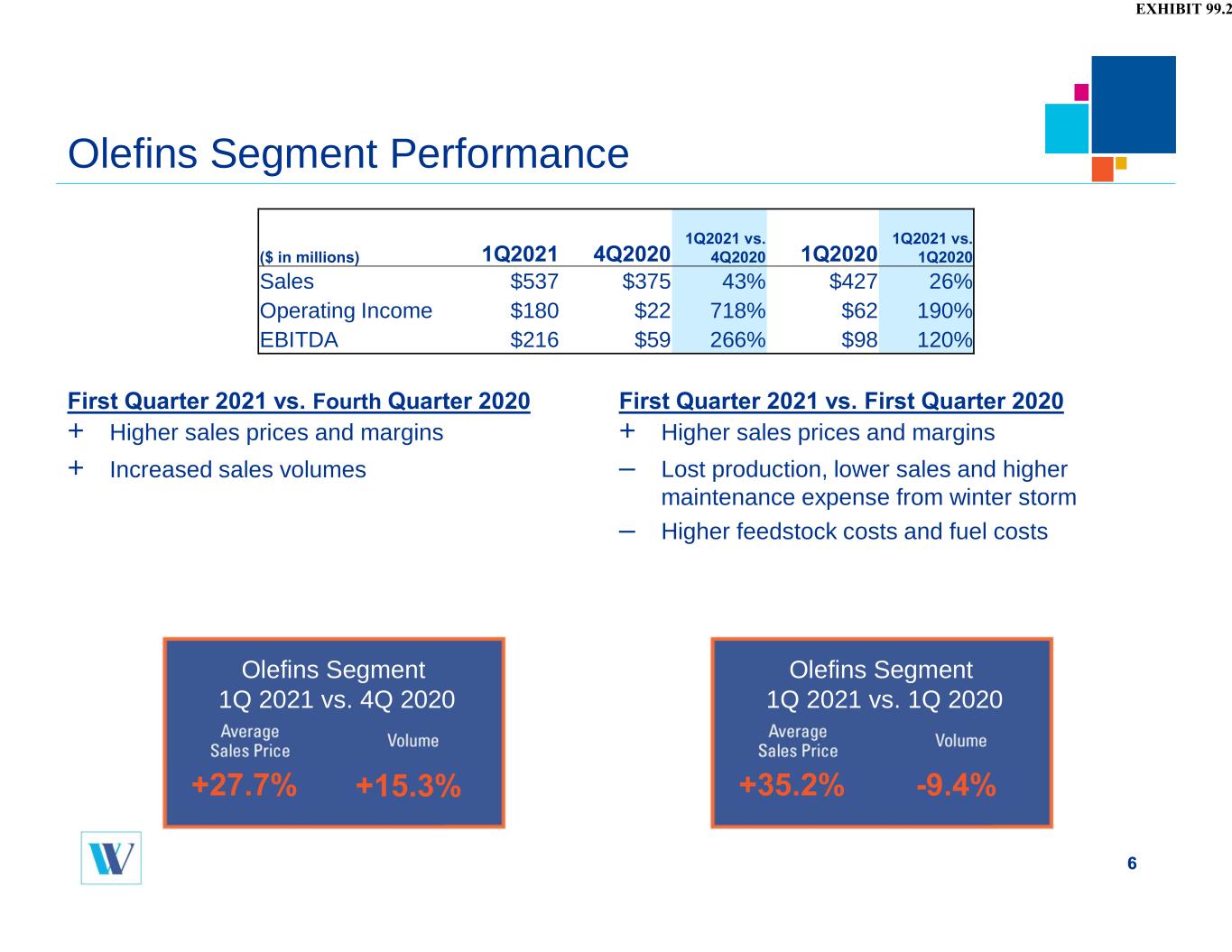

Olefins Segment Performance 6 First Quarter 2021 vs. Fourth Quarter 2020 + Higher sales prices and margins + Increased sales volumes First Quarter 2021 vs. First Quarter 2020 + Higher sales prices and margins – Lost production, lower sales and higher maintenance expense from winter storm – Higher feedstock costs and fuel costs ($ in millions) 1Q2021 4Q2020 1Q2021 vs. 4Q2020 1Q2020 1Q2021 vs. 1Q2020 Sales $537 $375 43% $427 26% Operating Income $180 $22 718% $62 190% EBITDA $216 $59 266% $98 120% +27.7% +15.3% Olefins Segment 1Q 2021 vs. 4Q 2020 +35.2% -9.4% Olefins Segment 1Q 2021 vs. 1Q 2020

Financial Reconciliations

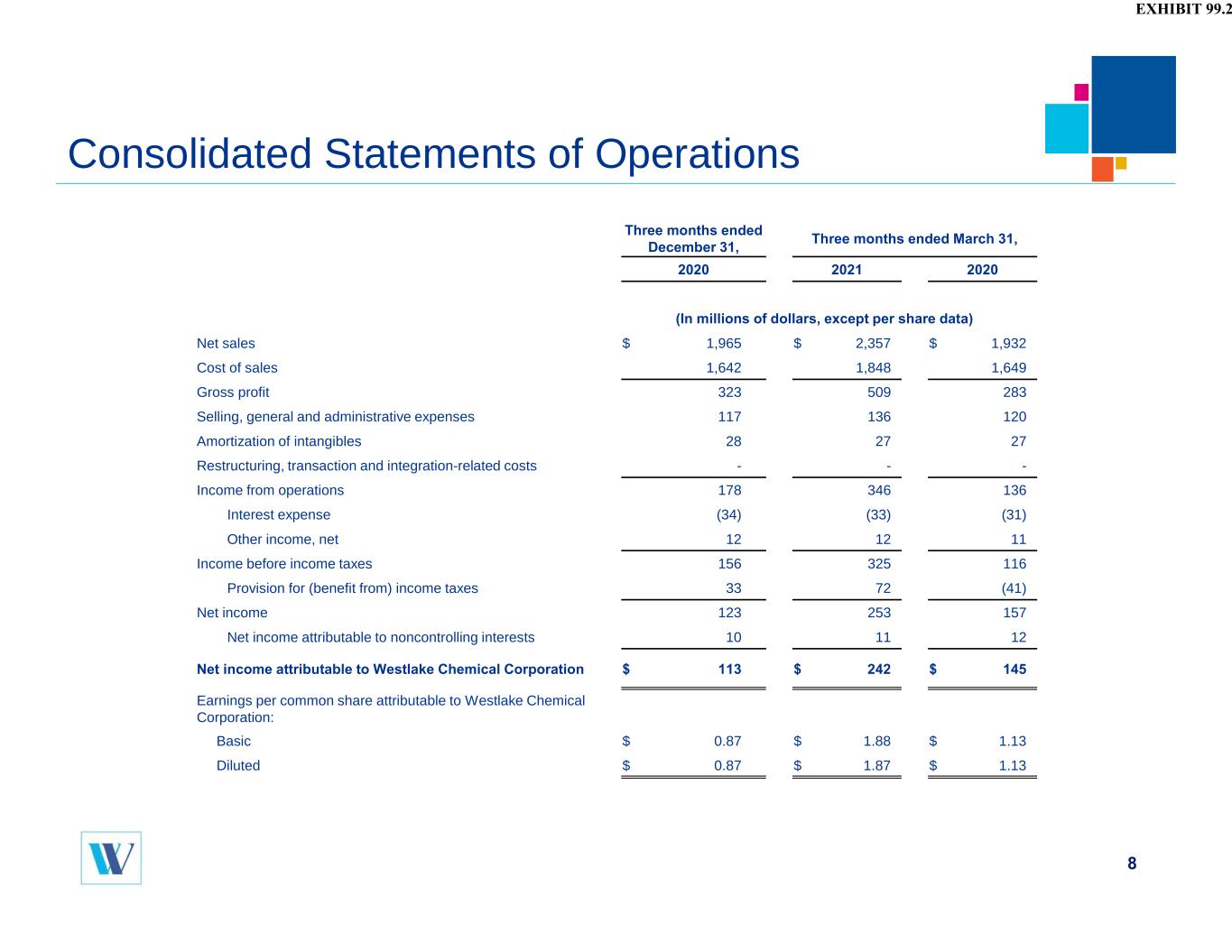

Consolidated Statements of Operations 8 Three months ended December 31, Three months ended March 31, 2020 2021 2020 (In millions of dollars, except per share data) Net sales $ 1,965 $ 2,357 $ 1,932 Cost of sales 1,642 1,848 1,649 Gross profit 323 509 283 Selling, general and administrative expenses 117 136 120 Amortization of intangibles 28 27 27 Restructuring, transaction and integration-related costs - - - Income from operations 178 346 136 Interest expense (34) (33) (31) Other income, net 12 12 11 Income before income taxes 156 325 116 Provision for (benefit from) income taxes 33 72 (41) Net income 123 253 157 Net income attributable to noncontrolling interests 10 11 12 Net income attributable to Westlake Chemical Corporation $ 113 $ 242 $ 145 Earnings per common share attributable to Westlake Chemical Corporation: Basic $ 0.87 $ 1.88 $ 1.13 Diluted $ 0.87 $ 1.87 $ 1.13

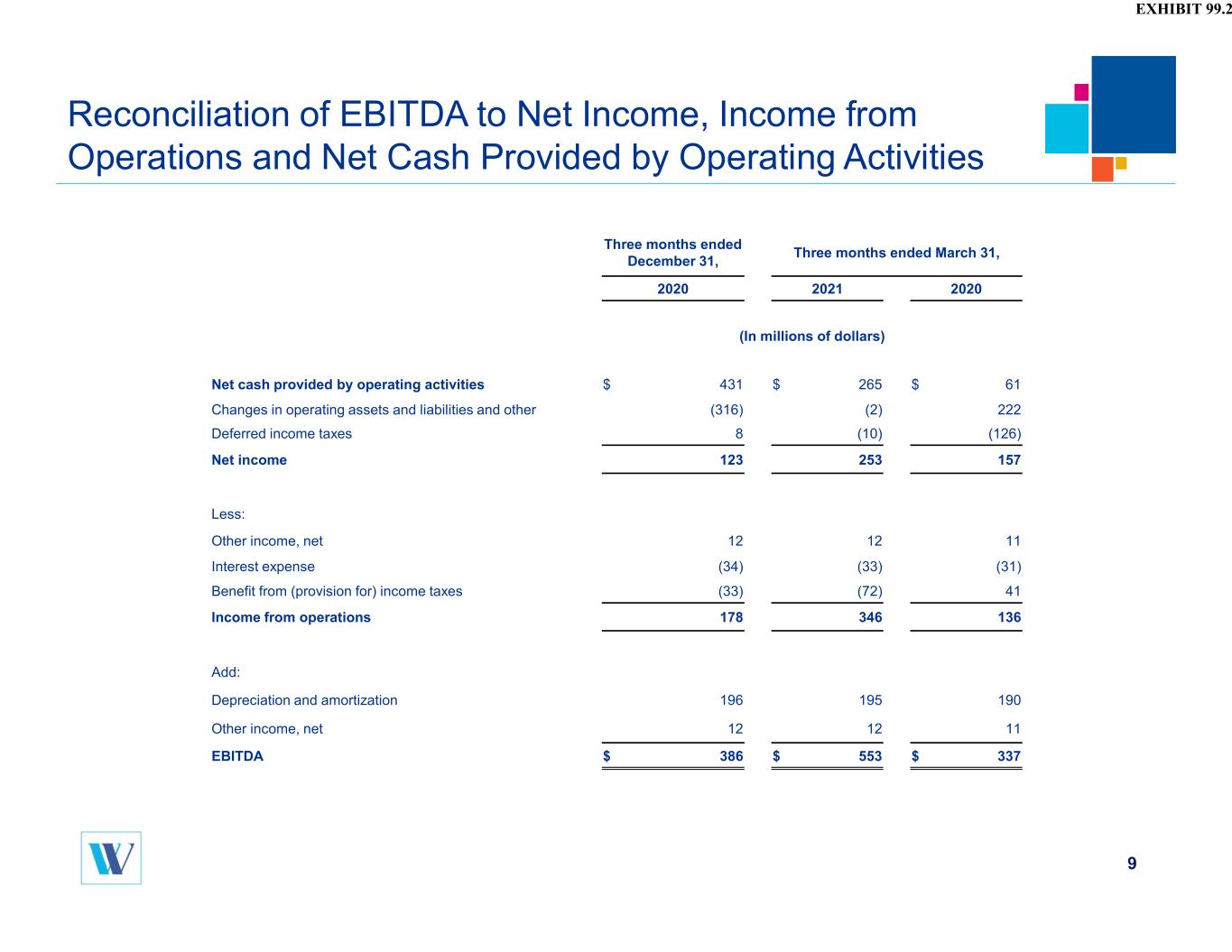

Reconciliation of EBITDA to Net Income, Income from Operations and Net Cash Provided by Operating Activities 9 Three months ended December 31, Three months ended March 31, 2020 2021 2020 (In millions of dollars) Net cash provided by operating activities $ 431 $ 265 $ 61 Changes in operating assets and liabilities and other (316) (2) 222 Deferred income taxes 8 (10) (126) Net income 123 253 157 Less: Other income, net 12 12 11 Interest expense (34) (33) (31) Benefit from (provision for) income taxes (33) (72) 41 Income from operations 178 346 136 Add: Depreciation and amortization 196 195 190 Other income, net 12 12 11 EBITDA $ 386 $ 553 $ 337

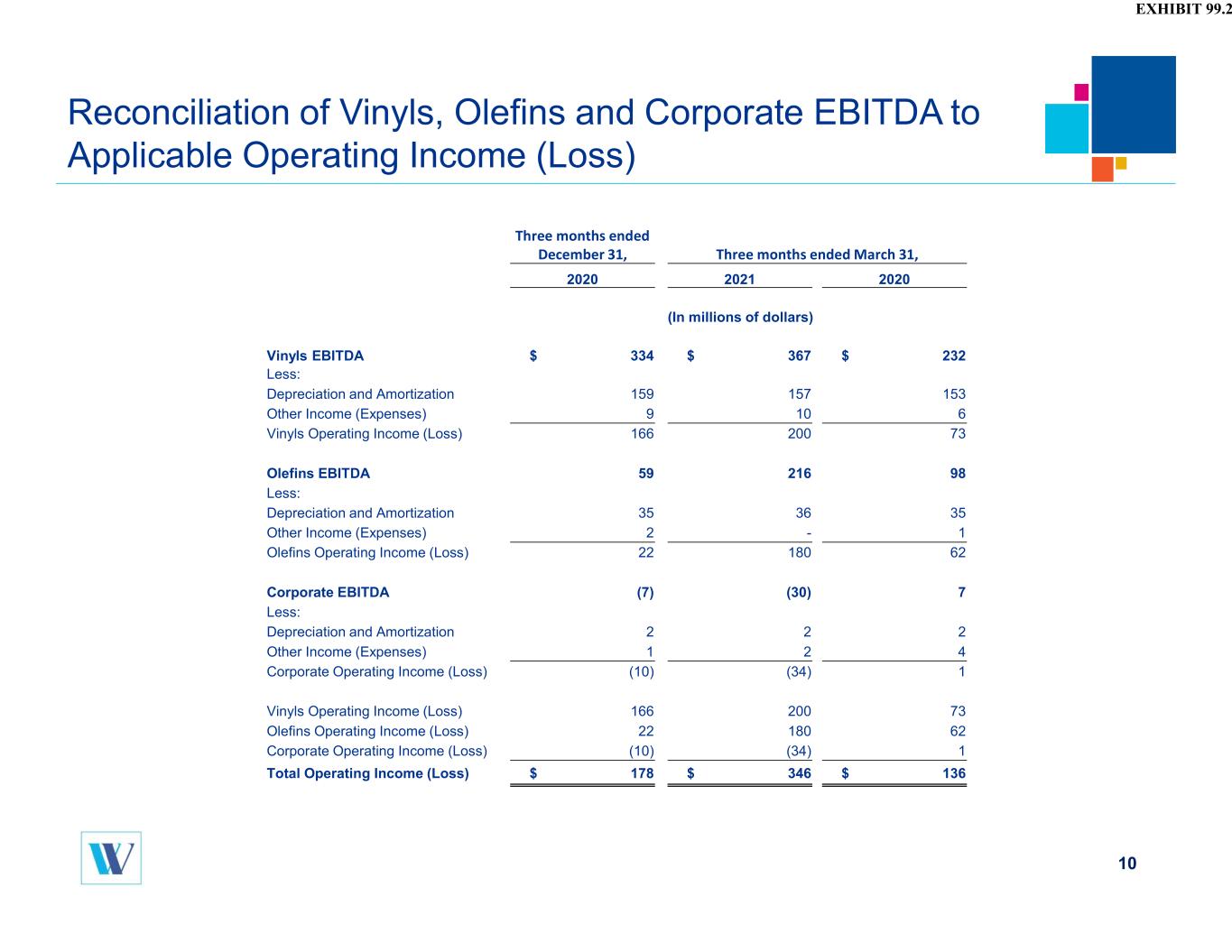

Reconciliation of Vinyls, Olefins and Corporate EBITDA to Applicable Operating Income (Loss) 10 Three months ended December 31, Three months ended March 31, 2020 2021 2020 (In millions of dollars) Vinyls EBITDA $ 334 $ 367 $ 232 Less: Depreciation and Amortization 159 157 153 Other Income (Expenses) 9 10 6 Vinyls Operating Income (Loss) 166 200 73 Olefins EBITDA 59 216 98 Less: Depreciation and Amortization 35 36 35 Other Income (Expenses) 2 - 1 Olefins Operating Income (Loss) 22 180 62 Corporate EBITDA (7) (30) 7 Less: Depreciation and Amortization 2 2 2 Other Income (Expenses) 1 2 4 Corporate Operating Income (Loss) (10) (34) 1 Vinyls Operating Income (Loss) 166 200 73 Olefins Operating Income (Loss) 22 180 62 Corporate Operating Income (Loss) (10) (34) 1 Total Operating Income (Loss) $ 178 $ 346 $ 136

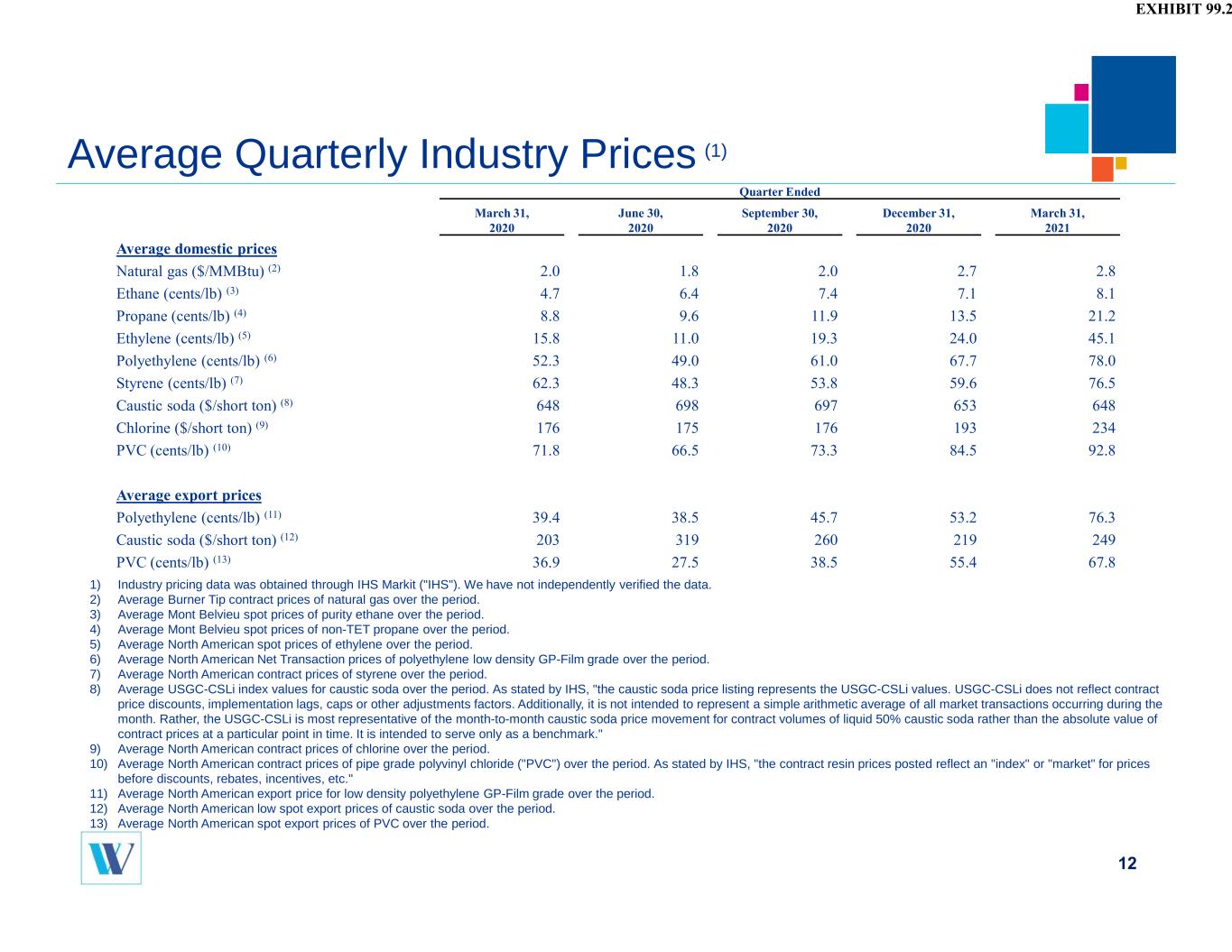

Quarterly Industry Pricing

1) Industry pricing data was obtained through IHS Markit ("IHS"). We have not independently verified the data. 2) Average Burner Tip contract prices of natural gas over the period. 3) Average Mont Belvieu spot prices of purity ethane over the period. 4) Average Mont Belvieu spot prices of non-TET propane over the period. 5) Average North American spot prices of ethylene over the period. 6) Average North American Net Transaction prices of polyethylene low density GP-Film grade over the period. 7) Average North American contract prices of styrene over the period. 8) Average USGC-CSLi index values for caustic soda over the period. As stated by IHS, "the caustic soda price listing represents the USGC-CSLi values. USGC-CSLi does not reflect contract price discounts, implementation lags, caps or other adjustments factors. Additionally, it is not intended to represent a simple arithmetic average of all market transactions occurring during the month. Rather, the USGC-CSLi is most representative of the month-to-month caustic soda price movement for contract volumes of liquid 50% caustic soda rather than the absolute value of contract prices at a particular point in time. It is intended to serve only as a benchmark." 9) Average North American contract prices of chlorine over the period. 10) Average North American contract prices of pipe grade polyvinyl chloride ("PVC") over the period. As stated by IHS, "the contract resin prices posted reflect an "index" or "market" for prices before discounts, rebates, incentives, etc." 11) Average North American export price for low density polyethylene GP-Film grade over the period. 12) Average North American low spot export prices of caustic soda over the period. 13) Average North American spot export prices of PVC over the period. Average Quarterly Industry Prices (1) 12 Quarter Ended March 31, 2020 June 30, 2020 September 30, 2020 December 31, 2020 March 31, 2021 Average domestic prices Natural gas ($/MMBtu) (2) 2.0 1.8 2.0 2.7 2.8 Ethane (cents/lb) (3) 4.7 6.4 7.4 7.1 8.1 Propane (cents/lb) (4) 8.8 9.6 11.9 13.5 21.2 Ethylene (cents/lb) (5) 15.8 11.0 19.3 24.0 45.1 Polyethylene (cents/lb) (6) 52.3 49.0 61.0 67.7 78.0 Styrene (cents/lb) (7) 62.3 48.3 53.8 59.6 76.5 Caustic soda ($/short ton) (8) 648 698 697 653 648 Chlorine ($/short ton) (9) 176 175 176 193 234 PVC (cents/lb) (10) 71.8 66.5 73.3 84.5 92.8 Average export prices Polyethylene (cents/lb) (11) 39.4 38.5 45.7 53.2 76.3 Caustic soda ($/short ton) (12) 203 319 260 219 249 PVC (cents/lb) (13) 36.9 27.5 38.5 55.4 67.8

Safe Harbor Language This presentation contains certain forward-looking statements including statements regarding PVC, polyethylene, building products and caustic soda pricing and demand, continued recovery in key end markets (such as housing starts), our cost control and efficiency efforts, our ability to capture integrated chain margin, results of reinvestment in our businesses and our reduction in carbon impact. Actual results may differ materially depending on factors such as general economic and business conditions; the cyclical nature of the chemical industry; the availability, cost and volatility of raw materials and energy; uncertainties associated with the United States, Europe and worldwide economies, including those due to political tensions in the Middle East and elsewhere; current and potential governmental regulatory actions in the United States and Europe and regulatory actions and political unrest in other countries; industry production capacity and operating rates; the supply/ demand balance for our products; competitive products and pricing pressures; instability in the credit and financial markets; access to capital markets; terrorist acts; operating interruptions including leaks, explosions, fires, weather-related incidents, mechanical failure, unscheduled downtime, labor difficulties, transportation interruptions, spills and releases and other environmental risks; changes in laws or regulations; technological developments; our ability to implement our business strategies; creditworthiness of our customers; uncertainties associated with the COVID-19 pandemic; and other factors described in our reports filed with the Securities and Exchange Commission. Many of these factors are beyond our ability to control or predict. Any of these factors, or a combination of these factors, could materially affect our future results of operations and the ultimate accuracy of the forward-looking statements. These forward-looking statements are not guarantees of our future performance, and our actual results and future developments may differ materially from those projected in the forward-looking statements. Management cautions against putting undue reliance on forward-looking statements. Every forward-looking statement speaks only as of the date of the particular statement, and we undertake no obligation to publicly update or revise any forward-looking statements. Investor Relations Contacts Westlake Chemical 2801 Post Oak Boulevard, Suite 600 Houston, Texas 77056 713-960-9111 Steve Bender Executive Vice President & Chief Financial Officer Jeff Holy Vice President & Treasurer 13