Attached files

| file | filename |

|---|---|

| EX-99.1 - EX-99.1 - Apollo Global Management, Inc. | erex9911q2021.htm |

| 8-K - 8-K - Apollo Global Management, Inc. | apo-20210504.htm |

A P O L L O G L O B A L M A N A G E M E N T Apollo Global Management, Inc. First Quarter 2021 Earnings Exhibit 99.2 May 4, 2021

GAAP Results • Net Income of $1.5 billion • Net Income Attributable to Apollo Global Management, Inc. Class A Common Stockholders of $670 million ($2.81/ share) Financial Measures & Dividend Assets Under Management Business Drivers ($ in millions, except per share data) 1Q'21 Per Share LTM Per Share • Distributable Earnings (“DE”) $293.8 $0.66 $1,021.5 $2.31 • Fee Related Earnings (“FRE”) $286.7 $0.65 $1,099.1 $2.50 Apollo 1Q'21 Financial Results Highlights • Total Assets Under Management (“AUM”) of $461.1 billion • Fee-Generating AUM (“FGAUM”) of $345.2 billion • Performance Fee-Eligible AUM (“PFEAUM”) of $142.8 billion • Dry powder of $49.7 billion available for investment • Inflows: $13.4 billion of capital inflows ($128.8 billion LTM) • Deployment: $24.9 billion ($92.3 billion LTM) • Drawdown deployment: $2.7 billion ($14.5 billion LTM) • Realizations: $3.7 billion of capital returned to investors ($10.4 billion LTM) Note: This presentation contains non-GAAP financial information and defined terms which are described on pages 30 to 33. The non-GAAP financial information contained herein is reconciled to GAAP financial information on pages 26 to 28. “LTM” as used throughout this presentation refers to the twelve months ended March 31, 2021 unless the context otherwise provides. LTM DE and FRE per share amounts represent the sum of the last four quarters. AUM totals may not add due to rounding. 1 • Net Performance Fee Receivable of $1.3 billion ($3.04 per share) and Net Clawback Payable of $73 million ($0.17 per share) as of 1Q'21 • Declared 1Q'21 dividend of $0.50 per share of Class A Common Stock and equivalent (payout ratio of 76%), bringing LTM dividends to $2.10 per share of Class A Common Stock (payout ratio of 91%)

($ in thousands, except share data) 1Q'20 4Q'20 1Q'21 Revenues: Management fees $396,604 $446,846 $457,185 Advisory and transaction fees, net 36,963 77,113 56,348 Investment income (loss): Performance allocations (1,734,323) 660,962 1,395,347 Principal investment income (loss) (187,849) 107,208 381,966 Total investment income (loss) (1,922,172) 768,170 1,777,313 Incentive fees 19,519 4,367 3,854 Total Revenues (1,469,086) 1,296,496 2,294,700 Expenses: Compensation and benefits: Salary, bonus and benefits 139,269 174,572 174,630 Equity-based compensation 52,122 51,872 56,448 Profit sharing expense (635,998) 315,731 655,480 Total compensation and benefits (444,607) 542,175 886,558 Interest expense 31,242 34,817 34,799 General, administrative and other 84,522 95,144 99,850 Placement fees 409 430 537 Total Expenses (328,434) 672,566 1,021,744 Other Income: Net gains (losses) from investment activities (1,264,551) 395,925 353,151 Net gains (losses) from investment activities of consolidated variable interest entities (165,920) 183,308 112,594 Interest income 7,934 1,586 798 Other income (loss), net (16,507) 23,851 (17,750) Total Other Income (Loss) (1,439,044) 604,670 448,793 Income (loss) before income tax (provision) benefit (2,579,696) 1,228,600 1,721,749 Income tax (provision) benefit 295,853 (153,139) (203,246) Net Income (Loss) (2,283,843) 1,075,461 1,518,503 Net (income) loss attributable to Non-Controlling Interests 1,287,625 (641,357) (839,613) Net Income (Loss) Attributable to Apollo Global Management, Inc. (996,218) 434,104 678,890 Series A Preferred Stock Dividends (4,383) (4,383) (4,383) Series B Preferred Stock Dividends (4,781) (4,781) (4,781) Net Income (Loss) Attributable to Apollo Global Management, Inc. Class A Common Stockholders ($1,005,382) $424,940 $669,726 Net Income (Loss) Per Share of Class A Common Stock: Net Income (Loss) Available to Class A Common Stock – Basic ($4.47) $1.80 $2.81 Net Income (Loss) Available to Class A Common Stock – Diluted ($4.47) $1.80 $2.81 Weighted Average Number of Class A Common Stock Outstanding – Basic 226,757,519 227,931,929 230,003,502 Weighted Average Number of Class A Common Stock Outstanding – Diluted 226,757,519 227,931,929 230,003,502 Net Income was $1.5 billion for the quarter ended March 31, 2021; Net Income Attributable to Apollo Global Management, Inc. Class A Common Stockholders was $669.7 million for the quarter ended March 31, 2021 GAAP Consolidated Statements of Operations (Unaudited) 2

($ in thousands, except per share data) 1Q'20 4Q'20 1Q'21 1Q'20 LTM 1Q'21 LTM Management fees $382,368 $437,322 $448,669 $1,514,815 $1,714,265 Advisory and transaction fees, net 36,732 80,677 55,495 140,562 270,283 Performance fees1 2,404 1,788 8,771 22,853 16,203 Total Fee Related Revenues 421,504 519,787 512,935 1,678,230 2,000,751 Salary, bonus and benefits (124,021) (157,028) (157,371) (481,612) (594,337) General, administrative and other (68,353) (86,392) (68,648) (278,324) (304,178) Placement fees (413) (430) (477) (1,938) (1,878) Total Fee Related Expenses (192,787) (243,850) (226,496) (761,874) (900,393) Other income (loss), net of Non-Controlling Interest (661) (144) 217 4,146 (1,231) Fee Related Earnings $228,056 $275,793 $286,656 $920,502 $1,099,127 Per share2 $0.52 $0.63 $0.65 $2.21 $2.50 Realized performance fees 65,746 186,895 106,754 604,063 321,931 Realized profit sharing expense (65,746) (96,279) (57,756) (314,859) (182,317) Net Realized Performance Fees — 90,616 48,998 289,204 139,614 Realized principal investment income, net3 5,583 9,167 26,634 59,844 43,902 Net interest loss and other (37,134) (33,524) (33,506) (89,768) (130,886) Segment Distributable Earnings $196,505 $342,052 $328,782 $1,179,782 $1,151,757 Taxes and related payables (22,193) (15,499) (25,786) (69,857) (93,582) Preferred dividends (9,164) (9,164) (9,164) (36,656) (36,656) Distributable Earnings $165,148 $317,389 $293,832 $1,073,269 $1,021,519 Per share2 $0.37 $0.72 $0.66 $2.57 $2.31 Net dividend per share2 $0.42 $0.60 $0.50 $2.31 $2.10 Payout ratio 114% 83% 76% 90% 91% Total Segments 1. Represents certain performance fees related to business development companies, Redding Ridge Holdings LP (“Redding Ridge Holdings”), an affiliate of Redding Ridge, and MidCap. 2. Per share calculations are based on end of period Distributable Earnings Shares Outstanding, which consist of total shares of Class A Common Stock outstanding, Apollo Operating Group Units that participate in dividends and RSUs that participate in dividends. LTM per share amounts represent the sum of the last four quarters. See page 22 for details regarding the stockholder dividend and page 27 for the share reconciliation. 3. Realized principal investment income, net includes dividends from our permanent capital vehicles, net of amounts to be distributed to certain employees as part of a dividend compensation program. 3

Quarterly Trailing FRE FRE Bridge Fee Related Earnings Rollforward “NM” as used throughout this presentation indicates data has not been presented as it was deemed not meaningful, unless the context otherwise provides. 1. FRE Margin is calculated as Fee Related Earnings divided by fee-related revenues (which includes management fees, transaction and advisory fees and certain performance fees), as well as other income attributable to FRE. ($ in millions) FRE increased 26% year-over-year and 4% quarter-over-quarter; FRE margin increased to 56%, driven by higher management fees and lower non-compensation expenses, partially offset by a decrease in advisory and transaction fees 1Q'21 Per Share $0.52 $0.59 $0.63 $0.63 $0.03 $0.02 $0.04 $(0.07) $0.65 FRE Margin1 4 $228.1 $259.2 $277.4 $275.8 54% 56% 55% 53% 1Q'20 2Q'20 3Q'20 4Q'20 $11.3 $7.0 $17.8 $(25.2) $286.7 Advisory & Transaction Fees Mgmt Fees Non comp • 56% Performance Fees

Dividend per Share1 DE decreased quarter-over-quarter, primarily due to lower realized performance fees, partially offset by an increase in FRE $0.42 $0.49 $0.51 $0.60 $0.50 1Q'20 2Q'20 3Q'20 4Q'20 1Q'21 Distributable Earnings per Share1 $0.37 $0.46 $0.47 $0.72 $0.66 1Q'20 2Q'20 3Q'20 4Q'20 1Q'21 Distributable Earnings and Dividend 5 1. Per share calculations are based on end of period Distributable Earnings Shares Outstanding. The declaration and payment of any dividends are at the sole discretion of the executive committee of AGM Inc.’s board of directors, which may change the dividend policy at any time, including, without limitation, to eliminate the dividend entirely. As previously announced, following the closing of Apollo’s proposed merger with Athene Holding, Apollo intends to distribute an annual dividend of $1.60 per share of common stock, with increases based on growth of the business, as determined by the board of directors. $0.40 Minimum Quarterly Dividend

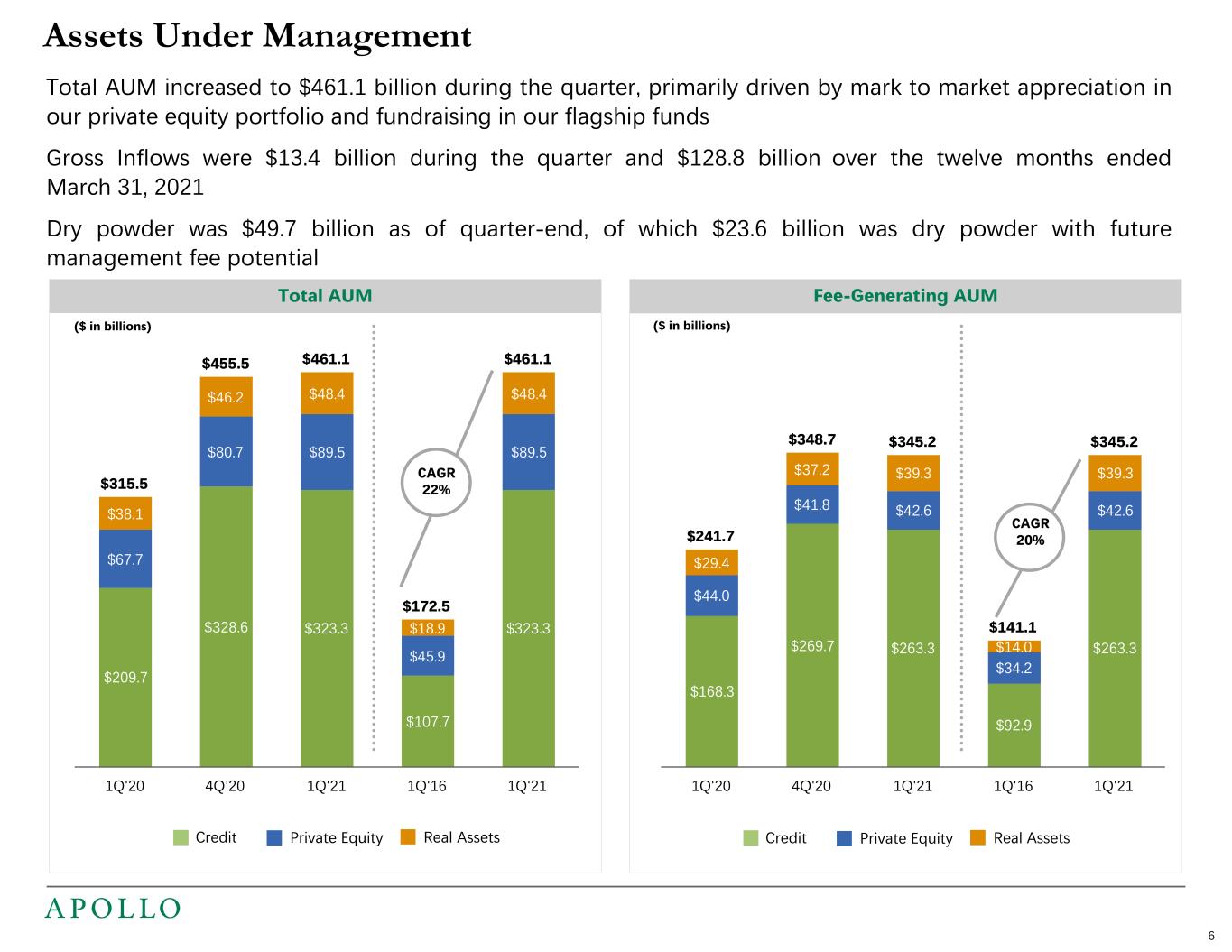

Total AUM Total AUM increased to $461.1 billion during the quarter, primarily driven by mark to market appreciation in our private equity portfolio and fundraising in our flagship funds Gross Inflows were $13.4 billion during the quarter and $128.8 billion over the twelve months ended March 31, 2021 Dry powder was $49.7 billion as of quarter-end, of which $23.6 billion was dry powder with future management fee potential Fee-Generating AUM $241.7 $348.7 $345.2 $141.1 $345.2 $168.3 $269.7 $263.3 $92.9 $263.3 $44.0 $41.8 $42.6 $34.2 $42.6 $29.4 $37.2 $39.3 $14.0 $39.3 1Q'20 4Q'20 1Q'21 1Q'16 1Q'21 Credit Assets Under Management Private Equity $315.5 $455.5 $461.1 $172.5 $461.1 $209.7 $328.6 $323.3 $107.7 $323.3 $67.7 $80.7 $89.5 $45.9 $89.5 $38.1 $46.2 $48.4 $18.9 $48.4 1Q'20 4Q’20 1Q'21 1Q'16 1Q'21 CAGR 20% Real Assets Credit Private Equity Real Assets CAGR 22% 6 ($ in billions) ($ in billions)

Performance Fee-Generating AUMPerformance Fee-Eligible AUM $22.8 $68.9 $82.3 $32.5 $82.3 $16.9 $34.7 $41.8 $19.9 $41.8 $2.2 $29.3 $35.2 $9.3 $35.2 $3.7 $4.9 $5.3 $3.4 $5.3 1Q'20 4Q'20 1Q'21 1Q'16 1Q'21 Performance Fee-Generating AUM increased to $82.3 billion during the quarter primarily driven by appreciation in our funds’ private equity portfolio, CLOs and MidCap Performance Fee Assets Under Management $119.3 $134.3 $142.8 $83.2 $142.8 $55.8 $61.3 $64.6 $37.3 $64.6 $53.7 $61.5 $67.0 $39.9 $67.0 $9.8 $11.4 $11.3 $6.1 $11.3 1Q'20 4Q'20 1Q'21 1Q'16 1Q'21 Credit Private Equity Real Assets Credit Private Equity Real Assets 7 ($ in billions) ($ in billions)

LTM Total AUM Rollforward1 ($ in millions) Credit3 Private Equity Real Assets Total 1Q'20 $209,745 $67,669 $38,097 $315,511 Inflows 110,235 7,706 10,879 128,820 Outflows2 (20,028) (234) (283) (20,545) Net Flows 90,207 7,472 10,596 108,275 Realizations (2,914) (6,021) (1,432) (10,367) Market Activity 26,223 20,343 1,153 47,719 1Q'21 $323,261 $89,463 $48,414 $461,138 YoY Change 54% 32% 27% 46% 1. Inflows at the individual segment level represent subscriptions, commitments, and other increases in available capital, such as acquisitions or leverage, net of inter-segment transfers. Outflows represent redemptions and other decreases in available capital. Realizations represent fund distributions of realized proceeds. Market activity represents gains (losses), the impact of foreign exchange rate fluctuations and other income. 2. Included in the 1Q'21 outflows for both Total AUM and FGAUM are $0.7 billion of redemptions. Included in the LTM outflows for Total AUM and FGAUM are $2.9 billion and $2.7 billion of redemptions, respectively. 3. As of 1Q'21, Credit AUM includes $23.0 billion of CLOs, $11.1 billion of which Apollo earns fees based on gross assets and $11.9 billion of which relates to Redding Ridge, from which Apollo earns fees based on net asset value. Total AUM & Fee-Generating AUM Total AUM Rollforward1 ($ in millions) Credit3 Private Equity Real Assets Total 4Q'20 $328,560 $80,716 $46,210 $455,486 Inflows 8,358 2,454 2,565 13,377 Outflows2 (5,891) (62) — (5,953) Net Flows 2,467 2,392 2,565 7,424 Realizations (914) (2,363) (434) (3,711) Market Activity (6,852) 8,718 73 1,939 1Q'21 $323,261 $89,463 $48,414 $461,138 QoQ Change (2%) 11% 5% 1% Fee-Generating AUM Rollforward1 ($ in millions) Credit Private Equity Real Assets Total 4Q'20 $269,658 $41,826 $37,190 $348,674 Inflows 5,975 1,034 2,354 9,363 Outflows2 (4,997) (188) (99) (5,284) Net Flows 978 846 2,255 4,079 Realizations (612) (147) (58) (817) Market Activity (6,694) 89 (85) (6,690) 1Q'21 $263,330 $42,614 $39,302 $345,246 QoQ Change (2%) 2% 6% (1%) LTM Fee-Generating AUM Rollforward1 ($ in millions) Credit Private Equity Real Assets Total 1Q'20 $168,262 $43,976 $29,412 $241,650 Inflows 99,818 3,883 10,644 114,345 Outflows2 (21,829) (4,754) (691) (27,274) Net Flows 77,989 (871) 9,953 87,071 Realizations (1,591) (998) (513) (3,102) Market Activity 18,670 507 450 19,627 1Q'21 $263,330 $42,614 $39,302 $345,246 YoY Change 56% (3%) 34% 43% 8

Deployment1 $69.0 $12.3 $11.0 $19.1 $2.4 $3.4 Dry Powder Composition $17.6 $18.4 $2.3 $7.5 $4.0 Performance Fee-Eligible AUM 1. For the three months ended March 31, 2021, drawdown deployment was $1.3 billion, $0.9 billion and $0.6 billion for credit, private equity and real assets, respectively. For the twelve months ended March 31, 2021, drawdown deployment was $6.0 billion, $6.0 billion and $2.5 billion for credit, private equity and real assets, respectively. 2. Represents invested AUM not currently generating performance fees for funds that have been investing capital for more than 24 months as of March 31, 2021. 3. Represents the percentage of additional appreciation required to reach the preferred return or high watermark and generate performance fees for funds with an investment period greater than 24 months. Funds with an investment period less than 24 months are “N/A” 4. All investors in a given fund are considered in aggregate when calculating the appreciation required to achieve performance fees presented above. Appreciation required to achieve performance fees may vary by individual investor. 5. The private equity funds disclosed in the table above have greater than $500 million of AUM and/or form part of a flagship series of funds. Strategy / Fund Invested AUM Not Currently Generating Performance Fees Investment Period Active >24 Months2 Appreciation Required to Achieve Performance Fees3,4 Corporate Credit $3.9 $3.9 2% Structured Credit 3.9 3.7 7% Direct Origination 2.6 2.6 3% Credit 10.4 10.2 4% Hybrid Capital 0.7 0.7 257% Other PE 2.7 2.4 40% Private Equity5 3.4 3.1 89% Real Assets 0.8 0.4 >250bps Total $14.6 $13.7 ($ in billions) Real Assets Private Equity $28.2 Credit $50 billion $46.0 $82.3 $14.6 Uninvested Performance Fee-Eligible AUM Currently Generating Performance Fees Not Currently Generating Performance Fees ($ in billions) $25 billion $92 billion 1Q'21 LTM $142.8 billionOther PE Fund VIII Fund IX ($ in billions) Real Assets Private Equity Credit Real Assets Private Equity Credit Capital Deployment, Dry Powder & Performance Fee-Eligible AUM 9

($ in millions) Period Ending $25 $72 $87 $136 $273 $269 49% 60% 58% 2012 2014 2016 2018 2020 1Q'21 Permanent Capital AUM Fee Related Revenue from Permanent Capital4 $195 $213 $235 $244 $260 1Q’20 2Q’20 3Q’20 4Q’20 1Q’21 Permanent Capital Vehicles, Athene, and Athora 1. Amounts are as of December 31, 2020. Refer to www.apolloic.com for the most recent financial information on AINV. The information contained on AINV’s website is not part of this presentation. Includes $1.6 billion of AUM related to a non-traded business development company. 2. Includes $41.9 billion of gross assets related to Athene Co-Invest Reinsurance Affiliate 1A Ltd. and $2.2 billion of unfunded commitments related to Apollo/Athene Dedicated Investment Program. 3. Other Assets include cash, treasuries, equities and alternatives. 4. Effective 1Q’21, fee related revenue includes revenues related to a non-traded business development company. Prior periods have been recast to conform to this change. ($ in billions) Supplemental Information ($ in billions) 4Q'20 1Q'21 Athene2 $184.3 $185.8 Athora 68.6 61.5 MidCap 8.1 8.9 ARI 7.0 7.3 AINV/Other1 4.4 4.4 AFT/AIF 0.7 0.7 Total AUM in Permanent Capital Vehicles $273.1 $268.6 10 Permanent Capital AUM % of Total AUM 47% Athene and Athora AUM ($ in billions) 4Q'20 1Q'21 Athene2 $184.3 $185.8 Core Assets 49.4 46.3 Core Plus Assets 41.5 41.8 Yield Assets 64.7 70.5 High Alpha 6.2 7.0 Other Assets3 22.5 20.2 Athora $68.6 $61.5 Non-Sub-Advised 60.8 52.8 Sub-Advised 7.8 8.7 Total Athene and Athora AUM $252.9 $247.3 45% 22%

Net Performance Fee Receivable1 Net Clawback Payable2 $0.07 $0.46 $1.05 $1.82 1Q'20 2Q'20 3Q'20 4Q'20 +$1.35 ($0.13) $3.04 Net Performance Fee Receivable Rollforward & Net Clawback Payable Note: All per share figures calculated using Distributable Earnings Shares Outstanding. 1. Net Performance Fee Receivable represents the sum of performance allocations and incentive fees receivable, less profit sharing payable as reported on the consolidated statements of financial condition, and includes certain eliminations related to investments in consolidated funds and VIEs and other adjustments. 2. As of March 31, 2021, certain funds had $149.0 million in general partner obligations to return previously distributed performance fees offset, in part, by $75.7 million in clawbacks from Contributing Partners and certain employees and former employees for the potential return of profit sharing distributions. These general partner obligations and potential return of profit sharing distributions are included in due to related parties and due from related parties, respectively, on the consolidated statements of financial condition. 3. Net Performance Fees/Other includes (i) unrealized performance fees, net of unrealized profit sharing expense and (ii) certain transaction-related charges, and excludes general partner obligations to return previously distributed performance fees. 1Q'21 (Per Share) Net Realized Performance Fees Net Performance Fees/Other3 11 ($0.31) ($0.17) 4Q'20 1Q'21 ($ in millions) $31 $205 $465 $802 $602 ($58) $1,346 ($138) ($73) Net performance fee receivable increased to $3.04 per share driven primarily by the appreciation in fair value of Fund IX and Fund VIII’s portfolio investments, while net clawback payable decreased to $0.17 per share as the fair values of certain funds appreciated

Segment Highlights

Commentary • Total AUM increased 54% over the twelve months ended March 31, 2021 to $323 billion, primarily driven by insurance company client transactions and robust fundraising • Fee-generating inflows excluding acquisitions of $3.0 billion during the quarter driven by strong growth in insurance assets under management and subscriptions to our corporate and structured credit funds • FRE increased 53% year-over-year, driven by growth in management fees from permanent capital vehicles and fundraising, partially offset by an increase in compensation costs due to higher headcount • Deployment of $19.1 billion during the quarter and $69.0 billion during the twelve months ended March 31, 2021; deployment for the quarter driven by strong growth in insurance clients, investments in our syndicated loans businesses, and middle market lending activity • Drawdown deployment of $1.3 billion during the quarter and $6.0 billion during the twelve months ended March 31, 2021 Financial Results Summary $162.7 $69.9 $25.7 $64.9 13 $323bn AUM Direct Origination Structured Credit Corporate Credit $231.5bn from Permanent Capital Vehicles Advisory and Other ($ in billions) % Change % Change ($ in thousands) 1Q'20 1Q'21 vs. 1Q'20 1Q'20 LTM 1Q'21 LTM vs. LTM’20 Management fees $208,229 $268,031 29% 804,753 994,654 24% Advisory and transaction fees, net 15,267 33,130 117% 56,535 135,397 139% Performance fees2 2,404 8,771 265% 22,853 16,203 (29%) Total Fee Related Revenues 225,900 309,932 37% 884,141 1,146,254 30% Salary, bonus and benefits (57,008) (69,379) 22% (208,847) (258,867) 24% Non-compensation expenses (35,679) (37,106) 4% (140,424) (159,058) 13% Total Fee Related Expenses (92,687) (106,485) 15% (349,271) (417,925) 20% Other income (loss), net of NCI (663) (559) (16) (205) (2,175) 961 Fee Related Earnings $132,550 $202,888 53% $534,665 $726,154 36% Realized performance fees 25,861 14,371 (44)% 192,145 176,951 (8)% Realized profit sharing expense (25,557) (7,954) (69)% (115,714) (111,239) (4)% Realized principal investment income, net 1,374 1,847 34% 7,089 8,848 25% Net interest loss and other (17,114) (13,785) (19)% (34,725) (52,871) 52% Segment Distributable Earnings $117,114 $197,367 69% $583,460 $747,843 28% Credit Corporate Credit3 2.6% / 19.2% Structured Credit 5.3% / 26.6% Direct Origination 6.3% / 16.4% 1Q'21 / LTM Credit Gross Return1 1. Represents Gross Return as defined in the non-GAAP financial information and definitions section of this presentation. The 1Q'21 Net Returns for corporate credit, structured credit and direct origination were 2.2%, 4.9% and 5.2%, respectively. The LTM Net Returns for corporate credit, structured credit and direct origination were 17.6%, 25.6% and 11.8%, respectively. 2. Represents certain performance fees related to business development companies, Redding Ridge Holdings, and MidCap. 3. CLOs are included within corporate credit. The 1Q'21 and LTM gross returns for CLOs were 1.6% and 18.7%, respectively. CLO returns are calculated based on gross return on assets and exclude performance related to Redding Ridge. $3.0bn / $20.3bn 1Q'21 / LTM Fee-generating inflows (excludes acquisitions)

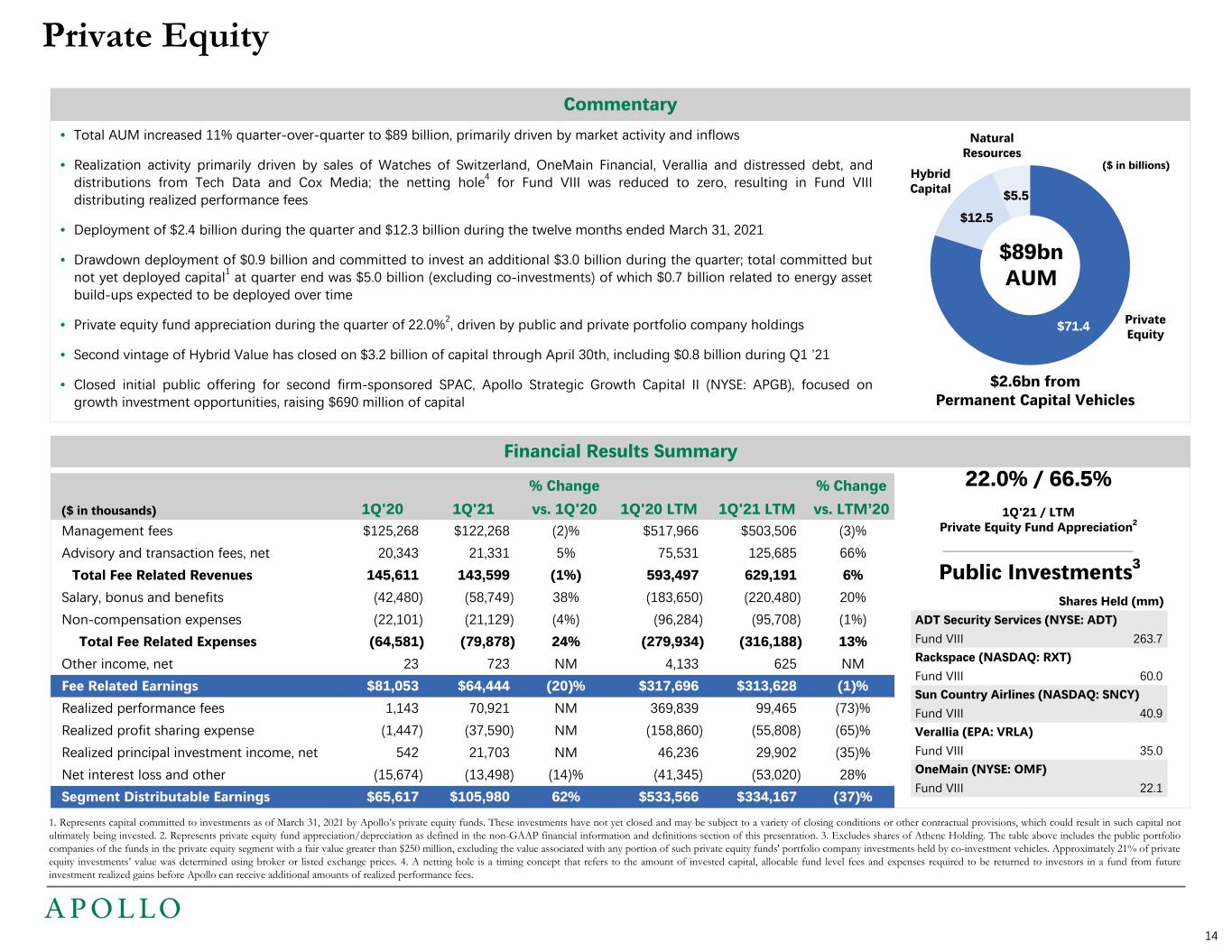

Commentary • Total AUM increased 11% quarter-over-quarter to $89 billion, primarily driven by market activity and inflows • Realization activity primarily driven by sales of Watches of Switzerland, OneMain Financial, Verallia and distressed debt, and distributions from Tech Data and Cox Media; the netting hole4 for Fund VIII was reduced to zero, resulting in Fund VIII distributing realized performance fees • Deployment of $2.4 billion during the quarter and $12.3 billion during the twelve months ended March 31, 2021 • Drawdown deployment of $0.9 billion and committed to invest an additional $3.0 billion during the quarter; total committed but not yet deployed capital1 at quarter end was $5.0 billion (excluding co-investments) of which $0.7 billion related to energy asset build-ups expected to be deployed over time • Private equity fund appreciation during the quarter of 22.0%2, driven by public and private portfolio company holdings • Second vintage of Hybrid Value has closed on $3.2 billion of capital through April 30th, including $0.8 billion during Q1 ’21 • Closed initial public offering for second firm-sponsored SPAC, Apollo Strategic Growth Capital II (NYSE: APGB), focused on growth investment opportunities, raising $690 million of capital Financial Results Summary 1. Represents capital committed to investments as of March 31, 2021 by Apollo’s private equity funds. These investments have not yet closed and may be subject to a variety of closing conditions or other contractual provisions, which could result in such capital not ultimately being invested. 2. Represents private equity fund appreciation/depreciation as defined in the non-GAAP financial information and definitions section of this presentation. 3. Excludes shares of Athene Holding. The table above includes the public portfolio companies of the funds in the private equity segment with a fair value greater than $250 million, excluding the value associated with any portion of such private equity funds' portfolio company investments held by co-investment vehicles. Approximately 21% of private equity investments’ value was determined using broker or listed exchange prices. 4. A netting hole is a timing concept that refers to the amount of invested capital, allocable fund level fees and expenses required to be returned to investors in a fund from future investment realized gains before Apollo can receive additional amounts of realized performance fees. 14 $71.4 $12.5 $5.5 $89bn AUM Natural Resources Hybrid Capital $2.6bn from Permanent Capital Vehicles ($ in billions) Private Equity % Change % Change ($ in thousands) 1Q'20 1Q'21 vs. 1Q'20 1Q'20 LTM 1Q'21 LTM vs. LTM’20 Management fees $125,268 $122,268 (2)% $517,966 $503,506 (3)% Advisory and transaction fees, net 20,343 21,331 5% 75,531 125,685 66% Total Fee Related Revenues 145,611 143,599 (1%) 593,497 629,191 6% Salary, bonus and benefits (42,480) (58,749) 38% (183,650) (220,480) 20% Non-compensation expenses (22,101) (21,129) (4%) (96,284) (95,708) (1%) Total Fee Related Expenses (64,581) (79,878) 24% (279,934) (316,188) 13% Other income, net 23 723 NM 4,133 625 NM Fee Related Earnings $81,053 $64,444 (20)% $317,696 $313,628 (1)% Realized performance fees 1,143 70,921 NM 369,839 99,465 (73)% Realized profit sharing expense (1,447) (37,590) NM (158,860) (55,808) (65)% Realized principal investment income, net 542 21,703 NM 46,236 29,902 (35)% Net interest loss and other (15,674) (13,498) (14)% (41,345) (53,020) 28% Segment Distributable Earnings $65,617 $105,980 62% $533,566 $334,167 (37)% Private Equity 22.0% / 66.5% 1Q'21 / LTM Private Equity Fund Appreciation2 Shares Held (mm) ADT Security Services (NYSE: ADT) Fund VIII 263.7 Rackspace (NASDAQ: RXT) Fund VIII 60.0 Sun Country Airlines (NASDAQ: SNCY) Fund VIII 40.9 Verallia (EPA: VRLA) Fund VIII 35.0 OneMain (NYSE: OMF) Fund VIII 22.1 Public Investments3

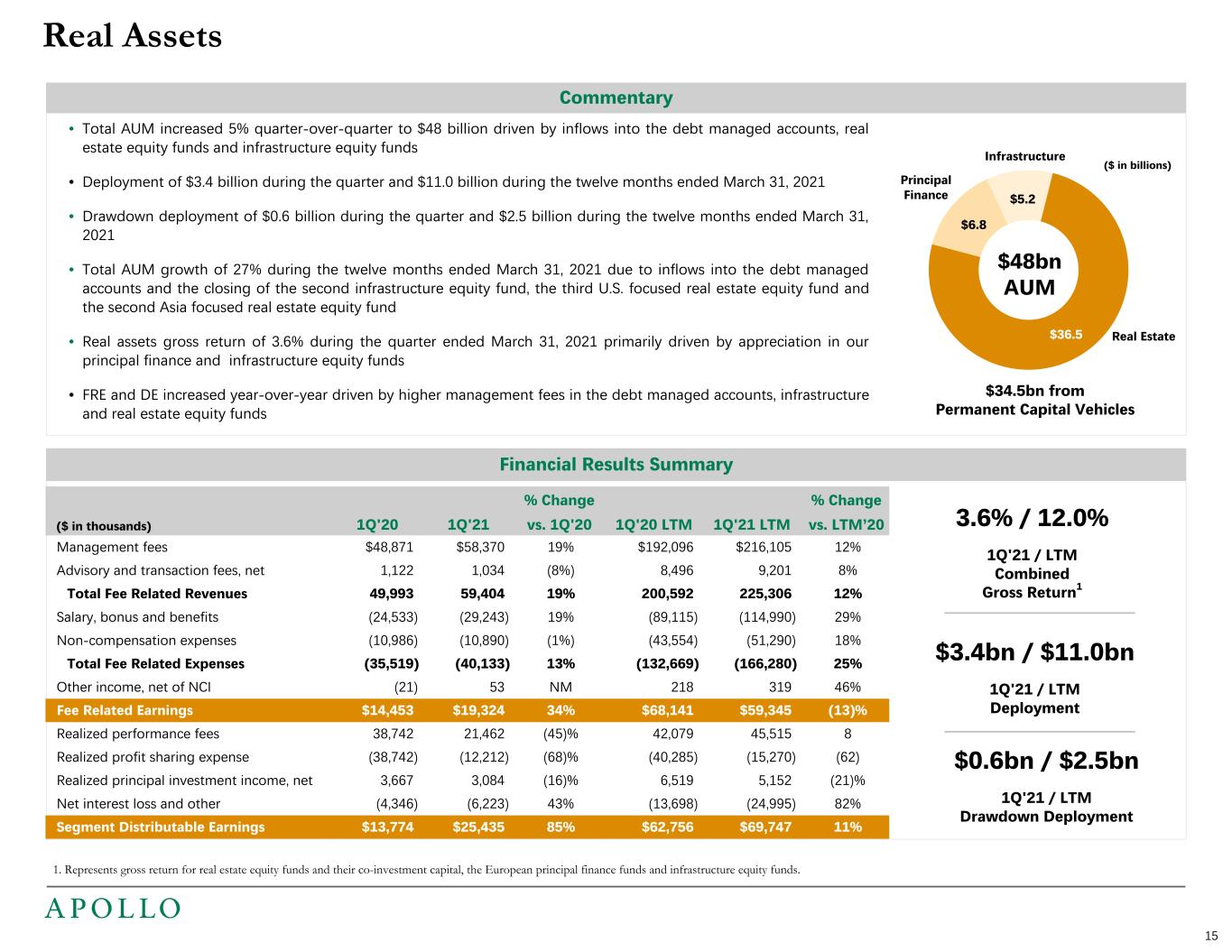

Commentary • Total AUM increased 5% quarter-over-quarter to $48 billion driven by inflows into the debt managed accounts, real estate equity funds and infrastructure equity funds • Deployment of $3.4 billion during the quarter and $11.0 billion during the twelve months ended March 31, 2021 • Drawdown deployment of $0.6 billion during the quarter and $2.5 billion during the twelve months ended March 31, 2021 • Total AUM growth of 27% during the twelve months ended March 31, 2021 due to inflows into the debt managed accounts and the closing of the second infrastructure equity fund, the third U.S. focused real estate equity fund and the second Asia focused real estate equity fund • Real assets gross return of 3.6% during the quarter ended March 31, 2021 primarily driven by appreciation in our principal finance and infrastructure equity funds • FRE and DE increased year-over-year driven by higher management fees in the debt managed accounts, infrastructure and real estate equity funds Financial Results Summary Capital DeploymentC111 1. Represents gross return for real estate equity funds and their co-investment capital, the European principal finance funds and infrastructure equity funds. 15 $36.5 $6.8 $5.2 $48bn AUM Infrastructure Real Estate $34.5bn from Permanent Capital Vehicles Principal Finance ($ in billions) % Change % Change ($ in thousands) 1Q'20 1Q'21 vs. 1Q'20 1Q'20 LTM 1Q'21 LTM vs. LTM’20 Management fees $48,871 $58,370 19% $192,096 $216,105 12% Advisory and transaction fees, net 1,122 1,034 (8%) 8,496 9,201 8% Total Fee Related Revenues 49,993 59,404 19% 200,592 225,306 12% Salary, bonus and benefits (24,533) (29,243) 19% (89,115) (114,990) 29% Non-compensation expenses (10,986) (10,890) (1%) (43,554) (51,290) 18% Total Fee Related Expenses (35,519) (40,133) 13% (132,669) (166,280) 25% Other income, net of NCI (21) 53 NM 218 319 46% Fee Related Earnings $14,453 $19,324 34% $68,141 $59,345 (13)% Realized performance fees 38,742 21,462 (45)% 42,079 45,515 8 Realized profit sharing expense (38,742) (12,212) (68)% (40,285) (15,270) (62) Realized principal investment income, net 3,667 3,084 (16)% 6,519 5,152 (21)% Net interest loss and other (4,346) (6,223) 43% (13,698) (24,995) 82% Segment Distributable Earnings $13,774 $25,435 85% $62,756 $69,747 11% 3.6% / 12.0% 1Q'21 / LTM Combined Gross Return1 Real Assets $3.4bn / $11.0bn 1Q'21 / LTM Deployment $0.6bn / $2.5bn 1Q'21 / LTM Drawdown Deployment

Balance Sheet Highlights

($ in thousands, except share data) As of March 31, 2021 As of December 31, 2020 Assets: Cash and cash equivalents $1,717,996 $1,555,517 Restricted cash and cash equivalents 707,714 17,708 U.S. Treasury securities, at fair value 817,128 816,985 Investments (includes performance allocations of $2,656,056 and $1,624,156 as of March 31, 2021 and December 31, 2020, respectively) 6,700,817 4,995,411 Assets of consolidated variable interest entities 15,777,032 14,499,586 Incentive fees receivable 3,854 5,231 Due from related parties 434,709 462,383 Deferred tax assets, net 380,992 539,244 Other assets 460,011 364,963 Lease assets 292,927 295,098 Goodwill 116,958 116,958 Total Assets $27,410,138 $23,669,084 Liabilities and Stockholders’ Equity Liabilities: Accounts payable and accrued expenses $130,691 $119,982 Accrued compensation and benefits 96,251 82,343 Deferred revenue 126,032 30,369 Due to related parties 519,957 608,469 Profit sharing payable 1,338,651 842,677 Debt 3,152,750 3,155,221 Liabilities of consolidated variable interest entities 12,352,264 11,905,531 Other liabilities 461,001 295,612 Lease liabilities 333,670 332,915 Total Liabilities 18,511,267 17,373,119 Redeemable non-controlling interests: Redeemable non-controlling interests 1,400,730 782,702 Stockholders’ Equity: Apollo Global Management, Inc. stockholders’ equity: Series A Preferred Stock, 11,000,000 shares issued and outstanding as of March 31, 2021 and December 31, 2020 264,398 264,398 Series B Preferred Stock, 12,000,000 shares issued and outstanding as of March 31, 2021 and December 31, 2020 289,815 289,815 Class A Common Stock, $0.00001 par value, 90,000,000,000 shares authorized, 232,222,572 and 228,873,449 shares issued and outstanding as of March 31, 2021 and December 31, 2020, respectively — — Class B Common Stock, $0.00001 par value, 999,999,999 shares authorized, 1 share issued and outstanding as of March 31, 2021 and December 31, 2020 — — Class C Common Stock, $0.00001 par value, 1 share authorized, 1 share issued and outstanding as of March 31, 2021 and December 31, 2020 — — Additional paid in capital 908,195 877,173 Retained earnings 477,343 — Accumulated other comprehensive loss (2,586) (2,071) Total Apollo Global Management, Inc. Stockholders’ Equity 1,937,165 1,429,315 Non-Controlling Interests in consolidated entities 3,114,805 2,275,728 Non-Controlling Interests in Apollo Operating Group 2,446,171 1,808,220 Total Stockholders’ Equity 7,498,141 5,513,263 Total Liabilities, Redeemable non-controlling interests and Stockholders’ Equity $27,410,138 $23,669,084 GAAP Consolidated Statements of Financial Condition (Unaudited) 17

Summary Balance Sheet1 ($ in millions) 4Q’20 1Q'21 Cash and cash equivalents $1,555 $1,717 GP & Other Investments3,4 3,603 4,297 Debt (3,155) (3,153) Net performance fees receivable2 802 1,346 Net clawback payable 9 (138) (73) Total Net Value $2,667 $4,134 Unfunded Future Commitments $978 $1,023 Undrawn Revolving Credit Facility $750 $750 Supplemental Details Segment Balance Sheet Highlights 1. Amounts are presented on an unconsolidated basis. 2. Net performance fees receivable excludes profit sharing expected to be settled in the form of equity-based awards. 3. Represents Apollo’s general partner investments in the funds it manages and other balance sheet investments. 4. Investment in Athene primarily comprises Apollo’s direct investment of 54.6 million shares (subject to a discount due to a lack of marketability) of Athene Holding valued at $42.08 per share as of March 31, 2021. 5. Since 1Q’16, the Company in its discretion has elected to repurchase 1.8 million shares of Class A Common Stock for $57.0 million, to prevent dilution that would have resulted from the issuance of shares granted in connection with certain profit sharing arrangements. These repurchases are separate from the March 2020 repurchase plan described in footnote 7 below and accordingly are not reflected in the above share repurchase activity table. 6. Represents a reduction in shares of Class A Common Stock to be issued to participants to satisfy associated tax obligations in connection with the settlement of equity-based awards granted under the Company’s equity incentive plan (the “Plan”), which the Company refers to as “net share settlement.” 7. On March 12, 2020, the Company announced a share repurchase authorization that allows the Company to repurchase up to $500 million of its Class A Common Stock. This authorization increased the capacity to repurchase shares from $80 million of unused capacity under the previously approved share repurchase plan. The share repurchase plan may be used to repurchase outstanding shares of Class A Common Stock as well as to reduce shares of Class A Common Stock to be issued to employees to satisfy associated tax obligations in connection with the settlement of equity-based awards granted under the Plan. 8. Average price paid per share reflects total capital used for share repurchases to date divided by the number of shares purchased. 9. Net clawback payable includes general partner obligations to return previously distributed performance fees offset by clawbacks from Contributing Partners and certain employees and former employees for the potential return of profit sharing distributions. A-/A Rated by S&P and Fitch $750 million Undrawn Revolving Credit Facility (Expiring in 2025) $1.7 billion Cash and cash equivalents and U.S. Treasury securities 18 Share Repurchase Activity - 1Q’16 through 1Q’215 ($ and share amounts in millions) Inception to Date Open Market Share Repurchases 9.0 Reduction of Shares Issued to Participants6 10.1 Total Shares Purchased 19.1 Total Capital Used for Share Purchases $586 Share Repurchase Plan Authorization Remaining 7 $335 Average Price Paid Per Share8 $30.66 Total net value increased to $4.1 billion primarily due to gains on our GP & Other Investments and an increase in net performance fees receivable

Supplemental Details

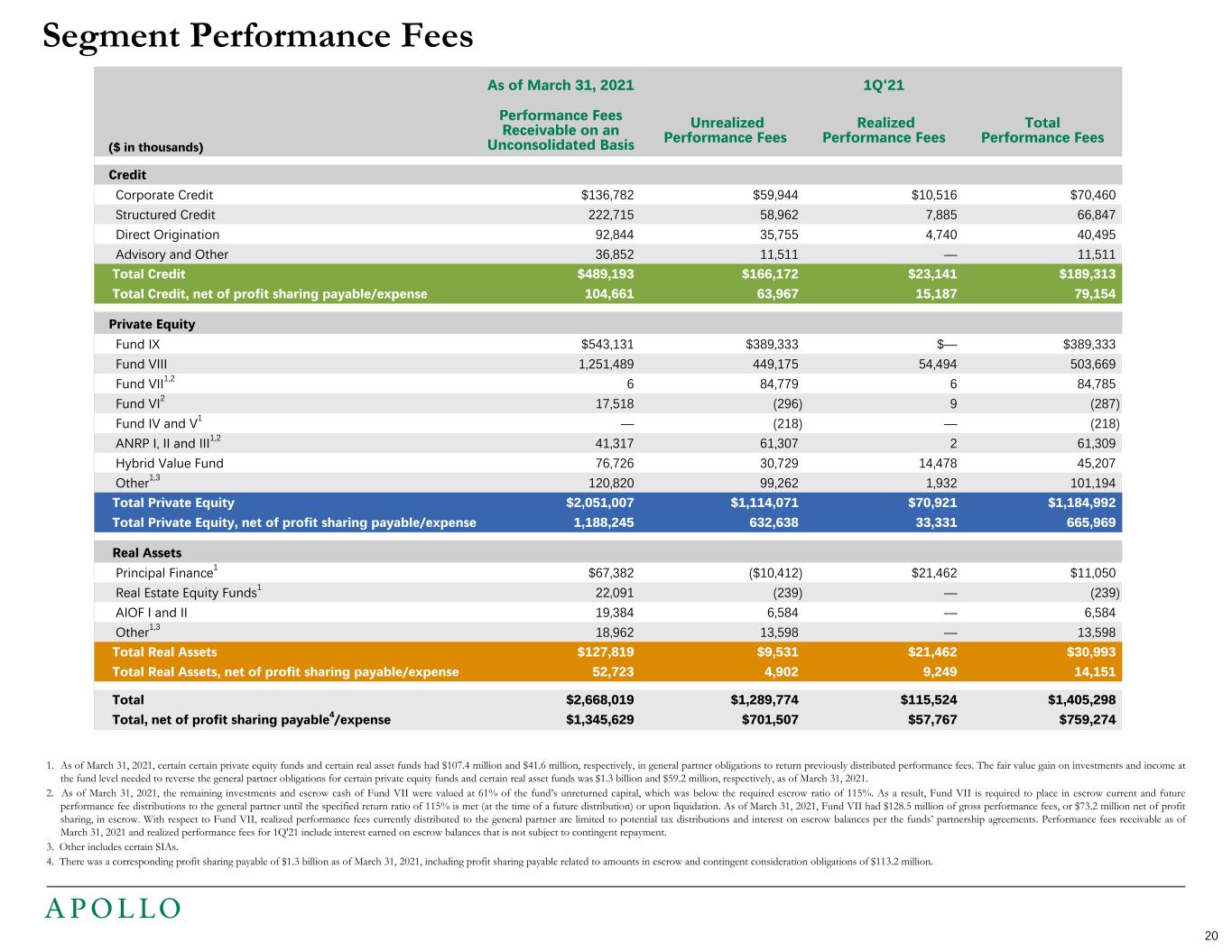

1. As of March 31, 2021, certain certain private equity funds and certain real asset funds had $107.4 million and $41.6 million, respectively, in general partner obligations to return previously distributed performance fees. The fair value gain on investments and income at the fund level needed to reverse the general partner obligations for certain private equity funds and certain real asset funds was $1.3 billion and $59.2 million, respectively, as of March 31, 2021. 2. As of March 31, 2021, the remaining investments and escrow cash of Fund VII were valued at 61% of the fund’s unreturned capital, which was below the required escrow ratio of 115%. As a result, Fund VII is required to place in escrow current and future performance fee distributions to the general partner until the specified return ratio of 115% is met (at the time of a future distribution) or upon liquidation. As of March 31, 2021, Fund VII had $128.5 million of gross performance fees, or $73.2 million net of profit sharing, in escrow. With respect to Fund VII, realized performance fees currently distributed to the general partner are limited to potential tax distributions and interest on escrow balances per the funds’ partnership agreements. Performance fees receivable as of March 31, 2021 and realized performance fees for 1Q'21 include interest earned on escrow balances that is not subject to contingent repayment. 3. Other includes certain SIAs. 4. There was a corresponding profit sharing payable of $1.3 billion as of March 31, 2021, including profit sharing payable related to amounts in escrow and contingent consideration obligations of $113.2 million. Segment Performance Fees As of March 31, 2021 1Q'21 ($ in thousands) Performance Fees Receivable on an Unconsolidated Basis Unrealized Performance Fees Realized Performance Fees Total Performance Fees Credit Corporate Credit $136,782 $59,944 $10,516 $70,460 Structured Credit 222,715 58,962 7,885 66,847 Direct Origination 92,844 35,755 4,740 40,495 Advisory and Other 36,852 11,511 — 11,511 Total Credit $489,193 $166,172 $23,141 $189,313 Total Credit, net of profit sharing payable/expense 104,661 63,967 15,187 79,154 Private Equity Fund IX $543,131 $389,333 $— $389,333 Fund VIII 1,251,489 449,175 54,494 503,669 Fund VII1,2 6 84,779 6 84,785 Fund VI2 17,518 (296) 9 (287) Fund IV and V1 — (218) — (218) ANRP I, II and III1,2 41,317 61,307 2 61,309 Hybrid Value Fund 76,726 30,729 14,478 45,207 Other1,3 120,820 99,262 1,932 101,194 Total Private Equity $2,051,007 $1,114,071 $70,921 $1,184,992 Total Private Equity, net of profit sharing payable/expense 1,188,245 632,638 33,331 665,969 Real Assets Principal Finance1 $67,382 ($10,412) $21,462 $11,050 Real Estate Equity Funds1 22,091 (239) — (239) AIOF I and II 19,384 6,584 — 6,584 Other1,3 18,962 13,598 — 13,598 Total Real Assets $127,819 $9,531 $21,462 $30,993 Total Real Assets, net of profit sharing payable/expense 52,723 4,902 9,249 14,151 Total $2,668,019 $1,289,774 $115,524 $1,405,298 Total, net of profit sharing payable4/expense $1,345,629 $701,507 $57,767 $759,274 20

Credit ($ in thousands) 1Q'20 2Q'20 3Q'20 4Q'20 1Q'21 1Q'20 LTM 1Q'21 LTM Management fees $208,229 $224,721 $246,159 $255,743 $268,031 $804,753 $994,654 Advisory and transaction fees, net 15,267 13,756 51,376 37,135 33,130 56,535 135,397 Performance fees1 2,404 3,440 2,204 1,788 8,771 22,853 16,203 Total Fee Related Revenues 225,900 241,917 299,739 294,666 309,932 884,141 1,146,254 Salary, bonus and benefits (57,008) (52,806) (61,975) (74,707) (69,379) (208,847) (258,867) General, administrative and other (35,373) (37,251) (40,367) (43,121) (36,629) (139,541) (157,368) Placement fees (306) (358) (425) (430) (477) (883) (1,690) Total Fee Related Expenses (92,687) (90,415) (102,767) (118,258) (106,485) (349,271) (417,925) Other income (loss), net of Non-Controlling Interest (663) (724) (780) (112) (559) (205) (2,175) Credit Fee Related Earnings $132,550 $150,778 $196,192 $176,296 $202,888 $534,665 $726,154 Realized performance fees 25,861 4,359 7,614 150,607 14,371 192,145 176,951 Realized profit sharing expense (25,557) (4,359) (7,614) (91,312) (7,954) (115,714) (111,239) Net Realized Performance Fees 304 — — 59,295 6,417 76,431 65,712 Realized principal investment income, net 1,374 1,810 928 4,263 1,847 7,089 8,848 Net interest loss and other (17,114) (11,857) (14,010) (13,219) (13,785) (34,725) (52,871) Credit Segment Distributable Earnings $117,114 $140,731 $183,110 $226,635 $197,367 $583,460 $747,843 Segment Results 21 1. Represents certain performance fees related to business development companies, Redding Ridge Holdings, and MidCap. Private Equity ($ in thousands) 1Q'20 2Q'20 3Q'20 4Q'20 1Q'21 1Q'20 LTM 1Q'21 LTM Management fees $125,268 $127,592 $128,446 $125,200 $122,268 $517,966 $503,506 Advisory and transaction fees, net 20,343 44,802 20,108 39,444 21,331 75,531 125,685 Total Fee Related Revenues 145,611 172,394 148,554 164,644 143,599 593,497 629,191 Salary, bonus and benefits (42,480) (53,202) (53,451) (55,078) (58,749) (183,650) (220,480) General, administrative and other (21,994) (21,770) (25,099) (27,522) (21,129) (95,230) (95,520) Placement fees (107) — (188) — — (1,054) (188) Total Fee Related Expenses (64,581) (74,972) (78,738) (82,600) (79,878) (279,934) (316,188) Other income (loss), net 23 2 23 (123) 723 4,133 625 Private Equity Fee Related Earnings $81,053 $97,424 $69,839 $81,921 $64,444 $317,696 $313,628 Realized performance fees 1,143 3,549 2,025 22,970 70,921 369,839 99,465 Realized profit sharing expense (1,447) (3,549) (2,025) (12,644) (37,590) (158,860) (55,808) Net Realized Performance Fees (304) — — 10,326 33,331 210,979 43,657 Realized principal investment income, net 542 3,404 1,598 3,197 21,703 46,236 29,902 Net interest loss and other (15,674) (11,686) (14,580) (13,256) (13,498) (41,345) (53,020) Private Equity Segment Distributable Earnings $65,617 $89,142 $56,857 $82,188 $105,980 $533,566 $334,167 Real Assets ($ in thousands) 1Q'20 2Q'20 3Q'20 4Q'20 1Q'21 1Q'20 LTM 1Q'21 LTM Management fees $48,871 $49,509 $51,847 $56,379 $58,370 $192,096 $216,105 Advisory and transaction fees, net 1,122 3,191 878 4,098 1,034 8,496 9,201 Total Fee Related Revenues 49,993 52,700 52,725 60,477 59,404 200,592 225,306 Salary, bonus and benefits (24,533) (28,991) (29,513) (27,243) (29,243) (89,115) (114,990) General, administrative and other (10,986) (12,782) (11,869) (15,749) (10,890) (43,553) (51,290) Placement fees — — — — — (1) — Total Fee Related Expenses (35,519) (41,773) (41,382) (42,992) (40,133) (132,669) (166,280) Other income (loss), net of Non-Controlling Interest (21) 116 59 91 53 218 319 Real Assets Fee Related Earnings $14,453 $11,043 $11,402 $17,576 $19,324 $68,141 $59,345 Realized performance fees 38,742 2,929 7,806 13,318 21,462 42,079 45,515 Realized profit sharing expense (38,742) (2,929) (7,806) 7,677 (12,212) (40,285) (15,270) Net Realized Performance Fees — — — 20,995 9,250 1,794 30,245 Realized principal investment income, net 3,667 5 356 1,707 3,084 6,519 5,152 Net interest loss and other (4,346) (5,507) (6,216) (7,049) (6,223) (13,698) (24,995) Real Assets Segment Distributable Earnings $13,774 $5,541 $5,542 $33,229 $25,435 $62,756 $69,747

($ in thousands, except per share data) 1Q'20 4Q'20 1Q'21 1Q'20 LTM 1Q'21 LTM Segment Distributable Earnings $196,505 $342,052 $328,782 $1,179,782 $1,151,757 Taxes and Related Payables (22,193) (15,499) (25,786) (69,857) (93,582) Preferred Dividends (9,164) (9,164) (9,164) (36,656) (36,656) Distributable Earnings $165,148 $317,389 $293,832 $1,073,269 $1,021,519 Add Back: Taxes & Related Payables Attributable to Common & Equivalents 19,244 11,862 20,319 56,583 64,635 DE Before Certain Payables1 184,392 329,251 314,151 1,129,852 1,086,154 Percent to Common & Equivalents 54 % 54 % 54 % 54 % 54 % DE Before Other Payables Attributable to Common & Equivalents 99,572 177,796 169,642 616,853 586,524 Less: Taxes & Related Payables Attributable to Common & Equivalents (19,244) (11,862) (20,319) (56,583) (64,635) DE Attributable to Common & Equivalents2 $80,328 $165,934 $149,323 $560,270 $521,889 Per Share3 $0.37 $0.72 $0.66 $2.57 $2.31 (Retained) Contributed Capital per Share3 0.05 (0.12) (0.16) (0.26) (0.21) Net Dividend per Share3 $0.42 $0.60 $0.50 $2.31 $2.10 Payout Ratio 114 % 83 % 76 % 90 % 91 % Generated $0.66 of Distributable Earnings per Share during the quarter Apollo declared a quarterly dividend of $0.50 per share of Class A Common Stock to holders of record as of May 20, 2021, which is payable on May 28, 2021 Stockholder Dividend 1. DE Before Certain Payables represents Segment Distributable Earnings before the deduction for estimated current corporate taxes and the amounts payable under Apollo’s tax receivable agreement. 2. “Common & Equivalents” consists of total shares of Class A Common Stock outstanding and RSUs that participate in dividends. 3. Per share calculations are based on end of period Distributable Earnings Shares Outstanding. LTM Per share amounts represent the sum of the last four quarters. See page 27 for the share reconciliation. 22

Investment Records as of March 31, 2021 ($ in millions) Vintage Year Total AUM Committed Capital Total Invested Capital Realized Value Remaining Cost Unrealized Value Total Value Gross IRR Net IRR Private Equity: Fund IX 2018 $27,034 $24,729 $6,017 $1,570 $5,256 $8,547 $10,117 49 % 26 % Fund VIII 2013 21,144 18,377 16,063 11,691 9,583 17,133 28,824 18 13 Fund VII 2008 2,881 14,677 16,461 32,583 1,419 912 33,495 33 25 Fund VI 2006 646 10,136 12,457 21,134 405 3 21,137 12 9 Fund V 2001 260 3,742 5,192 12,721 120 2 12,723 61 44 Funds I, II, III, IV & MIA2 Various 12 7,320 8,753 17,400 — — 17,400 39 26 Traditional Private Equity Funds3 $51,977 $78,981 $64,943 $97,099 $16,783 $26,597 $123,696 39 % 24 % ANRP III 2020 1,442 1,400 145 37 145 211 248 NM1 NM1 ANRP II 2016 2,877 3,454 2,704 1,558 1,884 2,121 3,679 17 9 ANRP I 2012 331 1,323 1,149 1,044 586 124 1,168 1 (4) AION 2013 549 826 699 326 413 454 780 5 (1) Hybrid Value Fund 2019 3,693 3,238 2,821 721 2,328 2,816 3,537 31 25 Total Private Equity $60,869 $89,222 $72,461 $100,785 $22,139 $32,323 $133,108 Credit: FCI III 2017 $2,420 $1,906 $2,734 $1,643 $1,878 $1,921 $3,564 20 % 15 % FCI II 2013 2,263 1,555 3,082 2,162 1,744 1,597 3,759 7 5 FCI I 2012 — 559 1,516 1,975 — — 1,975 12 8 SCRF IV6 2017 2,406 2,502 4,942 3,279 1,899 2,071 5,350 7 6 SCRF III 2015 — 1,238 2,110 2,428 — — 2,428 18 14 SCRF II 2012 — 104 467 528 — — 528 15 12 SCRF I 2008 — 118 240 357 — — 357 33 26 Accord IV 2020 2,366 2,337 266 (128) 129 157 29 NM1 NM1 Accord IIIB11 2020 1,230 1,758 660 537 102 99 636 23 19 Accord III 2019 611 886 2,352 2,282 96 173 2,455 NM 1 NM1 Accord II11 2018 — 781 801 821 — — 821 16 12 Accord I11 2017 — 308 111 113 — — 113 10 5 Total Credit $11,296 $14,052 $19,281 $15,997 $5,848 $6,018 $22,015 Real Assets: European Principal Finance Funds EPF III4 2017 $4,965 $4,578 $3,646 $1,796 $2,260 $3,000 $4,796 19 % 10 % EPF II4 2012 1,123 3,486 3,608 4,526 576 345 4,871 13 8 EPF I4 2007 244 1,519 1,996 3,359 — 2 3,361 23 17 U.S. RE Fund III5,12 N/A 683 687 158 3 155 166 169 NM1 NM1 U.S. RE Fund II5 2016 1,123 1,243 984 543 731 805 1,348 14 11 U.S. RE Fund I5 2012 197 657 641 816 145 112 928 12 9 Asia RE Fund II5,12 N/A 635 643 290 1 289 285 286 NM1 NM1 Asia RE Fund I5 2017 721 624 448 211 291 428 639 18 14 AIOF II12 N/A 1,104 1,080 214 — 214 250 250 NM1 NM1 AIOF I 2018 919 897 801 692 358 464 1,156 25 19 Total Real Assets $11,714 $15,414 $12,786 $11,947 $5,019 $5,857 $17,804 23 Note: The funds included in the investment record table above have greater than $500 million of AUM and/or form part of a flagship series of funds.

Investment Records as of March 31, 2021 - Continued Note: The above table summarizes the investment record for our Permanent Capital Vehicles as defined in the non-GAAP financial information & definitions section of this presentation. 1. Data has not been presented as the fund’s effective date is less than 24 months prior to the period indicated and such information was deemed not meaningful. 2. The general partners and managers of Funds I, II and MIA, as well as the general partner of Fund III, were excluded assets in connection with the 2007 Reorganization. As a result, Apollo did not receive the economics associated with these entities. The investment performance of these funds, combined with Fund IV, is presented to illustrate fund performance associated with Apollo’s Managing Partners and other investment professionals. 3. Total IRR is calculated based on total cash flows for all funds presented. 4. Includes funds denominated in Euros with historical figures translated into U.S. dollars at an exchange rate of €1.00 to $1.17 as of March 31, 2021. 5. U.S. RE Fund I, U.S. RE Fund II, U.S. RE Fund III, Asia RE Fund I, and Asia RE Fund II had $160 million, $771 million, $160 million, $281 million and $264 million of co-investment commitments as of March 31, 2021, respectively, which are included in the figures in the table. A co-invest entity within U.S. RE Fund I is denominated in GBP and translated into U.S. dollars at an exchange rate of £1.00 to $1.38 as of March 31, 2021. 6. Remaining cost for certain of our credit funds may include physical cash called, invested or reserved for certain levered investments. 7. Total returns are based on the change in closing trading prices during the respective periods presented taking into account dividends and distributions, if any, as if they were reinvested without regard to commission. 8. An initial public offering (“IPO”) year represents the year in which the vehicle commenced trading on a national securities exchange. 9. MidCap is not a publicly traded vehicle and therefore IPO year is not applicable. The returns presented are a gross return based on NAV. The net returns based on NAV were 8%, (4)% and 1% for 1Q'21, 1Q'20, and FY'20, respectively. Gross and net return are defined in the non-GAAP financial information and definitions section of this presentation. 10. All amounts are as of December 31, 2020 except for total returns. Refer to www.apolloic.com for the most recent financial information on AINV. The information contained on AINV’s website is not part of this presentation. Included within Total AUM of AINV/Other is $1.6 billion of AUM related to a non-traded business development company from which Apollo earns investment-related service fees, but for which Apollo does not provide management or advisory services. Total returns exclude performance related to this AUM. 11. Gross and Net IRR have been presented for these funds as they have a defined maturity date of less than 24 months and have substantially liquidated. Gross and net IRR for Accord IIIB is not annualized. 12. Vintage Year is not yet applicable as these funds have not had their final closings. 24 Permanent Capital Vehicles Total Returns7 ($ in millions) IPO Year8 Total AUM 1Q'21 1Q'20 FY'20 Credit: MidCap9 N/A $8,913 10% (4) % 6 % AIF 2013 350 4 (23) 4 AFT 2011 390 5 (22) 3 AINV/Other10 2004 4,446 32 (59) (27) Real Assets: ARI 2009 7,218 28% (57%) (29%) Total $21,317

Reconciliations and Disclosures

($ in thousands) 1Q'20 2Q'20 3Q'20 4Q'20 1Q'21 1Q'20 LTM 1Q'21 LTM GAAP Net Income (Loss) Attributable to Apollo Global Management, Inc. Class A Common Stockholders ($1,005,382) $437,164 $263,236 $424,940 $669,726 ($338,738) $1,795,066 Preferred dividends 9,164 9,165 9,163 9,164 9,164 36,656 36,656 Net income (loss) attributable to Non-Controlling Interests in consolidated entities (164,409) 41,068 100,021 141,698 70,578 (142,567) 353,365 Net income (loss) attributable to Non-Controlling Interests in the Apollo Operating Group (1,123,216) 511,688 303,679 499,659 769,035 (617,918) 2,084,061 GAAP Net Income (Loss) ($2,283,843) $999,085 $676,099 $1,075,461 $1,518,503 ($1,062,567) $4,269,148 Income tax provision (benefit) (295,853) 140,323 89,357 153,139 203,246 (444,501) 586,065 GAAP Income (Loss) Before Income Tax Provision (Benefit) ($2,579,696) $1,139,408 $765,456 $1,228,600 $1,721,749 ($1,507,068) $4,855,213 Transaction related charges1 (21,399) 32,110 10,835 17,640 20,094 22,351 80,679 Charges associated with corporate conversion 1,064 — 2,829 — — 23,051 2,829 (Gains) losses from changes in tax receivable agreement liability — — — (12,426) (1,941) 50,307 (14,367) Net (income) loss attributable to Non-Controlling Interests in consolidated entities 164,409 (41,068) (100,021) (141,698) (70,578) 142,567 (353,365) Unrealized performance fees 1,800,181 (907,656) (440,310) (487,011) (1,290,499) 1,549,982 (3,125,476) Unrealized profit sharing expense (681,183) 340,687 168,368 205,478 588,992 (549,353) 1,303,525 Equity-based profit sharing expense and other2 34,488 38,463 27,681 28,452 34,872 109,734 129,468 Equity-based compensation 14,070 17,747 17,962 18,073 16,158 66,609 69,940 Unrealized principal investment (income) loss 201,570 (107,110) (49,406) (107,539) (363,773) 125,322 (627,828) Unrealized net (gains) losses from investment activities and other 1,263,001 (277,167) (157,885) (407,517) (326,292) 1,146,280 (1,168,861) Segment Distributable Earnings $196,505 $235,414 $245,509 $342,052 $328,782 $1,179,782 $1,151,757 Taxes and related payables (22,193) (21,040) (31,257) (15,499) (25,786) (69,857) (93,582) Preferred dividends (9,164) (9,165) (9,163) (9,164) (9,164) (36,656) (36,656) Distributable Earnings $165,148 $205,209 $205,089 $317,389 $293,832 $1,073,269 $1,021,519 Preferred dividends 9,164 9,165 9,163 9,164 9,164 36,656 36,656 Taxes and related payables 22,193 21,040 31,257 15,499 25,786 69,857 93,582 Realized performance fees (65,746) (10,837) (17,445) (186,895) (106,754) (604,063) (321,931) Realized profit sharing expense 65,746 10,837 17,445 96,279 57,756 314,859 182,317 Realized principal investment income, net (5,583) (5,219) (2,882) (9,167) (26,634) (59,844) (43,902) Net interest loss and other 37,134 29,050 34,806 33,524 33,506 89,768 130,886 Fee Related Earnings $228,056 $259,245 $277,433 $275,793 $286,656 $920,502 $1,099,127 Reconciliation of GAAP to Non-GAAP Financial Measures 1. Transaction-related charges include contingent consideration, equity-based compensation charges and the amortization of intangible assets and certain other charges associated with acquisitions, and restructuring charges. 2. Equity-based profit sharing expense and other includes certain profit sharing arrangements in which a portion of performance fees distributed to the general partner are allocated by issuance of equity-based awards, rather than cash, to employees of Apollo. Equity-based profit sharing expense and other also includes non-cash expenses related to equity awards in unconsolidated related parties granted to employees of Apollo. 26

Reconciliation of GAAP to Non-GAAP Financial Measures - Continued 1. See page 26 for reconciliation of Net Income (Loss) Attributable to Apollo Global Management, Inc. Class A Common Stockholders, Income (Loss) Before Income Tax (Provision) Benefit, Distributable Earnings and Fee Related Earnings. 27 Share Reconciliation 1Q'20 2Q'20 3Q'20 4Q'20 1Q'21 Total GAAP Class A Common Stock Outstanding 228,834,099 229,189,715 228,747,302 228,873,449 232,222,572 Non-GAAP Adjustments: Participating Apollo Operating Group Units 204,028,327 204,028,327 204,028,327 204,028,327 202,098,812 Vested RSUs 244,240 195,499 158,007 1,833,332 153,379 Unvested RSUs Eligible for Dividend Equivalents 8,114,841 8,128,861 8,086,467 6,275,957 8,300,659 Distributable Earnings Shares Outstanding 441,221,507 441,542,402 441,020,103 441,011,065 442,775,422 Reconciliation of GAAP Net Income Per Share of Class A Common Stock to Non-GAAP Financial Per Share Measures ($ in thousands, except share data) 1Q'20 2Q'20 3Q'20 4Q'20 1Q'21 Net Income (Loss) Attributable to Apollo Global Management, Inc. Class A Common Stockholders ($1,005,382) $437,164 $263,236 $424,940 $669,726 Dividends declared on Class A Common Stock (205,602) (96,181) (112,075) (116,718) (139,180) Dividend on participating securities (7,247) (3,608) (4,008) (4,093) (5,102) Earnings allocable to participating securities — (13,947) (5,853) (11,595) (19,193) Undistributed income (loss) attributable to Class A Common Stockholders: Basic ($1,218,231) $323,428 $141,300 $292,534 $506,251 GAAP weighted average number of Class A Common Stock outstanding: Basic 226,757,519 227,653,988 227,771,678 227,931,929 230,003,502 GAAP Net Income (Loss) per share of Class A Common Stock under the Two-Class Method: Basic ($4.47) $1.84 $1.11 $1.80 $2.81 Distributed Income $0.89 $0.42 $0.49 $0.51 $0.60 Undistributed Income (Loss) ($5.36) $1.42 $0.62 $1.29 $2.21 Net Income (Loss) Attributable to Apollo Global Management, Inc. Class A Common Stockholders ($1,005,382) $437,164 $263,236 $424,940 $669,726 Net Income (Loss) Attributable to Apollo Global Management, Inc. Class A Common Stockholders to Income (Loss) Before Income Tax (Provision) Benefit Differences1 (1,574,314) 702,244 502,220 803,660 1,052,023 Income (Loss) Before Income Tax (Provision) Benefit ($2,579,696) $1,139,408 $765,456 $1,228,600 $1,721,749 Income (Loss) Before Income Tax (Provision) Benefit to Segment Distributable Earnings Differences1 2,776,201 (903,994) (519,947) (886,548) (1,392,967) Segment Distributable Earnings $196,505 $235,414 $245,509 $342,052 $328,782 Taxes and related payables (22,193) (21,040) (31,257) (15,499) (25,786) Preferred dividends (9,164) (9,165) (9,163) (9,164) (9,164) Distributable Earnings $165,148 $205,209 $205,089 $317,389 $293,832 Distributable Earnings Shares Outstanding 441,221,507 441,542,402 441,020,103 441,011,065 442,775,422 Distributable Earnings per Share $0.37 $0.46 $0.47 $0.72 $0.66 Distributable Earnings to Fee Related Earnings Differences1 62,908 54,036 72,344 (41,596) (7,176) Fee Related Earnings $228,056 $259,245 $277,433 $275,793 $286,656 Distributable Earnings Shares Outstanding 441,221,507 441,542,402 441,020,103 441,011,065 442,775,422 Fee Related Earnings per Share $0.52 $0.59 $0.63 $0.63 $0.65

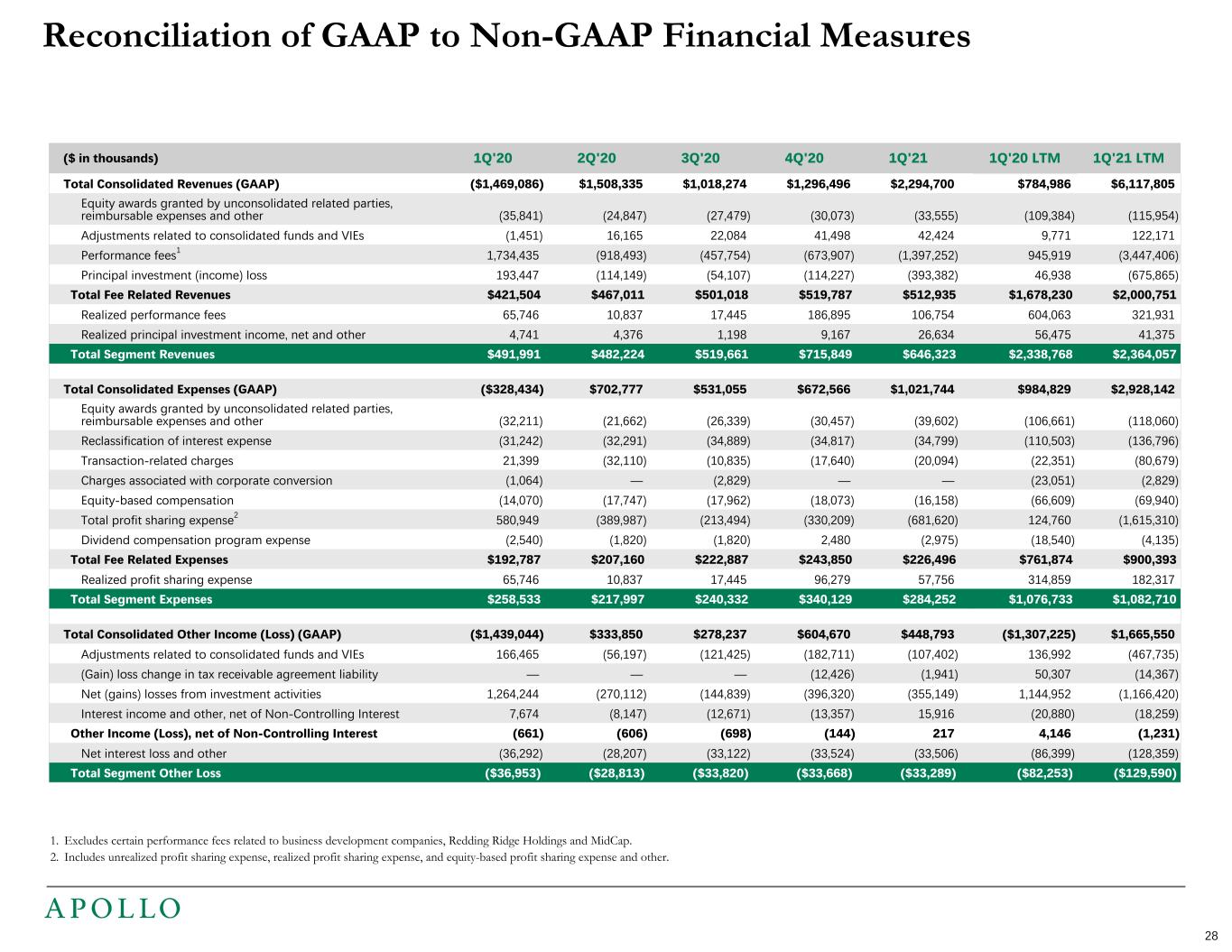

($ in thousands) 1Q'20 2Q'20 3Q'20 4Q'20 1Q'21 1Q'20 LTM 1Q'21 LTM Total Consolidated Revenues (GAAP) ($1,469,086) $1,508,335 $1,018,274 $1,296,496 $2,294,700 $784,986 $6,117,805 Equity awards granted by unconsolidated related parties, reimbursable expenses and other (35,841) (24,847) (27,479) (30,073) (33,555) (109,384) (115,954) Adjustments related to consolidated funds and VIEs (1,451) 16,165 22,084 41,498 42,424 9,771 122,171 Performance fees1 1,734,435 (918,493) (457,754) (673,907) (1,397,252) 945,919 (3,447,406) Principal investment (income) loss 193,447 (114,149) (54,107) (114,227) (393,382) 46,938 (675,865) Total Fee Related Revenues $421,504 $467,011 $501,018 $519,787 $512,935 $1,678,230 $2,000,751 Realized performance fees 65,746 10,837 17,445 186,895 106,754 604,063 321,931 Realized principal investment income, net and other 4,741 4,376 1,198 9,167 26,634 56,475 41,375 Total Segment Revenues $491,991 $482,224 $519,661 $715,849 $646,323 $2,338,768 $2,364,057 Total Consolidated Expenses (GAAP) ($328,434) $702,777 $531,055 $672,566 $1,021,744 $984,829 $2,928,142 Equity awards granted by unconsolidated related parties, reimbursable expenses and other (32,211) (21,662) (26,339) (30,457) (39,602) (106,661) (118,060) Reclassification of interest expense (31,242) (32,291) (34,889) (34,817) (34,799) (110,503) (136,796) Transaction-related charges 21,399 (32,110) (10,835) (17,640) (20,094) (22,351) (80,679) Charges associated with corporate conversion (1,064) — (2,829) — — (23,051) (2,829) Equity-based compensation (14,070) (17,747) (17,962) (18,073) (16,158) (66,609) (69,940) Total profit sharing expense2 580,949 (389,987) (213,494) (330,209) (681,620) 124,760 (1,615,310) Dividend compensation program expense (2,540) (1,820) (1,820) 2,480 (2,975) (18,540) (4,135) Total Fee Related Expenses $192,787 $207,160 $222,887 $243,850 $226,496 $761,874 $900,393 Realized profit sharing expense 65,746 10,837 17,445 96,279 57,756 314,859 182,317 Total Segment Expenses $258,533 $217,997 $240,332 $340,129 $284,252 $1,076,733 $1,082,710 Total Consolidated Other Income (Loss) (GAAP) ($1,439,044) $333,850 $278,237 $604,670 $448,793 ($1,307,225) $1,665,550 Adjustments related to consolidated funds and VIEs 166,465 (56,197) (121,425) (182,711) (107,402) 136,992 (467,735) (Gain) loss change in tax receivable agreement liability — — — (12,426) (1,941) 50,307 (14,367) Net (gains) losses from investment activities 1,264,244 (270,112) (144,839) (396,320) (355,149) 1,144,952 (1,166,420) Interest income and other, net of Non-Controlling Interest 7,674 (8,147) (12,671) (13,357) 15,916 (20,880) (18,259) Other Income (Loss), net of Non-Controlling Interest (661) (606) (698) (144) 217 4,146 (1,231) Net interest loss and other (36,292) (28,207) (33,122) (33,524) (33,506) (86,399) (128,359) Total Segment Other Loss ($36,953) ($28,813) ($33,820) ($33,668) ($33,289) ($82,253) ($129,590) Reconciliation of GAAP to Non-GAAP Financial Measures 1. Excludes certain performance fees related to business development companies, Redding Ridge Holdings and MidCap. 2. Includes unrealized profit sharing expense, realized profit sharing expense, and equity-based profit sharing expense and other. 28

($ in thousands) 1Q'20 2Q'20 3Q'20 4Q'20 1Q'21 1Q'20 LTM 1Q'21 LTM Management fees $382,368 $401,822 $426,452 $437,322 $448,669 $1,514,815 $1,714,265 Advisory and transaction fees, net 36,732 61,749 72,362 80,677 55,495 140,562 270,283 Performance fees1 2,404 3,440 2,204 1,788 8,771 22,853 16,203 Total Fee Related Revenues 421,504 467,011 501,018 519,787 512,935 1,678,230 2,000,751 Realized performance fees 65,746 10,837 17,445 186,895 106,754 604,063 321,931 Realized principal investment income. net and other 4,741 4,376 1,198 9,167 26,634 56,475 41,375 Total Segment Revenues $491,991 $482,224 $519,661 $715,849 $646,323 $2,338,768 $2,364,057 ($ in thousands) 1Q'20 2Q'20 3Q'20 4Q'20 1Q'21 1Q'20 LTM 1Q'21 LTM Salary, bonus and benefits $124,021 $134,999 $144,939 $157,028 $157,371 $481,612 $594,337 General, administrative and other 68,353 71,803 77,335 86,392 68,648 278,324 304,178 Placement fees 413 358 613 430 477 1,938 1,878 Total Fee Related Expenses 192,787 207,160 222,887 243,850 226,496 761,874 900,393 Realized profit sharing expense 65,746 10,837 17,445 96,279 57,756 314,859 182,317 Total Segment Expenses $258,533 $217,997 $240,332 $340,129 $284,252 $1,076,733 $1,082,710 ($ in thousands) 1Q'20 2Q'20 3Q'20 4Q'20 1Q'21 1Q'20 LTM 1Q'21 LTM Other income, net $133 $81 $126 $482 $870 $7,487 $1,559 Non-Controlling Interest (794) (687) (824) (626) (653) (3,341) (2,790) Other Income (Loss), net of Non-Controlling Interest (661) (606) (698) (144) 217 4,146 (1,231) Net interest loss and other (36,292) (28,207) (33,122) (33,524) (33,506) (86,399) (128,359) Total Segment Other Loss ($36,953) ($28,813) ($33,820) ($33,668) ($33,289) ($82,253) ($129,590) Total Segment Revenues, Expenses and Other Income (Loss) 29 1. Represents certain performance fees related to business development companies, Redding Ridge Holdings, and MidCap. The following table sets forth Apollo’s total segment expenses for the combined segments The following table sets forth Apollo’s total segment revenues for the combined segments The following table sets forth Apollo’s total segment other income (loss) for the combined segments

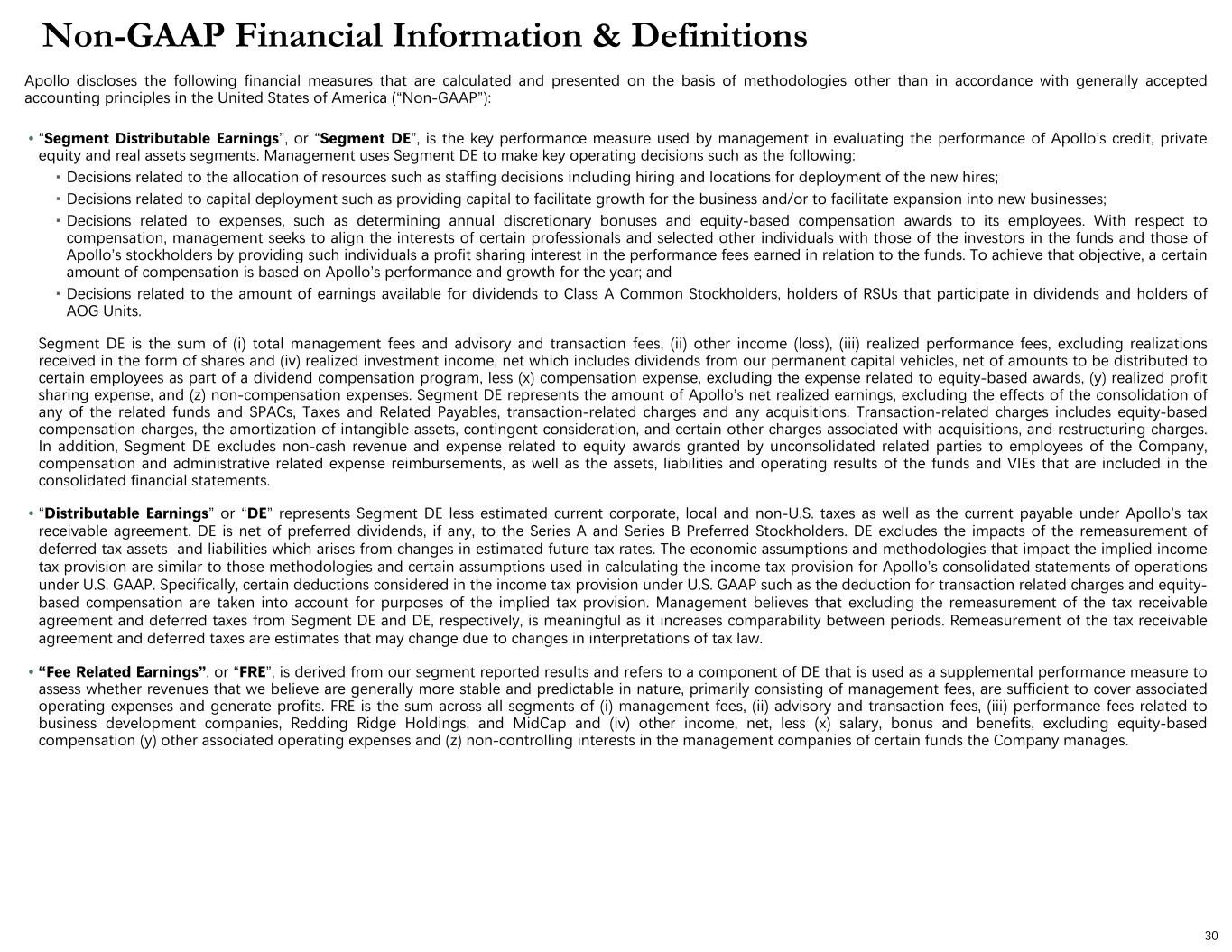

Non-GAAP Financial Information & Definitions Apollo discloses the following financial measures that are calculated and presented on the basis of methodologies other than in accordance with generally accepted accounting principles in the United States of America (“Non-GAAP”): • “Segment Distributable Earnings”, or “Segment DE”, is the key performance measure used by management in evaluating the performance of Apollo’s credit, private equity and real assets segments. Management uses Segment DE to make key operating decisions such as the following: ▪ Decisions related to the allocation of resources such as staffing decisions including hiring and locations for deployment of the new hires; ▪ Decisions related to capital deployment such as providing capital to facilitate growth for the business and/or to facilitate expansion into new businesses; ▪ Decisions related to expenses, such as determining annual discretionary bonuses and equity-based compensation awards to its employees. With respect to compensation, management seeks to align the interests of certain professionals and selected other individuals with those of the investors in the funds and those of Apollo’s stockholders by providing such individuals a profit sharing interest in the performance fees earned in relation to the funds. To achieve that objective, a certain amount of compensation is based on Apollo’s performance and growth for the year; and ▪ Decisions related to the amount of earnings available for dividends to Class A Common Stockholders, holders of RSUs that participate in dividends and holders of AOG Units. Segment DE is the sum of (i) total management fees and advisory and transaction fees, (ii) other income (loss), (iii) realized performance fees, excluding realizations received in the form of shares and (iv) realized investment income, net which includes dividends from our permanent capital vehicles, net of amounts to be distributed to certain employees as part of a dividend compensation program, less (x) compensation expense, excluding the expense related to equity-based awards, (y) realized profit sharing expense, and (z) non-compensation expenses. Segment DE represents the amount of Apollo’s net realized earnings, excluding the effects of the consolidation of any of the related funds and SPACs, Taxes and Related Payables, transaction-related charges and any acquisitions. Transaction-related charges includes equity-based compensation charges, the amortization of intangible assets, contingent consideration, and certain other charges associated with acquisitions, and restructuring charges. In addition, Segment DE excludes non-cash revenue and expense related to equity awards granted by unconsolidated related parties to employees of the Company, compensation and administrative related expense reimbursements, as well as the assets, liabilities and operating results of the funds and VIEs that are included in the consolidated financial statements. • “Distributable Earnings” or “DE” represents Segment DE less estimated current corporate, local and non-U.S. taxes as well as the current payable under Apollo’s tax receivable agreement. DE is net of preferred dividends, if any, to the Series A and Series B Preferred Stockholders. DE excludes the impacts of the remeasurement of deferred tax assets and liabilities which arises from changes in estimated future tax rates. The economic assumptions and methodologies that impact the implied income tax provision are similar to those methodologies and certain assumptions used in calculating the income tax provision for Apollo’s consolidated statements of operations under U.S. GAAP. Specifically, certain deductions considered in the income tax provision under U.S. GAAP such as the deduction for transaction related charges and equity- based compensation are taken into account for purposes of the implied tax provision. Management believes that excluding the remeasurement of the tax receivable agreement and deferred taxes from Segment DE and DE, respectively, is meaningful as it increases comparability between periods. Remeasurement of the tax receivable agreement and deferred taxes are estimates that may change due to changes in interpretations of tax law. • “Fee Related Earnings”, or “FRE”, is derived from our segment reported results and refers to a component of DE that is used as a supplemental performance measure to assess whether revenues that we believe are generally more stable and predictable in nature, primarily consisting of management fees, are sufficient to cover associated operating expenses and generate profits. FRE is the sum across all segments of (i) management fees, (ii) advisory and transaction fees, (iii) performance fees related to business development companies, Redding Ridge Holdings, and MidCap and (iv) other income, net, less (x) salary, bonus and benefits, excluding equity-based compensation (y) other associated operating expenses and (z) non-controlling interests in the management companies of certain funds the Company manages. 30

Non-GAAP Financial Information & Definitions Cont’d • “Assets Under Management”, or “AUM”, refers to the assets of the funds, partnerships and accounts to which we provide investment management, advisory, or certain other investment-related services, including, without limitation, capital that such funds, partnerships and accounts have the right to call from investors pursuant to capital commitments. Our AUM equals the sum of: 1. the net asset value (“NAV”), plus used or available leverage and/or capital commitments, or gross assets plus capital commitments, of the credit funds, partnerships and accounts for which we provide investment management or advisory services, other than certain collateralized loan obligations (“CLOs”), collateralized debt obligations (“CDOs”), and certain permanent capital vehicles, which have a fee-generating basis other than the mark-to-market value of the underlying assets; 2. the fair value of the investments of the private equity and real assets funds, partnerships and accounts we manage or advise, plus the capital that such funds, partnerships and accounts are entitled to call from investors pursuant to capital commitments, plus portfolio level financings; for certain permanent capital vehicles in real assets, gross asset value plus available financing capacity; 3. the gross asset value associated with the reinsurance investments of the portfolio company assets we manage or advise; and 4. the fair value of any other assets that we manage or advise for the funds, partnerships and accounts to which we provide investment management, advisory, or certain other investment-related services, plus unused credit facilities, including capital commitments to such funds, partnerships and accounts for investments that may require pre- qualification or other conditions before investment plus any other capital commitments to such funds, partnerships and accounts available for investment that are not otherwise included in the clauses above. Our AUM measure includes Assets Under Management for which we charge either nominal or zero fees. Our AUM measure also includes assets for which we do not have investment discretion, including certain assets for which we earn only investment-related service fees, rather than management or advisory fees. Our definition of AUM is not based on any definition of Assets Under Management contained in our governing documents or in any of our Apollo fund management agreements. We consider multiple factors for determining what should be included in our definition of AUM. Such factors include but are not limited to (1) our ability to influence the investment decisions for existing and available assets; (2) our ability to generate income from the underlying assets in our funds; and (3) the AUM measures that we use internally or believe are used by other investment managers. Given the differences in the investment strategies and structures among other alternative investment managers, our calculation of AUM may differ from the calculations employed by other investment managers and, as a result, this measure may not be directly comparable to similar measures presented by other investment managers. Our calculation also differs from the manner in which our affiliates registered with the SEC report “Regulatory Assets Under Management” on Form ADV and Form PF in various ways. We use AUM, Capital deployed and Dry powder as performance measurements of our investment activities, as well as to monitor fund size in relation to professional resource and infrastructure needs. • “AUM with Future Management Fee Potential” refers to the committed uninvested capital portion of total AUM not currently earning management fees. The amount depends on the specific terms and conditions of each fund. • “Fee-Generating AUM” or “FGAUM” consists of assets of the funds, partnerships and accounts to which we provide investment management, advisory, or certain other investment-related services and on which we earn management fees, monitoring fees or other investment-related fees pursuant to management or other fee agreements on a basis that varies among the Apollo funds, partnerships and accounts. Management fees are normally based on “net asset value,” “gross assets,” “adjusted par asset value,” “adjusted cost of all unrealized portfolio investments,” “capital commitments,” “adjusted assets,” “stockholders’ equity,” “invested capital” or “capital contributions,” each as defined in the applicable management agreement. Monitoring fees, also referred to as advisory fees, with respect to the structured portfolio company investments of the funds, partnerships and accounts we manage or advise, are generally based on the total value of such structured portfolio company investments, which normally includes leverage, less any portion of such total value that is already considered in Fee-Generating AUM. • “Performance Fee-Eligible AUM” or “PFEAUM” refers to the AUM that may eventually produce performance fees. All funds for which we are entitled to receive a performance fee allocation or incentive fee are included in Performance Fee-Eligible AUM, which consists of the following: • “Performance Fee-Generating AUM”, which refers to invested capital of the funds, partnerships and accounts we manage, advise, or to which we provide certain other investment-related services, that is currently above its hurdle rate or preferred return, and profit of such funds, partnerships and accounts is being allocated to, or earned by, the general partner in accordance with the applicable limited partnership agreements or other governing agreements; • “AUM Not Currently Generating Performance Fees”, which refers to invested capital of the funds, partnerships and accounts we manage, advise, or to which we provide certain other investment-related services that is currently below its hurdle rate or preferred return; and • “Uninvested Performance Fee-Eligible AUM”, which refers to capital of the funds, partnerships and accounts we manage, advise, or to which we provide certain other investment-related services that is available for investment or reinvestment subject to the provisions of applicable limited partnership agreements or other governing agreements, which capital is not currently part of the NAV or fair value of investments that may eventually produce performance fees allocable to, or earned by, the general partner. 31