Attached files

| file | filename |

|---|---|

| EX-23.3 - Alset EHome International Inc. | ex23-3.htm |

| EX-23.2 - Alset EHome International Inc. | ex23-2.htm |

| EX-23.1 - Alset EHome International Inc. | ex23-1.htm |

| EX-10.34 - Alset EHome International Inc. | ex10-34.htm |

| EX-10.33 - Alset EHome International Inc. | ex10-33.htm |

| EX-5.1 - Alset EHome International Inc. | ex5-1.htm |

| EX-4.6 - Alset EHome International Inc. | ex4-6.htm |

| EX-4.5 - Alset EHome International Inc. | ex4-5.htm |

| EX-4.3 - Alset EHome International Inc. | ex4-3.htm |

| EX-1.1 - Alset EHome International Inc. | ex1-1.htm |

As filed with the Securities and Exchange Commission on May 4, 2021.

Registration No. 333-

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

WASHINGTON, D.C. 20549

FORM S-1

REGISTRATION STATEMENT

UNDER

THE SECURITIES ACT OF 1933

Alset EHome International Inc.

(Exact name of registrant as specified in its charter)

| Delaware | 6799 | 83-1079861 | ||

(State or other jurisdiction of incorporation or organization) |

(Primary Standard Industrial Classification Code Number) |

(I.R.S. Employer Identification Number) |

Alset EHome International Inc.

4800 Montgomery Lane, Suite 210

Bethesda, Maryland 20814

(301) 971-3940

(Address, including zip code, and telephone number, including area code, of registrant’s principal executive offices)

Chan Heng Fai

Chairman and Chief Executive Officer

Alset EHome International Inc.

4800 Montgomery Lane, Suite 210

Bethesda, Maryland 20814

(301) 971-3940

(Name, address, including zip code, and telephone number, including area code, of agent for service)

Copies of all communications to:

| Darrin M. Ocasio, Esq. | Anthony W. Basch, Esq. | |

| Avital Perlman, Esq. | Kaufman & Canoles, P.C. | |

| Sichenzia Ross Ference LLP | 1021 E. Cary Street, Suite 1400 | |

| 1185 Avenue of Americas, 37th Floor | Two James Center | |

| New York, New York 10036 | Richmond, VA 23219 | |

| Tel.: (212) 930-9700 | Tel.: (804) 771-5700 |

Approximate date of commencement of proposed sale to the public: As soon as practicable after the effective date of this registration statement.

If any of the securities being registered on this Form are to be offered on a delayed or continuous basis pursuant to Rule 415 under the Securities Act of 1933, check the following box. [X]

If this Form is filed to register additional securities for an offering pursuant to Rule 462(b) under the Securities Act, check the following box and list the Securities Act registration statement number of the earlier effective registration statement for the same offering. [ ]

If this Form is a post-effective amendment filed pursuant to Rule 462(c) under the Securities Act, check the following box and list the Securities Act registration statement number of the earlier effective registration statement for the same offering. [ ]

If this Form is a post-effective amendment filed pursuant to Rule 462(d) under the Securities Act, check the following box and list the Securities Act registration statement number of the earlier effective registration statement for the same offering. [ ]

Indicate by check mark whether the registrant is a large accelerated filer, an accelerated filer, a non-accelerated filer, or a smaller reporting company. See the definitions of “large accelerated filer,” “accelerated filer” and “smaller reporting company” in Rule 12b-2 of the Exchange Act.

| Large Accelerated Filer [ ] | Accelerated Filer [ ] | Non-Accelerated Filer [X]

|

Smaller Reporting Company [X] Emerging Growth Company [X] |

If an emerging growth company, indicate by check mark if the registrant has elected not to use the extended transition period for complying with any new or revised financial accounting standards provided pursuant to Section 7(a)(2)(B) of the Securities Act. [ ]

CALCULATION OF REGISTRATION FEE

| Title of each class of securities to be registered | Proposed maximum aggregate offering price(1)(2) |

Amount of registration fee | ||||||

| Common Units (3) | $ | 49,450,000 | (4) | $ | 5,395.00 | |||

| Common Stock, par value $0.001 per share (“Common Stock”), included in the Common Units | (5) | |||||||

| Series A Warrants to purchase Common Stock, included in the Common Units | (5) | |||||||

| Series B Warrants to purchase Common Stock, included in the Common Units | (5) | |||||||

| Pre-funded Units (6) | (4) | |||||||

| Pre-funded Warrants included in the Pre-funded Units | (7) | |||||||

| Series A Warrants to purchase Common Stock, included in the Pre-funded Units | (7) | |||||||

| Series B Warrants to purchase Common Stock, included in the Pre-funded Units | (7) | |||||||

| Common Stock underlying the Pre-funded Warrants included in the Pre-funded Units | ||||||||

| Common Stock underlying Series A Warrants included in the Common Units and Pre-funded Units | $ | 49,450,000 | $ | 5,395.00 | ||||

| Common Stock underlying Series B Warrants included in the Common Units and Pre-funded Units | $ | 32,142,500 | $ | 3,506.75 | ||||

| Total | $ | 131,042,500 | $ | 14,296.75 | ||||

| (1) | Estimated solely for the purpose of computing the amount of the registration fee pursuant to Rule 457(o) under the Securities Act of 1933, as amended. |

| (2) | Includes shares the underwriter has the option to purchase to cover over-allotments, if any. |

| (3) | Each Common Unit consists of one share of Common Stock, one Series A Warrant and one Series B Warrant. |

| (3) | No fee pursuant to Rule 457(g) under the Securities Act. |

| (4) | The proposed maximum aggregate offering price of Common Units proposed to be sold in the offering will be reduced on a dollar-for-dollar basis based on the offering price of any Pre-funded Units offered and sold in the offering, and the proposed maximum aggregate offering price of the Pre-funded Units to be sold in the offering will be reduced on a dollar-for-dollar basis based on the offering price of any Common Units sold in the offering. Accordingly, the proposed maximum aggregate offering price of the Common Units and Pre-funded Units (including the Common Stock issuable upon exercise of the Pre-funded warrants included in the Pre-funded Units), if any, is $49,450,000. |

| (5) | Included in the price of the Common Units. No separate registration fee required pursuant to Rule 457(g) under the Securities Act of 1933, as amended. |

| (6) | Each Pre-funded Unit consists of one Pre-funded Warrant, one Series A Warrant and one Series B Warrant. |

| (7) | Included in the price of the Pre-funded Units. No separate registration fee required pursuant to Rule 457(g) under the Securities Act of 1933, as amended. |

The registrant hereby amends this registration statement on such date or dates as may be necessary to delay its effective date until the registrant shall file a further amendment which specifically states that this registration statement shall hereafter become effective in accordance with Section 8(a) of the Securities Act of 1933 or until the registration statement shall become effective on such date as the Commission, acting pursuant to said Section 8(a), may determine.

The information in this preliminary prospectus is not complete and may be changed. We may not sell these securities until the registration statement filed with the SEC is effective. This preliminary prospectus is not an offer to sell nor does it seek an offer to buy these securities in any jurisdiction where the offer or sale is not permitted.

Subject to Completion, dated May 4, 2021

PRELIMINARY PROSPECTUS

Up to 4,207,436 Common Units

Up to 4,207,436 Pre-funded Units

Common

Units Consisting of

One Share of Common Stock and

One Series A Warrant to Purchase One Share of Common Stock and

One Series B Warrant to Purchase One-Half of a Share of Common Stock

Pre-funded

Units Consisting of

One Pre-funded Warrant and

One Series A Warrant to Purchase One Share of Common Stock and

One Series B Warrant to Purchase One-Half of a Share of Common Stock

We are offering up to common 4,207,436 units (the “Common Units”), assuming a public offering price of $10.22 per share, the last reported sale price of our common stock as reported on the Nasdaq Capital Market on April 29, 2021, with each Common Unit consisting of (a) one share of common stock, par value $0.001 per share (which we refer to as our common stock), (b) one Series A warrant (the “Series A Warrant”) to purchase one share of common stock, and (c) one Series B warrant (the “Series B Warrant” and together with the Series A Warrants, the “Warrants”) to purchase one-half of a share of common stock, pursuant to this prospectus. The actual public offering price per Common Unit will be determined between us and the underwriters at the time of pricing and may be at a discount to this assumed offering price. Therefore, the assumed public offering price used throughout this prospectus may not be indicative of the final offering price.

We are also offering to those purchasers, if any, whose purchase of Common Units in this offering would otherwise result in the purchaser, together with its affiliates and certain related parties, beneficially owning more than 4.99% (or, at the election of the purchaser, 9.99%) of our outstanding common stock immediately following the consummation of this offering, the opportunity to purchase, if the purchaser so chooses, pre-funded units (each a “Pre-funded Unit”) in lieu of Common Units that would otherwise result in the purchaser’s beneficial ownership exceeding 4.99% (or, at the election of the purchaser, 9.99%) of our outstanding common stock. Each Pre-funded Unit will consist of a pre-funded warrant to purchase one share of common stock at an exercise price of $0.01 per share (each a “Pre-funded Warrant”, one Series A Warrant and one Series B Warrant. The purchase price of each Pre-funded Unit is equal to the price per Common Unit being sold to the public in this offering, minus $0.01. The Pre-funded Warrants will be immediately exercisable and may be exercised at any time until all of the Pre-funded Warrants are exercised in full. We are offering the Pre-funded Units at an assumed public offering price of $10.21 per Pre-funded Unit.

For each Pre-funded Unit we sell, the number of Common Units we are offering will be decreased on a one-for-one basis. Common Units and Pre-funded Units will not be certificated. The common stock or Pre-funded Warrants, as the case may be, and the Warrants included in the Common Units or the Pre-funded Units, can only be purchased together in this offering, but the securities contained in the Common Units or Pre-funded Units are immediately separable and will be issued separately.

The offering also includes the shares of common stock issuable from time to time upon exercise of the Pre-Funded Warrants and Warrants.

The Warrants will be exercisable immediately upon issuance and will expire on the fifth anniversary of the original issuance date. The Series A Warrants will have an initial exercise price equal to $ per whole share of common stock, equal to 100% of the public offering price of one Common Unit. The Series B Warrants will have an initial exercise price equal to $ per whole share of common stock, equal to 130% of the public offering price of one Common Unit.

Our common stock is listed on the Nasdaq Capital Market under the symbol “AEI.” We do not intend to apply for any listing of either of the Pre-funded Warrants or the Warrants on the Nasdaq Capital Market or any other securities exchange or nationally recognized trading system, and we do not expect a market to develop for the Pre-funded Warrants, the Series A Warrants or the Series B Warrants.

Investing in our securities involves a high degree of risk. See “Risk Factors” beginning on page 8.

Per Common Unit |

Per Pre-funded Unit | Total | ||||||||

| Public offering price | $ | $ | $ | |||||||

| Underwriting discounts and commissions (6.50%) (1) | $ | $ | $ | |||||||

| Proceeds to us, before expenses | $ | $ | $ | |||||||

| (1) | Does not include a non-accountable expense allowance equal to 1.5% of the gross proceeds of this offering payable to underwriters. Please see the section of this prospectus entitled “Underwriting” for additional information regarding underwriter compensation. |

We have granted a 45-day option to the underwriters to purchase additional shares of common stock and/or Pre-funded Warrants, representing up to 15% of the common stock and Pre-funded Warrants sold in the offering and/or additional Warrants, representing up to 15% of the Warrants sold in the offering, solely to cover over-allotments, if any.

Neither the Securities and Exchange Commission nor any other regulatory body has approved or disapproved these securities or determined if this prospectus is truthful or complete. Any representation to the contrary is a criminal offense.

The underwriters expect to deliver the Units to purchasers on or about , 2021.

Aegis Capital Corp.

The date of this prospectus is , 2021

| i |

TABLE OF CONTENTS

You should rely only on the information contained in this prospectus or contained in any free writing prospectus prepared by or on behalf of us. We have not authorized anyone to provide any information or to make any representations other than those contained in this prospectus or in any free writing prospectuses prepared by or on behalf of us or to which we have referred you. We take no responsibility for, and can provide no assurance as to the reliability of, any other information that others may give you. This prospectus is an offer to sell only the securities offered hereby, but only under circumstances and in jurisdictions where it is lawful to do so. The information contained in this prospectus is accurate only as of its date regardless of the time of delivery of this prospectus or of any sale of securities.

You should also read and consider the information in the documents to which we have referred you under the captions “Incorporation of Certain Information by Reference” and “Where You Can Find More Information” in this prospectus.

For investors outside the United States, we have not done anything that would permit this offering or possession or distribution of this prospectus in any jurisdiction where action for that purpose is required, other than in the U.S. Persons who come into possession of this prospectus and any free writing prospectus related to this offering in jurisdictions outside the U.S. are required to inform themselves about and to observe any restrictions as to this offering and the distribution of this prospectus and any such free writing prospectus applicable to that jurisdiction.

| ii |

This summary description about us and our business highlights selected information contained elsewhere in this prospectus, or incorporated in this prospectus by reference. This summary does not contain all of the information you should consider before buying securities in this offering. You should carefully read this entire prospectus, including each of the documents incorporated herein or therein by reference, before making an investment decision.

Unless the context requires otherwise, the words “we,” “us,” “our,” “our company,”“Alset”, “the Company” and “our business” refer to Alset EHome International Inc., a Delaware corporation, and its consolidated subsidiaries.

Our Company

We are a diversified holding company principally engaged through our subsidiaries in property development, digital transformation technology and biohealth activities with operations in the United States, Singapore, Hong Kong, Australia and South Korea. We manage our three principal businesses primarily through our 60.2% owned subsidiary, Alset International Limited, a public company traded on the Singapore Stock Exchange. Through this subsidiary (and indirectly, through other public and private U.S. and Asian subsidiaries), we are actively developing two significant real estate projects near Houston, Texas and in Frederick, Maryland in our property development segment. We have designed applications for enterprise messaging and e-commerce software platforms in the United States and Asia in our digital transformation technology business unit. Our recent foray into the biohealth segment includes research to treat neurological and immune-related diseases, nutritional chemistry to create a natural sugar alternative, research regarding innovative products to slow the spread of disease, and natural foods and supplements. We identify strategic global businesses for acquisition, incubation and corporate advisory services, primarily related to our operating business segments. We also have ownership interests outside of Alset International, including an indirect 16.8% equity interest in Holista CollTech Limited, a public Australian company that produces natural food ingredients, but this entity did not have a material asset value relative to our principal businesses. Under the guidance of Chan Heng Fai, our founder, Chairman and Chief Executive Officer, who is also our largest stockholder, we have positioned ourselves as a participant in these key markets through a series of strategic transactions. Our growth strategy is both to pursue acquisition opportunities that we can leverage on our global network using our capital and management resources and to accelerate the expansion of our organic businesses.

We generally acquire majority and/or control stakes in innovative and promising businesses that are expected to appreciate in value over time. Our emphasis is on building businesses in industries where our management team has in-depth knowledge and experience, or where our management can provide value by advising on new markets and expansion. We have at times provided a range of global capital and management services to these companies in order to gain access to Asian markets. We have historically favored businesses that improve an individual’s quality of life or that improve the efficiency of businesses through technology in various industries. We believe our capital and management services provide us with a competitive advantage in the selection of strategic acquisitions, which creates and adds value for our company and our stockholders.

We intend at all times to operate our business in a manner as to not become inadvertently subject to the regulatory requirements under the Investment Company Act by, among other things, (i) in the event of acquisitions, purchasing all or substantially all of an acquisition target’s voting stock, and only in limited cases purchase less than 51% of the voting stock; (ii) monitoring our operations and our assets on an ongoing basis in order to ensure that we own no less than a majority, or other control, of Alset International and that Alset International, in turn, owns no less than a majority, or other control, of LiquidValue Development Pte Ltd. (“LVD”) and other such subsidiaries with significant assets and operations; and (iii) limiting additional equity investments into affiliated companies including our majority-owned and/or controlled operating subsidiaries, except in special limited circumstances. Additionally, we will continue to hire in-house management personnel and employees with industry background and experience, rather than retaining traditional investment portfolio managers to oversee our group of companies.

| 1 |

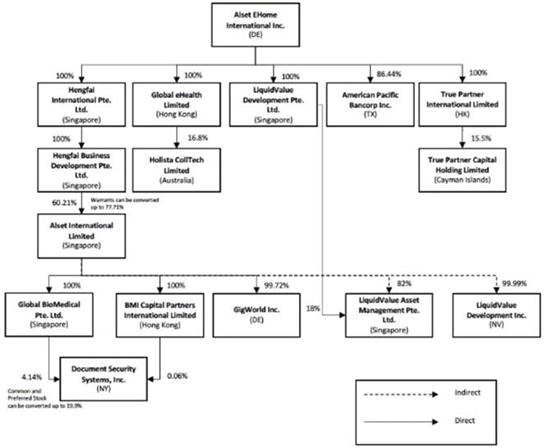

The following chart illustrates the current corporate structure of our key operating entities:

Selected Risks Associated with Our Business

Our business and prospects may be limited by a number of risks and uncertainties that we currently face, including the following:

| ● | We operate in the intensely competitive property development, digital transformation technology and biohealth markets against a number of large, well-known companies in each of those markets. | |

| ● | We and our majority-owned and/or controlled operating subsidiaries have a limited operating history and we cannot ensure the long-term successful operation of all of our businesses. | |

| ● | We had net losses of $4,398,435 and $8,053,428 for the years ended December 31, 2020 and 2019, respectively. There can be no assurance we will have net income in future periods. | |

| ● | We are a holding company and derive all of our operating income from, and hold substantially all of our assets through, our U.S. and foreign company ownership interests. The effect of this structure is that we will depend on the earnings of our subsidiaries, and the payment or other distributions to us of these earnings, to meet our obligations and make capital expenditures. |

| 2 |

| ● | There is no assurance that we will be able to identify appropriate acquisition targets, successfully acquire identified targets or successfully develop and integrate the businesses to realize their full benefits. | |

| ● | Our business depends on the availability to us of Chan Heng Fai, our founder, Chairman and Chief Executive Officer, who has developed and implemented our business philosophy and who would be extremely difficult to replace, and our business would be materially and adversely affected if his services were to become unavailable to us. | |

| ● | We are vulnerable to adverse changes in the economic environment in the United States, Singapore, Hong Kong, Australia and South Korea, particularly with respect to increases in wages for professionals, fluctuation in the value of foreign currencies and governmental trade policies between nations. |

In addition, we face other risks and uncertainties that may materially affect our business prospects, financial condition and results of operations. You should consider the risks discussed in “Risk Factors” and elsewhere in this prospectus before investing in our common stock.

Implications of Our Being an “Emerging Growth Company”

As a company with less than $1.07 billion in revenue during our last completed fiscal year, we qualify as an “emerging growth company” under the Jumpstart Our Business Startups Act of 2012, or the JOBS Act. An emerging growth company may take advantage of specified reduced reporting requirements that are otherwise generally applicable to public companies. In particular, as an emerging growth company, we:

| ● | are not required to obtain an attestation and report from our auditors on our management’s assessment of our internal control over financial reporting pursuant to the Sarbanes-Oxley Act; | |

| ● | are not required to provide a detailed narrative disclosure discussing our compensation principles, objectives and elements, and analyzing how those elements fit with our principles and objectives (commonly referred to as “compensation discussion and analysis”); | |

| ● | are not required to obtain a non-binding advisory vote from our stockholders on executive compensation or golden parachute arrangements (commonly referred to as the “say-on-pay,” “say-on-frequency” and “say-on-golden-parachute” votes); | |

| ● | are exempt from certain executive compensation disclosure provisions requiring a pay-for-performance graph and CEO pay ratio disclosure; | |

| ● | may present only two years of audited financial statements; and | |

| ● | are eligible to claim longer phase-in periods for the adoption of new or revised financial accounting standards under §107 of the JOBS Act. |

We intend to take advantage of all of these reduced reporting requirements and exemptions, including the longer phase-in periods for the adoption of new or revised financial accounting standards under §107 of the JOBS Act. Our election to use the phase-in periods may make it difficult to compare our financial statements to those of non-emerging growth companies and other emerging growth companies that have opted out of the phase-in periods under §107 of the JOBS Act.

| 3 |

Certain of these reduced reporting requirements and exemptions were already available to us due to the fact that we also qualify as a “smaller reporting company” under SEC rules. For instance, smaller reporting companies are not required to obtain an auditor attestation and report regarding internal control over financial reporting, are not required to provide a compensation discussion and analysis, are not required to provide a pay-for-performance graph or CEO pay ratio disclosure, and may present only two years of audited financial statements and related MD&A disclosure.

Under the JOBS Act, we may take advantage of the above-described reduced reporting requirements and exemptions for up to five years after our initial sale of common equity pursuant to a registration statement declared effective under the Securities Act of 1933, or such earlier time that we no longer meet the definition of an emerging growth company. The JOBS Act provides that we would cease to be an “emerging growth company” if we have more than $1.07 billion in annual revenue, have more than $700 million in market value of our common stock held by non-affiliates, or issue more than $1 billion in principal amount of non-convertible debt over a three-year period. Further, under current SEC rules, we will continue to qualify as a “smaller reporting company” for so long as we have a public float (i.e., the market value of common equity held by non-affiliates) of less than $250 million as of the last business day of our most recently completed second fiscal quarter.

Status as a Controlled Company

We are considered a “controlled company” within the meaning of the listing standards of Nasdaq. Under these rules, a “controlled company” may elect not to comply with certain corporate governance requirements, including the requirement to have a board that is composed of a majority of independent directors. We are taking advantage of these exemptions. These exemptions do not modify the independence requirements for our audit committee, and we intend to comply with the applicable requirements of the Sarbanes-Oxley Act and rules with respect to our audit committee within the applicable time frame.

Corporate Information

The Company was incorporated in the State of Delaware on March 7, 2018 as HF Enterprises Inc. Effective as of February 5, 2021, the Company changed its name from “HF Enterprises Inc.” to “Alset EHome International Inc.” The Company effected such name change pursuant to a merger entered into with a wholly owned subsidiary, Alset EHome International Inc. The Company is the surviving entity following this merger and has adopted the name of its former subsidiary. In connection with our name change, our trading symbol on the Nasdaq Stock Market was changed from “HFEN” to “AEI.”

Our principal executive offices are located at 4800 Montgomery Lane, Suite 210, Bethesda, Maryland 20814, telephone (301) 971-3940. We also maintain offices in Singapore, Magnolia, Texas, South Korea and Hong Kong. We maintain a corporate website at www.alsetehomeintl.com. Information on our website, and any downloadable files found there, are not part of this prospectus and should not be relied upon with respect to this offering.

Any information that we consider to be material to an evaluation of our company will be included in filings on the SEC website, http://www.sec.gov, and may also be disseminated using our investor relations website, www.alsetehomeintl.com, and press releases.

Available Information

We make available, free of charge on our corporate website at www.alsetehomeintl.com, copies of our Annual Reports on Form 10-K, Quarterly Reports on Form 10-Q, Current Reports on Form 8-K, Proxy Statements, and all amendments to these reports, as soon as reasonably practicable after such material is electronically filed with or furnished to the Securities and Exchange Commission, or the SEC, pursuant to Section 13(a) or 15(d) of the Securities Exchange Act. We also show detail about stock trading by corporate insiders by providing access to SEC Forms 3, 4 and 5. The SEC maintains a website that contains reports, proxy and information statements, and other information regarding issuers that file electronically with the SEC. The address of that website is www.sec.gov.

| 4 |

THE OFFERING

The summary below describes the principal terms of this offering. The “Description of Securities” section of this prospectus contains a more detailed description of our common stock.

| Securities being offered by us | 4,207,436 Common Units, assuming a public offering price of $10.22 per share, the last reported sale price of our common stock as reported on the Nasdaq Capital Market on April 29, 2021, with each Common Unit consisting of one share of common stock, one Series A Warrant to purchase one share of common stock and one Series B Warrant to purchase one-half of a share of common stock. The Common Units will not be certificated or issued as stand-alone securities. The shares of common stock and the Warrants composing such Common Units are immediately separable and will be issued separately but will be purchased together in this offering.

We are also offering to those purchasers, if any, whose purchase of Common Units in this offering would otherwise result in the purchaser, together with its affiliates and certain related parties, beneficially owning more than 4.99% (or, at the election of the purchaser, 9.99%) of our outstanding common stock immediately following the consummation of this offering, the opportunity to purchase, if the purchaser so chooses, pre-funded units (each a “Pre-funded Unit”) in lieu of Common Units that would otherwise result in the purchaser’s beneficial ownership exceeding 4.99% (or, at the election of the purchaser, 9.99%) of our outstanding common stock. Each Pre-funded Unit will consist of a pre-funded warrant to purchase one share of common stock at an exercise price of $0.01 per share (each a “Pre-funded Warrant”), one Series A Warrant to purchase one share of common stock and one Series B Warrant to purchase one-half of a share of common stock. The purchase price of each Pre-funded Unit is equal to the price per Common Unit being sold to the public in this offering, minus $0.01. The Pre-funded Warrants will be immediately exercisable and may be exercised at any time until all of the Pre-funded Warrants are exercised in full. For each Pre-funded Unit we sell, the number of Common Units we are offering will be decreased on a one-for-one basis.

We are offering Series A Warrants to purchase an aggregate of 4,207,436 shares of common stock and Series B warrants to purchase an aggregate of 2,103,718 shares of common stock. Because we will issue one Series A Warrant and one Series B Warrant as part of each Common Unit or Pre-funded Unit, the number of Warrants sold in this offering will not change as a result of a change in the mix of the Common Units and Pre-funded Units sold.

This prospectus also relates to the offering of the shares of common stock issuable upon exercise of the Pre-funded Warrants and the Warrants. | |

Overallotment option |

We have granted the underwriters a 45-day option to purchase additional shares of common stock and/or Pre-Funded Warrants, representing up to 15% of the shares of common stock and Pre-Funded Warrants sold in the offering and/or additional Warrants, representing up to 15% of the Warrants sold in the offering. | |

| Common stock to be outstanding immediately after this offering | 6,407,436 shares (or 7,038,551 shares, if the underwriters exercise their over-allotment option in full), assuming none of the Pre-funded Units are sold and none of the Warrants issued in this offering are exercised. | |

| Description of Series A Warrants | The Series A Warrants will be exercisable immediately upon issuance and will expire on the fifth anniversary of the original issuance date and have an initial exercise price equal to $ per share, or 100% of the price of each Common Unit sold in the offering, subject to appropriate adjustment in the event of recapitalization events, stock dividends, stock splits, stock combinations, reclassifications, reorganizations or similar events affecting our common stock. If at any time the closing price per share of the common stock shall exceed 200% of the exercise price then in effect for five consecutive trading days on each of which the daily dollar volume of the common stock equals or exceeds $5,000,000, the Company, at its option, may redeem the Series A Warrants, in whole or in part, at a price of $0.001 per share (subject to adjustment as provided therein).

See “Description of Securities—Series A Warrants” below for more information. | |

| Description of Series B Warrants | The Series B Warrants will be exercisable immediately upon issuance and will expire on the fifth anniversary of the original issuance date and have an initial exercise price equal to $ per share, or 130% of the price of each Common Unit sold in the offering, subject to appropriate adjustment in the event of recapitalization events, stock dividends, stock splits, stock combinations, reclassifications, reorganizations or similar events affecting our common stock. If at any time the closing price per share of the common stock shall exceed 200% of the exercise price then in effect for five consecutive trading days on each of which the daily dollar volume of the common stock equals or exceeds $5,000,000, the Company, at its option, may redeem the Series B Warrants, in whole or in part, at a price of $0.001 per share (subject to adjustment as provided therein). See “Description of Securities—Series B Warrants” below for more information. |

| 5 |

Use of proceeds |

We expect that the net proceeds from our sale of securities in this offering will be approximately $39,280,543 (or approximately $45,214,543 if the underwriters exercise their over-allotment option in full), based on a public offering price of $10.22 per Common Unit, after deducting the estimated underwriting discounts and commissions and estimated offering expenses payable by us. We intend to use the net proceeds from this offering (i) to fund possible acquisitions of new companies and additional properties, (ii) to fund the further development of properties, including services and infrastructure; (iii) to develop rental opportunities at properties; (iv) to exercise warrants of our subsidiaries to accomplish the items in (i) – (iii) and (v) for working capital and general corporate purposes. See “Use of Proceeds.” | |

| Risk factors | See “Risk Factors” below and the other information included or incorporated by reference in this prospectus for a discussion of factors that you should consider carefully before deciding to invest in our securities. | |

| Nasdaq symbol | Our common stock is listed on the Nasdaq Capital Market under the symbol “AEI.” We do not intend to apply for any listing of either of the Pre-funded Warrants or Warrants on the Nasdaq Capital Market or any other securities exchange or nationally recognized trading system, and we do not expect a market to develop for the Pre-funded Warrants, Series A Warrants or the Series B Warrants. |

The number of shares of common stock to be outstanding immediately after this offering is based upon 2,200,000 shares outstanding as of May 3, 2021, and excludes 6,380,000 shares of common stock issuable upon conversion of outstanding preferred stock.

| Unless otherwise indicated, this prospectus reflects and assumes the following: |

| ● | no sale of the Pre-funded Warrants in this offering, and no exercise of the Warrants or of the outstanding preferred stock described above; and | |

| ● | no exercise by the underwriters of their over-allotment option. |

| 6 |

INCORPORATION OF CERTAIN INFORMATION BY REFERENCE

The SEC allows us to “incorporate by reference” into this prospectus the information in other documents that we file with it. This means that we can disclose important information to you by referring you to those documents. The information incorporated by reference is considered to be a part of this prospectus, and information in documents that we file later with the SEC will automatically update and supersede information contained in documents filed earlier with the SEC or contained in this prospectus. We incorporate by reference in this prospectus the documents listed below and any future filings that we may make with the SEC under Sections 13(a), 13(c), 14, or 15(d) of the Exchange Act prior to the termination of the offering under this prospectus; provided, however, that we are not incorporating, in each case, any documents or information deemed to have been furnished and not filed in accordance with SEC rules:

| ● | our Annual Report on Form 10-K for the year ended December 31, 2020, filed with the SEC on April 14, 2021; |

| ● | our Current Reports on Form 8-K filed on January 7, 2021, January 12, 2021, January 15, 2021, February 4, 2021, February 11, 2021, February 12, 2021, March 5, 2021; March 18, 2021, May 4, 2021 and our Current Report on Form 8-K/A filed May 3, 2021; |

| ● | the description of our common stock, which is contained in the Registration Statement on Form 8-A, as filed with the SEC on November 23, 2020, as updated by the description of our common stock contained in Exhibit 4.4 to our Annual Report on Form 10-K for the fiscal year ended December 31, 2020, filed with the SEC on April 14, 2021. |

Additionally, all documents filed by us with the SEC under Sections 13(a), 13(c), 14 or 15(d) of the Exchange Act (i) prior to effectiveness of this registration statement, and (ii) after the effective date of this registration statement and before the termination or completion of any offering hereunder, shall be deemed to be incorporated by reference into this prospectus from the respective dates of filing of such documents, except that we do not incorporate any document or portion of a document that is “furnished” to the SEC, but not deemed “filed.”

Any statement contained in this prospectus, or in a document incorporated or deemed to be incorporated by reference into this prospectus will be deemed to be modified or superseded for purposes of this prospectus to the extent that a statement contained in this prospectus or any other subsequently filed document that is deemed to be incorporated by reference into this prospectus modifies or supersedes the statement. Any statements so modified or superseded shall not be deemed, except as so modified or superseded, to constitute a part of this prospectus.

We will furnish without charge to you, on written or oral request, a copy of any or all of the documents incorporated by reference in this prospectus, including exhibits to these documents. You should direct any requests for documents to Alset EHome International Inc., Attention: Michael Gershon, Chief Legal Officer.

You also may access these filings on our website at www.alsetehomeintl.com. We do not incorporate the information on our website into this prospectus and you should not consider any information on, or that can be accessed through, our website as part of this prospectus (other than those filings with the SEC that we specifically incorporate by reference into this prospectus).

| 7 |

Investing in our securities involves a high degree of risk. You should carefully consider the risk factors set forth below and under the caption “Risk Factors” in our Annual Report on Form 10-K for the year ended December 31, 2020, which are incorporated by reference in this prospectus. See “Incorporation of Certain Information by Reference” and “Where You Can Find More Information.” Before making any investment decision, you should carefully consider these risks as well as other information we include or incorporate by reference in this prospectus. The risks and uncertainties we describe are not the only ones facing us. Additional risks and uncertainties that we are unaware of or that we believe are not material at the time could also materially adversely affect our business, financial condition or results of operations. In any case, the value of our common stock could decline, and you could lose all or part of your investment. Please also see the section entitled “Cautionary Note Regarding Forward-Looking Statements.”

Risks Related to this Offering

We have broad discretion in the use of the net proceeds from this offering and may not use them effectively.

Our management will have broad discretion in the application of the net proceeds from this offering and could spend the proceeds in ways with which you may not agree. Accordingly, you will be relying on the judgment of our management with regard to the use of these net proceeds, and you will not have the opportunity, as part of your investment decision, to assess whether the proceeds are being used appropriately. It is possible that the proceeds will be invested or otherwise used in a way that does not yield a favorable, or any, return for our company. See the section entitled “Use of Proceeds” in this prospectus for a more detailed discussion of our expected use of the net proceeds from this offering.

We do not intend to apply for any listing of the Pre-funded Warrants or Warrants on any exchange or nationally recognized trading system, and we do not expect a market to develop for the Pre-funded Warrants or Warrants.

We do not intend to apply for any listing of either of the Pre-funded Warrants or Warrants on the Nasdaq Capital Market or any other securities exchange or nationally recognized trading system, and we do not expect a market to develop for the Pre-funded Warrants, the Series A Warrants or the Series B Warrants. Without an active market, the liquidity of the Pre-funded Warrants and Warrants will be limited. Further, the existence of the Pre-funded Warrants and Warrants may act to reduce both the trading volume and the trading price of our common stock.

The Pre-funded Warrants and the Warrants are speculative in nature.

The Pre-funded Warrants and the Warrants offered in this offering do not confer any rights of common stock ownership on their holders, such as voting rights or the right to receive dividends, but rather merely represent the right to acquire shares of our common stock at a fixed price, and in the case of the Warrants, for a limited period of time. Specifically, a holder of a Series A Warrant or two Series B Warrants may exercise the right to acquire a share of common stock and pay an exercise price equal to 100% of the offering price per Common Unit and 130% of the offering price per Common Unit, respectively, prior to the fifth anniversary of the original issuance date, upon which date any unexercised Warrants will expire and have no further value. A holder of a Pre-funded Warrant may exercise the right to acquire a share of common stock and pay a nominal exercise price of $0.01 at any time. Upon exercise of the Pre-funded Warrants and the Warrants, the holders thereof will be entitled to exercise the rights of a holder of common stock only as to matters for which the record date occurs after the exercise date. If at any time the closing price per share of the common stock shall exceed 200% of the exercise price then in effect for five consecutive trading days on each of which the daily dollar volume of the common stock equals or exceeds $5,000,000, the Company, at its option, may redeem the Series A Warrants and Series B Warrants, in whole or in part, at a price of $0.001 per share (subject to adjustment as provided therein).

Moreover, following this offering, the market value of the Pre-funded Warrants and the Warrants is uncertain. There can be no assurance that the market price of our common stock will ever equal or exceed the exercise price of the Warrants or the price of the Pre-funded Units, and, consequently, whether it will ever be profitable for investors to exercise their Warrants or to the Pre-funded Warrants.

| 8 |

If you purchase Common Units or Pre-funded Units in this offering, you will experience immediate dilution in the common stock included in the Common Units or Pre-funded Units you purchase. You will experience further dilution if we issue additional equity securities in future financing transactions.

Purchasers of Common Units or Pre-funded Units in this offering will pay a price per share of common stock included in the Common Units or Pre-funded Units you purchase that exceeds the net tangible book value per share of our common stock. Investors participating in this offering will incur immediate and substantial dilution. Assuming no sale of Pre-funded Units and giving effect to our receipt of approximately $39 million of estimated net proceeds, after deducting underwriting discounts and commissions and estimated offering expenses payable by us from our sale of Common Units in this offering at an assumed public offering price of $10.22 per Unit, the last reported sale price of our common stock as reported on the Nasdaq Capital Market on April 29, 2021, our pro forma as adjusted net tangible book value as of December 31, 2020, would have been $96,381,880, or $7.54 per share (not including other transactions after December 31, 2020, except this offering). This amount represents an immediate increase in net tangible book value of $0.88 per share of our common stock to existing stockholders and an immediate dilution in net tangible book value of $2.68 per share of our common stock to new investors purchasing in this offering. In addition, you could experience further dilution if the Warrants issued in this offering are exercised. See the section entitled “Dilution” below for a more detailed illustration of the dilution you would incur if you purchase Common Units in this offering.

If we issue additional common stock, or securities convertible into or exchangeable or exercisable for common stock, our stockholders, including investors who purchase shares of common stock in this offering, may experience additional dilution, and any such issuances may result in downward pressure on the price of our common stock. We also cannot assure you that we will be able to sell shares or other securities in any future offering at a price per share that is equal to or greater than the price per share paid by investors in this offering, and investors purchasing shares or other securities in the future could have rights superior to existing stockholders.

You may experience future dilution as a result of future equity offerings.

To the extent that we raise additional funds through the sale of equity or convertible debt securities, the issuance of such securities will result in dilution to our stockholders. We may sell shares or other securities in any other offering at a price per share that is less than the price per share paid by investors in this offering, and investors purchasing shares or other securities in the future could have rights superior to existing stockholders. The price per share at which we sell additional shares of our common stock, or securities convertible or exchangeable into common stock, in future transactions may be higher or lower than the price per share paid by investors in this offering.

Future sales, or the perception of future sales, of a substantial amount of our shares of common stock could depress the trading price of our common stock.

If we or our stockholders sell substantial amounts of our shares of common stock in the public market or if the market perceives that these sales could occur, the market price of shares of our common stock could decline. These sales may make it more difficult for us to sell equity or equity-related securities in the future at a time and price that we deem appropriate, or to use equity as consideration for future acquisitions.

As of May 3, 2021, we have 20,000,000 shares of common stock authorized and 2,200,000 shares of common stock outstanding. Of these shares, 2,160,000 shares are freely tradable. We, our executive officers and directors, and our majority stockholder have entered into agreements with the underwriters not to sell or otherwise dispose of shares of our common stock for a period of six months commencing on the date of this offering, with certain exceptions. Immediately upon the expiration of this lock-up period, 8,540,000 shares, assuming conversion of our outstanding shares of Series A Preferred Stock into 6,380,000 shares of common stock, will be eligible for resale pursuant to Rule 144 under the Securities Act, subject to the volume, manner of sale, holding period and other limitations of Rule 144.

Concentration of ownership of our common stock by our principal stockholder will limit new investors from influencing significant corporate decisions.

As of May 3, 2021, our Chief Executive Officer, Chan Heng Fai has the power to vote approximately 74.4% of our outstanding shares of common stock through his ownership of our Series A Preferred Stock. He will be able to make decisions such as (i) making amendments to our certificate of incorporation and bylaws, (ii) whether to issue additional shares of common stock and preferred stock, including to himself, (iii) employment decisions, including compensation arrangements, (iv) whether to enter into material transactions with related parties, (v) election and removal of directors and (vi) any merger or other significant corporate transactions. The interests of Chan Heng Fai may not coincide with our interests or the interests of other stockholders.

An

increase in our net asset value or market capitalization following this Offering could result in bonus payments to our Chief Executive

Officer.

On February 8, 2021, we entered into an Executive Employment Agreement (the “Employment Agreement”) with our Chief

Executive Officer. Under the Employment Agreement, Mr. Chan’s compensation will include a fixed salary of $1 per month

and two bonus payments each year consisting of: (i) one payment equal to Five Percent (5%) of the growth in market capitalization

the Company experiences in any year; and (ii) one payment equal to Five Percent (5%) of the growth in net asset value the Company

experiences in any year. To the extent this Offering contributes to an increase in our market capitalization and/or net asset

value at December 31, 2021 as compared to December 31, 2020, we would be obligated to pay such bonus in cash or stock, at Mr.

Chan’s election.

| 9 |

CAUTIONARY NOTE REGARDING FORWARD-LOOKING STATEMENTS

This prospectus and any free writing prospectus that we have authorized for use in connection with this offering, including the documents that we incorporate by reference, contain forward-looking statements concerning our business, operations and financial performance and condition, as well as our plans, objectives and expectations for our business, operations and financial performance and condition. Any statements contained herein that are not statements of historical facts may be deemed to be forward-looking statements. In some cases, you can identify forward-looking statements by terminology such as “anticipate,” “assume,” “believe,” “contemplate,” “continue,” “could,” “due,” “estimate,” “expect,” “goal,” “intend,” “may,” “objective,” “plan,” “predict,” “potential,” “positioned,” “seek,” “should,” “target,” “will,” “would” and other similar expressions that are predictions of or indicate future events and future trends, or the negative of these terms or other comparable terminology. These forward-looking statements include, but are not limited to, statements about our future financial performance, including our revenue, costs of revenue, operating expenses and profitability;

| ● | statements about our future financial performance, including our revenue, costs of revenue, operating expenses and profitability; | |

| ● | the sufficiency of our cash and cash equivalents to meet our liquidity needs; | |

| ● | our predictions about the property development, digital transformation technology and biohealth businesses and their respective market trends; | |

| ● | our ability to attract and retain customers in all our business segments to purchase our products and services; | |

| ● | the availability of financing for smaller publicly-traded companies like us; | |

| ● | our ability to successfully expand in our three principal business markets and into new markets and industry verticals; | |

| ● | our ability to effectively manage our growth and future expenses; and | |

| ● | our ability to respond to the potential risks resulting from the spread of the COVID-19 pandemic, and its potential impact on our operations. |

We believe that it is important to communicate our future expectations to our investors. However, there may be events in the future that we are not able to accurately predict or control and that may cause our actual results to differ materially from the expectations we describe in our forward-looking statements. These forward-looking statements are based on management’s current expectations, estimates, forecasts and projections about our business and the industry in which we operate and management’s beliefs and assumptions and are not guarantees of future performance or development and involve known and unknown risks, uncertainties and other factors that are in some cases beyond our control. As a result, any or all of our forward-looking statements in this prospectus may turn out to be inaccurate. Factors that may cause actual results to differ materially from current expectations include, among other things, those listed under “Risk Factors” and elsewhere in this prospectus. Potential investors are urged to consider these factors carefully in evaluating the forward-looking statements. These forward-looking statements speak only as of the date of this prospectus. We assume no obligation to update or revise these forward-looking statements for any reason, even if new information becomes available in the future.

You should not rely upon forward-looking statements as predictions of future events. Although we believe that the expectations reflected in the forward- looking statements are reasonable, we cannot guarantee that the future results, levels of activity, performance or events and circumstances reflected in the forward-looking statements will be achieved or occur. We undertake no obligation to update publicly any forward-looking statements for any reason after the date of this prospectus to conform these statements to actual results or to changes in our expectations.

You should read this prospectus and any free writing prospectus that we have authorized for use in connection with this offering with the understanding that our actual future results, levels of activity, performance and events and circumstances may be materially different from what we expect.

| 10 |

We estimate that the net proceeds from this offering, assuming we sell only Common Units, will be approximately $39,280,543 (or approximately $45,214,543 if the underwriter exercises its option in full to purchase additional shares of our common stock), based upon an assumed public offering price of $10.22 per Common Unit, which is the last reported sale price of our common stock as reported on the Nasdaq Capital Market on April 29, 2021, after deducting estimated underwriting discounts and commissions and estimated offering expenses payable by us. These amounts do not include the proceeds which we may receive in connection with the exercise of the Warrants offered hereby. We cannot predict when or if the Warrants will be exercised, and it is possible that the Warrants may expire and never be exercised.

We intend to use the net proceeds (i) to fund possible acquisitions of new companies and additional properties, (ii) to fund the further development of properties, including services and infrastructure; (iii) to develop rental opportunities at properties; (iv) to exercise warrants of our subsidiaries to accomplish the items in (i) – (iii) and (v) for working capital and general corporate purposes.

A significant portion of the net proceeds of this offering may be used to fund possible acquisitions of new companies in the markets in which we operate, or may operate in the future, and to acquire additional real estate development properties. We intend to acquire all or substantially all of an acquisition target’s voting stock and only in limited cases acquire less than 51% of the voting stock. We have no such acquisition agreements or commitments in place at this time.

Working capital and general corporate purposes may include amounts required to pay officers’ salaries, professional fees, ongoing public reporting costs, office-related expenses and other corporate expenses, including interest and overhead. Working capital may also include funds used for our sales and marketing and/or product enhancement efforts

The expected use of net proceeds from this offering represents our intention based upon our present plans and business conditions. We cannot predict with certainty all of the particular uses for the proceeds of this offering or the amounts that we will actually spend on the uses set forth above. Accordingly, our management will have significant flexibility in applying the net proceeds of this offering. The timing and amount of our actual expenditures will be based on many factors, including cash flows from operations and the anticipated growth of our business. Pending their use, we intend to invest the net proceeds of this offering in a variety of capital-preservation investments, including short- and intermediate-term, interest-bearing, investment-grade securities.

| 11 |

The following table sets forth our cash and cash equivalents and total capitalization as of December 31, 2020:

| ● | on an actual basis; and |

| ● | on an adjusted basis to give effect to (i) our acquisition of 4,775,523 shares of American Pacific Bancorp, Inc.’s (“APB”) Class B common stock, representing 86.44% of the total issued and outstanding common stock of APB on March 12, 2021, (ii) the exchange of 6,380,000 shares of common stock into 6,380 shares of Series A Preferred Stock on May 3, 2021, and (iii) the sale and issuance of 4,207,436 shares of common stock being sold as part of the Common Units in this offering at an assumed public offering price of $10.22 per Common Unit, the last reported sale price of our common stock as reported on the Nasdaq Capital Market on April 29, 2021, assuming no exercise of the underwriters’ option, after deducting the estimated underwriting discounts and commissions and estimated offering expenses payable by us |

The following information is illustrative only of our cash and cash equivalents and capitalization following the completion of this offering and will change based on the actual initial public offering price and other terms of this offering determined at pricing. You should read this table together with “Management’s Discussion and Analysis of Financial Condition and Results of Operations” and our consolidated financial statements and the related notes included in our Annual Report on Form 10-K for the fiscal year ended December 31, 2020, which is incorporated by reference in this prospectus, and the consolidated financial statements of APB, which is incorporated by reference in this prospectus.

| As of December 31, 2020 | ||||||||||||

| Actual | Pro Forma | As Adjusted | ||||||||||

| (Audited) | (Unaudited) | (Unaudited) | ||||||||||

| Cash and restricted cash | $ | 28,894,024 | $ | 31,235,456 | $ | 70,515,999 | ||||||

| Debt, net of debt discount | 2,335,276 | 67,079,228 | 67,079,228 | |||||||||

| Long-term debt, net of current portion and debt discount | 636,362 | 636,362 | 636,362 | |||||||||

| Stockholders’ equity: | ||||||||||||

| Preferred stock, $0.001 par value | - | - | * | - | ||||||||

| Common stock, $0.001 par value | 8,570 | 8,570 | * | 12,777 | ||||||||

| Additional paid-in capital | 97,950,440 | 47,035,389 | 86,311,725 | |||||||||

| Accumulated deficit | (43,010,991 | ) | (46,758,719 | ) | (46,758,719 | ) | ||||||

| Accumulated Other Comprehensive Income | 2,153,318 | 2,143,338 | 2,143,338 | |||||||||

| Alset EHome International stockholders’ equity | 57,101,337 | 2,428,578 | 41,709,121 | |||||||||

| Non-controlling interests | 37,622,517 | 37,980,325 | 37,980,325 | |||||||||

| Total stockholders’ equity | $ | 94,723,854 | $ | 40,408,903 | $ | 79,689,446 | ||||||

| Total capitalization** | $ | 95,360,216 | $ | 41,045,265 | $ | 80,325,808 | ||||||

*Not including the exchange of Chan Heng Fai’s common stock to preferred stock. The management expects that he will convert the preferred stock back to common stock in a short period.

** Total capitalization = Long-term debt + Total stockholders’ equity

| 12 |

If you invest in our Common Units in this offering, your ownership interest will be immediately diluted to the extent of the difference between the public offering price per Common Unit paid by the purchasers of the Common Units consisting of shares of common stock and Warrants to purchase shares of common stock in this offering and the pro forma net tangible book value per share of our common stock immediately after the closing of this offering.

Our net tangible book value is the amount of our total tangible assets less our total liabilities. Net tangible book value per share is our net tangible book value divided by the number of shares of common stock outstanding as of December 31, 2020. Our net tangible book value as of December 31, 2020 was $57,101,337, or $6.66 per share, based on 8,570,000 shares of our common stock outstanding as of December 31, 2020.

After giving effect to the sale and issuance by us of all of the Common Units (and shares of common stock included therein) in this offering at an assumed public offering price of $10.22 per Common Unit, the last reported sale price of our common stock as reported on the Nasdaq Capital Market on April 29, 2021, and the receipt and application of the net proceeds, after deducting estimated underwriting discounts and commissions and estimated offering expenses payable by us, assuming sale of Pre-funded Units in the offering and assuming that the underwriters do not exercise in full their option to purchase additional Common Units, our adjusted pro forma net tangible book value as of December 31, 2020 (not including other transactions after December 31, 2020, except this offering) would have been approximately $96,381,880, or $7.54 per share of common stock. This represents an immediate increase in pro forma net tangible book value of $0.88 per share to our existing stockholders and an immediate dilution of $2.68 per share to investors purchasing in this offering.

| Amount | ||||

| Assumed public offering price per Common Unit | $ | 10.22 | ||

| Pro forma net tangible book value before offering | $ | 6.66 | ||

| Increase in pro forma net tangible book value attributable to new investors | $ | 0.88 | ||

| Pro forma as adjusted net tangible book value after offering | $ | 7.54 | ||

| Dilution in pro forma net tangible book value to new investors | $ | 2.68 | ||

The tables and calculations above are based on 8,570,000 shares of common stock outstanding as of December 31, 2020, which excludes:

| ● | shares of common stock underlying the Warrants to be issued in connection with this offering; and |

| ● | shares of common stock and shares underlying Warrants issuable upon exercise of the underwriters’ overallotment option. |

| 13 |

The following description summarizes important terms of our securities. For a complete description, you should refer to our certificate of incorporation and bylaws, forms of which are incorporated by reference to the exhibits to the registration statement of which this prospectus is a part, as well as the relevant portions of the Delaware law. References to our certificate of incorporation and bylaws are to our certificate of incorporation and our bylaws, respectively, each of which will become effective upon completion of this offering.

General

Our authorized capital stock consists of 20,000,000 shares of common stock with a $0.001 par value per share, and 5,000,000 shares of preferred stock with a $0.001 par value per share, all of which shares of preferred stock will be undesignated. Our board of directors may establish the rights and preferences of the preferred stock from time to time. As of May 3, 2021, there were 2,200,000 shares of common stock issued and outstanding, and 6,380 shares of preferred stock were issued or outstanding.

Common Units

Each Common Unit being offered in this offering consists of (a) one share of our common stock, (b) one Series A Warrant entitling the holder thereof to purchase one share of our common stock at an initial exercise of $ per whole share, 100% of the public offering price of a Common Unit, exercisable until the fifth anniversary of the issuance date, and (c) one Series B Warrant entitling the holder thereof to purchase one-half of a share of our common stock at an initial exercise price of $ per whole share, 130% of the public offering price of a Common Unit, exercisable until the fifth anniversary of their issuance date. The common stock and Warrants that are part of the Common Units are immediately separable and will be issued separately in this offering, although they will have been purchased together in this offering.

Pre-funded Units

Each Pre-funded Unit being offered in this offering consists of (a) one Pre-funded Warrant, (b) one Series A Warrant entitling the holder thereof to purchase one share of our common stock at an initial exercise of $ per whole share, 100% of the public offering price of a Common Unit, exercisable until the fifth anniversary of the issuance date, and (c) one Series B Warrant entitling the holder thereof to purchase one-half of a share of our common stock at an initial exercise price of $ per whole share, 130% of the public offering price of a Common Unit, exercisable until the fifth anniversary of their issuance date. The Pre-funded Warrants and Warrants that are part of the Pre-funded Units are immediately separable and will be issued separately in this offering, although they will have been purchased together in this offering.

Common Stock

Each holder of our common stock is entitled to one vote for each share on all matters to be voted upon by the stockholders and there are no cumulative rights. Subject to any preferential rights of any outstanding preferred stock, holders of our common stock are entitled to receive ratably the dividends, if any, as may be declared from time to time by the board of directors out of legally available funds. If there is a liquidation, dissolution or winding up of our company, holders of our common stock would be entitled to share in our assets remaining after the payment of liabilities and any preferential rights of any outstanding preferred stock.

Holders of our common stock have no preemptive or conversion rights or other subscription rights, and there are no redemption or sinking fund provisions applicable to the common stock. All outstanding shares of our common stock will be fully paid and non-assessable. The rights, preferences and privileges of the holders of our common stock are subject to, and may be adversely affected by, the rights of the holders of shares of any series of preferred stock which we may designate and issue in the future.

Preferred Stock

Under the terms of our certificate of incorporation, our board of directors is authorized to issue shares of preferred stock in one or more series without stockholder approval. Our board of directors has the discretion to determine the rights, preferences, privileges and restrictions, including voting rights, dividend rights, conversion rights, redemption privileges and liquidation preferences, of each series of preferred stock.

| 14 |

The purpose of authorizing our board of directors to issue preferred stock and determine its rights and preferences is to eliminate delays associated with a stockholder vote on specific issuances. The issuance of preferred stock, while providing flexibility in connection with possible future acquisitions and other corporate purposes, will affect, and may adversely affect, the rights of holders of common stock. It is not possible to state the actual effect of the issuance of any shares of preferred stock on the rights of holders of common stock until the board of directors determines the specific rights attached to that preferred stock. The effects of issuing preferred stock could include one or more of the following:

| ● | restricting dividends on the common stock; | |

| ● | diluting the voting power of the common stock; | |

| ● | impairing the liquidation rights of the common stock; or | |

| ● | delaying or preventing changes in control or management of our company. |

We have no present plans to issue any shares of preferred stock.

Series A Preferred Stock

On May 3, 2021, the Board of Directors of the Company approved the creation of a class of Series A Convertible Preferred Stock (the “Series A Preferred Stock”). An amendment to the Company’s Amended and Restated Certificate of Incorporation (the “Certificate of Incorporation”), which sets forth the rights and preferences of the Series A Preferred Stock, was filed with the Delaware Secretary of State on May 3, 2021 (the “Series A Designation”).

Pursuant to the Series A Designation, 6,380 shares of the Company’s preferred stock were designated Series A Preferred Stock. Holders of the Series A Preferred Stock shall be entitled to receive dividends equal, on an as-if-converted basis, to and in the same form as dividends actually paid on shares of the Company’s common stock when, as and if paid on shares of common stock. Each holder of outstanding Series A Preferred Stock is entitled to vote equal to the number of whole shares of common stock into which each share of the Series A Preferred Stock is convertible. Holders of Series A Preferred Stock are entitled, upon liquidation of the Company, to receive the same amount that a holder of Series A Preferred Stock would receive if the Series A Preferred Stock were fully converted into common stock.

On the date on which an amendment to the Company’s Certificate of Incorporation to increase the Corporation’s authorized shares of Common Stock has been filed with the Secretary of State of the State of Delaware, each share of Series A Preferred Stock shall convert automatically into 1,000 shares of the Company’s common stock.

Warrants

Pre-funded Warrants Included in the Pre-funded Units

The term “pre-funded” refers to the fact that the purchase price of our common stock in this offering includes almost the entire exercise price that will be paid under the Pre-funded Warrants, except for a nominal remaining exercise price of $0.01. The purpose of the Pre-funded Warrants is to enable investors that may have restrictions on their ability to beneficially own more than 4.99% (or, upon election of the holder, 9.99%) of our outstanding common stock following the consummation of this offering the opportunity to make an investment in the Company without triggering their ownership restrictions, by receiving Pre-funded Warrants in lieu of our common stock which would result in such ownership of more than 4.99% (or 9.99%), and receive the ability to exercise their option to purchase the shares underlying the Pre-funded Warrants at such nominal price at a later date.

Exercise of Warrants. Each Pre-funded Warrant is exercisable for one share of our common stock, with an exercise price equal to $0.01 per share, at any time that the Pre-funded Warrant is outstanding. There is no expiration date for the Pre-funded Warrants. The holder of a Pre-funded Warrant will not be deemed a holder of our underlying common stock until the Pre-funded Warrant is exercised.

Subject to limited exceptions, a holder of Pre-funded Warrants will not have the right to exercise any portion of its Pre-funded Warrants if the holder (together with such holder’s affiliates, and any persons acting as a group together with such holder or any of such holder’s affiliates) would beneficially own a number of shares of common stock in excess of 4.99% (or, at the election of the purchaser prior to the date of issuance, 9.99%) of the shares of our common stock then outstanding after giving effect to such exercise.

The exercise price and the number of shares issuable upon exercise of the Pre-funded Warrants is subject to appropriate adjustment in the event of recapitalization events, stock dividends, stock splits, stock combinations, reclassifications, reorganizations or similar events affecting our common stock. The Pre-funded Warrant holders must pay the exercise price in cash upon exercise of the Pre-funded Warrants, unless such Pre-funded Warrant holders are utilizing the cashless exercise provision of the Pre-funded Warrants.

Upon the holder’s exercise of a Pre-funded Warrant, we will issue the shares of common stock issuable upon exercise of the Pre-funded Warrant within two trading days following our receipt of a notice of exercise, provided that payment of the exercise price has been made (unless exercised to the extent permitted via the “cashless” exercise provision). Prior to the exercise of any Pre-funded Warrants to purchase common stock, holders of the Pre-funded Warrants will not have any of the rights of holders of the common stock purchasable upon exercise, including the right to vote, except as set forth therein.

Warrant holders may exercise Pre-funded Warrants only if the issuance of the shares of common stock upon exercise of the Pre-funded Warrants is covered by an effective registration statement, or an exemption from registration is available under the Securities Act and the securities laws of the state in which the holder resides. We intend to use commercially reasonable efforts to have the registration statement, of which this prospectus forms a part, effective when the Pre-funded Warrants are exercised. The Pre-funded Warrant holders must pay the exercise price in cash upon exercise of the Pre-funded Warrants unless there is not an effective registration statement or, if required, there is not an effective state law registration or exemption covering the issuance of the shares underlying the Pre-funded Warrants (in which case, the Pre-funded Warrants may only be exercised via a “cashless” exercise provision).

Fundamental Transaction. In the event we consummate a merger or consolidation with or into another person or other reorganization event in which our common stock are converted or exchanged for securities, cash or other property, or we sell, lease, license, assign, transfer, convey or otherwise dispose of all or substantially all of our assets or we or another person acquire 50% or more of our outstanding shares of common stock, then following such event, the holders of the Pre-funded Warrants will be entitled to receive upon exercise of such Pre-funded Warrants the same kind and amount of securities, cash or property which the holders would have received had they exercised their Pre-funded Warrants immediately prior to such fundamental transaction. Any successor to us or surviving entity shall assume the obligations under the Pre-funded Warrants.

Exchange Listing. We do not intend to apply for listing of the Pre-funded Warrants on any securities exchange or other trading system.

Series A Warrants Included in the Common Units and Pre-funded Units

Exercise of Warrants. Each Series A Warrant is exercisable for one share of our common stock, with an exercise price equal to $ per share at any time for up to five (5) years after the date of the closing of this offering. The Series A Warrants issued in this offering will be governed by the terms of a global Series A Warrant held in book-entry form. The holder of a Series A Warrant will not be deemed a holder of our underlying common stock until the Series A Warrant is exercised.

Subject to certain limitations as described below, the Series A Warrants are immediately exercisable upon issuance on the closing date and expire on the five (5) year anniversary of the closing date. Subject to limited exceptions, a holder of Series A Warrants will not have the right to exercise any portion of its Series A Warrants if the holder (together with such holder’s affiliates, and any persons acting as a group together with such holder or any of such holder’s affiliates) would beneficially own a number of shares of common stock in excess of 4.99% (or, at the election of the purchaser prior to the date of issuance, 9.99%) of the shares of our common stock then outstanding after giving effect to such exercise.

| 15 |

The exercise price and the number of shares issuable upon exercise of the Series A Warrants is subject to appropriate adjustment in the event of recapitalization events, stock dividends, stock splits, stock combinations, reclassifications, reorganizations or similar events affecting our common stock. The Series A Warrant holders must pay the exercise price in cash upon exercise of the Series A Warrants, unless such Series A Warrant holders are utilizing the cashless exercise provision of the Series A Warrants.

Upon the holder’s exercise of a Series A Warrant, we will issue the shares of common stock issuable upon exercise of the Series A Warrant within two trading days following our receipt of a notice of exercise, provided that payment of the exercise price has been made (unless exercised to the extent permitted via the “cashless” exercise provision). Prior to the exercise of any Series A Warrants to purchase common stock, holders of the Series A Warrants will not have any of the rights of holders of the common stock purchasable upon exercise, including the right to vote, except as set forth therein.