Attached files

| file | filename |

|---|---|

| S-1/A - FORM S-1/A - Texas Community Bancshares, Inc. | tm218465d2_s1a.htm |

| EX-23.3 - EXHIBIT 23.3 - Texas Community Bancshares, Inc. | tm218465d2_ex23-3.htm |

| EX-8.1 - EXHIBIT 8.1 - Texas Community Bancshares, Inc. | tm218465d2_ex8-1.htm |

| EX-1.3 - EXHIBIT 1.3 - Texas Community Bancshares, Inc. | tm218465d2_ex1-3.htm |

Exhibit 8.2

Boards of Directors

Mineola Community Mutual Holding Company

Mineola Community Financial Group, Inc.

Texas Community Bancshares, Inc.

Mineola Community Bank, S.S.B.

215 West Broad Street

Mineola, TX 75773

Boards of Directors:

You requested BKD, LLP’s (“BKD”) opinion regarding the material Texas tax consequences that will result from the conversion of Mineola Community Mutual Holding Company, a Texas - chartered mutual holding company (the “Mutual Holding Company”), from the mutual to capital stock form of organization (the “Conversion”), pursuant to the Plan of Conversion and Reorganization of Mineola Community Mutual Holding Company, adopted March 3, 2021 (the “Plan”), and the integrated transactions described below.

Our opinion is limited solely to Texas tax consequences and will not apply to any other taxes, jurisdictions, transactions or issues.

Our opinion is based on the existing provisions of the Texas Tax Code, administrative regulations and rulings, Texas court decisions and other published guidance, any of which could be changed at any time. Any such changes may be retroactive and could significantly modify the statements and opinions expressed herein. This opinion is as of the date hereof, and we disclaim any obligation to advise you of any change in any matter considered herein after the date hereof.

In rendering the opinion set forth below, we have relied upon the Federal Opinion of Luse Gorman, PC related to the federal tax consequences of the Merger Agreement, without undertaking to verify the federal tax consequences by independent investigation. Our opinion is subject to the truth and accuracy of certain representations made by you to us and Luse Gorman, PC and the consummation of the proposed merger in accordance with the terms of the Merger Agreement. All capitalized terms used, but not defined herein, shall have the meanings assigned to them in the Merger Agreement.

Should it finally be determined the facts and federal income tax consequences are not as outlined in the Federal Opinion, the Texas tax consequences and our Texas Tax Opinion will differ from what is contained herein.

Boards of Directors

April 19, 2021

Page 2

We opine only as to the matters we expressly set forth herein, and no opinions should be inferred as to any other matters or as to the tax treatment of the transactions that we do not specifically address. We express no opinion as to other federal laws and regulations, or as to laws and regulations of other jurisdictions, or as to factual or legal matters other than as set forth herein.

DESCRIPTION OF PROPOSED TRANSACTIONS

Factual Overview

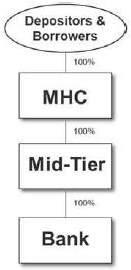

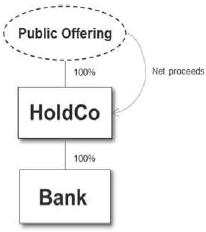

Based upon our review of the documents described above, and in reliance upon such documents, we understand that the relevant facts are as follows. The Bank and its affiliates currently file a Texas franchise tax combined report and are currently compliant with all Texas franchise tax laws. The Bank and its affiliates are duly registered for Texas sales and use tax. The Bank and its affiliates have not received any discretionary incentives exonerating them for liability for Texas franchise, sales, use, or property tax. The Bank is a Texas-chartered savings bank, which is headquartered in Mineola, Texas. The Bank was originally organized in 1934 but later reorganized into the mutual holding company structure in 2008. The Bank is currently the wholly owned subsidiary of the Mid-Tier Holding Company, which, in turn, is the wholly owned subsidiary of the Mutual Holding Company. The Mutual Holding Company is a mutual holding company with no stockholders. The depositors and borrowers of the Bank are considered the “owners” of the Mutual Holding Company and are entitled upon the complete liquidation of the Mutual Holding Company to any liquidation proceeds after the payment of creditors. It assumed the designated Texas property tax purposes use of any real or tangible personal property will not change due to the reorganization.

The beginning structure is as follows:

Boards of Directors

April 19, 2021

Page 3

The Boards of Directors of the Mutual Holding Company, the Mid-Tier Holding Company, and the Bank adopted the Plan providing for the Conversion of the Mutual Holding Company from a Texas- chartered mutual holding company to the capital stock form of organization. As part of the Conversion, the Holding Company will succeed to all the rights and obligations of the Mutual Holding Company and the Mid-Tier Holding Company and will offer shares of Holding Company Common Stock to depositors and borrowers of the Bank and to members of the general public in the Offering.

Proposed Reorganization

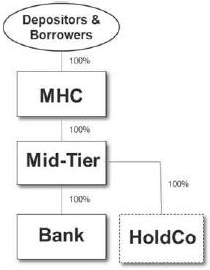

Pursuant to the Plan, the Conversion will be affected as follows and in the following order to consummate the Conversion as provided by Luse Gorman, P.C.:

| 1. | The Holding Company will be organized as a first tier Maryland-chartered stock holding company subsidiary of the Mid-Tier Holding Company. |

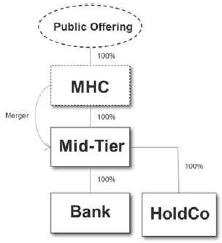

| 2. | The Mutual Holding Company will merge with and into the Mid-Tier Holding Company, with the Mid-Tier Holding Company as the surviving entity (the “MHC Merger”), whereby the shares of Mid-Tier Holding Company common stock owned by the Mutual Holding Company will be cancelled and the Members (e.g., depositors and borrowers of the Bank) will constructively receive liquidation interests in the Mid- Tier Holding Company in exchange for their liquidation interests in the Mutual Holding Company. |

Boards of Directors

April 19, 2021

Page 4

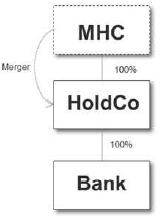

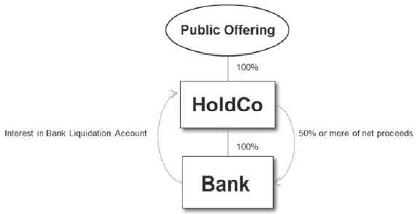

| 3. | Immediately after the MHC Merger, the Mid-Tier Holding Company will merge with and into the Holding Company (the “Mid-Tier Merger”), with the Holding Company as the resulting entity, whereby the Bank will become the wholly owned subsidiary of the Holding Company. As part of the Mid-Tier Merger, the liquidation interests in Mid-Tier Holding Company constructively received by the Members as part of the MHC Merger will automatically, without further action on the part of the holders thereof, be exchanged for an interest in a Liquidation Account. |

| 4. | Immediately after the Mid-Tier Merger, the Holding Company will offer for sale the Holding Company Common Stock in the Offering. |

Boards of Directors

April 19, 2021

Page 5

| 5. | The Holding Company will contribute at least 50% of the net proceeds of the Offering to the Bank in exchange for an interest in a Bank Liquidation Account. |

Following the Conversion, a Liquidation Account also will be maintained by the Holding Company for the benefit of Eligible Account Holders and Supplemental Eligible Account Holders who continue to maintain their deposit accounts with the Bank. Pursuant to the Plan, the initial balances of the Liquidation Account will be equal to the Mutual Holding Company’s total stockholders’ equity as reflected in the latest statement of financial condition contained in the final Prospectus used in the Conversion, plus the net assets of the MHC as reflected in the latest statement of financial condition of the Mutual Holding Company prior to the effective date of the Conversion (excluding its ownership of Mid-Tier Holding Company Common Stock). The terms of the Liquidation Account and Bank Liquidation Account, which supports the payment of the Liquidation Account in the event the Holding Company lacks sufficient net assets, are set forth in the Plan.

Boards of Directors

April 19, 2021

Page 6

As a result of the Conversion and Offering, the Holding Company will be a publicly-held corporation, will register the Holding Company Common Stock under Section 12(b) of the Securities Exchange Act of 1934, as amended (the “Exchange Act”), and will become subject to the rules and regulations thereunder and file periodic reports and proxy statements with the SEC. The Bank will become a wholly owned subsidiary of the Holding Company and will continue to carry on its business and activities as conducted immediately prior to the Conversion.

The stockholders of the Holding Company will be those persons who purchase shares of Holding Company Common Stock in the Offering. Nontransferable rights to subscribe for the Holding Company Common Stock have been granted, in order of priority, to Eligible Account Holders, the Bank’s tax-qualified employee plans (“Employee Plans”), Supplemental Eligible Account Holders, and certain other depositors and borrowers of the Bank as of the Member Voting Record Date who qualify as Other Members. Subscription rights are nontransferable. The Holding Company will also offer shares of Holding Company Common Stock not subscribed for in the Subscription Offering, if any, for sale in a Community Offering or Syndicated Community Offering to certain members of the general public (with preferences given first to persons residing in the Local Community and if shares remain after the subscription and community offerings, shares may be offered, at the sole discretion of the Holding Company, to members of the general public in a Syndicated Community Offering.

RELEVANT LAW

Texas

Texas Franchise Tax

Texas does not impose a net income tax on taxable entities, but instead imposes a franchise tax on the taxable margin on every taxable entity, including banking corporations, 1 that is organized, chartered, or does business in Texas.2 The taxable margin subject to the Texas franchise tax is the corporation's taxable margin from Texas sources minus allowable deductions.3 The starting point for calculating the taxable margin Texas franchise for tax purposes is Federal gross income minus cost of goods sold.4 Texas conforms to the version of the Internal Revenue Code (“IRC”) that existed on January 1, 2007, unless otherwise specified.5 Texas conforms to all provision of Subchapter C of the IRC without modification.6 Texas also conforms to any regulations adopted under that code applicable to that period.7

1 The term “taxable entity” includes banking corporations and savings and loan associations. Tex. Tax Code Ann. § 171.0002(a); Tex. Admin. Code 34 § 3.581(c). A banking corporation excludes from the numerator of its apportionment factor interest earned on federal funds and interest earned on securities sold under an agreement to repurchase that are held in Texas in a correspondent bank domiciled in Texas, but must include the interest in gross receipts from the entity's entire business.

2 Tex. Tax Code Ann. § 171.001(a).

3 Tex. Tax Code Ann. § 171.101(a); Tex. Tax Code Ann. § 171.103.

4 Tex. Tax Code Ann. § 171.101; Tex. Tax Code Ann. § 171.103.

5 Tex. Tax Code Ann. § 171.0001(9). “Internal Revenue Code” means the Internal Revenue Code of 1986 in effect for the federal tax year beginning on January 1, 2007, not including any changes made by federal law after that date, and any regulations adopted under that code applicable to that period.

6 Id. Subchapter C of the Internal Revenue Code encompasses IRC §§ 301-391.

7 Id.

Boards of Directors

April 19, 2021

Page 7

A taxable entity's total taxable margin is the lesser of 1.) 70 percent of the entity's total revenue from its entire business or an amount determined by subtracting from the entity's total revenue from its entire business the greatest of the statutorily defined cost of goods sold, compensation, or 2.) $1 million.8 The total revenue of a corporation, for purposes of computing taxable margin, is determined by adding specific items of income on federal Form 1120 and making specific subtractions from those items of income.9

Texas Sales & Use Tax

Texas imposes sales tax on the sale of taxable items in the state.10 “Taxable item” is defined to mean tangible personal property or taxable services.11 Texas does not provide a specific exemption from sales and use tax for corporate reorganizations under IRC §§ 351-368.

An occasional sale of a taxable item, however, is exempted from the Texas sales and use tax.12 The sale of the entire operating assets of a business or of a separate division, branch, or identifiable segment of a business is classified as an occasional sale, and thus is exempt from tax.13

Additionally, transfers in exchange for stock have been consistently held to be nontaxable by the Comptroller. The Comptroller has held the transfer of tangible personal property from one entity to another in a complete liquidation is not a taxable transaction.14 Tex. Tax Code Ann. § 151.005 requires that a sale be done or performed for consideration.15 Accordingly, a transfer of tangible personal property without consideration does not meet the definition of a “sale.”16 The Comptroller has also held that the transfer of assets to a newly formed corporation in exchange for stock is a nontaxable transfer because there is no value to the stock exchanged for the transferred assets.17 The Comptroller may look beyond individual transactions and view them as a series of related events that are, in fact, taxable if there is either no business purpose or no economic substance to the series of events.18 For purposes of this opinion, it is assumed a sufficient business purpose and economic substance exists for every applicable step in the reorganization.

8 Tex. Tax Code Ann. § 171.101(a)(1); Tex. Admin. Code tit. 34, § 3.587.

9 Tex. Tax Code Ann. § 171.1011(c)(1); Tex. Admin. Code tit. 34, § 3.587.

10 Tex. Tax Code Ann. §151.051(a); Tex. Tax Code Ann. §151.051(b).

11 Tex. Tax Code Ann. §151.010.

12 Tex. Tax Code Ann. §151.304(a).

13 Tex. Tax Code Ann. §151.304(b)(2).

14 See generally Tex. Tax Code Ann. § 11.01; See STAR Accession No. 200110530L (Oct. 2, 2001).

15 See Gifford-Hill & Co. v. State, 442 S.W.2d 320, 323 (Tex. 1969).

16 Id.

17 Texas Comptroller Decision No. 104,123, 01/26/2012.

18 See State Tax Automated Research System (STAR) Document No. 200908387L, August 6, 2009; See also Comptroller’s Decision No. 104,068 (2011), which affirmed that the policy was a reasonable interpretation of the Texas Tax Code.

Boards of Directors

April 19, 2021

Page 8

Texas Transfer Tax

Texas does not impose a transfer tax on real property.

Texas Property Tax

In Texas, all real property and personal property is taxable unless exempted by law.19 Texas does not impose tax on intangible personal property.20 The person holding title to the property is liable for remitting the property tax due.21 The Texas Legislature is authorized by the Texas Constitution to provide a classification scheme for taxable property.22 There are twenty-three property classifications in Texas that are used to categorize real property, tangible personal property, and intangible personal property.23 Transfer to title does not alone affect the classification of the property or any exemptions applicable to the property.24

Property tax liability is determined through a process that involves identifying the property's appraised value, assessed value, and taxable value, and then multiplying the taxable value by the appropriate property tax rate.25 The appraisal methods are the cost method, income method, and sales/market method.26 These methods do not consider the federal income tax basis of property in their determination.27 A property's assessed value is one-hundred (100) percent of its appraised value.28 A property's taxable value is the assessed value less any applicable exemptions.29 The resulting taxable value is multiplied by the applicable property tax rate set by each taxing jurisdiction to determine the property's tax liability.30

19 Tex. Tax Code Ann. § 11.01(a).

20 Id.

21 Tex. Tax Code Ann. § 32.07(a). It should be noted a person who sells a business or the inventory of a business is not released from any personal liability imposed on the person for the payment of taxes imposed on the personal property of the business or for penalties or interest on those taxes. A person is considered to have purchased a business if the person buys the name of the business or the goodwill associated with the business and the inventory of a business if the person purchases inventory of a business, the value of which is at least fifty (50) percent of the value of the total inventory of the business on the date of the purchase. See Tex. Tax Code Ann. §31.081(f)-(g). For purpose of this opinion, it is assumed all inventory property of Mineola and its affiliates is not subject to Texas property tax.

22 Tex. Const. art. 8, § 18.

23 Id.

24 See generally Tex. Tax Code Ann. § 11.01.

25 See Texas Tax Publication 96-1425.

26 Tex. Tax Code Ann. § 23.011; Tex. Tax Code Ann. § 23.0101; Texas Tax Publication 96-1738; Texas Tax Publication 96-308.

27 Id.

28 Tex. Tax Code Ann. § 26.02.

29 Tex. Tax Code Ann. § 1.04(10); Tex. Tax Code Ann. § 25.24; Tex. Tax Code Ann. § 26.04; Tex. Tax Code Ann. § 26.05; Tex. Tax Code Ann. § 26.09.

30 Id.

Boards of Directors

April 19, 2021

Page 9

Texas Excise Tax on Financial Institutions

Texas does not impose excise taxes on financial institutions.

OPINION(S)

Based on the foregoing description of the Conversion, including the MHC Merger and the Mid-Tier Merger, and subject to the qualifications and limitations set forth in this letter, BKD is of the opinion that:

| 1. | Assuming MHC Merger will qualify as a tax-free reorganization within the meaning of IRC § 368(a)(1)(A), it is more likely than not the tax-free reorganization will not be a taxable event for Texas franchise tax purposes because Texas conforms to Subchapter C of the IRC.31 It is more likely than not the reorganization will not be subject to Texas sales and use tax because no consideration for tangible personal property or a taxable service is involved in the reorganization.32 It is more likely than not the reorganization will not affect the property tax classification, applicable exemptions, or taxable value of any taxable property because a change in title or ownership does not affect any of these attributes; however, the Bank or Holding Company will be liable for remitting Texas property tax depending on which entity holds title to the taxable property.33 |

31 Tex. Tax Code Ann. § 171.0001(9). “Internal Revenue Code” means the Internal Revenue Code of 1986 in effect for the federal tax year beginning on January 1, 2007, not including any changes made by federal law after that date, and any regulations adopted under that code applicable to that period.

32 Texas Comptroller Decision No. 104,123, 01/26/2012.

33 See generally Tex. Tax Code Ann. § 11.01; See STAR Accession No. 200110530L (Oct. 2, 2001). It assumed the designated Texas property tax purposes use of any real or tangible personal property will not change due to the reorganization.

Boards of Directors

April 19, 2021

Page 10

| 2. | Assuming the constructive exchange of the Eligible Account Holders and Supplemental Eligible Account Holders liquidation interests in the Mutual Holding Company for liquidation interests in the Mid-Tier Holding Company in the MHC Merger satisfy the continuity of interest requirement of Treas. Reg. § 1.368-1(b),34 it is more likely than not the exchange will not be a taxable event for Texas franchise tax purposes because Texas conforms to the IRC.35 It is more likely than not the exchange will not be subject to Texas sales and use tax because the exchange does not involve consideration for tangible personal property or a taxable service.36 It is more likely than not the exchange will not affect the property tax classification, applicable exemptions, or taxable value of any taxable property because the exchange does not involve real or tangible personal property.37 |

| 3. | Assuming no gain or loss will be recognized by the Mutual Holding Company on the transfer of its assets to the Mid-Tier Holding Company and the Mid-Tier Holding Company’s assumption of its liabilities, if any, in a constructive exchange for liquidation interests in the Mid-Tier Holding Company or on the constructive distribution of such liquidation interests to members of the Mutual Holding Company pursuant to IRC §§ 361(a), 361(c) and 357(a), it is more likely than not the transfer will not be a taxable event for Texas franchise tax purposes because Texas conforms to Subchapter C of the IRC.38 It is more likely than not the transfer will not be subject to Texas sales and use tax because the transfer does not involve consideration for tangible personal property of a taxable service.39 It is more likely than not the transfer will not affect the property tax classification, applicable exemptions, or taxable value of any taxable property because a change in title or ownership does not affect any of these attributes; however, the Bank or Holding Company will be liable for remitting Texas property tax depending on which entity holds title to the taxable property.40 |

34 Cf. Rev. Rul. 69-3, 1969-1 C.B. 103, and Rev. Rul. 69-646, 1969-2 C.B. 54.

35 Tex. Tax Code Ann. § 171.0001(9). “Internal Revenue Code” means the Internal Revenue Code of 1986 in effect for the federal tax year beginning on January 1, 2007, not including any changes made by federal law after that date, and any regulations adopted under that code applicable to that period.

36 Texas Comptroller Decision No. 104,123, 01/26/2012.

37 Tex. Tax Code Ann. § 11.01(a).

38 Tex. Tax Code Ann. § 171.0001(9). “Internal Revenue Code” means the Internal Revenue Code of 1986 in effect for the federal tax year beginning on January 1, 2007, not including any changes made by federal law after that date, and any regulations adopted under that code applicable to that period.

39 Texas Comptroller Decision No. 104,123, 01/26/2012; See STAR Accession No. 200110530L (Oct. 2, 2001).

40 See generally Tex. Tax Code Ann. § 11.01; See STAR Accession No. 200110530L (Oct. 2, 2001). It assumed the designated Texas property tax purposes use of any real or tangible personal property will not change due to the reorganization.

Boards of Directors

April 19, 2021

Page 11

| 4. | Assuming no gain or loss will be recognized by the Mid-Tier Holding Company upon the receipt of the assets of the Mutual Holding Company in the MHC Merger in exchange for the constructive transfer of liquidation interests in the Mid-Tier Holding Company to the members of the Mutual Holding Company pursuant to IRC § 1032(a), it is more likely than not the constructive transfer will not be a taxable event for Texas franchise tax purposes because Texas conforms to Subchapter C of the IRC.41 It is more likely than not the constructive transfer will not be subject to Texas sales and use tax because the transfer does not involve consideration for tangible personal property of a taxable service.42 It is more likely than not the constructive transfer will not affect the property tax classification, applicable exemptions, or taxable value of any taxable property because a change in title or ownership does not affect any of these attributes; however, the Bank or Holding Company will be liable for remitting Texas property tax depending on which entity holds title to the taxable property.43 |

| 5. | Assuming persons who have liquidation interests in the Mutual Holding Company will recognize no gain or loss upon the constructive receipt of a liquidation interest in the Mid-Tier Holding Company in exchange for their liquidation interests in the Mutual Holding Company pursuant to IRC § 354(a), it is more likely than not the constructive receipt will not be a taxable event for Texas franchise tax purposes because Texas conforms to Subchapter C of the IRC.44 It is more likely than not the constructive receipt will not be subject to Texas sales and use tax because the receipt does not involve consideration for tangible personal property or a taxable service.45 It is more likely than not the constructive receipt will not affect the property tax classification, applicable exemptions, or taxable value of any taxable property because a change in title or ownership does not affect any of these attributes; however, the Bank or Holding Company will be liable for remitting Texas property tax depending on which entity holds title to the taxable property.46 |

41 Tex. Tax Code Ann. § 171.0001(9). “Internal Revenue Code” means the Internal Revenue Code of 1986 in effect for the federal tax year beginning on January 1, 2007, not including any changes made by federal law after that date, and any regulations adopted under that code applicable to that period.

42 Texas Comptroller Decision No. 104,123, 01/26/2012.

43 See generally Tex. Tax Code Ann. § 11.01; See STAR Accession No. 200110530L (Oct. 2, 2001). It assumed the designated Texas property tax purposes use of any real or tangible personal property will not change due to the reorganization.

44 Tex. Tax Code Ann. § 171.0001(9). “Internal Revenue Code” means the Internal Revenue Code of 1986 in effect for the federal tax year beginning on January 1, 2007, not including any changes made by federal law after that date, and any regulations adopted under that code applicable to that period.

45 Texas Comptroller Decision No. 104,123, 01/26/2012.

46 See generally Tex. Tax Code Ann. § 11.01; See STAR Accession No. 200110530L (Oct. 2, 2001). It assumed the designated Texas property tax purposes use of any real or tangible personal property will not change due to the reorganization.

Boards of Directors

April 19, 2021

Page 12

| 6. | Assuming the basis of the assets of Mutual Holding Company (other than the stock in the Mid-Tier Holding Company) to be received by the Mid-Tier Holding Company will be the same as the basis of such assets in the Mutual Holding Company immediately prior to the transfer pursuant to IRC § 362(b), it is more likely than not this basis will be identical for Texas franchise tax purposes because Texas conforms to Subchapter C of the IRC.47 It is more likely than not the basis at issue will not affect the property tax classification, applicable exemptions, or taxable value of any taxable property because the federal tax basis of property is not considered in determining any of these attributes.48 |

| 7. | Assuming the holding period of the assets of the Mutual Holding Company transferred to the Mid-Tier Holding Company will include the holding period of those assets in the Mutual Holding Company pursuant to IRC § 1223(2), it is more likely than not this holding period will be identical for Texas franchise tax purposes because Texas conforms to the IRC.49 It is more likely than not the holding period at issue will not affect the property tax classification, applicable exemptions, or taxable value of any taxable property because federal holding periods and the federal basis of property do not affect any of these attributes.50 |

| 8. | Assuming the Mid-Tier Merger will constitute a mere change in identity, form or place of organization within the meaning of IRC § 368(a)(1)(F) of the Code and therefore qualifies as a tax-free reorganization within the meaning of IRC § 368(a)(1)(F), it is more likely than not the change in identity will not be a taxable event for Texas franchise tax purposes because Texas conforms to Subchapter C of the IRC.51 It is more likely than not the mere change in identity will not be subject to Texas sales and use tax because the change does not involve consideration for tangible personal property or a taxable service.52 It is more likely than not the mere change in identity will not affect the property tax classification, applicable exemptions, or taxable value of any taxable property because a change in title or ownership does not affect any of these attributes; however, the Bank or Holding Company will be liable for remitting Texas property tax depending on which entity holds title to the taxable property.53 |

47 Tex. Tax Code Ann. § 171.0001(9). “Internal Revenue Code” means the Internal Revenue Code of 1986 in effect for the federal tax year beginning on January 1, 2007, not including any changes made by federal law after that date, and any regulations adopted under that code applicable to that period.

48 See supra, Notes 22-27.

49 Tex. Tax Code Ann. § 171.0001(9). “Internal Revenue Code” means the Internal Revenue Code of 1986 in effect for the federal tax year beginning on January 1, 2007, not including any changes made by federal law after that date, and any regulations adopted under that code applicable to that period.

50 See supra, notes 22-27.

51 Tex. Tax Code Ann. § 171.0001(9). “Internal Revenue Code” means the Internal Revenue Code of 1986 in effect for the federal tax year beginning on January 1, 2007, not including any changes made by federal law after that date, and any regulations adopted under that code applicable to that period.

52 Texas Comptroller Decision No. 104,123, 01/26/2012.

53 See generally Tex. Tax Code Ann. § 11.01; See STAR Accession No. 200110530L (Oct. 2, 2001). It assumed the designated Texas property tax purposes use of any real or tangible personal property will not change due to the reorganization.

Boards of Directors

April 19, 2021

Page 13

| 9. | Assuming the Mid-Tier Holding Company will not recognize any gain or loss on the transfer of its assets to the Holding Company and the Holding Company’s assumption of its liabilities in exchange for shares of Holding Company Common Stock and the constructive distribution of interests in the Liquidation Account to the Eligible Account Holders and Supplemental Eligible Account Holders pursuant to IRC §§ 354, 361(a), 361(c) and 357(a), it is more likely than not the exchange will not be a taxable event for Texas franchise tax purposes because Texas conforms to Subchapter C of the IRC.54 It is more likely than not the transfer will not be subject to Texas sales and use tax because it does not involve consideration for tangible personal property or a taxable service.55 It is more likely than not the transfer will not affect the property tax classification, applicable exemptions, or taxable value of any taxable property because a change in ownership or title does not affect any of these attributes; however, the Bank or Holding Company will be liable for remitting Texas property tax depending on which entity holds title to the taxable property.56 |

| 10. | Assuming no gain or loss will be recognized by the Holding Company upon the receipt of the assets of Mid-Tier Holding Company in the Mid-Tier Merger pursuant to IRC § 1032(a), it is more likely than not the receipt will not be a taxable event for Texas franchise tax purposes because Texas conforms to the IRC.57 It is more likely than not the receipt will not be subject to Texas sales and use tax because the receipt does not involve consideration for tangible personal property of a taxable service.58 It is more likely than not the receipt will not affect the property tax classification, applicable exemptions, or taxable value of any taxable property because a change in title or ownership does not affect any of these attributes; however, the Bank or Holding Company will be liable for remitting Texas property tax depending on which entity holds title to the taxable property.59 |

54 Tex. Tax Code Ann. § 171.0001(9). “Internal Revenue Code” means the Internal Revenue Code of 1986 in effect for the federal tax year beginning on January 1, 2007, not including any changes made by federal law after that date, and any regulations adopted under that code applicable to that period.

55 Texas Comptroller Decision No. 104,123, 01/26/2012.

56 See generally Tex. Tax Code Ann. § 11.01; See STAR Accession No. 200110530L (Oct. 2, 2001).

57 Tex. Tax Code Ann. § 171.0001(9). “Internal Revenue Code” means the Internal Revenue Code of 1986 in effect for the federal tax year beginning on January 1, 2007, not including any changes made by federal law after that date, and any regulations adopted under that code applicable to that period.

58 Texas Comptroller Decision No. 104,123, 01/26/2012.

59 See generally Tex. Tax Code Ann. § 11.01; See STAR Accession No. 200110530L (Oct. 2, 2001). It assumed the designated Texas property tax purposes use of any real or tangible personal property will not change due to the reorganization.

Boards of Directors

April 19, 2021

Page 14

| 11. | Assuming the basis of the assets of the Mid-Tier Holding Company (other than the stock in the Bank) to be received by the Holding Company will be the same as the basis of such assets in the Mid-Tier Holding Company immediately prior to the transfer pursuant to IRC § 362(b), it is more likely than not this basis will be identical for Texas franchise tax purposes because Texas conforms to Subchapter C of the IRC.60 It is more likely than not this basis issue will not affect the property tax classification, applicable exemptions, or taxable value of any taxable property the federal tax basis of any of property is not considered in determining any of these attributes.61 |

| 12. | Assuming the holding period of the assets of Mid-Tier Holding Company (other than the stock in the Bank) to be received by the Holding Company will include the holding period of those assets in the Mid-Tier Holding Company immediately prior to the transfer pursuant to IRC § 1223(2), it is more likely than not the holding period will identical for Texas franchise tax purposes because Texas conforms to Subchapter C of the IRC.62 It is more likely than not this basis issue will not affect the property tax classification, applicable exemptions, or taxable value of any taxable property because federal tax basis of property is not considered in determining any of these attributes.63 |

60 Tex. Tax Code Ann. § 171.0001(9). “Internal Revenue Code” means the Internal Revenue Code of 1986 in effect for the federal tax year beginning on January 1, 2007, not including any changes made by federal law after that date, and any regulations adopted under that code applicable to that period.

61 See supra, notes 22-27.

62 Tex. Tax Code Ann. § 171.0001(9). “Internal Revenue Code” means the Internal Revenue Code of 1986 in effect for the federal tax year beginning on January 1, 2007, not including any changes made by federal law after that date, and any regulations adopted under that code applicable to that period.

63 See supra, notes 22-27.

Boards of Directors

April 19, 2021

Page 15

| 13. | Assuming Eligible Account Holders and Supplemental Eligible Account Holders will not recognize any gain or loss upon the constructive exchange of their liquidation interests in Mid-Tier Holding Company for interests in the Liquidation Account in the Holding Company pursuant to IRC § 354, it is more likely than not the exchange will not be a taxable event for Texas franchise tax purposes because Texas conforms to Subchapter C of the IRC.64 It is more likely than not the exchange will not be subject to Texas sales and use tax because the exchange does not involve consideration for tangible personal property or a taxable service.65 It is more likely than not the exchange will not affect the property tax classification, applicable exemptions, or taxable value of any taxable property because a change in title or ownership does not affect any of these attributes; however, the Bank or Holding Company will be liable for remitting Texas property tax depending on which entity holds title to the taxable property.66 |

| 14. | Assuming 1.) the fair market value of the nontransferable subscription rights to purchase Holding Company Common Stock is zero, 2.) no gain or loss will be recognized by Eligible Account Holders, Supplemental Eligible Account Holders and Other Members upon distribution to them of nontransferable subscription rights to purchase shares of Holding Company Common Stock pursuant to IRC §356(a), and 3.) Eligible Account Holders, Supplemental Eligible Account Holders and Other Members will not realize any taxable income as a result of their exercise of the nontransferable subscription rights,67 it is more likely than not the exchange will not be a taxable event for Texas franchise tax purposes because Texas conforms to the IRC.68 It is more likely than not the exchange will not be subject to Texas sales and use tax because the exchange does not involve consideration for tangible personal property or a taxable service.69 It is more likely than not the exchange will not affect the property tax classification or taxable value of any taxable property because the exchange does not involve real or tangible personal property; however, the Bank or Holding Company will be liable for remitting Texas property tax depending on which entity holds title to the taxable property.70 |

64 Tex. Tax Code Ann. § 171.0001(9). “Internal Revenue Code” means the Internal Revenue Code of 1986 in effect for the federal tax year beginning on January 1, 2007, not including any changes made by federal law after that date, and any regulations adopted under that code applicable to that period.

65 Texas Comptroller Decision No. 104,123, 01/26/2012.

66 See generally Tex. Tax Code Ann. § 11.01; See STAR Accession No. 200110530L (Oct. 2, 2001). It assumed the designated Texas property tax purposes use of any real or tangible personal property will not change due to the reorganization.

67 Rev. Rul. 56-572, 1956-2 C.B. 182.

68 Tex. Tax Code Ann. § 171.0001(9). “Internal Revenue Code” means the Internal Revenue Code of 1986 in effect for the federal tax year beginning on January 1, 2007, not including any changes made by federal law after that date, and any regulations adopted under that code applicable to that period.

69 Texas Comptroller Decision No. 104,123, 01/26/2012.

70 Tex. Tax Code Ann. § 11.01(a).

Boards of Directors

April 19, 2021

Page 16

| 15. | Assuming 1.) the fair market value at the effective date of the Conversion of the benefit to Eligible Account Holders and Supplemental Eligible Account Holders provided by an interest in the Bank Liquidation Account which they constructively receive is zero, 2.) pursuant to the Plan, the Bank Liquidation Account supports the payment of the Liquidation Account in the unlikely event that either the Bank (or the Holding Company and the Bank) were to liquidate after the Conversion (including a liquidation of the Bank or the Bank and the Holding Company following a purchase and assumption transaction with a credit union acquiror) when the Holding Company lacks sufficient net assets to pay distributions from the Liquidation Account when due and 3.) no gain or loss will be recognized by Eligible Account Holders and Supplemental Eligible Account Holders upon the constructive distribution to them of such rights in the Bank Liquidation Account as of the effective date of the Conversion pursuant to IRC § 356(a), it is more likely than not the exchange will not be a taxable event for Texas franchise tax purposes because Texas conforms to Subchapter C of the IRC.71 It is more likely than not the exchange will not be subject to Texas sales and use tax because the exchange does not involve consideration for tangible personal property or a taxable service.72 It is more likely than not the exchange will not affect the property tax classification, applicable exemptions, or taxable value of any taxable property because a change in title or ownership does not affect any of these attributes; however, the Bank or Holding Company will be liable for remitting Texas property tax depending on which entity holds title to the taxable property.73 |

| 16. | Assuming the basis of the Holding Company Common Stock purchased in the Offering by the exercise of the nontransferable subscription rights will be the purchase price thereof pursuant to IRC § 1012, it is more likely than not this basis will be identical for Texas franchise tax purposes because Texas conforms to the IRC.74 It is more likely than not this basis will not affect the property tax classification, applicable exemptions, or taxable value of any taxable property because the federal tax basis of property is not considered in determining these attributes.75 |

71 Tex. Tax Code Ann. § 171.0001(9). “Internal Revenue Code” means the Internal Revenue Code of 1986 in effect for the federal tax year beginning on January 1, 2007, not including any changes made by federal law after that date, and any regulations adopted under that code applicable to that period.

72 Texas Comptroller Decision No. 104,123, 01/26/2012.

73 See generally Tex. Tax Code Ann. § 11.01; See STAR Accession No. 200110530L (Oct. 2, 2001). It assumed the designated Texas property tax purposes use of any real or tangible personal property will not change due to the reorganization.

74 Tex. Tax Code Ann. § 171.0001(9). “Internal Revenue Code” means the Internal Revenue Code of 1986 in effect for the federal tax year beginning on January 1, 2007, not including any changes made by federal law after that date, and any regulations adopted under that code applicable to that period.

75 See supra, notes 22-27.

Boards of Directors

April 19, 2021

Page 17

| 17. | Assuming the holding period of the Holding Company Common Stock purchased pursuant to the exercise of subscriptions rights will commence on the date on which the right to acquire such stock was exercised pursuant to IRC § 1223(5), it is more likely than not the holding period will be identical for Texas franchise tax purposes because Texas conforms to the IRC.76 It is more likely than not this holding will not affect the property tax classification, applicable exemptions, or taxable value of any taxable property because the federal tax basis of property is not considered in determining any of these attributes.77 |

| 18. | Assuming, no gain or loss will be recognized by the Holding Company on the receipt of money in exchange for Holding Company Common Stock sold in the Offering pursuant to IRC § 1032, it is more likely than not the receipt will not be a taxable event for Texas franchise tax purposes because Texas conforms to the IRC.78 It is more likely than not the receipt will not be subject to Texas sales and use tax because the receipt does not involve consideration for tangible personal property or a taxable service.79 It is more likely than not the constructive receipt will not affect the property tax classification, applicable exemptions, or taxable value of any taxable property because a change in title or ownership does not affect any of these attributes; however, the Bank or Holding Company will be liable for remitting Texas property tax depending on which entity holds title to the taxable property.80 |

76 Tex. Tax Code Ann. § 171.0001(9). “Internal Revenue Code” means the Internal Revenue Code of 1986 in effect for the federal tax year beginning on January 1, 2007, not including any changes made by federal law after that date, and any regulations adopted under that code applicable to that period.

77 See supra, notes 22-27.

78 Tex. Tax Code Ann. § 171.0001(9). “Internal Revenue Code” means the Internal Revenue Code of 1986 in effect for the federal tax year beginning on January 1, 2007, not including any changes made by federal law after that date, and any regulations adopted under that code applicable to that period.

79 Texas Comptroller Decision No. 104,123, 01/26/2012.

80 See generally Tex. Tax Code Ann. § 11.01; See STAR Accession No. 200110530L (Oct. 2, 2001). It assumed the designated Texas property tax purposes use of any real or tangible personal property will not change due to the reorganization.

Boards of Directors

April 19, 2021

Page 18

CONSENT

We hereby consent to the filing of the opinion as an exhibit to the Mutual Holding Company’s Application for Conversion filed with the Federal Reserve and the Texas Department, and to the Holding Company’s Registration Statement on Form S-1 as filed with the SEC. We also consent to the references to our firm in the Prospectus contained in the Application for Conversion and Form S- 1 under the captions “The Conversion and Offering-Material Income Tax Consequences” and “Legal Matters.”

Very truly yours,

BKD, LLP