Attached files

| file | filename |

|---|---|

| EX-99.2 - EX-99.2 - SelectQuote, Inc. | populationhealthpressrelea.htm |

| 8-K - 8-K - SelectQuote, Inc. | ainvestorpresentationxmay2.htm |

1 Presents: May 2021 Exhibit 99.1

Forward-Looking Statements This presentation contains forward-looking statements. These forward-looking statements reflect our current views with respect to, among other things, future events and our financial performance. These statements are often, but not always, made through the use of words or phrases such as “may,” “should,” “could,” “predict,” “potential,” “believe,” “will likely result,” “expect,” “continue,” “will,” “anticipate,” “seek,” “estimate,” “intend,” “plan,” “projection,” “would” and “outlook,” or the negative version of those words or other comparable words or phrases of a future or forward-looking nature. These forward-looking statements are not historical facts, and are based on current expectations, estimates and projections about our industry, management’s beliefs and certain assumptions made by management, many of which, by their nature, are inherently uncertain and beyond our control. Accordingly, we caution you that any such forward-looking statements are not guarantees of future performance and are subject to risks, assumptions and uncertainties that are difficult to predict. Although we believe that the expectations reflected in these forward-looking statements are reasonable as of the date made, actual results may prove to be materially different from the results expressed or implied by the forward-looking statements. There are or will be important factors that could cause our actual results to differ materially from those indicated in these forward-looking statements, including, but not limited to, the following: the ultimate duration and impact of the ongoing COVID-19 pandemic, our reliance on a limited number of insurance carrier partners and any potential termination of those relationships or failure to develop new relationships; existing and future laws and regulations affecting the health insurance market; changes in health insurance products offered by our insurance carrier partners and the health insurance market generally; insurance carriers offering products and services directly to consumers; changes to commissions paid by insurance carriers and underwriting practices and/or changes to laws, regulations or accounting practices that could impact the recognition of commissions received and expected future renewal commissions; competition with brokers, exclusively online brokers and carriers who opt to sell policies directly to consumers; competition from government-run health insurance exchanges; developments in the U.S. health insurance system; our dependence on revenue from carriers in our senior segment and downturns in the senior health as well as life, automotive and home insurance industries; our ability to develop new offerings and penetrate new vertical markets; risks from third-party products; failure to enroll individuals during the Medicare annual enrollment period; our ability to attract, integrate and retain qualified personnel; our dependence on lead providers and ability to compete for leads; failure to obtain and/or convert sales leads to actual sales of insurance policies; access to data from consumers and insurance carriers; accuracy of information provided from and to consumers during the insurance shopping process; cost-effective advertisement through internet search engines; ability to contact consumers and market products by telephone; global economic conditions; disruption to operations as a result of future acquisitions; significant estimates and assumptions in the preparation of our financial statements; impairment of goodwill; potential litigation and claims, including IP litigation; our existing and future indebtedness; developments with respect to LIBOR; access to additional capital; failure to protect our intellectual property and our brand; fluctuations in our financial results caused by seasonality; accuracy and timeliness of commissions reports from insurance carriers; timing of insurance carriers’ approval and payment practices; factors that impact our estimate of the constrained lifetime value of commissions per policyholder; changes in accounting rules, tax legislation and other legislation; disruptions or failures of our technological infrastructure and platform; failure to maintain relationships with third-party service providers; cybersecurity breaches or other attacks involving our systems or those of our insurance carrier partners or third-party service providers; our ability to protect consumer information and other data; and failure to market and sell Medicare plans effectively or in compliance with laws. For a further discussion of these and other risk factors that could impact our future results and performance, see the section entitled “Risk Factors” in our most recent Annual Report on Form 10-K filed by us with the Securities and Exchange Commission, as well as our more recent filings with the Securities and Exchange Commission. Accordingly, you should not place undue reliance on any such forward-looking statements. Any forward-looking statement speaks only as of the date on which it is made, and, except as otherwise required by law, we do not undertake any obligation to publicly update or review any forward-looking statement, whether as a result of new information, future developments or otherwise. Certain information contained in this presentation and statements made orally during this presentation relates to or is based on publications and other data obtained from third-party sources. While we believe these third- party sources to be reliable as of the date of this presentation, we have not independently verified, and make no representation as to the adequacy, fairness, accuracy or completeness of, any information obtained from such third-party sources. 2 Disclaimer

Notes: LTM represents Last Twelve Months financial results as of 12/31/2020 35+ Years in Operation 100% Internal Agents 1,500+ Licensed Agents $180Bn+ Total Addressable Market 3MM+ Policyholders Served 1 Billion+ Data Points Collected 50+ carriers entrust us to sell their “must own” insurance products WHAT WE DO LTM 2Q FY21 Revenue Mix WHO WE ARE We are a leading technology-enabled, direct-to-consumer (“DTC”) distribution platform HOW WE DO IT Our proprietary, purpose-built marketing technology optimizes lead delivery to our 100% internal agent force, maximizing marketing ROI WHY WE ARE DIFFERENT Our “Fly Wheel” is enhanced by over 1 billion data points and 35+ years of experience 3 SelectQuote’s 100% internal agent force and purpose-built technology make us the #1 direct-to-consumer insurance distribution platform. SelectQuote – The Leader in Direct-to-Consumer Insurance

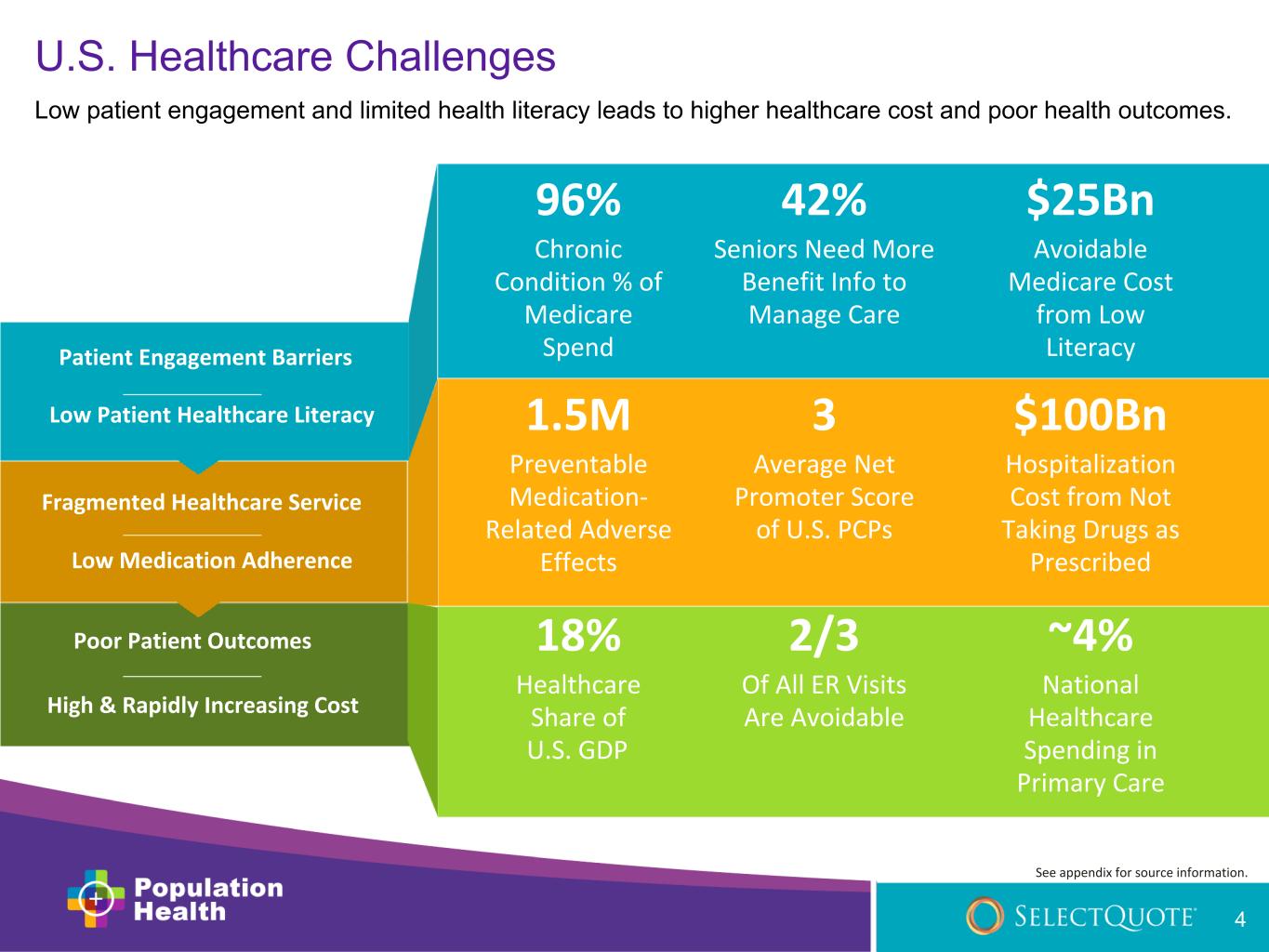

96% Chronic Condition % of Medicare Spend $25Bn Avoidable Medicare Cost from Low LiteracyPatient Engagement Barriers Low Patient Healthcare Literacy Fragmented Healthcare Service 4 Low Medication Adherence Poor Patient Outcomes High & Rapidly Increasing Cost 42% Seniors Need More Benefit Info to Manage Care $100Bn Hospitalization Cost from Not Taking Drugs as Prescribed 1.5M Preventable Medication- Related Adverse Effects 3 Average Net Promoter Score of U.S. PCPs 18% Healthcare Share of U.S. GDP ~4% National Healthcare Spending in Primary Care 2/3 Of All ER Visits Are Avoidable U.S. Healthcare Challenges Low patient engagement and limited health literacy leads to higher healthcare cost and poor health outcomes. See appendix for source information.

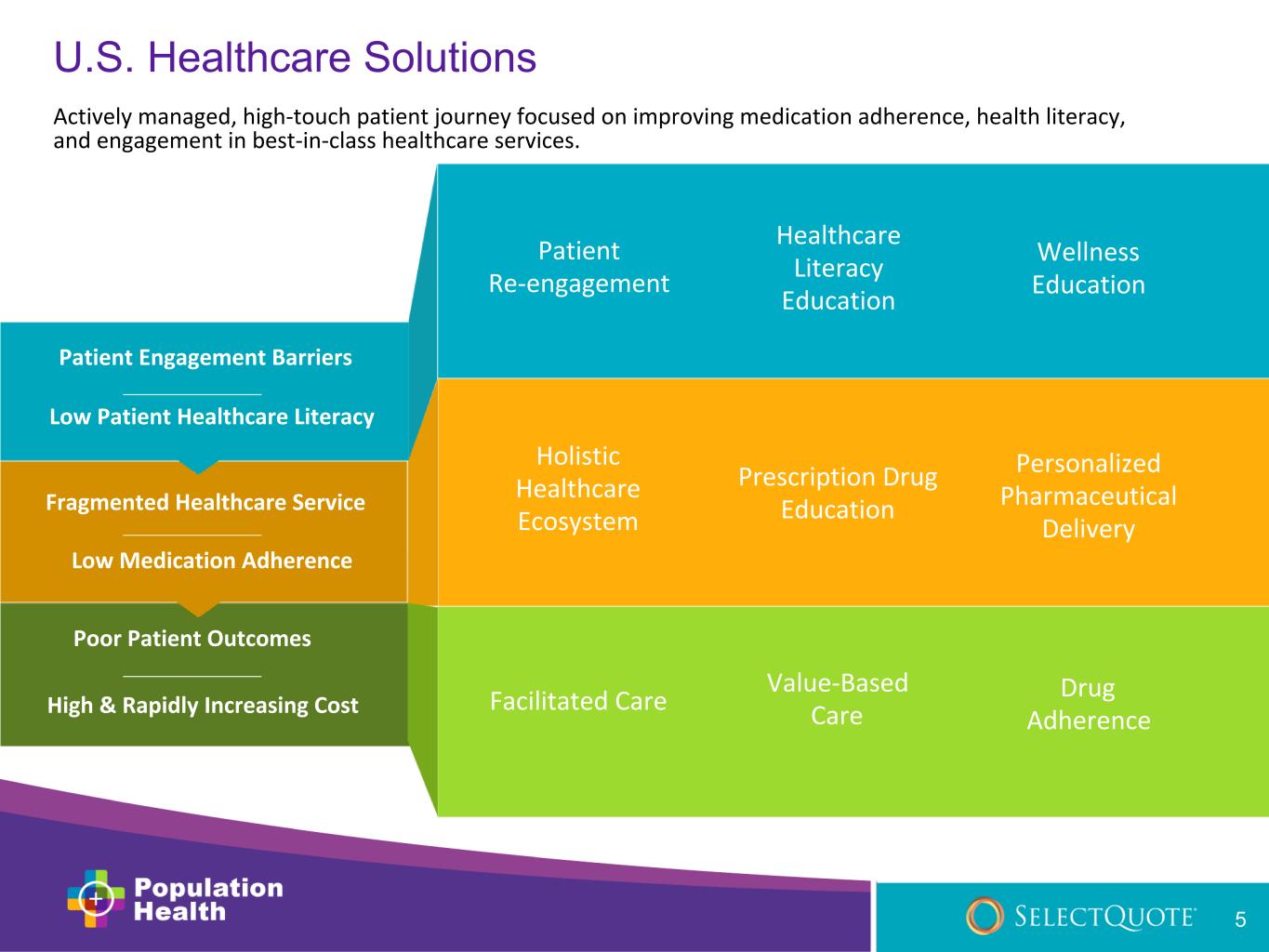

Patient Re-engagement Healthcare Literacy Education Wellness Education Holistic Healthcare Ecosystem 5 Prescription Drug Education Personalized Pharmaceutical Delivery Facilitated Care Value-Based Care Drug Adherence Actively managed, high-touch patient journey focused on improving medication adherence, health literacy, and engagement in best-in-class healthcare services. U.S. Healthcare Solutions Patient Engagement Barriers Low Patient Healthcare Literacy Fragmented Healthcare Service Low Medication Adherence Poor Patient Outcomes High & Rapidly Increasing Cost

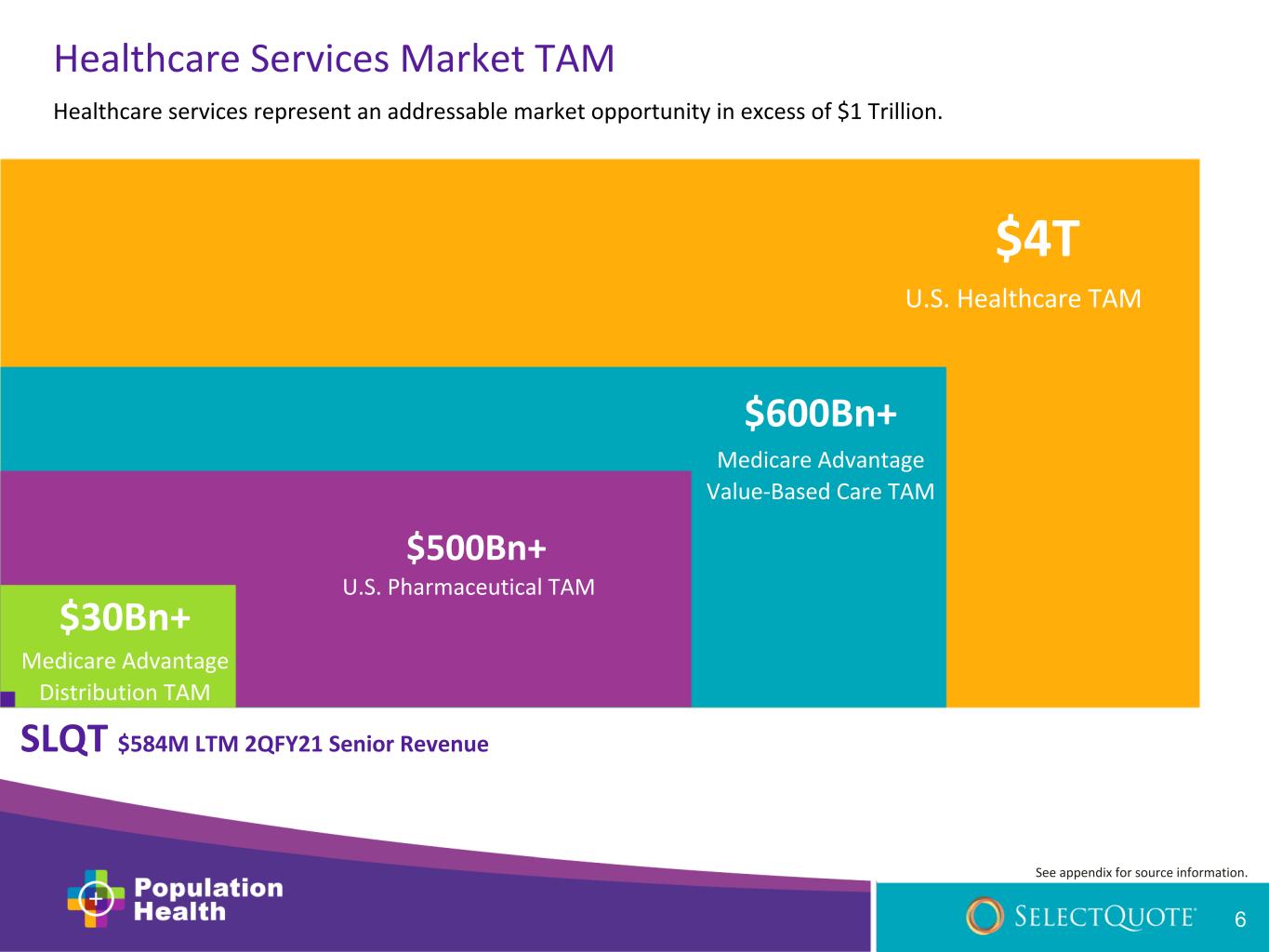

SLQT $584M LTM 2QFY21 Senior Revenue $30Bn+ Medicare Advantage Distribution TAM $4T U.S. Healthcare TAM $600Bn+ Medicare Advantage Value-Based Care TAM U.S. Pharmaceutical TAM Healthcare Services Market TAM Healthcare services represent an addressable market opportunity in excess of $1 Trillion. See appendix for source information. 6 $500Bn+

populationhealth.com Actively managed, high-touch patient experience focused on: • Improving patient engagement and health literacy to access more benefits through tailored education • Simplifying the healthcare journey through personalized solutions • Facilitating better healthcare options through strategic, value-based partnerships 7

One-Stop-Shop for Senior Health Information Needs Medicare Plan Benefits Healthcare Literacy + Wellness Value-Based Primary Care Prescription Drug Management Patient Engagement •Medicare Advantage •Medicare Supplement •Prescription drug plans •Dental, vision, hearing plans • Healthcare literacy assessments • Health risk assessments • Prescription drug assessments • Patient education • Patient surveys • Appointment scheduling • Appointment follow-up • Specialized medication management pharmacy • Simple packaging and delivery • Medication management education • Wellness & literacy education • Transportation services • Meal delivery • Home-based care Patients will look to Population Health as their valued advisors pertaining to healthcare plans and benefits. 8

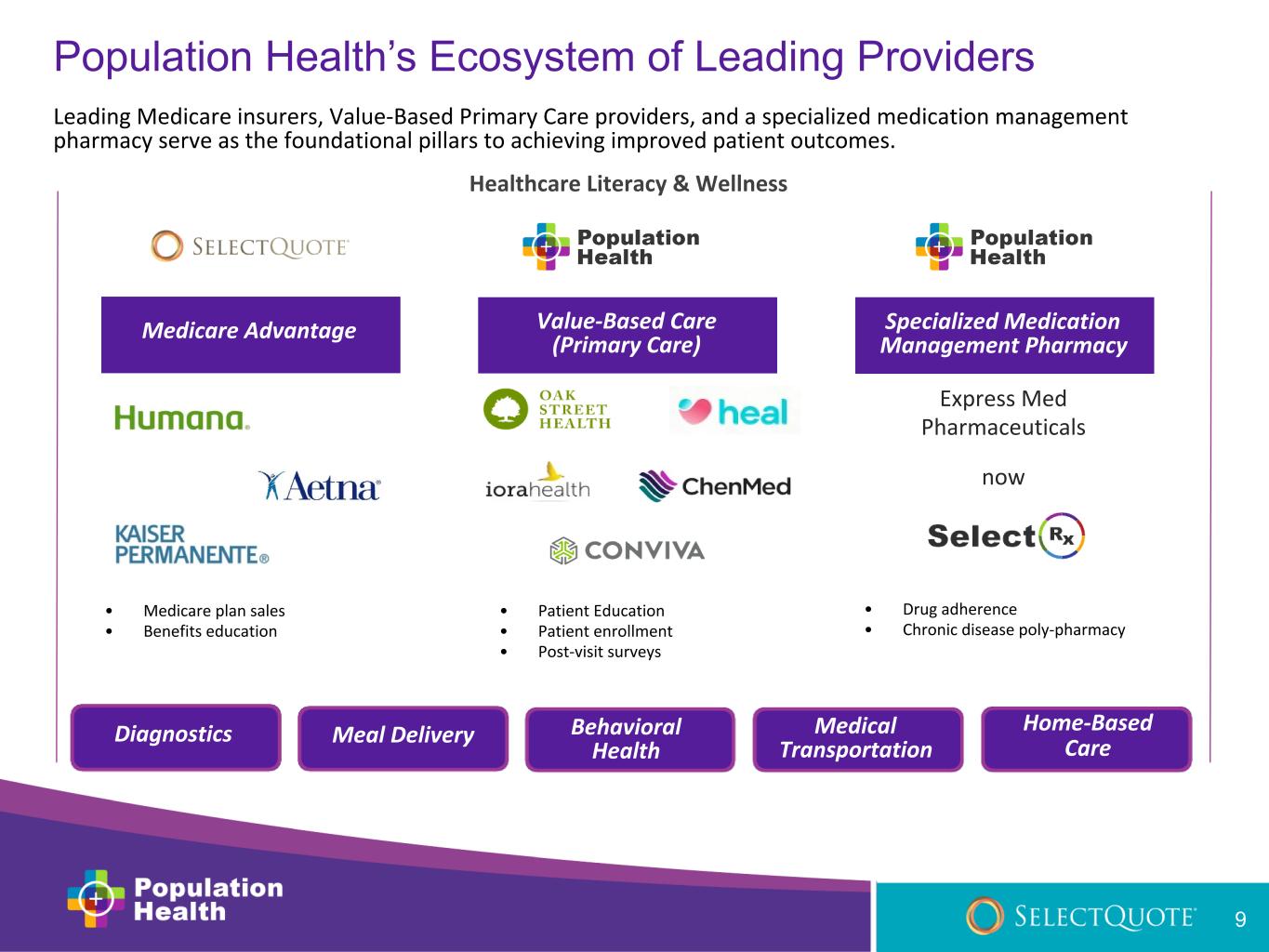

Home-Based Care Meal Delivery Medical Transportation Behavioral Health Diagnostics Value-Based Care (Primary Care) Medicare Advantage Specialized Medication Management Pharmacy Express Med Pharmaceuticals now Leading Medicare insurers, Value-Based Primary Care providers, and a specialized medication management pharmacy serve as the foundational pillars to achieving improved patient outcomes. Healthcare Literacy & Wellness Population Health’s Ecosystem of Leading Providers • Medicare plan sales • Benefits education • Patient Education • Patient enrollment • Post-visit surveys • Drug adherence • Chronic disease poly-pharmacy 9

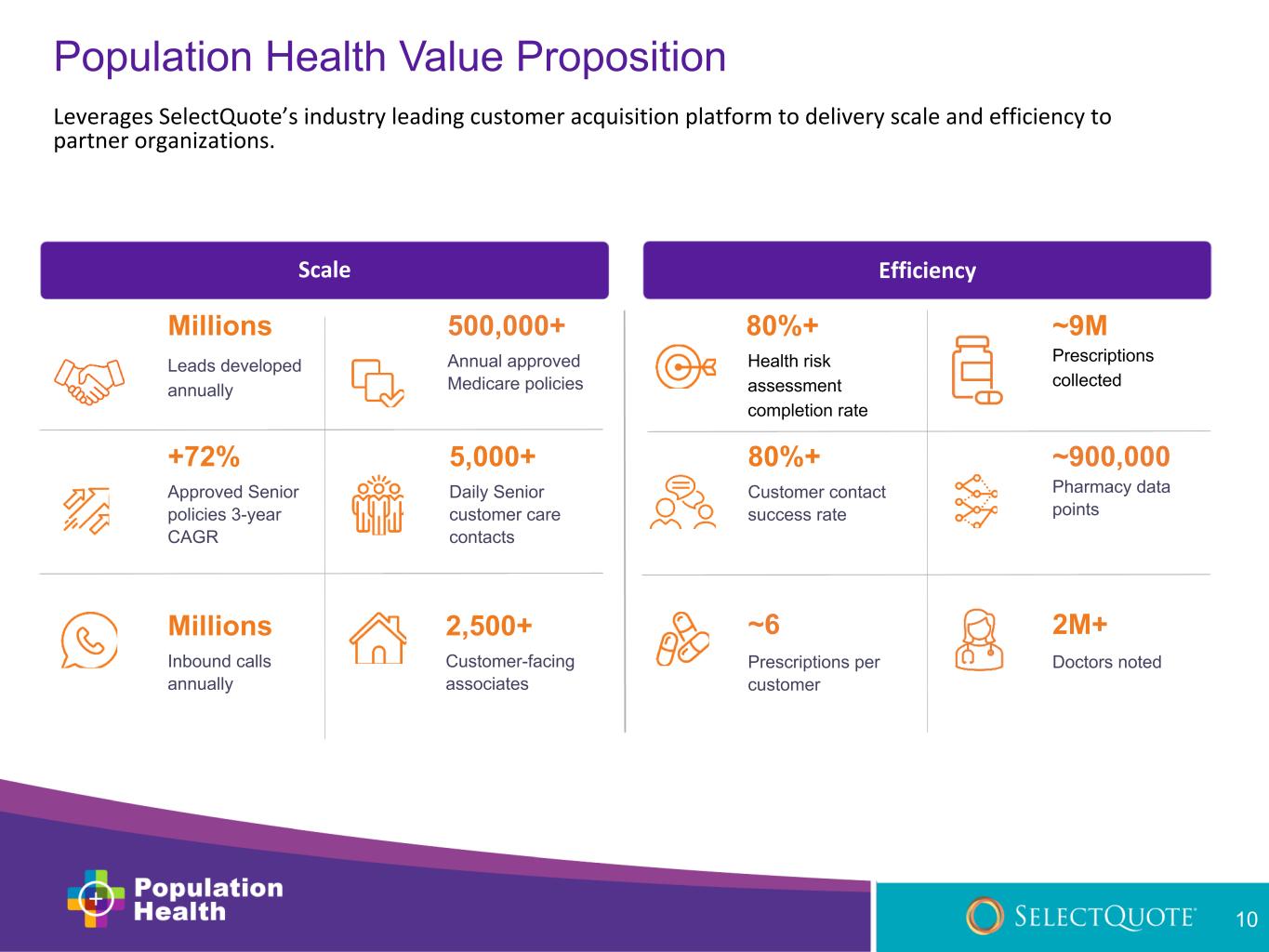

80%+ Health risk assessment completion rate ~9M Prescriptions collected 80%+ Customer contact success rate ~900,000 Pharmacy data points ~6 Prescriptions per customer 2M+ Doctors noted Millions Leads developed annually 500,000+ Annual approved Medicare policies +72% Approved Senior policies 3-year CAGR 5,000+ Daily Senior customer care contacts Millions Inbound calls annually 2,500+ Customer-facing associates Scale Efficiency Population Health Value Proposition Leverages SelectQuote’s industry leading customer acquisition platform to delivery scale and efficiency to partner organizations. 10

Population Health Delivers Tremendous Value to All Stakeholders Accelerating the alignment of patients with value-based care providers to deliver significant benefits to all parties. SelectQuote New revenue streams and improved retention Patients Better health outcomes and lower cost Service Providers Accelerated customer acquisition Carriers Lower medical loss ratios and improved patient satisfaction Population Health Tremendous value to all stakeholders 11

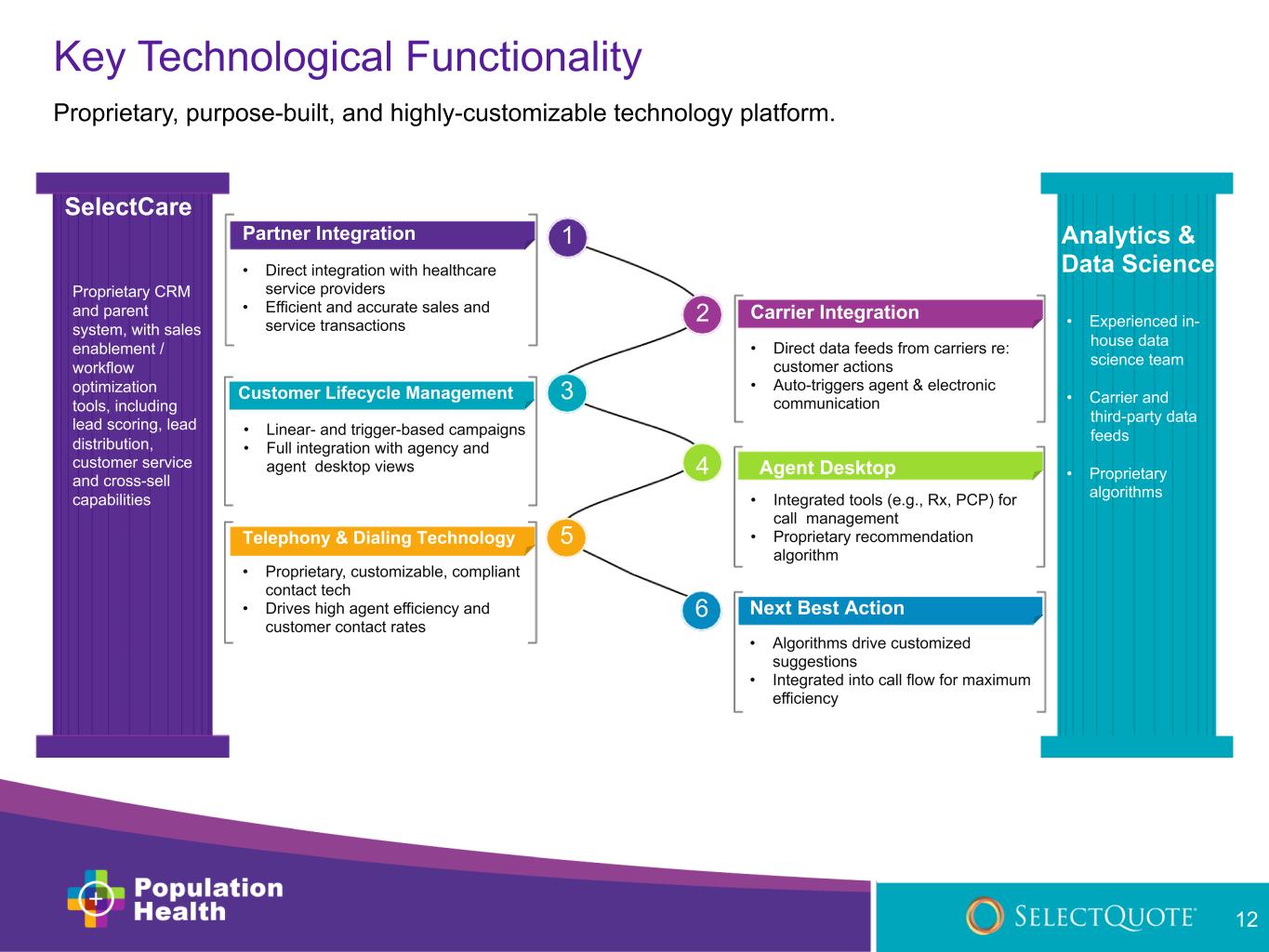

Key Technological Functionality Proprietary, purpose-built, and highly-customizable technology platform. Telephony & Dialing Technology • Proprietary, customizable, compliant contact tech • Drives high agent efficiency and customer contact rates 5 2 Carrier Integration • Direct data feeds from carriers re: customer actions • Auto-triggers agent & electronic communication 3Customer Lifecycle Management • Linear- and trigger-based campaigns • Full integration with agency and agent desktop views 4 Agent Desktop • Integrated tools (e.g., Rx, PCP) for call management • Proprietary recommendation algorithm 1Partner Integration • Direct integration with healthcare service providers • Efficient and accurate sales and service transactions 6 Next Best Action • Algorithms drive customized suggestions • Integrated into call flow for maximum efficiency Analytics & Data Science • Experienced in- house data science team • Carrier and third-party data feeds • Proprietary algorithms Proprietary CRM 12 and parent SelectCare system, with sales enablement / workflow optimization tools, including lead scoring, lead distribution, customer service and cross-sell capabilities

Code Modules Proprietary common code modules enable plug and play code features throughout our applications. Component Libraries Proprietary common component and UI pattern libraries for virtual cut-and- paste UI/UX layouts power accelerate new product development. Serverless APIs Applications that leverage scalable, stateless computer resources that are event-triggered, ephemeral and cloud native. 13 Container Orchestration Automation of many operational tasks including provisioning, deploying, scaling, and load balancing advanced applications. CI/CD Continuous Integration and Deployment enables business continuity, automatic updates, and collaboration efficiencies. Rapid Development Approach Utilizing a rapid development approach to design, build, and launch new applications quickly and effectively.

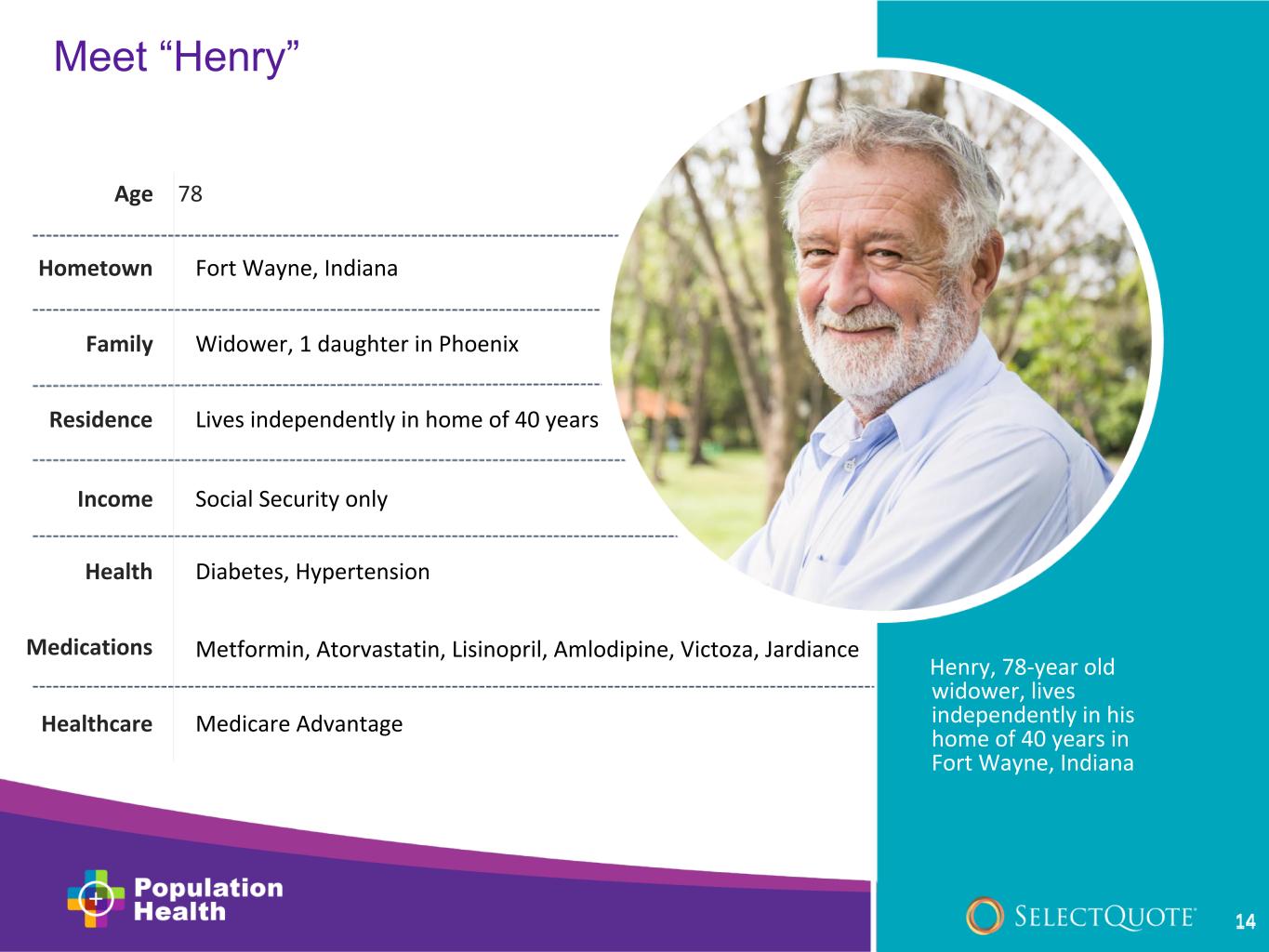

Meet “Henry” Henry, 78-year old widower, lives independently in his home of 40 years in Fort Wayne, Indiana Hometown Family Residence Income Health Medications Healthcare Fort Wayne, Indiana Widower, 1 daughter in Phoenix Lives independently in home of 40 years Social Security only Age 78 Diabetes, Hypertension Metformin, Atorvastatin, Lisinopril, Amlodipine, Victoza, Jardiance Medicare Advantage 14

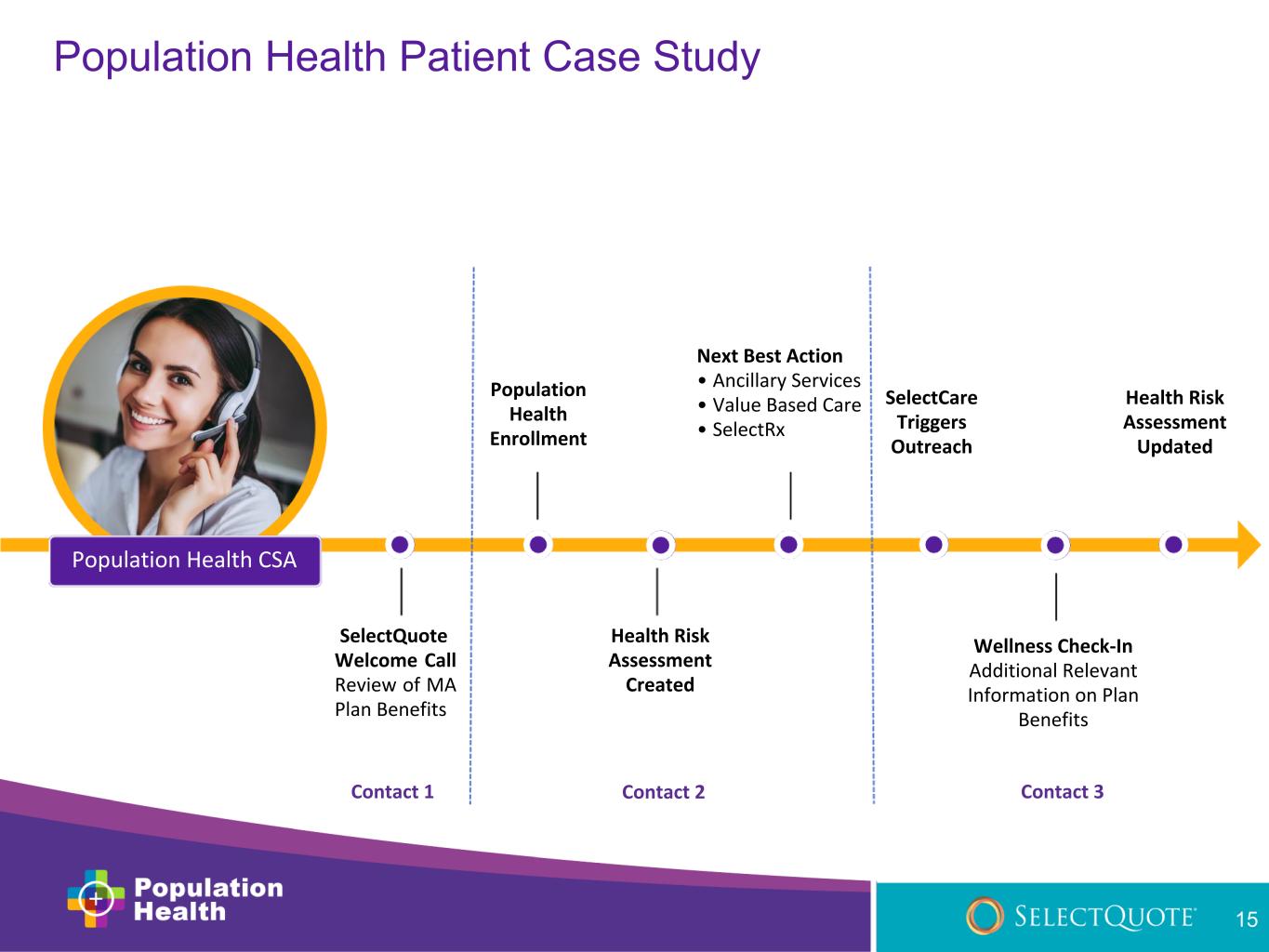

SelectQuote Welcome Call Review of MA Plan Benefits Population Health Enrollment Next Best Action • Ancillary Services • Value Based Care • SelectRx Health Risk Assessment Updated SelectCare Triggers Outreach Population Health Patient Case Study Population Health CSA Health Risk Assessment Created Wellness Check-In Additional Relevant Information on Plan Benefits 15 Contact 1 Contact 2 Contact 3

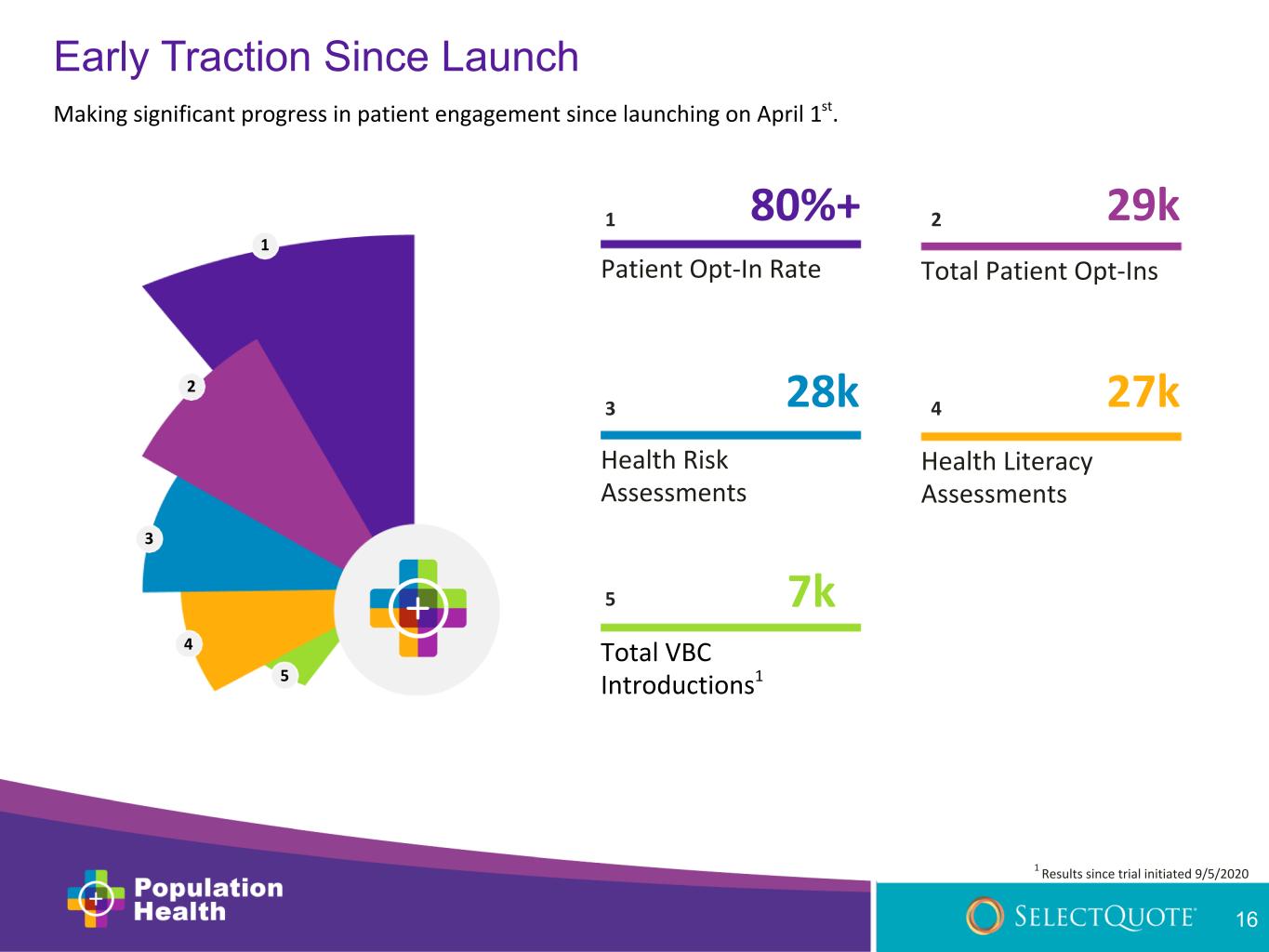

80%+ Patient Opt-In Rate Total Patient Opt-Ins Health Risk Assessments Health Literacy Assessments Total VBC Introductions1 29k 28k 27k 7k 1 2 43 5 1 5 4 3 2 Early Traction Since Launch 16 Making significant progress in patient engagement since launching on April 1st. 1 Results since trial initiated 9/5/2020

• MA customer base • Industry-leading retention • Flexible tech platform • Strong carrier relationships • Operational know-how Leading Direct-to-Consumer Insurance Distributor • Focused on innovative, market leading business with high growth potential • Contributes both growth and operational capital to scale business efficiently and effectively • Growing suite of leading healthcare service offerings • Owners’ economics Patients will look to Population Health as their valued advisors pertaining to healthcare plans and associated benefits. • Improved patient outcomes • Lower carrier MLRs • Improved MA retention SelectQuote’s Healthcare Flywheel • More benefits • Simple solutions • Better healthcare 17

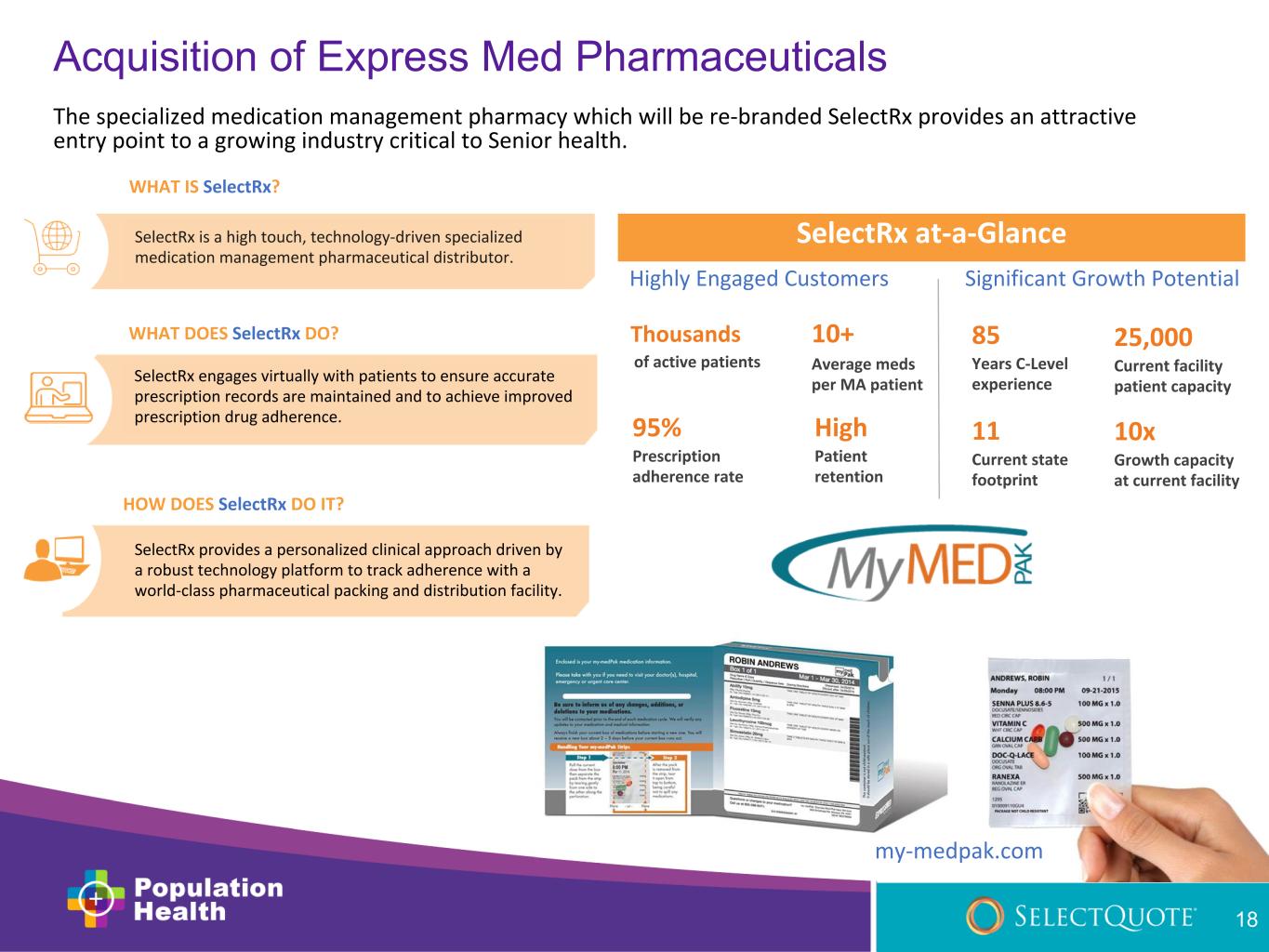

SelectRx engages virtually with patients to ensure accurate prescription records are maintained and to achieve improved prescription drug adherence. WHAT DOES SelectRx DO? SelectRx is a high touch, technology-driven specialized medication management pharmaceutical distributor. The specialized medication management pharmacy which will be re-branded SelectRx provides an attractive entry point to a growing industry critical to Senior health. WHAT IS SelectRx? HOW DOES SelectRx DO IT? SelectRx provides a personalized clinical approach driven by a robust technology platform to track adherence with a world-class pharmaceutical packing and distribution facility. 10+ Average meds per MA patient Thousands of active patients 11 Current state footprint 25,000 Current facility patient capacity 85 Years C-Level experience 95% Prescription adherence rate High Patient retention SelectRx at-a-Glance Highly Engaged Customers Significant Growth Potential 10x Growth capacity at current facility Acquisition of Express Med Pharmaceuticals my-medpak.com 18

~2,500 current members 11 states 25,000 total capacity Patients Sales Footprint Facility Size Target Patient Overlap Express Med 500k+ annual approved Medicare policies Expansion to all 50 states 75,000 – 100,000 total capacity SelectQuote MA Subscribers • 70 years old • ~6 prescription drugs • 80%+ with chronic conditions SelectRx Members • 67 years old • 10+ prescription drugs • 99.9% with chronic conditions SelectRx + Population Health – Significant Growth Potential Population Health provides SelectRx with a platform to rapidly scale its successful patient-focused specialized medication management pharmacy solution. with 19

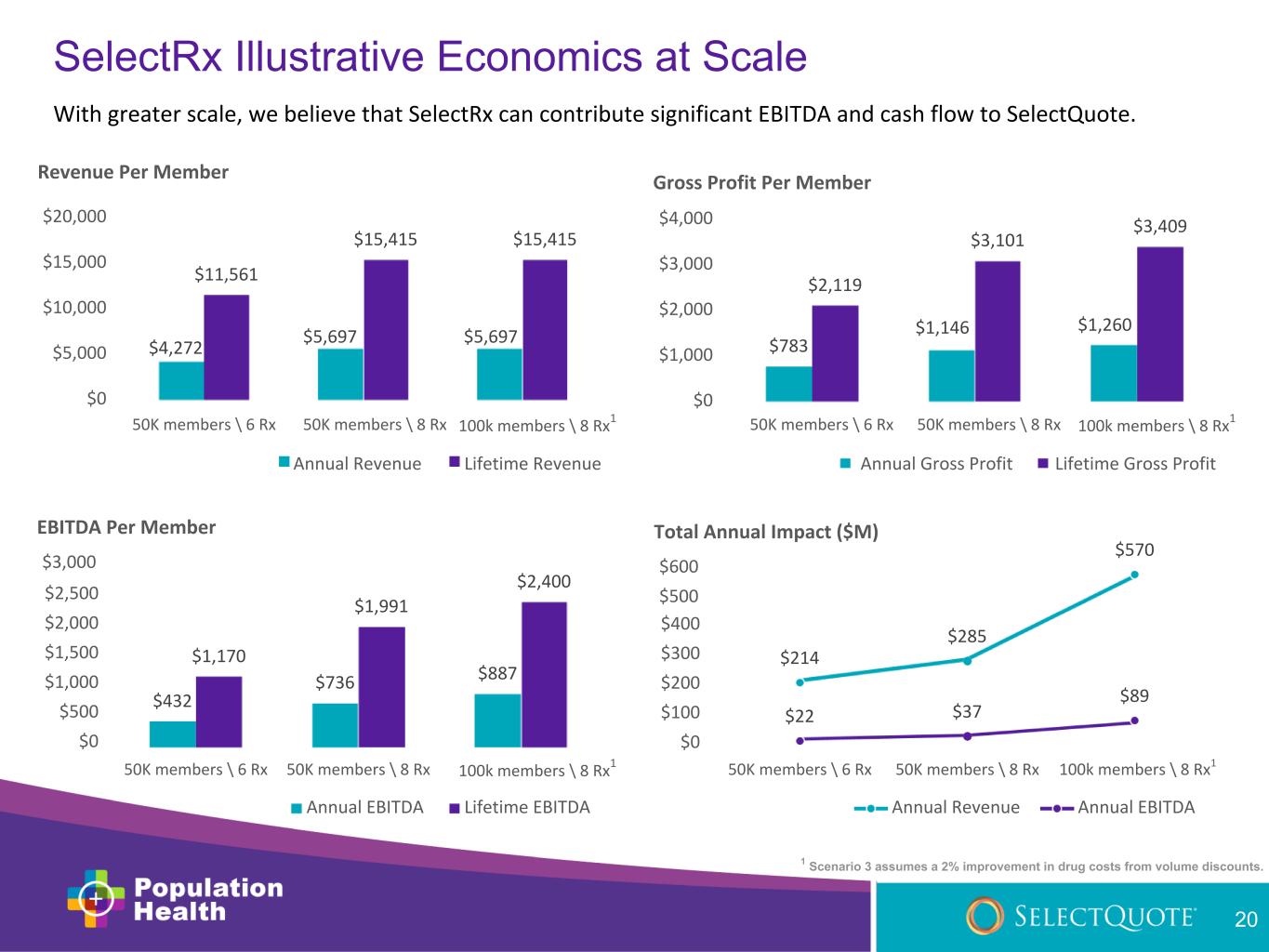

$4,272 $5,697 $5,697 $11,561 $15,415 $15,415 $0 $5,000 $10,000 $15,000 $20,000 Revenue Per Member $783 $1,146 $1,260 $2,119 $3,101 $3,409 $0 $1,000 $2,000 $3,000 $4,000 Gross Profit Per Member $432 $736 $887 $1,170 $1,991 $2,400 $2,500 $2,000 $1,500 $1,000 $500 $0 50K members \ 6 Rx 50K members \ 8 Rx 100k members \ 8 Rx 1 EBITDA Per Member $3,000 Annual EBITDA Lifetime EBITDA $214 $285 $570 $22 $37 $89 $400 $300 $200 $100 $0 50K members \ 6 Rx 50K members \ 8 Rx 100k members \ 8 Rx1 Total Annual Impact ($M) $600 $500 Annual Revenue Annual EBITDA SelectRx Illustrative Economics at Scale 20 With greater scale, we believe that SelectRx can contribute significant EBITDA and cash flow to SelectQuote. 1 Scenario 3 assumes a 2% improvement in drug costs from volume discounts. 100k members \ 8 Rx 1 50K members \ 8 Rx50K members \ 6 Rx Annual Revenue Lifetime Revenue Lifetime Gross ProfitAnnual Gross Profit 50K members \ 6 Rx 50K members \ 8 Rx 100k members \ 8 Rx 1

❶ Leverages SelectQuote’s proven, flexible acquisition platform (agents, technology, carriers, customers) ❷ Accelerates adoption of value-based care and pharmacy drug adherence solutions, creating a win- win-win-win for patients, carriers, Value-Based Care service providers, and SelectQuote ❸ As Value-Based Primary Care utilization increases among the SelectQuote Senior base, expected improvements to core Medicare persistency and LTV ❹ Expands TAM from already sizable and growing insurance distribution market into giant pharmaceutical and Senior healthcare markets ❺ Creates new, high-margin revenue streams leveraging existing infrastructure and at low incremental CAC and attractive cash conversion ❻ SelectRx acquisition provides an attractive entry point to the specialized medication management pharmacy space featuring attractive margins with potential to accelerate growth Investment Highlights 21

22 APPENDIX May 2021

Sourcing 23 • Slide 4 ◦ 96% Chronic Condition % of Medicare Spend – Centers for Medicare and Medicaid Services (CMS), https://www.cms.gov/mmrr/downloads/ mmrr2013_003_02_b02.pdf ◦ 42% Seniors Need More Benefit Info to Manage Care – National Center for Health Statistics, “Prescription Drug Use in the United States, 2015- 2016,” 2019. https://www.cdc.gov/nchs/products/databriefs/db334.htm ◦ $25Bn Avoidable Medicare Cost from Low Literacy – Centers for Medicare from Medicaid Services (CMS), https://www.cms.gov/Research- Statistics-Data-and-Systems/Statistics-Trends-and-Reports/NationalHealthExpendData/NHE-Fact-Sheet ◦ 1.5M Preventable Medication-Related Adverse Effects – Pharmacy Association, Ernst FR. Grizzle AJ. Drug related morbidity and mortality: Updating the cost-of-illness model. J Am Pharm. Assoc. 2001;41:192-9 ◦ 3 Average Net Promoter Score of U.S. PCPs – Centers for Medicare and Medicaid Services (CMS.gov) ◦ $100Bn Hospitalization Cost from Not Taking Drugs as Prescribed – Network for Excellence in Health Innovation, https://www.nehi.net/bendthecurve/sup/documents/Medication_Adherence_Brief.pdf ◦ 18% Healthcare Share of U.S. GDP – Centers for Medicare and Medicaid Services (CMS), https://www.cms.gov/Research-Statistics-Data-and- Systems/Statistics-Trends-and- Reports/NationalHealthExpendData/NationalHealthAccountsHistorical#:~:text=U.S.%20health%20care %20spending%20grew,For%20additional %20information%2C%20see%20below ◦ 2/3 of All ER Visits are Avoidable – The National Academies, ”Best Care at Lower Cost: The Path to Continuously Learning Health Care in American,” 2013. ◦ ~4% National Healthcare Spending in Primary Care – Primary Care Collaborative; https://www.pcpcc.org/primary-care-investment

Sourcing 24 • Slide 6 ◦ $30Bn Medicare Advantage Distribution TAM – MedicarePayment Advisory Commission, Source: MedPAC July 2020 Data Book, Part B and Part D Spending. http://medpac.gov/docs/default-source/data-book/july2020_databook_entirereport_sec.pdf?sfvrsn=0 ◦ $500Bn+ U.S. Pharmaceutical TAM – IQVIA, www.iqvia.com/insights/the-iqvia-institute/reports/medicine-spending-and-affordability-in-the-us, Pharmaceutical Technology, Sources: https://www.cms.gov/newsroom/press-releases/cms-office-actuary-releases-2019-national-health- expenditures; https://www.pharmaceutical-technology.com/research-reports/researchreportreport-us-pharmaceutical-market-projected-to- grow-at-a-cagr-of-44-up-to-2020-5720032/ ◦ $600Bn+ Medicare Advantage Value-Based Care TAM – Center for Medicare and Medicaid Services (www.cms.gov) ◦ $4T+ U.S. Healthcare TAM – Centers for Medicare and Medicaid Services (CMS), CMS.gov https://www.cms.gov/Research-Statistics-Data-and- Systems/Statistics-Trends-and-Reports/NationalHealthExpendData/NationalHealthAccountsHistorical • Glossary ◦ EBITDA: Earnings Before Interest, Taxes, Depreciation and Amortization ◦ CAC: Customer Acquisition Cost ◦ TAM: Total Addressable Market ◦ LTV: Lifetime Value