Attached files

| file | filename |

|---|---|

| 8-K - FORM 8-K - QCR HOLDINGS INC | f8k_050321.htm |

Exhibit 99.1

Investor Presentation U pda t e d Ap r i l 30 , 2021

A number of factors, many of which are beyond the ability of the Company to control or predict, could cause actual results to differ materially from those in its forward - looking statements. These factors include, among others, the following: (i) the strength of the local, state, national and international economies (including the impact of the new presidential administration; (ii) the economic impact of any future terrorist threats and attacks, widespread disease or pandemics (including the COVID - 19 pandemic in the United States), acts of war or threats thereof, or other adverse external events that could cause economic deterioration or instability in credit markets, and the response of the local, state and national governments to any such adverse external events; (iii) changes in accounting policies and practices as may be adopted by the state and federal regulatory agencies, the FASB, the Securities Exchange Commission, or the PCAOB, including FASB’s CECL impairment standards; (iv) changes in state and federal laws, regulations and governmental policies concerning the Company’s general business; (v) changes in interest rates and prepayment rates of the Company’s assets (including the impact of LIBOR phase - out); (vi) increased competition in the financial services sector and the inability to attract new customers; (vii) changes in technology and the ability to develop and maintain secure and reliable electronic systems; (viii) unexpected results of acquisitions, which may include failure to realize the anticipated benefits of acquisitions and the possibility that transaction costs may be greater than anticipated; (ix) the loss of key executives or employees; (x) changes in consumer spending; (xi) unexpected outcomes of existing or new litigation involving the Company; (xii) the economic impact of exceptional weather occurrence, such as tornados, floods and blizzards, and; (xiii) the ability of the Company to manage the risks associated with the foregoing as well as anticipated. These risks and uncertainties should be considered in evaluating forward - looking statements and undue reliance should not be placed on such statements. Additional information concerning the Company and its business, including additional factors that could materially affect the Company’s financial results, is included in the Company’s filings with the Securities and Exchange Commission. NON - GAAP FINANCIAL MEASURES These slides contain non - GAAP financial measures. For purposes of Regulation G, a non - GAAP financial measure is a numerical measure of the registrant ’ s historical or future financial performance, financial position or cash flows that excludes amounts, or is subject to adjustments that have the effect of excluding amounts, that are included in the most directly comparable measure calculated and presented in accordance with GAAP in the statement of income, balance sheet or statement of cash flows (or equivalent statements) of the issuer; or includes amounts, or is subject to adjustments that have the effect of including amounts, that are excluded from the most directly comparable measure so calculated and presented. In this regard, GAAP refers to generally accepted accounting principles in the United States. Pursuant to the requirement of Regulation G, the Company has provided reconciliations within the slides, as necessary, of the non - GAAP financial measure to the most directly comparable GAAP financial measure. For more details on the Company’s non - GAAP measures, refer to the Company’s Annual Report on Form 10 - K for the year ended December 31, 2020. F O R W A RD - L OO K I N G S T A T E M E N T S

• Local charters provide a competitive advantage • Strong, centralized risk management function • Efficient centralized group operations • Strong credit and asset quality • Consistent adjusted net income growth • High - touch service approach • Serving attractive Midwest markets • Significant expansion opportunities OVERVIEW 3 QCR Holdings, Inc. Overview

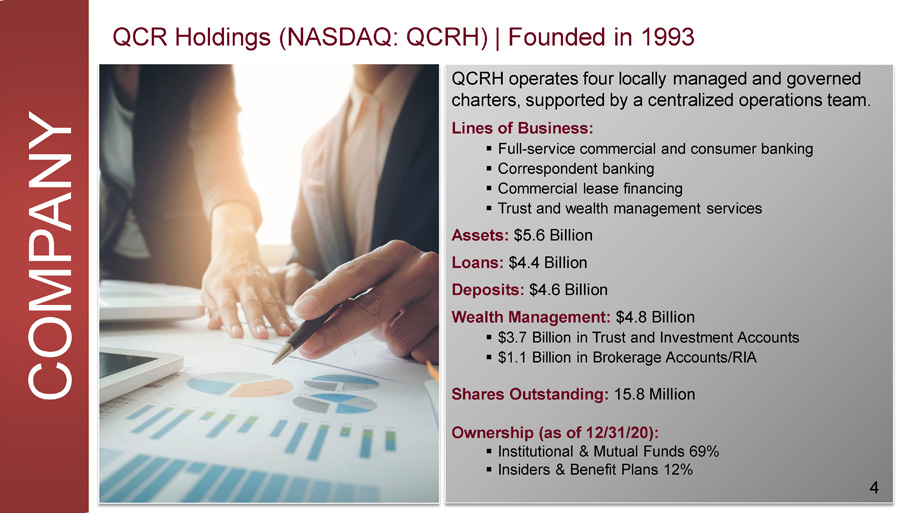

QCRH operates four locally managed and governed charters, supported by a centralized operations team. Lines of Business: ▪ Full - service commercial and consumer banking ▪ Correspondent banking ▪ Commercial lease financing ▪ Trust and wealth management services Assets: $5.6 Billion Loans: $4.4 Billion Deposits: $4.6 Billion Wealth Management: $4.8 Billion ▪ $3.7 Billion in Trust and Investment Accounts ▪ $1.1 Billion in Brokerage Accounts/RIA Shares Outstanding: 15.8 Million Ownership (as of 12/31/20): ▪ Institutional & Mutual Funds 69% ▪ Insiders & Benefit Plans 12% QCR Holdings (NASDAQ: QCRH) | Founded in 1993 C OM P A N Y 4

T od d A . G i pp l e President, COO and CFO ▪ O v e r 3 0 y ea rs o f c o mm e r c i a l ban k in g an d f inan c i al a cc oun t i n g e x pe r ien c e ▪ J oine d Q C R H olding s i n 2000 ▪ A ppoin t e d C hie f F inan c i a l O f f i c e r i n 2000 ▪ A ppoin t e d C hie f O pe r a t in g O f f i c e r i n 2008 ▪ QCR Holdings Board Director since 2009 Larry J. Helling C h i e f E x e c u t i v e O f f i c e r ▪ Over 30 years of commercial banking experience ▪ F oundin g m e m be r an d C E O o f C eda r R apid s B an k & T r u s t ▪ QCR Holdings Board Director since 2001 ▪ Oversight responsibility for specific product lines and services ▪ S pe c ial t y F inan c e G r oup – M uni c ip a l F inan c e an d G o v e r n m en t G ua r an t eed Lending , T a x C r edi t Lending , I n t e r e s t R a t e S w ap Products and Services ▪ m 2 E quip m e n t F inan c e LEADERSHIP 5 Seasoned Senior Leadership

WHO WE ARE Our Mission, Vision and Values Our Mission We make financial dreams a reality. Our Vision Exceptional people providing extraordinary performance for our clients, shareholders and communities. Our Values PASSION | We care. A CH I EVEME N T | W e e x pe ct t o w i n . ACCOUNTABILITY | We drive it. C O LL AB O R A T IO N | W e w o r k t oge t he r . INNOVATION | We embrace change. I NCLU S IO N | W e r e s pe ct a ll . 6

The Value of Separate Charters Source: FDIC deposit market share data a provided by S&P Global (as of 6/30/19). Managed and governed by local veteran bankers and boards with strong community ties and expertise • High touch service delivered by knowledgeable professionals • Strong community involvement with high employee participation • Local decisions and solutions Local autonomy has led to favorable relative performance metrics • Loan growth • Credit and asset quality • Deposit growth Focus on growing deposit market share • #1 deposit share in two markets • Within top 10 deposit share in our five bank markets Ample opportunities to expand products and services across footprint • Specialty lending & leasing • Correspondent banking • Wealth management CHARTER MODEL 7

1993 QCR Holdings F o unded $14 million IPO 1994 Quad City Bank & Trust (De Novo) 2001 Cedar Rapids Bank & Trust (De Novo) 2005 Rockford Bank & Trust (De Novo) & Quad City Bank & Trust acquires m2 Lease Funds, LLC 2013 C o mm uni t y National Bank acquisition 2016 C o mm uni t y State Bank acquisition 2017 Guaranty Bank & Trust acquisition 2018 Springfield B a n cs h a r e s , Inc. merger 2019 Rockford Bank & Trust sold Our History of Growth G R O W T H 8

G R O W T H Our Entities at a Glance Entity States/ R e g i on # Locations Deposits Market Share I o w a /I lli no i s Quad Cities 5 $1.8B #1 Iowa Cedar Rapids 5 $1.2B #1 Iowa Cedar Valley 3 $0.2B #7 Iowa D e s M o i ne s / A n k eny 9 $0.9B #7 Missouri S p r i ng f i e l d 1 $0.6B #7 9

Strong Market Share in Attractive MSAs * MSAs include Davenport - Moline - Rock Island, IA - IL, Cedar Rapids, IA, Rockford - IL, Waterloo - Cedar Falls - IA, Des Moines/West Des Moines - IA, and Springfield, MO. All banks reflect Pro Forma Data from acquisitions. ** Pro Forma based on Rockford Bank & Trust disposition. Source: S&P Global Market Intelligence and Company documents. Deposit data as of 9/30/20. Davenport - Moline, IA - IL Cedar Rapids, IA Des Moines - West Des Moines, IA Springfield, MO Waterloo - Cedar Falls, IA ▪ Ranked #3 most diversified metro economy in U.S. (Livability.com 2020) ▪ 16th in the nation for high - tech job growth ▪ Ranked #3 out of 382 metro areas for industry diversity (EMSI) ▪ #11 in the top American cities to live in after the pandemic (Business Insider) ▪ Cedar Rapids named 'mini megacity to watch' (2020) ▪ #2 Most Recession - Resistant City 2020 (Smart Asset) ▪ #5 Best Place to Live in the U.S . ( U.S. News & World Report, 2020) ▪ #8 Best City to Live in After the Pandemic ( Business Insider, 2020) ▪ Top 10 Best Place for Business and Careers (Forbes 2019) ▪ Top 5 Best Cities to start a business ▪ Top 20 Magnets for Young Adults ▪ O’Reilly Auto Parts and Bass Pro Shops headquarters ▪ First Gigabit city in Iowa and one of eight in the U.S. ▪ Cost of living is 2.2% below the national average ▪ W aterloo/Cedar Falls in the top 10 job markets in the U.S. (Zippia 2018) Deposit Market Share in Our Current MSAs* • Ranked 2nd in overall deposit market share in our current MSAs* • 48% of deposits are based in a Top 20 ranked Midwest MSA** Top 20 Banks Total Active B r a n c h e s 2020 T o t a l D e po s i t s 202 0 ( $000) Wells Fargo & Co. 42 $6,143,421 U.S. Bancorp 49 $4,464,731 QCR Holdings, Inc. 24 $4,402,997 BTC Financial Corp. 22 $3,644,844 G r ea t S o u t h e r n B a n c o r p I n c. 28 $2,509,893 B a n k o f A m e r i c a C o r p . 7 $1,899,179 West Bancorporation, Inc. 8 $1,850,593 Commerce Bancshares Inc. 11 $1,481,649 Central Banco. Inc. 22 $1,411,462 G r ea t W e s t e r n B a n c o r p I n c. 14 $1,376,927 Blackhawk Bancorp. Inc. 18 $1,034,314 FSB Financial Services Inc. 8 $911,928 Lincoln Bancorp 9 $820,687 N e i ghb o r I n s u r a n c e A g e n c y I n c . 9 $784,177 G u a r a n t y F e d e r a l B a n cs h a r e s I n c. 10 $750,608 BNP Paribas SA 15 $675,126 O a k S t a r B a n cs h a r e s I n c. 6 $672,967 Hills Bancorp. 7 $612,160 Regions Financial Corp. 11 $604,034 Reliable Community Bancshares Inc. 12 $549,927 MARKET SHARE 10

Unique and Diversified Products and Services • Fiduciary services • Investment management services • Financial planning • Brokerage services • 3/31/21 AUM: $4.8B • Competitive deposit products • Safekeeping and cash management services • 188 correspondent banking relationships • Bank stock loans • Commercial & retail banking services • Sophisticated lending and treasury management products and deposit services • Small ticket lease financing (m2 Equipment Finance) C o mm e r c i al Banking C o rr e s pondent Banking Wealth M anage m ent • Commercial loan fixed - floating rate swaps • Municipal and tax credit financing • Q 1 - 2021 swap & loan sale income : $14.9MM Specialty Finance G r oup UN I Q UE Fee - Based Businesses 11

12 A Broad Scope of Wealth Management Services S C O PE The wealth management business model and the scope of our services is unique at QCRH. Wealth Management & Trust Services • Investment management • F i nan c i a l p l ann i ng • Trust services • Fiduciary services • Tax services Investment Center • Investment management • Brokerage services • Services for a broad range of clients • Flexible model to serve at the right level

13 Diverse and Growing Client Relationships G R O W T H $8 . 2 $9 . 9 $11 . 3 $12 . 0 $12 . 6 $15.0 $0 . 0 $2 . 0 $4 . 0 $6 . 0 $8 . 0 $10 . 0 $12 . 0 $14 . 0 $16 . 0 2016 2017 2018 2019 2020 3/31/2021 (1) R e v e n u e (1) 2021 data annualized. All data excludes Bates and RB&T. Revenue ($MM) 1 .8 2 .5 2 .5 3 .1 3 .4 3 .7 0 .6 0 .9 0 .9 1 .0 1 .0 1 .1 0 1 2 3 4 5 6 2016 (1) 2019 2020 3/31/2021 Brokerage/RIA 2017 2018 Trust/Inv Mgmt $4 . 1 $4 . 4 $4.8 Assets Under Management ($B) • Diverse wealth management solutions serving a wide range of clients. • More than 1,000 new relationships added over the last three years. • Vast majority of clients have expanded their banking relationship with QCRH. $2 . 4 $3 . 4 $3 . 4

COMMITMENT Environmental, Social and Governance Environmental Responsible use of our resources with a focus on sustainability Social Commitment to support the communities in which we live and work Governance Integrity in our business practices Our Long - Term Commitment With numerous programs and activities aligned with the ESG framework, we continue to develop and enhance our long - term plan. We are advancing standard reporting processes and gathering benchmarking data to generate meaningful ESG goals for our company. 14

Our Strategy for Long - Term Success We’ve set a simple and focused strategy for our future. 9 - 6 - 5 is our plan to continue to grow earnings and drive attractive long - term returns for our shareholders. 9 – Grow loans by 9% per year, funded with core deposits 6 – Grow fee income no less than 6% per year 5 – Improve efficiencies and hold expense growth to no more than 5% S T R A T E G Y 15

F i nanc i a l Hi gh li gh t s 1 6

ASSET GROWTH 17 $2 . 2 $2 . 9 $3 . 5 $4 . 4 $4 . 9 $5 . 7 $5 . 6 67 . 6% 71 . 9% 73 . 8% 75 . 0% 75 . 2% 74 . 8% 77 . 3% 2 0 15 2 0 16 2 0 17 T o t a l A s se t s 2018 2019 2020 3/31/2021 Total Loans & Leases/Total Assets A Consistent Track Record of Asset Growth Asset growth has been driven by a combination of organic growth and strategic acquisitions (1) Rockford Bank & Trust assets were removed from this data. (2) includes $237.2 million of the assets of m2 Equipment Finance, as this entity is wholly - owned by and consolidated with Quad City Bank and Trust. Recent Acquisitions (Assets at acquisition date ($ Millions)): 2016: Community State Bank ($582) 2017: Guaranty Bankshares, Ltd. ($260) 2018: Springfield Bancshares, Inc. ($576) $0 . 8 14% $1 . 0 18% $2 . 1 36% $1 . 8 32% Quad City Bank and Trust (2) Cedar Rapids Bank and Trust Community State Bank Springfield First Community Bank Asset Distribution by Charter as of 3/31/21 ($B) T ota l C on s o li date d A ss et s ( $ B ) ( 1)

34% 31% 25% 20% 20% 25% 27% 48% 52% 60% 57% 62% 65% 63% 15% 15% 13% 16% 16% 10% 10% $2 . 4 2% 7% 2% $1 . 6 3% $2 . 9 2% $3 . 5 $3 . 9 $4 . 6 $4 . 6 20 1 5 20 1 6 20 1 7 Noninterest - bearing Deposits 20 1 8 20 1 9 20 2 0 3/31/2021 Interest - bearing Deposits T i m e D e p o s i t s B r o k e r e d D e p o s i t s Deposit Growth Driven by Core Deposits Core Deposits (1) Represent Virtually All of Total Deposits ($B) as of 3/31/21 (1) Core deposits are defined as total deposits less brokered deposits. Rockford Bank & Trust deposits excluded from this data. DEPOSIT GROWTH 18

$0.5 $0.7 $1.0 $1 . 3 $1 . 5 $1 . 7 $1 . 8 $0.6 $0.9 $1 . 1 $1 . 6 $1 . 8 $2 . 1 $2 . 2 $0.2 $0.2 $0.2 $0 . 1 $0 . 1 $0 . 1 $0 . 1 $0 . 1 $0 . 2 $0 . 2 $0 . 2 $0 . 3 $0 . 1 $0.1 $0.2 $0.1 $0.2 $0 . 1 $0 . 1 $0 . 1 $1. 5 $2. 1 $2. 6 $3. 3 $3. 7 $4. 3 $4. 4 $0.1 20 1 5 2016 Commercial & Industrial 2017 Commercial RE 2018 Direct Fin. Leases 2019 R e s i d e n t i al R E 2020 Consumer & Other 3/31/2021 Loan Growth Driven by Commercial Lending Commercial Loans (1) Represent Approximately 91% of the Loan Portfolio ($B) as of 3/31/21 (1) Includes Commercial & Industrial, Commercial RE and Direct Financing Lease. Loan composition excludes deferred loan/lease origination costs, net of fees. Rockford Bank & Trust is excluded from this data. LOAN GROWTH 19

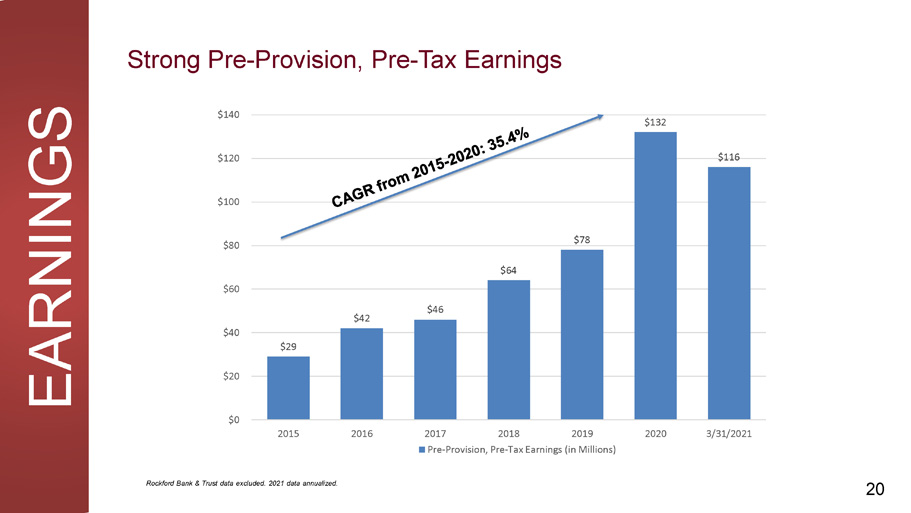

20 Strong Pre - Provision, Pre - Tax Earnings EARNINGS $42 $46 $64 $78 $132 $116 $40 $29 $20 $0 $60 $80 $100 $120 $140 2015 2016 2020 3/31/2021 2017 2018 2019 Pre - Provision, Pre - Tax Earnings (in Millions) Rockford Bank & Trust data excluded. 2021 data annualized.

21 CAPITAL POSITION Strong Capital Position 8.56% 8.14% 8.01% 8.13% 9.25% 9.40% 9.67% 13 . 91% 11 . 56% 11 . 15% 12 . 50% 13 . 33% 14 . 95% 15 . 22% 4.00% 6.00% 8.00% 10 . 00% 12 . 00% 14 . 00% 16 . 00% 2015 2016 201 7 2018 2019 2020 3/31/2021 QCRH is well - positioned for long - term success for several reasons: • Significantly improved capital position • Sale of Rockford Bank & Trust in 2019 strengthened TCE • Sub - debt raises Feb. 2019 and Sept. 2020 bolstered total risk - based capital • Lowest dividend payout ratio in peer group Tangible Common Equity & RBC Ratios TCE/TA RBC Ratio * *TCE/TA and TRBC ratios exclude PPP loans. *

ASSET QUALITY 22 98. 4% 1. 6% Nonaccrual Loans/Leases Other Real E s t a t e Ow ned & Repossessed Assets Asset Quality Management remains focused on maintaining excellent asset quality and resolving problem assets. $14.1 million Classified Loans & NPAs / Assets ($MM) Nonperforming Assets Composition as of 3/31/21 $28 .0 $49.0 $43 .7 $28 .6 $33 .6 $85 .0 0.74% 0.82% 0.81% 0.56% 0.27% 0 . 25% 0 . 25% 1 2 3 4 5 6 7 Classified Loans NPAs / Assets (%) $66 . 1 2015 2016 2017 2018 2019 2020 3/31/21 0 % - A cc r u i n g L o a n s / L e a s e s p a s t due 90 days or more

223% 145% 184% 215% 404% 575% 590% 193% 180 % 183% 214% 194% 347% 380% 20 1 5 20 1 6 20 1 7 20 1 8 20 1 9 2020 3/31/2021 Q C RH P r o x y P ee r s 1 . 45% 1 . 28% 1 . 16% 1 . 98% 1 . 88% 1 . 20% 1 . 08% 1 . 04 % 1 . 07% 1.03% 0.98% 0 . 95% 1 . 57% 1.53% 2 0 15 2 0 16 2 0 2 0 3 / 3 1 / 2 0 2 1 2017 Q C RH 2018 2019 P r o x y P ee r s (1) Proxy peer group is identified in the QCRH Proxy Statement, filed on 4/8/21. Peer metrics reflect the average of the peer group. 2021 peer average reflects companies that have reported results as of 4/29/21. Strong Credit Culture Supported by High Levels of Reserves ACL - Loans/Total Loans (%) ACL - Loans/Total NPLs (%) (1) $3 . 1 A m oun t o f r e m ainin g loa n di s c oun t ( $ MM ): $0.7 $10.1 $8.1 $11.6 $7.7 ( 1 ) R ESE R VES QCRH implemented CECL on January 1, 2021. 23 $2 . 5

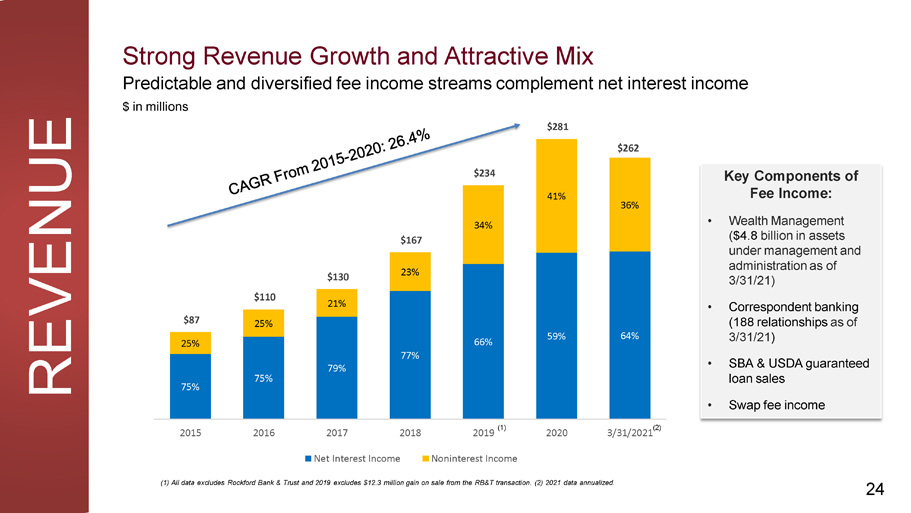

75% 75% 79% 77% 66% 59% 64% 25% 25% 21% 23% 34% 41% 36% $87 $110 $130 $167 $234 2015 2016 2020 3/31/2021 2017 2018 2019 Net Interest Income Noninterest Income Strong Revenue Growth and Attractive Mix Predictable and diversified fee income streams complement net interest income $ in millions $281 $262 Key Components of Fee Income: • W eal t h M anage m e n t ( $4 . 8 billio n i n a ss e t s unde r m anage m e n t and ad m ini s t r a t i o n a s of 3/31/21) • C o rr e s ponde n t ban k ing ( 188 relationships as of 3 / 31 / 21 ) • SB A & U S D A gua r an t eed loan sales • Swap fee income (1) All data excludes Rockford Bank & Trust and 2019 excludes $12.3 million gain on sale from the RB&T transaction. (2) 2021 data annualized. ( 1 ) REVENUE 24 ( 2 )

$21 $29 $36 $46 $59 $63 $74 $2.66 $2.31 $1.99 $3.08 $3.66 $3.96 $4.64 2015 2016 2017 2018 2019 2020 3 / 31 / 202 1 ( 1 ) Consistent Improvement in Shareholder Returns 0.82% 1.03% 1.03% 1.06% 1.15% 1.08% 1.27% 2015 2016 (1) 2021 data annualized. 20 1 7 20 1 8 20 1 9 20 2 0 3 / 31 / 2 0 2 1 ( 1 ) Return on Average Assets 72.8% 64.9% 66.5% 64.8% 66.2% 54.1% 56.9% 2015 2016 2017 2018 2019 202 0 3 / 31 / 202 1 ( 1 ) Efficiency Ratio (%) Adj. Net Income $ in millions Adj. EPS RETURNS 25

C O V I D - 1 9 E xposu r e Q 1 2021 26

PP P & L R P P a r t i c i pa t i on 27

QCRH originated 2,394 PPP loans, totaling $451MM to date. • As of March 31, 2021, 1,102 of these loans, totaling $207MM, were forgiven. • In 2021, QCRH originated 696 PPP loans, totaling $93MM. • New PPP clients have resulted in more than $80MM of additional new loan and deposit business to date. Client Participation in the Paycheck Protection Program (PPP) PPP 28

The QCRH LRP offered immediate payment relief to consumer and small business loan clients. • As of March 31, 2021, there were $7MM, or 0.16% of total loans and leases still on deferral. • This is down from $28MM, or 0.66% of total loans and leases on deferral, as of Dec. 31, 2020. Loan Relief Program Impact on NPAs: • As of March 31, 2021, five loans totaling $1.2 million received deferrals and are now classified as nonperforming assets. QCRH Loan Relief Program (LRP) LOAN RELIEF 29

LOAN RELIEF Bank Loan Relief Program (LRP) by Industry A breakdown of the industries for deferrals: 30 Industry Deferrals as of Dec. 31, 2020 Deferrals as of March 31, 2021 T ot a l A m o un t (in millions) % of Total Lo a ns /L e a s es T ot a l A m o un t (in millions) % of Total Lo a ns /L e a s es % of Loans in Industry Segment All Investment Real Estate $9 0.22% $0 0.00% 0.00% Hotels $6 0.14% $0 0.00% 0.00% Retail ( I n c l ud i n g A u t o m o t i v e ) $3 0.07% $0 0.00% 0.00% Arts, Entertainment and Recreation $2 0.05% $0 0.00% 0.00% Consumer $1 0.02% $0 0.00% 0.00% Media and Telecommunications $0 0.00% $0 0.00% 0.00% Health Care and Social Assistance $0 0.00% $0 0.00% 0.00% All Other $0 0.00% $0 0.00% N/A Construction $0 0.00% $0 0.00% 0.00% Other Services $0 0.00% $0 0.00% 0.00% Restaurants (Limited & Full Service) $0 0.00% $0 0.00% 0.00% Manufacturing $0 0.00% $0 0.00% 0.00% Management of Companies and Enterprises $0 0.00% $0 0.00% 0.00% m2 Equipment Finance LLC $7 0.16% $7 0.16% N/A TOTAL $28 0.66% $7 0.16% N/A

Trends in Criticized and Classified Loan Totals ASSET QUALITY 31 Category T o t a l A m o un t ( in m illi o n s ) 3/31/21 12/31/20 9/30/20 6/30/20 3/31/20 S pe c ia l M en t io n ( R a t in g 6) $53 $72 $80 $104 $35 S ub s t anda rd ( R a t in g 7) $85 $66 $70 $40 $36 D oub t f u l ( R a t in g 8) $0 $0 $0 $0 $0 TOTAL $138 $138 $150 $144 $71 Category T o t a l A m o un t ( in m illi o n s ) 3/31/21 12/31/20 9/30/20 6/30/20 3/31/20 C r i t i c i z e d Loan s * $138 $138 $150 $144 $71 C la ss i f ie d Loan s * * $85 $66 $70 $40 $36 C r i t i c i z e d Loan s a s a % of Total Loans/Leases 3.17% 3.24% 3.53% 3.49% 1.93% C la ss i f ie d Loan s a s a % of Total Loans/Leases 1.95% 1.55% 1.66% .96% 0.99% *Criticized loans are defined as C&I and CRE loans with internally assigned risk ratings of 6, 7, or 8, regardless of performance. **Classified loans are defined as C&I and CRE loans with internally assigned risk ratings of 7 or 8, regardless of performance.

I ndu s t r y C oncen t r a t i on Disclosures 3 2

P R I M A R Y The following industries were deemed higher risk in our commercial loan portfolio due to the COVID - 19 pandemic. As of March 31, 2021: Industry Amount % of Total Loans Hotels $80MM 1.83% Restaurants $36MM 0.82% Arts, Entertainment and Recreation $27MM 0.62% Aviation $0MM 0.00% Energy $0MM 0.00% TOTAL $143MM 3.27% 33 Primary Industry Concentration Overview

SE C O ND A R Y Secondary Industry Concentration | Retail As of March 31, 2021, QCRH retail exposure was $214MM, or 4.91% of total loans. Overview in Our Markets • Restrictions on gatherings eased or lifted in all markets. • All retail segments in our markets continue to see improvement. • Sales at bars and traditional restaurants showing positive growth as capacity limits are increased or removed. Retail Amount % of Total Loans Retail Investment CRE $132MM 3.03% C&I Retail $32MM 0.73% Retail Owner Occupied CRE $29MM 0.67% Other $21MM 0.48% TOTAL $214MM 4.91% 34

Appendix 3 5

QUAD CITY BANK & TRUST John H. Anderson, CEO Laura “Divot” Ekizian, President Assets: $2.1 Billion 1 (as of 3/31/21) Population: 382,268 Market Deposits: $8.2 Billion (1) Includes $241.5 million of the assets of m2 Equipment Finance, as this entity is wholly - owned and consolidated with the bank. Source: FDIC deposit market share data as provided by S&P Global.. Deposit data is as of 9/30/20 * Dollar s in m illion s . Institution Name Offices in MSA Deposits* ($ in millions) M a r ket Share 1. Quad City Bank & Trust 5 1,708.0 18.6% 2. W e ll s F a r go & C o. 10 1,272.2 14.0% 3. B l a ck ha w k B an c o r p. I n c . 18 1,034.3 11.4% 4. U.S. Bancorp 10 875.5 9.6% 5. Orion Bancorp. Inc. 8 438.7 4.8% 6. Triumph Bancorp Inc. 10 435.1 4.8% 7. F i r s t M i d w e s t B an c o r p I n c . 4 380.0 4.2% 8. A m B ank H o l d i ngs I n c . 8 324.4 3.6% 9. P r ophet s to w n B an ki ng C o. 1 228.5 2.5% 10. N o r th w e s t I n v e s t m ent C o. 3 200.4 2.2% MARKET SHARE Deposit Market Share 36 CEDAR RAPIDS BANK & TRUST Deposit Institution Name M a r ke t S Offices in MSA hare Deposits* ($ in millions) M a r ket Share 1. Cedar Rapids Bank & Trust 5 1,195.8 16.5% 2. U.S. Bancorp 7 1,026.9 14.2% Larry J. Helling, CEO 3. W e ll s F a r go & C o. 9 794.4 11.0% James Klein, President 4. Neighbor Insurance Agency Inc. 9 784.1 10.8% 5. H ill s B an c o r p. 7 612.1 8.5% Assets: $1.8 Billion (as of 3/31/21) 6. B T C F i nan ci al C o r p. 3 306.7 4.2% Population: 271,952 7. Dunn Investment Co. 4 281.8 3.9% 8. Fidelity Ban Corp. 3 175.6 2.4% Market Deposits: $5.9 Billion 9. Ohnward Bancshares Inc. 4 168.2 2.3% 10. Country Bancorp. 5 154.8 2.1%

Source: FDIC deposit market share data as provided by S&P Global. Deposit data is as of 9/30/20. * Dollar s in m illion s . COMMUNITY BANK & TRUST Stacey J. Bentley, President & CEO A sse t s : $9 1 M illi o n ( a s o f 3 / 31 / 21 ) Population: 169,565 Waterloo/Cedar Falls MSA Market Deposits: $1.7 Billion Institution Name Offices in MSA Deposits* ($ in millions) M a r ket Share 1. F S B F i nan ci al S e r v ic es I n c . 6 793.9 30.5% 2. U.S. Bancorp 6 457.6 17.6% 3. W e ll s F a r go & C o. 3 284.9 10.9% 4. L i n c o l n B an c o r p 4 194.5 7.5% 5. Regions Financial Corp. 3 163.4 6.3% 6. Fidelity Ban Corp. 3 158.9 6.1% 7. Community Bank and Trust 3 156.0 6.0% 8. First of Waverly Corp. 1 98.3 3.8% 9. G r eat W e s te r n B an c o r p I n c . 2 87.0 3.3% 10. E v ans B an cs ha r es I n c . 2 83.2 3.2% MARKET SHARE Deposit Market Share (Black Hawk County) 37 COMMUNITY STATE BANK Kurt A. Gibson, President & CEO Assets: $1.0 Billion (as of 3/31/21) Population: 682,877 Des Moines/West Des Moines MSA Market Deposits: $18.7 Billion Institution Name Offices in MSA Deposits* ($ in millions) M a r ket Share 1. W e ll s F a r go & C o. 18 3,610.2 15.2% 2. B T C F i nan ci al C o r p. 19 3,338.1 14.0% 3. W e s t B an c o r po r at i on, I n c . 8 1,850.6 7.8% 4. U.S. Bancorp 13 1,499.9 6.3% 5. G r eat W e s te r n B an c o r p I n c . 11 1,258.5 5.3% 6. B ank of A m e r ic a C o r p. 3 1,250.5 5.3% 7. Community State Bank 10 778.5 3.3% 8. BNP Paribas SA 12 547.1 2.3% 9. Albrecht Financial Services Inc. 7 392.9 1.7% 10. Bank Iowa Corp. 6 373.5 1.6% Deposit Market Share

SFC BANK Monte C. McNew, President & CEO Assets: $819 Million (as of 3/31/21) Population: 467,912 Springfield, MO - MSA Market Deposits: $9.9 Billion Source: FDIC deposit market share data as provided by S&P Global. Deposit data is as of 9/30/20. * Dollar s in m illions. Institution Name Offices in MSA Deposits* ($ in millions) M a r ket Share 1. Great Southern Bancorp Inc. 20 2,220.3 16.7% 2. C o mm e r c e B an cs ha r es I n c . 11 1,481.6 11.1% 3. Central Banco. Inc. 22 1,411.5 10.6% 4. Guaranty Federal Bancshares Inc. 10 750.6 5.6% 5. O a k S tar B an cs ha r es I n c . 6 673.0 5.1% 6. B ank of A m e r ic a C o r p. 4 648.6 4.9% 7. SFC Bank 1 564.7 4.2% 8. R e li ab l e C o mm un i ty B an cs ha r es I n c . 12 549.9 4.1% 9. U.S. Bancorp 11 512.6 3.9% 10. S i mm ons F i r s t N at i onal C o r p. 8 443.8 3.3% MARKET SHARE Deposit Market Share 38

3551 Seventh Street Moline, IL 61265 ww w .Q CRH . c o m © Copyright 2021 QCR Holdings, Inc. All Rights Reserved