Attached files

| file | filename |

|---|---|

| EX-99.1 - EXHIBIT 99.1 - FBL FINANCIAL GROUP INC | tm2114813d2_ex99-1.htm |

| EX-10.1 - EXHIBIT 10.1 - FBL FINANCIAL GROUP INC | tm2114813d2_ex10-1.htm |

| EX-2.2 - EXHIBIT 2.2 - FBL FINANCIAL GROUP INC | tm2114813d2_ex2-2.htm |

| EX-2.1 - EXHIBIT 2.1 - FBL FINANCIAL GROUP INC | tm2114813d2_ex2-1.htm |

| 8-K - FORM 8-K - FBL FINANCIAL GROUP INC | tm2114813d2_8k.htm |

Exhibit 99.2

Farm Bureau Property & Casualty Insurance Company and FBL Financial Group Amend Merger Agreement Increased Price to $61 Cash Per Share of FBL Financial – Compelling Valuation May 3, 2021 Proprietary and Confidential

Disclaimer This presentation has been designed to provide general information about FBL Financial Group, Inc. (“FBL Financial” or the “C omp any”) and the proposed acquisition by Farm Bureau Property and Casualty Insurance Company (“FBPCIC”) of FBL Financial’s common stock not held by FBPCIC or the Iowa Farm Bureau Federation. Any infor mat ion contained or referenced herein is suitable only as an introduction to the Company. The reader is strongly encouraged to refer to and supplement this presentation with information the Company has fil ed with the Securities and Exchange Commission (the “SEC”). The Company makes no representation or warranty, express or implied, as to the accuracy or completeness of the information co nta ined in this presentation, and nothing contained herein is, or shall be, relied upon as a promise or representation, whether as to the past or to the future. This presentation does not propose to in clu de all of the information that may be required to evaluate the subject matter herein and the reader is encouraged to conduct his or her own independent analysis of the Company and the data contained or r efe rred to herein. The Company has neither sought nor obtained consent from any third party for the use of previously published information. Any su ch statement or information should not be viewed as indicating the support of such third party for the views expressed herein. The Company shall not be responsible or have any liability for any misinf orm ation contained in any third party report, SEC or other regulatory filing. All registered or unregistered service marks, trademarks and trade names referred to in this presentation are the property of the ir respective owners and the Company’s use herein does not imply an affiliation with, or endorsement by, the owners of these service marks, trademarks and trade names. This presentation is provided merely for general informational purposes and is not intended to be, nor should it be, construe d a s (1) investment, financial, tax or legal advice, (2) a recommendation to buy or sell any security or (3) an offer or solicitation to subscribe for or purchase any security. This presentation does not co nsi der the investment objective, financial situation, suitability or the particular need or circumstances of any specific individual who may receive or review this presentation, and may not be taken as advice on th e m erits of any investment decision. Although the Company believes the information herein to be reliable, the Company and persons acting on its behalf make no representation or warranty, express o r i mplied, as to the accuracy or completeness of those statements or any other written or oral communication it makes, except as provided for by law, and the Company expressly disclaims any liability rela tin g to those statements or communications (or any inaccuracies or omissions therein). Risk Factors and Forward Looking Statements Some of the statements in this presentation are forward - looking statements (or forward - looking information). When we use words s uch as “anticipate,” “intend,” “plan,” “seek,” “believe,” “may,” “could,” “will,” “should,” “would,” “could,” “estimate,” “continue,” “predict,” “potential,” “project,” “expect,” or similar expressio ns, we do so to identify forward - looking statements. Forward - looking statements are based on current expectations that involve assumptions that are difficult or impossible to predict accurately and many of which are beyond our control, including general economic and market conditions, industry conditions, operational and other factors. Actual results may differ materially from those expres sed or implied in these statements as a result of significant risks and uncertainties, including, but not limited to, the occurrence of any event, change or other circumstances that could give rise to the termination of the merger agreement; the inability to obtain the requisite shareholder approval for the proposed transaction or the failure to satisfy other conditions to completion of the proposed tr ans action; the risk that shareholder litigation in connection with the proposed transaction may result in significant costs of defense, indemnification and liability; risks that the proposed transaction di sru pts current plans and operations; the ability to recognize the benefits of the transaction; the amount of the costs, fees, and expenses and charges related to the transaction; change in interest rates; ch ang es in laws and regulations; differences between actual claims experience and underwriting assumptions; relationships with Farm Bureau organizations; the ability to attract and retain sales agents; adver se results from litigation; and the impact of the COVID - 19 pandemic and any future pandemics. Additional information about these risks and uncertainties, as well as others that may cause actual results to differ materially from those projected, is contained in FBL Financial’s filings with the SEC, including FBL Financial’s Annual Report on Form 10 - K and FBL Financial’s quarterly reports on Form 10 - Q. The state ments in this communication speak only as of the date of this communication and we undertake no obligation or intention to update or revise any forward - looking statement, whether as a result of new information, changes in assumptions, future developments or otherwise, except as may be required by law. Important Additional Information and Where to Find It In connection with the proposed transaction, FBL Financial has filed with the SEC a definitive proxy statement on Schedule 14 A ( the “Proxy Statement”) and an amended Schedule 13e - 3 Transaction Statement, and may file other documents with the SEC regarding the proposed transaction. This communication is not a substitu te for the Proxy Statement or any other document that FBL Financial may file with the SEC. INVESTORS IN, AND SECURITY HOLDERS OF, FBL FINANCIAL ARE URGED TO READ THE PROXY STATEMENT AND ANY OTHER RELEVA NT DOCUMENTS THAT ARE FILED OR WILL BE FILED WITH THE SEC, AS WELL AS ANY AMENDMENTS OR SUPPLEMENTS TO THESE DOCUMENTS, CAREFULLY AND IN THEIR ENTIRETY BECAUSE THEY CONTAIN OR WIL L C ONTAIN IMPORTANT INFORMATION ABOUT THE PROPOSED TRANSACTION AND RELATED MATTERS. Investors and security holders may obtain free copies of the Proxy Statement and ac com panying proxy card, any amendments or supplements to the Proxy Statement and other documents filed with the SEC by FBL Financial through the web site maintained by the SEC at www.sec.gov or b y contacting the individuals listed below. Contacts 2 FBL Financial FBPCIC Media: Bryan Locke and Lindsay Molk Sard Verbinnen & Co FBLFinancial - SVC@sardverb.com Investors: Kathleen Till Stange Vice President Corporate & Investor Relations Kathleen.TillStange@FBLFinancial.com Nancy Wiles Marketing Communications Vice President Nancy.Wiles@FBFS.com

$61.00 Per Share Revised Offer is Highly Compelling 3 Revised Offer FBPCIC and FBL Financial agreed to amend their previously - announced definitive merger agreement to provide unaffiliated shareholders with merger consideration of $61.00 per share in cash FBPCIC indicated it would not increase the $61.00 per share purchase price further Special Meeting of Shareholders of FBL Financial to approve the transaction will reconvene on May 21, 2021 The transaction has already received regulatory approval and is expected to close in Q2 2021 Revised Offer Provides Highly Compelling Valuation Increase of 9% from the previously agreed price of $56.00 and 30% from FBPCIC’s original offer of $47.00 Substantial, 60%+ cash premium to FBL Financial’s unaffected stock price of $37.25 on September 3, 2020 Premium to peer price / earnings multiples and comparable transactions, despite being a controlled company Premium valuation to independent policy - by - policy actuarial appraisal Continued Rigorous Negotiation The Special Committee evaluated the revised offer in the context of the current market environment and FBL Financial’s Q1 2021 results and outlook before making its recommendation to the FBL Financial board of directors In response to FBPCIC’s initial indication that it was prepared to raise its offer to $61.00 per share, the Special Committee pursued a higher price; FBPCIC responded that $61.00 represented its “best and final” offer Capital Returns Management has entered into an agreement to vote its shares FOR the transaction and to withdraw its solicitation of proxies to vote against the transaction; Capital Returns will be reimbursed for up to $750,000 in reasonable, documented expenses in connection with its proxy solicitation

Share Performance Since 9/3/2020 63.8% 40.5% 29.7% FBL Financial Peer Average Peer Median ___________________________________ Source: FactSet. Market data as of April 30, 2021. 1. FBL Financial unaffected price of $37.25 as of September 3, 2020. 2. Peers include CNO, PRI, GL, ATH, and AEL. 4 2 2 The revised offer price of $61.00 per share is a premium to FBL Financial’s unaffected price that exceeds the appreciation among FBL Financial’s Life and Annuity peers over the same time period 1

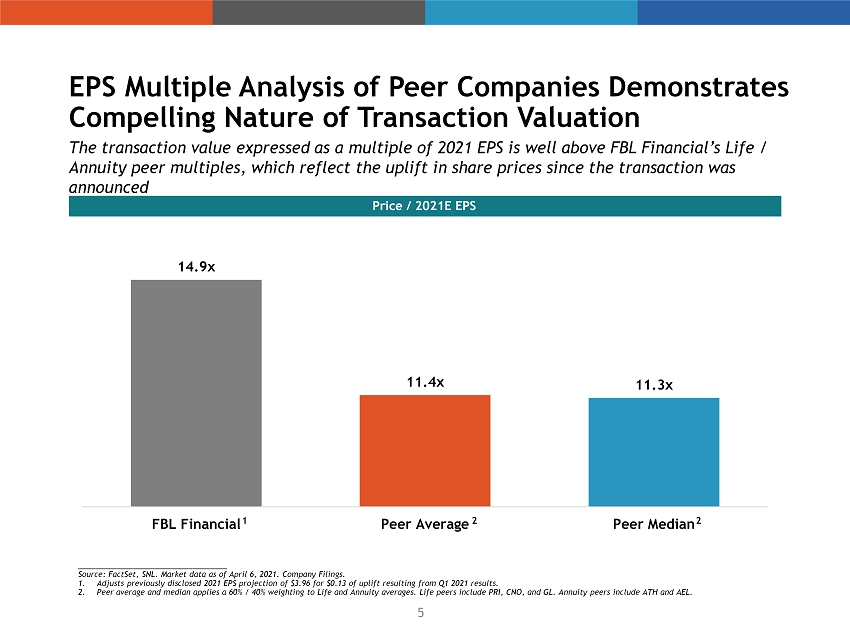

14.9x 11.4x 11.3x FBL Financial Peer Average Peer Median EPS Multiple Analysis of Peer Companies Demonstrates Compelling Nature of Transaction Valuation 2 5 Price / 2021E EPS 2 The transaction value expressed as a multiple of 2021 EPS is well above FBL Financial’s Life / Annuity peer multiples, which reflect the uplift in share prices since the transaction was announced 1 ___________________________________ Source: FactSet, SNL. Market data as of April 6, 2021. Company Filings. 1. Adjusts previously disclosed 2021 EPS projection of $3.96 for $0.13 of uplift resulting from Q1 2021 results. 2. Peer average and median applies a 60% / 40% weighting to Life and Annuity averages. Life peers include PRI, CNO, and GL. Annu ity peers include ATH and AEL.

Book Value Multiple for the Transaction Exceeds Relevant Transaction Comparables ___________________________________ Source: Company filings. Note: Multiples measured on the basis of deal value divided most recently disclosed book value excluding AOCI at the time of ann ouncement. 1. Multiple calculated on the basis of December 31, 2020 Book Value (ex. AOCI). 2. MassMutual/Athene proposal subsequently withdrawn. 1.35x 1.00x 1.25x 1.25x 1.00x FBL / FBPCIC KKR / GA MM / ATH / AEL MM / Great American APO / ATH Ann. Date 3/3/2021 7/8/2020 10/1/2020 1/27/2021 3/8/2021 Target FBL Financial Global Atlantic American Equity Great American Athene Acquirer FBPCIC KKR Mass Mutual / Athene 2 Mass Mutual Apollo 6 Price / Book Value (ex. AOCI) 1

$61.00 Represents a Premium to Intrinsic Value Based on Actuarial Valuation Per Share Actuarial Value, As Adjusted $52.15 $49.15 $46.53 $44.24 $5.78 $3.44 $1.59 $0.09 7% 8% 9% 10% ($ / share) Discount Rate Total Value Per Share (Excluding New Business) Value of New Business $52.59 $48.12 $44.33 $57.93 $61.00 / Share Value 7 ___________________________________ Source: All reliances and limitations are subject to the Milliman Report as of December 31, 2020. Full Milliman Report can be fo und in FBL Financial’s publicly disclosed SEC filings.

FBL Financial Group, Inc. www.fblfinancial.com www.fbfs.com