Attached files

| file | filename |

|---|---|

| EX-99.1 - EX-99.1 - Emergent BioSolutions Inc. | ebs2021-03x31ex99earningsr.htm |

| 8-K - 8-K - Emergent BioSolutions Inc. | ebs-20210429.htm |

1Q21 Investor Update 1 April 29, 2021

Introduction Robert G. Burrows Vice President, Investor Relations 2 1Q 2021 Investor Update

Safe Harbor Statement 3 1Q 2021 Investor UpdateINTRODUCTION This presentation includes forward-looking statements within the meaning of the Private Securities Litigation Reform Act of 1995. Any statements, other than statements of historical fact, including, without limitation, our financial guidance and related projections and statements regarding our ability to meet such projections in the anticipated timeframe, if at all; statements regarding future growth; procurement of AV7909; ACAM2000® vaccine deliveries; the award of a new procurement contract for raxibacumab, the strength of the naloxone market; the timing and number of generic naloxone entrants; the timing of the anticipated appellate decision on pending patent litigation; pipeline progress and the anticipated timing and number of regulatory submissions; the timing of CDMO revenues, our CDMO backlog and opportunity funnel; future growth; capital expenditures and total contract value; and any other statements containing the words “will,” “believes,” “expects,” “anticipates,” “intends,” “plans,” “targets,” “forecasts,” “estimates” and similar expressions in conjunction with, among other things, discussions of the Company’s outlook, financial performance or financial condition, financial and operation goals, product sales, government development or procurement contracts or awards, government appropriations, manufacturing capabilities, and the timing of certain regulatory approvals or expenditures are forward-looking statements. These forward-looking statements are based on our current intentions, beliefs and expectations regarding future events. We cannot guarantee that any forward-looking statement will be accurate. Investors should realize that if underlying assumptions prove inaccurate or unknown risks or uncertainties materialize, actual results could differ materially from our expectations. Investors are, therefore, cautioned not to place undue reliance on any forward-looking statement. Any forward-looking statements speak only as of the date of this presentation, and, except as required by law, we do not undertake to update any forward-looking statement to reflect new information, events or circumstances. There are a number of important factors that could cause our actual results to differ materially from those indicated by such forward-looking statements, including the impact of COVID-19 on the markets, our operations and employees as well as those of our customers and suppliers; the ability to obtain authorization from the FDA for our proposed COVID-19 treatment and its safety and effectiveness; the ability to obtain authorization from the FDA to produce the products and product candidates of our customers; availability of U.S. government funding for procurement of our products and certain product candidates and the future exercise of options under contracts related to such procurement; the negotiation of further commitments or contracts related to the collaboration and deployment of capacity toward future commercial manufacturing under our CDMO contracts; our ability to perform under our contracts with the U.S. government and our CDMO clients, including the timing of and specifications relating to deliveries; the continued exercise of discretion by BARDA to procure additional doses of AV7909 (Anthrax Vaccine Adsorbed, Adjuvanted) prior to approval by the FDA; our ability to secure licensure of AV7909 from the FDA within the anticipated timeframe, if at all; our ability to secure follow-on procurement contracts for our solutions to public health threats that are under procurement contracts that have expired or will be expiring; our ability to successfully appeal the patent litigation decision related to NARCAN® Nasal Spray 4mg/spray; our ability and the ability of our collaborators to enforce patents related to NARCAN® Nasal Spray against potential generic entrants; our ability to identify and acquire companies, businesses, products or product candidates that satisfy our selection criteria; our ability and the ability of our contractors and suppliers to maintain compliance with Current Good Manufacturing Practices and other regulatory obligations; our ability to comply with the operating and financial covenants required by our senior secured credit facilities and the indenture governing our senior unsecured notes due 2028; our ability to obtain and maintain regulatory approvals for our other product candidates and the timing of any such approvals; the procurement by government entities outside of the United States under regulatory exemptions prior to approval by the corresponding regulatory authorities in the applicable country; the success of our commercialization, marketing and manufacturing capabilities and strategy; and the accuracy of our estimates regarding future revenues, expenses, and capital requirements and needs for additional financing. The foregoing sets forth many, but not all, of the factors that could cause actual results to differ from our expectations in any forward-looking statement. Investors should consider this cautionary statement as well as the risk factors identified in our periodic reports filed with the Securities and Exchange Commission when evaluating our forward-looking statements.

Non-GAAP Financial Measures / Trademarks 4 1Q 2021 Investor UpdateINTRODUCTION NON-GAAP FINANCIAL MEASURES This presentation contains financial measures (Adjusted Net Income, Adjusted Net Income Per Diluted Share, Adjusted EBITDA (Earnings Before Depreciation and Amortization, Interest and Taxes), Adjusted Gross Margin and Adjusted Revenues) that are considered “non-GAAP” financial measures under applicable Securities and Exchange Commission rules and regulations. These non-GAAP financial measures should be considered supplemental to and not a substitute for financial information prepared in accordance with generally accepted accounting principles. The Company’s definition of these non-GAAP measures may differ from similarly titled measures used by others. For its non-GAAP measures, the Company adjusts for specified items that can be highly variable or difficult to predict, or reflect the non-cash impact of charges or accounting changes. As needed, such adjustments are tax effected utilizing the federal statutory tax rate for the US, except for changes in the fair value of contingent consideration as the vast majority is non-deductible for tax purposes. The Company views these non-GAAP financial measures as a means to facilitate management’s financial and operational decision-making, including evaluation of the Company’s historical operating results and comparison to competitors’ operating results. These non-GAAP financial measures reflect an additional way of viewing aspects of the Company’s operations that, when viewed with GAAP results and the reconciliations to the corresponding GAAP financial measure may provide a more complete understanding of factors and trends affecting the Company’s business. For more information on these non-GAAP financial measures, please see the tables in the Appendix included at the end of this presentation. The determination of the amounts that are excluded from these non-GAAP financial measures are a matter of management judgment and depend upon, among other factors, the nature of the underlying expense or income amounts. Because non-GAAP financial measures exclude the effect of items that will increase or decrease the Company’s reported results of operations, management strongly encourages investors to review the Company’s consolidated financial statements and publicly filed reports in their entirety. TRADEMARKS BioThrax® (Anthrax Vaccine Adsorbed), RSDL® (Reactive Skin Decontamination Lotion Kit), BAT® (Botulism Antitoxin Heptavalent (A,B,C,D,E,F,G)-(Equine)), Anthrasil® (Anthrax Immune Globulin Intravenous (Human)), VIGIV (Vaccinia Immune Globulin Intravenous (Human)), Trobigard® (atropine sulfate, obidoxime chloride), ACAM2000® (Smallpox (Vaccinia) Vaccine, Live), Vivotif® (Typhoid Vaccine Live Oral Ty21a), Vaxchora® (Cholera Vaccine, Live, Oral), NARCAN® (naloxone HCI) Nasal Spray and any and all Emergent BioSolutions Inc. brands, products, services and feature names, logos and slogans are trademarks or registered trademarks of Emergent BioSolutions Inc. or its subsidiaries in the United States or other countries. All other brands, products, services and feature names or trademarks are the property of their respective owners.

Agenda 5 1Q 2021 Investor Update • State of the Company • Financial Results: 1Q21 • Financial Guidance: Full Year 2021 and 2Q21 • Question and Answer Session INTRODUCTION

State of the Company Robert G. Kramer President and Chief Executive Officer 6 1Q 2021 Investor Update

Key Themes for 1Q21 Status of the Company 7 1Q 2021 Investor UpdateSTATE OF THE COMPANY • Since our founding, we have had a steadfast commitment to quality. • We stepped up and began to rapidly scale up Bayview capacity. • This kind of effort had never been done before – a process that normally takes years was compressed into months. • Biologics manufacturing is complex and product loss can occur despite checks, tests and fail safes. • Cross contamination is a well-known risk of producing drug substance for multiple viral products in a single plant. • The loss of a batch for viral contamination is an extremely serious event and we treated it as such. • We take full responsibility and are committed to resolving all issues safely and quickly. • With the benefit of additional time, we could have further mitigated the risks identified by the FDA, but this would have slowed our COVID response significantly, so we worked transparently with our government partners and fellow innovators and, together, chose to move ahead. • Importantly, gaining an accurate account of the challenges and lessons learned will help ensure future preparedness and response readiness. • We are taking immediate steps to improve our operations and expect to submit our response to FDA findings within days. • We are working together with Johnson & Johnson on a path forward with a goal of returning to producing new bulk material as soon as possible.

Financial Results Richard S. Lindahl Executive Vice President, Chief Financial Officer and Treasurer 8 1Q 2021 Investor Update

1Q21 Performance Summary Points 9 1Q 2021 Investor UpdateFINANCIAL RESULTS • Solid financial performance, consistent with expectations • Financial outcomes reflect strength and durability of diversified business • Financial condition remains sound with liquidity and financial flexibility to fund operations and pursue opportunistic investments • Despite recent headwinds, remain steadfast in commitment to supporting global preparedness and response to public health threats (PHTs)

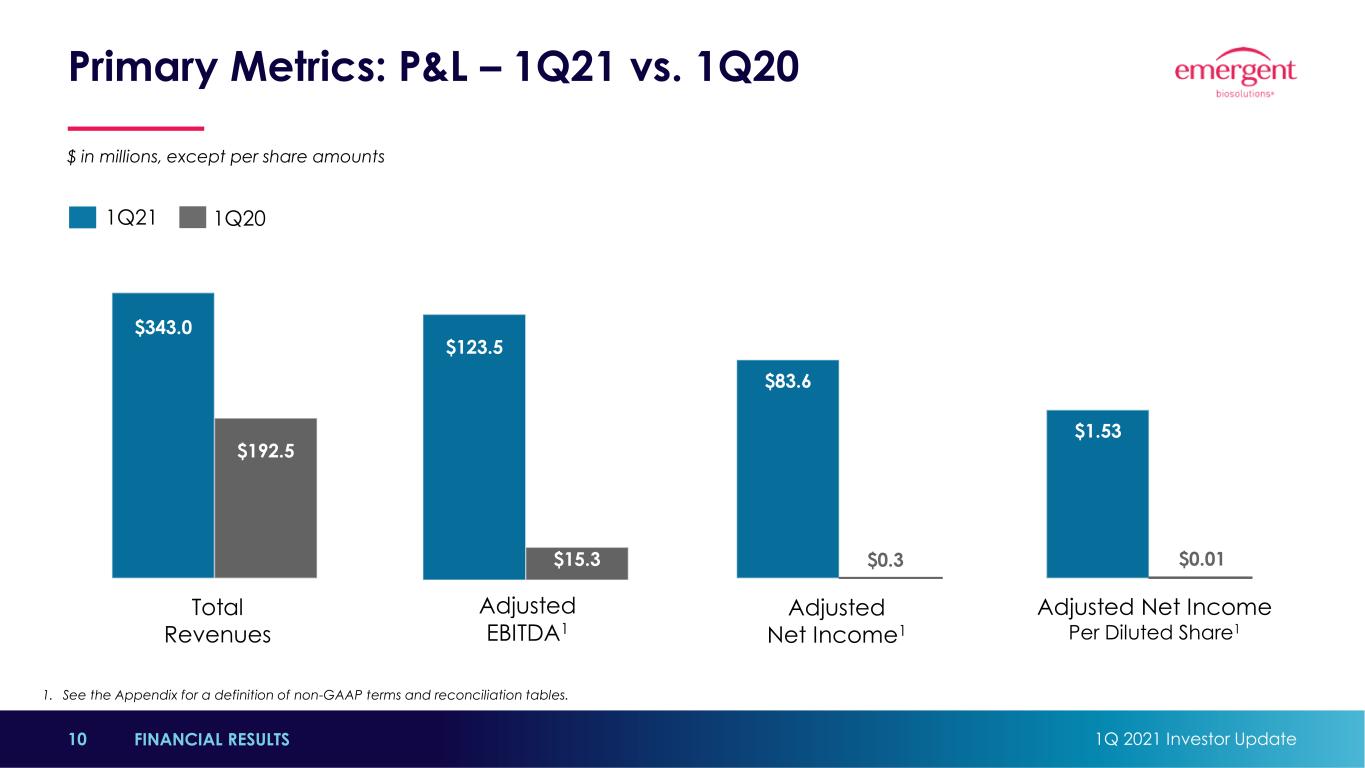

Primary Metrics: P&L – 1Q21 vs. 1Q20 10 1Q 2021 Investor UpdateFINANCIAL RESULTS $ in millions, except per share amounts $343.0 $192.5 $123.5 $15.3 $83.6 $0.3 $1.53 Total Revenues Adjusted EBITDA1 Adjusted Net Income1 Adjusted Net Income Per Diluted Share1 1Q21 1Q20 1. See the Appendix for a definition of non-GAAP terms and reconciliation tables. $0.3 $0.01

Additional Information: CDMO Metrics at 1Q21 11 1Q 2021 Investor UpdateFINANCIAL RESULTS $187M $1.34B $807M New Business1 In 1Q21 [net new contracted value included in Backlog] Backlog2 As of 3/31/21 Rolling Opportunity Funnel3 As of 3/31/21 1. New business is defined as initial value of contracts secured as well as incremental value of existing contracts modified within the indicated period and is incorporated into Backlog. 2. Backlog is defined as estimated remaining contract value as of the indicated period pursuant to signed contracts, the majority of which is expected to be realized over the next 24 months. 3. Opportunity funnel is defined as the initial proposal values from new work with new customers, new work with existing customers and extensions/expansions of existing contracts with existing customers, that if converted to new business, the majority of such value is expected to be realized over the next 24 months. This excludes any value associated with an extension of the commercial supply agreements (CSA) with Johnson & Johnson and AstraZeneca.

12 1Q 2021 Investor UpdateFINANCIAL RESULTS Additional Information: CDMO Metrics Trends ($ in millions) $60 $53 $187 3Q20 4Q20 1Q21 $475 $689 $807 9/30/2020 12/31/2020 3/31/2021 $1,484 $1,340 $1,343 9/30/2020 12/31/2020 3/31/2021 NEW BUSINESS1 [net new contracted value included in Backlog] ROLLING OPPORTUNITY FUNNEL3 BACKLOG2 1. New business is defined as initial value of contracts secured as well as incremental value of existing contracts modified within the indicated period and is incorporated into Backlog. 2. Backlog is defined as estimated remaining contract value as of the indicated period pursuant to signed contracts, the majority of which is expected to be realized over the next 24 months. 3. Opportunity funnel is defined as the initial proposal values from new work with new customers, new work with existing customers and extensions/expansions of existing contracts with existing customers, that if converted to new business, the majority of such value is expected to be realized over the next 24 months. This excludes any value associated with an extension of the commercial supply agreements (CSA) with Johnson & Johnson and AstraZeneca.

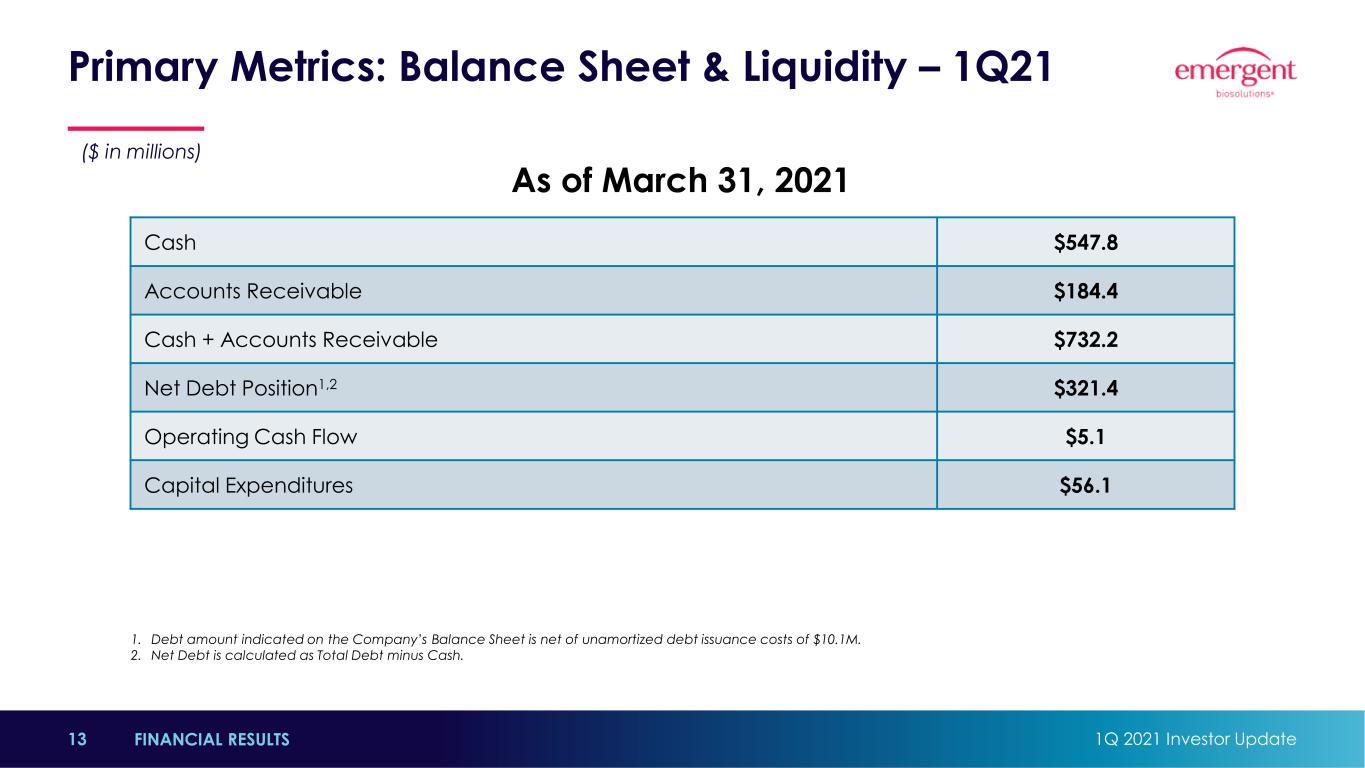

Primary Metrics: Balance Sheet & Liquidity – 1Q21 13 1Q 2021 Investor UpdateFINANCIAL RESULTS Cash $547.8 Accounts Receivable $184.4 Cash + Accounts Receivable $732.2 Net Debt Position1,2 $321.4 Operating Cash Flow $5.1 Capital Expenditures $56.1 As of March 31, 2021 1. Debt amount indicated on the Company’s Balance Sheet is net of unamortized debt issuance costs of $10.1M. 2. Net Debt is calculated as Total Debt minus Cash. ($ in millions)

Revised 2021 Forecast 14 1Q 2021 Investor UpdateFINANCIAL RESULTS 2Q21 forecasted total revenues: $370 to $430 Metric REVISED FORECAST [As of 04/29/2021] Previous Forecast Total revenues $1,700 - $1,900 $1,950 - $2,050 -- NARCAN Nasal Spray -- Anthrax vaccines -- ACAM2000 -- CDMO services $305 - $325 $280 - $310 $185 - $205 $765 - $875 $305 - $325 $280 - $310 $185 - $205 $925 - $965 Adjusted EBITDA1 $620 - $720 $750 - $810 Adjusted net income1 $395 - $470 $475 - $525 Gross margin 63%-65% 65% ($ in millions)

Revised 2021 Forecast: Key Considerations 15 1Q 2021 Investor UpdateFINANCIAL RESULTS • UNCHANGED from previous forecast: • Anthrax vaccines revenues are expected to continue to primarily reflect procurement of AV7909 under the terms of the Company’s existing contract with the Biomedical Advanced Research and Development Authority (BARDA) at a more normalized annual level. • ACAM2000® vaccine deliveries are expected to continue under the terms of the Company’s existing contract with the U.S. Department of Health and Human Services (HHS) at unit volume levels consistent with 2020 deliveries. • Narcan® (naloxone HCl) Nasal Spray revenues assume the naloxone market remains competitive, that at least one new entrant will enter the market by year end, and that no generic entrant will enter the market prior to the anticipated appellate decision related to the pending patent litigation, which is expected in the second half of 2021. • Pipeline progress is expected across the vaccines, therapeutics, and devices portfolios, anticipating at least one Phase 3 launch and one Biologics License Application (BLA)/Emergency Use Authorization (EUA) filing. • Capital expenditures, net of reimbursement, are expected to be in a range of 8% to 9% of total revenues, reflecting ongoing investments in capacity and capability expansions in support of the Company's CDMO services business and product portfolio. • REVISED from previous forecast: • CDMO services revenues have been reduced primarily due to the hold of certain COVID-19 vaccine bulk drug substance lots as well as commitment not to initiate new manufacturing at Bayview pending further review by the FDA. Even assuming FDA concurrence to re-initiate new manufacturing and/or release of lots, the Company expects a delay in the timing of expected revenue. • Total revenues, specifically other product sales, are expected to be impacted due to the Company's assumption that a new raxibacumab contract will be awarded later than previously planned.

Key Takeaways 16 1Q 2021 Investor UpdateFINANCIAL RESULTS • Strong financial results in 1Q21. • Protecting and enhancing lives across the globe. • Dedicated employees confronting the COVID-19 pandemic. • Remain confident in future growth.

Q&A 17 1Q 2021 Investor Update

APPENDIX 18 1Q 2021 Investor Update

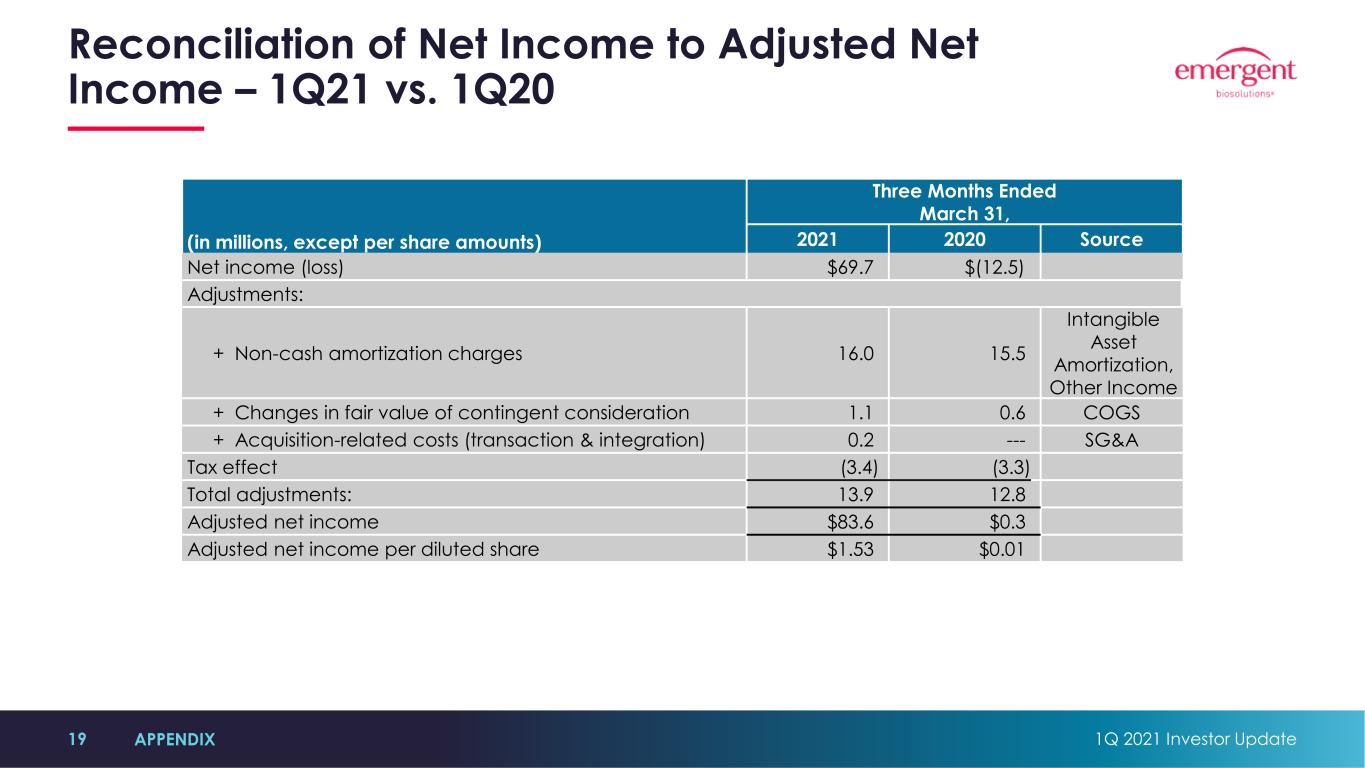

Reconciliation of Net Income to Adjusted Net Income – 1Q21 vs. 1Q20 19 1Q 2021 Investor UpdateAPPENDIX (in millions, except per share amounts) Three Months Ended March 31, 2021 2020 Source Net income (loss) $69.7 $(12.5) Adjustments: + Non-cash amortization charges 16.0 15.5 Intangible Asset Amortization, Other Income + Changes in fair value of contingent consideration 1.1 0.6 COGS + Acquisition-related costs (transaction & integration) 0.2 --- SG&A Tax effect (3.4) (3.3) Total adjustments: 13.9 12.8 Adjusted net income $83.6 $0.3 Adjusted net income per diluted share $1.53 $0.01

Reconciliation of Net Income to Adjusted Net Income – 2021 Forecast 20 1Q 2021 Investor UpdateAPPENDIX (in millions) Full Year Forecast 2021F Source Net income $340.0 - $415.0 Adjustments: + Non-cash amortization charges 64.0 Intangible Asset Amortization, Other Income + Changes in fair value of contingent consideration 3.0 COGS + Acquisition-related costs (transaction & integration) 2.0 SG&A Tax effect (14.0) Total adjustments: 55.0 Adjusted net income $395.0 - $470.0

Reconciliation of Net Income to Adjusted EBITDA – 1Q21 vs. 1Q20 21 1Q 2021 Investor UpdateAPPENDIX (in millions) Three Months Ended March 31, 2021 2020 Net income (loss) $69.7 $(12.5) Adjustments: + Depreciation & amortization 28.7 28.2 + Provision for income taxes 15.5 (8.8) + Total interest expense, net* 8.3 7.8 + Change in fair value of contingent consideration 1.1 0.6 + Acquisition-related costs (transaction & integration) 0.2 --- Total adjustments 53.8 27.8 Adjusted EBITDA $123.5 $15.3

Reconciliation of Net Income to Adjusted EBITDA – 2021 Forecast 22 1Q 2021 Investor UpdateAPPENDIX (in millions) Full Year Forecast 2021F Net income $340.0 - $415.0 Adjustments: + Depreciation & amortization 129.0 + Income taxes 114.0 – 139.0 + Total interest expense 32.0 + Change in fair value of contingent consideration 3.0 + Acquisition-related costs (transaction & integration) 2.0 Total adjustments 280.0 – 305.0 Adjusted EBITDA $620.0 – $720.0

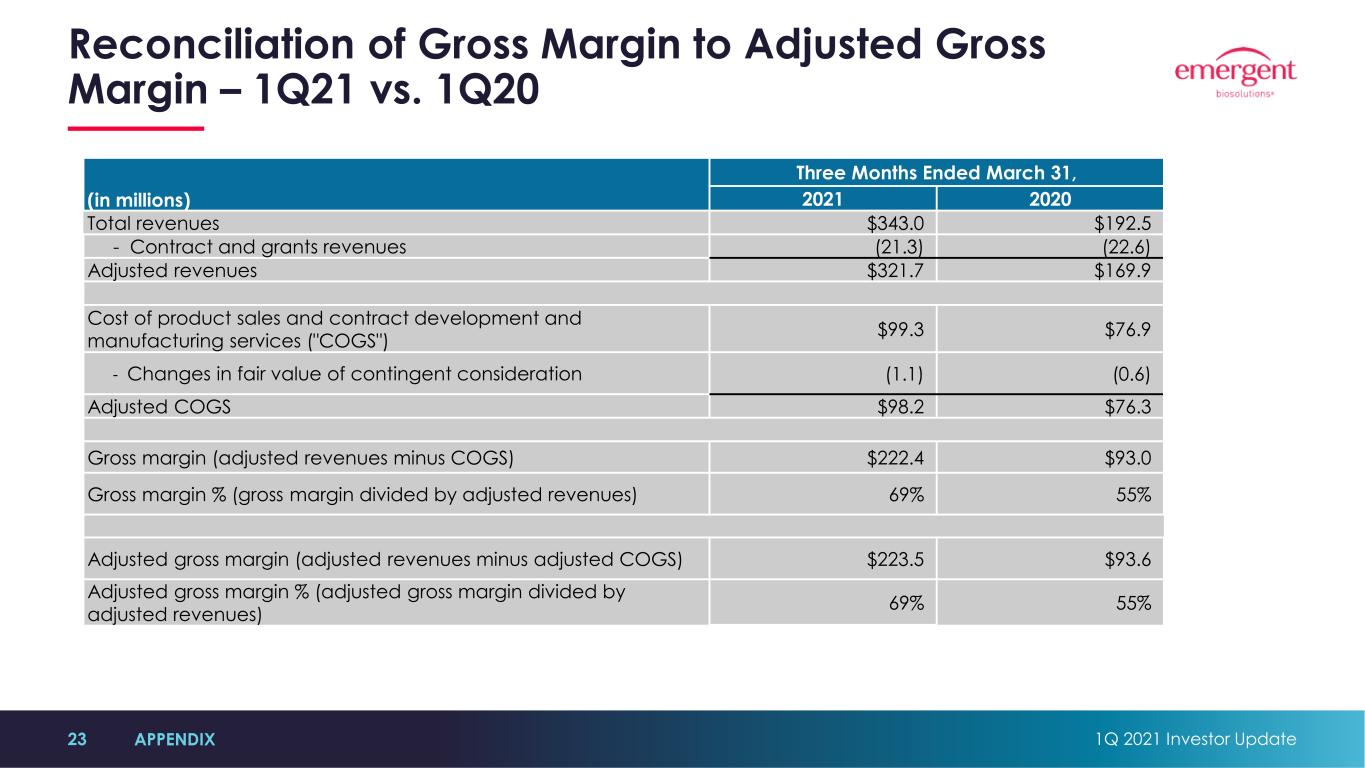

Reconciliation of Gross Margin to Adjusted Gross Margin – 1Q21 vs. 1Q20 23 1Q 2021 Investor UpdateAPPENDIX (in millions) Three Months Ended March 31, 2021 2020 Total revenues $343.0 $192.5 - Contract and grants revenues (21.3) (22.6) Adjusted revenues $321.7 $169.9 Cost of product sales and contract development and manufacturing services ("COGS") $99.3 $76.9 - Changes in fair value of contingent consideration (1.1) (0.6) Adjusted COGS $98.2 $76.3 Gross margin (adjusted revenues minus COGS) $222.4 $93.0 Gross margin % (gross margin divided by adjusted revenues) 69% 55% Adjusted gross margin (adjusted revenues minus adjusted COGS) $223.5 $93.6 Adjusted gross margin % (adjusted gross margin divided by adjusted revenues) 69% 55%