Attached files

| file | filename |

|---|---|

| EX-99.3 - EX-99.3 - Origin Bancorp, Inc. | a2q2021dividenddeclaration.htm |

| EX-99.1 - EX-99.1 - Origin Bancorp, Inc. | a03312021obnkexhibit991er.htm |

| 8-K - 8-K - Origin Bancorp, Inc. | obnk-20210428.htm |

ORIGIN BANCORP, INC. _______ 1Q TWENTY21 INVESTOR PRESENTATION ORIGIN BANCORP, INC.

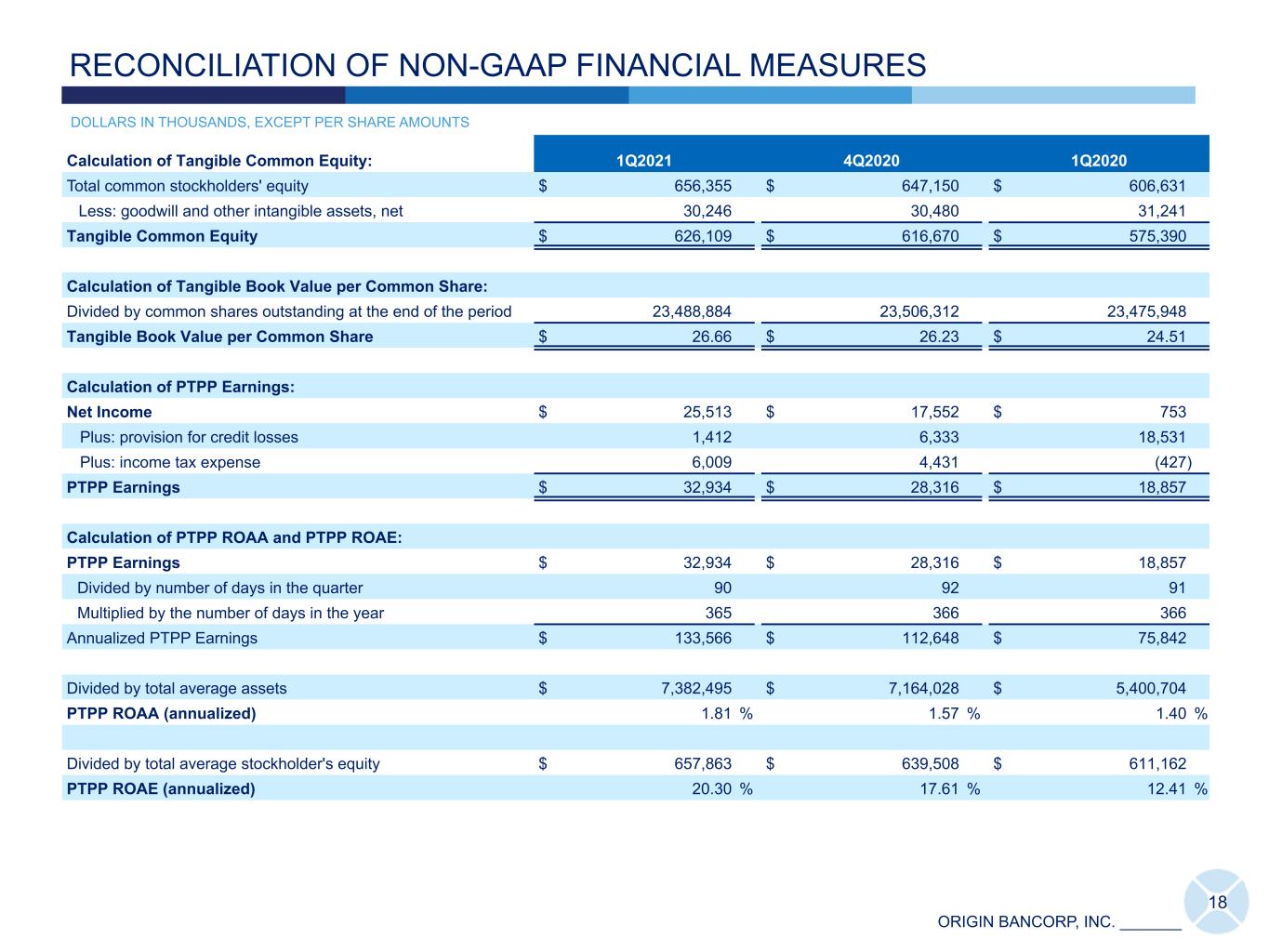

ORIGIN BANCORP, INC. _______ This presentation contains certain forward-looking statements within the meaning of the Private Securities Litigation Reform Act of 1995. Forward-looking statements include information regarding Origin Bancorp, Inc.'s ("Origin" or the "Company") future financial performance, business and growth strategy, projected plans and objectives, including the Company's loan loss reserves and allowance for credit losses related to the COVID-19 pandemic and any expected purchases of its outstanding common stock, and related transactions and other projections based on macroeconomic and industry trends, including expectations regarding and efforts to respond to the COVID-19 pandemic and changes to interest rates by the Federal Reserve and the resulting impact on Origin's results of operations, estimated forbearance amounts and expectations regarding the Company's liquidity, including in connection with advances obtained from the FHLB, which are all subject to change and may be inherently unreliable due to the multiple factors that impact broader economic and industry trends, and any such changes may be material. Such forward-looking statements are based on various facts and derived utilizing important assumptions and current expectations, estimates and projections about Origin and its subsidiaries, any of which may change over time and some of which may be beyond Origin's control. Statements or statistics preceded by, followed by or that otherwise include the words "assumes," "anticipates," "believes," "estimates," "expects," “foresees,” "intends," "plans," "projects," and similar expressions or future or conditional verbs such as "could," "may," “might,” "should," "will," and "would" and variations of such terms are generally forward-looking in nature and not historical facts, although not all forward-looking statements include the foregoing words. Further, certain factors that could affect the Company's future results and cause actual results to differ materially from those expressed in the forward-looking statements include, but are not limited to: the continuing duration and impacts of the COVID-19 global pandemic and continuing development and distribution of COVID-19 vaccines, as well as other efforts to contain the virus's transmission, including the effect of these factors on Origin's business, customers and economic conditions generally as well as the impact of the actions taken by governmental authorities to address the impact of COVID-19 on the United States economy, including, any economic stimulus legislation; deterioration of Origin's asset quality; factors that can impact the performance of Origin's loan portfolio, including real estate values and liquidity in Origin's primary market areas; the financial health of Origin's commercial borrowers and the success of construction projects that Origin finances; changes in the value of collateral securing Origin's loans; Origin's ability to anticipate interest rate changes and manage interest rate risk; the effectiveness of Origin's risk management framework and quantitative models; the risk of widespread inflation; Origin's inability to receive dividends from Origin Bank and to service debt, pay dividends to Origin's common stockholders, repurchase Origin's shares of common stock and satisfy obligations as they become due; business and economic conditions generally and in the financial services industry, nationally and within Origin's primary market areas; changes in Origin's operation or expansion strategy or Origin's ability to prudently manage its growth and execute its strategy; changes in management personnel; Origin's ability to maintain important customer relationships, reputation or otherwise avoid liquidity risks; increasing costs as Origin grows deposits; operational risks associated with Origin's business; volatility and direction of market interest rates; increased competition in the financial services industry, particularly from regional and national institutions; difficult market conditions and unfavorable economic trends in the United States generally, and particularly in the market areas in which Origin operates and in which its loans are concentrated; an increase in unemployment levels and slowdowns in economic growth; Origin's level of nonperforming assets and the costs associated with resolving any problem loans including litigation and other costs; the credit risk associated with the substantial amount of commercial real estate, construction and land development, and commercial loans in Origin's loan portfolio; changes in laws, rules, regulations, interpretations or policies relating to financial institutions, and potential expenses associated with complying with such regulations; periodic changes to the extensive body of accounting rules and best practices; further government intervention in the U.S. financial system; compliance with governmental and regulatory requirements, including the Dodd-Frank Wall Street Reform and Consumer Protection Act and others relating to banking, consumer protection, securities and tax matters; Origin's ability to comply with applicable capital and liquidity requirements, including its ability to generate liquidity internally or raise capital on favorable terms, including continued access to the debt and equity capital markets; changes in the utility of Origin's non-GAAP liquidity measurements and its underlying assumptions or estimates; uncertainty regarding the future of the London Interbank Offered Rate and the impact of any replacement alternatives on Origin's business; possible changes in trade, monetary and fiscal policies, laws and regulations and other activities of governments, agencies and similar organizations; natural disasters and adverse weather events, acts of terrorism, an outbreak of hostilities, regional or national protests and civil unrest (including any resulting branch closures or property damage), widespread illness or public health outbreaks or other international or domestic calamities, and other matters beyond Origin's control; and system failures, cybersecurity threats and/or security breaches and the cost of defending against them. For a discussion of these and other risks that may cause actual results to differ from expectations, please refer to the sections titled "Cautionary Note Regarding Forward-Looking Statements" and "Risk Factors" in Origin's most recent Annual Report on Form 10-K filed with the Securities and Exchange Commission ("SEC") and any updates to those sections set forth in Origin's subsequent Quarterly Reports on Form 10-Q and Current Reports on Form 8-K. If one or more events related to these or other risks or uncertainties materialize, or if Origin's underlying assumptions prove to be incorrect, actual results may differ materially from what Origin anticipates. Accordingly, you should not place undue reliance on any forward-looking statements. Any forward-looking statement speaks only as of the date on which it is made, and Origin does not undertake any obligation to publicly update or review any forward-looking statement, whether as a result of new information, future developments or otherwise. New risks and uncertainties arise from time to time, and it is not possible for Origin to predict those events or how they may affect Origin. In addition, Origin cannot assess the impact of each factor on Origin's business or the extent to which any factor, or combination of factors, may cause actual results to differ materially from those contained in any forward-looking statements. All forward-looking statements, expressed or implied, included in this communication are expressly qualified in their entirety by this cautionary statement. This cautionary statement should also be considered in connection with any subsequent written or oral forward-looking statements that Origin or persons acting on Origin's behalf may issue. Annualized, pro forma, adjusted projected and estimated numbers are used for illustrative purpose only, are not forecasts and may not reflect actual results. Furthermore, many of these risks and uncertainties are currently amplified by and may continue to be amplified by or may, in the future, be amplified by, the COVID-19 pandemic and the impact of varying governmental responses, including any future economic stimulus legislation that affect Origin's customers and the economies where they operate. Origin reports its results in accordance with United States generally accepted accounting principles ("GAAP"). However, management believes that certain supplemental non-GAAP financial measures used in managing its business may provide meaningful information to investors about underlying trends in its business. Management uses these non-GAAP measures to evaluate the Company's operating performance and believes that these non-GAAP measures provide information that is important to investors and that is useful in understanding Origin's results of operations. However, non-GAAP financial measures are supplemental and should be viewed in addition to, and not as an alternative for, Origin's reported results prepared in accordance with GAAP. The following are the non-GAAP measures used in this presentation: • Tangible common equity is defined as total common stockholders' equity less goodwill and other intangible assets, net • Tangible book value per common share is determined by dividing tangible common equity by common shares outstanding at the end of the period • Pre-tax, pre-provision earnings is calculated by adding provision for credit losses and income tax expense to net income • Pre-tax, pre-provision return on average assets is calculated by dividing pre-tax, pre-provision earnings by number of days in the quarter, multiplying by the number of days in the year, then dividing by total average assets • Pre-tax, pre-provision return on average stockholder's equity is calculated by dividing pre-tax, pre-provision earnings by number of days in the quarter, multiplying by the number of days in the year, then dividing by total average stockholder's equity See the last slide in this presentation for a reconciliation between the non-GAAP measures used in this presentation and their comparable GAAP numbers. 2 FORWARD-LOOKING STATEMENTS AND NON-GAAP MEASURES

ORIGIN BANCORP, INC. _______ 9 10 19 6 TEXAS Entry: DFW 2008 | Houston 2013 Loans: $2,649 Deposits: $2,917 LOUISIANA Entry: 1912 Loans: $1,470 Deposits: $2,559 DOLLARS IN MILLIONS (1) (2) 3 ORIGIN COMPANY SNAPSHOT • Origin Bancorp, Inc., the holding company for Origin Bank, is headquartered in Ruston, LA • Origin Bank was founded in 1912 • 44 banking centers operating across Texas, Louisiana & Mississippi DEPOSITS & LOANS BY STATE Note: All financial information is as of 3/31/21. (1) Non-market based deposits of $400.6 million are not included in state deposits. (2) Excludes mortgage warehouse loans. MISSISSIPPI Entry: 2010 Loans: $641 Deposits: $469 8% 13% 43% 31% 49% 56% Loans (2)Deposits (1) ICS ICS

ORIGIN BANCORP, INC. _______ 4 A UNIQUE & DEFINED CULTURE

ORIGIN BANCORP, INC. _______ Balance Sheet 1Q2021 4Q2020 1Q2020 Linked Qtr $ Δ Linked Qtr % Δ YoY $ Δ YoY % Δ Total Loans Held For Investment ("LHFI") $ 5,849,760 $ 5,724,773 $ 4,481,185 $ 124,987 2.2 % $ 1,368,575 30.5 % Total Assets 7,563,175 7,628,268 6,049,638 (65,093) (0.9) 1,513,537 25.0 Total Deposits 6,346,194 5,751,315 4,556,246 594,879 10.3 1,789,948 39.3 Tangible Common Equity(1) 626,109 616,670 575,390 9,439 1.5 50,719 8.8 Book Value per Common Share 27.94 27.53 25.84 0.41 1.5 2.10 8.1 Tangible Book Value per Common Share(1) 26.66 26.23 24.51 0.43 1.6 2.15 8.8 Income Statement Net Interest Income 55,239 51,819 42,810 3,420 6.6 12,429 29.0 Provision for Credit Losses 1,412 6,333 18,531 (4,921) (77.7) (17,119) (92.4) Noninterest Income 17,131 15,381 12,144 1,750 11.4 4,987 41.1 Noninterest Expense 39,436 38,884 36,097 552 1.4 3,339 9.3 Net Income 25,513 17,552 753 7,961 45.4 24,760 3,288.2 Pre-Tax, Pre-Provision Earnings ("PTPP")(1) 32,934 28,316 18,857 4,618 16.3 14,077 74.7 Diluted EPS 1.08 0.75 0.03 0.33 44.0 1.05 3,500.0 Dividends Declared per Common Share 0.10 0.10 0.0925 — — 0.01 8.1 Selected Ratios NIM - FTE 3.22 % 3.07 % 3.44 % 15 bp 4.9 -22 bp (6.4) Efficiency Ratio 54.49 57.86 65.69 -337 bp (5.8) -1120 bp (17.0) ROAA (annualized) 1.40 0.97 0.06 43 bp 44.3 134 bp 2,233.3 ROAE (annualized) 15.73 10.92 0.50 481 bp 44.0 1523 bp 3,046.0 PTPP ROAA (annualized)(1) 1.81 1.57 1.40 24 bp 15.3 41 bp 29.3 PTPP ROAE (annualized)(1) 20.30 17.61 12.41 269 bp 15.3 789 bp 63.6 DOLLARS IN THOUSANDS, EXCEPT PER SHARE AMOUNTS 5 (1) As used in this presentation, tangible common equity, tangible book value per common share, PTPP, PTPP ROAA, and PTPP ROAE are non-GAAP financial measures. For a reconciliation of these non-GAAP financial measures to their comparable GAAP measures, see slide 18 of this presentation. FINANCIAL RESULTS - FIRST QUARTER 2021

ORIGIN BANCORP, INC. _______ 6 1,311 1,741 1,956 2,562 2,649 884 1,067 1,127 1,553 1,600 427 674 829 1,009 1,049 DFW Houston 2017 2018 2019 2020 1Q2021 Deposit Trends by Texas Market ($) (1) Loan Trends by Texas Market ($) (2) TEXAS GROWTH STORY Texas Franchise Highlights DOLLARS IN MILLIONS • 19 branches throughout 5 counties in the 4th and 5th largest MSAs in the United States • Texas franchise represents 56% of LHFI, excluding mortgage warehouse loans, and 49% of deposits(1) at March 31, 2021 1,171 1,395 1,854 2,574 2,917 647 772 989 1,581 1,875524 623 865 993 1,042 DFW Houston 2017 2018 2019 2020 1Q2021 CAGR 2 4.2% CAG R 32. 4% (1) Non-market based deposits of $400.6 million are not included in state deposits. (2) Excludes mortgage warehouse loans.

ORIGIN BANCORP, INC. _______ 7 COVID-19 LHFI Forbearances Highlights 6/30/2020 9/30/2020 12/31/2020 3/31/2021 Industry Forbearance Amount $ % of LHFI(1) % Forbearance Amount $ % of LHFI(1) % Forbearance Amount $ % of LHFI(1) % Forbearance Amount $ % of LHFI(1) % Hotel 59,258 92.5 58,482 91.4 21,959 34.7 301 0.5 Non-Essential Retail 82,424 56.2 39,989 26.4 25,177 14.3 — — Restaurant 100,209 74.7 29,619 21.8 7,761 6.6 1,595 1.3 Assisted Living 48,935 34.9 21,625 14.9 11,470 8.1 — — Other 716,340 16.7 147,391 4.8 31,285 2.4 3,397 0.1 Total 1,007,166 21.1 297,106 5.9 97,652 1.9 5,293 0.1 SUPPORTING OUR CUSTOMERS - FORBEARANCE AND PPP LOANS DOLLARS IN THOUSANDS PPP Highlights ISOC ISOC ISOC ISOC ISOC Originations Forgiveness Fees PPP Round Total $ Total # Percent of PPP $ Applied for or Forgiven at 3/31/2021 % Percent of PPP $ Forgiven at 3/31/2021 % Total SBA Fees Received as of 3/31/2021 $ Net Fees Outstanding at 3/31/2021 $ Round 1 570,327 3,445 61.3 28.1 17,040 5,328 Round 2 197,068 1,491 — — 7,277 6,181 Total 767,395 4,936 61.3 28.1 24,317 11,509 (1) LHFI excluding PPP loans.

ORIGIN BANCORP, INC. _______ 8 MOBILE FEATURE ADOPTION RATES(1) SUPPORTING OUR CUSTOMERS - LEVERAGING TECHNOLOGY ZELLE® USERS 54.9% GROWTH ZELLE® TRANSFERS 95.5% GROWTH 32.8% TRANSFER ADOPTION % ORIGIN BANK 29.3% INDUSTRY BENCHMARK 24.3% DEPOSIT ADOPTION % ORIGIN BANK 17.4% INDUSTRY BENCHMARK 7.7% BILL PAY ADOPTION % ORIGIN BANK 5.5% INDUSTRY BENCHMARK (1) All data provided by FIS Metrics Intelligence based upon asset size peer groups for the month of March 2021. REGISTERED APP USERS 14.2% GROWTH MOBILE DEPOSIT TRANSACTIONS 29.5% GROWTH Note: Growth rates compare March 2021 to March 2020. ILT

ORIGIN BANCORP, INC. _______ 9 4,325 4,964 5,376 5,884 1,098 1,579 1,634 1,686 1,701 2,283 2,410 2,704 2,869 3,076 162 224 307 651 437 782 752 731 678 656 5,870 Noninterest-bearing Interest-bearing Brokered Time Deposits 1Q2020 2Q2020 3Q2020 4Q2020 1Q2021 Deposits by State (%)(1)Average Deposits ($) (1)Non-market based deposits are not included in state deposits. DEPOSIT TRENDS 1.98 1.75 1.50 1.20 0.95 1.28 0.79 0.61 0.43 0.37 0.95 0.54 0.42 0.26 Time Deposits Total Interest-bearing Deposits Cost of Total Deposits 1Q2020 2Q2020 3Q2020 4Q2020 1Q2021 Deposit Cost Trends (QTD Annualized) (%) Time Deposit Repricing Schedule * Maturity Balance WAR 2Q2021 $ 173 0.81 % 3Q2021 156 0.69 4Q2021 90 0.72 1Q2022 76 0.67 2Q2022+ 153 1.19 Total $ 648 0.84 % 0.31 0.51 1.05 DOLLARS IN MILLIONS 33 39 44 46 49 50 50 45 45 43 17 11 11 9 8 Texas Louisiana Mississippi 2017 2018 2019 2020 1Q2021 0.42 0.29% 0.26 0.260.39 IDT * Target time deposit rates 25 basis points or less for new and renewed deposits.

ORIGIN BANCORP, INC. _______ Real Estate & Construction: 5% Office Building: 5% Assisted Living: 3% Non-Essential Retail Shopping: 3% Other Healthcare: 2% Essential Retail Shopping: 2% Multi-family: 2% Hotel: 1% Misc: 3% Mtg. Warehouse: 21% Real Estate & Construction: 8% Finance & Insurance: 6% Transportation: 2% Retail Dealer: 2% Healthcare: 2% Restaurants: 2% Banks: 2% Professional Svc: 1% Customer Svc: 1% Commercial Svc: 1% Entertainment: 1% Wholesale Distribution: 1% Misc: 6% Owner Occupied Construction/Land/Land Development ("C&D"): 2% Owner Occupied Commercial Real Estate ("CRE"): 9% 10 WELL DIVERSIFIED LOAN PORTFOLIO (Dollars in thousands) 1Q2020 2Q2020 3Q2020 4Q2020 1Q2021 C&I excl. PPP $ 1,455,497 $ 1,313,405 $ 1,263,279 $ 1,271,343 $ 1,250,350 Owner Occupied C&D 122,928 120,776 100,589 100,755 104,415 Owner Occupied CRE 463,834 459,661 495,366 460,524 483,624 Mtg. Warehouse 437,257 769,157 1,017,501 1,084,001 1,090,347 Total Commercial 2,479,516 2,662,999 2,876,735 2,916,623 2,928,736 Non-Owner Occupied C&D 440,892 449,256 460,268 431,105 443,821 Non-Owner Occupied CRE 838,686 864,093 872,550 927,415 971,025 Residential Real Estate 703,263 769,354 832,055 885,120 904,753 Consumer Loans 18,828 17,363 18,729 17,991 17,277 PPP Loans — 549,129 552,329 546,519 584,148 Total Loans $ 4,481,185 $ 5,312,194 $ 5,612,666 $ 5,724,773 $ 5,849,760 Loan Portfolio Details Non-Owner Occupied C&D and CRE: (1) $1,415 C&I, Owner Occupied C&D and CRE, Mtg. Warehouse: (1) $2,929 C&I, Owner Occupied C&D and CRE, Mtg. Warehouse: 56% Non-Owner Occupied C&D and CRE: 26% (1) Does not include loans held for sale or PPP loans. Loan Composition at 3/31/2021: (1) $5,266 Commercial & Industrial ("C&I"): 24% Mtg. Warehouse: 21% Non- Owner Occupied C&D: 8% Residential Real Estate and Consumer: 18% Non-Owner Occupied CRE: 18% DOLLARS IN MILLIONS ILP

ORIGIN BANCORP, INC. _______ 11 LHFI(2) at 3/31/2021 Non-Essential Retail: 3.4% Assisted Living: 2.8% Restaurant: 2.3% Hotel: 1.2% All Other LHFI: 90.3% Outstanding Balance (Dollars in thousands) 3/31/2020 6/30/2020 9/30/2020 12/31/2020 3/31/2021 Hotel $ 63,264 $ 64,043 $ 63,951 $ 63,218 $ 62,319 Non-Essential Retail 131,187 146,566 151,201 176,522 180,394 Restaurant 132,430 134,104 135,801 117,844 119,700 Assisted Living 118,790 140,218 144,756 141,657 148,077 Subtotal 445,671 484,931 495,709 499,241 510,490 All other LHFI (2) 4,035,514 4,278,134 4,564,628 4,679,013 4,755,122 Total LHFI (2) $ 4,481,185 $ 4,763,065 $ 5,060,337 $ 5,178,254 $ 5,265,612 DEEP DIVE - SELECTED SECTORS (1) Selected sectors include hotel, non-essential retail, restaurant and assisted living and exclude PPP loans. (2) LHFI excluding PPP loans. (1) SELECTED SECTOR CREDIT METRICS: • Total selected sector past due: $808,000, or 0.16% of total selected sectors; • Total selected sector classified loans: $5.9 million, or 1.16% of total selected sectors; • Total selected sector NPL: $1.1 million, or 0.22% of total selected sectors; • Total selected sector allowance for loan credit losses ("ALCL"): $13.0 million, or 2.55% of total selected sectors; • Total selected sector forbearances: $1.9 million, or 0.37% of total selected sectors. ICDD

ORIGIN BANCORP, INC. _______ 1.70 2.00 2.00 2.10 1.81 Classified Loans / Total Loans excl. PPP Loans (%) Net Charge-Offs / Average LHFI excl. PPP Loans (annualized) (%) 1Q2020 2Q2020 3Q2020 4Q2020 1Q2021 0.11 0.58 0.15 0.14 0.23 0.74 0.63 0.60 0.50 0.63 1.14 0.50 0.58 0.50 0.50 Nonperforming LHFI / LHFI excl. PPP loans (%) Past due LHFI / LHFI excl. PPP loans (%) 1Q2020 2Q2020 3Q2020 4Q2020 1Q2021 12 CREDIT QUALITY Asset Quality Trends (%) Allowance for Loan Credit Losses 56,063 70,468 81,643 86,670 85,136 1.33 1.45 1.51 1.46 1.37 1.75 2.00 2.10 2.02 ALCL ($) ALCL as a percentage of LHFI (%) ALCL as a percentage of LHFI excl. PPP and mtg. warehouse (%) 1Q2020 2Q2020 3Q2020 4Q2020 1Q2021 • Provision expense for the 1Q2021 quarter was $1.4 million, a decline of $4.9 million from 4Q2020, and a $17.1 million decline from 1Q2020. The provision decline is due to: ◦ improvement in forecasted economic conditions ◦ credit quality profile in relation to ALCL • ALCL to nonperforming LHFI is 255.22% at 1Q2021, 331.45% at 4Q2020, and 169.72% at 1Q2020. 1.25

ORIGIN BANCORP, INC. _______ 13 LHFI: Fixed \ Variable (by Index) at 3/31/2021 • The yield on LHFI increased to 3.99% during 1Q2021 due to the PPP forgiveness process which accelerated fee earnings into interest income. • The cost of interest bearing deposits declined six bps, the cost of total deposits declined four bps and the cost of borrowings declined 61 bps during 1Q2021. • Variable rate LHFI made up 59% of total LHFI incl. PPP loans, with 35% based on 1 month LIBOR. Fixed: 41% 1m LIBOR: 35% Prime: 18% Other indices: 6% YIELDS, COSTS AND LHFI PROFILE Yield on LHFI (%) 4.44 3.25 3.25 3.25 3.25 4.85 4.09 4.02 3.89 4.03 4.22 4.20 4.06 3.99 1.40 0.35 0.16 0.15 0.12 Avg. Prime Rate Yield on LHFI Yield on LHFI excl. PPP Loans Avg. 1M LIBOR 1Q2020 2Q2020 3Q2020 4Q2020 1Q2021 Cost of Funds (%) 1.28 0.79 0.61 0.37 1.05 0.65 0.42 0.95 0.54 0.42 0.26 Cost of Interest Bearing Deposits Cost of Total Deposits & Borrowings Cost of Total Deposits 1Q2020 2Q2020 3Q2020 4Q2020 1Q2021 0.47 0.54 0.43 0.31

ORIGIN BANCORP, INC. _______ 14 DOLLARS IN THOUSANDS 42,810 46,290 50,617 51,819 55,239 42,810 43,238 47,187 48,542 49,101 3,052 3,430 3,277 6,138 3.44 3.09 3.18 3.07 3.22 3.15 3.28 3.17 3.15 Net Interest Income excl. PPP ($) PPP Net Interest Income ($) NIM (FTE) (%) NIM (FTE) excl. PPP (%) 1Q2020 2Q2020 3Q2020 4Q2020 1Q2021 • Net interest income increased $3.4 million in 1Q2021 from 4Q2020, and increased $12.4 million in 1Q2021 from 1Q2020. • Interest income on PPP loans contributed the greatest increase in net interest income with $2.8 million in accelerated fees earned through the forgiveness process. PPP accelerated fees contributed 16 bps to the NIM (FTE) in 1Q2021. • NIM (FTE) increased by 15 bps to 3.22% in 1Q2021 from 4Q2020, driven primarily by PPP fees and deposit cost reductions. • Excluding the impact of PPP loans, NIM (FTE) was 3.15% in 1Q2021, compared to 3.17% at 4Q2020. NET INTEREST INCOME AND NIM TRENDS 55,239 51,819 2,861 793 280 (223) (201) (90) 4Q 20 20 PP P Lo an s IB D ep os its C& I e xc l. P PP Re sid en tia l R E Lo an s LH FS Ot he r 1Q 20 21 $45,000 $50,000 $55,000 3.07 0.16 0.04 0.02 (0.02) (0.05) 4Q 20 20 PP P Lo an s IB D ep os its C& I e xc l. P PP Re sid en tia l R E Lo an s Ot he r 1Q 20 21 3.00 3.20 3.40 3.22 Net Interest Income Changes - 1Q2021 ($) NIM Changes - 1Q2021 (%) INIM

ORIGIN BANCORP, INC. _______ 15 12,144 19,076 18,051 15,381 17,131 3,320 2,990 3,268 3,420 3,343 2,769 10,717 9,523 6,594 4,577 3,687 3,109 3,218 2,732 3,771 676 1,527 110 233 348 1,692 733 1,932 2,402 5,092 Service Charges & Fees Mortgage Banking Revenue Insurance Commission & Fee Income Swap Fee Income Other 1Q2020 2Q2020 3Q2020 4Q2020 1Q2021 54,954 65,366 68,668 67,200 72,370 42,810 46,290 50,617 51,819 55,239 12,144 19,076 18,051 15,381 17,131 Net Interest Income Noninterest Income 1Q2020 2Q2020 3Q2020 4Q2020 1Q2021 Noninterest Income ($)Net Interest Income \ Noninterest Income ($) • Noninterest income historically accounts for approximately 20% of total net revenue, but accounted for 24% in 1Q2021 due to gain on sale of securities, limited partnership investment income, and insurance income. • Mortgage banking revenue for the quarter ended 1Q2021 decreased 30.6% from the linked quarter and increased 65.3% from the quarter ended 1Q2020. • Limited partnership investment income was up due to valuation increases as a result of investment performance in two funds. NET REVENUE DISTRIBUTION DOLLARS IN THOUSANDS

ORIGIN BANCORP, INC. _______ 36,097 38,220 38,734 38,884 39,436 21,988 24,045 22,597 22,475 22,325 4,221 4,267 4,263 4,271 4,339 2,003 2,075 2,065 2,178 2,173 1,441 1,344 1,367 1,472 1,454 1,142 1,509 1,809 1,856 1,705 5,302 4,980 6,633 6,632 7,440 Salaries and Employee Benefits Occupancy and Equipment, net Data Processing Office and Operations Loan Related Expenses Other 1Q2020 2Q2020 3Q2020 4Q2020 1Q2021 16 • Operating leverage reflects an overall improving trend in the efficiency ratio, coupled with a decline in the ratio of NIE to average assets primarily as a result of improved mortgage performance in recent quarters. • Existing positive efficiency trends continued. • Other noninterest expense in 1Q2021 included $1.6 million incurred related to the early termination of long-term FHLB advances during the quarter ended March 31, 2021. The Company terminated the advances early due to the relatively high cost of the advances partially funding the payoff with the sale of lower yielding securities during the quarter. • The focus remains on our technology strategy to build efficient scale to support additional organic growth, combined with branch strategy and operational efficiency to support the potential for an ongoing remote working environment. E F F IC E N C Y R A T IO ( % ) 2.69 2.38 2.28 2.16 2.17 65.69 58.47 56.41 57.86 54.49 1Q2020 2Q2020 3Q2020 4Q2020 1Q2021 40% 60% 80% 100% 1.5% 2.0% 2.5% 3.0% Operating Leverage NONINTEREST EXPENSE ANALYSIS N IE / AV E R A G E A S S E T S ( % ) DOLLARS IN THOUSANDS Noninterest Expense Composition ($)

ORIGIN BANCORP, INC. _______ Tier 1 Capital to Average Assets (Leverage Ratio) (%) 10.4 8.8 8.8 9.0 9.0 10.7 9.1 9.2 8.6 8.7 Bank Level Company Level 1Q2020 2Q2020 3Q2020 4Q2020 1Q2021 Tier 1 Capital to Risk-Weighted Assets (%) 10.7 10.1 9.6 10.5 10.7 11.0 10.5 10.1 10.1 10.3 Bank Level Company Level 1Q2020 2Q2020 3Q2020 4Q2020 1Q2021 17 CAPITAL Bank Level Company Level Sub-debt Impact Total Capital to Risk-Weighted Assets (%) 13.0 12.5 12.0 12.9 13.1 13.4 12.9 12.5 13.8 13.9 Bank Level Company Level 1Q2020 2Q2020 3Q2020 4Q2020 1Q2021 Total Capital to Risk-Weighted Assets Changes - 1Q2021 (%) 13.79% 0.44 (0.17) (0.06) (0.04) (0.02) (0.02) 4Q 20 20 Ne t I nc om e ex cl. Cr ed it L os s A cc ru als Lo an G ro wt h inc l. M LH FS Ot he r Di vid en ds M or tg ag e Se rv ici ng R igh ts St oc k R ep ur ch as es 1Q 20 21 10.00% 12.50% 15.00% 13.92% ICap

ORIGIN BANCORP, INC. _______ Calculation of Tangible Common Equity: 1Q2021 4Q2020 1Q2020 Total common stockholders' equity $ 656,355 $ 647,150 $ 606,631 Less: goodwill and other intangible assets, net 30,246 30,480 31,241 Tangible Common Equity $ 626,109 $ 616,670 $ 575,390 Calculation of Tangible Book Value per Common Share: Divided by common shares outstanding at the end of the period 23,488,884 23,506,312 23,475,948 Tangible Book Value per Common Share $ 26.66 $ 26.23 $ 24.51 Calculation of PTPP Earnings: Net Income $ 25,513 $ 17,552 $ 753 Plus: provision for credit losses 1,412 6,333 18,531 Plus: income tax expense 6,009 4,431 (427) PTPP Earnings $ 32,934 $ 28,316 $ 18,857 Calculation of PTPP ROAA and PTPP ROAE: PTPP Earnings $ 32,934 $ 28,316 $ 18,857 Divided by number of days in the quarter 90 92 91 Multiplied by the number of days in the year 365 366 366 Annualized PTPP Earnings $ 133,566 $ 112,648 $ 75,842 Divided by total average assets $ 7,382,495 $ 7,164,028 $ 5,400,704 PTPP ROAA (annualized) 1.81 % 1.57 % 1.40 % Divided by total average stockholder's equity $ 657,863 $ 639,508 $ 611,162 PTPP ROAE (annualized) 20.30 % 17.61 % 12.41 % 18 DOLLARS IN THOUSANDS, EXCEPT PER SHARE AMOUNTS RECONCILIATION OF NON-GAAP FINANCIAL MEASURES