Attached files

| file | filename |

|---|---|

| EX-99.4 - EX-99.4 - Synchrony Financial | non-gaapmeasures1q21.htm |

| EX-99.2 - EX-99.2 - Synchrony Financial | financialtables1q21.htm |

| EX-99.1 - EX-99.1 - Synchrony Financial | earningsrelease1q21.htm |

| 8-K - 8-K - Synchrony Financial | syf-20210427.htm |

1Q’21 FINANCIAL RESULTS A P R I L 2 7 , 2 0 2 1 Exhibit 99.3

2 Cautionary Statement Regarding Forward-Looking Statements The following slides are part of a presentation by Synchrony Financial in connection with reporting quarterly financial results. No representation is made that the information in these slides is complete. For additional information, see the earnings release and financial supplement included as exhibits to our Current Report on Form 8-K filed today and available on our website (www.synchronyfinancial.com) and the SEC's website (www.sec.gov). All references to net earnings and net income are intended to have the same meaning. All comparisons are for the first quarter of 2021 compared to the first quarter of 2020, unless otherwise noted. This presentation contains certain forward-looking statements as defined in Section 27A of the Securities Act of 1933, as amended, and Section 21E of the Securities Exchange Act of 1934, as amended, which are subject to the "safe harbor" created by those sections. Forward-looking statements may be identified by words such as "expects," "intends," "anticipates," "plans," "believes," "seeks," "targets," "outlook," "estimates," "will," "should," "may" or words of similar meaning, but these words are not the exclusive means of identifying forward-looking statements. Forward- looking statements are based on management's current expectations and assumptions, and are subject to inherent uncertainties, risks and changes in circumstances that are difficult to predict. As a result, actual results could differ materially from those indicated in these forward-looking statements. Factors that could cause actual results to differ materially include global political, economic, business, competitive, market, regulatory and other factors and risks, such as: the impact of macroeconomic conditions and whether industry trends we have identified develop as anticipated, including the future impacts of the novel coronavirus disease (“COVID-19”) outbreak and measures taken in response thereto for which future developments are highly uncertain and difficult to predict; retaining existing partners and attracting new partners, concentration of our revenue in a small number of Retail Card partners, and promotion and support of our products by our partners; cyber-attacks or other security breaches; disruptions in the operations of our and our outsourced partners' computer systems and data centers; the financial performance of our partners; the sufficiency of our allowance for credit losses and the accuracy of the assumptions or estimates used in preparing our financial statements, including those related to the CECL accounting guidance; higher borrowing costs and adverse financial market conditions impacting our funding and liquidity, and any reduction in our credit ratings; our ability to grow our deposits in the future; damage to our reputation; our ability to securitize our loan receivables, occurrence of an early amortization of our securitization facilities, loss of the right to service or subservice our securitized loan receivables, and lower payment rates on our securitized loan receivables; changes in market interest rates and the impact of any margin compression; effectiveness of our risk management processes and procedures, reliance on models which may be inaccurate or misinterpreted, our ability to manage our credit risk; our ability to offset increases in our costs in retailer share arrangements; competition in the consumer finance industry; our concentration in the U.S. consumer credit market; our ability to successfully develop and commercialize new or enhanced products and services; our ability to realize the value of acquisitions and strategic investments; reductions in interchange fees; fraudulent activity; failure of third-parties to provide various services that are important to our operations; international risks and compliance and regulatory risks and costs associated with international operations; alleged infringement of intellectual property rights of others and our ability to protect our intellectual property; litigation and regulatory actions; our ability to attract, retain and motivate key officers and employees; tax legislation initiatives or challenges to our tax positions and/or interpretations, and state sales tax rules and regulations; regulation, supervision, examination and enforcement of our business by governmental authorities, the impact of the Dodd-Frank Wall Street Reform and Consumer Protection Act (the “Dodd-Frank Act”) and other legislative and regulatory developments and the impact of the Consumer Financial Protection Bureau’s (the “CFPB”) regulation of our business; impact of capital adequacy rules and liquidity requirements; restrictions that limit our ability to pay dividends and repurchase our common stock, and restrictions that limit the Bank’s ability to pay dividends to us; regulations relating to privacy, information security and data protection; use of third-party vendors and ongoing third-party business relationships; and failure to comply with anti-money laundering and anti-terrorism financing laws. For the reasons described above, we caution you against relying on any forward-looking statements, which should also be read in conjunction with the other cautionary statements that are included elsewhere in this presentation and in our public filings, including under the heading “Risk Factors Relating to Our Business” and “Risk Factors Relating to Regulation” in the Company's Annual Report on Form 10-K for the fiscal year ended December 31, 2020, as filed on February 11, 2021. You should not consider any list of such factors to be an exhaustive statement of all the risks, uncertainties, or potentially inaccurate assumptions that could cause our current expectations or beliefs to change. Further, any forward-looking statement speaks only as of the date on which it is made, and we undertake no obligation to update or revise any forward-looking statement to reflect events or circumstances after the date on which the statement is made or to reflect the occurrence of unanticipated events, except as otherwise may be required by law. Disclaimers

3 $1.73 DILUTED EPS compared to $0.45 13.98% NET INTEREST MARGIN compared to 15.15% 17.4% CET1 liquid assets of $22.6 billion, 23.6% of total assets SUMMARY FINANCIAL METRICS CAPITAL 1Q’21 Financial Highlights $76.9 billion LOAN RECEIVABLES compared to $82.5 billion 66.3 million AVERAGE ACTIVE ACCOUNTS compared to 72.1 million $328 million CAPITAL RETURNED $200 million of share repurchases $62.7 billion DEPOSITS 81% of funding 3.62% NET CHARGE-OFFS compared to 5.36% 36.1% EFFICIENCY RATIO compared to 32.7%

4 1Q’21 Business Highlights ~60% DIGITAL APPLICATIONS* *Percentage of Total Applications 50% ONLINE SALES* *Percentage of Retail Card Total ~65% DIGITAL PAYMENTS* *1Q’21 % of Total Payments 14% MOBILE CHANNEL APPLICATION GROWTH BUSINESS EXPANSION CONSUMER PERFORMANCE DIGITAL ACCELERATION 4.9 5.0 1Q'20 1Q'21 $445 $524 1Q'20 1Q'21 $1,171 $1,182 1Q'20 1Q'21 3% 18% 1% New Accounts Purchase Volume per Account Average Balance per Account (a) (b) (c)

5 ~$405B Health OOP Expenditures ~$100B Pet Expenditures Ability to leverage our distribution and scale to access both markets to deliver new products, financing alternatives and experiences Market Overview Capitalize on Changing Healthcare and Pet Landscape, Increase Focus on Wellness Core Growth Expansion ‘Vet to Pet’ Continue to unlock growth opportunities in Dental, Veterinary and Specialty Markets Simplify customer and provider experience Extended flexible payments are currently a small component of OOP expense Enhance product offerings to grow core medical Access health systems and practice management systems More points of access to healthcare services Continue integration of Pets Best insurance offering capturing payment synergies Grow presence in pet insurance market Expand into adjacent pet products, services and retail (a) (b) CareCredit – Leading Franchise, Positioned for Growth

6 ~250,000 PROVIDER LOCATIONS up 41% from 1Q’14 >40 NUMBER OF SPECIALTIES expanded into 13 new specialties since 2018 $9.3 billion LOAN RECEIVABLES up 44% from 1Q’14 ENGAGEMENT DEPTH GROWTH 77 NET PROMOTER SCORE over 80% higher than the industry average ~59% REPEAT SALES compared to ~54% in 1Q’19 5.7 million ACTIVE ACCOUNTS up 28% from 1Q’14 13 HEALTH SYSTEMS launched 8 new programs in 2020 >350,000 PETS IN FORCE up 174% since acquisition of Pets Best 92% CUSTOMER SATISFACTION up from 78% in 2009 CareCredit – At a Glance (a) (a)

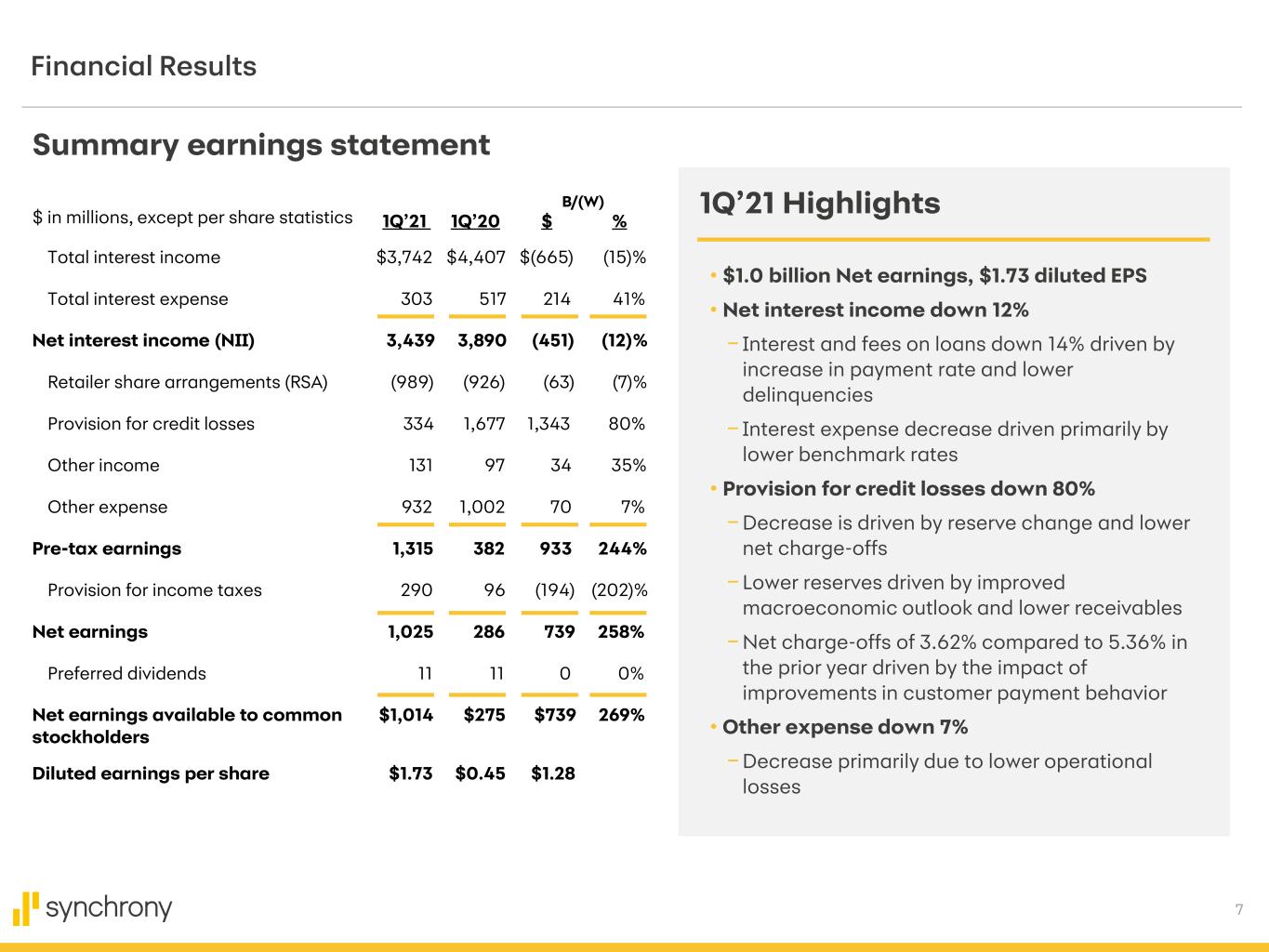

7 Financial Results • $1.0 billion Net earnings, $1.73 diluted EPS • Net interest income down 12% − Interest and fees on loans down 14% driven by increase in payment rate and lower delinquencies − Interest expense decrease driven primarily by lower benchmark rates • Provision for credit losses down 80% −Decrease is driven by reserve change and lower net charge-offs − Lower reserves driven by improved macroeconomic outlook and lower receivables −Net charge-offs of 3.62% compared to 5.36% in the prior year driven by the impact of improvements in customer payment behavior • Other expense down 7% −Decrease primarily due to lower operational losses 1Q’21 Highlights Summary earnings statement Total interest income $3,742 $4,407 $(665) (15)% Total interest expense 303 517 214 41% Net interest income (NII) 3,439 3,890 (451) (12)% Retailer share arrangements (RSA) (989) (926) (63) (7)% Provision for credit losses 334 1,677 1,343 80% Other income 131 97 34 35% Other expense 932 1,002 70 7% Pre-tax earnings 1,315 382 933 244% Provision for income taxes 290 96 (194) (202)% Net earnings 1,025 286 739 258% Preferred dividends 11 11 0 0% Net earnings available to common $1,014 $275 $739 269% stockholders Diluted earnings per share $1.73 $0.45 $1.28 $ in millions, except per share statistics B/(W) 1Q’21 1Q’20 $ %

8 $4,340 $3,732 1Q'20 1Q'21 $82.5 $76.9 1Q'20 1Q'21 $32.0 $34.7 1Q'20 1Q'21 72.1 66.3 1Q'20 1Q'21 8%Purchase volume $ in billions Loan receivables $ in billions Average active accounts in millions Interest and fees on loans $ in millions $94.0 $4,686 $44.0 75.1 Dual Card / Co-Brand $12.3 (10)%6% Dual Card / Co-Brand$13.0 $19.9 $17.9 Growth Metrics (7)% (8)% (14)%

9 $19.7 $20.0 1Q '2 1 1Q '2 0 $47.9 $52.4 1Q '2 1 1Q '2 0 Platform Results CareCredit Loan receivables, $ in billions (8)% $9.3 $10.1 1Q '2 1 1Q '2 0 Payment Solutions Loan receivables, $ in billions (1)% Retail Card Loan receivables, $ in billions (9)% Accounts $23.9 53.0 $3,037 $26.5 49.1 $2,547 11% (7)% (16)% V% Purchase volume Interest and fees on loans 1Q’211Q’20 Accounts (a) • Receivable reduction primarily due to 2020 shutdowns and higher payment rates. Broad-based strength in purchase volume. • Interest and fees on loans down 16% driven primarily by lower loan receivables and lower yield. • Receivable reduction primarily due to 2020 shutdowns and higher payment rates. Continued strength in Power Sports and Home Specialty. • Interest and fees on loans down 11% driven by lower late fees, finance charges, and merchant discount. • Receivable reduction primarily due to 2020 shutdowns and higher payment rates. • Interest and fees on loans down 7% driven primarily by lower late fees and merchant discount. $5.4 12.7 $706 $5.6 11.5 $627 3% (9)% (11)% V% Purchase volume Interest and fees on loans 1Q’211Q’20 Accounts $2.7 6.4 $597 $2.6 5.7 $558 (0)% (11)% (7)% V% Purchase volume Interest and fees on loans 1Q’211Q’20 Accounts

10 Net Interest Income Net Interest Income $ in millions % of average interest-earning assets (12)% • Net interest income decreased 12% −Driven by lower finance charges and late fees • Net interest margin (NIM) down 117 bps − Loan receivables yield: (111) bps o Receivables yield of 19.32%, down 135 bps, driven by higher payment rates and lower delinquencies −Mix of Interest-earnings assets: (61) bps o Receivable mix decreased as a percent of total Earning Assets to 78.6% from 81.7% − Liquidity portfolio yield: (23) bps − Interest-bearing liabilities cost: 78 bps o Total cost decreased by 93 bps to 1.57% due primarily to lower benchmark rates • 1Q’21 payment rate is ~200 bps higher compared to 5-year historical average 1Q’21 Highlights $3,890 $3,439 15.15% 13.98% 1Q'20 1Q'21 1Q’20 NIM 15.15% Loan receivables yield (1.11)% Mix of Interest-earning assets (0.61)% Liquidity portfolio yield (0.23)% Interest-bearing liabilities cost 0.78% 1Q’21 NIM 13.98% NIM Walk 17.8% 15.8% 19.4% 15.6% 15.2% 15.9% Jan '21 Feb '21 Mar '21 Avg. (‘16- ‘20) Payment Rate Trends (a)

11 Asset Quality Metrics Allowance for credit losses (a) $ in millions, % of period-end loan receivables $3,957 $3,625 $3,723 $3,874 $3,500 $2,453 $2,100 $2,514 $2,175 4.92% 4.43% 4.47% 4.44% 4.24% 3.13% 2.67% 3.07% 2.83% 1Q'19 2Q'19 3Q'19 4Q'19 1Q'20 2Q'20 3Q'20 4Q'20 1Q'21 $1,344 $1,331 $1,221 $1,109 $1,125 $1,046 $866 $631 $699 6.06% 6.01% 5.35% 5.15% 5.36% 5.35% 4.42% 3.16% 3.62% 1Q'19 2Q'19 3Q'19 4Q'19 1Q'20 2Q'20 3Q'20 4Q'20 1Q'21 Net charge-offs $ in millions, % of average loan receivables including held for sale 30+ days past due $ in millions, % of period-end loan receivables $2,019 $1,768 $1,723 $1,877 $1,735 $1,384 $973 $1,143 $1,170 2.51% 2.16% 2.07% 2.15% 2.10% 1.77% 1.24% 1.40% 1.52% 1Q'19 2Q'19 3Q'19 4Q'19 1Q'20 2Q'20 3Q'20 4Q'20 1Q'21 90+ days past due $ in millions, % of period-end loan receivables $5,942 $5,809 $5,607 $5,602 $9,175 $9,802 $10,146 $10,265 $9,901 7.39% 7.10% 6.74% 6.42% 11.13% 12.52% 12.92% 12.54% 12.88% 1Q'19 2Q'19 3Q'19 4Q'19 1Q'20 2Q'20 3Q'20 4Q'20 1Q'21

12 Other Expense $1,002 $932 1Q'20 1Q'21 Other Expense $ in millions (7)% Other expense down 7% • Decrease primarily due to lower operational losses, lower Marketing and Business Development costs partially offset by Employee costs Efficiency ratio 36.1% vs. 32.7% prior year • Increase driven by lower revenue partially offset by reduction in Other expense V$ V% Employee costs $324 $364 $40 12% Professional fees 197 190 (7) (4)% Marketing/BD 111 95 (16) (14)% Information processing 123 131 8 7% Other 247 152 (95) (38)% Other expense $1,002 $932 $(70) (7)% Efficiency(a) 32.7% 36.1% 3.4 pts. 1Q’20 1Q’21 1Q’21 Highlights

13 Funding, Capital and Liquidity Funding Sources $ in billions Deposits Securitization Unsecured $64.6 $62.7 $9.3 $7.2 $8.0 $8.0 1Q'20 1Q'21 $81.9 $77.9 Deposits Securitization Unsecured V$ $0 $(2.1) $(1.9) V% Liquidity (a) $ in billions $24.8 $28.0 1Q'20 1Q'21 Liquid assets Undrawn credit facilities Total liquidity % of Total assets CET1 Capital Ratio 14.3% 17.4% 1Q'20 1Q'21 Tier 1 Capital Ratio 15.2% 18.3% 1Q'20 1Q'21 Total Capital Ratio 16.5% 19.7% 1Q'20 1Q'21 Tier 1 Capital + Credit Loss Reserve Ratio 24.1% 28.7% 1Q'20 1Q'21 Capital Ratios (b) 79% 11% 10% 81% 9% 10% +2 pts. (2) pts. 0 pt. $19.2 5.6 $24.8 25.3% $22.6 5.4 $28.0 29.2% *The “Tier 1 Capital + Credit Loss Reserve Ratio” is the sum of our “Tier 1 Capital” and “Allowance for Credit Losses,” divided by our “Total Risk-Weighted Assets.” Tier 1 Capital and Risk- Weighted Assets are adjusted to reflect the fully phased-in impact of CECL. These adjusted metrics are non-GAAP measures, see non-GAAP reconciliation in appendix *

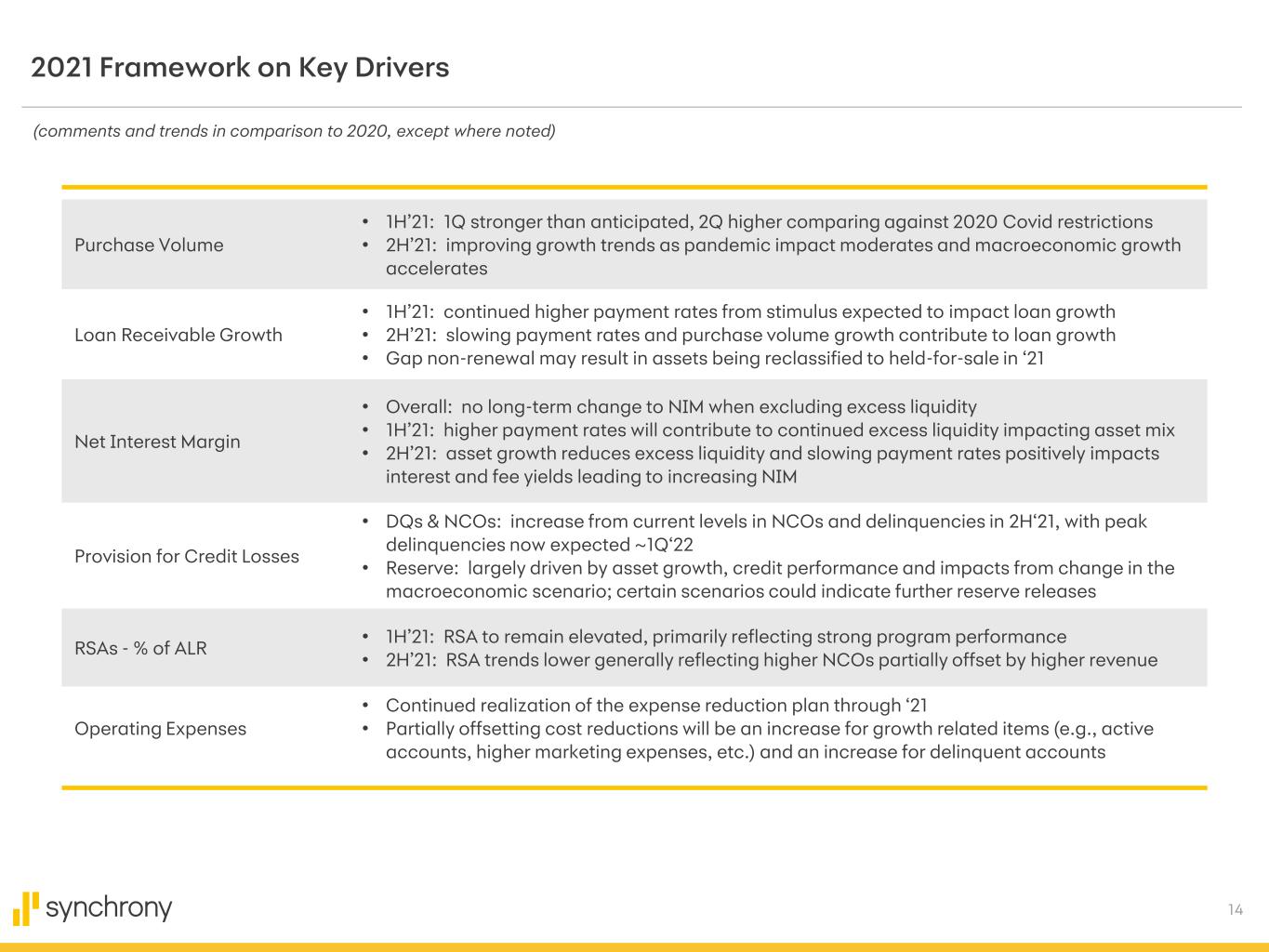

14 2021 Framework on Key Drivers Purchase Volume • 1H’21: 1Q stronger than anticipated, 2Q higher comparing against 2020 Covid restrictions • 2H’21: improving growth trends as pandemic impact moderates and macroeconomic growth accelerates Loan Receivable Growth • 1H’21: continued higher payment rates from stimulus expected to impact loan growth • 2H’21: slowing payment rates and purchase volume growth contribute to loan growth • Gap non-renewal may result in assets being reclassified to held-for-sale in ‘21 Net Interest Margin • Overall: no long-term change to NIM when excluding excess liquidity • 1H’21: higher payment rates will contribute to continued excess liquidity impacting asset mix • 2H’21: asset growth reduces excess liquidity and slowing payment rates positively impacts interest and fee yields leading to increasing NIM Provision for Credit Losses • DQs & NCOs: increase from current levels in NCOs and delinquencies in 2H‘21, with peak delinquencies now expected ~1Q‘22 • Reserve: largely driven by asset growth, credit performance and impacts from change in the macroeconomic scenario; certain scenarios could indicate further reserve releases RSAs - % of ALR • 1H’21: RSA to remain elevated, primarily reflecting strong program performance • 2H’21: RSA trends lower generally reflecting higher NCOs partially offset by higher revenue Operating Expenses • Continued realization of the expense reduction plan through ‘21 • Partially offsetting cost reductions will be an increase for growth related items (e.g., active accounts, higher marketing expenses, etc.) and an increase for delinquent accounts (comments and trends in comparison to 2020, except where noted)

15 Growth accelerates Payment rates remain a headwind Credit outperforms Continue CareCredit Expansion • Purchase volume of $35 billion, +8% • Originated 5 million new accounts, +3% • Leverage digital capabilities • Loan receivables of $77 billion down (7)% • NIM of 13.98% down (117) bps • Delinquencies down (141) bps for 30+ (58) bps for 90+ • NCOs down (174) bps • Capitalize on changing Healthcare and Pet Landscape • Deliver new products, financing alternatives and experiences 1Q’21 Key Business Themes

16 Footnotes 1Q’21 Business Highlights | slide 4: (a) New Accounts represent accounts that were approved in the respective period, in millions. (b) Purchase Volume per Account is calculated as the Purchase volume divided by Average active accounts, in $. (c) Average Balance per Account is calculated as the Average loan receivables divided by Average active accounts, in $. CareCredit: Leading Franchise, Positioned for Growth | slide 5: (a) Total out-of-pocket for human health expenditures per National Health Expenditure Data (2019): Centers for Medicare/Medicaid Services. (b) Total 2020 U.S. Pet Industry Expenditures per The American Pet Products Association (APPA). CareCredit: At a Glance | slide 6: (a) Based on Q3 2020 Cardholder Engagement Study by Chadwick Martin Bailey. Platform Results | slide 9: (a) Accounts represent average active accounts in millions, which are credit card or installment loan accounts on which there has been a purchase, payment or outstanding balance in the current month. Purchase volume $ in billions and Interest and fees on loans $ in millions. Net Interest Income | slide 10: (a) Payment rate is calculated as customer payments divided by beginning of period loan receivables. Payment rate data excludes amounts related to the Walmart portfolio, which was sold in October 2019. Asset Quality Metrics| slide 11: (a) Allowance for credit losses reflects adoption of CECL on January 1, 2020, which included a $3.0 billion increase in reserves upon adoption. Other Expense| slide 12: (a) “Other expense” divided by sum of “NII” plus “Other income” less “Retailer share arrangements (RSA)”. Funding, Capital and Liquidity | slide 13: (a) Does not include unencumbered assets in the Bank that could be pledged. (b) Capital ratios reflect election to delay an estimate of CECL’s effect on regulatory capital for two years in accordance with the interim final rule issued by U.S. banking agencies in March 2020. CET1, Tier 1, and Total Capital Ratio are on a Transition basis.

18 Non-GAAP Reconciliation* $12,405 (2,417) $9,988 9,175 $19,163 $81,639 (2,204) $79,435 The following table sets forth the components of our Tier 1 Capital + Reserve ratio for the periods indicated below. 2020 2021 Total At March 31, Tier 1 capital. . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . Less: CECL transition adjustment. . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . Tier 1 capital (CECL fully phased-in) . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . Add: Allowance for credit losses . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . Tier 1 capital (CECL fully phased-in) plus Reserves for credit losses. Risk-weighted assets . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . Less: CECL transition adjustment . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . Risk-weighted assets (CECL fully phased-in) . . . . . . . . . . . . . . . . . . . . . . $14,115 (2,595) $11,520 9,901 $21,421 $76,965 (2,386) $74,579 * - Estimated at March 31, 2021, $ in millions.