Attached files

| file | filename |

|---|---|

| EX-99.1 - EX-99.1 - STIFEL FINANCIAL CORP | sf-ex991_7.htm |

| 8-K - SF_8K_20210427 - STIFEL FINANCIAL CORP | sf-8k_20210427.htm |

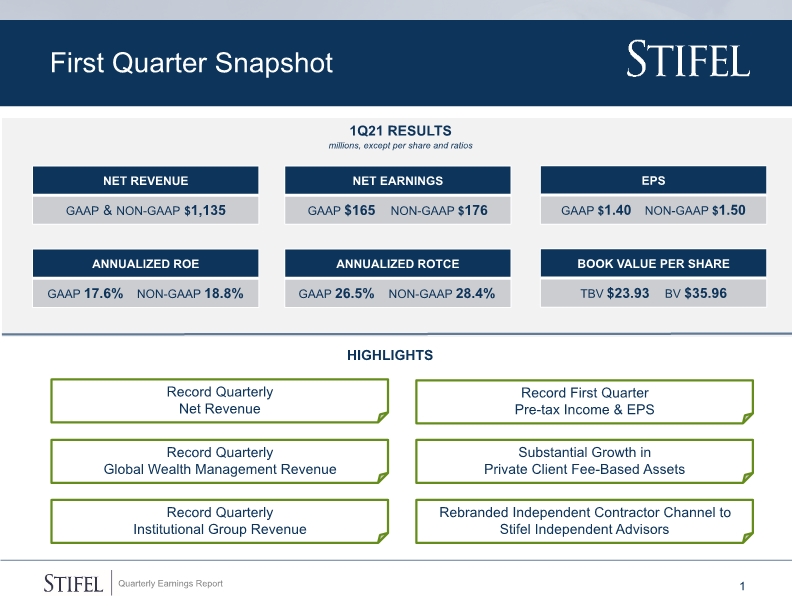

1st Quarter 2021 Financial Results Presentation April 27, 2021 Exhibit 99.2

Record Quarterly Net Revenue First Quarter Snapshot 1 1Q21 Results millions, except per share and ratios HIGHLIGHTS Record First Quarter Pre-tax Income & EPS Record Quarterly Global Wealth Management Revenue Record Quarterly Institutional Group Revenue Rebranded Independent Contractor Channel to Stifel Independent Advisors Substantial Growth in Private Client Fee-Based Assets

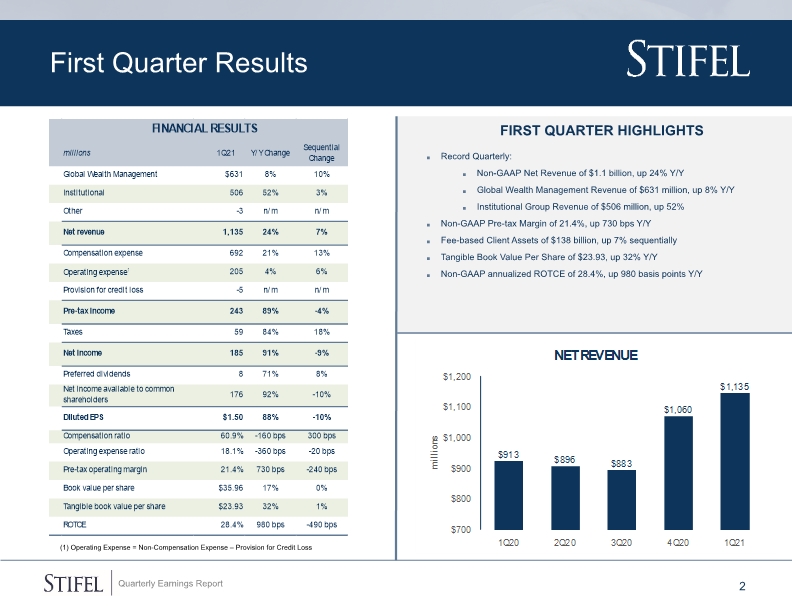

First Quarter Results 2 FIRST QUARTER HIGHLIGHTS Record Quarterly: Non-GAAP Net Revenue of $1.1 billion, up 24% Y/Y Global Wealth Management Revenue of $631 million, up 8% Y/Y Institutional Group Revenue of $506 million, up 52% Non-GAAP Pre-tax Margin of 21.4%, up 730 bps Y/Y Fee-based Client Assets of $138 billion, up 7% sequentially Tangible Book Value Per Share of $23.93, up 32% Y/Y Non-GAAP annualized ROTCE of 28.4%, up 980 basis points Y/Y (1) Operating Expense = Non-Compensation Expense – Provision for Credit Loss)

HIGHLIGHTS Record Quarterly Net Revenue of $631 million, up 8% Y/Y Record Quarterly Wealth Management Revenue, ex. Stifel Bancorp Inc., of $495 million Private Client Fee-based Assets Increased 49% Y/Y Recruited 15 Financial Advisors with total Trailing Twelve Month production of $13 million. Global Wealth Management 3

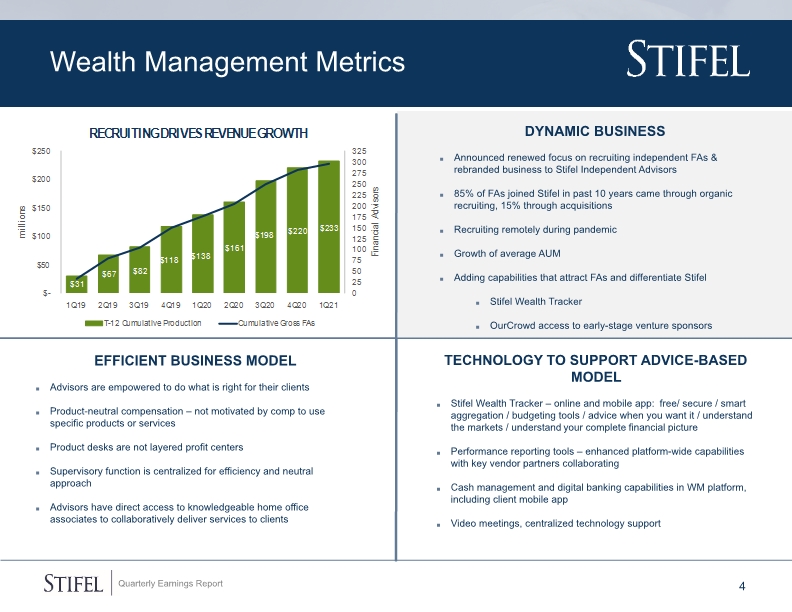

Wealth Management Metrics 4 EFFICIENT BUSINESS MODEL Advisors are empowered to do what is right for their clients Product-neutral compensation – not motivated by comp to use specific products or services Product desks are not layered profit centers Supervisory function is centralized for efficiency and neutral approach Advisors have direct access to knowledgeable home office associates to collaboratively deliver services to clients Technology to support advice-based model Stifel Wealth Tracker – online and mobile app: free/ secure / smart aggregation / budgeting tools / advice when you want it / understand the markets / understand your complete financial picture Performance reporting tools – enhanced platform-wide capabilities with key vendor partners collaborating Cash management and digital banking capabilities in WM platform, including client mobile app Video meetings, centralized technology support DYNAMIC BUSINESS Announced renewed focus on recruiting independent FAs & rebranded business to Stifel Independent Advisors 85% of FAs joined Stifel in past 10 years came through organic recruiting, 15% through acquisitions Recruiting remotely during pandemic Growth of average AUM Adding capabilities that attract FAs and differentiate Stifel Stifel Wealth Tracker OurCrowd access to early-stage venture sponsors

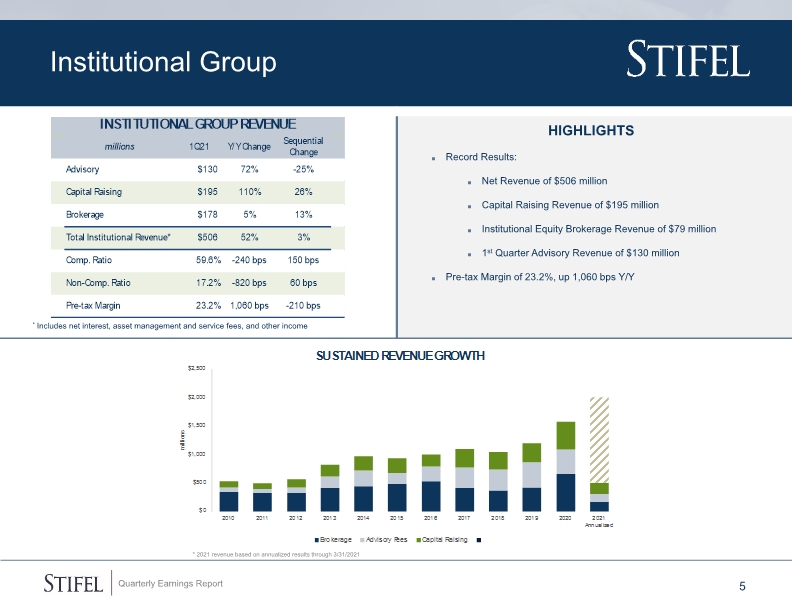

Institutional Group 5 * Includes net interest, asset management and service fees, and other income HIGHLIGHTS Record Results: Net Revenue of $506 million Capital Raising Revenue of $195 million Institutional Equity Brokerage Revenue of $79 million 1st Quarter Advisory Revenue of $130 million Pre-tax Margin of 23.2%, up 1,060 bps Y/Y * 2021 revenue based on annualized results through 3/31/2021

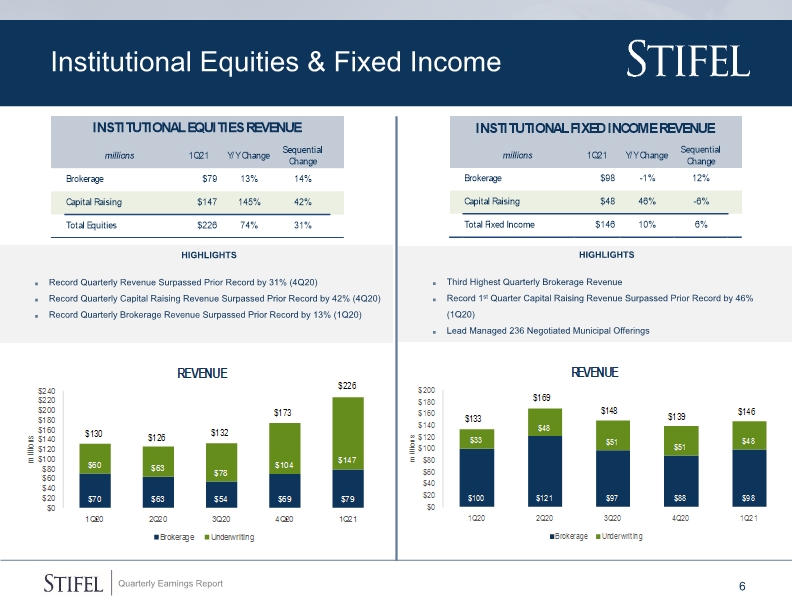

highlights Third Highest Quarterly Brokerage Revenue Record 1st Quarter Capital Raising Revenue Surpassed Prior Record by 46% (1Q20) Lead Managed 236 Negotiated Municipal Offerings Institutional Equities & Fixed Income 6 highlights Record Quarterly Revenue Surpassed Prior Record by 31% (4Q20) Record Quarterly Capital Raising Revenue Surpassed Prior Record by 42% (4Q20) Record Quarterly Brokerage Revenue Surpassed Prior Record by 13% (1Q20) Bar chart header numbers are a graphic

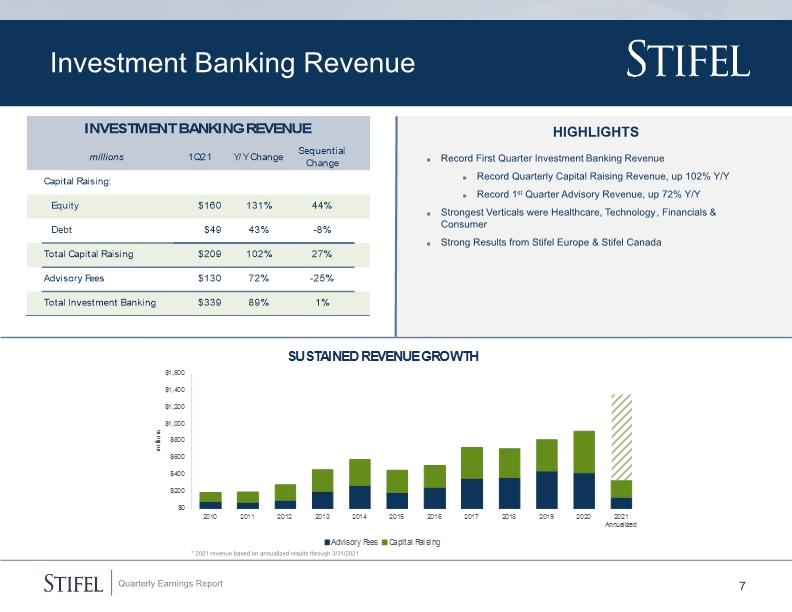

Investment Banking Revenue 7 Highlights Record First Quarter Investment Banking Revenue Record Quarterly Capital Raising Revenue, up 102% Y/Y Record 1st Quarter Advisory Revenue, up 72% Y/Y Strongest Verticals were Healthcare, Technology, Financials & Consumer Strong Results from Stifel Europe & Stifel Canada Bar chart header numbers are a graphic * 2021 revenue based on annualized results through 3/31/2021

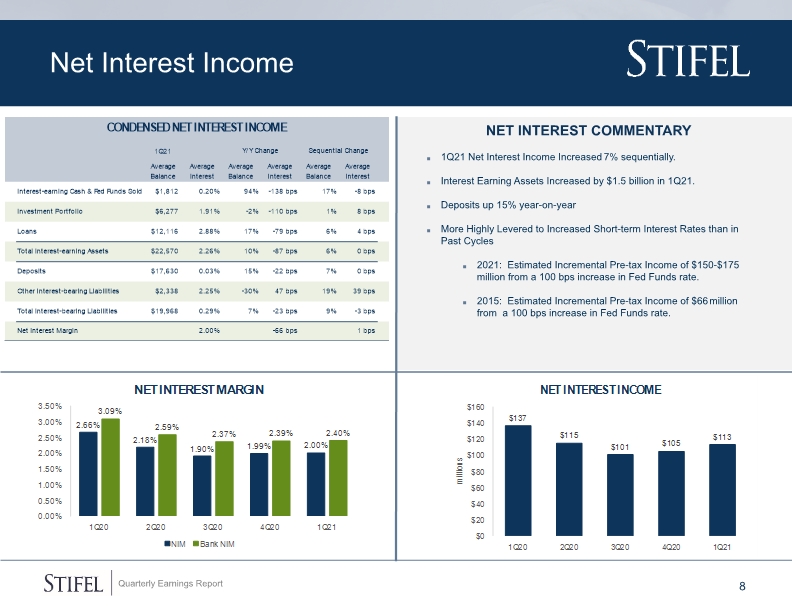

Net Interest Income 8 Net Interest commentary 1Q21 Net Interest Income Increased 7% sequentially. Interest Earning Assets Increased by $1.5 billion in 1Q21. Deposits up 15% year-on-year More Highly Levered to Increased Short-term Interest Rates than in Past Cycles 2021: Estimated Incremental Pre-tax Income of $150-$175 million from a 100 bps increase in Fed Funds rate. 2015: Estimated Incremental Pre-tax Income of $66 million from a 100 bps increase in Fed Funds rate.

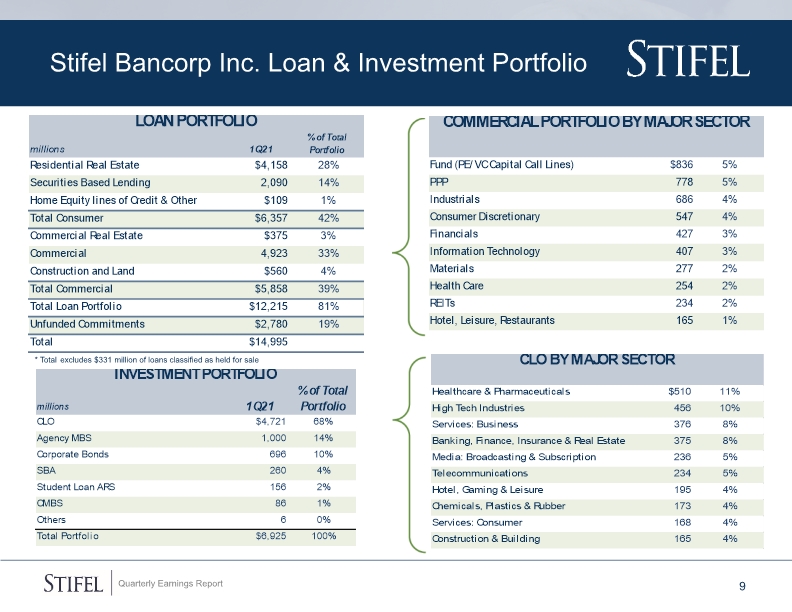

Stifel Bancorp Inc. Loan & Investment Portfolio 9 * Total excludes $331 million of loans classified as held for sale

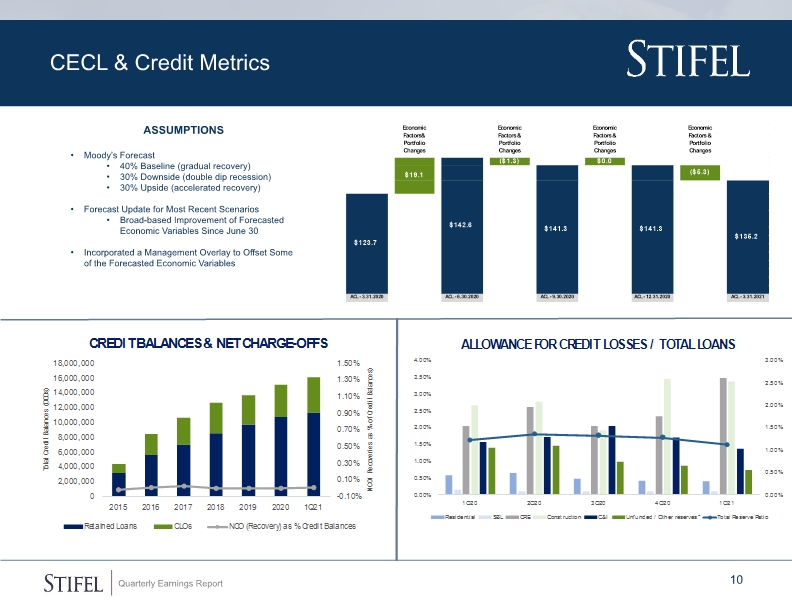

CECL & Credit Metrics 10 ASSUMPTIONS Moody’s Forecast 40% Baseline (gradual recovery) 30% Downside (double dip recession) 30% Upside (accelerated recovery) Forecast Update for Most Recent Scenarios Broad-based Improvement of Forecasted Economic Variables Since June 30 Incorporated a Management Overlay to Offset Some of the Forecasted Economic Variables

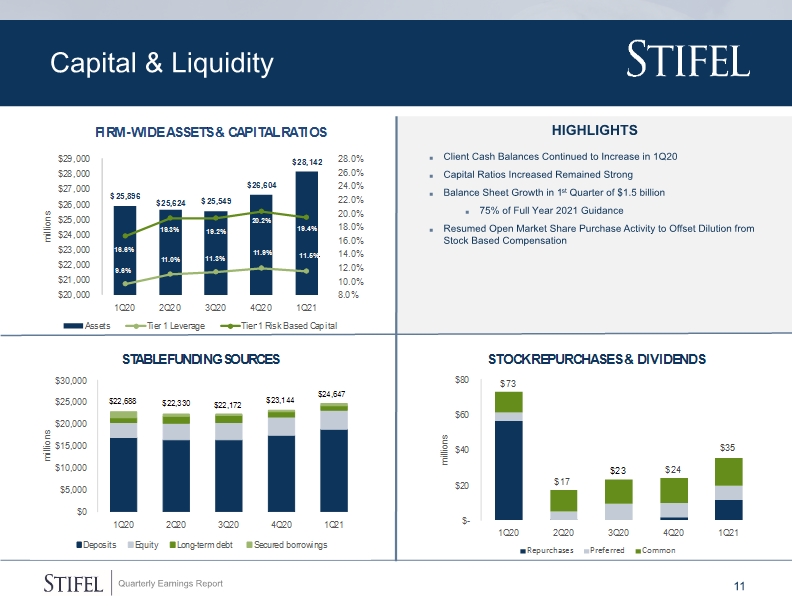

Capital & Liquidity 11 HIGHLIGHTS Client Cash Balances Continued to Increase in 1Q20 Capital Ratios Increased Remained Strong Balance Sheet Growth in 1st Quarter of $1.5 billion 75% of Full Year 2021 Guidance Resumed Open Market Share Purchase Activity to Offset Dilution from Stock Based Compensation

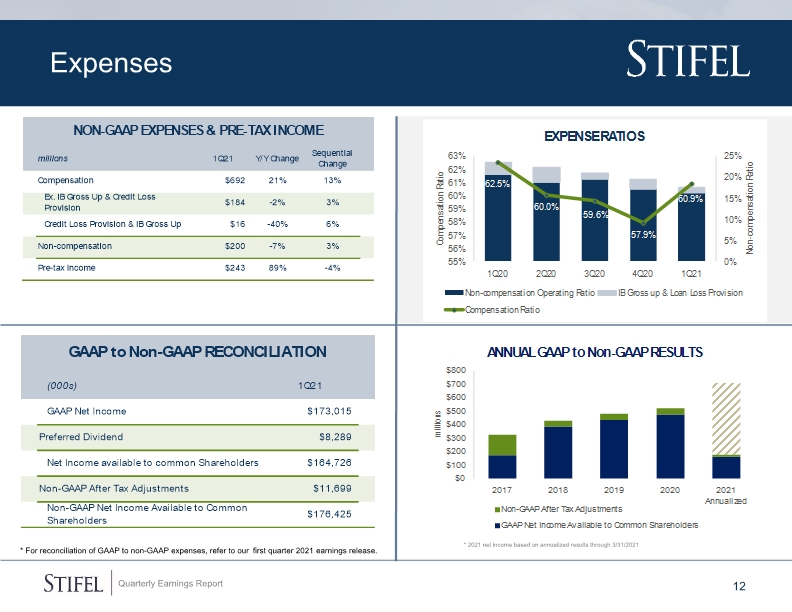

Expenses 12 * For reconciliation of GAAP to non-GAAP expenses, refer to our first quarter 2021 earnings release. Bar chart header numbers are a graphic * 2021 net income based on annualized results through 3/31/2021

Q&A

Disclaimer 14 Forward-Looking Statements This presentation may contain “forward-looking statements” within the meaning of the Private Securities Litigation Reform Act of 1995 that involve significant risks, assumptions, and uncertainties, including statements relating to the market opportunity and future business prospects of Stifel Financial Corp., as well as Stifel, Nicolaus & Company, Incorporated and its subsidiaries (collectively, “SF” or the “Company”). These statements can be identified by the use of the words “may,” “will,” “should,” “could,” “would,” “plan,” “potential,” “estimate,” “project,” “believe,” “intend,” “anticipate,” “expect,” and similar expressions. All statements not dealing with historical results are forward-looking and are based on various assumptions. The forward-looking statements are subject to risks and uncertainties that could cause actual results to differ materially from those expressed in or implied by the statements. For information about the risks and important factors that could affect the Company’s future results, financial condition and liquidity, see “Risk Factors” in Part I of the Company’s Annual Report on Form 10-K for the year ended December 31, 2020. Forward-looking statements speak only as to the date they are made. The Company disclaims any intent or obligation to update forward-looking statements to reflect circumstances or events that occur after the date the forward-looking statements are made. Statements about the effects of the COVID-19 pandemic on the Company’s business, results, financial position and liquidity may constitute forward-looking statements and are subject to the risk that the actual impact may differ, possibly materially, from what is currently expected. Use of Non-GAAP Financial Measures The Company utilized certain non-GAAP calculations as additional measures to aid in understanding and analyzing the Company’s financial results for the three months ended March 31, 2021. Specifically, the Company believes that the non-GAAP measures provide useful information by excluding certain items that may not be indicative of the Company’s core operating results and business outlook. The Company believes that these non-GAAP measures will allow for a better evaluation of the operating performance of the business and facilitate a meaningful comparison of the Company’s results in the current period to those in prior and future periods. Reference to these non-GAAP measures should not be considered as a substitute for results that are presented in a manner consistent with GAAP. These non-GAAP measures are provided to enhance investors' overall understanding of the Company’s current financial performance. The non-GAAP financial information should be considered in addition to, not as a substitute for or as being superior to, operating income, cash flows, or other measures of financial performance prepared in accordance with GAAP. These non-GAAP measures primarily exclude expenses which management believes are, in some instances, non-recurring and not representative of ongoing business. A limitation of utilizing these non-GAAP measures is that the GAAP accounting effects of these charges do, in fact, reflect the underlying financial results of the Company’s business and these effects should not be ignored in evaluating and analyzing its financial results. Therefore, the Company believes that GAAP measures and the same respective non-GAAP measures of the Company’s financial performance should be considered together.