Attached files

| file | filename |

|---|---|

| EX-99.1 - EX-99.1 - PS BUSINESS PARKS, INC./MD | d145223dex991.htm |

| 8-K - 8-K - PS BUSINESS PARKS, INC./MD | d145223d8k.htm |

Exhibit 99.2

| SUPPLEMENTAL INFORMATION

FIRST QUARTER 2021 |

|

701 WESTERN AVENUE | GLENDALE, CA 91201 | 818.244.8080 | PSBUSINESSPARKS.COM

ANALYSIS OF OPERATING RESULTS AND FINANCIAL CONDITION FOR

THE THREE MONTHS ENDED MARCH 31, 2021

| Page | ||||

| Consolidated Balance Sheets |

3 | |||

| Consolidated Statements of Income |

5 | |||

| Portfolio Summary |

7 | |||

| First Quarter Fact Sheet |

8 | |||

| Same Park Cash NOI by Region and Type |

9 | |||

| Analysis of Capital Expenditures |

10 | |||

| Funds from Operations (FFO), Core FFO and Funds Available for Distribution (FAD) |

11 | |||

| Capital Structure and Financial Condition |

13 | |||

| Portfolio Operating Analysis and Statistics |

14 | |||

| Lease Expirations |

18 | |||

| First Quarter 2021 Production Statistics |

21 | |||

| Definitions and Non-GAAP Disclosures |

22 | |||

Forward-Looking Statements

When used within this supplemental information package, the words “may,” “believes,” “anticipates,” “plans,” “expects,” “seeks,” “estimates,” “intends,” and similar expressions are intended to identify “forward-looking statements.” Such forward-looking statements involve known and unknown risks, uncertainties, and other factors, which may cause the actual results and performance of the Company to be materially different from those expressed or implied in the forward-looking statements. Such factors include the duration and severity of the COVID-19 pandemic and its impact on our business and our customers; the impact of competition from new and existing commercial facilities which could impact rents and occupancy levels at the Company’s facilities; the Company’s ability to evaluate, finance, and integrate acquired and developed properties into the Company’s existing operations; the Company’s ability to effectively compete in the markets that it does business in; the impact of the regulatory environment as well as national, state, and local laws and regulations including, without limitation, those governing REITs; the impact of general economic and business conditions, including as a result of the economic fallout of the COVID-19 pandemic; rental rates and occupancy levels at the Company’s facilities; and changes in these conditions as a result of the COVID-19 pandemic, the availability of permanent capital at attractive rates, the outlook and actions of rating agencies and risks detailed from time to time in the Company’s SEC reports, including quarterly reports on Form 10-Q, reports on Form 8-K, and annual reports on Form 10-K.

2

| March 31, 2021 | December 31, 2020 | |||||||||||

| ASSETS |

||||||||||||

| Cash and cash equivalents |

$ | 69,492 | $ | 69,083 | (a) | |||||||

| Real estate facilities, at cost |

||||||||||||

| Land |

865,081 | 864,092 | ||||||||||

| Buildings and improvements |

2,196,781 | 2,186,621 | ||||||||||

|

|

|

|

|

|||||||||

| 3,061,862 | 3,050,713 | |||||||||||

| Accumulated depreciation |

(1,199,381) | (1,181,402) | ||||||||||

|

|

|

|

|

|||||||||

| 1,862,481 | 1,869,311 | (b) | ||||||||||

| Properties held for sale, net |

25,698 | 26,273 | ||||||||||

| Land and building held for development, net |

42,870 | 40,397 | ||||||||||

|

|

|

|

|

|||||||||

| 1,931,049 | 1,935,981 | |||||||||||

| Rent receivable |

2,686 | 1,519 | (c) | |||||||||

| Deferred rent receivable |

37,996 | 36,788 | ||||||||||

| Other assets |

14,716 | 14,334 | (d) | |||||||||

|

|

|

|

|

|||||||||

| Total assets |

$ | 2,055,939 | $ | 2,057,705 | ||||||||

|

|

|

|

|

|||||||||

| LIABILITIES AND EQUITY |

||||||||||||

| Accrued and other liabilities |

$ | 82,925 | $ | 82,065 | (e) | |||||||

|

|

|

|

|

|||||||||

| Total liabilities |

82,925 | 82,065 | ||||||||||

| Equity |

||||||||||||

| PS Business Parks, Inc.’s shareholders’ equity: |

||||||||||||

| Preferred stock |

944,750 | 944,750 | ||||||||||

| Common stock |

274 | 274 | ||||||||||

| Paid-in capital |

736,336 | 738,022 | (f) | |||||||||

| Accumulated earnings |

72,809 | 73,631 | (g) | |||||||||

|

|

|

|

|

|||||||||

| Total PS Business Parks, Inc.’s shareholders’ equity |

1,754,169 | 1,756,677 | ||||||||||

| Noncontrolling interests |

218,845 | 218,963 | ||||||||||

|

|

|

|

|

|||||||||

| Total equity |

1,973,014 | 1,975,640 | ||||||||||

|

|

|

|

|

|||||||||

| Total liabilities and equity |

$ | 2,055,939 | $ | 2,057,705 | ||||||||

|

|

|

|

|

|||||||||

See following page for additional detail related to the tickmarks shown in the table above.

3

| (a) |

Change in cash and cash equivalents |

|||||||||||||

| Beginning cash balance at December 31, 2020 |

$ | 69,083 | ||||||||||||

| Net cash provided by operating activities |

68,824 | |||||||||||||

| Net cash used in investing activities |

(16,424) | |||||||||||||

| Net cash used in financing activities |

(51,991) | |||||||||||||

|

|

|

|||||||||||||

| Ending cash balance at March 31, 2021 |

$ | 69,492 | ||||||||||||

|

|

|

|||||||||||||

| (b) |

Change in real estate facilities, at cost |

|||||||||||||

| Beginning balance at December 31, 2020 |

$ | 1,869,311 | ||||||||||||

| Recurring capital improvements |

648 | |||||||||||||

| Tenant improvements, gross |

2,925 | |||||||||||||

| Capitalized lease commissions |

1,848 | |||||||||||||

| Nonrecurring capital improvements |

411 | |||||||||||||

| Depreciation and amortization of real estate facilities |

(22,289) | |||||||||||||

| Transfer from land and building held for development, net |

9,052 | |||||||||||||

| Transfer to properties held for sale, net |

575 | |||||||||||||

|

|

|

|||||||||||||

| Ending balance at March 31, 2021 |

$ | 1,862,481 | ||||||||||||

|

|

|

|||||||||||||

| Increase | ||||||||||||||

| (c) | Change in rent receivable | March 31, 2021 | December 31, 2020 | (Decrease) | ||||||||||

| Non-government customers (1) |

$ | 1,818 | $ | 646 | $ | 1,172 | ||||||||

| U.S. Government customers |

868 | 873 | (5) | |||||||||||

|

|

|

|

|

|

|

|||||||||

| $ | 2,686 | $ | 1,519 | $ | 1,167 | |||||||||

|

|

|

|

|

|

|

|||||||||

| Increase | ||||||||||||||

| (d) | Change in other assets | March 31, 2021 | December 31, 2020 | (Decrease) | ||||||||||

| Lease intangible assets, net |

$ | 8,043 | $ | 9,058 | $ | (1,015 | ) | |||||||

| Prepaid property taxes and insurance |

4,450 | 3,121 | 1,329 | |||||||||||

| Other |

2,223 | 2,155 | 68 | |||||||||||

|

|

|

|

|

|

|

|||||||||

| $ | 14,716 | $ | 14,334 | $ | 382 | |||||||||

|

|

|

|

|

|

|

|||||||||

| Increase | ||||||||||||||

| (e) | Change in accrued and other liabilities | March 31, 2021 | December 31, 2020 | (Decrease) | ||||||||||

| Customer security deposits |

$ | 39,304 | $ | 38,457 | $ | 847 | ||||||||

| Accrued property taxes |

10,748 | 12,513 | (1,765) | |||||||||||

| Customer prepaid rent |

13,236 | 12,518 | 718 | |||||||||||

| Lease intangible liabilities, net |

6,046 | 6,392 | (346) | |||||||||||

| Other |

13,591 | 12,185 | 1,406 | |||||||||||

|

|

|

|

|

|

|

|||||||||

| $ | 82,925 | $ | 82,065 | $ | 860 | |||||||||

|

|

|

|

|

|

|

|||||||||

| (f) |

Change in paid-in capital |

|||||||||||||

| Beginning paid-in capital at December 31, 2020 |

$ | 738,022 | ||||||||||||

| SEC offering registration costs |

(105) | |||||||||||||

| Stock compensation expense, net |

1,616 | |||||||||||||

| Cash paid for taxes in lieu of shares upon vesting of restricted stock units |

(3,197) | |||||||||||||

|

|

|

|||||||||||||

| Ending paid-in capital at March 31, 2021 |

$ | 736,336 | ||||||||||||

|

|

|

|||||||||||||

| (g) |

Change in accumulated earnings |

|||||||||||||

| Beginning accumulated earnings at December 31, 2020 |

$ | 73,631 | ||||||||||||

| Net income |

40,096 | |||||||||||||

| Distributions to preferred shareholders |

(12,046) | |||||||||||||

| Distributions to common shareholders |

(28,872) | |||||||||||||

|

|

|

|||||||||||||

| Ending accumulated earnings at March 31, 2021 |

$ | 72,809 | ||||||||||||

|

|

|

|||||||||||||

| (1) | Included in the balance at March 31, 2021 is $1.2 million of prior year expense recovery billings billed in the month of March 2021. |

4

| For the Three Months | ||||||||||

| Ended March 31, | ||||||||||

| 2021 | 2020 | |||||||||

| Rental income |

$ | 108,047 | $ | 106,216 | (a) | |||||

| Expenses: |

||||||||||

| Cost of operations |

33,218 | 31,263 | (b) | |||||||

| Depreciation and amortization |

22,985 | 26,619 | ||||||||

| General and administrative |

4,382 | 3,323 | (c) | |||||||

|

|

|

|

|

|||||||

| Total operating expenses |

60,585 | 61,205 | ||||||||

|

|

|

|

|

|||||||

| Interest and other income |

256 | 557 | (d) | |||||||

| Interest and other expense |

(211) | (161) | (e) | |||||||

| Gain on sale of real estate facility |

- | 19,621 | ||||||||

|

|

|

|

|

|||||||

| Net income |

47,507 | 65,028 | ||||||||

| Allocation to noncontrolling interests |

(7,411) | (11,092) | ||||||||

|

|

|

|

|

|||||||

| Net income allocable to PS Business Parks, Inc. |

40,096 | 53,936 | ||||||||

| Allocation to preferred shareholders |

(12,046) | (12,046) | ||||||||

| Allocation to restricted stock unit holders |

(164) | (275) | ||||||||

|

|

|

|

|

|||||||

| Net income allocable to common shareholders |

$ | 27,886 | $ | 41,615 | ||||||

|

|

|

|

|

|||||||

| Net income per common share |

||||||||||

| Basic |

$ | 1.01 | $ | 1.52 | ||||||

| Diluted |

$ | 1.01 | $ | 1.51 | ||||||

| Weighted average common shares outstanding |

||||||||||

| Basic |

27,495 | 27,448 | ||||||||

| Diluted |

27,594 | 27,550 | ||||||||

See following page for additional detail related to the tickmarks shown in the table above.

5

| For The Three Months Ended | Increase | |||||||||||||

| (a) | Rental income: | March 31, 2021 | March 31, 2020 | (Decrease) | ||||||||||

| Same Park (1) (2) |

$ | 99,558 | $ | 98,377 | $ | 1,181 | ||||||||

| Same Park non-cash rental income (1) (3) |

437 | 753 | (316) | |||||||||||

| Non-Same Park (1) (2) |

2,899 | 2,278 | 621 | |||||||||||

| Non-Same Park non-cash rental income (1) (3) |

870 | 143 | 727 | |||||||||||

| Multifamily |

2,327 | 2,560 | (233) | |||||||||||

| Rental income from assets sold or held for sale (4) |

1,956 | 2,105 | (149) | |||||||||||

|

|

|

|

|

|

|

|||||||||

| $ | 108,047 | $ | 106,216 | $ | 1,831 | |||||||||

|

|

|

|

|

|

|

|||||||||

| For The Three Months Ended | Increase | |||||||||||||

| (b) | Cost of operations: | March 31, 2021 | March 31, 2020 | (Decrease) | ||||||||||

| Same Park (1) |

$ | 29,684 | $ | 28,380 | $ | 1,304 | ||||||||

| Same Park non-cash expense (1) (5) |

435 | 263 | 172 | |||||||||||

| Non-Same Park (1) |

1,153 | 829 | 324 | |||||||||||

| Non-Same Park non-cash expense (1) (5) |

13 | 6 | 7 | |||||||||||

| Multifamily |

1,067 | 1,016 | 51 | |||||||||||

| Operating expenses from assets sold or held for sale (4) |

866 | 769 | 97 | |||||||||||

|

|

|

|

|

|

|

|||||||||

| $ | 33,218 | $ | 31,263 | $ | 1,955 | |||||||||

| For The Three Months Ended | Increase | |||||||||||||

| (c) | General and administrative expenses: | March 31, 2021 | March 31, 2020 | (Decrease) | ||||||||||

| Compensation expense |

$ | 1,643 | $ | 1,753 | $ | (110) | ||||||||

| Stock compensation expense |

1,324 | 668 | 656 | |||||||||||

| Professional fees and other |

1,415 | 902 | 513 | |||||||||||

| $ | 4,382 | $ | 3,323 | $ | 1,059 | |||||||||

| For The Three Months Ended | Increase | |||||||||||||

| (d) | Interest and other income: | March 31, 2021 | March 31, 2020 | (Decrease) | ||||||||||

| Management fee income |

$ | 68 | $ | 70 | $ | (2) | ||||||||

| Interest income |

4 | 303 | (299) | |||||||||||

| Other income |

184 | 184 | - | |||||||||||

| $ | 256 | $ | 557 | $ | (301) | |||||||||

|

|

|

|

|

|

|

|||||||||

| For The Three Months Ended | Increase | |||||||||||||

| (e) | Interest and other expense: | March 31, 2021 | March 31, 2020 | (Decrease) | ||||||||||

| Interest expense |

$ | - | $ | - | $ | - | ||||||||

| Credit facilities fees & other charges |

(211) | (161) | (50) | |||||||||||

| $ | (211) | $ | (161) | $ | (50) | |||||||||

|

|

|

|

|

|

|

|||||||||

| (1) | Refer to page 22, Definitions and Non-GAAP Disclosures, for the definitions of Same Park and Non-Same Park. |

| (2) | Same Park rental income is presented net of (a) accounts receivable write-offs of $0.0 and $0.1 million for the three months ended March 31, 2021 and 2020, respectively, and (b) rent deferrals and abatements of $0.3 million and $0.0 for the three months ended March 31, 2021 and 2020, respectively. Non-Same Park rental income is presented net of (a) accounts receivable write-offs of $0.0 for both the three months ended March 31, 2021 and 2020, and (b) rent deferrals and abatements of $0 for both of the three months ended March 31, 2021 and 2020. |

| (3) | Non-cash rental income represents amortization of deferred rent receivable, amortization of above and below market rents, net, and amortization of lease incentives and tenant improvement reimbursements. Same Park non-cash rental income is presented net of deferred rent receivable write-offs of $0.1 million for both of the three months ended March 31, 2021 and 2020. Non-Same Park non-cash rental income is presented net of deferred rent receivable write-offs of $0.0 for both of the three months ended March 31, 2021 and 2020. |

| (4) | Amounts shown for the three months ended March 31, 2021 include operating results attributable to assets held for sale comprising 442,000 square feet. Amounts shown for the three months ended March 31, 2020 include operating results attributable to assets held for sale comprising 442,000 square feet and assets sold in 2020 comprising 153,000 square feet. |

| (5) | Non-cash expense represents stock compensation expense attributable to employees whose compensation expense is recorded in costs of operations. |

6

| PROPERTY INFORMATION | ||||||||||||

| For The Three Months Ended March 31, | ||||||||||||

| 2021 | 2020 | % Change | ||||||||||

| Total Portfolio (1) |

||||||||||||

| Total rentable square footage at period end |

27,369,000 | 27,040,000 | 1.2% | |||||||||

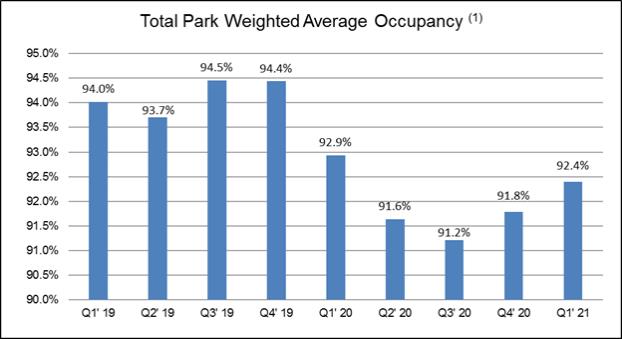

| Weighted average occupancy |

92.4% | 92.9% | (0.5%) | |||||||||

| Period end occupancy |

92.8% | 92.6% | 0.2% | |||||||||

| Cash rental income per occupied square foot (2) (3) |

||||||||||||

| Industrial |

$ | 13.84 | $ | 13.48 | 2.7% | |||||||

| Flex |

$ | 19.83 | $ | 19.36 | 2.4% | |||||||

| Office |

$ | 25.05 | $ | 25.26 | (0.8%) | |||||||

| Total cash rental income per occupied square foot |

$ | 16.23 | $ | 16.02 | 1.3% | |||||||

| Cash rental income per available foot (2) (3) |

||||||||||||

| Industrial |

$ | 13.02 | $ | 12.54 | 3.8% | |||||||

| Flex |

$ | 17.85 | $ | 18.03 | (1.0%) | |||||||

| Office |

$ | 21.77 | $ | 23.20 | (6.2%) | |||||||

| Total cash rental income per available foot |

$ | 15.00 | $ | 14.89 | 0.7% | |||||||

| Same Park Portfolio (2) |

||||||||||||

| Total rentable square footage at period end |

26,271,000 | 26,271,000 | - | |||||||||

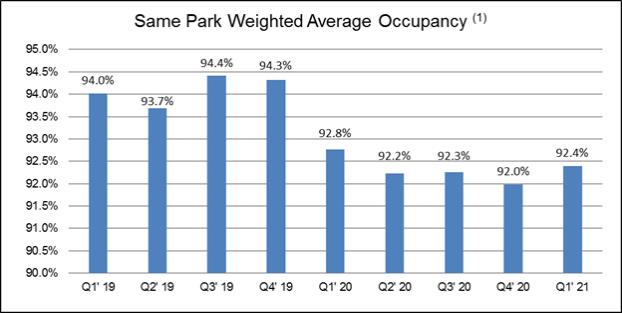

| Weighted average occupancy |

92.4% | 92.8% | (0.4%) | |||||||||

| Period end occupancy |

92.9% | 92.4% | 0.5% | |||||||||

| Cash rental income per occupied square foot (2) (4) |

||||||||||||

| Industrial |

$ | 13.99 | $ | 13.57 | 3.1% | |||||||

| Flex |

$ | 19.79 | $ | 19.34 | 2.3% | |||||||

| Office |

$ | 25.05 | $ | 25.26 | (0.8%) | |||||||

| Total cash rental income per occupied square foot |

$ | 16.40 | $ | 16.15 | 1.5% | |||||||

| Cash rental income per available foot (2) (4) |

||||||||||||

| Industrial |

$ | 13.17 | $ | 12.60 | 4.5% | |||||||

| Flex |

$ | 17.81 | $ | 18.01 | (1.1%) | |||||||

| Office |

$ | 21.77 | $ | 23.20 | (6.2%) | |||||||

| Total cash rental income per available foot |

$ | 15.16 | $ | 14.98 | 1.2% | |||||||

| Non-Same Park Portfolio (2) |

||||||||||||

| Total rentable square footage at period end |

1,098,000 | 769,000 | 42.8% | |||||||||

| Weighted average occupancy |

92.6% | 98.5% | (6.0%) | |||||||||

| Period end occupancy |

91.5% | 98.8% | (7.4%) | |||||||||

| Cash rental income per occupied square foot (2) (5) |

||||||||||||

| Industrial |

$ | 11.13 | $ | 11.13 | 0.0% | |||||||

| Flex |

$ | 22.41 | $ | 21.32 | 5.1% | |||||||

| Office |

$ | - | $ | - | - | |||||||

| Total cash rental income per occupied square foot |

$ | 11.98 | $ | 12.12 | (1.2%) | |||||||

| Cash rental income per available foot (2) (5) |

||||||||||||

| Industrial |

$ | 10.31 | $ | 11.05 | (6.7%) | |||||||

| Flex |

$ | 20.71 | $ | 19.70 | 5.1% | |||||||

| Office |

$ | - | $ | - | - | |||||||

| Total cash rental income per available foot |

$ | 11.10 | $ | 11.94 | (7.0%) | |||||||

| Multifamily Portfolio |

||||||||||||

| Number of units |

395 | 395 | - | |||||||||

| Weighted average occupancy |

94.2% | 94.9% | (0.8%) | |||||||||

| Period end occupancy |

93.6% | 94.1% | (0.5%) | |||||||||

| (1) | Excludes multifamily assets, assets held for sale comprising 442,000 square feet and assets sold in 2020 comprising 153,000 square feet for the periods shown. |

| (2) | Refer to page 22, Definitions and Non-GAAP Disclosures, for the definitions of Cash Rental Income per Available Foot, Cash Rental Income per Occupied Square Foot, Same Park, and Non-Same Park. |

| (3) | Included in the calculation of Total Park Cash Rental Income per Occupied Square Feet and Cash Rental Income per Available foot is (a) lease buyout income of $0.4 million and $0.3 million for the three months ended March 31, 2021 and 2020, respectively, (b) accounts receivable write-offs of $0.0 and $0.1 million for the three months ended March 31, 2021 and 2020, respectively, and (c) rent deferrals and abatements of $0.3 million and $0.0 for the three months ended March 31, 2021 and 2020, respectively. |

| (4) | Included in the calculation of Same Park Cash Rental Income per Occupied Square Feet and Cash Rental Income per Available foot is (a) lease buyout income of $0.4 million and $0.3 million for the three months ended March 31, 2021 and 2020, respectively, (b) accounts receivable write-offs of $0.0 and $0.1 million for the three months ended March 31, 2021 and 2020, respectively, and (c) rent deferrals and abatements of $0.3 million and $0.0 for the three months ended March 31, 2021 and 2020, respectively. |

| (5) | Included in the calculation of Non-Same Park Cash Rental Income per Occupied Square Feet and Cash Rental Income per Available foot is (a) lease buyout income of $0.0 for both the three months ended March 31, 2021 and 2020, (b) accounts receivable write-offs of $0.0 for both of the three months ended March 31, 2021 and 2020, and (c) rent deferrals and abatements of $0.0 for both of the three months ended March 31, 2021 and 2020. |

7

NET OPERATING INCOME

| For The Three Months Ended March 31, | ||||||||||||

| 2021 | 2020 | % Change | ||||||||||

| Rental income |

||||||||||||

| Same Park (1) (2) (3) |

$ | 99,995 | $ | 99,130 | 0.9% | |||||||

| Non-Same Park (1) |

3,769 | 2,421 | 55.7% | |||||||||

| Multifamily |

2,327 | 2,560 | (9.1%) | |||||||||

| Assets sold or held for sale |

1,956 | 2,105 | (7.1%) | |||||||||

|

|

|

|

|

|||||||||

| Total rental income |

108,047 | 106,216 | 1.7% | |||||||||

|

|

|

|

|

|||||||||

| Adjusted cost of operations (1) (5) |

||||||||||||

| Same Park (1) (6) |

29,684 | 28,380 | 4.6% | |||||||||

| Non-Same Park (1) |

1,153 | 829 | 39.1% | |||||||||

| Multifamily |

1,067 | 1,016 | 5.0% | |||||||||

| Assets sold or held for sale |

858 | 764 | 12.3% | |||||||||

|

|

|

|

|

|||||||||

| Total |

32,762 | 30,989 | 5.7% | |||||||||

|

|

|

|

|

|||||||||

| Net operating income |

||||||||||||

| Same Park (1) |

70,311 | 70,750 | (0.6%) | |||||||||

| Non-Same Park (1) |

2,616 | 1,592 | 64.3% | |||||||||

| Multifamily |

1,260 | 1,544 | (18.4%) | |||||||||

| Assets sold or held for sale |

1,098 | 1,341 | (18.1%) | |||||||||

|

|

|

|

|

|||||||||

| Total net operating income |

$ | 75,285 | $ | 75,227 | 0.1% | |||||||

|

|

|

|

|

|||||||||

| CASH NET OPERATING INCOME |

| |||||||||||

| For The Three Months Ended March 31, | ||||||||||||

| 2021 | 2020 | % Change | ||||||||||

| Cash rental income (1) (5) |

||||||||||||

| Same Park (1) (2) (4) |

$ | 99,558 | $ | 98,377 | 1.2% | |||||||

| Non-Same Park (1) |

2,899 | 2,278 | 27.3% | |||||||||

| Multifamily |

2,327 | 2,559 | (9.1%) | |||||||||

| Assets sold or held for sale |

1,956 | 1,938 | 0.9% | |||||||||

|

|

|

|

|

|||||||||

| Total cash rental income |

106,740 | 105,152 | 1.5% | |||||||||

|

|

|

|

|

|||||||||

| Adjusted cost of operations (1) (5) |

||||||||||||

| Same Park (1) (6) |

29,684 | 28,380 | 4.6% | |||||||||

| Non-Same Park (1) |

1,153 | 829 | 39.1% | |||||||||

| Multifamily |

1,067 | 1,016 | 5.0% | |||||||||

| Assets sold or held for sale |

858 | 764 | 12.3% | |||||||||

|

|

|

|

|

|||||||||

| Total adjusted cost of operations |

32,762 | 30,989 | 5.7% | |||||||||

|

|

|

|

|

|||||||||

| Cash net operating income |

||||||||||||

| Same Park (1) |

69,874 | 69,997 | (0.2%) | |||||||||

| Non-Same Park (1) |

1,746 | 1,449 | 20.5% | |||||||||

| Multifamily |

1,260 | 1,543 | (18.3%) | |||||||||

| Assets sold or held for sale |

1,098 | 1,174 | (6.5%) | |||||||||

|

|

|

|

|

|||||||||

| Total cash net operating income |

$ | 73,978 | $ | 74,163 | (0.2%) | |||||||

|

|

|

|

|

|||||||||

| EARNINGS BEFORE INTEREST, TAXES, DEPRECIATION AND AMORTIZATION FOR REAL ESTATE (EBITDAre) (1) |

| |||||||||||

| For The Three Months Ended March 31, | ||||||||||||

| 2021 | 2020 | % Change | ||||||||||

| Net income |

$ | 47,507 | $ | 65,028 | (26.9%) | |||||||

| Net interest (income) expense |

132 | (166) | 179.5% | |||||||||

| Depreciation and amortization |

22,985 | 26,619 | (13.7%) | |||||||||

| Gain on sale of real estate facilities and development rights |

- | (19,621) | (100.0%) | |||||||||

|

|

|

|

|

|||||||||

| EBITDAre |

$ | 70,624 | $ | 71,860 | (1.7%) | |||||||

|

|

|

|

|

|||||||||

| (1) | Refer to page 22, Definition and Non-GAAP Disclosures, for the definitions of Same Park, Non-Same Park, Cash Rental Income, Adjusted Cost of Operations, and EBITDAre. |

| (2) | Same Park rental income and cash rental income include lease buyout income of $0.4 million and $0.3 million for the three months ended March 31, 2021 and 2020, respectively. |

| (3) | Same Park rental income is presented net of (a) accounts receivable write-offs of $0.0 and $0.1 million for the three months ended March 31, 2021 and 2020, respectively, and (b) deferred rent receivable write-offs of $0.1 million for both of the three months ended March 31, 2021 and 2020. |

| (4) | Same Park cash rental income is presented net of (a) accounts receivable write-offs of $0.0 and $0.1 million for the three months ended March 31, 2021 and 2020, respectively, and (b) rent deferrals and abatements of $0.3 million and $0.0 for the three months ended March 31, 2021 and 2020, respectively. |

| (5) | Refer to page 6 for a reconciliation of cash rental income to rental income and adjusted cost of operations to cost of operations as reported on our GAAP statements of income. |

| (6) | The table below details Same Park Adjusted Cost of Operations: |

| For The Three Months Ended March 31, | ||||||||||||

| 2021 | 2020 | % Change | ||||||||||

| Cost of operations |

||||||||||||

| Property taxes |

$ | 11,424 | $ | 11,056 | 3.3 | % | ||||||

| Utilities |

4,637 | 4,972 | (6.7 | %) | ||||||||

| Repairs and maintenance |

5,468 | 5,364 | 1.9 | % | ||||||||

| Compensation |

4,280 | 4,270 | 0.2 | % | ||||||||

| Snow removal |

1,019 | 71 | 1,335.2 | % | ||||||||

| Property insurance |

1,178 | 879 | 34.0 | % | ||||||||

| Other expenses |

1,678 | 1,768 | (5.1 | %) | ||||||||

|

|

|

|

|

|||||||||

| Total cost of operations |

$ | 29,684 | $ | 28,380 | 4.6 | % | ||||||

|

|

|

|

|

|||||||||

8

| For the Three Months Ended | ||||||||||||||||||||||||||||||||||||

| March 31, 2021 | March 31, 2020 | Total % Change |

||||||||||||||||||||||||||||||||||

| Industrial | Flex | Office | Total | Industrial | Flex | Office | Total | |||||||||||||||||||||||||||||

| Cash rental income (1) |

||||||||||||||||||||||||||||||||||||

| Northern California |

$ | 22,376 | $ | 2,401 | $ | 2,605 | $ | 27,382 | $ | 21,039 | $ | 2,579 | $ | 3,127 | $ | 26,745 | 2.4% | |||||||||||||||||||

| Southern California |

9,430 | 4,941 | 192 | 14,563 | 9,002 | 4,898 | 187 | 14,087 | 3.4% | |||||||||||||||||||||||||||

| Dallas |

3,066 | 4,824 | — | 7,890 | 3,168 | 5,430 | — | 8,598 | (8.2%) | |||||||||||||||||||||||||||

| Austin |

2,205 | 6,428 | — | 8,633 | 2,184 | 6,100 | — | 8,284 | 4.2% | |||||||||||||||||||||||||||

| Northern Virginia |

5,063 | 5,431 | 8,990 | 19,484 | 5,017 | 5,317 | 9,089 | 19,423 | 0.3% | |||||||||||||||||||||||||||

| South Florida |

11,257 | 487 | 42 | 11,786 | 10,608 | 502 | 32 | 11,142 | 5.8% | |||||||||||||||||||||||||||

| Seattle |

3,031 | 1,754 | 135 | 4,920 | 3,004 | 1,735 | 186 | 4,925 | (0.1%) | |||||||||||||||||||||||||||

| Suburban Maryland |

1,148 | — | 3,752 | 4,900 | 1,042 | — | 4,131 | 5,173 | (5.3%) | |||||||||||||||||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

||||||||||||||||||||

| Total |

57,576 | 26,266 | 15,716 | 99,558 | 55,064 | 26,561 | 16,752 | 98,377 | 1.2% | |||||||||||||||||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

||||||||||||||||||||

| Adjusted cost of operations (1) |

||||||||||||||||||||||||||||||||||||

| Northern California |

4,928 | 674 | 742 | 6,344 | 4,737 | 648 | 781 | 6,166 | 2.9% | |||||||||||||||||||||||||||

| Southern California |

2,317 | 1,300 | 75 | 3,692 | 2,299 | 1,353 | 73 | 3,725 | (0.9%) | |||||||||||||||||||||||||||

| Dallas |

1,103 | 2,006 | — | 3,109 | 1,011 | 2,034 | — | 3,045 | 2.1% | |||||||||||||||||||||||||||

| Austin |

799 | 2,416 | — | 3,215 | 745 | 2,214 | — | 2,959 | 8.7% | |||||||||||||||||||||||||||

| Northern Virginia |

1,647 | 1,800 | 3,592 | 7,039 | 1,483 | 1,506 | 3,474 | 6,463 | 8.9% | |||||||||||||||||||||||||||

| South Florida |

3,024 | 140 | 20 | 3,184 | 2,844 | 134 | 14 | 2,992 | 6.4% | |||||||||||||||||||||||||||

| Seattle |

812 | 410 | 70 | 1,292 | 803 | 420 | 54 | 1,277 | 1.2% | |||||||||||||||||||||||||||

| Suburban Maryland |

405 | — | 1,404 | 1,809 | 351 | — | 1,402 | 1,753 | 3.2% | |||||||||||||||||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

||||||||||||||||||||

| Total |

15,035 | 8,746 | 5,903 | 29,684 | 14,273 | 8,309 | 5,798 | 28,380 | 4.6% | |||||||||||||||||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

||||||||||||||||||||

| Cash NOI (1) |

||||||||||||||||||||||||||||||||||||

| Northern California |

17,448 | 1,727 | 1,863 | 21,038 | 16,302 | 1,931 | 2,346 | 20,579 | 2.2% | |||||||||||||||||||||||||||

| Southern California |

7,113 | 3,641 | 117 | 10,871 | 6,703 | 3,545 | 114 | 10,362 | 4.9% | |||||||||||||||||||||||||||

| Dallas |

1,963 | 2,818 | — | 4,781 | 2,157 | 3,396 | — | 5,553 | (13.9%) | |||||||||||||||||||||||||||

| Austin |

1,406 | 4,012 | — | 5,418 | 1,439 | 3,886 | — | 5,325 | 1.7% | |||||||||||||||||||||||||||

| Northern Virginia |

3,416 | 3,631 | 5,398 | 12,445 | 3,534 | 3,811 | 5,615 | 12,960 | (4.0%) | |||||||||||||||||||||||||||

| South Florida |

8,233 | 347 | 22 | 8,602 | 7,764 | 368 | 18 | 8,150 | 5.5% | |||||||||||||||||||||||||||

| Seattle |

2,219 | 1,344 | 65 | 3,628 | 2,201 | 1,315 | 132 | 3,648 | (0.5%) | |||||||||||||||||||||||||||

| Suburban Maryland |

743 | — | 2,348 | 3,091 | 691 | — | 2,729 | 3,420 | (9.6%) | |||||||||||||||||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

||||||||||||||||||||

| Total |

$ | 42,541 | $ | 17,520 | $ | 9,813 | $ | 69,874 | $ | 40,791 | $ | 18,252 | $ | 10,954 | $ | 69,997 | (0.2%) | |||||||||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

||||||||||||||||||||

| (1) | Refer to page 22, Definitions and Non-GAAP Disclosures, for the definitions of Same Park, Cash Rental Income, Adjusted Cost of Operations, and Cash NOI. |

9

| For the Three Months Ended March 31, | ||||||||

| 2021 | 2020 | |||||||

| Commercial recurring capital expenditures (1) |

||||||||

| Same Park |

||||||||

| Capital improvements |

$ | 640 | $ | 1,162 | ||||

| Tenant improvements |

2,764 | 3,402 | ||||||

| Lease commissions |

1,791 | 1,822 | ||||||

|

|

|

|

|

|||||

| Total Same Park recurring capital expenditures |

5,195 | 6,386 | ||||||

| Non-Same Park |

||||||||

| Capital improvements |

6 | 3 | ||||||

| Tenant improvements |

92 | 3 | ||||||

| Lease commissions |

49 | 7 | ||||||

|

|

|

|

|

|||||

| Total Non-Same Park recurring capital expenditures |

147 | 13 | ||||||

|

|

|

|

|

|||||

| Total recurring capital expenditures |

5,342 | 6,399 | ||||||

| Assets sold or held for sale recurring capital expenditures |

63 | 452 | ||||||

|

|

|

|

|

|||||

| Total commercial recurring capital expenditures |

5,405 | 6,851 | ||||||

| Non-recurring property renovations (1) |

411 | 93 | ||||||

| Multifamily capital expenditures |

— | — | ||||||

|

|

|

|

|

|||||

| Total capital expenditures |

$ | 5,816 | $ | 6,944 | ||||

|

|

|

|

|

|||||

| Same Park recurring capital expenditures as a percentage of NOI |

7.4% | 9.0% | ||||||

| (1) | Refer to page 22, Definitions and Non-GAAP Disclosures, for the definitions of Recurring Capital Expenditures and Non-recurring Property Renovations. |

10

| For the Three Months Ended | ||||||||

| March 31, | ||||||||

| 2021 | 2020 | |||||||

| Net income allocable to common shareholders |

$ | 27,886 | $ | 41,615 | ||||

| Adjustments |

||||||||

| Gain on sale of real estate facility |

- | (19,621) | ||||||

| Depreciation and amortization |

22,985 | 26,619 | ||||||

| Net income allocable to noncontrolling interests |

7,411 | 11,092 | ||||||

| Net income allocable to restricted stock unit holders |

164 | 275 | ||||||

| FFO allocated to joint venture partner |

(27) | (43) | ||||||

|

|

|

|

|

|

| |||

| FFO allocable to diluted common shares and units (1) |

58,419 | 59,937 | ||||||

| Core FFO allocable to diluted common shares and units (1) |

58,419 | 59,937 | ||||||

| Adjustments |

||||||||

| Recurring capital improvements |

(646) | (1,165) | ||||||

| Tenant improvements |

(2,856) | (3,405) | ||||||

| Capitalized lease commissions |

(1,840) | (1,829) | ||||||

| Total recurring capital expenditures for assets sold or held for sale |

(63) | (452) | ||||||

| Non-cash rental income (2) |

(1,307) | (1,064) | ||||||

| Non-cash stock compensation expense |

1,780 | 942 | ||||||

| Cash paid for taxes in lieu of shares upon vesting of restricted stock units |

(3,197) | (3,655) | ||||||

|

|

|

|

|

|

| |||

| FAD allocable to diluted common shares and units (1) |

50,290 | 49,309 | ||||||

| Distributions to common shareholders |

(28,872) | (28,817) | ||||||

| Distributions to noncontrolling interests - common units |

(7,671) | (7,671) | ||||||

| Distributions to restricted stock unit holders |

(164) | (182) | ||||||

| Distributions to noncontrolling interests - joint venture |

(17) | (38) | ||||||

|

|

|

|

|

|

| |||

| Free cash available after fixed charges |

13,566 | 12,601 | ||||||

| Non-recurring property renovations (1) |

(411) | (93) | ||||||

| Investment in multifamily development |

(9,485) | (875) | ||||||

| Investment in industrial development |

(1,123) | (437) | ||||||

|

|

|

|

|

|

| |||

| Retained cash (1) |

$ | 2,547 | $ | 11,196 | ||||

|

|

|

|

|

|

| |||

| Weighted average outstanding |

||||||||

| Common shares |

27,495 | 27,448 | ||||||

| Operating partnership units |

7,305 | 7,305 | ||||||

| Restricted stock units |

47 | 77 | ||||||

| Common share equivalents |

99 | 102 | ||||||

|

|

|

|

|

|

| |||

| Total diluted common shares and units |

34,946 | 34,932 | ||||||

|

|

|

|

|

|

| |||

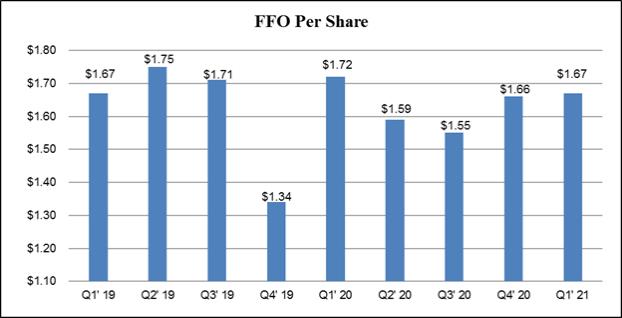

| FFO per share |

$ | 1.67 | $ | 1.72 | ||||

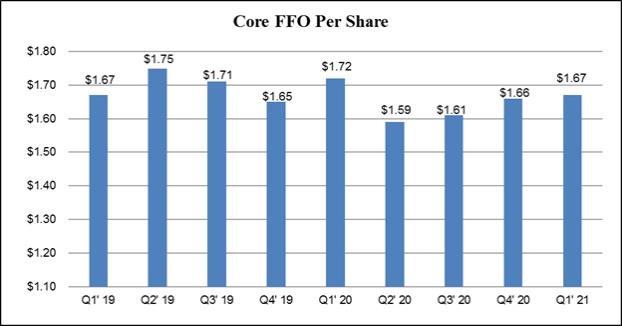

| Core FFO per share |

$ | 1.67 | $ | 1.72 | ||||

| FAD distribution payout ratio (3) |

73.0% | 74.4% | ||||||

| (1) | Refer to page 22, Definitions and Non-GAAP Disclosures, for the definition of FFO, Core FFO, FAD, Non-Recurring Property Renovations and Retained Cash. |

| (2) | Non-cash rental income includes amortization of deferred rent receivable (net of write-offs), in-place lease intangible, tenant improvement reimbursement, and lease incentive intangible. |

| (3) | FAD distribution payout ratio is equal to total distributions to common shareholders, unit holders, restricted stock unit holders and our joint venture partner divided by FAD during the same reporting period. |

11

12

| As of March 31, 2021 | As of December 31, 2020 | |||||||||||||||||||||||||||

| % of Total | % of Total | |||||||||||||||||||||||||||

| Market | Wtd Avg | Market | Wtd Avg | |||||||||||||||||||||||||

| Total | Capitalization | Rate | Total | Capitalization | Rate | |||||||||||||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|||||||||||||||||

| Unsecured Debt: |

||||||||||||||||||||||||||||

| Credit facility borrowing ($250.0 million at LIBOR + 0.825%) |

$ | - | - | - | $ | - | - | - | ||||||||||||||||||||

| Unrestricted cash |

(69,492 | ) | (69,083 | ) | ||||||||||||||||||||||||

|

|

|

|

|

|||||||||||||||||||||||||

| Net debt |

$ | (69,492 | ) | - | - | $ | (69,083 | ) | - | - | ||||||||||||||||||

|

|

|

|

|

|||||||||||||||||||||||||

| Preferred Equity: |

||||||||||||||||||||||||||||

| 5.200% Series W preferred stock (7,590,000 depositary shares outstanding) callable 10/20/21 |

$ | 189,750 | 3.0 | % | $ | 189,750 | 3.5 | % | ||||||||||||||||||||

| 5.250% Series X preferred stock (9,200,000 depositary shares outstanding) callable 9/21/22 |

230,000 | 3.7 | % | 230,000 | 4.2 | % | ||||||||||||||||||||||

| 5.200% Series Y preferred stock (8,000,000 depositary shares outstanding) callable 12/7/22 |

200,000 | 3.2 | % | 200,000 | 3.6 | % | ||||||||||||||||||||||

| 4.875% Series Z preferred stock (13,000,000 depositary shares outstanding) callable 11/4/24 |

325,000 | 5.2 | % | 325,000 | 5.9 | % | ||||||||||||||||||||||

|

|

|

|

|

|||||||||||||||||||||||||

| Total preferred equity |

$ | 944,750 | 15.1 | % | 5.10 | % | $ | 944,750 | 17.2 | % | 5.10 | % | ||||||||||||||||

|

|

|

|

|

|||||||||||||||||||||||||

|

|

|

|

|

|||||||||||||||||||||||||

| Total net debt and preferred equity |

$ | 875,258 | 14.0 | % | 5.10 | % | $ | 875,667 | 15.9 | % | 5.10 | % | ||||||||||||||||

|

|

|

|

|

|||||||||||||||||||||||||

| Common stock (27,516,939 and 27,488,547 shares outstanding as of March 31, 2021 and December 31, 2020, respectively) (1) |

$ | 4,253,568 | 68.0 | % | $ | 3,652,403 | 66.4 | % | ||||||||||||||||||||

| Common operating partnership units (7,305,355 units outstanding as of March 31, 2021 and December 31, 2020) (1) |

1,129,262 | 18.0 | % | 970,663 | 17.7 | % | ||||||||||||||||||||||

|

|

|

|

|

|||||||||||||||||||||||||

| Total common equity and operating partnership |

$ | 5,382,830 | 86.0 | % | $ | 4,623,066 | 84.1 | % | ||||||||||||||||||||

|

|

|

|

|

|||||||||||||||||||||||||

| Total implied market capitalization |

$ | 6,258,088 | 100.0 | % | $ | 5,498,733 | 100.0 | % | ||||||||||||||||||||

|

|

|

|

|

|||||||||||||||||||||||||

| For the three months ended March 31, 2021 | For the year ended December 31, 2020 | |||||||||||||||||||||||||||

| Interest expense and related expenses (2) |

$ | 136 | $ | 548 | ||||||||||||||||||||||||

| Preferred distributions |

12,046 | 48,186 | ||||||||||||||||||||||||||

| Total fixed charges and preferred distributions |

$ | 12,182 | $ | 48,734 | ||||||||||||||||||||||||

| Ratio of EBITDAre to fixed charges and preferred distributions |

5.8x | 5.7x | ||||||||||||||||||||||||||

| Ratio of FFO to total fixed charges and preferred distributions (3) |

5.8x | 5.7x | ||||||||||||||||||||||||||

| Ratio of net debt and preferred equity to EBITDAre (4) |

3.1x | 3.2x | ||||||||||||||||||||||||||

| (1) | Total common equity is calculated as the total number of common stock and operating partnership units outstanding multiplied by the Company’s closing share price at the end of each respective period shown. Closing share prices on March 31, 2021 and December 31, 2020 were $154.58 and $132.87, respectively. |

| (2) | Interest expense and related expenses includes facility fees associated with our unsecured credit facility. |

| (3) | Ratio of FFO to total fixed charges and preferred distributions is calculated by dividing FFO excluding fixed charges and preferred distributions by total fixed charges and preferred distributions. |

| (4) | Ratio of net debt and preferred equity to EBITDAre is calculated as total net debt and preferred equity divided by EBITDAre. Ratio of net debt and preferred equity to EBITDAre as of March 31, 2021 is calculated using annualized EBITDAre for the three months ended March 31, 2021. |

13

| Industry Concentration as of March 31, 2021 (1) (2) |

| |||||||||||

| Percentage of | ||||||||||||

| Total Rental Income | ||||||||||||

| Business services |

20.8% | |||||||||||

| Logistics |

13.1% | |||||||||||

| Technology |

10.5% | |||||||||||

| Retail, food, and automotive |

9.1% | |||||||||||

| Construction and engineering |

8.4% | |||||||||||

| Health services |

7.2% | |||||||||||

| Government |

6.3% | |||||||||||

| Electronics |

3.1% | |||||||||||

| Insurance and financial services |

2.6% | |||||||||||

| Home furnishings |

2.5% | |||||||||||

| Aerospace/defense |

1.8% | |||||||||||

| Communications |

1.8% | |||||||||||

| Education |

1.0% | |||||||||||

| Other |

11.8% | |||||||||||

|

|

|

|||||||||||

| Total |

100.0% | |||||||||||

|

|

|

|||||||||||

| Top 10 Customers by Total Annual Rental Income as of March 31, 2021 (2) |

| |||||||||||

| Customer |

Square Footage |

Annualized Rental Income (3) |

Percentage of Total Annualized Rental Income |

|||||||||

| US Government |

605,000 | $ | 14,554 | 3.4% | ||||||||

| Amazon Inc. |

543,000 | 6,670 | 1.6% | |||||||||

| KZ Kitchen Cabinet & Stone |

370,000 | 5,353 | 1.3% | |||||||||

| Luminex Corporation |

198,000 | 4,490 | 1.1% | |||||||||

| ECS Federal, LLC |

134,000 | 2,898 | 0.7% | |||||||||

| Lockheed Martin Corporation |

124,000 | 2,687 | 0.6% | |||||||||

| Carbel, LLC |

236,000 | 2,470 | 0.6% | |||||||||

| CentralColo, LLC |

96,000 | 2,417 | 0.6% | |||||||||

| Applied Materials, Inc. |

162,000 | 2,416 | 0.6% | |||||||||

| Quanta Computer Inc. |

179,000 | 1,941 | 0.4% | |||||||||

|

|

|

|

|

|

|

|||||||

| Total |

2,647,000 | $ | 45,896 | 10.9% | ||||||||

|

|

|

|

|

|

|

|||||||

| (1) | Industry concentration is categorized based on customers’ Standard Industrial Classification Code. |

| (2) | Excludes assets held for sale as of March 31, 2021. |

| (3) | For leases expiring within one year, annualized rental income includes only the income to be received under the existing lease from April 1, 2021 through the respective date of expiration. |

14

| Rentable Square Footage of Same Park Properties by Product Type as of March 31, 2021 (1) | ||||||||||

|

Markets |

Industrial | Flex | Office | Total | % of Total | |||||||||||||||

| Northern Virginia |

1,564 | 1,242 | 1,726 | 4,532 | 17.1% | |||||||||||||||

| South Florida |

3,728 | 126 | 12 | 3,866 | 14.7% | |||||||||||||||

| Silicon Valley |

3,094 | 367 | - | 3,461 | 13.2% | |||||||||||||||

| East Bay |

3,297 | 53 | - | 3,350 | 12.8% | |||||||||||||||

| Dallas |

1,300 | 1,587 | - | 2,887 | 11.0% | |||||||||||||||

| Austin |

755 | 1,208 | - | 1,963 | 7.5% | |||||||||||||||

| Los Angeles County |

1,256 | 317 | 31 | 1,604 | 6.1% | |||||||||||||||

| Seattle |

1,052 | 270 | 28 | 1,350 | 5.1% | |||||||||||||||

| Suburban Maryland |

394 | - | 751 | 1,145 | 4.4% | |||||||||||||||

| Orange County |

810 | 101 | - | 911 | 3.5% | |||||||||||||||

| San Diego County |

233 | 535 | - | 768 | 2.9% | |||||||||||||||

| Mid-Peninsula |

- | 94 | 340 | 434 | 1.7% | |||||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

| ||||||||

| Total |

17,483 | 5,900 | 2,888 | 26,271 | 100.0% | |||||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

| ||||||||

| Percentage by Product Type |

66.5% | 22.5% | 11.0% | 100.0% | ||||||||||||||||

| Same Park Weighted Average Occupancy Rates by Product Type for the Three Months Ended March 31, 2021 (1) | ||||||||||||||||||||

| Markets |

Industrial | Flex | Office | Total | ||||||||||||||||

| Northern Virginia |

93.8% | 96.2% | 86.6% | 91.7% | ||||||||||||||||

| South Florida |

95.9% | 83.1% | 100.0% | 95.5% | ||||||||||||||||

| Silicon Valley |

95.9% | 87.7% | - | 95.0% | ||||||||||||||||

| East Bay |

92.5% | 94.5% | - | 92.5% | ||||||||||||||||

| Dallas |

87.4% | 79.8% | - | 83.3% | ||||||||||||||||

| Austin |

95.5% | 94.8% | - | 95.1% | ||||||||||||||||

| Los Angeles County |

98.5% | 93.6% | 95.1% | 97.5% | ||||||||||||||||

| Seattle |

93.5% | 95.4% | 64.7% | 93.3% | ||||||||||||||||

| Suburban Maryland |

86.0% | - | 89.5% | 88.3% | ||||||||||||||||

| Orange County |

93.4% | 96.7% | - | 93.7% | ||||||||||||||||

| San Diego County |

98.4% | 92.4% | - | 94.2% | ||||||||||||||||

| Mid-Peninsula |

- | 84.0% | 82.1% | 82.5% | ||||||||||||||||

| Total |

94.2% | 90.0% | 86.8% | 92.4% | ||||||||||||||||

| (1) | Excludes assets held for sale as of March 31, 2021. |

15

| Rentable Square Footage of Properties by Product Type as of March 31, 2021 (1) | ||||||||||

| Markets |

Industrial | Flex | Office | Total | % of Total | |||||||||||||||

| Northern Virginia |

1,810 | 1,242 | 1,726 | 4,778 | 17.5% | |||||||||||||||

| South Florida |

3,728 | 126 | 12 | 3,866 | 14.1% | |||||||||||||||

| Silicon Valley |

3,094 | 446 | - | 3,540 | 12.9% | |||||||||||||||

| East Bay |

3,297 | 53 | - | 3,350 | 12.2% | |||||||||||||||

| Dallas |

1,383 | 1,587 | - | 2,970 | 10.9% | |||||||||||||||

| Los Angeles County |

1,946 | 317 | 31 | 2,294 | 8.4% | |||||||||||||||

| Austin |

755 | 1,208 | - | 1,963 | 7.2% | |||||||||||||||

| Seattle |

1,052 | 270 | 28 | 1,350 | 4.9% | |||||||||||||||

| Suburban Maryland |

394 | - | 751 | 1,145 | 4.2% | |||||||||||||||

| Orange County |

810 | 101 | - | 911 | 3.3% | |||||||||||||||

| San Diego County |

233 | 535 | - | 768 | 2.8% | |||||||||||||||

| Mid-Peninsula |

- | 94 | 340 | 434 | 1.6% | |||||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| ||||||

| Total |

18,502 | 5,979 | 2,888 | 27,369 | 100.0% | |||||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| ||||||

| Percentage by Product Type |

67.6% | 21.8% | 10.6% | 100.0% | ||||||||||||||||

| Weighted Average Occupancy Rates by Product Type for the Three Months Ended March 31, 2021 (1) |

| |||||||||||||||||||

|

| ||||||||||||||||||||

| Markets |

Industrial | Flex | Office | Total | ||||||||||||||||

| Northern Virginia |

93.5% | 96.2% | 86.6% | 91.7% | ||||||||||||||||

| South Florida |

95.9% | 83.1% | 100.0% | 95.5% | ||||||||||||||||

| Silicon Valley |

95.9% | 88.4% | - | 94.9% | ||||||||||||||||

| East Bay |

92.5% | 94.5% | - | 92.5% | ||||||||||||||||

| Dallas |

85.9% | 79.8% | - | 82.6% | ||||||||||||||||

| Los Angeles County |

97.6% | 93.6% | 95.1% | 97.0% | ||||||||||||||||

| Austin |

95.5% | 94.8% | - | 95.1% | ||||||||||||||||

| Seattle |

93.5% | 95.4% | 64.7% | 93.3% | ||||||||||||||||

| Suburban Maryland |

86.0% | - | 89.5% | 88.3% | ||||||||||||||||

| Orange County |

93.4% | 96.7% | - | 93.7% | ||||||||||||||||

| San Diego County |

98.4% | 92.4% | - | 94.2% | ||||||||||||||||

| Mid-Peninsula |

- | 84.0% | 82.1% | 82.5% | ||||||||||||||||

| Total |

94.1% | 90.0% | 86.8% | 92.4% | ||||||||||||||||

| (1) | Excludes assets held for sale as of March 31, 2021. |

16

| (1) | Excludes assets sold or held for sale as of March 31, 2021. |

17

| Lease Expirations - Total Portfolio (1) | ||||||||||||||||

| Annualized | % of Total Annualized | |||||||||||||||

| Year of Lease Expiration |

Leased Square Footage | Rental Income (2) | % Total | Rental Income | ||||||||||||

|

2021 |

3,972 | $ | 69,987 | 15.6% | 15.6% | |||||||||||

|

2022 |

6,018 | 105,557 | 23.5% | 23.5% | ||||||||||||

|

2023 |

5,271 | 89,545 | 19.9% | 19.9% | ||||||||||||

|

2024 |

3,795 | 67,189 | 15.0% | 15.0% | ||||||||||||

|

2025 |

2,873 | 49,723 | 11.1% | 11.1% | ||||||||||||

| Thereafter |

3,725 | 67,057 | 14.9% | 14.9% | ||||||||||||

|

|

|

|

|

|

|

|

|

|||||||||

|

Total |

25,654 | $ | 449,058 | 100.0% | 100.0% | |||||||||||

|

|

|

|

|

|

|

|

|

|||||||||

| Lease Expirations - Industrial | ||||||||||||||||

| Annualized | % of | % of Total Annualized | ||||||||||||||

| Year of Lease Expiration |

Leased Square Footage | Rental Income (2) | Industrial | Rental Income | ||||||||||||

|

2021 |

2,479 | $ | 36,321 | 13.6% | 8.1% | |||||||||||

|

2022 |

3,900 | 56,895 | 21.3% | 12.7% | ||||||||||||

|

2023 |

3,724 | 54,620 | 20.5% | 12.2% | ||||||||||||

|

2024 |

2,649 | 41,218 | 15.4% | 9.2% | ||||||||||||

|

2025 |

1,955 | 28,307 | 10.6% | 6.3% | ||||||||||||

| Thereafter |

3,019 | 49,747 | 18.6% | 11.1% | ||||||||||||

|

|

|

|

|

|

|

|

|

|||||||||

|

Total |

17,726 | $ | 267,108 | 100.0% | 59.6% | |||||||||||

|

|

|

|

|

|

|

|

|

|||||||||

| Lease Expirations - Flex (1) | ||||||||||||||||

| Annualized | % of | % of Total Annualized | ||||||||||||||

| Year of Lease Expiration |

Leased Square Footage | Rental Income (2) | Flex | Rental Income | ||||||||||||

|

2021 |

1,028 | $ | 20,718 | 18.3% | 4.6% | |||||||||||

|

2022 |

1,482 | 30,889 | 27.3% | 6.9% | ||||||||||||

|

2023 |

985 | 19,997 | 17.7% | 4.4% | ||||||||||||

|

2024 |

795 | 16,677 | 14.8% | 3.7% | ||||||||||||

|

2025 |

706 | 15,857 | 14.0% | 3.5% | ||||||||||||

| Thereafter |

431 | 8,912 | 7.9% | 2.0% | ||||||||||||

|

|

|

|

|

|

|

|

|

|||||||||

|

Total |

5,427 | $ | 113,050 | 100.0% | 25.1% | |||||||||||

|

|

|

|

|

|

|

|

|

|||||||||

| Lease Expirations - Office (1) | ||||||||||||||||

| Annualized | % of | % of Total Annualized | ||||||||||||||

| Year of Lease Expiration |

Leased Square Footage | Rental Income (2) | Office | Rental Income | ||||||||||||

|

2021 |

465 | $ | 12,948 | 18.8% | 2.9% | |||||||||||

|

2022 |

636 | 17,773 | 25.8% | 3.9% | ||||||||||||

|

2023 |

562 | 14,928 | 21.6% | 3.3% | ||||||||||||

|

2024 |

351 | 9,294 | 13.5% | 2.1% | ||||||||||||

|

2025 |

212 | 5,559 | 8.1% | 1.3% | ||||||||||||

| Thereafter |

275 | 8,398 | 12.2% | 1.8% | ||||||||||||

|

|

|

|

|

|

|

|

|

|||||||||

|

Total |

2,501 | $ | 68,900 | 100.0% | 15.3% | |||||||||||

|

|

|

|

|

|

|

|

|

|||||||||

| (1) | Excludes assets held for sale as of March 31, 2021. |

| (2) | Annualized rental income represents annualized outgoing rents inclusive of related estimated expense recoveries. Actual rental income amounts may vary depending upon re-leasing of expiring spaces. |

18

| Lease Expirations - Northern California | ||||||||||||||||

| Annualized | % of | % of Total Annualized | ||||||||||||||

| Year of Lease Expiration |

Leased Square Footage | Rental Income (1) | No. CA | Rental Income | ||||||||||||

|

2021 |

963 | $ | 19,852 | 15.6% | 4.4% | |||||||||||

|

2022 |

1,197 | 21,657 | 17.0% | 4.8% | ||||||||||||

|

2023 |

1,261 | 23,116 | 18.2% | 5.1% | ||||||||||||

|

2024 |

987 | 17,411 | 13.7% | 3.9% | ||||||||||||

|

2025 |

755 | 11,124 | 8.8% | 2.5% | ||||||||||||

| Thereafter |

1,856 | 33,965 | 26.7% | 7.5% | ||||||||||||

|

|

|

|

|

|

|

|

|

|||||||||

|

Total |

7,019 | $ | 127,125 | 100.0% | 28.2% | |||||||||||

|

|

|

|

|

|

|

|

|

|||||||||

| Lease Expirations - Southern California | ||||||||||||||||

| Annualized | % of | % of Total Annualized | ||||||||||||||

| Year of Lease Expiration |

Leased Square Footage | Rental Income (1) | So. CA | Rental Income | ||||||||||||

|

2021 |

618 | $ | 12,044 | 16.6% | 2.7% | |||||||||||

|

2022 |

1,189 | 21,918 | 30.2% | 4.9% | ||||||||||||

|

2023 |

779 | 15,050 | 20.7% | 3.4% | ||||||||||||

|

2024 |

477 | 9,951 | 13.7% | 2.2% | ||||||||||||

|

2025 |

288 | 5,228 | 7.2% | 1.2% | ||||||||||||

| Thereafter |

503 | 8,429 | 11.6% | 1.9% | ||||||||||||

|

|

|

|

|

|

|

|

|

|||||||||

|

Total |

3,854 | $ | 72,620 | 100.0% | 16.3% | |||||||||||

|

|

|

|

|

|

|

|

|

|||||||||

| Lease Expirations - Dallas | ||||||||||||||||

| Annualized | % of | % of Total Annualized | ||||||||||||||

| Year of Lease Expiration |

Leased Square Footage | Rental Income (1) | Dallas | Rental Income | ||||||||||||

|

2021 |

470 | $ | 6,571 | 19.6% | 1.5% | |||||||||||

|

2022 |

542 | 6,179 | 18.4% | 1.4% | ||||||||||||

|

2023 |

665 | 8,601 | 25.6% | 1.9% | ||||||||||||

|

2024 |

300 | 4,698 | 14.0% | 1.1% | ||||||||||||

|

2025 |

247 | 4,979 | 14.8% | 1.1% | ||||||||||||

| Thereafter |

230 | 2,555 | 7.6% | 0.6% | ||||||||||||

|

|

|

|

|

|

|

|

|

|||||||||

|

Total |

2,454 | $ | 33,583 | 100.0% | 7.6% | |||||||||||

|

|

|

|

|

|

|

|

|

|||||||||

| Lease Expirations - Austin | ||||||||||||||||

| Annualized | % of | % of Total Annualized | ||||||||||||||

| Year of Lease Expiration |

Leased Square Footage | Rental Income (1) | Austin | Rental Income | ||||||||||||

|

2021 |

323 | $ | 6,091 | 16.4% | 1.4% | |||||||||||

|

2022 |

413 | 7,759 | 20.9% | 1.7% | ||||||||||||

|

2023 |

248 | 4,910 | 13.2% | 1.1% | ||||||||||||

|

2024 |

298 | 6,429 | 17.3% | 1.4% | ||||||||||||

|

2025 |

397 | 8,409 | 22.7% | 1.9% | ||||||||||||

| Thereafter |

204 | 3,475 | 9.5% | 0.7% | ||||||||||||

|

|

|

|

|

|

|

|

|

|||||||||

|

Total |

1,883 | $ | 37,073 | 100.0% | 8.2% | |||||||||||

|

|

|

|

|

|

|

|

|

|||||||||

| (1) | Annualized rental income represents annualized outgoing rents inclusive of related estimated expense recoveries. Actual rental income amounts may vary depending upon re-leasing of expiring spaces. |

19

| Lease Expirations - Northern Virginia (1) | ||||||||||||||||

| Annualized | % of | % of Total Annualized | ||||||||||||||

| Year of Lease Expiration |

Leased Square Footage | Rental Income (2) | No. VA | Rental Income | ||||||||||||

|

2021 |

615 | $ | 11,193 | 12.7% | 2.5% | |||||||||||

|

2022 |

1,284 | 27,221 | 31.0% | 6.1% | ||||||||||||

|

2023 |

648 | 13,054 | 14.8% | 2.9% | ||||||||||||

|

2024 |

705 | 13,757 | 15.7% | 3.1% | ||||||||||||

|

2025 |

586 | 11,039 | 12.6% | 2.5% | ||||||||||||

| Thereafter |

575 | 11,561 | 13.2% | 2.6% | ||||||||||||

|

|

|

|

|

|

|

|

|

|||||||||

|

Total |

4,413 | $ | 87,825 | 100.0% | 19.7% | |||||||||||

|

|

|

|

|

|

|

|

|

|||||||||

| Lease Expirations - South Florida | ||||||||||||||||

| Annualized | % of | % of Total Annualized | ||||||||||||||

| Year of Lease Expiration |

Leased Square Footage | Rental Income (2) | So. FL | Rental Income | ||||||||||||

|

2021 |

622 | $ | 7,273 | 15.1% | 1.6% | |||||||||||

|

2022 |

974 | 12,701 | 26.4% | 2.8% | ||||||||||||

|

2023 |

974 | 12,530 | 26.0% | 2.8% | ||||||||||||

|

2024 |

710 | 9,354 | 19.4% | 2.1% | ||||||||||||

|

2025 |

328 | 4,189 | 8.7% | 0.9% | ||||||||||||

| Thereafter |

131 | 2,089 | 4.4% | 0.5% | ||||||||||||

|

|

|

|

|

|

|

|

|

|||||||||

|

Total |

3,739 | $ | 48,136 | 100.0% | 10.7% | |||||||||||

|

|

|

|

|

|

|

|

|

|||||||||

| Lease Expirations - Suburban Maryland | ||||||||||||||||

| Annualized | % of | % of Total Annualized | ||||||||||||||

| Year of Lease Expiration |

Leased Square Footage | Rental Income (2) | Sub. MD | Rental Income | ||||||||||||

|

2021 |

174 | $ | 3,201 | 14.8% | 0.7% | |||||||||||

|

2022 |

168 | 3,385 | 15.6% | 0.7% | ||||||||||||

|

2023 |

272 | 5,950 | 27.5% | 1.3% | ||||||||||||

|

2024 |

122 | 2,697 | 12.5% | 0.6% | ||||||||||||

|

2025 |

122 | 2,288 | 10.6% | 0.5% | ||||||||||||

| Thereafter |

163 | 4,107 | 19.0% | 0.9% | ||||||||||||

|

|

|

|

|

|

|

|

|

|||||||||

|

Total |

1,021 | $ | 21,628 | 100.0% | 4.7% | |||||||||||

|

|

|

|

|

|

|

|

|

|||||||||

| Lease Expirations - Seattle | ||||||||||||||||

| Annualized | % of | % of Total Annualized | ||||||||||||||

| Year of Lease Expiration |

Leased Square Footage | Rental Income (2) | Seattle | Rental Income | ||||||||||||

|

2021 |

187 | $ | 3,762 | 17.8% | 0.8% | |||||||||||

|

2022 |

251 | 4,737 | 22.5% | 1.1% | ||||||||||||

|

2023 |

424 | 6,334 | 30.1% | 1.4% | ||||||||||||

|

2024 |

196 | 2,892 | 13.7% | 0.6% | ||||||||||||

|

2025 |

150 | 2,467 | 11.7% | 0.5% | ||||||||||||

| Thereafter |

63 | 876 | 4.2% | 0.2% | ||||||||||||

|

|

|

|

|

|

|

|

|

|||||||||

|

Total |

1,271 | $ | 21,068 | 100.0% | 4.6% | |||||||||||

|

|

|

|

|

|

|

|

|

|||||||||

| (1) | Excludes assets held for sale as of March 31, 2021. |

| (2) | Annualized rental income represents annualized outgoing rents inclusive of related estimated expense recoveries. Actual rental income amounts may vary depending upon re-leasing of expiring spaces. |

20

| Total Portfolio Activity (1) (2) | ||||||||||||||||||||||||||||

| Wtd. Avg. | Leasing | Customer | Transaction Costs | Transaction Costs | Cash Rental Rate | Net Effective Rent | ||||||||||||||||||||||

| Industrial | Occupancy | Volume | Retention | per Executed Foot | as a % of Rents (3) | Change (3) | Change (3) | |||||||||||||||||||||

| Northern Virginia |

93.5% | 145,000 | 88.6% | $ | 3.75 | 7.0% | 5.3% | 8.0% | ||||||||||||||||||||

| South Florida |

95.9% | 283,000 | 75.1% | 1.35 | 4.1% | 8.4% | 24.7% | |||||||||||||||||||||

| Silicon Valley |

95.9% | 209,000 | 88.0% | 2.25 | 3.3% | 24.1% | 51.3% | |||||||||||||||||||||

| East Bay |

92.5% | 204,000 | 73.5% | 1.33 | 3.3% | 6.3% | 16.4% | |||||||||||||||||||||

| Dallas |

85.9% | 216,000 | 94.0% | 2.97 | 18.6% | 2.8% | 6.8% | |||||||||||||||||||||

| Suburban Maryland |

86.0% | 42,000 | 89.6% | 2.92 | 5.5% | -0.6% | 8.0% | |||||||||||||||||||||

| Austin |

95.5% | 26,000 | 0.0% | 5.87 | 19.0% | 16.7% | 38.0% | |||||||||||||||||||||

| Los Angeles |

97.6% | 150,000 | 88.1% | 1.43 | 3.8% | 7.6% | 13.9% | |||||||||||||||||||||

| Seattle |

93.5% | 74,000 | 92.1% | 2.43 | 6.9% | 17.9% | 34.7% | |||||||||||||||||||||

| Orange County |

93.4% | 82,000 | 56.1% | 3.92 | 8.8% | 5.2% | 11.6% | |||||||||||||||||||||

| San Diego |

98.4% | 25,000 | 79.0% | 0.62 | 2.2% | 1.3% | 4.5% | |||||||||||||||||||||

| Industrial Totals by Market |

94.1% | 1,456,000 | 82.8% | $ | 2.28 | 5.6% | 9.5% | 21.2% | ||||||||||||||||||||

| Flex (1) |

||||||||||||||||||||||||||||

| Northern Virginia |

96.2% | 87,000 | 70.4% | $ | 6.13 | 19.6% | -2.0% | 5.8% | ||||||||||||||||||||

| South Florida |

83.1% | 14,000 | 90.0% | 0.39 | 1.2% | 7.5% | 19.5% | |||||||||||||||||||||

| Silicon Valley |

88.4% | 37,000 | 73.9% | 2.00 | 6.5% | -6.6% | -4.1% | |||||||||||||||||||||

| East Bay |

94.5% | 4,000 | 37.3% | 0.46 | 0.8% | -5.3% | 0.0% | |||||||||||||||||||||

| Dallas |

79.8% | 108,000 | 93.5% | 2.50 | 8.4% | -3.9% | -5.2% | |||||||||||||||||||||

| Austin |

94.8% | 27,000 | 35.4% | 5.35 | 12.3% | 4.8% | 14.0% | |||||||||||||||||||||

| Los Angeles |

93.6% | 38,000 | 89.2% | 2.31 | 4.9% | -1.0% | 4.8% | |||||||||||||||||||||

| Seattle |

95.4% | 27,000 | 69.4% | 0.95 | 2.4% | 5.3% | 13.3% | |||||||||||||||||||||

| Orange County |

96.7% | 3,000 | 35.3% | — | 0.0% | 5.1% | 8.9% | |||||||||||||||||||||

| San Diego |

92.4% | 54,000 | 59.2% | 1.99 | 6.6% | 1.5% | 4.6% | |||||||||||||||||||||

|

Mid-Peninsula |

84.0% | 7,000 | 35.3% | 0.71 | 2.8% | -8.7% | -11.0% | |||||||||||||||||||||

| Flex Totals by Market |

90.0% | 406,000 | 72.1% | $ | 3.09 | 9.1% | -1.0% | 2.7% | ||||||||||||||||||||

| Office (1) |

||||||||||||||||||||||||||||

| Northern Virginia |

86.6% | 68,000 | 51.6% | $ | 6.91 | 16.7% | -8.6% | -2.1% | ||||||||||||||||||||

| South Florida |

100.0% | — | 0.0% | — | 0.0% | 0.0% | 0.0% | |||||||||||||||||||||

| Suburban Maryland |

89.5% | 18,000 | 86.4% | 1.54 | 3.1% | -2.6% | 6.1% | |||||||||||||||||||||

| Los Angeles |

95.1% | 3,000 | 32.3% | 4.08 | 9.5% | 3.3% | 9.6% | |||||||||||||||||||||

| Seattle |

64.7% | — | 0.0% | — | 0.0% | 0.0% | 0.0% | |||||||||||||||||||||

|

Mid-Peninsula |

82.1% | 14,000 | 80.4% | 0.79 | 1.4% | -2.8% | 0.8% | |||||||||||||||||||||

| Office Totals by Market |

86.8% | 103,000 | 58.5% | $ | 5.09 | 11.3% | -5.8% | 0.2% | ||||||||||||||||||||

| Company Totals by Type |

92.4% | 1,965,000 | 78.2% | $ | 2.59 | 6.6% | 5.7% | 14.8% | ||||||||||||||||||||

| (1) | Excludes assets held for sale as of March 31, 2021. |

| (2) | Average lease term for leases executed during the three months ended March 31, 2021 was 3.2 years. |

| (3) | Refer to page 22, Definitions and Non-GAAP Disclosures, for the definitions of Transaction Costs as a Percentage of Rents, Cash Rental Rate Change, and Average Net Effective Rent Growth. |

21

Provided within this supplemental information package are measures not defined in accordance with U.S. generally accepted accounting principles (“GAAP”). We believe our presentation of these non-GAAP measures assists investors and analysts in analyzing and comparing our operating and financial performance between reporting periods. These non-GAAP measures discussed below are not substitutes of other measures of financial performance presented in accordance with GAAP. In addition, other real estate investment trusts (“REITs”) may compute these measures differently, so comparisons among REITs may not be helpful.

Adjusted Cost of Operations – Adjusted cost of operations represents cost of operations, excluding non-cash stock compensation expense for employees whose compensation expense is recorded in cost of operations, which can vary significantly period to period based upon the performance of the Company. The GAAP measure most directly comparable to adjusted cost of operations is cost of operations.

Assets sold or held for sale – Assets sold or held for sale represents 113,000 square feet of assets sold in January 2020 and 40,000 square feet of assets sold in September 2020 and includes 442,000 square feet of assets held for sale. The assets held for sale represent a 244,000 square foot office business park located in Herndon, Virginia, and a 198,000 square foot office oriented flex business park located in Chantilly, Virginia.

Average Net Effective Rent Growth – Average net effective rent growth represents the weighted average percentage change in net effective rents for leases executed during a period compared against the prior leases for the same units. Net effective rent represents average rental payments for the term of a lease on a straight-line basis, excluding operating expense reimbursements

Cash NOI – We utilize cash NOI to evaluate the cash flow performance of our business parks. Cash NOI represents NOI adjusted to exclude non-cash items included in rental income and in cost of operations. The non-cash rental income includes amortization of deferred rent receivable (net of write-offs), in-place lease intangible, tenant improvement reimbursement, and lease incentive intangible. The non-cash expense is equal to stock compensation expense for employees whose compensation expense is recorded in cost of operations. We believe that cash NOI assists investors in analyzing cash flow performance of our business parks. The GAAP measure most directly comparable to cash NOI is net income.

Cash Rental Income – Cash rental income represents rental income, excluding non-cash rental income, specifically amortization of deferred rent receivable (net of write-offs), in-place lease intangible, tenant improvement reimbursement, and lease incentive intangible.

Cash Rental Income per Available Square Foot – Cash rental income per available square foot is computed by dividing Cash Rental Income for the period by weighted average available square feet for the same period. Cash rental income per available square foot for the three month period is annualized.

Cash Rental Income per Occupied Square Foot – Cash rental income per occupied square foot is computed by dividing Cash Rental Income for the period by weighted average occupied square feet for the same period. Cash rental income per occupied square foot for the three month period is annualized.

Cash Rental Rate Change – Cash rental rate change percentages are computed by taking the percentage difference between outgoing rents (including estimated expense recoveries) and incoming rents (including estimated expense recoveries) for leases executed during the period. Leases executed on spaces vacant for more than the preceding twelve months have been excluded.

Core FFO and Core FFO per share – Core FFO represents FFO excluding the net impact of (i) income allocated to preferred shareholders to the extent redemption value exceeds the related carrying value and (ii) other nonrecurring income or expense items as appropriate. Core FFO per share represents Core FFO allocable to diluted shares and units divided by the weighted average diluted shares and units. We believe our presentation of Core FFO and Core FFO per share assists investors and analysts in analyzing and comparing our operating and financial performance between reporting periods. The GAAP measures most directly comparable to Core FFO and Core FFO per share are net income and earnings per share, respectively.

Earnings before Interest, Taxes, Depreciation and Amortization for Real Estate (“EBITDAre”) – EBITDAre is defined by the National Association of Real Estate Investment Trusts (“NAREIT”) and is often utilized to evaluate the performance of real estate companies. EBITDAre is calculated as GAAP net income before interest, depreciation and amortization and adjusted to exclude gains or losses from sales of depreciable real estate assets and impairment charges on real estate assets. We believe our presentation of EBITDAre assists investors and analysts in evaluating the operating performance of our business activities, including the impact of general and administrative expenses, and without the impact from gains or losses from sales of depreciable real estate assets. The GAAP measure most directly comparable EBITDAre is net income.

Free Cash Available after Fixed Charges – Free cash available after fixed charges represents FAD less dividends and distributions.

22

Funds Available for Distribution (“FAD”) – FAD is a non-GAAP measure that represents Core FFO adjusted to (a) deduct recurring capital improvements that maintains the condition of our real estate, tenant improvements and lease commissions and (b) remove certain non-cash rental income or expenses such as amortization of deferred rent receivable and non-cash stock compensation expense. We believe our presentation of FAD assists investors and analysts in analyzing and comparing our operating and financial performance between reporting periods. FAD is not a substitute for GAAP net cash flow in evaluating our liquidity or ability to pay dividends, because they exclude investing and financing activities presented on our statements of cash flows. The GAAP measure most directly comparable to FAD is operating cash flow from our statements of cash flows.

Funds from Operations (“FFO”) and FFO per share – FFO and FFO per share are non-GAAP measures defined by NAREIT and are considered helpful measures of REIT performance by REITs and many REIT analysts. FFO represents GAAP net income before real estate depreciation and amortization expense, gains or losses on sales of operating properties and land and impairment charges on real estate assets, which are excluded because it does not accurately reflect changes in the value of our business parks. FFO per share represents FFO allocable to diluted shares and units, divided by aggregate diluted shares and units. The GAAP measure most directly comparable to FFO and FFO per share are net income and earnings per share, respectively.

Net Operating Income (“NOI”) – We utilize NOI, a non-GAAP financial measure, to evaluate the operating performance of our business parks. We define NOI as rental income less adjusted cost of operations (described below). We believe NOI assists investors in analyzing the performance and value of our business parks by excluding (i) corporate overhead (i.e. general and administrative expenses) because it does not relate to the results of our business parks, (ii) depreciation and amortization expense because it does not accurately reflect changes in the fair value of our business parks and (iii) stock compensation expense because this expense item can vary significantly from period to period and thus impact comparability across periods. The GAAP measure most directly comparable to NOI is net income.

Non-Recurring Property Renovations – Non-recurring property renovations represents renovations that substantially enhance the value of a property, including capitalized costs associated with repositioning acquired assets.

Non-Same Park – Non-Same Park includes assets acquired on or subsequent to January 1, 2019.

Recurring Capital Expenditures – Recurring capital expenditures are capitalized costs necessary to continue to operate the property at its current economic value. Capital improvements in excess of $2,000 with a useful life greater than 24 months are capitalized. Lease transaction costs (i.e. tenant improvements and leasing commissions) of $1,000 or more for leases with terms greater than 12 months are capitalized. All leasing costs, including first generation tenant improvements and leasing commissions, are included in recurring capital expenditures.

Retained Cash – Retained cash represents free cash available after fixed charges less non-recurring property renovations and funds used for development and redevelopment.

Same Park – Same Park includes assets acquired prior to January 1, 2019.

Transaction Costs as a Percentage of Rents – Transaction costs as a percentage of rents are computed by taking the total transaction costs divided by the total rents (including estimated expense recoveries) over the term of the lease.

23